speculative investors control the battery industry The year ahead: views of the great and the good Bringing the industry together www.batteriesinternational.comTHELASTWORD:DEATHOFANEWSHOUNDFORETOLD Issue 126 Winter 2022/2023 How India is braced for energy storage bonanza Formation at its finest: only the best will do Europe's giga dreams in tatters Decisions needed to avert battery crisis

Why

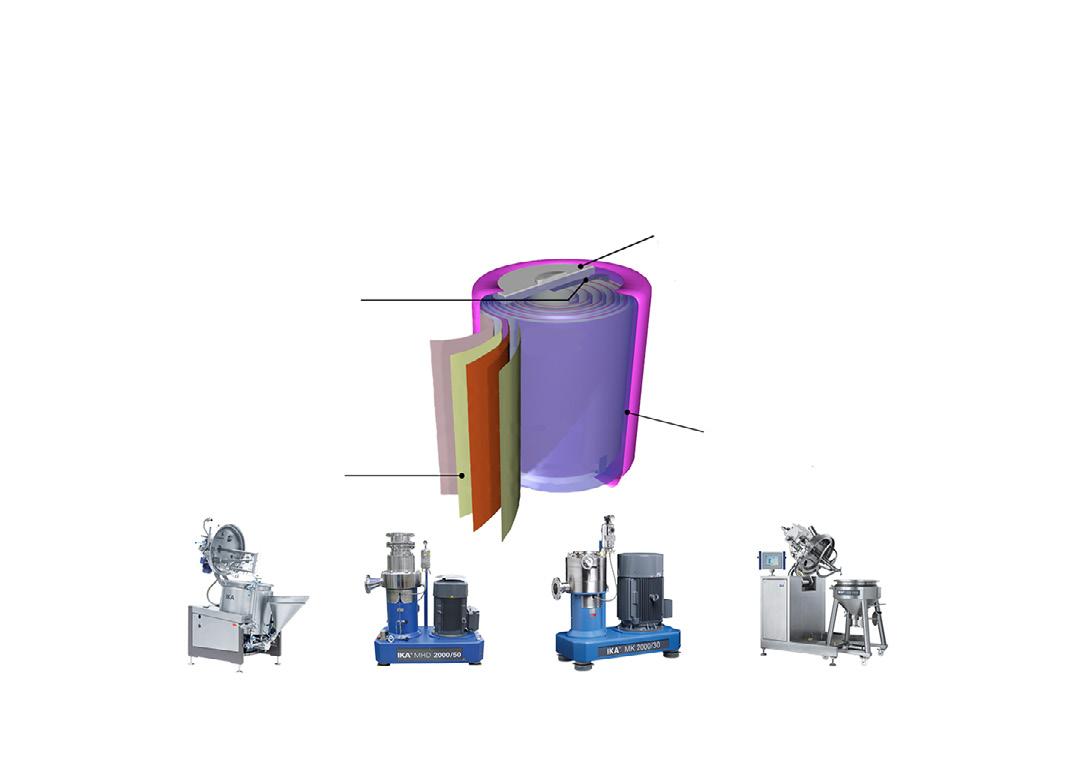

A G . D D B B , B W (C), B -B S C E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390 A B C ’ L E S S B -BE(TM) P R E G S (TM) T . B -BE S D M E S N T F G . D D B B , B W (C), B -B S C E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390 A B C ’ L E S S B -BE(TM) P R E G S (TM) T . B -BE S D M E S N T F G . D D B B , B W (C), B -B S C E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390

Time to fix Europe’s competitiveness problem

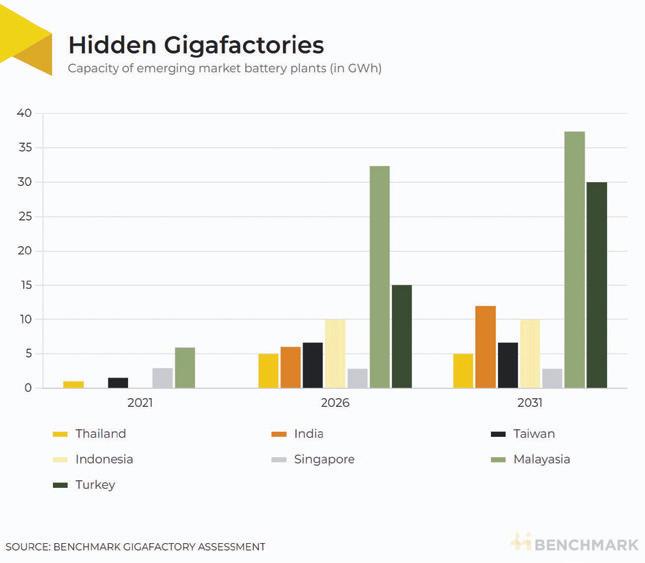

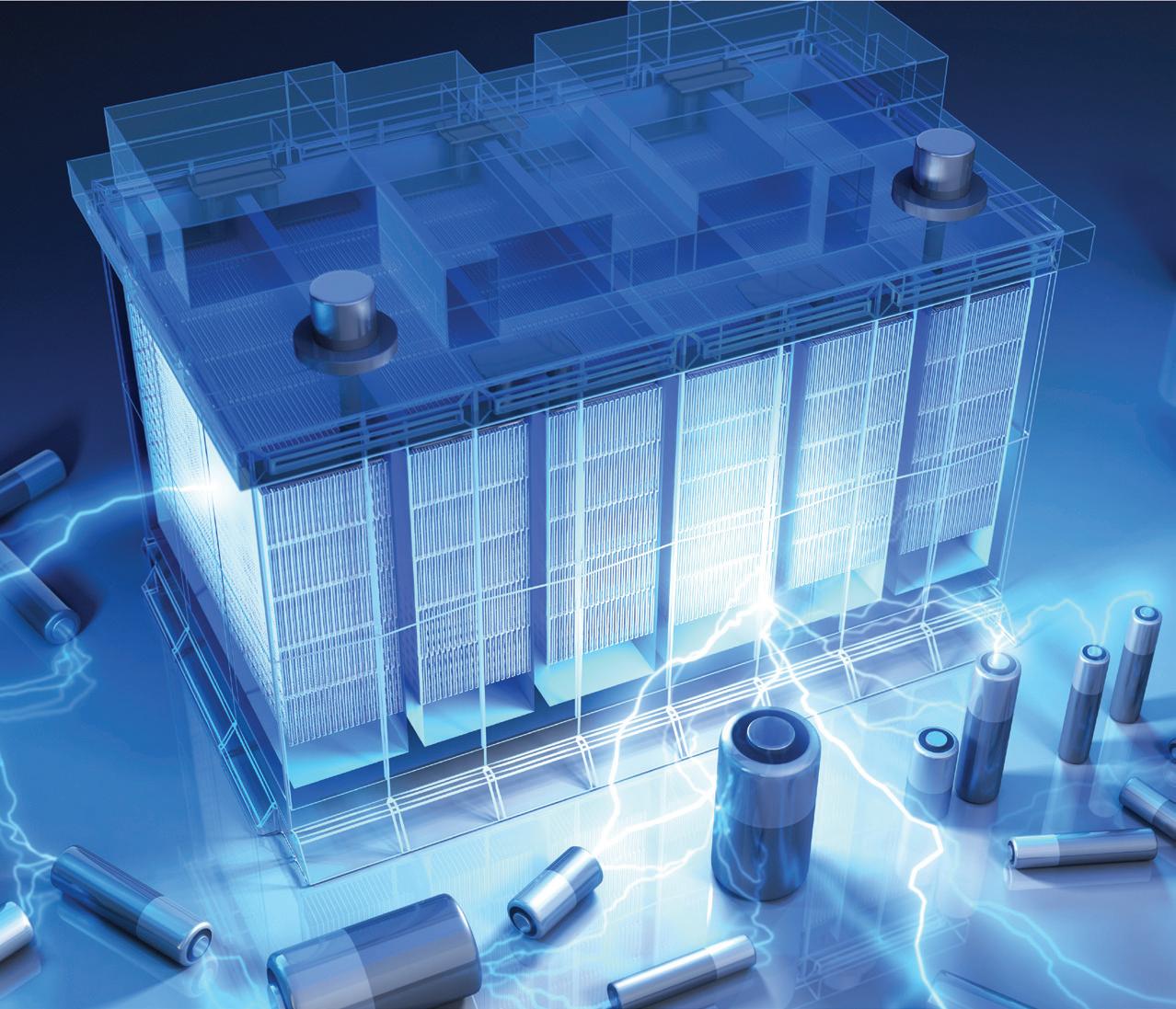

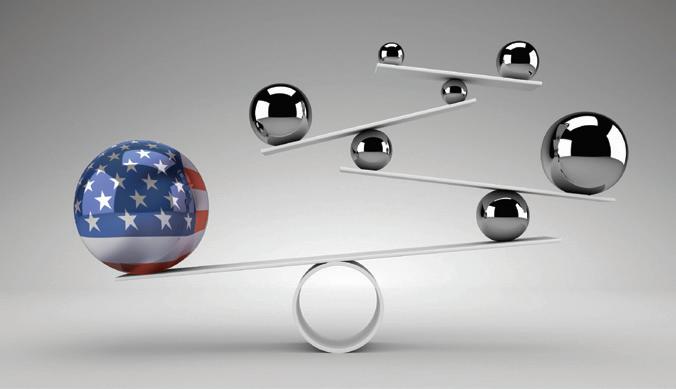

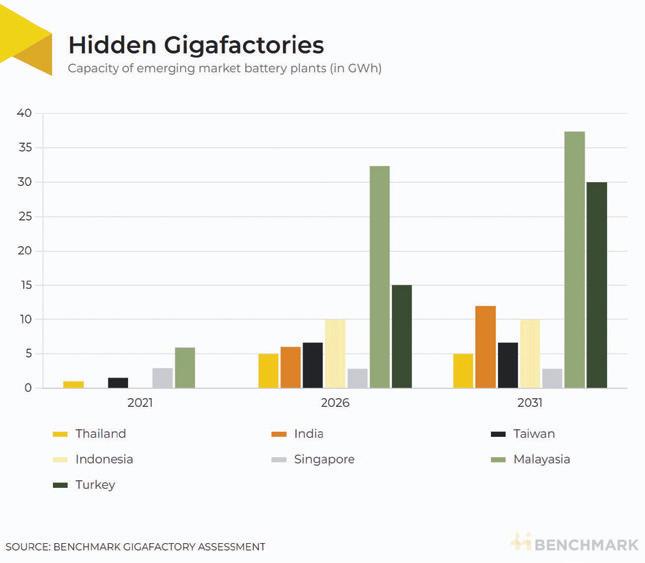

36 Europe’s ambition to become an EV batteries powerhouse could stall as lucrative US tax breaks lure gigafactory investors away and China extends subsidies. EU is now in a crisis to salvage its electric dreams as industry leaders accuse policymakers of being asleep at the wheel

Global giga investments tip scale in favour of US 40

Investment needed to secure critical materials to power EU’s electric future

UK giga-project runs out of road

Stryten incoming CEO Judd reunites previous Johnson Controls management, Vargo to become chairman • Grupe takes over as Digatron CEO

• Distinguished service honour for Ramesh Natarajan • Pam O’Brien leaves BCI • CBI appoints two in the US, seeks to recruit another in Brussels • Employer award honour for Gravita • Hammond Group names four industry experts to Innovation Leadership Council • Posters showcase added to BCI’s Kentucky program

• Giuliani joins Sunlight’s executive team • EnerSys appoints Tamara Morytko to board • Volt Resources makes Chintawar new CEO • Spearmint Energy makes Rood chief development officer • Jansen named as interim Solid Power CEO as Campbell retires • Highview Power appoints Redding as general counsel

NEWS

15

Metair rejects early batteries unit bids as plans for sell-off go on • Refined lead metal demand exceeds supply, says report • Exide Industries renames lithium business unit • US ‘set for 1,000GWh surge in EV battery capacity by 2030’ • Nala’s Belgium BESS set for commercial start

• Metair rejects early batteries unit bids as plans for sell-off go on

• Refined lead metal demand exceeds supply, says report • Exide Industries renames lithium business unit • US ‘set for 1,000GWh surge in EV battery capacity by 2030’

• Nala’s Belgium BESS set for commercial start

• Construction launch for Neoen’s 200MW Blyth Battery in South Australia • BASF in materials supply first for ToyotaPanasonic joint venture firm • ABC, Exide Industries reveal bipolar lead BESS plans for India • GS Yuasa online battery academy now multilingual

RECYCLING NEWS

23

Port Pirie back in operation as Nyrstar launches ‘early works’ on product recycling facility • New Nour battery recycling unit ‘operational by spring’ • ACE partners Tabono for Africa recycling

• Gravita forecasts recycling boom, but fewer participants

CONTENTS www.batteriesinternational.com Batteries International • Winter 2022/23 • 1 COVER STORY: EUROPE’S GIGA DREAM IN TATTERS 36

8

How to destroy Europe’s battery industry in three quick months PEOPLE NEWS

Stryten incoming CEO Judd

EDITORIAL 4

8

42

45 Work starts at Port Pirie 23 ABC opens BOX of deals 17 Hammond names four industry experts to Innovation Leadership Council 13

26

Redwood to start work on US battery materials site in $3.5bn investment • CATL in 123GWh Honda deal, plus BESS supplies agreement with Gresham House • Russia gigafactory plan is ‘first step toward batteries independence’ • US ‘set for 1,000GWh surge in EV battery capacity by 2030’ • Nala’s Belgium BESS set for commercial start

• Construction launch for Neoen’s 200MW Blyth Battery in South Australia

• BASF in materials supply first for Toyota-Panasonic joint venture firm

FEATURES

HERE COME THE MONEY MEN!

50

Private equity and venture capital investors have been circling the lead battery industry for well over the past decade. Their ownership can bring benefits but also difficult times.

THE YEAR AHEAD

Each December Batteries International asks leading figures in the battery and energy storage market for their take on the year gone by and the year ahead. BATTERY FORMATION

• The bright sparks at batteries’ journey end

• Supply chains and the new world order

58

Our definitive guide to the conferences and exhibitions in the months ahead

LAST WORD

95

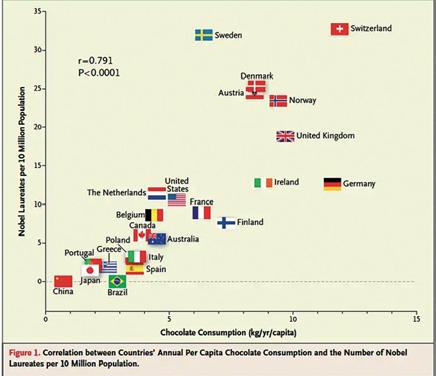

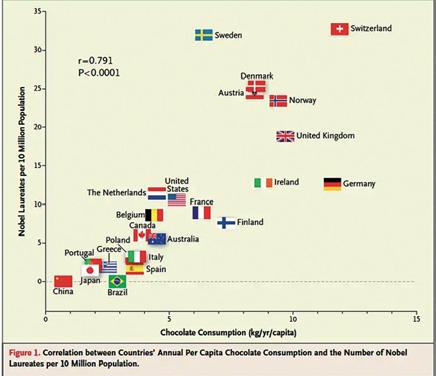

Death of the Newshound? The News-puss cometh • Nobel Laureates explained — it’s chocolate • The Curse of Moe returns

Publisher

Karen Hampton karen@batteriesinternational.com

+44 7792 852 337

Editor-in-Chief Michael Halls editor@batteriesinternational.com

+44 7977 016 918

Advertising director Jade Beevor jade@batteriesinternational.com

Editor

John Shepherd john@batteriesinternational.com

Contributing editor Frank Millard Researcher, journalist Frances Jones frances@batteriesinternational.com

Finance administrator Juanita Anderson juanita@batteriesinternational.com

Subscriptions, enquiries subscriptions@batteriesinternational.com admin@batteriesinternational.com

Production/design

Antony Parselle aparselledesign@me.com

International advertising representation advertising@batteriesinternational.com

The contents of this publication are protected by copyright. No unauthorized translation or reproduction is permitted. ISSN 1462-6322

© 2022 Mustard Seed Publishing UK company no: 5976361. Printed in the UK via Method

CONTENTS 2 • Batteries International • Winter 2022/23 www.batteriesinternational.com

ENERGY STORAGE NEWS

69

EVENT REVIEW — ILZDA 2022 76 International Conference on Lead and Lead Batteries December 5-6, New Delhi, India

EVENTS 81

•

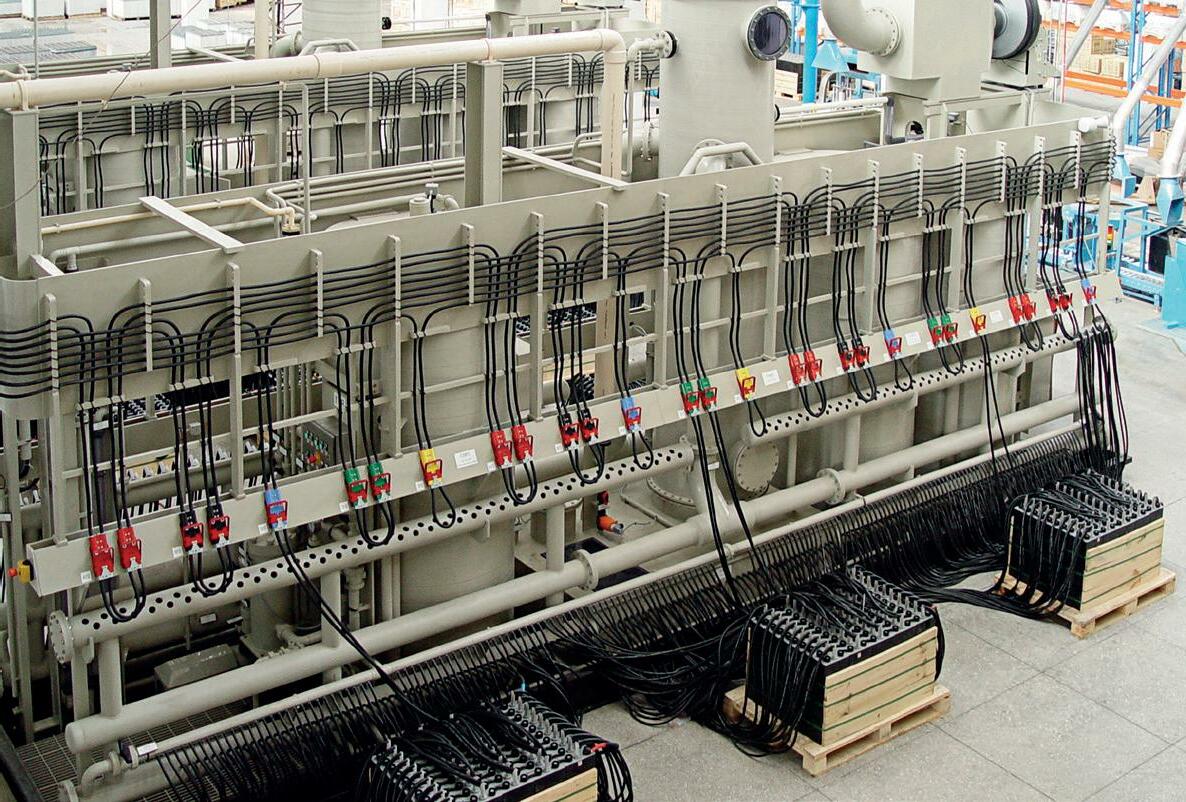

• Fine dining à la BCI

Poster, poster on the wall who is the smartest of them all? • Saving the environment, the US way • ‘Child’s play’ in Indian hotel mix-up

Disclaimer: Although we believe in the accuracy and completeness of the information contained in this magazine, Mustard Seed Publishing

warranties

representation

this. Nor should anything contained within it be construed as constituting an offer to buy or sell securities, or constitute advice in relation to the buying or selling of investments. Last Word: Poster time ahead 96 What’s in store for 2023? 58 Here come the money men 50 Formation at its finest 69

makes no

or

about

How to destroy Europe’s battery industry in three short months

In a former lifetime I spent over 20 years working as a financial journalist in the City of London. My speciality was the foreign exchange and derivative markets where a move of one US cent with leverage could earn a good trader’s bank a six figure profit in a matter of minutes.

In those days there were two types of trader. The analytical and the instinctive.

The first would work carefully at considering the trends, index weightings and charts looking for the pattern to make a winning trade. This is unmistakably similar to the analysis that goes on in predicting our future battery requirements, players, market penetration, investment subsidies and the like in working out the economies of the gigafactory and battery needs of the future.

The second trader was the instinctive one. They would have a gut feeling about the way a market was moving and would often choose something random as an omen. One favourite used to be the angle of the half-naked woman then found on page 3 of The Sun newspaper. Parts of her facing one way meant the dollar was going to go up. Or down.

Both traders made money. But they each did so in different ways. Interestingly enough they each had an interest in expensive wines — one would understand and savour the bouquet and taste. And the other? Well he’d spoof you that you couldn’t drink a $200 bottle of Château Lafite in one.

The relevance to the battery markets is that we’re in a situation where we have two fundamentally different approaches to how we can develop the gigafactories and battery cultures of the future.

Look to the US and China and you see two countries instinctively wanting to play at the top table for the new energy game in town.

The tax breaks in the US Inflation Reduction Act have been calculated and, yes, the entire $370 billion on offer has been analysed but fundamentally the American approach is knee-jerk and instinctive.

So too is China’s approach in handing out subsi-

dies to get the gigafactories of the future. The rest of the world — thinking particularly of Canada, Japan and South Korea — are also making moves.

If our electric future is going to be one powered by renewables with batteries for energy storage as now seems inevitable it’s just plain common sense that you’ll want to support your own nation’s attempts to become top dog in the technology.

But there’s also the analytic approach that seems to be part of a general European bureaucratic understanding of the world.

In this idealised future — imagine the whole continent is gently humming with everything from perfectly recyclable toothbrushes to infinite cheap power at its command — everything will be perfect.

In this analytic world the underpinning of it is being thrashed out now by the civil servants of the European Commission as we transition to this gleaming future where we all wear open-toed sandals, hum Joan Baez songs and there’s not a whiff of that deadly CO2 around.

But just a quick glance through the agenda that these dedicated and, we presume, well-meaning bureaucrats have, shows the immensity of the tasks they are setting out for themselves. And their inability to achieve them in any kind of sensible or time-realistic fashion.

The over-arching aim is set out in the European Green Deal but this and the regulation around it is huge.

Your eyes may blur over the next few paragraphs but there is a valid point considering the scope of what the European Commission seeks to achieve. We have the European Climate Pact, enabling the Green Deal, the Sustainable Products Initiative, the creation of the Circular Economy, the Renewable Energy Directive, the EU Biodiversity Strategy, the Zero Pollution Action Plan, the Carbon Border Adjustment Mechanism, the Energy Taxation Directive, the Fit-for-55 Package (55% reduction of CO2 by 2030) and the soonto-go-live Battery Passport to name the first ones to come to mind.

To add misery to this blur of legislation we have

Mike Halls • editor@batteriesinternational.com

EDITORIAL 4 • Batteries International • Winter 2022/23 www.batteriesinternational.com

In its Farm-to-Fork program the Commission sets the target to make 25% of EU agriculture organic by 2030 — none of the EU’s 440 million citizens or 12 million farmers were asked for their opinion let alone their vote on the matter.

just had the approval of the first phase of the Batteries Regulation (that update of the 2006 Battery Directive) which sets commercial logic to one side and says only batteries made to EU specifications can be allowed into the bloc.

However, to make the regulation actually work is going to require another six to eight years of secondary regulation and committee work to achieve its goals. As an aside is that really what European automotive OEMs want? More expensive batteries to go into their already expensive EVs?

The EU’s attempt to drive lead battery manufacturing out of Europe — sometimes it feels like the use of lead batteries too! — has its culmination in the magnificent REACH regulations banning all hazardous substances out of the continent. Lead, of course, being one of them.

At least it’s kept ILA staff more than busy for over a decade in combatting (mostly successfully) Commission inroads into the lead battery industry.

This attempt to regulate all life across the EU — the Economist newspaper once called it the potential de-industrialization of Europe — has even extended to the food we eat. In its Farm-toFork program the Commission set the target to make 25% of EU agriculture organic by 2030. A quirk of governance: none of the EU’s 440 million citizens or 12 million farmers were asked for their opinion or vote on the matter.

The odd thing about these targets — and let’s face it a lot of what the Commission hopes to achieve are sensible — is that no democratically elected body in Europe voted for most of them.

Europe’s system of governance is an odd one — the unelected civil servants set out the policy and the regulations while the elected European Parliament rubber-stamps them. This may be a slight over-generalization, but the generalization is valid.

The Commission itself is above the sordid world of business and accountable public expenditure — every month they ship the whole apparatus of EU governance from Brussels to Strasbourg for a few days as part of a treaty obligation to keep the French happy a couple of decades ago. (Imagine the uproar over the cost if the US moved the seat of government from Washington to New York for a few days every month!)

And in the next couple of months this difference in approach between the instinctive and over-analytic is going to come to a head as everyone that had previously been inclined to set up gigafactory plants in the EU is now voting with their feet and heading east and west.

The European Battery Alliance — an organization that stands out above others and dares to speak its mind — reckons that at least €100 billion ($106 billion) is needed to avert a potential investments meltdown for gigafactory plans.

EU Commission vice-president and batteries czar Maroš Šefcovic, who in fact set up the Alliance in 2017, has been told in no uncertain manner of the damage being done to Europe’s fledgling battery plans by foreigners.

But let’s not ignore the impressive achievements that the EU has made in drawing post-war Europe together and unifying a fractured continent. The ability, for example, to take a five-hour drive through Europe, going through seven different countries but using one currency is an impressive one.

The trouble with creating this cohesive entity — where there are 24 official languages by necessity — is that decision-making is complicated by the need to be consensual.

And, in the race to attract battery investment into individual member countries, a long, dragged-out partisan dialogue is more than likely to happen …

Mike Halls, Editor-in-Chief

EDITORIAL www.batteriesinternational.com Batteries International • Winter 2022/23 • 5

We’re in a situation where we have two fundamentally different approaches to how we can develop the gigafactories and battery cultures of the future.

Hammond-engineered to reduce acid New GravityGuard

Hammond is a Leading Developer of Lead-Acid Battery Chemistry for Advanced Energy Storage Applications

Red Lead & Oxides

High-Quality Staples of Battery Manufacture, Tailored & Processed

And has Served the Global Battery Industry

For 90 Years.

Technical Assistance

Better Paste. Better Plates. Better Battery. Engineered to Customers’ Specific Particle & Batch Size Documentable Savings of Paste Material & Curing Time SureCure® Accelerates TTBLS Crystal Growth More Tested & Proven Benefits of Hammond Original & Treated SureCure® Improved Charge Acceptance • Strengthened Positive Plates • Enhanced Curing Consistency Increased Cycle Life • Improved Partial-State-of-Charge Cycling • Reduced Carbon Footprint Hammond Group, Inc. announces two Senior Fellows to guide its Innovation Leadership Council — John Miller, recently Senior Director of Engineering for Stryten, and Dr. Francisco Trinidad, recently Director of Battery Technology for Exide Europe. With extensive battery industry expertise they will play leadership roles in supporting and advancing product development and innovation at Hammond. Also joining them on the Council are Rosalind Batson, President of Clear Science Inc., and Lash Mapa, Professor of Industrial Engineering and Technology at Purdue NW. We welcome these important voices in developing Hammond's next generation of innovations for the battery storage industry. Read more at HammondGlobal.com/news. Hammond Names Senior Fellows to Innovation Leadership Council INDUSTRY NEWS Miller Batson Trinidad Mapa

Stryten incoming CEO Judd reunites previous Johnson Controls management, Vargo to become chairman

as VP and general manager Americas. He left the firm when it became Clarios after being bought by Brookfield Business Partners in May 2019.

Stryten Energy unveiled a major shake-up of its leadership team on January 4 with a reformulation of ex-Johnson Controls senior management that had worked together in the previous decade.

Stryten president and COO Mike Judd will be promoted to succeed CEO Tim Vargo, who will become chairman. Judd who joined Exide Technologies in 2019 before it became Stryten had also spent 12 years in senior positions in Johnson Controls.

Both appointments are to take effect before the end of Stryten’s fiscal year on March 31.

Vargo, a former CEO and president of Exide Technol-

ogies, said Judd’s promotion to CEO was “the culmination of a succession plan the Stryten Energy board and I have developed over the last several years”.

“Mike is the right leader to take the reins of the business and achieve the company’s strategy for increased profitability and growth,” Vargo said.

Meanwhile, Petar Oklobdzija, CFO at separator manufacturer ENTEK, will join Stryten as executive VP and CFO effective February 1 to lead the company’s finance, accounting, treasury, information technology and strategic sourcing.

Before ENTEK Oklobdzija spent 18 years with Johnson Controls most latterly

Meanwhile, Dan Autey joined the company on January 3 as executive VP commercial. Autey had previously spent 19 years with Johnson Controls/Clarios most latterly as VP/GM aftermarket, US and Canada.

A further appointment has been the promotion of strategic sourcing VP Jeremy Furr to that of senior VP of strategic sourcing. This was confirmed in a LinkedIn post on January 3.

Incoming CEO Judd said Oklobdzija’s career in operations and finance in the automotive and battery industries would help the firm accelerate plans to expand in new and existing energy storage markets. Autey’s automotive and industrial battery expertise “will help strengthen our ability to serve our customers’ evolving energy needs”, Judd said.

Stryten arose from the creation of two standalone companies in 2020 — Stryten Manufacturing and Element Resources — following Atlas Holdings’ acquisition of lead battery manufacturer and recycler Exide Technologies’.

Stryten bought the vehicle power division of Galvion, a military equipment maker whose products included lithium batteries for onboard systems typically used in combat vehicles such as tanks, in 2021.

In January 2022, Stryten announced its move into vanadium following its acquisition of Storion Energy, a commercial spin-off from technology firm ITN Energy, which began its research into redox flow batteries in 2010.

That was followed in March 2022 by Stryten’s formation of two divisions — Motive Power and Essential Power — focused on developing and producing multiple battery technologies, including lead, for the energy storage market.

Posters showcase added to BCI’s Kentucky program

Registration is open for the next Battery Council International Convention + Power Mart, to be held in Louisville, Kentucky, on April 23-26.

The submission deadline for the prestigious annual Innovation Award and the 2023 Amplify Award — which recognizes a highly effective and toprated internal or external campaign, program or communication that serves to inform, educate and promote lead battery products, components, services

or the industry as a whole — was February 3 Keynote convention speakers have yet to be confirmed, but the golf tournament, receptions, Women in the Global Battery Industry networking event and technical sessions have been listed as usual.

A Poster Research Showcase is being added to this year’s convention.

“Undergraduate, graduate and postdoctoral level researchers and assistants are invited to submit post-

ers that will bring forward scientific work on lead and other battery types,” BCI said.

“The showcase will support researchers in university, government and commercial settings in

building awareness about the scientific opportunities, advancements and career objectives in today’s battery industry and to share cutting-edge science and technology across this critical industry.”

PEOPLE NEWS 8 • Batteries International • Winter 2022/23 www.batteriesinternational.com

Mike Judd Tim Vargo

Conference rendezvous in Louisville

Grupe takes over as Digatron CEO

Distinguished service honour for Natarajan

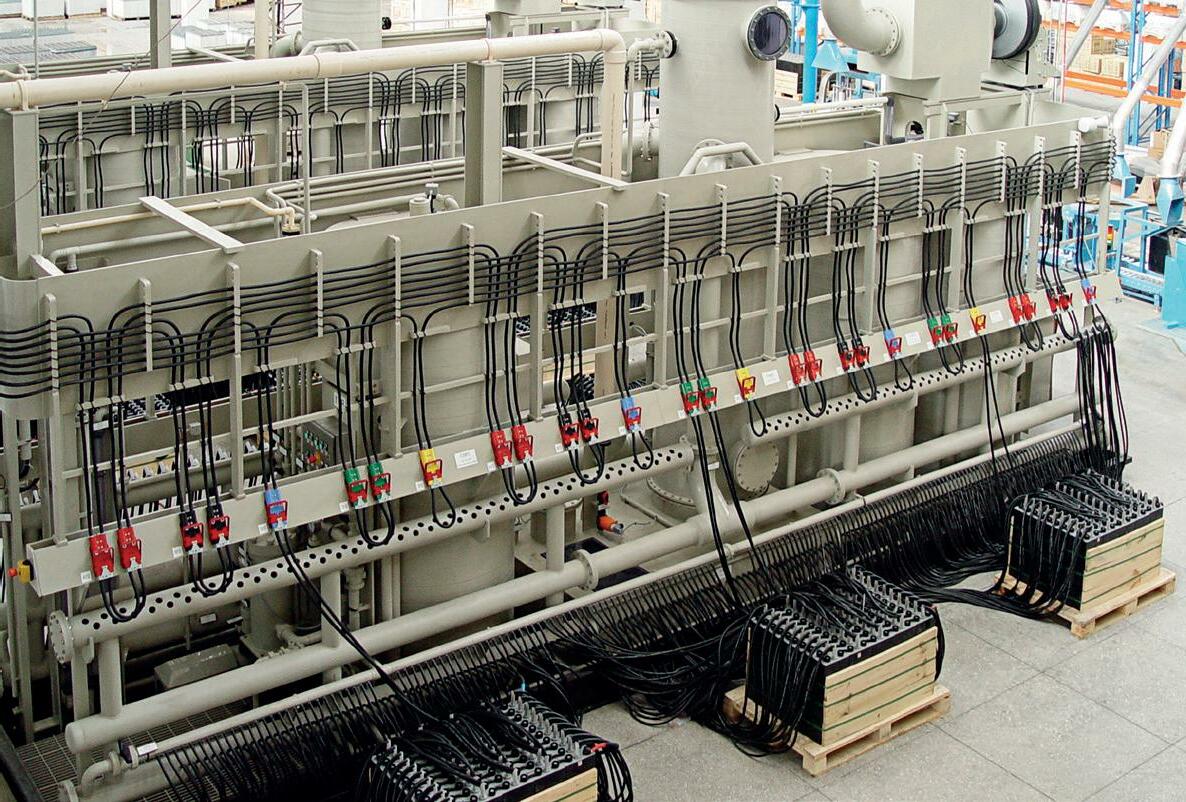

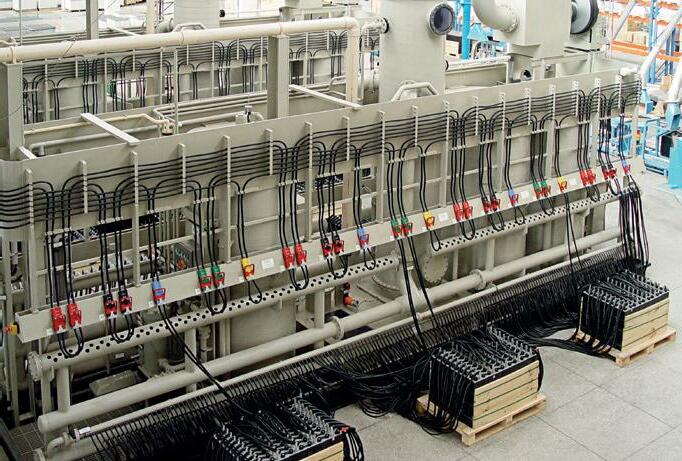

Friedrich Grupe has been promoted to chief executive officer at Digatron Power Electronics, effective January 1 and will be based in Aachen, North RhineWestphalia, Germany.

The firm is the central core of the larger Digatron group which has operations in Qingdao, China; Pune India (working through Ador Digatron); Milan, Italy; and Shelton, Connecticut, US; as well as its headquarters in Aachen.

Grupe, who is a wellknown and well liked figure in the battery community, says he is expecting great things in this coming year. “We’ve got an exciting range of existing products and a couple of new ones in the pipeline,” he says. “One of which we will be launching shortly.

“The market for high quality testing equipment is booming. We are also steadily moving into lithium battery formation equipment where we are developing work with Digatron Systems Italy which was set up in 2019.

“I see this as a time for ourselves and the wider group to grow internally and externally. We’ve just

moved into our brand new R&D facility here in Aachen and we have recruited new staff here with more to come.”

Grupe’s appointment comes at a potentially pivotal moment in the wider Digatron.

Bjoern Stoll took over as new CEO of Digatron Power Electronics Inc in Connecticut on January 1 which will concentrate on expanding further into both the lead and lithium sides to the energy storage market.

Ador Digatron last year launched its Quench, product which is making steady inroads into DC fast chargers for EVs in India.

Grupe takes over from Holger Driesch who has taken a senior management position in Mangoldt an electrical engineering firm.

Grupe has been with Digatron for almost 14 years and started as a project manager in May 2009. He was appointed vice president for sales and marketing in October 2015 and vice president for product management in September 2019.

Digatron was set up by Rolf Beckers in 1968.

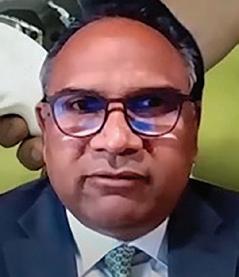

The India Lead Zinc Development Association distinguished services award for 2022 was presented to Ramesh Natarajan, a lead battery industry veteran of more than 42 years on December 5.

The award was presented on the first day of the ILZDA’s International Conference on Lead and Lead Batteries by Sudhendu Sinha, director of India’s Niti Aayog policy think-tank.

Natarajan’s work in the industry began as a graduate trainee at the age of 20. He went on to hold senior managerial posts, design batteries for various applications as well as lead training programmes

for quality management systems. He has also conducted technical training programs in Asia, the Middle East, South Africa and the UK.

Today, he is perhaps better known as an author — for his ‘batteries demystified’ books — the second of which was released during the conference.

Natarajan said he hope his books inspire ambitious young people with innovative ideas to enter the battery industry.

But he stressed that despite his foray into publishing, he wants to continue working with the lead batteries industry for many years to come.

EnerSys has appointed Tamara Morytko as a director, the company said on December 7. She joins the board with immediate effect for two years.

Morytko’s last worked as president of the pumps division at Flowserve, a US supplier of industrial and environmental machinery where EnerSys said she established a reputation as a supply chain subject matter expert.

Before that, Morytko spent two years as CEO of Norsk Titanium, a Norwegian aerospace and defence firm.

Previously Morytko spent seven years with

oil services company

Baker Hughes becoming Asia Pacific region president.

From 1996 until 2010, Morytko held a number of increasingly senior positions at aviation components manufacturer Pratt & Whitney.

PEOPLE NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 9

EnerSys appoints Tamara Morytko to board

Ramesh Natarajan

Friedrich Grupe

Tamara Morytko

Pam O’Brien leaves BCI

Pam O’Brien stepped down in December after seven years as vice president of operations at Battery Council International and almost 13 years with Smith Bucklin Corporation, the managing

agents for BCI. She will be sorely missed.

Working initially with Mark Thorsby, then EVP for the council, Pam took their plans to enlarge the ambit of BCI’s operation seri-

Jansen named as interim Solid Power CEO as Douglas Campbell retires

All-solid-state batteries developer Solid Power said on November 29 that CEO, board member and co-founder, Douglas Campbell, had decided to retire effective immediately.

David Jansen the company’s chair and president, has been appointed as interim CEO while the firm looks for a permanent replacement.

Solid Power independent director John Stephens said: “Since co-founding

Solid Power in 2011, Doug has served as a passionate entrepreneur, beginning with the company’s earliest stages as a spin-off from the University of Colorado.”

Stephens said Campbell and the board had decided new leadership was needed “as we enter the next phase in our evolution and build on our momentum as a newly public company”.

Campbell said he planned to spend more time with his family and pursuing other interests while “continuing as a significant shareholder of the company for years to come and watching the growth and progress that I know the talented team at Solid Power will continue to make”.

Solid Power has partnerships with both BMW and Ford to jointly develop allsolid-state batteries.

ously. She became a driving force in making BCI annual meetings worth attending (even if you didn’t play golf) and was one of the driving forces behind creating the Women in the Global Battery Industry.

Chris Pruitt, president of BCI, praised her for her “exemplary commitment and dedication to supporting the efforts of BCI to establish the Women in the Global Battery Industry, an organization of professionals, founded to promote and develop the growth of women in the battery industry.

“Her commitment to this program has exceeded that asked of her and demonstrates her full and complete dedication and passion to the industry as a whole, and to the industry’s goal of supporting the careers of women in the battery industry and STEM careers.”

Julie McClure, a BCI director and chair of MAC Engineering, said: “Over the past year, Pam has moved mountains to take the WGBI from a concept presented to the BCI board by a small group of BCI members and

staff, to a fully-fledged and functional networking and professional collaboration group of industry women. “

Roger Miksad, EVP at Battery Council International paid tribute to working with her. “She was not just highly efficient and effective at what she was working on but also fun to be with,” he said.

“Whatever she did, she did well,” says Mike Halls, the editor-in-chief of Batteries International. “She had a fantastic ability to organize her loyal and dedicated staff. But what made her truly effective was that she could always see beyond the details and would immediately grasp the bigger picture.

“BCI and the wider lead battery community will miss her and owe her a huge debt of gratitude.”

Pam said she intended to enjoy taking a break from some of the hectic schedules of working at BCI. “I intend to chill out and have some time to myself, I’ve plans to learn French, teach myself how to play the guitar and play more golf,” she said.

Employer award honour for Gravita

Lead recycling group

Gravita India was honoured by Rajasthan’s state government on December 23 for the company’s employment practices.

Gravita received the ‘President Trophy’ best employer award at a ceremony organized by the Employers’ Association of Rajasthan.

Rajasthan governor Kalraj Mishra and state industry minister Shakuntala Devi presented the award, which is given to recognize working conditions provided by companies including

health, safety and skills

development.

On September 17, Gravita was honoured by Rajasthan’s state government for the company’s services to the exports sector.

Gravita has 13 manufacturing facilities across Asia, Africa and Central America.

The company told Batteries International in June 2019 that it had started commercial production of lead in Ghana and Tanzania, with the aim of supplying European markets.

PEOPLE NEWS 10 • Batteries International • Winter 2022/23 www.batteriesinternational.com

Pam O’Brien

Doug Campbell

in Raman customisation.

Introducing our Raman microscope integrated with a battery cycler for Li-Ion battery research

For research on battery for both Raman spectroscopy and battery cycling

• Simultaneous test on Raman and battery cycling at error margin >= 0.1 seconds and at a regular interval

• 200 x 200µm Raman mapping on 40X

• For use with optical cells*

• 0.0002mA~ current control

www.nanobase.co.kr

nbsales@nanobase.co.kr

NANOBASE

*We have successfully tested compatibility with optical cells by EL -CELL® .

Discover the latest innovation

Battery Cycler

Scanning Raman Microscope Raman TRPL Photocurrent Battery Cycling

Find out more! Call Us: +39 0872 57724/5 Via Pedemontana 13, 66022 Fossacesia (CH) - ITALY Email : cam@cam-srl.com Web: www.cam-srl.com Oxide production without a melting pot, cylinder caster, exhaust chimneys, or gas burners provides significant energy savings with the CAM Lead Shaving System. Plus, our cold milling system avoids the mechanical stress of other processing systems. The Lead Shaver, comprising the use of lead shavings as feed material for ball mills was patented in 2004. The Lead Shaving system is composed of: CAM LEAD SHAVER PRODUCES WITHOUT CASTING OXIDE WITHOUT CASTING Heavy-Duty Italian Battery Equipment A ZERO-EMISSIONS SOLUTION FROM CAM Inclined lead shavings conveyor Lead shaver Lead ingot conveyor with automatic tipping system CAM R&D Department INCREASE YOUR PROFITS WITH A NO GAS LEAD SHAVER

Hammond Group names four industry experts to Innovation Leadership Council

Hammond Group announced mid-December two senior fellows to guide its Innovation Leadership Council. They are John Miller, recently senior director of engineering for Stryten Energy, and Francisco Trinidad, recently the director of battery technology for Exide Europe.

“We’re excited to have John and Francisco join Hammond,” said Gordon Beckley, chief operating officer at Hammond.

“With their extensive battery industry knowledge base they will play a leadership role in supporting our research and development staff, enhance our product development efforts, and contribute to Hammond’s continued innovations towards the industry’s goals of advanced energy storage solutions.”

With 37 years in the battery business, Miller has a long history of introducing innovative products to the marketplace. Before his most recent position at Stryten, Miller led teams in the areas of product engineering, process engineering, applications engineering, and R&D at GNB and Exide Technologies.

He has participated in

various industry committees and forums and has helped write battery standards, handbooks, and white papers for Battery Council International and the Society of Automotive Engineers.

During more than 43 years of experience with different electrochemical systems, Trinidad has been the author of 24 articles, more than 70 presentations in battery conferences, and holds 14 international patents. He looks to promote new technological approaches for automotive and industrial applications, including the use of different materials for positive, negative, and electrolyte of current battery designs as well as determine the added value of new alternative designs like bipolar plates and spiral wound cells.

In 1977, he joined the Tudor group and was promoted first to the position of research manager in Azuqueca (Spain) and then the industrial devel-

opment director in Madrid and Soest (Hagen Industrial plant). Following Exide’s acquisition of the company, he became its research director in Paris, then, the development director of transportation Europe, basic research director, and more recently, director of battery technology.

Also joining Miller and Trinidad on the Council are Rosalind Batson, president of Clear Science, and Lash Mapa, professor of industrial engineering and technology Purdue NW.

Batson is a lead-acid battery expert specializing in characterization of leadacid battery materials. She owns Minneapolis-based Clear Science, a laboratory focusing on the testing, research and development of metals, powders, porous materials, coatings, and advanced materials.

She is a metallurgist working with advanced materials and is a recognized expert in the Taguchi DOE method, which is de-

signed to produce a highquality product at a low cost for manufacturers.

Earlier in her career as the R&D manager for GNB Technologies, Batson co-invented a patented continuous process for making lead-acid grids and plates for a family of cells and batteries.

Professor Mapa has several years’ experience as a chemical engineer, process and project manager with European and US lead-acid battery manufacturing organizations.

Currently, he is associated with the MS Technology program at Purdue NW and has managed over 30 projects including lean six sigma projects with manufacturing, service industry, and educational institutions.

Beckley said: “We welcome these important voices in developing Hammond’s next generation of innovations for the battery storage industry and look forward to the years ahead.”

PEOPLE NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 13

“We welcome these important voices in developing Hammond’s next generation of innovations for the battery storage industry and look forward to the years ahead”

John Miller

Francisco Trinidad

Rosalind Batson

Lash Mapa

New Consortium for Battery Innovation makes new appointments

The Consortium for Battery Innovation has made two appointments to its staff in its Durham, North Carolina office in the US.

Alyssa McQuilling joined in December as a new research and innovation manager. She has over 10 years of research experience in energy storage, air quality, and advanced agriculture, and her scientific record includes peerreviewed publications and presentations on a wide range of topics.

Highview Power appoints Redding as general counsel

Highview Power has appointed Sandra Redding as general counsel, the company announced on November 23.

Redding has more than 20 years of international experience across a number of corporates in the en-ergy sector, and in a wide range of cultural and political environments. She most recently worked as general counsel for Seadrill and before that as general counsel

Previously she oversaw the operation and commissioning of two energy storage systems at Southern Research in Birmingham, Alabama. She reports to Carl Telford who becomes senior research and innovation manager.

Lara Papi Wilson becomes the new communications manager. She has a diverse background in communications, public relations, marketing, and events across a wide variety of industries including environment, real

of the Dubai governmentowned Dragon Oil.

She has also held several in-house legal positions within the RWE, Gaz de France and National Grid groups.

Giuliani joins Sunlight’s executive team

Gianpaolo Giuliani has joined the Sunlight Group as commercial energy stor¬age systems executive director, the company announced in a LinkedIn post on December 29.

estate and construction, government, military and defence, science, and technology.

Wilson has won national awards for marketing and event programs.

Meanwhile CBI is looking to appoint a research and innovation manager based in Brussels, Belgium. They will be responsible for managing government-funded project bids and running ongoing projects. They will report to Carl Telford.

Giuliani, a former global sales director of energy storage for GE, will lead a team focused on prod¬uct management for Sunlight’s ESS high voltage portfolio and business development for global markets.

He brings over 15 years of experience in energy, management and renewable hybrid generation and, as of 2014, has specialized in renewables and energy storage.

Volt Resources makes

Chintawar new CEO Volt Resources promoted Prashant Chintawar to become CEO on Janu¬ary

1. Chintawar joined the Austra¬lia-based company as battery metals senior adviser on September 1. He is a former director of global business development and sales for German chemicals conglomerate BASF.

Volt MD Trevor Matthews became financial and commercial executive direc-

tor on the same day, while COO Justine MacDonald, who joined Volt in 2021 after 22 years in the African mining industry, will expand her in¬volvement in the operation and ad¬vancement of the company’s graphite assets, Volt said.

Non-executive chairman Asimwe Kabunga said: “Since joining Volt, Prashant’s high-level industry expe¬rience and deep industry networks have shone through in the work he has done and the projects he has un¬derway.”

PEOPLE NEWS 14 • Batteries International • Winter 2022/23 www.batteriesinternational.com

Lara Papi Wilson

Carl Telford

Alyssa McQuilling

Prashant Chintawar

Sandra Redding Gianpaolo Giuliani

Monbat takes hit following from collapse of Britishvolt

Monbat revealed on January 17 that it had been forced to delay part of a bond loan repayment as a result of the collapse of UK gigafactory developer Britishvolt, because a cash and shares deal between the two had not been completed in time.

Monbat’s announcement came on the same day administrators were appointed for Power by Britishvolt Limited, which had insufficient equity investment to continue — as reported separately in this issue.

Bulgaria-based lead acid batteries giant Monbat had previously agreed to sell its lithium-based EAS Batteries company to Britishvolt in a cash and shares deal worth

€36 million (about $38 million), which was announced in May 2022.

Monbat said in a Bulgarian market update on January 17 it had expected to use the proceeds of the Britishvolt deal to repay a bond loan linked to that agreement.

Instead, Monbat has been forced to “alternatively secure funds” for the first principal instalment on the bond loan in the sum of €5,603,000, due on January 20. This will now be paid not later than January 31, the battery maker said.

“Due to circumstances outside our control, the transaction with Britishvolt was not finalized within the planned timeframe,” the

company said.

Under the terms of the bond loan, a substantial part of the proceeds from the issue were used to acquire shares in the capital of the entity Monbat Holding Germany, in the balance sheet of which the lithiumion division of the Monbat Group was consolidated.

Monbat said the expected cash portion to be received from the transaction significantly exceeded the amount of the obligation for its first principal payment of the convertible bond issue.

“For this reason, the intention of the management was to use the cash from the Britishvolt transaction to service this payment.”

Monbat, a predominantly

lead battery manufacturer, acquired EAS in 2017. Under the terms of the deal with Britishvolt, Monbat said it would continue to be part of the expected growth of the lithium ion industry through a minority stake it would hold in the UK developer.

Monbat’s announcement came on the same day administrators were appointed for Power by Britishvolt Limited

China facing ‘tighter’ lead market from pandemic, new-year holiday

The impact of the pandemic on China’s lead supply network has been revealed in a new survey conducted by the Shanghai Metals Market (SMM) — which has warned that supply could tighten further, exacerbated by the Chinese new year shutdowns.

SMM data confirmed by the benchmark prices provider to Batteries International on January 9 indicated that upstream and downstream enterprises of the lead industry chain were all affected by the continued effects of the pandemic across the domestic lead sector.

China produced 367,900 tonnes of secondary lead in December 2022, down 4.29% month-on-month and 0.49% year-on-year, according to SMM.

A secondary lead smelter in Inner Mongolia also halt-

ed production for around six days amid employee absences caused by the pandemic.

Separately, a secondary lead smelter in Guizhou reported that lead battery scrap available in the market had been limited because most traders had been affected by illnesses caused by the pandemic.

SMM said on January 10

that restocking of lead acid batteries by traders would be halted shortly in advance of the Chinese new year holiday period, which started on January 22.

Battery companies had already suspended deliveries to remote areas of the country — about 10 days earlier than in previous years — as firms broke up early following a decrease in raw mate-

BCI joins Global Battery Alliance

Battery Council International said on January 18 it had joined the Global Battery Alliance (GBA).

BCI executive VP and general counsel Roger Miksad said the move would bolster BCI’s work in promoting a responsible and circular battery value chain.

“As one of the first industries to develop a true circular economy across North America, BCI supports GBA’s guiding principles, in particular to establish a circular battery value chain to support the transition to a low carbon economy,” Miksad said.

GBA is a public-private

rial supplies.

Meanwhile, overall lead production was largely expected to be suspended for planned maintenance at facilities before and after the Chinese new year holiday. That, coupled with the country’s ongoing “unstable pandemic situation”, should result in a further tightening of the secondary lead supply market, SMM said.

collaboration initiative founded in 2017 at the World Economic Forum to help establish a sustainable battery value chain by 2030.

It brings together leading international organizations, NGOs, industry actors, academics and governments.

NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 15

European Commission chief warns China, US over battery investments

European Commission president Ursula von der Lyen has warned of tough action against China and other countries engaged in “aggressive” moves to lure industrial projects including battery manufacturing away from the EU.

Von der Lyen told the World Economic Forum in Davos on January 17 that it was no secret the EU also feared new US tax breaks were luring gigafactory investments to North America.

“Our aim should be to

avoid disruptions in transatlantic trade and investment. We should work towards ensuring that our respective incentive programmes are fair and mutually reinforcing,” she said. “But when trade is unfair, Europe must “respond more robustly.”

Von der Lyen’s warnings came as battery industry leaders warned that at least €100 billion ($106 billion) was needed to avert a potential investments meltdown for Europe’s gigafactory plans, because developers

were being lured away by more lucrative deals and incentives in Asia and the US.

She accused China of openly encouraging energy-intensive companies in Europe and elsewhere to relocate all or part of their production with a promise of cheap energy, low labour costs and a more lenient regulatory environment.

China simultaneously gives domestic energy heavy subsidises and restricts access to its market for EU companies, she said.

However, she agreed with critics in Europe that the Commission had to do more to support the bloc’s nascent EV batteries sector, saying there was “a small window of opportunity to invest in clean tech and innovation to gain leadership before the fossil fuel economy becomes obsolete”.

See the special Batteries International report on the EU’s battery investments crisis starting on page 36 of this issue.

PENOX EXPANDERS

PENOX EXANDERS

Improved Battery Performance

↗ High current charge acceptance

↗ Dynamic charge acceptance

↗ Life time

↗ Cold cranking

↘ Water consumption

All Battery Applications

EFB: In combination with TBLS+® for negative AM

EXTEND YOUR BATTERY’S LIFE

NEWS 16 • Batteries International • Winter 2022/23 www.batteriesinternational.com

EFB expander formulations NEW

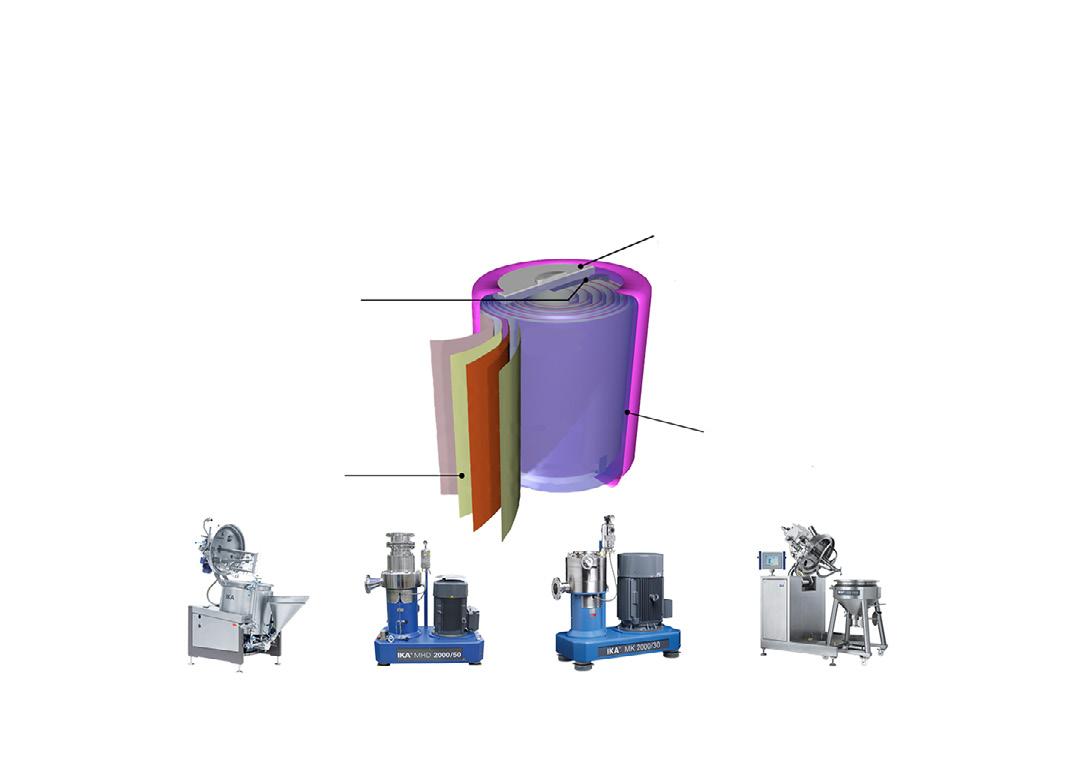

ABC agrees bipolar lead BESS projects deal for California, confirms $50m capital raise underway

Bipolar lead battery technology is to be deployed in a 646MWh energy storage deal for California, Advanced Battery Concepts announced on January 18.

ABC said its BOX-BE system, launched last September, will be supplied under an agreement with renewable power generation projects company Coram to benefit customers in the Coachella Valley and Los Angeles regions. The BOX-BE system uses the firm’s EverGreenSeal battery tech.

The Coram supply agreement is based on an initial project set consisting of three phases — an initial demonstration, followed by two installations at two different identified sites. The two sites, representing 646MWh, will require about 2,000 BOX-BE units.

The Palm Desert area of Southern California was an early adopter of renewable energy, hosting wind and solar farms that supply residential, commercial and agricultural locations with electricity.

However, the intermittency of renewable power supply means grid operators have had to turn to fossil power generation to meet peak electricity demand.

Coram founder and president Brian O’Sullivan said: “We look forward to working with ABC to commercialize its utility-scale BESS and address the only remaining issue for a fully renewable electric grid — the control, storage and on-command dispatchabil-

ity of clean and economic electric energy.”

The California announcement comes after ABC founder and CEO Ed Shaffer confirmed to Batteries International on January 11 that a $50 million cash raise was underway to further advance development of the firm’s bipolar lead battery technology and products.

Shaffer had already told Batteries International (Autumn issue 125) that fresh investment was being sought, including for ramping up production at its Michigan plant.

Now the New York arm

of investment bank Stephens has been named as the financial institution that is leading the series ‘C’ capital raise. This follows the series ‘B’ undisclosed growth equity round in October 2020 that was led by Nuveen, the global investment manager of TIAA Investments.

A series ‘C’ financing is typically for firms that are already quite successful. This type of funding is focused on scaling the company, growing it as quickly and as successfully as possible.

In addition to expanding manufacturing plant

capacity, the latest capital injection will be used to support increased bipolar battery production — especially the new EverGreenSeal batteries and to satisfy BOX-BE energy storage system orders we have in development, Shaffer said.

He said the company has already had “serious discussions” with various groups that have expressed interest in the capital raise and talks are ongoing.

“Current investors have committed to participating in the series ‘C’ round of investment, for which we are grateful.”

NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 17

In addition to expanding manufacturing plant capacity, the latest capital injection will be used to support increased bipolar battery production — especially the new EverGreenSeal batteries and to satisfy BOX-BE energy storage system orders we have in development

Ed Shaffer, founder and CEO, ABC

FLY HIGH Above the Rest Automation • Oxide Production • Material Handling • Service Sorfin Yoshimura LTD 100 Crossways Park West, Suite #215 Woodbury, NY 11797 Tel: + 1.516.802.4600 Email: sorfin@sorfin.com Eagle Oxide Services Inc. 5605 W 74th Street Indianapolis, IN 46278 Tel: 317.290.8485 Email: sales@eagleoxide.com www.eagleoxide.com Accurate Products Hvidsvaermervej 135 DK-2610 Roedovre Denmark Tel: +45.4453.4546 Email: accurate@accurate.dk FLY HIGH Above the Rest.

Metair rejects early batteries unit bids as plans for sell-off go on

Metair missed its 2022 year-end goal of selling off its international batteries division after rejecting unsuitable bids and has taken its search for a buyer into the new year, Batteries International has revealed.

The South Africa-based batteries and auto components group had hoped to find a buyer for its energy storage division — including battery firms in Romania (Rombat), Turkey (Mutlu Akü) and South Africa (First National Battery) — and announce a sale before the end of 2022.

However, a Metair spokesperson said on December 15 offers received up to that point “were not suitable for the current environment”.

“Metair and the board will consider future offers and revisit the strategic options,” the spokesperson said.

In a ‘voluntary operational update’ report to the Johannesburg Stock Exchange on December 5, the lead and lithium group said the failure to secure a

sale so far was “largely due to the geopolitical climate within Eastern Europe”.

The company said its energy storage division was performing “resiliently under tough operating conditions”, but cautioned that the last quarter of the calendar year was “the most volume sensitive time for the business” and sales in that period would have a strong bearing on annual figures.

Total sales of automotive batteries are expected to reach between 8.5 million and 9 million units for the full year, with the expectation that its Mutlu Akü lead battery manufacturing business will increase sales by at 17% compared to 2021.

However, Rombat sales are expected to be around 15% lower, mainly due to dampened consumer confidence from the ongoing conflict in Ukraine, Metair said.

Sales from the group’s First National Battery company in South Africa are “expected to be on par” with 2021 figures as a result of efforts to improve competitiveness and market share progressing, the company said.

Metair’s automotive components division continued to perform well too, relative to “challenging operating environments” and key projects remain on track despite the impact of global supply chain disruptions.

Refined lead metal demand exceeds supply, says report

World refined lead metal demand exceeded supply by 46 kilotonnes during the first 10 months of 2022 as total stock levels fell by 62k. This is according to preliminary figures released by the International Lead and Zinc Study Group (ILZSG) on December 14.

Global lead mine production reported to the group fell by 2.1%, which was primarily a consequence of reductions in Australia, Bolivia, China, Greece, Peru, Turkey and the US, the Lisbon-based study group said.

However, lower refined lead metal output in China, Germany, Italy, South Korea, Russia Turkey, Ukraine and the US was partially balanced by rises in India and Japan — resulting in an overall decrease globally of 1.3%.

Refined global lead metal usage fell by 0.4%, which the ILZSG said was

primarily influenced by reductions in South Korea, Mexico, Taiwan and Thailand, which were largely offset by rises in Europe, India, Japan and the US, Chinese imports of lead contained in lead concentrates fell 17% to 462kt, while net exports of refined lead metal totalled 93kt — an increase of 62kt compared to the first

10 months of 2021.

ILZSG market research and statistics director Joao Jorge told the International Conference on Lead & Lead Batteries in New Delhi on December 5 ( see our detailed conference report elsewhere in this issue ) that there would be no major change in trends in the lead market in the short to medium term.

“The main reason is lead’s still-dominant position in the automotive sector.

"Looking ahead, we are confident that lead batteries can continue to play a significant role in this sector and the growing energy storage market — particularly that generated from renewables,” Jorge said.

India’s Exide Industries said on January 4 it had changed the name of a lithium-focused subsidiary company set up under an initial joint venture with Swiss battery firm Leclanché.

Exide said the now wholly-owned Exide Leclanche Energy Private Limited, branded as ‘Nexcharge’, has been renamed Exide Energy Private

Limited.

The move follows Exide’s announcement on December 12 that it was considering proposals to merge the unit with another wholly-owned lithium subsidiary — Exide Energy Solutions (EES) — that was formed to collaborate with China’s SVOLT Energy Technology to manufacture lithium ion battery

cells in India.

Construction of the EES gigafactory in Bengaluru formally began on September 27.

Exide CEO and MD Subir Chakraborty said on November 16 the development and sale of lead batteries continued to be the company’s “core business”, despite its foray into the lithium ion sector.

NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 19

Exide Industries renames lithium business unit

Monbat signals entry into BESS market to support ‘energy independence’

European lead battery major Monbat is to unveil a range of energy storage systems for the industrial and residential markets, the company revealed on November 24.

The commercial director of Monbat’s industrial batteries division, Bozhidar Nekeziev, said the company intended to promote a range of BESS systems for the residential and small business sectors, deploying “traditional, well-established leadacid VRLA batteries” as well as lithium ion-based technologies.

Bulgaria-based Monbat says the move aims to support “energy independence” and could encourage customers to

form their own power supply microgrids as Europe looks to ramp up renewable electricity generation.

Monbat said enabling homes and business to play an active role in the deployment of future energy systems would “change the philosophy” of electricity generation, distribution and consumption from a linear, ‘producer-distributorconsumer’ relationship, “to an open system with complex and synergistic complementary roles and functions”.

Securing a “critical mass” of installed BESS capacity would support homes and businesses that use integrated systems in generating and consuming

“more than half or almost all of their electricity demand”, Monbat said.

The company did not say when it expected to launch its BESS products, but said it would offer options for outdoor or indoor modular systems, configured with lead acid or lithium batteries.

In June 2022, the senior management team of Monbat pledged to further develop operations after securing a 20.78% stake in the lead batteries group.

Also in June, Monbat and Advanced Battery Concepts announced plans to develop a commercial bipolar battery for mass production in an investment deal worth around €16 million ($17 million).

Exide Industries says lead batteries are still ‘core business’ as exports rise

The boss of India’s Exide Industries has said the development and sales of lead batteries continues to be the company’s “core business”, despite its foray into the lithium ion sector.

Exide CEO and MD Subir Chakraborty told a secondquarter earnings call on November 16 that the firm’s market share of the over-

seas lead batteries market “continues to grow rapidly” — along with increased requests for quotes to supply auxiliary lead batteries for electric vehicles.

“We are now exporting to 60 countries globally, with the largest markets being Europe, the US, Saudi Arabia and southeast Asia.”

Chakraborty also con-

Shandong Jinkeli opens R&D center, signs agreements

China’s Shandong

Jinkeli Power Sources Technology Co opened up a new R&D building on November 10 at its headquarters in Zibo City, Shandong province.

The firm said it celebrated its 40 years of trading at the opening with the signing of

strategic cooperation agreements with H&V, Yadea Group, KIJO Group, Xinfeng Group and Cane Battery.

Separately, Shandong Jinkeli, became a member of the Consortium for Battery Innovation in late November.

firmed that Nexcharge, its lithium ion joint venture with Swiss battery storage firm Leclanché, was now a 100%-owned Exide subsidiary. Exide previously held an 84.90% stake in Nexcharge.

Meanwhile, Chakraborty said Exide was pushing ahead with its collaboration with SVOLT Energy Technology for lithium ion cell manufacturing in India.

SVOLT, which has its headquarters in China’s Jiangsu province, is supporting the setting up of a state-of-the art green field manufacturing plant on a turnkey basis to be built by the Exide Energy Solutions (EES) subsidiary.

Exide said EES entered into an agreement on July 26 for the 80-acre site at the Hi-tech, Defence & Aerospace Park, in Karnataka state.

Deficit alert for battery metals Li, Co, Ni

Supplies of lithium, cobalt and nickel are unlikely to be available in quantities needed to meet the anticipated escalation of global demand for the battery metals over the next few years, a top analyst said on December 5.

Joao Jorge, market research and statistics director of the International Lead & Zinc Study Group (ILZSG), said it was “becoming clear that it is unlikely there will be sufficient supplies of the new battery metals” in the short term.

Jorge told the International Conference on Lead & Lead Batteries in New Delhi that a mix of battery technologies, including lead, would need to be deployed across industry sectors.

He said despite “the generally negative sentiment often directed toward lead”, the Lisbonbased study group believed there would be no major change in trends in that market in the short to medium term.

“The main reason is lead’s still-dominant position in the automotive sector. Looking ahead, we are confident that lead batteries can continue to play a significant role both in this sector and the growing energy storage market — particularly that generated from renewables,” Jorge said.

“This is mainly because lead acid batteries are a low-cost, safe and proven technology that is easily and effectively recycled.”

The ILZSG said in forecasts published on October 24 that global demand for refined lead metal was set to increase by 0.8% to 12.42 million tonnes this year after rising by 4.6% in 2021.

NEWS 20 • Batteries International • Winter 2022/23 www.batteriesinternational.com

ABC and Exide Industries reveal bipolar lead plans

A partnership aimed at building and selling bipolar lead battery technology energy storage systems in India was announced by Advanced Battery Concepts and Exide Industries on November 17.

The companies signed a non-binding letter of intent agreeing to “scope-out and define a program” for jointly commercializing ABC’s ‘BOX-BE’ systems, comprising the firm’s proprietary EverGreenSeal bipolar battery technology, for the Indian market.

The partners said they would determine and

explore the business opportunities, applications and addressable markets in India then agree on the design of a commercial EverGreenSeal battery. "This would depend on the appropriate testing of the resulting product or products,” they said.

“Based on successful testing of the battery design and favourable market indicators for investing and producing the products, further steps will emerge as a result of this initial effort,” the partners said.

ABC announced the launch of BOX-BE on September 15.

GS Yuasa online battery academy now multilingual

GS Yuasa has announced the European launch of its online battery training hub — expanding its Englishlanguage content to include German, Italian, Spanish and Swedish.

The company said on November 9 the GS Yuasa Academy is designed to provide training for professionals who are unable to take time out from work to attend faceto-face training.

Peter Whittaker, general manager of automotive and motorcycle engineering at GS Yuasa Battery Europe, said thousands had benefited from training via the online academy since it was launched in 2019.

“An understanding of batteries is essential for all technicians to ensure that batteries are stored, applicated and fitted correctly.”

Courses covering a range of battery-related topics are available in “easy-to-follow, bite sized modules” and certificates

can be downloaded after the successful completion of each course, Whittaker said.

The courses are supplemented by multiplechoice tests for users to check their understanding as they progress.

Jon Pritchard, general sales and marketing manager at GS Yuasa Battery Sales UK said the academy supported customers and workshops that fit the firm’s batteries.

“Results of a recent survey of workshop technicians highlighted a real need for comprehensive training,” Pritchard said.

“Worryingly, 62% of participants asked did not know what battery state of charge and state of health were, and 52% were unaware of the reasons battery failure is more common in the winter. These results highlighted some concerning knowledge gaps, replicating what we often see at our workshop training events.”

YOUR ITALIAN PARTNER FOR BATTERY RECYCLING AND LEAD PRODUCTION

S T C d e s i g n s a n d s u p p l i e s a f u l l r a n g e o f p l a n t s , s e r v i c e s a n d e n g i n e e r i n g s o l u t i o n s f o r W a t e r a n d W a s t e W a t e r t r e a t m e n t s p e c i f i c a l l y d e s i g n e d f o r B A T T E R Y

M A N U F A C T U R I N G , B A T T E R Y R E C Y C L I N G ,

L E A D P R O D U C T I O N O u r s o l u t i o n s i n c l u d e :

P u m p

E v a p o r a t i o n U n i t

H e a v y M e t a l s R e m o v a l

E l e c t r o l y t e C o n c e n t r a t i o n

T h e p l a n t s a r e m o d u l a r , s k i d - m o u n t e d c o m p l e t e o f p i p i n g , i n s t r u m e n t a t i o n a n d e l e c t r i c a l c o n n e c t i o n t o a l o c a l p a n e l w i t h

P L C r e a d y f o r I n d u s t r y 4 0

NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 21

U l t r a p u r e w a t e r p r o d u c t i o n f o r B a t t e r y M a n u f a c t u r i n g N e u t r a l i z a t i o n o f w a s t e w a t e r a n d s u l p h u r i c a c i d E l e c t r o l y t e F i l t r a t i o n a n d H e a t

www.stcitaly.com

Port Pirie back in operation as Nyrstar launches ‘early works’ on product recycling facility

Nyrstar is restarting its Port Pirie lead smelter in South Australia following a planned 55-day outage.

The shutdown, which began last October, was part of an AUD45 million ($28 million) works and maintenance programme — focused on rebricking the hearth of the top submerged lance furnace, as well as major capital works in the blast furnace, acid plant and across the site.

A Nyrstar spokesperson told Batteries International on January 4 that the plant was restarting production, having concluded work to “further support improvement of Port Pirie’s emissions and operational performance”.

Meanwhile, the spokesperson confirmed the start of “early works” on its product recycling facility at Port Pirie aimed at further reducing lead in air concentrations.

Once completed, the facility will be sealed and under negative air pressure, allowing intermediate materials used in the production process to be stored

and mixed in an enclosed facility.

The facility will be built near existing processing plants to “reduce the handling and transport of materials in the open air”, Nyrstar said.

South Australia’s state government is contributing AUD7 million to the AUD23 million project.

Port Pirie general manager Mat Lynn said: “Nyrstar Australia will continue

to focus on how we can continue to improve our operations to reduce lead in air concentrations and complement the targeted lead abatement program and actions of the state government, Port Pirie Regional Council and people of Port Pirie to reduce lead levels within the local community.”

In June 2020, Port Pirie signed a new licence agreement with Australia’s

Environment Protection Authority to cap emissions by 20% as well as submit a comprehensive lead monitoring plan.

The Port Pirie smelter has been in continuous operation for more than 130 years on the Port Pirie river, 230km north of Adelaide. The plant is one of the world’s largest multi-metal smelters, producing lead, silver and by-products such as sulphuric acid.

Aqua Metals gives battery metal recovery update

Aqua Metals said on January 11 it had recovered its first battery metal from spent lithium-ion batteries at production scale by electroplating.

The company claimed its pilot Li AquaRefining system had proven its ability to remove impurities and trace metals from tons of recycled lithium battery black mass and then “selectively recover pure metal using electricity” instead of using furnaces or chemical processes.

Aqua Metals is one of several firms competing in the space for environmentally friendly recycling of lithium battery parts. RecycLiCo Battery Materials (formerly American Manganese) announced in November significant advances in its hydrometallurgical testing and its demonstration plant has now advanced to the next stage of the RecycLiCo patented process to demonstrate lithium recovery at demo-scale.

Aqua Metals says copper

is the first of the products to be recovered using the process and the company said it intends to follow by recovering lithium hydroxide, nickel, cobalt, and manganese dioxide.

Aqua Metals president and CEO Steve Cotton said the move represented a “significant milestone” towards supporting development of a US domestic supply chain for materials essential to electric vehicle and battery energy storage system manufacturers.

New Nour battery recycling unit ‘operational by spring’

A new lead battery breaker plant supplied by Italian engineering company STC for Tunisian battery producer Nour is to start operations before spring, Batteries International has learned.

STC said last April that it had been awarded a $5 million contract to supply a lead battery recycling plant to Nour.

An STC spokesperson said on January 4 that production of the five-tonnes-

per-hour unit had been completed on schedule and was in the pre-assembly stage ahead of delivery.

Installation of the unit will be carried out by technicians of STC, which is part of the Monbat group.

Technology featured at the plant will include the company’s novel ‘U4Lead’ paste desulfurization tech, which STC says will produce “highly desulfurized lead paste and ammonium

sulfate as a by-product, which is easily saleable as fertilizer”.

The facility will comprise an automated scrap batteries feeding system, together with systems for magnetic metals separation, battery crushing with an STC hammer mill, components separation, paste filtration with membrane squeezing, a fully automatic filter press, electrolyte collection and neutralization and a

general ventilation and gas scrubbing system.

STC said the components separation system will be able to recover polypropylene chips, PE separators, fine metallic lead, poles and posts, fine paste, coarse paste and clean electrolyte. The Nour recycling deal was agreed following Monbat’s formal acquisition of a 60% stake in Nour, announced on April 6 in 2022.

RECYCLING NEWS www.batteriesinternational.com Batteries International • Winter 2022/23 • 23

Gravita forecasts recycling boom, but fewer participants

The CEO of lead recycler

Gravita India has welcomed the introduction of a series of regulations to ensure lithium ion and other batteries are disposed of responsibly and of which some are subject to waste management rules that currently only apply to lead batteries.

Yogesh Malhotra also welcomed plans to introduce a national online system of tradeable EPR certificates, similar to carbon credits, which he said “created opportunities for recyclers” such as Gravita in terms of buying waste batteries on the domestic market and exporting recycled lead products.

He said as new regulations start to force unregulated recycling out of the market, he expects this will eventually lead to consolidation of only around 20 or so main industry recycling players in India.

However, he said there would still be scope for the reduced number of recyclers to increase overall lead production by two to three times current levels in

the years ahead.

Gravita, which has a panIndia presence, could see even higher growth, he said.

Malhotra told a secondquarter earnings call on November 3 the rules, some of which supersede regulations dating back to 2001, are designed to crack down on unregulated battery recycling and ensure all such activities are managed in “a proper, organized manner”, as is the case with lead batteries.

The new rules apply to entities involved in the collection, segregation, transportation, refurbishment, and recycling of waste batteries, in addition to producers and those already covered by existing rules.

“If we can shift away from the disorganized processes we have now, that is going to help companies such as Gravita,” Malhotra said.

He also welcomed incoming ‘extended producer responsibility’ (EPR) requirements — which will make producers responsible for the collection, recycling or refurbishment of waste bat-

teries, and for the use of recovered materials from waste.

EPR requires all waste batteries to be collected and sent for recycling/refurbishment and it prohibits disposal of batteries in landfills or by incineration.

The EPR regulations are being finalized and should enter into force within six months, Malhotra said.

In addition, battery producers will be required to register with the Central Pollution Control Board, submit an EPR plan and file regular returns detailing information on waste batteries collected or received.

Malhotra revealed that Gravita expects to expand its lead production capacity to 425,000 tonnes by 2026, on the back of increased investment in recycling facili-

ties in India and abroad.

The company’s Ghana lead battery recycling plant is currently one of its biggest and producing around 16,000 tonnes per annum, he said.

Gravita as a whole boosted its lead production capacity by around 6% in the first half of financial year 2023 (which began last March) from 159,000 tonnes to 168,000 tonnes, compared to the corresponding period a year ago.

In terms of future prospects for the company, Malhotra said diversification will lead to at least 25% of its business by 2025-26 coming from recycling commodities other than lead — such as aluminium and plastic — and in future, lithium, copper and paper.

ACE partners Tabono for Africa recycling

ACE Green Recycling is teaming up with Tabono Investments to build and operate battery recycling facilities for lead and lithium ion batteries in South Africa, the firms announced on December 13.

The partners have signed the term sheet to form a joint venture to build and operate two plants on greenfield sites that will separately process and recycle lead and lithium ion batteries using

ACE’s technology, which it claims operates without fossil fuel-based heating.

Under the partnership, ACE will have a 51% ownership of the joint

venture to Tabono’s 49%.

Tabono co-founder Reon Barnard said that the business aimed to help South Africa retain valuable battery materials such as lithium and cobalt, which might otherwise be lost without recycling.

ACE’s vice-president for global strategy and business development Farid Ahmed said in July 2022 that the company was on track to produce refined lead in the US towards

the end of 2023. Some industry commentators say that the hydrometallurgical process for battery recycling is fraught with potential commercial and technical difficulties, making such projects unfeasible (see Batteries International issue no 121).

However, Ahmed said ACE expects production to start at the plant it is building in Texas around the fourth quarter of 2023.

RECYCLING NEWS 24 • Batteries International • Winter 2022/23 www.batteriesinternational.com

“If we can shift away from the disorganized processes we have now, that is going to help companies such as Gravita”

Yogesh Malhotra, CEO, Gravita

Under

the partnership, ACE will have a 51% ownership of the joint venture to Tabono’s 49%

ATOMIZED PRODUCTS GROUP, INC. atomizedproductsgroup.com info@atomizedproductsgroup.com SERVICE VALUE QUALITY TEXEX ® NEGATIVE EXPANDER Expanding the Possibilities Your Trusted Partner APG produces our TEXEX® Negative Expander in our Texas and Virginia locations using the best raw material components from around the world. We export our products to over 20 countries where they are used by many of the largest battery manufacturers. We offer a comprehensive line of expander formulations designed for a variety of battery applications. After 25+ years of business, we are still proudly family owned and operated!

Recharge Industries and Accenture gets set to build 30GWh

Recharge Industries announced on January 16 that Accenture, the Dublin-based information technology services firm, will be its engineering and design provider to build its gigafactory in Australia.

The large-scale lithium-ion battery cell production plant, to be located in Geelong, Victoria, at full capacity will generate up to 30GWh of energy storage per year. Recharge Industries says it will make it one of the world’s

gigafactory

largest. Building will start in the second half of 2023, with the goal of producing batteries equal to 2GWh annually in the second half of 2024 and 6GWh by 2026.

At full capacity, the factory will employ up to 2,000 workers.

Recharge Industries has secured the production equipment for the first 2GWh production line, which is scheduled to arrive in Australia in May.

The two companies will

Asahi Kasei wins China patents legal battle

Asahi Kasei revealed on January 10 that it had won a series of court challenges in China to protect its patent for lithium ion battery separators.

The Japanese tech firm said a final ruling by China’s supreme people’s court, handed down on November 2, has ended four years of legal wrangling concerning Li battery separator patents in Asia.

The final ruling brought to an end a protracted legal battle launched in August 2018, when Asahi filed a patent infringement lawsuit with the Shenzhen intermediate people’s court against Shenzhen Xu Ran Electronic Co Ltd and others.

The move sought to prohibit the companies from selling their ‘single-layer Wscope’ battery separators in China and to receive damages for patent infringement amounting to a total of Rmb1 million ($148,000).

Asahi said its claim was initially accepted in full by the supreme people’s court in December 2020.

However, Xu Ran then tried to have Asahi’s patent invalidated — a bid that was rejected by the China

in Australia

also collaborate with Charge CCCV (C4V) a technology partner of Recharge Industries, to support the project’s timing. C4V will provide IP, supply chain blueprints and technology concepts for battery manufacturing, which will accelerate the project.

Rob Fitzpatrick, CEO of

Recharge Industries, said: “Establishing a sovereign manufacturing capability to produce state-of-the-art lithium-ion battery cells is critical to Australia’s renewable energy economy — meeting national demand, generating export income and securing supply chains.”

National Intellectual Property Administration and also by the Beijing Intellectual Property Court, which handed down its decision in September 2021.

Xu Ran made a final appeal to the supreme people’s court, whose November ruling ends the matter.

Asahi said it is paying close attention to protect its intellectual property rights, warning that it stands ready to deal with infringements.

A new initiative using residential solar and battery storage systems to create a virtual power plant has been launched in California, the Sacramento Municipal Utility District (SMUD) and not-for-profit electricity supply firm Swell Energy announced on December 22.

The VPP aims to boost energy supply reliability and initially should give the district 10MW/20MWh of renewable capacity by recruiting, installing and aggregating capacity from customers’ battery storage systems in the utility’s service area.

However, the project

could eventually be scaled up to 27MW/54MWh.

The initiative should start operating in April, with contract capability based on a two-hour deliverable capacity.