Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

Phone 615.385.1898

Toll Free: 1.800.264.1898

Email: marketing@insurors.org

Editor: Ron Travis Publisher: MarketWise, Inc

President ..............................................Matt Swallows, CIC, CRM

IIABA National Director ........................John McInturff III, ARM

VP Region I ...................................................................Bobby Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III, President-elect .............Kym Clevenger, CPCU

Treasurer ....................................................Richard Whitley, CIC

Secretary ..................................................................Kevin Ownby

Director, Region I ....................................Eric Collison, CIC, CRM

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ........................................................... Cy Young

Director, Region II .....................................Cameron Winterburn

Director, Region II ......................................................... Chip Piper

Director, Region II ...................................... Paul Steele, CIC, CRM

Director, Region III .................................................... Tim Goss, CIC

Director, Region III .......................................... Bill Oldham III, CIC

Director, Region III ...................................................Josh Gibbons

Director, Young Agents .................................John Brock, CAWC

Immediate Past President ......................... Norfleet Anthony III

As we celebrate the 130th Year of the Insurors of Tennessee, it is a suitable time to reflect on where we are as an association, how we build upon the past success of this association and think about the way forward. We cannot help but think about what it was like in the early days of the organization and what the historical backdrop was like in the last decade of the nineteenth century.

In 1893 when the forerunner of this organization was founded, The Panic of 1893 occurred fueled by the collapse of the stock market in New York. This led to a protracted depression that nearly rivaled the Great Depression of the 1930’s. The burgeoning city of Nashville was not immune to the Panic of 1893. For example, there were four national banks in Nashville at the time including the American National Bank, the First National Bank, the Fourth National Bank, and the Commercial Bank of Nashville. The Commercial Bank of Nashville failed and was sold on Saturday, April 25, 1893. The Commercial Bank of Nashville would not be the only bank

across Tennessee that failed that year. Banks that did survive across the state were facing their own financial pressure and struggles. More importantly, businesspeople including insurance agencies, insurance companies and citizens across the state were facing tough times.

It was during this decade that the The Tennessee Centennial and International Exposition was held in Nashville from May 1 – October 31, 1897 in what is now Centennial Park. Construction running a year behind, it celebrated the 100th anniversary of Tennessee's entry into the union in 1796. President William McKinley officially opened the event from the White House, where he pressed a button that started the machinery building at the fair; he would visit in person a month later.

This was a major event for Tennesseans. People came from across this state, other states and even other countries to help design and construct the buildings that covered the 200 acres of Exposition grounds located on the western fringe of the city, with access to the streetcar line. The more than 100 buildings included those devoted to agriculture, commerce, education, fine arts, history, machinery, minerals and forestry, and transportation. Others had special exhibits related to children, women and the United States Government. Many cities and organizations built buildings and exhibit halls on the Exposition grounds.

For example, Memphis’s contribution to the Centennial grounds took the shape of the Great Pyramid of Cheops in Egypt. Memphis looked to its namesake, the ancient city on the Nile, and constructed a building that represented the unique architecture of Egypt. This reproduction served as the headquarters of both the Memphis and Shelby County delegations.

Major Eugene Castner Lewis was the director general of the Tennessee Centennial Exposition. He had suggested that a reproduction of the Parthenon be built in Nashville to serve as the centerpiece of Tennessee’s Centennial Celebration and highlight the city as "Athens of the South". Lewis also served as the chief civil engineer for the Nashville, Chattanooga and St. Louis Railroad, which carried tourists to the exposition.

The total attendance was 1,786,714. The Parthenon was so popular that it was kept after most buildings and exhibits were dismantled. The original exposition grounds were adapted as Centennial Park for the city. Lake Watauga was also retained in the city park. The Centennial Exposition was a great success and is still considered one of the most notable events ever to be held in the state. Unlike most World's Fairs, it did not lose money, but the final accounting showed a direct profit of less than $50.

To finish the decade, the USS Maine exploded in the harbor of Havana, Cuba in April of 1898 leading to the SpanishAmerican War and sending shock waves around the world. Fortunately, the war ended by the end of December 1898 with the signing of a peace treaty in Paris.

In the photo above you can see the large pyramid exhibit designed and built by the city of Memphis, in honor of its Egyptian name. The Parthenon and the Pyramid were located next to each other on the shore of Lake Wautaga. Both of the exhibits were lit at night. The separate Egyptian Pavilion featured popular belly dancers. During the exposition, Italian-style gondolas plied the lake, carrying tourists by water between exhibits.

Also located along Lake Watauga, the Negro Building was designed in a Spanish Renaissance style. Exhibits came from numerous cities, and Fisk University and Tuskegee Institute had their own exhibits. Booker T. Washington, president of the latter, was a featured speaker on Emancipation Day.

So, during that first decade of the association, the founders and members faced significant challenges as well as many notable accomplishments. Life was not so easy for most folks at home or in business. Yet, they persisted, as has each successive generation has, through major wars, severe economic dislocations, social unrest, terrorist attacks, political turmoil, pandemics, societal turbulence, and the list goes on. If you are a student of history and business trends, it really calls into the question the notion of the “good ole days” as we look back through proverbial rose-colored glasses. To ask a rhetorical question, are we living in the “good ole days” now and just do not know it?

So, as we have built on the perseverance, endurance, innovation, and vision of the members of this association through the years, where are we now in 2023? The good news is that your association is one of the most influential and respected trade or industry associations in the state of Tennessee.

Certainly, within the insurance industry in our state, we are the premier association in Tennessee offering the most value to members through the services we offer and the most influential via our advocacy capabilities relative to governmental affairs. Our membership, including agency members and company associate members exceeds 450 members. We are one of the top five members of the Big “I” in the country which is even more impressive when you compare the relative population and economic size of Tennessee to larger states within the constellation of the Big “I” community. In addition, our state InsurPacTN and InsurPac national contributions rank among the best in the state and at the national level. There is much to celebrate in our 130th year!

However, as we celebrate our accomplishments this year we must continue to look forward and not rest on the work of the past. As we all know in this business, past performance is no guarantee of future results. We must continue to renew and adapt our association to meet the needs of members today and engage members of the insurance community with purpose. We have the leadership in place and the staff to create new opportunities in the coming months and years. Most importantly, we have the engagement and support of our membership including agency members and company partners to power intelligent initiatives going forward.

A key element we need to concentrate on for the balance of

2023 and in 2024 is the growth of membership. During the pandemic, like many organizations, we lost some momentum on the member development front. While our membership base is quite strong, we know there are insurance agencies and companies across the state of Tennessee who are not currently enjoying the benefits of being a member of the Insurors of Tennessee. Moreover, there is also an opportunity to reach out to newly formed agencies and minority owned agencies across the state that could also benefit significantly from being a member of this historic association.

We ask that each of you think about independent insurance agencies and insurance companies in your communities who are not members of this association. Please reach out to them and extend an invitation to become a member.

You can refer worthy candidates to the Insurors of Tennessee website at www.insurors.org/membership-opportunities or contact Jake Smith at jsmith@insurors.org to let him know about potential new candidates for membership. We look forward to your support and assistance! u

Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson

We’ve all heard it. Thousands of times. "15 minutes could save you 15% or more on car insurance!" The origin of this slogan was the implication that an agent ‘skims’ 15% of the premium for essentially doing nothing. The reality is that the days of 15% commission rates on auto are largely a thing of the past. The slogan also ignores the fact that the carrier known for this advertising mantra spends huge amounts on advertising and other acquisition costs such as salaries and benefits of sales and service staff. After all, only licensed agents can legally sell insurance and what’s cheaper, a 15% commission premium component or a salary, benefit and overhead component?

So, as an independent agent, how to you combat this misleading advertising?

First of all, be transparent as necessary about what portion of the insurance transaction is your compensation. Many consumers who think they know what your remuneration is would be surprised to know what it actually is. It’s very different from that of a life insurance agent.

Second, debunk their claim. When looking at the median premium for auto insurance, a carrier might average 15% below that amount, but there are almost always insurers who can do that or better.

Third, look at the numbers. For example, a few years ago, the Florida Association of Insurance Agents (FAIA) had a blog thread about the direct writer in question. At the time, they spent $1.4 BILLION on advertising and wrote 974,000 new policies the prior year for people that wanted to save 15%. That amounts to an acquisition cost of at least $1,437 per policy. Presumably their existing customer base of 18 million or so customers subsidized that advertising budget so that newly acquired insureds can “save 15%.”

There is an adage, “Torture numbers and they’ll confess to anything.” The “Save 15%” assertion is similar to claims that “People who switched their insurance to us saved an average of $346 a year!” The question is, what about the people that didn’t switch, maybe because the premium quote was higher than their current premium. And, of course, we haven’t even addressed the issue of quotes based on minimum limits and inferior coverage. This leads us to another counter to these advertising approaches….

Fourth, stress the FACT that insurance is NOT a commodity differentiated only by price. When a carrier (not the one we’re talking about above) advertises, “You get the SAME COVERAGE, often for less” or “SAME COVERAGE, better value,” the reality is that it’s NOT the same coverage. Policies are different and, even if two carriers are selling the same

Lifting your business to new heights,

Our business model is designed to support yours. With our transparent National Personal Auto Commission Schedule, you can earn more as you write more business with us. Then, as you grow, you’ll have the opportunity to unlock additional compensation and benefits with our partner programs.

Whichever path you choose to grow your business, we have a way forward and upward.

ISO-standard form, they are likely attaching different endorsements and their claims practices can be significantly different.

Over the years, I’ve addressed this issue in hundreds of articles and seminars with countless examples of a claim covered by one policy and not another. This is probably the most important thing you can initially do for a prospect or existing customer…educate them that coverage matters.

Fifth, sell the value of an independent agent, not price. Have a fact sheet touting the advantages of an independent agent. You are a consumer’s “Trusted Choice.” You represent multiple companies with multiple products, making it far more likely that you are able to match and customize the right product with the right customer.

And, perhaps most important, you can be an advocate for your customer at claim time. Good luck getting a captive agent like or any direct writer call center agent to help you get a claim paid. Keep in mind that, unlike captive and direct writer agents, YOU own the customer and, as a result, have a vested interest into ensuring that YOUR customer is treated right.

Keep in mind that this is still a relationship business. Make sure the prospect and your existing customers understand that they can trust you to do what’s right. Word of mouth advertising is worth a fortune.

Sixth, sell yourself personally, and your staff, as coverage counselors and claim advocates. Counseling and advocacy

require significant knowledge…tout the experience and educational accomplishments of your staff. Consider creating a bulleted list specifically of what you do, from loss exposure analysis to product selection and placement, to claims advocacy so that prospects and customers can understand and appreciate all that you do for them. Demonstrate that you EARN that “15%” by providing value to your customers. Share your success stories, if possible, with testimonials from existing customers.

Seventh, keep in mind that your preferred clientele base is most likely far different from that of direct writers and agents who sell on price. Don’t waste your time on marketing to customers that you and your carriers don’t want. Sell yourself. Sell value. Recognize what is at stake for your customers and keep that in mind with every transaction you have with them. Finally, always follow what I call The Insurance Golden Rule: “Never, ever forget in everything that you do professionally that the purpose of insurance is to insure and that the mission of this industry and every professional in it is to assist individuals ,families and organizations in minimizing their exposure to serious or catastrophic financial loss.” This begins with the insurance contract and ends with YOU.

About the Author—Bill Wilson, CPCU, ARM, AIM, AAM, a 50+ year veteran of the P&C insurance industry, is the founder and CEO of InsuranceCommentary.com and the author of six books, including “When Words Collide: Resolving Insurance Coverage and Claims Disputes.” u

The 2023 Agency Growth Conference in Chattanooga was one for the books! We had such a great turn out for both agents and company representatives.

We kicked off the event with a presentation from Insurors staff members, Jake Smith and Kyra Garrison, on specific ways that members can maximize their membership. This included a lot of information from legal advocacy, events, marketing content calendars and many more topics in between.

Following the presentation, attendees enjoyed an afternoon trade show with thirty-two companies and vendors who exhibited with the anticipation of connecting and developing relationships with our agents. The buzz of the exhibit hall was notable as 60+ agents made their way around the room. The Insurors staff is grateful to have two risk management students from MTSU Jones College of Business, Abigail Smith and Presley Hamby, volunteer their time to help assist the many logistical needs at the conference. Presley and Abigail made sure all attendees had everything they needed upon check-in as well as capture plenty of pictures.

After a full day of networking and exploring new opportunities, everyone enjoyed a sit-down dinner sponsored by Progressive. The good times did not end for the night after that as our Young Agents group headed down the street to Naked River Brewing Company for an extended time of socializing. In an industry where frequent travel can be common for many, connecting with familiar faces at the Insurors events is just another reason why we do what we do.

The following day opened with a full southern breakfast sponsored by some of our Chattanooga-area agency members (RSS Insurance, Brock Insurance, Stevens & Associates Insurance, SBK Insurance, and Timothy Goss) which provided some excellent brain food that attendees were able to bring with them. Their first session was a 2-hour CE credit called ‘Premium Finance Express’ presented by Laura Gaunt from Imperial PFS. Then, the crowd was able to hear from our next speaker Ryan Sherrer, from our preferred digital marketing vendors, Titan Digital. Ryan gave an engaging presentation on the history of advertising and how attendees can leverage new techniques to increase their digital presence via web marketing.

Insurors of Tennessee is privileged to serve such a wonderful network of agents and company representatives. We are tremendously thankful to those who were able to attend the Agency Growth Conference in Chattanooga! We look forward to the continued success of this conference for our members!

As the trade show was wrapping up, our WINS breakout event was getting started. With over 50 brilliant women attending this event, we were happy to be able to provide a space where they could network and unwind after the trade show. We also received several helpful suggestions for future events as well as obtain ideas for local charities our members want to support placed in our suggestion jar upon check-in. A big thanks to Imperial Finance for donating four Starbucks gift cards and Insurors that gave away two bottles of wine in an drawing. Based on the enthusiasm of our winners we will definitely incorporate more giveaways at future events.

We had over 20 first-time WINS event attendees with us and were happy to be able to send them home with small WINS branded candle and several new connections with Tennessee women in our industry. Our group is growing quickly and Insurors could not be happier about uplifting the amazing women who strive to advance our industry for the better! We want to thank all the ladies that attended our WINS event in Chattanooga. Your enthusiasm and energy are what makes these events so great!

The premier event for independent agents to engage elected leaders at the federal level is being held April 26-28 at the Renaissance Washington, D.C. Downtown Hotel. Once again, this year, several of your colleagues from across Tennessee will travel to Washington to attend a series of important events and sessions designed to get members up to speed on pending legislation and issues in Washington. Perhaps most importantly members will have the opportunity to meet with elected leaders and their staff.

Tennessee has a long history of sending a strong contingent of members to Washington to help make certain our elected leaders serving in Congress hear our concerns and receive our input on a range of issues. CEO Ron Travis and State National Director, John McInturff III along with experienced veterans of this event will lead our group while in the nation’s capitol.

With a busy year ahead, the Big “I" is looking forward to having agents and brokers from across the country advocating on Capitol Hill. This “grassroots” effort at the national level is vital in making certain political and legislative decisions in Congress are not made in a policy vacuum or rhetorical echo chamber. Below is a brief overview of the schedule for the week from 10,000 feet.

Schedule of Events:

Emerging Leaders Day - Wednesday, April 26

A congressional rising star takes center stage on a day dedicated to emerging independent agency leaders.

Capitol Hill Day -Thursday, April 27

Hear from congressional leaders at breakfast and visit your lawmakers and their staff on Capitol Hill.

Industry Day - Friday, April 28

Big "I" chairman John Costello addresses the state of the association and industry.

The agenda is typically quite packed with opportunities to learn, develop relationships with colleagues from across the nation and most importantly communicate with our elected leaders from Tennessee. The event is also a great place for Young Agents to gain exposure to the importance of advocacy work at the state and national level.

In the next issue of the Tennessee Insuror magazine which focuses on legislative affairs and advocacy, we will provide you with greater detail on the trip to Washington and the results of our time spent in Washington, D.C. u

Harford Mutual Insurance Group is a Ward’s 50® top-performing property-casualty insurance company for the second consecutive year.

We partner with independent agents to insure restaurants, contractors, mercantile, and other commercial entities.

The focus of the Small Town Agency Spotlight in this issue of the Tennessee Insuror magazine is the Waggoner Insurance Agency located in beautiful Maryville, Tennessee. Maryville is just a short twenty-five-minute drive almost due south of Knoxville in the foothills of the Great Smoky Mountains. In fact, the Great Smoky Mountains are visible from many parts of town. Maryville is the birthplace and home of former Tennessee Governor and U.S. Senator Lamar Alexander. Maryville College is also located in town and was founded in 1819 by Presbyterian minister Isaac L. Anderson with the mission of furthering education and enlightenment in the region.

The story of the Waggoner Agency begins in 1929 when Mr. A.B. Waggoner decided to become a life insurance agent for Mutual of New York providing life insurance to Maryville and nearby communities. One can surmise that he must have encountered some significant headwinds with the crash of the stock market in October of 1929 and the start of the Great Depression. In those days life insurance was sold door to door in the homes and businesses of people in the community from sunup to sundown. In the best of circumstances selling life insurance was no easy mission and had to be even more challenging with the depression weighing heavily on the pocketbooks of households across the region. Nevertheless, Mr. A.B. Waggoner preserved and in time became the number one agent in sales for Mutual of New York in the nation. Shortly after December 7, 1941, the United States formally entered World War II and A.B. Waggoner’s son A.B. Waggoner, Jr. joined the United States Army to serve in the war effort.

At the end of World War II A. B. Waggoner, Jr. returned home to Maryville after serving in the Army. Like many veterans at the time, he found his way into the insurance industry and started a small property and casualty agency selling home, auto and farm insurance to people in the area. After the war, the peacetime economy roared to life creating more opportunity. Families purchased cars, homes and started small businesses that all needed to be insured. So, A.B. Wagoner, Jr.’s father, joined the agency writing life insurance, property & casualty coverage and assisting with other aspects of managing the agency.

The small agency prospered during the postwar years as the agency served the community.

In 1978 A. B. Waggoner Jr.’s daughter Nell joined the agency after graduating from the University of Tennessee. In 1983, his son Andrew (A.B. Waggoner, III) also joined the agency after graduating from the University of Tennessee. Andrew and Nell became the third generation of the family to become involved in the insurance business. Eventually, their father retired from the agency due to health reasons. Andrew and Nell assumed full responsibility for managing the agency and providing insurance products and services to the community. Today, the agency writes primarily personal lines insurance and some commercial insurance for clients. The agency’s market reach extends beyond Maryville to Alcoa, Knoxville, Tellico Village, and other nearby towns. The agency represents several premier insurance carriers giving their clients excellent options relative to coverage and price.

While the agency demands much of their time, both Andrew and Nell are avid University of Tennessee Volunteer fans and enjoy following the football, basketball, and baseball teams in their quest for SEC championships and national championships. They both also enjoy going outdoors to enjoy the Maryville area and the beautiful foothills and mountains on their doorstep. u

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership.

Why insurance firms choose to partner with Higginbotham:

• Ten-year average return of 30% IRR

• Ten-year average annual shareholder distribution of 25%

• Insurance Business America, 2022 Top Insurance Employer

• Privately-held and run by insurance professionals

• Majority ownership held by employee shareholders

• Leverage Higginbotham’s consistent 20% compound annual growth rate

• Broad risk management and benefit plan services add client value to support your growth

• Maintain your leadership role

• $5 million donated to nonprofits through the Higginbotham Community Fund

Are you ready to soar?

Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts ext 7514

Jane Kinard ext 7518

Andy Wilder ext 7545

I hope Spring is off to a great start for each of you across the state. Springtime in Tennessee is a beautiful time of the year, yet it is also a time of severe weather that touches every part of the state at one time or another. From high wind and extreme rain events to hailstorms and tornados, agency principals and staff have all have had moments when they mobilized to aid clients impacted by severe weather. It was not all that long ago when we experienced a major tornado and subsequent damage in my hometown of Cookeville and the Upper Cumberland Region. It is at moments like this when professional independent insurance agencies and their company partners deliver on the promise of insurance at a time when it is needed most. In the aftermath of major weather events, it is frequently the inflow of insurance claim dollars paid to insureds that supports local economies as they rebuild. We should all be proud of the important role we play in helping our clients and communities recover from these extreme weather events.

A key point I want to focus on centers around value. Specifically, value that membership in the Insurors of Tennessee can deliver to members. Through your membership, you have access to a valuable set of products and services that can help propel your agency forward and keep your agency competitive in an ever-changing marketplace.

Membership provides access to personal umbrella insurance, flood insurance, and home business insurance. To learn more, please reach out to Stephen Holmes at 615.515.2609 or by e-mail at sholmes@insurors.org. Stephen has many years of underwriting experience and deep expertise in the products we offer and can be of great assistance to you. In addition, you can gain

access to Big “I” Markets to round out your agency's existing product offering.

Another significant value of your membership is the full range of insurance education and professional development products offered by and through the Insurors of Tennessee. Education and professional development are the keys to differentiating you and your agency in the marketplace and essential to provide your clients with the professional guidance they need to navigate the complexities of insurance and risk management. The simple truth is that professional insurance education and the development of expertise is the engine that drives success in the most successful agencies. The Insurors of Tennessee is the premier source for insurance education and professional development in Tennessee. Be sure to see page 48 for upcoming education opportunities. You can also visit www.insurors.org for more information. Our Insurance Education Specialist, Teresa Durham, has substantial experience and knowledge to help support the education program in your agency. Please contact Teresa at 615.515.2607 or by e-mail at tdurham@insurors.org.

Another important and impactful component of your membership, centers around the advocacy efforts conducted by your association to support a healthy and competitive insurance marketplace in Tennessee. These efforts benefit the independent agents across the state, insurance company partners and the citizens of Tennessee. A competitive marketplace ensures superior products and competitive prices are available to our clients. From Capitol Hill in Nashville to the halls of Congress in Washington D.C., critical advocacy work is being conducted at this very moment. Trey Moore, who serves as our Govern-

ment Affairs Consultant is actively representing our interests in Nashville along with the support and guidance of members of the state legislative affairs committee. At the national level, members of the Insurors of Tennessee along with our leadership are preparing to attend the Big “I” Legislative Conference in Washington on April 26-28, to meet with our elected leaders and make certain they understand the position of this association and our members on pending legislation. From a macro perspective, the time, effort and financial resources we spend on legislative affairs and advocacy efforts in both the near term and long term are vital to the ongoing health of our industry.

The capstone to the many services the Insurors of Tennessee provides are the events the association offers each year including the Agency Growth Conference, Young Agents gatherings across the state, Women in Insurance (WINS) meet-ups, education opportunities and the Insurors of Tennessee Annual Conference. These events further extend the services we provide, offer opportunities to network, build relationships and share experiences. For many, these events are one of the most consequential elements of membership.

If you know of an agency in your community that is not a member of the association, please reach out to them and extend an invitation to join. Please refer them to www.insurors. org or Jake Smith at 615.922.6204 or jsmith@insurors.org. Let’s grow our association in 2023 in celebration of our 130th Anniversary! u

The national board meeting of the Big I held January 18-21 was a very productive meeting and helped set the stage for our efforts in 2023. Your national association is working hard to improve the business environment for independent agents. At the national level, we are looking closely at the challenges independent agents have operating in a new environment where more employees are working from home. Specifically, the group is addressing the need for additional support from the agency management systems we utilize each day to support remote work. The board meeting centered also around several InsurTech discussions which we plan to bring to the Insurors of Tennessee convention in Knoxville in October.

One of the biggest meetings of the year for Big I and the Insurors of Tennessee is the National Legislative Conference on Capitol Hill in Washington DC.

The meeting is on April 26 –29, 2023. Tennessee will have fourteen or more agents visiting our legislators on the 26th and 27th. These face-to-face meetings are critical in establishing relationships to support communications when we need help from our delegation of elected leaders in Washington, D.C relative to issues, administrative rules, or specific legislation.

As I mentioned in my first article, it is so important that we have a strong PAC effort. A robust PAC position enables us to support those legislators who are sensitive to our needs as an industry and are willing to hear our concerns about a range of topics related to specific legislation in Nashville and Washington, D.C.

If you have not contributed to InsurPacTN at the state level and InsurPAC at the national level, please do so at your earliest convenience. If you need addi -

tional information on how to donate, please contact me, Kevin Owenby, or the Insurors of Tennessee office.

As the year goes forward, I will continue to represent the interests of Tennessee independent agents at the Big “I” national level and work to create the conditions for greater success for our industry. If you have any issues or concerns, please reach out to me anytime. u

Scan the QR code for a direct link to InsurPAC domation.

"A robust PAC position enables us to support those legislators who are sensitive to our needs as an industry and are willing to hear our concerns about a range of topics related to specific legislation in Nashville and Washington, D.C."

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like childcare, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

I want to start my column by expressing my great appreciation to our 2023 Company Partners. This year more than sixty insurance companies and organizations stepped up to become partners providing your association with the support and resources to go forward with objectives and plans on this 130th anniversary of the association. You can find an exhibit in the center of this magazine highlighting the 2023 Diamond, Platinum, Gold, Silver, and Bronze Partners for 2023. You can also see the list of Company Partners on the Insurors of Tennessee website. Throughout this year we will be presenting the partners to you in this publication, on the website and via our social networks. At the various events to be held this year, including the 2023 Agency Growth Conference and the 130th Insurors of Tennessee Annual Convention, you will have the opportunity to visit with these partners to learn more about who they are and how they might assist your agency. As the CEO of the Insurors of Tennessee, I offer a heartfelt thank you to our partners. I encourage members to take note and give these companies strong consideration as you seek the insurance products and services you need to grow and develop your agency.

We had a great turnout at the Agency Growth Conference in Chattanooga on March 30-31. Thank you to all who participated in the conference. Stay tuned to our announcements about upcoming events and make plans to attend.

In addition to professional development opportunities, these events are a fantastic way to maintain and build great relationships. Many of our industry veterans speak warmly of the relationships they have built and how much they learn from peers over the years at Insurors of Tennessee events.

We have so much to offer independent agencies no matter their stage of development. From new start-ups to those more established and realizing their full potential, this association has helped and continues to help agencies succeed. So many agency principals have shared with me how the Insurors of Tennessee first helped their new start up agencies develop, and then over the years mature into successful enterprises. This started me wondering about how many agencies are across the state are not enjoying the support of this association. Even with the tide of agency consolidations, there are new agency start-ups, agencies migrating from single company models, and others that we have not connected with yet.

I would like to suggest we start a “grassroots” effort to recruit new agencies into the association. Since this is the 130th Anniversary of the Insurors of Tennessee, what if we seek to recruit 30 new members between now and the end of the year? Perhaps we call it the “30 at 130” project. Insuror members who know of worthy agencies in their communities that are not members, could

reach out to these folks and invite them to become members. Refer them to www.insurors.org for more information. They can also contact Jake Smith at 615.922.6204 or jsmith@insurors.org to have a conversation about joining. Such an initiative would be one way to commemorate the 130th Anniversary of our association. In today’s lexicon this might be called #crowdsourcing. From the perspective of a former agency owner and a state representative, I would just call it a “grassroots” campaign. We hope you will participate in this volunteer effort.

On a final note, historically, the MarchApril edition of the magazine has always been the “Government Affairs” issue focused on advocacy topics at the state and federal level. Last year, we decided to move the “Government Affairs” issue to May-June to better reflect the legislative calendar in Nashville and Washington. By making this change, we will be able to give you a more complete review of the legislative season. As always, we communicate government and legislative affairs matters that require immediate attention or response via e-mail communications and social media as needed.

I hope you all had a great start to 2023. I look forward to seeing you at events and hearing from you. If you have questions or comments, please feel free to reach out to me rtravis@insurors.org. u

Will Canterbury is the principal owner of The South Insurance Agency located in Nolensville, Tennessee serving the greater Nashville area and beyond. More on the beyond part later. The agency was officially formed in 2022 after Will and two producers exited an insurance entity that was ceasing operations. The opportunity to form The South Agency with a new vision for the future and greater opportunity has Will and his colleagues energized and excited about the future. It is important to note that Will worked in the insurance industry since 2015 first as a producer and then as a principal.

Will is a native of Mississippi and grew up on a 160-acre farm where his family raised cattle and grew corn. Will’s father was also a firefighter, and his mother was a teacher and counselor. So, early on in his life, Will learned the value of putting in a good day of work. After high school, Will attended Ole Miss University where he earned a Bachelor of Science degree in Public Relations in 2006. He then had the opportunity to intern in the Washington, D.C. office of a member of the Tennessee Congressional delegation and was then transferred to the local district office in 2007.

As is often the case in life, unexpected events occurred when his father in Mississippi was diagnosed with a serious medical condition. Will returned home to Mississippi to help his father with the farm and to be there for him during this challenging time. Fortunately, a new medication was developed that helped his father manage the condition giving Will’s father the ability to return to work. Will is quick to tell you that he and his father are very close and have a special relationship. It is apparent that Will places a strong emphasis on his family, friends, and colleagues. Clearly, strong relationships are important to Will.

Eventually, Will returned to Franklin, Tennessee where he hoped to explore music industry opportunities in Nashville. Will is also a musician who plays multiple instruments and enjoys playing rock, Christian rock, and country music. As is the case for many talented musicians who come to Nashville, Will found the road to success as an artist to be quite difficult.

Fortunately, he was then contacted by the Lieutenant Governor of Tennessee’s office at the time and offered a position on the staff. He accepted the position serving from 2007 to 2011. He then joined the business world representing a major furniture manufacturer travelling to Mississippi and Louisiana driving many miles per week in his car. He drove back to Nashville at the end of virtually every week to spend time with his future wife. Will was able to get off the road after finding work with a major local copier and office automation company as a sales representative in the Nashville area. By 2015, Will was recruited by two insurance companies and ultimately went to work for Nationwide in the Nashville area as an agent on the advice of a trusted friend. This started his now eight-year insurance career. Will believes his diverse and somewhat circuitous route into the insurance industry provides him with unique experience and skill sets he leverages each day as an insurance professional.

Will talked about three people who were instrumental in his business and personal life offering valuable advice and guidance including Congressional Chief-of-Staff Steve Brophy who he worked with during his time in Washington, DC., Dusty Haley who is a principal in the Hawsey Agency and Robert Pierce who was a beloved uncle and a highly

respected executive with Allstate Insurance Company for many years.

In the near term, Will and his colleagues, Barrett Coffey, Kyle Greene, and Heather Hutchins are clearly focused on growing and developing the agency in the greater Nashville market while providing exceptional service to clients. Will’s long-term plan is to expand the market reach of his agency beyond the Nashville market across “The South” from Texas to the Carolinas. This bold vision and mission propel the plans and work of the agency as it grows and develops. Conceptually, “The South” name expresses Will’s hope to capture all that is the best of Southern culture as it delivers service to clients with a warm and friendly spirit where relationships matter and doing business the right way is the only way.

The center of Will’s life is his wife Tali and their two daughters Lennon and Lyla Joy. He loves spending time as much time as possible with Tali, Lennon, and Lyla Joy each day. The three of them also enjoy their Australian Shepard, Georgia, that his been part of the family for the past seven years. To put it simply they are his “why” for much of what he does in this life personally and professionally.

Will describes Tali as being a “rockstar” telling how she worked more than one job as she put herself through law school and passed the bar on her first attempt. Will is very proud of his wife’s accomplishments and describes her as his North Star providing trusted advice and guidance in both their personal and professional life. She is a music industry executive and partner in 50 Eggs Music Company. They are active members of Grove Hill Church in Chapel Hill, Tennessee.

Will Canterbury and “The South” agency embodies the future of independent insurance agents in Tennessee and across the nation. These Young Agents come from diverse backgrounds with new ideas, exceptional talent, and a mission to serve people and their communities. They share many of the very same values as those who came before them in this industry. On this 130th Anniversary of the Insurors of Tennessee, the future looks bright for professional independent insurance agents in our state as the next generation leads the way forward! u

While April showers bring May flowers, they also signal the end of session may be around the corner for the Tennessee General Assembly. And although it has been another quiet year for insurance-specific legislation (usually a good thing), there are several bills of a broader nature we think are of interest to our members.

Lee’s “Tennessee Works Tax Act”

The Lee administration is proposing legislation to reduce multiple taxes. Called “Tennessee Works Tax Reform Act of 2023,” SB 275/HB 323 by Sen. Jack Johnson (R-Franklin) and Rep. William Lamberth (R-Portland) proposes changes to the sales tax, franchise tax, excise tax, and business tax. The governor recently outlined his plan to make several progrowth changes to Tennessee’s tax code.

The governor’s stated plan to conform to the federal treatment of capital investment, adopt single sales factor apportionment, and reduce the business gross receipts tax rate would strengthen the state’s economy, according to the non-partisan Tax Foundation. Among the changes:

Business License Tax

• Exempts any business with less than $100,000 of sales in Tennessee.

• Lowers tax rate on industrial loan and thrift companies from 0.003% to 0.001% of gross income.

Corporate Franchise & Excise Tax

• Adopts single sales factor apportionment for Tennessee (with a two-year phase-in with 5x weighted sales for the first year, 11x weighted sales for the following year, and single sales factor for all years ending on or after December 31, 2025). Expected tax increase of $17M in the first year and early $100M after fully-phased in.

• Makes 100% bonus depreciation for qualified property under the Tax Cuts & Jobs Act permanent for Tennessee excise tax, otherwise known as “full expensing.”

• Excludes up to $500,000 of real and tangible property from the alternative franchise tax on property.

• Excludes up to $50,000 of net earnings from excise tax, a boon to new businesses

"Garrison-Jordan Survivor Benefits Act”

SB 97/HB 396 by Sen. Page Walley and Rep. Ron Gant (an Insurors member) creates the “Garrison-Jordan Survivor Benefits Act” which increases the maximum weekly workers’ compensation death benefit to a surviving spouse with no dependent child or one dependent orphan from 50 percent to 66.67 percent of the employee’s average weekly wage. Other provisions of the bill:

• Removes remarriage as a terminating event regarding workers’ compensation death benefits, thereby entitling the surviving spouse to one lump sum payment equal to 100 weeks based on 25 percent of the average weekly wages of the deceased employee, subject to the maximum total benefit.

• Authorizes an orphan or other child under certain circumstances to be paid workers’ compensation benefits until 22 years of age.

• Allows an employer or insurer to periodically require a dependent to provide relevant information to ensure integrity of the benefit.

Continued on page 32.

A delegation from Insurors plans to attend the Big “I" Legislative Conference, which will take place April 26-28 in Washington, D.C. This premier event for independent agents offers an opportunity for agents to speak to their federal legislators with a unified voice, and Tennessee agents will be well represented!

With a busy year ahead, the Big “I" is looking forward to having agents and brokers from across the country advocating on Capitol Hill. The deadline to register for this year’s conference is April 7. If you missed it, circle it for next year. We would love to have you join us in 2024. Check back in these pages in our May/June issue for a recap of Insurors of Tennessee’s visit to “the Hill.”

For more information about the conference and to see the full schedule of events, visit the dedicated Legislative Conference webpage: https://www.independentagent.com/ Events/LegislativeConference/home.aspx

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

At Stonetrust, we know a little something about showing up when it matters most, and we strive to always be there for the independent insurance agents and policyholders that trust us with their business.

Along with offering workers’ compensation and employers’ liability insurance, Stonetrust works to help companies prevent accidents and remain Stonetrust Safe - an entire system of in-house processes and services designed to achieve safety goals and keep premiums and claim costs down. 800.311.0997

We are dedicated to the independent agency system and proudly stand behind the agents who represent us. auto-owners.com

Congratulations to Douglas & Lanier, MCMinnville, for being voted 2022 Best of the Best in the "Insurance" category by Southern Standard. Southern Standard is the local newspaper covering Warren, Van Buren and DeKalb Counties. Each year readers vote on local businesses to recognize outstanding businesses in the local area. This is an impressive recognition and we congratulated Douglas and Lanier for their excellent service to clients.

We were delighted to give 90 items plus $120 in monetary donations from our WINS group to Dress for Success! These items were collected at our January networking social at the Insurors office.

Dress for Success is global not-for-profit organization that empowers women to achieve economic independence by providing a network of support, professional attire, and the development tools to help women thrive in work and in life.

Since starting operations in 1997, Dress for Success has expanded to almost 150 cities in 25 countries and has helped more than 1.2 million women work towards self-sufficiency.

Our own Matt Swallows joined Michael Aikens on WCTE's It's Your Business. The episode aired April 13. Michael and Matt discussed the challenges and rewards of owning a small business. Way to represent our industry Matt!

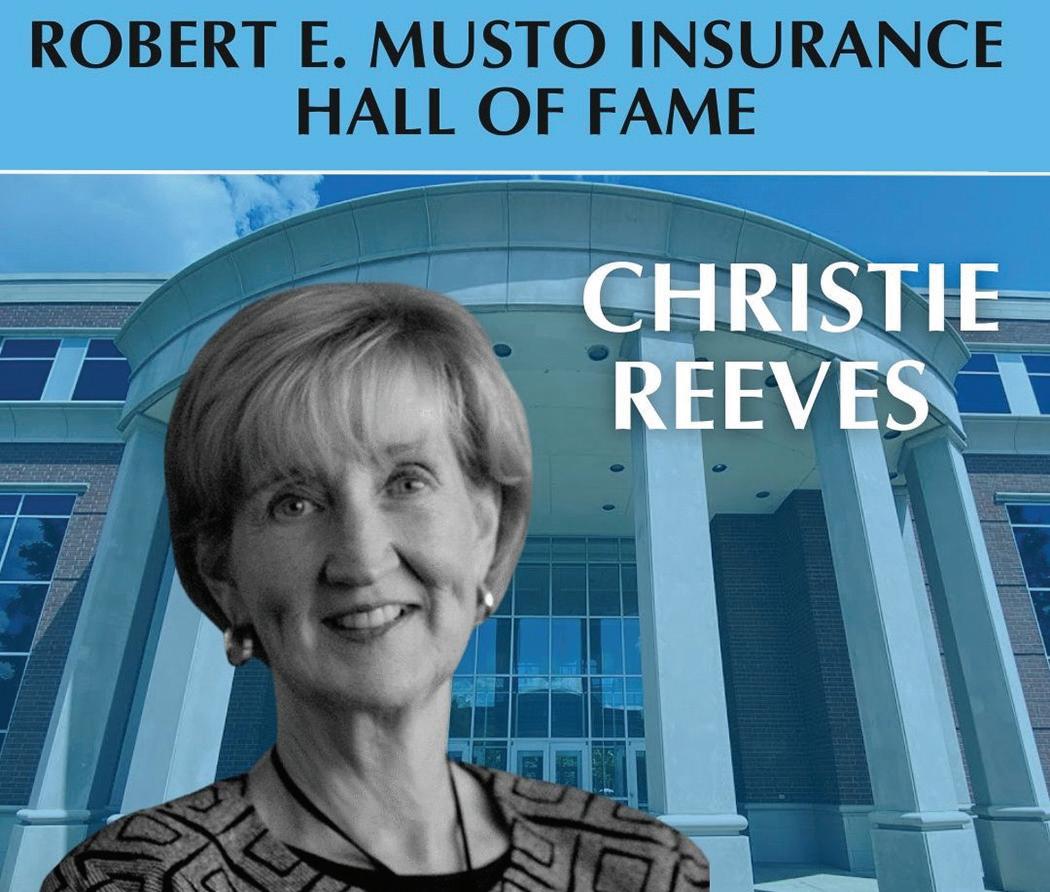

#HallofFame - Did you know that the Robert E. Musto Tennessee Insurance Hall of Fame is on the MTSU campus? It was created in 1999 to give long-overdue credit to the greats of the insurance industry in Tennessee. Over the next few months we'll be spotlighting some of our inductees.

Christie Reeves, CPCU, CIC was inducted into the Hall of Fame in 2012. The Nashville resident spent over 40 years in the insurance industry, working on both the agency and carrier sides of the business. She held many roles in industry organizations, including President of Insurors of Tennessee, and retired from her role as an Area Senior Vice President for Gallagher in 2017. Thanks to Christie for her contributions to the industry! Learn more about the Hall of Fame at https://lnkd.in/eSkdVdTt

Congratulations to V. R. Williams & Company for being awarded the Franklin County Chamber of Commerce, Large Business of the year. The award was presented to Joe Hunt who you may recognize as a Past President of Insurors of Tennessee. (photo below) V. R. Williams & Company has provided insurance solutions in Winchester since 1896. Happy

Colleen Vance is celebrating her 27th anniversary with the Insurors of Tennessee this year serving as the association Accounting Specialist. Colleen’s first job in 1996 with the association was the receptionist position. She also worked in support of the Education efforts of the association after that and eventually moved into the accounting role that she performs now. Colleen is always quick to assist members of the association when they need assistance. She has been an important part of the success of the association for many years. To the woman who wears many hats, we are so grateful for you and all that you do! u

Spend less time managing your payroll and more time focusing on success. When you partner with BBSI for your payroll needs, you’ll be matched with a dedicated payroll analyst who is committed to helping you ensure your employees are paid efficiently, accurately and on time, every time.

You’ll have access to our proprietary payroll system to help you streamline payroll and employee onboarding with the ability to scale as your business grows.

Ryan Specialty Underwriting Managers is an industry leader in delegated authority underwriting services. Our family of managing general underwriters (MGUs) and national programs have the expertise and authority to design, underwrite, bind, and administer a diverse portfolio of risks. Our value proposition originates with our 550+ industry professionals who are empowered by centralized technical support and policy lifecycle administration, coupled with a broad distribution network of retail and wholesale brokers. We have been diligently servicing our valued clients and trading partners in North America, the UK and Europe since our establishment in 2010.

Ryan Specialty Underwriting Managers is committed to providing best in class service to the distinct needs of independent agents. We know that time is a precious commodity. We can provide access to field and industry experts that will support providing tailored insurance solutions for your insureds. With offerings that cover a vast array of market niches, we are here to help you.

Shaffer Chief Retail Distribution Officer

WILL THEIR HOMEOWNERS INSURANCE PROVIDE COVERAGE WHEN…

• Business equipment is stolen out of their vehicle? . . . . . . . . . . . NO!

• They accidentally knock over the display next to them at an exhibition or show? . . . . NO!

• Groceries spill onto inventory in the trunk of their car? . . . . . . . . . . . . NO!

• A power surge damages their computer and fax machine? NO!

• Someone steals their cash box? . . . . . . NO!

Most homeowners and renters policies do not cover liability or damage to property from business activities.

PROTECTION FOR HOME-BASED BUSINESSES!

Your customers are not home free with most homeowners policies. What would happen if your client had inventory damaged or stolen? Typical homeowners insurance does not cover those losses for people if they run a small business out of their home.

We are pleased to offer the perfect coverage for your inhome business: RLI’s Home Business Insurance policy. Features:

• Liability limits up to $1 million

• Satisfies most event or show liability requirements

• Business property protection up to $100,000 (with $250 deductible)

• Optional Coverages Include: Money & Securities, Garagekeepers, Unmanned Aircraft (state restrictions apply)

• Electronic data processing coverage (optional in CA & FL)

• Loss of income coverage

• Premiums starting as low as $150 annually*

In March, Arthur J. Gallagher & Co. announced the acquisition of Nashville, Tennessee-based Anderson Benson. Terms of the transaction were not disclosed.

Founded in 2012, Anderson Benson is a retail insurance broker and risk management firm with an entertainment niche expertise as well as specializations in hospitality, construction, transportation and private clients across the US.

George Anderson, Reno Benson, Brent Daughrity, Steve Buzzell, Will Wright and their team will remain in their current location under the direction of Bumpy Triche, head of Gallagher's Mid-South retail property/casualty brokerage operations.

"Anderson Benson's entertainment market expertise offers us significant opportunities for growth," said J. Patrick Gallagher, Jr., Chairman, President and CEO. "I am delighted to welcome George, Reno, Brent, Steve, Will and their associates to Gallagher."

FSB Insurance in Jackson, TN announces its acquisition of the Redman-Davis Insurance agency in Columbia, TN. FSB President and CEO, Andy Gaddie, said, “We couldn’t be more excited about the Redman-Davis agency and its rich history and service to the Columbia area. They complement our Middle TN footprint and fit well with our growth strategy.” FSB has four West TN locations and two in Middle TN. FSB is part of Sunstar Insurance Group based in Memphis, TN.

Redman-Davis Insurance Agency, formed in 1894, offers personal, commercial, life, health and employee benefits insurance and is led by veteran agents Chad Williams and Sonny Shackelford.

National Security has provided competitive, affordable insurance to policyholders for 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

As a Southeastern based regional company, National Security prides itself on fast, efficient service from a friendly small town company. Our agent website provides fast quotes, online policy issuance, and real-time policy information. Find out more about our products by calling 1-800798-2294 or visiting nationalsecuritygroup.com

Elba, Alabama

Harford Mutual Insurance Group, a Ward’s 50® top performing commercial property and casualty insurance company headquartered in Maryland, announces its plan to merge into the Group, ClearPath Mutual Insurance Company, a monoline workers’ compensation carrier in Louisville, Kentucky.

“We are constantly seeking opportunities that complement our strategic goals and provide our policyholders and independent agents with the products and services they need,” says Steve Linkous, President & CEO of Harford Mutual Insurance Group (HMIG). “ClearPath Mutual perfectly complements our product line offering while expediting our plans for geographic diversification. We look forward to welcoming ClearPath’s employees, agents, and policyholders into HMIG as we fulfill our mutual vision of being a carrier of choice.”

ClearPath Mutual, formerly KESA of Kentucky for over 40 years,

was created in 2018 and currently provides monoline workers’ compensation coverage in Indiana, Kentucky, Georgia, Tennessee, and West Virginia. Through an independent agency plant and relationships with local chambers of commerce and associations, ClearPath has steadily grown and writes over $52 million in direct written premium across nearly 7,000 policies. ClearPath will continue to operate under its company name, and the office in Louisville, Kentucky will remain in place and serve as HMIG’s Midwest Regional Office.

“Since 2018, the mission of the ClearPath board and leadership has been to chart a path to sustainable success. We are financially strong and committed to the communities we serve,” says Jeff Borkowski, President & CEO of ClearPath Mutual. “This merger into Harford Mutual Insurance Group will provide us with the scalable infrastructure and regional reach to meet our strategic goals of providing communityfirst workers’ compensation coverage to our policyholders.”

The transaction is expected to close once customary reviews and approvals are received.

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

Justin Steigenga has been promoted to Southern Region Branch Manager. Justin is responsible for managing the day-today operations of the Southern Region team and developing relationships that foster growth with carriers and new and existing independent insurance agents in Florida, Georgia, North Carolina, South Carolina, and Tennessee. Justin joined JM Wilson in 2016 as a Transportation Underwriter, later receiving promotions to Senior Transportation Underwriter, Executive Transportation Underwriter, and Assistant Transportation Manager, before his latest promotion to Branch Manager. Justin is an Olivet College graduate with a bachelor’s degree in Insurance and Risk Management.

Natalie Staruch has been promoted to Senior Property & Casualty Underwriter for the Southern Region Team. Natalie is responsible for underwriting new and renewal property and casualty risks and maintaining relationships with carriers and independent insurance agents in Georgia, North Carolina, South Carolina, and Tennessee. Natalie joined JM Wilson in 2021 as Property and Casualty Underwriter. She has over 12 years of experience in the insurance industry, including four years with another MGA/ Broker. Natalie is a Florida State University graduate with a bachelor’s degree in Insurance and Risk Management.

Paige Craft has been hired as Assistant Surety Underwriter. Paige is responsible for assisting surety underwriters on a wide variety of risks, including processing bond renewals and following up on new and renewal quotes for independent insurance agents in all states that JM Wilson serves. Prior to joining JM Wilson, Paige was a Senior Administrative Assistant for three years at a claims processing company, as well as a Front Desk Supervisor for three years at a hotel management group. A graduate of IUPUI (Indiana University – Purdue University Indianapolis), Paige earned a bachelor’s degree in Tourism Convention Event Management.

Lesley Boles has been hired as Personal Lines Underwriter. Lesley is responsible for underwriting a wide variety of new and renewal personal lines risks, as well as strengthening relationships with independent insurance agents and company underwriters in all states

that JM Wilson writes in. Lesley has prior experience in an insurance agency where she was a Personal Lines Manager and Claims Service Manager. A Grand Valley State University graduate, Lesley earned a bachelor’s degree double majoring in Finance and Marketing. Lesley has also obtained her CIC and CISR.

Kristin Becker is promoted to Territory Director. Kristin joined Acuity in 2006 as a Commercial Field Underwriter and was promoted to Senior Commercial Field Underwriter in 2013. Kristin earned a bachelor's degree from the University of Nebraska and holds the CPCU and AU.

Nicole Bender is promoted to Senior Business Analyst. Nicole joined Acuity in October 2012 as a Commercial Processor and was promoted to Claims Representative in 2014 and Business Analyst in 2018. Nicole earned a bachelor’s degree in English and critical literary study from the University of Wisconsin-Milwaukee.

David Bulgrin is promoted to General Manager - Business Systems. David started his Acuity career in 1997 as a Business Analyst and was promoted to Senior Business Analyst in 2004 and Manager – Business Systems in 2013. He is a graduate of Carroll University with a bachelor's degree in business administration.

Paige Alexis Christenson is promoted to Senior Business Analyst. Paige started her Acuity career in January 2016 as a Business Analyst. She graduated from the University of Wisconsin-Milwaukee with a double major in accounting and supply chain and operations management. Paige is currently working toward her master’s degree in business administration with an emphasis in data analytics.

Ellyn Hansen is promoted to ManagerBusiness Systems. Ellyn started her Acuity career in 2012 as a Business Analyst and was promoted to Senior Business Analyst in 2017. Ellyn graduated from the University of Wisconsin-Green Bay with a double major in statistical mathematics

and economics and a minor in business.

Daniel Heyen is promoted to Manager - Field Claims. Daniel started his Acuity career in 2013 as a Claims Representative and was promoted to Field Claims Representative in 2015 and Senior Field Claims Representative in 2018. He is a graduate of Carroll University with a degree in communications. Daniel holds the CLP and CCP.

Renea Mertens is promoted to Senior Claims Consultant. SHe started her Acuity career in 2011 as a Claims Representative and was promoted to Field Claims Representative in 2013, Senior Field Claims Representative in 2018, and Staff Claims Consultant in 2019. She earned her bachelor’s degree in elementary education and political science from Ripon College. Renea also holds the AINS.

Brittney Passini is promoted to Director - Product Development. Brittney joined Acuity in 2012 as a Regulatory Affairs Analyst and was promoted to Senior Product Analyst in

June 2019. Brittney earned a bachelor's degree in political science and public administration from the University of Wisconsin-Green Bay.

Jeff Sass is promoted to ManagerCentral Claims. Jeff started his Acuity career in 2019 as a Claims Representative. Prior to joining Acuity, Jeff was in law enforcement for more than 20 years. Jeff also holds the AINS, AIC, and AIC-M professional designations.

Shannon Van Roo is promoted to Manager - Regulatory Affairs. Shannon joined Acuity in 2015 as a Regulatory Analyst and was promoted to Senior Regulatory Analyst in January 2020. Shannon studied political science at the University of Wisconsin-Milwaukee. u

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com

Boyle Insurance Memphis, was a proud sponsor of the Junior North American Field Hunter Championship recently hosted by Mells Foxhounds. Nearly 100 young riders converged in Lynnville, TN and participated in a weekend of riding in new territory, challenging their horses, and meeting new friends. The event emphasizes the importance of countryside preservation for future generations.

Did you know that Boye Insurance has been insuring clients since 1933? We are proud to have Boyle Insurance as a member. u

Selective Insurance Company of America, the lead insurance company of Selective Insurance Group, Inc. (NASDAQ: SIGI), commenced a month-long collegiate competition to encourage risk management and insurance students to build industry knowledge and experience. Teams of students from seven universities around the country have begun running virtual insurance agencies in a computersimulated environment to gain insights into key processes and decisions commonplace in the insurance industry. With support from local independent insurance agents and leaders from Selective, the teams will compete against each other in weekly exercises using highlevel learning objectives that will help them build business and financial acumen. The first-place team will present their winning strategy to Selective's leadership team.

"Today's risk management and insurance students are tomorrow's insurance industry leaders, so helping students get acquainted with careers in our industry and on the path to success is something that we at Selective feel is our responsibility to see through," said Chuck Musilli, Executive Vice President, Chief Human Resources Officer, Selective Insurance. "Selective's collegiate competition is a fun and engaging introduction to our business and a preview of some of what they can expect in an exciting and fulfilling career in insurance."

Rewarding careers in the insurance industry continue to be one of the best-kept secrets across college campuses. According to the Insurance Information Institute, the insurance industry is a major U.S. employer, providing some 2.7 million jobs that encompass a wide variety of careers, including engineering and data science, IT, human resources, and financial analysis. Some jobs, such as claims adjusters, actuaries and insurance underwriters, are unique to the insurance industry, but other roles are also needed, such as public relations and innovation professionals, for example.

The academic institutions participating in Selective's Collegiate Competition include: Appalachian State University, Howard University, Indiana State University, Illinois State University, Middle Tennessee State University, Temple University and University of North Carolina-Charlotte. MTSU's team is comprised the following students: Presley Hamby, Caleb Chunn, Abigail Smith, Emma Ward, and Brian

Dunn who are in their 3rd year or higher of college studies and maintain a GPA of 3.0 or higher. Each collegiate team is assigned an Agency Mentor, Jack Wallace (an independent insurance agent located near each school) and a company representative, Ryan Miller from Selective to guide and advise them as they navigate the challenges of the competition. Dr. Dave Wood from MTSU Marin Chair of Insurance alongside Lori Huertas Gamma Iota Sigma Omega chapter advisor support students as needed in the state of the art MTSU RMI lab, "The Selective collegiate competition is a tremendous experience for college students to learn the intricacies of the insurance industry and how to run a business. I'm thrilled to be an Agency Mentor for Appalachian State for the third year and am looking forward to supporting the students, answering questions, and pushing them to ensure they have evaluated all angles and options throughout the simulation exercises," said Jeffrey Haney, President & Partner, ECM Solutions.

Teams will meet weekly with their assigned Agency Mentors, who will review their progress and provide assistance. The competition simulates the control of foundational business tools with a focus on: strategy, carrier/customer/source management, staffing, sales, and financial management. Every week throughout the month of February, the teams will be challenged to make educated decisions on these key industry topics and try to outperform competitors in a simulated marketplace.

Last year, the competition was a joint initiative of InVEST and the Big "I" Diversity Task Force and is now being sponsored and managed by Selective Insurance. For the third year, PriSim will be running its Agency Challenge computerized business simulation for the competition. InVEST is a schoolto-work insurance education and training program that works with high school and college educators to teach insurance curriculum to students and raise awareness about career opportunities in the industry. A 501(c)(3) non-profit arm of the Independent Insurance Agents & Brokers of America, Inc., InVEST educates, prepares, and attracts diverse young people to new exciting opportunities and career paths in the industry. PriSim is an industry leader in customized, computerized business simulation games, management simulation training and offers insurance-specific simulations, including Insurance Challenge and Agency Challenge. u

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. Classes with (*) have option for in person or webinar event.

5/10

Additional courses for designation programs are offered on-demand at your own pace and as live webinars.

The National Alliance for Insurance Education & Research is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417. Website: www.nasba.org. Advanced Curriculum Rating = 20 CPE Credits. For more information regarding administrative policies such as complaint and refund, please contact our offices at 800-633-2165.

Additional courses are available On-Demand and as Live webinars at the IIABA Virtual University *check the VU site for course offerings, CE and pricing (independentagent.com/vu)

From The National Alliance (www.scic.com)

Choose from the following programs CIC, CRM, CISR, CPRM, CSRM, Dynamics, RGS, MEGA, PROFOCUS, WTH, Intro, Producer School, Ethics, Flood and other. Choose by topic, location, delivery method and/or date.

From The Institutes (ceu.com/customer/insurors-tn )

Insurors of Tennessee has partnered with CEU, powered by The Institutes, to provide you with relevant and convenient online insurance continuing education (CE) courses. Through our partnership with CEU, you will enjoy a 35% discount on any of CEU’s relevant, practical courses when you log in. More than 150 course topics

ABEN Webcasts (insurors.aben.tv)

To the right is a partial listing of upcoming webcasts. Please view the website for additional webcasts.

(insurors.aben.tv) Active

1 1

Map your career track and customize your learning experience by selecting the designations and course offerings that fit your needs. 2 2

The Introductory Series is a good choice for those interested in finding out more about the industry and industry fundamentals. The Dynamics Series, offers career-changing sales training. Providing a variety of pertinent topics, the William T. Hold Seminars are invaluable for expanding your insurance knowledge. The Dynamics Series can be used to meet update requirements across the designations. WTH Seminars satisfy update requirements for CISRs and CSRMs

4 3

3 3

The Certified Insurance Service Representative (CISR) designation provides quality insurance education geared toward customer service representatives, account executives, servicing agents, new producers, and other professionals. The Certified School Risk Manager (CSRM) designation fills a need for quality risk management education for those associated with schools.

The Certified Insurance Counselor (CIC) provides an in-depth, practical approach to education for agents and other insurance practitioners. The Certified Risk Manager (CRM) designation is recognized as being the foremost education available in the field of risk management. The Certified Personal Risk Manager (CPRM) designation yields the best training for meeting the needs of an affluent clientele.

The James K. Ruble Seminars are advanced programs that offer a variety of specialty topics. CICs, CRMs, and CPRMs can meet their annual updates with a Ruble seminar.

Dedicated exclusively to construction since 1984, we understand this industry better than anyone else. We will be here for years to come to protect you, your employees, and your business.

Big I Education Convocation

September 6-8, 2023

Grand Rapids, MI

Save the Date!

Next year's Big "I" Education Convocation is at the Amway Grand Plaza Hotel.

Big I Fall Leadership Conference

September 6-10, 2023

Grand Rapid, MI

130th Annual Insurors of Tennessee Convention

October 21-24, 2023

Knoxville, TN

Young Agents TopGolf - Sponsored by BBSi

May 11, 2023 1:00 PM - 4:00 PM (CDT)

Calling all Nashville-area Young Agents!!!

Join us for a fun TopGolf outing in Nashville provided by the folks at BBSi! We will have an informative session on the strategies of business services for Young Agents and then hit the bays for a round of TopGolf!

1:00-2:00pm Networking & Development Session

2:00-4:00pm TopGolf

Save the Date!

Next year's convention will be held at the Knoxville Downtown Marriott.

We are very excited for future WINS events. We are currently in the planning stages of another event in the Memphis area in May and will soon be making plans for our Knoxville WINS event at the Insurors annual convention in October. Stay tuned for events/dates to be released soon.

Bridging

•

•