There are lots of insurance carriers that sell Workers’ Compensation. But only one is fanatical about protecting the lives of those that grow our communities. We take safety seriously. You could even say we’re hard headed about it.

To learn more about our complete insurance solutions, visit buildersmutual.com.

Email:

Editor:

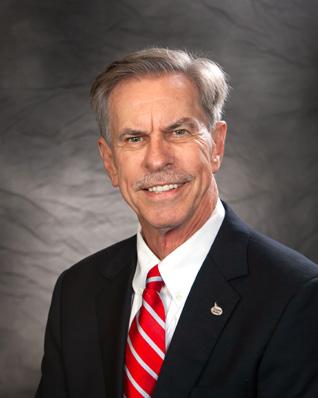

President

IIABA National Director

VP Region I, President-elect

Clevenger, CPCU, CIC, CAWC

McInturff III, ARM

Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III ................................................................Kevin Ownby

Treasurer ......................................................Richard Whitley, CIC

Secretary ................................................................Jamie Williams

Director, Region I ............................................Andrew Maddox

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ........................................................... Cy Young

Director, Region II ................................. Matt Felgendreher, CIC

Director, Region II ......................................................... Chip Piper

Director, Region II .....................................Cameron Winterburn

Director, Region III ...................................................Josh Gibbons

Director, Region III .................................................... Tim Goss, CIC

Director, Region III .................................................. Stuart Oakes

Director, Young Agents ............Samantha Organek, CIC, CISR

Immediate Past President ................. Matt Swallows, CIC, CRM

Cy Young | cy@haveninsurance.com | 731.577.4300

Jamie Williams | jwilliams@hcbins.com | 731.926.1200

Bobby Sain | bobby@bir-tn.com | 731.658.3011

Samantha Organek | skinney@griffinins.com | 865.376.3612

Chip Piper | chip@powell-meadows.com | 615.735.1111

Timothy Goss | timg@gossinsurance.com | 423.875.2500

VP Reg. I/Pres. Elect

Battle Bagley, III VP Region II

Kym Clevenger, CPCU, CIC, CAWC is a principle at Oakbridge Insurance in Knoxville and serves as the Vice President of Region III and President Elect. She is a Knoxville native and earned her Bachelor of Arts in Biology, Zoology and Medical Technology from The University of Tennessee at Knoxville. She is also a Registered Nurse. She started her career in the insurance industry in 1996 and earned her CIC in 2001, CPCU in 2007, and CAWC in 2013. Outside of her work with Insurors, Kym is a former president of the Associated Construction Women and enjoys reading, working out, traveling, scuba diving and sporting clays. She and her dog Betty have homes in Knoxville and Nashville.

Bobby Sain is President of Bolivar Insurance & Real Estate and serves as Vice President of Region I and President Elect. Bobby graduated from Bolivar Central High School and attended University of Mississippi. He later received an Associate Degree from Jackson State Community College. After JSCC, he went to work with his father at Bolivar Insurance & Real Estate. Bobby attended and completed several insurance educational classes including Hartford Insurance School for personal and commercial insurance, Hartford, CT. Bobby has always been active in his community where he enjoyed coaching baseball and supporting all Bolivar sports. In his spare time, he loves playing golf and music. He served as one of the youngest City Councilman in Bolivar at age 21 and in 2005 Bobby ran and was elected Mayor, City of Bolivar. In his term, the city received a grant which helped renovate and bring new businesses to downtown Bolivar. Bobby is presently Vice-Chair of Bolivar Downtown Development Corporation. He is also a board member at Western Mental Health Board of Trustees. Bobby and his wife DaJuan have 3 children, Blake, Chase and Shelby. They are members of First Baptist Church in Bolivar.

Battle Bagley, III, CIC, CPA is President of Bagley & Bagley, Inc. in Fayetteville and serves as Vice President, Region II. Battle has been working in the insurance business since 1987. Before that, he practiced accounting with the firm currently known as Puryear & Noonan CPA’s PLLC from 1982 to 1987. He earned his Bachelor of Business Administration in Accounting from Middle Tennessee State University in 1982. Battle has three grown children, Battle Bagley, IV, Samantha B. Jennings, and John Robert Bagley. He also has two granddaughters, Lilly Beth and Amelia Jennings.

Josh Gibbons | josh.gibbons@wataugainsurance.com | 423.929.7103

Matt Felgendreher | mfelgendreher@irmllc.com | 615.269.7887

Cameron Winterburn | cam@winterburninsurance.com | 931. 363.8638

Kym Clevenger | kclevenger@oakbridgeinsurance.com | 865.675.6500

Andrew Maddox | andrew@maddoxinsurance.com | 731.586.2241

Kevin Ownby is a co-owner of Ownby Insurance Service, Inc., in Sevierville and currently serves as Vice President Region III. A 1992 graduate of Sevier County High School, Kevin went on to obtain his Bachelor degree in Finance from the University of Tennessee in 1997. He has been with the family agency for 27 years, where he is now a third-generation owner. He previously served on the Board as Young Agent Chair, Director of Region III, Region III Vice President and Secretary. He also serves on the Big I National Health Care Task Force committee. Kevin also volunteers on the Board for the Boys and Girls Club of the Smoky Mountains where he has served as President and chairman of the One Campaign for the Boys and Girls Club’s annual fundraising efforts and is the state treasurer of the Boys and Girls Club of Tennessee. He currently lives in Seymour with his wife Brooke and their children Kendall and Braden.

John McInturff III, ARM is the President of McInturff, Milligan and Brooks in Greeneville and serves as your IIABA National Director. A Greeneville native, John Graduated from Greeneville High School and then attended the University of Tennessee, earning a B.S. in Business Administration in 1985. He began his insurance career with USF&G and then joined Bennett & Edwards of Kingsport in 1988 where he later became President. In 2006 the Tri-State Claims division of Bennett & Edwards merged with McInturff, Milligan & Brooks to form the current agency. John is a Past-president of the Insurors of Tennessee and has served the Insurors as the Young Agent Chair, Director of Region III, VP of Region III, Secretary, and Treasurer. In addition to his involvement with the Insurors, John is the Past President of Kingsport Jaycees, Past President of HVFC Soccer Club, Past President of Kingsport Rotary-Sunshine Club, and has been involved with Junior Achievement of Tri-Cities. He is a member of First Presbyterian Church of Kingsport and is currently serving his second term as an Elder. He and his wife Tonya reside in Kingsport and have two grown children, Lauren and Lindsey.

Richard Whitley, CIC is a principal agent with McDaniel-Whitley / Memphis Insurance Group in Memphis, and serves the IOT as Treasurer. He is a native of Covington and earned his BBA from Ole Miss. After working in the banking industry, he entered the insurance industry in 1997. Professional education for Richard includes earning the CIC and CBIA designations. Organizations he has previously been active with include the Insurors of Memphis, Collierville Rotary Club, West Tennessee Chapter of the Associated Builders and Contractors and Construction Financial Management Association. Richard is a twenty-eight year volunteer for the FedEx St Jude Championship, Memphis’ PGA Tour tournament. He and his wife Michelle have two daughters, Caroline and Emmy.

Jamie Williams, CIC, CRM is the agency manager for Hardin County Bank Insurance Agency in Savannah and serves as a Director of Region I. He is a native of Savannah and earned his Bachelor of Science degree in Business Administration from Union University. In addition to his work with Insurors, he is involved in his local church and is a member of the River City Kiwanis club. He and his wife, Lauren, have been married for 17 years and have 2 children, Lexie and Logan. Jamie enjoys hunting and golf as well as spending time with family.

Cy Young is a principal agent at both Young-Hughes Insurance and Haven Insurance Partners and serves as Director of Region I. Cy grew up in Alamo, TN, where he had been working in the Insurance industry and serving the community since graduating from Mississippi State in 2004. Having worked in the Insurance industry for over 15 years, Cy understands the need for an agency that is focused, forward-thinking, and always puts the client first. His experience as an independent agent continues to grow knowledge and skills to break the mold of traditional agencies and best serve the community. Cy is married to Jordan Leigh, and they have one daughter, Eliza, and a mini golden doodle, Stella. This State fan has converted his University of Mississippi Rebel wife, and together they enjoy cheering on the Bulldogs with their young daughter. In his free time Cy enjoys spending time with his family, grilling out with friends or on the golf course.

Andrew Maddox is the president of Maddox Insurance and serves as Director of Region I. Maddox Insurance has locations in Huntingdon, Camden, and McKenzie. Andrew has been in the insurance industry since 2009, and has a Bachelor’s degree in Business Administration and Management from Bethel University in McKenzie. He and his wife, Meagen, have three children, Bryce, Grey, and Elyza, and reside in Huntingdon, where they are very active in the community. Andrew has served on the City Council since 2018, is heavily involved at Huntingdon Church of Christ, and loves coaching his kids in youth sports. He is also the public address announcer for Huntingdon High School Football and helps support youth athletics programs across Carroll and Benton Counties. In his spare time, Andrew also enjoys hunting and traveling.

Pam Lofton-Wells is the owner of Lofton-Wells Insurance in Memphis and serving as Director Region I. She earned a degree in Risk Management from the University of Memphis and began her insurance career working with her father, Harry Lofton, starting an agency in their kitchen in 1982. Pam started her own agency in 1998 and helped build both businesses to what they are today merging the agencies when her father retired in 2019. Pam has served on the board for Mi Techo Inc., a nonprofit company that teaches about home ownership and guides individuals through purchase and the Crohn's and Colitis Foundation. She is passionate about building strong relationships with other female agents, mentoring to help them better their businesses. Before becoming an independent agent, Pam was a captive agent for Nationwide, winning six Nationwide’s Conference of Champions and was a four-time winner for Life University. Pam is a part of the IAOA and is a Dave Ramsey ELP. She resides in Memphis with her husband, Michael, who also works for the agency. They have two daughters, Lindsey and Kelsi. Kelsi has become a 3rd generation agent.

Matt Felgendreher is a native of Lexington, Kentucky, and a 2006 graduate of Rhodes College, Matt began his business career as a property and casualty insurance producer in Memphis, before joining WC Dillon Company/Insight Risk Management in August 2011. He combines strong technical insurance knowledge with the business acumen to fully interpret and mitigate a client’s exposure. In his current role as Executive Vice President, he oversees the commercial lines department of the agency, mentors new producers, and manages client relationships. Matt is a Certified Insurance Counselor (CIC). Matt served on the board of the Insurors of Tennessee as the Young Agent Director in 2022 and was recipient of the Insurors Young Agent of the Year award in 2022. He is also a legacy member of the Phoenix Club of Nashville, past-president of the Insurors of Nashville and past board member of the Nashville Humane Association. Matt and his wife Tori enjoy running, golfing and rooting for the Kentucky Wildcats..

Chip Piper is a vice president for Powell & Meadows and serves as a Director of Region I. Chip started working at Powell & Meadows after graduating from the University of Tennessee-Knoxville in 2009. He has enjoyed working with and learning from his father Phillip Piper. In 2017, Chip became Vice President and Minority Partner at the agency. Chip enjoys his job for many reasons but mainly because the insurance industry is constantly evolving which presents new opportunities and challenges. He enjoys finding the best solution for each customer's situation and helping them grow their business or protect their family. Chip and Phillip look to continue Powell & Meadows 127 year history well into the future. Chip is married to Stefani Piper and they have twins, Ella Lee and Cohen.

Cameron Winterburn is a principal of Winterburn & Associates Insurance Agency located in Pulask. He is graduate of the University of Tennessee at Martin in 2010 where he earned a BSBA degree in Business Administration and Finance. He has served on the Board of Directors of the Giles County Chamber of Commerce and is a member of the GCHS Booster Club. He and his wife, Katie, have been married 10 years and have two children, Ledger and Evelyn. Outside of work he loves to spend his time on the family cattle farm in Giles county.

Stuart F. Oakes, CIC, CRIS is the President of the Construction Division and Partner at TIS Insurance Services, Inc. in Knoxville, and serves as Director of Region III. Born and raised in Knoxville, Stuart graduated from the University of Tennessee in 2006 with a degree in Finance. He joined TIS shortly after graduating, and has held various positions in the agency, and was named President of Construction in 2020. Stuart is involved in several construction associations and the Construction Financial Management Association (CFMA). Serving the Insurors is in his blood, as both his grandfather, R.L. Oakes Jr., and his father, R.L. "Bunny" Oakes III, served as President of the Insurors of Tennessee in 1967 and 2002 respectively. His favorite thing outside of work is spending time with his wife, Mary Bailey, and his three boys James (9), Bailey (7) and Johnny B. (4).

Tim Goss, CIC is the president of Goss Insurance Agency in Chattanooga, and serves as a Director of Region II. Tim is a seasoned insurance professional with over 40 years of industry experience. He holds a CIC designation and is both president and founder of Goss Insurance Agency, established in 1985. Tim resides in Hixson but can often be found cycling on the roads in Chattanooga or traveling to Mexico with his wife Krista for mission work with villages in the Yucatan Peninsula.

Josh Gibbons is the President of Watauga Insurance, Inc. and serves as a Director of Region III. He is a past Young Agent Chair and past Region III Director. Josh began his insurance career as an underwriter for the Cincinnati Insurance Companies and has been in the family agency for over 20 years. He received his Bachelors in Business Administration from the University of Kentucky and is proud to be a part of the Big Blue Nation. Josh has been married to his lovely wife and better half, Lisa, for 23 years and they have 3 amazing children, Marisa, Grant and Corinne. When he’s not spending time with family, Josh is involved in his hometown community of Johnson City. He is Past President and currently serves on the Board of the Johnson City/ Washington County Boys & Girls Club. On the weekends, Josh enjoys English Premier League football, working in the yard, and playing golf on Sunday evenings.

Samantha Organek has been with Griffin Insurance, Kingston, since 2013 and has proven to be a vital agent demonstrating how far one can come by perseverance and believing in oneself. She completed her CIC designation in just one year’s time. She has served on the Young Agents Committee for two prior years before elevating to the role of Young Agent Director. Samantha (Sam) is knowledgeable in both commercial and personal lines in the agency and can help in both areas with new business and customer service. She currently resides in Oakdale with her two sons, Cooper & Sawyer and dogs George & Tulip. Sam enjoys exploring new places, hiking, kayaking, spending time with her boys and attending the Grove Church in Kingston.

Matt Swallows, CIC, CRM is the president of the Swallows Agency in Livingston, Cookeville and Smithville, and serves as Immediate Past President. He earned a degree in Finance from Tennessee Tech University and started his insurance career with Aetna in 1999. In 2001 he started with Swallows Agency, and has since earned his CIC designation (2007) and his CRM designation (2010). In addition to his work with Insurors, Matt served as the Mayor of Cookeville from 2010-14, and has served on the Cookeville Regional Medical Center Board of Directors and the Cookeville/Putnam County Chamber. He is the current Chairman of the Putnam County YMCA. He is married to Kelly Swallows, who is the VP of Operations for the agency, and they have two children, Channing and Xavier. u

The Insurors of Tennessee along with other insurance industry associations and companies hosted a Legislative Reception at the historic Hermitage Hotel in Nashville recently. The event was well attended by Insuors of Tennessee Board members and others giving them the opportunity to establish or strengthen relationships with their elected representatives in the Tennessee General Assembly.

The Legislative Reception was a prime opportunity for members to make their voices heard on a wide range of issues that directly or tangentially impact our industry including independent agents, insurance companies and insurance clients.

As an association, the Insurors of Tennessee is also able to make clear our collective position on pending or proposed

legislation to ensure we maintain a healthy independent agency system and insurance industry in Tennessee.

We are pleased to report that well over one hundred elected leaders attended the reception and actively engaged with our members. In addition, Carter Lawrence, who serves as the Commissioner of the Tennessee Department of Commerce and Insurance along with members of his staff also attended the event.

The 2024 Legislative Reception was a great success! We extend our appreciation to all who attended the reception and engaged with each other during the event. Provided below are photos from the reception at the Hermitage Hotel. u

The Young Agents of the Insurors of Tennessee are on the move. The organization has a new structure with individuals on the Young Agent’s Committee having different roles and responsibilities to power the activities of the group. In addition, the Young Agents Committee will meet virtually each month following a similar format of the Insurors of Tennessee Board meetings. There will be quarterly social events and new initiatives created across the state to enable Young Agents to have a greater impact on our industry and in our communities. Please see the list and photographs of the 2024 Young Agents Committee below:

Samantha Organek

Young Agents Director

Griffin Insurance Agency Inc

Kingston

Clark Kelman

Vice Chair

Chaffin & Riggins Insurance

Cordova

Jonathan Peters

Secretary

SouthPoint Risk

Nashville

John Brock

Immediate Past Chair

Brock Insurance Agency, Inc.

Rossville

Mac Hill Membership Development Chair

McDaniel-Whitley, Inc.

Memphis

Clark Powers InsurPAC Chair

Boyle Insurance Agency, Inc.

Memphis

We’re right here to do more.

To help support both your physical and mental health while giving back to our communities is to go beyond what is expected from a health insurance company. And that’s exactly why we do it.

RLI is a proud member of the Big “I”. Contact us to gain access to comprehensive insurance solutions and protect your commercial and personal lines customers from the unique risks they face. From our specialized solutions to our focus on building strong relationships with the agents we work with, we’re different. And at RLI, DIFFERENT WORKS .

