PET PROJECT

From the editor

By Mari-Len De Guzman

Knowledge is power

Imade my first legal cannabis purchase recently. My friends and I just finished having dinner and we decided to walk to a nearby coffee shop when I saw a line-up of people wanting to get into what looked like a very inconspicuous establishment. I would not have given it a thought if it were not for the people standing outside waiting to get in, and my natural curiosity got the best of me. I looked up and saw the Tokyo Smoke sign.

Since the Ontario Cannabis Store opened online, I’ve been tinkering around that site intending to make a purchase but I always end up with an empty basket. As someone with very little experience with cannabis consumption, I need a lot of education on this front. But there isn’t a lot of information on the OCS that would help me in the buying process. It seems the online store was made for consumers with a fairly adequate knowledge of strains and brands –who already know what they want to purchase – but not for people who are just exploring these products now that it’s legal.

So I stepped inside the Tokyo Smoke store on Yonge Street in Toronto, expecting the human budtenders would be able to enlighten me in a way that the impersonal online store was never able to. And so about 40 minutes and $19 later, I came out with a small package containing a

gram of pre-rolled joint – albeit as unenlightened as the time I entered the store.

Thanks to Health Canada regulations, the knowledgeable budtenders are very cautious about what they can and can’t say to a potential customer. And it’s doing a disservice to the consumers.

People are taking charge of their own wellness, the cannabis industry and the government can only benefit from a wellinformed consumer population

.

The federal government has earmarked $100 million over the next six years to fund public education and awareness on the health effects and the risks associated with cannabis use. For such a huge investment, there is not a lot of education going on at the point of sale, where the people who are or potentially will be using cannabis actually are. Budtenders can talk about the plant, the strains, THC and CBD content, maybe recommend dosage. What they can’t talk about is anything that has to do with consumer experience, particularly about the therapeutic benefits of cannabis.

The Ontario government has announced it will issue 50 new licences for cannabis retail outlets. With a very restrictive regulation pertaining to what information legal

cannabis sellers can provide through their product packaging or at the retail stores, the government is failing to capitalize on perhaps the most effective resource they have for public education: the budtenders.

In Ontario, sales of legal cannabis rose significantly after the first few licensed cannabis retail stores opened in April. People seem to want to interact with a physical store and engage the knowledgeble budtenders when purchasing cannabis – especially for the first time.

Of course, making unsubstantiated health claims about a product should be illegal. Consumers who are exploring how cannabis can help with their health and wellness must do their own homework about what evidence exists around the benefits of cannabis – but they are not always as savvy.

The scientific literature is limited currently but the research is increasing. In as much as Health Canada is funding programs that promote public awareness about the health and safety risks associated with cannabis use, resources must also be allocated, not only in building the evidence, but finding ways to bring those evidence information to the public. People are increasingly taking charge of their own health and wellness, the cannabis industry and the government can only benefit from a well-educated, well-informed consumer population.

July/August 2019 Vol. 3, No. 4 growopportunity.ca

EDITOR Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

ASSOCIATE EDITOR Jean Ko Din JKodin@annexbusinessmedia.com 416-510-5211

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexbusinessmedia.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexbusinessmedia.com 905-431-8892

ACCOUNT COORDINATOR Mary Burnie mburnie@annexbusinessmedia.com 519-429-5175 888-599-2228 ext 234

CIRCULATION MANAGER

Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext.3546

MEDIA DESIGNER

Brooke Shaw

GROUP PUBLISHER/VP SALES

Martin McAnulty mmcanulty@annexbusinessmedia.com

COO Scott Jamieson

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

1 year subscription (6 issues: Jan/Feb, Mar/Apr, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec):

1 year offers: Canada $25.50 + Tax

USA $36.00 USD FGN $41.00 USD GST # 867172652RT0001

SUBSCRIPTIONS

Roshni Thava rthava@annexbusinessmedia.com Tel: 416-442-5600, ext. 3555 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. We recognize the support of the Government of Ontario

Product. Design. Service. Masterfully interconnected.

Experience the Gavita approach to lighting.

Light cycles. Growth cycles. Business cycles. We craft lighting solutions to improve all three. With expert lighting calculations, custom designs tailored to your environment, and post-installation performance testing, Gavita has what you need to reach your cultivation goals.

Ontario to issue new cannabis store licences

Ontario is set to get 50 more cannabis stores starting in October.

The announcement came as some of the first 25 of the province’s legal pot shops that were supposed to open April 1 are still not up and running.

Those initial retailers were chosen through a lottery to open Ontario’s first brick-and-mortar cannabis and that lottery system has faced criticism for not including a merit component.

The Alcohol and Gaming Commission of Ontario (AGCO) will hold a new lottery on Aug. 20 for the next 42 retail store authorizations. Another eight stores will be located on First Nations reserves through a separate process.

Applicants must show evidence that if selected, they have already secured retail space for the store and that they have enough capital to open it, the AGCO said, noting that a bank letter confirming access to $250,000 cash and another confirming the ability to get a $50,000 standby letter of credit would be needed. One licensed cannabis producer said the latest initiative will position the industry for significant sales growth in Ontario.

“After the first 25 stores began to open in Ontario, the industry saw overall sales of cannabis basically double,” Avtar Dhillon, executive chairman and president of Emerald Health Therapeutics said in a statement.

“Adult-use consumers are showing a preference for going into a physical location where they can interact with educated, savvy budtenders.”

The Ontario government had initially decided on just 25 stores, citing supply issues, but that appears to be easing.

“Our government is continuing to take a responsible approach to opening cannabis stores across Ontario, allowing private sector businesses to build a safe and convenient retail system to combat the illegal market,” Finance Minister Rod Phillips said in a statement.

– ALLISON JONES AND ARMINA LIGAYA, THE CANADIAN PRESS

Bruce Linton steps down as Canopy Growth co-CEO

Canopy Growth’s Bruce Linton has stepped down from his post as co-CEO and board member, a statement from the company said.

Mark Zekulin remains as the sole CEO and will work with the company’s board to begin a search to identify a new leader to guide the company in its next phase of growth, which will include both internal and external candidates. Rade Kovacevic, a long-serving member of the team currently leading all Canadian operations and recreational strategy, has assumed the role of president. The board also appointed John Bell to replace Linton as chairman. Bell has served on the board as lead director for five years.

“Creating Canopy Growth began with an abandoned chocolate factory and a vision,” said Linton. “The board decided today, and I agreed, my turn is over.”

The 42 new stores in Ontario will include 13 in the City of Toronto, 11 and 7 in the west and east regions, respectively, 7 in the north, 6 in the GTA, and one each in Kenora, North Bay, Sault Ste. Marie, Thunder Bay and Timmins.

While noting that “change is never easy,” the outgoing CEO expressed full confidence in the Canopy team to progress through the transition and to the future.

In a separate interview, Linton said he was “terminated” and added that the board’s decision to make Zekulin the sole CEO could have been handled differently.

“I did not wish to leave,” Linton said. “I was asked to leave and I left under the terms that we mutually agreed to... This is not an expected change, and not one I necessarily welcome, but it’s not going to be bad for the company.”

While thanking Linton for establishing the foundation of Canopy Growth, board director David Klein said the company is “also excited to embark upon our next phase of growth as global leader in the cannabis industry.”

Canopy Growth’s shares fell last month following the company’s earnings report for a three-month period ending March 31st. The company reported net revenues of $94.1 million for its financial fourth quarter, up from $22.8 million and above analyst estimates. However, the Smiths Falls, Ont.-based firm posted a net loss attributable to shareholders of $335.6 million, or 98 cents per share, up sharply from a loss of $61.5 million or 31 cents a year earlier.

In reporting the results, Linton said Canopy invested heavily during the quarter for longer-term growth, such as boosting its production capacity and preparing for the launch of edibles and other next-generation pot products once legal later this year.

Canopy was founded in 2013 and recently received a $5 billion investment from Constellation Brands, the massive alcohol company.

Constellation Brands said last week that it was “not pleased” with Canopy’s recent year-end results as it recorded a loss in its own financial first quarter in connection with its stake in the Canadian cannabis company. – WITH FILES FROM THE CANADIAN PRESS

Bruce Linton

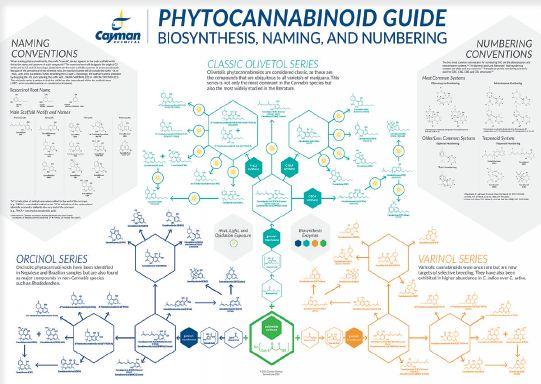

Better Cannabis... with Better Science!

