As organic products gain market momentum, cannabis producers are taking on the

JORDAN WHITEHOUSE

From the editor

By Mari-Len De Guzman

As organic products gain market momentum, cannabis producers are taking on the

JORDAN WHITEHOUSE

By Mari-Len De Guzman

Corporate social responsibility and global sustainability have been an i ncreasing trend across all industries all over the world – manufacturing, agriculture, energy production, and many others. Consumers are getting more sophisticated and interested in knowing the ‘story’ behind the products they consume. Companies that are responding to this trend stand to gain – both from a fiscal and moral perspective

The new and burgeoning cannabis industry has the opportunity to be on the right side of history. And the best time to do it is now, when the industry is in its infancy and in the process of shaping its course.

The frameworks for sustainability, as well as corporate social and environmental responsibility, already exist in other industries, and can be a template for cannabis companies pursuing this path –from cultivation and processing to packaging and merchandising.

Indeed, a number of Canadian licensed cannabis producers have taken on the challenge of producing and marketing their products in a sustainable and environment-friendly fashion. Grow Opportunity aims to highlight some of Canada’s most innovative and best-managed cannabis companies in the pages of this publication. Our pub -

lishing team believes that sharing these stories and promoting best practices for growing a sustainable and responsible cannabis business will help this industry become the best it can ever be.

This issue of Grow Opportunit y is particularly focused on sustainable business practices – from growing the plant to packaging products for the end-consumers. Our cover story is a homage to one of Canada’s top ecological destinations and home to

Consumers are getting more sophisticated and interested in knowing the ‘story’ behind the products they consume.

some of the highest-quality and sustainably grown cannabis in the country: British C olumbia. The aim is to provide the story behind some of the best-loved cannabis in the country – because having a high-quality pr oduct that consumers love and come back to over and over again does not happen by chance.

This issue also highlights the importance of creating regulatory policies that create opportunities for companies to do the right thing. Our legal expert, Matt Maurer, highlights this important issue in our Legal Matters column.

As in past issues, and in future issues of Grow Opportunity, we will strive to highlight organizations in the cannabis industr y that have a great story to tell and best practices to share. If you work for a company that promotes environmental responsibility, production sustainability or is embarking on innovative ideas for sustainable growth, we’d like to hear from you. Send me an email (address below) and let’s talk. ****

Speaking of innovative ideas, Grow Opportunit y will soon be launching the brand new Canada’s Top Growers Award – a recognition program that celebrates the people behind the plant, the growers, master growers and cultivators in your cannabis enterprise responsible for nurturing and growing your high-quality cannabis products.

I am proud to note that we have assembled a team of industry leaders to sit on our judging panel to help us find and honour Canada’s best cannabis growers. We will be announcing the members of our judging panel as well as the nomination details in the next issue. So stay tuned and think about nominating an outstanding cannabis grower.

It’s time to highlight the achievements of these fine folks and give them the recognition they deserve.

January/February 2019 Vol. 3, No. 1 growopportunity.ca

EDITOR Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

ASSOCIATE EDITOR Tamar Atik tatik@annexbusinessmedia.com 416-510-5211

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexbusinessmedia.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexbusinessmedia.com 905-431-8892

ACCOUNT COORDINATOR Mary Burnie mburnie@annexbusinessmedia.com 519-429-5175 888-599-2228 ext 234

CIRCULATION MANAGER Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext.3546

MEDIA DESIGNER

Curtis Martin

GROUP PUBLISHER Martin McAnulty mmcanulty@annexbusinessmedia.com

PRESIDENT & CEO Mike Fredericks

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

1 year subscription (6 issues: Jan/Feb, Mar/Apr, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec):

SUBSCRIPTIONS

Roshni Thava rthava@annexbusinessmedia.com Tel: 416-442-5600, ext. 3555 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com

Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

We recognize the support of the Government of Ontario

Reinforced hook

Low and high humidity resistant

100% industrial compostable

Minimizes carrier material on the crop

Quick release and easy to use

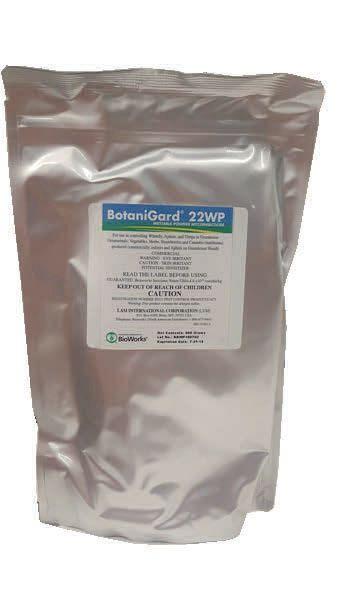

Our new sachet for spider mite control has been designed for cannabis crops with regulatory compliance and ease of use in mind.

CLARENVILLE, N.L. - A privately-owned cannabis store in Newfoundland has closed, and the manager said supply issues are largely to blame.

Puff Puff Pass Headshop in Clarenville, N.L., is the province’s first private cannabis store casualty since recreational marijuana was legalized in October.

The store, which permanently closed on Jan. 31, is one of just six private, regulated cannabis retailers in Newfoundland and Labrador.

Business manager Tina Greening said retailers in the province are only allowed to purchase from seven licensed producers, picked by the province’s liquor commission.

She said the suppliers provided stores with a “small list” of what they were allowed to order, and even dictated quantities.

The owners of other private, regulated stores in the province have raised similar concerns about supply, and some shops have run out of product routinely.

Shoppers Drug Mart has launched its e-commerce platform for medical cannabis after acquiring a licence from Health Canada to sell the product online. Product information is available nationally, but Shoppers Drug Mart can initially only sell medical cannabis to patients in Ontario.

Patients will be required to take a medical document similar to a prescription to an Ontario pharmacy to begin the process.

Specialized advisers will then contact patients, review their medical history and provide support with online registration and product selection.

Shoppers Drug Mart says it has signed supply agreements with 10 licensed producers of dried cannabis and cannabis oil, and will provide products and medical accessories.

MONTREAL – Quebec’s cannabis agency generated about $40 million of sales in its first three months of operation, but supply shortages are forcing the public retailer to reduce its expansion plans.

The province now expects to have 40 points of sale by March 2020 – it’s 20 per cent less than the 50 outlined in the original plan.

Retail store shelves across the country became empty soon after recreational cannabis was legalized on Oct. 17.

The subsidiary of the Societe des alcools du Quebec cut back its hours of operation so that its 12 stores were open four days a week.

Jean-Francois Bergeron, president of the Societe quebecoise du cannabis (SQDC), says the agency has put the network’s expansion on hold. He also said more time is needed to adapt to the recommendations of the provincial government, including a prohibition on stores opening near community colleges and universities.

Quebec Premier Francois Legault has said the profitability of cannabis operations is of little concern to him as he prefers to focus on terms governing the sale and consumption of the substance.

Legault told reporters at the World Economic Forum in Davos, Switzerland, that his government has been busy raising the legal age to purchase marijuana to 21 years. The legislation tabled last month would also prohibit consumption in all public places, including parks and playgrounds.

While supply shortages continue, Bergeron said there

should be an improvement by late spring when new volumes become available.

However, he said it will take patience before the situation is fully resolved, even as it plans three new store openings by summer.

“I think it’s better for customers to have a larger network at four days a week than a seven-day network,” Bergeron told The Canadian Press. “When branches are open, it’s easier to gradually add a day of operation.”

Bergeron expects the cannabis retailer will generate a profit at the end of its first full fiscal year of operations on March 31, 2020.

Bergeron estimates Quebec’s 5.7 tonnes of sales have accounted for 35 per cent of the Canadian legal market. The average price per gram was $7.27 including taxes, compared with the Canadian average of $9.70.

The black market remains the lowest at $5.50 per gram, Bergeron added.

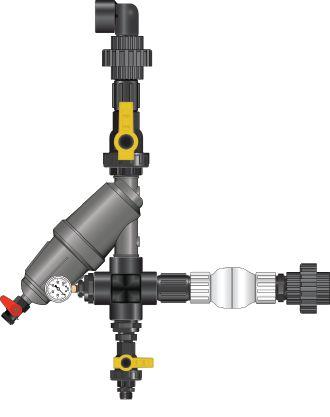

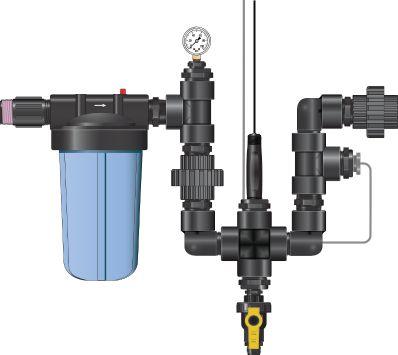

Lower labor, fertilizer and water costs while acheiving higher yields and better quality crops. Growlink precision nutrient injection systems provide a quick return on investment by providing plants with only what they need, when they need it.

Program up to 32 di erent recipes and feed your entire farm from a single system. Works with both in-line and diluted tank applications.

Aurora Cannabis is acquiring Whistler Medical Marijuana Corporation in a $175-million deal.

The Whistler, B.C.-based company is one of Canada’s original 10 licensed producers and was the country’s first licensed producer to obtain organic certification by the Fraser Valley Organic Producers Association (FVOPA) in April 2014. Edmonton, Alta.-based Aurora says the deal will expand the company’s medical and recreational product portfolio with the addition of Whistler’s organic certified products suite. Whistler operates two indoor production facilities. Once the recently licensed second location reaches full capacity the combined production capacity of the locations is expected to be more than 5,000 kilograms per year.

“Whistler has achieved average selling prices in excess of 50 per cent greater than the average Canadian medical market, and maintains a similar premium to provinces for adult-use,” Aurora stated in a release.

Spectrum Cannabis, a subsidiary of Canopy Growth, has expanded its production and distribution network into the European market..

Spectrum Biomedical UK is the company’s U.K. venture, providing access to cannabis-based medicinal products to U.K. patients with severe unmet clinical need, a release stated. Under the British government’s new classification, which took effect Nov. 1, specialist doctors in the U.K. can prescribe cannabis-based medicines to patients managing a wide range of symptoms, the release stated.

In Poland, Spectrum Cannabis Polska successfully completed its first import of medical cannabis after completing a rigorous regulatory approval process, the company stated.

The Polish Pharmaceutical Chamber estimated that up to 300,000 patients in Poland could qualify for medical cannabis treatment.

A legal gram of cannabis in Canada costs nearly 50 per cent more than those sold through illicit means, according to a new analysis of price quotes compiled by Statistics Canada.

The average price of a legal gram of medical or non-medical marijuana during the fourth quarter last year was $9.70, compared to the black market price of $6.51, the Ottawa-based agency said.

The conclusions were based on price quotes gathered using the StatsCannabis crowdsourcing application between Oct. 17 – when adult-use was legalized in Canada – and Dec. 31.

Roughly half of respondents indicated they bought cannabis from a legal channel, such as government-run stores or websites, based on 385 price quotes the agency deemed plausible.

Still, StatCan said caution should be used when interpreting the crowdsourced data.

The Green Organic Dutchman (TGOD) has appointed Rav Kumar, PhD, as the company’s chief science officer. Kumar will lead TGOD’s science & innovation division and oversee all aspects of science-related initiatives. Kumar has more than 25 years of experience in the pharmaceutical industry with international experience in Europe, Asia and North America.

“ These estimates are subject to potential statistical bias because the sample is self-selected and responses are limited in number,” the agency said in a release.

Prior to Oct. 17th, the unweighted price per gram of cannabis was $6.83 last year, based on the 19,442 submissions by Canadians to the StatsCannabis crowdsourcing application. Post-legalization during the fourth quarter, the overall average price of legal or illegal cannabis per gram was $8.02, or 17.4 per cent higher.

Demand for legal pot was high on legalization day, as evidenced by lineups at brick-and-mortar stores and brisk sales online. Initial delivery problems and widespread product shortages at government-run cannabis retailers, however, have not helped to encourage cannabis users to make the switch to legal sources.

The agency said its latest analysis found that the average amount of cannabis purchased from an illegal supplier in the fourth quarter was more than double the quantity bought from legal channels.

Respondents told the agency they purchased an average 17.2 grams from illegal sources, compared with 8.3 grams from legal channels.

Out of the 300 respondents that answered a survey question about first-time buyers, 23 indicated that this was their first-ever cannabis purchase, StatCan said. Of those first-time buyers, 14 said they bought cannabis from legal sources.

“Overall, 17 of 23 respondents answered that they have begun consuming cannabis because it is now legal,” the agency said.

— ARMINA LIGAYA, THE CANADIAN PRESS

Cannabis store sales totalled $54 million in November, the first full month of legal recreational sales, according to Statistics Canada.

The cannabis sales for the month was a little more than 25 per cent from $43.1 million recorded in October, which included roughly two weeks of legal cannabis sales after Canada legalized adult use on Oct. 17.

“Data for this Canadian industry are presented in unadjusted form as there is no seasonal pattern established by official statistics yet,” Statistics Canada said.

Cannabis stores saw the biggest percentage increase in sales among the retail sectors, with every other group showing single-digit increase or decrease.

Overall retail sales across Canada slipped 0.9 per cent to $50.4 billion in November. Economists had expected a drop of 0.6 per cent, according to Thomson Reuters Eikon.

The latest data comes as cannabis retailers continue to grapple with a supply crunch more than three months after legalization.

Government-run entities tasked with sales and distribution of adult-use cannabis have said they have received less product than expected and warned the shortages could linger for months.

The statistics shed light on the market potential of the cannabis industry, but sales performance varied widely among provinces.

Sales in Ontario, where cannabis can currently only be legally purchased through a government website, fell to $10.1 million in November from $11.7 million in October.

In B.C., sales also slipped to $1 million in November from $2.3 million in October.

Recreational marijuana retail sales saw an uptick in Newfoundland and Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Quebec, Alberta and Saskatchewan.

Alberta, which had issued 17 cannabis retail licences on Oct. 17, saw the largest overall amount of sales in November at $12.1 million, up from $7.3 million in October.

— ARMINA LIGAYA THE CANADIAN PRESS

By Mohyuddin Mirza

Field production of industrial hemp is getting lot of attention in Canada and the U.S., with some changes in the regulations for processing various parts of the plant.

Oil from the seed and fiber from the stem are the two most common uses, and now the possibility of extracting cannabinoids (CBD) from flowers appears very attractive. Here are a few basic facts before you jump into cultivation for CBD extraction.

This is one of the very important aspects growers must understand. If CBD is the focus of production, be aware that there is practically no information available on CBD contents of Health Canada approved varieties.

In 2014, my colleagues at the Alberta Innovates – Technology Futures facility in Vegreville and myself completed a one-year study screening four hemp varieties for CBD content and developing best management practices. We tested four varieties and selected X-59 because of its smaller size.

Male plants were removed and all female plants were grown to maturity. In the final analysis, the CBD contents ranged from 0.36 per cent to 3.94 per cent, and THC was always below the limit of 0.3 per cent. It was also observed that at a density of five plants per square meter, average CBD was higher.

So, in order to select a variety, gather as much information as possible. Also keep in mind that some variety, like Finola, set buds earlier than many other varieties. Gather more data on production of hemp in your geographical area.

be suggested?

The most commonly asked question about hemp cultivation is: How many plants per acre, hectare, square meters? For production of seeds and fiber, the densities tested are anywhere from 100 to 300 plants per square meter. For potential CBD production, my recommendation is to go between 600 to 1,000 plants per acre in proper rows.

Dr. Mohyuddin Mirza (drmirzaconsultants@gmail.com) is an industry consultant with more than 37 years of experience in crop development, production and marketing. He specializes in the technical aspects of hydroponics and systems for plant production.

The plants will grow fairly large and good branching will take place.

What about male and female plants?

We are interested in female plants that flower – that is where CBD is. The male plants can be sorted out and removed in the field at about six weeks of age. I have learned that the window to remove male plants is very narrow, between two and three days. This means you need labour to get it done quickly. The other alternative is to grow plants in liners, like bedding plants, and remove the plants and use transplants in the field. This requires greenhouse capacity. The growing media and fertilizers are just about the same as that of bedding plants.

In my discussions with many greenhouse bedding plant growers, it was suggested that they can grow these seedlings towards the end of the bedding plants season. Normal planting times in Canada are around the third week of May and can continue to early June. I am not sure at this time if one requires a licence from Health Canada to grow hemp seedlings in a greenhouse. You do, however, need a licence to grow hemp.

What’s the best time to harvest?

If you seeded the fields directly, then the vegetative phase is continued until end of June or early July, and it is based on varieties. The Finola does not seem to depend on longer photoperiod for flower set and can start flowering by end of June. This variety can start flowering from 25 to 30 days of seeding.

Do we know about CBD and timings?

The picture shown is from a plant about 70 days old from seeding. The flowers are turning brown and trichomes are white opaque. They are almost ready for harvesting. In a field scenario, where the flowers did not get pollinated, late-May planted crop can possibly be harvested by end of July. As mentioned earlier, the variety Finola can be harvested a few weeks earlier.

On smaller acreage, manual harvest is possible when density guidelines are followed, that is 600 to 1,000 plants per acre. Because it will be taller and wider, some mechanics have to be developed to access all buds. Many growers consider using the stems for fiber. For extraction, one has to depend on commercial, licensed extraction facilities which are coming up now. I am aware of people developing mobile units –which have to be certified by Health Canada for GMP and other safety aspects.

There is still a lot to learn about hemp production for CBD. Some marketers claim they have higher CBD – up to 20 per cent varieties – available as feminized seeds, but they are likely more suited for total indoor operations. For high CBD, we have to avoid seed formation and harvest at proper times.

Hemp cultivation for CBD is still a huge learning curve. There is a very nice field production manual available from Alberta, entitled Industrial Hemp Enterprise, that may be useful for those exploring the opportunities with hemp.

By Matt Maurer

Not even a week had passed since the recreational use of cannabis was legalized on Oct. 17, 2 018, when the rumblings first started. Customers were shocked at the amount of excess packaging and corresponding waste that accompanied their cannabis purchases.

Plastic containers, inside of cardboard boxes, wrapped in clear plastic, tucked away in a shopping bag – all for one gram of cannabis. One customer in Nova Scotia purportedly weighed the packaging from their purchase and discovered that it w eighed forty times the amount of the product it housed.

In addition to the sheer number of layers of packaging that accompanied the product, consumers were also quick to point out that the size of the containers were far larger than was necessary to properly store the product.

Although concerns over the amount of waste that is being generated by cannabis packaging continue to be voiced, the issue is not going to be resolved any time soon unless significant changes are made to the regulations under the Cannabis Act.

The regulations impose a number of requirements that ensures keeping waste to a minimum is a difficult, if not impossible, task.

The regulations require that the immediate container in which cannabis is packaged must, among other things, prevent contamination of the cannabis, have a security feature that provides reasonable assurance to consumers that it has not been opened prior to receipt, and meet the requirements of a child-resistant package under the Food and Drug Regulations.

While these requirements may not, in and of themselves, create excess waste,

The regulations impose a number of requirements that ensures keeping waste to a minimum is a difficult, if not impossible, task.

they do significantly limit the types of materials licence holders can use to package their products.

Issues with the size of the containers is directly tied to labeling requirements and the significant amount of information that is required to be displayed on the labels. The regulations require more than 10 different pieces of information to be displayed on the label of cannabis packages, in a manner that is “clearly and prominently displayed and readily discernible under the customary conditions of purchase and use.” Additionally, the regulations provide for minimum font sizes and mandatory use of bold font in some instances.

On top of this lengthy list of required information, producers are also required to display the standardized cannabis symbol as well as health warning messages, both of which are governed by minimum displa y sizes set out in the regulations.

Given all of these requirements, it is not hard to see how licensees’ hands are tied to some degree. While certain steps can be taken to help avoid unnecessary waste, the requirements to display certain information in certain minimum sizes virtually ensures that packaging can never be as small as it otherwise ought to be.

Fortunately, it appears that the government is listening and is now taking steps to alleviate some of these issues. Under the proposed regulations for the new classes of cannabis (i.e. edibles, concentrates and topicals), which were released just before Christmas 2018, certain information could be displayed on expanded panels or through alternative display formats, such as a peelback or accordion style panels. These types of labels would allow for smaller packaging, which could serve to greatly reduce the amount of waste currently being generated. Whether these types of changes will have a significant impact remains to be determined. However, it is encouraging to see that the government has heard the concerns raised by the industry and the general public, and is starting to take steps to address those concerns so quickly after legalization occurred.

By Jeff Hannah

One of the most exciting changes that came with the introduction of the Cannabis Act was the oppor tunity for licence holders to cultivate cannabis outdoors. For years, knowledgeable growers have argued that outdoor cultivation is a viable way to produce high quality cannabis and it seems that regulators are finally onside.

Reduced production cost is a huge benefit, when compared to indoor cultivation, and the coming market for edibles means that the demand for “extraction grade” cannabis has never been higher.

Outdoor cultivation can take place at a dedicated, licensed site or be added to any existing standard licence. From an outdoor grow to an existing licence, the cultivation has to take place in the same facility address and within an area that meets the perimeter security requirements.

Licence holders who have suitable land around their facility would do well to consider taking advantage of this unique opportunity. I would also encourage prospective cultivators to consider the requirements for outdoor growing when selecting a site for their application.

Once the decision to engage in outdoor cultivation has been made, it is best to consult with someone who knows the security requirements and involve them in the design process from the beginning. I may be somewhat biased, but it really is critical to integrate security and compliance into your design at the early stages.

An outdoor growing operation requires much more than just an empty field with a fence around it. There’s a need for staging and support areas, equipment and supply storage areas, heavy machinery access, and many other considerations. All of these elements have unique security implications.

Another major consideration is the loca-

Jeff Hannah is director of consulting services at 3 Sixty Secure Corp.

You can contact him at jeffh@3sixtysecure.com.

tion of processing areas. Outdoor grown cannabis will still have to be dried, trimmed and potentially stored in compliance with the regulations. Will the outdoor growing facility have a dedicated processing area onsite or will the plants have to be transported? If cannabis is to be brought into an existing facility, how will the risk of cross contamination be controlled? Having knowledgeable and experienced people on your team is critical.

Outdoor growing operations tend to be located on farms and, as a result, there’s often a residence on the property. There was a time when that would have disqualified the site but thankfully, with the proper precautions, those days are over.

Today there are several licensed facilities with residences on the site. Health Canada will permit it under certain circumstances and it’s always reviewed on a case-by-case basis. The presence, location and proximity to operations should all be considered when determining a site’s suitability for outdoor growing.

Not surprisingly, outdoor growing facilities are subject to the same site perimeter security requirements as other standard licences. Those specific requirements can be found in the Cannabis Regulations and include surveillance and intrusion protection which fully encircles the site. For

those who understand those requirements and have seen them applied to growing and processing facilities, that can seem a bit unreasonable when the site perimeter is potentially miles of fence.

As I’ve said before, the regulations are outcome-based and always open to interpretation. My approach to consulting in this industry has always been to encourage my clients to take calculated risks when interpreting the security requirements for their facilities. In some cases, Health Canada won’t agree with a certain interpretation and the approach has to be adjusted. When creative interpretations are accepted, my clients benefit from security solutions that are far more practical and cost-effective.

Outdoor cultivation is no different. Being new, there are lots of opportunities for creativity that is tempered by knowledge and experience. As always, I’m learning with every new application and passing those lessons on to my clients.

Most importantly, be weary of rumors and misinformation. I’ve been in the cannabis consulting industry since 2013 and I’ve seen the regulatory framework change and evolve over that time. There have always been those who believe that the only way to gain Health Canada’s favour is through over-engineering and unnecessary complexity. Those people tend to waste a lot of money and end up changing their approach later to make things more practical.

Outdoor cultivation has been no different. I’ve heard rumors ranging from requirements for double fences, to flood lights, and security systems more commonly seen around missile silos.

Even this early in the process, there are already proven and practical solutions available that won’t blow your budget or alienate your neighbors. Health Canada is far more reasonable than some give them credit for. The federal agency has a mandate to create a sustainable, thriving cannabis industr y that doesn’t compromise public safety. Those interests can be e ffectively balanced with the business interests of license holders.

Packaging your cannabis products with the environment in mind

By Cheryl Sullivan

Confused about sustainable packaging? You are not alone. There are many options in the market and, quite frankly, designing for the environment is not straightforward.

The materials available for packaging products differ in their composition and structure as well as in their preservation and protection properties. Products require barrier properties to prevent odour, moisture and oxygen transmission, and need materials that offer this protection. Packaging must be functional and prevent physical damage. It is important to know the needs of your product so that packaging can be designed to protect it throughout the entire supply chain, and even when in the hands of the consumer.

These product requirements can present a challenge when designing for sustainability while meeting the product’s preservation and protective requirements.

To understand the life of a package, one must consider the path from raw material extraction through to its end-of-life. A package produced, purchased and distributed in one region may have a very different environmental impact than one in a different area. This is because the collection of post-consumer waste and recycling varies from region to region. There are efforts to harmonize these systems in Canada but at the moment, each province, and even municipalities within provinces, can operate independently. These differences in regional post-consumer waste management capabilities and systems are what’s impeding harmonization.

The circular economy promotes optimization through design by keeping materials circulating at their highest value for as long as possible. Packaging should be developed with this closed loop thinking in mind. We are moving away from the linear approach – where materials were extracted, used and then thrown away – toward a system where packaging is made to be made again.

The packaging waste hierarchy lists priorities in terms of the impact on the environment, from the most to the least favourable:

Optimize design to keep the materials circulating;

Reduce to eliminate use or lessen the amount utilized;

Reuse in a functional capacity;

Recycle for recirculation;

Compost for regeneration;

Upcycle into other products;

Recover for further processing or into energy through incineration.

The goal is to keep packaging materials from entering the environment or the landfill. This is a challenge when it comes to multilayer, flexible plastic materials, such as pouch bags, because they are not widely recovered. These plastics offer the needed protection and are lightweight, durable and less bulky than alternative materials, and this makes them an ideal choice for many products.

Despite not being recovered, these plastics generally have a lower environmental impact than other substrates such as paper. However, at the moment, recycling the pouches is onerous and expensive because of their light weight and multi-material composition.

The good news is that research is underway to find methods to recover and recycle these plastics. For example, in British Columbia, Recycle BC is running a pilot project to collect these post-consumer flexible plastics at all their depots and explore methods to process the materials.

Whether the packaging material is recyclable, compostable or biodegradable is not as important as whether it is identified and disposed of properly within the waste stream system available today.

PAC, Packaging Consortium (www.pac. ca) in Ontario recently published two documents to help companies design their packaging. The PAC NEXT Sustainability Checklist assists structural designers in choosing sustainable packaging. There are six key elements for consideration:

1. Source – what are the materials and from where are they sourced?

2. Reduce and Optimize – can materials be eliminated or reduced?

3. Reuse – are systems in place to reuse the packages?

4. Recycle – can the packaging be collected, separated and recovered in existing programs?

5. Compost – do the materials meet the requirements for composting and are facilities available for collection and processing?

