6 minute read

How to Start Forex Trading in Sri Lanka: A Clear 2025 Guide

from Exness

by Exness Blog

If you're in Sri Lanka and wondering how to start forex trading, the answer is simple: You can start right away with just a smartphone, an internet connection, and a trading account. Forex trading is legal in Sri Lanka, but it is not regulated by a local financial authority. This means you must rely on trusted international forex brokers. In this guide, you’ll learn exactly how to begin, step-by-step, with no fluff—just what matters.

Top 4 Best Forex Brokers in Sri Lanka

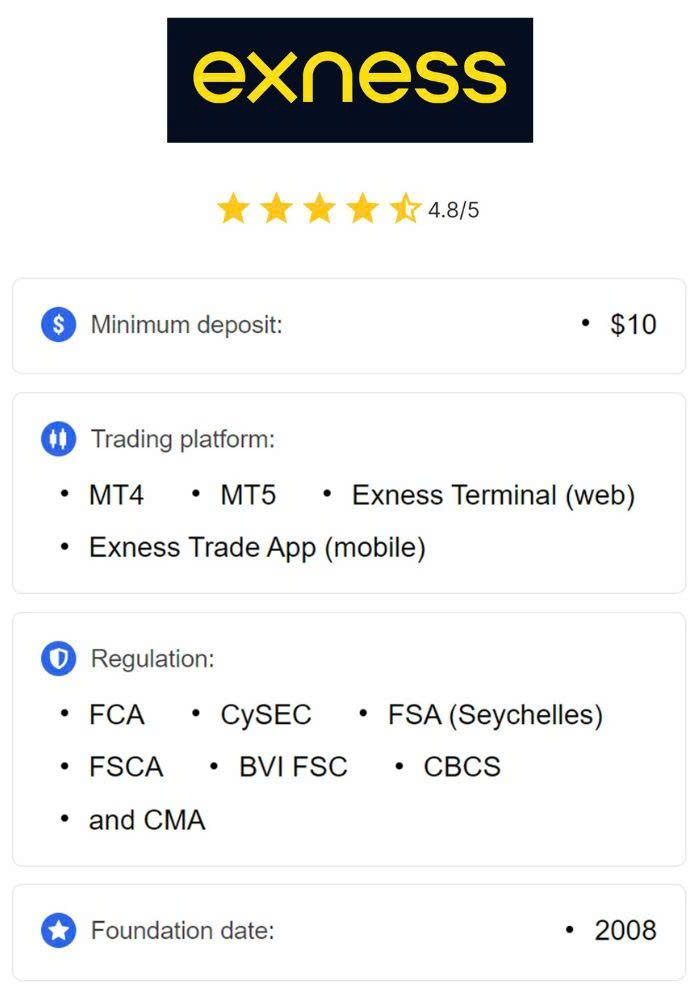

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

1. Understand What Forex Trading Is

Forex (foreign exchange) trading involves buying one currency and selling another. For example, when you trade the EUR/USD pair, you are betting on whether the euro will rise or fall against the US dollar. The forex market is the largest financial market in the world, operating 24 hours a day, five days a week.

In Sri Lanka, retail traders use global online platforms to access this market. These platforms provide real-time charts, indicators, and tools to analyze price movements and make trades.

2. Is Forex Trading Legal in Sri Lanka?

Yes, forex trading is legal for individual Sri Lankans if done through international brokers. However, it is not regulated by a local authority like the Central Bank of Sri Lanka. That means your funds are not protected under Sri Lankan law if something goes wrong.

Because of this, choosing a reputable forex broker regulated by top-tier financial institutions (like FCA, CySEC, or ASIC) is critical for safety.

3. Choose a Trusted Forex Broker

This is the most important step. A good broker offers fast trade execution, a user-friendly interface, strong customer support, and tight spreads. Popular and trusted brokers that accept Sri Lankan clients include:

· Exness

· IC Markets

· Pepperstone

· FBS

· Deriv

These platforms offer demo accounts (risk-free practice accounts), multiple trading platforms (like MetaTrader 4 or 5), and low minimum deposits. Always check the broker’s regulation and user reviews before depositing real money.

