9 minute read

Literature Review

The studies that have been done earlier about hedging and financial risk management have led to different findings. Some researchers have unveiled that financial risk management is a good tool for limiting the risk exposure of a company. There are also studies that affirm that companies may not have to use the hedging strategies to handle the financial risks that are apparent on the market. Even though theoretical literature pinpoints the reasons why firms are supposed to hedge, there is a need for empirical studies to support such theoretical findings. Some of the studies did not unveil the usage of the hedging tools in the various corporations. For instance, Fabozzi, Mann, and Choudhry (2003) selected companies that do not use the hedging strategies (non-hedgers) and those that use the hedging strategies. The sample was determined by searching for financial databases. Eiteman et al. (2003) used firms with the foreign exchange rate exposure and labeled them as hedgers after finding after establishing references to the derivative instruments in their financial statements. However, it should be noted that making a comparison between the non-users and derivative users in order to infer about hedging can lead to a wrong classification whereby the hedgers will be deemed to be non-hedgers while the speculators will be regarded as hedgers.

The model and/or empirical analysis

Advertisement

A quantitative approach was widely adopted for the study. The qualitative approaches emphasize words as opposed to the quantification of information when it comes to the analysis and collection of information. Such studies intend to utilize an inductive approach in constructing the relationship between research and theory, where there is an emphasis on the generation of theory. However, this study is more tailored towards testing the existing theories as opposed to generating theories. A scientific approach is widely adopted for the study. For this study, the data obtained from the financial analysis and reports will be used as a platform to increase the knowledge on the utilization of the financial hedging strategies for the banking business. The study will strive to link and compare the existing theories about financial hedging and the findings obtained from the financial institutions' reports and analyses. As such, the study is more tailored towards a deductive approach as opposed to an inductive approach. Given the need to do a more specific study, there is a need to limit the study to a few financial institutions which operate on the mortgage market. It may not be practical to compare the financial institutions from different countries considering the fact that the market reality may not be similar from one country to another. For instance, financial institutions may exhibit different repo rates. In studying the hedging practices, there is a need to consider the financial risks in general, and then delve into the major financial risks .e the exchange rate risks, interest, and credit (Bielecki & Rutkowski, 2015). The approach may increase the study's specificity and help in considering the situation of the market at the moment in line with the above factors.

Practical relevance and significance of the work

The contemporary corporate finance theory affirms that companies are supposed to hedge risks to be in a better position to cut down on the variance of cash flow. Some firms are supposed to hedge all risks, while other firms are not supposed to worry about risks. Other firms should worry only about specific types of risks. The level to which a firm is supposed to hedge depends on the estimate of the exposure of the risk. It is still not clear whether the utilization of hedging techniques is good protection for organizations against financial exposures. Although a lot of research has been done in risk management, there is a need for more information and knowledge about the various hedging strategies and the effectiveness exhibited by these strategies when it comes to containing the financial risks. There is a need to consider hedging practice and risk management, especially when the market is facing distress and financial insecurity.

The study will entail a historical analysis of finances from financial institutions to detect changes that are likely to occur in the institutions due to a financial crisis. The study will scrutinize the hedging policies against the various risks that these institutions are exposed to. There is a need to identify some of the hedging strategies used by the institutions, identify the strategies utilized in containing the financial risks, and make necessary suggestions from the research findings. This will help the financial institutions in applying appropriate hedging policies when faced with financial risks.