PRODUCTS AVAILABLE THROUGH BIG “I” MARKETS:

• Home Business

•

Clark Hasler

Collegiate Relations Chair

Assured Insurance Consultants, LLC Dandridge

Nikki Reeder Events Chair

Boyle Insurance Agency, Inc.

Memphis

Jeremy Thacker Technology Chair

Gary Thacker Insurance

Chattanooga

Miller Lane

Region 1 Representative Bradshaw & Company Insurors Dyersburg

Chad Richardson

Region 2 Representative Swallows Insurance Agency Cookeville

Whitney Breazeale Thomas

Region 3 Representative Griffin Insurance Agency Inc

Kingston

Sopheary Le Company Liaison

Liberty Mutual Insurance

Nashville

Beth Roe Company Liaison

West Bend Mutual Insurance Co.

Bluff City

Kyra Garrison Staff Liaison Insurors of Tennessee

Nashville

Jake Smith Staff Liaison Insurors of Tennessee

Nashville

HLDI and IIHS study the effects of crash avoidance features by comparing rates of police-reported crashes and insurance claims for vehicles with and without the technologies. Results below are for passenger vehicles unless otherwise noted.

July 2023

Automatic emergency braking

50% Front-to-rear crashes

56% Front-to-rear crashes with injuries

14% Claim rates for damage to other vehicles

24% Claim rates for injuries to people in other vehicles

41% Large truck front-to-rear crashes

Automatic emergency braking with pedestrian detection

27% Pedestrian crashes

30% Pedestrian injury crashes

Lane departure warning

11% Single-vehicle, sideswipe and head-on crashes

21% Injury crashes of the same types

Blind spot detection

14% Lane-change crashes

23% Lane-change crashes with injuries

7%

8%

Claim rates for damage to other vehicles

Claim rates for injuries to people in other vehicles

Rear automatic braking

78% Backing crashes (when combined with rearview camera and parking sensors)

9%

Claim rates for damage to the insured vehicle

29% Claim rates for damage to other vehicles

Rearview cameras

17% Backing crashes

Rear cross-traffic alert

22% Backing crashes

Added costs

Lower crash rates are a clear benefit of these technologies, but some features can lead to higher repair costs in the crashes that do happen. That’s because sensors and other components are often located on the vehicle’s exterior. For example, in the case of forward collision warning without autobrake, the average payment per claim for damage to the insured vehicle goes up $118 for vehicles equipped with the feature.

The subject of this edition’s small town feature is the J. Paul Richardson & Son agency located in Fayetteville. Fayetteville is about fifty miles south of Murfreesboro on US 231 and a bit over thirty miles from Huntsville, Alabama. The city is the county seat of Lincoln County and was established in 1809 by an Act of the Tennessee General Assembly. Through the years Fayetteville became the county’s hub for government, commerce, culture, and events. The town has a rich history that features historic sites and a town square that offers visitors interesting shops and restaurants to enjoy. The town square is also home to festivals and celebrations throughout the year including the famous annual Slawburger Festival held every Spring.

for the United States. All this to say that Mr. Richardson could not have known the headwinds ahead for his family, business, hometown, and the nation when he started the agency. Yet, he and his business adapted, persevered, and prevailed to navigate the difficult war years. By 1951 the agency added insurance to its portfolio of services to diversify their offering and develop a new revenue stream for the business. It is interesting to note this would have coincided with the post WWII boom years, interrupted in part by the Korean War, where people were starting to form households, buy cars, and purchase houses that needed insurance. Fayetteville and the nation were growing and this created new opportunities.

J. Paul Richardson & Son is just off the town square and was founded in 1939 by J. Paul Richardson as a real estate firm. It was the first real estate firm to be formed in Lincoln County. Clearly, 1939 was a challenging year to start any business as America had just started to emerge from the Great Depression and the clouds of war were gathering in Europe. In fact, Nazi Germany conducted a surprise blitzkrieg attack on Poland during the morning hours of September 1, 1939. Within two days, Great Britain and France declared war on Germany and the start of WWII in Europe began with major implications

In 1968, John Richardson, son of J. Paul Richardson, joined the agency after earning a degree from the University of the South in Sewanee and attending the University of Tennessee School of Law in Knoxville for two years. John returned home to help his family in the agency and perpetuate the family business. John became a principal in the agency and continued to provide real estate and insurance to the Fayetteville community and beyond until his retirement in 2018. His son Paul Richardson worked in the agency part time while he was going to high school and when he was home from college on breaks.

After graduating from the UT, Knoxville with a degree in Animal Science and Agricultural Economics, Paul joined the firm in 2002 being the third generation of Richardsons to run the agency. Paul also operates a livestock farm on 170 acres using the knowledge he gained with his college degree.

Today, the agency continues to grow and prosper eighty-five years after it was founded by Paul’s grandfather. The agency primarily focuses on personal lines insurance while also writing commercial insurance for businesses. Through the superior service the agency delivers to clients it keeps retention ratios in the high nineties. As we all know, the best way to build a strong and resilient book of business is to keep the clients you have through great service as you seek new business. When asked what the greatest challenge is for the agency these days, Paul talks about the hard market which presents ongoing challenges relative to price and availability to varying degrees depending on the line of business and the exposure. When asked what he enjoys most about the business, he speaks about the ability to really get to know people, understand their insurance needs, and help them protect their property, exposure to liability, and overall financial security. Paul said he appreciates the small-town atmosphere of Fayetteville, where people are friendly, and everyone seems to know each other. It is the sense of a close-knit community that is perhaps most rewarding to Paul and his family.

Paul is a former Rotarian, having been a member of that organization for over 20 years and is a current member of the local Elks Lodge. He has also served on the board of the local public utility for over 15 years and continues in that role today.

Paul is married to his wife Jana who is a speech pathologist in Fayetteville. They have two children including daughter Allie who is attending MTSU pursuing a degree in business and son Jaxon who is in sixth grade. The family enjoys attending UT football games where they have had the same seats for over fifty years and traveling to new destinations each year. They also often make the short trek down to Gulf Shores, Alabama or Destin, Florida to enjoy the beach. Paul and his family are members of First Baptist Church of Fayetteville. u

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

Brent

Jane

This is my first article for the President’s section of the Tennessee Insuror magazine. I look forward to sharing my thoughts, plans, and observations about the business of the association including trends in our industry throughout the year. Ours is a complex business that is constantly changing to meet the needs of clients and is always evolving to adjust to the marketplace and economic realities. Fortunately, we have the Insurors of Tennessee at the state level and the Big “I” at the national level to help us all learn, adapt, and navigate this rapidly changing world. So, let's get started together.

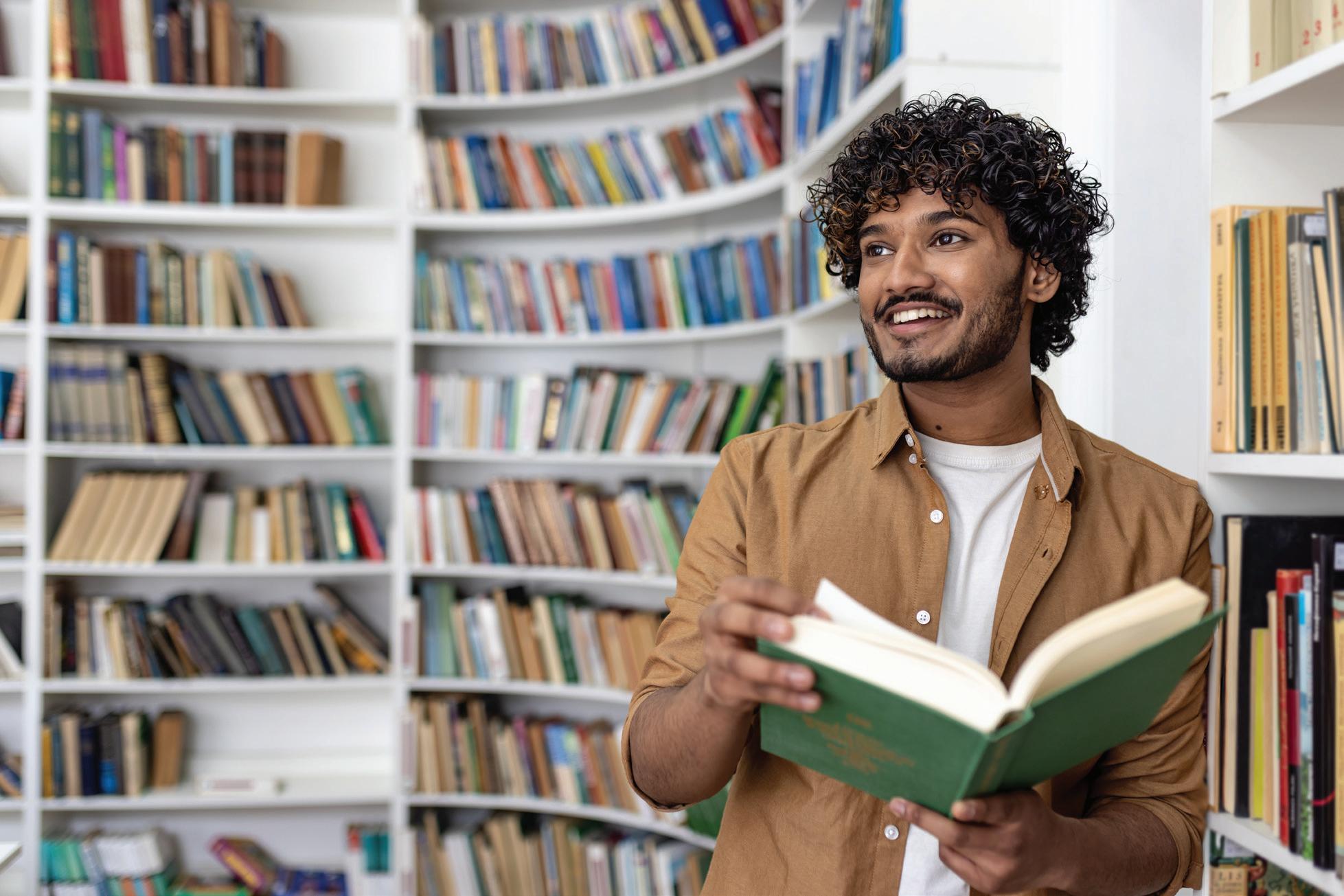

In my view, one of the keys to success for any insurance agency or insurance company is professional education. Knowledge and expertise are vital in providing the right insurance and risk management solutions to clients on a consistent basis. Professional education is also one of the most effective ways to differentiate your agency and to create a competitive advantage in a crowded marketplace. This is even more true during the hard market conditions we are encountering now. Insurance and risk management knowledge is the currency insurance agencies trade upon to consult with clients to help them make the right insurance and risk management choices. Moreover, strong expertise can assist in countering the myth that insurance is just a commodity product where the least cost option is the best value.

So, the first step in professional insurance education starts with effective licensing classes. These classes help ensure new entrants successfully pass their state mandated licensing requirement and leave the course with a durable foundation for future learning. In January, the Insurors of Tennessee hosted a new in person insurance licensing class in Nashville as a proof of concept. Over fifteen

students attended the class at no cost since this was the initial class. The new class was taught by an insurance professional that historically has a 100 percent license exam pass rate. From what we know anecdotally at this point, the students are performing quite well on the exams and have commented that the class was much better than on-line options. We anticipate moving forward with more in-person classes hosted in Nashville this year. In addition, the classes can be live streamed so people can access the class virtually from anywhere with the ability to ask the instructor questions and get answers in real-time. Beyond licensing classes, we encourage all principals and agency staff to avail themselves of the many insurance education opportunities the association offers both in-person and online this year.

For the past year or so, we have been emphasizing the growth and development of the Young Agents initiative in Tennessee. While it has always been an important part of the association, we recognize the need to have a more robust and active Young Agents program. After all, Young Agents are the future of this association and our individual agencies. In 2024, we have put in place a more structured program with members of the group being appointed to chair functional committees that mirror the Insurors of Tennessee Board of Directors. This new structure with distributed responsibilities will help the group set objectives and accomplish more in 2024. The new structure and responsibilities will also introduce the members of the Young Agents Committee to what it is like to serve on a board. In fact, this year’s Young Agents President, Sam Organek commented, “I am already getting acquainted with Robert’s Rules of Order to follow in the meetings.”

The Young Agents have an exciting Young Agents Conference scheduled in Nashville for April 25-26 in the Green Hills area of Nashville. Please mark your calendars accordingly. There will also be Young Agents social gatherings across the state throughout the year to build relationships and networks. Stay tuned for more from the 2024 Young Agents!

Another vibrant and active group within the association is the Women in Insurance (WINS) organization. Women comprise a vital part of the staff and leadership in agencies, insurance companies and in this association. We will continue to support this group of women who are so important to our continued success. WINS has already held their 2024 Kick-off meeting in January at the Insurors of Tennessee office in Nashville. The event offered a guest speaker, great food and refreshments, and the opportunity to build business connections and relationships. The group is planning additional events and activities throughout the year, so please watch out for communications from the group.

As you know, the Tennessee General Assembly and Congress are both in session. As a staff and board, we are fully engaged in important government affairs work at both the state and national level to protect the critical interests of members. In addition, 2024 is an election year and we need your financial support to ensure InsurPACTN at the state level and InsurPAC at the national level have funds available to support worthy candidates who are willing to hear what we have to say. Please visit the Insurors of Tennessee website at www.insurors.org/donate-toinsurpactn/ and download the forms to make your contribution today! u

The annual Big “I" Legislative Conference will take place April 10-12 at the Westin Washington, D.C. Downtown Hotel. During the conference, independent insurance agents and brokers from across the country will share their perspectives with legislators on issues important to the independent agency system.

This year's conference will focus on issues that have the potential to have a real impact on every agency's bottom line, which means your participation is crucial.

Here are four issues that will be a focus at this year's conference:

1) Oppose tax increases on Main Street America. The Big “I" supports “The Main Street Tax Certainty Act," which would make permanent the 20% small business deduction—Section 199A of the U.S. tax code—that was passed as part of the 2017 Tax Cuts & Jobs Act.

2) Address the insurance market crisis by cracking down on lawsuit abuse and encouraging risk mitigation. The property & casualty insurance market is cyclical and fluctuates between hard and soft

BY Teddie Norton Reilly - Big “I" Chief of Staff

BY Teddie Norton Reilly - Big “I" Chief of Staff

markets. However, insurance is currently amid an unprecedented property insurance crisis.

3) Protect the Federal Crop Insurance Program (FCIP). As Congress negotiates a new five-year Farm Bill it is critical to support policies that strengthen the stability and effectiveness of the FCIP. Crop insurance is an important risk management tool that helps farmers navigate the challenges posed by weather, supply chain disruptions, and uncertain markets. The Big “I" supports a strong and robust FCIP that provides certainty for farmers and communities and is strongly opposed to any legislative or regulatory efforts to reduce FCIP funding in the new Farm Bill or otherwise weaken the efficient and effective private sector delivery of crop insurance.

4) Extend and reform the National Flood Insurance Program (NFIP). The Big “I" strongly supports reauthorization of the NFIP before its expiration and recognizes the importance of a modernized program to increase take-up rates in both the NFIP and the private market.

Specifically, the Big “I" supports H.R. 900,

which would allow private flood insurance to satisfy continuous coverage requirements and ensure that consumers who leave the NFIP for the private market, but are later forced to return, can do so without penalty.

The Big “I" also opposes any policies that would harm the Write-Your-Own (WYO) Program, including WYO reimbursement reductions, and undermine the valuable and trusted role that independent agents play in the offering, sale and servicing of flood insurance. Finally, it is essential for FEMA to communicate with agents more clearly so they can explain rate setting and changes in premiums to their customers now that Risk Rating 2.0 has been fully implemented.

With a busy year ahead, the Big “I" is looking forward to agents and brokers from across the country advocating on Capitol Hill. Join us in April to bring your message to Congress. Visit the dedicated 2024 Big “I" Legislative Conference webpage to register and see the full schedule of events.

Excerpt from full article at www.iamagazine.com/topics/topic/on-the-hill

When Main Street is the main focus.

Running a successful small business is hard work, but finding the right insurance program for your client is easy with West Bend. Our business insurance program covers liabilities and expenses specifically designed for small business operations.

Learn more about the variety of business line coverages available through West Bend by visiting thesilverlining.com.

The worst brings out our best.®

I hope you all are doing well, and your year is off to a great start. To be sure, the first quarter of any year in the insurance business is important in helping to set the table for the remainder of the year relative to pursuing initiatives, meeting goals, staying on budget, and creating success. To that point, your association has gotten off to a fast start out of the gate to position the organization for a successful year as we meet the needs of members and advance key initiatives of the association in 2024. In January, I attended the Big “I” Winter Conference in Puerto Rico where Big “I” staff, association executives from the states, and members from across the nation met to discuss priorities for 2024 at the national level. As a group, we made real progress on a range of topics and issues in service of members across the nation.

Here in Tennessee, your state Board of Directors has already been active meeting and setting priorities for 2024 led by incoming President, Kym Clevenger. The board also welcomed its newest members, who were approved to serve at the 2023 Annual Convention. We look forward to their input and contributions this year. In this issue of the Tennessee Insuror, we introduce you to the full 2024 board complete with short biographies and photos. Please take a few minutes to get to know your representatives on the board. I encourage you to contact the member that represents your area if you have questions, comments, or issues you would like to put before the Board.

With the return of the Tennessee General Assembly to Capitol Hill, we are clearly focused on legislation being considered and issues that may arise in this session that warrant our attention. Our Government Affairs Consultant, Trey Moore along with the Insurors of Tennessee is carefully tracking bills to ensure we make our voices heard on any legislation or rules changes that require us to mobilize and engage to protect the interests of members. The government affairs work of this association is vital to the ongoing success of our industry in Tennessee.

In fact, the Insurors of Tennessee along with other industry related associations held a Legislative Reception at the historic Hermitage Hotel in Nashville at the end of January. I am pleased to say that we had excellent attendance and participation at the event by members of the association. We also had well over one hundred members of the Tennessee General Assembly stop by the reception to meet and speak with members of the Insurors of Tennessee. We were happy to see Tennessee Department of Insurance and Commerce Commissioner, Carter Lawrence, and his staff at the Legislative Reception as well. The value of establishing relationships, opening communication channels, and exchanging ideas at this event is substantial. While the Legislative Reception is important, we encourage you to stay in touch with your elected representatives to continue to build healthy and respectful relationships with your elected leaders throughout the year.

At the national level, we are preparing to travel to Washington, D.C. for the Big “I” Legislative Conference being held April 10-12, 2024, in Washington, D.C. where we will have the opportunity to meet the Tennessee’s congressional delegation to discuss issues and any pending legislation of importance to our members, staff and Board. We will also have ample opportunity to learn from the Big “I” staff, other state associations and others as we work together to make certain our voices are heard in Washington, D.C. on critically important issues relative to our industry.

This conference is also a great event for a promising Young Agent or future leader in your agency to attend. The leadership and development opportunities are significant throughout the conference. So, consider bringing a young agent with you this year as you build the strength of agency staff. There will be more detailed information about the conference forthcoming. We sincerely hope you will plan on making the trip with us in April. Please be sure to contact me or Jake Smith, if you have any questions about the conference. We hope to see you there!

One last point. I encourage you to take advantage of your membership and all the Insurors of Tennessee has to offer. From education to products, we can help build and strengthen your agency in an ever more competitive marketplace in these “hard market” conditions. Be sure to visit our website, engage at our events, and feel free to call me or a member of our staff to answer questions or assist you. We are here for you and interested in helping you create success. u

The Tennessee Insuror

Many of you may already know Sam Organek from her participation in the Young Agents the past several years serving on the committee and working to advance the mission of the Young Agents across the state. Since some of you may not be acquainted with Sam, we are pleased she is the subject of the Future Leader’s Spotlight in this edition of the Tennessee Insuror magazine. It should also be noted that Sam is the 2024 President of the Young Agents in Tennessee.

Sam is employed by Griffin Insurance Agency located in Kingston, Tennessee just outside of Knoxville. She was hired and introduced to the insurance business by Johnny Griffin who is a stalwart member and supporter of the Insurors of Tennessee for many years. Sam grew up in nearby Oakdale, Tennessee and is a graduate of Harriman High School. She also attended Roane State Community College.

We all end up in the insurance business through different routes and from diverse backgrounds. It is in fact one of the great strengths of our industry. This is one of those stories. At eighteen years old, Sam Organek worked at a local Hardee’s restaurant as a manager when she was approached by a member of the community who knew Johnny Griffin was seeking to hire a new employee for the agency. As it turns out, Sam was looking to make a change. The interview went well, and Johnny Griffin offered her a job in the agency. So, in 2013, Sam joined the Griffin Agency and started her insurance career as a receptionist. About six months later, she studied for and passed her insurance license test,

opening new opportunities for her in the agency. She started working in the Personal Lines department and continued to work in that department for three years and then moved into the Commercial Lines. She worked in Commercial Lines for a time and is now back working in Personal Lines today.

Sam earned her CISR designation in 2016 and her CIC designation in 2022. She noted that Johnny Griffin strongly encourages professional education and continuing education for all members of the staff. As such, she is currently considering additional professional education to further her knowledge about insurance and risk management.

When asked what her long-range goals are for her career, she says “I want to own an agency at some point and continue to assist people to protect their property and financial interests.” She explains that she genuinely enjoys consulting with clients to help them identify their insurance and risk management needs and the solutions available to them to mitigate their exposure to risk. She makes clear, rather than just “selling” to clients she is a proponent of establishing a truly consultative relationship.

In discussing the biggest challenges, she has encountered thus far in her career, she quickly identifies the current “hard market” everyone is having to deal with while trying to serve clients. Sam, like many in her peer group, has not encountered these market conditions before, so it is an eye-opening experience. Nevertheless, she is using this experience to continue to develop her capabilities to serve clients going forward.

Sam became involved with the Young Agents when Derek Wright recommended her to the Insurors of Tennessee. She started her tenure with the group serving on the Young Agents committee in 2020 where she learned about the activities and mission of the group. In 2024, she is now President of the Young Agents

in Tennessee and is looking forward to collaborating with other members of the organization to enhance the development of the group and to have a meaningful impact on the insurance business in our state.

Already, the group has embarked on a restructuring effort where members of the group will have specific areas of responsibility to enhance their effectiveness. They are now meeting monthly via video conference, holding quarterly Young Agent socials across the state, and getting ready for the 2024 Young Agents Conference being held in Nashville on April 25-26. If you’re a Young Agent, please mark your calendars and make plans to attend. You can register now at https://www.insurors.org/young-agents-conference/.

On a personal note, Sam shared some big news during our teleconference. She is now engaged and will be planning a wedding soon with her fiancé Tyler. Sam has two sons Cooper (age 9) and Sawyer (age 5) while Tyler has one son Kainen (age 5). With three boys in the mix, the couple stay quite busy. In their free time, they enjoy going to museums, historical sites, and visiting national parks. They have already visited the Great Smoky Mountains National Park, Ft. Sumter National Historic Park, and the Wright Brothers National Memorial, among others. In fact, they have a National Parks Passport and look forward to visiting America’s great parks across the nation.

We look forward to seeing all Sam Organek and her colleagues in the Young Agents can accomplish this year. We also offer best wishes to Sam and Tyler as they embark on this new journey together as a family! u

ACCIDENT FUND INS. COMPANY OF AMERICA

AMTRUST

ASSOCIATED INSURANCE ADMINISTRATOR

BERKSHIRE HATHAWAY GUARD INS.

BURNS & WILCOX

THE CASON GROUP

CELINA INSURANCE GROUP

CINCINNATI INSURANCE

CORNERSTONE NATIONAL INSURANCE

EMC INSURANCE

FRANKENMUTH INSURANCE

J.M. WILSON

GOVERNMENTAL RISK INSURANCE PLANS

METHOD INSURANCE

NATIONAL GENERAL, AN ALLSTATE COMPANY

PIE INSURANCE

PREVISOR INSURANCE

RT SPECIALTY

SAFEWAY INSURANCE COMPANY

SOUTHERN INSURANCE UNDERWRITERS

UTICA NATIONAL

WESTFIELD

As legislators reconvened for the second session of the 113th Tennessee General Assembly, Insurors of Tennessee was on hand through its continued commitment to be the voice for independent insurance agents. Your association continues to advocate for policies that balance the needs of the industry, consumers, and communities; and it’s never been more important.

By actively engaging in the legislative process to keep lawmakers informed about the potential impact of proposed legislation, the association serves as a vital bridge between policymakers and our members. Through continuous dialogue, Insurors of Tennessee ensures that legislative and regulatory decisions are well-informed and grounded in an understanding of the crucial role independent agents play in safeguarding the well-being of consumers across the state.

Current market dynamics make our efforts even more critical as we turn the page to 2024. The hard market, characterized by increased premiums and reduced capacity, poses significant challenges for both agents and policyholders. At Insurors, we are hard at work to educate lawmakers on the root causes of this market shift, including increased claims costs and loss escalation, economic inflation, and increased extreme weather events. Insurance investment capital contracted in 2022 while home values, replacement costs, and prices for used cars rose through 2023.

In educating policymakers about the current hard market, Insurors of Tennessee emphasizes the importance of lawmakers understanding the intricacies of the insurance market to make informed decisions that benefit both industry professionals and the consumers who rely on your expertise.

Effective January 1, 2024, the Tennessee Department of Commerce and Insurance (TDCI) has implemented Rule 0780-01-86-.07, “Suitability of Annuity Transactions for Life Insurance Producers.” The rule prohibits insurance producers from soliciting the sale of annuity products unless they possess sufficient knowledge to recommend the product and comply with the insurer's training standards. Producers can fulfill this requirement by relying on insurer-specific training standards and materials.

• Producers engaged in annuity sales and holding a life insurance line of authority before January 1, 2024 must complete a one-time four (4) credit training course approved by the Department by June 30, 2024.

• Producers who obtain(ed) a life insurance line of authority after January 1, 2024 cannot sell annuities until completing the mandated training course.

To verify compliance, insurers must confirm that producers have completed the required training, maintaining records accessible to the Commissioner upon request.

We field a lot of questions from members throughout the year, and many of them force us to do some real thinking (and research) which we enjoy. (Although we appreciate your patience when the legislature is in session!) Sometimes a particular question will surface a number of times, from multiple agents, signaling trends across the state. So, we thought we would try a new feature in these pages where we choose one that seems to be on the minds of a lot of Insurors members and share our response here, in the hope that you find it useful.

“We’ve seen a number of carriers recently move to begin depreciating labor when calculating actual cost value (ACV). Can they do that?”

Good question! A quick Google search returns this headline from the reputable National Law Review: “Tennessee Supreme Court Holds That Replacement Cost Less Depreciation Does Not Allow for Depreciation of Labor When Calculating Actual Cash Value of a Property Loss.” And note this one from the state’s Administrative Office of the Courts (AOC), “Tennessee Supreme Court Rules Insurance Companies Cannot Depreciate Labor Costs in Insurance Payments for Property Damage.”

Pretty clear, right? Not exactly. A closer reading of these and the underlying case, Lammert, et. al. v. Auto Owners (Mutual) Insurance Company (2019), is nuanced, limited to the specific facts of the case.

The AOC eventually summarized the crux of the issue as follows: “The Supreme Court determined that the language of the policies was ambiguous, that is, susceptible to two or more reasonable interpretations, regarding whether labor costs could be depreciated. Under Tennessee law, when an insurance policy is ambiguous, the policy is construed against the insurance company as the author of the policy. Consequently, the ambiguous policy language in this case had to be interpreted in favor of the homeowners, meaning that labor costs could not be depreciated when calculating actual cash value.”

That is to say, the real issue in the case was that the policy terms were unclear (i.e. ambiguous) as to what was depreciable. Although the headline seems definitive and sweeping, it would have been more accurate to say, “Tennessee Supreme Court Rules Insurance Companies Cannot Depreciate Labor

Costs in Insurance Payments for Property Damage Where the Terms of the Policy are Ambiguous.”

It begs the (next) question: what if the policy is clear and unambiguous? At this point the Tennessee Supreme Court hasn’t said they can’t; but we suspect they’ll be asked in the not-so-distant future. In the meantime, we would answer that question the way we often do: “What does the policy say?”

The information contained in this article is provided for informational purposes only and should not be construed as legal advice.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

Our consulting services compliment your dedicated payroll analyst and our proprietary payroll system through a dedicated Business Unit. That Business Unit is the key to unlocking all the expertise and tools BBSI has to offer. They’ll work with you to strategically address the HR, Risk or Safety issues that hold you back from achieving your goals.

Each dedicated Business Unit, in addition to the Payroll Analyst, includes a Human Resources Consultant (HRC), a Risk Management Consultant (RMC), and a Business Partner (BP)

Our WINS group started the new year on a high note with the annual kickoff event. Held at the Insurors office on January 25, the event brought together over 30 insurance professionals from across the state to celebrate successes, share insights, and set the tone for a year of growth and collaboration. We were also delighted to be joined by three aspiring insurance professionals from the MTSU Risk Management Program and their program coordinator, Rebecca Darden. Attendees were treated to inspiring speaker Greg Nagel, who led an interactive Dale Carnegie for beginners session, ensuring that attendees gained practical knowledge applicable to their roles. By the end of the session all attendees were feeling comfortable and confident in engaging with one another.

Networking has always been a cornerstone of Insurors of Tennessee events, and the January WINS kickoff was no exception. Attendees had the chance to connect with peers, exchange ideas, and establish valuable professional relationships. The collaborative atmosphere encouraged open discussions and the sharing of best practices, further strengthening the sense of community within the association. The event also provided an opportunity to welcome new members to the Insurors of Tennessee.

The WINS community left the kickoff event energized and ready to embrace the challenges and opportunities that 2024 will undoubtedly bring.

we give you peace of mind, which gives us peace of mind.

We are dedicated to the independent agency system and proudly stand behind the agents who represent us. auto-owners.com

Tech solutions for you and your customers—now and into the future

At Progressive, we’re always thinking about ways to push our business forward with innovations like our leading telematics solutions: Snapshot® for personal auto and Snapshot ProView® and Smart Haul® for your commercial customers. Plus, we’ve rolled out a multi-product quoting platform that makes bundling easier than ever.

With breakthroughs like these and more, you can feel confident that while you’re focused on your customers, we’re focused on what’s ahead.

Tech leadership—it’s in our DNA.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

National Security has provided competitive, affordable insurance to policyholders for over 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

National Security prides itself on fast, efficient service from our experienced staff teamed with an agent website that provides fast quotes, online policy issuance, and real-time policy information.

To learn more about our products call 1-800-798-2294 or visit nationalsecuritygroup.com.

WeSure Digital Insurance Services, Inc. (“weSure Digital”), the US MGA subsidiary of the Israel-based WeSure Global Tech Ltd, has entered into a Partnership agreement the Ohio based network, Insurors of Tennessee weSure currently writes over $1.8 billion in DWP globally as a multi-line and multi-segment publicly traded international insurance group, and in the US, weSure Digital is backed by a large industry-leading insurance carrier with a financial strength rating of “A-” (Excellent) by AM Best.

Earlier this year, weSure launched its fully digital insurance offering for small businesses in the US, starting with a Business Owner’s Policy (BOP) product in Ohio, and soon after they rolled-out their innovative digital BOP product into Indiana and Michigan. weSure is excited to now expand to Pennsylvania, Virginia, Tennessee, North Carolina, and South Carolina. weSure will be continually expanding to additional states and will be introducing additional products for the small commercial segments in 2023 and beyond.

With this exciting new partnership, weSure Digital brings its highly efficient, flexible and transparent business model with a competitive edge on pricing and coverages to agents, brokers and wholesalers. With their next-generation BOP product, weSure offers fully digital quote to bind capabilities for a very wide variety of business classes through multiple distribution platforms, including B2B & white-labeled B2B2C.

Ben Schreurs, Vice President of Sales & Distribution at weSure Digital adds: “We’re proud and excited to partner with Insurors of Tennessee and to support independent insurance agents under their umbrella. This partnership will help Tennessee agents better serve their SME clients and efficiently grow their businesses with a range of small commercial digital insurance products and tools. I would like to thank the Ron Travis and The Insurors of Tennessee for their wonderful support and cooperation in making this partnership a reality – we look forward to jointly supporting the agencies associated with Insurors of Tennessee and are quite excited to build on this new partnership.”

weSure Digital is currently actively appointing agents within Insurors of Tennessee. Getting appointed is very simple!

To submit your appointment application and take advantage of this new partnership opportunity, visit https:// wesuregroup.com/

To learn more about weSure Digital, visit https://wesuregroup.com/ or reach out directly to:

· Mark Stephenson, Regional Sales Leader at Markst@wesure-usa.com

· Ben Schreurs, Vice President of Sales & Distribution at bensch@wesure-usa.com

· Stefan Stefanov, Chief Strategy & Commercial Officer at stefan@wesure-usa.com

J.M. Wilson announces the promotion of Laura Cole to Fleet Transportation Underwriter. She is responsible for underwriting a wide variety of new and renewal fleet transportation risks, as well as nurturing relationships with carrier underwriters and independent insurance agents in all states. Laura joined JM Wilson in 2020 as an Assistant Fleet Transportation Underwriter. Her background includes previous roles as Intake Specialist, English Instructional Assistant, Adjunct English Instructor, and ESL Instructor. Laura has earned a Master of Arts in English/English Literature, as well as a TESOL certification from Youngstown State University. In addition, she earned a Bachelor of Arts in Humanities/Comparative Studies in Literature from Ohio State University.

Brendan Hagan and Zeb Cornwell join J.M Wilson as Assistant Fleet Transportation Underwriters. Their responsibilities include providing vital support to underwriters with a wide variety of new and renewal fleet transportation risks.

Brendan Hagan is a Central Michigan University graduate with bachelor’s degree in management and Spanish. Prior to joining JM Wilson, he was a carrier sales representative.

Zeb Cornwell is a graduate of Olivet College with a bachelor’s degree in insurance and risk management. His previous experience includes an internship in personal lines sales.

JM Wilson announces the addition of Samantha Mitchell as Accounting & Finance Specialist. Samantha’s responsibilities include a variety of accounting duties including invoice processing, collections, cash management, month-end closing, and customer support for all JM Wilson offices. Samantha joins JM Wilson with over five years in the insurance industry working for an agency. In addition, she earned a Bachelor of Applied Arts degree in Management from Baker College of Muskegon.

Acuity announced that in 2023 the company surpassed $2.6 billion in annual revenue for the first time in its 98-year history. The insurer’s 17% growth rate in 2023 generated a record $378.3 million increase in topline revenue.

“Our continued growth validates our business strategy and provides resources that position Acuity for the future,” said Melissa Winter, Acuity President. “As we move forward with intentionality, we will continue to target profitable opportunities by leveraging our partnerships with independent agents, diversifying our operations, and integrating market strategy across our organization.”

“Acuity’s ongoing business expansion and financial stability enable us to fulfill our common purpose of caring for our family of employees, agents, and customers while staring down risk,” said Ben Salzmann, Acuity CEO. “We are proud to be providing peace of mind to even more customers, serving more and more agents, and creating additional career opportunities for our people.”

Acuity’s 2023 growth was fueled by increases across its 31-state operating territory and gains in both personal and commercial lines. In personal lines, the company achieved a record $611 million in revenue, including nearly $146 million in new business premium. In commercial lines, Acuity wrote over $340 million in new business premium, issued over 37,000 new policies, and responded to nearly 129,000 quote requests. With Acuity’s growth comes increased job opportunity: the insurer plans to hire approximately 150 in 2024.

RLI Corp. announced today that its A+ (Superior) financial strength rating (FSR) has been affirmed by AM Best Company for the following insurance subsidiaries: RLI Insurance Company, Mt. Hawley Insurance Company and Contractors Bonding and Insurance Company (CBIC).

AM Best also affirmed the Long-Term Issuer Credit Ratings (ICR) for each RLI company. The RLI Corp. ICR of “a” (Excellent) was affirmed and the ICRs of “aa” (Superior) have been affirmed for the following subsidiaries: RLI Insurance Company, Mt. Hawley Insurance Company and CBIC.

AM Best, a global credit rating agency, news publisher and data analytics provider specializing in the insurance industry, stated in its press release that the ratings “reflect RLI’s balance sheet strength, which AM Best assesses as strongest, as well as its strong operating performance, favorable business profile and very strong enterprise risk management.”

Selective Insurance Group, Inc. reported financial results for the fourth quarter ended December 31, 2023, with net income per diluted common share of $2.01 and non-GAAP operating income per diluted common share of $1.94.

For the quarter, Selective reported a combined ratio of 93.7%, 1-point better than a year ago. NPW grew 17% from a year ago with strong top-line growth across all three insurance segments. After-tax net investment income increased to $78 million, 20% higher than the fourth quarter of 2022. This strong underwriting and investment performance generated non-GAAP operating ROE of 18.2%.

For the year, Selective generated net income per diluted common share of $5.84 and non-GAAP operating income1 per diluted common share of $5.89. The 2023 combined ratio was a profitable 96.5% and overall NPW increased 16% from a year ago. After-tax net investment income was $310 million, 33% higher than 2022.

"2023 marked a significant milestone for Selective as we achieved our 10th consecutive year of double-digit operating ROE and exceeded $4 billion of net premiums written for the first time in our nearly 100-year history," said John J. Marchioni, Chairman, President and Chief Executive Officer.

"Our annual operating ROE of 14.4% exceeded our 12% target, and net premiums written increased 16%. In an environment of elevated and uncertain loss trends, we remain focused on disciplined underwriting to consistently achieve our 95% combined ratio target. Standard Commercial Lines and Excess & Surplus Lines, representing approximately 90% of NPW, are performing at or better than our combined ratio target and producing excellent top-line growth. As we continue our transition to the mass affluent market, aggressive profit improvement plans are underway in Standard Personal Lines."

"Selective's consistent ROE, averaging 12.2% over the past decade, is a significant accomplishment. During this time, we more than doubled NPW and book value per share, nearly tripled operating income, and advanced key strategic initiatives. Our talented employees and close relationships with distribution partners are two core competitive advantages enabling us to uniquely serve our customers and generate profitable growth. We are very well-positioned heading into 2024," concluded Mr. Marchioni.

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership.

Why insurance firms choose to partner with Higginbotham:

• Ten-year average return of 30% IRR

• Ten-year average annual shareholder distribution of 25%

• Insurance Business America, 2022 Top Insurance Employer

• Privately-held and run by insurance professionals

• Majority ownership held by employee shareholders

• Leverage Higginbotham’s consistent 20% compound annual growth rate

• Broad risk management and benefit plan services add client value to support your growth

• Maintain your leadership role

• $5 million donated to nonprofits through the Higginbotham Community Fund

Are you ready to soar?

Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com

See what our agency partners are saying

Our Tennessee-based Partners

BlueCross BlueShield of Tennessee (BCBST) has earned a spot on Forbes’ annual list of America’s 600 best large employers for the seventh time since 2016.

“As we continue embracing remote work and providing meaningful opportunities for our people to thrive, it’s clear our people appreciate our approach,” said Roy Vaughn, senior vice president and chief human resources officer at BCBST. “Our employees share a consistent commitment to excellence in serving our members, and it’s an honor to know that our efforts to be an employer of choice are highly valued.”

The 2024 ranking once again places BCBST well ahead of some of the globe’s most-recognized companies. Coming in at #11 this year, BCBST is the state’s second highest-ranked large employer. The company is the top insurer for the second consecutive year and the highest-rated of the six Blue plans that earned placement.

BCBST’s latest rating adds to its list of Forbes achievements. Over the past eight years, the company has ranked in Forbes as one of the best employers for women and one of the best employers in Tennessee. Additionally, Forbes research has rated BCBST a top employer for diversity every year since 2019.

The list is developed by Forbes and market research firm Statista, who surveyed more than 170,000 Americans working for businesses with 5,000 or more employees. Surveyers asked respondents how likely they were to recommend their own employer to friends and loved ones, and to share their thoughts about other employers in their respective industry. Respondents were offered the opportunity to nominate organizations other than their employer. The final list ranked the top 600 large employers that received the most recommendations.

For the fourth consecutive year, Liberty Mutual Insurance has been named one of Foundry's Computerworld 2024 Best Places to Work in IT, ranking number 34 among large organizations. The list, which recognizes organizations that provide exciting career opportunities for their IT teams while offering great benefits and compensation, selected Liberty Mutual based on results received from the 2023 Best Places to Work in IT survey.

“Technology is playing an increasingly important role in modern business. IT professionals continue to benefit from this trend, as this year’s winning organizations increase staffing and offer a variety of pathways to upskill, reskill, and diversify their teams,” said Rob O’Regan, global director, content strategy, Foundry. “These companies provide a model for IT and HR leaders who are looking for new ways to attract, engage, and retain talent in an increasingly competitive IT environment.”

Through an investment in comprehensive benefits, flexible hybrid work, and a continuous learning environment, Liberty Mutual is dedicated to supporting employees personally and professionally. With opportunities to work in areas across cloud, cybersecurity, data, software engineering, and data science, employees are empowered to use their skills to drive impactful change and the industry forward.

“At Liberty Mutual, we are not just building platforms and products on a global scale, we are also building the future of the industry with our innovative approach to technology and employment," said Liberty Mutual Insurance Executive Vice President and Chief Information Officer, Monica Caldas. “Our achievement is a testament to our dedication of empowering our employees to do their best work, providing them with the necessary tools and environment to pave the way forward in a rapidly evolving industry landscape.

Ryan Specialty Holdings, Inc., a leading international specialty insurance firm, announced that William J. Devers retired from the Company’s Board of Directors, effective December 31, 2023. “Bill Devers has been on the Board of Ryan Specialty since 2013 and has been a trusted advisor, colleague and friend over the years. We thank Bill for his time and advice that has been so instrumental in guiding Ryan Specialty these past 11 years,” said Patrick G. Ryan, Chairman of the Board of Directors.

Concurrently, Pat Ryan, Jr. has been appointed to Ryan Specialty’s Board of Directors, effective January 1, 2024. Pat Ryan, Jr. is a technology entrepreneur and investor. Pat founded two high growth software as a service (SaaS) companies, each of which was ranked by Inc. Magazine as one of the four fastest growing U.S. software companies. He also cofounded early-stage venture capital firm Chicago Ventures and is currently the Founder and CEO of Incisent Labs Group, a holding company and incubator for creating new technology companies. Pat served for 25 years on the board of Penske Corp.

“We are very excited to welcome Pat to Ryan Specialty’s Board of Directors,” said Patrick G. Ryan. “Pat will bring a new

dimension to our Board with his deep knowledge of technical excellence in business. He has a proven track record of success with high growth companies, and we welcome his strategic and knowledgeable insights.”

Commenting on his appointment to the Board, Pat Ryan, Jr. stated: “It is an honor to join the Board of Ryan Specialty. As an industry leader, the firm continues to evolve and innovate based on the needs of their clients and the insurance market. I look forward to assisting in the guidance of Ryan Specialty’s continued long-term growth.”

The Travelers Companies, Inc. today completed its previously announced acquisition of Corvus Insurance Holdings, Inc., an industry-leading cyber insurance managing general underwriter that is powered by proprietary technology. “We have forged a strong strategic partnership with the talented team at Corvus over the past year, and we are pleased to officially welcome them to the Travelers family,” said Alan Schnitzer, Chairman and Chief Executive Officer of Travelers. “With a proven platform and deep cyber underwriting and risk management expertise, Corvus brings to Travelers important cyber capabilities.”

Corvus has developed an industry-leading suite of integrated cyber sales, underwriting, service and support capabilities. Through its platform, Corvus effectively identifies vulnerabilities throughout the policy period to reduce customers’ exposure to cyber events. Corvus’ platform also delivers distribution efficiencies to insurance agents and brokers. Travelers funded the acquisition through internal resources. u

Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

Cyber Liability

Energy

Healthcare

Hospitality

Marine

Social Services

Sports & Entertainment Transactional

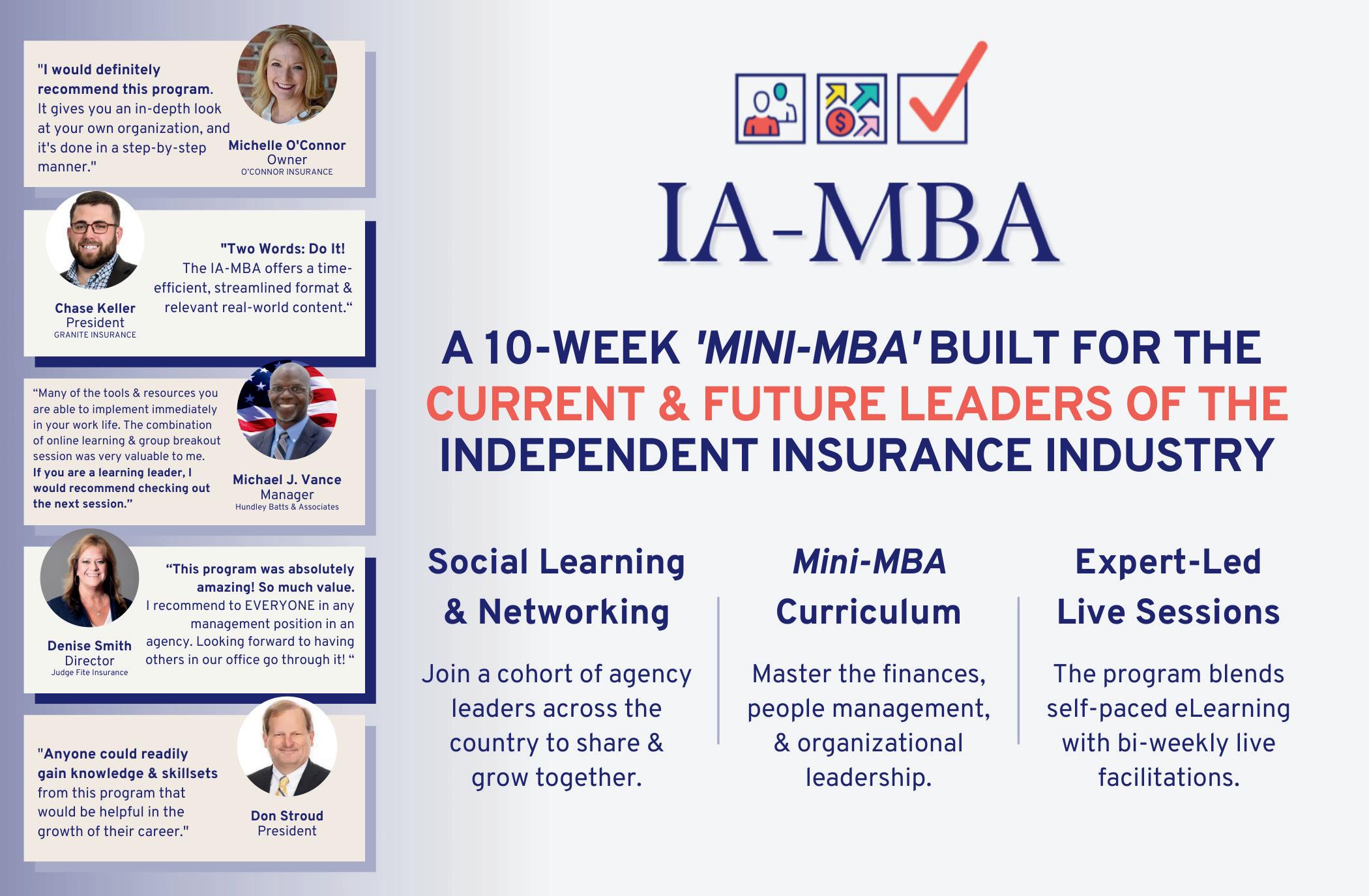

Who: Young Agents, Seasoned Agents, Company Reps, & Exhibitors!

What: 2 Days of industry and association connection for agents and company representatives alike. We will have interactive sessions, a trade show, evening party, industry guest speakers, and more!

When: April 25th - 26th

Where: Hilton Green Hills, Nashville

Why: The younger generation of agents is shaping the future of our industry!

Register NOW to attend the 2024 Young Agents Conference in Nashville...scan the QR for a direct link!

Formerly the 'Agency Growth Conference' this event is tailored to our Young Agent members who are looking to connect, learn, and engage within our industry to build a better foundation for their insurance career! We also encourage our experienced agent members to attend and connect with our Young Agents - your industry expertise is vital for the future generation of our industry!

Schedule All Times Central

Thursday, April 25

11:00am - 2:15pm Exhibitor Setup

1:00pm Onsite Registration

Hello TN Young Agents! I'm Kelly Donohue-Piro. Join me to learn all about "Navigating the Hard Market" on Friday, April 26. See you soon!

1:30pm - 2:15pm Agent Opening Session "Meet Your Young Agents Committee" (Tyne Ballroom)

2:!5pm - 4:15pm Trade Show & Reception (Jackson + Harding Ballroom)

4:15pm - 5:00pm WINS Breakout Session

5:00pm - 6:00pm Charity Breakout Session (Tyne Ballroom)

6:00pm - 9:00pm Evening Party (Offsite - The Crows Nest)

Friday, April 26 All Friday sessions take place in Jackson + Harding Ballroom

7:45am - 8:45am Breakfast + Words from our President

8:45am - 9:00am Business Break

9:00am - 10:00am Agent Session #1 "Navigating the Hard Market" with Kelly Donohue-Piro Approved for CE

10:00am - 10:15am Business Break

10:15am - 11:15am Agent Session #2 Cyber Coverage with Jay Williams Approved for CE

11:15am - 11:30am Closing Remarks

Lunch served at conclusion of program

For more than 60 years, we’ve built a business based on basic principles: handle claims quickly and fairly, provide superior service and put people first. At FCCI, we help businesses thrive, manage risks and face the future with confidence.

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. Classes with (*) have option for in person or webinar event.

3/14 Commercial Casualty I* Nashville

4/11 Insuring Personal Residential Property * Nashville

6/13 Commercial Casualty II* Nashville

7/11 Insuring Personal Auto Exposures* Nashville

4/23-24 Ruble* Nashville

5/13-14 Agency Management * Nashville

7/31-8/1 Commercial Property * Nashville

Other

4/25-26 CE at Young Agents Conference 2024 Nashville

Additional courses for designation programs are offered on-demand at your own pace and as live webinars.

The National Alliance for Insurance Education & Research is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417. Website: www.nasba.org. Advanced Curriculum Rating = 20 CPE Credits. For more information regarding administrative policies such as complaint and refund, please contact our offices at 800-633-2165.

Additional courses are available On-Demand and as Live webinars at the IIABA Virtual University *check the VU site for course offerings, CE and pricing (independentagent.com/vu)

From The National Alliance (www.scic.com)

Choose from the following programs CIC, CRM, CISR, CPRM, CSRM, Dynamics, RGS, MEGA, PROFOCUS, WTH, Intro, Producer School, Ethics, Flood and other. Choose by topic, location, delivery method and/or date.