CHEMISTRY

Top quality analytical standards for analysis of Phytocannabinoids, Terpenes, Pesticides, Residual Solvents, and Mycotoxins.

Available as single standards or multi-component mixtures.

MICROBIOLOGY

Guaranteed authentic quality control microbial strains for licensed testing labs, provided in a convenient frozen format –Just open, plate, and go!

PLANT BIOLOGY

Cannabis plant culture cultivation kits and reagents including dry powder media, pre-poured media, plant growth regulators, growth vessels, and bioreactors.

COMPLETE WORKFLOW SOLUTIONS

• Plant tissue culture reagents (regulators, antimicrobials, etc.)

• Sample labelling, packaging

• Sample extraction, cleanup

• DNA / RNA / Protein analysis

• Microbiology QC Strains

Contact us today

to discuss your project and how shopping with Cedarlane will save your lab time & money. Reference code GROWOPP19 to receive 10% off your first order PLUS a complimentary wall poster for your lab: A guide to the biosynthesis, naming, and numbering of phytocannabinoids

• Biochemicals/ Buffers

• HPLC / MS consumables (Filters, Columns, Resins, etc.)

• Analytical standards (compounds/chemicals)

• Industrial vacuum sealers, stackable drying racks

Edibles, infused products coming in mid-December

A “limited selection” of next-generation cannabis products such as edibles will “gradually” hit retail shelves no earlier than mid-December 2019, Health Canada said.

The government has released details of the final version of its regulations governing these cannabis products, including topicals and extracts, and indicated the rules will come into force on Oct. 17.

However, federal cannabis licence holders must provide 60 days notice to Health Canada of their intent to sell new products. That means these new cannabis products won’t be available for legal sale until Dec. 17 at the earliest.

“As with any new regulatory framework, federally-licensed processors will need time to become familiar with and prepare to comply with the new rules and to produce new products,” Health Canada said in a statement.

A recent report by Deloitte estimated the Canadian market for these cannabis products is worth about $2.7 billion annually, with edibles contributing more than half of that.

The final rules dictate that edible cannabis, whether food or beverage, will have a cap of 10 milligrams of tetrahydrocannabinol (THC) per package, consistent with the proposed regulations. Cannabis extracts for inhalation or topicals, such as pot-infused lotions, will have a cap of 1,000 milligrams of THC per package, also in line with the draft rules.

All packaging must be plain and child resistant, and must not be appealing to young people.

As well, as proposed in the draft guidelines, no elements on these products would associate them with alcoholic beverages, tobacco products, or vaping products.

The major rollout of this new class of cannabis products will likely happen further into 2020, said Jefferies analyst Ryan Tomkins in a note to clients before the government announcement.

“We are likely to only see the first products launched late into December… with regulators likely to review numerous details of proposals including testing, manufacturing and packaging procedures as well as product data and ingredient specifications.”

- ARMINA LIGAYA, THE CANADIAN PRESS

New funding for cannabis public education

The Canadian government is investing $15.2 million to support organizations across Canada that are engaged in cannabis public education and awareness initiatives, Health Minister Ginette Petitpas said in a statement.

Thirteen organizations will receive funding, as part of Health Canada’s federal grant under the Substance Use and Addictions Program (SUAP) to educate Canadians on cannabis and the health and safety risks associated with its use.

This new funding is in addition to previously announced investments of $9.8 million through SUAP on cannabis public education.

The value of the extracted cannabis market, such as edibles and topicals, is estimated at $2.7 billion annually. Edibles are expected to contribute more than half of that amount.

Organizations funded through SUAP will carry out national and community-based projects that raise awareness about the health effects of cannabis, Health Canada said. Public education initiatives will be implemented across the country, targeting youth and young adults, pregnant and breastfeeding individuals, and other segments of the population requiring tailored information about cannabis. Funding will also support Indigenous peoples, front-line workers, including healthcare professionals, educators and law enforcement officers, by providing the tools, resources, skills and training needed to address cannabis use.

“These newly-funded cannabis public education and awareness-building projects will allow for the development of much-needed resources that will serve Canadians, including populations that are at greater risk,” Petitpas said.

The following organizations will receive SUAP funding for cannabis public education initiatives:

• Boys and Girls Club of Canada

• Canadian Consortium for Early Intervention in Psychosis

• Canadian Nurses Association

• Canadian Paediatric Society

• Centre for Addiction and Mental Health

• Centre of Excellence for Women’s Health

• First Nations Health and Social Secretariat of Manitoba

• Métis Nations of Ontario

• Ngwaagan Gamig Recovery Centre Inc.

• Ontario Lung Association

• Parachute

• Schizophrenia Society of Canada

• Society of Obstetricians and Gynaecologists of Canada

The total planned investment in cannabis public education, awareness and surveillance is more than $100 million over six years, according to Health Canada.

Nova Scotia to sell edibles, extracts before end of year

HALIFAX – The Nova Scotia Liquor Corporation will sell cannabis edibles, extracts and topicals when the products become legal later this year.

Finance Minister Karen Casey says the government had great success with NSLC when they were asked to take on the retail for cannabis last year. “They’ve proven they could take on the cannabis and so we asked them what it might look like if they were given the expanded mandate for the edibles, extracts and topicals,” Casey said in an interview.

“They came back with the same kind of parameters and the same kind of priorities that we wanted, and that was that they would do education and awareness with their staff. They want, and we want, the staff handling the products to be comfortable doing that and to be knowledgeable,” she said.

Casey said there have been ongoing discussions with the private sector and First Nations, but for now, the government needed a retailer who was ready and could follow the same retail model set out for cannabis.

She said the new products will be sold in the same 12 NSLC stores that currently sell cannabis.

Casey said the NSLC said it will be able to handle the new products in the existing stores with very little capital costs.

Amended Health Canada regulations governing the sale of edibles, extracts and topicals come into force on Oct. 17.

However, a 60-day review process for new products will mean they won’t be ready for sale until at least mid-December.

“As soon as the product is available, we’re going to be ready,” Casey said.

- The Canadian Press

TGOD, Neptune team up for organic cannabis extraction

Laval, Que.-based Neptune Wellness Solutions has entered into a definitive long-term agreement to provide extraction, formulation and packaging services to Mississauga-based organic cannabis producer The Green Organic Dutchman (TGOD).

Neptune will extract and purify cannabinoids and terpenes from cannabis and hemp biomass received from TGOD, and transform them into premium certified organic finished products.

The price of cannabis from the illicit market continues to drop as legal prices are on the rise, Statistics Canada said. The average price of illegal cannabis is $5.93 per gram, while legal cannabis costs $10.65 per gram.

Under the terms of the contract, TGOD will supply more than 230,000 kilograms of cannabis and hemp biomass to Neptune over a three-year period. “Volumes are expected to be back-end loaded with the first year accounting for approximately 20 per cent of the total volumes of the contract,” a statement from Neptune said.

Most of the active ingredients extracted at Neptune’s Sherbrooke, Que., facility will be transformed into value added delivery forms onsite. Neptune will manufacture, package and provide formulation assistance, as required, in multiple product verticals to be sold under TGOD’s brands. Neptune will also formulate and package for TGOD

capsules using its Licaps.

Health Canada is expected to authorize the sale of new product forms, including vape pens and infused food and beverages beginning this fall.

“We are excited to work with TGOD, an innovation driven company focused on value added and differentiated products,” said Jim Hamilton, CEO of Neptune.

In a statement, TGOD CEO Brian Athaide said the Neptune agreement is significant not only because it enables the cannabis producer to start manufacturing certified organic consumer wellness products at scale, but also “because of the large and sustained economic impact it will have in Quebec where TGOD is building the world’s largest organic cannabis production facility.”

TGOD will work closely with Neptune’s team to assist the extraction firm in obtaining its organic certification. Neptune is in the process of achieving EU-GMP certification, allowing TGOD to export products to other jurisdictions, according to Neptune.

The first shipment of biomass from TGOD is expected to be received by Neptune in Sept. 2019.

