12 minute read

What is cent account in forex?

from Exness

by Exness Blog

What is a cent account in forex? It refers to a specific type of trading account designed for individuals who want to engage in forex trading with minimal financial risk. A cent account allows traders to experience the foreign exchange market by dealing in smaller denominations, ultimately enabling them to trade without exposing themselves to significant capital loss. This makes cent accounts particularly appealing to beginners and those looking to test their strategies in a practical environment.

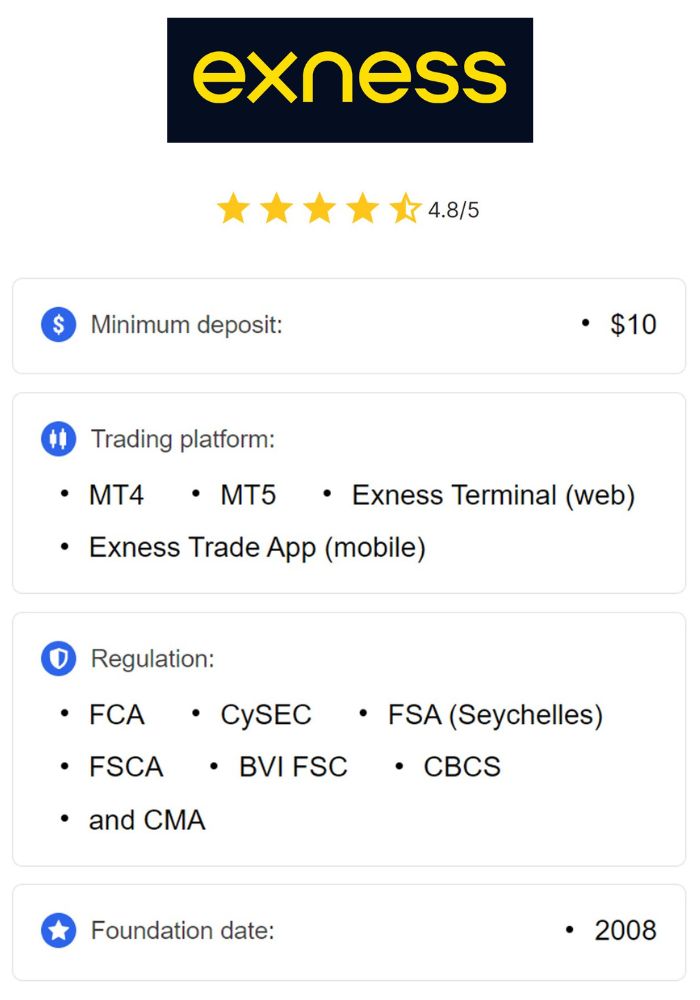

Top 4 Best Forex Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Understanding Forex Accounts

In the world of trading, especially in currencies, having the right tools at your disposal is essential. A Forex trading account is one of these vital tools. It serves as the primary interface through which traders interact with the Forex market.

Overview of Forex Trading Accounts

A Forex trading account can be described as a digital wallet that holds the funds necessary for trading various currency pairs. This account functions as a bridge between traders and brokers, facilitating the buying and selling of currencies.

When you open a Forex trading account with a broker, you deposit funds that you wish to use in trading. The broker then provides you with access to their trading platform where you can place orders, manage trades, and conduct analysis. Each broker offers different types of accounts tailored to diverse trader profiles, including minimum deposit requirements, available leverage, spreads, and more.

Differences Between Forex Account Types

Understanding the differences between account types is key to navigating the Forex landscape effectively. There are several account types, each catering to different trading needs.

Minimum Deposit: Some accounts might require a higher starting balance than others, affecting who can participate in trading activities.

Leverage: Different accounts provide varying levels of leverage, which allows traders to control larger positions with smaller capital.

Spreads: Spreads, representing the broker's commission, vary from account to account, impacting overall profitability.

Account Currency: Traders have the option to choose accounts denominated in various currencies such as USD, EUR, or GBP.

Trading Platforms: The software used for executing trades may differ across account types, influencing user experience and efficiency.

Customer Support: The quality and availability of customer support play a crucial role in ensuring traders have assistance when needed.

These variables significantly influence your trading journey, making it imperative to choose an account type that aligns with your trading strategy, risk tolerance, and financial goals.

Defining a Cent Account

To grasp what a cent account entails, we must begin by defining its core characteristics and purpose.

Concept and Purpose of a Cent Account

A cent account, often referred to as a mini or micro account, is specifically structured for traders who desire to explore the Forex market with reduced financial exposure. The unique attribute of a cent account is that profits and losses are measured in cents instead of whole dollars, thus allowing traders to operate with substantially lower amounts.

The primary purpose behind cent accounts is to provide a low-risk entry point into Forex trading. By allowing traders to utilize very small lot sizes—often starting at 0.01 lots—cent accounts make it possible to manage risks effectively. This is particularly beneficial for those new to the trading space, as they can experiment and learn without the pressure of losing large sums of money.

Key Features of Cent Accounts

Several features distinguish cent accounts from other account types. Understanding these can help traders make informed decisions.

Low Minimum Deposit: Most cent accounts demand a minimal initial deposit, making them accessible to a broader audience. This is particularly advantageous for new traders who may not have substantial capital to invest.

Small Lot Sizes: Trading on cent accounts typically involves smaller lot sizes, which translates to lower risk per trade. This feature allows traders to make mistakes while learning without incurring devastating losses.

Lower Risk Exposure: With the ability to trade in smaller increments, traders can minimize their exposure to the market. This feature is crucial for those still developing their trading skills.

Access to Trading Tools & Platforms: Cent accounts generally offer access to the same trading platforms and analytical tools available in standard accounts, ensuring that traders can execute their strategies effectively.

Advantages of Using a Cent Account

Choosing a cent account comes with numerous benefits, especially for traders seeking to enter the Forex market.

Lower Risk for New Traders

One of the most significant advantages of a cent account is its capacity to mitigate risk for beginners. The Forex market can be intimidating for novices due to its volatility and unpredictability. By using a cent account, new traders limit their potential losses to manageable amounts.

This aspect is crucial because many inexperienced traders make mistakes when starting out. With a cent account, they can learn from these errors without suffering catastrophic financial consequences. This gentle introduction to trading helps build confidence and skills over time.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Ease of Access to Trading

Another appealing feature of cent accounts is their accessibility. They often require a low initial deposit which invites a broader range of participants. This is especially critical in encouraging individuals who may otherwise feel excluded from the Forex market due to high capital requirements.

With fewer barriers to entry, cent accounts allow aspiring traders to dip their toes in the water of Forex trading. This ease of access encourages exploration and experimentation, fostering a community of learners eager to refine their trading craft.

Practical Learning Environment

A cent account also creates an invaluable practical learning environment. Unlike demo accounts, which simulate trading but lack real monetary stakes, a cent account offers the chance to trade with real money, albeit in small amounts.

Traders can implement strategies and analyze market trends in real-time, becoming familiar with how the Forex market operates. This hands-on experience aids in developing intuition around price movements and market reactions.

Through a cent account, traders gain a deeper understanding of order execution and the emotional aspects of trading, such as managing fear and greed—all critical components for long-term success.

Disadvantages of Cent Accounts

While cent accounts present various advantages, it is equally important to acknowledge their limitations.

Limitations on Trading Volume

One inherent drawback of cent accounts is the restriction on trading volume. Since these accounts facilitate trading in smaller lot sizes, generating significant profits per trade becomes challenging.

This situation requires traders to adopt a more active approach, executing multiple trades to accumulate meaningful returns. Consequently, this may lead to increased transaction costs and the need for meticulous trade management.

Potentially Higher Spreads

Traders should also be aware that some brokers might impose wider spreads on cent accounts compared to standard accounts. Wider spreads can erode profits, as they represent additional costs incurred every time a trade is executed.

Although these spreads may not always be significantly larger, they can noticeably impact profitability, especially for day traders aiming to capitalize on small price movements. Therefore, selecting a broker with tight spreads is crucial to maximizing the benefits of a cent account.

Withdrawal Restrictions

Another disadvantage associated with cent accounts lies in potential withdrawal restrictions. Some brokers set minimum withdrawal limits, which could impede access to profits accrued in a cent account if they do not meet the required threshold.

New traders may find this structure frustrating, as they might prefer to withdraw their earnings more frequently. Thus, understanding the broker's withdrawal policies before opening a cent account is essential.

Who Should Use a Cent Account?

Cent accounts are tailor-made for specific groups of traders, primarily those who benefit from low-risk trading environments.

Beginner Traders

As previously discussed, cent accounts are ideally suited for novice traders embarking on their Forex trading journey. With their low-risk nature and accessibility, cent accounts empower new traders to gain valuable experience without risking large sums of money.

An inexperienced trader can familiarize themselves with trading platforms, develop technical analysis skills, and establish a solid trading strategy. This foundational knowledge equips them for future trading endeavors and increases their chances of success.

Experienced Traders Testing Strategies

Cent accounts also serve as a valuable resource for seasoned traders wishing to test new strategies or refine existing ones. Experienced traders can engage in simulated trading scenarios to assess the efficacy of different approaches without risking their main trading capital.

The low-stakes environment of a cent account allows experienced traders to experiment with varying risk profiles or trial new strategies in a controlled manner. This practice can lead to improved decision-making and enhanced performance when applied to their primary trading accounts.

How to Open a Cent Account

Opening a cent account is a straightforward process, but it is essential to follow best practices to maximize your trading experience.

Choosing the Right Broker

Selecting an appropriate broker is the first step. It is crucial to consider factors such as:

Regulation and Reputation: Ensure the broker is regulated by recognized financial authorities, as this adds a layer of protection for your funds.

Trading Platform: Choose a broker that provides a user-friendly platform you feel comfortable using. Popular options include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Spreads and Commissions: Look for brokers offering competitive spreads and low commissions to enhance overall profitability.

Customer Support: Prioritize brokers that provide responsive customer support, ensuring assistance is available whenever needed.

Educational Resources: Brokers that offer educational materials can help you build your knowledge base and instill a sense of confidence in your trading abilities.

Registration Process

The registration process for a cent account is generally quick and uncomplicated. Most brokers feature a simple signup procedure requiring basic personal information like:

Full Name

Email Address

Phone Number

Residential Address

Proof of Identification (ID)

After submitting your application, the broker will review it, usually approving your account within a short timeframe.

Funding Your Cent Account

Once approved, you’ll need to fund your cent account to start trading. Most brokers provide multiple deposit methods, including bank transfers, credit cards, electronic payment systems, and even cryptocurrencies.

Take note of any associated fees for deposits or withdrawals, as these can vary by provider. Additionally, ensure that the minimum deposit amount aligns with your trading goals.

Trading with a Cent Account

Now that you have opened and funded your cent account, it's time to explore effective trading strategies and techniques.

Setting Up Trading Platforms

Most Forex brokers provide cent accounts with access to popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). It's crucial to take the time to set up your chosen platform according to your preferences.

Familiarize yourself with various functionalities, such as charting tools, technical indicators, and order types. Customizing your trading environment enhances comfort and efficiency during trading sessions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tips for Effective Trading

Develop a Trading Plan: Establish clear objectives and create a comprehensive trading plan. Outline your risk tolerance, preferred currency pairs, and specific strategies. Stick to this plan consistently.

Practice Money Management: Implement effective money management techniques to minimize risks. This can include setting stop-loss and take-profit levels for every trade and never risking more than a small percentage of your total capital.

Stay Informed: Keep abreast of economic news, market trends, and geopolitical events that may affect currency prices. Staying informed enables you to make educated trading decisions.

Review and Reflect: Regularly review your trades, both successful and unsuccessful. Analyzing past performance can reveal patterns and insights to improve your trading strategy moving forward.

Comparing Cent Accounts with Standard Accounts

It's helpful to understand how cent accounts stack up against standard accounts to determine which is the better fit for your trading style.

Margin Requirements

Margin requirements refer to the amount of collateral a trader must maintain in their account to open positions. Cent accounts often have lower margin requirements compared to standard accounts. This allows traders to control a larger position size relative to their deposited capital.

Leverage Options

Leverage enables traders to amplify their trading power, but the extent varies among account types. Typically, standard accounts provide higher leverage ratios, which can lead to greater gains but also increase risks. Cent accounts, however, promote responsible trading practices by limiting leverage.

Account Currency Considerations

Traders must consider the currency in which their account is denominated. Standard accounts can be opened in various currencies, often providing flexibility for international traders. Conversely, most cent accounts predominantly operate in the domestic currency of the broker, potentially limiting options for some traders.

Popular Brokers Offering Cent Accounts

With so many brokers available in the market, identifying reputable providers that offer cent accounts is essential.

Broker A: Features and Benefits

Broker A stands out thanks to its comprehensive offerings for cent account holders. They provide a user-friendly interface, competitive spreads, and a wide selection of currency pairs for trading. Additionally, they offer robust educational resources that cater to beginners, making them an ideal choice for novice traders.

Broker B: Platform Comparison

Broker B is notable for its advanced trading platform, which boasts innovative features suited for both new and experienced traders. Their cent accounts come with exceptional customer support and a variety of funding options, ensuring traders have ample choices to suit their needs.

Read more: Why is forex trading illegal in India?

Frequently Asked Questions about Cent Accounts

As with any trading accounts, cent accounts elicit many questions from prospective traders. Here, we address some common inquiries.

Common Misconceptions

Many believe that cent accounts are only suited for beginners; however, they can also serve experienced traders testing new strategies. This misconception overlooks the versatility and practicality of cent accounts.

Clarifying Confusion Around Account Types

There is often confusion regarding the differences between cent accounts, micro accounts, and standard accounts. While all serve distinct purposes, cent accounts specifically focus on minimizing risk through smaller lot sizes and lower capital requirements.

Conclusion

In summary, a cent account in Forex trading offers a unique opportunity for individuals wishing to enter the Forex market with minimal risk. By understanding the intricacies of cent accounts, their advantages and disadvantages, as well as identifying who should use them, traders can navigate their Forex journey effectively.

Whether you're a beginner looking to learn the ropes or an experienced trader wanting to experiment with new strategies, a cent account provides a safe and practical environment to cultivate your trading skills. With careful consideration and proper management, cent accounts can serve as a valuable stepping stone toward success in the dynamic world of Forex trading.

Read more: