Register for 2023’s best ever digital manufacturing event.

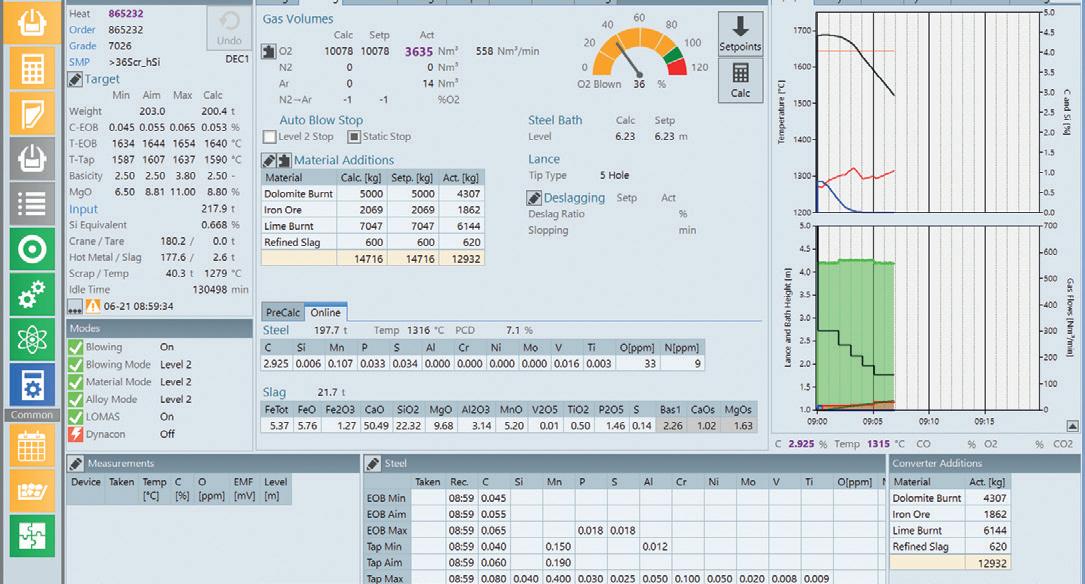

Revolutionizing converter steelmaking.

#itsmorethanjustamachine

Register for 2023’s best ever digital manufacturing event.

Revolutionizing converter steelmaking.

#itsmorethanjustamachine

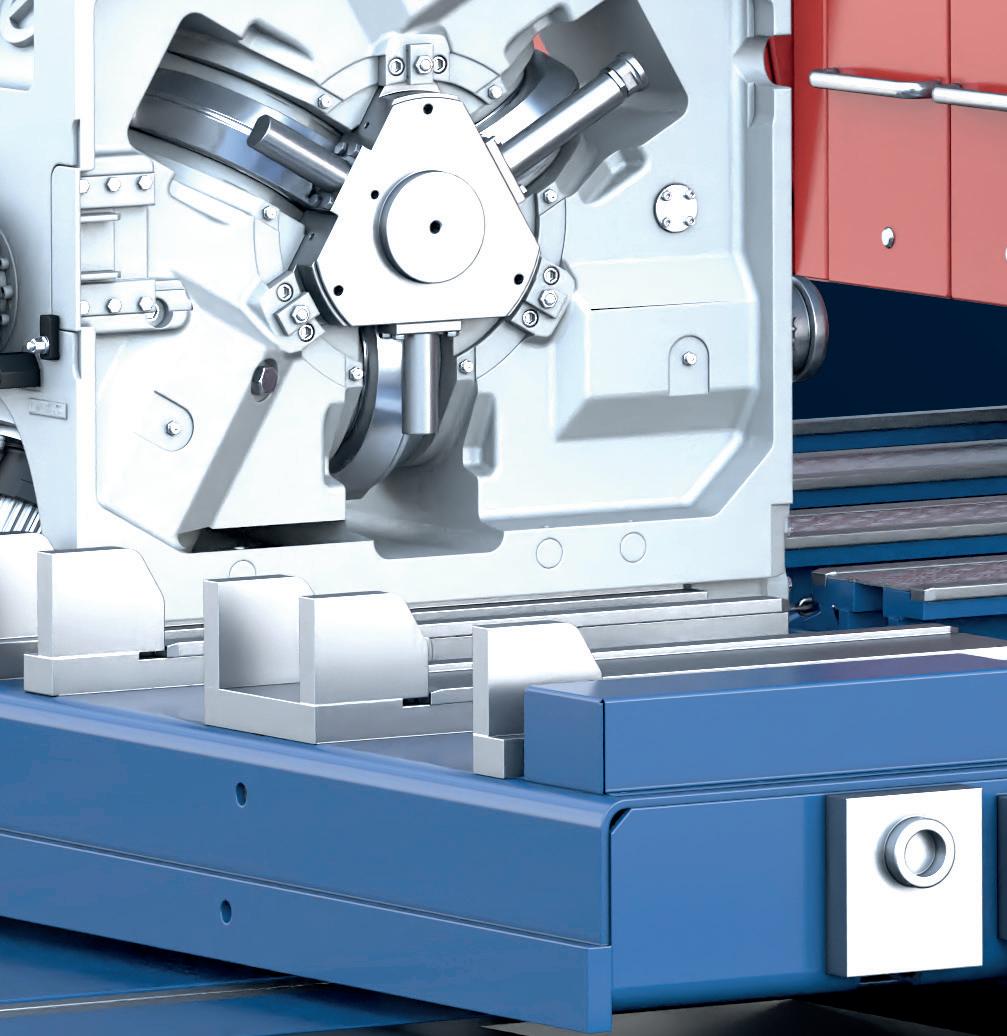

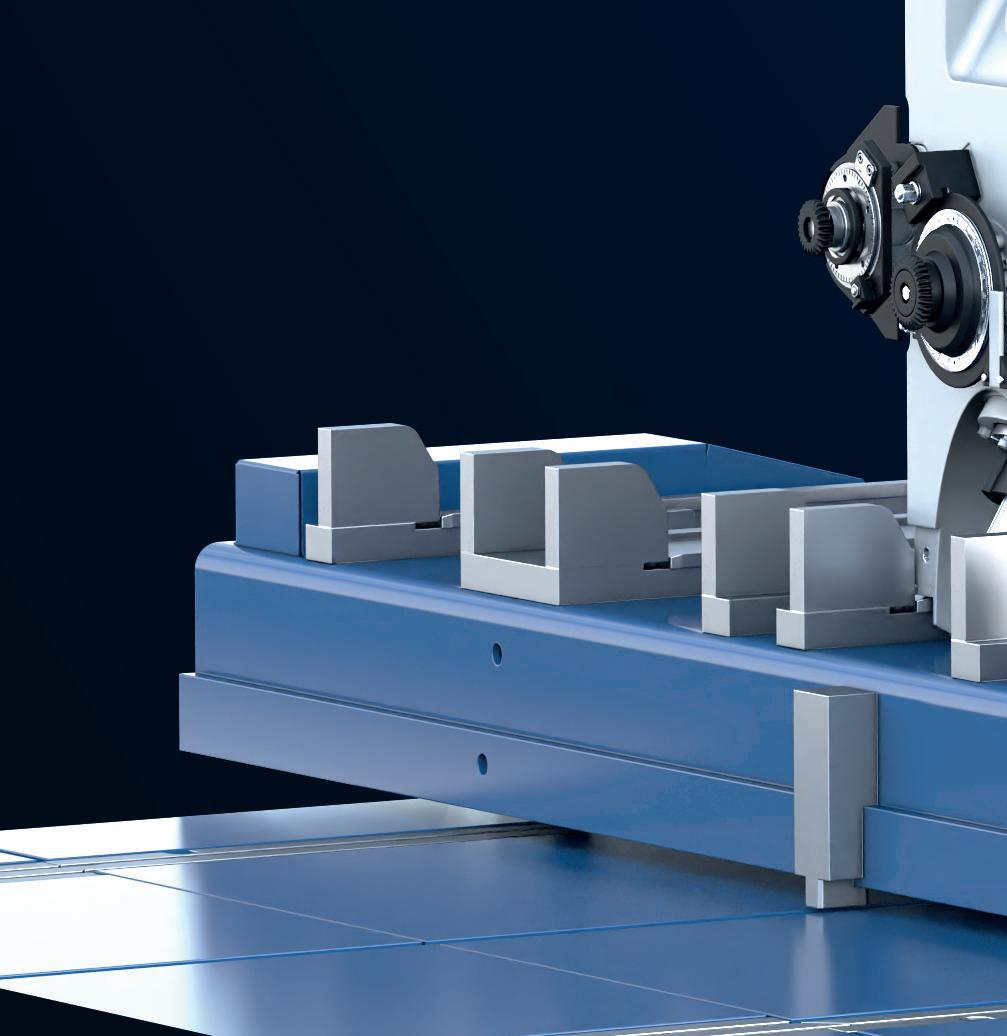

3-ROLL TECHNOLOGY FOR SBQ SIZING. A Reducing & Sizing Block for long products keeping its promises. Achieve your goals with KOCKS RSB®

up to 160mm

finishing size in round or hexagonal dimensions

up to 20%

increase in production

up to 10% energy savings in the mill line

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com Steel

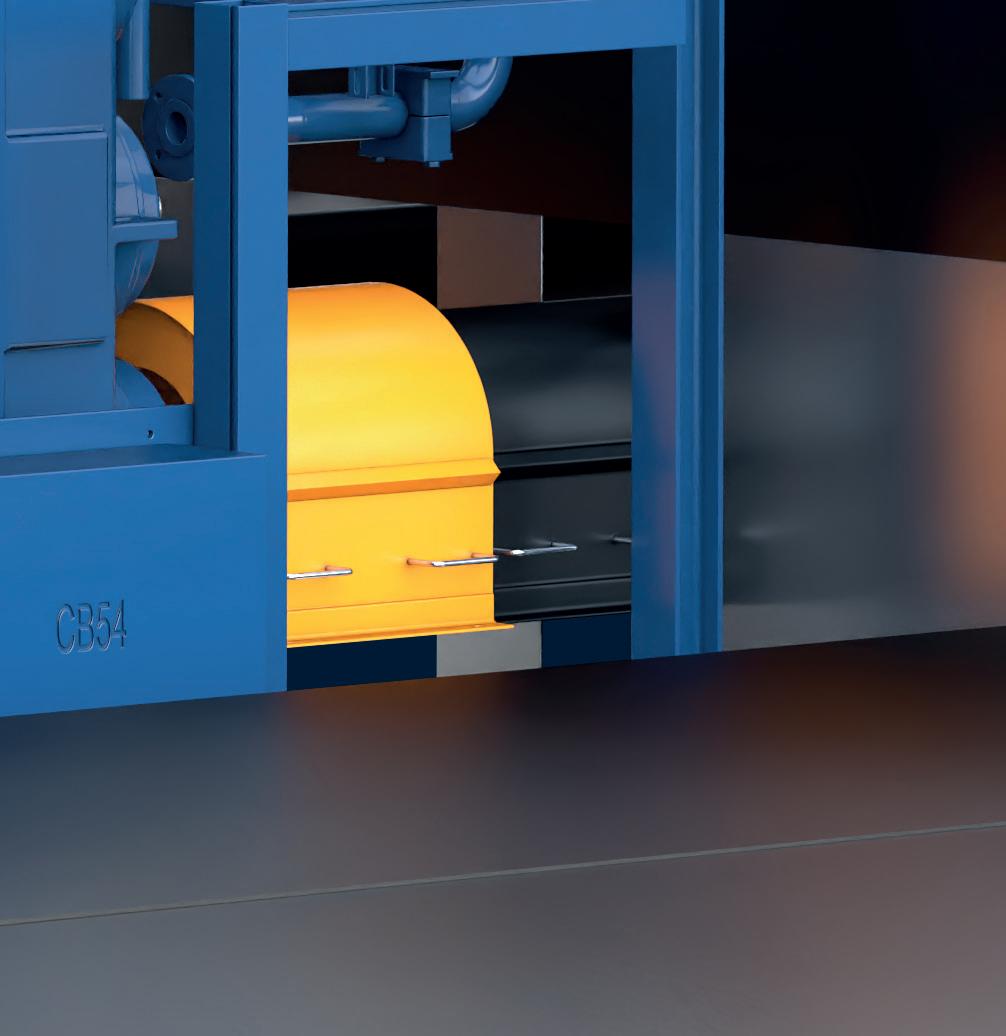

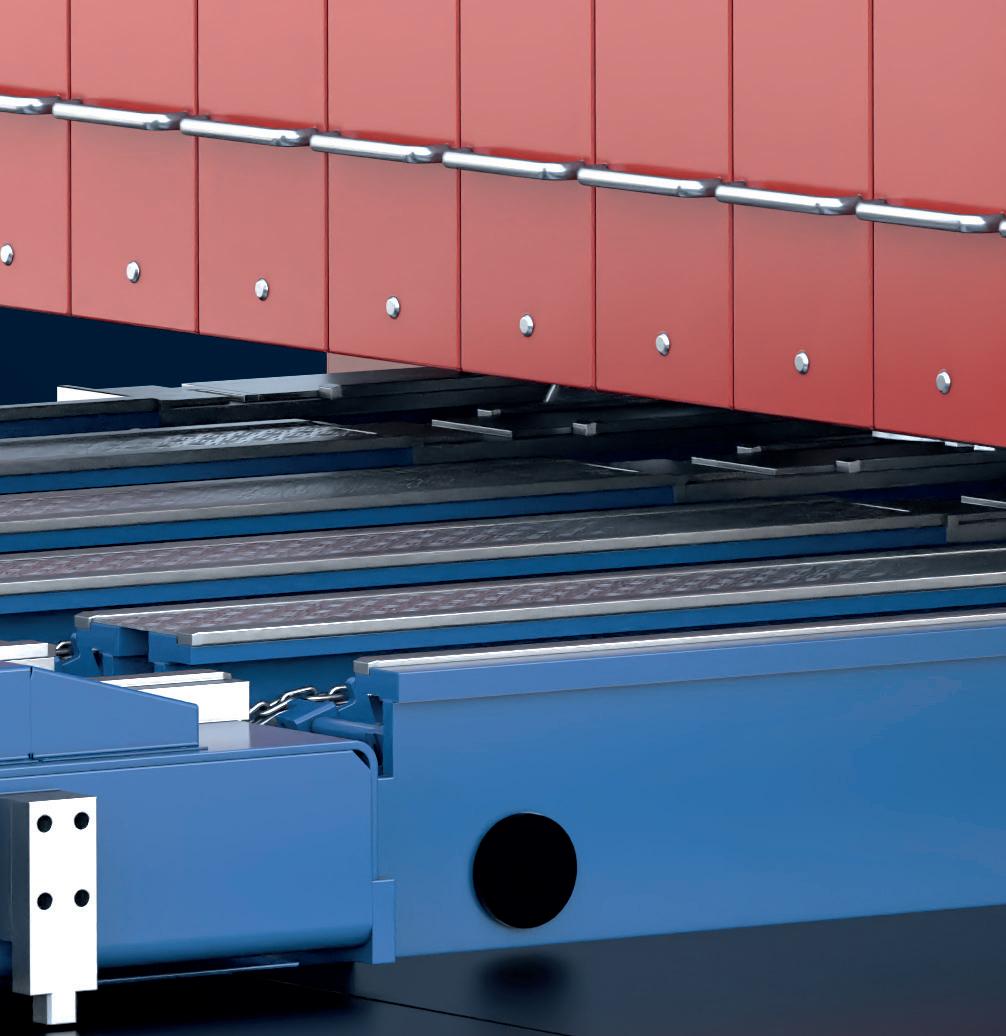

Cover courtesy of Guild International Guild International is a world leader in engineering and building coil processing and end-welding machines for steel processing lines. The company’s products include laser welders, arc welders and resistance welders and are regarded as the most technically advanced welding machines on the market. Guild International also produces a full line of tube mill entry equipment including uncoilers, speed funnels, flatteners and accumulators. Each one of these machines is designed and manufactured to improve the productivity of any strip processing line requiring coil handling and coil end joining and welding. For more information, please visit Guild’s website at www.guildint.com

36 Processing Keeping order.

39 Lubrication Raising the game.

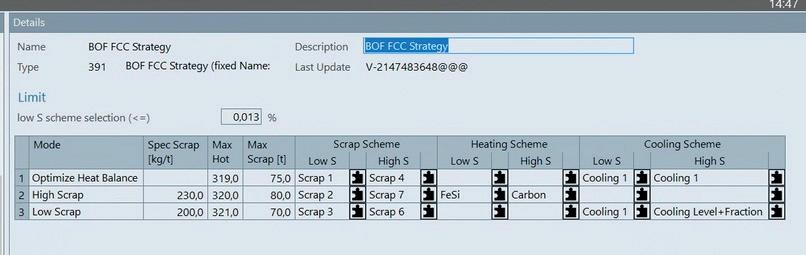

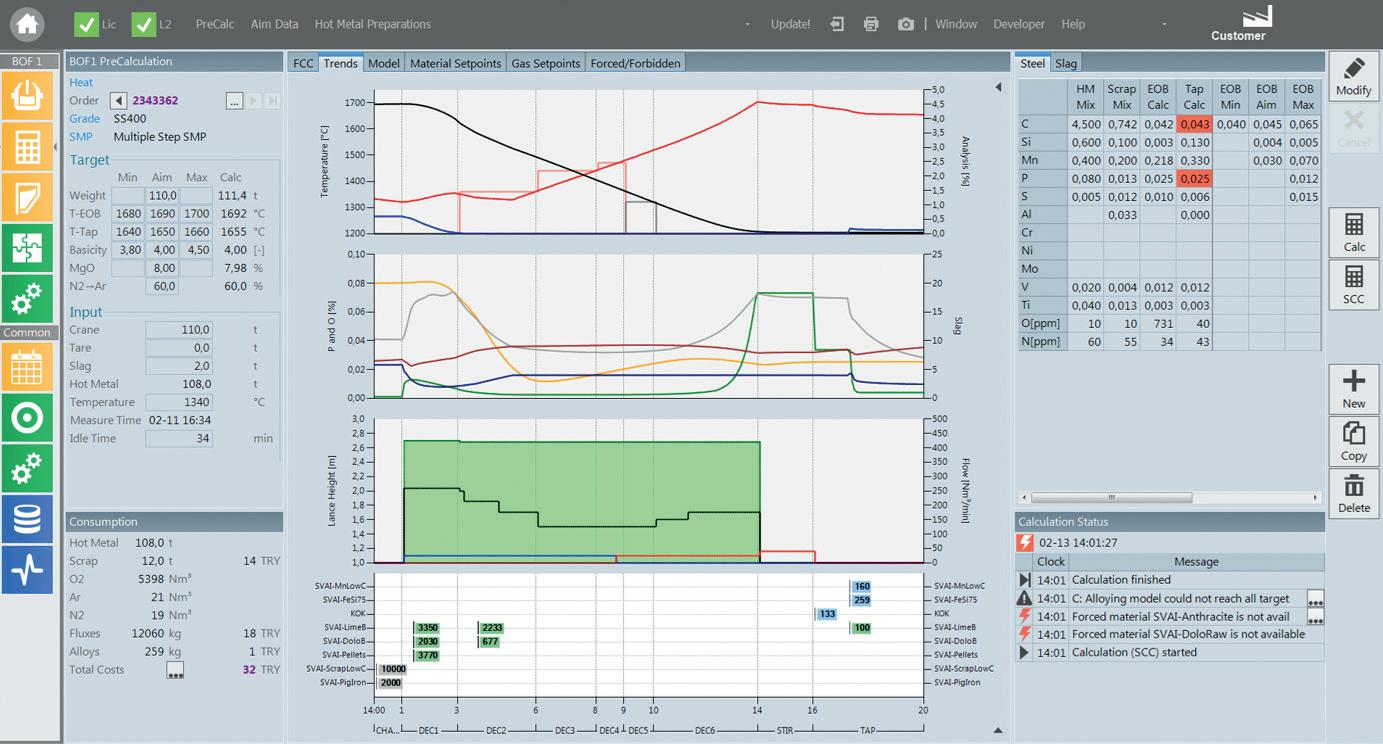

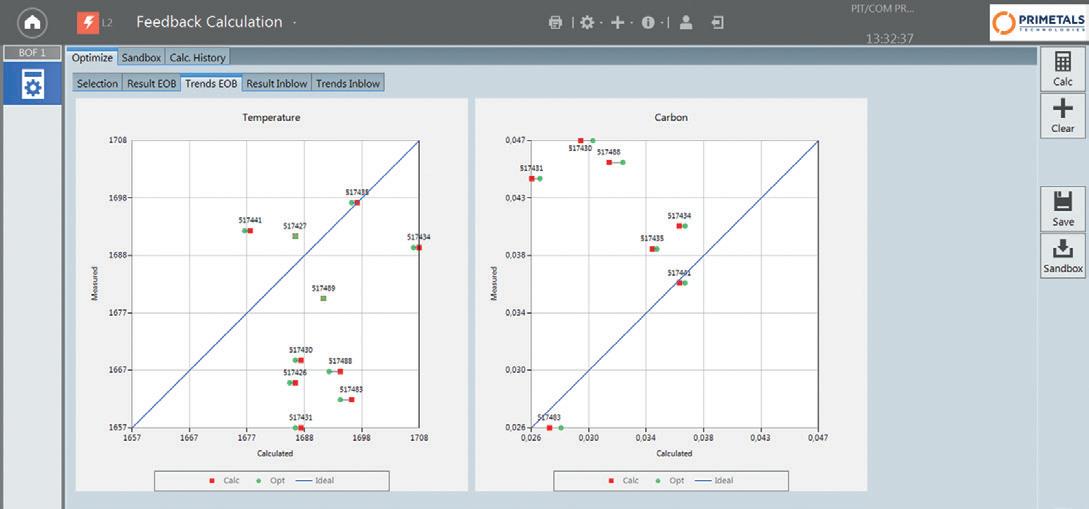

42 Oxygen steelmaking Revolutionizing converter steelmaking.

46

Perspectives Q&A: Quantolux Optimizing production.

48

History

Meldon viaduct – UK’s wrought iron trellis viaduct on Dartmoor.

England.

Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437.

ISSN0143-7798

matthewmoggridge@quartzltd.com

I would rather not be viewed as somebody who supports Shell – the multinational conglomerate still buying Russian oil – but when I read recently that Wael Sawan, the oil giant’s head honcho, believes that cutting oil and gas production would be ‘dangerous and irresponsible’ – bearing in mind that alternative energy sources are not being developed fast enough – I did stop and wonder. Was he being truthful or simply mindful of protecting his and his shareholders’ profits as the climate lobby cranks up the pressure? I guess the answer depends on your perspective. On both sides of the argument, viewpoints are entrenched in long-held beliefs about the climate emergency, so we’ll never get to the heart of the matter unless something actually happens (or doesn’t happen) and those on one side of the argument either apologise or smugly announce ‘I told you so’. Sawan says ‘if we’re going to have a transition it needs to be a just transition.’ Who am I to disagree with that? It’s all very well Western countries dictating that the whole world should transition yesterday, but that’s because the West has had its industrial revolution, thank you very much. Other nations (notably India

and China) are still in the midst of theirs.

Where steel manufacturing is concerned, development by Global Energy Monitor of a Global Blast Furnace Tracker is a good idea and a helpful resource, but it shouldn’t be used to name and shame developing nations still actively building blast furnaces in order to develop their economies. While it is clear that – environmentally – the BF is the steel industry’s climate ‘villain’, they’re not going anywhere, and some say they will never leave the building because there are specific types of steel that can only be produced using traditional processes.

Personally, I am hopeful that some of the many technologies under development will mitigate the effect blast furnaces are having on the planet, even if CCUS – something I have always regarded as a ‘go to’ solution for greener BF steelmaking – will not play a major role in the decarbonization of steelmaking going forward, or so says the Institute for Energy Economics and Financial Analysis (IEEFA).

Having recently chaired a debate on the use of CCUS in the global steel industry, I find it hard to believe that it can be written off so decisively when so many companies are actively engaged in its development.

Combilift is the perfect fit for the steel industry. Our multidirectional forklifts, straddle carriers and mobile gantry cranes are perfect for handling long product, allowing you to maximise your storage, efficiency and safety.

• Safer product handling

• Optimised production space

• Improved storage capacity

• Increased productivity & output

• Enhanced profits

Automatic Yard means no human on the floor, nor on the cranes. Q3-DYMS represents a breakthrough technology to automate semifinished and finished product logistic operations, simplifying the complex management of a yard during production in fully automatic mode. Its features make it part of a plant digitalization strategy.

Tata Steel celebrated World Environment Day on 5 June with several plantation drives, and events organised across Jamshedpur, India. A plantation drive was organised at CRM Bara Transport Park in the morning followed by a plantation drive at New Bara Flats, Agrico Colony where Mamta Priyadarshi, divisional forest officer, Jamshedpur forest division and Chanakya Chaudhary, vice president, corporate services, were both present. Several plantation drives were organised inside Tata Steel’s Jamshedpur works, with over 5,000 saplings being planted across multiple locations in a day.

Source: The Avenue Mail, 5 June 2023.

South Korean steelmaker POSCO has launched Greenate: a ‘groundbreaking low-carbon steel product’, as part of the company's ambitious mission to achieve carbon neutrality by 2050. This eco-friendly steel has already gained its first customer, with LG Electronics becoming the inaugural client to purchase the lowemission steel for its home appliances production, as per a report from Korea Herald. In addition, Samsung Electronics is currently considering the procurement of Greenate certified steel for its premium ovens.

Source: Steel Guru, 5 June 2023.

Attacks by the Russian army on a hydroelectric power plant in Nova Kakhovka in southern Ukraine on 6 June has affected steelmaking operations at Kryvyi Rih, where ArcelorMittal’s Ukrainian steel mill and Metinvest’s mining and processing plants are located, Fastmarkets reported. “70% of the water supply to Kryvyi Rih comes from the Kakhovka Reservoir, so the situation with the city’s water supply is complicated, but it is under control,” Oleksandr Vilkul, head of the Kryvyi Rih Defence Council, said in a social media message.

Source: Fastmarkets, 6 June 2023.

British Steel has secured a major contract win with Belgian railway infrastructure manager Infrabel. The fouryear agreement will see British Steel supply 40kt of high-quality rail in various profiles for the maintenance and renewal of track across Belgium’s rail network. It is the second successive contract, having penned a deal in late 2018 that saw the Brussels team return to British Steel after a ‘short break’, with quality, security of supply and reliability all being raised as areas of priority for Infrabel.

Source: Business Live, 7 June 2023.

Turkish steel profile manufacturer Kocaer Celik has announced plans to conduct a feasibility study for a 24-MW geothermal power plant investment in Kuyucak District, Turkey. Through this investment, the company aims to diversify its clean energy production resources with geothermal energy production, following the success of its roof-type solar power plants. An operating license and a total area of 10,844.18 hectares have been acquired by Kocaer Celik for the plant’s construction.

Source: Think Geo Energy, 7 June 2023.

Danish clean energy giants Ørsted and Vestas have entered a commercial sustainability alliance to use low-carbon steel in their jointly developed offshore wind projects. The partnership will see Vestas, a wind turbine manufacturer, supplying green energy solution provider Ørsted with low-carbon steel towers and blades made from recycled materials. Both companies have highlighted the need to limit carbon in the manufacture of materials and components used in wind farms and to put in place cost-efficient solutions to resolve decarbonization challenges and circularity issues in the wind sector. Source: Power Technology, 8 June 2023.

Tata Power Renewable Energy, through its subsidiary TP Vardhaman Surya, has received a contract to set up a 966MW round-the-clock hybrid renewable power project for Tata Steel. The project has the hybrid renewable capacity of 379MW solar and 587MW wind power, a company statement said. Praveer Sinha, CEO and managing director, Tata Power, said in the statement: "The 966MW round-the-clock hybrid renewable power project marks a significant step towards our combined efforts to accelerate the adoption of clean and green energy to meet the net zero target." Source: The Economic Times, 8 June 2023.

Trinidad and Tobago's TT Iron Steel Company (TTIS) has agreed to purchase an idled iron and steel plant, originally owned by ArcelorMittal, the company has announced. The purchase agreement comes seven years after ArcelorMittal closed operations in Trinidad following layoffs amid low global steel prices, which have since rebounded. The plant, built in 1980, will be subject to initial refurbishment expected to cost between $150 million and $200 million. Source: Reuters, 8 June 2023.

The chairman of Tata Steel UK has called for a ‘level playing field’ as it seeks UK government subsidies to decarbonize its Port Talbot steelworks. Henrik Adam, CEO, Tata Steel Europe, said European competitors were receiving ‘billions of pounds’ from governments to transition to greener operations. The UK government department for business and trade said: "The business secretary knows how critical the steel industry is to Wales, and made her commitment to securing a

decarbonized, competitive future for the sector clear when she visited Port Talbot earlier this year…we cannot comment on commercially sensitive negotiations."

Source: BBC, 13 June 2023.

Gerdau North America has commissioned UK-based plant supplier Primetals Technologies to supply a new static synchronous compensator (Statcom) for the company's steel mill located in Petersburg, Virginia, USA. Primetals Technology plans to build the largest Statcom that has ever been implemented in North American steelmaking operations in order to supply power for the facility's 69-kilovolt alternating current electric arc furnace. Source: Kallanish, 8 June 2023.

Mining company Rio Tinto and China’s Baowu Steel Group have signed a memorandum of understanding (MOU) to explore several initiatives including setting up green steel facilities in China and Western Australia, Rio Tinto said in a statement. “This MOU aims to address one of the biggest challenges faced by the industry – developing a low-carbon pathway for low-tomedium grade iron ores, which account for the vast majority of global iron ore supply,” Rio Tinto’s chief commercial officer Alf Barrios said in a statement. Source: SCMP, 12 June 2023.

Mining giant Glencore has made a proposal to buy Teck Resources’ steelmaking coal business as part of an ongoing takeover deal. Glencore first made an unsolicited takeover bid for the entirety of Teck’s operations in April. Teck rejected the $23bn offer, calling it ‘unsolicited and opportunistic’.

Under Glencore’s latest proposal it would buy the coal and steelmaking element of Teck’s business, joining the unit with its own demerged energy coal assets two years after the deal closes. Source: Mining Technology, 12 June 2023.

United States Steel Corporation has issued its 2022 Environmental, Social and Governance (ESG) report entitled, ‘Essential for our Future,’ which the company has stated reaffirms its commitment to sustainable steelmaking and a greener

economy. "Every single employee is playing a role in creating a more sustainable future," said David B. Burritt, US Steel president and chief executive officer. "Steel's importance to our society is undeniable, both in the past and into the future as we collectively tackle climate change. It’s of particular significance that we were the first American steel company to set a goal of achieving net-zero greenhouse gas emissions by 2050.”

Source: Business Wire, 13 June 2023.

Tata Steel has said that 18 people were injured, with two in intensive care, following a steam leak at its Odisha power plant. The company reported that the accident occurred at its Meramandali BFPP2 power plant in Dhenkanal, Odisha, during an inspection, leaving a few people injured, and has started an internal investigation into the cause of the accident. The injured persons were immediately shifted to the Occupational Health Centre inside the plant premises and then to a hospital in Cuttack for further treatment. Source: Reuters, 14 June 2023.

