Phone 615.385.1898

Toll Free: 1.800.264.1898

Email: marketing@insurors.org

Editor: Ron Travis

Publisher: MarketWise, Inc

President ..............................Kym Clevenger, CPCU, CIC, CAWC

IIABA National Director ........................John McInturff III, ARM

VP Region I, President-elect ......................................Bobby Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III ................................................................Kevin Ownby

Treasurer ......................................................Richard Whitley, CIC

Secretary ................................................................Jamie Williams

Director, Region I ............................................Andrew Maddox

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ........................................................... Cy Young

Director, Region II ................................. Matt Felgendreher, CIC

Director, Region II ......................................................... Chip Piper

Director, Region II .....................................Cameron Winterburn

Director, Region III ...................................................Josh Gibbons

Director, Region III .................................................... Tim Goss, CIC

Director, Region III .................................................. Stuart Oakes

Director, Young Agents ............Samantha Organek, CIC, CISR Immediate Past President ................. Matt Swallows, CIC, CRM

Display advertising rates, deadlines and specifications may be obtained by writing to Insurors of Tennessee, 2500 21st Avenue South, Suite 200, Nashville, TN 37212, calling 615.385.1898, e-mailing marketing@insurors.org or online at www.insurors.org

Tennessee Insuror is provided to all Insurors of Tennessee members and associate members as a member service.

OF TENNESSEE

2500 21st Avenue South, Suite 200 Nashville, TN 37212-0539

www.insurors.org

From the banks of the Mississippi River to the Blue Ridge and Smoky Mountains to the East, Tennessee is a large and diverse state geographically and culturally. In fact, the state of Tennessee is 432 miles long from East to West and 112 miles at its narrowest point going North to South. The state has 41,227 square miles of land and 11,000 miles of shoreline along its many rivers and lakes. Tennesseans are blessed to call this beautiful state home.

We just concluded the Young Agents Conference in Nashville on April 25-26 that brought together the next generation of insurance leaders in our state. By any measure, it was a great success. It is important to note the Young Agents are adapting and growing their organization to mirror the Insurors of Tennessee Board of Directors more closely. This accomplishes two primary objectives to help them improve their effectiveness as a group and to enhance their development as future leaders.

However, for those of you who have driven from Bristol to Memphis on business or for pleasure in a day or two, you know it is quite a trek. While the geography and the topography of the state is a tremendous asset, it can also be a challenge for businesses and organizations operating on a statewide basis. It is simply a function of time and distance. Indeed, the Insurors of Tennessee is always seeking to find ways to better serve all our members across the state in communities both large and small from Memphis to Bristol.

Clearly, technology has helped with the ability to conduct remote conferences via Zoom or Teams meetings from a coordination and communication perspective. Nevertheless, as we all know from the remote meeting fatigue we all endured during the pandemic, there is just no substitute for gathering in person from time to time.

The Young Agents also hold social gatherings across the state throughout the year to build relationships and to create a network of support. This year events have already been held in Memphis and Jackson. If you are someone who fits the Young Agent demographic, please be sure to make plans to attend as we host these events across the state. If you’re an agency principal, please encourage Young Agents in your organization to engage and participate.

We are also fortunate to have an ever-growing Women in Insurance (WINS) organization who have held and will hold more gatherings across the state this year. Women are a key element in driving the success of most every agency, insurance company, and this association. It is important for these professionals to gather to share experiences, exchange ideas, and build relationships. If you are a woman insurance professional, please strongly consider attending these events as they occur in your area. It is a win-win!

For the past 131 years, we have had a state-wide convention to bring members together from across the state. The conference is where the statutory business of the association is conducted, great speakers are presented, and professional development opportunities are offered. This year we once again gather in Nashville on October 5-8 at the J.W. Marriott in Nashville. The Insurors staff is already hard at work putting together a great conference. More information will be forthcoming about the annual conference in the

coming months. Be sure to mark your calendars and make plans to attend.

One of the ways we address the issue of time and distance in our state is by holding regional and local events such as the Young Agents socials, WINs gatherings and other events. When we offer an event in your area, we will do our best to make you aware via social media, our website and e-mailers. We hope you will take advantage of these opportunities to build the ties that bind this association together and create lasting relationships that will enhance your professional experience in the insurance industry. While technology and remote meetings serve a key purpose, they simply do not replace in-person gatherings and events.

If you ask many of the more tenured members of the association what they remember and value, it is almost always about the friendships and relationships developed through this organization. They recall the camaraderie and the wise counsel often offered by their peers in addressing challenges and issues that inevitably occur in this business. The time invested in engaging others and being part of something bigger than yourself is often returned many times over.

The Insurors of Tennessee offers tremendous value to professional independent agencies in Tennessee through the association at the state level and at the national level through the Big “I”. From advocacy services that protect your livelihood, the health of our industry and the future of our business to products and services designed to contribute to the success of your agency, we are here for your agency or organization.

Be sure to visit our website at www.insurors.org to learn more about everything available to you. We welcome your phone calls and e-mail inquiries as well. This is your association, so to develop the most value from your membership your engagement and involvement is key to shared success.

Thank you to our partners and sponsors who provide the Insurors of Tennessee with the resources to plan, organize and fund events across Tennessee that bring the people in our industry together. The contributions of these generous organizations also enable us to offer an array of services to members that helps to create the healthy and vibrant insurance industry we all enjoy in this in this state. Please take a few minutes to review the partners pages in the center of this magazine to see who supports this association and be sure to thank them for their support when you have the opportunity.

At Insurors we realize that protecting the future of your agency is a major priority. You trust us to represent your interests at the highest political levels and as your Association we also want to provide you with the security of knowing you are getting the best overall E&O value in the marketplace— not just a policy, but a comprehensive program. Learn more about each of these products at insurors.org.

For over 25 years, the Big "I" Professional Liability Program underwritten by Westport Insurance Corporation, a member of the Swiss Re Group, has been the premiere choice of IIABA member agents for insurance agents and brokers E&O insurance.

Insurors of Tennessee has partnered with Arlington/Roe, Inc. to offer our members an exclusive program to help protect their agencies from information security breaches. This program is a holistic risk management process that will help train your staff on privacy compliance in addition to handling data breach notification and third party suits.

Online Resources for North American Specialty Insureds Big “I” members whose agency E&O insurance is written by Swiss Re through the Big “I” Professional Liability Program have access to an exclusive risk management website.

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

Exclusive E&O Audits for Insurors Members

In early 2013, Insurors initiated a new service to member agencies to provide on-site assessment of errors and omission liability potential. The assessment process is approved by Swiss Re, the underwriter of many E&O Liability policies written for Insuror members.

The Big I Advantage Plus powered by Rough Notes is an online sales and service resource designed to help your agency better serve your customers. Using this tool will lead to increased sales by improving your staff’s knowledge of a prospect’s operation enabling them to better identify and cover customer exposures.

Both Insurors of Tennessee and the IIABA National Association (the Big "I") offer numerous products and services for both your agency and your clients. You will find more detailed information at insurors.org. If you do not find the information you need, call 615-385-1898 or 1-800-264-1898.

ACORD provides standard forms used by the insurance industry. Using ACORD's forms allows for increased efficiency, accuracy, and speed of information processing. Our

members with an annual group gross P&C revenue under $50 million are eligible for a complimentary license to use ACORD Forms.

The IdealTraits platform helps small to large insurance agencies hire top performing sales and service staff.

DocuSign is used to accelerate transaction times to increase speed to results, reduce costs, improve customer service, and reduce E&O exposure.

ePayPolicy was developed by insurance professionals specifically for the insurance industry. The platform enables independent insurance agencies to accept payments via credit card or automatic ACH from the payer's bank account.

INSBANK offers banking and loan services to agents and other small businesses throughout the state. INSBANK entity Finworth Mortgage adds residential mortgages to its available

Imperial PFS provides members with a first class premium financing experience. IPFS is the nation's leading premium finance company, offering multiple benefits to agency partners.

Exclusive Insurance Market Access for Big "I" Members

• No fees. • No minimums.

• Own your expirations.

RLI Personal Umbrella program offers a market for standalone personal umbrella policies.

RLI Home Business responds to the needs of over 100 eligible business classes on an ISO BOP form.

The Big “I” Flood Program through SELECTIVE provides access to flood markets, offering the National Flood Insurance Program (NFIP) for primary flood coverage and excess flood products for risks that have higher values or are ineligible for the NFIP.

Access logos, customizable advertisements, shareable content, training programs, reimbursement money and more to get the word out about your agency.

Trusted Choice was created because there is a critical need to differentiate your value-added to consumers and to dispel the notion that agents are merely "middlemen." Trusted Choice does that more effectively than anything else. By signing the Pledge of Performance, your agency will receive:

• Consumer-tested brand and collateral materials

• National advertising and public relations exposure

• Local advertising and public relations support

• Eligibility for the Marketing Reimbursement Program

• Agency Locator with qualified leads

• Automatically updated consumer content for your website

TrustedChoice.com is a collection of agency marketing programs unlike any we’ve offered before. All of these solutions integrate perfectly with one another to help you leverage the full power of the Internet and The Power of Independents. u

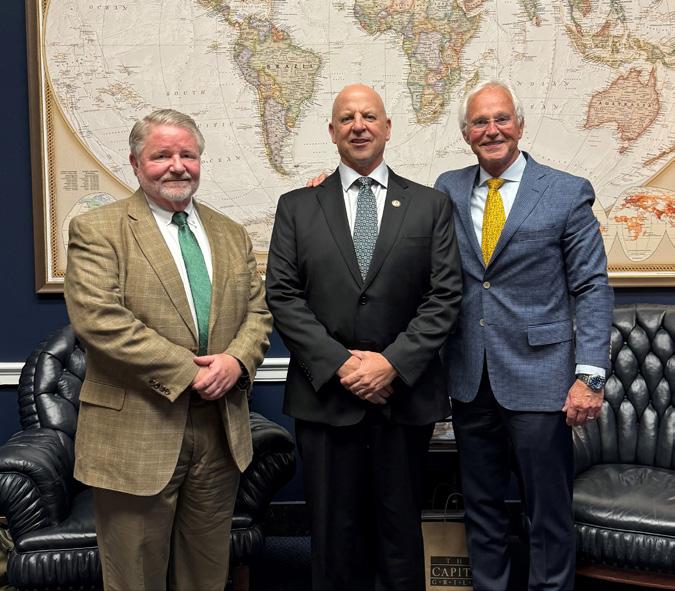

In April, a contingent of Insurors of Tennessee members traveled to Washington for the national associations Big “I” Legislative Week. The Big “I" had a star-studded cast of guest speakers throughout the week. Rep. Ritchie Torres (D-NY) kicked off the conference at the Emerging Leader Luncheon on Wednesday, April 10. Later that evening, Sen. John Thune (R-SD) spoke at a smaller event for large agents, brokers, and carrier CEOs.

on April 11. On Friday, April 12, U.S. House Financial Services Committee Chairman Patrick McHenry (R-NC) joined Big “I" President & CEO Charles Symington for a fireside chat reflecting on his congressional career and longtime relationship with the association.

Sen. Mike Rounds (RSD) and Rep. Josh Gottheimer (D-NJ) addressed the Big “I" Legislative Breakfast

Perhaps most importantly, members of the Insurors of Tennessee had the opportunity to meet with our elected leaders serving the people of Tennessee and the nation. These brief meetings allow members of our association to maintain relationships with our Senators and Congressmen and discuss matters important to this association. Thank you to everyone who made the trip to the nation’s capital and to those elected leaders who took time out of their busy schedules to meet. u

This article was authored by Kelly Donahue-Piro, Agency Performance Partners. Kelly was a guest speakers at the 2024 YA Conference.

This hard market is well hard. It’s hard on the staff, clients, and underwriters. While many agencies are growing, many are not having fun.

Before the hard market, many team members were already facing burnout so the hard market added that next level of difficulty.

Burnout doesn’t have to happen to you or your agency. It will take a very specific plan to address hard market insurance burnout and stay ahead of the curve.

Before we identify the signs of hard market burnout let's take a moment to identify why burnout is happening:

• Many agencies are struggling to find and keep staff

• We have many team members that are in pre-retirement mode

• Agencies have welcomed new team members and they are still in training causing imbalances

• Carriers are also backlogged causing tension between agencies and carriers

• Technology changes

• Groundhog Day-type phone calls (same call over and over again)

• Working out of our desire zone (dealing with upset people all day)

• Lack of an agency plan to address the hard market

• No agency standards - we serve everyone

• No training on how to help clients in a hard market

If you are a leader looking at this list you may start feeling burned out solving these challenges. It’s ok - all you need to do is make progress and address and confront these matters.

Now not every dropped ball is a sign of burnout. However, several dropped balls may mean that the team member is

disengaged. For some people when they are overwhelmed they get paralyzed.

As the snowball grows they become despondent. To combat dropped balls you need to make sure your team is accurately using your management system to document and suspend activities (each system calls tasks, memos, suspends, etc something different).

When everything is in the system you can track backlog and extend a helping hand.

If you notice someone on your team that is generally pleasant starts being snarky you may have a problem on your hands. Now just a note, sometimes this new attitude may come from home or personal matters.

The team member may just feel comfortable letting loose at work. The only way to confront a bad attitude is to communicate with this person.

Now they may have themselves worked up that you may need two to three interactions to get them to be honest and break the shell. A bad attitude never yields a positive result to the bottom line dive in as a leader and assist.

Have you ever seen the I Love Lucy episode at the chocolate factory where Lucy is hiding chocolates in her hat and pockets etc? She’s doing this to hide from her boss that she’s behind.

Some team members will say yes to remarkets, bending over backward for the wrong clients or helping team members when they are completely backlogged. The bottom line is that they have no idea what is on their radar screen so it’s all a yes.

Now go see sign 1 for what happens next.

This one is perhaps the hardest and generally happens when you are short-staffed. This team member does the bare minimum and they know you can’t fire them.

This person is not being a team player and they have given up but need a paycheck. They feel that the agency doesn’t understand or care about their workload so they only do up to a certain amount.

Now, these team members can be saved but you have to work with the person.

Some people will show signs of burnout more directly. This could be by calling out sick, taking longer lunches, and breaking down at work.

They are dying for a break! You have to watch your team’s signs for how they manage and handle stress. It’s a great question to ask in coaching meetings or 1:1s.

When you know people’s signs you can work to help them.

Conclusion

You may also be facing burnout! However, as a leader, you must also prevail. You lead when things are good and difficult.

In fact, in difficult times your team needs you more. Make sure you have an industry friend to vent to - never vent to your team.

Establish routine 1:1 meetings with your team to get a pulse on how everyone is doing. Make sure you plan fun and you share metrics. Burnout is generally an emotional response and emotions when validated and addressed can be turned into an aha moment. u

Ed Felsenthal, a recent graduate of Washington & Lee University, joined his father in the wholesale grocery business serving Memphis and West Tennessee until the company ran into formidable competition from Malone & Hyde, forcing the company to close its doors. It should be noted Malone & Hyde evolved into a major distributor of groceries in the region, becoming a publicly traded company on the New York Stock Exchange with diverse interests through the years.

After helping his father close the doors of the grocery business, Ed Felsenthal sought out a new opportunity and landed on starting in the insurance business in 1929. At that point, Ed Felsenthal, like many businesspeople, did not foresee the stock market would crash in October of 1929 sending shock waves through the economy. This would begin the Great Depression, a time of hardship for people and strong economic headwinds for businesses across America. Nevertheless, Ed Felsenthal persevered against the backdrop of economic turmoil in the 1930s and the clouds of war building on the horizon in Europe.

After the attack on Pearl Harbor on December 7, 1941 the United States would be fully involved in WWII in Europe and across the Pacific. Ed Felsenthal and his company just kept working building the business by offering insurance products that were commensurate with the needs of the marketplace during this time. Ed insured several noteworthy companies on Front Street in Memphis involved in the cotton industry and many of the main street retail merchants of the day. The company prospered during the post-war years and the robust economic growth of the 1950s.

In July 1963, Ed Felsenthal’s son Eddie joined the agency after graduating from Princeton University. While working in the agency, Eddie also went to law school at night at what is known today as the University of Memphis where he earned his J.D. degree from the university. Eddie’s education would help to fuel his success along with the growth and development of the agency.

Eddie recalls, “One key to my success is that my father encouraged me to sell Fuller Brushes door to door while I was going to high school.” Eddie’s father explained to his son that by learning to sell, he could be dropped into anyplace or circumstance and be successful using the salesmanship skills and life lessons learned selling brushes door to door.

Sadly, a year later Ed Felsenthal died of lung cancer at the age of fifty-nine. In the ultimate gift a father provides to a son, Ed had equipped his son Eddie with everything he needed to carry the business forward and be successful in life.

In the 1960s Eddie Felsenthal and his staff pushed forward and provided innovative employee benefits products to the greater Memphis marketplace. As an example, the agency developed and provided Le Bonheur Children’s Hospital in Memphis with its first group retirement plan.

In 1969, David Deadrick, a recent graduate of the University of Arkansas armed with a master’s degree joined the agency contributing significantly to the success of the firm with his effort and expertise running the company’s Group Insurance Division. Through the years the agency has continued to grow and develop its group employee benefit practice offering plans and programs to organizations in Memphis and beyond.

One plan the agency developed for a client includes a 15,000-member home and auto voluntary plan available to employees that simplifies the acquisition and lowers the cost of these property and casualty insurance products.

In the early 1980s Judy Vair joined Felsenthal Financial Services, Inc. to support the company’s individual insurance program. Judy has helped propel this segment of the agency’s business forward for the past forty years.

Another key person who has contributed to the success of the organization is Cecilia Watson who joined the firm in 2009 and is a Certified Public Accountant. Cecilia assists with the development and administration of 401K and other retirement plans for employers.

It should be noted that Eddie Felsenthal has been recognized as a top performer by his peers, earning the Top of The Table Award from the Million Dollar Round Table organization comprised of accomplished financial services professionals from across the nation. Eddie was also awarded MetLife’s top performance award for providing extraordinary service to policyholders. In addition, the agency has been a member of the Insurors of Tennessee for more than 60 years.

The Felsenthal Agency is celebrating its 95th year of service this year. This is a testament to the organizational perseverance of the company and the determination of Ed Felsenthal, Eddie Felsenthal, and the team of employees who successfully navigated economic downturns, wars, terrorist attacks, a pandemic and societal upheaval over almost a century of doing business. The Insurors of Tennessee congratulates the agency for reaching this exceptional milestone.

Eddie Felsenthal has been married to his wonderful wife Gloria for 60 years. He is quick to say she has been an important part of his success, contributing in countless ways. Gloria is quite accomplished in her own right, earning a bachelor’s degree from Rhodes College and a master’s degree from the University of Memphis. Through the years, she tutored students helping them gain entrance into the colleges and universities of their choice. In fact, she helped develop a large cadre of National Merit Scholars at White Station High School in Memphis.

The Felsenthal family is engaged in the Memphis and Shelby County community through various organizations. They are a significant supporter of the Perea School where they made a contribution to assist in education efforts to help eighty third and fourth graders meet the state of Tennessee’s

new reading requirements. They are also long-time members of Temple Israel and are an active part of the congregation.

Eddie is enormously proud of his three sons including Edward Felsenthal who is the Executive Chair of TIME and Senior Advisor, Office of the CEO at Salesforce, Martin Felsenthal who is the founder of and partner in Health Velocity Capital, and David Felsenthal who serves as CEO of the Educational Advisory Board.

The story of Felsenthal Insurance Services, Inc. and the Felsenthal family is one of endurance, perseverance, determination, and accomplishment. It is a uniquely American story shared by many members of the insurance industry in Tennessee and across America. We applaud Eddie Felsenthal and his firm as they celebrate their 95th year serving clients with integrity and professionalism! u

The Felsenthal Agency is celebrating its 95th year of service this year. This is a testament to the organizational perseverance of the company and the determination of Ed Felsenthal, Eddie Felsenthal, and the team of employees... Insurors of Tennessee congratulates the agency for reaching this exceptional milestone.

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts ext 7514

Jane Kinard ext 7518

Andy Wilder ext 7545

“The day you think you know everything is the day you’re in trouble.”

I hope you all are enjoying the beautiful Spring weather and getting outside to recharge and refresh. There is nothing like a good run or walk to exercise your body and clear your mind. Getting some fresh air helps reduce stress and improves your well-being. It also helps to make you more focused and productive. So, get out there and enjoy the great weather, the beautiful parks, hiking trails and greenways available across the state.

Now on to business. Veterans of the insurance world know this is a complex business that is challenging to master with real consequences if mistakes are made. The adage that goes something like “The day you think you know everything is the day you’re in trouble” is true. The complexity of insurance and risk management coupled with the ever-changing nature of the business environment underscores the very real need for continuing education and professional development.

Whether you are someone new to the business still trying to figure it all out, or a seasoned professional seeking to keep pace with the latest developments in coverages, technologies, or insurance regulations, the Insurors of Tennessee is your solution. Through our various channels and providers, we offer world-class insurance education and professional development courses. From initial licensing classes to the latest addition of an IA – MBA offered through the association; we can provide you with the courses to propel you and your agency forward.

In a highly competitive business such as ours, one of the best ways to differentiate your agency is through the competency and capability of your staff. Through better knowledge and understanding, your staff can more effectively help clients develop the right strategy and mix of products to protect their financial interests and ultimately their peace of mind. To put it simply, knowledge is a strong competitive advantage in the marketplace.

I encourage you to take a look at the snapshot education calendar provided in the Tennessee Insuror magazine in each edition and visit the Education Section of the Insurors of Tennessee website at www.insurors.org to learn more about the education options available to you and your staff.

For the past several months, we have been in government affairs and advocacy mode at both the state and national levels. We just returned from the Big “I’ Legislative Conference in Washington D.C. where a strong contingent of Tennessee agents and the leadership of this association had the opportunity to hear from guest speakers about key topics and initiatives. We were pleased to have the opportunity to meet with our elected representatives in Congress to discuss legislative priorities this year and the concerns of our membership. Thank you to everyone who travelled to Washington, D.C. this month to represent our interests in the nation’s capital.

At the state level, advocacy efforts continue as the Tennessee General Assembly approaches the conclusion of this session for 2024. Our Governmental Affairs Consultant and the Legislative Committee of the Insurors of Tennessee continues tracking pending legislation at this point. Please see Trey Moore’s article in this edition of the magazine for more information. He will provide a final wrapup of the session in the June-July edition of the magazine.

If you have not yet contributed to InsurPACTN or InsurPAC, please visit the Insurors website at www.insurors.org and navigate to the Advocacy Page. Since we are in an election year, we are building resources to support candidates who are worthy and who will listen to our input as professional independent insurance agents on pending legislation. Thank you for your continued support.

In closing, please be aware of Young Agent and WINs events coming up over the next few months in your area. By the time you read this article, we will have just concluded the Young Agents Conference in Nashville which was preceded by social events in Memphis and Jackson. Our Women in Insurance (WINS) organization continues to plan events across the state for women in our industry to gather and build professional relationships. The Insurors of Tennessee leadership sees both organizations as important to our success as an association and the perpetuation of our industry. u

"Knowledge is a strong competitive advantage..."

INDEPENDENT MEMBER AGENCIES PREMIUMS WRITTEN

2020 PROFIT SHARING DISTRIBUTED TO MEMBERS

INDEPENDENT AGENCY START-UPS ASSISTED $400M+ 140+ 20+ 5 $4M $3M

2020 BONUSES DISTRIBUTED TO MEMBERS WAYS TO EARN ON A SINGLE BOOK

Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson MEAA

Independent insurance agents have an opportunity to proactively help customers consider the value of a workers compensation policy beyond price—before they learn the hard way.

In a hard market environment, many small business owners are cost-conscious when it comes to workers compensation insurance coverage. However, experiencing a claim shifts insurance priorities away from price, according to The Hanover's “2024 Small Business Risk Report: A Focus on Workers' Compensation."

For small businesses without any workers comp claims, price is a significant factor when purchasing a workers comp policy, according to the survey. In fact, 60% of small business owners who have not experienced a claim rank price as one of the two most important factors in their purchase decision.

However, of business owners who have made more than one workers comp claim, 40% rank price as one of their top two factors. Instead, small business owners who have experienced workers comp claims place greater value on risk management and claims handling than their claimless peers.

Forty-seven percent of business owners that have experienced claims say employee services is one of their top considerations for a workers comp policy, versus 44% of their non-claim peers. Additionally, 40% of businesses with claims prioritize claims handling, versus 36% of businesses with no claims, and 36% of businesses with claims prioritize risk management services, compared to only 28% of those without claims.

Independent insurance agents have an opportunity to proactively help customers consider the value of a workers comp policy beyond price—before they learn the hard way. More than 2 in 3 small business owners reported that they consider a recommendation from their insurance agent to be a very

important factor when purchasing workers comp insurance, making it clear that small business owners value the input of a trusted advisor.

Agents can also educate small business clients on thorough risk mitigation. The vast majority—94%—of small business owners believe they have a very strong safety culture, 89% are very confident they have proactive measures to help keep employees safe, and 95% say they provide safety training to employees at least once a year. However, The Hanover survey shows that small business owners lack a comprehensive approach to these proactive measures and that it often takes a claim to burst that bubble.

Only 51% of small business owners without claims conduct regular safety inspections and audits, compared to 68% of small business owners who have experienced claims. Fifty-three percent of businesses without claims have a health and wellness program, rising to 65% among those who have claims. And only 21% of those without claims leverage a nurse triage service—an amount that jumps up to 51% among those who have claims.

"With most business costs rising, small business owners continue to look for ways to reduce risk exposures," said Charles F. Hamann, president of small commercial at The Hanover. "The report data indicates small businesses value support from their independent agents. Additionally, the risk management services carriers offer today are critical to their success. While such services are ranked highly, there is an opportunity for agents and business owners to take a more proactive and holistic approach to worker safety." u

The Spring of the year is historically active relative to Governmental and Legislative Affairs for the Insurors of Tennessee. This year has been no different. Just a few months ago we hosted the Legislative Reception along with other industry partners at the beautiful Hermitage Hotel in downtown Nashville. The event created an opportunity for members of the Tennessee General Assembly to meet and gather with members of the Insurors of Tennessee to learn about our questions and issues as they relate to the business of the Tennessee General Assembly and state government in general. Conversely, elected leaders and staff members were able to communicate with members about trends they are seeing and about their legislative priorities based on the input of constituents from across the state. The exchange of ideas and building of relationships was healthy and productive for all who attended.

In the second week of April a contingent of members from this association traveled to Washington, D.C. to attend the Big “I” legislative conference. This one-ofa-kind event helps Big “I” members from across the nation get up to speed on the many legislative, regulatory, and legal challenges our profession is encountering now and may face going forward. We had the opportunity to hear from Big “I” leadership and industry leaders on a wide array of topics important to our collective success as an industry. In addition, we had the opportunity to meet with members of the Tennessee Congressional delegation to talk about issues impor-

tant to the Insurors of Tennessee members at the national level. As always, the meetings were positive and constructive. We appreciate the time and attention of these important elected leaders who serve the people of Tennessee in our nation’s capital.

The event also offered important educational opportunities for Young Agents who attended from across the country. The Young Agent’s part of the conference helps provide exposure about how our industry works with Congress at the national level to inform and provide guidance to elected leaders on critical legislation and initiatives. Perhaps most importantly, it also helps to build our bench of future leaders as the association moves forward.

As this article is being written, the Tennessee General Assembly is getting closer to the end of the session. Be sure to see Trey Moore’s column for details about pending legislation and related topics in his article. Trey will also provide a final recap of the session in the next edition of the Tennessee Insuror magazine.

As you all know, it is an election year, so we are working to build resources in our state and national political action committees. If you have not yet contributed, I encourage you to make a contribution at your earliest convenience. Visit the Insurors of Tennessee website at https://www. insurors.org/donate-to-insurpactn/ and make your contribution to InsurPACTN and InsurPAC at the national level.

Your support of both PACS enables us to support worthy candidates who will be open to hearing from us about issues important to this association, the industry, and consumers of insurance across our state.

By the time you read this edition of the Tennessee Insuror, we will have concluded the 2024 Young Agent’s Conference on April 24-26 in Nashville. A great event is planned with the opportunity to meet your new and expanded Young Agent’s Committee, hear from exceptional speakers, and enjoy fellowship with your peers from across the state. We expect a great turnout and will report back to you about the much-anticipated success of the event in the next issue of this magazine.

Now is a good time to save the date for the 131st Insurors of Tennessee Convention being held on October 5-8 in Nashville at the J.W. Marriott just a few blocks away from the entertainment district. Be sure to mark your calendars now and plan to attend the event.

Your association has accomplished much this Spring on multiple fronts. I want to thank the members of the Insurors of Tennessee staff, the Board and associated committees, the active Young Agents, and WINS groups and most importantly our members. We are truly fortunate to have such an active and vibrant association.

Keep up the great work! u

The subject of the Future Leader Spotlight for this edition of the Tennessee Insuror magazine is Jeremy Thacker of the Gary Thacker Insurance Agency located in the greater Chattanooga market area of Ft. Oglethorpe, Georgia. Jeremy is a member of the Young Agents of the Insurors of Tennessee and serves as the Chairperson of the Technology Committee. This is his first year serving as a committee chair in the newly revamped structure of the Young Agents. He says, “I am enjoying membership in the Young Agents and my role on the Technology Committee since it allows me to get out of my bubble working in the agency and my community.” He also enjoys meeting his peers from across the state and building professional relationships that serve as a valuable resource and sounding board.

Jeremy’s story is like many in the insurance industry across America where he became part of a family-owned business. He started working part-time in his father’s insurance agency in 1999 doing filing and assorted other tasks as needed while he was in high school. It was at that point Jeremy started learning about the insurance business from his father who started Gary Thacker Insurance in 1997. Importantly, Gary’s insurance experience goes back to the 1970’s when he worked with MetLife and subsequently started working with an agency owned by Frank Steil in Hixson, Tennessee as a producer. When Gary expressed an interest in forming his own agency, Frank generously assisted and supported Gary with the eventual start-up of his new agency in Ft. Oglethorpe. At the very beginning of our conversation, Jeremy was quick to credit his dad with teaching him about insurance, how the business works, and the importance of serving your clients and your community. His dad was and is his North Star relative to the insurance business.

After graduation from high school Jeremy went to college at nearby University of Tennessee – Chattanooga (UTC) studying business and decided to transfer to Georgia State University in Atlanta. After a year at Georgia State, he decided

UTC was a better fit and returned to Chattanooga to continue his college education and changed his major to Psychology. He was intrigued by the notion of studying human behavior and how it related to his business studies he had already taken. After all, he reasoned people, and their behavior is a key element of business from both a macro and micro perspective. Jeremy graduated from UTC with a degree in Psychology with a strong dose of business education as well. It is important to note, while Jeremy was studying at UTC, he worked part-time in the agency continuing his insurance education on a parallel track.

As is the case in many family-owned insurance agencies, while he was a professional licensed insurance agent, he wore many hats depending on the needs of the agency on any given day. It was a wonderful way to learn about the agency, the needs of their clients and how to serve the community. In fact, the most significant thing Jeremy has learned is the importance of relationships and serving the community. For Jeremy, those two elements define who he is as a business professional. It turns out he was right about the alchemy that happens between business and psychology.

In addition to working in the agency with his father, he also works closely with his brother-in-law, Daniel Chase Rhodes. Daniel Chase was married to Jeremy’s sister Julie Rhodes, who sadly passed away in 2020 at the age of 37 after complications arose from a heart transplant that had been done fourteen years earlier.

Jeremy is also proud to work with Christina Audis, Andrew Stephens, Sue Ganier and Mike Morgan who play a key role in the ongoing success of the agency. In a family agency, every single person pulling on the oars together is critical to the success of the organization. This team accomplishes that mission.

The agency is active in the community contributing gener-

ously to school projects, sports teams, and community initiatives on a regular basis. Jeremy is a member the nearby Ringold, Georgia Downtown Development Authority Board working to enhance and improve the Ringold downtown area while preserving the historic character of the area. Previously, he served for two years on the Local School Governance Team for the Lakeview/Ft. Oglethorpe High School collaborating with other team members to provide guidance to the school on a range of topics including their budget.

In addition to Jeremy’s insurance agency responsibilities, he just secured his real estate license to be able to offer clients assistance with their real estate needs. Jeremy sees the addition of this capability to be a good fit for the portfolio of services he can offer clients going forward.

Jeremy is married to his wife Rachel. Together they have a vibrant and active family including their four children Raelynn, Teagan, Arlo and Remi. Rachel is the full-time chief executive officer of the household, ensuring the family is happy, healthy, and always learning. In their spare time, they enjoy the great outdoors including the many parks, lakes, rivers, and trails in the beautiful Chattanooga area.

So, if you find yourself driving down Battlefield Parkway in Ft. Oglethorpe, you might just see Jeremy mowing the lawn of the agency, since sharing groundskeeper responsibilities is one of several hats he wears as a member of the Gary Thacker Agency. Be sure to wave as you drive by the agency! u

Below is just a broad listing. If you don’t see what you’re looking for, please contact us.

• General Contractors

• Building Trade Contractors

• Utility Contractors

• Land Improvement Contractors

• Pavement Maintenance-Non DOT

• Services Contractors

• Building Cleaning & Maintenance Contractors

• Construction Material Suppliers

• Manufacturing

• Wholesale and Distributing

All classes may not be available in all states.

• 24/7/365 loss reporting-including online • • Accelerated auto and property estimating and repair options • • “Fast Track” medical only claims handling program • • Tele-emergent medicine program-connects injured workers to medical care, not “triage” •

Vanderslice, Regional Vice-President 615-932-5508 | bvanderslice@berkleysig.com or your Middle Market Underwriter

AF

ASSOCIATED INSURANCE ADMINISTRATOR

BERKSHIRE HATHAWAY GUARD INS.

BUILDERS INSURANCE GROUP

CENTRAL INSURANCE COMPANIES

EMC INSURANCE

FRANKENMUTH INSURANCE

GOVERNMENTAL RISK INSURANCE PLANS

J.M. WILSON

MARKEL SPECIALTY

SAFEWAY INSURANCE COMPANY

UTICA NATIONAL

As the legislative wheels continue to turn in Tennessee, it's imperative for independent insurance agents and brokers to stay abreast of the latest developments that could impact their industry. Since our last update in January, the Tennessee General Assembly has been busy deliberating on various bills and policies that could have far-reaching effects on insurance practices within the state. Let's take a closer look at some of the key updates and how they may influence the landscape for independent agents.

The Tennessee General Assembly was in “full swing” in March with an eye toward adjournment in late April. We will have a full breakdown of legislation that Insurors has been monitoring or engaging on at the conclusion of session, but below is an update on some of the main issues of interest.

2629/SB 2687)

Tennessee Code Annotated § 56-6-107(c)(1) requires that an insurance producer who has been continuously licensed since January 1, 1994, is exempt from continuing education requirements for licensure renewal. This legislation would exempt those insurance producers who have been continuously for more than 20 years, since January 1, 2004, from continuing education courses for licensing renewals. After numerous conversations with the sponsors and the Department of Commerce and Insurance (TDCI), there was considerable concern that the proposed change may jeopardize licensing reciprocity with other states. Additionally, we heard from many of you that think the state’s continuing education can and should be reformed and improved, but not simply eroded via broader exemptions.

With all of that in mind, the sponsor agreed to IOT’s request to suspend any further action on the legislation this year in an effort to give TDCI and the industry more time to assess what meaningful reforms should be implemented in the future.

Collateral Source Rule in Healthcare (Medical Malpractice) Liability

SB2253 by Sen. John Stevens (R-Huntingdon) / HB2001 by Rep. Andrew Farmer (R-Sevierville) seeks

to restore Tennessee’s healthcare liability law to its historic interpretation dealing with the “collateral source rule” in healthcare liability cases prior to a 2023 case (Robert Crotty, et al. v. Mark Flora, M.D.) that altered the standard. The legislation, broadly supported by the insurance, business, and healthcare industries, seeks to restore the statute to its traditional intent and provide more clarity, predictability, and consistency in health care liability cases.

As amended, the legislation establishes that in all healthcare liability actions, the common law collateral source rule is abrogated as specified by the legislation. In a healthcare liability action, the damages awarded may include past and future actual economic losses suffered by the claimant, and the past actual economic losses must be limited to: (1) the amounts that have been paid or will be paid by the assets of the claimant or on the claimant's behalf; and (2) the amounts the claimant's providers have accepted or will accept as full payment for reasonable and necessary medical care, rehabilitation services, or custodial care. The amendment establishes that actual economic losses will only be limited to the extent that documentation of the reduction is submitted. It would apply to all healthcare liability actions filed on or after September 29, 2023 (the date of the Crotty decision).

Local Government Insurance Pools (HB 2010/SB 2378)

Requires the Comptroller of the Treasury (COT) to conduct a study of all insurers, including insurance pools, that provide policies of workers' compensation coverage to local governmental entities, including a review of each insurer's solvency, a comparative rate study, and an analysis of the process to bid out, procure, or otherwise obtain such a policy. Requires the COT to report the findings of the study to the Speaker of the Senate and the House of Representatives by January 1, 2025. Defines “local governmental entity" to mean a county, incorporated city or town, metropolitan government, and the governing body of a local education agency and charter school.

2281/SB 2698)

Public Chapter 57 of 2023 removed the requirement for an individual applying for an insurance producer license to take a pre-licensing education preparation program for any line of authority. The proposed legislation would restore the requirement for pre-licensing programs only for a line of authority for title insurance.

The filing deadline for candidates to seek state office in the 2024 election was at 12:00pm on April 4. The upcoming primary elections in Tennessee are shaping up to be particularly noteworthy for Senate Republicans, with nine out of the 13 incumbents facing primary challenges. Some noteworthy races include Senate Education Chair Jon Lundberg from Bristol, who is being opposed by pharmacist Bobby Harshbarger, son of U.S. Rep. Diana Harshbarger of Kingsport.

The retirement of Sen. Art Swann from the District 2 seat this year's only open race in the upper chamber. Competing for

Swann's seat are State Rep. Bryan Richey of Maryville, Blount County Court Clerk Tom Hatcher, and hotelier John Pullias, all vying for the GOP nomination.

In East Tennessee, incumbent senators face formidable primary opponents as well. Becky Massey of Knoxville is being challenged by Monica Irvine in District 6, while Frank Niceley of Strawberry Plains contends with Jessie Seal of New Tazewell in District 8. Todd Gardenhire of Chattanooga faces Ed LeCompte in District 10, and Ken Yager of Kingston will try to fend off Teena Hedrick in the sprawling District 12, which spans nine counties on the Cumberland Plateau.

Moving to Middle Tennessee, incumbent senators Ferrell Haile of Gallatin and Joey Hensley of Hohenwald are both being challenged in their respective districts. Haile faces Sumner County “Constitutional Republicans” co-founder Chris Spencer in District 18, while Hensley is up against Jim Grippo of Columbia.

In the western part of the state, incumbents John Stevens of Huntingdon and Paul Rose of Covington also face primary

challenges. Stevens squares off against Charlie Cooper of Camden, while Rose contends with Jacaranda Williams of Ripley in District 32.

34 House seats have a contested primary or general election, including seven open seats due to incumbent retirements. We will provide a more detailed breakdown of competitive races as we learn more throughout the summer.

We field a lot of questions from members throughout the year. Sometimes a particular question will surface frequently from agents across the state. So, we thought we would try a new feature in these pages where we choose one that seems to be on the minds of a lot of Insurors members and share our response here, in the hope that you find it useful.

One that pops up regularly deals with fees and commissions:

“Can we charge an additional fee or commission on certain products as long as we disclose it to the insured?”

It is an unfair trade practice for an insurance producer to charge fees for the sale, solicitation, or negotiation of insurance not authorized by a written agreement with an insurer, and, where applicable, incorporated in the insurer’s rate filing. The Tennessee Department of Commerce and Insurance considers any money paid for a specific policy of insurance by the consumer to be a part of the premium.

TENN. CODE ANN. § 56-6-125; 1983 Bulletin.

Thus, TDCI treats fees connected to the sale, solicitation, and negotiation of policies just like commissions in that they must be incorporated into the premium. This means they must be included with the insurers rate filing and approved by the commissioner. As a practical matter, this requirement makes a fee difficult to implement due to those filing and rate approval requirements, as it’s not something the agency can impose unilaterally.

Lifting your business to new heights, with commission and bonus programs

Our business model is designed to support yours. With our transparent National Personal Auto Commission Schedule, you can earn more as you write more business with us. Then, as you grow, you’ll have the opportunity to unlock additional compensation and benefits with our partner programs.

Whichever path you choose to grow your business, we have a way forward and upward.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

An insurance producer may charge fees for services not connected with the sale, solicitation, and negotiation of insurance if the fees are based upon a qualified written agreement, signed by the party to be charged in advance of the performance of the services under the agreement. The agreement must include:

· The services for which the fee is to be charged;

· The amount of the fee to be charged or how it will be determined or calculated; and

· A disclosure stating that the client is under no obligation to purchase any insurance product through the insurance producer. TENN. CODE ANN. § 56-6-125.

The information contained in this article is provided for informational purposes only and should not be construed as legal advice.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

For more than 60 years, we’ve built a business based on basic principles: handle claims quickly and fairly, provide superior service and put people first. At FCCI, we help businesses thrive, manage risks and face the future with confidence.

The Region 1 Young Agents recently convened for 2 networking social events in West Tennessee. Across two days and two cities, Young Agents enjoyed a blend of business and brews.

Kicking things off in Memphis at Wiseacre Brewing Company was a great afternoon sponsored by Gold Partner LUBA Workers’ Comp. Agency Member Nikki Reeder (Boyle Insurance Agency)serves as Events Chair on the Young Agents Committee, expressed her enthusiasm for bringing Memphis-area Young Agents together for the first social of the year. "We brought the Young Agents in Memphis together for a great time of gathering conversations and company! I look forward to these events and the connections and relationships that they form!“ said Reeder. There was also a moment where the Young Agents celebrated Nikki’s birthday.

Nikki has been working with our Young Agents Committee and our association Partners to line up more events in the coming months locally and across Tennessee. “The next Memphis event will be in the summer. I cannot wait to see you all there!" said Reeder, reflecting the excitement and anticipation for future gatherings.

Jackson was the next stop for Young Agents where Silver Partner Stonetrust Workers’ Compensation sponsored a networking social for our Young Agents from the surrounding area. Hub City Brewing accommodated 20 Young Agents who took time to connect with each other and develop business relationships.

Agency Member John James, Carnal-Roberts Agency, an enthusiastic young agent attendee, shared his experience, saying, "This was my second Young Agents event, and I have found that it is one of the best networking events for young professionals in this industry!" Many shared the same sentiments of the valuable opportunity to connect with industry peers, exchange insights, and build key relationships in a relaxed and enjoyable atmosphere.

Sixteen member agencies were represented at these two events. We are thankful to all who attended and for the support from LUBA Workers’ Comp and Stonetrust Workers’ Compensation. Events like these serve as a testament to the Association's mission of fostering a strong sense of community and collaboration among industry professionals. We encourage all young insurance professionals to get involved with Young Agents. A list of upcoming Young Agents socials can be found online at members.insurors.org/event-calendar as well as following the Insurors of Tennessee on Facebook, LinkedIn, and Instagram.

WINS is off to a strong start in 2024, hosting a Kickoff Social in January at the Insurors office in Nashville. A record breaking 40+ were in attendance. A mini Dale Carnegie Course was incorporated, with guest speaker, Michele Bicknell. Several MTSU risk management students attended the event.

Starting this year, WINS appointed additional committee members to help with outreach across the state. Committee members are listed below. Pleases reach out to one of these women, if you would like to learn more or get involved.

