For more than 60 years, we’ve built a business based on basic principles: handle claims quickly and fairly, provide superior service and put people first. At FCCI, we help businesses thrive, manage risks and face the future with confidence.

Phone 615.385.1898

Toll Free: 1.800.264.1898

Email: marketing@insurors.org

Editor: Ron Travis Publisher: MarketWise, Inc

President ..............................................Matt Swallows, CIC, CRM

IIABA National Director ........................John McInturff III, ARM

VP Region I ...................................................................Bobby Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III, President-elect .............Kym Clevenger, CPCU

Treasurer ....................................................Richard Whitley, CIC

Secretary ..................................................................Kevin Ownby

Director, Region I ....................................Eric Collison, CIC, CRM

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ........................................................... Cy Young

Director, Region II .....................................Cameron Winterburn

Director, Region II ......................................................... Chip Piper

Director, Region II ...................................... Paul Steele, CIC, CRM

Director, Region III .................................................... Tim Goss, CIC

Director, Region III .......................................... Bill Oldham III, CIC

Director, Region III ...................................................Josh Gibbons

Director, Young Agents .................................John Brock, CAWC

Immediate Past President ......................... Norfleet Anthony III

The 130th Insurors of Tennessee Annual Convention currently known as Insurefest is rapidly approaching on October 2123. The first convention was held in Nashville in 1893 by the founders of the organization that would become the Insurors of Tennessee. We are proud to be celebrating our 130th year in service to members across the state of Tennessee. This year we are excited to be back in Knoxville with Insurefest for the first time since 2015 to conduct the business of the association, learn about key insurance topics from a slate of exceptional speakers, and spend some time together experiencing all Knoxville has to offer.

So, perhaps we should also address the “elephant” in the room if you’ll pardon the pun. This is the same weekend the University of Tennessee Volunteers travel about 310 miles down the road to Tuscaloosa, Alabama to play the University of Alabama Crimson Tide. As you may recall, the University of Tennessee won that game last year 52-49 and somehow Neyland Stadium goal posts ended up in the Tennessee River. No doubt, this will be a big game for both teams again this year. The great news is that we will be hosting a Watch Party at the

hotel complete with game snacks and beverages so you will be able to watch the game and cheer for your team on Saturday evening. If the Volunteers win the football game again this year, it’s great to celebrate. However, please be sure no hotel property ends up in the Tennessee River in a moment of exuberance. Note: Our host venue will also allow us to showcase other football games during our party if you prefer another game.

Preview of Insurefest 2023 by Day of Conference

We have a great conference planned for attendees once again this year. Provided below is a day-by-day preview of the event to help you know what to expect and to plan your participation in the event.

Sunday, October 21, 2023 – On Sunday, our Board of Directors will hold their 4th quarter meeting where substantive decisions are usually made setting the course for the next year and beyond. The Women in Insurance (WINS) group will convene for a session that features team trivia, which

The third Saturday in October historically carries with it great significance on calendars in Tennessee, Alabama and across the South for that matter. For many years, the third Saturday in October was the date the University of Tennessee and the University of Alabama met for a Southeastern Conference football classic. Beginning in 1928, the rivalry was scheduled on its traditional date. It was around this time General Robert Neyland became the head coach of the team to put the Tennessee Volunteers on a path to regularly challenge the Alabama Crimson Tide for the top spot in the SEC. The title “the third Saturday in October” became official in 1939. In 1992 the normal order of scheduling for the two schools was disrupted by conference realignment and the split of the SEC into the East and West divisions. Nevertheless, the game was scheduled intermittently in the month of October on numerous occasions. Once again, this year the game will be played on the third Saturday in October at Alabama renewing the tradition established in 1928.

was a huge hit last year! The Insurors of Tennessee trade show will be open on Sunday afternoon with many opportunities for agency members and associate members to discuss new developments from companies and vendors.

Sunday night will conclude with a dinner featuring keynote speaker and special guest – U.S. Representative Dr. Mark Green representing the 7th Congressional District in Tennessee. Congressman Green first took the oath of office to represent the 7th District of Tennessee in Congress on January 3, 2019. It is the exact oath he first took as a cadet at West Point more than thirty years earlier. After graduating from West Point, Green came to Tennessee on his last assignment in the Army as the flight surgeon for the elite 160th Special Operations Aviation Regiment (SOAR). As a Night Stalker, Green deployed to both Iraq and Afghanistan in the War on Terror. His most memorable mission was the capture of Saddam Hussein. During the mission, he interrogated Hussein for six hours. The encounter is detailed in a book Green authored, A Night with Saddam. Congressman Green was awarded the Bronze Star and the Air Medal with V Device for Valor, among many others.

Marriott Knoxville Downtown 525 Henley Street, Knoxville, Tennessee, USA, 37902

Check In: 3:00 pm, Check Out: 11:00 am

Located adjacent to the Wold's Fair Exhibition Hall and World's Fair Park

865-522-2800

As a successful business leader, decorated combat veteran, ER physician, and former Tennessee State Senator, Green is uniquely equipped to represent the people of his district. Rep. Green serves as Chairman of the House Committee on Homeland Security and is a member of the House Committee on Foreign Affairs.

Monday, October 22, 2023 - Monday begins with the opportunity to have breakfast followed by time to browse the trade show floor prior to the start of Breakout Sessions.

Breakout Session 1 - Our first breakout session features industry expert Bill Wilson, CPCU, ARM, AIM, AAM who will be giving his presentation titled “When Words Collide: Resolving Insurance Coverage and Claims Disputes.” Bill Wilson is a longtime insurance professional and was awarded the Jeff Yates Lifetime Achievement Award by the Big I in 2016 in recognition for his work in the independent agency system.

Breakout Session 2 - Following the first session, the second breakout session features several thought leaders for an indepth and enlightening panel discussion about InsureTech tools and trends. The InsureTech panel includes - Chip Bac-

ciocco, CEO of TC.com, Jason Walker, President of Agency Revolution, and Lou Moran III, Chair of the IIABA aka Big I InsurTech Taskforce. We encourage all attendees who are interested in peering into the future of our business to attend this interactive panel discussion.

Breakout Session 3 - The third breakout session is presented by Martin & Zerfoss and Chubb. This session features an informative presentation about recreational marine and provides 1-hour of continuing education credit. Those who register for this session will be invited to join Martin & Zerfoss for an exclusive fall foliage yacht cruise on the Tennessee River. Note: Any spouses or guests looking to attend the river yacht cruise but do not need CE credit, will need their accompanying agent or company representative to attend the breakout session to secure their yacht ticket.

Harford Mutual Insurance Group is a Ward’s 50® top-performing property-casualty insurance company for the second consecutive year.

We partner with independent agents to insure restaurants, contractors, mercantile, and other commercial entities.

Monday afternoon is open for attendees to utilize free time in the schedule to explore all Knoxville has to offer. Travelers will be hosting a TopGolf outing for attendees to swing a golf club and enjoy some friendly competition for prizes. Monday evening will be open this year for ‘Company Night’ allowing company representatives and agents to attend company sponsored events or dinners arranged by the companies.

Tuesday, October 23, 2023 – InsureFest will conclude with our Association Day Breakfast and Annual Business Meeting where we will take time to review the 130th year of Insurors of Tennessee. It will be a great opportunity to reflect on the exceptional year we’ve created together and give us the opportunity to recognize a few of our member agents deserving of special recognition. As always, courtesy of our generous sponsors, we will end the conference by passing out some highly coveted and valuable door prizes including the now moderately famous company representative lava lamp.

We want to be sure to express our great appreciation to the sponsors of this association. It is with your support that we are able to bring the convention to members this year and every year. The contributions you make to the Insurors of Tennessee provide the foundation for many of our initiatives each year and assists the Insurors of Tennessee in its mission to ensure a vibrant and healthy insurance industry in this state. If you’re not already doing business with our sponsors, we encourage you to get to know them and consider establishing a business relationship. In addition, we hope you will take time to explore the trade show floor this year to see this year’s exhibitors and learn about how they might contribute to the growth and profitability of your agency. Many of them offer free giveaways and participate in our convention raffle offering some very nice prizes.

Knoxville, in the Fall of the year, is a beautiful place to visit, so we hope to see you there. If you have not yet registered for the convention and secured accommodations, we encourage you to do so at your earliest convenience. You may visit www.insurors.org to locate the Convention tab to register or use your smartphone to scan the QR code that appears with this article to register from your smart phone. If you have questions, please feel free to contact the Insurors of Tennessee office. u

RLI is a proud member of the Big “I”. Contact us to gain access to comprehensive insurance solutions and protect your commercial and personal lines customers from the unique risks they face. From our specialized solutions to our focus on building strong relationships with the agents we work with, we’re different. And at RLI, DIFFERENT WORKS .

PRODUCTS AVAILABLE THROUGH BIG “I” MARKETS:

• Home Business

• Personal Umbrella

Learn more about our specialty insurance solutions at RLICORP.COM

(All times are Eastern)

Saturday - October 21

Time to be announced - Tennessee vs Alabama Watch Party

Sunday - October 22

8:00am - 1:00am Board of Directors Meeting

11:30am - 12:30am Past Presidents Luncheon (by invitation only)

1:00pm - 5:00pm Registration Table Opens

1:00pm - 2:00pm WINS: Women in Insurance Breakout Session

2:00pm - 6:00pm Sunday Trade Show

6:30pm - 8:00pm Opening Night Dinner

Monday - October 23rd

7:30am - 9:00am All Attendee Breakfast

8:00am - 12:00pm Registration Table Open

8:00am - 10:00am Monday Trade Show

9:00am - 10:30am Breakout Session #1 – When Worlds Collide

10:00am - 11:00am Breakout Session #2 - InsureTech Panel

11:00am - 12:00pm Breakout Session #3 - Recreational Marine CE Course (Presented by Martin & Zerfoss and Chubb)

12:00pm - 6:00pm Free Time (Optional Activities Available)

1:00pm - 3:00pm Exclusive Fall Foliage Tennessee River Cruise (Presented by Martin & Zerfoss and Chubb Insurance) (registration required)

2:00pm - 4:00pm TopGolf Outing (Presented by Travelers Insurance (registration required)

6:00pm - 9:00pm Company Night (events and/or dinner on your own)

Tuesday - October 24th

8:00am - 10:00am - Association Day Breakfast and Annual Business Meeting 10:00am - 11:00am - 2024 Board of Directors Meeting & Photos

National Security has provided competitive, affordable insurance to policyholders for 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

As a Southeastern based regional company, National Security prides itself on fast, efficient service from a friendly small town company. Our agent website provides fast quotes, online policy issuance, and real-time policy information. Find out more about our products by calling 1-800798-2294 or visiting nationalsecuritygroup.com

Dedicated exclusively to construction since 1984, we understand this industry better than anyone else. We will be here for years to come to protect you, your employees, and your business.

Reprint from The Tennessee Insuror Magazine Vol. 29 No. 4. Updated 2023

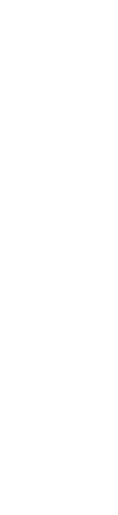

In general, the year 1893 was not a good one for the insurance industry in Tennessee. Court decisions and "extreme" regulations had mounted against carriers. A new "charter" tax law had been passed that would greatly increase costs for non-Tennessee-based entities. This left many insurers considering leaving the state altogether. Meetings were held throughout the year with insurance company representatives and Tennessee's then-leaders, Governor Peter Turney and State Attorney General Pickle.

At a national meeting of Fire Insurance agents held in Niagara Falls that May, resolutions were adopted between agents and carriers to stand firm against insurance laws and regulations that were restricting business in the State. The meeting discussions determined that, "The condition of the insurance business in Tennessee was greatly deplored," and that, "Adverse legislation and opinions discriminating against companies brought this about."1

In July, many carriers indeed stopped writing new business in the state. Among those that stayed active were Aetna, Continental, Hartford and Royal. In the months that followed, agents in the state determined that they must gather to protect their business interests. A group of agents that had been part of the Kentucky and Tennessee Insurance Association organized their own meeting, stating that, "We cannot expect the Kentucky and Tennessee association to do this (protect their interests) because they have no power."2

The meeting that group held is considered the first convention of our Association, although the group was not formally defined at that time. Among that group were Thomas M. Hart, a "well-known local insurance man" of Hart, Sharpe & Co. in Nashville and Sol Moyses, a respected insurance agent from Chattanooga. The two later decided that a more formal structure needed to be introduced for the meetings.

In 1899, the Kentucky-Tennessee Board of Underwriters ruled that 5 percent of advance commissions would be withheld

from Tennessee agents. This prompted Hart and Moses to action. On October 19, 1899, after "several weeks on the project," a meeting was held at the Maxwell House in Nashville to formalize the agent group and discuss opposition of the Kentucky-Tennessee group. It was determined at the meeting that the group would be formed as the Tennessee Underwriters Association of Local Agents Association (sometimes referred to as the Tennessee Fire Insurance Agents' Association) and operate under the National Local Agents Association federal organization, which had been formed in 1896.

A board was formed, and Hart was named as the first president of our Association, while Moyses became the first Secretary and Treasurer. Turmoil continued in the industry into the new century, and the agents' group went through several years of turmoil as the market continued to be dismal in Tennessee. In 1907, carriers began returning to the state and prospects improved. The Association strengthened its role as an advocate for the industry, and a campaign by the group to "reduce fire waste" in the state served as a rallying cry. In 1908, the fire campaign, along with increased efforts to simplify carrier operations in the state, cemented the long-term role of the group.

In 1914, Miss Julia Hindman was elected as the first female Secretary of our Association and served the organization for 17 years. Her efforts were known across the country as she was involved in many insurance-related groups and activities. She was widely known to her fellow agents as "Miss Julia" and worked in insurance for almost 50 years at the agencies of Metzger-Keith Insurance, Hindman & Brock Company and later Loventhal Brothers in Nashville.

Around this time, the rise in automobile insurance also increased the role of the independent agent, and thus the Association's activities gained more importance. In fact, much of the Association's role during this period included fighting for rate changes, carrier appointments and commission increases for agents in Tennessee. Does that sound familiar?

In 1938, John D. Saint was hired as the first "state manager-secretary" of the Association. He had formerly been the manager of the Oklahoma agent’s association, and previously worked with agents in North Carolina and Louisiana. He opened the first Association headquarters and worked to build a framework for the organization. In 1940, R.T. Cawthon succeeded Saint in the role.

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership.

Why insurance firms choose to partner with Higginbotham:

• Ten-year average return of 30% IRR

• Ten-year average annual shareholder distribution of 25%

• Insurance Business America, 2022 Top Insurance Employer

• Privately-held and run by insurance professionals

• Majority ownership held by employee shareholders

• Leverage Higginbotham’s consistent 20% compound annual growth rate

• Broad risk management and benefit plan services add client value to support your growth

• Maintain your leadership role

• $5 million donated to nonprofits through the Higginbotham Community Fund

Are you ready to soar?

Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com

Sometime after World War II, the organization began operating under the name Insurors of Tennessee. The name change was related to the Association's new participation in advertising campaigns encouraging consumers to utilize an "Insuror" for all their insurance needs. The group's new "executive manager" George Moss, started in the early 1950s and had the role of promoting the advertising program.

The advertising program continued into the 1960s, and new Insurors executive secretary George Nordhaus was at the forefront of growing it. Nordhaus expanded the Insurors activities into other avenues, and also was the founding publisher of the weekly version of The Insurors Bulletin, which began circulation in January of 1963. He also was instrumental in introducing the "Rapid Rater" system to Tennessee and endorsing the first agency management system for our members to use.

In 1962, the Insurors offices had moved from the Commerce Bank (downtown Nashville) to 1700 West End Avenue. Two years later, Insurors member Bud Curtis and Nordaus bought the building at 1700 Hayes Street where the offices would later move. The Association had also contracted with a member to handle its lobbying efforts. As Nordhaus was not involved in the legislative efforts, longtime agent and Board Treasurer Jim Alexander became the lobbyist for Insurors and is still known as one of the most effective at the job we have ever had.

In 1966, Bill Sirls took the role of Executive Secretary, with Ted Moody continuing in his role as Assistant Executive Secretary. Sirls continued many of the programs we had in place, but in January of 1971 he resigned due to "uncertainty in the industry," and a new era of Insurors was about to be ushered in.

In March of 1971, the Insurors was changed forever as their lobbyist and member agent, Jim Alexander, was named Executive Director. Alexander defined a new path for the Association, taking us more to the forefront of government affairs and expanding on our education and marketing efforts. He was responsible for increasing our role on the Vol Network with John Ward as the Insurors spokesperson, and got the Association involved as a sponsor of the Tennessee Sports Hall of Fame. (Continued on page 46)

The Warren Agency is located in historic Collierville, Tennessee in the eastern part of Shelby County situated along the county line with Fayette County. First a brief introduction to Collierville for those folks who do not live in West Tennessee is in order.

The history of Collierville goes back to the 1830’s. A few years after the founding of Memphis on the bluffs overlooking the Mississippi River in 1819 by John Overton, James Winchester and Andrew Jackson, the state of Tennessee started to encourage settlement of the area. To spur population growth, the state offered land grants. In fact, one hundred fifty acres of land was awarded to a land speculator named Jessie R. Collier who advertised them for sale in the Memphis Enquirer under the tagline “The Town of Collier for Sale” in 1836. A Post Office moved to “The Town of Collier” where it is believed to have petitioned to incorporate Collierville was accepted by the Shelby County Court.

Today, Collierville is the second largest city in Shelby County with a population of over 50,000 people according to the 2020 census. It is a vibrant community that offers a great place to live, work and play. The city has done an exceptional job preserving historic buildings with the help of the Main Street Collierville initiative. The town square is the social and economic hub for concerts, festivals, and celebrations for the city. In fact, in 2014 Parade Magazine named Collierville as the Best Main Street in America. The magazine said Collierville Town Square welcomes visitors yearround with a delightful mix of architectural styles around the historic district with browsing boutiques, specialty shops, a museum, and more. More recently, the Hallmark Channel filmed scenes from its movie "Wedding at Graceland" on Collierville Town Square.

To be sure, Collierville is a great city for an insurance agency location. Jan Warren established the agency in the 1990’s as the primary affiliate of one company serving personal insurance clients. The agency grew and developed in a rapidly changing market and officially became independent in 2021 representing several top-rated carriers. The Warren Agency continued its focus on primarily writing personal insurance for clients and started writing commercial insurance for select clients. Today, the agency writes business in the greater Memphis market area including northern Mississippi and across the state of Tennessee. Jan states, “much of our growth through the years has come from referrals from existing clients, relationships in the community and establishing a reputation for providing exceptional service.” In It is ev-

ident that she and her staff truly care about their clients and seek to make sure they have the right coverage to protect their families and businesses. For Jan, providing great insurance products and service is a mission. She is refreshingly authentic and passionate about serving clients.

Jan was born and raised in Louisiana and graduated from Louisiana Tech where she earned a bachelor’s degree in consumer science/nutrition science. For some folks in the South, this university is also known affectionately as “La Tech”. The university offers a strong academic curriculum but is well known for its athletic programs producing an impressive number of professional athletes in football, basketball, and other sports. During the time Jan was attending Louisiana Tech, Karl Malone played basketball for the Bulldogs and established himself as a force to be reckoned with on the court. He led the team to its first ever NCAA Tournament appearance in 1984 and a Southland Conference Championship in 1985. The Utah Jazz drafted him in the first round of the 1985 draft. Perhaps the school’s most famous athlete is NFL Hall of Fame quarterback Terry Bradshaw who led the Pittsburgh Steelers to Super Bowl victories in 1975,1976, 1979 and 1980. Post-retirement from the game Terry Bradshaw became an iconic broadcaster doing NFL shows for CBS and Fox.

Jan is married to her husband Nathan who is a Financial Advisor. They have two sons who are now in their twenties. Lindsey and Payton are now both computer engineers in the Memphis area. Jan and her husband are very proud of their two sons and all they have accomplished. Outside of work, Jan and Nathan are members of First Baptist Church of Collierville and enjoy spending time with their church family.

When asked about what Jan and her husband like to do in their spare time, she laughed and said for most of their lives they both worked hard and raised their kids. They were able to go on numerous trips that either she or her husband won by reaching performance targets in their jobs. These days, Jan and her husband enjoy travelling to the Dominican Republic, the Bahamas and other places that have nice beaches where they can relax and unwind from the rigors of business life. u

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts ext 7514

Jane Kinard ext 7518

Andy Wilder ext 7545

This year we are all experiencing the challenges of operating insurance organizations in a “hard market” to varying degrees. Depending on the line of business, the state, and the geographic proximity to areas with greater exposure to weather driven perils, the task can be even more difficult. For some of the younger members or our association, this might be the first “hard market” they have ever experienced. Escalating premiums, more restrictive underwriting, and lack of availability in the most severe cases, means professional independent agents must work harder and smarter to deliver value to their personal and commercial insurance clients. It is in these turbulent market conditions that independent insurance agents excel and outperform other distribution segments of the insurance industry. The combination of experience, expertise, access to multiple carriers and alternative markets, enables independent agencies to competently meet the needs of most clients through the inevitable ups and downs of insurance markets.

Independent agents also have a distinct advantage over their competitors in the marketplace as members of the Insurors of Tennessee and the Big “I”. The association works to keep members informed about key topics via its various media

outlets including the Tennessee Insuror magazine, The Bulletin, e-mailers, and social media channels. As we all know, staying current about the latest insurance news at the state and national level is key to our ongoing success.

From a legislative affairs and advocacy perspective, “hard markets” historically create pressure on legislative bodies to “do something” about the price of insurance, underwriting actions taken by companies or the availability of some lines of insurance. Indeed, at times public outcry can push legislatures to act. Under pressure, such legislation can result in unintended outcomes including greater disruption of insurance markets over the long-term. The work of our Government Affairs Consultant, Trey Moore at the state level and the staff of the Big “I” advocacy staff in Washington D.C. helps to inform and educate legislators about complex insurance and risk management issues. They seek to improve proposed legislation or have misguided legislation set aside to prevent negative outcomes for the industry and the consumer. The participation of the Insurors of Tennessee Legislative Affairs Committee and members across the state is also a vital part of the advocacy process.

Another way the association serves members in difficult market conditions is by providing access to insurance programs offered by the Insurors of Tennessee and through programs available via the Big “I” Markets at the national level. I encourage you to explore the options available to you via your association membership by contacting Stephen Holmes at sholmes@insurors.org or visiting our website at www.insurors.org.

One of the keys to overcoming challenges and thriving no matter the state of insurance markets is to make certain

you have the insurance knowledge to develop the solutions clients need for even the most complex of challenges. As I have mentioned before, knowledge fuels success in our business. The Insurors of Tennessee offers a comprehensive catalogue of seminars and courses designed to keep agencies on the leading edge of insurance and risk management topics. The resources available can help you become a subject matter expert and thought leader on insurance, risk management, risk transfer and risk mitigation. Be sure to go to our website at www.insurors.org to learn more.

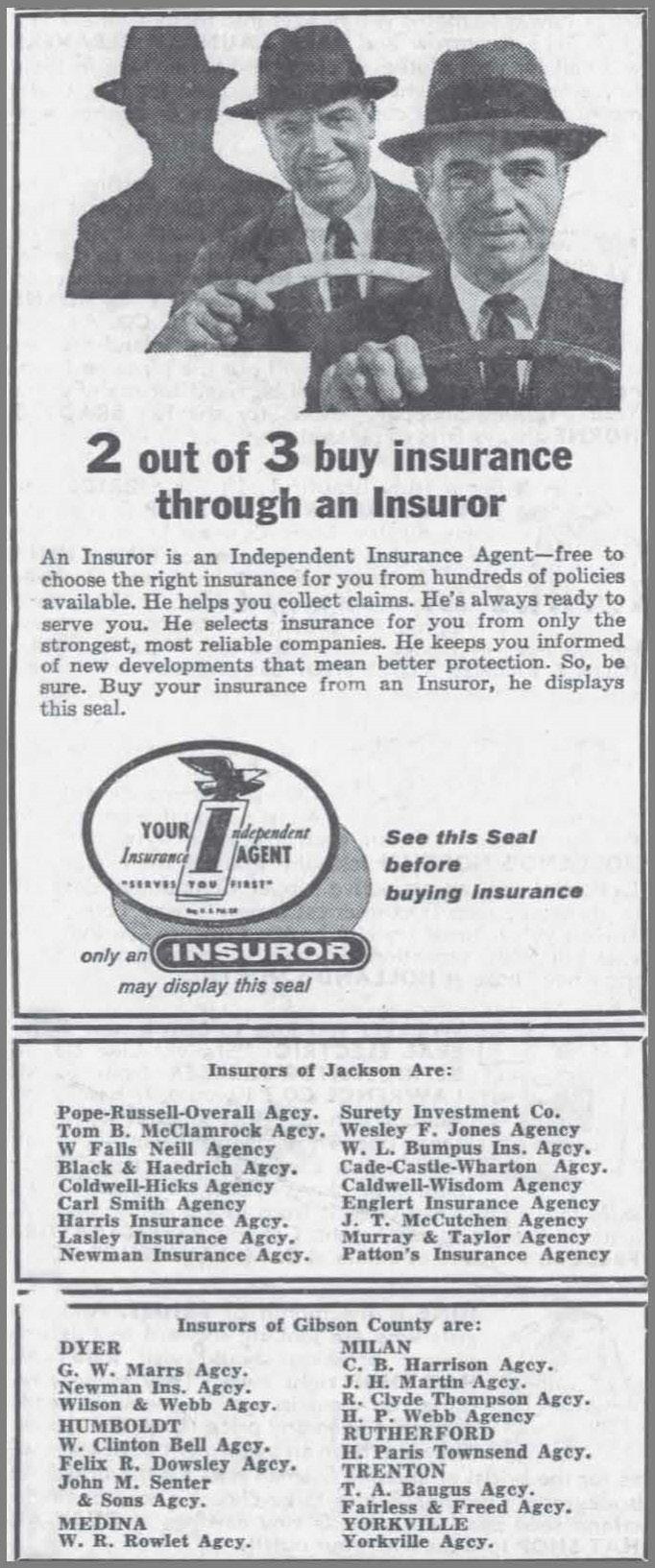

In closing, I am very pleased to tell you that the Insurors of Tennessee is in an exceptionally good place today. At a time when associations across many different industries are struggling in the wake of the pandemic, we are growing and thinking forward as we celebrate the 130th Anniversary of this historic association. Your board has been busy with its oversight responsibilities and working to make sure we are on a path to future success. I appreciate the board’s commitment of time and talent in service to this association. I am also grateful to our members and associate members who are the foundation of the Insurors of Tennessee. To each of our company partners, I thank each of you for your contributions and support in helping to power our association forward. Together, we continue to build an organization that we can all be proud of across the state of Tennessee.

I hope to see you at the Insurors of Tennessee Annual Convention being held in Knoxville on October 12-24, 2023. If you have not yet registered, please do so at your earliest convenience. u

The global average breach cost reached $4.45 million, with detection and escalation the most expensive component— indicating a shift toward more extended and complex investigations.

The cost of the global average data breach in 2023 has set a record high, with the average breach cost reaching $4.45 million, a 2.3% increase from 2022 and a 15.3% from 2020, according to IBM's “Cost of a Data Breach" report, which determines that organizations must invest in cybersecurity to limit damage.

The 2023 research, conducted independently by Ponemon Institute and sponsored, analyzed, and published by IBM Security, studied 553 organizations impacted by data breaches that occurred between March 2022 and March 2023.

When cyber breaches were detected by an organization itself, they were able to reduce the impact to the firm, the report found. However, only one-third of companies surveyed discovered the data breach through their own security teams and approximately 67% of breaches were reported to firms by a benign third party or by attackers. Further, when attackers disclosed a breach, it cost organizations nearly $1 million more per incident than when detected internally.

Identifying and containing a breach disclosed by an attacker required a mean time of 320 days, 80 additional days compared to breaches identified internally and 47 days longer than breaches identified by a benign third party. The report identified three ways organizations can help mitigate the effects and costs of a cyber breach:

1) Involve law enforcement. Organizations that involved law enforcement in a ransomware attack saved money and shortened the lifecycle of the breach compared to those that didn't. Neglecting to involve law enforcement incurred an additional $470,000 in expenses on average. Approximately 63% of respondents said they involved law enforcement while the 37% that did not paid 9.6% more and experienced a 33-day longer breach lifecycle.

2) Explore artificial intelligence (AI). Organizations that extensively used AI and automation security capabilities within their approach experienced, on average, a 108-day shorter time to identify and contain the breach. These organizations also reported $1.76 million lower data breach costs compared to organizations that didn't.

3) Focus on incident response (IR) planning and testing. Organizations that reported high levels of IR planning and testing saved $1.49 million over the year compared to those reporting low levels. Yet, only 51% of organizations surveyed plan to increase security investments following a breach with others focusing on IR planning and testing, employee training, and threat detection and response technologies, according to the report.

Despite the growing overall expense of cyberattacks, lost business costs hit a five-year low, the report said. In contrast, detection and escalation costs were the costliest category of data breach expenses, increasing from $1.44 million in 2022 to $1.58 million in 2023. This is indicative of a shift toward more extended and complex breach investigations, including forensic and investigative activities, assessment and audit services, crisis management and communications to executives and boards.

Since 2020, healthcare data breach costs have increased by 53.3% and for the 13th year in a row, the industry reported the most expensive data breaches at an average cost of $10.93 million. Additionally, cloud environments were also frequent targets for cyber attackers in 2023, comprising 82% of reported attacks in public, private or multiple environments, with 39% of breaches spanning multiple environments and incurring a higher-than-average cost of $4.75 million, the report said.

The impact of these costs is felt primarily by customers and consumers with the majority (57%) of respondents indicating that data breaches led to increased pricing of their business offerings. u

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like childcare, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

I hope you have all had an enjoyable Summer and found some time to relax and unwind with your friends and family. Summer in Tennessee is such a great time of the year with so many beautiful parks and lakes to enjoy across the state. We are fortunate to be blessed with such natural beauty, rich history, and great attractions to enjoy across our state. It is no wonder Tennessee is one of the leading destinations for travelers across the country and around the world. Tennessee reached a record $27.5 billion in visitor spending in 2022, marking a $3 billion increase (+14%) over 2021, according to U.S. Travel. Travel spending propelled Tennessee to 11th in the nation in 2021 and 2022, up from its previous record of 14 in 2020. The industry contributed $1.8 billion in actual sales tax collections in 2022 helping to fund initiatives from Bristol to Memphis. So, the next time someone looks like they might be lost, or they hesitate at an intersection please be patient and kind as they might be a visitor exploring our spectacular state.

With Fall quickly approaching that means two things. It is “football time in Tennessee” using the iconic words of John Ward and it is convention time for the Insurors of Tennessee. This year Insurefest is being held in Knoxville from October 21-24, 2023, at the Downtown Marriott just across from the Knoxville Convention Center and World’s Fair Park. This is the first time we have been back to Knoxville with the event since 2015.

This year we are celebrating the 130th anniversary of our association and have a great conference planned. We are excited to offer a content rich event that will provide you with valuable information you can share with your staff and leverage to advance the operation of your agencies.

We are pleased to welcome Bill Wilson, CPCU, ARM, AIM, AAM back to the convention where he will be giving a compelling presentation based on his book “When Worlds Collide: Resolving Insurance Coverage and Claims Disputes”. Bill Wilson has deep roots with this association and the Big “I” at the national level and is widely recognized as one of the foremost insurance experts in our nation. You will want to be sure to see his presentation on Monday. To learn more about Bill see his full biography at www. insurancecommentary.com.

We are also offering an InsureTech Panel featuring Chip Bacciocco of TC.com, Jason Walker, President of Agency Revolution and Lou Moran III, Chair of the IIABA InsurTech Taskforce where they will discuss the impact InsurTech is having on our business and may have in the future. Martin & Zerfoss and Chubb are presenting a Recreational Marine CE Course to keep you current on the latest trends and coverage issues on the water.

There will also be organized events including a Fall cruise on the Tennessee River and an outing at Top Golf in Knox-

ville to give members the opportunity to relax and find time to renew old friendships and make new ones.

On Monday night, we cleared the schedule for Company Night to allow sponsors and companies the opportunity to host events and gather with members. We hope you will take advantage of these opportunities to spend quality time with each other. In talking with many of our more senior members, the one constant between all of them is how much they enjoyed and valued the relationships they formed through the Insurors of Tennessee over the years. Even in this age of social media, high speed internet and artificial intelligence, gathering with people in person and building relationships matters. Perhaps it matters more now than ever.

If you have not yet registered for Insurefest, now is a good time to get that done since the convention is rapidly approaching. In addition to agency principals and other leaders, we encourage Young Agents from across the state to attend and get involved. You can register for Insurefest by visiting the Insurors of Tennessee website at www.insurors. org and clicking on the Events tab. We look forward to seeing you all in Knoxville in a couple of months. u

We are pleased to introduce you to Tyler Massey, who is employed as a Client Executive with RSS Insurance located in Chattanooga. His career in the insurance business started just three and half years ago when he joined RSS. Tyler noted that he began his insurance career just as the Covid-19 Pandemic started presenting unexpected challenges to a young producer just getting started in the insurance business. Nevertheless, he was productive and made good use of his time. He learned as much as possible about the insurance business from a macro perspective while also focusing on learning about the various policy forms and the details of personal and commercial insurance coverages. Tyler understood quickly that insurance is a knowledge driven business, and that ongoing insurance education and professional development was key. Tyler credits agency principal Dave Allen with serving as his mentor and always being present to answer questions and provide guidance as needed. He is very appreciative of the support he received and continues to receive from David and other members of the RSS team.

Tyler’s path to an insurance career was unique in that after playing baseball in high school at Chattanooga Baylor he was drafted to play professional baseball by the Colorado Rockies. After a great deal of thought, he decided to put his college plans on hold while he pursued his dream of playing professional baseball. Tyler’s professional baseball career lasted more than nine years playing primarily in the Colorado Rockies minor league organization with teams like the Triple A Albuquerque Isotopes and others. Tyler played right field and learned a tremendous amount about baseball at the professional level and about life. In 2016, his professional baseball career came to an end. After baseball, Tyler completed his college degree at Lee University in Cleveland, Tennessee earning a degree in finance following through on the goal he post-postponed to pursue his baseball career.

When asked about what he learned over those nine years in professional baseball that carries over into his insurance career, Tyler states, “I learned a great deal about

presented by

presented by

perseverance, pushing through failure and trusting the process”. He remarks, “Baseball is a sport where if you hit the ball 30% of the time as a batter you are succeeding, so you must get used to failing 70% of the time and learn how to push through that mentally.” Tyler described how at all levels of professional baseball, the talent of pitchers makes hitting the baseball a real challenge, so you must have consistent mechanics, be able to track the baseball and maintain mental focus to perform at a high level. Many of those same principles hold true on the defensive side of baseball as well. One of the most important elements Tyler learned in baseball that overlaps in business is knowing how to be a part of a successful team where everyone is moving forward with enthusiasm to accomplish a goal or set of goals. Tyler states, “It is very rewarding when everyone is pulling together as a team to overcome challenges whether it is winning a baseball game or hitting agency goals as a group."

Tyler grew up around athletics since his father, Phillip Massey, was the head football coach at Chattanooga Baylor High School for sixteen years where his teams advanced to two state championship games. His father is among Tennessee's top 12 active coaches in career victories and has a 184-112 overall record. He is now the head football coach at Briarcrest Christian School located in Shelby County.

Tyler’s mother, Sandy Massey, was also a Cross Country and Track coach at Hutchinson School in Memphis years ago. This Fall Sandy Massey is being inducted into the Baylor University Sports Hall of Fame for holding records in the 1500-meter and 3000-meter events and qualifying for the 1984 U.S. Olympic Trials. So, Tyler was introduced to the concept of being part of a team by both parents early on in life.

(Continued on page 51)

Insurefest 2023 is just around the corner and it’s an event that you do not want to miss, especially if you’re a Young Agent. As a Young Agent, attending the convention is truly the place to be where you'll gain valuable experience on both a personal and professional level.

It's a great opportunity to network with other insurance professionals, learn about the latest industry trends and developments, and participate in educational sessions that can help you give you the tools necessary to be the best agent possible.

There are great sessions on the agenda for this year's convention. I'm looking forward to Bill Wilson's "When Words Collide: Resolving Insurance Coverage and Claims Disputes" the Monday morning of the 23rd. A few of my colleagues have read this book and came away with improved technical skills through Bill's real-life claim scenarios. I've always learned best by examples, so I'm excited to see and hear from him in person.

The convention is also a great place to make new acquaintances and build existing relationships with your peers from across the state. Relationships you develop early in your career can become lifelong friendships and critical professional relationships that become an important resource to you on a professional basis. When you talk to more senior members of our profession, the thing they remember most fondly are the relationships they formed as members of the Insurors of Tennessee.

As always, we will have the big Young Agent’s party on Sunday night. TBD on the location and time, but you can count on it being a good time.

Year after year, I always come out of the convention with new ideas and inspiration that I'm able to use in working to be the best version of an agent as possible. I hope to see you there! u

In May, Gov. Bill Lee publicly signaled his intent to convene legislators for a special session to address firearms legislation in the wake of the school shooting in Nashville. Per Article III, Section 9 of the Tennessee Constitution, the governor “may, on extraordinary occasions, convene the General Assembly by proclamation, in which he shall state specifically the purposes for which they are to convene; but they shall enter on no legislative business except that for which they were specifically called together.”

That is to say, while the governor may convene an “extraordinary” session, such session is limited specifically to issues germane to the subject(s) of the governor’s proclamation (i.e. Executive Order]. As this magazine went to print, no such Executive Order had yet been issued, but the governor’s public statements indicate the issues he would like to address.

“After speaking with members of the General Assembly, I am calling for a special session on August 21 to continue our important discussion about solutions to keep Tennessee communities safe and preserve the constitutional rights of law-abiding citizens,” said Gov. Lee in May. “There is broad agreement that action is needed, and in the weeks ahead, we’ll continue to listen to Tennesseans and pursue thoughtful, practical measures that strengthen the safety of Tennesseans, preserve Second Amendment rights, prioritize due process protections, support law enforcement and address mental health.”

Lee reiterated his commitment to the issue recently, despite facing pushback by fellow republican lawmakers. “Tennessee will be a safer state as a result of the efforts of the legislation and the legislators who are engaged in the process of this special session on public safety,” Lee said, according to media outlets.

Opposition to legislation related to “extreme risk protection orders” (ERPO) and whether such bills may be characterized by conservatives as “red flag laws,” has resulted in pushback by prominent republicans in the General Assembly.

“Should the governor choose to introduce an ERPO during special session, I will not be the sponsor. Because the special session, itself, is controversial and lacks support in the Senate,

this is a unique circumstance. Once the governor’s other proposals are finalized, I will review each one and consult with my Senate colleagues prior to agreeing to sponsor any administration bills,” Senate Majority Leader Jack Johnson (R-Franklin) said, responding to questions from the Tennessee Lookout.

House Speaker Cameron Sexton told a firearms interest group this summer he doesn’t think the governor’s ERPO legislation will make it out of committee system. The speaker, for his part, indicated that bills relative to non-voluntary committals and “mass threats” directed at specific groups and locations in addition to improving the state’s background check system for gun purchases, according to local outlets.

On August 5th, the 66-member Tennessee Republican State Executive Committee adopted a formal resolution calling on the governor to abandon such plans, discouraging Lee from calling the special session. According to the Chattanooga Times Free Press, State GOP Chairman Scott Golden told two reporters following the meeting that the executive committee would rather the administration address firearms issues during the regular session that commences in January.

"We'll send [the resolution] as soon as we get the final language and everything, we'll send it to the governor and all the appropriate officials the sense of where the Republican Party" is,” Golden said. He added that the State Executive Committee and Republicans in the General Assembly are aligned on the issue, stating “I think our members are very reflective, they talk to their legislators as well, and I think that was the sense of what the Tennessee Republican Party said today.”

If it feels to you like there have been a lot of special sessions these days, you’re right. “Extraordinary sessions” are becoming considerably less “special” or “extraordinary” in recent years, with seven such sessions being called by the governor or General Assembly since 2015. Five of those have been called since 2020, including three in 2021 alone. From 2005 through 2014, the General Assembly convened just once for a special session.

As for the upcoming special session, although no legislation impacting producers and agencies is anticipated, Insurors will be on-hand to monitor the proceedings and engage where appropriate.

InsurPACTN, the Insurors state political action committee (PAC), InsurPACTN, has raised just over $18,000 in the first half of 2023. To help us get back on track, Insurors President Matt Swallows (Swallows Insurance, Cookeville) and Secretary Kevin Ownby (Ownby Insurance, Sevierville) have issued a challenge to fellow members and pledged to matching all first-time donors and increases over 2022 levels, up to $10,000. Be on the lookout for an email announcing the matching challenge. A big thanks to Matt and Kevin for their generosity and leadership!

Businesses and individuals can contribute to political action committees (PACs) in Tennessee. There is no limit on the dollar amount of contributions to InsurPACTN. All contributions are voluntary.

Director of Agent Licensing Kim Biggs retired in June after 38 years working at the Department. Kim spent her career in the Agent Licensing section and served as Director for eight years. She lead the transition from paper to electronic license filings, navigated the section through challenges surfaced during the pandemic, and helped her team through a massive influx of applications from prospective insurance agents. During Kim's leadership, Tennessee's insurancerelated licensees hit record high numbers, according to TDCI.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

The National Oceanic and Atmospheric Administration (NOAA) revised its prediction for the 2023 Atlantic hurricane season from a near-normal level of activity to an abovenormal level of activity. So far, the 2023 season has seen five storms, four named and one unnamed. But the climatological peak of hurricane season has not yet begun.

Warmer-than-normal sea surface temperatures across much of the tropical and subtropical Atlantic are likely to offset the usually limiting atmospheric conditions caused by an El Niño, NOAA said. NOAA forecasters are predicting 21 named storms, of which up to 11 could become hurricanes, compared to a typical yearly average of 14 named storms and seven hurricanes, meteorologists announced during an updated hurricane outlook call last week, noting that they are 70% sure that this will occur.

“The main climate factors expected to influence the 2023 Atlantic hurricane activity are the ongoing El Niño and the warm phase of the Atlantic Multi-Decadal Oscillation, including record-warm Atlantic sea surface temperatures,"

said Matthew Rosencrans, lead hurricane season forecaster with NOAA's Climate Prediction Center. “Considering those factors, the updated outlook calls for more activity, so we urge everyone to prepare now for the continuing season."

More than 32 million single-family residences (SFRs) and 1 million multi-family residences (MFRs) are at moderate or more significant risk of sustaining damage from hurricaneforce winds, according to CoreLogic's "2023 Hurricane Risk Report." This damage is projected to have a combined reconstruction cost value (RCV) of $11.6 trillion. A total of 6.4 million homes are at an extreme risk level for hurricane-force wind damage at a cost of $1.8 trillion.

Additionally, approximately 7.8 million homes, with a combined RCV of $2.6 trillion, are susceptible to storm surge flooding due to their direct or indirect coastal exposure. The Atlantic hurricane season historically peaks between August and October, when about 90% of tropical storms tend to occur. NOAA urges everyone in vulnerable areas to have a well-thought-out hurricane plan and stay informed through official channels as this season progresses. u

It is with great excitement and pleasure that we announce: Katherine Strate Smith has purchased a controlling interest in our company and is now President and CEO of Strate Insurance Group. Tom Strate, our fearless leader for 40 years, is Vice President and CFO and remains closely aligned with Katherine as they move into this new phase.

It is very rare for businesses to perpetuate into the 3rd generation. For those of you who don't know, Strate Insurance Group was founded in 1978 by Jack, Agnes, and Tom Strate. Katherine is Tom's daughter and Jack and Agnes's granddaughter. Many of you reading this post might even remember working with Jack and Agnes in the early days.

We hope this announcement shows our customers and our community that we intend to remain independent and locally owned. We know trust isn't given--it's earned. Thank you for your support of our business over the last 40 years. Please celebrate this important milestone alongside us!

Katherine and the team will lead Strate Insurance Group to even greater heights. Our values of trust, relationship, experience, and knowledge will remain the same.

Each year, a group of exceptional insurance professionals are selected to represent their states and then compete to become the National Outstanding CSR of the Year. This prestigious award, regarded as the foremost national award of its kind, recognizes the contributions and commitment of those who serve clients within the insurance industry.

To be eligible for the top state honor, the 2023 candidates submitted an essay on the following topic:

“Empathy is an important aspect of customer-facing jobs, and it will only become more important as companies place a greater emphasis on making customer interactions feel natural and effective. Explain how empathy has helped you become a better CSR. Give three examples of how you’ve used empathy in your role and describe the positive effects it’s had on your organization.”

Additionally, entrants must have demonstrated commendable service to their agencies, their industry, and their community.

The 2023 Tennessee winner is Julia Simpson from Insight Risk Management, Cordova. Congratulations, Julia!

COOKEVILLE and JAMESTOWN, Tenn., SmartBank recently announced the rebranding of their insurance subsidiary including Chattanooga-based Sunbelt Insurance and Upper Cumberland-based Rains Insurance, to SBK Insurance.

Sunbelt and Rains, leading insurance agencies in Tennessee, are now unified in a single entity positioned to provide enhanced insurance services throughout the SmartBank footprint.

“This is a great opportunity that will allow us to better leverage the strength and capabilities of our entire agency to provide quality products and services to all of our clients,” said Billy Carroll, SmartBank President and CEO. “The new name, SBK Insurance, is a natural fit for the SmartBank brand and we look forward to expanding this line of business in all of our markets.”

Over the years, Sunbelt and Rains have been providing reliable insurance solutions to individuals and businesses,

Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

Energy

Healthcare Hospitality

Marine

Social

Sports

Transactional

offering a wide range of products including personal, commercial, life & health, and transportation insurance.

“We are excited to launch our new brand identity as SBK Insurance, which better reflects who we are today and where we are headed tomorrow,” said SBK Insurance CEO, Mark Slater. “Our clients can expect the same level of exceptional service, expertise, and value that they have come to trust from Sunbelt and Rains, with a renewed focus on innovation, growth, and excellence."

The rebranding initiative includes a new logo, website, and marketing collateral that feature the SBK Insurance name and brand identity. The company's email addresses and contact information will also be updated to reflect the new name.

“Our rebranding is more than just a new name,” said Jessica Parrott, SBK Insurance President. “While our name may have changed, our commitment to clients remains the same and we will continue to provide them with excellent service and unwavering dedication. We are proud of our legacy, but we’re even more excited about our future as SBK Insurance

and the opportunities it brings for our team and our clients.” For more information about SBK Insurance, visit sbki.com.

Bagley & Bagley insurance located in Fayetteville, Tennessee announced that Walter Phillips of the agency was recently recognized by Blue Cross Blue Shield of Tennessee for being one of the company’s Top 25 producers. It should be noted there are more than one thousand Blue Cross Blue Sheild producers across the state of Tennessee. So, to finish in the Top 25 is quite an accomplishment. The agency stated in a recent social media post that Walter is vital to their business

Tech solutions for you and your customers—now and into the future

At Progressive, we’re always thinking about ways to push our business forward with innovations like our leading telematics solutions: Snapshot® for personal auto and Snapshot ProView® and Smart Haul® for your commercial customers. Plus, we’ve rolled out a multi-product quoting platform that makes bundling easier than ever.

With breakthroughs like these and more, you can feel confident that while you’re focused on your customers, we’re focused on what’s ahead.

Tech leadership—it’s in our DNA.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

and continues to expertly navigate the ever-changing healthcare insurance landscape like a true professional. Walter specializes in both individual and group health insurance solutions. Relative to the individual health insurance side of the business, he has deep expertise helping clients with Medicare, Supplemental Coverage, Advantage Programs and Life Insurance.

The Swallows Insurance Agency was pleased to sponsor the Cookeville Chamber of Commerce State of the Schools Luncheon held on July 25, 2023. Kelly Swallows, Vice President of Operations with Swallows Insurance Agency took the stage to announce they are launching a new grant program for educators K-12 in DeKalb, Overton, and Putnam counties to support specific projects within the schools. The grant, called Swallows' Scholars, will award up to $500 per teacher on a monthly basis. Applications for educators to apply for the awards from the afore-mentioned counties can be found on the agency website.

The Swallows Agency is a long-time supporter of area schools and places a strong emphasis on education as part of its mission to support the community. u

“Our goal has always been to grow, innovate, and evolve in step with our agents. I’m focused on ways we can enhance our products and expertise to do just that,” says Zemberi. “We’ve consistently heard that our agents love doing business with Central. They’re eager for us to expand our appetite so we can write heavy civil contractors and larger construction clients together. Our Construction book is growing, and I want to keep that momentum going.”

Central Insurance is a property and casualty insurance carrier based in Van Wert, Ohio, with offices throughout the country. Working in partnership with local independent agents, we proudly provide coverage for hundreds of thousands of individuals and businesses in 24 states. Our commercial lines verticals include Real Estate, Transportation, Manufacturing, and Construction.

Central’s growth strategy has always been rooted in intention. Industry specialization allows us to provide our agents with the products they need and want. As our first formally established industry vertical, Construction has been a longstanding part of Central’s success story. It remains a significant part of our commercial book today, and our most profitable vertical over the past five years.

Last year, we expanded our Construction expertise by bringing Scott Zemberi on board as Central’s new Director of Construction Underwriting. With over two decades of experience in commercial and large construction, Scott brings a wealth of insight and experience to the vertical.

Specialization has always played a role in Central’s growth. As we continue moving into the larger Construction space, Zemberi is building out the teams and expertise to enrich our agent partnerships and add even greater value.

“Agents want our underwriters involved in the sales process to speak to the Central difference. We’re supporting this by enhancing underwriting expertise through ongoing education. Expanding in the Construction space doesn’t happen overnight, but we’re listening to our agents, taking action, and excited to grow alongside them.”

“Insurance is a relationship business. Agents need to have immense faith in the carriers they place their large accounts with. Central is one of the few carriers to ask agents what they want and need rather than just dictating the type of business we want to write. We’re focused on enhancing our partnerships by developing products and expertise aligned with agent needs. This supports solid relationships and sets us all up for shared success.”

As always, relationships remain the cornerstone of everything we do at Central—a philosophy shared by Zemberi.

Insurance is a relationship business.

Scott Zemberi, Director of Construction Underwriting

Ryan Specialty, headquartered in Chicago, Ill. appointed Kathy Guerville to chief underwriting officer of its underwriting management specialty, Ryan Specialty Underwriting Managers.

Guerville has 15 years of insurance actuarial experience, including seven years with Ryan Specialty where she served in several roles, including senior actuary, actuarial director and deputy chief underwriting officer. Prior to joining Ryan Specialty, she was with Zurich Insurance Company in the US, Zurich and London.

Nashville-based Tenco Services Inc., a multi-line claims ad-

justing firm in six Southeastern states, plans to acquire the James C. Greene adjusting company in Raleigh, North Carolina, Tenco announced.

Greene has offices in North and South Carolina and also works in Georgia and Virginia. Both firms are family-run, independent adjusting firms that are two of the oldest in the South. Greene began in 1932 and Tenco has been operating since 1947, according to a company press release.

Greene is led by James C. Greene Jr., president. Brian Duncan is president of Tenco. The combined firm will have more than 75 adjusters.

Dieter Pinner Joined Brentwood Services, Inc. as Vice President of Managed Care Services this past Spring. Dieter is responsible for the oversight of Brentwood’s premier panel

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

claims handling Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

of providers and for measurable improvements to our cost containment services.

Dieter has over 20 years of experience dedicated to identifying and designing effective cost containment and managed care solutions. His most recent post was as a Senior Sales Executive with Paradigm.

Dieter brings expertise in multiple aspects of managed care including pharmacy, physical therapy, coordinating with medical providers and in bill review. Dieter has a track record of fostering excellent client relationships combined with a capacity to implement new outcome-focused solutions that generate savings and service enhancements for clients. Brentwood Services is establishing advanced, innovative solutions for our client partners that we look forward to offering this upcoming year.

Tennessee based MidSouth Mutual Insurance Company is pleased to report that its A, Exceptional Financial Stability Rating (FSR) from Demotech, Inc was affirmed on July 31, 2023.

The company participated in an extensive multi-step review process to earn the rating. The process included a comprehensive financial and operational review to develop the “FSR” for MidSouth Mutual.

FSRs are a leading indicator of the financial stability of Property & Casualty insurers. The rating process provides an objective baseline for assessing solvency based upon changes in financial stability, as manifested in an insurer's balance sheet. FSRs are based upon a series of quantitative ratios and considerations which together comprise the Financial Stability Analysis Model.

We’re right here to do more.

To help support both your physical and mental health while giving back to our communities is to go beyond what is expected from a health insurance company. And that’s exactly why we do it.

Acuity has been named to the 2023 Ward’s 50 list of top-performing property-casualty companies, putting the company in the top 2 percent of insurers nationwide. Acuity has earned a spot on the Ward’s 50 every year since 2000, making the company one of only four insurers, and the only regional carrier, to be named to the list for 24 consecutive years. Ward Group is the leading provider of benchmarking and best practices studies for insurance companies.

“We recognize Acuity for outstanding financial results in the areas of safety, consistency, and performance over a five-year period,” said Jeff Rieder, partner and head of Ward Group. “In selecting the Ward’s 50, we analyze the financial performance of nearly 2,900 property-casualty insurance companies, identifying the 50 companies that pass financial stability requirements and demonstrate the ability to grow while maintaining strong capital positions and underwriting results.”

“Acuity’s continued recognition by Ward Group as a top performer is something we can all be proud of,” said Melissa Winter, Acuity President. “We all play a part in maintaining the strength and stability that our customers, agents, and staff depend on.”

“Independent agents and Acuity have created a winning team that delivers a consistent performance that is virtually unheard of in the industry,” said Ben Salzmann, Acuity CEO. To be at the top of our game for 24 years is an incredible achievement.”

Builders Mutual, a leader in providing insurance coverage to the construction industry, is proud to announce it has been named to the prestigious Ward's 50 group of top performing companies for the fifth consecutive year. The recognition focuses on Builders Mutual’s outstanding financial results in the

Spend less time managing your payroll and more time focusing on success. When you partner with BBSI for your payroll needs, you’ll be matched with a dedicated payroll analyst who is committed to helping you ensure your employees are paid efficiently, accurately and on time, every time.

You’ll have access to our proprietary payroll system to help you streamline payroll and employee onboarding with the ability to scale as your business grows.

We are dedicated to the independent agency system and proudly stand behind the agents who represent us. auto-owners.com

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

areas of safety, consistency, and performance over a five-year period (2018-2022).

This annual designation from the industry-leading organization, Ward Group, identifies companies that pass financial stability requirements and measure their ability to grow while maintaining strong capital positions and underwriting results. To be awarded this designation, insurance companies must pass thresholds of performance and excellence.

“We are thrilled to be recognized by Ward Group in the esteemed Ward’s 50 for the fifth consecutive year,” said Mike Gerber, President and CEO of Builders Mutual. “Our staff works diligently each day to excel in safety, consistency, and performance. Receiving this honor shows the commitment the Builders Mutual team has to the construction industry, our policyholders, and our agents.”

Donald Fry, Harford Mutual Board member since 2005, has been elected Chair of the Board of Directors. Fry is the former president & CEO of the Greater Baltimore Committee (GBC), a regional business advocacy group. He joined the GBC in 1999 and became president & CEO in 2002. Fry retired from the GBC in 2022. Fry has also previously served in the Maryland House of Delegates and the Maryland State Senate.

Throughout his years of service on the Harford Mutual Board, Fry has been a member of the Audit, Compensation (Chair), and Executive Committees. Fry earned his B.S. from Frostburg University and his J.D. from the University of Baltimore School of Law.

Harford Mutual also announced the elections of Sandra Rich and John DeMartini to the Board of Directors.

Rich has over 30 years of experience in C-Suite leadership, complex mergers and acquisitions, real estate and investment transactions, regulatory compliance, corporate governance, and corporate legal. She is the former Senior Vice President, Chief Compliance Officer at Nationwide Insurance and Nationwide Financial, retiring in 2021. Rich will serve on the Board’s Governance and Risk Committees.

Since 2012, Rich has served on the Boys & Girls Clubs of Central Ohio Board of Directors. She is also the co-founder of the National Association for Diversity in Compliance, which was formed in 2015 to promote and enhance diversity in the compliance profession. Rich earned her bachelor’s degree in political science from The University of Akron and her Juris Doctorate from The Ohio State University College of Law.

DeMartini has over 40 years of experience in strategic risk management. He is the former Executive Vice President and Principal of Towers Perrin, which was acquired by Guy Carpenter, LLC., a leading global risk and reinsurance specialist. DeMartini served as Managing Director at Guy Carpenter before transitioning to Treaty Broker. DeMartini will serve on the Board’s Compensation and Risk Committees.

DeMartini received the Chairman’s Award and the Vandegraff Award for Outstanding Service while with Towers Perrin. He is a founding member of the International Society of Catastrophe Managers, former President and Board Member of the Yorktown Athletic Club, and former Vice President and Board Member of Mahopac Golf Club.

A.M. Best publicly announced the reaffirmation of Harford Mutual Insurance Group’s Financial Strength Rating (FSR) of “A” (Excellent) with a Stable outlook and the Long-Term Issuer Credit Rating (Long-Term ICR) “a” (Excellent) with a Stable outlook. The ratings reflect Harford Mutual’s balance sheet strength, which A.M. Best categorizes as “Strongest”, as well as its adequate operating performance, neutral business profile, and appropriate enterprise risk management.

Oakbridge Insurance Agency LLC announced it has acquired Cole Agency Inc. Montezuma, Georgia-based Cole specializes in poultry insurance and the agribusiness sector, from site prep and construction to equipment, vehicle and general liability, an Oakbridge statement said.

Cole, which lists 13 employees on its website, will maintain its office in Montezuma, the statement said. u

Alexander also introduced "education cassette tapes" for members and helped introduce a larger Young Agents program, including our first Young Agents Conference in 1973.

In 1975, Alexander hired a young professor at UTNashville named Chuck Bidek to teach licensing courses for the Association. In 1979, Chuck joined Insurors full time as the Assistant Executive Director. Over the next few years, Chuck continued teaching classes and developing materials for agents, including his work with Joe Rackley on computer rating systems. His role expanded with the Association over time, as he introduced Insurors to the world of computerized data and became heavily involved in the planning of the Annual Convention.

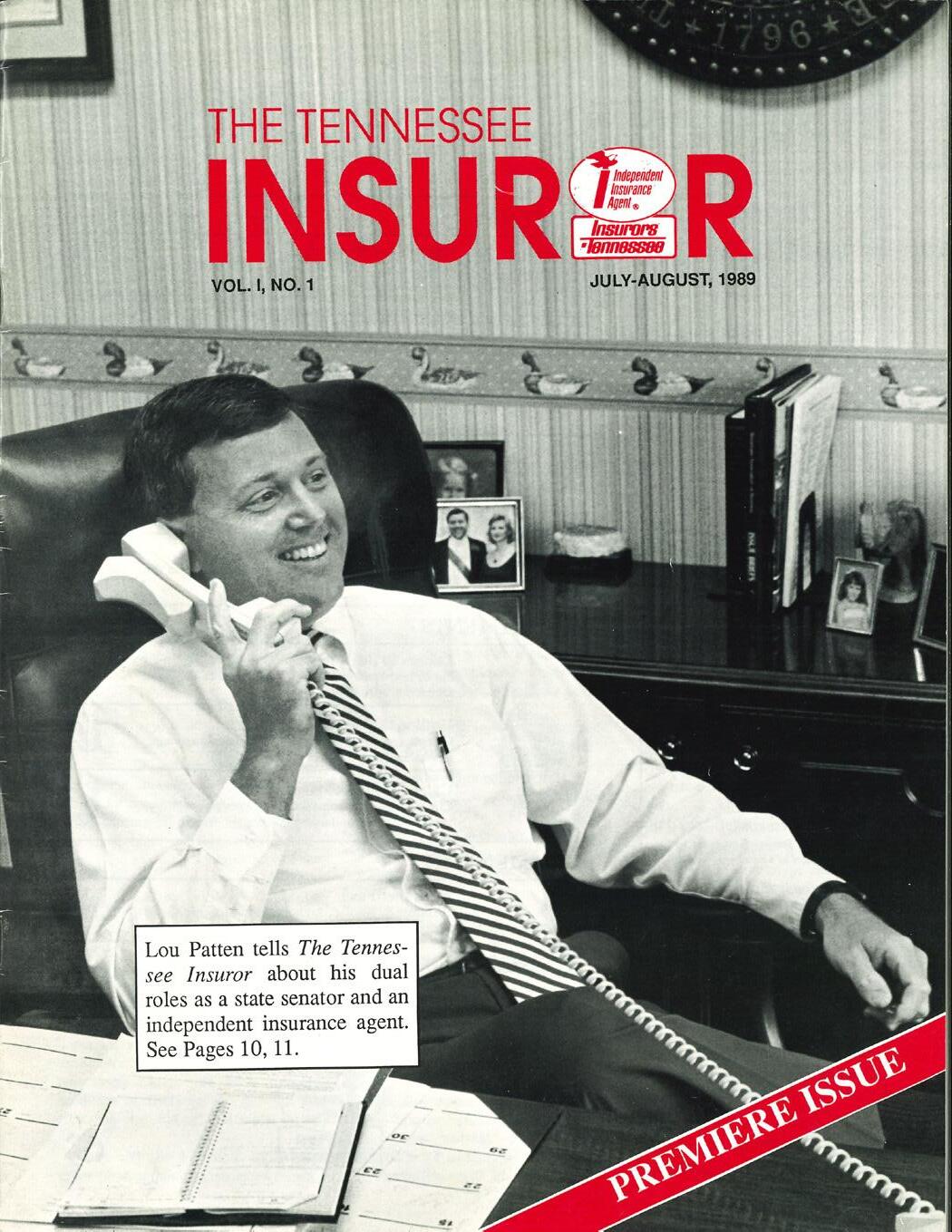

In 1987, Alexander announced he would be retiring, and the Board President Don Jordan called a special meeting to address the situation. A plan was put in place for Chuck to transition into the role of Executive Director for Insurors of Tennessee, with Alexander staying on for a time as the Director of Legislative Affairs. Chuck assumed his duties in January of 1988, and went right to work on new ideas for the Association’s future. One of the early tasks in Chuck’s tenure was moving the Association office from Parkway Towers to the Vanderbilt Plaza Office Building. The new location was valuable at the time because of its conference space and connection to the Vanderbilt Plaza Hotel. In July of 1989, Chuck unveiled the inaugural issue of this publication, The Tennessee Insuror. Lou Patten, a member and State Senator at the

time, graced the cover of what would become our flagship publication.

Insurors continued to grow under Chuck’s leadership, so much in fact that a new location was sought out to hold the Association offices. In April of 1994, the new office building at 2500 Hillsboro Road (now 21st Avenue) completed its renovation and was occupied. The Insurors portion of the building featured 11 offices and a classroom/meeting facility with a full kitchen. It provided a lot of new opportunities for the Association, including revenue generation through rent from other tenants, classes, and meeting rentals. Chuck added landlord to his list of many responsibilities and the building continues to be a great home base for our staff.

In 1996, with a volatile workers’ comp market and not enough competition in the state, Chuck helped form a new member services program called Preferred Comp of Tennessee. The program was launched in July and received over $1 million in submissions in the first week! The program expanded in 1997 with VolComp and went on to hit levels as high $25 million

in written premium. Chuck also spearheaded member programs for premium financing, earthquake insurance, public entities and many more.

In 1999, a landmark addition for the Association was set into motion. That was the year Insurors members began discussions to create Insurors Bank of Tennessee (now INSBANK). The bank was a response to the increasing fear of banks taking over the insurance industry through acquisitions and mergers. Chuck worked with the Board and Cumberland Bancorp to help set the new bank in motion. In under a year, the bank met its capitalization requirements and received regula¬tory approval from the State and the FDIC.

Prosperity for the Association continued into the new millennium, but the world changed on 9/11. Our 2001 convention was held just five weeks after the terrorist attacks, and many carriers and agents were involved in the insurance fallout. An estimated $32.5 billion in insured losses occurred, making it one of the largest insurance loss events in global history. Our convention continued, but with some of our lowest numbers in years.

With the recession hitting in late 2007, we saw even more change in the industry. Agencies were bought, merged and/ or went out of business. Workers' compensation changed in Tennessee and the markets changed with it. Insurors never took the hit we thought might be coming, but we had to brace for impact.