10 minute read

Aussie Home Loan Holdings Pty Ltd: Case Study

Executive Summary

Aussie Home Loan Holdings Pty Ltd operates in Australia serving in the financial sector where it provides numerous services such as mortgage provision, general insurance, asset investment, securitisation, stock registry and shares, and credit cards. The Australian financial sector has previously been under the strong services of major banks but the government moved to liberalise the sector by allowing other players, including non-bank institutions to as well service it. AHL, thus, is a non-bank company but effectively competes with banks to provide services to the market. The government’s move of liberalisation helped the industry to improve on its overall services as competition intensified and players sought for added quality services to attract more customers. Buy this excellently written paper or order a fresh one from acemyhomework.com

Advertisement

The government also abolished the capping of interest rates charged by companies in order to allow for added competition. This move has seen service penetration, particularly in the insurance sub-sector rise up considerably while costs charged by companies have gone down. The financial services have growingly become affordable to majority of Australians as more people today continue to seek for house loans and other security services. However, Australia’s position comparatively lags behind in the region as well as compared to other countries with similar economic size to Australia’s. Currently there are industry players of almost the same magnitude which have continued to effectively compete against each other in quest for establishing strong market leadership. The government has established regulations that ensure healthy competition between players as well as protection of consumer interests and rights.

Aussie Home Loan Holdings Pty Ltd: Case Study

Introduction

Organizations draw out their business plans for the near and unforeseen future well in advance to determine their course of action as they seek to attain their objectives. Strategy management, thus, enhances chances of an organization meeting its objectives accurately and in the most efficient manner. This paper seeks to discuss strategy management with reference to Aussie Home Loans, AHL, an Australian proprietary company that deals in mortgages, credit cards, insurance, as well as personal loans.

AHL Holdings Pty Ltd Background Information

According to Aussie (2012, para 1), AHL Holdings Pty Ltd is a retail financial services company that began its operations in Australia in 1992. The company operates both as a franchise and privately owned retail outlet. It is a non-bank company with its headquarters located in Sidney, and whose operations extend across the whole of Australia. About 180 workers have been employed by the company which also works with over 750 accredited mortgage brokers with its main services offered to the market being issuance of mortgages, life and general insurance, personal loans, and credit cards services. AHL operates in a multiple of industries that include stock exchange and share registry, mortgage broking, securitization vehicles, general insurance, as well as financial asset investors.

Macro-environment Analysis

Political environment

The government of Australia eliminated a previously existing standard rate of home loan interest which stood at 13.5% for all banks. The government’s move in 1986 of unrestricting interest rates for home buyers resulted into the entry of non-bank mortgage lenders, such as

AHL, into the market to effectively compete with the main banks. The move by government, apart from providing a chance for new entrants into the market, also enabled interest rates to decline and players to improve on their quality service performance as competition intensified (Robert & Wayne 1999, p. 7). In the insurance industry which AHL is also a player, the government has established regulatory measures that put a limit to discounting, which is at 12% of the premium value. The regulations also stipulate that discounts be warranted in terms of payroll cost savings, as well as the direct debit deductions instead of the health risks concerned. These regulatory constraints which apply on product differentiation together with the effective claims collectivisation consequently imply that competition in terms of price is ‘marginally effective’ (Varkevisser & van der Greest 2002, p. 65).

Economic environment

The effects of the slowing global economy in the period beginning in 2008 and stretching to 2012 have had some negative consequences in the Australian economy, subsequently weakening domestic demand. In essence, the unemployment rate of the country rose 3.9% in the beginning of 2008 to register comparatively higher figures of up to 6.0% in 2009. These changes affected the insurance industry as it caused the market to remain generally stagnant for quite some period of time. With the interest rates recording an all time high of 7.25% in the third quarter of 2008, financial borrowing and lending market, in which the mortgage sub-sector falls, also suffered from choked off consumption. The heavily indebted households which were repaying their mortgages at the time found it difficult to continue with the same while the numbers of fresh seekers of mortgages were also declining. The table below summarises the Australian insurance industry in general, including forecasts, for the period between 2005 and 2012.

Source: Australia Insurance Report Q1 2009

Socio-cultural environment

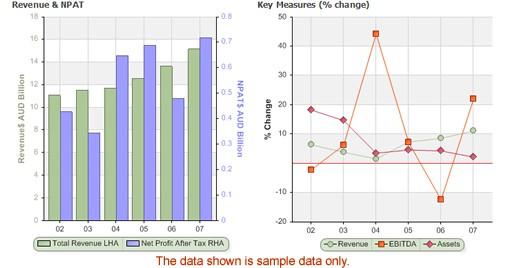

Mortgage and loan borrowers in Australia are increasingly resorting to multiple mortgage brokers as a way of attempting to verify offerings in the market. This change of tact by the consumers has particularly been enhanced by the fact that borrowers previously relied on the services of mortgage brokers in order to arbitrage banks’ mortgage prices. In general, the potential mortgage consumer market in Australia remains relatively low due to the high charges and revenues that are levied onto the consumers. Equally, the oligopoly structure of the insurance industry which has caused inefficient operation by the players has continued to discourage most Australians from seeking mortgages and other loans. The graph below indicates the general structure of the mortgage industry in the country between 2002 and 2007.

Source: IBIS World

Technological environment

Australian borrowers of mortgage and loans are increasingly turning to using the internet as a perfect mechanism through which they can discover price. However, quite a substantial number of borrowers still rely on physical face to face meeting in order to close deals. With the presence of the internet, a new trend has emerged among borrowers where applications are done online as opposed to the traditional practice of doing the same at the existing branch offices. Environmental environment

Every business player in the Australian market is expected by law to adhere to environmentally friendly practices. Both federal and territorial laws require that companies provide environmental planning for approval by the jurisdiction, to showcase how the entity intends to operate in its dealings without causing negative effects to the surrounding.

Legal environment

The Australian regulatory arrangements require that financial service providers, such as AHL, be holders of the Australian Financial Services licence, commonly referred to as the AFS licence. These providers include credit unions, financial advisors, insurance companies, as well as commercial banks. Part of the conditions required before the attainment of licence include obtaining membership of the overall industry dispute resolution scheme for the entire industry, as well as meeting all training requirements. The Uniform Consumer Credit Code, on its part, regulates the provision and general handling of credit, and its enactment is based on State legislation. Under Uniform Customer Credit Code regime, credit firms are not mandatorily required to be AFS license holders and thus may opt out of dispute resolution scheme membership. The Australian Prudential Regulation Authority, abbreviated as APRA oversees overall operations of financial institutions in the country. APRA particularly ensures that depositor’s interests, together with policy holders and other consumers in the industry have their interests protected against any unfair practises that may be pursued by players.

Analysis of the industry using Porter’s 5 Forces

Entry of new players into the market

The Australian financial sector has a low threat of market entry for new players seeking to join the financial sector. The existing players are elaborately established and enjoy large economies of scale which consequently makes it difficult for small firms with limited capital to effectively compete. The major banks, for instance, have been in existence for several decades and have deep market experience which can hardly be challenged by new entrants. Equally, the financial firms already in existence, such as AHL, have successfully managed to differentiate the market such that it would require any new player seeking to explore the industry to pay huge penetration costs in order to match or even out do the established companies (Shamsullah 2011, p. 23).

Risks posed by substitutes

The threat of substitution is high in the industry due to the fact that there exists quite a number of financial institutions, both banking and non-banking, which offer services to the market. These firms are well established, with long term experience, and performance track records which loan borrowers and insurance service seekers can check and ascertain as promising. Due to the high market competition experienced in the industry, companies have improved on the quality and service delivery in order that they may attract as many customers as possible. Customers can opt for services with enhanced satisfaction, and those that are specially customised to perfectly suit their individual needs from numerous institutions and firms in the market (Salter & Rush 2001, p. 39).

The bargaining power of buyers

Buyers in the industry are less powerful due to the fact that the switching costs for most consumers remain relatively high, limiting their options of changing their service providers. It is also difficult for buyers to enjoy backward vertical integration in which case they can supply their own insurance and mortgage services.

The bargaining power of suppliers

The industry suppliers, in this case the reinsurance service providers, are powerful owing to the fact that they are limited in number. The services provided by the reinsurance firms are critical in the sense that it is mandatory by law that each insurance company be insured in the first instance before they can seek to provide the same services to the external buyer market. Thus, reinsurance companies not only provide a rare service but also one which is mandated by the law before firms can be allowed to operate. Companies, including banks, will incur exorbitant costs if they attempted to switch suppliers at any given point, making it almost impossible to do business with such huge costs. In this industry, most of the suppliers can also integrate forward, by supplying their services without necessarily requiring the other financial firms.

Competitors and rivalry between them

Competition degree in the overall Australian financial sector is high owing to the aggressiveness shown by competitors as they seek to gain market leadership. While the nonbanking financial companies, such as AHL, Australian Finance Group, as well as Mortgage Choice, among many others are working hard towards establishing their market positions, the banking institutions are also involved in extra service that seeks to maintain them in the leadership position within the industry (McCredie 2011, p. 2). The larger competitors in the industry are also equally of the same size and share an almost similar power to compete for the market against each other. The fixed costs of operation in the industry are high as companies pay their professional workers comparatively high wages, and pay higher amounts for other service necessities such as office space and accompanying bills. The differentiation levels in the industry also remain low as players appear to offer similar services across board.

VRIN Analysis at AHL to enhance Sustainable Competitive Advantage

Value of strategic high level technology

Technology will increase quality provision to customers through increasing the accuracy levels. Although strategic technology is expensive to acquire, its boost on service provision will enable AHL to recoup its initial cost and eventually enable the firm to continue earning high profits.

Rarity of strategic technology

In developing and acquiring its own unique technology, AHL must involve its Research and Development department such that it becomes unique to AHL. This will make it almost impossible for competing firms in the industry to gain access to it.

Inimitability of strategic technology

By involving internal IT workers as well as other professionals at the Research and Development department, AHL’s technology idea will only be unique to the company. This implies that the technology would not be available in the market to allow other firms access to it.

Non-substitutability of strategic technology

Given the exclusive nature of AHL’s developed and adopted strategic technology, it would be impossible for other firms in the industry to out do it by availing a better or superior piece of technology. This is because no competitor will have the idea, in the first instance, about AHL’s technology.

Generic Strategy Business Type

Low-cost producer strategy

AHL adopts a general low-cost business strategy which basically highlights the company’s objective of cutting down on its operation costs while also seeking to enhance its service delivery to the clients. The adoption of this business strategy has mainly been advised by the fact that the Australian market is basically one that is comprised of price conscious buyers. Additionally, the industry experiences stiff competition particularly among the well established firms, and more so the main established banks, and therefore AHL typically seeks to establish itself as the leading industry player ahead of the rest. The company thus plays a crucial role introducing comparatively low prices in order to win sales, as well as build stronger market share (Kraal & Yapa 2012, p. 93).

Conclusion

AHL Holdings Pty Ltd is a non-bank financial institution operating in Australia, and whose main services to the market include provision of home loans, securitisation, insurance, asset investment, and credit cards services. The company is among other non-bank firms which were allowed to advance mortgage services to the Australian market, a business function that had previously been a preserve of banks. The government’s move to liberalise financial services and consequently eliminate rate capping allowed competition into the industry as new players lowered prices and attracted more customers. The government regulates the industry through enactment of policies that seek to enhance customer protection from players, as well as provide a level playing ground to ensure healthy competition between players. Australia’s relatively good economic stance has seen most industry players cushioned against harsh conditions, both internal and external, that could harm performance. However, the market remains relatively smaller, particularly in terms of home loan borrowers, mainly due to high costs charged previously by earlier players. AHL pursues a low-cost producer strategy in a bid to establish itself as the market leader and effectively compete against its main rivals who are of an almost equal size. The company needs to build a competitive advantage by seeking to introduce more customised products that would attract the market and establish loyal customers.