4 minute read

Braithewaite

& Co. Company Financial Analysis

Ratio Analysis

Advertisement

The ratios to be analyzed for proper judgment of the rolling stock industry are the cash ratio, quick ratio, current ratio, current assets turnover, inventory turnover, debtor turnover, credit turnover, debt-equity ratio, interest coverage ratio, gross profit margin, operating profit ratio, pre-tax profit ratio, net profit ratio, operating ratio, and earnings per share. Generally, the ratios can be classified into liquidity, activity, leverage, profitability, and valuation ratios.

Liquidity Ratios

Liquidity ratios assess the capacity of a company to repay its short-term obligations. The ratios include cash ratio, quick ratio, and current ratio. Braithewaite & Co. had a cash ratio of 0.0944 in 2015, which increased to 0.3292 in 2019. Also, the company’s quick ratio increased from 1.0992 in 2015 to 1.5131 in 2019. The current ratio also increased from 1.3491 in 2015 to 1.8528 in 2019 (Kumar & Dhingra, 2022). The increase in liquidity ratios implies that the company's capacity to repay short-term obligations is increasing.

Activity Ratios

Activity ratios show how efficiently Braithewaite & Co. Company uses its assets to enhance its operations. The activity ratios include current asset turnover, inventory turnover, debtor turnover, and credit turnover. The current asset turnover of the company increased from 0.8092 in 2015 to 1.5625 in 2019. The inventory turnover increased from 4.6 in 2015 to 8.057 in 2019. The debtor turnover increased from 1.2396 in 2015 to 3.6130 in 2019 (Kumar & Dhingra,

2022). Also, the credit turnover increased from 1.8640 in 2015 to 3.9748 in 2019. The increasing trend of all activity ratios implies that the company utilizes its assets to enhance its operation.

Leverage Ratios

Leverage ratios assess the company's ability to meet its financial obligations. The ratios include the debt-to-equity ratio and interest coverage ratio. In 2015, Braithewaite & Co. had a debt-to-equity ratio of 2.4929. The debt-to-equity ratio reduced to 0.1632 in 2019. The reduction implies that the company is raising more capital through equity than debt, which is a good financial symptom. The company's interest coverage ratio was -19.71 in 2015, which increased to 4.2768 in 2019. The increase implies that the company can pay interest on its outstanding debt.

Profitability Ratios

Braithewaite & Co.'s profitability ratios include gross profit margin, operating profit ratio, pre-tax profit ratio, net profit ratio, and operating ratio. The profitability ratios show the propensity of the company to make profits. In 2015, the company had a gross profit margin of4.3%. The company's gross profit margin increased to 21.8% in 2019. The operating profit ratio of the company was -35.7% in 2015, and it increased to 3.9% in 2019. The pre-tax profit ratio was -37.5% in 2015, increasing to 3.0% in 2019. The net profit ratio was -37.5% in 2015, increasing to 2.5% in 2019. Also, the operating ratio was 119.6%, decreasing to 90.2% in 2019 (Kumar & Dhingra, 2022). Improving all profitability ratios implies that the company generates more profits.

Valuation Ratios

The valuation ratios assess the relationship between the market value of Braithewaite & Co. stock and its earning metrics. EPS is used to assess the valuation of the company. The company’s earnings per share increased from -1813.66 in 2015 to 94.2251 in 2019 (Kumar & Dhingra, 2022). The increase depicts increased profits relative to the number of outstanding shares. As such, the company is increasing value for shareholders.

Forecasts

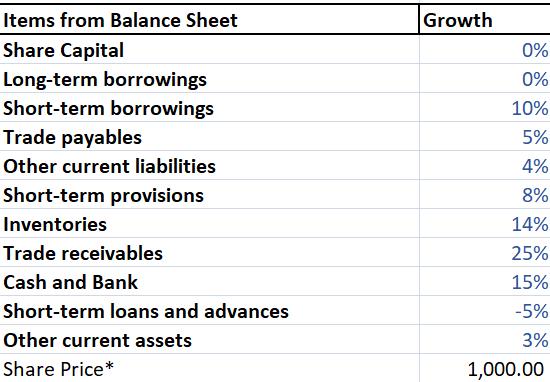

The growth rate of the company’s financial metrics is expected to be as shown in the tables below.

Table 1: Income statement growth rate

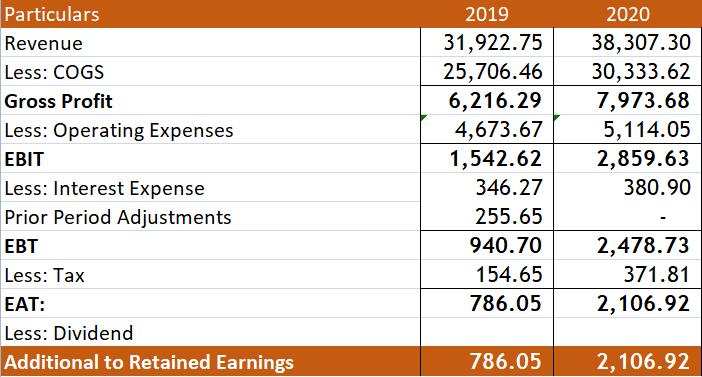

Thus, the forecasted income statement is shown below.

Table

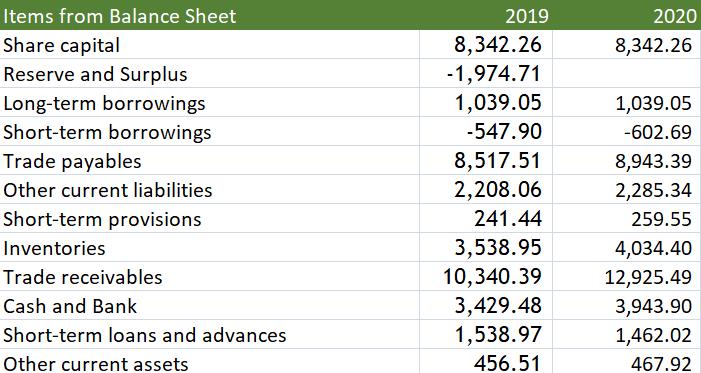

Also, the balance sheet is expected to grow at the following rates.

The forecasted balance sheet is, therefore, as shown below.

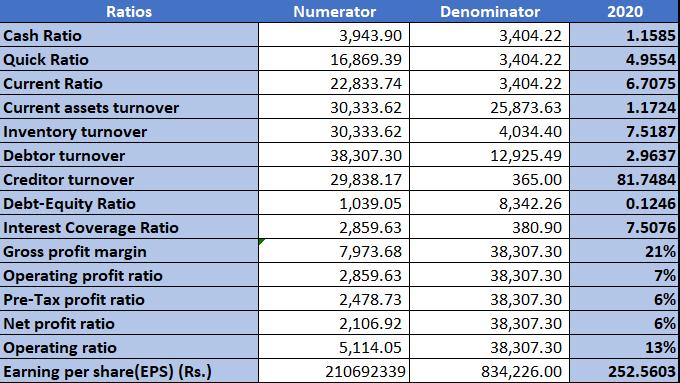

Generally, the company's financial and operational performance is forecasted to improve, increasing value for the Indian government. As shown in Table 5, all the financial ratios are expected to improve in 2020, indicating that the company will generate more revenues from its activities due to the proper utilization of resources, hence more profits. The liquidity ratios are expected to improve, implying that the company will have a high capacity to pay its short-term obligations.

Improving Market Position

Braithewaite & Co. Company operates in a highly competitive environment with high consumer power.

The market position of the company in 2019 was 1.36%. Despite the improvement from 0.56% in 2015, the company needs to improve its market position by diversifying its goods and services. According to Kumar & Dhingra (2022), the Indian Railway is the only consumer of the company's products and services. To improve its revenues, the company should diversify into other subsidiary businesses, enabling it to explore other markets in the country and reduce overdependency on Indian Railways.

Loan Acceptance

Financial ratios are the major consideration for a bank to issue a loan to a company. The company's current ratio is 2019 is 1.8528, projected to be 6.7075 in 2020. The current ratio implies that the company has a high capacity to repay its current liabilities. On the other hand, the company has a high asset turnover, implying that it is generating high revenue from its assets. The interest coverage ratio is also high, implying that the company has enough money to cover the interest requirements of its debt. Incidentally, the debt-to-equity ratio is low, implying that the company is not overburdened by debt. Thus, the CEO of the bank should accept the company’s loan requests.

Preferable Source of Funding for Expansion

As a CFO, the source of finance I would prefer to fund the company’s off-shore expansion is equity. The government of India is the major stockholder in the company. As such, the cost of raising equity from the government may be lower than the cost of debt from banks. Debt will also burden the company through interest. Thus, raising capital by issuing more equity to the government will be the ideal funding source for off-shore expansion.