WINS Liaisons: Teresa Durham, Kyra Garrison, Kym Clevenger

Director: Tammy Spearnock, West Bend Mutual

Secretary: Chrisite Jones, Martin & Zerfoss

Community Give Back Chair: Laura Gaunt, IPFS

Collegiate Relations Chair: Shelby Wright, R T Specialty

West TN Member Relations Chair: Pam Wells, Lofton Wells Insurance

West TN Member Relations Co-Chair: Mandy Robers, Insight Risk Management

June 4, East TN WINS Event from 4-7 PM Lookout Winery | Working on a speaker for this event and local charity to support.

June 6, West TN WINS Event

Hyde Lake Pavilion @ Shelby Farms Park Sponsored by IPFS | Speaker and charity TBD.

Watch for details of these events plus more events to be scheduled throughout the year. u

We’re sure other networks are great.

But do they come with all the extras?

Aggregation? Check. National carrier contracts? Check. Basic networks can do a lot for an agency. Keystone does all that and more.

Learn more about how Keystone can sweeten your agency offerings

https://lp.keystoneinsgrp.com/sa-learn-more

WILL THEIR HOMEOWNERS INSURANCE PROVIDE COVERAGE WHEN…

• Business equipment is stolen out of their vehicle?

• They accidentally knock over the display next to them at an exhibition or show?

. NO!

. NO!

• Groceries spill onto inventory in the trunk of their car? NO!

• A power surge damages their computer and fax machine?

• Someone steals their cash box?

NO!

. NO!

Most homeowners and renters policies do not cover liability or damage to property from business activities.

PROTECTION FOR HOME-BASED BUSINESSES!

Your customers are not home free with most homeowners policies. What would happen if your client had inventory damaged or stolen? Typical homeowners insurance does not cover those losses for people if they run a small business out of their home.

We are pleased to offer the perfect coverage for your inhome business: RLI’s Home Business Insurance policy.

Features:

• Liability limits up to $1 million

• Satisfies most event or show liability requirements

• Business property protection up to $100,000 (with $250 deductible)

• Optional Coverages Include: Money & Securities, Garagekeepers, Unmanned Aircraft (state restrictions apply)

Electronic data processing coverage (optional in CA & FL)

• Loss of income coverage

Premiums starting as low as $150 annually*

Contact Stephen Holmes 615.515.2609 sholmes@insurors.org

Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

Insurance Business America Recognizes Fortified as one of the Top

KNOXVILLE, TN — Each year, Insurance Business America publishes a list of the top insurance networks and alliances in the country. Fortified is one of just 15 networks to make this list, earning the title of 2023 IBA 5-Star Network.

How are the winners selected? The success of an insurance alliance or network can only be measured by the satisfaction and success of its members, so Insurance Business America collects feedback from agents and brokers to identify the organizations that are worthy of their recognition. Researchers asked brokers and agents what is most important to them when choosing a network. Next, agents across the country were asked to rank their networks from 1-10 based on the following factors identified by their peers:

• Access to Insurance Companies and Products

• Commissions and Profit Share

• Access to Niche and Non-Traditional Markets

• Marketing Support

• Training and Education

• Administrative Support

• Access to Technology

• Overall Business Consultation

• Perpetuation Planning

• Vendor Discounts

The networks and alliances with the highest average scores were named IBA 5-Star Networks and Alliances.

This award is the icing on the cake for Fortified’s first year. Fortified may be a new name, but they have managed to unite some of the most well-established, highest performing independent insurance agencies in the Southeast. “To win this award in our first year as an organization is such an honor and an exciting accomplishment. It shows what a meaningful, positive impact joining Fortified has had on each of our agencies,” said Joe Craven, Fortified CEO.

Members of Fortified are given access to new markets, exclusive lines, and an expanded list of carrier partners to help their businesses thrive. Fortified is a community where agents can learn from one another and invest in their future together.

“Members can lean on each other’s expertise and that goes a long way for members that are coming in. We also do a really good job of managing the relationships with the carriers on their behalf,” said Craven.

In just one year Fortified has seen massive growth in terms of membership and business. They have over 1,800 employees across 8 states, $3 billion in premiums, and more than 225,000 clients.

“Fortified is without a doubt a 5-star organization. We only have 1-year under our belt, and we are already among the top networks in the nation, that’s because we have great people on our team. We have a strong foundation to build upon, and I expect to see Fortified on this list for years to come,” Craven continued.

This award is proof that Fortified is a valuable asset for independent agencies and brokers as well as a wise investment for carriers looking to grow their network.

DAYTON, TN. — Representatives from the City of Dayton and the BlueCross BlueShield of Tennessee Foundation recently gathered to celebrate the grand opening of the BlueCross Healthy Place at Pendergrass Park.

The BlueCross BlueShield of Tennessee Foundation provided $4 million for the project build and an additional $800,000 for a maintenance fund, bringing the total investment in the space to $4.8 million.

Pendergrass Park is a municipal park located off Main Street in Dayton. The city applied for BlueCross Healthy Place funding in the hopes of bringing additional amenities to the space and making it a gathering place for residents. Construction began during the summer of 2023.

BlueCross Healthy Places are designed to strengthen communities across Tennessee by providing neighbors with places for connection and healthy activity. They are developed to be accessible for visitors of all ages and abilities.

“The City of Dayton wants to thank the BlueCross BlueShield of Tennessee Foundation for choosing us to receive BlueCross Healthy Place funding,” said Dayton Mayor Hurley Marsh. “Without their generosity, we would not have been able to make so many improvements to our park. We are excited to share the revitalized park with community members, and we know our families and their children will enjoy this all-inclusive and accessible facility for years to come.”

Keith King, manager of the BlueCross Healthy Place program, added, “We’ve enjoyed partnering with the City of Dayton on the revitalization of Pendergrass Park, and we’re excited to celebrate the re-opening of this popular space. We hope the new amenities will make the park more accessible for everyone and enhance Dayton’s strong community spirit.”

To date, the BlueCross Foundation has invested $59 million in BlueCross Healthy Place projects across the state. There are 21 projects open statewide with more on the way. The BlueCross Foundation will accept proposals for 2024 BlueCross Healthy Place funding throughout the month of August 2024. For more on the BlueCross Healthy Place program, see BlueCrossHealthyPlaces.com.

BRANCHVILLE, NJ – Selective Insurance, a leading business, home, and auto insurer, is proud to highlight advances on key sustainability initiatives in 2023. By embedding these strategies into Selective's business, the company aims to deliver significant value over time for its customers, distribution partners, employees, and shareholders. "Responsible corporate actions are deep-rooted in Selective's history, furthered by our recent sustainability initiatives,” said Tracy Morato, Sustainability Manager. “We are addressing critically important areas that impact our stakeholders, including building a highly engaged workforce, generating renewable energy, and strengthening the communities where we live and work."

Selective's sustainability highlights this year include:

• Completing a solar facility at our corporate headquarters that generates approximately 5 million kWh of energy that Selective sells to others

• Named one of America’s Best Mid-Size Employers by Forbes and awarded our fourth consecutive Great Place to Work Certification™

• Publishing our third sustainability report, Progress Through Impact

• Issuing a second Task Force on Climate-Related Financial Disclosures (TCFD) Report showcasing Selective's approach

to climate-related risks and opportunities and recent Scope 1 and 2 greenhouse gas emissions;

• Creating a Corporate Social Responsibility digital experience containing updated Sustainability information, and

• Allocating funding through the Selective Insurance Group Foundation and coordinating employee volunteerism to support charities that empower safe, sustainable, just, and diverse communities across the country

Stonemark, Inc. announced that it is officially part of the IPFS family. With this acquisition, which closed on April 1, we welcomed 48 new associates and nearly 4,000 agency clients. The acquisition marks an exciting moment for the insurance industry, bringing together two organizations each known for providing exceptional service and client care. The alignment in our values, backgrounds, and company cultures made this acquisition a natural choice for both IPFS and Stonemark.

Hartford Financial Services Group Inc. reported first-quarter net income of $748 million, a 41% increase compared with the year-ago period. The increase was attributed in part to improved underwriting results, spurred by investments in technology, Chairman and CEO Christopher Swift said during an earnings call Friday. “We are using our data science advancements pricing expertise and industry-leading underwriting tools to drive profitable double-digit new business growth,” he said. In commercial lines in particular, “Performance reflects strong top-line growth and highly profitable margins. The stellar performance in this business is a direct result of our underwriting discipline, enabled by the investments we have made to enhance our capabilities.”

Commercial lines core earnings of $546 million in first-quarter 2024 represented a 25% increase over the year-ago period, which the insurer said were the result of increases in earned premium, net investment income, and lower current-year catastrophe losses: $109 million in the first quarter of 2024, primarily from winter storms, mainly in the Northeast, Pacific and South, as well as tornado, wind and hail events in the Midwest, South and mid-Atlantic, and down from losses of $138 million over the year-ago period. The company’s commercial lines combined ratio stood at 90.1% in the first quarter, a 2.6% improvement over last year.

Arthur J. Gallagher & Co. reported double-digit revenue increases in both of its major business segments in the first quar-

ter of 2024 as insurance rates continued to increase across most lines and it added more revenue through acquisitions.

Average rate hikes for middle-market accounts appeared to rise more than for large account business in the quarter, the brokerage’s top executives said on a call with analysts Thursday. Meanwhile, while Gallagher opposes the Federal Trade Commission’s recently announced ban on noncompetes, the executives said the move likely won’t affect its ability to acquire companies or hire and retain staff.

Gallagher reported $3.26 billion in revenue for the quarter, a 20.3% increase over the same period last year. On an organic basis, which excludes the effect of mergers and acquisitions and foreign currency fluctuations, revenue rose 9.4%, Gallagher said. In its core brokerage business, Gallagher reported $2.86 billion in revenue, up 20.6%, and for its risk management segment, which includes its third-party administration unit Gallagher Bassett Insurance Services Inc., it reported $391.4 million in revenue, up 18.3%.

The company closed 12 acquisitions in the first quarter, which represented a total of $69.2 million in annualized revenue. Gallagher was the most acquisitive publicly traded brokerage in

the period. Gallagher reported net earnings of $612.7 million for the quarter, a 25.9% increase over the 2023 period.

Global primary renewal premiums, which includes rate and exposure changes, were up about 7% in the quarter, said J. Patrick Gallagher Jr., chairman and CEO. Property premiums increased about 10%, umbrella was up 9%, general liability up 7%, package policies up 8% and workers compensation up 2%, he said. Two exceptions to the increases were directors and officers liability insurance, where premiums were down about 5%, and cyber liability, where premiums were flat, Mr. Gallagher said. “These two lines appear close to be reaching a pricing bottom but combined represent around 5% of our P/C business globally,” he said.

Reinsurance pricing in the quarter was stable with increased demand for property catastrophe coverage, Mr. Gallagher said.

Rates and exposure values are increasing more for middle and small accounts than for large account business, said Douglas K. Howell, chief financial officer. “If you go back a year or so ago, it might have been just the opposite." u

On March 18 the Insurors and several members enjoyed an afternoon at TopGolf in Nashville for the 40th Annual MTSU Martin Chair of Insurance fundraiser. Over 100 insurance professionals were on hand to support the program that produces higher education for students looking to pursue a career in the insurance industry. Close to $30,000 was raised to supports scholarships and program development.

Department Chair Dr. Dave Wood and Program Coordinator Rebecca Darden facilitated the fundraiser and included some unique opportunities for participants to contribute to the cause while enjoying the exciting challenges of TopGolf. “The new format and venue was enjoyed by all who participated,” said Dr. Wood. “We are extremely thankful to everyone who participated and offered their time and support to our MTSU Risk Management Program.”

Joining the Insurors team was Director of Operations

Jake Smith, Associate Member Tammy Spearnock (West Bend Insurance Co.), Associate Member Shelby Wright (RT Spe -

cialty), Agency Member John Caleb Ball (Martin & Zerfoss), and Associate Member Tyler Siddens (CMS Insurance/CAP LLC).

“I’m appreciative of the Insurors of Tennessee for inviting me to participate in the MTSU Martin Chair of Insurance TopGolf Fundraiser. It was a fun experience and worthy opportunity to support the Risk Management & Insurance program at MTSU,” said Associate Member Tyler Siddens.

To learn more about the MTSU Martin Chair of Insurance program, visit w1.mtsu.edu/martinchair/ or contact Dr. Dave Wood at dave.wood@mtsu.edu or Rebecca Darden at rebecca.darden@mtsu.edu or by calling 615-898-237. u

National Security has provided competitive, affordable insurance to policyholders for over 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

National Security prides itself on fast, efficient service from our experienced staff teamed with an agent website that provides fast quotes, online policy issuance, and real-time policy information.

To learn more about our products call 1-800-798-2294 or visit nationalsecuritygroup.com.

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. Classes with (*) have option for in person or webinar event.

6/13 Commercial Casualty II* Nashville 7/11 Insuring Personal Auto Exposures* Nashville 8/22 Life & Health Essentials* Nashville

5/13-14 Agency Management * Nashville

7/31-8/1 Commercial Property * Nashville

9/25-26 Ruble MEGA Seminar * Nashville

Other

6/25-26 Property & Casualty Pre-Licensing* Nashville 10/5-8 Insurefest Nashville

Additional courses for designation programs are offered on-demand at your own pace and as live webinars.

The National Alliance for Insurance Education & Research is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417. Website: www.nasba.org. Advanced Curriculum Rating = 20 CPE Credits. For more information regarding administrative policies such as complaint and refund, please contact our offices at 800-633-2165.

Additional courses are available On-Demand and as Live webinars at the IIABA Virtual University *check the VU site for course offerings, CE and pricing (independentagent.com/vu)

From The National Alliance (www.scic.com)

Choose from the following programs CIC, CRM, CISR, CPRM, CSRM, Dynamics, RGS, MEGA, PROFOCUS, WTH, Intro, Producer School, Ethics, Flood and other. Choose by topic, location, delivery method and/or date.

From The Institutes (ceu.com/customer/insurors-tn ) Insurors of Tennessee has partnered with CEU, powered by The Institutes, to provide you with relevant and convenient online insurance continuing education (CE) courses. Through our partnership with CEU, you will enjoy a 35% discount on any of CEU’s relevant, practical courses when you log in. More than 150 course topics.

(insurors.aben.tv)

The below are examples of the webcast classes that are available at insurors.aben.tv. View website for more.

Independent insurance agents who are considering the impact of the new regulation on their agencies and firms should consider some of the rule’s key elements and certain revisions that were incorporated in the final text.BY Wes Bissett, Big “I" Senior Counsel,

Government Affairs

The Federal Trade Commission (FTC) completed its work on a high-profile regulation that prohibits the use and enforcement of most noncompete agreements. The FTC commissioners voted 3-2 to approve the “Non-Compete Clause Rule." The rule targets employment agreements that prohibit, penalize or effectively prevent a worker from seeking or accepting work elsewhere or operating a business after leaving a particular job.