Description of data

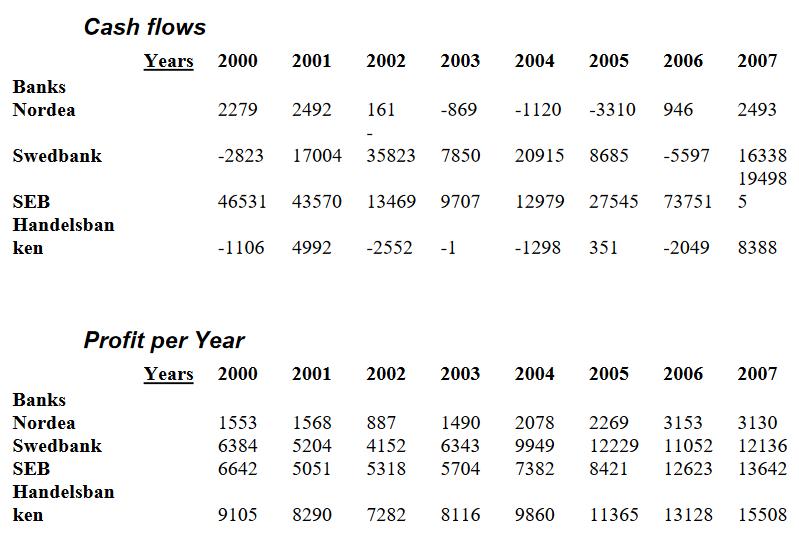

Cash flow variability will be used because of the arguments advanced by the proponents of the hedging strategies; this includes sentiment that hedging tends to reduce the variability of the cash flows. There is a need to look at how the cash flows from the financial institutions vary from time to time. To make the study more analytical, there will be a need to analyze the cash flows in line with the total operating incomes of the financial institutions. The information about the cash flows is obtained from the cash flow statements of the respective financial institutions and their annual reports. The information about the total operating incomes will be obtained from the income states from the annual reports of the institutions. Another important data that should be considered is the profit per year variation. In this regard, the proponents for hedging strategies affirm that the companies are likely to increase their values through hedging. The evaluation of the value of a company can be done in various ways. One of the ways which can be used to value a company is by looking at the performance or the annual profit. The information on the profit per year and the total operating incomes for the respective banks can also be found in the financial institutions' annual reports and income statements.

The figure below represents the cash flows and profit per year for the four financial institutions.

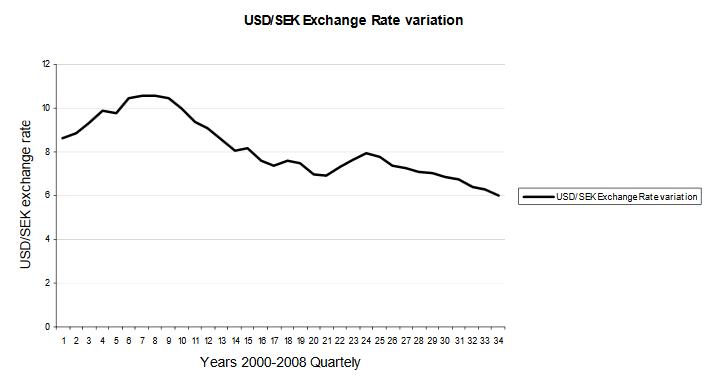

Another piece of data that should be scrutinized is about the loan losses variations. The rationale for tracking the data is the argument by proponents that hedging has the ability to cut down the costs incurred by the companies, especially during times of financial distress. One of the most important costs incurred by financial institutions during times of financial distress is basically loan losses. Such a component is likely to be important for a financial institution, especially in a situation where the institution is acting in the mortgage market under a financial crisis. There is a need to study this component to check on how the loan losses are likely to fluctuate between the fluctuating periods in the financial market. Other data to be incorporated in the study include the repo rates and USD exchange rates, among others. There is a need to use the historical data obtained from within a period that was marred with financial instability, i.e., between 2000 to 2008, which was characterized by the global financial crisis. This will be used to ascertain the resilience of the hedging practices that were exhibited by the financial institutions under consideration.

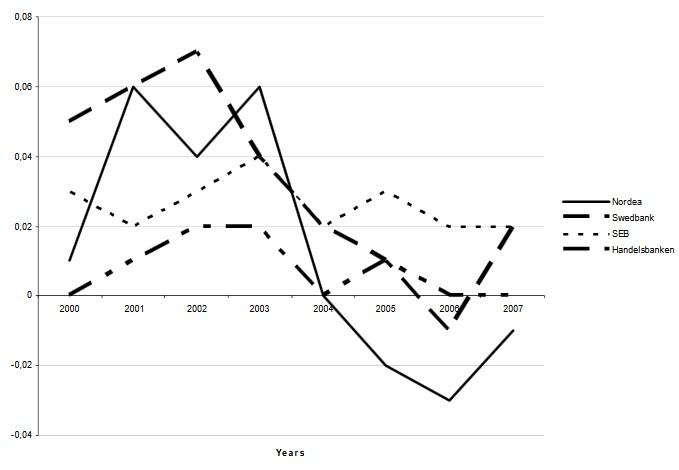

Results

Theories affirm that the use of hedging strategies is likely to allow forms to reduce the variability of the expected cash flows, which will, in turn, lead to a reduction of risks. The control of the cash flow variability enables a company to garner competitive planning capability that will make it possible to implement investments and activities which could not have been possible (Bielecki & Rutkowski, 2015). The figure below shows a situation where the two companies, Handelsbanken and Nordea, can keep good control of their cash flows compared to their total operating incomes. On the other hand, Swedbank and SEB depict variable cash flows compared to the total operating incomes. The former two companies are more effective and successful when it comes to hedging the variability considering the fact that they have been able to keep them stable. They have been in a better position to utilize the hedging practices in taking care of the variability and panning for the cash outflows and inflows. On the other hand, SEB depicts a situation where there are variable cash flows when compared to operating incomes. As such, the financial institution's hedging strategies have failed to manage the cash outflows and cash inflows.

There is a decreasing trend when it comes to the loan losses for the four financial institutions, until 2006. However, Handelsbanken and SEB are in a position to keep the loan losses stable while their other two counterparts show an upward trajectory when it comes to the loan losses. SEB and Handelsbanken have proved to be more successful in their hedging initiatives, considering the manner in which they have been able to keep their loan losses low (Bielecki & Rutkowski, 2015). There was no full data for 2008 in order to ascertain what transpired at this time. See figure 2 below.

(Bielecki & Rutkowski, 2015)

Credit losses increased for the year 2008, although it was not possible to ascertain how much every institution was able to spend on credit derivatives for the entire period under consideration. The information would be critical in measuring the effectiveness of the hedging strategies for credit risks, which are used by the four banks. However, it was evident that Handelsbanken and SEB have performed better when it comes to hedging credit losses as compared to their two counterparts.

The reports from the four financial institutions do not pinpoint much information about the exchange rate risks and the interests depicted by the institutions. There is scanty information that is not as much as the information that one would obtain on credit risk. There are short descriptions in the financial reports about the hedging strategies that have been deployed when it comes to controlling the exchange rate risks and interest rates. Institutions such as the Swedbank have made it clear that they use the interest rate swap contracts in order to be able to hedge against the interest rate risks. The institution has portrayed how they use the forward exchange agreements and the currency interest rates swaps to be in a position where they can manage the exchange rate risks. The other institutions do not appear to have a clear strategy in this regard. The figure below shows how the repo rate and interest rate varies from time to time. The repo rate is an important factor that determines the other market rates. The institutions cannot clearly present the policies used in exchange risks and handling the interest rates. This points to the possibility that they do not value exchange rate risks and interest rates to be more important than the credit risks.

Bank, Soner & Voß (2017)

Considering the exchange rates within the timeframe, the four financial institutions consider the U.S. financial institutions to be some of the most important markets for them. There is a dire need to ensure that an unstable USD is properly managed. This is managed through the use of money markets on payables and receivables, forwards contracts, and currency features contracts, among others. Financial institutions such as SEB and Swedbank depicts indices that show that exchange rate hedging practices have similarities with what is recommended in theory. The other counterparts did not present how they have been able to manage this risk.

Discussion of the results and their robustness

Management of financial risks tends to be a very detailed and complex subject that should take into consideration various factors. The data obtained from the financial reports may not clearly depict how the financial institutions have been able to deploy different strategies in managing their financial risks. However, it is clear from the findings that the financial institutions have embraced some hedging strategies they use to cushion themselves against the risks. In the period under consideration (2000 to 2008), the demand for more sophisticated and complex financial instruments has grown in an attempt to deal with the financial risks that the financial institutions face in their business. The financial statements of the institutions also show that they are not using derivatives. This may be a way of telling the shareholders that they are cognizant of the existing risks and are reluctant to pursue the derivatives market. Most importantly, the four financial institutions are aware of the use of viable hedging strategies in their various risk management plans. The cash flow statement of Handelsbanken and Nordea shows that the companies have strived to deploy appropriate hedging strategies better than their other two competitors. Handelsbanken and SEB have performed better when it comes to hedging credit losses than their two counterparts. As depicted by SEB and Swedbank, the indices show that the companies are embracing some exchange rate hedging practices (Bielecki & Rutkowski, 2015). The results were not adequately robust due to inadequate data across the different data elements discussed above.

Conclusion

Financial institutions are exposed to different financial exposures and require effective hedging strategies in their risk management endeavors. Although there is no clear proof that financial institutions perform better when they use the hedging strategies, the institutions have a lot to lose when the market is not behaving as anticipated. Hedging risks may be appropriate in limiting the financial exposures, as they were associated with better outcomes in the financial institutions. There is a need to do further research on the extent to which hedging instruments should be used and the tools that are more reliable than others. It would also be necessary to understand the extent to which financial institutions invest in derivatives for purposes of hedging.