7 minute read

Minimise ingredient variability and supply chain risk with sustainable US soy, says USSEC

Soy is everywhere in animal nutrition. As an oilseed and a legume, it is an extremely versatile ingredient for food, feed, and energy: soybean meal is, of course, a staple in monogastric diets, whole soybeans can be fed to cattle, and soy-derived ingredients are even increasingly used in fish and shrimp diets as a sustainable alternative to marine-sourced feed.

However, all soy is not created equal — at least not according to the US Soybean Export Council (USSEC). Instead, argues Tom D’Alfonso, director for animal nutrition and aquaculture at USSEC, those interested in maximising the nutritional value for their animals, minimising the carbon footprint of their consumption, and avoiding potential supply-chain disruptions caused by logistical chokepoints should pay careful attention to the origins of the soy products they purchase. In today’s Perspectives piece, D’Alfonso presents the evidence for these claims, making the case that this economical and nutrient-dense ingredient can and should remain an important part of sustainable feed formulations.

[Feedinfo] Soybean meal quality is a function of several different factors, including whole soybean quality, soybean processing indicators, digestible amino acids, and energy content. Can you explain how US soy performs on these metrics?

[Tom D’Alfonso] The value of soybean meal in the diet is determined by its amino acid (AA) profile and the digestibility of those amino acids. U.S. soybean meal has better AA digestibility for swine and poultry compared to products sourced from Argentina and Brazil. Higher amino acid digestibility translates into superior animal performance, less nitrogen wasted, and reduced diet costs. The energy content must be considered when assessing the total intrinsic nutritional value of the soybean meal in swine and poultry diets. Compared to other soybean meal origins analyzed, the U.S. has a higher Net Energy (NE) and Apparent Metabolizable Energy, nitrogen corrected (AMEn) values than Brazil and Argentina. NE and AMEn are the most common energy measures for swine and poultry diets, respectively. Sucrose also contributes to higher energy levels. Sucrose levels in U.S. soybean meal have been consistently higher than Brazil, and comparable to the Argentinian meal. The higher level of energy and sucrose gives an advantage to U.S. soybean meal, which contributes to reducing diet costs, increasing animal performance and sustainability.

[Feedinfo] How does US soy measure up in terms of the consistency of its amino acid content? Are there other relevant characteristics in which US soy is more consistent than soy from other origins? And why is consistency important for feed formulators?

[Tom D’Alfonso] One of my favorite sayings is “There is no quality without consistency” and this is where U.S. soy really excels. For the meal to be consistent, every upstream practice demands world-class quality control. Our growing and harvesting conditions for the beans are the most advanced and sustainable in the world by a large factor, hands-down. When crushers receive consistent US soybeans, they are better able to control their process and produce more consistent soybean meal. This is a big factor in keeping the nutrients, such as amino acids and calories, digestible and metabolizable. Nutritionists can formulate feed with more confidence in the nutrient composition. Feed millers also like the consistency of the meal in terms of particle size distribution, flowability, and consistent pellet quality.

[Feedinfo] Tell me more about the studies which identified this difference between the quality and consistency of soy of different origins. How were samples deemed representative of a whole country’s supply selected? Who ran the tests? When did they take place? Was this a one-time study or part of an ongoing monitoring program?

[Tom D’Alfonso] Quality measurements are collected, analyzed, and shared on an ongoing basis. Protein, amino acid, and energy data are obtained from Evonik and summarized based on international trading specifications. Additional U.S. data are sourced from the USDA FGIS public database. Brazilian and Argentinian data are collected from different surveyors and summarized by Ag-Commodities (Tap Top Ventures, Ltd.) Since 2017 we have seen that total damage of Brazilian-origin beans is approximately 5 times that of US soy.

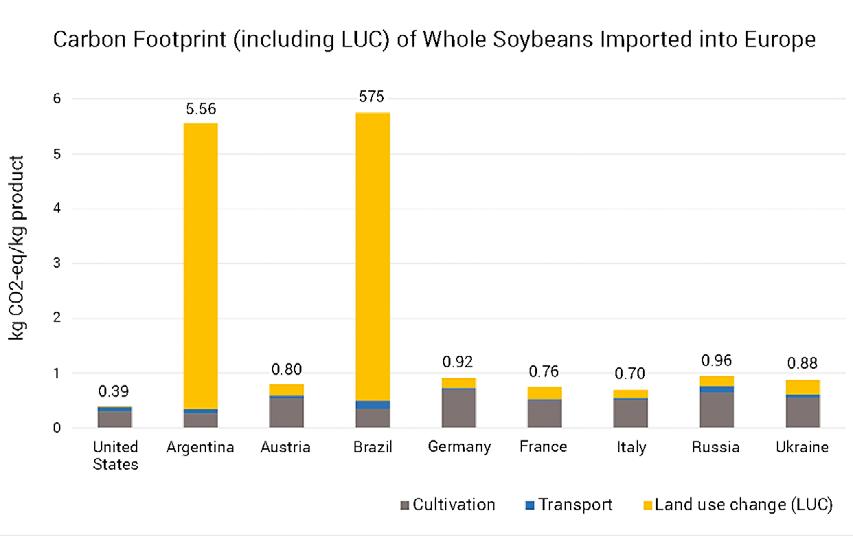

[Feedinfo] USSEC claims that the carbon footprint of U.S. soybeans is significantly lower than those of other origins, at 0.4 kilograms CO2 per kg of U.S. soybeans vs. 5.6 kilograms for soybeans from Argentina and 5.7 kilograms for soybeans from Brazil. What accounts for this difference? And what more can you share about the methodology for this assessment?

[Tom D’Alfonso] More often than not, the dialogue about the sustainability of soy speaks in generalities and doesn’t account for differences by origin. To demonstrate the U.S. soy advantage, we worked with Blonk Consultants using the Agri-footprint database to compare the carbon footprint of U.S. soybeans to other sourcing countries of soy. In the specific case you’re mentioning, this compares whole soybeans shipped to Europe. This calculation includes the cultivation, the transportation (both within the country of production and transportation from the point of export to destination), and land use change. The largest difference between the values is attributed to land use change, with it accounting for only 4% of the U.S. carbon footprint, but 94% of Argentina’s and 91% of Brazil’s. These calculations evaluate land use change over the last twenty years, which is the industry standard. It is important to look at the environmental impact of soybean production and there are several third-party sources that allow users to make these comparisons, including Agri-footprint and The Global Feed LCA Institute.

[Feedinfo] Beyond land-use change, US soy producers are proactively working to improve the sustainability of their production practices. Can you give any more information about this work, including examples of the kinds of practices that can help bring about improvements such as better resource efficiency or lower emissions?

[Tom D’Alfonso] U.S. soybean farmers have long prioritized sustainability and continuously strive to improve their farming practices. As predominantly family-owned operations (97% of farms), U.S. soybean farmers are committed to leaving the land in better condition for future generations. This can be seen in the adoption of practices like no-till and conservation tillage, cover crops, precision agriculture, and participation in programs offered by the U.S. Department of Agriculture (USDA) Natural Resources Conservation Service. This is reflected in U.S. soybean farmers’ commitment to achieve specific sustainability goals by 2025 (with year 2000 as the benchmark):

• Reduce land use impact by 10%

• Reduce soil erosion by 25%

• Increase energy use efficiency by 10%

• Reduce total GHG emissions by 10%

[Feedinfo] Finally, USSEC claims that the reliability of US infrastructure is another competitive advantage for US-origin soy. Can you elaborate?

[Tom D’Alfonso] One of the cardinal rules in supply chains is to avoid putting all your eggs in one basket. The U.S. soybean industry benefits from being able to access multiple supply chain options. Soybeans grown in the U.S. are ultimately exported from the Mississippi Gulf, the Pacific Northwest, the Atlantic Coast, the Texas Gulf, the Great Lakes, and via railroad to border countries. As a result, when challenges materialize in one of our supply chain options, they may cause inconvenience, but the industry is able to remain resilient by redirecting to other transportation options.

While many opportunities exist to invest more thoroughly into our transportation system, the U.S. still enjoys infrastructure that allows soybeans to be transported more cost effectively and reliably than our competitors. We continue to benefit from the investments in locks and dams, freight rail, roads and bridges, and ports that consistently allow U.S. soybeans to reach our valued customers more predictably and economically. One of the secrets to the U.S. soybean supply chain is the utilization of barge and rail transportation — the modes of transportation designed to transport high volume commodities long distances in an economical manner. The cargo capacity of barge and rail far exceeds trucking, which is still disproportionately utilized by many of our international competitors.