AS l A’S LEAD l NG m AGA z l NE for th E p LAS t l c S AND rubb E r l ND u S try DIGITAL www.plasticsandrubberasia.com

Features

9 Country Focus – Though China has made notable progress in its clean energy transition, it still faces some challenges and is working on energy efficiency improvements, expansion of renewables and a reduction in coal use to achieve lower carbon emissions

13 Packaging – Towards the reduction of carbon emissions, designing consumer product packaging is a win-win situation for global sustainability

17 Biomaterials – Kuraray’s new grade of Plantic sustainable, highperformance barrier material is targeted at packaging food with a prolonged shelf life in a modified atmosphere

18 Exhibition Preview – At Chinaplas 2023, to be held in Shenzhen, China, from 14-17 April, exhibitors such as ExxonMobil, Kiefel and Coperion/Herbold are showcasing sustainable technology at their stands

21 Thermoplastic Elastomers – Kraiburg TPE’s newly launched sustainable Thermolast R TPE compound for the Asia Pacific market has been used by Thailand’s top toothbrush maker The First Thai Brush Co in the handles of its Victory toothbrush

publisher/editor-in-chief

Arthur Schavemaker

Tel: +31 547 275005

Email: arthur@kenter.nl

Associate publisher/executive editor

Tej Fernandez

Tel: +6017 884 9102

Email: tej@plasticsandrubberasia.com

senior editor

Angelica Buan

Email: gel@plasticsandrubberasia.com

circulation

Stephanie Yuen

Email: stephanie@taramedia.com.my

permits

ISSN 1360-1245

printer

Automotive: With the automotive sector’s eventual transition to EVs, sustainable manufacturing and recycling of EV batteries has become a focus

Italian machinery sector: Amaplast reports higher turnover for its members, based on export growth; meanwhile, the PLAST show will be back to Milan later this year from 5-6 September

The Malaysian Rubber Council (MRC) has launched the Global Funding for Rubber Innovation (GFRI), a holistic initiative to source for ideas, innovation and to expand the rubber sector further

Global and Asian markets for silicones in the healthcare and medical industries have grown in tandem with the advancement of devices and equipment

United Mission Press Sdn Bhd (Co. No: 755329-X) 25 & 27, Jalan PBS 14/14, Taman Perindustrian Bukit Serdang, 43300 Selangor, Malaysia.

is published 4 (four) times a year in English by Kenter & Co Publishers’ Representatives BV.

Whilst every effort is made to ensure that the information contained in this publication is correct, the publisher makes no warranty, expressed or implied, as to the nature or accuracy of such material to the extent permitted by applicable law.

© 2023 Kenter & Co Publishers’ Representatives BV No part of this publication may be reproduced, stored or used in any form, or by any means, without specific prior permission from the publisher.

PRA is circulated free to trade readers in the plastics and rubber industry. Airmail subscriptions are available at uS$160 within Asia and uS$250 to all other countries outside Asia.

is a member of ABC (Audit Bureau of Circulation)

www.plasticsandrubberasia.com

www.rubberjournalasia.com

www.injectionmouldingasia.com

facebook.com/PRA.Malaysia twitter.com/PRA_Malaysia

www.plasticsandrubberasia.cn

AS l A’S LEAD l NG MAGA z l NE F o R THE PLAST l CS AND R u BBER l ND u STRy Volume 38, No 267 publlshed slNce 1985

In this issue

Industry News

Materials News supplements th LAS t S AND rubb E ND S try DIGITAL www.plasticsandrubberasia.com

Regulars 2

5

On the Cover

Recycling is of utmost importance in the plastics sector, with collaborations focused on improving recycling rates and recycled material quality, and increasing recycled content in products

Connect @

1 APRIL 2023

M&As/Tie-ups/ Investments

• German chemical firm Evonik has invested in the British company Interface Polymers that supplies Polarfin additives to simplify the processing of plastics such as mixtures with PE or PP.

Evonik has also invested in Chinese battery specialist SuperC, specialising in graphene materials for lithium-ion batteries.

• Japan’s Toyo Ink SC Holdings Co.’s subsidiary Toyo Ink (Thailand) has acquired Thai Eurocoat Ltd, a manufacturer of external coatings for non-printed cans in the Thai canned food market.

• US private equity firm Apollo Global Management is taking Univar Solutions Inc. private in a deal valued US$8.1 billion. Univar will continue to operate under its name and brand. The transaction is expected to close in the second half of 2023. The acquisition includes a minority investment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority (ADIA).

• Chemical firm LyondellBasell is acquiring Mepol Group, a manufacturer of recycled, highperforming technical

compounds located in Italy and Poland.

• Saudi Arabian Oil Company (Aramco) has completed the acquisition of the Valvoline Inc’s global products business for US$2.65 billion, through one of its wholly-owned subsidiaries.

• Belgian chemical firm Solvay has sold its 50% stake in the RusVinyl joint venture to its joint venture partner Russian petchem firm Sibur The agreement is based on a purchase price for Solvay’s 50% stake of around EUR430 million.

• Constantia Flexibles, the third largest producer of flexible packaging worldwide, has acquired Polish company Drukpol Flexo

• Japanese firms Asahi Kasei and Mitsui Chemicals are combining their spunbond nonwovens businesses in a new joint venture, effective October 2023, due to the impending competitive environment expected for the spunbond business sector in Asia.

• Milan-based technology firm

Maire Tecnimont, through its subsidiary NextChem Holding, it is expanding into the high-value derivatives and biodegradable plastic by-products licensing markets with the acquisition of an 83.5% stake of Conser, an Italian technology licensor and process engineering design company.

• Austrian chemical firm Borealis has acquired a majority stake (50%) in Renasci, a Belgiumbased provider of recycling solutions and creator of the Smart Chain Processing (SCP) concept.

As well, Abu Dhabi National Oil Company (Adnoc) has acquired a 25% shareholding in Borealis from Mubadala Investment Company The other 75% equity will be owned by Austrian multi-national integrated oil OMV.

• Poland’s PKN Orlen has acquired a part of the business of Poland’s largest LDPE manufacturer Basell Orlen Polyolefins, in which the company holds an equity interest together with LyondellBasell.

• US-based precision component packaging provider Advantek has acquired Malaysian precision packaging firm LKTT Plastic Technology.

• Swiss construction chemicals maker Sika has sold part of its admixture business to UK-based Ineos, paving the way for its almost US$6 billion acquisition of former BASF Construction Chemicals business (MBCC). Sika sold MBCC's admixture assets in the US, Canada, Europe and Britain, and the entire MBCC business in Australia and New Zealand to Ineos to satisfy the concerns of competition authorities.

• Brazilian polyolefins maker Braskem has acquired taulman3D, a 3D filament supplier of nylon, recycled PETG, and PET filaments to aerospace, automotive, healthcare, industrial, government and higher education professionals worldwide.

• South Korea’s SK Chemicals has accelerated its entry into the global market and business expansion for chemically recycled BHET plant of 70,000 tonnes/year and chemically recycled PET plant of 50,000 tonnes/year, with its acquisition of Chinese green materials firm Shuye The acquisition price for this deal is around US$100 million.

Industry n ews 2 APRIL 2023

Plant Expansions/Opening/Set-ups

• Saudi Basic Industries Corporation (Sabic) has commenced commercial operations at its 260,000-tonnes/ year PC facility in Tianjin, China. The US$1.7 billion project was developed by Sinopec Sabic Tianjin Petrochemical Company (SSTPC), a joint venture between Sabic and Sinopec.

• Manufacturer of printing inks/ packaging solutions DIC India has inaugurated its 10,000 tonnescapacity toluene-free plant for liquid Ink manufacturing in Gujarat, India.

• LyondellBasell has started up the world's largest propylene oxide (PO) and tertiary butyl alcohol (TBA) unit in Texas, US. These new assets on the US Gulf Coast have a capacity of 470,000 tonnes/year of PO and 1 million tonnes/ year of TBA and its derivatives.

Also, LyondellBasell has licensed its highpressure Lupotech process technology to PetroChina Jilin Petrochemical Company for its facility in Jilin, China, for a 100-kilotonne/ year autoclave and a 300-kilotonne/ year tubular line.

Additionally, a 400-kilotonne/ year Hostalen Advanced Cascade Process (ACP) line will be built for the production of HDPE.

• Zhangzhou Chimei Chemical Co has started up its 350,000-tonnes/year PS production lines in Fujian, China, to strengthen the group's presence and bring its total PS production capacity to 920,000 tonnes/year.

• QatarEnergy and Chevron Phillips Chemical (CPChem) marked the construction of a US$8.5 billion polymers plant in Texas, US, with a groundbreaking ceremony. The facility will feature an ethylene cracker unit with a capacity of 2 million tonnes/year, making it the largest in the world, and two HDPE units with a combined capacity of 2 million tonnes/year, also making them the largest derivatives units of their kind in the world. The plant is expected to start up in 2026 and will be owned by Golden Triangle Polymers Company, owned by QatarEnergy (49%) and CPChem (51%).

• German materials firm Covestro is increasing its global

production capacity for PC specialty films, with new extrusion lines at the Map Ta Phut Industrial Park in Thailand. Completion is scheduled for 2025.

Covestro has also started up a new world-scale facility for the production of chlorine in Tarragona, Spain, for its MDI production also in Tarragona.

Covestro is also building its largest TPU site in Zhuhai, China, by 2033 and with a production capacity of 120,000 tonnes/year of TPU.

• German materials firm BASF has begun production of its first biobased polyol, Sovermol, in Mangalore, India, for applications in energy vehicles, windmills, flooring and protective industrial coatings in Asia Pacific.

BASF is also expanding its polymer dispersions production capacity by adding a second production line at its site in the Daya Bay Petrochemical Industrial Park in Guangdong, China, to start operations by 2024.

BASF has also broken ground on a new production complex at its site in Zhanjiang, China, that includes plants for glacial acrylic acid (GAA), butyl acrylate (BA) and 2-ethylhexyl acrylate (2-EHA).

Planned to come on stream by 2025, the complex will have capacity of 400,000 tonnes/year of BA and 100,000 tonnes/ year of 2-EHA.

In the US, BASF has broken ground on the third and final phase of the MDI expansion project at its site in Louisiana to increase production capacity to 600,000 tonnes/ year. Including the first and second phases, the investment totals around US$1 billion, making the MDI expansion project BASF’s largest wholly owned investment in North America.

• Joint venture firm Lotte Ineos Chemical (between Ineos and South Korea’s Lotte) plans to increase vinyl acetate monomer (VAM) production capacity in South Korea from 450,000 tonnes-700,000 tonnes with the addition of a third VAM plant, to startup by 2025.

• Japan’s Sumitomo Chemical has constructed a new pilot facility for chemical recycling of acrylic resin (PMMA) at its Ehime Works in Niihama City. Samples of chemically recycled MMA monomer produced in this facility and acrylic

INDUSTRY NEWS

3 APRIL 2023

resin made from the monomer will become available in 2023.

• CJ HDC biosol and CJ Biomaterials, a division of South Korea-based CJ CheilJedang and a primary producer of polyhydroxyalkanoate (PHA), will work together to accelerate the development of ecofriendly bioplastics. Biosol has completed construction of a new South Korean bioplastic compounding plant in Jincheon, which has capacity to produce 11,000 tonnes/ year of bioplastics. Biosol, established in February 2022, is the result of the joint venture between CJ CheilJedang and HDC Hyundai EP, South Korea’s largest plastic compounding manufacturer.

• US-based carbon negative materials firm Origin Materials has completed Origin 1, its first commercial manufacturing plant, located in Ontario, Canada, to produce sustainable materials including chloromethylfurfural (CMF), which can be converted into highperformance products used in packaging, textiles, apparel, automotive, as well as hydrothermal carbon (HTC).

• Tokyo-headquartered chemical firm Asahi Glass Co (AGC) is increasing its

production capacity for fluorochemicals for semiconductorrelated applications. The US$260 million expansion will take place at AGC's Chiba plant and start up in 2025.

• Indian specialty chemicals major Anupam Rasayan India Limited will invest US$80 million to set up three new plants for fluorochemicals in Gujarat, India, by 2025.

• Domo Chemicals, a manufacturer of engineered materials, has broken ground for its new EUR14 million plant in Haiyan, China, to produce 50 kilotonnes of Technyl nylon grades and to start up by 2024.

• Technology firm Suez, Canada’s Loop Industries and South Korea’s SK Geo Centric have selected Saint-Avold, in France, as the site to manufacture virgin-quality PET plastic made from 100% recycled content leveraging the Infinite Loop process in a 70,000 tonnes/ year facility with an investment of EUR450 million.

• Japan’s Mitsubishi Chemical Group is setting up a new facility at the Okayama Plant to double the production capacity of its Gohsenx and

Nichigo G-Polymer specialty brands of polyvinyl alcohol resin (PVOH resin). It will start up in 2024.

• Japanese chemical firm Kuraray Co new plant in Map Ta Phut, Rayong Province, Thailand, for isoprenes has been completed and will soon start operations in stages.

• Toray Advanced Materials Korea Inc will increase annual production capacity for Torelina PPS resin by 5,000 tonnes at its plant in Gunsan, South Korea, by 2024 bringing the group's combined PPS capacity, including output at this facility and in Japan, to 32,600 tonnes/year.

• India’s Revalyu Recycling, a subsidiary of parent company Revalyu Resources GmbH, has started the construction of a 200-tonne/day PET plastic recycling plant in Nashik, India. Revalyu is also investing US$50 million in its first facility in Georgia, US, with commissioning planned for 2024.

• Alpla Group, together with its joint venture partners Ecohelp and United Polymer Trading (UPT) from Switzerland, has opened its first EUR7.5 million

PET recycling plant in Romania, with a capacity of 18,000 tonnes/year of recycled material from household waste.

• Healthcare solutions provider Berry Global Group will begin product production at its second manufacturing facility and healthcare centre in Bangalore, India, by 2023.

• PureCycle Technologies will build its first PP recycling facility in Europe in the Port of Antwerp-Bruges’s fast-growing NextGen district. The new plant will have a capacity of 59,000 tonnes/year, with a total capacity of 240,000 tonnes/year, and construction to start in 2024.

• Canadian materials supplier Nova Chemicals’s second Advanced Sclairtech technology (AST2) facility and the third phase of the Corunna cracker expansion project have each reached mechanical completion. The Ontario-located facility will have a capacity of 450,000 tonnes/year of LLDPE. The cracker expansion will provide ethylene feedstock to the AST2 facility, expanding the existing cracker’s current capacity by more than 50%.

Industry n ews 4 APRIL 2023

New technologies to push the recycling agenda

Recent industry developments in recycling technologies and collaborations are focused on improving recycling rates and recycled material quality, and increasing recycled content in products, says

Angelica

Buan

in this report.

Wastes still rising even with recycling

Whenever the staggering amount of waste plastics is mentioned, recycling comes to mind as a solution. No doubt that recycling offers the sweet spot in reducing wastes.

Recycling conserves resources by converting used materials into new products, reducing the need to consume natural resources; it saves energy because manufacturing with recycled materials requires significantly less energy than manufacturing new products from raw materials; it reduces the need for raw material extraction, which pollutes the air and water; and it conserves energy while lowering greenhouse gas emissions.

However, it is clear that current recycling rates have not kept up with the rate of plastic waste production.

Citing data from the UN , the production of 400 million tonnes/year of plastic waste is only the tip of the iceberg when it comes to the enormous environmental problem that must be addressed.

Single-use plastics (SUPs) contribute to the mounting waste. Every minute, 1 million plastic bottles are purchased globally, and up to 5 trillion plastic bags are used annually. All of these will almost certainly be discarded after use.

According to the OECD's Global Plastics Outlook report, only 9% of plastics are successfully recycled today, with the remaining 22% being mismanaged. Of that, 15% is collected for recycling, but 40% is discarded as waste.

According

Some plastic materials are not recyclable

Recycling, according to Greenpeace USA , is a "dead end street" in terms of reducing the amount of plastic waste in the environment. Or, in the case of most plastics, recycling is ineffective. Circular Claims Fall Flat Again, a report released in October 2022, stated that a majority of plastics cannot be recycled.

No type of plastic packaging in the US meets the Ellen MacArthur Foundation's New Plastic Economy (EMF NPE) Initiative's 30% recycling rate criteria to be classified as "recyclable."

Commonly used resins in bottles and containers in the US, PET #1 and HDPE #2, and previously thought to be recyclable, have reprocessing rates of 20.9% and 10.3%, respectively. Every other type of plastic has a reprocessing rate of less than 5%.

Similarly, mechanical and chemical recycling of plastic waste have failed because plastic waste is difficult to collect and sort for recycling, is environmentally hazardous to reprocess, often consists of and is contaminated by toxic materials, and is not economically viable to recycle.

According to the report, paper, cardboard, metal, and glass do not have these issues, which is why they are recycled at much higher rates.

Also is the fact that post-consumer recycled (PCR) plastic from household waste poses toxicity risks and is not produced on a commercial scale for food-grade uses anywhere in the world, including the US. As a result of its findings, the organisation deemed that the real solution is to switch to reusing and refilling systems.

Advanced sorting for flexible packaging

Choosing which plastic items are accepted in recycling facilities or can be recycled is a difficult task in itself. That is why, sorting plastic waste is critical if recycling rates are to improve, with high purity rates that are free of contaminated and nonrecyclable items. Advanced sorting technologies enable more efficient and effective sorting that is less complex and uses less energy.

Materials News 5 APRIL 2023 Materials News

to a report, only 9% of plastics are successfully recycled today, with the remaining 22% mismanaged. 15% of this is collected for recycling, while 40% is discarded as waste

The EU-funded Circular FoodPack, which addresses the challenge of recycling flexible packaging with multilayer composites, is one of the most recent developments in the European recycling sector.

The Circular FoodPack project, which started in June 2021 and will end in November 2024, will be implemented by 14 businesses and research centres from six different European nations, with the Fraunhofer Institute for Process Engineering and Packaging serving as the project coordinator.

Flexible plastic packaging is used in food and personal care because of its ability to meet safety and hygiene standards. However, modern sorting and recycling processes are incapable of reliably sorting and recycling flexible packaging with multi-layer film structures.

As a result, the majority of multi-material composites are disposed of in landfills or used for energy recovery. Furthermore, EU legislation prohibits the use of recyclates in food packaging applications.

Circular FoodPack's Tracer-based sorting systems are being further developed to separate food from non-food packaging as well as improve mechanical and physical recycling processes. The project is also developing ecodesign innovative mono-material food and personal care packaging that is easy to sort and recycle.

Tracer-based sorting identifies packaging items that contain unique printed, fluorescent tracers that emit an unambiguous signal when exposed to laser light, resulting in the assignment of a material-specific sorting code.

The mechanical and physical solvent-based recycling process cascades will allow Circular FoodPack to purify the recyclates, resulting in a reduction of contaminants, colour, and odour.

A promising deinking technology that can remove all types of inks while also ensuring deodourisation will be scaled up in the existing mechanical treatment cascades. The cleaned material is then recycled using solvents through the patented CreaSolv Process for separation

Improvements are being made to the mechanical and physical recycling procedures as well as the separation of food packaging from non-food packaging using Circular FoodPack's tracer-based sorting systems

into various material components such as fillers, additives and PE.

At the same time, the project aims to create a recyclable and reusable packaging material containing at least 50% PCR materials, with applications in dry food packaging, home care, and personal care packaging.

The project ensures that all newly developed process steps and (by-) products are subjected to comprehensive sustainability assessments that take into account the entire life cycle, including environmental, economic, and social impacts. This will allow evidence of the new packaging's sustainability to be compared to advance multilayer multi-material packaging.

Plastic waste recycling presents a number of challenges in terms of collection, sorting, and reprocessing, whereas other materials do not, which explains why they have higher recycling rates

Pushing waste out of incineration waste streams

Incineration is thought to be effective at reducing waste volume by up to 95% and solid waste volume by up to 85%, depending on the components of the solid waste. However, incineration neither promotes recycling nor waste reduction. It is also said to emit toxic compounds and particulates that are hazardous to human health.

A partnership between chemical firm LyondellBasell and the European thermal waste treatment company EEW Energy from Waste GmbH ( EEW ) takes waste reduction

Materials News 6 APRIL 2023

to the next level by extracting and recycling plastics from incineration waste streams using advanced sorting technology.

This agreement could include the development of waste pre-sorting facilities at or near EEW incineration plants to remove plastics from waste streams destined for incineration, as well as investment in advanced sorting facilities to further sort and refine the plastic that has been removed.

This collaboration is also expected to close the loop on plastics sent for incineration by sorting them for use as feedstock in mechanical and advanced recycling processes. EEW will first construct a sorting facility to recover plastics for the raw material cycle.

LyondellBasell also announced a partnership with Kirkbi A/S , Lego brand's family-owned holding/ investment company, to invest in APK , a German company that specialises in a solvent-based recycling technology for LDPE.

APK aims to increase the recycling of multi-layer flexible packaging materials, which currently account for the majority of mixed plastic waste from the consumer sector. APK’s solvent-based Newcycling process separates the different polymers of multi-layer packaging materials and produces recycled materials with what is said to be “a high degree of purity” suitable for new packaging materials.

Depolymerisation technology to produce rPET

PET bottles have the advantages of convenience, low cost, and design flexibility, but have a short shelf life (around 6 months) and are likely to end up in landfills due to their single-use characteristic.

Despite the fact that PET is fully recyclable, only 7% of the PET produced globally is recycled bottle-to-bottle.

LyondellBasell and EEW's collaboration is expected to close the loop on plastics destined for incineration by sorting them for use as feedstock in mechanical and advanced recycling processes

7 APRIL 2023

According to the European Chemical Industry Council ( Cefic ), this is partly because mechanical recycling, the current technology, is unable to remove colours from PET waste and also has an adverse effect on the material's quality after each cycle.

Low quality recycled materials have always been a concern for manufacturers adopting more recycled content in their packaging.

A recent collaboration between Italian oil firm Saipem, and Garbo , an Italian chemical company, focuses on improving recycled PET quality. ChemPET is Garbo's proprietary depolymerisation technology that converts PET waste, into new PET that has high value in the chemical and food industries, it says.

European plastics supply chain push for higher legal certainty of recycled content

With the recent meeting of 31 trade associations for the EU to be clear on how it legally views chemical recycling and how recycled content is tracked in plastic products, the tracking of recycled content is a major issue with industry pressing for the legal acknowledgement of a mass balance approach.

Essentially, this is push for policy support from the European Commission and EU member states for chemical recycling that could help speed investment and add more overall plastic recycling capability.

“The rules currently being developed for the SingleUse Plastics Directive (SUPD) implementing act will have a key impact on both mechanical and chemical recycling investments in Europe,” the associations said.

The timelines for targets set out in frameworks such as the proposed Packaging and Packaging Waste directive, which set out goals for chemical recycling capacity by 2030 and 2040, will require the sector to begin work on commercial-scale production facilities immediately, according to the associations.

“It is therefore key that policymakers set a precedent as to when and how a mass balance chain of custody in recycled plastics will be applied in the EU sooner rather than later,” the trade groups said. “This precedent should also set the direction of policy in non-packaging sectors such as automotive or construction, where recycled plastics targets are currently under discussion or may arise in the future.”

Saipem and Garbo have tied up to improve recycled PET quality. ChemPET is Garbo's proprietary depolymerisation technology that converts PET waste, into new PET resins

Saipem and Garbo will also cooperate on the industrial scale construction of Italy's first chemical plastic recycling plant, which will be located in Cerano, in the province of Novara.

ChemPET, according to Garbo, is based on a chemical recycling technology that, unlike the mechanical process, allows for the recycling of types of plastics, such as coloured plastics, for which there are currently no alternatives, and produces higher quality material. Furthermore, unlike the mechanical process, rPET from this process does not lose its properties during the recycling process.

ChemPET also makes process and by-product management easier while avoiding the use of flammable or hazardous materials.

This technology, as well as upcoming solutions, represents the industry's major push to increase not only recycling rates and recycled material quality, but also compliance with the regulations that plastic products must contain more recycled materials, and in the case of PET bottles, at least 25% recycled content, according to EU directives.

There are clear concerns over the mass balance approach to approximating the recycled content of individual plastic items and customer acceptance is critical. If recycling capacity is to grow however, and the move towards greater plastics circularity accelerated, then clearer policy support is required.

The industry view is that the mass balance model can be based on credible third-party verification and certification. Chemicals trade group Cefic says that process losses and outputs, consumed as energy, should not count towards the recycled content targets. At present the sector lacks a standardised approach, with the commonly-used methodology behind mass balance remaining contentious.

In mechanical recycling mass balance can also refer to the process of using a credit system to substitute the use of recycled material in one end-use for another in order to meet sustainability targets.

The concept of greenwashing is coming under increasing scrutiny in the EU, with regulators announcing a stronger push on eliminating the practice as deadlines to reach certain thresholds for recycling and carbon abatement draw closer.

At present, many of the systems for quantifying decarbonisation and waste-reduction remain fragmented, with McKinsey noting that the environmental, social and governance (ESG) space is currently similar to the state financial reporting was in a century ago.

Systems are likely to become more standardised over time, but the complexity of chemical – and even mechanical – makes the process a complex one, with few easy answers.

Materials News 8 APRIL 2023

Adopting pathways to carbon neutrality

China is leading the way in increasing the use of renewable energy and developing new energy vehicles to reduce carbon emissions, adds Angelica Buan in this article.

Becoming net-zero by switching to low-carbon energy

Without a doubt, China is the world's factory, an industrial powerhouse that is a major pillar of global economic growth. However, the negative consequences of its brisk economic activity can be traced back to the volume of carbon emissions, specifically those emitted by the energy sector, which accounts for 90% of China's greenhouse gas (GHG) emissions.

According to the World Bank 's Country Climate and Development Report for China , China emits 27% of global carbon dioxide and one-third of global GHG. With the global push to reduce carbon emissions, China's success in reducing carbon emissions will help the world meet its 1.5°C global warming limit target.

As it works toward its economic goals, the country has made it a priority to achieve carbon neutrality by 2060, and green energy policies are being developed as a result.

Energy Agency ( IEA ) report, An Energy Sector Roadmap to Carbon Neutrality in China

Furthermore, Nearly 10% of the renewable energy and electric vehicle patents are filed in China.

Over the years, China has made significant investments in the energy transition. According to the Energy Foundation China ’s, China 2050 High Renewable Energy Penetration Scenario and Roadmap Study , the nation has committed to reducing CO2 emissions by 2030. This is made possible by the development of its renewable energy sector.

Not moving away from coal

Coal, like oil and gas are non-renewable fossil fuels and by far the largest contributor to global climate change, accounting for over 75% of GHG emissions and nearly 90% of all carbon dioxide emissions, according to the United Nations ( UN ).

Despite its efforts to promote renewable energy, China, the world’s largest consumer, producer and importer of coal continues to invest in coal plants.

China's new coal-fired power capacity in 2022 reached 26,765 MW, up from 26,217 MW in 2021 but less than half of the 40,860 MW in 2019.

According to the 2023 briefing from Centre for Research on Energy and Clean Air , 50 GW of coal power capacity began construction in China in 2022, an increase of more than 50% from 2021.

New coal power projects totalling 106 GW, or two sizable coal power plants every week, were approved; 60 GW of the projects permitted in 2022 were not under construction in January 2023, but are expected to begin soon.

But an expansive shift in resources and innovation is needed to make this transition. The fact that China pioneers clean energy innovation is not surprising. China's public spending on low-carbon energy R&D has increased by 70% since 2015, according to the International

In total, 86 GW of new coal power projects were launched, more than doubling the 40 GW planned for 2021. The most capacity was added in Guangdong, Jiangsu, Anhui, Zhejiang, and Hubei.

Coal production and imports both increased dramatically. Between January and February, 730 million tonnes of raw coal were produced,

9 APRIL 2023

Country FoCus

Prefecture-level regions are said to boost installed wind and solar energy capacity by at least 800 million kW between 2021 and 2025

representing a 5.8% increase year-on-year, with an average daily output of 12.44 million tonnes.

According to the National Bureau of Statistics , coal imports totalled 60.64 million tonnes, a 70.8% increase year-on-year.

The immense and ongoing use of coal, however, does not imply that the country is abandoning its commitments to reduce carbon emissions.

China has the fourth largest coal reserves in the world and produces roughly 90% of the coal it consumes. With the country's rising energy demand, it relies on coal, which is cheap and abundant, to power its industries and meet its electricity needs.

Robust adoption of high renewable energy

At the rate of renewable energy development, China's 14th Five-Year Plan target of requiring 33% of electricity consumption to come from renewables by 2025 is likely to be met sooner than expected. This is demonstrated by ongoing and planned installations across the country.

Research conducted by the Institute of Public and Environmental Affairs and the Chinese Research Academy of Environmental Sciences indicated that prefecture-level regions plan to increase installed capacity for wind and solar energy by at least 800 million kW between 2021 and 2025.

Overall, the pace of renewable energy capacity development is rapid. Installed capacity increased in the first two months of 2023.

News agency Xinhua has reported that wind power installed capacity increased 11% yearon-year to approximately 370 million kW by the end of February 2023, while solar power installed capacity increased 30.8% year-onyear to approximately 410 million kW. Over this period, China's installed power generation capacity totalled about 2.6 billion kW, an increase of 8.5% over the previous year.

At the same time, major Chinese power companies invested a total of RMB28.3 billion in solar energy in the first two months of the year.

Meanwhile, efforts are clearly paying off as a recent data from National Bureau of Statistics of China show that in 2022, the electricity generated by clean energy such as hydropower, nuclear power, wind power and solar power was 2,959.9 billion kWh, up by 8.5% over the previous year,

Hotspot for solar energy

China currently dominates global solar photovoltaic (PV) supply chains, according to an IEA report.

Since 2011, China has invested more than US$50 billion in new PV supply capacity, ten times more than Europe, and has created more than 300,000 manufacturing jobs across the solar PV value chain. China accounts for more than 80% of all solar panel manufacturing processes (including polysilicon, ingots, wafers, cells, and modules), which is more than twice its share of the world's PV demand.

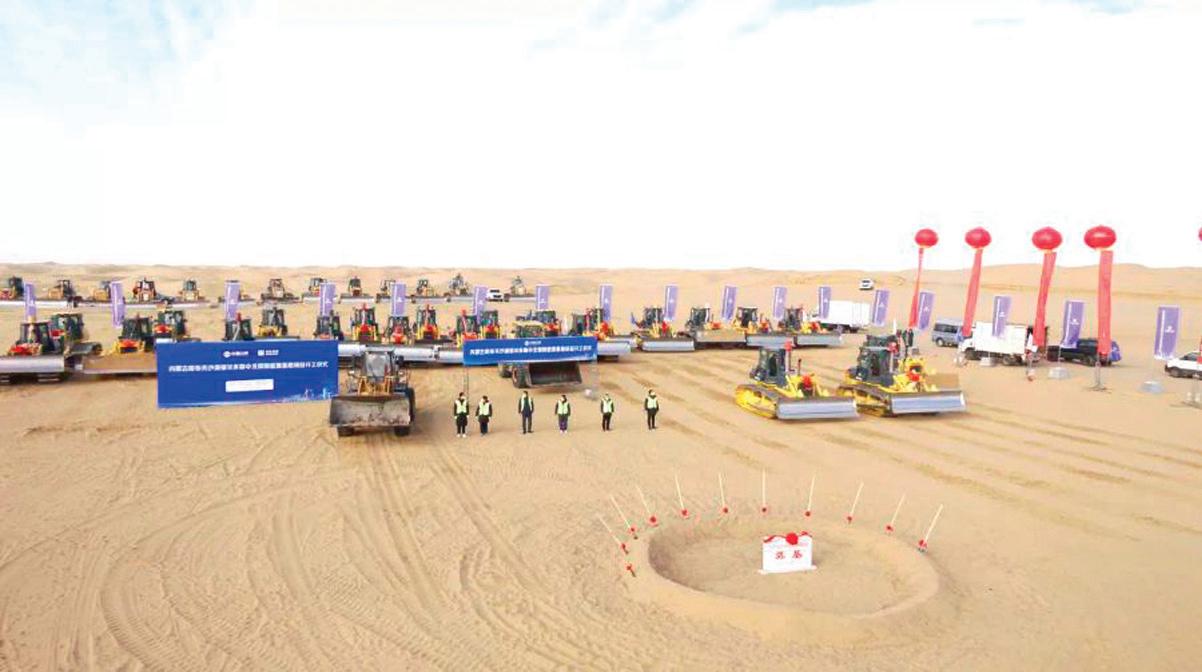

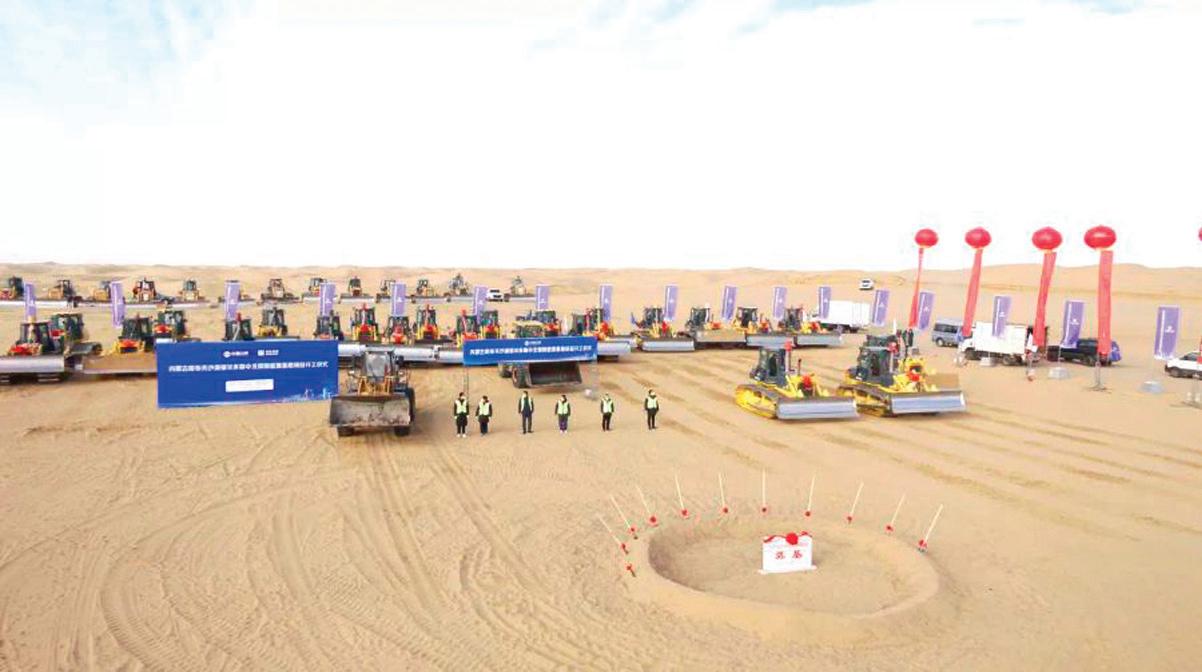

China is currently building what it claims is the world's largest wind power and PV base in the Kubuqi Desert, China's seventh largest desert, and Gobi areas.

10 APRIL 2023

Country Fo C us

Guangdong remains one of the provinces with the most coal power plant capacity, despite a ban on the expansion and construction of coal-fired power plants and privately owned captive power stations in the Pearl River Delta's central region

CTG is constructing the world's largest wind power and PV base project in the Kubuqi Desert of Ordos, north China's Inner Mongolia Autonomous Region. It is China's first 10-million-kW new-energy power plant in the works

The project, which is being undertaken jointly by state-owned power company China Three Gorges Corporation ( CTG ), and electricity integrated services provider Inner Mongolia Energy Group , is expected to have a total installed capacity of 16 million kW.

The project, which has received over RMB80 billion in investment, is expected to deliver approximately 40 billion kWh/year of electricity to the Beijing-Tianjin-Hebei region, or onetenth of Hebei Province's annual electricity consumption. Also located in the Kubuqi Desert is the Junma Solar Power Station, another massive PV facility with more than 196,000 PV panels and has produced more than 2.312 billion kWh of electricity.

INTERFOAM CHINA 2023

Jun.14-16, 2023

Green light for new energy vehicles

The transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs) is likewise intended to reduce the carbon footprint of the automotive industry and meet the 2060 carbon neutrality expectations.

Policies such as the New Energy Vehicle Industrial Development Plan 2021- 2035, which follows the Energy-Saving and New Energy Vehicle Industry Plan 2012-2020, are in place to create a globally competitive automotive industry through the creation of cutting-edge EV technologies, a charging service network, and battery electric vehicles (BEVs); as well as to improve national energy security and air quality, combat climate change, and promote high-growth industries.

SNIEC, SHANGHAI

2023上海国际 发泡材料技术工业

Interfoam China focuses on the displays of the latest foam products and equipment, new technologies, new trends, new applications and so on, and spares no e orts to build a professional platform integrating trade, brand display as well as academic exchange for both upstream and downstream of the foam industry and its application enterprises.

Concurrent activity

3 Days 60 + Topics

Country Fo C us

展览会

fiona.gao@hjtexpo.com +86 010 5867 7126 www.interfoam.cn “Redefine Foams”The 2nd International Forum of Foams and Applications

Chinese NEV manufacturers Li Auto and XPeng increased electric vehicle deliveries in the first quarter of the year

Country Fo C us

Additionally, the latest 14-year plan is intended to put China in a position to successfully meet future demand for autonomous, connected, electrified, and shared mobility, according to the International Council for Clean Transportation ( ICCT ).

The growing popularity of EVs, which includes fuel cell electric vehicles (FCEVs), plug-in hybrid electric vehicles (PHEVs) and BEVs, is evident.

Based on data from China Automobile Association of Manufacturers ( CAAM ), production of EVs in February 2023 increased by 18.1% year-on-year, while sales increased by 20.8% year-on-year.

To meet market demand, major automotive makers are also speeding up the rollout of EVs.

Leading manufacturer of EVs in China, Li Auto , delivered 20,823 vehicles in March 2023, an increase of 88.7% from the same month the previous year. According to Li Auto, it has captured nearly 20% of the RMB300,000 to RMB500,000 SUV market in China, establishing itself as a premium family SUV brand of choice.

Similarly, Guangzhou-based smart EV manufacturer XPeng intends to drive Smart EV transformation through technology and data in order to improve mobility experience, it said.

With strong sales, the company reported it delivered almost 7,000 Smart EVs in March 2023, a 17% increase over the previous month. In the first quarter of 2023, it delivered a total of 18,230 vehicles.

Can

the country achieve its net-zero status?

Thus, though China has made notable progress in its clean energy transition, but it still faces some significant challenges.

Coal accounts for over 60% of electricity generation, and China continues to build new coal power plants domestically. At the same time, China has added more solar power capacity than any other country year-after-year. It is the second largest oil consumer in the world, but it also home to 70% of global manufacturing capacity for EV batteries.

At the same time, reaching China’s climate targets cannot rely solely on the rollout of renewables and EVs. It will need to involve solutions to tackle emissions from its huge

existing fleet of fossil fuel-based power plants, steel mills, cement kilns and other industrial facilities. If the existing emissions-intensive energy infrastructure in China continues to operate in the same way as it does today, its CO2 output between now and 2060 would amount to onethird of the global carbon budget for limiting the global temperature rise to 1.5°C. This is aside from any new plants that may be built to meet growing demand, says the IEA.

China Roadmap , thus, sets out a pathway consistent with the enhanced ambitions that China announced last year in which CO2 emissions reach a peak before 2030 and carbon neutrality is achieved before 2060.

The main drivers of emissions reductions between now and 2030 in this pathway are energy efficiency improvements, expansion of renewables and a reduction in coal use.

Electricity generation from renewables, mainly wind and solar PV, increased seven-fold between 2020 and 2060, accounting for almost 80% of China’s power mix by then.

Industrial CO2 emissions are expected to decline by nearly 95% by 2060, with the role of emerging innovative technologies, such as hydrogen and carbon capture, growing strongly after 2030.

All these changes will boost China’s labour market, with more new jobs created in growing low-carbon energy technologies than are lost in declining fossil fuel industries.

12 APRIL 2023

The China Roadmap lays out a path that is consistent with the country's target of peaking CO2 emissions before 2030 and achieving carbon neutrality before 2060

Improving global carbon emissions, one package at a time

Designing consumer product packaging to reduce carbon footprint is a win-win for global sustainability causes, adds Angelica Buan in this report.

In 2022, global CO2 emissions from energy increased by 0.9% or 321 tonnes, setting a new record of more than 36.8 gigatonnes. According to the International Energy Agency ( IEA )’s CO2 Emissions in 2022 report, emissions from energy combustion increased by 423 metric tonnes (Mt) while emissions from industrial processes decreased by 102 tonnes.

Meanwhile, the Climate Collaborative (comprising a community of businesses joining forces to tackle climate change) says that packaging contributes significantly to greenhouse gas emissions (GHG) because it typically consumes 5% of the energy used during a food product's life cycle. Furthermore, some goods' packaging has a greater impact on climate change than the fuel used to transport them to market.

As noted in UNEP's Emissions Gap Report 2022 , only an immediate system-wide transformation will result in the significant reductions in GHGs required to meet a 1.5°C target by 2030, or by 45% compared to current policy projections.

Current policies predict a 2.8°C temperature rise by the end of the century, well short of the Paris Agreement target of keeping global warming well below 2°C.

As a result, adopting the circular economy model is expected to accelerate progress toward these goals.

The Carbon Collaborative defines circular economies as systems that "eliminate waste and pollution, keep products and materials in use, and regenerate natural systems."

A company's bottom line can benefit from adopting a circular ethos, and brand reputation and leadership can be strengthened as a result, it adds. To accomplish this, circular product packaging has to be designed, and resources invested in materials and methods to close resource loops.

Packaging

Tackling rising carbon emissions with circular packaging solutions

With these figures obviously on the uptrend, rising carbon emissions is seemingly becoming out of control. And that seems to be the case, because authoritative institutions like the United Nations Environmental Programme ( UNEP ) are issuing dire warnings after new findings that emissions are not going down significantly.

Meanwhile, by utilising advancements in design and end-of-life systems, the World Economic Forum has estimated that 50% of the world's plastic packaging can generate income even after its initial use, amounting to as much as US$3 billion annually across all OECD countries, including the US.

Thus, awareness to circular packaging has reached fever pitch and currently, industry leaders, brands and manufacturers are collaborating in efforts to improve the carbon footprint of packaging.

True sustainable packaging with rPLA

Consumers consider the packaging's ability to be recycled and biodegraded as well as its sustainability. The amount of recycled content in a packaging also matters today, so companies are increasing the amount of recycled content materials in their products.

13 APRIL 2023

typically consumes 5% of the energy used during the life cycle of a food product

Packaging

Packaging

Consultant McKinsey 's True Packaging Sustainability report provides these insights on sustainability, which it claims can be divided into three main components, namely, removing packaging leakage into the environment, increasing recyclability and utilising recycled content in packaging, as well as minimising packaging's carbon footprint.

Closed-loop economy with rPET PET is the most recycled plastic in the world, and its recyclable, flexible, safe, and lightweight properties are driving sustainable growth. Due to rising demand from the food and beverage industry, the recycled PET (rPET) market size is anticipated to surpass US$ 17.2 billion by 2030 at a CAGR of 7.6%, according to Acumen Research Investments in rPET are also increasing, as indicated by partnerships to produce more rPET materials and rPET-based packaging.

Thailand-based chemical firm Indorama Ventures ( IVL ) is collaborating with Evertis , a producer of mono and multilayer semi rigid barrier films, on the development of a PET film suitable for use in food packaging trays based on recycled PET flakes.

TotalEnergies Corbion, Posco International, and Esol have joined forces to improve PLA recycling infrastructure and technology in South Korea

Building on growing carbon neutrality initiatives worldwide, TotalEnergies Corbion , Posco International , and Esol formed a partnership to advance polylactic acid (PLA) recycling infrastructure and technology in South Korea, which is pushing its five-year National Strategy for Green Growth strategy to decarbonise and achieve net-zero emissions by 2050.

Posco, South Korea’s largest trading company, intends to expand its green portfolio by entering the biobased plastic recycling sector. While Posco will manage and finance the project, Esol, also from South Korea that already produces PLAbased products in the country, is in charge of retrieving the post-consumer recyclate (PCR) PLA waste and advancing the technology to collect and sort, purify, clean, and rework the PLA.

The partnership will enable TotalEnergies Corbion, which is already supplying its Luminy brand of rPLA to the South Korean market, to leverage its existing advanced recycling technology and infrastructure to establish a recycling infrastructure throughout its supply chain for a more sustainable use of plastics in the country’s growing PLA market.

PLA, a low-carbon-footprint alternative to traditional plastics, is quickly becoming a popular material for bottles, containers, and other food service and packaging products. Luminy's mechanical and advanced recycling is increasing PLA demand in the food packaging sector, adds TotalEnergies Corbion.

After six years of R&D, IVL is now commercially producing rPET flakes from PCR trays in Verdun, France, that are comparable in quality to flakes derived from bottles, it adds. The Deja carbon neutral PET pellet, the latest addition to its Deja portfolio, is said to be the world’s first certified carbon neutral PET pellet solution.

The tie-up will support Evertis’s target of an average incorporation of 50% recycled content in its films by 2025, helping it to further meet its sustainability goals. Plus, Evertis adds that the new technology also protects and preserves food, reducing about 154 million tonnes/year of food waste costing EUR143 billion across the EU.

IVL says its new recycling technology has the potential to divert over 50 million post-consumer PET trays from landfills or incineration each year, and supports the EU’s plastic collection and recycling targets.

14 APRIL 2023

Indorama Ventures and Evertis are collaborating to strengthen circularity in PET food tray packaging

Packaging

Global-scale sustainability with rPET PET producers and chemical companies are likely to support a technology that enables true circularity for PET by using alternative feedstock to petroleum-based monomers and is fully compatible with existing polymerisation plants. Carbios, a French company in the field of biochemistry, offers brand owners a way to comply with expanding regulatory standards and achieve their sustainability goals for using rPET in their goods and packaging.

Carbios , which is preparing to commercialise its PET biorecycling technology on a global scale, said that the engineering basis and operational guidelines for units to be operated under license agreements are defined by the successful ongoing operations in its demonstration unit in ClermontFerrand and the advanced engineering study for its first commercial plant that is due to be commissioned in 2025.

Future Carbios licensees will be given all necessary process documentation to engineer, procure, construct, and operate their PET biorecycling plants under stringent HSE standards. Also this relates to high product quality, from technology promotion with the technical information summary to project development with a specific process design package and process book, it adds.

Carbios says it aims to reach out to other players in the value chain, such as waste management companies and public entities, by adding value to all possible sources of PET feedstock, including complex plastic packaging and textile waste.

Meanwhile, elsewhere, the Technical Committee of the Tray Circularity Evaluation Platform (TCEP) of PETCORE Europe has officially endorsed

DESIGN &materials Sustainability smart technology

Carbios is gearing up for global commercialisation of its PET biorecycling technology

Perstorp’s products have been endorsed in Europe for the design of circular thinwall food packaging solutions for hot-fill applications

the use of Akestra 100 and Akestra 110, products manufactured by specialty chemicals innovator Perstorp , for the production of heat-resistant PET trays. Furthermore, the committee has recognised that the use of Akestra 100 and Akestra 110 do not have a negative impact on current European PET recycling streams.

TCEP is a voluntary European industry initiative that provides PET thermoforms design guidelines for recycling, evaluates thermoform packaging solutions and technologies, and facilitates understanding of the effects of new PET thermoforms innovations on the recycling process.

Akestra 100 and Akestra 110 enable customers to enhance rPET by adding heat resistance capabilities and also achieve sustainability targets by increasing recycled material content and enabling design for circularity.

With this endorsement, Akestra 100 and Akestra 110 are established to enable circular packaging solutions with high PCR content, and for being recyclable in existing recycling streams for tray-to-tray.

The products can also be used in Europe as replacement of linear traditional packaging made of PS or PP in the design of circular thinwall food packaging solutions for hot-fill applications.

Malaysia being developed as a biohub

In a related development, Hotpack Global , a Dubai-based food packaging manufacturer, is investing around US$90 million over the next ten years to build biodegradable packaging plants in Malaysia in collaboration with Free the Seed Sdn Bhd , a Malaysian manufacturer of biodegradable products from rice straw.

The company said that it aims to produce 70 million units/year of sustainable, fastmoving consumer goods (FMCG) packaging products, since the completion of the first plant. The project is being facilitated by Malaysian Bioeconomy Development Corporation (MBDC) and Malaysian Investment Development Authority ( MIDA ).

Construction of Hotpack Global’s 3,200 sq m plant, its first-ever manufacturing unit of in Malaysia and Southeast Asia, has commenced with a recently held ground-breaking ceremony in Gurun, Kedah. Construction will begin in May and is slated to be completed in August this year.

Malaysia is committed to environmental protection and meeting global targets with lower carbon emissions, as highlighted in its own 12th Malaysia plan and expected to become a leading biodegradable hub in Southeast Asia as a result of the project.

The project also allowed Hotpack Global to reach an agreement with local Malaysian farmers to ensure a consistent supply of agricultural raw materials.

The factory will make biodegradable food packaging out of agricultural waste such as rice straw, pineapple leaves, bagasse (the pulpy fibrous material left over after crushing sugarcane) and other agro-biomass materials.

In addition, as part of its 2025 strategy, the UAEbased company will be able to manufacture and supply a new line of biodegradable products for its global markets, including the Gulf Cooperation Council (GCC) countries, as well as establish a presence in Southeast Asia.

Eventually, the project is expected to position Hotpack Global as one of the world's top five producers of disposable food packaging products, within the next three years – an ambition that is going to accelerate the reduction of global carbon emissions.

16 APRIL 2023

Packaging

Hotpack Global will invest approximately US$90 million over the next ten years in Malaysia to construct biodegradable packaging plants

Biomaterials

Kuraray develops biobased, highbarrier, recyclable granulate for paper coating

Kuraray, the global speciality chemicals company headquartered in Japan, has launched a new grade of its sustainable, high-performance barrier material named Plantic. As a plant-based granulate developed specifically for extrusion coating, Plantic EP can is suitable for the development of sustainable gas and aroma-barrier solutions for paper, cardboard and traditional film substrates. A recent certificate awarded by Western Michigan University (WMU) confirms that this new material is repulpable and recyclable. It can therefore be used as the basis for sustainable barrier pouch and carton formats for brand owners and converters. Plantic EP gives the market a high-barrier material that is fully recoverable and recyclable in the US paper stream.

“Companies have recognised the importance of packaging that maintains product integrity and shelf life, while consumers don’t want to buy products that add to landfills,” says Tom Black of Kuraray’s Plantic unit. “We noticed a gap in the market and the need for a sustainable material that could be used to produce pouches and cartons with high barrier properties. It was clear that Plantic EP could be a game-changer. As well as complementing customers’ and retailers’ dynamic product ranges, Plantic EP helps them achieve their sustainability goals – thanks to certification from Western Michigan University that it is both repulpable and recyclable, enabling us all to leave behind a better world for our children.”

“We noticed a gap in the market and the need for a sustainable material that could be used to produce pouches and cartons with high barrier properties. It was clear that Plantic EP could be a game-changer,” said Tom Black, Director of Plantic Sales at Kuraray America

(MAP) for food with a longer shelf life, for example, for odour-free packaging of dry foods. In bags, trays, tubes and pouches, combined with paper or plastics, Plantic is said to be versatile and can be applied by extrusion coating, lamination or extrusion lamination

Since the Plantic layer simply dissolves in water, additional inner sealing layers can be separated cleanly from paper in the repulping process. That increases the yield of paper fibres, resulting in pulp without specks and impurities. The Plantic layer also dissolves during high-temperature washing in conventional PET recycling streams and decomposes into biomass, CO2 and water without any residues. Plantic biopolymer is certified for industrial and home composting. It is also produced without plasticisers and genetically modified raw materials and allows energy savings of up to 40% compared with conventional polymers. Thus, it can significantly reduce the environmental impact compared with conventional packaging and enables re-use of materials that could not previously be recycled, according to Kuraray.

Recyclable, high-barrier properties

To develop a recyclable, high-barrier pouch, Kuraray applied Plantic EP to kraft paper using the extrusion coating process with a bonding/heat-sealing layer of polyethylene from Westlake. Flexible pouches and cartons with high barrier properties can be produced using Plantic EP in combination with multi-layer films. The additional structural layers can be separated, re-used and, where appropriate, recycled or composted.

Starch-based material with benefits

Plantic contains more than 80% corn starch, a renewable and fully biogradable raw material. Thanks to its high gas barrier properties, this highperformance film enables the development of sustainable multi-layer packaging that effectively keeps out oxygen and optimally preserves aromas. Therefore, Plantic can also in modified atmosphere packaging

Plantic is suitable for packaging foods with a prolonged shelf life in a modified atmosphere (MAP) as it is for odour-proof packaging of dry foods, from coffee and tea to dry animal feed

17 APRIL 2023

Biomaterials

“In this collaboration with Kuraray, we used all our application development resources to create a really unique offering,” says Amy Moore, Vice President of Westlake. “We see the benefits of Kuraray’s technology and look forward to working together on further developments as Kuraray commercialises the technology across the bandwidth of market segments and categories.”

Speciality chemicals expert Kuraray recognised brand owners’ the need for sustainability-certified packaging. Therefore, it asked WMU to assess the repulpability and recyclability of the Plantic EP/Westlake pouch made from coated paper. Since it can be completely washed out in the recycling process, WMU certified the recyclability of the Plantic EP/Westlake pouch in October 2022.

“WMU certification as confirmation of recyclability is an important first step in securing a How2Recycle label,” says Black. “When developing packaging formats for brand owners, producers want to see that the materials they are using have been vetted by WMU. Certification enables them to apply to How2Recycle for a prevalidation letter, which speeds up the introduction of Plantic EP-based high-barrier solutions.”

Plantic EP is currently available for testing and is already being used commercially by several brands around the world. Specific application scenarios include the production of pouches and cartons for products such as coffee, pet food, dry goods, and so on.

exhiBition Preview

Kuraray adds that it is currently assessing the recyclability of this product in European recycling streams. Initial internal test results are now available and are promising.

"We see a great demand for materials that improve the sustainability profile of packaging," says Stefan Corbus, Market Development Engineer at Kuraray. "Food packaging is particularly demanding, because here ecological aspects must go hand in hand with functional properties - the sensitive food must be perfectly protected by its packaging. Many brand owners are already well on their way here, and with Plantic, Kuraray is making an important contribution to enabling our customers in the food industry to develop innovative packaging solutions."

Plantic Technologies Ltd. has been a part of Kuraray Group since 2015. Plantic is certified for renewable content, biodegradability in soil and water and compostability by independent international testing and certification companies in numerous countries, including TÜV Austria.

For further information please contact: stefan.corbus@kuraray.com

Find out more on: https://www.packaging.kuraray.eu/

Exhibitors at Chinaplas 2023 add sustainability to their focus

ExxonMobil targets Chinese processors with portfolio of sustainable solutions

US materials firm ExxonMobil, with a focus on serving the fast-growing market in China, is progressing a world-scale chemical complex with a 1.6 million-tonne/year flexible feed steam cracker and more than 2.5 million tonnes/ year high performance PE and PP units in HuiZhou, GuangDong Province.

The company also recently celebrated the key milestones of lifting the project towers and groundbreaking at the Dayawan Technology Centre (DTC). DTC will be ExxonMobil’s fifth global technology centre and the first comprehensive technology centre equipped with a pilot plant outside of North America, integrating product R&D and process development.

To serve the Chinese market further, the company will demonstrate a host of products at its Chinaplas 2023 Booth 17J61 and at the booths of machine manufacturers (OEMs).

Solutions with sustainability benefits will be featured

that highlight the use of Exceed S performance PE, ExxonMobil PP, Achieve Advanced PP, Vistamaxx performance polymers, and Exxtend technology for advanced recycling of plastic waste in a broad range of applications including packaging, hygiene, automotive, agriculture, building and construction, and consumer products.

Some of the solutions produced with sustainability benefits through collaborations include:

• Downgauged solutions that can do more with less by reducing material use while helping to maintain or boost performance using ExxonMobil performance polymers. Samples will include downgauged air tube bags.

• Solutions designed for recyclability by reducing the number of components, including those often considered more difficult to mechanically recycle. Samples will include:

- Mono-material full PE stand-up pouches (SUP); full PE laundry seed packaging; and thermoformed

18 APRIL 2023

packaging containing no polyamides.

- An electric vehicle (EV) neat resin pillar.

- Resilient luxury polyolefin tile (LPT) flooring; thermoplastic polyolefin (TPO) carpet tiles; and PE raised temperature resistant (PE-RT) pipe.

• Solutions that help enable mechanically recycled content to be incorporated, and even increased, because ExxonMobil says its performance polymers are used to help maintain or boost performance. Samples will include:

- Heavy duty sacks (HDS), trash liners and courier bags that incorporate recycled PE content.

- Mobil lubricant bottles that incorporate recycled HDPE content that has been modified with Vistamaxx that can help enhance bottle durability.

- Mini suitcases incorporating Vistamaxx and recycled PP content.

• Solutions made with ISCC PLUS certified-circular polymers through mass balance allocation that leverage Exxtend technology for advanced recycling of plastic waste, which can help broaden the range of plastic waste that can be recycled. Certified-circular polymers can deliver the same performance as virgin resins, which are critical if the value chain wants to use these materials in sensitive applications like food packaging.

Also being featured is ExxonMobil’s new Exceed S performance PE that can offer combinations of stiffness and toughness while being easy to process, enabling converters to rethink film redesign for simpler solutions. Exceed S can help facilitate solutions with sustainability benefits by enhancing film performance, maintaining comparable performance at a thinner gauge, producing more durable mono-material film structures, or enabling the incorporation of high percentages of recycled content.

Demonstrating how Exceed S can deliver “so much, so simply”, Nordmeccanica (Booth 1B15) will run a PE// PE pillow pouch made with Exceed S; and Haboshi (Booth 2S41) will run a downgauged HDS made with Exceed S.

ExxonMobil’s Exceed S performance PE resins are said to provide tougher, stiffer air tube packaging, helping products ordered through e-commerce transactions get delivered safely and potentially reducing product returns

For the first time in China, ExxonMobil will also introduce an Exact plastomer medical grade, which complies with a number of regulatory requirements for use in a variety of medical applications including syringes, IV bags and bottles. Several medical product samples will be showcased, while Borche (Booth 12J31) will run medical pipette tips made with ExxonMobil PP6014MED, a medical compliant homo-polymer PP grade.

Kiefel showcasing new KMD 90 Smart; capable of processing recycled/PLA resins

German machinery firm Kiefel is demonstrating the new Speedformer KMD 90 Smart steel rule cutting machineengineered in Germany and made in China, it adds. The model is equipped with the latest features and options, processing various materials for the packaging industry. Furthermore, new solutions for the appliance industry - also engineered in Germany and made in China - will be shown at its booth 10Q21 in Hall 10.

The world premiere of the new Kiefel machine, Speedformer KMD 90 Smart, will launch it globally for sales in China and many other countries. It is engineered for the production of food and non-food plastic packaging e.g. trays and containers, made from PET, PP, PLA, PS, PE or recycled plastics.

The machine is 100% made by Kiefel and combines German technology with Chinese local manufacturing benefits, made in parent company Brueckner Group’s factory in Suzhou, China.

The KMD 90 Smart complements the smaller KMD 78 Smart, which was shown at Chinaplas 2021.

The high degree of automation and the time-saving tool change system are as much part of the mature concept as the steel rule cutting and the integrated stacking station. Additionally the machine comes with a forming area of 870 x 920 mm, a tool dimension area of 890 x 940 mm and can produce formed parts with a height of up to 160 mm. The machine is said to be efficient and sustainable, e.g. through the film temperature measurement with closedloop control or drives with energy recovery system.

Kiefel is also underlining its presence in China with its new machine solutions for the appliance industry. From now on Kiefel is building Sharpformer Kid 1.250 Smart machines in China.

This inline thermoforming machine for the production of HIPS and ABS refrigerator inner-liners and doorliners utilises vacuum-pressure forming technology for more demanding shapes and higher production speeds. The 1.250 Smart can produce side-by-side products using just one mould.

Following Kiefel’s strategy dedicated to the Chinese market, the 1.250 Smart is also engineered in Germany and assembled in China, Suzhou.

Furthermore, Kiefel says that since the machine has been “well received” by Chinese customers, further machine

19 APRIL 2023

Exhibition PrEviEw

Exhibition PrEviEw

Several packaging products, like this PET container, can be produced in high volumes on the KMD 90 Smart

of recipes. Coperion says it has already realised numerous systems for the production of bioplastics and therefore has know-how in designing the process steps needed to achieve the required mechanical properties of the bioplastic end product.

The STS 25 Mc11 laboratory extruder that Coperion will show at Chinaplas, has a 25 mm screw diameter and features a simple design. It is operator-friendly and easy to clean.

By having the same screw diameter ratio and the same maximum specific torque as the entire STS Mc11 extruder series, production parameters can be reliably scaled up to a larger STS model.

types for the refrigerator industry will be successively offered according to the same concept, engineered in Germany and assembled in China.

Chinese and Asian customers, in particular, therefore benefit from shorter delivery times, faster spare parts availability, as well as competent local support from the Kiefel team in China.

Coperion and Herbold display compounding/recycling solutions and for production of bioplastics

Machine maker Coperion GmbH, Stuttgart/Germany, will showcase its expertise in plastics recycling at its Booth 10K31 in Hall 10 with a virtual complete system for recycling PET. This plant allows a look inside numerous key components from Coperion and recently acquired partner Herbold Meckesheim, with whom Coperion now offers complete systems for plastics recycling.

In terms of its conventional compounding systems, the ZSK 58 Mc18 twin-screw extruder, with a specific torque of 18 Nm/cm³ that will be on display, has been locally assembled at Coperion’s manufacturing site in Nanjing, China. With the assembly in China, Coperion is able to meet to customer demand, such as faster service and parts.

The extruder will be fitted with a Coperion K-Tron K-MLSFS-KT20 twin-screw loss-in-weight feeder.

In addition to compounding and recycling, Coperion extruders are suitable for the production of bioplastics. This process places high demands on the extrusion system due to the diversity of base polymers being used and the variety

To extend the process window, Coperion has increased the screw speed of the STS 25 Mc11. Thus, the laboratory extruder is ideally suited for recipe development and basic research with small batch sizes of 2 kg and achieves throughput rates of up to 110 kg/hour.

Also on display will be a Coperion K-Tron K2-ML-D5-T35/ S60 quick change feeder, featuring the ActiFlow smart bulk solid activator and Electronic Pressure Compensation (EPC) in combination with a 2400 Series vacuum receiver for refill.

The T35/S60 quick change feeder (QC) on display is designed for applications requiring quick changeover of materials and convenience of fast cleaning. The QC feeder allows for fast removal of the entire feeding module with screws in place for replacement with a second unit. Twin and single-screw feeding modules are available.

The ActiFlow smart bulk solid activator offers an innovative method to reliably prevent bridging and rat-holing of cohesive bulk materials in stainless steel hoppers without internal hopper agitation. The smart flow aid applies gentle vibrations to the hopper wall, hereby carefully activating the contained material with the optimal amplitude and frequency. It is designed specifically to work with Coperion K-Tron’s line of gravimetric loss-in-weight feeders.

As well, the 2400 Series vacuum receivers provide a high-capacity sequencing system primarily used where larger conveying rates or long distances are required, in applications with one or multiple destinations. They are designed to high quality standards for pneumatically conveying powder, pellets and granular materials for most industries. Conveying rates range from 327 to 6,804 kg/hour.

The 2415 pellet receiver will be on display at Chinaplas 2023.

20 APRIL 2023

Coperion and Herbold will demonstrate a PET recycling system at the booth

KRAIBURG TPE’s sustainable TPE gets a grip on the Victory toothbrush

It is without doubt premium environmental toothbrushes with innovative features and aesthetics will gain a larger share of the oral hygiene products market in time to come.

As functionalities and designs must meet the expectations of discerning consumers, advanced materials such as sustainable thermoplastic elastomers (TPEs) are beneficial for the environment.

Global TPE manufacturer offering custom-engineered TPE solutions for a wide range of consumer product applications

KRAIBURG TPE, which only recently introduced its sustainable Thermolast R TPE compound for the Asia Pacific market, has seen the compound series make its foray into the toothbrush consumer daily use market; in collaboration with Thailand’s top toothbrush maker The First Thai Brush Co Ltd

Teaming up with a market leader

KRAIBURG TPE’s sustainable TPE series, which contains up to 35% post-consumer recycled (PCR) content (hardnessdependent), has had one of its first applications in Asia by First Thai Brush for its new Victory toothbrush.

The new sustainable TPE compound provides the properties needed to create cutting-edge toothbrushes in terms of aesthetics, safety, compliance, durability, versatility, and sustainability. Additionally, this material solutions are meet food contact regulatory standards (FDA) CFR21, REACH SVHC, and RoHS.

Moreover, the addition of a sustainable TPE portfolio allows First Thai Brush Co to align their commitment to environmental stewardship.

"We've been using KRAIBURG TPE materials since the 1990s and have found them to be a great fit for our toothbrush application,” said Kit Tae, Deputy Managing Director of First Thai Brush.

He also added that KRAIBURG TPE's team had been “extremely helpful with material selection, design

optimisation, and processing recommendations”.

“Their technical knowledge and customer service are exceptional. We particularly value the materials' versatility, which can be tailored to meet our specific needs. The sustainability of the materials has also impressed us, which aligns with our commitment to environmental responsibility," he furthered.

Adding comfort to a toothbrush

First Thai Brush says its Victory Toothbrush has soft and thin tapered bristles for deep penetration of tooth and gum lines.

Based on Japanese technology, the wide brush head and longer handles allow the user to reach deeper into their mouth for a more thorough clean, adds the firm.

The TPE application on the toothbrush handle provides a soft touch and an anti-slip grip, allowing for brushing with a firm hold.

The compound series, available in translucent and natural colours, includes a variety of colour options, including colour effects, for greater design flexibility.

Good adhesion with PP

KRAIBURG TPE also says that its sustainable TPE has good adhesion with PP resin and a hardness range of 30 Shore A to 90 Shore A, providing a variety of options for application requirements.

Additionally, theTPE series has good mechanical properties, a non-sticky surface, temperature stability up to 80°C, and can be used as an alternative material to EPDM, PVC-P, and elastomers.

Sustainability and safety – the way ahead

With sustainability being a big issue of late in consumer products, KRAIBURGTPE’s sustainableTPE series has also been tested and certified that it can be introduced into the PP and HDPE recycling streams without affecting the recycled thermoplastics properties.

KRAIBURG TPE claims that it is currently the only global TPE supplier with this valid EU-wide certification.

Exclusive giveaways at Chinaplas 2023!

KRAIBURG TPE says it will be giving away the latest wide and long special edition of the Victory Toothbrush made by with its sustainable TPE at the upcoming Chinaplas 2023 exhibition, to be held at the Shenzhen World Exhibition & Convention Centre in Shenzhen, China.

The freebies will be available at its booth P73, Hall 17. Visitors can fill out the form at https://www.kraiburg-tpe. com/en/chinaplas

21 APRIL 2023

ThermoplasTics elasTomers

The Victory toothbrush features a handle made from sustainable TPE from Kraiburg

Injection Moulding Asia

Building a zero-net waste solution for EV batteries

With the automotive sector’s eventual transition to electric vehicles (EVs), sustainable manufacturing and recycling of EV batteries has become a focus, according to Angelica Buan in this article.

From charging stations to batteries: EV concerns

The global market for electric vehicles (EVs) is booming, especially following the downturn in the automotive sector during the pandemic period. The first half of 2022 saw more global sales of EVs than the six months before, according to an audit by European consultancy Roland Berger

Meanwhile, according to a Goldman Sachs Research , EVs will account for 50% of new vehicle sales globally by 2035, with EV sales expected to reach 73 million units in 2040, up from around 2 million in 2020. Meanwhile, IDTechEx predicts that EV markets on land, sea, and air will generate US$2.6 trillion by 2042, with a double-digit annual growth rate.

The rapid adoption of EVs has created a gap in charging infrastructure. In Roland Berger’s third edition EV Charging Index report, which polled over 15,000 customers in 30 countries, representing more than 93% of global EV sales, insufficient charging infrastructure was cited as the top concern by more than half of respondents (53%).

In Southeast Asia, however, a decline in the global EV-to-charging point ratio from 2 to 1.8 in the first half of 2022 suggests that the region’s sector is able to meet the level of demand at this time.