Take a bite out of your aphid problem!

Our lacewings get the job done

Koppert’s lacewing eggs and larvae products control aphids at all levels of infestation. CHRYSOPA-L and CHRYSOPA-E are effective as preventative and control measures.

ww w.koppert .ca

Spotlight: Grower Day 2019

By Mari-Len De Guzman

Case for organic

David Perron, vice-president of growing operations for The Green Organic Dutchman (TGOD), provided attendees with an overview of organic cannabis cultivation. TGOD is a fully certified organic cannabis producer, under EcoCert and ProCert, using end-to-end organic processes. With a combined 1.6-million sq.ft. of cultivation and processing facilities across Ontario, Quebec, Jamaica and Denmark, the company plans to grow its annual production capacity to 219,000 kilograms.

Perron said certification is important for companies to be able to give credence to its organic growing processes, which provides opportunities for value-add and price products at a premium.

He said some of the product benefits of growing organic cannabis include: richer terpene profiles, cleaner burn, better taste, fresher aroma, and offers peace of mind for the eco-conscious consumer.

“Through the certification we get the recognition for the extra work that we’re doing,” Perron told Grow Opportunity. “I like to think about organic in terms not of the stuff that we’re not allowed to do but all the little extra steps that we’re doing along the way that adds value to the product.”

Grower focus

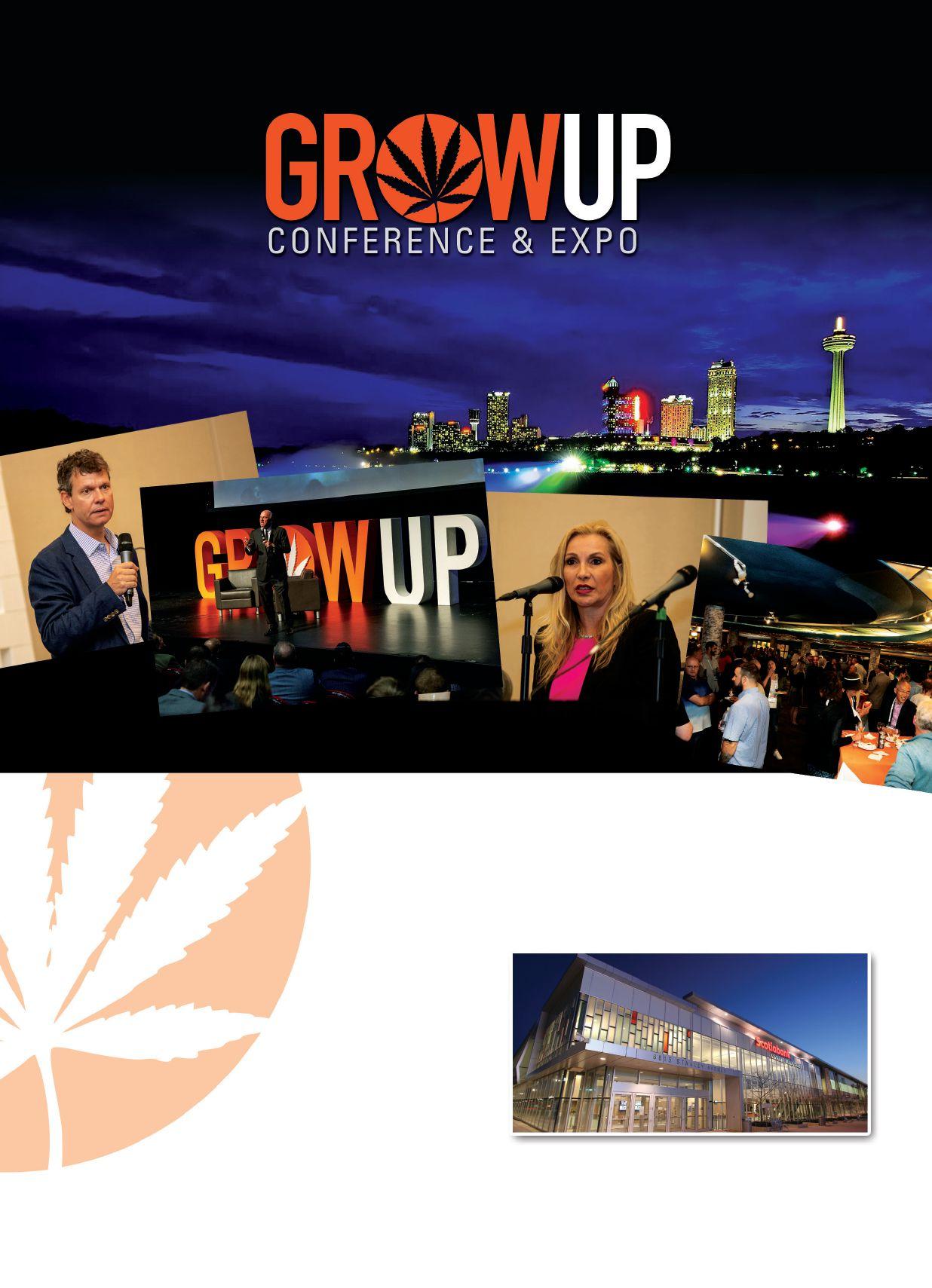

Grower Day 2019, held June 18 and 19 in St. Catharines, Ont., was an opportunity for growers to share best practices and be informed of the latest trends, not only on growing cannabis but also ensuring operational efficiencies in managing your cannabis enterprise.

“It’s been great. As soon as we walk in, there are suppliers, friends, students from Niagara College, some businesses that are producing bio control insects, and suppliers that we’re using for soil and equipment,” commented TGOD’s David Perron, when asked about his impression of Grower Day. “The good people are here, it’s a cozy and friendly vibe, and it’s nice to be able to shake hands with everybody, exchange growing tricks and see where everybody is at. It’s been a pleasure to be here.”

Outdoor grow

“The biggest failure in facilities is record keeping.”

– Georges Routhier, CEO, PipeDreemz Inc.

In his presentation, Jayson Goodale, senior cultivation consultant for Cannabis Compliance Inc., outlined some of the challenges and opportunities for the commercial cultivation of cannabis outdoor.

“With outdoor grow, I see a lot more supply agreements being signed with extraction companies,” Goodale said of some of the opportunities he sees with outdoor cannabis cultivation.

Most cannabis crops grown outdoors are destined for extracted products such as edibles and topicals, which are expected to become legal in the market by October this year.

One of the advantages of growing cannabis outdoors is the significantly lower operational costs associated with growing outdoors, Goodale said. The typical production cost associated, such as electricity and HVAC, are almost non-existent as outdoor farms rely on the natural environment to grow the plants. But with opportunities come some challenges as well, and they are typically associated with the outdoors. “There are a lot of unknowns with what happens with Mother Nature,” said Goodale, citing the risk of cannabis pollen drifting to nearby agriculture operations, as well as the potential for pesticides in adjacent farms drifting and contaminating the cannabis crops.

Pest and disease management in outdoor grow may also be a challenge, he added. Currently, there is no approved pesticides for cannabis that are labelled for use on commercial cannabis crops produced outdoors. Using beneficial insects for pest control can be a challenge as well as there is no way to prevent these insects from flying away from the crops in an outdoor grow.

David Perron

Jayson Goodale

Future of hemp

Patricia Korosi, sector specialist for Agriculture and Agri-Food Canada, was also a speaker at Grower Day, outlining the current state of Canada’s industrial hemp industry and the opportunities for growth.

Hemp is a multi-purpose, sustainable crop, Korosi said in her presentation. As a rotation crop, hemp can break diseases and pest cycles, improve soil conditions and produce high value products. The global demand for plant-based protein and source for omega-3 fatty acids, as well as the increasing number of countries that are legalizing hemp and cannabis are creating market opportunities for hemp production, Korosi said. As an emerging industry, there are also industry challenges that need to be addressed. For starters, there is a lack of industry standards for the hemp industry – although one is currently under development, the government official said.

Trends in cannabis production

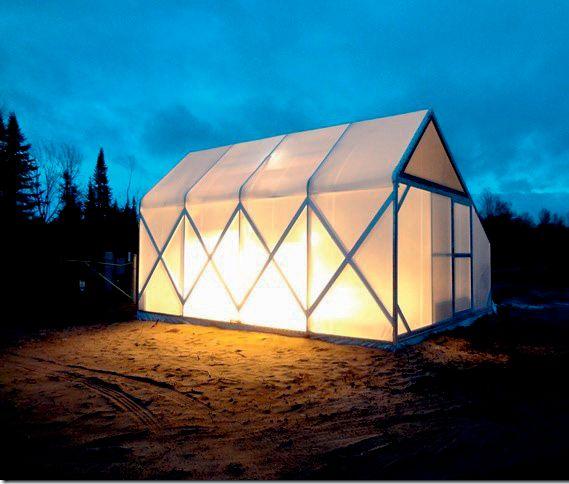

Building new, massive greenhouse and indoor cannabis cultivation facilities could become a thing of the past as new outdoor cultivation sites become increasingly popular. It’s a trend that cannabis security expert David Hyde is seeing in the current Canadian cannabis industry landscape.

In his keynote presentation at Grower Day in St. Catharines, Ont., Hyde said while greenhouses and indoor production facilities will continue to be built to increase production capacities, size will scale down, but processor, research and testing facilities will increase in number across the country.

“The tendency will be toward larger, multi-licence sites,” the president of 3 Sixty Secure said, adding that micro-cultivation, micro-processor and nursery sites will also ramp up across the country and, “in some cases, may be vulnerable to crime than standard

licensed sites.”

Nearly 250 professionals in the commercial growing and cultivation industry attended this year’s Grower Day event, which featured education sessions on ornamental and vegetable growing, as well as cannabis production and business operations.

Day Two of Grower Day, which focused on topics relevant to cannabis production, featured presentations on cannabis security, outdoor cultivation, the opportunities for industrial hemp, organic growing as well as the importance of having standard operating procedures (SOP) in cannabis production facilities.

“The biggest failure in facilities is record keeping,” said Georges Routhier, CEO of consulting firm PipeDreemz Inc. “SOPs can transform your business if they are used daily as part of the management structure.” SOPs are set methods to be followed routinely to perform operations or designated activities, and are submitted to Health Canada to define regular business protocols, Routhier said. A cultivation SOP, for example, should outline strategies for pest prevention and management, facility design features, daily routines, including production processes, workflow, and change management strategies.

Featuring some of the leading product and service providers in the cannabis industry, Grower Day was an opportunity for growers to interact with their suppliers.

Georges Routhier

Patricia Korosi

David Hyde

Cultivation

By Mohyuddin Mirza

Understanding heat and humidity for bud growth and quality

Temperature in the greenhouse or indoor operations has to be understood as it affects growth and development of cannabis.

To understand temperature and how it affects greenhouse or indoor climate, consider the energy inputs to a typical greenhouse where natural light is allowed to come in and supplemental lights are used for cannabis production yearround. When sunlight or solar energy falls on a greenhouse glazing material, 19 per cent is reflected back into the air, 12 per cent is absorbed by the material, and 69 per cent is transmitted into the greenhouse enclosure. This transmission percentage can vary in different materials like glass, plastic or acrylic. The figures for these materials are also very important to know. Out of the light that enters the greenhouse, 14 per cent is reflected, 17 per cent is given off as heat and 38 per cent is used in evapotranspiration.

Cannabis plants, like other greenhouse crops, are relatively inefficient users of light. Only 5 to 20 per cent of light entering the greenhouse is used by the plants to manufacture sugars; the balance is either reflected, transmitted or used for transpiration. In indoor operations, the amount of light is fixed in terms of “installed capacity” but the intensity can be changed by the distance between the lights and the plants. As the plants grow upward, the light intensi-

ty increases at the top of the canopy, and lower leaves get less light. Most of the yellow leaves we see in a plant are at the bottom.

TEMPERATURE AND RELATIVE HUMIDITY

There is some confusion about what is ideal relative humidity (RH) for cannabis production. The confusion is that RH should not be used as a “stand alone” parameter; instead, it is related with temperature. RH and temperature should go hand in hand. They are related and dependent on each other.

RH is the amount of water vapour in the air at a given temperature, compared to the maximum water vapour air could hold at saturation. The warmer the air, the more water vapour it can hold, thus reducing the relative humidity in the greenhouse air. For example, at zero degrees Celsius, air can hold four to eight grams of water vapor/m3. Whereas at 30C it can hold 30.4 grams/m3 of water vapour. Humidity plays an important role in a number of key areas of cannabis production and performance. These include vapour pressure deficit, degree of stomatal opening, and dew point.

VAPOUR PRESSURE DEFICIT (VPD)

VPD is a measure of water loss from the cannabis plant. It is a measurement calculated by the environmental control computers and reported in grams/m3 of air, kilopascals or millibars. I use grams/m3 of air more than

the other two measurements. VPD provides an idea of transpiration loss from leaves and it depends on temperature and relative humidity. Temperature, in this case, should be of the leaf not just the air temperature. A VPD of between 3 and 7 grams/ m3 of air during the light periods is a general guideline for cannabis plant performance. During dark periods a VPD of above 1.5 to 2 grams/m3 is desirable. A VPD of below 1 gram/m3 of air indicates very high RH, and poses a danger of condensation on the leaves and buds if proper temperature ramping is not practiced. Growers can use the principle of VPD to target optimum growth environment.

DEW POINT

I am seeing more and more leaf

symptoms on cannabis which appear to be related to dew forming on the leaf surface. I have also seen water dripping from cannabis greenhouse roofs, although relatively less in indoor operations. In one case I saw condensation on walls, which means that these surfaces were cold enough for water vapors to condense and thus form dew. Dew point is reached when RH is very high and the temperature drops.

As an example, at 25C temperature and 65 per cent RH, dew point is 18C. At 70 per cent RH, dew point is 19.1C, at 80 per cent RH the dew point is 21.3 C, and at 100 per cent RH, it is 25C. It is important to understand the temperature and RH interactions carefully and apply it to cannabis management on a daily basis.

The picture shown here is of a young cannabis plant in a greenhouse where plants were grown at very warm day (30C) and night (22C) temperatures. The leaves grew fast and chlorophyll did not keep up with the leaf expansion.

Carefully analyze your temperature and RH data on a daily basis. Also check that out of the lighted period, how many hours the plants were in that window of 3 to 7 grams/m3. If VPD is not in the proper range, then the plant is not “working” properly to make good buds for you. I find that out of 18 hours of lighted period, the plants were barely in that VPD range for eight hours. So lots of energy may be being wasted at the expense of bud size and quality.

Dr. Moyhuddin Mirza is the chief scientist with the Cannabis Nature Company in Edmonton, and is a consultant with the cannabis industry. Email him at drmirza@cannabisnature.ca

This cannabis plant was grown in very warm day and night temperatures.

Legal Matters

By Matt Maurer

Beyond our borders

This article will examine the legal framework of one of the global aspects of the Cannabis Act: the importation and exportation of cannabis.

Section 11(1) of the Act restricts the importation or exportation of cannabis to or from Canada unless otherwise authorized under the Act. However, import and export is permitted by virtue of section 62 of the Act, which allows for the issuance of licences or permits for the importation or exportation of cannabis.

It is noteworthy that the Act provides that: “Licences and permits authorizing the importation or exportation of cannabis may be issued only in respect of cannabis for medical or scientific purposes or in respect of industrial hemp.”

The Government of Canada has explicitly stated that it does not support facilitating a regime premised on servicing global demand given the associated public health, safety and security risks. It is for these reasons that importation and exportation is permitted under very limited circumstances, such as importing starting materials for a new licensee or exporting a unique strain for scientific investigation for a foreign laboratory.

Permits required for each shipment

Under the regulations, any holder of a federal licence is

authorized to import or export cannabis for medical or scientific purposes provided that they obtain a permit for each shipment of cannabis that is imported or exported. The fact that a permit must be obtained for “each shipment” explains in part why the import and export of cannabis from Canada is more limited than many would think.

application pertains would contravene the Canadian regulations or the laws of the country of import/ export or any country of transit or transhipment;

• If the government has reasonable grounds to believe that the importation of the cannabis is for the purpose of exporting it; or

• If the government has reasonable grounds to

Loosening export rules would allow Canadian companies to potentially profit by serving global markets

Grounds for refusal to issue permit

When applying for a permit to import or export, there are a number of grounds upon which the government may rely in determining to refuse to issue the permit. Some of the more notable grounds include the following:

• If the issuance of the permit is likely to create a risk to public health or safety;

• If there are reasonable grounds to believe that false or misleading information or documents were submitted in support of the application;

• If the government feels that it is in the public interest to do so;

• If the government has reasonable grounds to believe that the shipment to which the permit

believe that the shipment that is being exported would not comply with the permit for importation that has been issued by the country of import. If the government is inclined to not grant the permit, Health Canada will usually send an “intent to refuse notice,” either to refuse to consider an application, or to refuse to issue a permit. The notice will generally provide the applicant 30 days to respond, after which a notice of refusal will be issued.

Limited period of validity

In addition to a permit being required for each shipment, there is also a limited period of validity attached to every permit that is granted.

Each permit expires on the earliest of the following dates:

• the date on which the shipment is imported or exported;

• the date of expiry of the permit or the date of its revocation;

• the date of the expiry of the licensee’s license or the date of its revocation; or

• the date of revocation of the permit issued by the competent authority of the country of import/export that pertains to the shipment

Information required

When applying for a permit to import or export, the licensee has to provide a substantial amount of information to Health Canada including the following:

• the name, mailing address and license number of the license holder;

• the name and address of the importer or exporter, as the case may be;

• the port of entry or exit into or from Canada, as the case may be;

• the address of the customs office where the shipment will be delivered;

• each mode of transport used;

• any country of transit or transshipment (if applicable);

• anticipated shipment date, if known;

• description of the cannabis;

• name and address of the exporter;

• intended use of the cannabis;

• brand name, if applicable;

Continued on page 26

Matt Maurer is vice-chair of the Cannabis Law Group at Torkin Manes LLP.

By Roxanne Franckowski

Precision testing

As the cannabis industry is now a multibillion-dollar global market and will only continue to grow, consumer safety is of the utmost importance.

To ensure product safety, as with any product intended for human use, various governments, regulatory bodies, and stakeholders are working toward standardization within the industry. This is best accomplished by quality control testing of cannabis, including potency determination. The quality of these test results is influenced by the proficiency of the laboratory staff, conditions in the laboratory, maintenance of analytical instrumentation, and the reliability of the reference materials used. Cannabis testing laboratories that follow a rigorous quality system, such as those accredited under ISO/IEC 17025, offer confidence in the identification of key components and accuracy of quantitative measurements.

INTERNATIONAL STANDARD

ISO/IEC 17025 accredited laboratories establish metrological traceability of measurements made during analysis. With metrological traceability, as defined in ISO/IEC Guide 99, a result is “related to a reference through a documented, unbroken chain of calibrations, each contributing to measurement uncertainty.” Having a measurement with metrological traceability is important because it gives the end-user assurance that the reported measurement agrees with results obtained from other laboratories using the same standard. Without metrological traceability, the measurement provided may be skewed, providing an inaccurate result that, if not caught, has the potential to cause harm to the consumer.

Metrological traceability is maintained using properly calibrated equipment and, when available, certified reference materials (CRMs). CRMs are produced by reference material producers (RMPs) accredited to ISO 17034 – the international standard on the general requirements for the compe-

tence of reference material producers. To identify and quantitatively measure the components found in a cannabis product, CRMs are available as single-component or multi-component solutions. These CRMs may be used to create calibrators and/or control samples. ISO 17034 CRMs are guaranteed to be metrologically traceable. Together with properly maintained instrumentation, CRMs will ensure that the results will be consistent and accurate. RMPs with ISO 17034 accreditation must adhere to a list of requirements before producing a CRM. Each step of CRM production is planned, and acceptance criteria are specified to ensure product consistency throughout the lifespan of CRM batches.

HOW IT’S MADE

When a CRM is manufactured, the RMP first evaluates the neat material to verify its identity and overall purity, as this will be used to calculate the certified concentration of the CRM. Next, a compatible solvent is carefully considered. Solvent selection is critical to the overall accuracy and stability of the CRM. An incompatible solvent will negatively impact the CRM. For example, if the neat material is not fully soluble or precipitates out over time, then the CRM is not sufficiently homogeneous; if the solvent is too acidic, this could cause steep degradation of the material, impacting the stability. The neat material and solvent are measured using calibrated equipment to provide the metrologically traceable solution with certified concentration and corresponding measurement uncertainty. Once the solution is produced and packaged, the concen-

tration and homogeneity of the CRM is verified by selecting random ampules throughout the batch for screening. For multi-component CRM solutions, compound incompatibilities within the mixture are evaluated. For instance, even if single-component CRMs show stability for several years, when placed in a multi-component solution, interactions between the components may cause an accelerated degradation, rendering the solution inaccurate. Stability of the CRM is monitored first to determine the optimal storage and shipping conditions and then over a longer period for long-term storage.

Not all cannabis testing laboratories are ISO/IEC 17025 accredited. Labs doing any type of quantitative measurement will benefit from using ISO 17034 CRMs in their analysis. RMPs take rigorous steps to ensure that CRMs are adequately characterized, stable, homogenous, and metrologically traceable, making CRMs ideal for quantitative analysis. RMPs must provide this information in a certificate of analysis, with the certified property value, the associated uncertainty of the material, and instructions for proper use. Testing labs should look for the ISO 17034 accreditation logo and/or number on the certificates of analysis to ensure the solution being used is a CRM.

The decision to use single- or multi-component CRM solutions comes down to the individual laboratory’s policies, procedures and preferences. For example, single-component CRM solutions offer versatility to the lab by allowing the creation of their own multi-component control sample at varying concentrations. Alternatively, having a premade multi-component CRM solution may be ideal when creating calibration standards. They offer the benefit of reducing dilution errors, materials consumed, and preparation time.

No matter where you are in the cannabis product supply chain, odds are you are either providing or relying on quantitative analysis. CRM use by well-trained staff, under proper lab conditions, allows for confidence in the accuracy of analytical results. After all, product quality control testing is only as accurate as the quality of analysis.

Roxanne Franckowski is manager of ISO Quality at Cayman Chemical, supplier of authentic reference materials for the most prominent phytocannabinoids, and emerging psychoactive substances from ISO/IEC 17025 and ISO 17034 accredited facilities.

With its high perlite content, PRO-MIX® HP BIOSTIMULANT + MYCORRHIZAE™ provides a great growing environment to growers looking for a significant drainage capacity, increased air porosity and lower water retention. The added benefit of fibrous peat moss and coarse perlite makes this formulation ideal for growers who require a superior-quality product adapted to their needs for watering flexibility and crop seasonality.

PET PROJECT

As opportunities for CBD product development grow, veterinary professionals are calling attention to the needs of our fourlegged companions By Mike Straus

Consumer and industry interest in CBD supplements designed for pets has grown significantly in recent years. Legalization of hemp-derived CBD in other jurisdictions has resulted in many Canadians looking to CBD products for all manner of pet health issues, and this rise in consumer demand has important implications for the cannabis industry.

The proliferation of black market products and regulations that tie veterinarians’ hands are giving rise to an important debate about the role of CBD in animal medicine. And now, producers and other industry stakeholders are advocating for legislative changes that would provide consumers with safe, legal alternatives to the unregulated products currently on the market.

CBD is reaching a tipping point, and it owes it’s time in the spotlight in large part to the pet health industry. Here are just some of the dynamics driving the niche – and factors that are hindering its growth.

SCIENCE AND SAFETY

CBD may have significant therapeutic potential for pets. Dr. Sarah Silcox, a veterinarian with the Toronto-based Greenwood Veterinary Services and president of the Canadian Association for Veterinary Cannabinoid Medicine, notes that both hemp-derived and cannabis-derived CBD may have roles in veterinary medicine, provided the appropriate veterinary oversight is in place.

“Even a small level of THC (like that present in hemp) may be enough to produce some side effects at first,” Silcox says. “A lot of veterinarians’ only experience with THC in pets is with dogs that come in intoxicated.

“There are conflicting reports on whether or not dogs have more CB1 receptors (than humans). Dogs are certainly more sensitive to THC on first exposure. But it now appears that they may acclimate to the effects after multiple exposures.”

One July 2018 pilot study published in Frontiers in Veterinary Science examined the effects of a small dose of hemp-derived CBD on arthritis in dogs. While this study is very early-stage and had

several limitations, it did show encouraging results – namely, a decrease in pain as measured by the canine brief pain inventory. George Smitherman, senior VP of corporate affairs for Biome Grow and former Ontario Minister of Health, says that studies like this one are very promising – and he’s excited to see more research in the future. Smitherman says that while the extensive grey-market application of CBD has led to a number of anecdotal reports, there’s been little research in a proper health context.

EVIDENCE-BASED: As in the case of medical cannabis for humans, there are numerous anecdotal reports on the benefits of CBD for pets, but there has been little research done to support these claims and pet advocates are calling for increasing the body of evidence.

“These are the kinds of studies that will be validated with more science,” Smitherman says. “It takes time to build the science, but this study is one very promising example of moving beyond the anecdotes and into the proofpoints.”

While evidence pertaining to the effects of CBD on dogs is already scarce, there is even less information when it comes to other members of the animal kingdom.

Silcox notes that there’s little data on how CBD may impact

cats, specifically. While cats are more sensitive than dogs to some common animal pain medications, there are no published studies showing the efficacy of CBD in treating pain in cats.

Anecdotally, though, Silcox has heard from a number of cat owners who say that cannabis-derived medications have considerably eased their cats’ chronic pain.

Silcox says that much of veterinary cannabinoid medicine is about implementing proper oversight procedures such as using the

right product at the right dosage level. Cannabinoid medicine is variable and dependent on the individual, she says, and no two animals will respond to the same dosage in the same way. This means manufacturers that are researching or developing cannabis-derived products for pets will need to implement strict dosage protocols and quality controls, preferably with veterinary input.

BLACK MARKET

There does not currently exist a federally approved CBD product

By the numbers

Since the passing of the US Farm Bill, hemp-derived CBD sales have grown in the United States. The pet market was worth nearly US$7 million in just the four states of California, Colorado, Oregon, and Washington, with Colorado averaging 49 per cent annual growth in 2017. As more jurisdictions move toward legalization, expect sales of pet CBD supplements to grow.

for pets, and CBD itself remains a prescription-only drug. While veterinarians are currently permitted to prescribe drugs that contain cannabis derivatives, it’s illegal for them to prescribe cannabis.

Despite the lack of legal products, however, consumers are showing keen interest in giving cannabis products to their pets. In a December 2018 interview with the CBC, Dr. Andrew Morrison, a veterinarian in Lake Echo, N.S., said that a number of pet owners are purchasing unregulated CBD or hemp products that have been designed for human use, and “experimenting on their own with their animals.”

Unclear laws aren’t helping matters. Dr. Jenna Valleriani, PhD, a UBC postdoctoral fellow studying cannabis policy, told The Globe and Mail in January 2019 that Health Canada and the RCMP have failed to enforce the existing laws around CBD products, which is creating confusion among both consumers and industry professionals around what is and is not legal.

Dr. Ian Sandler, founder and CEO of Grey Wolf Animal Health in Toronto, says current cannabis legislation doesn’t offer a legal pathway for consumers to access CBD pet supplements. Instead, he explains, pet stores are illegally selling unregulated CBD products, and the lack of a legal pathway is pushing pet owners into “buyer beware” situations.

Sandler, who is also a member of the Canadian Veterinary Medical Association’s National Issues Committee, says the CVMA and the CAVCM are jointly lobbying Health Canada for an amendment to

Part 14 of the Cannabis Regulations that would permit veterinarians to authorize cannabis therapy in animals.

“Given the increased risk that high-THC products have to pets, and the likelihood that edible and topical products will be particularly appealing to pets, an amendment warning label is imperative.”

“We’re also asking that Health Canada add a warning on THC products (that would say) ‘keep out of reach of children and animals’,” Sandler says. “Given the increased risk that high-THC products have to pets, and the likelihood that edible and topical products will be particularly appealing to pets, an amended warning label is imperative.”

The recent passing of the Farm Bill in the United States, Sandler notes, has caused a proliferation of hemp-derived CBD products in pet shops, grocery stores, and pharmacies south of the border. This stands in stark contrast to the regulatory situation in Canada. Sandler says that as long as Health Canada continues to classify cannabidiol as a prescription drug, it will be tightly regulated.

“If the status of CBD changes to Natural Health Product,” Sandler says, “we might expect to see CBD available ubiquitously, as it is in the United States.”

REGULATORY CHALLENGES

Silcox warns that if Health Canada fails to reclassify CBD as a non-prescription item, Canada will fall behind in the global market. Tight regulations, she says, have put Canada at a disadvantage on the world stage. Silcox advocates for a more balanced approach

Prescription drug or natural health product?

The Canadian Health Food Association and Canadian Hemp Trade Alliance are currently lobbying the federal government to reclassify CBD as a natural health product. Silcox says that if reclassification passes for human products, veterinarians will examine reclassifying CBD for animal products.

that allows for market opportunities without leaving CBD completely unregulated.

“The United States is a bit of a ‘wild west’ right now, so there does need to be some regulation,” Silcox says. “We need to ensure that products are being properly tested and labelled. When we (the CAVCM) met with the policy director for the Minister of Health, she said the fact that veterinarians weren’t given the authority to prescribe cannabis products was likely an oversight.”

Health Canada is planning to consider giving veterinarians prescribing authority at the next tri-annual review. But Silcox says three years is too long to wait.

“There are a lot of (animal) patients that won’t be alive in three years,” Silcox says. “And from a safety standpoint, pet owners are continuing to use cannabis products for their pets – products designed for human use. That warning label needs to be changed now.”

Addressing these many legislative problems though, is going to be a challenge. Smitherman says the

wheels of government turn slowly, even in the best of circumstances. He says governments often fail to make progress in certain areas because resources are being committed to other initiatives.

“As someone who had the privilege of running a large government department, it’s hard to deploy resources in one area when you already have a lot of resources focused somewhere else,”

Smitherman says. “So, in one sense, we’re suffering from all the progress that’s been made on the broader medicinal and recreational regulations. In the context of CBD, we don’t have an easy-topoint-to regulatory model.”

Smitherman says despite the lack of a regulatory framework, the industry is still in an exciting place. Some of the early players in the Canadian medical cannabis market, including Biome Grow, are now in a position to source CBD from indoor-grown, medical-grade cannabis.

ROAD FORWARD

Sandler hypothesizes that legislative changes may permit veterin-

arians to prescribe CBD in much the same way that Canadian doctors can currently authorize cannabis for human use through the existing medical channel. Whether CBD will be reclassified as a natural health product remains to be seen, Sandler notes, but companies like Grey Wolf Animal Health and cannabis producer CannTrust are in the process of developing safe and effective cannabis-derived products for all manner of animal species.

Should CBD be reclassified as a natural health product, experts say it would unleash a sales boom in the cannabis industry. Smitherman notes the regulatory environment is rapidly changing, but there are many reasons to be optimistic.

CBD is in a period of rapid definition with plenty of research and development activity in progress, and reclassification, he says, would create an entirely new cannabis market essentially overnight.

Mike Straus is a freelance writer living in Kelowna, BC.

Legal Matters

Continued from page 16

• quantity of the cannabis;

• percentage of THC and CBD by weight of the cannabis; and

• in the case of export, an import permit from the competent authority in the country of import.

A more expansive future

It is noteworthy that the Canadian government has also indicated that the import and export provisions operate in the context of Canada’s international drug treaty obligations. Given that Canada is

only the second country in the world after Uruguay to legalize the recreational use of cannabis at the federal level, the countries where cannabis can be imported from, and exported to, are exceptionally limited when viewed within the context of Canada’s international treaty obligations.

Additionally, current supply and demand issues create a domestic climate where there is no political incentive to expand the ability of Canadian companies to import and export cannabis. Domestically, we are in the midst of a supply shortage. Allowing licensees to export large amounts of cannabis would only exacerbate the problem.

On the other hand, allowing for more imports of cannabis would create economic challenges for current domestic licensees who have spent years and many millions of dollars becoming licensed and launching and expanding operations. A flood of imported cannabis from jurisdictions with low production cost, such as Africa, Central and South America, might be a boon for Canadian consumers but could easily put many domestic licensees out of business, costing thousands of people their jobs.

However, we are also currently in the midst of a sweeping wave of liberalization and legalization across the globe. In the not-too-distant future, it is safe to believe that many countries will have legalized cannabis for both medical and recreational purposes. This would lay to rest most of the treaty obligation concerns. Moreover, if history is any indication, Canada will be moving from an era of a domestic supply shortage to an era of oversupply sooner than later.

With the domestic market adequately serviced, loosening the export rules would allow Canadian companies to potentially profit by serving global markets that are just coming on-line and going through their own growing pains.

Global challenge

Conquering the international cannabis market.

By Mari-Len De Guzman

The European market is ripe for the picking for Canadian cannabis enterprises, but venturing into the market may not be as easy as many would believe.

Despite Canada being an early mover in the cannabis industry and well-positioned to take on global markets, panelists participating at the Lift Cannabis Business Conference (LCBC) held in Toronto in June cautioned there are multiple things to consider before jumping into the international cannabis market.

For starters, not all European jurisdictions are created equal. There are regulatory differences, consumer nuances and product preferences to consider.

Secondly, a European expansion may not be everybody’s cup of tea.

“There is a real opportunity to springboard ahead in Europe using some of the mistakes that we’ve learned at home, of which there’s been quite a few,” said Deepak Anand, co-founder and CEO of Materia Ventures. “However, it’s not for every Canadian company to go international but there’s certainly opportunities for a great chunk of companies to go abroad.”

Anand was part of a panel discussing opportunities for Canada to expand into the growing European cannabis market.

Going global also does not necessarily mean going big. There are good opportunities for investments in the European market, but not all companies can emulate the big LPs, like Aurora Cannabis, Amanda de Freitas, director at Red Fund Capital, pointed out.

“A huge part of our population is of European descent, so if you are a small guy

looking to take your business to Europe and you’ve got family and connections, you have the ability to set up a business,” she said.

But that’s not all it’s going to take, de Freitas added. “You can’t just come up with an idea; you have to have boots on the ground and be able to build that infrastructure. That’s very important. You’re turning economies. It’s a lot of education, it’s a lot of lobbying, it’s a lot of work.”

Figuring out the nuances of consumer preference and what products will work well in a particular market is also part of the homework.

Aurora’s chief commercial officer, Darren Karasiuk, talked about his company’s strategy when considering a new market.

“It’s critically important to have local market knowledge and understanding. There’s a whole lot of nuance between

The LCBC panel discussing opportunities for Canadian companies in the global cannabis market. (L-R) Amanda de Freitas, director, Red Fund Capital; Darren Karasiuk, chief commercial officer, Aurora Cannabis; Guillermo Delmonte, president, RAMM Pharma Corp; Deepak Anand, CEO, Materia Ventures; and moderator Laleh Bighash, dean of pharmaceutical and scientific affairs, Academy of Applied Pharmaceutical Sciences

Shield Your Yield

Sustainable Facility Disinfection for Yield Protection

SHYIELD™ One-Step Disinfectant Cleaners are the 1st disinfectants designed specifically for use in Cannabis Facilities with relevant use directions and efficacy claims. Registered with Health Canada, SHYIELD™ disinfectants can improve your sanitation program by ensuring:

Consistency — Prevent microbial contamination with effective products & protocols

Efficiency — Streamline sanitation processes with one solution

Sustainability — Protect your facility & the environment

Improve your sanitation program today.

SHYIELD.ca

the various countries. There’s also the integration part… that cross-pollination piece of it so you get the best knowledge transfer going both ways,” Karasiuk said.

CBD opportunity

Where the biggest opportunity for short-term revenue in Europe currently may be in CBD, according to Guillermo Delmonte, president and COO, RAMM Pharma Corp.

“We can have revenue (with CBD) in the short term; the entry barriers are very low,” Delmonte said. “If you want to start selling or get medical products into Europe, you have EU-GMP standards and requirements, the entry barriers are much higher, so you need much more investment, dedication and work in order to get those products.”

Still, Anand cautioned companies need to be “very careful” when navigating the European CBD market.

“Let’s not forget there’s domestic companies within Europe that are currently selling CBD that have a big chunk of the market. They are U.S. operators that are getting into black market,” Anand said, which will cause an imminent shake-up in that market.

European authorities might soon be cracking down on products currently being sold in the market. A recent report that investigated the contents of CBD products being sold showed varying degrees of discrepancies. The report found not all the products being sold are what they’re supposed to be.

“Some of them are downright unsafe,” Anand said. “So that whole market is going to be shaken up and there’s a real opportunity to get into that market as long as you know what you’re doing, what products are you actually launching, and that’s where you need to focus your strategy in.”

Southern exposure

No doubt, Europe is going to be the biggest cannabis market in the world, predicts Anand. And as much as Canada is able to bring the expertise of scale and regulatory compliance to the table, its U.S. counterparts cannot be ignored, not just their potential to become a significant player in Europe but in Canada as well.

“There’s opportunity right now to take brands from the U.S. into Canada,” said Tahira Rehmatullah, managing director of Hypur Ven-

the U.S. is a market that will always be in the company’s radar, but it’s not the end-all-be-all.

“For us there is a gigantic global opportunity, but the U.S. is certainly one that we’ve been working on for some time,” said Peter Aceto, CannTrust CEO. Although the Farm bill has made some progress south of the border, the regulatory details are something that still needs to be ironed out.

“I do think that Canadian licensed producers have an opportunity (in the U.S.) but we don’t have a lot of

“You have to have boots on the ground and be able to build that infrastructure.”

tures. “A lot of the brands in the U.S. right now are very regional… As retail here continues to grow, and as licences continue to roll out, you can take a lot of what the U.S. has already done in those regions and replicate it here.”

Rehmatullah was part of the LCBC panel, “The northern invasion: How Canada can capitalize on U.S. legislation,” which discussed the potential for Canada to play in the U.S. market and vice versa.

The ancillary businesses that serve the cannabis industry is a huge potential.

“When we think about cannabis we always just think about the product and the end-consumer and the path to get there. But there’s so many things along the way that we should all consider,” Rehmatullah said. Everything from software applications and technologies for retail to marketing and packaging, they all have the potential to grow alongside the cultivation and production side of the cannabis business.

For licensed producer CannTrust,

time in order to be a part of it. The opportunity is not just in the U.S., it’s a global one as well.”

Aceto stressed, however, that while he anticipates and is cautious about the potential flow of U.S. products into the Canadian market, his company still believes it’s important to forge partnerships with market leaders in the U.S. for knowledge sharing.

“The world is watching Canada and sees us as a leader in working on solving this problem about legalized cannabis,” Aceto said. “Any provider (in Canada) who has been in this industry and learned how to evolve and perfect it and do it in a regulatory compliant way… gets an opportunity outside of the U.S. to be listened to.

“I think we’ve built a good brand so far in terms of how this country has gone about doing what we do. I do think the opportunity is significant and can exclude the U.S. I think it’s an opportunity that shouldn’t be ignored, but I just think that that’s a choice,” the CannTrust chief executive said.

Re-growing Ontario

Cannabis producers rebuilding economies across the province

By Andrew Snook

In 2010 and 2011, the town of Smiths Falls, Ont., was a tough place to earn a living. Between 2007 and 2009, the small town of less than 9,000 residents had its economy devastated through the closures of the Hershey’s chocolate plant, Stanley Tools plant, and the Rideau Regional Centre; which combined, employed a total of nearly 1,500 people in the area. The closures of Hershey’s and Rideau Regional Centre were particularly harmful, and not just because they were the town’s two largest employers. Hershey’s was a major draw for tourism to the town, which meant further job losses and reduced town revenues followed; and the closure of the Rideau Regional Centre left many of its inhabitants calling Smiths Falls their new home, creating a greater strain on the town’s already stretched resources.

Closures of additional businesses followed, bringing the total job losses up to about 1,800 – taking what little air of optimism was left out of many of the town’s residents. I can say this great certainty, because I was there, working as a reporter for one of the local newspapers during that time. While covering stories for the newspaper and chatting with local residents, the atmosphere was often one of great negativity and hopelessness in regards to the town’s economic situation. When I left the newspaper and moved to Toronto at the end of 2011, I had hoped the town would find a way to rebuild, but I couldn’t fathom how it would overcome such losses.

Then in 2013, I read about a company setting up a small cannabis operation in

the old Hershey’s plant. When I asked old friends and acquaintances about the existence of this new entity, I was met with my first taste of optimism surfacing in the town. No one I spoke with back then knew that Tweed would one day transform into Canada’s largest Cannabis producer, Canopy Growth Corporation; but residents were excited that a company was willing to take over part of the old chocolate plant that had sat dormant for five years.

This spring I had the opportunity to travel back to Smiths Falls for the first time since the passing of the Cannabis Act, and what a difference it has made. Canopy Growth currently employs approximately 1,300 people in Smiths Falls, and the company is not done yet.

“They’re looking at hiring possibly another 500 to 550 people locally by the end of their fiscal year,” says Mayor of Smiths Falls Shawn Pankow during a meeting at the town’s Department of

The emergence of the cannabis industry in Canada has sparked new hopes for economic prosperity in towns where some of the biggest cannabis producers in the country are setting up shop.

Andrew Snook is a freelance writer based in Toronto.

Economic Development.

Pankow estimates that the company will be close to 2,000 employees a year from now and will boast over one million square feet of production space. Canopy Growth’s expansion has not only resulted in additional new jobs, but also an increase in demand for residential and commercial construction, higher property values, new restaurants and services popping up in town, and is expected to bring back tourism dollars with its new welcome centre and retail cannabis shop set to open in the near future.

“This year we’ll probably eclipse all the job losses, and overall, have a bigger economic impact,” Pankow says. “Certainly our sense of optimism has never been higher.”

Unemployment stands at about half what it was before Canopy Growth came to Smiths Falls, and the potential for the company’s employees to share in the riches is impressive.

“Every employee has stock options. Everyone from the guys trimming the plants to the executives,” Pankow says, adding that he recently chatted with a

woman in her forties who turned her luck around when she and her husband both decided to move to Smiths Falls to work at Canopy Growth. “She said, ‘A few years ago we had $2,400 in savings. Now, we have over $200,000.’ Multiply that by hundreds of people.”

Smiths Falls’ recent good fortune shouldn’t be entirely contributed to Canopy Growth, the town itself helped chart the path it is now on.

“In 2013, the town themselves was willing to allow a cannabis facility into their community,” says Canopy Growth’s vice-president of communications Jordan Sinclair, who adds that back then cannabis still battled a significant stigma.

Sinclair says his company’s team was very good about being transparent with the town and made modest promises in terms of employment and its use of the Hershey’s facility when they initially addressed the town.

“Bruce Linton (the company’s founder) had a good track record – no connection to organized crime. Just a high-tech professional that saw a changing landscape,” Pankow says.

THE GOOD FARM: 48North’s 100-acre outdoor farm in Brant County will be the site for cultivation and production of up to 40,000 kilograms of cannabis grown outdoors. The farm is expected to employ between 50 and 200 workers throughout the year.

Project SHARE received a donation of $25,000 from CannTrust, as part of the licensed producer’s We Care initiative. Project Share operates community gardens that grow organic produce for local food banks.

BUILT TO ACCELERATE GROW TH

Your fire. Our fuel. We put the brands that matter, in your hands, when you need them. With 6,000+ skus in stock across 11 North American distribution centers, Hawthorne is built to accelerate your growth.

And it’s not just a boost in employment that Canopy Growth wants to bring to Smiths Falls’ current residents. Sinclair says the company is interested in investing in building a place that attracts more people from outside of town to come and live there. The company invests in the town’s local theatre and has announced plans to help with the re-development of Smiths Falls’ old water treatment plant.

“I can’t imagine any other industry that could have come into town and changed our futures like this,” Pankow says.

NOT JUST WINE COUNTRY

Smiths Falls isn’t the only town in Ontario to benefit from a booming cannabis industry.

The Niagara Region, due to its prime agricultural lands, is now home to several cannabis production operations that have set up shop in towns throughout the region. One of those companies is CannTrust, which employs more than 400 people at its facility in Welland; and approximately 700 in total across Ontario when you include the company’s facilities in Vaughan.

CannTrust is heavily invested in the communities it operates within and believes in building positive relationships with the

residents of those towns and cities.

The company recently launched its We Care national social responsibility platform, which focuses on four key areas: lifting people out of poverty; health and wellness; safe consumption; and sustainability.

Morgan Cates, director of communications for CannTrust, says the We Care platform showcases her company’s special culture.

“We want to showcase how caring and giving the people in our company actually are,” she says, adding that the We Care platform originated from the company’s philosophy within its customer care team.

The first We Care partnerships announced were a $50,000 donation to the Canadian Alliance to End Homelessness (CAEH) for the non-profit’s Built for Zero campaign; a donation of $25,000 to Project SHARE; and a three-year commitment of $25,000 in annual donations to Hospice Niagara for its music therapy program.

For Project SHARE’s executive director Diane Corkum, who has worked with the organization off and on for the past 30 years, the donation from CannTrust was “a wonderful bolt of lightning from the sky.”

Project SHARE provides emergency foods to 126 families living below the poverty line every day in the Niagara Falls area. The organization runs three community and allotment gardens that grow 4,000 pounds of organic produce for local food banks. In addition to the $25,000 donation for the

Project SHARE provides emergency food items daily to 126 families living below the poverty line in the Niagara Falls, Ont., area.

And where there’s mold, there’s crop loss.

Unlike condensing technologies that can actually grow and distribute mold, Agam’s liquid desiccant dehumidification technology captures & neutralizes fungal spores, continuously cleaning the air.And since we use a salt solution, not refrigerants, we’re also helping make plant cultivation a lot greener.

Visit EnvirotechCultivation.com/agam to watch Agam VLHC in action. Plants, People, Passion

Project SHARE 2019 community garden season, CannTrust is donating volunteer hours and its knowledge as experts in cultivation.

Over the past three years, Project SHARE had been receiving its funding through the Ontario Trillium Foundation, but those funds had run out this past February; leaving the organization scrambling for new funding. CannTrust reached out to the organization to offer donations to cover the funding for materials and other needed funding for the 2019 growing season.

“It was a really nice surprise. They’ve been wonderful to deal with,” Corkum says.

Director of Hospice Niagara Carol Nagy attended the local launch of the We Care platform and thanked CannTrust for its support of the hospice’s music therapy program, designed to help people through one of the most difficult times in their lives.

“One of our dreams was to start a music therapy program because we know how music can touch our lives,” she says, adding that her organization spent years trying to search out corporate funding for the program without success.

Michael Caplin, general manager for CannTrust’s Niagara operations, said that the giving and caring

philosophies of his organization are something shared by all its employees.

“It has become our mantra that every CannTrust employee lives and breathes,” he says.

NORTHERN EXPOSURE

Although Southern Ontario has benefited greatly from the cannabis boom, at least one town in Northern Ontario is starting to reap the rewards of marijuana legalization.

Approximately 600 kilometres north of 48North’s headquarters on Queen Street in Toronto is the cannabis producer’s 40,000-sq.-ft. DelShen facility in Kirkland Lake, Ont., which was constructed in late 2015 and 2016. 48North received its cultivation license for the property in February 2017 and its sales license in June 2018.

This location has a maximum annual production capacity of 2,500 kilograms of cannabis. The only post-processing currently performed at the facility is for dry flower sales, and for pre-rolls for the Ontario and Alberta markets, says Jeanine Lassaline Berglund, vice-president of operations for 48North.

The DelShen facility currently employs close to 40 full-time staff, a few students in the summertime, and

Tweed now employs 1,300 people, helping operate 168,000-sq.ft. of licensed production facility.

Canopy Growth’s Tweed farm in Smiths Falls, Ont., was previously the site of the Hershey’s chocolate factory. When the factory closed, the town was devastated with significant job losses.

expects to hire additional staff in the future. The company partners with First Nations communities in the area to utilize their local agricultural knowledge, and for access to local talent.

“In some cases it comes at a subsidized rate, which is building skills for those groups who don’t necessarily have access to skill building, while simultaneously meeting our needs,” Berglund says.

When the company set up shop in the small town of less than 8,000 residents, the operation initially went fairly unnoticed.

“People are coming with transferrable skills who might not be able to grow anything, but if you know finance, or done some work in HR, or you’re in IT or in manufacturing and engineering – all of those things will play a role.”

“At the dawn of this industry when everything was indoors it went relatively unnoticed for a long time… but as soon as you put a farm in next door, all of a sudden everybody is on board or against you. Those are the risks,” Berglund says, adding that residents mostly welcomed the facility as a new option for employment. “Particularly in that area, gold mining is a significant employer. If you want to find other kinds of work you might be forced to leave the community. But for the people who are looking to do something a little bit different, or are not pre-disposed to be in that industry, the cannabis industry offers a good living, a nice place to work.”

In addition to the 40 people employed at Kirkland Lake, the company employs another 25 people in Toronto and 15 people in Brantford; which is in the midst of an expansion with the company’s recent approval for outdoor cultivation at its 100-acre Good Farm in Brant County. The Good Farm out-

door cultivation facility is expected to produce approximately 40,000 kilograms of cannabis. Berglund says this location has the potential to employ 50 full-time staff and upwards of 200 seasonal employees in peak season.

SCHOOL IS IN