2 minute read

Debt-Equity Ratio

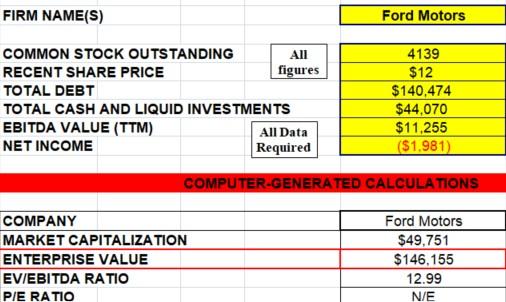

According to Yahoo Finance (2023), the share of Ford is trading at $12. The common stock outstanding for the company is 4139 million. Therefore, the market capitalization of the company is $49.751 billion. However, the valuation will use the enterprise value approach to determine the value of the company because the enterprise value approach takes into account the cash and debt of the company. Thus, the value of the company is $146.155 billion. This is the value BYD will pay to acquire Ford Motors. The valuation is summarized in the following figure.

15: EV Value of Ford Motors

Advertisement

The growth in revenue and assets will greatly benefit BYD in enhancing its operations and penetrating new markets. The company has a positive average growth in revenues and assets. The table below summarizes the revenue and asset average growth rate.

Also, the company’s weighted average cost of capital is 7%, which is affordable for BYD.

Final Discussion and Conclusion

The study was centred on identifying a company that BYD will acquire to underpin its leadership in the electric vehicle industry. The findings indicate that Ford Motors is a strategic company that BYD will acquire and gain market traction and growth. The company's financial ratios indicate that it is profitable, liquid, efficient, and well managed its debt. The company also has an enterprise value of $146.155 billion. Also, the company’s revenue and asset growth are positive. Incidentally, the company has a weighted average cost of capital of 7%.

The findings mean that Ford is a good company to acquire for BYD. The financial ratios indicate that the company is in financial health. Also, an enterprise value of $146.155 indicates that the company is highly valuable. The weighted average cost of capital of 7% indicates that the company has a good credit history. The positive revenue and asset growth indicate the company's operations are efficient. These findings are crucial to the study because they show that Ford Motors is a valuable company.

Balawardhana (2020) researched Ford Motors and found similar results to the results arrived at by this study. Balawardhana (2020) discovered that Ford's electric vehicles are giving the company a great boost in market expansion and revenues. In 2020, Balawardhana (2020) valued the company at $33.46 billion, and this study valued the company at $49.751 billion, indicating that the company's value has increased.

The study's main limitation is that it used accounting figures availed by the company. Therefore, the study assumes that the financial statements available to the public are well-audited and reflect the truth about the company's financial position. Also, the study only exhausted some of the valuation criteria. Thus, the study suggests further study on the company, including an intensive study of the company's dividends, stock history, and financial statements.

The information is crucial in deciding whether to acquire a company or not. When evaluating a company for acquisition, it is crucial to consider financial ratios, historical revenues, and the company's assets. It is also crucial to consider how the company's financing is structured.

Incidentally, using the enterprise value approach to value a company is crucial because it considers the company’s debt and cash.

Reflection

The assignment taught me how to research a company for acquisition. Also, the study enlightened me on how to undertake company valuation, including ratio analysis, financial statement analysis, and calculating enterprise value. Incidentally, the assignment taught me how to report valuation results.

References

Balawardhana, M. (2020). Marketing and Digital Future - Ford Motor Company. Marketing and Digital Future with Ford Motor Company, https://www.researchgate.net/publication/345228131_Marketing_and_Digital_Future__Ford_Motor_Company.