6 minute read

Exness Raw Spread Account Review: Everything You Need to Know

from Exness

by Exness Blog

If you're considering the Exness Raw Spread account, here's the truth: it’s one of the most powerful tools for serious traders who need fast execution, ultra-low spreads, and institutional-grade trading conditions without paying excessive commissions. In this review, you’ll get a straightforward, no-fluff breakdown of what this account offers, how it performs, and whether it’s right for you.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

What Is the Exness Raw Spread Account?

The Exness Raw Spread account is a type of trading account offered by Exness designed for traders who want direct access to the market with minimal spreads. Unlike standard accounts with wider spreads and no commission, this account gives you ultra-tight spreads (starting from 0.0 pips) and charges a fixed commission per trade.

This means that instead of paying through the spread (the difference between the bid and ask price), you’re paying a transparent, fixed commission. This model is favored by scalpers, day traders, and those who use Expert Advisors (EAs), as it offers more predictable and efficient cost structures.

How Low Are the Spreads?

The spreads on the Raw Spread account are as close to zero as you can get in retail trading. During major trading sessions, spreads can be 0.0 pips on major pairs like EUR/USD. This is a big deal. It means you can enter and exit trades without needing the price to move much to cover your trading costs.

However, keep in mind that spreads can widen during news events, low-liquidity periods, or off-market hours. But even then, Exness maintains a highly competitive environment.

Commission Fees – Are They Worth It?

Yes, the Raw Spread account charges a commission — but it’s fair and transparent. Exness charges up to $3.5 per side per lot, or $7 per round turn (opening and closing). This is in line with industry standards, and when combined with the extremely low spreads, the total cost of trading is often lower than what you’d get with a Standard or Zero Spread account in the long run.

If you’re trading frequently or with large volumes, this cost structure helps you manage risk better and calculate your break-even points more accurately.

Execution Speed and Slippage

The Exness Raw Spread account benefits from lightning-fast order execution. Most orders are filled in milliseconds, which is vital for strategies that depend on quick entries and exits.

Because this account is often routed through top-tier liquidity providers, slippage is minimal. Of course, no broker can guarantee zero slippage, especially during volatile conditions, but Exness does a solid job minimizing it thanks to their strong infrastructure and global server presence.

Leverage and Margin Requirements

Exness offers flexible leverage on the Raw Spread account. For many regions, you can access up to unlimited leverage, depending on your account equity and trading instrument. This gives you the ability to maximize your capital efficiency.

However, it’s important to be cautious with leverage. While it can multiply your profits, it can also accelerate your losses. The Raw Spread account is best used by experienced traders who understand how to manage risk and use leverage responsibly.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Trading Instruments Available

You’re not limited in what you can trade. With the Raw Spread account, you can access:

· Forex pairs (majors, minors, exotics)

· Commodities (like gold, oil, silver)

· Indices

· Stocks

· Cryptocurrencies

This diversity allows you to apply different strategies across different markets — all with the same tight spreads and fast execution.

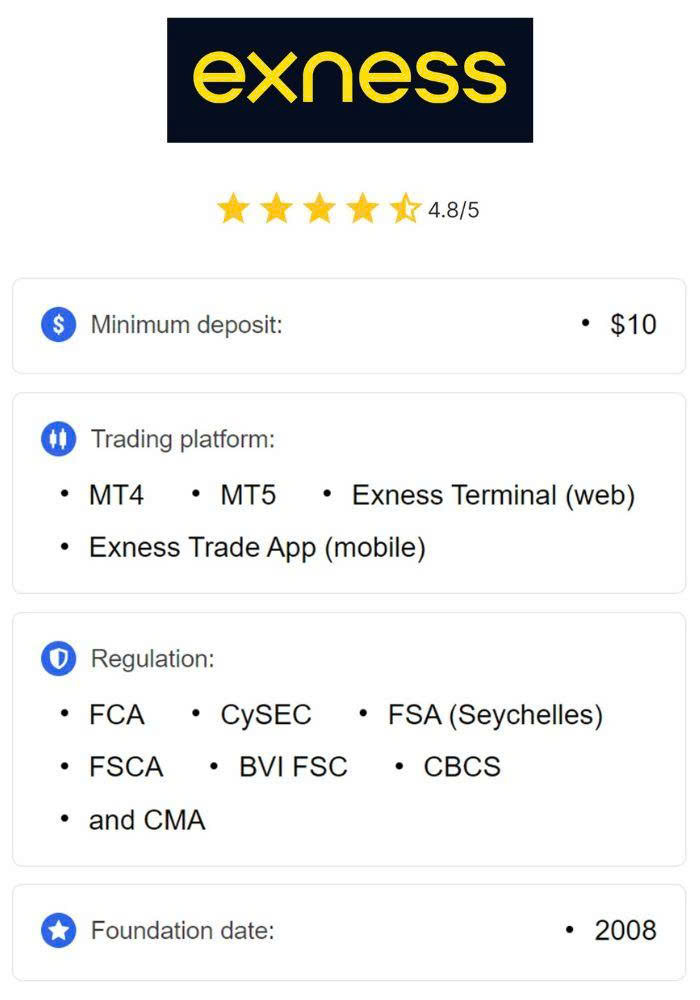

Minimum Deposit and Accessibility

One of the best parts about Exness is that it makes professional-level trading accessible to almost anyone. The Raw Spread account only requires a minimum deposit of $200, which is extremely reasonable considering the quality of trading conditions.

You can fund your account using multiple methods, including local payment systems, internet banking, cards, e-wallets like Skrill or Neteller, and even crypto in some regions. Most deposits and withdrawals are instant or processed within hours.

Trading Platforms and Tools

The Raw Spread account can be used on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness’s own web-based and mobile platforms. These platforms are feature-rich, stable, and support automated trading.

You can also benefit from:

· VPS hosting for EAs

· Economic calendars

· Market sentiment indicators

· Advanced charting tools

· Multi-terminal for managing several accounts

These tools are especially useful if you’re running automated strategies or scalping — which is common among Raw Spread account users.

Regulation and Trust

Exness is regulated by top financial authorities including CySEC (Cyprus), FCA (UK), FSCA (South Africa), and FSA (Seychelles). This gives traders confidence that their funds are secure and the trading environment is transparent.

Moreover, Exness is known for its clean track record, fast withdrawal system, and strong customer support — all of which contribute to its reputation as one of the most trusted brokers globally.

Who Should Use the Raw Spread Account?

The Exness Raw Spread account is not for complete beginners. It’s tailored for:

· Scalpers who need tight spreads and fast execution

· Day traders who place multiple trades per day

· Algorithmic traders using EAs

· Professionals who want institutional-grade pricing

· High-frequency traders managing tight stop-loss and take-profit setups

If you’re just starting, a Standard account might be more forgiving. But once you understand the mechanics of the market and start focusing on cost-efficiency, the Raw Spread account becomes a powerful tool in your arsenal.

Pros of the Raw Spread Account

· Spreads from 0.0 pips on major pairs

· Transparent commission structure

· Fast execution and low slippage

· Supports EAs and scalping strategies

· Access to all major markets

· Strong regulation and global presence

· Low minimum deposit ($200)

Cons to Consider

· Not ideal for beginners

· Commission charges might not suit low-frequency traders

· Spreads can widen during off-hours or news events

· Requires more hands-on risk management

Final Verdict: Is the Exness Raw Spread Account Worth It?

Absolutely — if you’re an experienced trader looking to optimize your trading costs and execution speed. The combination of near-zero spreads, fast order execution, and transparent commissions makes the Raw Spread account one of the most competitive offerings in the forex and CFD industry.

It bridges the gap between retail and institutional trading, giving you access to top-tier trading conditions without needing tens of thousands in your account. If your strategy demands precision and speed, this account is made for you.

Whether you’re a scalper who relies on 0.1 pip movements or a day trader who opens 20 trades per day, the Raw Spread account from Exness gives you the edge — with flexibility, low costs, and top-notch reliability.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: