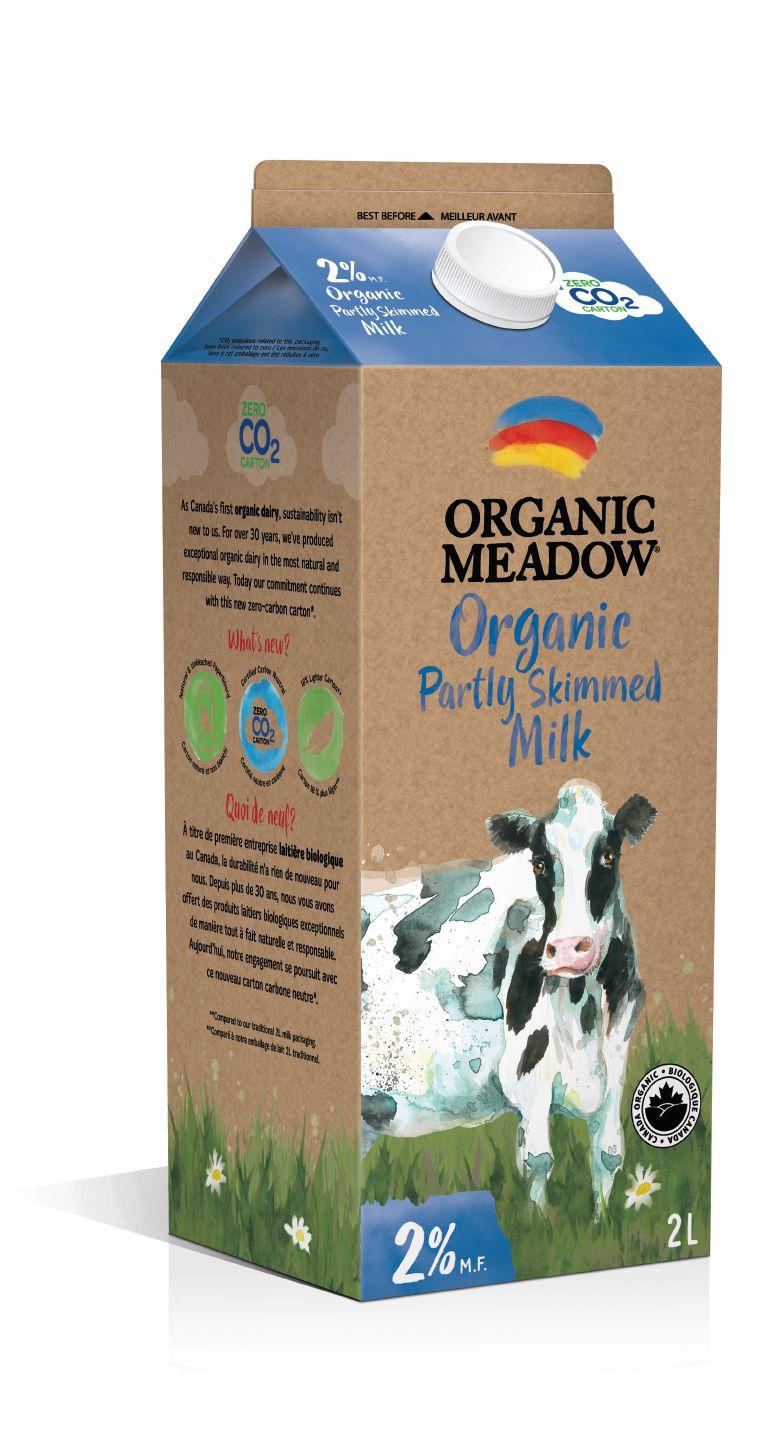

Net-zero packaging

for milk

Organic Meadow leads the way with carbonneutral cartons PG. 16

Food safety

YOU CAN’T JUST BUILD A PLANT, AND ASSUME IT’S SAFE PG. 8

+ GOURMET EDIBLES FROM WHITE RABBIT PG. 27

This B.C.-based company uses proprietary tech to create unique chews

2022 FCC Beverage Report:

Demand shifting from retail to service

The annual FCC Beverage Report highlights opportunities and risks for Canadian beverage manufacturers. It includes an annual sales forecast for 2022, product sales performance and a gross margin rate index.

Industries featured in the report are:

• Breweries

• Wineries

• Distilleries

• Soft drinks and other non-alcoholic beverages

Three key observations from this year’s report:

1. Beverage manufacturing sales increased in 2021

Increased foodservice volumes and continued retail growth boosted total sales 11.3% YoY to $14.5 billion in 2021.

Beverage manufacturing sales are projected to decrease 1.0% in 2022, driven by:

• Broad inflation shifting consumers’ choices

• Elevated wholesale/retail inventory levels limiting downstream sales

• Shift towards service-based sales where consumers tend to drink fewer alcoholic beverages than at home

2. Industry gross margins expected to improve

Despite growing topline sales, gross margins struggled to regain 2019 levels. Strong competition in the alcoholic beverage sector makes it difficult to pass on higher costs, resulting in beverage inflation lagging food inflation.

We expect margins to improve in 2022 as consumers are willing to pay higher prices for beverages, assuming costs don’t continue to rise. Bar, taproom, wine tasting rooms and restaurant sales are also often at a higher margin than retail.

3. Beer remains the number one alcoholic choice among Canadians but also faces pressure

Beer sales at the retail level for the 2020-21 year declined 1.4%, with total litres sold falling 2.3%. Total beer volumes have now declined for five consecutive years. Canadian breweries have taken market share from internationally produced beer over that timeframe, although their volume has also declined, just at a smaller rate. Overall, beer’s market share compared to wines and liquor fell by two percentage points to 36%.

The bottom line

Low retail inflation relative to rising input costs is a trend to monitor. Look for data-driven ways to boost margins, manage inventory, product mix and pricing strategies. Find ways to maintain or grow market share by connecting with Canadian consumers, through tourism or capitalizing on their desire for niche and “locally produced.” The alcoholic beverage market is competitive; however, product innovations, including seltzers, pre-mixed drinks, non-alcoholic drinks and other beverages, are supporting growth.

Kyle Burak, FCC Senior Economist

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

MEDIA SALES MANAGER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Alice Chen achen@annexbusinessmedia.com 416-510-5217

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Martin McAnulty mmcanulty@annexbusinessmedia.com

COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $84.95

Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2022 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Tel: 416-442-5600

Fax: 416-442-2230

ISSN 1188-9187 (Print)

ISSN 1929-6444 (Online)

RELEVANT CONTENT

Creating a circular food economy while reducing food waste

The last few years have been tough for the Canadian food and beverage industry, to put it mildly. From rising costs of ingredients to supply issues, food manufacturers are experiencing challenges never seen before. As the year went by, it became apparent we had to get a holistic view of the food and beverage processing business. So, we conducted the 2022 Food in Canada Business Outlook Survey. The survey results have been compiled and published as a supplement to this issue. I hope you find the data useful. One of the key findings of the report is that 65 per cent of survey respondents are “cautiously optimistic” about market conditions in the new year.

I find that stat uplifting. Despite the doom and gloom of 2022, some companies hit key milestones this year. I’d like to highlight some of them, but first, some news.

Acquisitions

A lot of deals closed this summer. In August, Del Monte Foods acquired Kitchen Basics, a line of ready-to-use stocks and broths from McCormick & Company. Premier Foods bought one of my favourite start-ups, the Spice Tailor, a premium Indian and Southeast Asian meal kits and accompaniments brand. Cargill and Continental Grain Company completed the previously announced acquisition of Sanderson Farms, Inc. At the close of the transaction, Cargill and Continental Grain combined Sanderson Farms

with Wayne Farms to form a new privately held poultry business called Wayne-Sanderson Farms, which will be headquartered in Oakwood, Ga. Lastly, Arva Flour Mills, North America’s oldest continuously operating commercial flour mill, acquired the Red River Cereal Brand from Smucker Foods of Canada Corp..

Blume

This superfood latte brand from Vancouver, B.C., shocked the industry by raising $2 million, an oversubscribed first raise, within a five-week period. It attracted investment from leading players like Fulmer & Co, Judy Brooks, Ethan Song, Jerin Mece, and Mike Fata. Considering that only three per cent of female-led businesses are funded, Blume’s super successful first raise is worth celebrating.

Bluu Seafood

This European foodtech company’s fish fingers and fish balls containing cultivated fish cells have reached market readiness and will soon enter the regulatory approval process. While the company targets initial approval and market launch in Singapore, it is also planning to apply for approval in the U.S., the U.K., and the EU.

Psigryph

Founded in 2018, Psigryph, Guelph, Ont., has developed a nano-delivery system called Nanopect that can

Nithya Caleb

transport large numbers of molecules across cell membranes of plants, animals, and humans, thereby increasing bioavailability. The company recently received a grant from the Sustainable Development Technology Canada.

This issue

Just like these companies, we are looking at processes that can address some of the burning issues (e.g. climate change) in the food sector. So, most of the articles and columns in this issue focus on sustainability and reducing food waste.

With a carbon-neutral packaging, Organic Meadow has moved the needle in terms of sustainability in the North American dairy industry.

On page 12, Mark Juhasz highlights the potential of upcycling to create a circular food economy. Consumers don’t understand upcycling, yet, but food insecurity is a big concern, and no one wants to waste food.

On the same theme, Jane Dummer shines the light on some companies that are creating unique products with discarded whey and milk permeate.

On page 30, our packaging guru, Carol Zweep, stresses eco-friendly alternatives to single-use plastics. These products use food waste that has been upcycled into packaging materials. Have you tried any of these upcycled products? What did you like about them? Drop me a note!

Nithya Caleb ncaleb@annexbusinessmedia.com

Merit Functional Foods unveils new pea protein

Merit Functional Foods, a Winnipeg-based ingredient supplier, has a new pea protein solution. The Peazazz pea protein offers gelling, emulsification, and cold and hot binding to uphold an animal meat-like texture in meat alts. Recent applications work has also demonstrated that it can replace methylcellulose, a commonly used ingredient in alt meat formulations.

News> file

Cacao Barry’s WholeFruit Chocolate earns Upcycled Certification

Cacao Barry’s WholeFruit Chocolate, made from 100 per cent pure cacao fruit, is the first-ever chocolate to be Upcycled Certified by the Upcycled Food Association (UFA).

Made for and by chefs, not only does WholeFruit Chocolate provide a unique sensory of flavours and nutritional values, but also gives value to the pulp of the cacao fruit that used to be discarded.

Government of Canada unveils new front-ofpackage nutrition symbol

The federal government announces new nutrition labelling regulations for packaged foods to help Canadians make informed food choices. These regulations will require a new symbol to be displayed on the front of packaged foods that are high in saturated fat, sugars and/ or sodium. Manufacturers have until January 1, 2026, to change their labels and comply with the new requirement. The new nutrition symbol includes a magnifying glass and text to draw attention to important information

Canadians should consider as they are buying groceries. The symbol will complement the Nutrition Facts table displayed on the back of food packages.

Cargill and Continental Grain acquire Sanderson Farms

Cargill and Continental Grain Company complete the previously announced acquisition of Sanderson Farms, Inc. Sanderson Farms shareholders are receiving USD203 per each share of common stock they owned as of immediately prior to the completion of the transaction.

Cargill and Continental Grain have combined Sanderson Farms with Wayne Farms, a subsidiary of Continental Grain, forming a new privately held poultry business. The new business, named Wayne-Sanderson Farms, will be headquartered in Oakwood, Ga. Clint Rivers, currently CEO of Wayne Farms, has been appointed CEO of the combined company.

Chinova Bioworks earns FDA GRAS status

Chinova Bioworks receives a No Questions Letter from the U.S. Food and Drug Administration (FDA) regarding their Generally Recognized As Safe (GRAS) application for Chiber mushroom fibre, a natural food and beverage preservative.

FDA created the GRAS procedure to ensure companies performed the necessary research and testing, demonstrating their food ingredients are safe for the public at the intended levels and use specified within the application. A No Question Letter is the FDA’s communication showing an ingredient is permitted for use. FDA GRAS status is recognized in many countries outside the U.S. and aids in garnering regulatory ingredient acceptance abroad.

Kellogg to split into three companies

The Kellogg Company will separate its North American cereal and plant-based foods businesses, via tax-free spin-offs, resulting in the three independent public companies of Global Snacking Co., which will focus on global snacking, international cereal and noodles, and North America frozen breakfast categories; North America Cereal Co., which will specialize in ready-to-eat cereal in the U.S., Canada, and Caribbean, and its portfolio comprises Kellogg’s, Frosted Flakes, Froot Loops, Mini-Wheats, Special K, Raisin Bran, Rice Krispies, Corn Flakes, Kashi and Bear Naked; and Plant Co., which will be anchored by the MorningStar Farms brand.

EnWave earns SQF Certification for vacuum-microwave toll manufacturing facility

EnWave Corporation’s vacuum-microwave toll drying facility, Revworx, in its Vancouver head office has successfully completed the Safe Quality Food (SQF) certification process. The SQF program is a rigorous and credible food safety and quality program that is recognized by retailers, brand owners, and food service providers worldwide. Recognized by the Global Food Safety Initiative, the SQF family of food safety and quality codes are designed to meet industry, customer,

and regulatory requirements for all sectors of the food supply chain, from the farm all the way to retail stores.

Following the SQF certification process, Revworx is now officially open for business, offering on-demand contract manufacturing services for the production of vacuum-microwave dried snack and ingredient applications for food companies.

Arva Flour Mills acquires Red River Cereal Brand

Arva Flour Mills, North America’s oldest continuously operating commercial flour mill, acquires the Red River Cereal Brand from Smucker Foods of Canada Corp.

“Since acquiring Arva Flour Mills last fall, hardly a day went by at our retail store without a customer asking if we carried Red River Cereal. This prompted our initial research, and we soon came to the decision that this iconic, nearly century old brand would be a natural fit alongside the historic, Arva Flour Mills Brand,” said owner of Arva Flour Mills, Mark Rinker. “We know that the countless customers who used to start their day with Red River Cereal share in our excitement to get this beloved brand back on store shelves.”

Barry Callebaut to open new chocolate factory in Ontario

Barry Callebaut picks Brantford, Ont., for their new chocolate factory. Earlier this year the company announced plans to invest USD104 million in the new plant which will include office space for corporate operations and chocolate processing.

The plant will focus on sugar-free, high protein, and other specialty chocolate products. The new operation is the first new factory for Barry Callebaut in North America since 2008 and is expected to bring more than 200 jobs to Canada.

Heavy crate transportation in cold and humid environment

Storcan, manufacturer and integrator of agri-food production line, launched on the market its new conveyor system, allowing high-speed boxes transportation (max. 110120 lb) in a highly sanitary environment. The 48V motorized roller conveyor, in stainless steel, is driven by an intelligent controller, offering the possibility of creating different zones. Its unique design has many strengths: easy to install, low maintenance, transportation without pressure, with accumulation and automatic management of jams. www.storcan.com

Antares Vision Group introduces new series of inspection machines

Antares Vision Group introduces a new series of inspection machines. The company’s all-in-one equipment portfolio incorporates multiple inspection controls into single machines. Combinable features for the series include regulatory compliance, container integrity, microleak (micro-hole) and contaminants detection, weight control, and labelling/ print verification for parameters such as expiration date and lot code. www.antaresvision.com

Key Technology introduces new auto diverter

Key Technology introduces its new and improved auto diverter for its Iso-Flo vibratory conveyors. Ideal for bulk product and packaging distribution lines, the auto diverter splits the product flow to two downstream systems, such as digital sorters or packaging machines, and changes the proportion of product going to each of the two lanes as needed. This patented auto diverter features a stronger diverter blade, an improved pneumatic hold-down system and more to achieve longer equipment life and greater accuracy for better performance of downstream systems.

www.key.net

Key Technology introduces reversible Zephyr conveyor

Key Technology launches a reversible Zephyr conveyor. Now equipped to flow in either direction, the reversible Zephyr maximizes production line versatility while improving sanitation and minimizing maintenance. The reversible Zephyr is suitable for frozen bulk foods including potato products, fruits, vegetables, meat and poultry, as well as dry products like potato chips/crisps, nuts and cereals. Reversible Zephyr can be configured to separate a single product stream to two side-by-side machines or even divert a single stream to two different downstream production lines to produce different products.

www.key.net/en/products/zephyrhorizontal-motion-conveyor

IYou can’t just build a plant, and assume it’s safe

Dr. Amy Proulx

t’s an exciting time for food businesses. During the past few years, many food service operators have pivoted to packaged goods, creating micro-businesses in the industry. Statistics Canada’s 2021 data indicates that of the 10,252 food manufacturing businesses identified in the country, 26 per cent employs less than four people, and another 64 per cent have less than 100.1 CFIA’s SFCR registry database lists more than 17,000 licensees in Canada, implying there are alternative food businesses, such as farm processors and hybrid businesses. Small and micro-businesses dominate the sector.

Michelle Lang, facilities manager at Venture Park Labs in Toronto, recently asked, “Many of my small business clients are building out facilities for manufacturing or bringing in different products into our food incubator space. It just seems that there are so many unknowns in these products’ compositions since they might inadvertently get into the food. Can you give some insights into the rules?”

Firstly, please don’t pick up supplies for your food manufacturing space from a local store. There is a methodical process to follow before using any construction or non-food materials in the food manufacturing space.

Before jumping into the process, let’s understand the “why” behind it. In SFCR, the emphasis is on the licensed establishment to have validation or documented proof that the environment and the process are safe to produce food. The research process proving non-food materials is an important document record that could be called on by inspectors or auditors, so you must keep a record file proving that each non-food material is going to have minimal risk when used appropriately.

There is a methodical process to follow before using any construction or non-food materials in the food manufacturing space.

Accepted materials

Back in the day, there used to be a CFIA Letter of Acceptance process for nonfood materials. Producers of materials, such as paints, packaging materials, glues for labels, caulking, lubricants, descaling treatments, boiler water treatments, construction materials, printer inks, and other non-food materials would submit reports to CFIA to describe the risks for food premises use. This process was phased out starting in 2014. However, remnants to that historical process still inform the way non-food materials are evaluated. First, CFIA recommends reviewing Health Canada’s Reference Listing of Accepted Construction Materials, Packaging Materials and NonFood Chemical Products Database to evaluate the appropriate use of non-food materials.2 It’s not modernized so set aside time for manual searches. CFIA’s second approach is to have a Letter of Acceptance on file from the historical CFIA approval process. This would be available for older manufacturing facilities that were federally inspected historically. New startups, or plants recently brought into SFCR licensing would not have this option.

No objection

CFIA’s third approach is to identify if there is a Health Canada Letter of No Objection

(LONO) for the materials in question. Manufacturers of non-food materials may apply to Health Canada for a LONO. The manufacturer subsequently distributes this letter upon request to food establishments for their record keeping. While Health Canada keeps a list of approved non-food chemicals, such as boiler water agents, it is best to ask the manufacturer for their LONO file.

CFIA’s last recommended approach is licensed food establishments should request a Letter of Guarantee (LOG) from the chemical or material manufacturer. This is becoming common, as more novel packaging materials and environmental solutions are being introduced.

This LOG would imply that the manufacturer has done a rigorous evaluation on their own to ensure the materials are suitable for food premises or food contact under appropriate conditions.

Packaging materials are part of this whole process. We’re seeing an uptick in novel packaging for environmental improvement. As a food premise, make sure to request information for record keeping and to validate appropriate use in food systems depending on how your product is being used at the manufacturing, distribution, and consumer levels.

In conclusion, while you can buy materials from a local store, you must do your homework first.

Check the databases and make phone calls or e-mails to the manufacturer to verify compliance. To manage your SFCR records, retain a copy of a valid document demonstrating safe use.

Notes

1 Visit http://www.cirb-ccri.gc.ca/app/scr/ app/cis/businesses-entreprises/311.

2 Details at https://food-nutrition.canada. ca/food-safety/referencelist/index-en.php.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

Health Canada targets saturated fat, sugars, and sodium with its new FOP nutrition labelling regulations

Laura Gomez

On June 30, 2022, the health minister announced the long-anticipated front-ofpackage (FOP) nutrition labelling regulations. These regulations will require certain prepackaged foods to display the FOP nutrition symbol, with manufacturers given until January 1, 2026, to change their labelling. While finalizing FOP labelling was part of the minister’s 2021 mandate letter, the timing is not ideal, as these regulations will trigger costly label changes for the food industry at a time when Canadians are already facing higher prices for many foods.

Under the new regulations, Health Canada announced most prepackaged foods that meet or exceed certain daily value levels of saturated fat, sugars and/ or sodium will be required to display the FOP nutrition symbol. On the same day as the announcement, Health Canada released examples of the finalized symbol. The symbol consists of a black and white magnifying glass and accompanying text in English and French and must be located on the front, upper right half of the label.

The regulations form part of Health Canada’s Healthy Eating Strategy, with the intent to make it easier for Canadians to make informed food choices by drawing attention to important information Canadians should consider as they are buying groceries. The symbol is intended to compliment the Nutrition Facts table (NFt) displayed on the back of food packages.

Health Canada’s backgrounder provided the following details regarding those foods that will require the FOP nutrition symbol:

• general prepackaged foods that meet

or exceed 15 per cent of the daily value of saturated fat, sugars or sodium (e.g. deli meats, soups, frozen desserts or puddings);

• prepackaged foods with a small reference amount (meaning the amount of food a person typically consumes in one sitting) that meet or exceed 10 per cent of the daily value of saturated fat, sugars or sodium (e.g. pickles, salad dressings, cookies or breakfast cereals); and

• prepackaged main dishes with a reference amount greater than or equal to 200 grams that meet or exceed 30 per cent of the daily value of saturated fat, sugars or sodium (e.g. frozen lasagna, meat pie or pizza).

Health Canada’s announcement also indicated that the regulator has decided to exempt certain foods from the requirement to display the FOP nutrition symbol, including:

• foods that have recognized health protection benefits, including fresh, frozen, canned or dried fruits and vegetables; two-per cent and whole milk; eggs; foods with a healthy fat profile, such as vegetable oils, nuts and fatty fish; and any combination of these foods as long as they do not include ingredients that contain saturated fat, sugars and/or sodium;

• foods that are a source of nutrients that are not readily available in other foods and that most Canadians do not get enough of, such as cheese and yogurt, which contain calcium and are made from dairy products; and

• foods that are formulated to meet the needs of specific populations, such as

rations for military personnel use. Additionally, Health Canada’s backgrounder identified the following technical and practical exemptions:

• foods that do not require an NFt;

• raw, single-ingredient ground meats and poultry;

• foods not sold directly to consumers and foods in very small packages (e.g. coffee creamers); and

• foods on which a symbol would be redundant (e.g. sugar, butter or table salt).

The food industry will be given until January 1, 2026, to make these changes. The delayed coming into force is meant to reduce the immediate compliance costs to industry and allow industry to plan for the changes (as a shorter coming into force could have easily doubled estimated compliance costs). Even so, this change will represent a significant cost investment for those companies in food product segments specifically targeted by the regulations.

Laura Gomez is an Ottawa-based Gowling WLG partner who advises on food law and has been recognized in both The Best Lawyers in Canada and the Canadian Legal Lexpert Directory. Contact her at laura.gomez@ gowlingwlg.com or visit https://gowlingwlg. com/en/sectors/food-beverage/global.

MAINSTREAMING FOOD WASTE REDUCTION WITH UPCYCLING

Upcycling is gaining traction as processors work to create a circular food economy

— BY MARK JUHASZ —

Food waste is a huge problem once you become aware of it. It has significant impact on freshwater supplies and contributes to greenhouse gas emissions. According to FAO, about 30 per cent of all food is wasted at some point in the supply chain from source to consumer. Additional studies also state that about a third of all food is lost to waste. This translates to approximately a billion tonnes of food waste globally, or a trillion dollars’ worth, annually. Further, food waste exacerbates food scarcity and insecurity. In North America, a plethora of labelling confusion around food safety terminology and shelf-life considerations along with lack of diversion practices and purchase impulsiveness are contributing to massive amounts of food waste.

According to Project Drawdown, led by the U.S.-based Upcycled Food Association (UFA), food waste reduction can help minimize global warming and the effects of climate change. One waste-reduction approach that’s gaining favour is upcycling, as part of a broader circular economy.

What is upcycling

Upcycled foods do not have a solid definition other than ingredients that would otherwise have gone to waste, but find a new life, whether for human consumption or other positive uses. Co-ordination of effective food waste reduction strategies is often specific to each sub-sector in the supply chain, be it on-farm, in transit, or with consumer choices. Different business models, and experts focus are different aspects, whether that is preventing waste at the farm level, creating animal feed from discarded produce or energy from by-products, or upcycling into new food products such as juices and flours. It is important to see the bigger picture for the many opportunities, and to see the current enthusiasm for upcycling as the ‘branding’ of a much larger and longer consideration of effective resource management and responsibility.

Part of the branding and communications aspect to reducing food waste and promoting upcycling is the favourable market and consumer response to its initiatives. Clear communication of the benefits and value will be critical to uptake. According to New Food, only about 10 per cent of consumers are familiar with the term, upcycling, and the field may well be under

created in April 2021 the Upcycled Certified label. It is the first third-party verified certification mark that can be easily recognized by consumers. More than 200 certified companies with ambitions of reducing 1 billion lb of food waste annually over the next couple of years use this label.

As another step in building a food waste reduction infrastructure, the Food Waste Funder Circle has been created in the U.S. to manage the deal flow and logistics in the food industry. With consistent investment and support, analysts believe it will reduce food waste per year, while creating new food products and categories. Financing is coming from a combination of foundations, venture capital and philanthropy.

Leading players

researched. Different consumer segments will likely respond uniquely to product and service offerings to reducing waste, or to buying upcycled products or ingredients. Some shoppers are more motivated by frugality and cost savings, while others may be averse to new foods. Social and environmental messaging may also resonate strongly with some consumer segments, while others will have quality and food safety concerns. The definitions of food waste and upcycling have different meanings and implications, while not being completely new in context. For example, Toronto-based Second Harvest has for decades worked to redistribute food items to those in need, which would otherwise have gone to waste.

Certification

To give some structure and reliability to the specifics of upcycling in the food manufacturing space, UFA

Amidst growing capacity and certification infrastructure, a new crop of companies is gaining recognition. Brooklyn Bouillon makes broth from what was ordinarily discarded animal bones. Renewal Mills intends to become the go-to source for upcycled ingredients, and continues to add mixes, flours and beyond to their portfolio. Lamb Weston intends to use pea starches (from the growing pea processing industry in North America) as an alternative batter ingredient.

Greenhouse Juice is making new beverages by reusing discarded fruits and vegetables. Companies like GroundUp Eco Ventures, Wellington Brewery, and ReGrained are working with either beer or coffee brewers to collect their spent grains and grinds and gave them new life as nutritious, minimally processed products, flours, baking mixes, livestock feed, or as raw ingredients for fermentation processing (as in the case of Mushlabs partnership with a German brewer).

Retailers are being offered new products apart from upcycled feedstock for food and beverage manufacturers. Misfits Market is a food upcycling delivery app that aligns grocery shoppers with foods nearing expiration. Users of the app can expect 20 to 50 per cent savings on their orders, while Chicago-based Hazel Technologies has created a sachet that uses ethylene to control the aging process of fresh product and extend its shelf life. These offerings help food-focused companies mitigate the fluctuations and inflation currently impacting costs.

Consumer awareness

Amidst all these initiatives and pressures leading food waste awareness and a new circular economics, the verdict is still out on consumer willingness to pay for upcycled food products. Whether it is environmental messaging, climate change and impact that will resonate with some consumers, or the rationality of cost savings and frugality with others, communications will be an important consideration for food brands in this space. The conversation will also look quite different depending on the target market (e.g. farmer, input supplier, manufacturer, ingredients company, retailer or consumer). Experts

and engineers alike seem confident agri-food waste could produce massive amounts of useful sidestreams. Some applications are more fully realized, such as anaerobic digestion of cattle manure, or feedstock from spent grains. It also begs to mention that reducing food waste is not a totally new concept when considering the origins of sausages, hot dogs, soup stocks and pet foods.

With its message of frugality, circularity, and careful use of resources, upcycling will resonate with the broader public and consumers, companies, and governments alike. However, large food companies and major CPGs remain slow to get on board amidst concerns with supply consistency and quality control. This will require greater co-ordination, and the Food Waste Funder Circle is a step in the right direction. Depending on how one defines it, upcycling, reducing (food) waste, and circularity are here to stay, and they can increasingly make good business sense. Also, upcycling has been identified by several market analysts as a leading trend for 2022.

Mark Juhasz is CEO and founder of Harvest Insights. He has more than 20 years of experience in the agri-food industry. He can be reached at www.harvestinsights.com.

Reiser Form/Fill/Seal Packaging

n High-speed production of vacuum, MAP and VSP packages to extend product freshness and shelf life

n Rapid Air Forming for high-quality, high-speed forming

n Superior sealing system virtually eliminates leakers

n Stainless steel, rugged, low cost of ownership

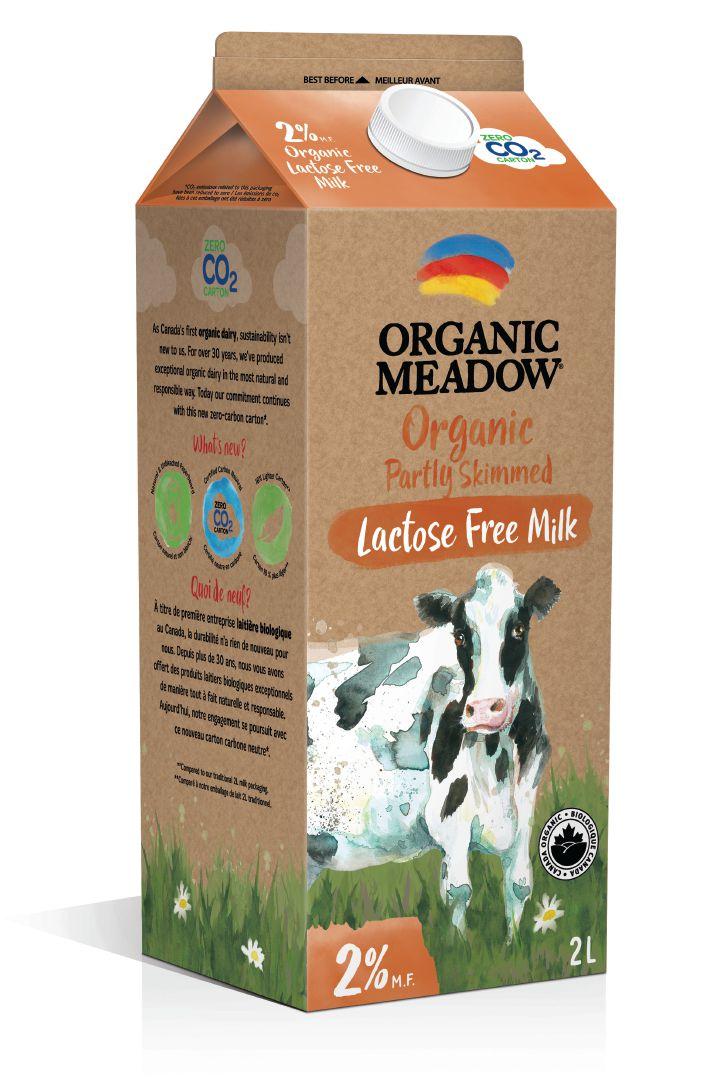

packaging for milk A NOVEL, NET-ZERO

Organic Meadow leads the way with carbon-neutral milk cartons

— BY MARK CARDWELL —

Ontario dairy pioneer Organic Meadow made a splash a decade ago when it introduced returnable glass bottles for its premium organic milk brand to the marketplace. Now the company is making hay with another novel milk container that again connects sustainability with the healthy and responsible nature of organic dairy products and production.

Since October 2021, Organic Meadow has been selling its five varieties of 2L organic milk in brown, carbon-neutral cartons.

Made by global packaging leader Elopak from unbleached paperboard and with one less layer of packaging than traditional milk cartons, the new packaging generates net-zero emissions of carbon dioxide.

Organic Meadow is the first dairy producer in North America to use the carbon-neutral Pure-Pak cartons, which were developed in Europe. The effort earned the Guelph-based (Ont.) business the top award for innovative packaging at the Retail Council of Canada’s 29th annual Canadian Grand Prix New Product Awards in June 2022.

“Sustainability is engraved in our DNA,” Maurice Bianchi, Organic Meadow’s vice-president of sales and marketing, told Food in Canada in a phone interview. “We are organic pioneers in Canada (and) we always pursue sustainable options when they become available.”

NEW PACKAGING

In addition to its carbon-free footprint, Bianchi said the torti-

marketing manager.

lla-brown hue and brightly coloured letters, logos, and artwork on its new gable-top milk cartons—including a bucolic painting of a milk cow in a grassy meadow—have been a hit with organic milk drinkers from the get-go.

“Retail reception has been extremely strong,” said Bianchi. He added the fully recyclable, visually appealing cartons “catch people’s attention” and “jump off the shelf” in organic dairy sections of the many health food and grocery stores across Canada that carry Organic Meadow’s lineup of products, which includes milk, cream, kefir, yogurt, cheese, butter and ice cream.

For Bianchi, the advent of carbon-free milk cartons is a welcome advance in the always-challenging issue of sustainable packaging facing food and beverage makers of all stripes. The issue takes on added importance for organic food makers like Organic Meadow, whose core customers are people in search and/or need of natural and/or organic alternatives to conventional products that are made according to sustainable organic farming and processing values, methods, and practices.

COMMITTED TO ORGANIC FARMING

It’s been that way since 1989, when a half-dozen organic dairy farmers in Durham, a rural community an hour’s drive north of Guelph, founded Organic Meadow as a small co-op with the vision to build a sustainable system for the manufacture of wholesome organic dairy products.

“They were a very tightknit bunch who honoured and were guided by values like sustainability, authenticity, community and quality,” said Michelle Schmidt, Organic Meadow’s senior

For dairy products to be sold as organic, producers must be certified as organic. Certification requirements include managing crop and pastureland without the use of synthetic fertilizers or genetically engineered or modified organisms and feeding antibiotics-free cows and heifers only natural and organic grasses and grains.

Despite the higher production costs and marketing headwinds from public debate and bad press about the benefits of consuming pricier organic dairy products (a July 2018 investigative story by the Toronto Star entitled ‘Milked’ notably concluded organic milk was no different than conventional ones), organic milk production has continued to grow in Canada.1

The co-op grew to the point where in 2010 it opened the first fully organic dairy in Eastern Canada and the first independent dairy to be built in Ontario in 20 years.

Some 50 people work at the 22,000-sf facility in southend Guelph, where fluid milk from organic dairy farms across Ontario, which represents 60 per cent of company sales, is minimally processed using HTST pasteurization and used to fill all sizes of Organic Meadow milk containers, including 500 ml and 1L cartons, 4L bags, 946 ml glass bottles and the new 2L zero-carbon cartons.

For the past decade, the company’s best-known container has been its returnable glass bottles, which were introduced in 2009.

“They’re an iconic throwback to the old days,” said Bianchi, a marketing expert who worked for a half-dozen years at both Schneider Foods and Maple Leaf Foods before joining Organic Meadow in 2013. “They’re also a perfect circular packaging method with zero waste.”

Returnable bottles, however, come with sizeable costs and challenges. In addition to being heavy and breakable, they also must be picked up at retailers who charge a $1 deposit and then sanitized, and heat treated for reuse up to 10 times, or until the label wears out.

The company has continued making bottled milk since 2015, when it was acquired by Agrifoods Co-operative. Organic Meadow is one of a half-dozen brands that now belong to the Burnaby, B.C.-based, farmer-owned co-op, which has nearly 3,000 members and makes dozens of wholesome, premium-priced foods and beverages that are sold at retailers across Canada.

According to Statistics Canada, annual organic milk production continues to grow, reaching an all-time

Organic Meadow is the first dairy producer in North America to use the carbon-neutral

Pure-Pak cartons

high of nearly 1.5 million hectolitres in 2020. However, that is only a fraction of the 95 million hectolitres Canadian dairy farmers produced the same year.

CARTON DESIGN

Bianchi said he was all ears a year ago when he first heard about Norway-based Elopak’s carbon-neutral Pure-Pak milk cartons, which had been successfully tested in the European food market. A deal was quickly struck to bring the zero-CO2 container to Canada for Organic Meadow’s 2L format.

“It made sense for us as innovators and pioneers in the Canadian organic dairy marketplace,” said Bianchi. “It’s not easy to come up with new products or sustainable initiatives that we can build on. But packaging is an example of something we have control over.”

Toronto-area design packaging agency Davis was hired to help come up with a visual plan to make the humble dairy cow the hero of the new carbon-neutral milk carton. An artist was notably commissioned to do the watercolour portrait of a Holstein cow that appears on the distinctive brown cartons, which are 18-per cent lighter and generate 27-per cent less CO2 than traditional milk cartons.

For now, Bianchi says Organic Meadow will continue to use the new container exclusively for its five 2L varieties of organic milk, which include 3.8 per cent, two per cent, one per cent, skim and lactose-free.

“We’re extremely proud to be the first dairy to bring this innovative new carton to Canadians,” said Bianchi. “It’s not a huge step in terms of sustainability but it’s a first one and maybe it will lead to other brands and groups getting on board.”

NOTE 1Visit https://projects.thestar.com/organic-milk.

INNOVATIONS. CONNECTIONS. SOLUTIONS.

Now in its 25th year, we are happy to announce the biennial Meat Industry Expo will return to Niagara Falls Convention Centre, Niagara Falls, this October. The only show of its kind in Canada, this is your opportunity to network with colleagues, learn from industry experts, and keep up to date on trends and issues in the industry; all while visiting exhibitors showcasing the latest innovations, new technologies, and equipment and service solutions.

Visit the ‘Flavours’ section and try some of the finest meat and poultry products available in Ontario. 18 MPO Business members will be on hand sampling, answering questions, and talking to visitors about how they may get these unique artisan products on their shelves.

Friday, October 14, 10:00am to 5:00pm Saturday, October 15, 10:00am to 3:00pm Niagara Falls Convention Centre

OCTOBER

14 -15

2022

MEET OUR 2022 EXHIBITORS TO DATE:

• 3M

• Abell Pest Control

• AKR Consulting Canada Inc.

• Arbourdale

• Beef Farmers of Ontario

• Busch Vacuum Technics inc.

• Carlisle Technology

• CSB System International

• DATAHEX

• DPEC Food Solutions Inc.

• Duropac

• eLease Financial Corporation

• Fanshawe College

• Food and Beverage Ontario

- CareersNow

• Handtmann Canada Limited

• Harpak-ULMA Packaging, LLC

• Klever Equipped Inc.

• Kungfu Butchers

• Malabar Super Spice Company Ltd

• Markenello Equipment Litd.

• Meat & Poultry Ontario

• Medium Rare Chef Apparel Inc

• Moore Packaging Corp

• NIC System Inc.

• PACK3000 CANADA LTD

• Pemberton & Associates Inc.

• Polytarp Products

• David Food Processing

• Reiser Canada Company

• SPD Sales Limited

• Spectrim Label & Equipment

• Toronto Metropolitan University

• VC999 Canada Ltd.

• Viscofan Canada Inc.

• Yes Group Inc.

More to come...

Unused dairy finds new uses in beverages

These companies create unique products with discarded whey and milk permeate — BY

JANE DUMMER —

Upcycling is a new term for an old concept of using food processing by-products to generate new food ingredients. Years ago, we made sausages from meat scraps and jams from overripe fruit. Today, consumers want to reduce food waste. Upcycled ingredients offer food processors an innovative opportunity to create appealing, often nutritious ingredients and products for the market, while reducing food waste and supporting a circular economy.

Donna Berry, a Chicago-based dairy consultant agrees, “Upcycling is all about

reducing food waste by taking overlooked ingredients and creating delicious new foods and beverages. That’s what the Spare Food Company is doing with its first creation of an effervescent drink called Spare Tonic.”

Spare Food Company

Spare Tonic is made using four ingredients: whey, fruit, spice, and a touch of honey. The latter acts as the fermentation catalyst.

“Spare Tonic naturally provides a good source of protein, is rich in electrolytes including calcium, magnesium, and potassium, and is an excellent source of vitamins B6 and B12. It has a natural 3:1 carbohy-

drate to protein ratio, which makes it ideal as a post-workout recovery beverage. It consists of about 85 to 95 per cent whey that would have otherwise been discarded from the production of strained yogurt. For every one cup of strained yogurt produced, two cups of whey are created,” says Berry.

Whey is naturally acidic, so it must be neutralized before going into the waste stream or it could wreak havoc on the ecosystem.

“Spare Tonic captures what would have been the lost value of this whey (nutritionally, economically, and environmentally) and crafts it into the beverage,” adds Berry.

Spare Food sources whey from the White

Moustache in Brooklyn, which uses milk from Hudson Valley, New York-based dairy farms. According to Berry, ever since Spare Food started purchasing the excess whey to make Spare Tonic, the White Moustache has been able to expand its yogurt production, which, in turn, means they have been able to hire more people and buy more milk.

Spare Tonic is available in four flavours and comes in 12-ounce cans, with one can containing 100 to 120 calories.

Wheyward Spirit

Upcycling dairy ingredients to the spirits industry sounds like an odd transition at first. Underutilized by-products of whey and milk permeate are used to create unique, fresh spirits in the United States and Canada.

Emily Darchuk, founder and CEO, Wheyward Spirit, explains, “Wheyward Spirit is a mission-driven company with the aim to transform the spirit and dairy industries for the better by making a sippable, sustainable spirit through repurposing the whey that typically goes to waste. We are female-owned, operated, and distilled, which is rare in spirits. It gives a fresh voice and thoughtful approach to not only what we make, but [also] how we make it. Wheyward Spirit’s versatile signature flavour profile has been described as ‘vodka and sake had a baby.’ This comes from our whey base and proprietary approach to fermentation and distillation. As a result, our lovely, unique flavour profile has won gold and double gold at San Francisco World Spirits Competition and New York World Spirits Competition, respectively.”

Wheyward Spirit works with California dairies to recapture their whey. “The hardest part is setting up the initial load since all the specifications, quality metrics and certifications must be met for our loads. It often creates an entirely new production stream since the dairies are accustomed to unloading their whey into outlets like animal feed. We work closely with our sourcing partners to make the transition easy, since their core

focus is cheese production, and our goal is to upcycle the whey into our award-winning spirit,” explains Darchuk.

Wheyward Spirit can be purchased online and is shipped across the United States. It is also sold in select stores in Oregon and California.

Dairy Distillery

In addition to whey, milk permeate is being upcycled to create spirits. Milk permeate is produced during the filtration process to make skim milk. A lactose-rich by-product, milk permeate contains almost no proteins or fats, which makes it ideal for alcohol production.

Omid McDonald, founder, Dairy Distillery based in Almonte, Ont., explains, “When we first released our Vodkow vodka, we were worried about how people would react to the waste reuse. So, we used the term ‘unused milk sugar.’ We were pleasantly surprised to find consumers liked our upcycling of a waste stream. With the increasing focus on food security and carbon footprint reduction, we feel our products are well positioned. We work with

Lactalis dairy processing plant in Winchester, Ont., and take in 18,000 L of milk permeate every week or almost 1 million L a year, which would otherwise go unused. We’ve found processors are supportive of our efforts since they are eager to find new uses for their by-products.”

Fermenting lactose is technically difficult. In the beginning, Dairy Distillery didn’t have access to the required yeast. Therefore, they worked with Professor Poulain and his research student Jessica Gaudet at the University of Ottawa to find a yeast that consumed lactose. After 18 months, Gaudet found a yeast that fermented milk permeate.

“With success in the lab, we moved to build our distillery. Once we add this special yeast into our fermenters, it takes two days to convert all the lactose into alcohol. We then use standard distillation to concentrate the alcohol, which is used to make our vodka and cream liqueurs (and hand sanitizer),” explains McDonald.

Vodkow vodka and cream liqueurs are available at the distillery, online, and at retailers like LCBO, SAQ, BC Liquor Stores and Wine and Beyond in Alberta.

Meaningful ESG goals can help address labour issues

Cher Mereweather

My drive to the office only takes a few minutes, but I pass a dozen or more companies who are all offering signing bonuses in a desperate effort to fill vacancies.

As we exit the pandemic, navigate through the Great Resignation, and scale the wall of the worst inflation in a generation, we are facing what Food and Beverage Canada calls a “debilitating workforce crisis”. Vacancy rates of 25 per cent are now the average across our industry and things are predicted to get worse.1 Food Processing Skills Canada (via Food and Beverage Ontario) estimates there will be 54,000 vacancies in the food system within the next two-and-a-half years.2

Companies are dropping product lines, staff are getting burnt out, and food is staying in the field. The financial impact is real: agricultural producers lost nearly $3 billion in sales in 2020, directly attributed to unfilled vacancies.3

Companies are trying different solutions to resolve this problem. Nearly a third of all Canadian firms are now providing signing bonuses, 29 per cent are offering more paid time off and 46 per cent are increasing salaries.4 I even saw one consultant suggesting recruiters offer free Friday dinners for a year to new staff. These measures are not cheap and directly impact bottom lines at a time when margins are being squeezed from all sides. Are they effective, though? Well, the jury is out on that. Yes, if you put up a sign outside your food processing facility offering a five-figure signing bonus, you’ll likely have a line up, but will that fix your labour problems? How many of those people will still be with you in six months, and how will they perform in the interim?

A study entitled, “Can offering a

attract future employees who care about the same things you do.

Volunteer days

signing bonus motivate effort” found signing bonuses positively impacted employee effort and built trust with new employees only when labour markets were slack.5 When vacancy rates were high, signing bonuses had significantly less impact. So, what is the solution?

Food and Beverage Canada continues to lead action in lobbying for changes in policy to support the food sector, but in my opinion, we cannot wait for policy changes.6 Individual firms must look into their toolbox and find new solutions, and the tool appearing to have the most impact right now is sustainability and ESG.

In their recent State of Employee Engagement research, employee engagement firm WeSpire showed 93 per cent of employees who felt “their company was making a strong positive impact in this world were planning to stay in their jobs”. This contrasted with only 50 per cent for employees who felt their company was not making a positive impact.

Similarly, Deloitte’s research shows purpose-driven companies are seeing up to 40 per cent increased employee retention.7

So, as an alternative to hiring bonuses, settling-in allowances, training bonuses or extra time off (all of which are lovely to offer if you can afford it), consider investing funds in solutions that will set you up for success in the long term.

Compelling, authentic goals

Good intentions lead nowhere in the world of ESG. You need goals and targets, preferably ambitious ones, for how you are going to reduce your environmental impact and improve the well-being of your people and communities. You need to monitor, measure, track, and report progress toward these goals to the public and your people. It will build trust and

Provide the structure and incentives for employees to work with community organizations to design projects for how they want to use this volunteer time. Going beyond this, build out an annual program of employee community engagement, of which the two days are just highlights. Sure, you lose a couple of days of production every year but think about what you will gain.

Impact success meetings

Hold a meeting every six months for your employees to learn about the impact you are collectively making on environmental and social goals. Ensure your CEO gets up to talk alongside some of your frontline teams.

Holistic conservation assessment

Your employees see waste, particularly water and food waste because they are so visible, and they don’t like it. Conduct a holistic conservation assessment, identify the root causes, and give ownership and accountability to your team to execute the solutions. They will feel empowered and see themselves as part of the solution. Then share the success across the organization in your impact success meetings.

Translate the savings into meaningful data points. Use calorie calculators, such as the Food Loss and Waste Toolkit, to identify the number of people who could be fed with the food waste prevented, and convert your reductions in carbon emissions into equivalent numbers of cars being taken off the road.8

Sustainability training

According to RBC, 3.1 million jobs will change during the next decade due to the climate transition.9 Green skills are the future and your willingness to invest in all your staff members could be key to attracting the right talent, while at the same time building leaders for the Decisive Decade.

Peer-learning is key to not just learning outcomes, but also to building trust across your organization, which is why we recommend community-based training platforms, such as our own LEAP Academy.10

It is clear now that we are not going to return to life circa 2019. Too much has changed. The labour market has been truly disrupted and to misquote Einstein, we are not going to be able to fix these problems with pre-pandemic thinking. So, let’s take down the signs advertising large hiring bonuses and turn the industry into a magnet for people who want to make a meaningful difference.

Notes

1 Visit https://fpsc-ctac.com/faq.

2 Visit https://foodandbeverageontario.ca/ news/new-investment-connecting-peopleto-jobs-in-ontario-s-food-and-beverageprocessing-sector.

3 Details at https://fbc-abc.com/strategicplan-announced-to-address-labour-andskills-shortages-in-agriculture-and-foodand-beverage-manufacturing.

4 Visit https://www.benefitscanada.com/ human-resources/hr-other/employersraising-wages-offering-bonuses-amidlabour-shortages-surveys and https://www. newswire.ca/news-releases/nearly-halfof-canadian-companies-plan-to-expandtheir-teams-in-first-half-of-2022-roberthalf-research-shows-884326423.html.

5 Read at https://www.jstor.org/ stable/24468362.

6 Visit https://fbc-abc.com/food-andbeverage-manufacturing-emergencyforeign-worker-program.

7 Read at https://www2.deloitte.com/ content/dam/insights/us/articles/2020global-marketing-trends/DI_2020%20 Global%20Marketing%20Trends.pdf

8 Visit https://provisioncoalition. com/toolsandresources/ foodlosswastetoolkit#:~:text=The%20 award%2Dwinning%20and%20 UN,of%20your%20avoidable%20 food%20waste.

9 Details at https://thoughtleadership.

rbc.com/green-collar-jobs-the-skillsrevolution-canada-needs-to-reach-netzero/#:~:text=According%20to%20 our%20research%2C%203.1,as%20 this%20evolution%20plays%20out.

10 Visit https://theleap.academy.

Cher Mereweather, CEO of Anthesis Provision, is a Canadian-based food industry sustainability expert.

Rely on U rs c hel , The Global Leader in Food Cu t tin g Techno l og y, to del i ver opti m a l f ruit and vegetabl e cut t ing s olut i ons. Del i cate appl i cat i ons, li ke frui t d i c i ng , requi re gen t le, e f fec t i ve cu t ting to gene rate a h i gher ra t e of des i red cu t s and p rolonged s helf-life H i gh volume Sanita r y design. Ba c ked by U r s che l sales and suppo r t , p roces s or s achi eve s uc c ess f u l ope ration s th roughout p roduct i on run s

www.urschel.com

For sales and service in Canada contact: Chisholm Machinery Solutions info@chisholmmachinery.com | 905-356-1119

FROM FRONTLINE TO FOUNDER

Think about how far technology has advanced in the past decade. In just a few short years 3D printing has emerged as a viable manufacturing process. Artificial intelligence is automating tasks and fuelling innovation. The Industrial Internet of Things (IIoT) has emerged to perform functions we could not even dream of, and smart phones, intelligent thermostats and doorbells have made connectivity a part of daily life.

While technology has evolved at lightspeed in recent years, the adoption of Industry 4.0 technologies by small and medium manufacturers remains surprisingly slow. Lacking the information needed to make data-driven decisions, many of these companies remain trapped in a cycle of waste and inefficiency that has plagued them since opening their doors.

Actionable data

As a manufacturing engineer and operations manager at a local meat processing plant, Yannick Desmarais was constantly searching for opportunities to enhance productivity and profitability. But prioritizing continuous improvement projects required validation drawn from hard and reliable data. Information that was all but impossible to get.

“It was frustrating,” Desmarais admitted. “I talked with everyone, from shop floor workers to supervisors and maintenance but no one could provide adequate infor-

mation. Everyone had a different opinion as to what our goals were, why production had slipped, or why business objectives weren’t being met.”

Despite best efforts, a pragmatic business roadmap could not be created without reliable data. Without this information the company was spinning its wheels and could not expect to develop an effective process improvement plan. The fact that this was becoming a pattern to other jobs Desmarais had held only added to his frustration.

One significant challenge facing the company was excessive waste. Desmarais recognized this but did not fully grasp its magnitude until he witnessed an inordinate amount of meat on the floor.

“I was shocked at the waste. I immediately stopped the line and assembled the entire department. Opening a box of packaged meat, I dumped it on the shop floor. People looked at me in amazement and I said, ‘Do you realize that every day we’re doing exactly this multiplied by 100?!’ That was the moment I realized things had to change,” recalled Desmarais.

Selecting a line that was consistently falling short of its goals, Desmarais launched a pilot project designed to eliminate waste and improve yield. Sensors were installed and data collected on the line’s 13 scales. At the same time a television screen was installed along the line displaying up-tothe-minute yield data. This allowed workers

to continually monitor where they stood in relation to production goals.

For the first time, line workers had a clear understanding of their department goals and were given the information they needed to know where they stood in relationship to those objectives. This, in turn, provided a sense of ownership and the workers began challenging themselves and others to improve the department’s efficiency rate. In less than a month yield and productivity increased.

Desmarais explained that from that day on the department was motivated to improve performance and throughput. Each day they asked about production and how much meat had been wasted. They had become inspired stakeholders, and within a few short weeks had transformed the line into one of the company’s most efficient.

“Immediately people could see and understand performance data and were driven to make improvements. They asked, ‘OK, so what is our goal? Where should we be in a week, a month, three months?’ They began to communicate why goals weren’t being met and offered suggestions. When management listens and removes hurdles, you get buy-in and ownership from employees because for the first time they feel as if they provided input and management responded.”

Due to the program’s success, Desmarais was asked to implement similar initiatives across multiple lines in two factories. In addition to productivity and yield, he incorporated improvement steps that accounted for costs such as energy and water consumption. In the end, the company’s profitability moved from breakeven to six per cent growth.

Worximity technology

That experience opened Desmarais’ eyes to the possibilities beyond meat processing. Motivated to challenge business as usual, he began assembling a team and developing a technology that could deliver similar results to manufacturers of all types and sizes. That realization, along with the emergence of the iPad, provided a clear direction.

“The answer was actionable information. I knew that to be successful we had to put real-time data into the hands of the worker on the floor allowing them to respond quickly to changing conditions,” he said.

In 2012, Desmarais launched Worximity Technology. The company leverages smart digital technologies to replace subjective guesswork with accurate metrics. This insight allows manufacturers, regardless of the industry they serve, to reach new levels of productivity while continuing to meet progressive improvement goals.

Worximity complements in-house resources to accelerate improvement and help transform companies into smart factories. The software is customizable and scalable to adapt to a specific company’s requirements and goals.

According to Desmarias, the company differentiates itself in a couple of key areas. “Simplicity is one of our biggest strengths. In just an hour we’re able to install the equipment and start the improvement process. We collect line data through smart sensors and feed that information back to the customer. But it doesn’t stop there.

Built upon years of practical experience, our intelligent technology provides actionable information and guidance. We interpret the data to provide recommendations regarding what to do and in what order to make improvements,” he explained.

Desmarais added the yield component unique to Worximity is of special significance to a growing number of companies, especially those in food and pharmaceutical industries.

Work and proximity

Too often, improvement initiatives are more of an art than a science. Without hard data and a clear roadmap, improvements (if any) are often incremental at best. Worximity was founded on the belief that bringing the workforce closer to the objective, data, and goal of the business, will generate measurable and sustained improvement.

“People have pride in themselves and their company and will push themselves and their co-workers toward improvement,” concluded Desmarais. “But they must have a clear roadmap based on quantifiable data, not guesswork.”

ALet it rain regulations

Gary Gnirss

monsoon of regulatory and food labelling changes is raining this summer. On July 20, 2022, the final front-ofpackaging (FOP) nutrition labelling and new supplemented food regulations were published in Canada Gazette II.

FOP labels

FOP is everyone’s favourite subject these days. For some, it’s more of a nightmare. Prepackaged foods with more than the threshold level (15 per cent of daily value in most cases) of saturated fat, sodium, or sugar will need to place a less than pleasing symbol on the main label panel alerting consumers to the high levels of these nutrients unless an exemption is applicable. In a brilliant campaign, the meat industry got ahead of the rules and forced an exemption for ground meats.

The main reason for FOP labels is to inform consumers. Foods with FOP symbols may still be nutritious when consumed within limitations. If Canadian FOP labelling rules have the same impact as in other countries, it will change consumer purchasing behaviour.

The new FOP rules will be effective only on January 1, 2026. You can bet food product development professionals will be hard at work getting their saturated fat, sodium, and sugar content under the threshold levels.

Supplemented foods

After years of managing supplemented food temporary marketing authorizations (a.k.a. TMAL), such as those related to caffeinated energy beverages and foods with added supplements like vitamins, minerals and amino acids, final rules are in place. TMALs were needed to allow these foods to be sold legally in Canada. Existing TMALs will be respected until they expire.

The TMAL process placed an enormous

burden on Health Canada, so they must be more excited than industry to get those off their plates. It has been no fun for industry either. The new rules carve out a whole new division in the Food and Drug Regulations (FDR). To be clear, these are foods, not natural health products. They will be governed and labelled as food. Besides a new supplemented food facts table, caution identifiers and warning statements may also be required.

The benefit of final rules is that as long as a manufacturer follows them, they do not need to ask for special permission to market supplemented foods. It is worthy to remember the new rules do not cover novel foods. It might include those with herbal products with no safe history of use as food.

Food product innovation

Canadian Food Inspection Agency’s (CFIA’s) food product innovation (FPI) rules were published in Canada Gazette II on July 6, 2022. Those rules are essentially a watered-down version of CFIA’s grand food labelling modernization (FLM) initiative for which proposed regulations were published in June 2019. Those proposed rules, had they been finalized, would have ushered in a broad-based overhaul of food labelling including updates to naming foods, best before dates, country of origin labelling and specific rules concerning emphasized characterizing of ingredients and flavours.

CFIA rebranded FLM to FPI by stripping out much of the rules requiring mandatory label changes for most foods. Housekeeping amendments not necessarily resulting in broad-based label changes was left in FPI. However, the FPI rules consolidate many of the redundant commodity labelling rules in SFCR and FDR. They have also repealed other labelling rules, such as descriptive

statements previously applicable to certain commodities, and placed the remaining descriptive statements in the document, “Descriptive Words, Expressions and Identification Names”, which is incorporated by reference (IbR) under SFCR. CFIA has also stripped container standard sizes from SFCR and incorporated those in the “Standard Container Sizes” document, also IbR. Several container sizes for most juice products were repealed too.

Amendments to FDR were also included. A new IbR document, “Common Names for Ingredients and Components”, will permit CFIA to update acceptable collective ingredient terminology more efficiently.

CFIA has, however, updated the rules concerning seasonings and, has codified new rules on how to declare seasonings when their presence in a food is two per cent or more.

CFIA has also amended the definition of a “common name”. The definition is now more prescriptive—for foods where a name is not prescribed, that name must also be, “a name that is not generic and that describes the food”. The definition was revised because CFIA repealed certain commodity specific naming and descriptive statements. CFIA still expects such commodities to be clearly differentiated from similar foods. It, however, has a far reach, as it applies to all foods that are not subject to specific common names, which effectively captures most food. The FPI rules are final. There is not transition period for these.

Beyond these updates, CFIA is still looking to complete its food labelling modernization initiative or restart that.

Gary Gnirss is a partner and president of Legal Suites Inc., specializing in regulatory software and services. Contact him at president@legalsuites.com.

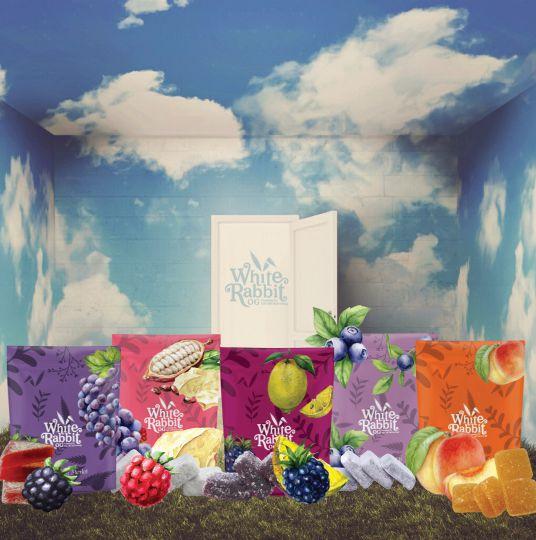

White Rabbit creates a niche with edibles

Many CPG companies begin when their founders are inspired by a grand vision and motivated enough to turn their basement or garages into experimental kitchens. A similar thing happened at White Rabbit OG, a South Surrey, B.C. -based cannabis edibles company.

After years of working in the food manufacturing and cannabis sectors, Kyrsten Dewinetz, co-founder and CEO, and David Lluncor, co-founder and chief revenue officer, realized that “people were almost looking [to recreate] the past versus looking to the future.”

In January 2020, the duo decided to start White Rabbit Naturals, the parent company of White Rabbit OG, to create a portfolio that would deliver on key fundamentals customers were looking for in the cannabis edibles market—products with unique flavour combinations and whole fruits. Dewinetz’s basement became their office and formulations lab.

Talk about timing! The pandemic made for a rocky start. White Rabbit isn’t a licensed producer. “The ability to seek out a partner with the appropriate licensing and facilities was greatly hampered by COVID-19, as a lot of people didn’t want to open their doors to strangers at that time,” explained Lluncor. They have now managed to find a licensed facility in Delta, B.C.

Lluncor and Dewinetz firmly believe cannabis edibles is a growing category. Consumers who are interested in trying cannabis and are hesitant to smoke it would prefer to experiment with edibles. Currently, the maximum THC dose in a pack of edibles in Canada is 10 mg and 100 mg in the U.S. Companies like White Rabbit OG would experience more growth when Canadian regulatory limits ease. Also, as more countries legalize recreational marijuana, business opportunities would also increase for White Rabbit OG.

Products

White Rabbit OG edibles are made with whole fruit puree, organic and gluten-free sugars, and cannabis in small batches. The chewables are vegan, plant-based, gelatin- and gluten-free

with no artificial flavours or colours. Flavours include Craft Blueberry, Craft Sour Peach, Blackberry Lemonade, Raspberry White Chocolate, Blackberry Merlot, and Strawberry Fig Balsamic CBD.

“We’re really looking to create fusion and excitement for the customer. The Raspberry White Chocolate chewable was inspired by white chocolate cheesecake with raspberry coulis. The Blackberry Merlot is a take on the wine and the Blackberry Lemonade is like a cocktail,” explained Dewinetz. “Our competitors are primarily using gelatin, artificial colours and flavours. Customers can expect from us a fruit offering using real fruit ingredients.”

The soft chews are available in recreational cannabis stores

in British Columbia, Alberta, Saskatchewan, and Ontario, and on Medical Cannabis by Shoppers Drugmart.

The edibles are powered by Eat Me Technology, a proprietary cannabis emulsion made using plant-based extracts like Quillaja and sunflower oil.

Eat Me Technology

Since Cannabis distillate is fat-soluble, it is difficult to evenly distribute into edibles products. By using an emulsifier, White Rabbit OG’s proprietary technology homogenizes the cannabinoids into a uniform mixture, which allows for an even distribution. This means the dosing is consistent throughout the product.

“The Eat Me Technology was developed to create operational efficiencies and to comply with regulations for potency. It was also created with specific ingredients and particle size to ensure there was better bio availability,” explained Dewinetz. “One of

Success is sweeter with a great partner.

Trust your business banking needs to TD. Our team of local, experienced professionals will provide customized solutions, industry insights and financial advice to help you feel confident moving forward in pursuit of your goals. At TD Commercial Banking, it’s our business to know yours. Visit www.tdcommercialbanking.com

the challenges with edibles is that when you’re ingesting cannabis, the effects on the body are much lower than when inhaling it. Typically, edibles can take an hour-and-a-half to two hours to take full effect, and that can be a little bit dangerous. It can lead to overconsumption because people want instant gratification. By reducing particle size, you’re increasing the bio availability. You see a faster onset time and it’s a little easier to dose appropriately. It also makes the experience more predictable each time.”

Challenges

Being a small firm, the founders have bootstrapped everything. They were managing the entire business and were up against large corporations with endless amount of funds for marketing. It was difficult to gain a presence in the marketplace. “We really had to dig deep to push through and persevere through the challenges we were facing,” said Lluncor. Further, White Rabbit OG uses premium ingredients. The heat waves and floods in 2021 made it hard for them to procure fruits. Supply chain has been challenging for the founders. “We’re trying to find alternative suppliers for some of the

ingredients but because we have fairly unique ingredients it’s definitely becoming more and more tight. The lead times are longer. Most of the ingredients we use don’t typically have a long shelf life, so we’re trying to find that balance between having sufficient supply and using them before they expire,” said Dewinetz.

Future plans

When asked where they want to see White Rabbit OG in five years, the duo shared their desire to expand and introduce their technology and premium gummies to other countries. But first, the focus is on conquering their backyard.

Lluncor hopes that in the near future, cannabis edibles with CBD can be sold in grocery or wellness stores.

“CBD has a host of wellness to offer to customers that aren’t looking just to get high. We’re seeing a lot of neutraceuticals coming into everyday foods. Consumers are looking to enhance their health and address conditions by not taking a lot of pills and drugs. I’d love to see products with CBD and cannabinoids that don’t have psychotropic effects incorporated into the CPG channel,” shared Dewinetz. “Our hands are tied with what we can put into those gummies. Everything has to be specifically only for the function of the gummy. I can’t incorporate omegas or fibre just for health reasons. Gummy vitamins are a big part of many people’s lives nowadays. So, when they’re taking their all-in-one vitamin, I can’t really see CBD being very much different than adding a ginseng, ginkgo biloba or any other neutraceutical ingredient. I’d love to incorporate all of those” in the gummies.

FUpcycling in food packaging

Carol Zweep

ood waste is a global issue. According to the Food and Agriculture Organization of the United Nations, over one-third of food produced globally for consumption is lost or wasted per year. The National Zero Waste Council conducted research on Canadian household food waste in 2022 and found 2.3 million tonnes of edible food is wasted each year. With concerns about food waste rising around the world, the food industry is looking to upcycling as a potential solution. The Oxford Dictionary defines upcycling as “reuse (discarded objects or material) in such a way as to create a product of higher quality or value than the original.” Upcycled food creates new, highquality products from food that would otherwise be going to waste.

There are many examples of upcycled food containing beneficial nutrients such as fibre, protein, potassium and antioxidants. Coffee plant fruit, a byproduct of coffee bean harvesting, can be made into gluten-free flour. Spent grain from beer production can be made into barley milk. The pulpy byproduct of soy milk and tofu production (okara) can be added as an upcycled ingredient in pasta.

In addition to upcycling food waste into viable food products, food waste can also be upcycled into packaging materials. In Canada, over three million tonnes of plastic waste are thrown away each year. The Council of Ministers of the Environment (CCME) developed a Canada-Wide Strategy on Zero Plastic Waste. To support this strategy, the Government of Canada published the Single-use Plastics Prohibition Regulations on June 22, 2022. The Regulations apply to six single-use plastic categories (checkout bags,

cutlery, foodservices ware, ring carriers, stir sticks and straws) and prohibit the manufacture, import, sale and, eventually, export of these items.

Eco-friendly alternatives to single-use plastics are actively being developed, with some incorporating food waste into upcycled packaging materials. These innovations include packaging made from mycelium (the vegetative root structure of a mushroom), risk husk, brewers’ spent grain, and boxes and papers containing sun-dried grass. Legumes, such as soybeans, can be a source of fibre and protein used to make packaging. Extracted soy fibre can be processed physically via compression molding or enzymatically. Isolated soy proteins combined with additives (plasticizer, surfactants, biodegradable polymers, and oils) can be made into packaging materials. Protein can also be modified by chemical or enzyme crosslinking or UV modification. Legume wastewater can be a source of fibre and protein used in edible packaging.

MiTerro is using new technology to upcycle milk proteins into plastic and cotton-like fibre to create more sustainable fabric and packaging. Oregon State University scientists have turned apple waste into compostable packaging

material that can be used as moulded pulp packaging for egg cartons, beverage cartons and take-out containers. Upcycling food waste into packaging presents a new era for bioplastics and sustainable food packaging.