3 minute read

Horticultural Growth Strengthens Trade Relations between The U.S. and Mexico

U.S.-Mexico trade relations have experienced significant growth in recent decades, especially in agri-food exports. From 1994 to 2022, total U.S. exports to Mexico have increased more than sixfold, from $4.6 billion to $28.4 billion, with an annual growth rate of 6.66%. The horticultural products sector has experienced a remarkable increase in terms of the number of products exported from 1994 to 2022. Specifically, the amount of product exported has increased from 585 million tons recorded in 1994 to 2.3 billion tons reached in 2022. This increase translates into an average annual growth rate of 5.05%, on average, throughout that period.

This significant increase in the number of exported horticultural products reflects this sector's importance in the U.S. economy. High-quality horticultural products are in high demand in international markets, and the ability of the United States to produce and export these products makes it a key player in this area.

Advertisement

We expect the horticultural products sector to continue to grow in the coming years, thanks to a combination of increased global demand and the ability of the United States to produce and export these products. This growth will not only have a positive impact on the U.S. economy but will also help meet the growing demand for horticultural products around the world, helping to improve food security and promote international trade.

With horticultural products, growth has been even more dramatic. In 1994, U.S. horticultural exports to Mexico were valued at $604 million; in 2022 they reached $3.9 billion. This impressive increase is due to the increased opening of markets and improved trade relations between the two countries.

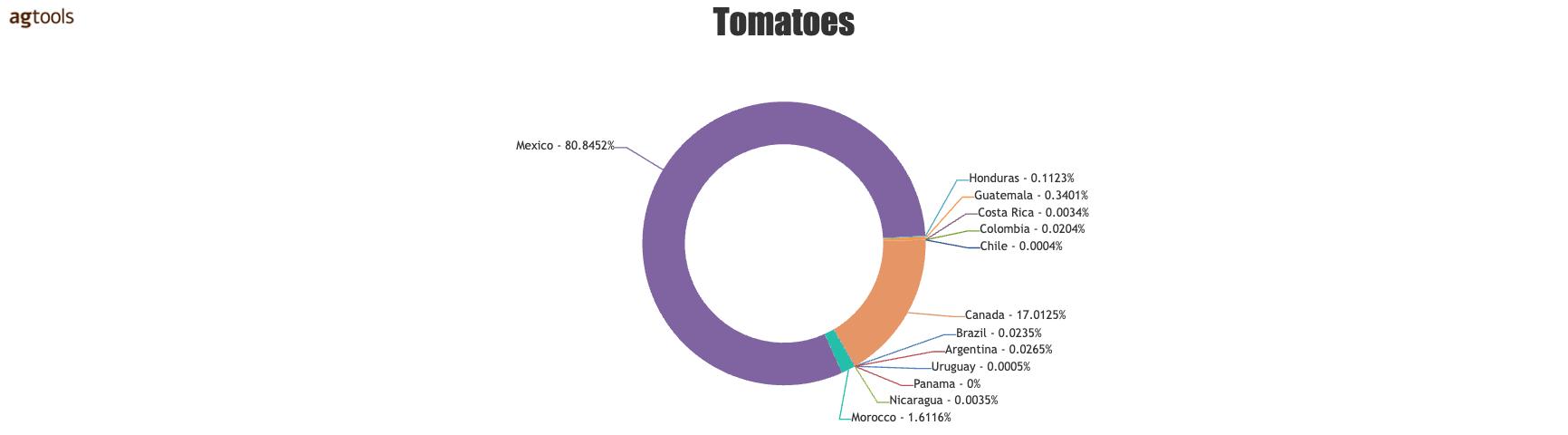

Tomatoes - Export Global

04-19-2022 to 04-19-2023

In terms of horticultural products, the major products that the United States exports to Mexico are fruits, vegetables, and greens, and their demand has increased in recent years. Product quality and transportation infrastructure are key factors in the success of these exports.

In summary, U.S. horticultural exports to Mexico have experienced exceptional growth in recent decades, demonstrating the importance of cooperation and trade between these two neighboring countries.

The horticultural products export market is highly dynamic and presents significant fluctuations in demand during different periods. During January 2019, ORG ONION SET FR and ONIONS/SHALL,F/C led exports with values of $6.358 million and $5.125 million respectively. Throughout the period from 1994 to February 2023, ONIONS/SHALL,F/C and TOMATOES OTHER exports stood out in February 2017, with values of $4.757 million and $3.858 million, respectively. In March, the best export year was 2011, where TOMATOES OTHER and ONIONS/SHALL,F/C topped the list with values of $3.867 million and $3.777 million respectively.

The United States has exported significant quantities of vegetable products to Mexico in the last three months of the year. During October 2020, ONIONS/SHALL,F/C and ONION SETS FR/CH led exports with values of US$11.373 million and US$8.218 million, respectively. In November, ONIONS/SHALL,F/C and OTHER TOMATOES topped the list with values of $7.635 million and $4.803 million, respectively.

Finally, in December 2006, ONIONS/SHALL,F/C reached its best level with a monthly export of US$11.876 million. This data shows the relevance of agricultural products in international trade and the importance of being aware of demand fluctuations to make production and export decisions.

This data shows the importance of U.S. vegetable product exports from the United States to Mexico, which has experienced tremendous growth in recent decades. The quality and value of these products are key factors in the success of these exports, and we expect that this market will continue to be an important driver of trade between the two countries in the future.

The United States imports from Mexico have undergone a significant increase in recent years. In 1994, total agricultural imports from Mexico reached US$3.0 billion, increasing to US$43.4 billion by 2022, representing an average annual growth rate of approximately 9.96%.

Among the main sectors that have improved their growth in average annual terms is dairy products with an annual growth rate of 17.68%, followed by poultry products with an annual growth rate of 14.14%, Grains & Feeds at 13.13%, Oilseeds & Products 10.51%, and with Horticultural Products 10.48%.

Onions Dry - Import USA

- Import USA 04-19-2022 to 04-19-2023

In recent years, U.S. imports from Mexico have undergone a significant change in terms of growth and expansion. In 1994, total U.S. agricultural imports from Mexico amounted to US$3.0 billion, but by 2022 this figure had increased dramatically to US$43.4 billion, which is equivalent to an average annual growth rate of close to 9.96% on average.

Among the top sectors that have experienced the highest growth in terms of average annual growth rate is dairy products, with an impressive annual increase of 17.68%. poultry products follow closely behind, with an annual growth rate of 14.14%. Grains & feed have also seen steady growth, with an annual growth rate of 13.13%. Oilseeds products and Horticultural products recorded annual growth rates of 10.51% and 10.48%, respectively.

This increase in imports of agricultural products from Mexico reflects the growing importance of Mexico as a food supplier to the United States and the close collaboration between the two countries in the agricultural sector. The quality and diversity of Mexico's agricultural products are key factors in its success, and we expected that this market will continue to grow in the coming years, strengthening the relationship between the two countries.