The M VersaPro® (MVP) Dicer, by Urschel, provides a sanitary (IP69K) design and versatile cutting (VFD-equipped 5HP Crosscut) of proteins. Patented fluted crosscut. Deeper circular knife penetration. It outperforms the M6 by a resounding 33%.

Explore the MVP to improve your line.

NOVEMBER/DECEMBER 2024 • VOL. 84, ISSUE 6

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE ED ITOR | Ojasvini Parashar oparashar@annexbusinessmedia.com 416-510-5206

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Barb Vowles bvowles @annexbusinessmedia.com 416-510-5103

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $86.65 per year

Canada 2-year – $127.45

Single Issue – $15.00

United States/Foreign – $163.15 All prices in CAD funds

Food in Canada is published 6 times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission ©2024 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

It’s the season of trend reports. So, let’s dive into some of the key trends.

Kerry’s 2025 Taste Trends imagines a world where product innovation combines intelligence using technology like artificial intelligence, social media (think Tik Tok influencers) trends and societal shifts to create unique dishes and drinks for consumers who want a mix of fun and functional.

Consumers are also rethinking classic cuisines with a huge dose of personal creativity inspired largely by social media influencers. Nourish Food Market’s Trend Report 2025 speaks of the ‘Return to Intuitive Cooking’. Cottage cheese and cucumber were given new lives on social media, ensuring every bite is a comfort as well as an experience.

“As consumers shift away from strict recipes, they’re embracing a more spontaneous, ingredient-led approach fuelled by social media’s celebration of improvisational cooking. This trend empowers consumers to use creativity in the kitchen while exploring new ingredients and methods,” the report said.

Of course, consumers want small indulgences, or ‘little luxuries,’ as described by Kerry.

“This trend delights in everyday indulgences that punctuate life with pleasure and sophistication. In an era of heightened cost-awareness, these petite pleasures help elevate

the ordinary into micro moments of happiness,” explained Kerry.

Mintel’s 2025 Global Food and Drink Trends Report found that “consumers would be unwilling to compromise on moments of pleasure and indulgence.”

“Rather than marketing certain foods and drinks as ‘guilty pleasures’, brands could encourage overwhelmed consumers with the freedom to indulge,” it suggested.

Nourish emphasized that consumers are increasingly seeking food that engages all five senses, “creating a rich, immersive experience. Brands are innovating to bring multi-sensory elements—sight, smell, texture, and sound—into their products to enhance enjoyment and deepen emotional connections.”

As mentioned earlier, consumers want food that are nutrient dense while being delicious. This could be the fallout of the rise of GLP-1 weight-loss medications, but consumers want novel flavours along with functional benefits like boosting energy, high in protein or fibre, etc.

“Starting in 2025, brands must streamline their health claims to the critical nutrients they contain. Simplified claims that highlight protein, fibre, vitamins and mineral content will appeal to people who are using weightloss drugs as well as the majority of consumers who define their diets based on their individual needs and how food makes them feel. Promoting well-known

essential nutrients will also help to differentiate products in an age of nearly infinite access to information—and misinformation,” explained Mintel.

The rise of functional foods also addresses another consumer desire to live long, healthy lives. Both the Mintel and Nourish reports highlight the growing popularity of Blue Zone (regions including Okinawa, Japan; Sardinia, Italy; Nicoya, Costa Rica; Ikaria, Greece; and Loma Linda, Calif., where people lead long lives) diets, which is rich in plant-based and whole foods.

“The global average lifespan has increased by 20 years over the last century, but healthspan has not kept pace. Increasingly, consumers are looking to their diets to close the gap,” explained Nourish.

This desire has translated into the continued demand for hi-protein foods.

“Consumers are looking to incorporate more protein in their diet beyond traditional powders and bars, with an emphasis on ramping up protein consumption at mealtimes and with ‘whole food’ snacking,” it said.

In other trends, water is no longer just for hydration. As part of the wellness movement, consumers are seeking water with added minerals, vitamins and herb infusions. What trends are you tracking? Let me know. Happy New Year!

Nithya Caleb ncaleb@annexbusinessmedia.com

Maple Leaf Foods decides to call its pork business Canada Packers. The pork company is expected to be spun off as an independent, publicly traded firm in 2025. Maple Leaf Foods will retain a 19.9 per cent ownership position in Canada Packers and the two companies will have a pork supply agreement. This will ensure that Maple Leaf Foods has continued access to pork products.

Nanak Foods gets $5M federal funding

The federal government invests $5 million in Nanak Foods through the Pacific Economic Development Agency of Canada’s Business Scale-up and Productivity program. The funding will help the North American dairy-based and South Asian-inspired food manufacturer to increase the production of paneer by expanding its operations with new equipment.

Hain Celestial Group divests ParmCrisps snack brand to Our Home, an independent snacks company. Hain Celestial will use sale proceeds to pay down its debt. The deal also includes the ParmCrisps production facility in York, Pa.

PepsiCo acquires Siete Foods, a company that makes Mexican-American food, for US$1.2 billion. Siete was founded in 2014 and sells tortillas, salsas, and snacks in grocery stores and other retailers. The deal is expected to be completed in the first half of 2025.

$200M

Jungbunzlauer, the sole producer of xanthan gum in Canada, is investing $200 million to expand its facility in Port Colborne, Ont. This multi-year project will create 50 new jobs and has received $4.8 million from the Invest Ontario Fund. The expansion is expected to be operational by spring 2026 and will produce biodegradable xanthan gum, a fermented sugar used as a thickener and stabiliser in food and beverages.

Dainty Rice invests $20 million in new retort production lines at its Windsor, Ont., plant. The first phase of this launch is now operational. Phase 2 will be completed in early 2025. The new lines will aid Dainty in producing ready-to-heat rice, grains, pulses, and pasta. Dainty estimates they’ll also help reduce the company’s carbon footprint by approximately 2,000 mt annually.

Smucker divests Voortman Cookies

J.M. Smucker sells its Voortman cookie brand to Second Nature Brands for approximately US$305 million. This all-cash transaction includes all Voortman trademarks and the manufacturing facility in Burlington, Ont. Around 300 employees will transition to Second Nature Brands. Smucker plans to use proceeds from the sale to pay down debt. The transaction is expected to close in the third quarter of Smucker’s fiscal year, ending April 30, 2025.

Keurig Dr Pepper (KDP) acquire Ghost Lifestyle and Ghost Beverages, makers of the RTD energy drink Ghost Energy. The acquisition will take place

in two stages. In the first stage, KDP will initially purchase a 60 per cent stake in Ghost. This is expected to close in late 2024 or early 2025. The company will acquire the remaining 40 per cent stake in 2028. Ghost will continue to be led by its co-founders, Dan Lourenco and Ryan Hughes.

Los Angeles County filed a lawsuit against Coca-Cola and PepsiCo, alleging the companies misled the public about the recyclability of their plastic bottles and downplayed the harm plastic disposal causes to the environment and human health. The lawsuit claims that the companies engaged in “disinformation campaigns” to encourage consumers to buy single-use plastic bottles, leading them to believe the bottles are recyclable and environmentally friendly. The lawsuit aims to stop the companies’ allegedly deceptive practices and seeks restitution for consumers and civil penalties. This is not the first time Coca-Cola and PepsiCo have faced legal action for their role in plastic pollution. In 2020, the Earth Island Institute sued several companies, including Coca-Cola and PepsiCo, for plastic waste. Similarly, New York state sued PepsiCo last year for plastic waste in the Buffalo River, but a judge dismissed the case.

The P&H Milling Group is building a new flour milling facility in Red Deer County, Alta., for $241 million. The facility will mill an estimated 750 t of wheat from western Canadian farmers each day. It is equipped with advanced processing technology and designed for high throughput, energy efficiency

and a low carbon footprint. In addition to the milling operations, the site will include offices, warehousing, logistics infrastructure, rail siding and provisions for future expansion. The facility is expected to generate up to 200 jobs.

Health Canada authorizes new lipase source

Health Canada authorizes the use of lipase derived from Aspergillus niger strain PLR at the maximum use level of “Good Manufacturing Practice” in the manufacture of bread, flour, whole wheat flour, pasta, and a range of unstandardized bakery items such as cakes, cookies, and tortillas.

Daiya Foods and partners invest $16M to enhance plant-based cheese

Daiya Foods, Ingredion, Ingredion Plant Based Protein Specialties and Lovingly Made Flour Mills are combining their expertise to use Canadian pulses, such as pea and fava, in the development of new protein ingredients and plant-based cheeses. A combined total of $16 million has been invested into the project, with Protein Industries Canada committing $5.8 million and the partners together committing the remainder. Throughout the project, Ingredion and IPBPS will turn Canadian pulses into functional ingredients for use in Daiya’s plant-based cheeses. At the same time, Lovingly Made Flour Mills will develop extruded pulse ingredients for use in Daiya’s products.

Mars shakes up leadership team

Jim Wood (Red Deer County Mayor), Lloyd Heimbecker (executive vice-president, Parrish & Heimbecker), RJ Sigurdson (Alberta Minister of Agriculture and Irrigation), Bruce MacIntyre (president and COO, P&H Milling Group), and Devin Dreeshen (Alberta Minister of Trade and Economic Corridors) at the groundbreaking ceremony.

Mars appoints Dave Dusangh as regional president for North America and Hans Bakker as regional general manager for its food and nutrition business in Europe. Dusangh and Bakker will report to the global president of Mars Food and Nutrition, Shaid Shah, and will begin these roles immediately. Before becoming Mars Food and Nutrition regional president for North America, Dusangh was the regional general manager for Mars Food and Nutrition Europe. Dusangh started at Mars in 2011 with Mars Pet Nutrition Canada and moved on to lead Mars Food and Nutrition Canada in 2016. In 2018, he also became GM of Tasty Bite North America. In his new role, he will oversee brands including Ben’s Orginial, Seeds of Change, and Tasty Bite.

Molson Coors takes majority stake in Zoa Energy

Molson Coors is taking a majority ownership stake in Zoa, the better-for-you energy brand co-founded by Dwayne “The Rock” Johnson, Dany Garcia, Dave Rienzi and John Shulman. This move now allows Molson Coors to lead the entirety of Zoa’s marketing, retail and direct-to-consumer sales and development. Molson Coors and Zoa first struck a partnership when the brand launched in 2021, and Molson Coors increased its stake in Zoa last September while also assuming a presence on Zoa’s board.

Crosby Foods acquires sweetener portfolio from Caesars Tea

Crosby Foods expands its product line by acquiring the sweetener portfolio from Caesars Tea. The acquisition adds five SKUs to Crosby’s nutritive sweetener range, including three organic golden sugar, organic agave, and crystal rock sugar. The acquisition enables Crosby to offer resealable stand-up pouch packaging.

Fontaine Santé, Boursin launch new cheesy dips

Hummus and dip brand Fontaine Santé partners with Boursin to launch four new products featuring Boursin’s garlic and fine herbs cheese. The new products include: hummus with Boursin garlic and fine herbs cheese; tzatziki with Boursin garlic and fine herbs cheese; artichoke dip with Boursin garlic and fine herbs cheese; and cavatappi salad with Boursin garlic and fine herbs cheese.

Dr. Amy Proulx

he food safety world has been inundated with coverage of the Boar’s Head Listeria crisis. In the ready-to-eat meat world, Listeria is not an unknown or emerging pathogen. We know it kills people. So the sheer scale of the incident has created quite a stir when it comes to food safety systems management.

Food safety takes a systems-based approach. Large crises of this type typically do not occur due to a single mistake. Rather, a compounding of small and seemingly insignificant issues cause a major incident. Inspection services, third-party auditors, and, of course, the establishment’s management and ownership play unique roles in these incidents.

The United States Food Safety Inspection Service reports from Boar’s Head are explosive. There were 69 non-conformities in the inspection review of records from June 3, 2023, to July 27, 2024. Many of these inspection reports identify critical non-conformities that should have alerted several stakeholders, across inspection, establishment management and ownership, and even retailers and distributors who should be carrying out third-party audits on a company of this size. Many of these non-conformities, in my opinion, should have increased directed microbial testing requirements, and possibly temporary facility closures.

Lesson two

What happened to the multiple layers of inspection and audit that facilities of this type typically have? Blog postings

are mentioning how GFSI benchmarked audits were performed during the period when these non-conformities were being reported on Food Safety Inspection Service reports, including one on June 6, 2023, with an Excellent rating, and one on May 1, 2024, also with an Excellent rating. We’ve tried searching the supplier verification databases and it appears records have been revoked from previous audits. This still begs the question, how did third-party auditors not see the nonconformity reporting from government inspections, and ask about corrective action plans and preventive actions? Inevitably all food safety incidents become the responsibility of plant management and ownership. This is why one of the first requirements is management commitment to the oversight and implementation of food safety plans. Given the enormity of nonconformities, it again begs the question, was there a sense of clutter blindness to the issues at hand? I’ve worked with a wide range of companies in my career

We must keep walking into our establishments with fresh eyes for continuous improvement, prioritizing the risks we observe, and working diligently to correct hazards and non-compliances every single day.

where small issues and broken systems become a habit. They get to the point where people start ignoring them and create workarounds. When those small issues start compounding, then crises of this sort start to occur. Boar’s Head had approximately 600 employees at the time. A strong food safety culture across the entire workforce should have alerted these non-conformities to supervisors or managers who should have put in place corrective and preventive measures. Employees get blinded and exhausted by small non-conformities, and the constant requests to fix things. Managers get overwhelmed on how to prioritize infrastructure improvements and program changes within fixed budgets. Inspectors have only limited time at different establishments and may be focused on performing specific requested tasks and unable to look holistically at the entire establishment. Third-party auditors equally get a very limited time to perform their enormous and exhaustive tasks. We already know there are skilled worker shortages in the food and beverage manufacturing sector, making experienced food safety and food manufacturing professionals hard to find. And customers want food at low prices, meaning profits are always razor thin for manufacturers. This leads to a constant shrinking of budgets for infrastructure improvements, training and quality management systems. A little bit of each of these contributes to the whole. When working in food safety we must have an insatiable and tireless curiosity to make things better. It’s easy to point fingers, and try to create blame, instead of focusing on the root cause and problem solving. We must work diligently to correct hazards and non-compliances every single day.

Dr. Amy Proulx is academic program coordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. Email: aproulx@niagaracollege.ca.

Gary Gnirss

n November 2023, proposed regulations that would significantly amend the Food and Drug Regulations (FDR) were published in Canada Gazette I. When finalized, the amendments would impact how food standards, food additives, microbiological criteria and methods of analysis govern foods at a federal level. While the amendments would significantly alter the anatomy of food regulations in FDR, the application of the new rules would generally have the same outcome as the current one. However, the proposed changes would address some housekeeping issues, such as repealing the food additive tables that are currently still codified in Division 16, FDR. Perhaps the most significant focus of the proposed changes is that Health Canada and the Canadian Food Inspection Agency (CFIA) can modernize rules related to the substantive elements of food standards, which is desperately needed for some (e.g. those for spices and flavours). Essentially the updates carve out the structure of modern rules, including incorporation by reference (IbR), whereby Health Canada and CFIA can more effectively address modernization. In Canada, food standards are governed by federal and provincial governments. Food standards at the federal level are split into those under IbR by FDR and Safe Food for Canadian Regulations (SFCR). The proposed amendments speak specifically to those under FDR. The current FDR (Part B) is subdivided into various divisions, largely related to commodity groups like alcoholic beverages, grain and bakery products, dairy, meat, etc. Within those divisions, certain foods with prescribed

composition, strength, potency, purity, quality or other properties are designated as standardized foods.

When first established, FDR was intended to be administered and enforced by a government entity dedicated to those rules. These rules, in a simplified generic perspective, can be related to ‘health and safety’ as well as ‘trade and commerce’.

The proposed amendments would essentially separate criteria related to ‘health and safety’ and ‘trade and commerce’. From an administration viewpoint, this would then better align with Health Canada and CFIA’s mandates.

If, as an example, we examine the current food standard for wheat flour in B.13.001, FDR, we can see that standard prescribes the particle size of the bolted flour, moisture content, the grain proportion of bran and germ, and what other ingredients (e.g. malted barley flour) can be added. The standard also requires the flour to be fortified with thiamin, riboflavin, niacin, folic acid and iron. Optional addition of vitamin B6, pantothenic acid, magnesium and calcium is also permitted. It can be observed that the standard for white flour, as many other current standards, prescribes the use of food additives. However, food additive rules under FDR were amended in 2012, when 15 separate food additive tables were established (IbR) under 15 food additive marketing authorizations (MA). MAs are ministerial regulations under FDR Within the 15 MAs for food additives are notwithstanding provisions whereby when a food additive is identified for use

in a food in its respective food additive table, the application of the food additive is not limited by the food standards. In other words, the 15 food additive MAs and their IbR tables are paramount when it comes to applying food additive rules. This was done as a temporary workaround until the needed FDR changes can be made. Now is the time. It has been proposed that the vitamin and mineral rules for wheat flour be retained in the FDR (B.13.001). The other compositional parts and ‘trade and commerce’ aspects of the flour standard would be repealed and consolidated in a new IbR document called Food Compositional Standards Document. The food additive reference would be wholly repealed. Health Canada also proposes to repeal the current 15 food additive MAs and their IbR tables and reconsolidate those in 15 List of Permitted Food Additives table, IbR directly under FDR. Health Canada will add another column, ‘Notes,’ to these tables. This new column will identify the reference to the notice of modifications amending the table, making archival research simpler. The proposed food compositional standards capture 19 specific food commodities currently governed in Divisions 1 to 22, FDR. Divisions 3 (Baking Powder), 4 (Cacao and Chocolate Products), 5 (Coffee) and 20 (Tea) would be repealed entirely. Of course, their standard will be transferred to Canadian Food Compositional Standards IbR document.

Gary Gnirss is a partner and president of Legal Suites, specializing in regulatory software and services. Contact him at president@legalsuites.com.

Tyson MacInnis

tlantic Canada has long been known for its seafood and shellfish sector, its food processing and agricultural operations, and for its diverse culinary contributions. More recently the region is being recognized as a foodtech hub, as research centres and foodtech startups appear with solutions to help the provinces’ food industries remain robust and sustainable.

Federal and Atlantic provincial governments have invested in transformative technology for the region, including AI, digitization, biosciences, and precision fermentation. In 2023, the Verschuren Centre for Sustainability in Energy and the Environment, a cleantech development and deployment centre in Sydney, N.S., received more than $1.1 million in funding from the Canadian Food Innovation Network (CFIN), which in part will go to the construction of a 10,000-L precision fermentation facility to help cellular food companies scale up and commercialize. The facility will feature “integrated AI advanced automation, digital twin technology, and machine learning,” says Verschuren Centre CEO Beth Mason. In September 2024 the Ocean Supercluster announced a $1.6-million project to develop generative AI/machine learning software technology for the seafood sector with the help of B.C.’s ThisFish.

The industry’s digital transformation has been supported by regional companies such as software developers Tracktile in Stratford, P.E.I., and Milk Moovement, Acuicy and FoodByte in Halifax; IT services providers including Mabel Systems in Sydney, and Agyle

imaging for real-time analysis of a person’s intoxication level. Once the program is completed Dispension Industries hopes to provide unattended beer kiosks in stadiums and other venues.

Foodtech companies such as Rfine Biomass Solutions are innovating to address concerns around sustainability and food waste. In collaboration with regional and national coffee chains, the Halifax company is developing a precommercial pilot of its Kaffika process to upcycle spent coffee grounds into a nutrient-rich food-grade ingredient.

Intelligence in Mount Stewart, P.E.I.; and foodtech startups like Cleanbands in Charlottetown. Meanwhile, emerging innovators are introducing foodtech that is disrupting traditional sectors, addressing food industry challenges, and helping to keep the industry competitive. Regional organizations and companies supporting the food processing sector locally and globally in areas such as automation and efficiency include CMP in Charlottetown, New Brunswick’s Area52, ABCO Industries in Lunenburg, N.S., and SmartSkin Technologies in Fredericton.

Examples of projects supported through CFIN funding include Dartmouth, N.S.based Dispension Industries, which offers manufacturers a unique retailing option through its contactless, self-service kiosks for ready-to-drink beverages and canned beer. The kiosks operate on proprietary software and biometric access controls as well as are secure and simple to use. The company is currently developing the Intoxivision software, an intoxication detection system that uses thermal

Creating innovative, sustainable options is also the aim of Dartmouth, N.S.-based Smallfood, which uses microalgae and biomass fermentation to produce a highquality protein with Omega-3 DHA for use in plant-based alternative seafood. Gülten Izmirlioglu, vice president of research and development for Smallfood, believes this type of foodtech offers a solution to feeding the world’s growing population.

“At Smallfood, our quest for a sustainable solution to the world’s massive food production challenge resulted in the discovery of something ‘small’ with very ‘big’ potential,” she explains. “Microbes are the world’s most energy-efficient production systems so we set out in search of a microbe that could produce abundant protein and DHA with the highest nutritional quality, while conserving the Earth’s precious resources.”

Tyson MacInnis is regional innovation director for Atlantic Canada for the Canadian Food Innovation Network (CFIN), which funds transformative foodtech projects, stimulates collaboration, and fosters a growing community of food and beverage professional that’s free to join.

— BY NITHYA CALEB —

Seafood is an expensive protein but has excellent health credentials. According to a study by IBISWorld, referenced by Agriculture and Agri-Food Canada’s (AAFC’s) Fish and Seafood Trends in Canada report, growing disposable income and rising health awareness is encouraging Canadians to increase their consumption of fish and seafood products. However, it’s also one of the first products to be left out of shopping carts when the economy hits rough waters, as has been the case for the past few years. High Liner Foods, one of Canada’s leading frozen seafood processing companies, saw its sales volume decrease

by 4.2 million lb, or 6.9 per cent, to 56.8 million lb compared to 61 million lb in Q3 2024 due to customer pull back, decline in contract manufacturing business and exiting of low margin business. However, it’s foodservice business “saw continued growth in alternative species despite the overall YoY decline in volume,” thanks to expanded distribution, promotional policies and supply chain diversification.

High Liner Foods’ branded products are sold throughout the U.S. and Canada under the High Liner, Fisher Boy, Mirabel, Sea Cuisine, and Catch of the Day labels. The company also sells branded products to foodservice establishments under the High Liner, Mirabel, Icelandic Seafood and FPI labels. It is also a supplier of pri-

vate label value-added seafood products to North American food retailers and foodservice distributors. It employs more than 1,100 workers worldwide. It has three processing facilities in Lunenburg, N. S., Portsmouth, N.H., and Newport News, Va.

High Liner Foods, which celebrates its 125th anniversary this year, has seen many challenges and evolutions over the years. Headquartered in Lunenburg, N.S., it began as a ship chandler under the name, W.C. Smith & Company, in 1899. In 1926, the High Liner fresh fish brand was launched. In 1945, a group of fishing companies including W.C. Smith formed National Sea Products, which then became the largest fish company on Canada’s East Coast. In 1953, it launched frozen seafood products like battered fish and chips. In 1956, National Sea Products entered the U.S. by acquiring 40-Fathoms fishing company, and in 1964, it opened one of the world’s largest fish processing plants in Lunenburg. In 1999, the company changed its name to High Liner Foods, which is how it’s known today. In 2004, High Liner exited the harvesting and primary processing business, largely triggered by the moratorium placed on cod fishing on the East Coast. With fishing opportunities severely limited, High Liner had to reposition itself as a processor and importer of frozen seafood products. The change worked, and High Liner has continued to grow by expanding its business as well as by acquiring companies like Fishery Products International (2007), Viking Seafoods (2010), Icelandic Group (2011), American Pride Seafoods (2013), and Atlantic Trading Company (2014). These acquisitions have enabled High Liner Foods to expand its U.S. business so much so that its U.S. foodservice business is the company’s biggest revenue generator.

“About 70 per cent of our business in total is in the U.S. and

almost 75 per cent of our U.S. business is foodservice,” explained Paul Jewer, company president and CEO.

To acknowledge High Liner’s impact on the local community, economic development and maritime heritage, the town of Lunenburg will celebrate Dec. 12 as ‘High Liner Foods Day’. High Liner has contributed more than $1 million and 290,000 kg of food to Feed Nova Scotia since 2016. It also had a goal of providing 10 million meals over 10 years across North America through both financial contributions and in-kind support. This goal, set in 2015, was achieved three years early in 2022.

I spoke to Jewer about High Liner’s storied history and future plans. Given that there are not too many F&B manufacturing companies with a 100-plus-year history, I began by asking about the factors for High Liner’s longevity.

“The primary thing I would have to focus on is our people, right? And it’s been the people that have supported High Liner across the 125 years that have really made the difference in our success and have allowed us to have that kind of longevity,” said Jewer. “You don’t get to 125 without a level of resiliency because, if you can imagine, a lot has changed in our business over the course of 125 years. High Liner has shown a willingness and an ability to predict what some of those changes are going to be so that you’re not just reacting to them. But when you do have to react to them, you’ve created a capability to react in the best possible way”

Indeed, High Liner has been successful in repositioning its business in response to market conditions. Earlier this year, High Liner invested US$10 in Andfjord Salmon Group AS, a landbased salmon aquaculture company in Andøya, Norway, as

well as US$5 million in Norcod AS, a cod aquaculture farm in Trondheim, Norway. These investments provide High Liner with secure aquaculture suppliers in a world where wild caught fish stock is slowly depleting.

“Aquaculture now has surpassed wild caught as a percentage [of total seafood production] and we think that will continue to be the case. I mean the good news is we’ve worked hard to ensure the sustainability of wild caught species. That’s sustainable, but it’s not growing. And the reality is consumption of seafood globally is growing. Aquaculture is going to be the solution to that growing demand and consumption. So yeah, we do see aquaculture increasing as a percentage of our overall product,” explained Jewer.

However, for now, most of High Liner’s fish is wild caught—70 per cent in terms of volume. Its strongest business is in white fish, such as value-added cod, haddock, sole, pollock, salmon and tilapia.

“We believe there’s a lot of growth opportunity for us beyond that. We already have a decent-sized shrimp business [but that can be grown]. Atlantic salmon is a big growth platform for us. In this current environment where we know that a lot of consumers are struggling with inflation, we’ve introduced some lower cost alternative species to the market,” such as blue cod fish from New Zealand and pike fish primarily from South Africa and Namibia, said Jewer.

Since most of High Liner’s products are made from wild caught fish, the continued availability of those species is a big focus for the company. So, “for literally more than a decade, we’ve invested in supporting sustainable fisheries. That includes supporting what’s called fishery improvement projects to help fisheries get to that level of sustainability,” said Jewer. Due to these efforts, more than 90 per cent of the raw products sourced by High Liner are certified sustainable. It asks its suppliers to sign a code of conduct, and High Liner conducts compliance audits on a regular basis using third parties.

“We spend quite a bit of time ensuring the fishing companies that we work with are treating their people the right way. Unfortunately, occasionally we will still find examples where people raise concern about whether a certain supplier is behaving in the way they said they would. And in that case, we’ve had to suspend suppliers or stop buying from them altogether,” added Jewer.

In the recent past, High Liner cut ties with Yantai Sanko Fisheries, a supplier in China, after a four-year investigation by Outlaw Ocean found that the company used forced labour.

Besides ensuring suppliers are following sustainable fishing practices as well as meeting high labour standards, High Liner must have the logistics and distribution capabilities to get the fish from across the world to North America.

“We have, in some cases, pieced together seasonal fisheries to make sure our customers have supply year-round,” he explained.

This gets complicated in times of uncertainties when shipping lanes that were once open are no longer open. Pandemics and geo-political issues can also impact supply.

“Unfortunately, when you have unrest, uncertainty and conflicts in parts of the world where seafood historically could come from it adds complexity to supply,” explained Jewer.

Another challenge for High Liner is consumer education. This is important because many Canadians don’t consider seafood as diet staple. According to Mintel, more than half view seafood as a treat rather than an everyday meal. Additionally, Canadians are uncomfortable with preparing seafood. However, AAFC’s report estimates fish and seafood per household consumption to increase to $348.1 in 2026 with a growth of CGAR at 2.1 per cent from 2021 to 2026. Foodservice sales are also estimated to increase at a rate of 3.42 per cent, nearly 79,000 t, by 2027.

“We must make seafood more convenient for them to consume. We need to make sure they are comfortable cooking it and preparing it so that they have the recipes they need in order to feel confident in their preparation of seafood. That’s where some of the value adding we do can help. We need to continue to educate them on why seafood is not only better for them, but also better for the planet,” said Jewer, who grew up in Newfoundland, and has been with High Liner Foods for nearly 11 years. He was appointed CEO a year ago. Prior to that, Jewer was the company’s CFO.

As someone who grew up eating High Liner products, Jewer feels, “We’re in a protein that we believe is ripe for further growth for all the reasons that we’ve talked about. So we have a big focus on continuing to grow organically and meeting the needs of more U.S. and Canadian consumers and customers.”

In 2022, the Weston Foundation launched the Homegrown Innovation Challenge, partially in response to the impacts felt post-COVID to commodity supply chains as well as the Ukraine-Russia war. These major global disruptions to food supplies were felt not only in Canada, but also around the world. In the category of fruits and vegetables, Canada has had to deal with harsh to zero growing conditions in winters. However, with new technologies in horticulture, extending seasons, and freezing produce, Canada is entering a new wave of innovation in the produce sector. The Homegrown Innovation Challenge has sought to reduce reliance on imported produce. With $33 million in funding, the challenge wants to spark creative collaborations to boost sustainable fruit and vegetable production in Canada, where approximately 80 per cent of all produce consumed is imported—a fact that puts Canada at risk of food shortages from economic or natural disaster disruptions.

To help offset produce imports into Canada, the greenhouse and vertical farming sectors have continued to grow domestically. From a macro perspective, Canada remains a net importer of fresh fruits and vegetables. However, Canada is a net exporter of some fresh produce, namely peppers, radishes, white potatoes, cranberries, mushrooms, and cucumbers. One argument can be made that some of this fresh produce should be frozen and sold domestically. Canada is also a net importer of a significantly broader category of fresh produce, that includes but is not limited to sweet potatoes, celery, broccoli, green and wax beans, cauliflower, apricots, blueberries, peaches, cherries, corn, apples, pumpkins, squash, and carrots. Crops such as celery, broccoli, beans, cauliflower, corn, stone fruits (e.g. apricots, peaches, cherries) and berries should be grown in larger volumes in Canada. There is a clear opportunity, especially in those fruit and vegetable categories where Canada is extensively importing despite having the capacity to grow them domestically, to cultivate them in summer in greater abundance and market as domestically sourced, frozen produce.

Canada celebrates National Frozen Veggie Week in February, and a survey of Canadians about frozen vegetables in 2024 by Leger

found that 85 per cent of Canadians enjoy the convenience, nutrition, price advantage, and durability of frozen produce, and nearly half purchase them at least once a month. Locally grown frozen vegetables are harvested at their peak freshness and then flash-frozen, helping to preserve essential nutrients. Canadians are motivated to purchase frozen produce because it has an extended shelf life, is easy to incorporate into meal planning, has year-round availability and is tasty and fresh. Further, a third of Canadians say they are now purchasing frozen produce more often due to increased grocery costs. According to the Leger survey, green peas are the most purchased frozen vegetable in Canada, followed by corn, mixed veggies, and broccoli. Relating these survey findings to the vegetables most imported to Canada, there is clearly room to increase the

frozen produce category in Canada.

According to the Government of Canada’s food guide, promoting the increased consumption of Canadian-grown frozen fruits and vegetables has numerous benefits including:

• is a nutritious option;

• saves cost and time;

• reduces food waste (fresh produce in Canada accounts for 45 per cent of food waste);

• offers diversity of choice and applications;

• provides longer lasting food options that are fresh and flavourful year-round.

Some examples of leading frozen produce companies from Canada include Cavendish Farms from New Brunswick (frozen potatoes) and Bonduelle North America from Quebec. Ontario-based Nude Fruit has carved out a focused offering of frozen produce. Innovation in the frozen produce category could be offering consumers conveniently formatted and colourfully presented fruits and vegetables at competitive prices.

From a macroeconomic perspective, frozen fruits and vegetables are expected to grow 5 per cent (CAGR 2024-2029), as food prices lead consumers to frozen produce. A 2022 Caddle survey found that nearly 50 per cent of respondents shifted from fresh to frozen products to save money.

Frozen food processors are continually thinking of efficiencies in

their production systems and utilizing artificial intelligence-based technologies to reduce energy consumption, which is a big expense for frozen produce specialists. The increase in energy costs has also spiked the prices of frozen produce, which have increased compared to fresh produce since 2021. Frozen produce also tends to require more packaging than fresh, and packaging materials increased in price by 5 per cent in 2023, even though refrigerated trucking rates fell in 2023.

Towards the end of 2024, and leading into 2025, an opportunity exists from a combined effort of the private sector, in partnership with farmers and governments, in diversifying the range of offerings of locally grown, Canadian frozen produce offered to consumers. This marketing campaign could have a multi-tiered strategy. Firstly, increase the supply capacity of frozen produce to meet existing demand for crops that are currently imported into Canada, whether that is fresh or frozen. Consumer communications would emphasize the smaller carbon footprint of purchasing Canadian-grown frozen produce.

Secondly, increase the varieties of fruits and vegetables that are grown in Canada, which in turn meets the demands and desires of a rapidly growing ethnically diverse population (e.g. bok choy or okra). Thirdly, creative opportunity exists to diversify the offerings of unique crops, herbs, spices, and fruits native to Canada, which only have a short growing season (such as cloudberries from northern Canada), but also would increase the nutritional and gastronomic diversity of frozen fruit and vegetable offerings.

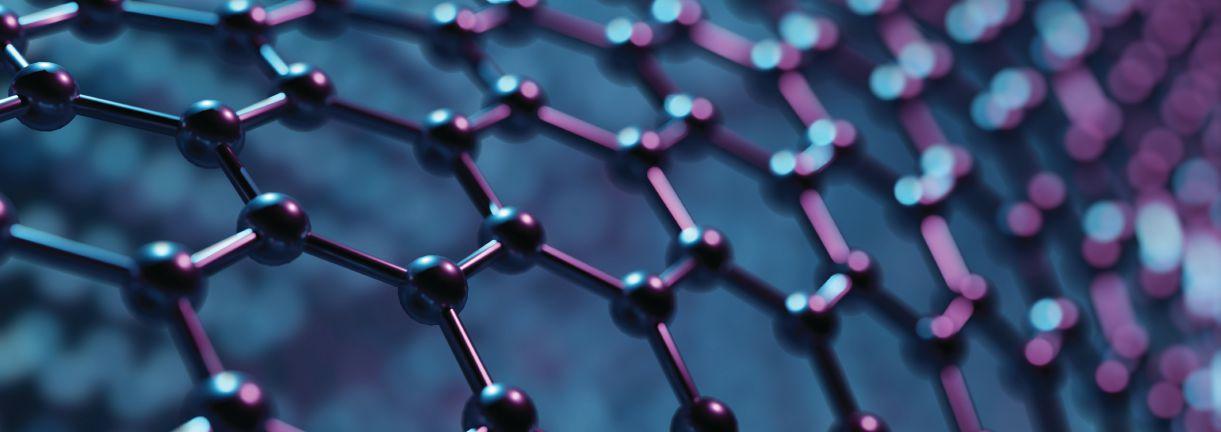

There has been a strong focus in the packaging industry on sustainability, food quality and safety. Sustainable developments have targeted recyclable packaging that support the circular economy of plastics. Polymer nanocomposite can provide enhanced barrier and mechanical strength to plastic packaging without interfering with the recyclability of the material. Packaging with polymer nanocomposites can avoid the use of multi-polymer structures as well as reducing the weight of the package. Antimicrobial and antioxidant nanostructures can also be incorporated in the package.

Nanomaterials are tiny particles ranging from 1 to 100 nm in size and can be made from organic or inorganic materials. Polymer nanocomposites are formed by dispersing an inert, nanoscale filler (2-8 per cent) within the polymer. The most common filler materials include clay, silica, carbon, graphene, starch, cellulose, and chitosan. The tortuous path created by nanofillers changes the diffusion rate, thereby improving the barrier of the material. It is also thought that nanoparticles improve the barrier properties by creating changes in the polymer matrix. Uniform distribution of the fillers within the polymer matrix is a challenge with this technology. The industry is moving toward biobased packaging, but these materials generally have inferior properties (poor barrier, brittleness, low heat distortion)

compared to conventional fossil-based plastics. Nanobiopolymer packaging overcomes these limitations by offering better barrier performance, increased mechanical strength, and improved thermal stability.

Nanobiopolymer packaging offers better barrier performance, increased mechanical strength, and improved thermal stability.

Nanocomposites with antimicrobial and antioxidant properties have the potential to prolong the shelf life of the food products by suppressing their enzymatic, oxidative, and microbial spoilage. Metal and metal oxide nanoparticles, such as silver, titanium, copper, zinc, zinc oxide, magnesium oxide, titanium oxide, have antimicrobial properties. Adding antioxidants can deter oxidation of fat and proteins, thus maintaining product quality. Use of synthetic antioxidants such as butylated hydroxy-toluene, have been extensively used in food packaging. The use of natural antioxidant compounds (tocopherols, polyphenols, and essential oils) has gained increased interest.

Studies have shown that nanomaterials

can migrate from packaging into food, presenting concerns about consumer exposure and safety. Migration rate from packaging materials depends on factors such as the food composition, contact time and temperature. Additionally, nanomaterials can have different properties compared to the macro-sized counterpart. There are few specific regulations on nanotechnology packaging, which also differs from country to country. Deeper understanding of nanostructure toxicology is still evolving.

There is ongoing research in new areas of nanotechnology use. Development is underway for sensor and indicator technology that conveys information to the consumer about the freshness of the packaged food, providing time and temperature data, and detecting pathogenic micro-organisms and harmful chemical agents. Nanotechnology for packaging is expanding to encompass release of value-added substances into the packaged food such as nutraceuticals, vitamins and nutrients.

Although there is huge potential for nanotechnology in food packaging, this technology has not become mainstream. Commercial advances in this industry have not been made due to consumer wariness as well as regulatory and safety concerns, high development and manufacturing costs.

Carol Zweep is the packaging researcher at Conestoga Food Research & Innovation Lab, Conestoga College.

PPM Technologies launches new food coating system

PPM Technologies introduces the FlavorWright SmartSpray food coating system for vitamins, gummies, and other confectionery goods. The system combines a belt conveyor, liquid applicator, and tumbling drum with a fully integrated control system. The SmartSpray system utilizes a continuous coating process that starts as the product enters the tumbling drum via the belt conveyor. According to a media statement, the adjustable liquid applicator creates controlled spray patterns for uniform coverage while preventing oversaturation, while the tumbling action ensures even distribution across all product surfaces. www.ppmtech.com

Key Technology launches high-capacity vibratory conveyors that can move 100,000 lb of product per hour and are available in widths greater than 10 ft. The product is customizable too. These conveyors are engineered for a variety of functions, such as grading, aligning, distributing, and other specialized food-handling tasks. They are suitable for handling fruits, vegetables, potato products, nuts, meat, poultry, seafood, dairy, confections, snacks, bakery products, cereals, and grains. www.key.net

Mettler-Toledo unveils new inspection systems

Mettler-Toledo releases new CM (checkweighing and metal detection) and CX (checkweighing and x-ray) combination systems. These systems integrate the new M30 R-Series metal detectors and X2 Series of high performing x-ray inspection systems into high-precision checkweighers. www.mt.com/pi

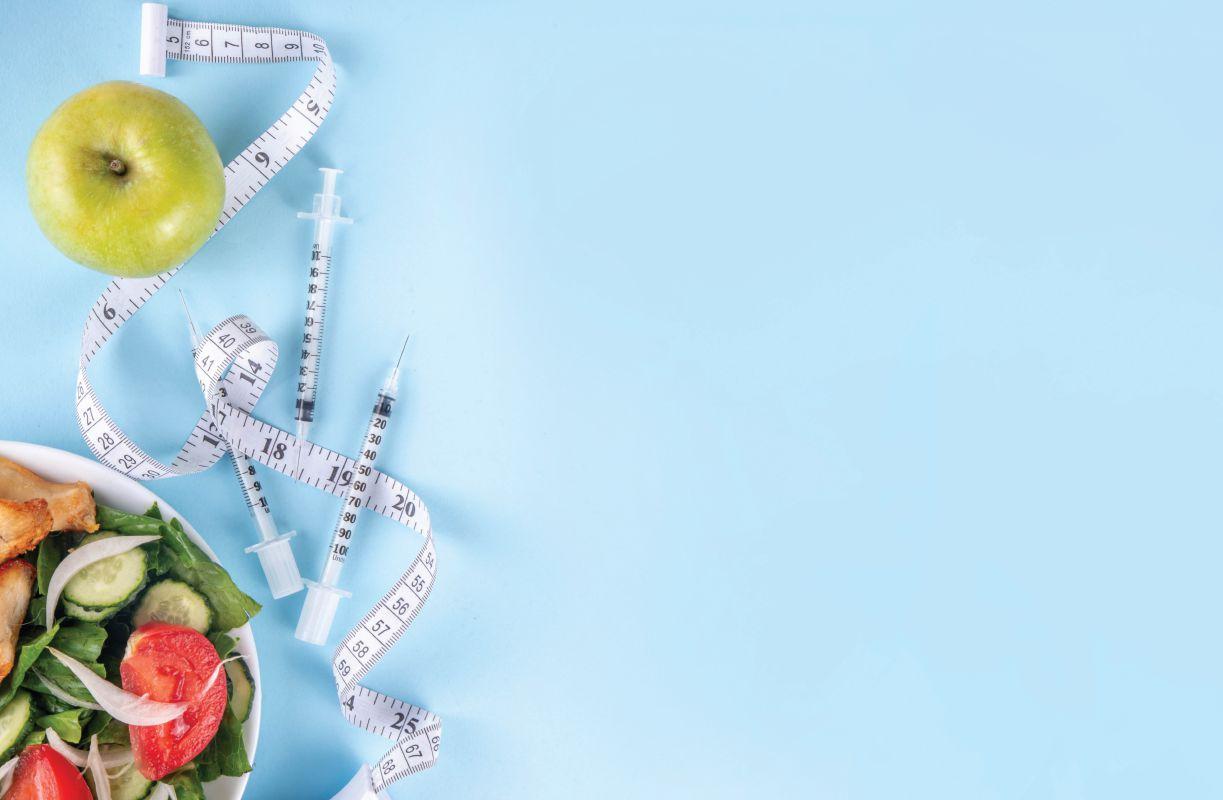

You don’t have to tell food companies, especially snack food manufacturers that there’s a new kid in town. It’s not a competitor per se, but it’s taking business away, nonetheless. GLP-1 medications, commonly referred to by the catch-all name Ozempic, were created to control type 2 diabetes, but their ability to suppress food cravings has made them an extremely popular weight loss medication. And although they don’t work for everyone, they’re reducing overall food consumption, especially snacks and desserts. What’s the food industry to do?

First, let’s go over the current landscape. Ozempic is the name of Novo Nordisk’s GLP-1 medication for diabetes patients, and Wegovy is the name of its weight loss drug. Several other GLP-1 medicines are available worldwide as an injection typically, although in the U.S., Ozempic is sold in a small-dose pill form. There is also an implantable delivery device on the way, along with more GLP-1 drug options. In the U.S, where about 42 per cent of adults are obese, about one in 60 adults were prescribed a GLP-1 drug in 2023, according to the American Pharmacists Association. J.P. Morgan predicts that

How can the North American food industry cater to a growing number of consumers who eat less

— BY TREENA HEIN —

total GLP-1 users in the U.S. may reach 30 million by 2030, around 9 per cent of the population. But right now, according to a March 2023 survey by Agri-Food Analytical Sciences Laboratory at Dalhousie University, about 10 per cent of Canadian adults—between 900,000 and 1.4 million of us—are consuming a GLP-1 drug. And several studies have shown that GLP-1 drugs can be safely prescribed to teens and children as young as six to reduce obesity.

“Oprah Winfrey was the catalyst,” notes Dr. Sylvain Charlebois, director of the Agri-Food Analytical Sciences Lab. “It was very big news when she left Weight Watchers and said she was taking GLP-1.”

The use of the drug exploded despite the high cost ($500 per month). In January 2024, the Ontario government was taking steps to conserve the supply of GLP-1 drugs for diabetes patients amid shortages. In September, the government of Quebec announced a pilot project to determine whether it should cover the use of GLP-1 drugs to treat obesity and not just diabetes.

New research links GLP-1 drugs to bone density

The growing popularity of GLP-1 medications for weight loss is an opportunity for F&B manufacturers to create a whole set of products for a new group of consumers with specific dietary needs.

loss and doctors advise patients to do resistance training and weight-bearing exercises. GLP-1 drugs also slow digestion, and GLP-1 makers warn of constipation and other potential digestive side effects such as nausea, diarrhea, stomach pain, vomiting, bloating and heartburn. Other common side effects include headache, fatigue, dizziness and flu-like systems. Rare, serious side effects could include allergic reactions as well as cancer, pancreatitis, gallbladder problems and hypoglycemia.

So, hi-fibre food is a good idea for GLP-1 drug consumers, as are foods high in calcium and magnesium to mitigate potential bone density loss. GLP-1 takers should avoid foods high in fat as they also slow digestion, and ensure they get enough protein, so they don’t lose muscle mass.

GLP-1 users don’t feel hungry as often as prior to going on the medication. This is impacting consumption. Charlebois and his team have found that the amount of money being spent on groceries in Canada per person is lower, despite higher prices due to inflation. “Yes, people are buying cheaper brands, growing gardens and buying elsewhere than grocery stores, but I think GLP-1 drugs are also a factor,” he says. “I find it hard to believe that their impact is that big, but it has to be.”

A Morgan Stanley report also notes that spending on groceries in the U.S. drops by up to 9 per cent

in households where at least one member is taking a GLP-1 drug, mostly due to fewer purchases of snacks. The firm predicts sales of soda, baked goods and snacks could fall nationally in the U.S. by up to three per cent in 2025.

Many huge food companies rely on snack food sales and impulse buying, but companies of all sizes are watching the Ozempic trend, says Charlebois.

“When we released the study in March 2024, we had conversations about this with different firms and they are paying attention to this for sure,” he reports. But what can companies do?

Yogurt is one product that hasn’t been affected by the GLP-1 trend and is seeing an increase in sales. That makes sense as it’s high in calcium and protein and generally low-fat. Morgan Stanley found GLP-1 householders are buying fewer snacks, baked goods and ice cream but more yogurt, fish and vegetables, and other firms have found similar results. In an interview in April with U.S. media, the CEO of Danone said he sees his products as “highly complementary” to GLP-1 drug use. Danone did not respond to inquiries from Food in Canada.

In May, Nestle announced the Vital Pursuit product line that’s “high in protein, is a good source of fibre, contains essential nutrients, and is portion-aligned to a weight loss medication user’s appetite.” This line of 12 frozen meals, currently being rolled out in the U.S., includes bowls with whole grains or protein pasta, sandwich melts and pizzas, gluten-free options and several air-fryer-ready items. Nestle didn’t respond to our inquiries.

U.S. meal kit company Daily Harvest has launched a high-fibre, pre-portioned GLP-1 Companion Food Collection.

While it hasn’t specifically launched GLP-1 products, Conagra Brands sees opportunities in marketing new or smaller-portioned frozen meals, meat snacks and popcorn to those taking the drugs. Conagra makes Healthy Choice frozen meals, Bertolli Italian foods, Duncan Hines cake mixes and more.

In December 2023, Coca-Cola CEO James Quincey said his firm was seeing “minimal impact” from

GLP-1 drug use, and that for years, “we…have been on a journey for those people who want to consume less calories, to provide zero calorie drinks…to take down the calories in other drinks and to have smaller package sizes.”

However, the survey that Charlebois and his team conducted of Canadians on GLP-1 drugs found that about 30 per cent of them now drink fewer soft drinks, eat fewer sweet baked goods and other sweet treats such as candy and packaged cookies. About 25 per cent are consuming fewer salty snacks.

“Alcoholic consumption and purchases were also impacted,” says Charlebois, “with 19 per cent of respondents claiming to drink less alcohol since starting a GLP-1 drug.”

Consumer market analysts have already raised the alarm. Let’s look at the numbers, remembering the Pareto rule for frequently purchased products that many researchers have described: 20-30 per cent of North American adults (so-called super-consumers) account for the consumption of 70-80 per cent of ice cream, coffee, soda, cigarettes etc. For candy, it’s even more extreme, with 34 per cent of consumption by 9 per cent of U.S. adults.

Those ‘Pareto’ consumers are already taking, or likely will soon start taking, a GLP-1 drug. With candy, if only a third of those adult super-consumers experience the intended cravings suppression, that’s at least a 10 per cent drop in candy sales.

The situation for snack food makers is growing more serious by the day and the era of marketing snack foods as irresistible or craveable is over. Indeed, there are perhaps few at this point in the food industry who would disagree with Dr. Marion

Nestle, professor emeritus at New York University. Earlier this year, she stated in the New York Times that GLP-1 drugs represent “an existential threat to the food industry and certainly an existential threat to the processed food industry.”

While the GLP-1 spectre looms large for snack manufacturers in particular, a related shadow is hanging over the head of the greater food industry, in Charlebois’ view.

“There’s a perception among people and in the media that the food industry is to blame,” he says, “for a lot of people being obese and overweight and unhealthy, and there’s truth to that, and Big Pharma has had come up with a solution for the problem. Yes, the food industry has been providing healthy products for a long time, but I think there’s a sense out there that the food industry has failed consumers. It’s up to the food industry to do something about that.”

But like others, Charlebois and his colleagues note there is hope ahead in new ways of developing and marketing products. They advise that while some companies may launch GLP-1 product lines, the entire food industry should invest in R&D to better understand the needs of consumers with various health conditions and create innovative products that are both health-conscious and palatable. Charlebois and his team add that “collaborating with health-care providers and organizations to endorse products as part of a healthy lifestyle for those on diabetes or anti-obesity medication could improve brand trust and loyalty.”

75% of consumers want foods made with NON-GMO SUNFLOWER OIL1

If you are creating plant-based or free-from foods, healthy snacks or specialty products, premium mid & high oleic sunflower oil offer:

ü extended shelf-life

ü superior stability

ü longer fry-life than other oils

ü light neutral taste

South American foods are becoming popular in Canada, presenting the food industry with new opportunities — BY

JACK KAZMIERSKI —

Arecent study on consumer trends in Canada, Mexico and the U.S. points to an interesting trend: South American ingredients, spices and dishes are becoming more mainstream in the U.S. and Canada.

According to Griffith Foods, the authors of the study, “Restaurants, CPG companies and retailers across the continent are adding the flavours of South America into everyday foods. Examples include spices added to chips and other snacks, Peruvian-style marinades for meat in the prepared foods section, and frozen options like arepas and even pizza toppings.”

Mark Serice, VP, global culinary, Griffith Foods, says that interest in South American cuisine was first seen in 2016 during the Olympics in Brazil. However, that interest quickly faded after the games ended. Then, during the pandemic, people started exploring regional cuisines online, and once travel resumed post-COVID, foodies were free to travel and explore South American flavours in person.

“The reason this trend hit hard in the U.S. and Canada is because the ingredients were fairly familiar, easily obtainable and offered new preparations and new flavours as well as the ease with which they meld into other cuisines or comfort dishes,” Serice says. “This, coupled with immigration and new restaurants filling the void of COVID [related] restaurant closures, only increased the popularity of this trend.”

Although Americans and Canadians might see South America as a single continent where all nationalities share a similar palate, Serice says that nothing could be further from the truth (see ‘South America: A continent rich in variety,’ pg 25). “Variations in cooking methods, combinations of spices and global influences create dramatically different tastes, despite similar dish names,” he adds.

The fact that North American consumers seem eager to explore South American flavours presents the food industry with new opportunities.

“The cuisines of South America offer unique flavours and exotic appeal with familiar ingredients,” says Serice. “The consistent use of a fresh element (citrus, herbs, sub-tropical fruit and fresh chilies) in slow-cooked dishes

South American flavours are slowly making their way into everyday foods in Canada largely because the ingredients are easy to meld into other cuisines or comfort dishes.

Although South America is made up of many countries, Griffith Foods’ study focused on Argentina, Brazil, Chile, Colombia and Peru. All of them are unique with a cuisine that reflects each country’s people and history. Mark Serice, VP, global culinary, Griffith Foods, explains the foods and flavours found in the five countries featured in the study:

Argentina’s cuisine is a fusion of Italian, Spanish, German, Indigenous, and Creole cuisines. Featured foods include asado, empanadas, milanesa, chimichurri and choripan.

Brazil’s cuisine has Indigenous, Portuguese, West African, German and Japanese influences. Featured foods include churrasco, feijoada, moqueca and picanha.

Chile’s cuisine is a combination of Indigenous and Spanish foods, with later influences from other European cuisines including France, Germany and the U.K. Featured foods include humitas, cazuela, pastel de choclo and empanadas.

Columbia’s cuisine has Indigenous influences mixed with Spanish and African flavours. Featured foods include ajicaco, sancocho, arepas, aji and bandeja paisa.

Peru’s cuisine is best described as an Indigenous and Hispanic fusion. It has a mix of Spanish, Indian, Creole, African, Chinese, Japanese, and Mestizo cuisines. Featured foods include ceviche, pollo a la brasa, butifarra, anticucho, tiradito, lomo saltado and aji amarillo.

wakes up some of the muted flavours in long-simmering techniques. Additionally, some dishes are perfect for portability (empanadas, arepas, etc.) and convenient for Canadian and U.S. consumers.”

Serice notes that aji amarillo is the perfect entry point to explore South American flavours.

“This Peruvian staple is the star of dishes like aji del gallina (chicken stew), ceviche and papa a la huancaína (cheesy potatoes),” he says. “Using it in a condiment is an appealing way to encourage trial and introduce consumers to new flavours. South America is known for its vibrant sauces—think guasacaca, aji criollo and chimichurri—which can be used to innovate across sandwiches, pizzas, salads, side dishes and more.”

Dyana Biagi, founder and CEO of Surrey, B.C.-based Aji Gourmet Products knows all about aji because it was a part of her everyday experience in her native Colombia. She says that this versatile ingredient can give any dish or condiment a “South American zing.”

“In South America, the word aji means hot pepper,” says Biagi. “If you go to any small town, you’ll find a bowl of aji on every table. Aji is also the name of the mixture we make with chopped tomatoes, onions, cilantro, vinegar, lemon juice, hot peppers and salt.”

Biagi sells her aji sauces in several retail stores in Canada and is hoping to get them into restaurants in the near future.

“It’s an incredibly versatile ingredient,” she says. “In South America, you put it on your eggs, your steak, everything. It adds a bit of spice, and it naturally enhances the flavours of any food you add it to.”

She contrasts the way aji enhances the flavour of foods vs. the impact of other hot sauces.

“When you put sriracha on your food, for example, then all your food tastes like sriracha,” she says. “When you put aji on your food, you get an elevated flavour of the food. In other words, you get a zing from the aji, but you still taste the food.”

Biagi discovered how much Canadians love aji by accident. She once made guacamole with aji for an end-of-season party that was organized by one of the sports teams her children belonged to.

“The people were blown away,” she says. “It disappeared in minutes, and then I saw people scraping the bowl with their fingers. I thought they were weird, but then they told me that I need to make and sell aji.”

Biagi took their advice, started selling aji at the local farmer’s market, and 18 years later, Aji Gourmet Products are now on the shelves of almost 600 stores in Canada.

According to Griffith Foods’ study, 47 per cent of Canadian consumers use international or internationally inspired sauces when cooking at home, while 37 per cent of Canadian consumers like to try flavours that are inspired by the food and drink in other countries. Biagi’s success is a testament to the growing popularity of South American ingredients, spices and dishes in Canada as consumers explore and embrace flavours from around the world.

Kibble

Sausage

Bars

Meals

Supplements

Chews

Patties

Biscuits

A review of a study on its effectiveness as a novel pet food supplement

— BY MARK JUHASZ —

Across Canada, and North America, there continues to be significant growth in pet ownership. In Canada more than half of the households own a pet, and about 42 per cent own a dog. Dogs remain the most popular pet in North America. Canadians spend billions annually on their pets, and pet food has a consistent CAGR of nearly 4 per cent leading towards 2026. The evolving relationship between pets and their owners has been termed ‘humanization,’ where dogs are considered as members of the family, with human-like emotions. From a generational perspective, millennials and Gen Z consider themselves more as pet parents, investing in their dogs’ health. This also translates into pet nutrition where functional, high-quality foods and supplements are sought after. Pet food manufacturers are conscious of this reality and modifying the formulations of their portfolios.

To meet this opportunity, alternative supplements that demonstrate high nutritional value, bioactive compounds, and a lower ecological footprint compared to conventional dog food ingredients are of growing interest. Algae is one of these promising ingredients. It refers to a diverse group of aquatic organisms which range from macro- to micro- organisms that convert sunlight and carbon dioxide into high-quality biomass. Macro- and micro- algae are important sources of nutrients and bioactives that include peptides, proteins, polyunsaturated fatty acids, lipids, minerals, vitamins, and polyphenols, which provide anti-inflammatory, immune system modulation, prebiotics, and anti-oxidant support. While complete diets and treats for dogs that include algae are commercially available, scientific research into their effectiveness and health-promoting claims is scarce. Further, in pet food formulation, even small inclu-

sions of 1.5 per cent of either macroalgae or microalgae have been examined, however, no study has evaluated the potential to combine macro- and micro-algae into a novel algal blend. Therefore, we summarize here the results of a recent study, completed by a team of Portuguese and German animal nutritionists, and led by Mota, C.S.C et al (2024) who examined the effects of an algal blend in dog food formulation. The researchers supplemented a complete diet with a commercial algal blend, composed of two macroalgae (Ulva rigida [Chlorophyta, Ulvophyceae] and Fucus vesiculosus [Ochrophyta, Phaeophyceae]) and one microalga (C. vulgaris) species, at up to 1.5 per cent dry matter basis, to test palatability, intake, digestibility, and fecal characteristics, metabolites, and microbiota of 12 adult Beagle dogs (evenly split between males and females).

Algaessence, a Portuguese commercial algal blend, was evaluated as the novel pet food supplement. The commercial algal blend was provided as a spray-dried powder. A commercial extruded complete diet with no algal blend for adult medium-size dogs was provided as kibbles and used as the control diet. Four experimental diets were prepared with incremental inclusion levels of the algal blend in replacement of the extruded commercial complete diet. The maximum inclusion of the algal blend was set at 1.5 per cent (dry matter basis) based on previous studies with individual macroalgae or microalgae

species inclusion. The algal blend powder was added in each meal immediately before presenting the experimental diets to dogs. From this foundation, the same 12 Beagle dogs were used to assess palatability, while six of those dogs were randomly selected to test for digestibility, and the results for the control diet were compared to diets with the algal blends.

The premise of the study is that algal blends as a supplement in dog foods have various health-promoting effects, including proteins, and essential amino acids for a range of support including neural development, visual and cognitive acuity, anti-inflammation, anti-viral, and immune function. The study also noted that the algal blend presented high sodium content, and although not advised for dogs with hypertension, there is no evidence that high sodium intake alters the blood pressure of healthy dogs if access to water is provided.

Diet palatability is a major issue for dog owners and may dictate the success of a new formulation in the market, and many factors affect food palatability. In the study, the dog food that contained the algal blend at 1.5 per cent had reduced consumption. The researchers suggest one reason may be the powdery texture of the algal blend, added on top of the kibble rather than integrated

into the formulation. As a result, further food palatability studies are proposed.

Once the food was consumed by the dogs, the algal blend was well accepted. Good acceptance of functional supplements is pivotal for dogs to benefit from the bioactive properties. Most nutrients and energy intake were similar among diets, reflecting the small differences in chemical composition. Several factors affect nutrient digestibility in dogs, such as ingredient composition, animal physiology, and food production processes. A more pronounced effect on digestibility was observed when algal blend supplemented diets were compared with the control diet. This is the first study assessing the blend of macro and micro alga as a supplement for dog food, thus eliminating direct comparisons with current dog nutritional science. The researchers suggest that more beneficial effects could be attained from the algal blend if pretreated with chemical, mechanical, or enzymatic techniques to improve the digestibility, and bio-availability of algal nutrients, and that further studies are needed to better understand the effects of long-term algal blend supplementation on dog health parameters.

As a study on the effectiveness of utilizing a commercial algal blend as a novel supplement in dog nutrition, some general observations are revealed. The dogs preferred the diets without the algal blend powder; however, it is important to note that this was applied on top of the kibble. The dietary algal blend did not affect food intake, which raises the offer of increased nutrients, energy digestibility, and improved fecal quality, when compared to the controlled, non-algal blend diet. The researchers emphasized that further studies are required to address enhanced formulations to improve algal blend palatability and assess more completely the potential benefits of algal bioactive compounds for dog’s health and well-being. This is in alignment with growing supporting for greater vitality and health of pets amongst North American dog owners.

During the study, consumption of dog foods containing an algal blend at 1.5 per cent was reduced.

For the full study, visit https://doi. org/10.1016/j. algal.2024.103775 or scan the QR code above.

General Mills is set to acquire Whitebridge Pet Brands’ North American cat feeding and pet treating business from NXMH for US$1.45 billion. The deal is expected to close in Q3 of 2025 fiscal. The acquisition includes Tiki Pets and Cloud Star brands. Whitebridge Pet Brands generated approximately US$325 million in U.S. retail sales over the last 12 months. The acquisition will be funded with cash on hand and new debt. General Mills will also take over the operations of two manufacturing facilities in Joplin, Miss. NXMH will retain Whitebridge Pet Brands’ European business.

Caru Pet Food partners with Kane Pet Supplies for the national distribution of its products across Canada. For this, Caru is updating all product packaging to include bilingual English and French content. Caru products are made in the U.S. with human-grade ingredients. The company’s products include stews and broths in Tetra Pak cartons, as well as treats and smoothies.

Nestle algorithm predicts dog’s biological

Nestle scientists create an algorithm to determine a dog’s biological age, which can better indicate a dog’s overall health and lifespan. The algorithm was developed and verified using data from various studies conducted over the past 12 years. It considers factors such as changes in routine blood markers, fasting glucose, and kidney functions.

This information helps predict biological age relative to a dog’s chronological age, serving as an indicator of their health status and lifespan.

Elanco Animal Health will pay a US$15 million fine penalty to resolve charges of misleading investors brought by the U.S. Securities and Exchange Commission (SEC). The SEC found that from the first quarter of 2019 to the first quarter of 2020, Elanco employed tactics like discounts, rebates, and extended payment terms to incentivise its distributors to purchase more products than was justified by end-user demand. Elanco has settled the charges without admitting to or denying SEC’s findings.

Mars is providing financial incentives to farmers to implement regenerative agriculture practices in North America. The company has partnered with several North American agricultural companies, including ADM, the Andersons, Riceland Foods, and Soil and Water Outcomes Fund to transition 150,000 acres to regenerative agriculture. These partnerships will support farmers in implementing practices like cover crops,

reduced tillage, and extended crop rotations across key agricultural regions, including Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, Ohio, Michigan and Ontario. Mars, through brands like Royal Canin, Pedigree and IAMS, will offer financial incentives to encourage farmers to adopt these practices. The partnerships will help reduce Mars’ scope 3 emissions.

Mars hires Gabriel Millan as chief financial officer for its pet health, services, and nutrition business. Millan will join the business in December and report to Loïc Moutault, president of Mars Petcare. He has over 25 years of experience in corporate finance, strategy, M&A and IT at Fortune-500/FTSE-100 companies across consumer goods and life sciences.

Modern Plant Based Foods buys AnimalKind, a plant-based pet food company based in Richmond, B.C.. This acquisition will allow Modern Plant Based Foods to expand into the plant-based pet food market.

Hagen Industries, which turned 50 this year, is investing $8 million in modernizing its manufacturing facility in Quebec. The investment will be used to automate operations, deploy new manufacturing workflow software, and buy packaging equipment.

Driving your team towards their goals? That’s something we definitely have in common. Our safe, adventurous vehicles help them carve their path to success, while our expert service and high resale value let you redefine the impact of your fleet. We share a vision, let’s get there together.

Full-time all-wheel drive for full-time confidence in motion. Superior drivability, outstanding control and handling you can count on.

On-board technology system connecting your Subaru to the world. 24/7 safety and convenience wherever you go2