14 minute read

How much do i need to start forex trading in South Africa?

from Exness

by Exness Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies on a global decentralized market. In Forex trading, currencies are traded in pairs, such as USD/ZAR (US Dollar/South African Rand), where traders buy one currency while selling another. The goal is to profit from the fluctuations in exchange rates between these currency pairs, driven by factors like economic conditions, interest rates, and geopolitical events.

Top 4 Best Forex Brokers in South Africa

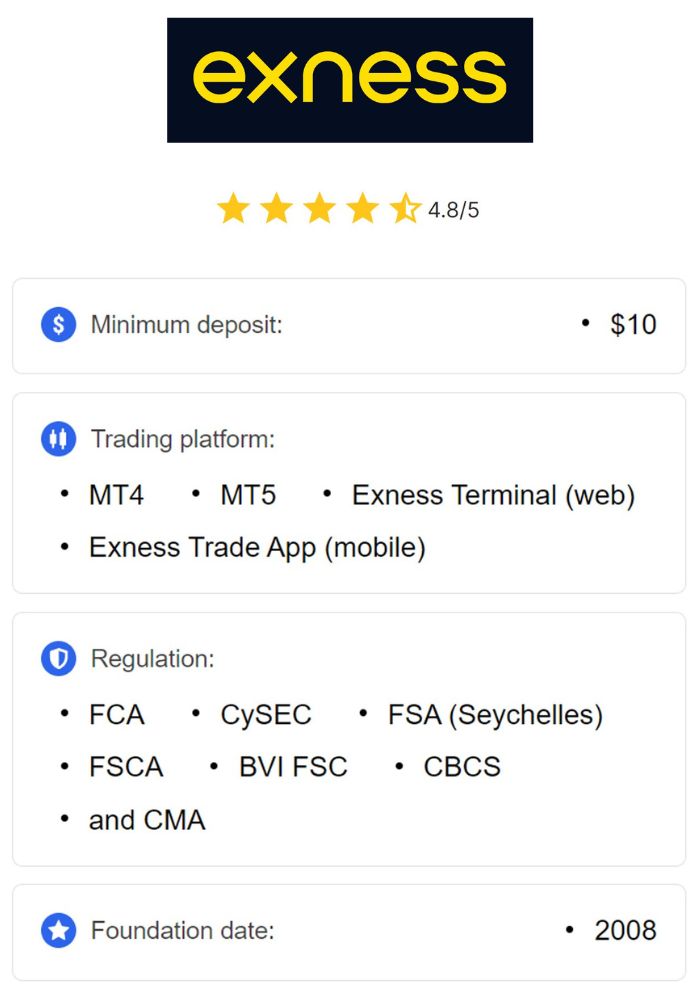

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The Forex market operates 24 hours a day, allowing traders flexibility to participate from anywhere in the world, including South Africa. Given its high liquidity and accessibility, Forex trading has become increasingly popular among South Africans seeking additional income opportunities.

The Importance of Currency Pairs

Currency pairs are the foundation of Forex trading, as each trade involves buying one currency while selling another. Major pairs, like EUR/USD and GBP/USD, offer high liquidity and low spreads, making them popular among traders. In South Africa, many traders focus on pairs involving the ZAR, such as USD/ZAR or EUR/ZAR, as these pairs are influenced by local economic factors, giving traders more familiar insights.

Understanding currency pairs and their dynamics is essential for identifying profitable opportunities and managing risks effectively. A good grasp of currency behavior helps traders make more informed decisions, especially in a market as dynamic as Forex.

The Initial Investment Requirements

Minimum Capital for Beginners

The amount needed to start Forex trading varies depending on the broker and the type of account chosen. Many brokers offer accounts with minimum deposits as low as $10 (approximately 180 ZAR), allowing beginners to get started with a small capital. While it’s possible to start with minimal funds, small accounts often limit the potential for substantial gains due to limited leverage and position sizing.

For new traders, a minimum starting capital of $100 to $200 (around 1800 to 3600 ZAR) is recommended to allow some flexibility in trade sizes and better risk management. This amount provides enough capital to start learning without excessive financial risk.

Recommended Investment Levels for Success

While starting with $100 to $200 is feasible, many experienced traders recommend a minimum starting capital of $500 to $1,000 (around 9000 to 18000 ZAR). This amount allows for more substantial trades and improves the potential for significant gains, especially when used with a disciplined risk management plan. Starting with a larger capital also allows traders to absorb market fluctuations better, minimizing the risk of account depletion from small losses.

By investing more upfront, traders in South Africa can better utilize position sizing and control leverage to enhance profitability.

Costs Associated with Forex Trading

Trading Fees and Commissions

Forex brokers typically charge fees in the form of spreads or commissions. Some brokers offer commission-free trading with variable spreads, while others charge a small commission per trade in exchange for lower spreads. For traders in South Africa, understanding the fee structure is essential, as high trading costs can eat into profits, particularly for traders with smaller accounts.

Researching broker fees and selecting options with competitive rates can help optimize trading profits and reduce costs over time.

Spreads and How They Affect Your Capital

The spread is the difference between the bid (buy) and ask (sell) price of a currency pair. It represents the broker’s profit and can vary depending on market conditions and currency pairs. Major pairs usually have lower spreads, while exotic pairs like ZAR-based pairs may have higher spreads due to lower liquidity. Small spreads are beneficial for traders, as they reduce the cost of entering and exiting trades.

Understanding spreads helps traders make cost-effective choices, especially when working with a limited starting capital.

Leverage: Benefits and Risks

Leverage allows traders to control a larger position with a smaller amount of capital, amplifying both potential profits and losses. For example, with 1:100 leverage, a trader can control a $10,000 position with only $100. While leverage can boost profits, it also increases the risk of significant losses if trades go against the trader’s position.

In South Africa, brokers offer various leverage options, often up to 1:500. However, using high leverage requires careful risk management to prevent rapid account depletion.

Choosing a Forex Broker

Factors to Consider When Selecting a Broker

Selecting the right Forex broker is essential for a successful trading journey. Key factors to consider include:

Regulation and safety of funds

Low fees and tight spreads

Available trading platforms (such as MT4 or MT5)

Leverage options and account types

Quality of customer support

For South African traders, finding a broker with ZAR account options can also simplify transactions and minimize currency conversion costs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulation and Safety in South Africa

In South Africa, the Financial Sector Conduct Authority (FSCA) oversees the regulation of Forex brokers. Choosing an FSCA-regulated broker ensures that your funds are protected, and the broker adheres to ethical trading practices. Regulation provides peace of mind and legal recourse if issues arise, making it an essential factor in selecting a broker.

Comparison of Popular Forex Brokers

Some reputable brokers for South African traders include Exness, FXTM (ForexTime), and HotForex. These brokers offer a mix of competitive spreads, high leverage options, and FSCA regulation. Comparing brokers based on features, costs, and user reviews can help traders select a platform that aligns with their trading style and budget.

Types of Trading Accounts

Standard Accounts vs. Mini and Micro Accounts

Forex brokers offer various account types to suit different trading needs. Standard accounts require a higher minimum deposit but offer standard lot sizes for trading, suitable for experienced traders. Mini and micro accounts, on the other hand, require lower capital and offer smaller trade sizes, making them ideal for beginners.

For South Africans starting with smaller capital, micro accounts allow for smaller positions, reducing risk while gaining trading experience.

Islamic Accounts and Their Relevance in South Africa

Islamic accounts, also known as swap-free accounts, are designed to comply with Sharia law by removing interest (swap) fees. These accounts are relevant for Muslim traders in South Africa who wish to trade without incurring overnight interest charges. Many brokers offer Islamic account options, ensuring all traders have access to fair and compliant trading opportunities.

Risk Management Strategies

Importance of a Risk Management Plan

A risk management plan is fundamental to long-term success in Forex trading, especially for traders in South Africa starting with limited capital. The Forex market can be highly volatile, and without a structured plan, traders risk losing their investments quickly. A good risk management plan includes setting limits on how much of your capital to risk on each trade, as well as establishing clear stop-loss and take-profit levels.

Risk management helps traders control their exposure, reducing the chance of significant losses. For instance, many successful traders recommend risking no more than 1-2% of their capital on a single trade. This conservative approach helps ensure that even a series of losing trades doesn’t deplete the account entirely, allowing traders to remain in the game and recover from losses over time.

Position Sizing Techniques

Position sizing is a key element in any risk management strategy. It refers to determining the size of a trade based on the trader’s account size and risk tolerance. Proper position sizing prevents overexposure to a single trade, thereby reducing the impact of potential losses on overall capital.

For example, with a $500 (around 9,000 ZAR) account, risking 2% per trade means a maximum loss of $10 (around 180 ZAR) per trade. This amount may seem small, but by managing position sizes carefully, traders can increase the longevity of their trading journey and avoid catastrophic losses. Position sizing calculators and tools offered by trading platforms like MT4 or MT5 can help traders set appropriate trade sizes according to their risk tolerance.

Using correct position sizing in combination with stop-loss orders can provide a balanced approach to capital protection while maximizing potential returns.

Trading Platforms and Tools

Overview of Popular Trading Platforms

When it comes to Forex trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry standards due to their robust functionalities. Both platforms offer advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs), making them suitable for both beginners and advanced traders. MT4 is widely recognized for its user-friendly interface and reliability, while MT5 provides additional features, including more timeframes, order types, and an economic calendar.

Other popular platforms include cTrader and TradingView, which are known for their intuitive design and social trading features, allowing traders to share strategies and insights. Many brokers provide access to these platforms, so it’s essential to choose one that offers the tools best suited to your trading style and preferences.

Essential Tools for Forex Traders

Forex traders can benefit greatly from using a variety of tools to enhance their analysis and decision-making process. Some essential tools include:

Economic Calendars: An economic calendar provides a schedule of important economic events and data releases, such as interest rate announcements and employment reports. These events often impact currency prices, so staying informed helps traders anticipate potential market movements.

Technical Indicators: Tools like Moving Averages, Relative Strength Index (RSI), and Fibonacci Retracement help traders analyze price trends and identify entry and exit points. These indicators are crucial for technical analysis, enabling traders to make data-driven decisions.

Risk Calculators: Risk calculators assist in determining appropriate trade sizes and potential risk levels for each trade, helping traders stick to their risk management plan.

Trading Journals: Maintaining a trading journal allows traders to track their trades, assess performance, and identify areas for improvement. Analyzing past trades helps traders understand what works well and refine their strategies over time.

Using these tools effectively enables traders to make informed decisions, manage risks, and continually improve their trading skills.

Training and Education

Resources for Learning Forex Trading

Education is crucial for success in Forex trading, as understanding the market, strategies, and risks helps traders make better-informed decisions. Many brokers provide free educational resources, including webinars, tutorials, e-books, and articles that cover a range of topics from Forex basics to advanced trading techniques. Additionally, online courses and books authored by seasoned traders can offer valuable insights into effective strategies, risk management, and trading psychology.

Some recommended resources for South African traders include:

Online courses: Platforms like Udemy and Coursera offer courses specifically focused on Forex trading, covering fundamental and technical analysis.

Books: Popular books like Currency Trading for Dummies and Market Wizards provide in-depth knowledge and personal experiences from expert traders.

By investing time in learning, traders can build a strong foundation, improving their chances of achieving profitability in Forex trading.

The Role of Demo Accounts in Skill Development

Demo accounts play a vital role in developing trading skills without the financial risk. With a demo account, traders use virtual funds to practice in real market conditions, enabling them to test strategies, understand market dynamics, and become familiar with the trading platform. This hands-on experience helps traders build confidence and refine their techniques before committing real capital.

Most brokers offer demo accounts with no time limit, making them an ideal tool for continuous learning and improvement. For South African traders, using a demo account to test strategies and develop risk management skills is a highly recommended step before trading live.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Market Analysis Techniques

Fundamental Analysis Basics

Fundamental analysis is the study of economic, political, and social factors that influence currency values. For example, interest rate changes by central banks, employment data, and inflation reports are key economic indicators that can impact currency prices. South African traders may focus on the Reserve Bank’s monetary policy decisions, as these can directly affect the value of the South African Rand (ZAR) against other currencies.

Fundamental analysis helps traders understand the long-term direction of a currency pair, making it particularly useful for those who prefer swing or position trading. By staying informed on global economic developments, traders can anticipate market trends and make well-timed trades.

Technical Analysis Strategies

Technical analysis involves studying price charts and identifying patterns that indicate future price movements. Popular strategies include trend-following, where traders look for patterns like ascending or descending channels, and breakout trading, which involves entering trades when prices break through established support or resistance levels.

Technical indicators, such as Moving Averages, RSI, and MACD, help traders identify trends, momentum, and potential reversal points. Technical analysis is a valuable tool for short-term traders, such as scalpers and day traders, as it provides insights into optimal entry and exit points.

Combining both fundamental and technical analysis can offer a more comprehensive approach, allowing traders to make data-driven decisions based on both market trends and economic indicators.

Building a Trading Strategy

Elements of an Effective Trading Plan

A well-structured trading plan acts as a roadmap, helping traders stay focused, disciplined, and consistent in their trading approach. Key elements of a trading plan include:

Trading Goals: Setting realistic goals, such as weekly or monthly profit targets, helps traders measure their progress and maintain motivation.

Risk Tolerance: Defining how much capital to risk per trade or session ensures that traders don’t take on excessive risk.

Preferred Trading Style: Deciding whether to use scalping, day trading, or swing trading aligns with the trader’s schedule and risk tolerance.

Trade Management Rules: Clear entry, exit, stop-loss, and take-profit levels prevent emotional decision-making.

An effective trading plan allows traders to respond to market changes systematically and consistently, rather than making impulsive decisions.

Backtesting Your Strategy

Backtesting involves testing a trading strategy on historical data to evaluate its effectiveness. By applying a strategy to past market conditions, traders can assess its potential profitability and identify any weaknesses. Many trading platforms, such as MT4 and MT5, support backtesting, allowing traders to optimize their strategies before risking real money.

Backtesting helps traders gain confidence in their approach and refine their strategy based on historical performance. This process is essential for validating a strategy’s success rate and risk-reward ratio before implementing it in a live trading environment.

Emotional Discipline in Trading

Overcoming Psychological Challenges

Trading psychology is a critical component of success in Forex. Emotional challenges, such as fear of missing out (FOMO), greed, and frustration, can lead to impulsive decisions and significant losses. To overcome these challenges, traders must develop self-discipline, manage stress, and avoid overtrading.

Maintaining emotional discipline helps traders stick to their plan, execute trades objectively, and minimize the impact of emotions on their performance. Techniques like setting clear boundaries, taking breaks, and reviewing progress can help traders stay grounded and avoid common psychological pitfalls.

Maintaining Consistency in Your Trading Approach

Consistency is essential in Forex trading, as it allows traders to build a track record of reliable performance. Traders should commit to following their strategy, setting realistic goals, and reviewing results regularly. Regular performance evaluations help identify areas for improvement, while consistency builds confidence and fosters a disciplined approach to trading.

Legal and Tax Implications in South Africa

Understanding Forex Trading Regulations

In South Africa, Forex trading is regulated by the Financial Sector Conduct Authority (FSCA). Trading with an FSCA-regulated broker ensures compliance with local financial laws, providing traders with legal protection and security. It’s essential for South African traders to use only FSCA-authorized brokers to reduce the risk of fraud and ensure that their funds are safe.

Tax Obligations for Forex Traders

Profits earned from Forex trading are subject to taxation in South Africa. Traders must report their income and pay taxes based on their earnings from Forex activities. Consulting with a tax professional can help traders understand their obligations and file taxes correctly, ensuring compliance with South African tax laws.

Community and Support Networks

Joining Forex Trading Communities

Forex trading communities offer valuable resources, support, and mentorship for traders at all levels. Online forums, social media groups, and local meetups allow traders to share insights, discuss strategies, and stay updated on market trends. For South African traders, joining a community helps build knowledge and provides a support system for overcoming challenges.

Finding a Mentor in the Forex Space

A mentor can offer guidance, share valuable experiences, and provide feedback, helping traders improve their skills and avoid common mistakes. Finding an experienced mentor in the Forex community can accelerate the learning curve and improve overall trading performance.

Conclusion

Starting Forex trading in South Africa requires a well-thought-out approach, an understanding of costs, risk management, and realistic financial goals. With a minimum investment of around $100 to $200, South African traders can start small and build their skills through education, practice, and disciplined trading. By choosing a regulated broker, using effective strategies, and focusing on continuous improvement, traders can navigate the Forex market successfully and work toward sustainable profitability.

Read more: