10 minute read

Top 10 Best Forex Brokers in Pakistan for 2025: Exness Leads the Way

from Exness

by Exness Blog

Forex trading has surged in popularity in Pakistan, driven by increasing access to global financial markets and a growing interest in wealth-building opportunities. With the right broker, Pakistani traders can tap into the world’s largest financial market, where over $7.5 trillion in trades are executed daily. However, selecting a reliable and efficient forex broker is crucial for success, especially in a market as dynamic as Pakistan’s. This article explores the top 10 best forex brokers in Pakistan for 2025, with Exness taking the top spot for its exceptional features, low costs, and trader-friendly platform.

Top 4 Best Forex Brokers in Pakistan

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Why Choosing the Right Forex Broker Matters in Pakistan

Forex trading in Pakistan is legal but operates in a regulatory gray area for retail traders using international brokers, as the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP) primarily regulate local exchange houses and banks. International brokers, however, are not required to be licensed by the SECP to accept Pakistani clients, making it critical to choose brokers regulated by reputable global authorities like the FCA, CySEC, or ASIC. Factors such as low spreads, fast execution, reliable platforms, and local payment support (e.g., easypaisa, JazzCash) are vital for Pakistani traders. Additionally, features like Islamic (swap-free) accounts, low minimum deposits, and robust customer support in Urdu enhance the trading experience.

Below, we rank the top 10 forex brokers in Pakistan based on regulation, trading costs, platform usability, and suitability for local traders, with detailed insights into why Exness stands out as the best choice.

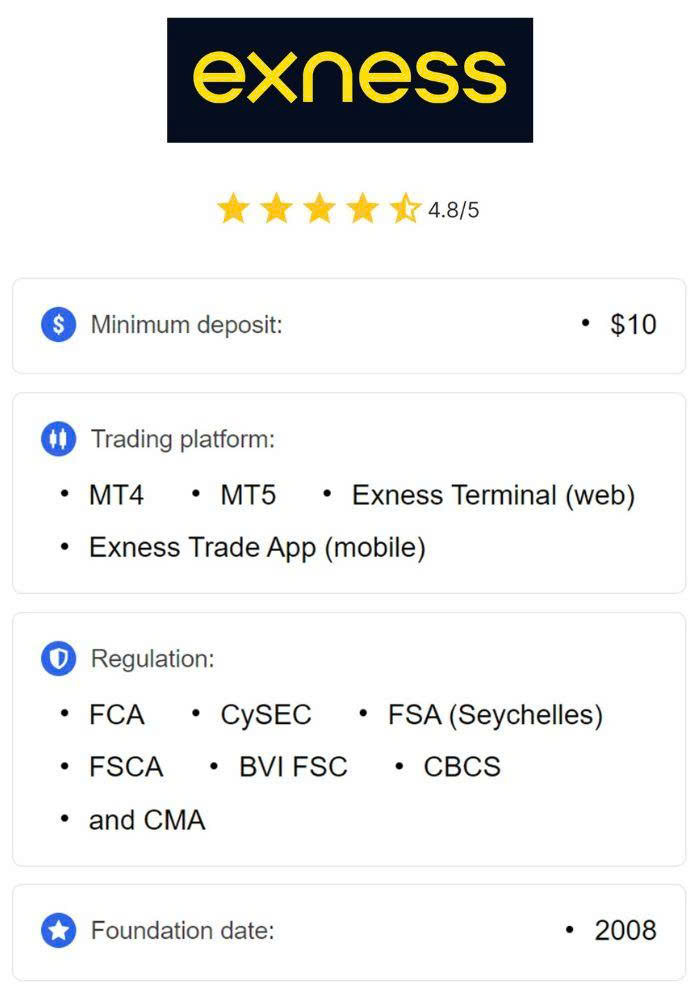

1. Exness – The Best Forex Broker in Pakistan

Why Exness is #1: Exness has earned its reputation as the top forex broker for Pakistani traders due to its low spreads, fast execution, and feature-rich platform. Founded in 2008, Exness is regulated by multiple authorities, including the FCA, CySEC, and FSCA, ensuring a secure trading environment. Its proprietary Exness Terminal and support for MT4 and MT5 cater to both beginners and advanced traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Key Features:

· Low Spreads: Exness offers spreads starting at 0.1 pips on major pairs like EUR/USD, making it cost-effective for high-volume traders.

· High Leverage: Up to 1:2000 leverage, ideal for experienced traders looking to maximize returns (with caution due to high risk).

· Islamic Accounts: Swap-free accounts compliant with Sharia law, perfect for Muslim traders in Pakistan.

· Flexible Deposits: Supports local payment methods like easypaisa and JazzCash, with a low minimum deposit of $10.

· Fast Execution: Average execution speeds of 45 milliseconds, beating the industry average of 60 milliseconds.

· Educational Resources: Exness Academy provides webinars, tutorials, and market analysis, helping beginners build trading skills.

Pros:

· Competitive trading fees with no deposit or withdrawal charges.

· Multilingual support, including Urdu, available 24/5.

· Over 100 currency pairs, including majors, minors, and exotics.

Cons:

· No negative balance protection for Pakistani traders.

· Limited customer support hours (not 24/7).

Why Choose Exness? Exness combines affordability, reliability, and flexibility, making it the go-to choice for Pakistani traders. Its low-cost structure and localized support ensure accessibility for both novice and seasoned traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

2. IC Markets – Best for Low Spreads and Fast Execution

Overview: IC Markets, established in 2007, is a favorite among Pakistani traders for its raw ECN pricing and ultra-low spreads. Regulated by ASIC, CySEC, and FSA Seychelles, it offers a secure and transparent trading environment.

Key Features:

· Low Spreads: Average EUR/USD spreads of 0.65 pips, well below the industry average of 1.08 pips.

· Trading Platforms: Supports MT4, MT5, and cTrader, offering flexibility for algorithmic and manual traders.

· Diverse Instruments: Over 2,250 tradable assets, including forex, commodities, indices, and cryptocurrencies.

· Islamic Accounts: Swap-free options for Muslim traders.

· Minimum Deposit: $200, slightly higher than Exness but reasonable for ECN accounts.

Pros:

· Fast order execution with no requotes.

· Low commission of $6 per lot (round turn) on Raw Spread accounts.

· Beginner-friendly tools like demo accounts and instructional materials.

Cons:

· Higher minimum deposit compared to Exness.

· Limited local payment options.

Why Choose IC Markets? IC Markets is ideal for scalpers and high-volume traders seeking low-cost, high-speed trading with access to a wide range of markets.

3. AvaTrade – Best for Trading Apps and Education

Overview: Founded in 2006, AvaTrade is a globally regulated broker (CySEC, ASIC, FSCA) known for its user-friendly platforms and extensive educational resources. It’s a top choice for Pakistani beginners.

Key Features:

· Trading Platforms: Offers MT4, MT5, AvaTradeGO, AvaSocial, and AvaOptions for diverse trading needs.

· Low Spreads: Average EUR/USD spread of 0.9 pips, competitive for commission-free accounts.

· Islamic Accounts: Swap-free accounts with no overnight fees for up to 5 days.

· Minimum Deposit: $100, accessible for most traders.

· Educational Tools: AvaTrade’s trading academy includes webinars, videos, and Trading Central market research.

Pros:

· Commission-free trading.

· Urdu-language support and local payment methods.

· Over 1,250 tradable instruments, including forex, stocks, and crypto.

Cons:

· Inactivity fees after three months.

· No negative balance protection for Pakistani traders.

Why Choose AvaTrade? AvaTrade’s robust mobile apps and beginner-friendly resources make it perfect for new traders in Pakistan looking to learn and trade on the go.

4. FP Markets – Best for Professional Traders

Overview: FP Markets, based in Australia, is regulated by ASIC and CySEC, offering competitive fees and a wide range of trading instruments. It’s well-suited for experienced Pakistani traders.

Key Features:

· Low Fees: Spreads from 0.1 pips on EUR/USD with a $6 per lot commission.

· Platforms: Supports MT4, MT5, cTrader, and TradingView.

· Islamic Accounts: Swap-free accounts available for Muslim traders.

· Minimum Deposit: $100 (AUD), reasonable for professional accounts.

· Copy Trading: FP Markets’ copy trading platform allows beginners to follow seasoned traders.

Pros:

· Over 850 tradable instruments.

· Fast execution speeds and ECN pricing.

· 24/5 multilingual support.

Cons:

· Complex registration process for Islamic accounts.

· Limited local payment options compared to Exness.

Why Choose FP Markets? FP Markets is ideal for professional traders seeking advanced platforms and competitive pricing.

5. XM – Best for Beginners

Overview: XM, regulated by CySEC, ASIC, and FSCA, is known for its low minimum deposit and beginner-friendly features. It’s a strong contender for new Pakistani traders.

Key Features:

· Low Minimum Deposit: $5, one of the lowest in the industry.

· High Leverage: Up to 1:1000 for experienced traders.

· Islamic Accounts: Swap-free accounts with dedicated support.

· Platforms: MT4 and MT5 with real-time execution.

· Educational Resources: Extensive webinars, tutorials, and market analysis.

Pros:

· Negative balance protection.

· Multilingual support, including Urdu.

· Wide range of assets, including forex and CFDs.

Cons:

· Higher spreads on standard accounts (1.6 pips on EUR/USD).

· Customer support not available 24/7.

Why Choose XM? XM’s low entry barrier and educational tools make it a top pick for beginners in Pakistan.

6. Octa – Best for Copy Trading

Overview: Octa, operating since 2011, is popular for its commission-free trading and user-friendly platform. It’s regulated by CySEC and offers Islamic accounts.

Key Features:

· Low Deposit: $25 minimum deposit via cryptocurrencies.

· Spreads: Starting at 0.6 pips on EUR/USD.

· Copy Trading: Large community for replicating experienced traders’ strategies.

· Platforms: MT4, MT5, and OctaTrader.

· Islamic Accounts: Sharia-compliant accounts with no hidden fees.

Pros:

· Commission-free trading.

· Fast and secure withdrawals.

· Mobile app optimized for Pakistani traders.

Cons:

· Limited asset range compared to IC Markets.

· No Urdu support.

Why Choose Octa? Octa’s copy trading feature and low deposit make it ideal for beginners and passive traders.

7. HFM (HF Markets) – Best for Swap-Free Trading

Overview: HFM is a well-regulated broker (FCA, CySEC, FSCA) offering swap-free accounts and low-cost trading, making it a great choice for Muslim traders in Pakistan.

Key Features:

· Low Deposit: $5 minimum deposit.

· Spreads: Starting at 0.1 pips on major pairs.

· Islamic Accounts: No hidden fees or charges.

· Platforms: MT4 and MT5 with advanced tools.

· Leverage: Up to 1:1000.

Pros:

· Negative balance protection.

· Multilingual support available 24/5.

· Extensive educational resources.

Cons:

· Higher spreads on some exotic pairs.

· Limited local payment options.

Why Choose HFM? HFM’s swap-free accounts and low deposit make it a strong option for Pakistani traders seeking Sharia-compliant trading.

8. Fusion Markets – Best for Low Fees

Overview: Fusion Markets is known for its low trading costs and fast account opening, regulated by ASIC and VFSC.

Key Features:

· Low Spreads: Starting at 0.0 pips with a $4.5 per lot commission.

· Platforms: MT4, MT5, and cTrader.

· Minimum Deposit: No minimum, but $100 recommended.

· Islamic Accounts: Available upon request.

Pros:

· Low withdrawal fees.

· Fast and digital account opening.

· Wide range of currency pairs.

Cons:

· Limited educational resources.

· No Urdu support.

Why Choose Fusion Markets? Fusion Markets is ideal for cost-conscious traders seeking low fees and reliable platforms.

9. Tickmill – Best for Welcome Bonuses

Overview: Tickmill, regulated by the FCA and CySEC, offers competitive spreads and a $30 welcome bonus for new traders.

Key Features:

· Low Spreads: From 0.1 pips on EUR/USD.

· Minimum Deposit: $100.

· Islamic Accounts: Swap-free options available.

· Platforms: MT4 and MT5.

· Leverage: Up to 1:500.

Pros:

· $30 welcome bonus for new traders.

· Fast execution and low latency.

· Regulated by top-tier authorities.

Cons:

· Limited asset range (62 currency pairs).

· No local payment options.

Why Choose Tickmill? Tickmill’s welcome bonus and low spreads make it attractive for new traders in Pakistan.

10. Vantage – Best for Fast Account Opening

Overview: Vantage, regulated by ASIC and FCA, offers seamless account opening and low non-trading fees, making it a solid choice for Pakistani traders.

Key Features:

· Low Fees: Spreads from 0.0 pips on ECN accounts.

· Platforms: MT4, MT5, and Vantage App.

· Minimum Deposit: $50.

· Islamic Accounts: Swap-free accounts available.

· Leverage: Up to 1:500.

Pros:

· Fast and digital account opening.

· No deposit or withdrawal fees.

· Strong customer support.

Cons:

· Limited educational resources.

· No Urdu support.

Why Choose Vantage? Vantage’s quick setup and low fees make it a practical choice for traders seeking efficiency.

How to Choose the Best Forex Broker in Pakistan

When selecting a forex broker, Pakistani traders should consider the following factors:

· Regulation and Safety: Choose brokers regulated by reputable authorities like the FCA, CySEC, or ASIC to ensure fund security.

· Trading Costs: Look for low spreads, minimal commissions, and no hidden fees. Exness and IC Markets excel in this area.

· Platforms: Ensure the broker offers user-friendly platforms like MT4, MT5, or proprietary apps (e.g., Exness Terminal).

· Islamic Accounts: For Muslim traders, swap-free accounts are essential. Most brokers in this list offer Sharia-compliant options.

· Local Support: Urdu-language support and local payment methods (e.g., easypaisa, JazzCash) enhance accessibility.

· Minimum Deposit: Low deposits (e.g., $5-$100) make trading accessible for beginners.

· Educational Resources: Brokers like AvaTrade and XM provide extensive learning materials for new traders.

· Leverage: High leverage (e.g., 1:1000) can amplify profits but increases risk. Use cautiously.

Tips for Successful Forex Trading in Pakistan

· Start with a Demo Account: Practice with virtual funds to test strategies without risking real money.

· Understand Risk Management: Never trade more than you can afford to lose, and use stop-loss orders.

· Stay Educated: Leverage free resources like webinars, tutorials, and market analysis offered by brokers like Exness and AvaTrade.

· Monitor Leverage: High leverage can lead to significant losses. Start with lower leverage if you’re a beginner.

· Choose Local Payment Methods: Brokers like Exness support easypaisa and JazzCash, making deposits and withdrawals seamless.

Conclusion

The forex trading landscape in Pakistan is thriving, and selecting the right broker is key to capitalizing on this opportunity. Exness stands out as the best forex broker in Pakistan for 2025 due to its low spreads, high leverage, Islamic accounts, and local payment support. Other brokers like IC Markets, AvaTrade, and XM also offer excellent features tailored to different trading styles. By prioritizing regulation, low costs, and user-friendly platforms, Pakistani traders can navigate the forex market with confidence. Always conduct thorough research and start with a demo account to ensure a safe and profitable trading journey.

Read more: