6 minute read

Financial Statements Analysis

The efficiency of its operations determines a company's value. Highly efficient operations result in high profits, which result in high earnings for investors. On the other hand, companies with low operational efficiency earn low profits, which results in low earnings for investors. Financial statements are crucial in reflecting the efficiency of the operations of ABC Corporations. Crucial financial statements that reflect the efficiency of ABC Corporation include the balance sheet, the income statement, and the cash flow statement.

Balance Sheet

Advertisement

A balance sheet shows the assets, liabilities, and equity of ABC Corporation for the current year and previous years. Assets are important because they show if the company has been investing its revenues in a manner that aids operations (Mashkour, 2020). In 2017, the company had assets amounting to $ 35.316 billion. In 2018, the value of assets increased to $ 37.670 billion; in 2019, the value of assets increased to $ 39.172 billion. The increase in the value of assets indicates that the company has increasingly added its assets to maximize productivity. Also, the company's liabilities grew from 2017 to 2019. In 2019, the company's total liabilities were valued at $ 33.252 billion. In 2018, the value of ABC's liabilities increased to $ 34.620 billion, and in 2019, the value of the company’s liabilities increased to $ 36.179 billion (Macrotrends, 2023). The increase in liabilities resulted from the company's debt to finance its operations. Incidentally, the shareholder’s equity was $ 35.316 billion in 2017. The equity increased to 37.670 billion in 2018 and $ 39.172 billion in 2019 (Macrotrends , 2023). The increase in equity financing indicates an increase in the number of shareholders of the company, and a growing interest of the current shareholders in cases of purchases of rights issue.

Income Statement

The income statement indicates the company’s revenues, cost of sales, and profits. In 2017, ABC Corporation generated revenues amounting to $ 153.144 billion. In 2018, the company’s revenue increased to $ 167.940 billion, and in 2019 ABC Corporation increased to $ 179.589 billion. The increase in revenues indicates that the company used its resources, including added assets to maximize shareholders’ value. The company’s net income also increased commensurately with the revenues, implying that the company managed its costs properly. In 2017, ABC had net profits amounting to $ 364 million. In 2018, the company’s net profits increased to $ 1.658 billion, and in 2019, the company’s net profits decreased to $855 million (Macrotrends , 2023)

Cash Flow Statement

The cash received by ABC Corporation was generated from operating activities, investing activities, and financing activities. In 2017, the company generated $1.504 billion from operating activities. The revenue decreased in 2018 to $1.411 billion. In 2019, the revenue from operating activities increased to $2.344 billion. On the other hand, ABC Corporation lost $498.0 million to investing activities in 2017. In 2018, the company lost $1.11 billion, and in 2019, the company lost $375.8 million to investing activities. Conversely, the company lost $1.3 billion to financing activities in 2017. In 2018, the company lost $242.8 million and in 2019, the company lost $1.086 billion to financing activities (Macrotrends , 2023).

Ratio Analysis

Liquidity Ratios

Liquidity ratios indicate whether ABC Corporation will be able to repay its financial obligations to other financial institutions (Mashkour, 2020). The ratios include the current ratio, the quick ratio, and the debt-to-equity ratio. The company’s current ratio assesses if the current assets will be sufficient to repay its current liabilities. From the table below, the company’s current ratio remained fairly constant over the period under review. A current ratio of less than one indicates that the company’s current assets are less than its current liabilities. As such, the company may not be able to use its current assets to repay its current liabilities. On the other hand, the quick ratio of the company increased steadily from 0.5 in 2017 to 0.56 in 2019. The increase indicates that even though the company may not use its most liquid assets to completely cover its obligations, its potential is increasing. Incidentally, the debt-to-equity ratio of the company is high for the entire period, implying that the company finances most of its operations preferably through debt and not through equity.

Efficiency Ratios

The select efficiency ratios show the company’s ability to convert inventory into cash, and to receive payment from debtors (Mashkour, 2020) As shown in the table below, ABC Corporation had an inventory turnover of 12.87 in 2017. The inventory turnover increased to 14.11 in 2018, and to 15.34 in 2019. The increase in inventory turnover indicates that the company’s capacity to make sales increased throughout the period under review. On the other hand, the company’s propensity to collect outstanding money from debtors decreased from 15.68 in 2017 to 15.64 in 2018, and to 15.6 in 2019. The decrease implies that the ABC Corporation’s capacity to collect receivables from debtors decreased over time.

Profitability Ratios

Profitability is very crucial because it determines ABC Corporation’s propensity to create real value for investors (Mashkour, 2020) The most fundamental ratios to assess the company’s profitability are ROE and ROI. In 2017, the ROE of ABC Corporation was 39.03 as shown in the following table. In 2018, the company’s ROE decreased to 37.03, implying that the company’s equity decreased against net income. In 2019, the company’s ROE decreased further to 21.3. On the other hand, the company’s ROI assesses the return on the cost of investments for investors. In 2017, the ROI of ABC Corporation was 16.57. In 2018, the ROI increased to 19.32. In 2019, the ROI decreased to 12.43, indicating that the increase in 2018 could be as a result of the sale of an asset or a one time income.

Price-to-Earnings Ratio

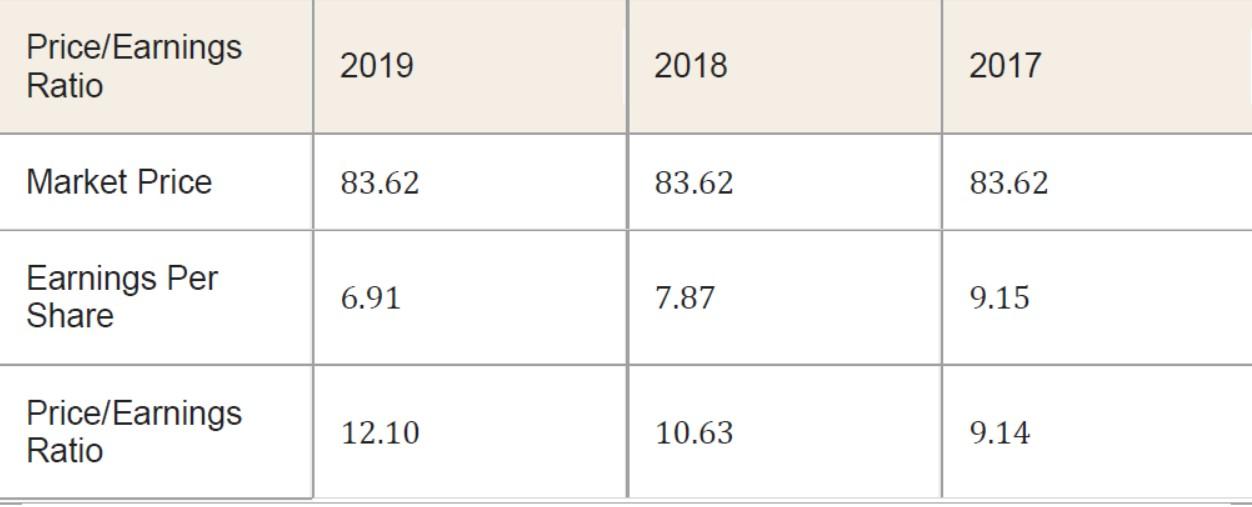

Price to earnings ratio is a very crucial indicator of how much an investor should pay to the company to earn one dollar from the investment (Kurach & Slonski, 2015). Price earnings ratio takes into consideration the net profit of the company, and the stock price of the company.

A low P/E is considered to be good because apart from an investor paying few dollars to earn one dollar from the company, it is also believed to suggest that the stock is undervalued. On the other hand, a high P/E ratio implies that an investor has to spend more dollars to earn one dollar from the company (Kurach & Slonski, 2015). The following table summarizes the company’s P/E ratio for the three years under review.

From the table above, the market price of ABC Corporation stocks remained constant while the earnings per share decreased consistently from $9.15 in 2017, to $7.87 in 2018, and finally to $6.91 in 2019. The decrease in earnings per share explains the consistent increase in the P/E ratio from 9.14 in 2017 to 10.63 in 2018, and finally to 12.10 in 2019. The increase in P/E ratio implies that the company’s net profits decreased against the increasing number of outstanding shares. However, ABC Corporation had a healthier P/E ratio that HCA Health, which is one of the company’s great competitors. HCA Health had a P/E ratio of 14.08 in 2017, 13.09 in 2018, and 11.73 in 2019 (Macrotrends , 2023). The difference between the P/E of ABC and that of HCA is that the one for ABC is rising while the one for HCA is decreasing. The P/E ratio for the healthcare industry in 2017 was 37.71, 30.83 in 2018, and 25.0 in 2019 (Macrotrends , 2023). Thus, the P/E ratio of ABC Corporation is good for investment.

Price-to-Book Ratio

The price-to-book ratio is crucial in assessing the amount of money investors are willing to pay for $1 of value equity. As shown in the following table, the company’s price-to-book ratio increased from 0.37 in 2017 to 0.40 in 2018, and to 0.42 in 2019. The values imply that investors are paying very little for $1 of value equity, which is very good for investment. HCA Health, which is a competitor in the industry had a price-to-book ratio of -5.86 in 2017, -14.10 in 2018, and -86.40 in 2019 (Macrotrends , 2023). The negative price-to-book values indicate that HCA Health had more liabilities than assets. The industry price-to-book ratio in 2017 was 8.17, 5.79 in 2018, and 3.46 in 2019 (Macrotrends , 2023). As such, the price-to-book ratio was better than that of the industry throughout the period.

Recommendations

Reduction of Debt

The company is using more debt than equity to finance its operations. The high debt of the company lowers the value of investors since a huge amount of money is used to finance it, hence reducing the amount of money investors earn from their shares. Also, debt increases risk for shareholders because in case the company is wound up, debt financiers will be paid first before shareholders are paid. As such, the management of ABC Corporation needs to restructure its financing to increase equity and reduce debt.

Increase of Current Assets

Current assets are important in that they can be used to repay current liabilities. The company can use part of its retained earnings to purchase current assets. Honoring current obligations enables the company to run smoothly without a threat of financial fines due to failure to honor such obligations.

Investing More Money in Operating Activities

Operating activities contributed the highest income to the company. Thus, for the company to maximize returns on investments, the management shall consider investing more money in operating activities. The management can increase the inventory turnover by intensifying marketing, increase receivable turnover through enhanced payment methods, and pay suppliers in time to ensure seamless operations.

Conclusion

Over the years, ABC Corporation has shown operational efficiency and proper utilization of resources to maximize returns for investors. However, the company needs to restructure its capital financing to reduce the debt-to-equity ratio, increase its current ratio through increasing