6. Communication – is your disposal messaging clear to consumers?

The white paper, “Ocean Plastics – What the Packaging Industry Can Do,” published by PAC in partnership with Ocean Wise, offers the following guidelines to prevent plastics from entering our oceans:

• Optimize package design – ensure products are protected but not over-packaged;

• Choose materials wisely – biodegradable and compostable plastics are not ocean-friendly;

• Use recycled content and ocean plastic – incorporate recycled content and recovered ocean plastics into your packaging;

• Drive closed loop systems – design packaging that works within current collection systems;

• Communicate proper disposal –avoid misleading claims to ensure the packaging is disposed of responsibly.

Another great resource is the Association of Plastic Recyclers Design Guide for Plastics Recyclability. This guide covers plastics items entering the post-consumer collection and recycling systems most widely used in the market today.

Upon choosing your packaging material, be transparent with your sustainability claims. It is not acceptable to claim that a package is recyclable or compostable if the infrastructure to recover it is not available. Consumers want accurate information so they can make informed choices about purchasing. They will buy from companies that align with their own philosophies.

Canada’s West Coast is proving to be a haven for sustainable cannabis production

By Haley Nagasaki

Sustainable production is a growing trend across major industries. A number of licensed cannabis producers are taking on this challenge, making sustainability a core part of their company identity.

Grow Opportunity takes you to Canada’s West Coast, in British Columbia, home to producers of some of the best-grown cannabis in the country. These producers employ different practices for cannabis cultivation, but they share a common expression of staying true to authentic, sustainable cultivation as it’s been practiced in B.C. for decades.

A common thread among these LPs is the recognition of value and desire to grow cannabis with integrity. “There’s definitely a craft and a skill involved that w e’re really keen to protect and maintain,” affirms Sophie Rivers, brand manager at Whistler Medical Marijuana Corporation (WMMC).

WMMC has been selling certified organic cannabis within the medicinal market from since April 1, 2014. This small-scale operation, born in the mountains of Whistler and founded in 2013 by Christopher Pelz, has maintained the integrity of organic cultivation with the help of seasoned growers from B.C.

“It’s really important to stay true to the original roots and make sure everything’s done properly. We don’t want to be a huge producer where the love has gone out of it, and we firmly believe in growing organic medical products in order to offer people alternatives,” Rivers says.

In Maple Ridge on B.C.’s lower mainland, Tantalus Labs CEO Dan Sutton shares his own incentives for getting into the cannabis space.

“We saw that opportunity really manifesting in the

intersection of this body of agricultural science and knowledge that we have here in British Columbia, and then this great history we have with cannabis. That was the genesis of it all; myself looking at a commercial scheduled regulation scheme implemented by Health Canada in 2012, and saying, ‘Look, the cannabis industry stands to benefit so much from the knowledge that we have here in B.C.’”

Sutton founded Tantalus Labs in 2012, and received his cultivation licence in 2017. The company has built what it claims as the world’s first cannabis-tailored, industrial greenhouse.

“The environmental control of our facility combined with the natural inputs of sunlight, through our

translucent greenhouse roof and walls, have yielded cannabis that I think is a lot more exciting than we had ever expected,” Sutton says.

The future of cannabis is sun-grown, he notes, and greenhouses will play a major role in creating “commercial and social” opportunities in the industry.

“ When you start to look at the social implications of legal cannabis, they’re so wide-ranging, and environmental is one that is not often discussed. It also really allows us to leverage our natural environment; we’re blessed with this natural hospitable environment for cannabis cultivation in B.C., and there’s no other environment, except for greenhouse, that could really take advantage of that.”

When you start to look at the social implications of legal cannabis, they’re so wideranging, and environmental is one that is not often discussed.

Good Buds hails from Salt Spring Island in B.C.’s coastal gulf islands. A location which reserves a known flavour in its own right with regards to organic agriculture and the legacy of sustainable growing practices – particularly in outdoor cultivation. Good Buds was founded by Toronto-born, brother team, Alex and Tyler Rumi.

The gulf islands exhibit potentially the most temperate weather in the country, and “cannabis loves that mid temperature weather,” says Tyler. “Down the whole west coast of the continent, from Mexico to Alaska, people grow cannabis outdoors with success. Salt Spring is very privileged.

“We are located in the pacific channel, which is excellent for cultivation. Growers here have always been speaking the language of organic soil, and symbiotic relationships within the biosphere while building upon community. This is everything that we are looking to achieve,” says Tyler.

While Good Buds await organic certification from Ecocert, the cannabis producer is already implementing organic practices in its grow, aligning with the company’s core values, reflected by the community in which it resides.

“People will find you because they are seeking the product you’re producing. I don’t think it’s niche; I think it’s the way people are expressing their consciousness – through the desire for cleaner products, and awareness around where and how these things are produced. This includes cannabis,” says Tyler.

Good Buds is currently growing cannabis indoors, but is gearing up for 2019 outdoor organic cultivation. “The goal is to be majority outdoor sun-grown cultivation,” says Alex.

Among the sustainable growing practices implemented is rainwater collection, sun-grown methods, living soil, cover crops – as explored by Good Buds’ expert cannabis cultivator, and the potential for reusable packaging made from recycled plastic. These methods not only offer patients and consumers a superior and, in the case of WMMC and Good Buds, organic product, but also promotes energy efficiency and reduces the carbon footprint associated with an otherwise energy intensive practice.

Sustainability in an industry of this scale is imperative. Sophie Rivers of WMMC believes there’s plenty of room for improvement in the cannabis industry.

“ The amount of chemicals that people put into their plants can be quite scary and not sustainable.” Toxic environmental pollution as an externality is an impor tant issue because of how damaging it is on a large scale, she added.

At WMMC, “the main sustainable growing practice that we use is called living soil,” Rivers says. “All of our plants are grown in soil, and we do it in a way that the soil can be re-used for up to two years. Every time we grow a new harvest, we re-use that soil rather than throwing it out, which a lot of people who grow in soil do, but it’s very wasteful and awful for the environment.” The water inherent to their location grows exceptional cannabis, and is a major blessing for WMMC.

Power consumption is another concern the company addresses through the use of more efficient grow lights.

CEO Dan Sutton and his team at Tantalus Labs have done well in reducing ener gy consumption at its production facilities. They have designed a greenhouse in the Fraser Valley where “economic self-interest, and social and environment sustainability” converge to create the best opportunity for cannabis

to thrive, “while saving so much energy input,” Sutton says.

“I think light levels are often underestimated. When you walk into a grow room in a traditional grow-op style environment, you see these really bright lights that are really close to the plants. It’s easy to overestimate how much light is actually getting onto those plants, but the sun is a 15-billion-year-old fusion reactor that hangs in our sky. Even on a cloudy day, the plants are getting a higher intensity and broader spectrum of sunlight into their leafy green fan leaves than if it was through a synthetic lighting environment alone,” says Sutton.

In addition to sunlight, Sunlab also uses natural rainwater collection for feeding cannabis plants. The retention ponds hold 5.3 million liters of water, and can fill up in two major rain events, “so we could legitimately be using reserves all summer long,” Sutton says. “Rainwater is not treated with chlorine or fluoride, so it’s a better input to irrigation.”

Over at Good Buds, brothers Alex and Tyler – with the expertise of its all-female cultivation team led by master gr ower Samantha Mikolajewski – use 100 per cent rain water collection, sun-

grown methods, and living soil as part of their growing practices. The land on which they built their operation is “already agriculturally solid,” the say. They are also working with organic nutrients from Vancouver Island.

Good Buds’ master grower Mikolajewski comes from “an organic background in California” with a history of cannabis activism. She is using outdoor cover crops to reduce energy input, irrigation and water storage, and to enable organic pest management. Through these practices, Good Buds is fostering a symbiotic ecosystem based on the important principles of permaculture.

Good Buds also suppor ts the cannabis community that already exists and thrives on Salt Spring and the surrounding islands. The company created the Buddy Program for microcultivators on the coast. Through this agreement, they are teaming up with small-scale cultivators to assist them in achieving compliance within the regulated market. The company wants to “provide the facility and licensing” in exchange for the existing expertise widespread in the gulf islands among craft growers. This program has already seen lots of success, according to Tyler. Good Buds is allowing microcultivators to set their own prices and maintain their own identity so consumers know exactly where the product is coming from.

“This will allow for great recognition within the space,” Tyler says.

While there are frustrations regarding excessive product packaging, some producers are going for the more sustainable option. Good Buds is looking to use post-consumer plastic for its cannabis containers, and is in the “early exploratory stage” of potentially establishing a point of sale r eturn so that packaging may be re-used to reduce waste.

These three West Coast licensed producers are demonstrating how sustainable growing practices can be implemented fruitfully within Canada’s booming cannabis industr y, and ultimately produce a superior quality product that does not necessarily put a huge strain on the environment.

A constructed wetland for treatment of greenhouse irrigation leachate & process water.

Our sub-surface, vertical flow constructed wetland consists of sand & gravel beds planted with moisture tolerant plant species. There is no open or standing water & the system is designed to operate winter & summer.

Ontario Regulation 63/09 classifies all process & irrigation leachate water leaving a greenhouse as industrial sewage. Therefore this water requires an

Environmental Compliance Approval (ECA) prior to discharge. In addition to sanitary sewage from toilets etc. this industrial sewage is defined as.

• water with added nutrients

• water that has been used for irrigation & washing of crops

• recycled water

• water carried through floor drains inside the greenhouse operation, including water that mixes with storm water (www.ontario.ca/page/rules-greenhouse-operators#section)

Recent projects include:

1) Treatment & re-use of greenhouse irrigation leachate/process water, Niagara & Haldimand counties;

2) Treatment of sanitary sewage combined with greenhouse process water (cannabis) in Niagara & Norfolk;

3) Treatment of winery/brewery process water at numerous sites in Niagara. We provide turn key systems, including design, permitting (required for discharge) & installation or will partner with your chosen consulting/engineering company.

Contact: Lloyd Rozema at 905-327-4571 or lrozema@aqua-tt.com

Aqua Treatment Technologies Inc. 4250 Fly Road, Campden, Ontario, Canada, L0R 1G0 www.aqua-tt.com

As organic products gain market momentum, here’s a look at what goes behind the production of organic cannabis

By Tamar Atik

Growing organic cannabis is becoming a differentiating factor for licensed producers that have a stake in the new yet increasingly competitive Canadian cannabis industry. For these organic growers, staying close to nature in their production process sums up their distinct identity, setting them apart from the rest – and allowing them to capture an important segment of the consumer market.

For David Perron, vice-president of growing operations at Mississauga, Ont.based The Green Organic Dutchman (TGOD), organic growing is full of opportunities to improve the environment and the experience of consumers who choose organic. TGOD obtained its organic certification from Ecocert Canada (Ecocert) in May 2018.

Organically grown products use no fertilizers, pesticides or genetic modifications, and the organic process takes steps to protect the environment.

“The main difference is the quality of the input that we’re using,” Perron says. “They’re all raw, natural ingredients and that’s what allows us to achieve a higher quality of cannabis and also achieve our organic certification.”

Whistler Medical Marijuana Corporation (WMMC) also grows organic cannabis in B.C. It was the first licensed cannabis producer to achieve organic-certified status, acquiring its certification from the Fraser Valley Organic Producers Association in 2014.

“[Organic production] gives people an

alternative, a choice in what they’re consuming,” Sophie Rivers, brand manager at WMMC, notes

Another cannabis producer that recently obtained its Ecocert certification is Organigram. The Moncton, N.B.-based LP worked with Ecocert for two years to ensure it met the requirements for organic certification. It received its certification in October 2018.

Ecocert essentially validated all of the company’s products, processes and the infrastructure to cultivate cannabis, Organigram’s chief commercial officer Ray Gracewood tells Grow Opportunity.

“Even for [Ecocert], the cannabis production environment is a new one that they’re still kind of working through the processes as well,” Gracewood explains. “It’s been a really great experience for both of us going through that and understanding how the cannabis industry can be unique and working through some of the issues that make for a healthy relationship going forward.”

Each organic certified producer will have variations for how it grows its cannabis, and although the exact method is kept under wraps, one of the main differentiators is using living soil and organic fertilizers.

“It’s definitely a more expensive soil, but one of the really great things about it is that it can be re-used as part of the process, so we’re not throwing out soil every time we do a harvest,” Rivers tells Grow Opportunity.

The difference between conventional fertilizer and organic fertilizer is how much each is processed. Organic growing uses a natural input or fertilizer that is processed by the soil’s microbiology, beneficial fungi and other beneficial microorganisms which offer the plants a broader range of vitamins and nutrients, which are then transferred to the end-product.

Given all the time and investment these three producers poured in to attain the golden certification ticket, it would be worth discussing if it was all worth it. The

We focus on the automation of indoor farming So you have full control over the growth of your cannabis plants

Hoogendoorn’s next generation iSii monitors and controls all climate,irrigation and energy equipment in all types of facilities such as greenhouses and buildings. The iSii is equipped with advanced controls that work according to the principles of Plant Empowerment. This way light, temperature, humidity and CO2 are aligned with each other for a maximum photosynthesis. In addition, to prevent water stress, irrigation is driven by the evaporation energy and water balance of the crop. With the iSii process computer, you set the base for high quality production.

info@hoogendoorn.ca

overall consensus was quite simply, Yes.

“Through our organic system with our living soil we’ve seen an increased concentration of terpenes and that translates to a better flavour for the patient,” TGOD’s Perron says. “We’re also producing a cleaner medicine, so it’s a better experience as well as a high medicinal value.”

Gracewood says although it’s a small percentage of the market that prefers organically grown cannabis, Organigram was motivated to cater to that niche.

“ We think organic production is one of those products that we want to clearly identify as something that consumers are looking for,” he says.

Obtaining organic certification essentially validates a company’s organic claim and adds transparency to what they do to create their final product.

As with any organically grown product, consumers know the bottom line is that they’ll be paying more. According to data from CannStandard, the average cost of one gram of regular grade cannabis is $9.02, compared to an average cost of $11.40 for one gram of organic cannabis – but it’s an added cost consumers are

willing to pay for.

The health benefits and the higher quality product might be why 10 to 15 per cent of Canadian consumers want an organic choice, Gracewood says.

When it comes to other organic products, Canadian consumers have shown they are willing to pay a premium for higher quality goods. According to Hill+Knowlton Strategies, 57 per cent of Canadians prefer organically grown cannabis.

For Perron, the cannabis industry is in the best position to get it right from the beginning.

“We’re building a new industry and we have the opportunity to pick all the knowledge from other agricultural industries, so we’re building something from the ground up and we have the opportunity to build it right and make a difference in terms of sustainability and in the lives of people,” Perron says. “That’s something that’s really exciting for me.”

For a more in-depth look at organic cannabis production and the certification process, read the full feature at growopportunity.ca

Not all extraction methods are created equal, but a little bit of everything may go a long way

By Jordan Whitehouse

When Organigram bought its second extraction system in 2017, it knew it wouldn’t be its last. The Moncton, N.B., LP plans to triple its cannabis kilos by 2020, and a big chunk of its sales will undoubtedly come from extract.

Deloitte thinks that by next year, when edibles become legal, six out of 10 cannabis consumers will choose to eat their cannabis. Vapers will be wanting legal oils in unprecedented numbers, too.

Simply put, “our capacity has to increase,” says Jeff Purcell, Organigram’s senior vice-president of operations.

The only questions for him and anyone else wanting more extract will be which method of extraction to add — CO2? Ethanol? Both? — and how many systems they’ll need.

Right now, Organigram uses ethanol and CO2, and both process about 5,000 kilograms of plant material per year.

Purcell isn’t ready to say which method they’ll add next, but they’ll probably always use a combination of the two.

“Looking into the future, there will definitely be importance placed on retaining terpenes in the process, which CO2 gives you but ethanol doesn’t.”

With ethanol, though, producers can extract very quickly, and if they’re looking just to isolate THC or CBD, it’s a good choice.

Organigram isn’t the only LP using both. While CO2 is the “gold standard” and the dominant method in Canada, the recent trend has been to add ethanol to the com-

pany portfolio, says Pete Patterson, the co -founder and chief operating officer of Vitalis Extraction Technology in Kelowna, B.C., one of the two biggest manufacturers of CO2 systems in the country.

The other big manufacturer, Advanced Extraction Systems in Charlottetown, P.E.I., sees similar movement happening, especially within the hemp industry.

“You may get less yield with ethanol, but the shear tonnage of hemp that is coming off the field at harvest means you have to extract it quickly,” says company cofounder David Campbell.

Some ethanol systems out there allow users to extract thousands of pounds of cannabis every day with a single machine. Organigram’s isn’t one of them, but it’s definitely a “workhorse,” says Purcell. They can run it 24 hours a day, seven days a week if they want.

With some ethanol systems, the extraction process is like dunking teabags in teacups, as Lucid Labs’ co-founder Jim

Makoso aptly described it recently. You take huge bags of plant material and dunk them in huge vats of ethanol. The only things that can limit efficiency are the size of the bags and the cups.

Once in the ethanol, the cannabis trichomes get pulled into the liquid. After the cannabis is removed, the liquid gets filtered and the alcohol gets purged from the extracted material.

The initial extract usually needs further refinement through distillation after winterization and/or filtration, but still, there’s less labour involved than with most CO2 systems.

The big hurdle to overcome with ethanol is its polarity. A polar solvent like ethanol makes it easy for chlorophyll to get extracted too. The result can be a dark, bitter product that tastes like grass.

Avoiding chlorophyll is all about temperature, says Vitalis’ Patterson. “If you cool the solvent to sub-zero temperatures, you can reduce the polarity of the molecule and reduce the amount of chlorophyll that is extracted.”

Unlike condensing technologies that can actually grow and distribute mold, Agam’s liquid desiccant dehumidification technology captures & neutralizes fungal spores, continuously cleaning the air.And since we use a salt solution, not refrigerants, we’re also helping make plant cultivation a lot greener.

Visit EnvirotechCultivation.com/agam to watch Agam VLHC in action. Plants, People, Passion

Vitalis now manufactures an ethanol extraction system to go along with its CO2 systems, and Patterson says they’ve seen a huge upswing in requests for quotes on ethanol from Canadian companies recently.

Advanced Extraction’s Campbell has also seen ethanol’s popularity grow, but more with smaller scale producers. Soon, though, he expects more companies will look at industrial ethanol extraction, especially those hemp processors.

CO2:

There’s no doubt that CO2 is dominant in Canada and growing. Campbell estimates that there are well over 20 LPs with CO2 systems right now.

He’s been making them since 2013, when he started a company that provides total supercritical fluid extraction services for pharmaceutical, nutraceutical and biotech companies.

“But the technology has been around since the ’70s, and it’s always been good,” he says.

Everything from decaffeinated coffee to fruit extracts to essential oils for perfumes are all now typically made with supercritical CO2 extraction.

The big draws are that the extraction process is clean, green and safe, and that the result is a high-quality product.

That process is more complicated than ethanol, but essentially it starts with pressurizing carbon dioxide until it becomes a supercritical fluid. The fluid then passes through a chamber with raw cannabis, where those treasured cannabinoids get extracted before the fluid is stabilized back into a gas to be used again.

Not only is CO2 non-toxic and non-flammable, but it can pull a wider range of cannabinoids from the plant than ethanol, including THCA, CBG, THCV and others.

It can also pull terpenes, which are the organic compounds that give plants their flavour and smell. That’s big for Canadian LPs, says Patterson.

“In Canada’s current regulations, LPs are not allowed to add foreign terpenes into their concentrates. Therefore, they have to use what is extracted from the plant. CO2 is the best solvent to pull a full-spectrum extract, which includes the terpenes.”

CO2 is popular south of the border too, but the market is split not only by ethanol but by hydrocarbon systems as well. Hydrocarbon typically uses solvents like butane or propane – many of which are banned in Canada – for the use of cannabis extract.

In Europe, there’s a heavy focus on good manufacturing processes and quality standards, says Patterson, which makes CO2 a better fit.

“Almost every company that we interact with in the EU is requesting CO2 only.”

3,100+

2.58

So where does all of this leave Canadian LPs, like Organigram, that need to increase their extract output and systems? With a foot in both ethanol and supercritical CO2 fluid, it would seem.

Ethanol is one of the most efficient options available, and it’s ideal for producing

quality THC and CBD extracts. CO2, on the other hand, produces a range of premium extracts that retain the same rich flavour and smell profiles of broken nugs of flower. With both, LPs can respond to the evolving array of tastes and budgets out there.

However, for Canada in particular, CO2 will continue to be the dominant method,

Industry leader INDIVA has taken the matter of environmental sustainability and protecting our planet seriously. Using our BioRoter Compost Digester to denature all waste plant material and destroy pathogens, while creating high quality compost is just one way INDIVA is breaking ground in this competitive and innovative marketplace.

FEATURES:

•

•

•

especially as the country begins to allow the use of vape pens, says Patterson.

“We’ll see a huge uptick in larger CO2 extraction systems to create the full-spectrum oils required for these pens.”

Campbell says the trend to go bigger is already happening. In 2016, it sold a CO2 system to Canopy Growth that had three 25-litre vessels. A recent sale, to an unknown buyer, had four 100-litre vessels capable of processing 325,000 lbs of plant material per year.

Organigram’s Purcell says they’ll decide in early 2019 what they’ll add to their line, but for now they’re on the fence about adding a larger CO2 system or multiple smaller systems.

Either way, he doesn’t see ethanol or CO2 singling the other out in the future at Organigram.

“In manufacturing, it’s always good to have options.”

100,000

New grow room climate control technology enters market

Dehumidified Air Solutions (DAS) recently unveiled its Agronomic IQ technology for grow room temperature and humidity control.

After more than 42 years’ experience with indoor pool temperature and humidity control, DAS is helping cannabis growers achieve precise grow room control with robust, reliable and technologically advanced equipment.

When it comes to grow rooms, precise temperature and humidity control at the various stages of growth are essential to maximizing both yield and quality. With such valuable crops at stake, systems must also be 100 per cent reliable day-in, day-out in order to prevent crop loss.

Despite this, growers are challenged to find the right equipment that delivers precisely controlled conditions throughout every season and every phase of growth. Of equal importance, is the requirement that the equipment be energy efficient. To help address these critical issues, the Agronomic IQ product line solves both with patent-pending technology. agronomiciq.com

CBD

Radio frequency technology creates volumetric heat

Global food safety solutions company Ziel has teamed up with Canadian cannabis Licensed Producers to help meet Health Canada regulations, while reducing operating costs.

Ziel’s APEX technology is a non-irradiating and cost-effective solution for broad spectrum microbial pathogen reduction. Using the precision of radio frequency technology, APEX reduces total yeast and mold (TYMC) to less than 10,000 cfu/g without compromising sensory quality.

Radio frequency works by creating an oscillating electromagnetic field between two electrodes in the APEX cavity. Operating at a 27.12 MHz frequency level, polar water molecules contained in the natural moisture of the cannabis rotate 27 million times per second, generating the heat necessary to kill microbial pathogens. The long radio wave profile penetrates uniformly throughout the flower, creating ‘volumetric heat,’ as opposed to traditional thermal heating.

Ziel’s proprietary process settings, administered by a Siemens PLC/HMI system, precisely control heat via temperature probes, reducing the targeted microbials to a safe level, without compromising the flower’s sensory qualities.

Cannabis and CBD hemp harvesting equipment provider Triminator has announced the debut of the Triminator Kirpy CBD Hemp Harvester. The hemp harvester is a whole plant harvester released in the U.S. by Triminator in collaboration with KIRPY, a French specialty equipment manufacturer. The machine is designed for infield cutting and loading of whole hemp plants, which takes place prior to CBD extraction. The Triminator Kirpy hemp harvester is a tractor mounted attachment capable of harvesting up to five acres a day. The harvester cuts the plant at the base, notches the stem, and transports the entire plant to a transport trailer, which moves to the processing facility. CBD hemp flowers are then extracted for use in topicals, edibles, and medicines, which utilize CBD for a rapidly expanding number of products. With the CBD market expected to grow to $22 billion by 2022 according to the Bright Field Group, a CBD research firm, hemp farmers are scaling rapidly and searching for equipment to help meet demand.

thetriminator.com

Benefits include: an organic, chemical free, non-irradiating and non-ionizing process; zero THC loss or conversion; zero decarboxylation; moisture loss of <0.5 per cent; <15 minutes per batch cycle, and more.

zielcannabis.com

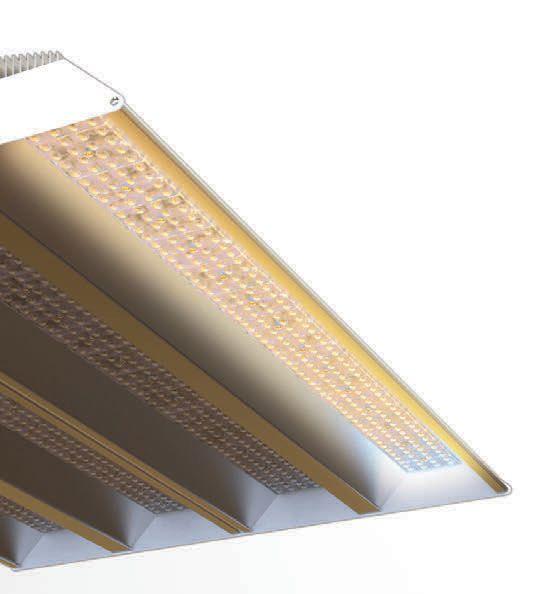

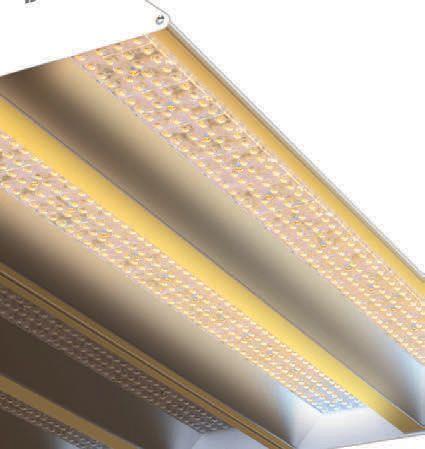

The HarvestEdge horticulture LED grow lighting modular system from Illumitex is designed for greenhouse supplemental and indoor primary grow lighting applications. When configured for supplemental greenhouse lighting with the high-performance F3 spectrum (25% blue, 5% green, 75% photo red) the system delivers nearly 30 per cent more efficiency than competitive products, the company says.

While Illumitex’s unique thermal-fin design maximizes performance, it also enables a low-cost solution that delivers 20 per cent more light for the same dollar. The aesthetically pleasing fixture is lightweight, thin, easy to install, has integrated power, and comes with wet, IP67, ETL, and cETL certifications depending on modules.

illumitex.com/products