Tata Steel has signed a MOU with Germany plant supplier SMS group to collaborate on technology to reduce carbon emissions from the steelmaking process. Under the MOU, the two companies will hold technical discussions and demonstrate SMSdeveloped decarbonization technology at a blast furnace in Tata’s Jamshedpur plant in Jharkhand, India. The technology aims to reduce more than 50% of CO2 emissions from the blast furnace’s baseline operation.

Source: Mining Technology, 15 June 2023.

Singapore based steelmaker Meranti Steel has announced that it has signed a MOU with Thailand-based energy company Global Power Synergy to establish renewable solutions for its new green steel plant to be built in Thailand. Meranti Steel aims to use renewable solutions such as solar and wind energy and create a future green hydrogen supply chain for its new plant. The plant, which will have a capacity of 2Mt/yr of hot rolled coil, is planned to start production in late 2027.

Source: Steel Orbis, 15 June 2023.

Brazilian steelmaker Gerdau has said that it will invest $666.64 million by 2026 in a new sustainable mining platform in the Minas Gerais state, in a bid to boost its iron ore output while reducing emissions. The new platform will raise the production capacity of Gerdau's Miguel Burnier mine to 5.5Mt/yr of iron ore and is scheduled to start operating at the end of 2025, according to the company. The project will rely on the dry stacking method for disposal of 100% of the mining tailings, eliminating the need to use a dam, Gerdau said. Source: Reuters, 15 June 2023.

A steel frame measuring more than twice the size of Wembley football pitch is nearing completion at a new facility to support the British Army’s vehicle and equipment fleet. The Vehicle Storage and Support Programme at the Ministry of Defence site in Ashchurch aims to enhance the British Army’s operational readiness and future capability, through the delivery of modern sustainable storage and maintenance solutions for its vehicle and equipment fleet.

Source: Gov.uk, 16 June 2023.

ArcelorMittal has announced that it has partnered with Japan-based Sekisui Chemicals on a project called NEDO to

capture and reuse carbon from steelmaking. The companies have achieved a carbon conversion rate of 90%, and a hydrogen conversation rate of 75% using blast furnace gas at ArcelorMittal’s Asturias plant in Spain, higher than the projected target of 85% for carbon conversion and 60% for hydrogen conversion.

Source: Steel Orbis, 20 June 2023.

Liberty Steel Georgetown in South Carolina, USA, has announced the commencement of a new apprenticeship programme, which will allow workers

One person was killed and three others were injured in an explosion at a steel factory in Palakkad district, southwestern India, on 20 June. The incident took place at 0500hrs with a loud explosion, according to local people. According to preliminary investigations, the explosion started in the furnace. There have since been allegations about security lapses in the factory. A district collector has said that action will be taken against the factory if this is the case, adding that the police and the pollution control board are investigating the accident.

Source: The Hindu, 20 June 2023

at the company’s South Fraser Street mill to train at Horry-Georgetown Technical College. Starting later this year, the programme will focus on improving the technical skills of present employees on campus and on the job. New hires will also receive training, and Liberty Steel hopes the programme will expand to serve as a pipeline for future workers.

Source: Georgetown Times, 20 June 2023.

Ternium Mexico, a subsidiary of Ternium, has stated that its new slab mill will be built in Pesqueria. The mill will be located next to the existing hot rolling mill, which has a capacity of 4.4Mt/yr. The company will invest $3.2 billion in the new electric

arc furnace steel mill which will create more than 1,800 jobs. Construction of the mill is expected to begin in December this year, while it is anticipated to commence operations in early 2026.

Source: Steel Orbis, 21 June 2023.

Engineers at Swansea University, UK, have developed a heat storage material made from seaweed that they plan to test at Tata Steel’s Port Talbot-based steel plant to see how well it can capture waste heat from industrial operations. The new thermochemical material is made using alginate, a polymer produced by seaweed. The team has created beads using the material which capture heat and can be made to release it using humid air.

Source: The Chemical Engineer, 3 July 2023.

Tata Power has emerged as India’s most ‘attractive employer brand’, followed by e-commerce giant Amazon and Tata Steel, a research report has revealed. HR services provider Randstad India’s annual report ‘Randstad Employer Brand Research (REBR) 2023’ revealed that Tata Power scored highly on financial health, good reputation, and career progression opportunities. IT company Tata Consultancy Services secured 4th position in the top 10 most ‘attractive employer brand’, followed by Microsoft, Samsung India, Infosys, Tata Motors, IBM and Reliance Industries.

Source: The Indian Express, 21 June 2023.

A new report has found that carbon capture, usage and storage (CCUS) for coalconsuming blast furnaces will not play a major role in global steel decarbonization, and that a phase-out of coal in the steel sector is technically feasible by the early 2040s. Research undertaken by IEEFA has highlighted that CCUS has a long history of significant under-performance and failure in other sectors, and ‘even projects that the fossil fuel industry likes to cite as successes raise major questions about project risk and the feasibility of rolling out such projects globally.’

Source: IEEFA, 3 July 2023.

Out of three offers to buy the assets of two Liberty Steel plants in Liége, Belgiium, one has finally been accepted by the Liége Court of Appeal.

Liberty Steel Galati, the Romanian subsidiary of UK steelmaker Liberty Steel, has beaten ArcelorMittal and a NLMK/Marcegaglia consortium for the two plants, which employ a total of 582 workers. The Liberty Galati offer took preference over the others, according to a report by The Brussels Times, because it included the acquisition of all activities and workers. However, while the workers are confident they will be able to return to work soon, no deadline has been given.

Source: The Brussels Times, 21 June 2023

The European Commission has said that it has approved $308 million in state aid granted by Belgium to steel maker ArcelorMittal to help it decarbonize its steel production. The aid will support the construction of a direct reduction iron

plant, which together with a new electric arc furnace will replace one of two existing blast furnaces. The plant, which is expected to be operational by 2026, will ultimately be operated using renewable hydrogen.

Source: Reuters, 22 June 2023

Plant supplier ABB will provide electrification and automation systems for ArcelorMittal Nippon Steel India’s advanced steel cold rolling mill (CRM) in Gujarat, India. ArcelorMittal Nippon Steel India (AM/NS India), a joint venture between steel companies ArcelorMittal and Nippon Steel, is setting up the new CRM as part of its downstream expansion and sustainability plans. The steel manufacturer has a crude steel capacity of 9Mt/yr. It produces a range of flat steel products and has a pellet capacity of 20Mt.

Source: Power Engineering International, 4 July 2023.

cunova, a market leader for customised products and solutions made of copper and copper alloys, is adding a fourth supporting pillar to its business units. In addition to melting and casting technologies, industrial applications, and maritime applications, the service division will be integrated into the company’s organisational structure with immediate effect, according to CEO Werner Stegmüller.

The new unit will be headed by Jack A. Roser, CEO of the US company Roser Technologies Inc (RTI), which was acquired by cunova last year. For more than 20 years, RTI has set the standards in service offerings in the field of melting and casting technology, and has ‘remarkable expertise’, according to industry sources. With the integra-

tion of RTI into the cunova group of companies, successfully tried and tested processes and structures can now be applied to all cunova service centres worldwide.

“We are convinced that we can leverage significant potential in the service sector by improving our organisational structure,” emphasised Stegmüller. “With the decision to establish a fourth business unit for Service Division, we underline our high demand for the best possible customer and service orientation. We are convinced that this decision will enable us to achieve our ambitious growth targets even better.”

For further information, log on to www.cunova.com

which mostly include grades traditionally produced via the integral cycle only, such as interstitial-free grades for the automotive industries and the much-coveted electric steel grades required, for instance, by all providers of electrical mobility and green power generation solutions.

EAF safety and user-friendliness some BOF users might still harbour.

Tenova, a leading developer and provider of sustainable solutions for the green transition of the metals industry, will supply an electric arc furnace (EAF) equipped with Consteel® and Electromagnetic Stirrer Consteerrer® to POSCO for its Gwangyang plant in South Korea.

The South Korean steelmaker, the sixth largest worldwide with about 43Mt of steel produced in 2022, has a track record of pursuing the decarbonization of its high-quality steel products,

A key part of this transformation towards sustainability consists in the gradual conversion from the BF-BOF route towards electric steelmaking based on EAF. After a two-year process of co-engineering and competitive comparison, POSCO has selected Tenova’s equipment: a full-platform EAF capable of tapping 280t of liquid steel, equipped with the continuous scrap charging system Consteel® and the electromagnetic stirring system Consterrer® - jointly patented by Tenova and ABB.

The new EAF will be uniquely designed to match the needs of quality, productivity, and efficiency that such an experienced steelmaker demands, and will be equipped with a full set of robotic applications and enhanced safety solutions such as the Safe+ EAF water leakage detection system to dispel any concerns about

“Besides requiring a radical re-thinking of the production process, an EAF of this size and power is an entirely new machine for most integral steelmakers and may understandably scare away engineers who are accustomed to the relative quietness of most BOF Converters halls,” said Paolo Stagnoli, sales director for EAF and LF, Tenova. “As a member of Tenova, I find profoundly gratifying that such a top-class steelmaker recognized our unique experience in large EAFs and understood the value of our patented technology. We are committed to become a long-standing partner of POSCO as we build together a new environmentally friendly and record-breaking furnace.”

The new EAF will be installed in a dedicated new section of the Gwangyang plant and is scheduled to enter production by the end of 2025.

For further information, log on to www.tenova.com

A growing demand for electrification within several industries like steel, solar and semiconductors has provoked Kanthal to expand its production site in Walldorf, Germany. The aim of the investment is to capture the growth within electric industrial heating and drive operational improvements through increased automation.

At the Walldorf site, Kanthal manufactures

products such as Fibrothal® heating modules, flow heaters, metallic heating elements, and diffusion cassettes. All these products, says Kanthal, enable industries to make the green technology shift.

The investment includes expanding the current premises with ~2500 m² manufacturing area through a lease agreement of a nearby facility, as

well as new equipment and automation improvements. The number of employees is expected to increase by approximately 10 people.

“The investment ensures that we can capture the growth in electrification of industrial heating, which will require a ramp-up of our operations globally. We expect a rapidly growing demand for our traditional heating solutions, but also for our

Austrian solutions provider ELIN Motoren and global technology company Voith have launched the first electric motor with integrated safety coupling for the main drive of tunnel boring machines. Water-cooled asynchronous motors from ELIN Motoren contain either the Voith SafeSet to safeguard the entire drive train or the Voith SmartSet for continuous operation, even with frequent torque peaks. According to Voith, torque limitation increases the productivity of the TBM, protects the machine components, and avoids costly downtimes.

Depending on size and geology, the cutting head of a TBM is powered by between four and 24 drive units. These drive trains consist of a pinion, planetary gear unit, torsion shaft, safety coupling, and electric motor and represent the heart of a TBM that should be protected. Clogging in the cutting head causes a sudden torque much higher than the maximum permissible torque with which the drive train is rated. As it is activated at a predefined torque, the integrated safety coupling in the new MKH-SafeSet and MKH-SmartSet electric motors from ELIN Motoren protects all the drive train components of tunnel boring machines. A triggered coupling can be re-activated within a few minutes. If only a few couplings are released, the TBM can continue to tunnel until the next maintenance shift.

The weight of the new Voith SafeSet has been reduced by more than 80% and is only around 15% of that of conventional safety couplings. A lower mass minimizes rotor inertia and the bearing loads of the drive train, which improves efficiency and achieves lower temperatures, thus extending the service life of the drive train.

The MKH-SmartSet is an optional add-on to the MKH-SafeSet and allows continuous tunnelling despite any torque peaks that are non-critical for the drive train. Adding a SmartSet results in an automatic reset if the TBM slows down or comes to a stop which allows continuous operation, even if the frequency of high torque load peaks increases, which positively affects the productivity of the TBM.

“Partnering with ELIN Motoren, we have a powerful new to-the-market technical solution that will transform the tunnelling boring market segment,” stated Per-Olof Berg, product management torque limiting and connection couplings

at Voith. Berg added: “The new MKH-SafeSet and MKH-SmartSet is a further development of the well-known SafeSet portfolio which is in operation on thousands of ELIN Motoren cutter head motors. The new MKH-SmartSet instantly shaves the torque peak and protects the drive without releasing. Furthermore, MKH-SafeSet, with the coupling integrated into the cutter head motors from ELIN Motoren, is the perfect lightweight and compact solution for tunnel boring machines that do not need peak shaving and automatic resetting.”

“The pooling of the expertise of ELIN Motoren and Voith offers manufacturers of tunnel boring machines a powerful yet safe technical solution from a single source,” said Markus Frickh, key account manager at ELIN Motoren. “As a manufacturer of customized electric motors, we aim to offer products that meet the stringent individual requirements in the mechanized tunnelling segment.”

For further information, log on to www.voith.com

newly developed high temperature process gas heaters that are currently being tested in a number of pilot projects,” said Aaron Roy, president of business unit heating systems at Kanthal.

“This will benefit customers with better availability and faster delivery of products that will be key in achieving their sustainability goals. In addition, the expansion shows the local community

that we are investing in Walldorf and offering new and attractive jobs.”

The initiative started in May and is expected to be fully implemented in early 2024.

For further information, log on to www.kanthal.com

IIoT service provider thyssenkrupp Materials IoT is automating the calculation and assembly of knives in steel service centres with the help of its new toii®.Cut software. The software solution digitalizes all preparatory and execution steps on slitting lines: from software-based knife calculation and the automated creation of knife assembly plans to digital tool management. It is a further module of toii®, the IIoT platform that digitizes and automates production in the steel and metalworking industry.

The high degree of automation on the shop floor leads to more efficient work, the company says, and helps to sustainably save costs and reduce throughput times. In addition, the use of the solution means that users are able to focus on infrequently occurring cases, such as calculated knives with warnings or error messages.

The toii®.Cut software was developed in a

two-year cooperation with the processing specialist thyssenkrupp Materials Processing Europe. The aim was to find a solution that could be seamlessly integrated into thyssenkrupp Materials Processing Europe’s existing IT system – including its own ERP system – in the ongoing digitalization of steel service centres.

With the help of the solution, the processing specialist is now able to meet increasing requirements such as on-time delivery, even for orders with small batch sizes or a large quantity of knives to be built. Handwritten work and paper-based processes are also to be replaced.

“From an operational excellence point of view, with toii®.Cut we have another building block to increase efficiency, process stability and quality at all our sites through digitalization,” said Michael Panzer, head of operational excellence at thyssenkrupp Materials Processing Europe.

The web-based software solution promises its users a cross-site application with numerous functions and features as well as an intuitive user interface. With the aid of integrated tool management, the use of tools can be optimized and longer knife service lives achieved.

“We are in contact with our customers in steel service centres from all over Europe beyond the initial development process and have gained a very good understanding of their requirements. This allows us to ensure that our software remains up-to-date and also meets the individual needs of users,” explained Sebastian Lang, managing director of thyssenkrupp Materials IoT.

For further information, log on to www.thyssenkrupp-materials-services.com

ABB will purchase low-carbon copper winding wire from global provider Dahrén for use in the manufacturing of its electromagnetic stirring (EMS) equipment. The commitment builds on similar supply chain connections for ABB stirrers used in the production of metals.

The supplier, which operates primarily in Sweden, Germany and Poland, will receive raw copper mined by Swedish mining and smelting company Boliden using fossil-free energy, then processed into wire. Copper is a vital material for manufacturing industrial electrical equipment, but its production is energy intensive. The carbon footprint of the Boliden product used by Dahrén is known to be 65% lower than the industry average, says ABB.

“We believe we are in a breakthrough year for low-carbon and recycled copper,” said Håkan Svensson, CEO of Dahrén. “Thanks to the longterm partnerships in our supply chain, we are able to secure a significant supply of this raw material and offer our customers the possibility to reduce their own carbon footprint, while retaining the high quality and performance of

their products.”

“Through close collaboration with Dahrén and Boliden, ABB is helping to build a supply chain ecosystem with a low-carbon and ultimately a zero-carbon approach at its centre,” said Ola Norén, head of metallurgy products, process industries, ABB. “We are increasing our use of low-carbon and recycled copper winding wire in our EMS technologies all the time.”

ABB’s Metallurgy Products team has now ordered a stock of copper wire from Dahrén for use in the air-cooled EMS for aluminium applications, and the intention is to grow this to higher volumes in the future. The largest model has

2,200kg of copper wire per unit and the smallest 500kg of copper wire per unit.

Separately, ABB has a relationship with Finnish metals manufacturing specialist Luvata for hollow conductor wire made from Boliden’s certified recycled copper. The models of stirrers constructed using this stock of copper each have up to 2,700 kg of copper, saving up to 6,700 kg of CO2 per stirrer, based on verified industry-standard calculations.

For further information, go to go.abb/processautomation

The most technically advanced coil joining equipment available. Period.

Guild International can design and build the welding machinery you need to keep your coil processing lines up and running smoothly and profitably. We are the world leader in supplying highly-engineered coil processing equipment known for reliability and performance. Contact us today to begin designing the perfect coil joining equipment for your processing lines.

For more information, visit our website at www.guildint.com or call +1.440.232.5887

World Leader in Coil Processing Equipment for the Steel Processing, Tube Producing and Stamping Industries Since 1958

WHEN inflation began raising its ugly head some time ago, the industry’s Cassandras were quick to chorus the sentiment that the US economy was in the throes of a deep recession which would leave its scars on everyone connected with steelmaking – suppliers, sub-contractors, the industries which relied on steel, workers’ jobs and what have you.

Fortunately, that has not come to pass, or at least not on the scale feared. It was a high-inflation situation with no job losses – a soft landing then? The politicians who support the steel industry, and also expect to be supported by the latter, heaved a sigh of relief that it was not a stagflation, the horror situation that we had experienced in the past. The job market right now is pretty much strong and many industries, including steel, are willing to pay a premium to get good and able workers.

Of interest in this regard is the recently released 2022 Annual Statistical Report by the American Iron and Steel Institute, which is touted as the steel industry’s ‘voice’. The report contains comprehensive data on the US and North American steel industry.

According to the AISI report, US steel shipments in 2022 amounted to 89.5Mt (net tons), down 5.5% from the previous

year. The nation’s crude steel production in 2022 declined by 6.2% to 94.7Mt (net tons). Total domestic steel imports into the US declined 2.0% in 2022 over the previous year, while finished steel imports rose 11%, accounting for a 24% share of apparent steel consumption. The construction and automotive industries remained the primary end-use markets for US steel products.

Describing the steel industry as ‘constantly evolving’, AISI president and CEO, Kevin Dempsey, said that the annual statistical report (ASR) provided the industry standard for reporting on the steel industry in the US.

Steel mills remained below 80% capacity as of the third week of June but, as Dempsey puts it, have been ‘inching back toward that key threshold for financial success for the steel sector’.

After years of record profitability, the industry saw imports account for 24%

of market share last year as prices started to tumble once again from all-time highs. Steel prices have since been on the mend as automotive orders have picked up and automotive production has risen while appliance manufacturing has remained stable.

Moving on to that hotlydebated subject of tariffs under Section 232, some countries have been quietly trying to get exemption on their exports from steel and aluminium tariffs.

India is a case in point. It had already asked the Biden administration for exemption off tariffs, offering to exempt US agricultural exports from tariffs; however, Washington remained unmoved. The exemption gesture would have been portrayed as an ‘achievement’ during the high-profiled state visit of Indian Prime Minister Narendra Modi to Washington in the third week of June.

Section 232 tariffs were imposed by former President

There’s never a dull moment in the US steel industry what with rising inflation possibly leading to a recession but not quite, Section 232 tariffs still in place and some nations, like India, trying to be exempted from them, and, of course, China still producing far too much steel than is needed. Throw decarbonization into the mix and it starts to get even more exciting. Manik Mehta* reports.

Amid the ongoing emphasis on decarbonization and producing ‘green steel’ by the industry – which is said to be responsible for generating some 7% to 9% of the world’s CO2 emissions – attention has turned to Boston Metal which reportedly worked for some 10 years to develop, refine and scale technologies aimed at reducing carbon emissions and combatting climate change; the company is trying to reinvent a process, originally developed by the Massachusetts Institute of Technology (MIT), to reduce CO2 emissions.

Boston Metal was formed in 2013 and has since raised a total of $250 million to develop a ‘green path’ to steel production which is the backbone of modern infrastructure construction.

Though Boston Metal has yet to generate revenue and is still working on the final technology to be applied on scale for clean steel production, the company has, nevertheless, signed a $20 million funding arrangement with the International Finance Corp (IFC)., the private sector investment organization of the World Bank.

IFC’s director William Sonneborn has been telling the media that this is the first-ever investment made by the IFC in a pre-revenue start-up, thus underscoring the importance which the World Bank attaches to helping low-income nations produce steel without the CO2 emissions.

Sonneborn, who was recently in Africa, has been pointing out that there are hundreds of millions of people who do not have a proper house and that, at some

stage, they will need steel for properlyconstructed houses. Thus, the incremental steel production of the world will not be in the US, even though the technology may have been developed at the MIT. Indeed, the bulk of crude steel, estimated at 59%, was produced in developing countries in 2021, the IFC claims. Boston Metal’s process will be particularly attractive in developing nations that also have access to clean electricity such as Chile, Ethiopia, Malawi, Uruguay and Zambia, according to the IFC.

Meanwhile, Boston Metal, based in Woburn, Massachusetts, has attracted investments from ArcelorMittal, Microsoft’s Climate Fund, and Bill Gates’ Breakthrough Energy Ventures besides the World Bank. It is not surprising that many steel executives are closely monitoring Boston Metal’s activities. American steelworkers have voiced concern over unfair trade which threatened their jobs. At a recent hearing of the Congressional Steel Caucus (CSC), labour and business representatives urged

Congress ‘not to let down its guard’ against unfair trade practices.

The nation’s steel industry, after years of job losses and plant closures resulting from surging imports of – particularly subsidized – steel, has been on a growth trajectory since the start of this decade

Section 232 tariffs imposed during the Trump administration – and retained by the successor Biden administration – have helped stabilize the industry and created thousands of new jobs in the steel industry nationwide, attracting investments in and upgrading of existing steelmaking facilities. The industry is also engaged in reducing CO2 emissions and producing clean steel, with Cleveland Cliffs investing $1 billion

to build a direct reduction plant that has helped the company reduce greenhouse gas emissions by some 32%, the company’s CEO and president Lourenco Goncalves recently said.

US Steel has also announced a goal of net zero carbon emissions by the year 2030. However, the problem of excess steel capacity worldwide remains. China continues to be the worst offender of excessive steel production. According to a 2021 report of the Economic Policy Institute, China ‘used subsidies and other forms of distortionary government support to expand steel capacity by 418% (about 930 million metric tonnes) since 2000; it controlled just shy of half of global steel capacity’.

The problem seems to have taken a turn for the worse; China is now investing in steel production in a number of third countries. The United Steelworkers’ legislative director Roy Houseman testified that China will add ‘nearly 100 million tons of steel capacity in Southeast Asia alone, if all planned investments in the region go forward. �

While an estimated 72% of Columbian steel demand is related to construction, recent years have been challenging for indigenous steel companies active in the field of long products fabrication. According to one of them – Acerías Paz del Río, part of Andi Acero (the Columbian Committee of Steel Producers) – a better performance from the construction market is anticipated this year. By Germano Mendes de Paula*

THE Colombian Committee of Steel Producers (Andi Acero) represents the five steel companies dedicated to the fabrication of long steel products in Colombia. Those five companies are: Acerías Paz del Río (ADP), Gerdau Diaco, Siderúrgica Nacional (Sidenal), Siderúrgica Del Occidente (Sidoc), and Ternium. According to Andi Acero, the apparent consumption of long steel products in Colombia expanded slightly from 2.2Mt in 2018 to 2.3Mt in 2019. However, because of COVID-19, it temporarily retracted to 1.8Mt in 2020, followed by a quick and substantial recovery to 2.4Mt in 2021 (Fig 1).

The share of rebar in Colombian long steel demand has been relatively stable at

around the 66% plateau along the referred period. The same trajectory was observed for wire rod (20%) and other products (14%).

Due to its prominence, rebar is an important segment of the market and, therefore, needs attention. A webinar promoted by Andi Acero examined the different perspectives of the Colombian steel market earlier in the year. ADP, a participant in the webinar, delivered an interesting presentation. The following information is based on ADP’s lecture.

Fig 2 shows the evolution of rebar steel consumption over the period 2018 to 2022, highlighting that the latest year has

preliminary figures.

The market recovery of 2021 was not sustainable, as rebar demand retracted to 1.4Mt in 2022, which was the same amount registered in 2018. Nonetheless, it is important to highlight that the market share of imported products diminished from 32% in 2018 to 17% in 2022. This outcome derived from the expansion of domestic installed capacity. In particular, Ternium commissioned a new 520kt/yr rebar rolling mill in Palmar de Varela in November 2020. It was added to a previous 220kt/yr nominal capacity. Not surprisingly, the main motivation of this $76M investment was to replace imports.

Regarding the origin of the imports, Fig 3 shows that Mexico was a key

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

supplier with a share of 62% in 2022. It maintained its participation around the 60% level during the analysed period. However, Peru gained considerable traction, by enlarging its share from 1% in 2018 to 16% in 2022. Turkey, the world’s largest exporter of rebar, diminished its relative importance from 21% to 16%, respectively. Brazil, after improving its participation from 17% in 2018 to 25% in 2020, had a disappointing performance, ending with a 5% share.

Roughly 83% of the imported rebar came from countries that have free trade agreements (FTAs) with Colombia. The country has signed FTAs with several nations or trade blocs aimed at liberalising trade between them. Currently, it is negotiating with Japan and Turkey. Imports from countries without FTAs are subject to tariffs of between 5% and 10%.

Domestic rebar production was boosted from 790kt in 2019 to 922kt in 2022 (Fig 4). Meanwhile, the respective numbers for wire rod were 154kt and 213kt. Other long steel products registered a slight decrease from 392kt to 350kt. As a whole, the aggregate production of long steel products in Colombia amplified from 1.34Mt in 2019 to 1.49Mt in 2022.

It is estimated that approximately 72% of Colombian steel demand is related to

the construction sector. Obviously, this is of great importance to the long steel segment. In 2022, higher interest rates and inflation combined with political uncertainty (due to the Presidential elections) led to an unsatisfactory performance of the construction industry. ADP data ratifies the weak conditions of the country’s construction market in 2022 year-on-year by showing that: a) real estate launches plummeted 17.2%; b) construction starts declined 0.5%; c) sales decreased by 11.2%;

rates are estimated to be transitory, returning to historical averages as of Q3 and Q4; b) continuity of housing policy instruments: subsidies to the “Mi Casa Ya” programme will achieve the historical maximum; c) construction risk indicators at favourable levels: builders do not expect project interruption, and the drop-out ratio is within typical parameters; d) acceleration in the execution of large infrastructure projects, such as the improvement of roads, the expansion of Bogotá and Cartagena airports, and the investments related to 4G and 5G networks.

Bearing all this in mind, ADP forecasts that the construction industry’s demand for long steel products will reach 1.9Mt in 2023, equivalent to an increase of 5% year-on-year, recovering to the level verified in 2021 (Fig 5). In 2023, the informal segment (which means building without appropriate licenses and permits) will be equivalent to 33%, followed by residential (31%), infrastructure (23%), wire rod (9%), and others (3%).

and d) supply dropped 7.1%.

ADP, however, expects a better performance from the construction market in 2023, because of: a) increased interest

In conclusion, the ‘hangover’ that characterised the Colombian long steel market in 2022 is over. It is highly likely that the import ratio will continue to decline as a consequence of the Ternium Palmar de Varela’s ramp-up. It is not clear, however, if and when the industry will start facing a less unstable demand trajectory. �

A boost in India’s infrastructure spending has supported a rapid rise in steel consumption – with the country expected to become one of the largest economies in the world. By Dilip Kumar Jha*

AFTER witnessing double-digit growth in the past two years, India’s steel consumption is likely to increase by 7-8% in the current financial year (FY) 2023-24 (April-March) due to the government’s massive capital expenditure on the construction of new infrastructure and the upgrade of existing ones, along with the rapidly expanding road and rail network. With economists forecasting India’s economic growth at 6.5-6.8% in FY 202324, after recording the world’s fastest 7.2% growth in the previous financial year, the government is confident about increasing capex on infrastructure. This increase is expected to support the rise in India’s steel consumption this year.

The Union Ministry of Steel has reported that India’s steel consumption reached an all-time high record at 119.17Mt in the financial year 2022-23, compared to 105.75Mt in the previous year. The growth in steel consumption for FY 2022-23 represents more than a quarter of 94.89Mt recorded in the pandemic years FY 2020-21. India’s crude steel production, according to the Ministry of Steel, stood at 125.32Mt in FY2022-23 as against 120.29Mt reported in the previous year. Similarly, finished steel production in the country was reported at 121.29Mt in FY 2022-23 versus 113.60Mt in FY 2021-22. India recorded a record production of crude and finished steel

production in the recently ended FY 202223.

Jayanta Roy, senior vice-president and group head of the Indian Credit Rating Agency (otherwise known as Icra) stated that the steel sector in India is expected to witness two significant milestones in FY 2022-23. “Firstly, the central government’s current year capex is expected to reach the average annual run-rate envisaged in the National Infrastructure Pipeline for the first time. Secondly, the sector will experience phenomenal consumption growth following two consecutive years of doubledigit booster, after more than a decade.”

According to the Ministry of Steel, India’s crude steel production stood at 125.32Mt in FY 2022-23, compared to 120.29Mt in the previous year. Similarly, finished steel production in the country was reported at 121.29Mt in FY 2022-23, compared to 113.60Mt in FY 2021-22. India achieved a record production of crude and finished steel in the recently ended FY 2022-23.

Roy further added that the first time

this feat was achieved was in FY 2009-10 and FY 2010-11. Although private sector investments have been relatively subdued, the government’s capex drive has helped maintain the industry’s capacity utilization rate at an estimated 79% in FY 202223. With steel consumption expected to grow in the high single-digit next year, it is anticipated that the industry’s capacity utilization rate will improve to around 80% in FY 2023-24, despite the commissioning of more new expansion projects.

T V Narendran, managing director of Tata Steel, stated that India’s steel demand will continue to remain strong this year. Urban demand has recovered to some extent, particularly in the automotive sector, which has returned to pre-Covid levels.

Commercial vehicles, the steel-intensive segment of the automotive demand, are back on track. However, motorcycle demand, which reflects rural consumption trends, appears to be more fragile. Nevertheless, there is a reasonable demand for construction steel.

Dave Stickler is no stranger to success in the sphere of developing hi-tech and green steel mills. The chief architect behind Big River Steel in Osceola, Arkansas – now part of US Steel – is now pushing ahead with Hybar LLC, another ambitious project that represents the zeitgeist of 21st Century steel making.

By Richard McDonough*MISSISSIPPI County, Arkansas, is on its way to likely being proclaimed as the county with the largest amount of steel production in the United States of America (US). Currently, it is likely ranked as the second largest such county. Its growth has come, for the most part, in just the past 35 plus years.

This county is located along the river of the same name between Memphis and St. Louis.

To provide some perspective on this growth, consider a statement from the Great River Economic Development

Foundation: “Between 1932 and 1960, Mississippi County held the title of largest cotton-producing county in America… Today, the county stands as the #2 steel producing county in the US...”

Part of that anticipated growth will be coming from a new rebar mini mill planned by Hybar LLC in the Osceola area of Mississippi County.

On 1 November 2022, Hybar LLC (then using the name of “Highbar LLC”) announced in a news statement that it would be investing approximately (US) $500 million to build a new rebar mini mill

on a site of more than 600 acres in this community in the central US.

According to that news statement, “Hybar LLC [will be] focused on sustainable scrap metal recycling and steel production.”

Preliminary geotech work has been underway during the subsequent months.

Ground breaking is scheduled for late July/early August of 2023, with construction anticipated to take about 22 months after the first shovel of dirt is moved at the ceremony. “Peak construction employment is expected to exceed 600 jobs,” according to a press announcement from the

company. Commercial steel operations are projected to begin in the Spring of 2025.

Annual production is anticipated to be 630kt of steel.

“We’ll be the steel company with the lowest carbon footprint and the lowest water usage,” said Dave Stickler, senior managing partner of Global Principal Partners LLC (GPP) and chief executive officer of Hybar LLC (Hybar). “We aim to be the most environmentally-sensitive steel plant.”

GPP is 20% owner of Hybar.

“The other 80% ownership is composed of high-profile equity investors that have invested alongside GPP in previous projects,” stated Mr. Stickler. “GPP will manage and oversee the construction and operations of Hybar.”

Local and state officials have welcomed

the new investment in Mississippi County.

“The addition of [Hybar’s] first rebar mill in Arkansas will not only support the growing steel industry in northeast Arkansas, but it will further diversify our economy and provide hundreds of highwage jobs to deserving families,” [then] Governor Asa Hutchinson said in a news statement dated 1 November 2022.

“I’m excited about the opportunities this

significant investment will bring to the region.”

“We’re excited for Osceola and Mississippi County to have another steel company locate here,” stated Megan Owens, executive director of the Osceola/ South Mississippi County Chamber of Commerce. “The new jobs created here will be life changing for our residents. We look forward to working with Hybar.”

Approximately 200 high-paying, permanent jobs – both direct and indirect – will come from this development.

“We will directly have 140 workers, with average annual incomes of no less than (US) $125,000,” noted Mr. Stickler. “In addition, we will be paying weekly bonuses to workers.”

Beyond the direct employees, Mr. Stickler indicated that because of Hybar, “there will also be about 60 indirect workers, including people working at the port and in slag handling, for example. These workers will be earning (US) $75,000 in annual income, on average.”

Part of the labour structure planned by Hybar involves few layers of management.

“We tend to be the employer of choice,” said Mr. Stickler. “We’re able to take a clean piece of paper to develop work rules from scratch.”

Hybar will stay focused on rebar manufacturing and only rebar

manufacturing, according to Mr. Stickler.

“We’re not going to get into the fabrication business,” he stated. “There are two big rebar steel companies – Nucor and Commercial Metals Company. Both also do fabrication.”

“We’re going to convert scrap into highquality steel,” Mr. Stickler continued. “Our customers can then fabricate our rebar steel.”

He sees demand increasing for ‘green’ rebar steel at competitive pricing.

A substantial amount of the planned annual production of rebar steel has already been sold by Hybar.

“We have sold 23% of our annual projected output to LMS Reinforcing Steel Group (LMS),” detailed Mr. Stickler. “This company is based in British Columbia in Canada. The firm has agreed to purchase 150,000 tonnes of our rebar steel each year for the next 10 years.”

According to a statement from LMS, the firm describes itself as “…a leading independent fabricator and installer of reinforcing steel.” (Pic 1, Pic 2 and Pic 3)

Sustainability is being built into the operations of Hybar even before its rebar mini mill opens.

“We will have a closed water system,” explained Mr. Stickler. “The only water loss will be through evaporation. There will be 0% discharge into the environment.”

“We’re also having our own solar energy system directly connected to the plant,” continued Mr. Stickler. “This will produce 100% renewable energy for our operations.”

In addition, he stated that “we’ll be using DC [Direct Current] in our operations. We’ll have an electric arc furnace, single-strand caster and a 14-housingless-stand rolling mill with an eight-pass, high-speed finishing block. Most rebar mills use AC [Alternating Current]. DC improves energy efficiency, allows better energy controls, and allows for a larger hot heel.”

The rebar mini mill is designed to utilise less energy on a day-to-day basis.

“The design of the furnace is specifically targeted to reduce the amount of energy needed to produce a tonne of steel,” said Mr. Stickler. “The evacuation system – the bag house – is designed to capture a higher percentage of emissions. This improves

plant operations and overall, creates an environmentally-sustainable footprint.”

The rebar mini mill will be built by SMS group Inc. The company has its headquarters in Pittsburgh, Pennsylvania. It is part of SMS group GmbH headquartered in Düsseldorf, Germany.

“SMS has been and continues to be at the forefront of advancing the world’s steel industry in terms of operating efficiency, ever-increasing quality capabilities, and environmental sustainability,” stated Mr. Stickler. “I fully expect the SMS-supplied rebar mini mill to build on the tremendous success my partners and I have had

developing many of the finest scrap metal recycling and steel production facilities in the world whilst using SMS technology.”

According to a news statement issued by SMS on 6 February 2023, “SMS group’s relationship with the founders of Hybar stretches back almost three decades with a high number of successful projects being completed between the two partners.”

“SMS group appreciates the continued trust of Hybar in our innovations,” said Jens Oliver Haupt, chief sales officer for SMS group Inc. “Jointly, we stand for bringing the most profitable combination of technology and talent to create cutting edge solutions for the industry.” (Pic 4)

There were several strategic reasons why this specific location – Mississippi County, Arkansas – was chosen to be the site for this rebar mini mill by Hybar.

“The Mississippi River is important,” Mr. Stickler stated. “It’s key to transportation. We can bring in scrap steel to the plant, and we can ship out finished goods.”

Mr. Stickler also said that this community has a better logistics network when compared to other locales. In particular, he noted that in addition to transport options available because of the Mississippi River, there is transit access through a Class 1 railroad as well as nearby interstate highways.

He stated that while there are other states along the Mississippi River with interstate highways and railroads, this area has the labour pool of skilled workers needed for steel operations.

The power contract was significant – both in terms of expenses and sources of energy.

“The area has a highly competitive electricity rate,” he continued. “Even more so, a high percentage of the electricity produced is based on low-carbon sources like nuclear energy and solar energy. And those levels are growing.”

He indicated that Hybar will be using minimal amounts of natural gas in its operations.

Changes in energy use are possible in future years.

“Initially, we’re not using hydrogen to power the plant,” detailed Mr. Stickler. “The technology is not there yet. The design of the equipment being built for this plant will allow us the flexibility to convert portions of

operations to hydrogen in the future.”

“We are also considering battery storage, but no final decision has been made,” he said. Governmental support was an important aspect of the decision to locate the first Hybar rebar mini mill in Arkansas.

“There has been a true embrace of operational technologies and steel production here,” Mr. Stickler continued. “Arkansas has been a favourable place to conduct business through the years. The support for investments in the steel industry has been seamless between Republican and Democrat administrations.”

Mr. Stickler explained that Hybar is receiving some tax credits – “available to any other business” – in the area of recycling as well as credit rebates to assist with payroll during training of workers.

“All of these tax credits only come to us after we make the specific investments in the plant and after we have hired and paid our workers,” stated Mr. Stickler.

Hybar publicly committed in March of this year that, upon the rebar mini

36Mt new capacity in three years

Fresh steel capacities totalling around 36Mt/yr are scheduled for commissioning by FY 2025-26. Despite these upcoming capacities, the government’s capex drive and the resulting push towards domestic steel consumption are expected to maintain the industry’s capacity utilization rate at around 80% in FY 2023-24. However, as the industry’s earnings moderate from the high levels of FY2021-22, there is likely to be an increased reliance on external financing to meet expansion plans. Early signs of this can be seen in the 22% increase in the steel industry’s bank borrowings during FY 2022-23.

As a result, the industry’s leverage (total debt to operating profits) is expected to deteriorate to an estimated 2.5-3.0 times in FY 2022-23 and FY 2023-24, compared to 1.1 times in FY 2021-22. However, this is still lower than the industry’s leverage level of 2.9 times recorded during the previous upcycle of FY 2018-19. The industry’s average EBITDA (earnings before interest, taxes, depreciation, and amortization) per metric tonne is expected to be around $110-115 per tonne in FY 2023-2024.

mill beginning operations, the firm will be providing Osceola (US) $1.5 million annually for the next 30 years.

“This annual contribution will be in addition to our taxes that we will be paying,” said Mr. Stickler. “The funds we will be contributing will be part of our corporate contributions to the local community. Funds will be used in the local schools as well as for fire, police, and ambulance services in the community.”

While Hybar was newly-formed, it was founded by individuals with a long history in steel production.

Mr. Stickler has been active in steel and finance for decades, leading and structuring “…a number of transactions involving scrap metal recycling companies and scrap substitute facilities,” his biography stated.

“Dave and his wife, Rebecca Li, formed GPP in 2003 to provide capital raising and hands-on management services to metals industry participants in North America and China,” noted his biography. “Based on GPP’s early success in working with both

mini mill and integrated steel producers, GPP expanded its business to include direct investment.”

GPP has made past investments in such companies as Big River Steel, now part of US Steel; Mississippi Silicon; and SeverCorr, now part of Steel Dynamics, Inc.

GPP and Hybar has ambitious plans for its latest venture in the steel industry.

Mississippi County is anticipated to be just the start of Hybar operations.

Two additional rebar mini mills are planned by the firm, each projected to have a capacity of approximately 600kt/yr (short tonnes) of steel.

Locations for the second and third mini mills have not yet been disclosed, but those sites are likely to be in other parts of North America.

“Arkansas is a great place for us to locate our first plant,” Mr. Stickler explained. “But geographic diversity is important.”

Details of new locations chosen by Hybar will be published in an upcoming edition of Steel Times International. �

Indian steel mills are expected to be more resilient in facing any deterioration in the macroeconomic environment in fiscal years 2023-24.

A strong infrastructure is the cornerstone of any developed economy, yielding a multiplier effect with manifold growth across various sectors. India is now taking measures to achieve the target of becoming a $5 trillion economy (up from the current $3.5 trillion) earlier than forecasted by the International Monetary Fund (IMF) by 2025-26.

There has been a significant increase in budgetary allocations for infrastructure development, with the government believing it will pave the way for India to become a developed economy. Consequently, the government has been consistently expanding existing infrastructure projects and planning new ones to accelerate economic growth. This growth in the infrastructure sector will also provide impetus to other critical areas such as education and skill development, urban development, the green economy, job

creation, and global competitiveness.

The infrastructure sector in India has witnessed a paradigm shift in recent years, with increased government allocations and incentives for private players to boost capital expenditure in the steel industry. The government’s focus is on infrastructure development through increased budget allocations. India has allocated INR 100 trillion ($122 billion) for FY 2023-24 for infrastructure, representing a 33% increase from the previous year and equivalent to 3.3% of India’s GDP.

According to a report by the Confederation of the Indian Economy, India is expected to become one of the largest economies in the world, with a gross domestic product of approximately $35-40 trillion by 2047, compared to around $3.5 trillion in 2022. India has implemented the National Infrastructure Pipeline, which has facilitated projects worth INR 108 trillion ($1.3 trillion). These projects are at various stages of completion. �

AIST executive director Ron Ashburn opened the 2023 President’s Breakfast at the AISTech convention and exposition with some rousing, senatorial comments. “We’re going to make this industry as green as it can be,” he told the assembled masses as they tucked into their bacon and eggs. It was a theme picked up by AIST president Keith Howe, ArcelorMittal North America’s CEO John Brett, Nucor Corporation’s chairman, president and CEO Leon Topalian and SSAB’s executive vice president and chief technology officer, Martin Pei. Matthew Moggridge* was there.

WANDERING the mean streets of Windsor, Ontario, on the opposite side of the Detroit River in Canada, I found a record store and dived in to see if I could find an album that has eluded me ever since I ditched vinyl for CDs back in nineties. At the time I thought it was progress, but for some time now I’ve bemoaned the loss of vinyl in my life and the fact that I only possess three ‘long players,’ which are stored away in my loft.

The album in question was Future Games – a Kahauna Dream by Spirit, and when I later inserted it into the CD player of my decidedly uncool car I was transported back to some weird times. One track on the album was entitled Detroit City and, true to the lyric, ‘I walked into Detroit City with a suitcase in my hand,’ although I had no intention of playing ‘with a group called Angels to prove I was a man’. I did manage to talk to the people and walk among the crowd, and if I’m honest, I would have to say out loud, that it was a ‘good, good feeling’ and that’s about as far as I can take this musical allusion.

That said, while I did walk into Detroit City with a suitcase, it wasn’t so much in my hand, it was on plastic casters, and I pulled it noisily behind me as I walked towards a taxi that would ferry me across the river to where I was staying in the Doubletree by Hilton on the riverside. Room 526 offered panoramic views of the Detroit skyline. I could even see the Huntingdon Convention Centre where I would be spending the next three or four days at an event I’ve praised for many years, AISTech. Every day I took the bus across the river, showed my passport, answered a few border control questions, such as ‘am I carrying any firearms?’ and then repeated the process on the Canadian side of the border later in the day.

Ron Ashburn, executive director of the AIST, always looks the same – which is a good thing – he doesn’t age, and it was good to see his familiar face on stage at the start of the President’s Breakfast. “We’re going to make this industry as green as it can be,” he said, senatorially, adding

*Editor, Steel Times International

that the ‘steel industry has helped build the modern world’ and that ‘clean energy needs steel and vice versa’. Ron insisted that ‘what we do is really good for the world’, sounding like he was campaigning in the primaries, but he was preaching to the converted, all 1,300 of us who were sitting there eating our bacon and eggs and Danish pastries. I was thanking my lucky stars that the need to take an early bus through the Windsor-Detroit tunnel stopped me enjoying a hotel breakfast. Normally, I manage to eat both, but not on this occasion.

Ron continued, stating that we’d have ‘net zero in three decades’ and then provided a few facts about the event that was soon to unfold upon the great and the good of the American steel industry. In truth, it wasn’t just American steelmakers present in Detroit. Representatives of the global industry were in the Motor City contributing to the 445 technical presentations and being a part of the 588 exhibitor companies.

When AIST president Keith Howe took to the podium he described decarbonization as ‘the moon shot of our time’. The race to decarbonize society was on, he said, and it was a great opportunity, a global problem that needed a global solution, but, he asked, can it be achieved? “Some say the answer is elusive, but it’s not impossible,” he added. “It is achievable, we have the talent and the will,” he continued, acknowledging that words and phrases like ‘green steel’ and ‘decarbonization’ were now commonplace and that society is demanding decarbonization. “It won’t be easy or inexpensive,” he concluded, stating that there was no single road to reach carbon neutrality.

Howe reminded the attentive audience that the AIST now has 16,643 members and that female membership was up 23.4%.

Martin Pei, executive vice president and chief technology officer at Swedish steelmaker SSAB was in town to pick up the Tadeusz Sendzimir Medal and was keen to point out that steel was a fantastic material, infinitely recyclable, and that demand

will increase in future. He pointed out, however, that steelmaking with iron ore was associated with massive greenhouse

‘the climate frontline’. “What we’ve done so far is not enough,” he said, which was an odd thing to say when you consider that SSAB is, arguably, streets ahead of any other steel company in the sphere of developing green steel technology, but I think he was referring to the global steel industry. Pei said that in 2015 the time felt right to launch a new process involving the use of hydrogen gas instead of coal as a reducing agent for ironmaking. The company has since proved that it’s possible to produce steel using hydrogen-reduced iron, but Pei admitted that the industry was still at the beginning of its journey towards fossil-free steel.

Leo Topalian, chair, president and chief executive officer of Nucor Corporation described winning the 2023 Steelmaker of the Year award as an ‘incredibly humbling honour’. Speaking of the AIST’s first ever winner of the award, Ken Iverson, Topalian said, “We stand on the shoulders of giants”. He said that Nucor’s goal was to become the world’s safest steel company and said there were several exciting greenfield projects coming through. “We’ve just come off two phenomenal years across a range of use markets,” he said, adding that the industry ‘must remain vigilant on trade laws’. He said that American manufacturing was experiencing a renaissance, that the North American steel industry has an ‘enormous competitive advantage’ and that ‘sustainability transcends competition’.

John Brett, CEO of ArcelorMittal North America, talked about decarbonization as a path forward, brazenly promoting the business and boasting steel manufacturing in 16 countries, customers in 155 countries, steel production of 59Mmt, 8.2Mt in North America alone. He spoke of an EBITDA of $14.2 million, 158,000 employees globally, 16,000 in the USA, free cashflow of $6.4 billion in the USA and record low net debt of $2.2bn.

Brett said that ArcelorMittal North America was gunning for net zero carbon emissions by 2050 and that company has more than 150 research and development programmes on the go.

gas emissions, ‘a problem that needs to be solved’. Pei said that SSAB had been working for a long time on what he called

He said that health and safety had been a top priority since the company was formed in 2006 and that the plan was to double the number of women in management positions. In short, he was throwing out a lot of positive facts about the business, including that 41 new

“We’re going to make this industry as green as it can be.”

RON ASHBURN, EXECUTIVE DIRECTOR OF THE AIST

products and solutions were launched in 2022 and that 79 new inventions had been protected last year.

On decarbonization, Brett was a little more cautious. He said that while 70% of the global economy has established a net zero target, concrete plans to deliver on those commitments were in their infancy for two reasons: staggering costs and technical readiness. “Sure, increasing scrap will reduce our CO2 emissions, but sufficient quantities of scrap will not be available for decades. Primary steelmaking will be around for years so how do we decarbonize the steel industry? There are multiple ways to make steel so multiple paths to decarbonize, that’s the approach we’re taking at ArcelorMittal.”

Brett said that the first pathway to decarbonize was ‘smart carbon’ – meaning increased use of clean fuels. He highlighted a number of pilot programmes in progress around the world including one at Torero where waste wood and end-of-life plastics were being converted into bio-coal, and a joint development with Lanzatech involving gas fermentation transforming waste gas into bio-ethanol. He also discussed the IGAR project at the company’s Dunkirk facility where the name of the game is reforming carbon to reduce iron ore.

The idea is to capture waste CO2 from the blast furnace and convert it into a synthetic gas (syngas) that can be reinjected into the blast furnace in place of fossil fuels. “Since the amount of coal and coke needed in steelmaking is reduced, this process helps to reduce CO2 emissions,” claims ArcelorMittal.

The syngas is made up of carbon monoxide (CO) and hydrogen (H2) and is formed by heating waste CO2 with natural gas to high temperatures using a ‘plasma torch’ in a process known as dry reforming. ArcelorMittal’s plan is to use bio-gas or waste plastics instead of natural gas, furthering the use of circular carbon. With the plasma torch running on clean power, the entire process enables substantial emissions reductions, it is claimed. The IGAR project has been through a number of phases, says ArcelorMittal. “Last year, to overcome the corrosive effects of the high-temperature syngas involved, our R&D labs in Maizières, France, developed both the specialist metals and refractories needed,” the company says on its website, adding that, “Today in Dunkirk, France, ArcelorMittal is running a €20 million project, supported by the French ADEME,

to construct a plasma torch. To test-use the hot syngas created by the plasma torch, a pilot project is also running at the same plant.”

Brett said that the scale of ArcelorMittal globally means there are pilot programmes underway around the world. He said that the company was investing $500 million in tech companies supporting decarbonization – referencing Boston Metal, Heliogen and Lanzatech – and claimed that half of that money had already been committed: Projects like a state-of-the-art 5.3Mt finishing facility with a 1.5Mt EAF and an option to double capacity intensity at ArcelorMittal/NipponSteel’s Calvert facility; ArcelorMittal Mines Canada converting 10Mt of annual pellet production to DRI pellets by the end of 2025 to supply feedstock to ArcelorMittal’s North America operations; and ArcelorMittal Mexico’s 4.5Mt DRI capacity, four 3.8Mt EAFs and new hot strip mill that produced its first coil in December 2021.

“Incentives contained in the USA’s Inflation Reduction Act IRA provide economically viable paths to address the vast majority of remaining CO2 emissions,” said Brett, who then name-checked the recently acquired ArcelorMittal HBI Texas, a 2Mt capacity facility with its own deep water port.

Brett said he was ‘very very excited’ about the future for ArcelorMittal North America. It was, he said, very fortunate that the US and Canadian governments provided assistance to support what he called ‘the tremendous cost of decarbonization’.