Moment of Reckoning

n

n

NOVEMBER/DECEMBER 2022 • VOL. 82, I006

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

MEDIA SALES MANAGER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Mary Burnie mburnie @annexbusinessmedia.com 519-429-5175

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $84.95 per year

Canada 2-year – $124.95

Single

prices in CAD

$159.95

Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2022 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Tel: 416-442-5600

Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

A winter of discontent

In January 2022, a bounce back in the markets from a pandemic-induced recession was the general expectation. However, the Omicron variant and the Russia-Ukraine war turned economic forecasts upside down this year.

Finance minister Chrystia Freeland has repeatedly warned the coming months would be brutal for Canadians.

“Our economy will slow. There will be people whose mortgage rates will rise. Businesses will no longer be booming. Our unemployment rate will no longer be at its record low. That’s going to be the case in Canada. That will be the case in the U.S. and that will be the case in economies big and small around the world,” Freeland said at a news conference earlier this fall. “There are still some difficult days ahead for Canada’s economy. To say otherwise would be misleading.”

The Bank of Canada has been steadily raising interest rates to cool down inflation. In October 2022, the Consumer Price Index (CPI) rose 6.9 per cent on a year-over-year basis, decelerating from a seven per cent gain in August 2022, marking the fourth consecutive monthly slowdown in headline inflation.

Faster price growth for gas and mortgage interest costs were moderated by slowing price growth for food. Excluding food and energy, prices rose 5.3 per cent year over year in October. Prices for food rose less in October (+10.1 per cent) compared with September

Our economy will slow. Businesses will no longer be booming.

— Chrystia Freeland

(+10.3 per cent) on a year-over-year basis. Despite the slowdown in price growth, prices for food purchased from stores (+11.0 per cent) continued to increase at a faster rate year over year than the all-items CPI for the 11th consecutive month. The Mortgage Interest Cost Index continued to put upward pressure on the all-items CPI, as Canadians renewed or initiated mortgages at higher interest rates. Average hourly wages rose 5.6 per cent on a year-over-year basis in October, meaning that, on average, prices rose faster than wages.

CPI remained steady in October due to slower food price growth. As explained by Avery Shenfeld of CIBC, “Crude oil prices aren’t really going anywhere, however, and if that continues, we’ll get a nice downward tug on inflation as we move further in 2023. To some extent, markets are a bit premature in hoping for a broader disinflation just yet because we’ll need to get into more of the slowing impacts of interest rate hikes before that really shows up, which again will be a 2023 story. Manufacturing shipments look headed for a dip in the other key release, and the Bank of

Nithya Caleb

Canada will be eyeing its Loan Officers survey for signs on how its tightening cycle is impacting credit markets.”

His colleague and senior economist Andrew Grantham believes Canada doesn’t need a recession to contain inflation for the following reasons. Unlike the U.S., we don’t have excess demand in Canada. Further, Canadians are more sensitive to interest rate hikes. A one per cent hike tends to reduce CPI by two per cent because of high household debt.

The red flag, though, is that most of the inflation we’re experiencing now is driven by supply chain constraints. If these conditions persist, interest rates would be high to control inflation. This could tip us into a recession.

Grantham hopes that even if the Canadian economy experiences a recession, it wouldn’t be a deep one. Since Canada didn’t benefit much from the global export market recovery, it may not fall a lot during the economic downturn. Further, Canada has the potential to become a part of the solution to overcome supply chain constraints. These factors could hold us in good stead during the winter of discontent.

Nithya Caleb ncaleb@annexbusinessmedia.com

Sign up for our enewsletters at www.foodincanada.com

Barry Callebaut breaks ground on factory in Ontario

Barry Callebaut breaks ground on new specialty chocolate factory in Brantford, Ont. This factory will focus on sugar-free, high protein, and other specialty chocolate products. In attendance were Barry Callebaut executives Chris DiMambro; Balaji Padmanabhan; Angie Kipper; Jin Kim, Americas’ CFO; Steve Woolley, Americas’ president & CEO; Brantford-Brant Member of Provincial Parliament William Bouma; and Brantford City Councillor John Sless.

News> file

Olymel cuts 177 management jobs

Olymel eliminates 177 management positions, 120 of which became vacant in recent months. The company has notified the affected 57 employees.

Olymel believes this decision will help eliminate duplicate tasks and lead to savings and efficiency gains to meet market conditions. These job cuts will mostly affect administrative positions, primarily in Quebec.

“The effects of the COVID-19 pandemic and a historic labour shortage at our facilities, market and supply chain disruptions, raw material price inflation and an uncertain global economic landscape are all factors that make a case for optimized company business models. Olymel is no exception. After careful analysis, the difficult decision to significantly reduce our management staff is an answer to the need to adapt to unpredictable market conditions and to better position the company for the future. On behalf of all my colleagues, I want to extend our deepest gratitude to each of the managers affected by this decision for their service to the company over the years. Olymel will do everything possible to en-

NEW PRODUCT

sure that these employees are supported as they continue their careers,” said Yanick Gervais, president and CEO, Olymel.

Roquette

launches

new line of organic ingredients

Roquette releases a new line of organic pea ingredients: organic pea starch and organic pea protein. These ingredients are produced at its plant in Portage la Prairie, Man., and supported by peas sourced from organic pea growers in Canada. This new organic line is suitable for specialized nutrition, non-dairy or meat alternative markets.

Sokol

expands senior leadership

team

Sokol Custom Food Ingredients expands its senior leadership team with the appointments of John Pimpo as vice-president of ingredients, sales and marketing, and Lauren Davis as vice-president of

finance and strategy.

Pimpo will be responsible for increasing sales revenues while improving the company’s profitability and developing strategic marketing initiatives for the ingredients division. Davis will lead the finance and strategy functions, working as a strategic link between the operations, sales and finance teams to ensure growth in areas that best serve customers and optimize profitability.

Beyond Meat axes 200 jobs, reduces revenue outlook

Beyond Meat reduces its current workforce by 200 employees, representing approximately 19 per cent of the company’s total global workforce. While the company continues to review the drivers behind recent performance, it believes it has been negatively impacted by ongoing softness in the plant-based meat category overall and by the impact of increased competition. The company is also reducing its full year revenue outlook. Full year 2022 net revenues are expected to be in the range of approximately $400 million to $425 million, representing a decrease of approximately 14 to nine per cent compared to 2021.

Schenck Process releases new USDA Dairy Certified airlock

The newly released Global Hygienic Blow-through Airlock (GHB) is a USDA Dairy Certified dismountable airlock that is suitable for applications where dry raw or finished products are being handled in the process and where inspection or system clean-out are required.

The GHB is a dismountable round inlet, blow through, convey line outlet rotary valve, which incorporates seals and product contact surfaces that meet food safety requirements. Endplates and rotor can be disassembled and removed from the valve housing for cleaning. Each GHB is equipped with a wide range of features that include a design for NFPA 69 blocking valve requirement, 32 Ra surface finish on all wetted and primary food contact surfaces and a casting exterior surface that is free of all pits and porosity. www.schenckprocess.com

Lauren Davis

TEffective quality assurance tactics are key to reducing waste

Dr. Amy Proulx

hroughout the industry, there are conversations about food waste reduction as part of the food processing sector’s commitment to environment, social responsibility, and climate change. At the processing level, food waste occurs because of checks and balances in food safety systems. If food does not meet safety standards, that product often becomes a waste stream. Using good strategy and tactical approaches in food safety and quality can be key to food waste reduction.

Hierarchy of waste

The old adage, “Reduce, reuse, recycle,” is foundational in food waste. The first stage is prevention. Good quality management and quality control systems take a preventive approach to food waste: identify the root cause of the waste, then reduce or eliminate the cause. When food waste streams are identified, using DMAIC-type analysis can reduce prevalence of waste. Within many quality management programs such as Lean or Six Sigma, “Waste Walks” are an essential part of management’s commitment to waste reduction. They give management the chance to observe and speak with the workforce to hear about ways waste may occur and perform rapid problem solving with employees.

Effective quality control

Quality control often emphasizes the quality evaluation of finished product. It’s better to look far upstream in the production process to find opportunities where quality can be determined as a preventive activity. To identify opportunities,

Using good strategy and tactical approaches in food safety and quality can be key to food waste reduction.

review the process and production flow of product to identify where rapid quality control evaluations can reduce defects and waste product. Each process will be unique. Is it review of incoming ingredient quality? Is it better environmental controls of temperature or humidity, better sanitation or improved process controls within production? It’s often possible to pinpoint key quality control points in the process to reduce waste.

Rework

A procedure must be in place for taking defective goods and reprocessing and repurposing for waste reduction. Whether it is work in progress being reworked, or finished goods, it is vitally important from a food safety perspective to track production and formulation records to know what process controls have or not been applied to rework product. Formulation records are essential for allergen cross contamination on rework. Rework can reduce waste but should not be a trigger for wasteful recall based on poor production tracking.

Waste becomes a new product

Companies are now converting waste streams into new packaged goods through thoughtful and innovative

processing methods. This includes using spent grain from breweries as a bakery ingredient, or repurposing fruit and vegetable trim into beverages. When converting post-processing waste into food products, there is need for enhanced oversight on the process flow. Frequency of sanitation on trim containers, temperature control on product for management of pathogen or spoilage organism growth, personnel hygiene, and transportation cold chain must be maintained.

Repositioning product effectively

One last tactic for food waste reduction is the repositioning of safe but unsaleable product. Waste often occurs when product is underfilled and not meeting weight or volume tolerances. Packages or product may be physically damaged but don’t pose a safety risk. Unsaleable could also include mislabelled product. Often this product may be useable by charitable organizations. Be prepared to do product specific food safety risk assessment as part of a charitable donor program to evaluate consumer risk. Beware of mislabelled nutrition facts or allergens from a consumer risk perspective as this could be putting a product into a recall situation.

Food safety systems are integral for food waste reduction. The preventive control mindset of food safety professionals works perfectly in partnership with waste reduction and environmental initiatives.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

TGood vs. bad

Gary Gnirss

he eternal battle between good and bad foods has seen the teeter shift recently in Canada with the publication of final rules on front of package (FOP) nutrition labelling. Products entering the stream of commerce on January 1, 2026, must, if applicable, be with the appropriate FOP symbol. There is no incentive to engage in FOP labelling currently, and no one wants to be first out of the gate with these symbols. Many manufacturers are also considering reformulation, where possible, to avoid FOP.

Health Canada has said the purpose of FOP is not to scare, but alert consumers about the level of sugar, saturated fat, and sodium in a food. However, consumers are more likely to perceive these foods as ‘bad’ and avoid them. The new rules do not prohibit foods with FOP symbols from making nutrient content or health claims but there are restrictions and prohibitions on claims related to sugar, sodium and/or saturated fat. However, the rules protect an FOP symbol as a prominent first impression. In my experience, first impressions usually prevail.

If a food label bears an FOP symbol, then foods that do not, must be ‘good’. Of course, this logic is also failed. Corn starch will not need an FOP, but how ‘good’ is it? Perhaps the more important question is what foods are ‘good’ for you. Health Canada’s reasoning tends to be that all foods, including those with FOP symbols, are ‘good’ when consumed as part of a healthy diet.

Food guide

Canada’s Food Guide, as amended in 2019, is simplistically beautiful. It’s like what mom said: “Eat plenty of fruits, vegetables and protein, choose

The federal government’s healthy eating strategies should balance steering consumers away from and toward suitable foods.

whole grain foods and drink water”. It is not easy, however, to use the 2019 food guide for labelling and advertising purposes, as it has moved away from recommended healthy eating serving sizes. That is not a terrible thing, but it creates a void for food marketers who must ensure all claims on a label or in advertising are truthful. A food label may provide messaging consistent with Canada’s Food Guide. If that message suggests eating more vegetables and fruits, how much vegetable or fruit content would be expected in that product? Is a bit of cauliflower dust enough? When a label or advertisement of a food suggests eating more protein foods as part of healthy diet, that would trigger the food to meet the conditions to be claimed as a “source of protein”. Those conditions involve both the quantity and quality of the protein source. The latter requirement is very demanding, so much so that it may disqualify some protein foods from being claimed as a source.

Despite these complications, we do not want to go back to the days of recommended serving sizes. That was also awkward for food labelling purposes, as those were recommended servings whereas for nutrition labelling purposes, reference amount represent

quantities that Canadians actually eat. Dietary recommendations consistent with Canada’s Food Guide are classified as a type of health claim. Similar ‘healthy’ claims in the U.S. are considered implied nutrient content claim.

Health claims

An interesting development in the U.S. was the recent proposal to amend the criteria for ‘healthy’ claims. The proposal sets minimum quantitative criteria for a food to be claimed ‘healthy’. It also includes disqualifying nutrient levels for added sugars, saturated fat, and sodium. For instance, a grain product may be claimed to be ‘healthy’ if it contains at least 3/4 oz equivalent of whole grain, contains zero per cent of the DV for added sugars, no more than 10 per cent of the DV for sodium and five per cent of saturated fat. The criteria are based on U.S. reference amounts, so would then be consistent with nutrition labelling. Now that Canada has finalized rules on CFIA’s FPI (food product innovation), Health Canada’s FOP and supplemented food regulations, perhaps there is a window of opportunity to do something similar to what is being proposed in the U.S. It may be time to migrate ‘healthy’ as an implied nutrient content in Canada as well, and have that criteria tethered on a more predictable and communicable manner with Canada’s Food Guide. The government’s healthy eating strategies should consider balancing of steering consumers both away from and toward suitable foods. The raison d’être of health and nutrient content claims is hinged on them being the ‘carrot’ to steer consumers toward healthy eating. The government first prohibits such claims and then only permits those they want. Perhaps it is time for a new healthy ‘carrot’.

Gary Gnirss is a partner and president of Legal Suites Inc., specializing in regulatory software and services. Contact him at president@legalsuites.com.

Bio-based, biodegradable, or compostable?

Carol Zweep

With Canada and other countries around the world banning single-use plastics, environmentally friendly options are on the rise. However, you may be confused by the numerous terminologies and types available, such as biodegradable, biobased, oxo-degradable, and compostable. What do these terms mean, and which terms describe the best eco-friendly material? Some plastics degrade into microplastics, others take a long time to disappear from the environment, and in certain conditions, materials can produce powerful greenhouse gases. Several factors affect product breakdown into fragments or into natural products (including water, carbon dioxide, and compost). Plastics can be classified as biodegradable or nonbiodegradable. The shape and thickness affect the breakdown of products (i.e. thinner bags tend to breakdown faster than thicker cutlery). The environmental condition of disposal is another factor (presence or lack of heat, moisture, and microbes can impact decomposition). Finally, under suitable conditions, biodegradable plastics can take weeks to decompose, whereas conventional plastics take centuries to breakdown.

Biodegradable

Biodegradable plastics describe a range of plastics that break down into natural substances within a certain time after disposal. When biodegradation occurs under different conditions, varied terms are used, such as composting, anaerobic digestion, and biodegradation in soil and marine water. A subset of biodegradable plastics is compostable plastics. Composting

occurs in an environment of elevated temperature and moisture and in the presence of aerobic micro-organisms.

Plastics that have been tested and certified by a third party and meet international standards (e.g. ASTM D6400 or EN 13432) are considered compostable. Under industrial composting conditions, certified products must break down into carbon dioxide, water, inorganic compounds, and biomass at a rate consistent with known compostable materials (e.g. cellulose). The resulting compost must have an acceptable metal content level and be able to foster plant growth. Consumers may not be aware of how to dispose of compostable plastics. If they are disposed of in a landfill where there is low to no oxygen, anaerobic reaction will result in the production of methane. The environmental impact of methane as a greenhouse gas is 84 times that of carbon dioxide. The temperatures of home compost bins aren’t usually as high as those in industrial composting facilities. Since there is often inadequate moisture and oxygen exposure in home compost bins, these conditions result in a slower breakdown process.

Bio-based plastics

Biodegradable plastics may be classified as being either renewable (bio-based) or non-renewable (petrochemical-based). The former plastics are mostly biodegradable by nature and produced from natural origins such as polysaccharides (e.g. starch, cellulose, lignin and chitin). Not all bio-based plastics are biodegradable. Bio-based plastics are defined as materials for which at least a portion of the material is produced

from renewable raw materials. Common commodity plastics like polyethylene terephthalate, polyamide, and polypropylene have been manufactured from fermentation byproducts of biological feedstocks such as sugarcane, sugar beets, and corn. Although biobased, these plastics are chemically identical to petrochemical-based plastics and therefore not biodegradable.

Oxo-degradable plastics are conventional plastics mixed with an additive to accelerate the breakdown of plastic into smaller fragments called microplastics. Microplastics don’t break down at the molecular level like biodegradable and compostable plastics, which causes significant harm in the environment.

Bio-based and biodegradable plastics are under constant development with the objective to overcome resource depletion and counteract plastics pollution. Transparency about environmentally friendly packaging will allow consumers to make informed purchasing and disposal decisions. Package functionality and end-of-life disposal should be considered during the innovation process. New technologies for production of bio-based plastics using urban, agricultural, and food waste as feedstock will establish a sustainable production value chain for the future design of bioplastics.

Carol Zweep is consulting and technical service manager for NSF Canada. Contact her at czweep@nsf.org.

The great RESET

Alternative food companies must address the taste-texture expectation

— BY MARK JUHASZ —

This year we have seen a significant shift in stock valuations of large banner brands in animal and plant protein. Major U.S. food companies such as Tyson Foods and Pilgrim’s Pride (major suppliers of pork and poultry) have been relatively steady, while leading plant-based brands like Oatly, Beyond Meat and Impossible Foods, as well as the plant-based subsidiary of Canada’s Maple Leaf Foods, have experienced a significant drop in sales and revenue.

Acerbated by high food prices is a growing ‘trust gap’ among Americans in the food that is being grown, produced, and sold to them. Earlier this year, Beyond Meat faced a class action lawsuit about false claims and labelling misinformation.

Further, McDonald’s test pilot of the McPlant burger with Beyond Meat’s patties, and processed cheese, buns, and mayo was a failure. Some might argue fast food restaurant chains, such as McDonald’s, Burger King, and KFC, which are built on a history of low-priced meat may not be the best place for a plant-based alternative to gain traction. In October, Impossible Foods laid off

six per cent of its staff. These developments have prompted food industry analysts to reassess the market size of meat alternatives, at least for the near future.

This is also the best time for ‘resetting’ the direction of innovation in the plant-based sector, and for companies to pay more attention to consumer expectations.

Value for money is critically important, as always. However, taste, texture and sensory pleasure do not take a back seat to moral and environmental signals in food choices. While we might be living in a very food-curious time, where people, especially millennials and Gen Z are open to trying new products, there won’t be a repeat purchase if the experience isn’t satisfying.

Adjusting the response

Some large plant-based brands are doubling down on production capacity to increase and improve their economies of scale and offer market prices at parity with meat and dairy products. Earlier this year, Just Egg claimed to have reached price parity for its 12-ounce bottle of plant-based liquid egg with a comparable 12-count egg carton. In the case of Just Egg, it has been able to deal with inflation by scaling up production. It recently acquired a 30,000-sf facility to produce mung bean protein isolate, the main source of its liquid egg substitute.

However, scaling up production to meet meat and dairy

Plant-based food companies like Beyond Meat are seeing a big drop in sales.

Photo © Andriy Blokhin / Adobe Stock

price parity is not the only priority for plant-based brands. The broader societal movement toward healthier eating and concern for immune boosting choices has accelerated since the pandemic. Whether it is ‘clean label’ or ‘natural’ ingredients, plant-based food companies are reformulating their products. Companies may be hitting a saturation point with burger patty and ground meat alternatives, but there are opportunities in jerky, seafoods, and ready-to-eat (RTE) meals. Indeed, Impossible Foods launched a line of frozen RTE meals in September. Evidence is strong the texture-taste-nutrition combination shouldn’t be compromised, especially for consumers motivated to purchase plant-based foods. It is also worth noting that consumers choosing plant-based foods are making healthy eating a cornerstone of their diets, which includes conventional meat.

To meet the challenge of taste, texture and nutrition, ingredient companies can create formulations that are able to function like and provide the taste and texture of meat and dairy

22_003111_Food_In_Canada_NOV_DEC_CN Mod: September 20, 2022 11:10 AM Print: 09/30/22 11:39:48 AM page 1 v7

products, while being as natural as possible. For example, a range of ingredients are coming out that use fermentation in everything from grains and mycoproteins to algae, microalgae, fungi, legumespulses, and bacterial cellulose that provide distinctly umami flavours. Through the applied science of fermentation, new textures, thickening, gelling, stabilizing, and water-holding capacity can be applied to the taste experience.

Sustainability

Under the significant groundswell of plant-based industry growth in products over the past decade, and its subsequent media, regulatory and cultural attention, it is worth noting the differences in response from European governments and their North American counterparts. In the EU, meat and dairy traditions have deep roots, and many of these cultural practices have specific production standards and designations (think British Stilton, Parma ham, or French Roquefort). There has been some concerted resistance in Europe to allowing emerging meat and dairy alternatives to call themselves ‘milk’, ‘meat’, ‘steak’ or ‘sausage’. This argument has not seemed to hold up in North American courts or via regulation.

The animal protein sector’s response to the rise of plant-based alternatives has been equally diverse and nuanced. There is a growing movement toward recognizing the food value chain’s importance

Just Egg claims to have achieved price parity for its plantbased liquid egg with chicken eggs.

Photo © ltyuan, Tada Images / Adobe Stock

to regenerative agriculture, which links soil health, farm and food system biodiversity, and integrated livestock as part of sustainable production practices. For example, Neutral Foods, became the first carbon-neutral dairy milk company in the U.S. It has received financing from prominent investors like Mark Cuban and Bill Gates’ Breakthrough Ventures. Neutral works with dairy farmers to reduce their carbon footprint by implementing emissions reduction strategies.

New directions

A 2021 study conducted by the Agri-food Analytics Lab at Dalhousie University (in partnership with Caddle data company) found 72 per cent of Canadians identify as having no dietary preferences (including being an omnivore and including meat in their diet), 5.7 per cent identify as vegetarian, and 4.5 per cent as a flexitarian (mostly a vegetarian with some meat and fish). Gen Z respondents were twice as likely to identify as vegetarians. What was also interesting from the survey of more than 10,000 Canadians was that about 20 per cent of all respondents in the 12 months between October 2020 and 2021 claimed to have consumed:

• more dairy products;

• more meat products, but also, and somewhat ironically;

• more plant-based meat/protein alternatives.

In Canada, consumers are trying plant-

based offerings, but the important market determinant is whether it becomes a repeat, or regular purchase.

Additionally, it could be argued that the broader socio-economic-environmental arc of history is a growing concern for personal health, animal welfare, and ecosystem sustainability. This will continue to have an important influence on consumer eating habits. It also means plant-based foods will have an increasing role to play in our diets along with meat, dairy, and seafood.

For the industry, though, the question is something very basic. As explained by the co-director of the Alt. Meat Lab at

Working to grow your business?

UC Berkeley, “Ultimately people’s taste buds lead them in a certain direction, but until they are informed or guided in that way, they won’t get there.” Overly complicated processing, labels, inadequate nutrition, a lack of format varieties and poor taste experiences deter interest and repeat purchase. The industry must address these challenges to gain consumer trust and market share.

Mark Juhasz is CEO and founder of Harvest Insights. He has more than 20 years of experience in the agri-food industry. He can be reached at www.harvestinsights.com.

Success is sweeter with a great partner.

Turning risks into opportunities

Cher Mereweather

In the world of risk management, there are two broad categories of risk: positive and negative. Naturally, positive risks are considered opportunities, and negatives are regarded as threats. Often, the difference between the two is preparation.

There are four chief risks currently facing the food system, any combination of which will affect small-to-medium food and beverage companies in Canada as threats or opportunities, or perhaps most likely a mix of both. While many of these risks arise from macro-level drivers or in tandem with movements by major manufacturers and retailers, they will have profound impacts on the 97 per cent of food and beverage companies in Canada classified as small-to-medium.

The four top risks facing food and beverage companies right now, in no specific order, are:

• expanded supply chain governance;

• carbon policy and regulation;

• ongoing and expanding labour crisis; and

• access to capital and insurance.

I want to focus on how food and beverage companies might prepare for and leverage the risk in supply chain governance as an opportunity.

Retail commitments

When we examine the market forces at play currently, we see major retailers making public commitments aligned with the Canada Plastics Pact, food loss and waste reduction commitments in line with the United Nations Sustainable Development Goals, and net zero targets (i.e. the amount of greenhouse gasses a company emits is no more than the amount it removes). Commitments making waves include Walmart’s goal to reach net zero by 2040 and to ensure

There are four chief risks currently facing the food system, any combination of which will affect small-tomedium food and beverage companies.

all global private brand packaging is recyclable, reusable, or industrially compostable by 2025. Loblaws and Sobeys aim to reach net zero by 2040 and 2050, respectively. Metro has focused on reducing packaging weight, increasing recyclable content, and aiming to reach 100 per cent recyclable or compostable packaging. Costco is developing a scope 3 emissions action plan, and Sysco is engaging suppliers across their supply chain to set their science-based targets for scope 1 and 2 emissions by 2026 and developing a sustainable agriculture program by 2025. Finally, Loblaws, Save-On-Foods, Metro, Sobeys, and Walmart have all made commitments to reduce food waste by 50 per cent by 2025.

These impressive commitments cannot be realized without these major retailers engaging with vendors and suppliers across their supply chain. They will rely on their food and beverage partners to collaboratively engage, or these public commitments are unachievable. For suppliers, the question becomes, how are you preparing to meet these growing demands around food waste, packaging, greenhouse gas emissions, and climate impacts? How are your plans turning a

potential risk into a reward as a partner of choice?

Collaborations

Suppliers who position themselves as collaborative partners with major retailers and manufacturers in achieving these public commitments will be in a powerful position to leverage this opportunity and, potentially, market share. This is where risk management turns crucial: what are you doing now to ensure you are ready to report on your scope 1 and 2 emissions? Have you begun exploring ways to make your packaging recyclable, reusable, or compostable? How are you addressing and preventing food loss and waste? There are three actionable steps you can take right now to be one of the prepared. First, support the net zero targets of your major retail partners by establishing your scope 1 and 2 baselines, and begin planning how you will be reducing your organization’s emissions. Second, support your partners’ plastic packaging commitments by gaining a clear sense of how recyclable, reusable, and compostable your packaging is and exploring alternative packaging available to support the broader commitments being made. The Canada Plastics Pact (https://plasticspact.ca/) is an excellent set of goals to align with, as many of the major players are already signatories. Finally, support your partners who have made food loss and waste reduction commitments by rooting out waste within your own operation, with the bonus of putting profit back on your own bottom line, while having a great environmental and social story to share. Fortune favours the prepared. Taking steps now to prepare for inevitable risk factors will ensure stability, long-term value, and future resiliency across our food system.

Cher Mereweather, CEO of Anthesis Provision, is a Canadian-based food industry sustainability expert.

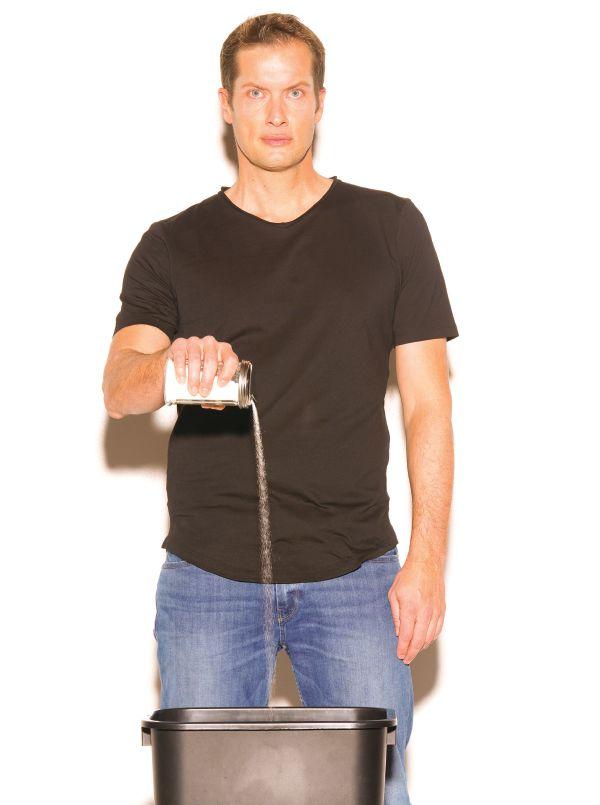

ON THE NO-SUGAR DRINKS MISSION

Brad Woodgate is one of the most dynamic food entrepreneurs in Canada. After taking the North American healthy snack food market by storm in 2018 with the No Sugar Company—a business he founded after a late-night epiphany on the ‘evils’ of refined sugar, and now generates more than $200 million a year in sales from over 30 products in 70 countries—Woodgate is now charging his way into the energy drink space with Joyburst.

Launched earlier this year, Joyburst is a sugar-free sparkling drink made with natural caffeine extracted from green tea. Six SKUs of 355-ml cans are available both online (through Amazon and the company’s own website) and in-store (at major and independent retailers across Canada and the U.S., including Walmart and Costco).

Like other brands in the highly competitive fitness drink category, including Guru here in Canada, and Celsius, Zoya and Alani Nu in the U.S., it promises to deliver a healthier boost than the spike-and-crash effects of energy drinks that use synthetic caffeine made from urea and chloroacetic acid. But what sets Joyburst apart from the competition is Woodgate. From the get-go, the 44-year-old father of two girls has been the front man for his new product, starring in high-profile TV ads, novel live-music marketing events, and a Joyburst Song that is now on Spotify.

“I’ve strategically made the decision to be the face of the franchise,” Woodgate

Brad Woodgate is determined to remove sugar from the food chain — BY MARK CARDWELL —

Photos © No Sugar Company

Joyburst by food entrepreneur Brad Woodgate is a sugar-free sparkling drink.

told Food in Canada in a recent phone interview. “I’m on a personal mission to get sugar out of the food chain.”

Exceeding expectations

According to Woodgate, sales of Joyburst private-label products, which are being made under contract by beverage manufacturers in Calgary, Toronto, and Niagara Falls, are on a moon-shot trajectory like his No Sugar brand.

“It’s been crazy,” said Woodgate, who decided to spin Joyburst off as a standalone business in September. “The brand has far exceeded our expectations.”

The brand’s original five flavours— Elderberry, Frosé Rose, Peach-Mango, Lime and Grape—got a big boost in February when Woodgate took centre stage in a splashy 30-second TV ad that aired across Canada during the Super Bowl. Dancing in a Super Bowl ad, however, was just a warmup for Woodgate’s next act: teaming up with 1980s American rapper Vanilla Ice to write and sing the Joyburst Song.

“We wanted to reach a mass audience with a lighthearted, viral and joyful message that you don’t need synthetic ingredients or sugar to energize your day,” said Woodgate. He also added a sixth Joyburst flavour—Vanilla Ice, which tastes like cotton candy and blueberry.

Woodgate and Vanilla Ice have since recorded the Joyburst Song, which is on Spotify and Joyburst’s website, and continue to perform together at shows in the U.S.

Woodgate is also continuing to work hard to get his products into more major grocery banners, an effort aided by a rigorous sampling program that has put more than 100,000 cans in people’s hands in recent months.

“I’m going flat out to make Joyburst a major market brand,” said Woodgate. “I work seven days a week and sleep only a few hours a night. But I enjoy what I’m doing, and I’ll keep giving it all I’ve got.”

Entrepreneurial beginnings

Joyburst isn’t Woodgate’s first product

launch. Born and raised in Toronto’s Brampton neighbourhood in a tightknit family, Woodgate grew up dreaming of playing in the NBA.

He displayed his tenacious character and competitive spirit as a teenager when he bought jump shoes and got up to train at 6 a.m. every second day for two

www.urschel.com

years until he was able to dunk a basketball. Both he and his older brother Derek went on to play varsity basketball at Canadian universities.

In his final year of studies at Western University in London, Ont., Woodgate struck out in business with Derek, who was then doing a PhD in kinesiology and working for a nutrition supplement company.

The brothers’ new company, called Wellnx Life Sciences, marketed diet pills and healthcare supplements that Derek made and Brad sold, initially to fellow students from the trunk of his car.

“Brad has a magnetic personality and a gift to communicate and engage with people,” said Derek Woodgate. “And he applies himself to sales with the same fierce energy and competitive spirit he did with basketball on our driveway.”

After years of struggle and near bankruptcy, the brothers finally got a chance to sell their products in five of the 160 stores that health and nutrition store chain giant GNC, then the biggest sports nutrition and weight loss retailer in North America, had in British Columbia. Eighteen months later, the brothers were in all of GNC’s 5,000 stores across North America and were one of the chain’s biggest third-party vendors. By 2006, Wellnx had national accounts with major retailers across Canada and the U.S. and was the No. 1 brand in the supplements category. Over the next decade, the company generated more than $1 billion in sales.

“Yes, we were successful, but we paid a price,” said Woodgate. “We worked all the time. We didn’t take a vacation for 10 years. I slept four hours a night. It was brutal.”

We wanted to reach a mass audience with a lighthearted, viral, and joyful message that you don’t need synthetic ingredients or sugar to energize your day.

Battle with sugar

In 2015, Brad bought his brother’s share of Wellnx. At that time, he also began to suffer from a variety of wellness issues, including sleeplessness, lethargy and skin irritations.

“I started tinkering with my diet,” he said. “I eliminated coffee and tried to take out sugar, but it was hard to do because it is everywhere. I learned that marketers use 72 terms for sugar to deceive consumers.”

Woodgate decided to create a food product without refined sugar. He used his experience, knowledge, and resources to pull together a team of food and packaged goods industry experts and developed new snack products using natural sweeteners instead of refined sugar.

“We hire the best scientists in the world for each food category and give them a sandbox to play in,” said Woodgate. “We have our own R&D team here in Toronto, but they quarterback outside scientists and the development process, which can involve hundreds of iterations to allow feedback at all levels, especially for texture and taste.”

Like Joyburst, the No Sugar Company uses different manufacturers in Canada and the U.S. to make its products as private label brands. His company’s first retail food offering—No Sugar Keto Bars—was launched in early 2018. By the end of 2020, No Sugar had sold more than 100 million bars and 400 million cups to more than 1 million people. In 2021, the brand went global and added several new products to its line up, including nut bars, bread, energy drinks and ice cream. This year, the No Sugar Co. launched a dozen more keto-friendly items such as Browniez, Gemz, Barz and Cookiez. A new seven-layer meta energy bar is set to launch in January.

According to Woodgate, No Sugar’s success is helping his personal mission to eliminate refined sugar from the world.

The No Sugar Company generates more than $200 million a year in sales.

Healthy for us, healthy for our pets

Pet food ingredients are mimicking human food

— BY JANE DUMMER —

Today’s consumer is not only concerned about their physical and mental health, but also their pet’s health.

In June 2022, Euromonitor International identified the top five trends in pet care. Both premiumization and well-being are on that list. The report revealed humanizing pets, owners are increasingly eager to provide them with high-quality, premium food and products. Premiumization involves giving pets foods made from ingredients people would accept on their own plates. As consumers are searching for specific benefits from the products they purchase, brand owners are expanding their premium products with the aim of achieving higher margins.

More than ever the nutritional value of pet food and snacks is top of mind for consumers. A spotlight has been shone on our mind-body since the pandemic. Increasing demand for functional and natural ingredients is expanding from

our packaged food to pet care. A shift from general well-being for pets to specific functionality drives ingredients that address digestive, joint, heart, dental and skin health, as well as mental health.

Food claims

Euromonitor International reviewed the top health-related claims made by pet food brands. High protein was the most common, appearing in nearly 12 per cent of products with claims available online. Natural claims were the second most frequent with more than eight per cent of products claiming to be natural. Other top claims were related to vitamins, antioxidants and immune system health. In mature markets, mental health of pets is also receiving attention, as consumers become increasingly concerned about stress that they observe when leaving pets alone, especially following home seclusion during lockdowns.

David Pastor, national sales director, Tender and True Pet Nutrition, Omaha,

Nebraska, agreed. “Pet parents love to see their pets grow up healthy. They eat healthier and want to share healthy treats they know are better for their pets. The same way they feel happier about feeding their kids a healthier diet. Many of our pet parents follow an organic diet and want the same for their pets. The key benefit of our pet food is the high-quality ingredients. We have organic recipes; limited ingredients recipes and all our meat proteins are Global Animal Partnership (G.A.P.) Certified. The recipes are for all stages of life, so it is not necessary to change recipes as the pet ages. Our products are available for sale online and at Canadian grocery retailers including Longo’s, Sobeys, and Whole Foods,” he said.

Freshpet

Pet food ingredients mimicking human food ingredients is increasing in different formats, delivery and storage systems. Freshpet has been a leader in the refrig-

The nutritional value of pet food and snacks is top of mind for consumers.

Increasing demand for functional and natural ingredients is expanding from our packaged food to pet care.

erated format. Freshpet recipes are blends of fresh meats, vegetables and fruits farmed locally and made at their Kitchens in Bethlehem, Penn. All food is prepared in small batches at lower temperatures to preserve the ingredients’ natural goodness. Freshpet foods and treats are kept refrigerated from the moment they are made until they arrive at Freshpet fridges in local markets.

The global health crisis has emphasized consumer behaviour of pursuing functional, wholesome ingredients that signal a health halo, not only for humans and pets, but also for the entire planet.

“We’ve been on a journey to accelerate our commitment to creating products that are not only better for our pets, but are also kinder to the planet. The relaunch of Nature’s Fresh is fundamental to the future of our business, helping us achieve our ambition to reduce our environmental impact and make every bowl matter. Helping create a more sustainable world includes how food is produced for pets, and that pet parents can feel confident that with Nature’s Fresh they’re selecting the most sustainable pet food,” explained Scott Morris, president and co-founder, Freshpet.

Trendi

Food waste reduction continues to be part of the good for us (pets included) and the planet theme. As a result, it has driven revised practices across the entire food value chain. Trendi, a Canadian robotics agri-tech company based in British Columbia is dedicated to stopping food waste at the source and feeding more people (and pets). Trendi’s ingredients (purees, powders, and flakes) are made from upcycled produce at the source via their Biotrim units.

Founded in 2019, an early stage venture in the pet food ingredient space, Trendi is gathering insights and piloting their ingredients.

“Our ingredients retain over 90 per cent of their

nutrients. We’re working with pet food and animal nutrition experts, who recognize that our ingredients are valuable and nutritious for pet food innovation. Positive feedback from these experts includes the taste, colour, aroma, nutrition and that the rescued fruits and vegetables lead to clean ingredient decks,” said Christine Couvelier, president, Trendi.

“We believe the industry has come a long way in the development of health-conscious products as customers increasingly ask questions about what is good for their pet and what is not. There are more products coming to market with healthy ingredients, better for pets and often more palatable. There is an increased focus on transparency. Knowing what is in our food is paramount for humans, and pet parents want the same transparency for the food and treats they buy for their furry family members. With pets increasingly viewed as members of the family, the overall concern and emphasis on health is reflected in devoted pet lovers’ buying decisions for their pet. If people are not content eating low quality, unhealthy foods and snacks, they most likely will not be content giving their pet something of a similar nature,” concluded Karen Rushton, vice-president, merchandising, Pet Valu Canada.

Pet parents want to provide their pets foods made with ingredients they would eat.

Barks&bites

Matt Pirz named president of Primal Pet Foods

Matt Pirz will be returning as president of Primal Pet Foods. In this newly created role, the industry veteran and Primal Pet Group board member will lead and take ownership of all commercial activities for the brand.

He will work collaboratively with customers and distributors to support the continued growth of the brand within the neighborhood pet channel.

“About a decade ago, Matt Pirz had the vision and foresight to partner with neighborhood pet stores to turn the freezer into a competitive advantage, and that strategy continues to prove successful for our partners and our brand,” said Tim Simonds, CEO of Primal Pet Group. “With his strong relationships and track record of success, I’m confident Matt will continue to find ways to strengthen our business and grow together with all our key partners.”

“Thanks to the help and support of neighborhood pet, we were able to build a market for a new category of pet food—raw and gently prepared—over the last decade,” said Pirz. “I am eager to build on this success and continue to accelerate growth within this influential channel.”

Purina completes $156M factory expansion in Iowa

Earlier this fall, Purina leaders and community representatives gathered in Clinton, Iowa, to celebrate the completion of a $156 million expansion at the company’s local factory. The project expands capacity and production capabilities for Purina’s pet care brands and adds a technical training center. The expansion results in 96 new positions at the factory, which

now employs approximately 570 people.

The pet food production expansion includes new cooking and packaging lines that will be used to make a variety of pet food brands, including Purina One, Purina Pro Plan and Purina Pro Plan Veterinary Diets.

Purina also purchased a building adjacent to the factory that has been retrofitted for the packaging and storage of two Purina brands: Purina Pro Plan Veterinary Supplements and Just Right.

“The pet care industry is dynamic and thriving, and Purina’s role as the category leader is one that we take seriously,” said Andrea Faccio, chief growth officer at Purina. “The ongoing investment in our business, including this expansion in Clinton, sets us up for continued growth in the future and helps us meet increasing demand from pet owners who have placed their trust in Purina to deliver nutritious and high-quality dog and cat foods.”

United Petfood acquires Gold Line Feeds

United Petfood takes over Gold Line Feeds in the UK. United Petfood Group will take over the brands and customer base of the factory. They will house production and distribution at their current sites and move administrative functions to United Petfood UK.

Gold Line Feeds is an independent animal feed manufacturer with 80 years of experience situated in Northamptonshire, UK. The British factory supplies about 20 tonnes of dry pet food each year.

Phillips earns Pet Sustainability Coalition accreditation

Phillips is one of the first distributors in the pet industry to be officially accredited through the Pet Sustainability Coalition (PSC).

Last year, Phillips partnered with PSC, Animal Supply Company and Pet Food Experts to accelerate sustainability in the industry. Over the course of the past year, the Philips team worked behind the scenes to achieve PSC accreditation.

Accreditation required completing the SDG Action Manager, a sustainability assessment established by the UN Global Compact. Accredited companies must reach a minimum score on their assessment, then undergo a third-party verification of the assessment.

Phillips has also created an internal team of employees to lead the charge on sustainability efforts across the entire organization.

PSC is a nonprofit organization dedicated to creating a more sustainable pet industry. PSC works with companies throughout the entire supply chain to advance business through profitable environmental and social practices.

Photos © Purina, Tanya / Adobe Stock

•

•

•

•

•

• Pick up trends at the Canadian Pizza Chef of the Year competitions!