4. Open and Verify Your Trading Account

To start trading, go to your chosen broker’s website and create an account. You’ll need to provide:

· Your full name

· National ID or passport

· Proof of address (utility bill or bank statement)

· Email and phone number

Verification usually takes less than 24 hours. Once approved, you’ll gain access to the trading dashboard and can begin using the demo account.

5. Download a Trading Platform (MT4 or MT5)

Most brokers use MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms are free and available on PC, web, or mobile.

They allow you to:

· Analyze charts and price movements

· Use technical indicators

· Set stop-loss and take-profit orders

· Execute real-time trades

Beginners should start with MT4 because of its simplicity and vast educational support online.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

6. Fund Your Account

After testing with a demo account, you can deposit real money. Most brokers accept the following deposit methods in Sri Lanka:

· Visa/Mastercard

· Skrill or Neteller

· Cryptocurrency (e.g., Bitcoin)

· Bank transfer

Start small—$10 to $100 is enough to begin learning in a real environment. Choose an account type with low spreads and leverage suitable for beginners (e.g., 1:100 or 1:200).

7. Learn the Basics of Forex Trading

Forex trading is not gambling. You need knowledge and discipline. Focus on learning:

· How currency pairs work

· What affects price movement (news, interest rates, etc.)

· How to use charts and indicators (like RSI, MACD, Moving Averages)

· Risk management (never risk more than 1-2% per trade)

Free resources like Babypips.com, YouTube tutorials, or the broker’s education center are great places to start.

8. Use a Demo Account to Practice

Never jump into real-money trading without practicing. A demo account lets you simulate real market conditions with fake money. Spend at least a few weeks practicing your strategy and getting used to the platform.

Test how to enter and exit trades, apply stop-loss, and analyze charts. This practice helps build confidence without any risk.

9. Start Small and Manage Risk

Once you’re comfortable, switch to a real account with a small deposit. Avoid the temptation to “go big” quickly. Success in forex trading is about survival and consistency, not fast profits.

Use stop-loss orders to protect your funds, and never risk all your capital on one trade. Stick to a clear trading plan and always review your results.

10. Stay Updated With the Global Market

Global events like central bank decisions, inflation reports, or geopolitical tensions affect currency prices. As a trader, you must stay informed. Use forex calendars (like Forex Factory or Investing.com) to follow key events and plan your trades accordingly.

Even if you only trade technical charts, being aware of news events can help you avoid sudden market spikes that could wipe out your account.

11. Understand Tax and Withdrawal Rules

Profits from forex trading are not currently taxed specifically in Sri Lanka, but you are still required to report your income if it’s substantial. It’s best to consult a local tax advisor.

Also, remember that Sri Lankan banks may question large foreign remittances. Withdraw small, frequent amounts or use e-wallets like Skrill or Neteller to avoid banking issues.

12. Avoid Scams and Unrealistic Promises

Be careful of:

· Online forex “gurus” offering guaranteed returns

· Signals or bots that promise 100% accuracy

· MLM forex schemes asking you to recruit others

Legitimate forex trading requires time, effort, and knowledge. If something sounds too good to be true, it probably is. Focus on learning, practicing, and improving your strategy.

Final Thoughts: Is Forex Trading Right for You?

Forex trading is a legitimate way to earn online income from Sri Lanka, but it’s not a get-rich-quick method. With the right broker, proper education, and disciplined risk management, anyone can start and gradually improve.

Take your time. Start with a demo. Learn every day. And remember: it’s better to grow slow and steady than to rush and lose everything.

Whether you’re a university student, an office worker, or someone looking for a side hustle in Sri Lanka, forex trading is a skill that, once mastered, can offer long-term financial independence. But only if you treat it with respect.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: