COOKING WITH CANNABIS

Fluence creates advanced lighting solutions for controlled environment crop production.

We apply the latest research in photobiology, evidence-based design, precise engineering and advanced technology to foster a healthier and more sustainable world.

Learn more at www.fluence.science

From the editor

By Mari-Len De Guzman

Pink is the new green, or not

At a recent gathering, I found myself in conversation with my female friends about cannabis and Canada’s legal market. My friends knew what I do for a living, so naturally, I ended up being on the receiving end of many curious questions, about cannabis consumption, smoking, THC, CBD, edibles, topicals, and everything in-between. I tried my best to answer many of their questions, but I certainly don’t consider myself an expert. We even ended up Googling the answers to some of the questions.

What I did notice from that exchange is the varied ways people reacted to the subject of cannabis, which was largely dependent on the context of the conversation. A discussion about smoking weed or vaping almost certainly elicited guarded reactions, conjuring up past misconceptions about marijuana and illegal drugs. “Why do people get high?” “Can you get addicted to marijuana?” “Is it safe?”

But things took a 360-degree turn once discussions turned to medical marijuana and the health benefits of cannabis. The women, especially, were curious to know how it can help their current ailments and discomforts. “I don’t want to smoke it, but I want to try this CBD stuff.”

“Can it help with my back pain?” “Do I need a doctor’s

prescription?” “I want to try it but I don’t want to get high.”

As Cannabis 2.0 gets underway and the market for cannabis-infused products continues to expand, the opportunity for cannabis producers to redeem themselves from a series of lower-than-expected revenue results becomes more evident. One just has to sit in one of these conversations I just had with my friends to realize that CBDbased products have the potential to blow up the market. And women consumers will be a significant slice of that market.

Just making everything pink as a branding strategy is not going to capture the female market. Product quality and consistency must be a top priority.

Generally speaking, women are the most powerful consumers in the world. Harvard Business Review says women control $20 trillion of the world’s annual consumer spending. They drive 70 to 80 per cent of all consumer spending. It makes business sense to invest marketing dollars to target women consumers. For the cannabis industry, the potential is in health, wellness, and skin and beauty products.

The Global Wellness Institute estimates the global

wellness market at $4.2 trillion, with women controlling 85 per cent of it. Denver, Colorado-based Cannabis Consumer Coalition reported that women have overtaken men in cannabis consumption, with 53 per cent having tried it compared to 43 per cent of men.

Dataset after dataset reveals the vast potential for women-focused brands. Cannabis 2.0 products are in a strong position to grab hold of the female market. Keep in mind that women purchase products not only for themselves but for family members as well, whether it’s for their kids, husbands, parents, partners, friends.

The vast buying power of women comes as a doubleedged sword, however. They can raise you up as quickly as they can take you down. When they love a product they will stick to it and tell their friends about it. When they’ve had a bad experience with a product or service, they will not likely be a repeat customer – and tell their friends about it.

Just making everything pink as a branding strategy is not going to capture the female market. Product quality and consistency must be a top priority for Cannabis 2.0.

I am looking forward to seeing wellness and beauty products that the cannabis industry will whip up. And I know from speaking with my friends that this is an area they are excited to explore as well.

January/February 2020 Vol. 4, No. 1 growopportunity.ca

EDITOR Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

ASSOCIATE EDITOR Jean Ko Din jkodin@annexbusinessmedia.com 437-990-1107

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexbusinessmedia.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexbusinessmedia.com 905-431-8892

ACCOUNT COORDINATOR Mary Burnie mburnie@annexbusinessmedia.com 519-429-5175 888-599-2228 ext 234

CIRCULATION MANAGER

Jay Doshi

jdoshi@annexbusinessmedia.com 416-510-5124

MEDIA DESIGNER

Brooke Shaw

GROUP PUBLISHER/VP SALES Martin McAnulty mmcanulty@annexbusinessmedia.com

COO Scott Jamieson

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

1 year subscription (6 issues: Jan/Feb, Mar/Apr, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec):

1 year offers: Canada $25.50 + Tax

USA $47.00 CDN FGN $53.50 CDN GST # 867172652RT0001

SUBSCRIPTIONS

Jay Doshi jdoshi@annexbusinessmedia.com Tel: 416-510-5124 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

We recognize the support of the Government of Ontario

SHYIELD® One-Step Disinfectant Cleaners are the 1st disinfectants designed specifically for use in Cannabis Facilities with relevant use directions and efficacy claims. Registered with Health Canada, SHYIELD® disinfectants can improve your sanitation program by ensuring:

Consistency — Prevent microbial contamination with effective products & protocols

Efficiency — Streamline sanitation processes with one solution

Sustainability — Protect your facility & the environment Improve

Alberta chocolatier acquires licence for infused confectionaries

Alberta-based artisan chocolate maker, Choklat Inc., has received a processing licence to produce a line of infused chocolate bars, drink mixes and infused sugar.

Choklat CEO Brad Churchill said the company has been developing recipes for the product line for two years and is looking to bring products to retail shelves in March, allowing for the Health Canada notice period.

“Receiving the processing license from Health Canada is a significant achievement and milestone,” said Churchill in a statement on Jan. 14. “Our high-quality cannabis-infused bars and beverages will be based on our own chocolate recipe made from a special cocoa bean sourced from the jungles of South America.”

Founded in 2008, Choklat is one of the first craft chocolate manufacturers to be established in Western Canada. It imports premium cocoa beans from around the world which is then processed by expert chocolatiers in its Calgary facility. Choklat products are available in more than 150 retail outlets across the country, including Safeway and Sobeys stores in Western Canada. Choklat’s non-infused chocolate bars are also available in some stores in the United States.

The announcement was made by cannabis eCommerce company, Namaste Technologies Inc., which holds 49 per cent equity position in the company.

“We invested in Choklat not only to maximize the significant market opportunity for cannabis-infused edibles but also because we see Brad as a true craftsman in his trade and the quality of his products speak for themselves,” said Namaste Technologies CEO Meni Morin.

PRICE MATCH

Statistics Canada’s data shows Quebec has the lowest legal cannabis prices in Canada at $7.88 per gram, while Ontario has the highest illegal cannabis price with an average of $6.21 per gram.

Cannabis pricing gap widens: Stats Can

The gap between what Canadians pay for legal and illicit cannabis is widening – a sign experts say points to the need for the marijuana industry to make prices a priority this year.

Statistics Canada said Jan. 23 that the average price of legal cannabis increased to $10.30 per gram between October and December 2019 from $9.69 per gram the year before.

The change came as the average price of illegal cannabis fell to $5.73 per gram in that fourth quarter from $6.44 per gram a year earlier and as the overall average price of cannabis rose to $7.50 per gram, an increase from $7.46 per gram a year earlier.

The agency based its conclusions on price quotes gathered using its StatsCannabis crowdsourcing application between Oct. 1 and Dec. 31.

The data comes as the industry is grappling with how to minimize the underground cannabis market – one of the key reasons why the country chose to legalize recreational cannabis in October 2018.

Some dispensaries reported being busier than before in the months following legalization, even as police departments and governments conducted raids to

force many illegal cannabis stores to shut their doors. The industry’s efforts to stamp out the illicit market, however, have been plagued with supply constraints and in some regions, a lack of physical cannabis retailers, hampering access for those unwilling or unlikely to buy online.

“Legal cannabis has been priced much higher than the black market ever since legalization day,” said Michael Armstrong, associate professor at the Good man School of Business at Brock University in Ontario.

“I think for any of the mass market producers, (price) has to be their objective for this year, if it hasn’t been already.”

In a bid to undercut the illicit market, licensed producer Hexo Corp. rolled out Original Stash, a 28-gram product in Quebec cannabis stores for $125.70 with taxes included, or $4.49 per gram, in October.

Hexo chief executive Sebastien St-Louis said his company was able to offer it at that price for various reasons, such as less plastic packaging for the larger size, its increased production scale and lower electricity costs in Quebec. – TARA DESCHAMPS, THE CANADIAN PRESS

Hexo’s Original Stash is priced at $4.49 per gram in a bid to undercut the illegal market PHOTO:

Tailor-made solutions for cannabis crops

Our best sachets yet!

Control Spider Mites, Russet Mites, Thrips, White y

No carrier material on the crop

Low and high humidity resistant

Quick release and easy to use

Preventive and corrective solutions

Industrial compostable

In the news

Thousands flock to OCS website for Cannabis 2.0 products launch

Ontario cannabis shoppers scooped up thousands of edibles and vape products within an hour of them going on sale for the first time on the Ontario Cannabis Store’s website.

The online retailer experienced 2,000 transactions on Jan. 16 in the hour after 70 products – cannabis-infused chocolates, cookies, soft chews, mints, tea and vapes – were made available at 9 a.m. local time.

Some products sold out within a half-hour, said the cannabis distributor’s spokesperson Daffyd Roderick.

“At 8:59 a.m., we had 3,000 people in the lobby hitting refresh, waiting to get online, so there was obviously some excitement in the marketplace,” he said.

The rollout is part of Cannabis 2.0, where the country is allowing a second wave of products like edibles, extracts and topicals to hit the market following the October 2018 legalization of cannabis in Canada. Such items were approved for sale in Canada in mid-December, but several provinces, including Ontario, delayed their rollout.

When the OCS website was first launched and the first round of cannabis products went on sale in 2018, Roderick said the site experienced “high demand,” causing online deliveries to take as long as five days to arrive. Ontario Premier Doug Ford said in the first 24 hours, the OCS processed 38,000 orders.

Roderick said the online debut of the edible and vape products went well, but acknowledged that there were “a few bumps.”

“Because there were so many people simultaneously refreshing, their page would drop and then they would hit refresh a couple times and they would get back,” he said.

“It’s similar when you’re buying concert tickets or anything else where everyone is online trying to do the same thing at the exact same moment, so we did face some challenges but that’s completely sorted itself out now.”

When shoppers did make it through to the site, which was down between 12:01 a.m. and 9 a.m. on Jan. 16 to prepare for the launch, Roderick said they were most interested in soft chews.

Several packs were priced for between $6.65 and $12.35 and came in flavours like raspberry vanilla, peach mango, pineapple orange, apple green tea and grapefruit hibiscus.

Roderick figured their popularity stemmed from soft chews having a “convenience factor” and because “not everybody loves chocolate.”

There were only three kinds of chocolate left for shoppers by noon, when The Canadian Press reviewed the website.

Roderick would not share when more stock will arrive or how much of each product was available for sale, but said its allotment is equal to physical stores and the distributor has a limited supply it has been provided with by licensed producers.

From purse to pot: Industry leaders warn against knock-off cannabis

LAS VEGAS – Counterfeiters are setting up shop in the cannabis market with increasing availability of knock-off cannabis products with packaging that’s made to look like it came from a licensed producer.

Canadian cannabis industry leaders raised concerns about the challenges for the legal market to safeguard against counterfeit cannabis – and the problem is expected to intensify as licensed producers start to build stronger brands. They spoke at a panel at the recent MJBiz Conference in Las Vegas on Dec. 11-13, 2019

“It is an issue because a lot of companies are devoting a lot of money developing unique intellectual property, and they run the risk of having that counterfeited,” Mitchell Osak, consulting partner at business advisor firm MNP based in Calgary, said in an interview with Grow Opportunity.

He urged Canadian cannabis companies to put more attention on brand protection and intellectual property to safeguard against counterfeiting.

“On the other hand, you can’t stop the innovation engine,” he pointed out. “You can’t rest on your laurels and say, ‘OK, we’re going to develop a new vaping device and we’re going to rest there.’ You have to constantly keep that going and stay ahead of the counterfeiters.”

Some evidence of counterfeit cannabis have surfaced online, according to Jeannette VanderMarel, CEO of Beleave. In some of these products the packaging were made to look like a legal product so that people can carry them around in public.

“It is a challenge and we are going to see more knock-offs. Especially once we do create good, strong bands in Canada, we’re going to see copycats, whether in the United States or in Europe, those are things that are very difficult for us to control,” VanderMarel told Grow Opportunity.

“(The vape crisis) has created hesitancy around vaping but it also created a lot of education around the importance of having a legal product.”

- Jeannette VanderMarel, CEO, Beleave

Counterfeit cannabis is not only an economic problem for licensed producers, it can also be a liability issue for producers, she said.

“We’re not going to see any difference from purses to cannabis, unfortunately. It’s scary because there is liability if you don’t protect your patent and you know it’s being knocked off.”

Public awareness and education will be key in countering the counterfeiters, said Osak. He cited the vaping crisis, which has consequently raised awareness around illegal versus legal, regulated products. Vaping and vape products have come under attack recently following a spate of lung injuries that led to the death of nearly two dozen people in the U.S. Vaping has been directly linked to these incidents.

“The vape crisis, as bad as it’s been for all those unfortunate people who had gotten sick in the past, in a way it has shone the light on the dangers of illicit or black market or counterfeit product,” Osak said.

“I foresee over the medium to long-term it will give more of a boost to legal products that are made by reputable manufacturers and sold through legitimate channels.”

The crisis had been a two-edged sword, said VanderMarel. “It’s created a hesitancy around vaping but it also created a lot of education around the importance of having a legal product.”

Much like expensive, luxury-brand purses, cannabis products are becoming a target for counterfeiters and industry leaders are calling for vigilance.

Spotlight: MJBizCon 2019

Torsten Kuenzlen (2nd from left), former CEO of Sundial Growers; Mitchell Osak (3rd from left) of MNP; and Jeannette VanderMarel (right), CEO, Beleave, discuss the market outlook for the Canadian cannabis industry at MJBizCon.

“It’s not about having one great idea; it’s about building a process, a system and culture to try out some bad ones.” Netflix co-founder and first CEO Marc Randolph was the keynote speaker at MJBizCon in Las Vegas last December.

MJ BizCon 2019 featured more than 1,300 exhibitors and 180 speakers. MJBizCon 2020 will be held on December 2 – 4, 2020, in Las Vegas.

Corporate governance an emerging priority for Canadian cannabis firms

LAS VEGAS – Good governance is emerging as among the highest priorities for Canadian cannabis companies in 2020, as organizations get a better handle on operational processes and develop more effective metrics and key performance indicators (KPI).

This was highlighted in a panel discussing the Canadian cannabis market outlook for 2020, held at MJBizCon 2019 in Las Vegas.

MJBizCon 2019 facts

Exhibitors: 1,300+

Education: 70+ sessions, 180 total speakers

Attendees: From 75 countries, including the US, Canada, Israel, UK, Colombia, Australia, Netherlands and more

Pointing to a recent report on governance ranking among Canadian corporate boards, Torsten Kuenzlen, then CEO of Sundial Growers in Olds, Alta., said the cannabis industry needs to do better in the corporate governance game.

“Most of you have seen the good governance rankings come out recently and cannabis companies don’t feature very highly on those rankings. In fact, it’s very much towards the bottom,” Kuenzlen said, referring to the Globe and Mail’s recently released Report on Business.

Kuenzlen added, however, that as cannabis corporate leaders overcome the initial challenges of building multimillion-dollar companies in such a short time, good governance will increasingly become a priority for them.

“There are so many things that you have to do as CEO, as the leadership team of the company. But that doesn’t excuse not being there when we need to be on governance. We had to work through our priorities, we need to build capacity, we had to hire and train people, we had to get the products out to service the market. The operational challenges are many. I think now that we are getting on top of those, it’s time to

add more tools and that’s where governance comes in,” Kuenzlen pointed out.

Ensuring diversity among corporate boards in the cannabis industry will also be an emerging priority as corporate governance moves up the hierarchy of corporate priorities, said Jeannette VanderMarel, CEO of cannabis licensed producer Beleave, based in Hamilton, Ont.

As one of the first female CEOs in Canada’s young cannabis industry, VanderMarel understands the challenges of navigating a male-dominated industry.

“Less than five per cent of board seats in Canadian companies are held by female. There are four female CEOs in the cannabis industry (currently). We really need to encourage and mentor women to take on these roles. I think it’s leading by example,” said VanderMarel, who was part of the Canadian Market Outlook 2020 panel at MJBiz Conference.

Cannabis companies are also beginning to look at resiliency and business continuity as part of their priorities for 2020, said Mitchell Osak, national cannabis advisory services leader at Calgary-based business advisory firm MNP.

“There’s also big awareness and interest in cybersecurity and protecting the data of your firm and the data of your customers, particularly in medical cannabis,” Osak said. “We see a significant push there and that is driven significantly by our internal clients as well as external stakeholders and investors. They want to make sure there are no massive blindspots that can cripple their companies.”

PHOTOS:

Q&A: Michael Straumietis, CEO, Advanced Nutrients

Behind every high-quality cannabis yield is great nutrition. Over the last 20 years, Advanced Nutrients has been providing growers the nutrients to grow bigger and better buds. Michael “Big Mike” Straumietis is the man behind this $90-million-a-year empire. But Straumietis is not just your ordinary businessman; he has spent the last 36 years in the cannabis space advocating against prohibition, engaging plant researchers and scientists, donating significant sums to help patients get access to medical marijuana, and even creating a political party in Bulgaria to fight against government corruption. Grow Opportunity caught up with Straumietis in Las Vegas during MJBizCon in December.

Grow Opportunity: Canada has just passed one year of legalization. What are your observations of how the industry has fared so far?

Michael Straumietis: People are rushing into a space that they don’t understand. Even the money guys aren’t understanding it and they are not seeing it. They are treating it like it’s a regular space – and it’s not. This is highly regulated space. Not only that, it’s very new and countries have to make decisions on what they are going to do. The path to eventually where we want to go is going to take some time. What is happening is people are burning through cash because of that. I will tell you this, in five years 90 percent of these companies that are here today will not be in this hall because they’re just going to run out of money because the business isn’t there. Certain sectors are doing better than others. If you’re on the touch side and you’re growing and you got a product, you have got to pace yourself. This is a marathon, it’s not a sprint. People are treating it like it’s a sprint, and you see what their burn rates are when it comes to financing. Eventually those investors are going to throw their hands up. In fact, they’ve already done that in Canada as you’re well aware. Investments have slowed down so the market can stabilize and see what’s really going on.

Canada produces $16 billion worth of cannabis every year in a marketplace that is $4 billion. I predict very easily three quarters to 80 per cent of the businesses from Canada will go out business or will be absorbed by another company. There will probably be three big players out there left standing when this is all said and done.

GO: One of the biggest challenges for the legal market is the price gap between the legal products and illicit cannabis. How important is it for the industry to address this?

MS: That’s the biggest issue is the black market. They have not controlled the black market and until they do, investors are not going to realize the full profit potential that’s actually out there. In my particular sector, it doesn’t really matter. It doesn’t matter if it’s black market or if it’s a licensed producer; they need fertilizer to grow their cannabis. So either way, I’m in a position

to win. However, I would like to see the legal market thrive. I would like to see the black market controlled even further than what they’ve done because it’s going to be essential to this industry growing the way that they need to grow.

If you look around, all the technologies that are here at this show, it’s absolutely amazing. If you have said five years ago to me that this is what it’s going to look like, I would have had a hard time wrapping my head around this enormity of what’s going on at this show today at MjBizCon.

GO: Where are the potential opportunities for growth and higher revenue for licensed producers?

“This is a marathon; it’s not a sprint.”

- Michael Straumietis, CEO, Advanced Nutrients

MS: Let’s look at the price of what it costs to grow. Indoor crops are going to be somewhere between $400 to $700 per lb. If you’re growing in a greenhouse, it’s somewhere between $100 to $150 per lb. If I grow outdoors, it’s going to be about $12 per lb. So you’re going to see a lot of outdoor growers. You’re still going to have indoor craft growers, you’re going to grow at the very, very pinnacle out there, like anything. They are the ones that are going to survive.

They are going to look where labour and land are cheap and they are going to produce this. They are going to make what’s called recombinant products because that’s the only way you can ensure quality whether it’s in London, Los Angeles or Tokyo. You have to be able to take that plant apart and recombine it in a way that you can replicate it every single time.

GO: You’re organization also invests in research and development. What do you see as lacking in the industry when it comes to research and where are the opportunities to do R&D?

MS: There’s 115 different cannabinoids and 120 different terpenoids and there’s 529 different chemicals in cannabis that have been discovered to this date. I have to say that we are at the tip of the iceberg. We know very, very little about the potential of those plants. We are unlocking it very quickly. And so, when you ask that question, research comes to mind.

Research is the single most important thing for us moving forward and governments have to realize that and allow us to research that plant unimpeded, and be able to then license that and get it to marketplace without spending $300 million or so to do that. There has to be a better way of doing this.

GO: What has been the biggest takeway for you from the legalization of cannabis?

MS: Slow down in the marketplace and think about the moves that you’re going to make more carefully. In the U.S., I would be very careful if you’re a medical marijuana state only and that’s because the FDA hasn’t come out with the regulations yet. For any medical claim that you want to make for medical marijuana, you’re going to have to spend a lot of money – $50 to $90 million or more – to be able to make that claim. So if you’re investing in medical marijuana, be aware that there’s going to be some very hard FDA regulations coming down. – MARI-LEN DE GUZMAN

Vantage Point

By Christina Casile

10 design considerations for your cannabis retail store

As Canadian regulators issue more cannabis retail licences, cannabis companies venturing into the retail space should put more thought into the look and feel of the store. Put on your designer hats and consider these 10 points when planning your retail store build.

LOCATION. LOCATION. LOCATION.

These three words are the mantra of real estate professionals. And yes, your retail location is essential. Keep in mind that things you don’t see while walking through a prospective site could impact your success the most.

Regulations like local building codes and ordinances dictate the size, location and layout of your store. You must research local laws to ensure your building and its location are compliant with the codes.

“I’M CALLING SECURITY!”

The rules and regulations for maintaining the security of cannabis products often influence the design of a retail outlet, but it does not need to limit it. After you have a compliant plan for the ingress and egress of delivery vehicles, employees and customers, your imagination can run wild.

BRANDING IS MORE THAN YOUR LOGO.

Translating your brand’s message through the design of your store is a challenging but significant feat. It creates a dynamic atmosphere where customers feel engaged and energized.

Proper lighting, accessibility and connectivity are some key design elements to incorporate into your cannabis retail store.

A brand is not just an identity. It is your company’s culture, exemplified by the space. Your store needs to do more than sell products. It should inspire customers to return by connecting them with the emotions and vibe that your brand conveys.

FIRST IMPRESSIONS ARE LASTING IMPRESSIONS.

The saying, “you never get a second chance to make a first impression,” is right on the money when considering the design of your cannabis retail store. The increasing acceptance of marijuana has diversified the demographics of your customer base. The design of your store needs to offer a positive environment for consumers ranging in age and backgrounds, so they feel comfortable in their exploration.

ACCESSIBLE MEANS REACHABLE.

Due to various medical conditions, some of your customers may require wheelchairs or crutches. Canada’s federal and provincial accessibility regulations may dictate that your retail location must be accessible to people of all abilities, which entails building a ramp anywhere there are stairs. Even inside, your cannabis store should support an enhanced, accessible experience. Include counter levels for customers in wheelchairs and adequate space for maneuvering to reinforce accessibility within your retail store.

DECODING DELIVERIES

It is your responsibility to ensure a secure environment for product delivery. I recommend an attached, pull-in garage or loading dock for

Christina Casile is a Philadelphia-based interior designer with more than 20 years of experience. She is the owner of Design 710, which specializes in retail and production strategy, brand creation, and customer communications focused on the cannabis industry.

shipments that will allow drivers to pull their vehicles completely into the facility and enable the external door to be closed and locked. The additional layer of security not only keeps your employees and business safe, but it also allows your vendors to feel more comfortable when delivering.

GIVE THEM A BREAK

Your employees are your front-line staff; therefore, you will need to invest time to train them in safety protocols and emergency procedures. Don’t forget that they are humans too, and working in cannabis retail can be tiring like any other retail environment. Employees are typically standing on their feet all day, interacting with customers. If you want to keep your employees’ morale high, consider implementing a break room for them to take a moment for themselves.

TAKE A MEETING

Many retail store owners forget to include a conference or consultation room when planning the layout of their facilities. While it is a retail location, you are providing much more than products to a consumer. To some of your customers, you are providing medicine. A private consultation space can be utilized for those seeking information on potentially sensitive topics such as cannabinoid therapy and application methods. You can also use this addition as a conference room for meetings with potential employees and vendors without bringing them inside the secure area of your facility.

LET THERE BE LIGHT

Proper lighting is critical to product presentation and the atmosphere of your retail space. You cannot depend on harsh, fluor-

escent ceiling lights to sell your products. The use of track lighting and smaller lights that focus downward help bring out the color and texture of your products without producing a glare.

RETAIL THERAPY

Your product has value and should be displayed in a way that conveys that value. The goal is to encourage customers to keep browsing. Take a lesson from other upscale retailers, such as jewelry stores, opticians, and perfume boutiques. These displays are organized, layered and visually appealing. There are a lot of decisions that go into designing a successful cannabis retail store. Relying on the expertise of architects and interior designers who know the “ins and outs” of store design will help you get up and running more quickly and profitably.

Legal Matters

By Lei Liu

To grow and protect

Canada has had its first year of legalization of recreational cannabis and recently commenced the official legalization of Cannabis 2.0 products (edibles, extracts and topicals). Canadian cannabis growers and retailers area all vying for the attention of consumers with different brands and strains of cannabis in a market that is heating up very quickly. While trademarks play a significant role in brand protection, patent and plant breeder’s rights (PBR) are two main forms of intellectual property (IP) protection that offer benefits for plant strains. The requirements for obtaining patent and plant breeder’s rights are different, as is the scope of protection afforded. A sophisticated grower should be mindful of both rights in order to build a balanced IP portfolio with maximum protection.

THE ACT

Under the Plant Breeders’ Rights Act, a plant breeder may obtain legal protection of a new “plant variety,” namely, a plant grouping defined by a set of unique, genetically-governed characteristics that will not change upon reproduction of the plants in the grouping.

REQUIREMENTS

To obtain PBR, an applicant must demonstrate that the variety is: new (the sale of a variety prior to applying for PBR is restricted); distinct (a variety must be measurably different from all varieties of common knowledge, which are known to exist at the time the application was filed); uniform (a variety must be sufficiently uniform in its relevant characteristics); and

stable (a variety must remain true to its description over successive generations).

Examination of whether the requirements for distinctness, uniformity, and stability are met involves field trials, a site examination, and submission of information by the applicant. This could represent a challenge for growers who may not have the necessary knowledge, skills or facility to conduct field trials and accommodate site examination.

BENEFITS

Once granted, PBR for a hemp or cannabis strain lasts 20 years, and a PBR holder may bring an action in court against any party who infringes its exclusive rights. These include producing and reproducing the propagating material of the variety; selling the propagating material of the variety; importing or exporting the propagating material of the variety; and authorizing (conditionally or unconditionally) the doing of any of these acts. The scope of protection afforded by PBR is limited to a specific plant variety.

PATENTS

In contrast to PBR, patent rights

can protect one or more novel and inventive technical features that can be shared by various hemp or cannabis strains, or even different plant species. For example, if through genetic research, one unique characteristic of a cannabis strain (e.g., a specific cannabinoid profile) can be attributed to one or more genetic markers unique to the strain, it may be possible to obtain patent protection for any cannabis strains that have been genetically modified to incorporate the genetic markers.

PATENT REQUIREMENTS

In order to obtain a patent, an invention must be directed to a patentable subject matter, and must be novel, non-obvious and useful.

Plants are not patentable in Canada (in contrast to certain jurisdictions, such as the United States) because our laws provide that “higher life forms” (which includes plants as well as animals) are not patentable subject matter. However, a cell of a higher life form, methods of making higher life forms, as well as use of a higher life form, may constitute patentable subject matter. Therefore, if a breeder or grower has created a new cannabis cultivar and the cells of the new cultivar can be identified by technical features (e.g., genetic modifications), it may be possible to protect the cultivar and any other cultivars having these technical features via patents.

Unfortunately, traditional breeding methods are not eligible for patent protection under the current practice guidelines of the Canadian Patent Office.

Examination of whether the requirements for novelty, non-obviousness and utility are met does not involve any field trial or site examination, although data are often required to support the advantages of an invention claimed.

Lei Liu, is a patent agent and senior associate at Smart & Biggar. He harnesses his knowledge of biotechnology, biological science and chemistry to help clients protect their valuable innovations.

Genetic modifications to a cannabis cultivar may be subject to patent protection in Canada.

For novelty and non-obviousness, the Canadian Patent Office generally will carry out a search of known patent or scientific literature databases to identify whether an invention has previously been disclosed or rendered obvious by what is known.

PATENT BENEFITS

A granted patent provides its owners with the rights to stop others from making, using or selling the invention protected by the patent for a maximum of 20 years from the day the patent application is filed.

PLANT BREEDER’S RIGHTS VS. PATENTS

So if a grower has obtained a novel cannabis strain with unique characteristics, how should the grower decide whether to

pursue patent protection, plant breeder’s rights, or both?

PBR may be preferred over patent if the grower has the capacity to conduct field trials and accommodate site examinations, but does not understand the genetic factors that lead to the characteristics of the strain. On the other hand, if a genetically modified cannabis strain (for example, strains with altered cannabinoid profiles and strains with altered resistance to mould or pests) is developed, it may be possible to protect the genetic modification itself without being limited to a particular strain. That is, in the latter scenario, the scope of patent protection may be broader than PBR, rendering patent a more attractive option. Of course, in many instances, obtaining both PBR and patent could be the optimal outcome in order to maximize protection.

FREEDOM-TO-OPERATE

One important IP consideration for companies interested in entering the cannabis field or developing cannabis products is freedom-to-operate (FTO). While it is expected that a large amount of cannabis-related patent applications have been filed in recent years, many of these applications may remain in the 18-month confidentiality period (patent applications are generally not published until 18 months from the earliest priority date) and cannot be detected by any search. Therefore, even if a FTO search does not reveal any potential patent barrier for product entry in a given market, companies should be alert to the rapidly evolving patent landscape and consider updating the FTO search regularly, especially when new market intelligence is obtained about potential competitors.

We focus on the automation of

indoor farming

So you have full control over the growth of your cannabis plants

The process computer for Plant Empowerment

Hoogendoorn’s next generation iSii monitors and controls all climate,irrigation and energy equipment in all types of facilities such as greenhouses and buildings. The iSii is equipped with advanced controls that work according to the principles of Plant Empowerment. This way light, temperature, humidity and CO2 are aligned with each other for a maximum photosynthesis. In addition, to prevent water stress, irrigation is driven by the evaporation energy and water balance of the crop. With the iSii process computer, you set the base for high quality production.

info@hoogendoorn.ca | www.hoogendoorn.ca

COOKING UP THE FUTURE OF EDIBLES

A look inside the burgeoning food trend that will shape the cannabis industry

By Jean Ko Din

Canada’s food culture is about to change. Cannabis 2.0 has opened the doors to a new wave of products that are expected to inject $2.7 billion into the Canadian market in the first year. According to Deloitte’s 2019 study, edibles and infused beverages are the top two product types that Canadians are most eager to try. Together, edibles ($1.6 billion) and infused beverages ($529 million) are said to account for $2.1 billion or almost 78 per cent of the total revenue.

Major brands from across the country have been gearing up for extracts legalization for years. Leading up to Oct. 17, 2019, cannabis brands were doubling down on research and development to be ready for their own infused products to launch in 2020.

Outside of the industry, major food brands, like Edible Arrangements, Molson Coors and Constellation Brands, were racing to partner with Canadian cannabis producers

so that they could get their own piece of one of the fastest growing industries in the country.

With the diverse potential of this new range of product types, Grow Opportunity looks at the different ways the industry is leveraging Canada’s newest food trend.

THE HIGH LIFE

Luxury cannabis bars and cafés are cropping up in trendy neighbourhoods all over the country, but byMinistry wants to make its name as Canada’s high-end cannabis lifestyle hub.

Last summer, Tokyo Smoke cofounder Lorne Gertner announced his plan to build a new kind of cannabis space on the same foundations as the original Tokyo Smoke café in downtown Toronto. The 8,000-square-foot future home of byMinstry on Adelaide Street will have three dedicated spaces for food, art and design.

The flagship location was slated to open in late 2019 but construction has forced the company to postpone its opening to Winter 2020. Still,

buzz for this upcoming high-end, high-culture space continues after the announcement that top chef Ted Corrado will be joining its executive team.

Corrado is a former executive chef for the Drake Hotel, Drake Commissary and Drake Devonshire. Now as byMinistry’s culinary director, Corrado is in charge of building the “cannabistronomy” hub for the lounge. He will also be developing the brand’s new cannabis culinary school, Lab byMinistry.

The first of byMinistry’s culinary experiences include an Enlightened Dinner Club, which launched in January this year. These private dinner parties – which are only re-

Buttered leeks, smoked black cod, Canadian sturgeon caviar beurre blanc infused with cannabis strain: Delahaze. (Photo: Sarjoun Faour for byMinistry)

vealed to exclusive members of a mailing list – take place in trendy design studios across the city. These dinners, Corrado says, are aimed at educating guests about removing stigmas through design-forward experiences.

“Standing outside, smoking a joint isn’t where I’m at right now,” says Corrado. “I want a beautiful experience. I want to sit down and have a great meal. I want the perfect playlist and have a beautifully-designed space. That’s what I’m looking for my cannabis experience to be.”

Even before he was hired to be part of the byMinistry executive team, Corrado has curated many

private cannabis dinners himself. In fact, cannabis-infused dinner parties aren’t new to fine-dining chefs. Many cannabis-trained chefs find that curating dinner experiences for an intimate crowd is a great opportunity to safely experiment with cannabis as a food ingredient.

“Beyond flavour profile, you’re looking at what effect the plant will have, as well,” says Corrado. “Depending on where a dish fits into the course of an evening, I’m looking to create that experience for the guest… sativas and hybrids to start off your evening and CBDs to end a menu or a meal.”

As infused food experiences start to become the “new normal” in the

industry, Corrado says he is looking forward to more innovations in producers and extraction companies. As a chef, he said that having reliable infused pantry products, like flour, sugar, salt, butter and oil, will be a huge next step for the food industry.

“Chefs are creatures of habit. If we like something, we will go back to it over and over and over again,” he says. “I want to be able to buy that exact same strain and make sure that it breaks down in the same way, that the DNA of that strain is the same. I don’t think we’re there with cannabis right now. The strains are a bit all over the place.”

Lesson in edibles

No one has to tell Health Canada that extracts are a tricky thing to regulate on a commercial scale. Although the government agency has been criticized for its prudent regulations, one only has to look at cannabis markets, like Colorado, Oregon or Washington State, to understand the risk of relaxing rules too soon. The first recreational dispensaries in Colorado went into business in 2014. There were almost no restrictions for edible products in the beginning. Many were packaged in clear bags, undistinguishable from other typical snack foods, with no standardized dose. Many consumers didn’t know to pace themselves and in that first year, the Rocky Mountain Poison and Drug Center received double the number of calls of young people 18 years and younger accidentally ingesting large amounts of THC. These incidents brought industry leaders and government officials together to develop appropriate policies. In Colorado, edibles are a $170-million industry and have been growing 15 per cent faster than the overall cannabis market, even as dried flowers began to fall 62 per cent over the same amount of time.

COOK IT YOURSELF

For those who cannot afford the $100 to $200 price tag of a private cannabis dinner, home cooks have been concocting their own infusion recipes through trial and error. The Cannabis Cooking Company is looking to alleviate that guesswork for people through its hands-on workshops.

Lead cannabis chef and instructor Don Gingrich has been cooking with cannabis for almost 30 years. As a cancer survivor at a young age, Gingrich turned to medicinal cannabis to alleviate the painful symptoms of his chemotherapy. He remembers his first edibles recipe, which was a brownie recipe he developed with some chopped up pieces of his homegrown plant.

“Back then, we didn’t decarboxylate or anything like that… We didn’t strain anything, it had stems and seeds and all sorts of stuff. It tasted like weed but it worked,” laughs Gingrich. “It was a lot of trial and error, but once we narrowed down on the math, my wife and I now make caramels and all sorts of stuff.”

Gingrich says in this new era of legalization, trial and error doesn’t have to be people’s starting point anymore. Every week, classes are led by trained chefs, cannabis sommeliers and experts to teach participants about the decarboxylation process of infusing CBD and THC into olive oil. They also learn micro-dosing their food with a controlled amount of THC to ensure a pleasant experience throughout the meal. Then, Gingrich leads the class through simple recipes that can incorporate the infused oil in a variety of dishes.

“For example, today we’re pairing the limonene in the plant and pairing it with the earthiness of mushrooms and adding some lemongrass, as well,” explains Gingrich as he furiously chops herbs to prep

for the class’s potstickers recipe. “Sourcing our viable cannabis, I look for something that is stocked with a high amount of terpenes, high THC, you’re looking for organic, mould-free, fungus-free… no different from picking out produce, it’s the same thing.”

The Cannabis Cooking Company sees its role mainly as an education space for people who are just learning about infused food, says Vanessa Labrecque, co-founder and chief operations officer. Hands-on workshops allow people to absorb all the information they learn that day and apply it into their real-life situations right away, she adds.

“When we started classes (in October 2018), we thought our demographic would’ve been younger people ranging 25 to 30 years old and actually, the people

ism now. People want to have experiences,” she says. “So, we’ve done well incorporating activities like mushroom foraging and cooking as part of their overnight stay… So this is going to be one that we’re introducing – the concept of cannabis and cooking. People can come and stay with us for the weekend, they can bring their own and indulge if they wish.”

LEGACY BRANDS SAY ‘NO’

President and CEO of the Baking Association of Canada, Peter Hetherington, says the baking industry won’t be jumping on the infused foods trend any time soon.

“There was a lot of initial interest in the opportunity,” says Hetherington. “But once they start to drill into it and the requirements, at the federal level and the distribu-

“I want to be able to buy that exact same strain and make sure that it breaks down in the same way, that the DNA of that strain is the same.”

who have been coming to our classes are older people,” says Labrecque. “People who have been told their whole lives that cannabis is bad for them, but now they want to be educated because they want to see the health benefits that come with it.”

Labrecque says they have also been getting tourists, who are coming from as far away as Singapore, Israel and Brazil, to learn more about cannabis. Patty Clark, who is an owner of a bed and breakfast in Creemore, Ont., decided to take classes herself after learning more about Canada’s growing reputation as a cannabis experience destination.

“It’s all about experiential tour-

tion limitations, a lot of companies decided to take a pass on it.”

The Baking Association conducted a survey early 2019 to see if companies saw opportunities in Canada’s cannabis industry. The response, according to Hetherington, was overwhelmingly skeptical.

There are niche bakeries, however, that are specializing specifically with infused baked goods and confectionary products. But largely, Hetherington says major baking companies are staying away from cannabis-infused foods.

To acquire a cannabis producer licence, a company is required to build a completely separate infrastructure to develop and then mass-produce its edibles products.

Import and export of goods would also be difficult in the United States and in European countries.

“Some, for example, have expressed concerns around if they’re exporting to the U.S., would they have challenges with continued access, so it’s complicated,” says Hetherington. “A current bakery would be looking at this market and asking themselves, ‘Is the investment worthwhile?’ And right now, it’s not.”

BEVERAGE BOOST

There is no doubt in Dooma Wendschuh’s mind that cannabis beverages are the future of the market. Wendschuh is co-founder and chief executive of Province Brands of Canada, an Ontario-based brand that is hoping to develop the first cannabis crafted beer.

“It’s a crazy idea. We really

shouldn’t have done it because it’s taken us down this rabbit hole,” Wendschuh laughs. “We’re not a typical marijuana company because our goal is not to make a good marijuana product. Rather, our goal is to create what we consider a firstever, less-harmful alternative to alcohol.”

The idea for Province Brands started in September 2016. There was not yet any indication in the public space that cannabis would be legalized but Wendschuh and his co-founder Jennifer Dianne Thomas saw it as an eventuality.

The company has invested more than $10 million in direct research and development. Last October, the company announced it will be collaborating with Western University on a patented method of developing yeasts which can be used in crafting beers made from

hemp and cannabis. The $45,000 grant was funded by the Ontario Center of Excellence and by the Natural Sciences and Engineering Research Council of Canada.

The company is using specialized equipment and technology to extract fermentable sugars during a patented milling process that Wendschuh said does not yet exist in typical breweries.

“Our process basically takes the waste material from the growers. We are looking for a supply of stalks, stems and roots,” he explains. “Certain strains wouldn’t be useful for us that are low in THC and CBD but it probably won’t meet the minimum threshold of phytocannabinoids that we would need.”

Wendschuh says the company also looks for ingredients that are under the limit in pesticides, heavy metals and other contaminants.

Along with the research and development happening at Province Brands, Wendschuh says extensive product testing is valuable in order to prepare the company for a successful product launch in 2020.

Doubling down on the cannabis beverages market made the most sense to Wendschuh because year after year, edibles and beverages are the fastest growing product type in the U.S. market, and he sees no reason why Canada would not follow suit. He believes the main reason for this is because food is inherently a social activity without the health risks of smoking or vaping.

“Your friend won’t call you up to go to a bar and eat a plate of gummy bears. We’re used to drinking and so it makes a lot of sense,” says Wendschuh. “Now there’s a lot of reasons that hasn’t happened yet. There’s a lot of technological hurdles that has to be overcome to make really phenomenal edibles and beverages and those have not all been overcome yet.”

Top chef Ted Corrado (left) is byMinistry’s new director of culinary who will develop a new space to showcase its cannabis-infused culinary hub. The Cannabis Cooking Company (right, top and bottom) teaches people how to cook with cannabis at home.

Extraction point

Market opportunities for Cannabis 2.0 and overcoming challenges ahead

By Jennifer Brown

As edibles and other Cannabis 2.0 products continue to roll out to consumers in Canada, some extraction companies and licensed producers are already looking ahead to the next wave of product development with a focus on using technology to refine stability and consistency in consumer experience.

“We’re already looking at what we’re internally calling 3.0,” says Tyler Robson, chief executive officer of The Valens Company (formerly known as Valens GroWorks before it rebranded in December), a third-party extraction company with facilities in Kelowna, B.C. and Bolton, Ont.

“That means developing active pharmaceutical ingredients where the product has shelf stability, and data where a pharmacist or doctor can prescribe a certain cannabinoid for a certain ailment, but also natural health products such as a protein powder or a multi-vitamin,” explains Robson. “Another big category we feel will be here eventually is health and wellness products for pets. Those are the next big three for us.”

Currently, veterinarians can’t prescribe cannabis products for pets in Canada, but many cannabis extract producers are eyeing

it as a significant potential market.

“It will open up, and we’re ready,” says Robson.

Valens has an annual capacity of 425,000 kilograms of dried cannabis and hemp biomass. With a recent facility expansion, they are looking at the potential for one million kilograms annually.

Cannabis extraction is an essential step in creating cannabis oils, cannabis-infused food items, skin topicals and infused beverages. Right now, Valens, like many other cannabis companies, offers soft gels, oral sprays and vaporizer pens as well as topicals, edibles and beverage concentrates.

While some LPs and extractors use CO2 extraction only, Valens uses sub/supercritical CO2, ethanol, hydrocarbon, solventless and terpene extraction.

“To be a one-stop-shop, you have to own multiple extraction platforms,” says Robson. “For example, CO2 has an efficiency rate of about 60 per cent, and ethanol has about a 95 per cent rate. CO2 is full-spectrum, whereas ethanol alcohol isn’t. With ethanol, because it’s such a volatile solvent, you’re losing a lot of the terpenes, flavonoids and cannabinoids in that process. So it depends on what is the desired outcome you’re looking for.”

Cannabis extraction companies are gearing up for expected growth as Cannabis 2.0 products gain momentum in the market.

Quest for consistency

While some licensed producers have opted to have their own extraction production facilities, Quebec-based Hexo Corp. partnered with Valens in April 2019 in a two-year cannabis and hemp extraction agreement.

“We see extractions as the next step of where products are going,” says James McMillan, senior vice-president, strategic business development at Gatineau-based Hexo Corp. “We do some extraction ourselves and partner with Valens. It’s an opportunity for us to be able to increase our capacity, but also use different extraction methods.”

McMillan says Hexo is interested in honing in on the technology that will help define consistency.

“We’re very interested in leveraging technology to ensure our consumer packaged good partners can provide a consistent product at high quality with known onset and known offset times,” he says. “Those organizations are going to be bringing products to market to help normalize the consumption of CBD, THC and even the minor cannabinoids. We’re looking much further down the road about how do we normalize this so this becomes an everyday component of someone’s lifestyle.”

To that end, McMillan says Hexo is “building up a great tech-

nology war chest” that will help produce a “really predictable, consistent quality and effect” from the product.

“That’s what the big consumer packaged good brands are looking for, and the consumer is too — you want to be able to know when you have a product that it’s going to have the same effect each time,” he says.

Technology suppliers to the extraction market also remain busy installing equipment to meet demand in Canada.

“We see increased purchasing from our existing customers and new customers,” says Jon Thompson, CEO of United Science

LLC, makers of supercritical CO2 cannabis extraction equipment and GMP manufacturing systems.

“There’s a whole new batch of LPs that are just starting to get their operations up and running, and we are involved in helping them set up their GMP operations and providing equipment specifications at the front end,” he says. “We sell them an entire suite of equipment that really helps them meet the requirements for the edibles and vapour categories and various categories that are going to be legalized in Canada.”

“We have just done a large install with some customers in Ontario, and we’re servicing customers in B.C. and Saskatchewan,” says Thompson. “I would say that the established LPs we deal with are adding resources right now — they made capital investments early on in the year, and so that’s what we’re busy installing.”

Market prospects

In Canada, the market for extraction and oils and derivative products is “rather robust,” says Beau Whitney, vice-president and senior economist with Washington, D.C.-based New Frontier Data, a firm that monitors the cannabis industry. As the future of the market matures, he predicts there is going to be more significant opportunities for product differentiation and deployment via derivative channels.

Whitney says much of the innovation in the sector is taking place on the derivative side. “In that sense, there’s a lot of potential in the Canadian market for these derivative products and derivative suppliers,” he says.

However, he points out it won’t be a linear path to increasing business, due in part to the need for more retail outlets — the same hurdle producers experienced in the first year of legalization.

“That’s what the big consumer packaged good brands are looking for, and the consumer is too — you want to be able to know when you have a product that it’s going to have the same effect each time.”

“It will be somewhat turbulent in the near term because you have got some of these retail deployment hiccups and lack of access, and higher prices in the legal market than in the illicit market,” he says.

Whitney says there are inevitable tradeoffs for those producers who are trying to do everything themselves as opposed to partnering with an extractor.

“On the one hand, when you’re vertically integrated and do the cultivation yourself along with everything else, the advantage is you manage the production costs and can optimize your cost structure. In that zone, you have to be an expert in many things. Or do you take the Heinz ketchup approach where you become an expert in ketchup making and then let all of the tomato farm ers feed into you? There is value in each one of these models, it depends on where the company wants to go and what their cost structure looks like,” says Whitney.

Knowing how much to produce and what will be required to meet market demand is something many agree has been challenging to predict in these early days of legalization of extract products. Thompson sympathizes with LPs and other producers who are trying to figure out what they will need to meet market demand, without having too much inventory if consumers don’t buy.

“It’s extremely difficult to plan and very capital intensive from the standpoint of inventory,” says Thompson. “If you put too much in the market, the street will punish you. It’s an intractable problem. You don’t want to have something that sells out, but on the other hand, you don’t want to be sitting on millions of dollars of inventory.”

Jennifer Brown is a freelance writer based in the Greater Toronto Area.

Cannabis industry analysts are expecting a “robust” market for oils and derivative products.

growing environment, a simple, flexible, and sustainable control system is crucial. This is why proactive LPs are turning to Reliable Controls. Our nation-wide network of factory-certified

Authorized Dealers will design, install, and commission a comprehensive control system paired with an intuitive, custom-tailored graphical interface. Take command of your precisely-controlled environment. Generate tracking reports and analytics. Reduce your carbon footprint while improving productivity, quality, and serviceability.

To learn more about this cost-effective and Canadian-made solution, please contact a local Reliable Controls

Authorized Dealer near you.

CANNABIS TECH

University-bred portable analysis device seeks commercial debut

By Jordan Whitehouse

About three years ago, after the Liberals unveiled their bill to legalize recreational cannabis, Adam Shuhendler got curious. He had been talking to his wife, a policy advisor with a nursing organization, about all of the regulations that would be coming out and the first question he had was: How would they regulate the actual sensing of the product? How, for instance, would police detect cannabis in a vehicle? Or how would producers have to determine THC and CBD ratios?

It makes sense he had these questions; Shuhendler is a chemistry professor at the University of Ottawa interested in chemical sensing. Eventually his curiosity led him to U of O colleagues Benoit Lessard, who specializes in organic electronic devices, and Cory Harris, whose lab focuses on licensed cannabis research and analytics. Together, they realized that there was a technology gap that they might be able to fill: rapid cannabis detection. Then, as now, most producers and labs test the ratios of THC and CBD using slow and expensive technology, usually high-performance liquid chromatography (HPLC). But, they thought, if there was a way to integrate chemical sensors into organic electronics for the testing of cannabis, they could be on to a much faster, cheaper, and easy-to-use solution.

Fast forward three years and that thought has translated into a hand-held prototype that can detect the presence of cannabis as well as measure the ratio and

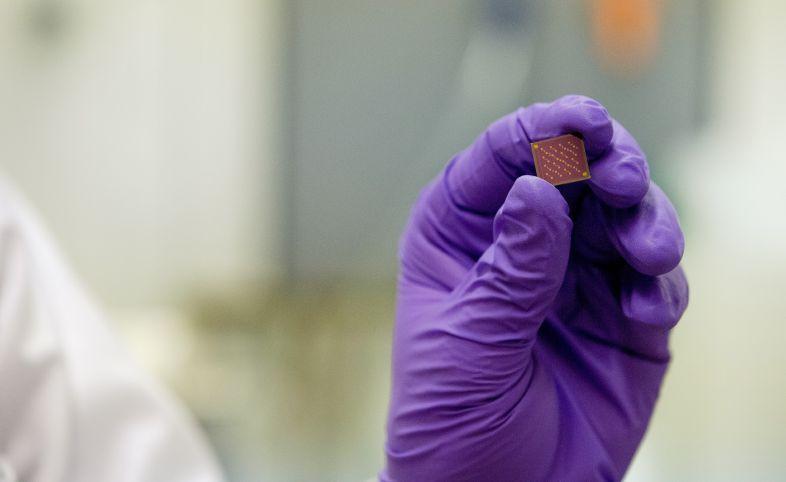

potency of THC and CBD in a sample. About the size of a two-slice toaster, the device’s sensor looks like a microchip. Using it first requires shaking a cannabis sample in a special liquid and then applying that liquid to the sensor. Within a couple of minutes, there is an output. Users can also just put the sensor in vaporized material and get a reading. “We kind of joke: if you have a thumb and a finger than can apply a sample and push a button, you can run this thing,” says Shuhendler with a laugh.

The three researchers recently launched a company called Ekidna Sens-

ing to support the commercialization of the device, but right now they are getting the prototype into the hands of LPs of different sizes to get their feedback, as well as talking to venture capitalists and angel investors. They’re hopeful about the future, they say, one reason being because there are examples of similar scalable technologies, like the OLED on your cellphone. “Scaling costs money, that’s all,” says Lessard.

THE GOLD STANDARD

Scaling also means understanding the technologies you’re up against, and in

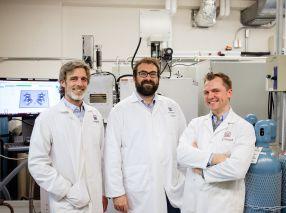

This trio of University of Ottawa scientists developed a prototype handheld device that can measure CBD and THC ratio in a given sample. (L-R): Cory Harris, Adam Shuhendler, Benoit Lessard

Jordan Whitehouse is a freelance writer based in Kingston, Ont.

their case, it is, by and large, HPLC. Considered the gold standard for cannabis analysis, an HPLC machine can cost upwards of $100,000, and that’s on top of paying analytical chemists to run and maintain the machine as well as other inputs, such as solvents. The machine can also take up a lot of physical space. For all of these reasons, some producers use outside labs to analyze their cannabis. James E. Wagner Cultivation (JWC), in Kitchener, Ont., is one of them. The LP uses A&L Laboratories in London, Ont. While JWC’s chief compliance officer Laura Foster says A&L is reliable, consistent and accurate in its analysis, the wait times, as with almost any lab, can be lengthy. “That’s the main downside for us,” she says. “Generally speaking, we have to wait until the drying process is complete and then collect the representative sample, ship that off,

and then it usually takes about a week for turnaround on just simple cannabinoids. And it’s a full two weeks for the full complement of testing, which includes pesticides, microbial, all of that.”

Those wait times are the main reason why JWC is currently looking for a piece of technology they can use in-house in

their operations. There is a growing number of non-HPLC options for them, but many use photonic analysis rather than the U of O researchers’ electrical analysis. Photonic can be sensitive, but the technology can be expensive, and it’s not always portable or easy to use.

The reliability and accuracy of some of

The analysis device developed by three University of Ottawa researchers includes a small sensor that looks like a microchip. The cannabis sample must first be shaken into a special liquid. The liquid is then applied to the sensor to get an analysis.

YOUR ANALYTICAL EXPERTS

From R&D, cultivation and disease diagnostics to final Health Canada testing -- we are your Complete Cannabis & Hemp Testing Lab

Health Canada Approved Cannabis Lab -- over 4 years

Plant Sex ID Assay / Density on Oils / Terpenes

Microbiological Environmental Testing

Plant / Soil / Media Disease

Diagnostics

Water / Tissue / Soil Nutrient Analysis

Residual Solvents

Biologicals

Seed to Harvest QC Compliant Cultivation Software

Cannabis 2.0 Edible & Beverage market ready

these technologies have also been questioned. Shuhendler, Lessard and Harris have tried to allay those concerns by comparing their device to HPLC. The results were published in the October issue of the journal ACS Sensors in a paper entitled, “On-the-Spot Detection and Speciation of Cannabinoids Using Organic Thin-Film Transistors.” The study shows that the U of O researchers’ device can derive THC to CBD ratios that are within ± 2.5 per cent of the ratio values provided by HPLC analysis of the same samples.

NEXT STEPS

While those results are promising, much still needs to be done before the device can reach commercial availability. For one, when the researchers did their study, it was in a controlled lab environment. They have to figure out if the device needs to be tweaked to work optimally in environments that might be cold or humid, for example.

They also need to continue meeting with industry and putting their prototype in producers’ hands to get their feedback. They did develop that protype after a year of industry consultations, but more testing needs to be done. “We need that feedback to know if it’s faster they want, or is it more sensitive analysis they want,” says Shuhendler. “Because it depends on the application; they might just want a yes or no, another may want quantification.”

For JWC, Laura Foster says this technology might help them develop new products a lot more rapidly. When JWC grows a batch of new test plants now, they have to send each of those samples to the lab for cannabinoid testing. But if they could do that testing in-house with a device like this, they could quickly identify the plants they would want to continue growing and forget or adjust the others, she explains.

Feedbacks from multiple user types might lead to multiple versions of the technology. Law enforcement agents might just want to know if there is THC in the air, for instance, so they would need a much simpler device than what a producer would. Likewise, the hemp community might just be interested in a straightforward THC to CBD ratio, so that could also mean a different device. The researchers have also thought about developing a device for home growers who are serious about what they’re producing in their backyards. “The sensors that we’re building have the potential to give us all of this information, so it’s going to all depend on who is buying it,” says Lessard. “But there is potential to hit all of these markets; we’d just need to tune the technology.”

And again, they would also need to scale. But Shuhendler, Lessard and Harris think they can. “As a technology, there are roadmaps to commercialization, so it’s not unreasonable for us to say, ‘Okay, we’re making 20 in the lab a day,’ but that could be scaled and we could make thousands of these and get them in the hands of every producer or home grower in Canada or North America,” says Lessard. “It’s not an unreasonable request.”

Time – and money – will tell if they’re right.

Suppliers’ Corner

Cannabis lab solutions

HEMCO has introduced its extensive line of UniMax Floor Mount Hoods for cannabis/hemp extractions to safely exhaust fumes and odours from botanical processes. HEMCO also designs and constructs analytical testing clean labs that can be equipped with lab furniture, countertops, and fume hoods in standard packaged sizes or can be engineered to meet the facility’s specific requirement. UniFlow composite resin UL classified fume hoods are offered complete with work surfaces, base cabinets, and optional electrical and plumbing accessories. Ventilation and safety equipment including emergency safety showers, exhaust blowers, and inline HEPA or carbon filters are available to integrate with a lab system. www.hemcocorp.com

Dissolved carbon dioxide

CO2 GRO Inc.’s CO2 Delivery Solutions creates an aqueous carbon dioxide (CO2) solution that is saturated at 80 to 100 per cent with CO2 gas. This means eight to 10 out of 10 gas molecules in the solution are CO2, versus only one to three out of 2,500 gas molecules in the air being CO2. The aqueous CO2 solution is then misted directly on to the plant leaves. The CO2 solution’s micro droplets create an aqueous film around the entire leaf surface, isolating the leaf from the atmosphere. This creates a diffusion gradient favoring CO2 transport into the leaf and other gases out of the leaf. Cannabis growers understand the value of carbon dioxide augmentation to cannabis yields and profits. To date, only indoor and sealed greenhouse growers can augment their plants with CO2 by a technique called “CO2 gassing,” which is basically pumping CO2 gas into the air of a grow room. However, over half of the CO2 gas that is pumped in escapes to the atmosphere and is wasted through leaks in the building structure. Many greenhouses in hotter climates are not sealed and have open ventilation to help release the hot air, and if CO2 is pumped in, that CO2 will escape wasting most of it. Sealed greenhouses therefore require expensive HVAC systems to circulate the hot air and keep the greenhouse cool, while preventing the CO2 from escaping. Since aqueous CO2 solution has very little off gassing and uses far less CO2 gas to begin with, greenhouses do not have to worry about containing CO2 gas in the rooms by sealing. This means they can have open ventilation to allow heat to escape, thereby reducing the need for expensive energy consuming HVAC systems. www.co2gro.ca

No plan B

Belgium-based Biobest was the first company to use bumblebees to pollinate commercial fruits and vegetable crops thirty years ago. Biobest is now taking its biological crop protection expertise to Canada’s cannabis industry. “Growers originally thought that by growing cannabis in enclosed spaces – or socalled growth chambers – they could keep the pests that ravage other crops out,” explained Sam Gui, IPM and pollination specialist at Biobest. “But these pests – such as spider mites, aphids or thrips – always end up finding their way inside, by way of the growers themselves, for example. And because the use of pesticides is prohibited, biological protection is the only option for safeguarding the cannabis plants. There is no plan B.” The Belgian company has experts who support cannabis growers locally, but the majority of Biobest’s R&D takes place in the Kempen region of Belgium. Biobest provides a complete selection of natural solutions, such as beneficial insects, mites, nematodes, biopesti cides, and bumblebees. www.biobestgroup.com

Guide for indoor growers

The new book by Geoff Brown and Dan Dettmers is a reference guide for indoor growing environments and offers some answers to common grow room challen ges when it comes to temperature and humidity controls – critical factors in ensuring the healthy growth of cannabis plants. From the economics of growing and navigating the building design and equipment procurement process to achieving the best growing conditions and tips for installation, Getting Grow Rooms Right, offers an exten sive array of valuable information and insights for cannabis cul tivators, facility owners, engineers and contractors. “I wrote Getting Grow Rooms Right because I was noticing a great deal of misunderstanding within and outside the grow room industry when it comes to getting optimal temperature and humidity control,” said Brown, an HVAC industry expert and the director of Agronomic IQ, supplier of temperature and humidity control equipment for the cannabis industry. Co-author Dettmers is an applications engineer at Quest Dehumidifiers. Getting Grow Rooms Right is now available through Agronomic IQ. www.agronomicIQ.com/book

Suppliers

Integrated security

March Networks, a global video security and video-based business intelligence leader, has integrated its Searchlight for Retail software with Cova, the point-of-sale (POS) software system designed specifically for cannabis dispensaries. The integration enables cannabis businesses using the Cova POS platform to improve performance and profitability with Searchlight’s video-based business intelligence. Through its unique combination of surveillance video, POS transaction data and analytics, Searchlight helps retailers gather transformative insights on customer service, operations and promotional efforts, the company said. It also alerts businesses to suspicious transactions, like frequent voids or unusual discounts, and ties all POS transactions to surveillance video for rapid investigation. Tailormade for the cannabis industry, Cova POS is used by more than 500 cannabis stores. It incorporates features like an age verification scanner and purchasing limits to help retail dispensaries comply with state/provincial and federal regulations on cannabis sales. March Networks’ solution for cannabis operators also helps with seed-to-sale tracking and compliance by correlating data from radio frequency identification (RFID) tags with surveillance video in Searchlight. www.marchnetworks.com

P.L. Light reveals new ceramic metal technology

P.L. Light Systems announced a new professional-grade luminaire that uses ceramic metal halide (CMH) technology.

The 315W NXT-LP CMH luminaire is a low-profile lighting solution that emits low radiant heat output. Sales manager Eric Moody says this product was created ideally for vertical applications or for facilities with limited ceiling height.

The CMH technology promises to deliver a natural white light that helps reduce internodal stretching during a plant’s vegetative growth cycle. The full spectrum light is also ideal for grading crop and makes for a more visually comfortable environment.

“A big advantage is the low wattage, allowing for close-to-crop mounting, better uniformity and reduced BTUs resulting in reduced AC costs,” explains Moody. “The NXT-LP CMH luminaire also provides the ideal spectrum for vegetative growth cycles as well as supplemental blue light in HPS flowering rooms.”

At specific color temperatures, CMH delivers a light output that is similar to natural daylight – providing a broad spectrum of wavelengths (including UV) so the plant can absorb exactly what it needs. With a total height of just 8.25 inches, the NXT-LP CMH luminaire can deliver optimum light output, along with unparalleled uniformity and canopy penetration in spaces with a low ceiling. www.pllight.com

Retail training