6 minute read

How Much Does Exness Charge Per Withdrawal? A Clear Breakdown

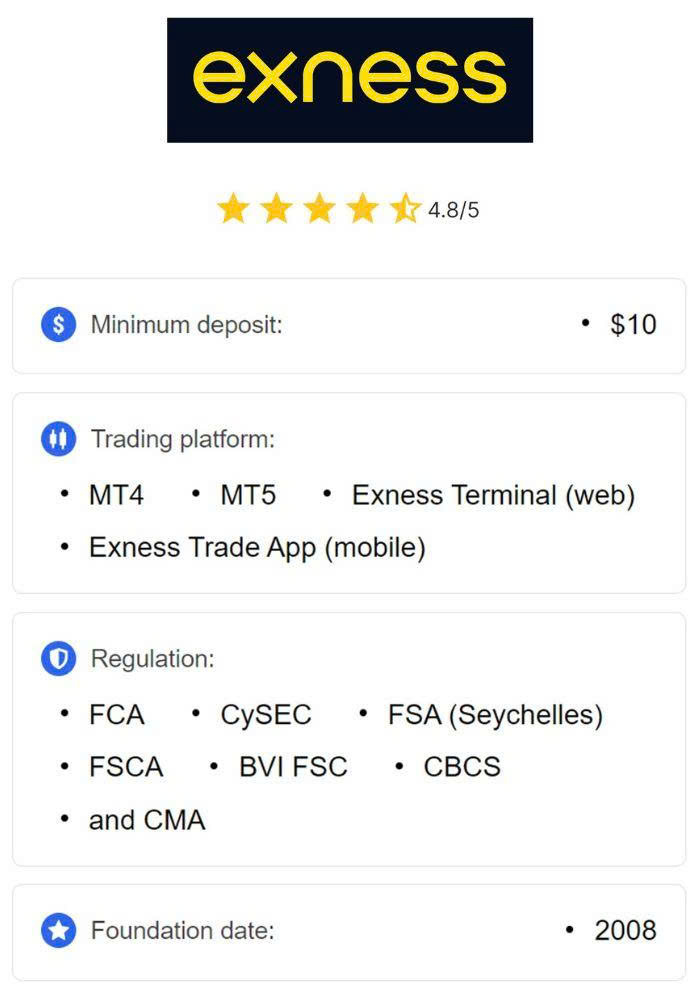

from Exness

by Exness Blog

If you're using Exness to trade forex, crypto, or other financial instruments, one of the most important questions you’ll want answered right away is: How much does Exness charge per withdrawal? The straightforward answer is this: Exness does not charge any internal fees for withdrawals. That means when you withdraw money from your Exness account to your preferred payment system, Exness itself won’t deduct a withdrawal fee.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

However, this answer comes with nuances that are important for any trader to understand, especially those aiming to minimize costs and maximize efficiency. Let’s dive deeper into what “no fees” really means, the payment systems available, possible third-party charges, and how to optimize your withdrawals on Exness.

No Internal Fees by Exness

First, it’s important to reiterate: Exness does not apply withdrawal fees on its side. This is a key part of their business model and client-first approach. Whether you're withdrawing via a bank card, crypto wallet, e-wallet, or local payment system, Exness itself will not impose a charge.

This fee-free policy makes Exness one of the more cost-effective brokers for active traders and scalpers who move funds frequently.

Payment Systems and Possible External Fees

While Exness doesn’t charge withdrawal fees, that doesn't mean every withdrawal is entirely free of cost. Some third-party payment processors may charge fees, and those costs are not controlled or covered by Exness. Here’s how it works across different payment methods:

1. Bank Cards (Visa/Mastercard)

When withdrawing to your bank card, Exness doesn’t charge a fee. However, your card-issuing bank might charge a currency conversion fee, international transfer fee, or even a fixed transaction charge. These are external fees that you, as the client, would need to verify with your bank.

2. Electronic Wallets (Skrill, Neteller, Perfect Money, etc.)

Withdrawals to e-wallets are generally fast and fee-free from Exness. But again, the e-wallet provider may apply a small fee when you move the money from their wallet to your bank account or other destination. For example, Skrill might charge a percentage-based fee to withdraw to a local bank.

3. Cryptocurrencies (Bitcoin, Tether, Ethereum, etc.)

Crypto withdrawals from Exness don’t include any fees from the broker. However, blockchain network fees (also called “gas fees”) apply. These are dynamic and depend on the network congestion at the time of your transaction. Exness does not profit from these fees; they’re purely technical costs imposed by the network.

4. Local Payment Systems

In many countries, Exness integrates with local payment gateways (such as bank transfers, mobile payments, and regional e-wallets). Exness doesn’t charge fees here either, but the local provider might apply a service fee or currency exchange spread depending on your country.

Minimum and Maximum Withdrawal Limits

Although Exness doesn’t charge for withdrawals, each payment method has its own minimum and maximum limits. These limits can indirectly impact your cost efficiency. For instance, if your payment method has a high minimum withdrawal amount, you may need to accumulate more funds before cashing out, potentially missing short-term profit opportunities.

Examples:

· Skrill and Neteller: Minimum $10 per withdrawal

· Bank card: Minimum $3 per withdrawal

· Crypto: Varies based on currency (e.g., minimum 0.001 BTC)

· Local bank transfers: Minimums depend on country

Note: Always check the exact limits and rules within your Exness client portal, as these can vary based on account verification level, region, and recent account activity.

Withdrawal Processing Time

While not directly a fee, withdrawal speed matters for cost-sensitive traders. Exness processes most withdrawals instantly or within a few hours, particularly with e-wallets and crypto. Bank transfers and card withdrawals might take 1–5 business days, depending on your bank’s processing times.

Quicker withdrawals mean quicker reinvestment or spending, which has an opportunity cost benefit, especially for high-frequency traders or fund managers.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Currency Conversion Fees

Another important factor is currency conversion. If your trading account is in USD, but you withdraw to a local bank account in another currency (e.g., VND, IDR, NGN), the intermediary bank or payment processor will apply an exchange rate spread. This isn’t a fee per se, but it effectively reduces the amount you receive.

Exness does not set these exchange rates — they are determined by the external financial institutions handling the currency exchange.

To reduce these costs:

· Use a trading account in the same currency as your withdrawal method

· Choose local payment systems that support your currency directly

· Avoid converting multiple times (e.g., USD → EUR → IDR)

Real-World Example

Suppose you're a trader in Indonesia using Exness. You fund your account with USD using a local bank and trade profitably. You then withdraw to your local bank account.

· Exness charges you $0 withdrawal fee.

· Your bank might apply a 1–2% currency conversion spread.

· If you use an intermediary like Skrill, you may also face a 1% withdrawal fee from Skrill when moving funds to your bank.

So while Exness doesn’t charge a withdrawal fee, your real net payout might still incur minor costs depending on the route you choose.

Tips to Minimize Withdrawal Costs on Exness

1. Choose the Right Payment Method

Use local payment systems or e-wallets that align with your withdrawal currency to avoid double conversions.

2. Keep Funds in One Currency

Try to deposit, trade, and withdraw in the same currency to eliminate conversion losses.

3. Avoid Frequent Small Withdrawals

Even though Exness doesn’t charge per withdrawal, doing many small withdrawals may increase third-party fees.

4. Withdraw During Weekdays

Some banks process faster during weekdays, potentially avoiding hold times and associated delays.

5. Check with Your Bank or E-wallet Provider

Get clarity on their own fees so you can factor those in before selecting a withdrawal method.

Final Verdict: Exness Withdrawal Fees Are Zero — But Stay Informed

To sum up, Exness does not charge a fee for any withdrawals, regardless of the payment system used. However, third-party providers like banks, blockchain networks, and e-wallets may apply their own charges, which are outside of Exness’s control.

Understanding this structure gives you a competitive edge. It allows you to strategically plan your deposits and withdrawals, minimize costs, and ensure that more of your profits stay in your hands. Always review the withdrawal conditions inside your Exness account and consult your payment provider for the most accurate fee information.

If you're looking for a transparent broker with zero withdrawal fees and a wide range of funding options, Exness is a strong contender. Just remember: while the broker plays fair, it’s up to you to choose the most cost-efficient route to move your money.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: