17 minute read

Is forex trading legal in South Africa? A Comprehensive Guide

from Exness

by Exness Blog

Understanding Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, refers to the act of buying and selling global currencies with the aim of making a profit from fluctuating exchange rates. Unlike traditional stock markets, Forex operates as a decentralized market, meaning there is no central exchange for currencies. Instead, currency pairs like USD/ZAR or EUR/USD are traded over the counter (OTC) on a global network of financial institutions, banks, and brokers. This allows Forex to operate continuously across different time zones, making it accessible 24 hours a day, five days a week.

Top 4 Best Forex Brokers in South Africa

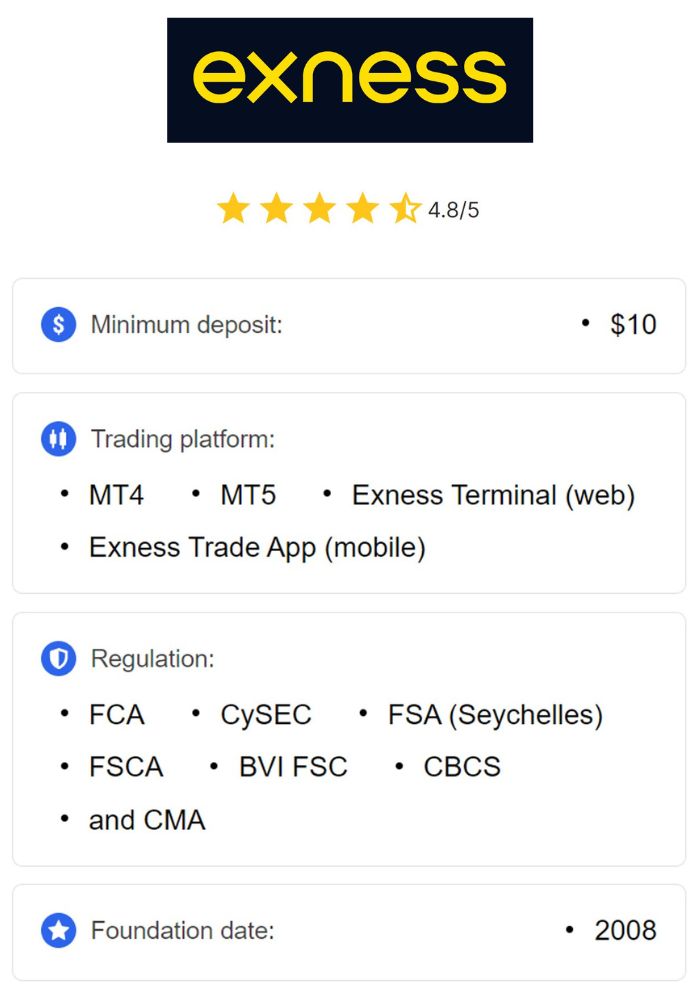

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Forex trading allows participants, from banks to individual retail traders, to exchange currencies at set prices. The primary goal is to predict which currency in a pair will increase or decrease in value relative to the other, enabling traders to “buy low and sell high” or vice versa. This unique structure has made Forex trading the largest financial market globally, with daily volumes exceeding $6 trillion.

How Forex Trading Works

Forex trading operates on the principle of currency pairs, where one currency is exchanged for another. Each currency pair has a “base” currency (the first in the pair) and a “quote” currency (the second in the pair). For example, in the USD/ZAR pair, USD is the base currency, and ZAR is the quote currency. Traders buy or sell the base currency in relation to the quote currency based on expected price movements.

Forex trades generate profit from the difference between the “bid” price (buy) and the “ask” price (sell), known as the spread. Traders can use leverage to control larger positions with relatively small capital, which magnifies both potential gains and risks. Successful Forex trading requires an understanding of technical and fundamental analysis, allowing traders to make informed decisions based on economic indicators, price charts, and news events.

Popularity of Forex Trading in South Africa

Forex trading has surged in popularity in South Africa, positioning the country as a leading hub for Forex in Africa. Several factors contribute to this trend, including the high volatility of the South African Rand (ZAR), access to mobile trading platforms, and the promise of financial independence. Economic factors like inflation and currency fluctuations have driven South Africans to explore Forex as a means to hedge against currency devaluation and earn additional income.

Many South Africans see Forex trading as an accessible investment opportunity, thanks to brokers offering low initial deposits, educational resources, and demo accounts. This accessibility has fostered a vibrant community of retail traders, with increasing numbers of individuals taking advantage of the 24-hour Forex market.

Regulatory Framework for Forex Trading in South Africa

Overview of Financial Regulatory Bodies

South Africa’s financial sector is regulated by key institutions such as the South African Reserve Bank (SARB) and the Financial Sector Conduct Authority (FSCA). SARB is primarily responsible for managing monetary policy, overseeing exchange rates, and promoting financial stability, while the FSCA focuses on protecting investors and ensuring fair conduct within the financial markets.

The FSCA specifically regulates Forex trading within South Africa by setting standards for brokers and ensuring that only licensed firms operate within the market. This regulatory environment is designed to protect consumers and uphold market integrity, reducing the likelihood of fraud and misconduct. Together, SARB and FSCA create a balanced and secure environment for South African Forex traders.

Role of the Financial Sector Conduct Authority (FSCA)

The FSCA plays a crucial role in Forex trading in South Africa. As the main regulatory body for financial services, the FSCA is responsible for licensing Forex brokers, enforcing compliance standards, and protecting traders’ rights. Licensed brokers under FSCA are required to segregate client funds, adhere to AML (anti-money laundering) policies, and maintain transparent trading practices.

For traders, the FSCA’s oversight provides confidence that they are trading in a regulated environment. FSCA-regulated brokers are subject to periodic audits and financial reporting, ensuring they operate responsibly. This regulatory support enables traders to participate in Forex with confidence, knowing that the FSCA can intervene in case of unethical or fraudulent practices.

Licensing Requirements for Forex Brokers

To legally offer Forex trading services in South Africa, brokers must obtain a license from the FSCA. The licensing process includes strict assessments of financial stability, operational transparency, and compliance with local and international standards. Brokers are also required to hold sufficient capital and implement client fund protections to ensure they can meet their financial obligations.

Licensed brokers must comply with regular audits, maintain detailed financial reports, and uphold client protections. For South African traders, choosing an FSCA-licensed broker is essential, as it provides a level of recourse if disputes arise. This regulatory framework ensures a safer trading environment by setting minimum standards for all brokers operating in South Africa.

Legal Status of Forex Trading

Legality of Retail Forex Trading

Retail Forex trading is entirely legal in South Africa, allowing individual investors to engage in the Forex market freely. Both institutional and individual traders are permitted to buy and sell currency pairs through licensed brokers. This legality provides South Africans with a legitimate avenue for investment, whether as a supplemental income or as a full-time trading endeavor.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The FSCA regulates Forex trading activities, ensuring that South Africans have access to a regulated market. However, while Forex trading is legal, traders are strongly advised to use only licensed brokers to avoid the risks associated with unregulated entities. The clear legal status has contributed to the growth of Forex in South Africa, making it a popular and viable option for investment.

Differences Between Legal and Illegal Forex Trading

In South Africa, the distinction between legal and illegal Forex trading largely hinges on the choice of broker. Trading with an FSCA-licensed broker is legal, while engaging with unlicensed brokers, especially those based abroad or lacking regulatory oversight, is considered illegal. The FSCA actively monitors and issues warnings against unauthorized brokers to protect South African traders.

Illegal Forex trading can also involve fraudulent schemes that promise unrealistic returns or unregulated “investment programs” masquerading as Forex opportunities. Participating in these schemes is risky, as it exposes traders to potential fraud and financial loss. South Africans are encouraged to verify a broker’s regulatory status with the FSCA to ensure their trading activities are within legal bounds.

Consequences of Engaging with Unlicensed Brokers

Trading with unlicensed or unregulated brokers exposes South African traders to significant risks. Unlicensed brokers operate outside FSCA oversight, which means traders have limited recourse if disputes arise or if a broker becomes insolvent. In the worst cases, traders risk losing their entire investment due to fraudulent practices or mismanagement of funds.

In addition to financial loss, trading with unlicensed brokers may lead to legal consequences, as the FSCA can investigate and take action against traders involved with unauthorized firms. The FSCA frequently updates its list of blacklisted brokers and advises South Africans to avoid unlicensed entities to protect their investments.

Tax Implications for Forex Traders

Tax Responsibilities for Forex Earnings

In South Africa, Forex earnings are classified as taxable income and must be reported to the South African Revenue Service (SARS). Profits from Forex trading can be categorized as either capital gains or business income, depending on the trader’s level of activity and intent. Hobby traders typically report gains as capital income, while professional traders or those whose primary income is from Forex may be subject to standard income tax rates.

South African traders should consult with tax professionals to ensure compliance and avoid potential penalties. Failure to report Forex income accurately may result in fines or legal action from SARS.

Reporting Forex Income in South Africa

Forex traders are required to report all profits and losses on their annual tax returns. Maintaining detailed records of trading activity, including account statements and trade summaries, is essential for accurate reporting. Traders should include all income generated through Forex trading and ensure they meet SARS’s requirements for transparency.

Using a qualified tax advisor can help traders properly categorize their earnings and adhere to SARS regulations. In cases where traders incur losses, these may also be reported to potentially offset taxable income, depending on specific tax regulations.

Tax Deductions and Allowances for Traders

Forex traders in South Africa can claim deductions on expenses directly related to their trading activities. Deductible expenses may include broker fees, trading software costs, educational materials, and other related costs. Keeping thorough records of all expenses is crucial for claiming deductions and optimizing tax obligations.

Consulting with a tax professional can provide clarity on eligible deductions and ensure compliance with SARS’s tax policies. Understanding tax deductions can significantly impact a trader’s bottom line, enabling them to maximize profits after accounting for tax liabilities.

Risks and Challenges in Forex Trading

Market Volatility and Its Impact

The Forex market is known for its high volatility, driven by global economic events, political changes, and financial policies. For South African traders, market volatility can result in rapid currency fluctuations, which may lead to significant profits or losses. The ZAR/USD pair, for instance, is often influenced by South Africa’s economic data, political stability, and global market trends.

To manage volatility, South African traders use risk management tools like stop-loss orders, position sizing, and diversification. Understanding the causes of market volatility is essential for making informed trading decisions and mitigating potential losses in unpredictable market conditions.

Importance of Risk Management Strategies

Effective risk management is a cornerstone of successful Forex trading. South African traders are encouraged to set strict limits on losses, avoid over-leveraging, and diversify their portfolios to protect against sudden market shifts. Leveraged trading amplifies potential profits but also increases risk, making risk management crucial for sustained success.

A disciplined approach to risk management helps traders maintain consistent performance, safeguard capital, and reduce the likelihood of substantial losses. This discipline is especially important for new traders who may lack experience navigating the volatile Forex market.

Psychological Factors Affecting Traders

Trading psychology significantly influences a trader’s decisions and outcomes. Emotional factors like fear, greed, and impatience can lead to impulsive trades or hesitation in executing well-planned strategies. South African traders often undergo training in trading psychology to build resilience and discipline, enabling them to stick to their strategies regardless of market emotions.

Experienced traders know that maintaining composure and avoiding emotionally driven decisions can improve long-term performance. Practicing emotional control and implementing a structured trading plan helps traders manage stress and make objective decisions.

Benefits of Forex Trading in South Africa

Opportunities for Profit Generation

Forex trading offers South Africans a unique opportunity to generate income by leveraging price fluctuations in currency pairs. Since the Forex market is highly liquid and operates globally, traders can capitalize on economic shifts, political events, and market sentiment changes to generate profits. Unlike traditional investments, Forex trading allows for profit potential in both rising and falling markets, as traders can go “long” or “short” on currency pairs.

For many South Africans, Forex trading has become a supplementary income stream and, in some cases, a primary source of revenue. With appropriate strategies, risk management, and continuous learning, traders can navigate the market’s volatility to build wealth over time.

Accessibility for Individual Traders

One of the greatest advantages of Forex trading is its accessibility. Thanks to online platforms and mobile trading apps, individuals in South Africa can easily start trading with minimal initial investment. Many brokers offer accounts with low deposit requirements, making Forex trading accessible even to those with limited capital. Additionally, the availability of demo accounts allows new traders to practice without risking real money, helping them build confidence and understand the mechanics of the market before committing funds.

This accessibility has fueled the popularity of Forex trading in South Africa, allowing a broader segment of the population to engage in a market once limited to financial institutions and wealthy individuals.

24-Hour Market Operation

The Forex market operates around the clock from Monday to Friday, with trading sessions in major financial hubs such as New York, London, Tokyo, and Sydney. This 24-hour schedule offers South African traders the flexibility to trade at times that suit their schedules, whether they prefer to trade during the morning, afternoon, or late evening.

This continuous operation is beneficial for traders with other commitments, such as full-time jobs or personal responsibilities, as it allows them to participate in the market outside of typical business hours. Moreover, the flexibility to trade multiple sessions provides opportunities to capitalize on different market movements and volatility patterns associated with each trading session.

Common Myths About Forex Trading Legality

Misconceptions Regarding Regulation

A common misconception in South Africa is that Forex trading is entirely unregulated or operates in a “legal gray area.” However, Forex trading is a well-regulated activity under the Financial Sector Conduct Authority (FSCA). South Africa’s regulatory framework ensures that brokers adhere to strict standards, protecting traders from fraud and unethical practices. Working with FSCA-licensed brokers provides traders with security, as these brokers are regularly audited and must follow consumer protection guidelines.

Understanding the regulations surrounding Forex helps traders operate within the law, as some misconceptions may discourage potential traders who are unsure of the market’s legitimacy. Clarifying these regulations can empower South Africans to enter the Forex market confidently and safely.

Myths Surrounding Broker Selection

Another prevalent myth is that all brokers offer the same level of service, making broker selection irrelevant. In reality, choosing the right broker is one of the most critical decisions a trader can make. FSCA-regulated brokers in South Africa are required to meet specific financial standards, maintain transparent pricing, and protect client funds through segregated accounts. Unlicensed brokers, on the other hand, may lack these protections and could expose traders to unnecessary risks, including fund mismanagement and poor execution practices.

South African traders should carefully research brokers, prioritize regulatory status, and read customer reviews to ensure they are selecting a reputable partner. This diligence can safeguard their investments and provide a smoother trading experience.

Clarifying the Perception of High Risks

Forex trading is often associated with high risk, leading to the belief that it is a form of gambling. While Forex trading does involve risk, it is not inherently a gamble. Unlike gambling, Forex trading requires knowledge, skill, and disciplined risk management strategies. Through the use of stop-loss orders, position sizing, and careful analysis, traders can effectively manage risks and improve their chances of long-term success.

For South African traders, understanding that Forex trading is a skill-based activity can shift the perception from a “get-rich-quick” scheme to a legitimate investment practice. With proper education and strategy development, Forex trading can be a viable, structured, and rewarding financial endeavor.

Steps to Start Forex Trading Legally in South Africa

Selecting a Regulated Forex Broker

The first step to trading Forex legally in South Africa is choosing a regulated broker that holds an FSCA license. South African traders should verify a broker’s regulatory status on the FSCA’s website to ensure it meets local standards. Regulated brokers are held accountable for transparency, secure transactions, and ethical conduct, providing a safer trading environment. Selecting a reliable broker is crucial, as unlicensed brokers can pose significant risks, including fraud or mismanagement of funds.

After selecting a regulated broker, traders should familiarize themselves with the broker’s trading platform, available currency pairs, and offered tools to determine if it aligns with their trading goals and style.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Opening a Trading Account

Once a broker is selected, the next step is to open a trading account. This process typically involves submitting identification documents, proof of residence, and financial information to comply with Know Your Customer (KYC) and anti-money laundering (AML) requirements. South African brokers often offer different account types, including demo accounts, which allow traders to practice without risking real money, and live accounts for actual trading.

Starting with a demo account is advisable for new traders, as it allows them to understand the platform and test strategies in a risk-free environment. Once comfortable, traders can transition to a live account with a minimum deposit, depending on the broker’s requirements.

Understanding Trading Platforms and Tools

A reliable trading platform is essential for executing trades, analyzing currency pairs, and managing positions. Popular platforms in South Africa include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which offer robust charting tools, technical indicators, and automated trading options. Other platforms, like cTrader, also provide advanced features, catering to traders with specific preferences or strategies.

South African traders should spend time exploring the platform’s features, including chart types, drawing tools, and order types, to become proficient. Knowledge of trading platforms and tools empowers traders to make informed decisions, manage risk effectively, and capitalize on market opportunities.

Resources and Support for South African Forex Traders

Educational Programs and Courses

A variety of educational resources are available to help South African traders build a strong foundation in Forex trading. Many brokers offer free webinars, online courses, and tutorial videos that cover essential topics like technical analysis, risk management, and trading psychology. Some brokers also provide in-person workshops and mentorship programs for a more hands-on learning experience.

For beginners, taking advantage of these resources can demystify Forex trading, helping them develop a structured approach to the market. Advanced courses are also available for experienced traders looking to refine their strategies or learn about complex concepts like algorithmic trading.

Online Communities and Forums

The Forex trading community in South Africa is active and supportive, with numerous online forums, social media groups, and trading communities available. These platforms allow traders to exchange insights, discuss strategies, and share their experiences with both local and international peers. Engaging with fellow traders in these communities can provide valuable insights, especially for beginners who benefit from real-world advice and emotional support.

Popular online platforms like Forex Factory, BabyPips, and TradingView host discussions on various aspects of trading, including technical analysis, broker reviews, and market updates. South African traders can gain a broader perspective by participating in these communities, learning from seasoned traders and industry experts.

Professional Advisory Services

For traders seeking personalized guidance, professional advisory services are an excellent resource. Some brokers offer access to dedicated account managers or financial advisors who provide tailored advice on trading strategies, portfolio management, and risk mitigation. While these services may incur additional fees, they are particularly valuable for traders with specific goals or those seeking to elevate their trading performance.

Working with an advisor can help traders develop a comprehensive trading plan, monitor progress, and adapt strategies to changing market conditions. This professional support can be instrumental in helping traders navigate complex situations and achieve consistent results.

Conclusion

Forex trading is indeed legal in South Africa, provided traders work with FSCA-regulated brokers that adhere to the country’s financial regulations. South African traders have access to a well-structured regulatory framework that protects their interests, offering a secure environment for both beginners and experienced traders. By selecting a licensed broker, understanding tax obligations, and utilizing available resources, South Africans can participate in Forex trading responsibly and effectively.

Forex trading offers a range of benefits, including flexibility, accessibility, and profit potential. However, success in Forex requires education, discipline, and risk management. By debunking common myths and understanding the realities of Forex trading, South Africans can approach the market with realistic expectations and a commitment to long-term growth. As the South African Forex community continues to expand, traders can capitalize on opportunities while contributing to the country’s growing financial landscape.

Read more: