10 minute read

Is Exness Legal in Rwanda? A Comprehensive Guide for Traders

from Exness

by Exness Blog

Forex trading has surged in popularity worldwide, and Rwanda is no exception. As more Rwandans explore opportunities in the global financial markets, questions about the legality and reliability of trading platforms like Exness have become increasingly common. Exness, a globally recognized forex and CFD broker, is known for its competitive spreads, robust trading tools, and user-friendly platforms. But one critical question remains: Is Exness legal in Rwanda?

In this in-depth guide, we’ll explore the legal status of Exness in Rwanda, the country’s regulatory framework for forex trading, and what Rwandan traders need to know before choosing this broker. We’ll also cover Exness’s features, benefits, risks, and practical steps for getting started, ensuring you have all the information needed to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

What Is Exness? An Overview of the Broker

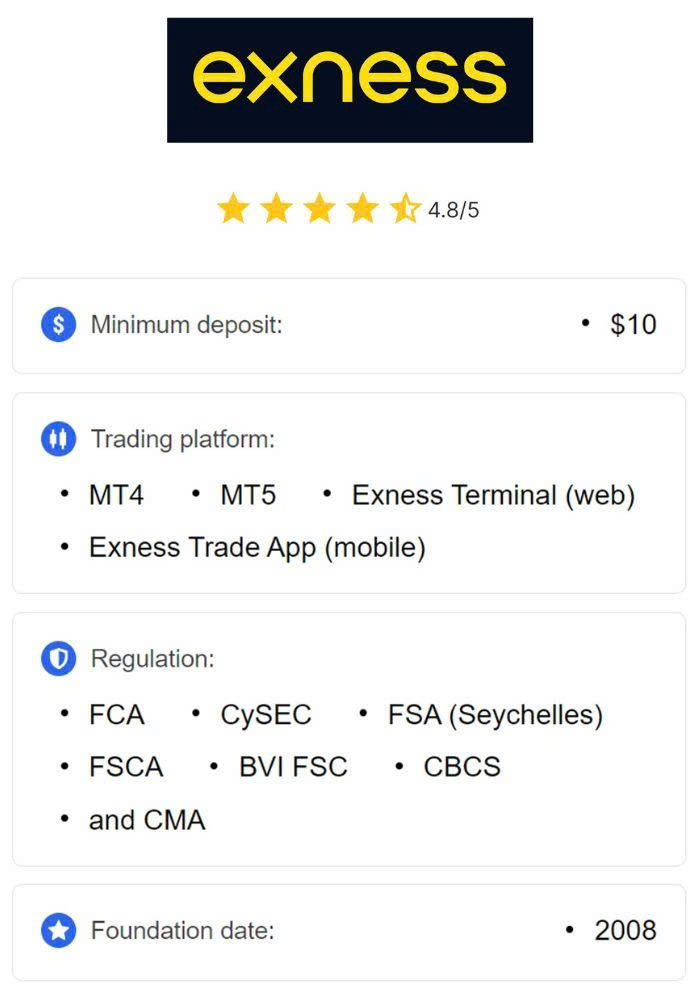

Before diving into the legality of Exness in Rwanda, let’s understand what makes Exness a popular choice among traders globally. Founded in 2008, Exness is a multi-asset broker headquartered in Cyprus, offering trading services in forex, commodities, cryptocurrencies, indices, and stocks. With over 600,000 active traders and a monthly trading volume exceeding $4 trillion, Exness has established itself as a leading player in the forex industry.

Exness is regulated by several reputable financial authorities, including:

· Financial Conduct Authority (FCA) in the UK

· Cyprus Securities and Exchange Commission (CySEC)

· Seychelles Financial Services Authority (FSA)

· Financial Sector Conduct Authority (FSCA) in South Africa

· Capital Markets Authority (CMA) in Kenya

These licenses ensure Exness adheres to strict standards for client fund protection, financial transparency, and fair trading practices. For Rwandan traders, Exness offers appealing features such as low spreads starting from 0.0 pips, unlimited leverage on select accounts, and support for popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). But how does this global reputation translate to operations in Rwanda?

The Regulatory Landscape for Forex Trading in Rwanda

To determine whether Exness is legal in Rwanda, we must first examine the country’s regulations surrounding forex trading. Rwanda has made significant strides in developing its financial sector, positioning itself as an emerging economic hub in East Africa. The government has embraced financial innovation, including digital payments and investment opportunities, to foster economic growth. However, the regulatory framework for retail forex trading is still evolving.

Key Regulatory Bodies in Rwanda

· National Bank of Rwanda (BNR)The BNR is Rwanda’s central bank, responsible for maintaining monetary stability, regulating banks, and overseeing foreign exchange transactions. While the BNR plays a crucial role in the financial system, its oversight of retail forex trading—where individual traders buy and sell currencies through online brokers—is less clearly defined.

· Rwanda Capital Market Authority (CMA)The CMA regulates Rwanda’s capital markets, including securities, investments, and financial intermediaries. Established to promote a robust financial ecosystem, the CMA ensures that financial institutions operating in Rwanda comply with local laws and protect investors from fraud. For forex brokers to operate legally in Rwanda, they must obtain a license from the CMA, demonstrating financial stability, transparency, and adherence to anti-money laundering (AML) and know-your-customer (KYC) protocols.

Is Forex Trading Legal in Rwanda?

Yes, forex trading is legal in Rwanda. The Rwandan government supports a free foreign exchange market, allowing commercial banks to acquire foreign currency at regulated floating exchange rates. However, the lack of specific regulations for retail forex brokers creates a gray area. While forex trading is permitted, the BNR and CMA have not yet established comprehensive guidelines explicitly addressing online forex brokers. This means Rwandan traders often rely on international brokers like Exness, which are regulated by global authorities.

Is Exness Legal in Rwanda?

Now, let’s address the core question: Is Exness legal in Rwanda? The answer is nuanced. Exness is not officially licensed by the Rwanda Capital Market Authority (CMA), which raises questions about its full compliance with local regulations. However, Exness operates legally in Rwanda under its global regulatory framework, and there are no explicit restrictions preventing Rwandan residents from signing up, depositing funds, and trading with the broker.

Why Exness Is Accessible in Rwanda

Exness provides its services to traders in numerous countries, including Rwanda, through its online platform. Rwandan traders can access the Exness website, register an account, and start trading seamlessly, provided they meet the basic requirements, such as completing the KYC verification process. The broker’s global entity, Exness (SC) Ltd, regulated by the Seychelles FSA, typically serves clients in regions like Rwanda where local regulation is absent or underdeveloped.

Risks of Trading with an Unlicensed Broker

While Exness is accessible and legal for Rwandan traders, the lack of CMA licensing means it may not be fully compliant with Rwanda’s local laws. This creates potential risks, including:

· Limited Legal Recourse: If disputes arise, Rwandan traders may not be covered by local consumer protection laws, making it harder to seek recourse.

· Regulatory Uncertainty: The evolving regulatory landscape in Rwanda could lead to future restrictions on unlicensed brokers.

· Financial Risks: Trading with an unlicensed broker carries inherent risks, though Exness mitigates these through its global regulations and client fund protection measures.

Despite these risks, Exness’s robust international oversight, including FCA and CySEC licenses, provides a layer of security for Rwandan traders. The broker complies with AML and KYC protocols, segregates client funds in Tier 1 banks, and undergoes regular audits to ensure transparency.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

How Exness Ensures Trader Safety

Exness takes several measures to protect its clients, making it a reliable choice despite the lack of local licensing in Rwanda. Here’s how Exness ensures a safe trading environment:

· Segregated Accounts: Client funds are held separately from the broker’s operational funds, ensuring protection in case of bankruptcy or financial difficulties.

· Top-Tier Regulation: Exness’s licenses from FCA, CySEC, and other authorities require adherence to strict financial standards.

· Negative Balance Protection: Traders cannot lose more than their deposited funds, reducing the risk of debt.

· Advanced Security: Exness uses SSL encryption and two-factor authentication (2FA) to protect user accounts and transactions.

· Transparent Practices: The broker provides clear information on spreads, fees, and trading conditions, fostering trust.

For Rwandan traders, these measures offer peace of mind, even in the absence of CMA oversight. However, traders should exercise due diligence and understand the risks involved.

Benefits of Trading with Exness in Rwanda

Exness offers several advantages that make it an attractive option for Rwandan traders. Here are the key benefits:

1. Competitive Trading Conditions

Exness is known for its low spreads (starting from 0.0 pips), fast order execution, and flexible leverage options (up to unlimited on select accounts). These conditions are ideal for both novice and experienced traders looking to maximize profits.

2. Variety of Account Types

Rwandan traders can choose from multiple account types, including:

· Standard Accounts: Ideal for beginners with low minimum deposits.

· Pro Accounts: Designed for experienced traders with tighter spreads and advanced features.

· Zero Accounts: Offer zero spreads on select instruments for high-volume traders.

· Cent Accounts: Allow trading with smaller amounts, perfect for testing strategies.

3. Robust Trading Platforms

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Trader app. These platforms provide advanced charting tools, technical indicators, and automated trading capabilities, accessible on desktop, web, and mobile devices.

4. Flexible Payment Methods

Exness offers multiple deposit and withdrawal options suitable for Rwandan traders, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Transactions are processed quickly, with instant withdrawals available for some methods.

5. Educational Resources

Exness provides webinars, tutorials, and market analysis to help traders improve their skills. This is particularly valuable for Rwandan traders new to forex trading.

6. 24/7 Customer Support

Exness offers multilingual support via live chat, email, and phone, ensuring Rwandan traders can get assistance anytime.

How to Start Trading with Exness in Rwanda

Getting started with Exness in Rwanda is straightforward. Follow these steps to open an account and begin trading:

· Visit the Exness WebsiteGo to the official Exness website and click “Register.”

· Complete the Registration FormProvide your email address, phone number, and select Rwanda as your country of residence.

· Verify Your IdentityUpload a government-issued ID (passport or national ID) and proof of address (e.g., utility bill) to complete the KYC process.

· Choose an Account TypeSelect an account that suits your trading style and experience level.

· Deposit FundsLog in to your Exness account, navigate to the “Funding” section, and choose a payment method. Enter the deposit amount and confirm the transaction.

· Start TradingDownload MT4, MT5, or the Exness Trader app, log in with your account details, and begin trading.

Risks and Considerations for Rwandan Traders

While Exness offers a reliable trading platform, Rwandan traders should be aware of the following risks:

· Lack of Local Regulation: Trading with an unlicensed broker carries legal and financial risks.

· High Leverage Risks: Unlimited leverage can amplify profits but also lead to significant losses.

· Market Volatility: Forex trading is inherently risky due to price fluctuations.

· Tax Obligations: Rwandan traders must declare trading profits for tax purposes to comply with local laws.

To mitigate these risks, traders should:

· Use risk management tools like stop-loss orders.

· Start with a demo account to practice trading.

· Stay informed about Rwanda’s evolving forex regulations.

· Consult a financial advisor if unsure about tax obligations.

Success Stories from Rwandan Traders

While specific success stories from Rwandan traders using Exness are not widely documented, the broker’s global reputation suggests it has empowered many retail traders in emerging markets. For example, traders in similar African markets like Kenya and Nigeria have praised Exness for its low spreads, fast withdrawals, and educational resources. Rwandan traders can leverage these features to build their skills and potentially achieve financial success, provided they approach trading with discipline and caution.

Alternatives to Exness for Rwandan Traders

If you’re hesitant about trading with an unlicensed broker, consider these CMA-regulated or globally reputable alternatives:

· AvaTrade: Regulated by multiple authorities, including CySEC and FSCA, with a user-friendly platform.

· XM: Known for excellent customer support and a variety of account types.

· FXTM: Offers competitive spreads and educational resources for beginners.

These brokers may offer similar features to Exness but could provide additional peace of mind for traders concerned about local regulation.

Conclusion: Should You Trade with Exness in Rwanda?

So, is Exness legal in Rwanda? While Exness is not licensed by the Rwanda Capital Market Authority, it operates legally under its global regulatory framework and is accessible to Rwandan traders. The broker’s top-tier licenses, client fund protection measures, and competitive trading conditions make it a reliable choice, but the lack of CMA oversight introduces some risks.

Rwandan traders can confidently use Exness by exercising due diligence, understanding the risks, and complying with local financial laws. Whether you’re a beginner or an experienced trader, Exness offers a robust platform to explore the forex market. However, always start with a demo account, use risk management strategies, and stay informed about Rwanda’s evolving regulatory landscape.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: