FC July 2012_FC December 06 20/06/2012 12:57 Page 2

WORLD

www.AvBuyer.com ™

The global marketplace for business aviation

July 2012

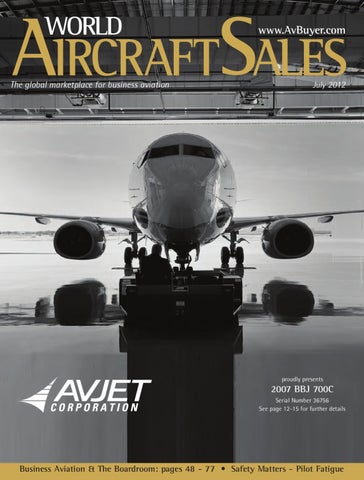

proudly presents

2007 BBJ 700C Serial Number 36756 See page 12-15 for further details

Business Aviation & The Boardroom: pages 48 - 77 • Safety Matters - Pilot Fatigue

Project2 21/06/2012 15:52 Page 1

PRE-OWNED FALCON

WE BUILT THESE PLANES, WE TRACKED THEIR LIVES, WE KNOW THEM BEST. No one knows a pre-owned Falcon like we do. No one knows more about its past. Because we record the details of every Falcon’s history in our databases. And no one cares more about helping you get the best out of it. Because wherever you fly your pre-owned Falcon, our reputation flies with you.

Visit falconjet.com/preowned France: +33.1.47.11.60.71 - US: +1.201.541.4556

Project2 21/06/2012 15:53 Page 1

Falcon 2000

2001 • s/n 133 • 5,033 hrs. total time • 10 passengers • EUOPS 1 compliant • Eng on CSP, APU on MSP • Aero I Sat Com • May 2012 C check, Landing gear overhaul, and white paint scheme.

Falcon 2000EX EASy

2005 • s/n 063 • 2,242 hrs. total time • 8 passengers • EUOPS1 compliant • Engines on JSSI, APU on MSP • Aug 2011 C check, new white paint scheme and winglets installation • Swift 64 Satcom : 3FMS, 3IRS, 3VHF, 2EFB

Falcon 2000LX

2008 • s/n 151 • 1,285 hrs. total time • 10 passengers • EUOPS1 compliant • One owner since new • Under FalconCare • Iridium Satcom • EFB

Falcon 900EX EASy

2004 • s/n 128 • 3,847 hrs. total time • 14 passengers • EASYII retrofitted • Engines & APU on MSP • One owner since new • EUOPS1 compliant • 2010 C check, 3FMS, 3IRS, 3VHF, Aero H+ • Swift 64 Satcom

Falcon 900EX EASy

2005 • s/n 150 • 2,149 hrs. total time • 14 passengers • EUOPS1 compliant • FWD and AFT Lav • Sept 2011 fresh C check • Aero I Satcom

Falcon 7X

2011 • s/n 128 • 172 hrs. total time • 14 passengers • No Crew Rest • Pristine condition, • HUD, EFVS, EFB, Aero H • Swift 64 high speed Satcom • Brakes wheel well heat modification

AC Index July2011 21/06/2012 13:10 Page 1

Aircraft For Sale AIRCRAFT

PAGE

AIRCRAFT

PAGE

605 . . . . . . . . . . . 6, 11, 22, 63, 148, 850 . . . . . . . . . . . 23, 148,

AEROSTAR Superstar 700 . . 34,

Learjet

AIRBUS A318 Elite. . . . . . 18, ACJ . . . . . . . . . . . 22, 148,

BOEING/MCDONNELL DOUGLAS BBJ . . . . . . . . . . . 11, 15, 31, 67, 71, BBJ 700C . . . . . . 1, 14, Super 27-100 . . 87, Super 727-100-VIP. .93, Super 727-100-REW. .18, Super 727-200-REW. .87, 737-300-VIP. . . . 141, 757-200 . . . . . . . 87,

BOMBARDIER CRJ-200 XR . . . 148, Global 5000 . . . . 17, 18, 63, 148, Global 6000 . . . . 6, 148, Global 7000 . . . . 25, Global Express . 6, 13, 18, 23, 24, 65, . . . . . . . . . . . . . . . 126, 127, 148, Global Express XRS.. 31, 148,

Challenger 300 . . . . . . . . . . . 19, 22, 63, 69, 148, 601-1A . . . . . . . . 28, 35, 65, 79, 601-3A . . . . . . . . 17, 20, 22, 65, 69, . . . . . . . . . . . . . . . 148, 601-3A ER . . . . . 144, 604 . . . . . . . . . . . 17, 19, 20, 21, 22, 25, . . . . . . . . . . . . . . . 37, 39, 57, 148,

31A . . . . . . . . . . . 29, 65, 103, 35A . . . . . . . . . . . 34, 63, 65, 81, 40 . . . . . . . . . . . . 25, 40XR . . . . . . . . . . 103, 124, 125, 45 . . . . . . . . . . . . 20, 25, 63, 65, 81, . . . . . . . . . . . . . . . 115, 45BR . . . . . . . . . . 71, 45XR . . . . . . . . . . 21, 103, 60 . . . . . . . . . . . . 25, 55, 65, 60SE . . . . . . . . . . 20, 60XR . . . . . . . . . . 65, 71, 144,

CESSNA

PAGE

Encore . . . . . . . . 147, Encore +. . . . . . . 147, Excel . . . . . . . . . . 28, 103, 147, 148, Jet . . . . . . . . . . . . 33, 55, 65, Mustang . . . . . . . 63, SII . . . . . . . . . . . . 28, 37, Sovereign. . . . . . 35, 65, 79, T206H . . . . . . . . . 33, Ultra . . . . . . . . . . 20, 28, 103, 137,

Conquest I . . . . . . . . . . . . . . 141, II. . . . . . . . . . . . . . 29,

CIRRUS SR22 . . . . . . . . . . 33,

AIRCRAFT

PAGE

20Cargo . . . . . . . 34, 20C-5BR . . . . . . 34, 50 . . . . . . . . . . . . 17, 19, 23, 34, 57, . . . . . . . . . . . . . . . 71, 146, 50EX . . . . . . . . . . 5, 63, 146, 50-4. . . . . . . . . . . 146, 900B . . . . . . . . . . 34, 65, 103, 130, . . . . . . . . . . . . . . . 146, 900C . . . . . . . . . . 146, 900EX EASy . . . 3, 19, 146, 147, 900EX . . . . . . . . . 19, 146, 2000 . . . . . . . . . . 3, 17, 25, 37, 133, . . . . . . . . . . . . . . . 147, 2000DX EASy . . 23, 148, 2000EX. . . . . . . . 148, 2000EX EASy . . 3, 19, 148, 2000LX . . . . . . . . 3, 85, 139,

Citation

DORNIER

ISP . . . . . . . . . . . 28, 33, 55, II. . . . . . . . . . . . . . 33, 34, 40, IISP . . . . . . . . . . . 34, III . . . . . . . . . . . . . 35, V. . . . . . . . . . . . . . 34, 65, VII . . . . . . . . . . . . 28, 91, 133, X . . . . . . . . . . . . . 6, 17, 22, 55, 57, . . . . . . . . . . . . . . . 148, XLS+ . . . . . . . . . . 28, 148, 208 . . . . . . . . . . . 144, 650 . . . . . . . . . . . 5, CJ1. . . . . . . . . . . . 113, CJ2. . . . . . . . . . . . 33, 34, 55, 142, 145, . . . . . . . . . . . . . . . 148, CJ2+ . . . . . . . . . . 28, 136, CJ3. . . . . . . . . . . . 65, Bravo . . . . . . . . . 34, 35, 55, 103, . . . . . . . . . . . . . . . 138,

Dornier 328 . . . . 141,

GULFSTREAM

EMBRAER

III . . . . . . . . . . . . . 19, 39, 69, IV . . . . . . . . . . . . . 11, 19, 23, 65, 73, . . . . . . . . . . . . . . . 129, 132, IVSP . . . . . . . . . . 31, 65, 67, 134, 148, V. . . . . . . . . . . . . . 11, 27, 31, 103, 150 . . . . . . . . . . . 81, 200 . . . . . . . . . . . 6, 21, 27, 35, 65, 81, 450 . . . . . . . . . . . 6, 18, 27, 31, 39, 550 . . . . . . . . . . . 6, 12, 17, 18, 27, 39, . . . . . . . . . . . . . . . 148,

Aviation Companies, Inc.

1980 MU-2 SOLITAIRE S/N 424SA, N82AF, 7485TT, 385/385 SOH, 75/75 SPOH, GNS 530 WAAS, Avidyne Flight Max, 7500-hr, inspection, New P&I (2010) to customer specs. U.S. $675,000.

1981 MU-2 MARQUISE S/N 1510SA, N17HG, 3840TT, 3840/3840 SNEW, 630/630 SHSI/SGBI, 135/320 SPOH, GNS-400, Collins Pro-Line, Sandel 4” EFIS, SPZ-500 A/P, New Interior (2012). U.S. $650,000.

1974 MU-2K Dash 10 on MSP - Price Reduced S/N 305, N50K, 6370TT, 1180/1180 since -10 (MSP), 750/750 SPOH, Dual Garmin 430’s, RDR-2000, M4-D A/P, New Paint (2009). U.S. $535,000.

1980 MU-2 MARQUISE S/N 756SA, 5Y-MUZ. 12925TT, 1990/2060 SOH, 1990/2060 SHSI, 260/220 SPOH, Collins Pro-Line, M4D A/P, New Paint (2010), Located in Africa. U.S. $475,000.

1975 MU-2M S/N 326, N165MA, 3750TT, 3750/3750 SOH, 235/235 SHSI, 680/370 SGBI, 410/410 SPOH, GTN-750/650, Traffic, XM Weather. U.S. $395,000.

1974 MU-2K S/N 285, N11SJ, 4630TT, 2350/2350 SOH, 525/525 SHSI, 230/230 SPOH, Garmin 530W, RDS-81 Color Radar, M4D A/P, New Paint & Interior (2009). U.S. $345,000.

1972 MU-2K S/N 240, N64LG, 6100TT, 4655/4655 SOH, 1100/1100 SHSI/SGBI, 920/775 SPOH, Garmin G-600, Dual GNS-430W’s, Dual GTX-320 TXP’s, TCAS, XM Weather. U.S. $295,000.

234 Air Park Blvd., Aiken, SC (USA) 29805-8921 Tel: USA +1 803-641-9999 • Fax: USA +1 803-641-4040 www.air1st.com • Email: mike@air1st.com 4

AIRCRAFT

IN THIS ISSUE

WORLD AIRCRAFT SALES MAGAZINE – July 2012

ERJ 135 . . . . . . . 11, ERJ 145 . . . . . . . 11, Legacy 600 . . . . 18, 55, 63, 67, 69, . . . . . . . . . . . . . . . 148, Legacy 650 . . . . 103, Lineage 1000. . . 18, Phenom 100 . . . 55,

FAIRCHILD Merlin IIIB . . . . . 55,

FALCON JET 7X . . . . . . . . . . . . 3, 6, 23, 28, 57, 69, . . . . . . . . . . . . . . . 103, 146, 148,

HAWKER BEECHCRAFT Beechcraft 400 ............34, 400A . . . . . . . . . . 25, 29, Premier 1A. . . . . 34, 39, 115,

AC Index July2011 21/06/2012 13:11 Page 2

07.12

• AIRCRAFT • HELICOPTERS • PRODUCT & SERVICE PROVIDERS AIRCRAFT

PAGE

AIRCRAFT

PAGE

King Air

MITSUBISHI

200 . . . . . . . . . . . 29, 34, 35, 350 . . . . . . . . . . . 29, 34, 57, 65, 81, B200 . . . . . . . . . . 29, 55, 81, 103, 105 C90 . . . . . . . . . . . . . 34, 103, C90B . . . . . . . . . . 20, 59, 81, 103, F90 . . . . . . . . . . 34, 105, 115,

MU-2K . . . . . . . . 4, MU-2M . . . . . . . . 4, MU-2K Dash 10 4, MU-2 Marquise . 4, MU-2 Solitaire. . 4,

Hawker

PIAGGIO

400XP . . . . . . . . . 34, 65, 148, 700A . . . . . . . . . . 35, 800A . . . . . . . . . . 6, 142, 800B . . . . . . . . . . 31, 63, 800SP. . . . . . . . . 87, 800XP . . . . . . . . . 20, 23, 34, 43, 65, . . . . . . . . . . . . . . . . 69, 81, 850XP . . . . . . . . . 31, 39, 71, 900XP . . . . . . . . . 25, 39, 147, 1000B . . . . . . . . . 128, 4000 . . . . . . . . . . 20, 59, 147,

P180 Avanti . . . 65,

PILATUS PC12/45. . . . . . . 29, 65, PC12/47 . . . . . . . 141,

PIPER Meridian . . . . . . . 29, Malibu Mirage . . 33,

SAAB IAI

AIRCRAFT

PAGE

TBM 700B . . . . . 34, 105, 135, 141, . . . . . . . . . . . . . . . 144, 147, TBM 700C1 . . . . 35, TBM 850. . . . . . . 105,

HELICOPTERS

LANCAIR

SOCATA

Lancair L4 . . . . . 65,

TBM 700A . . . . . 105,

65 . . . . . . . . . . . . 34,

AS 365 N2 . . . . . 30, AS 365 N3 . . . . . 115, EC 120B . . . . . . . 30, EC135T2i . . . . . . 103, EC135P2i . . . . . . 143, EC135P2+ . . . . . 131,

MCDONNELL DOUGLAS

AW 109C . . . . . . 103, AW 109E. . . . . . . 30, AW Grand . . . . . . 103, A109S Grand. . . 115, 143, A119 Koala . . . . 39,

MD 600N . . . . . . 39,

SIKORSKY

BELL

C++ . . . . . . . . . . . 51, C1+ . . . . . . . . . . . 51, S-76A+ . . . . . . . . 115, S-92 . . . . . . . . . . 51,

206B . . . . . . . . . . 143, 206L3 . . . . . . . . . 115, 206L4 . . . . . . . . . 142, 212 ............142, 412EMS . . . . . . . 142,

CORPORATE AVIATION PRODUCTS & SERVICES PROVIDERS

EUROCOPTER SABRELINER

PAGE

AGUSTAWESTLAND

340B . . . . . . . . . . 37,

Astra 1125 . . . . . 65, 147, Astra 1125SP . . 27, Astra SPX. . . . . . 37, 57,

AIRCRAFT

AS 332C1 . . . . . . 143, AS350BA . . . . . . 103, AS350B3 . . . . . . 103, AS 355 N . . . . . . 115, AS 355 NP . . . . . 103,

Find an Aircraft Dealer The World’s leading aircraft dealers and brokers - find one today

Aircraft Engine /Support . 61, Aircraft Perf & Specs . . . . . 46, 119, Aircraft Title/Registry . . . . 47, 95, Finance . . . . . . . . . . . . . . . . 78, 107, Ground Handling . . . . . . . . 41, Mods-Parts-Spares . . . . . . . 41, Photography . . . . . . . . . . . . 46,

avbuyer.com/dealers

WORLD AIRCRAFT SALES MAGAZINE – July 2012

5

Project3 21/06/2012 16:11 Page 1

Project3 21/06/2012 16:11 Page 1

Panel July12 20/06/2012 09:18 Page 1

Subscribe Online

World Aircraft Sales EDITORIAL Deputy Editor (London Office) Matthew Harris 1- 800 620 8801 editorial@avbuyer.com

Now you can subscribe to the print edition of World Aircraft Sales Magazine online!

Editor - Boardroom Guide J.W. (Jack) Olcott 1- 973 734 9994 Jack@avbuyer.com

WORL D The gl obal marke tplace for bu siness aviatio n

Editorial Contributor (USA Office) Dave Higdon Dave@avbuyer.com

www .AvBu yer.co m ™

April

2012

Consulting Editor Sean O’Farrell +44 (0)20 8255 4409 Sean@avbuyer.com

WORL D The gl obal marke tplace for bu siness aviatio n

www .AvBu yer.co m ™

May

2012

ADVERTISING WORL D Busine The Je ss Av t Colle iation ction & Th 2014 proudly pres e Bo See pa ardroo ents BB ge 17 m: pa for fur J ges 48 ther de tails - 73 • Pl GLOB ane Se AL 50 Aircr nse on af t de 00 S/N 9158 tails Cabin Avioni and other inv ento cs ry

The gl obal marke tplace for bu siness aviatio n

www .AvBu yer.co m ™

June 20

12

page

s 11– 13

Busine ss Av iation & Th e Bo ardroo m: pa ges 54 - 79 • Te n Que stions for EB AA

Karen Price 1- 800 620 8801 Karen@avbuyer.com Karen Schaefer (USA Office) 1-386 767 8460 ks@avbuyer.com STUDIO/PRODUCTION Helen Cavalli/ Mark Williams 1- 800 620 8801 Helen@avbuyer.com Mark@avbuyer.com

pro

Busine Gulfs udly presents tream ss Av iation GIVSP Se & Th See pa rial Numb er 14 ge 19 e Bo 33 for fur ardroo ther de m: pa tails ges 50 - 77 • Pl ane Se nse on Pape rless Cock pits

CIRCULATION Lynne Jones 1- 800 620 8801 Lynne@avbuyer.com AVBUYER.COM Nick Barron Nick@avbuyer.com

www.avbuyer.com/worldaircraftsales/print.asp

The global marketplace for business aviation News - Aircraft listings - Editorial World Aircraft Sales (USPS 014-911), July 2012, Vol 16, Issue No 7 is published monthly by World Aviation Communications Ltd, 1210 West 11th Street, Wichita, KS 67203-3517 and has a targeted circulation to decision makers within business and corporate aviation throughout the world. It is also available on Annual Subscription @ UK £40 and USA $65. POSTMASTER: Send address changes to: World Aircraft Sales Magazine 1210 West 11th Street, Wichita, KS 67203-3517. Postage is paid at Wichita, KS and additional mailing offices.© Copyright of World Aviation Communications Ltd. Every effort is made to ensure the accuracy of material published in World Aircraft Sales Magazine. However, the publishers cannot accept responsibility for claims made by manufacturers, advertisers or contributors. The views expressed are not necessarily those of the Editor or the publishers. Although all reasonable care is taken of all material, photographs, CD & Disc’s submitted, the publishers cannot accept any responsibility for damage or loss. All rights reserved. No part of World Aircraft Sales Magazine - Advertising, Design or Editorial - may be reproduced, stored in a retrieval system, or transmitted in any other form, or by any other means, electronic, mechanical, photographic, recording or otherwise, without prior written permission of the publishers.

WORLD AIRCRAFT SALES MAGAZINE IS A MEMBER OF THE FOLLOWING ORGANISATIONS: Aircraft Electronics Association (AEA) - British Business and General Aviation Association (BBGA) British Helicopter Association (BHA) - European Business Aviation Association (EBAA) Helicopter Association International (HAI) - National Aircraft Finance Association (NAFA) National Aircraft Resale Association (NARA) - National Business Aviation Association (NBAA)

8

WORLD AIRCRAFT SALES MAGAZINE – July 2012

www.AvBuyer.com

Emma Davey Emma@avbuyer.com PUBLISHER John Brennan 1- 800 620 8801 John@avbuyer.com USA OFFICE 1210 West 11th Street, Wichita, KS 67203-3517 EUROPEAN OFFICE Cowleaze House, 39 Cowleaze Rd, Kingston, Surrey, KT2 6DZ, UK +44 (0)20 8255 4000 PRINTED BY Fry Communications, Inc. 800 West Church Road, Mechanicsburg, PA 17055

Panel July12 20/06/2012 14:09 Page 2

Contents

Volume 16, Issue 7 – July 2012

Featured Articles Business Aviation and the Boardroom 48

48

It’s Just Transportation: Those constrained by the rhetoric of politicians concerning Business Aviation should consider the use of it by federal, state and local governments.

50

The Fundamental Need for Transportation: Government—like industry—needs efficient, effective and secure transportation. That’s why government employs Business Aviation too.

52

Endowed Aviation Services: Aviation services are either endowed from on high or they are managed as a business unit. Which approach do you use?

56

Celebrate Business Aircraft: Are concerns about public perception

60

toward Business Aviation still clouding your judgment about the long-term benefits of this mode of travel? They shouldn’t do, here’s why.

60

The Value of Time: A wise man once observed we cannot save time; we can only spend it wisely. So how can, and does that apply to Business Aviation?

64

Tax Implications of Personal & Recreational Use: Expenses that are ordinary, necessary and reasonable for the conduct of business are deductible as appropriate costs. Proscribed limits exist, though...

68

‘PUNC’ - Your Checklist for Insurance Coverage: Pilots, Use, Named Insured and Contracts capture the four most important areas of aviation insurance. Read more…

72

The Light Jet Value Guide: A look at the benefits of Light Jets, and a

64

listing of values for models built over the last 20 years.

Main Features 42

Aircraft Comparative Analysis - Hawker 800XP: How does the performance of the Hawker 800XP stand out against the Learjet 60?

88

GA Airports: For more than 4,600 locales, the GA Airport is the main, primary or only access to the nation’s air-transportation network. They’re worth protecting…

96

Ethics & Aircraft Sales: What should buyers look for to ensure they are dealing with one of the many reputable, ethical dealers and brokers in an aircraft purchase?

98

Inside Maintenance – Older Gulfstreams: It’s a balancing act between the lower costs of older Gulfstreams with the maintenance to keep them flying, as Dave Higdon outlines.

104

BizAv’s Niche Jets: A fuller understanding about some of the ‘off the radar’ air planes can lead to true buyer satisfaction.

Regular Features 10

Viewpoint

26

BizAv Round-up

80

Aircraft Specs & Performance Tables

102 Aviation Leadership Roundtable 108 Regional Sales & Use Tax Forum

112

Global Markets – Asia Pacific: Mike Vines gives a round-up of the latest key

110 Pre-Owned Aircraft Sales Trends

stories to emerge from China and Hong Kong, India, Japan and Australia.

118

Safety Matters – Pilot Fatigue: Dave Higdon discusses the issue of Pilot

Next Month’s Issue

Fatigue. How can it creep up unawares, and how can you counter this potentially lethal, but surprisingly common problem?

* Dealer Broker Market Update

Advertising Enquiries see Page 8

www.AvBuyer.com

* Plane Sense on Refurbishments

WORLD AIRCRAFT SALES MAGAZINE – July 2012

9

Gil WolinJuly12_Gil WolinNov06 19/06/2012 12:51 Page 1

VIEWPOINT

XXX Marks The Spot by Gil Wolin n July 27, athletes from 204 countries will gather at the opening ceremony of London’s Summer Olympics – officially, the Games of the XXX Olympiad. During the ensuing 17 days, more than eight million tickets will be sold, and 906 medals awarded to participants in 302 events across 32 sports – including, for the first time, women’s boxing. For business jet operators, that means flights to the various London area airports will increase by more than 3,000 during this international quadrennial event, according to UK Civil Aviation estimates. That’s an average of 176 incremental arrivals, and 176 departures each day. I remember working an FBO ramp with that kind of volume during the Indianapolis 500. Massive planning and logistics are required to marshal each aircraft, deplane its VIP passengers proximate to the executive terminal and then park the aircraft appropriately based upon its scheduled departure. But to do that daily for 17 consecutive days – not to mention nurturing very special relationships with ground transport and catering companies – Whew! Those planning to fly into any Londonarea airport during the Games had best have slots already reserved. No IFR arrivals or departures will be allowed into or out of London’s terminal maneuvering areas, some 40 airports covering most of southeast England’s controlled airspace, without a slot. London City is likely to be the biggest beneficiary of the Olympic spike, as they are adjacent to the primary venues. Biggin Hill, Farnborough, Luton, Oxford, Southend and Stansted, though a bit further out from the stadia, also will do well. While the passengers will be at the Olympics to watch world-class athletic performances, those of us in Business Aviation will be far more concerned with aircraft performance. Nothing dampens VIP spectators’ celebratory moods over victory – or deepens their gloom over losses – than to find their jet AOG for the flight home.

O

10

WORLD AIRCRAFT SALES MAGAZINE – July 2012

So the major airframe and engines maintenance organizations have made special preparations to support transient aircraft during the Summer Games. GE will have dedicated field service representation on site at Luton, ready to address engine issues. Eurojet at Birmingham has a new hangar facility, home to an authorized Cessna Citation service center. And JSSI, the hourly cost maintenance service provider, will have personnel at strategic locations to provide AOG technical support at all London area airports. These maintenance companies – and the tens of thousands of other behind-thescenes personnel – will be working together to help bizav users get to and from the 2012 Summer Games easily, safely and efficiently. Teamwork – as well as individual preparation – is behind every champion athlete and every safe flight. Working together underscores the primary purpose of the Olympics: to showcase not only individual achievement, but to foster understanding and cooperation among nations - and sometimes much more, as we saw during the 1968 Olympic Games in Mexico. There, certain champions – rather than nations – made statements with their actions as well as their performances. That same year found me a high school senior on the Millburn, NJ track team. Our coach was Paul “Boomer” Beck – nicknamed for his commanding voice. Paul demanded – and got – the best possible performance from his athletes. He was tough, but fair: he never asked his team to do anything he wouldn’t or couldn’t do, be it sprints, push-ups…or those hated squat thrusts. But he was a father, too, and often served in loco parentis to team members. My own dad traveled extensively throughout his long career in aviation, and saw me run only once. But he loved track, and appreciated the role that Boomer unwittingly filled during those Wonder Years. Every March 1st since graduation, I’d call Boomer to mark the first day of track season. And I would thank him, for helping www.AvBuyer.com

me learn discipline, how to pursue excellence as an individual and as a team member, and how to win – and lose – gracefully. Even after many years he remembered each team, each athlete, each meet. Then we’d talk about the here and now. He was fascinated with my chosen career in aviation, and our conversations ranged far and wide, well beyond the past and mere athletics. I was not alone – many former Millburn tracksters stayed connected with Boomer, from as far back as his first years there in the mid-1950s. When I made my annual call this year, I got a disconnect message. I reached out to his son, only to find that Boomer was seriously ill. To the great sorrow of all who knew him, Paul passed away last month. I will miss our conversations, his perspective – and his sometimes-not-so-gentle reminders of what is really important in life. Those of us in bizav – as well as Olympic athletes – can take a few lessons from Coach Paul Beck. No matter how hard you work, never make the mistake of thinking that the safe flight, the stellar performance, the track meet win, is a sole venture. You might be the star, but it’s the team behind you – whether flight crew, maintenance technician, or logistics planner – who supports your own pursuit of excellence. ❯ Gil Wolin draws on almost forty years of aviation marketing and management experience as a consultant to the corporate aviation industry. His aviation career incorporates aircraft management, charter and FBO management experience (with TAG Aviation among others), and he is a frequent speaker at aviation, travel and service seminars. Gil is a past director of the RMBTA and NATA, and currently serves on the Advisory Board for Corporate Angel Network and GE Capital Solutions-Corporate Aviation. Gil can be contacted at gtwolin@comcast.net Aircraft Index see Page 4

Bristol Associates April 19/03/2012 16:33 Page 1

Acquisitions * Appraisals * Consulting * Remarketing Challenger 605 sn 5711

Gulfstream IV sn 1124

Gulfstream V sn 627

New to Market! Boeing BBJ sn 30496

ERJ 135 and 145s Available

+1 (202) 682-4000 bristol@bristolassociates.com Www.bristolassociates.com

Avjet - FP July 19/06/2012 17:36 Page 1

Global Sales & Acquisitionss Andrew C. Bradley Senior Vice President, Global Sales S and Acquisitions andrew@avjet.com Phone: +1 (410) 626-6162

Charter & Management Mark H. Lefever President charter@avjet.com Phone: +1 (818) 841-6190

AV VJET T.COM

World Headquarters Marc J. Foulkrod Chairman and Chief Executivve OfďŹ cer info@avjet.com Phone: +1 (818) 841-6190

Avjet - FP July 19/06/2012 17:36 Page 2

World Headquarters Marc J. Foulkrod Chairman and Chief Executivve OfďŹ cer info@avjet.com Phone: +1 (818) 841-6190

Global Sales & Acquisitions Andrew C. Bradley Senior Vice President, Global Sales S and Acquisitions andrew@avjet.com Phone: +1 (410) 626-6162

Charter & Management Mark H. Lefever President charter@avjet.com Phone: +1 (818) 841-6190

AVJET V T.COM

Avjet - FP July 19/06/2012 17:36 Page 3

World Headquarters Marc J. Foulkrod Chairman and Chief Executivve OfďŹ cer info@avjet.com Phone: +1 (818) 841-6190

Charter & Management Mark H. Lefever President charter@avjet.com Phone: +1 (818) 841-6190

AV VJET T.COM

Global Sales & Acquisitionss Andrew C. Bradley Senior Vice President, Global Sales S and Acquisitions andrew@avjet.com Phone: +1 (410) 626-6162

Avjet - FP July 19/06/2012 17:37 Page 4

World Headquarters M J Marc J. FFoulkrod lk d Chairman and Chief Executive OfďŹ cer info@avjet.com Phone: +1 (818) 841-61990

t 4FSJBM /VNCFS t /FWFS $PNQMFUFE t 4FWFO 5BOL $POmHVSBUJPO t *NNFEJBUFMZ "WBJMBCMF

Global Sales & Acquissitions Andrew C. Bradley Senior Vice President, Global G Sales and Acquisitions andrew@avjet.com d @ j Phone: +1 (410) 626-61622 Charter & Managemen nt Mark H. Lefever President charter@avjet.com Phone: +1 (818) 841-61990

AV VJET T.COM

Project2 21/06/2012 15:56 Page 1

Project2 21/06/2012 15:58 Page 1

Avpro July 18/06/2012 16:19 Page 1

Avpro July 18/06/2012 16:19 Page 2

Avpro July 18/06/2012 16:20 Page 3

O'Gara July 19/06/2012 15:47 Page 1

Project2 21/06/2012 16:01 Page 1

Project2 21/06/2012 16:03 Page 1

2000 Global Express SN 9062

HIGHLIGHTS:

Only 3625 Hours Total April 2012 8C by Bombardier - Hartford Engines on Corporate Care Smart Parts Plus Privately Owned Since New

www.jetcraft.com I info@jetcraft.com I Headquarters +1 919-941-8400

WAS Global Express 9062.indd 1

6/18/12 11:09 AM

New Jet Intl July 18/06/2012 16:30 Page 1

2006 LEARJE LEARJETT 40

Engines enrolled enrolled on MSP Engines Certified EU OPS Certified

s/n 2053

Air frame eT.T - 2400 hrs AirframeT.T Fresh MPI Fresh

2002 LEARJE LEARJETT 45

FFresh resh 4800 hr inspec inspection tion EU OPS C ertified Certified

s/n 226

En ngines & APU on MSP Engines R V VSM C ertified RVSM Certified

2001 LEARJE LEARJETT 60

s/n 211

Engines Pro-Rata Eng ines on JSSI P ro-Rata Airframe Air frame TT.T .T 2664 hrs RVSM, R VSM, RNP5 & 10 Compliant Compliant + EU OPS 1 Equipped Equipped

2001 CHALLENGER CH HALLENGER 604

SP G old prog. prog. APU on M MSP Gold Engines on o GE on Point Point Engines

A ir frame on Smar tParts Airframe SmartParts IInt. nt. / Ex t. rredone edone in ‘09 Ext.

2001 FFALCON A CON 2000 AL

A Airframe ir frame TT.T. .TT. - 3455 hrs EU OP PS 1 C ertified OPS Certified

s/n 5487

s/n 161

Eng ines enr olled on CSP Engines enrolled HUD C AT IIIA CAT

2000 LE LEARJET EARJET 45

s/n 068

Engines on Engines n MSP B B-RNAV, RNP-5 Compliant Compliant -RNAV, RVSM, RVSM, RNP-5 Certified EU OPS C ertified Airframe A ir frame e TT.T .T 6767 hrs

2002 BEECHJE BEECHJETT 400A

Eng ine maint. maint. pr og. JSSI Engine prog. EU OPS Compliant Compliant

A ir fram meT.T - 2602,25 hrs AirframeT.T R VSM Compliant Compliant RVSM

2008 HA HAWKER WKER 900XP

C Collins ollins P Pro ro Line 21 EFIS EU OPS Compliant Compliant

s/n RK RK-343 -343

s/n HA HA-56 -56

Eng iness & APU MSP G old Engines Gold A ir frame e: 965 hrs (01/12) Airframe:

1999 LEARJE LEARJETT 45

Airframe Air frame TT.T .T 3553 hrs Engines Gold old Engine es on MSP G Certified, B-RNAV, EU OPS C ertified, B -RNAV, RVSM RVSM & RNP-5 RNP-5 Compliant Compliant

GLOBAL GLOBAL 7000

NE NEW W JE JET T INTERNATIONAL, INTER RNATIONAL, FOR ALL Y YOUR O OUR AVIATION AVIATION NEEDS. NEEDS . New air aircraft rcr craft sales, saless, helicopter helicoptteer sales sales, s, pr pre-owned re-owned air aircraft rcr cra aft sales & ac acquisitions, quisitionss, flight hour pack a s, memb ages ership programs prrogrra ams & on o demand charter charteer packages, membership NEW SALES

PRE- OWNED

s/n 036

CHARTER

or the full inventory, inventory, please contact: contact: FFor +377 97 70 7 10 20 - sales@newjet.com sales@new wjet.c j om - www.newjet.com www..new wjjet.com D Delivery elivery position available available

IT TA AL LY Y - M O N A C O - P O R T U G A L - S PA PA I N - S W I T Z E R L A N D NEWJET INTERNATIONAL IS A CERTIFIED CARBON FREE COMPANY

s/n 13

BusAviationNewsJuly12_Layout 1 20/06/2012 11:08 Page 1

BizAv Round-Up

07.12

NEWS IN BRIEF Aerion Corporation is reportedly collaborating with NASA’s Glenn Research Center to mature NASA’s new SUPersonic INlet (SUPIN) computer code, which has been developed to perform aerodynamic design and analysis on engine inlets for future highspeed aircraft, such as Aerion’s planned supersonic business jet. Aerion and NASA will work together on inlet design and advanced boundary layer control methods to achieve efficient and stable supersonic inlet operation without boundary layer bleed. / More from www.aerioncorp.com

BUSINESS AVIATION: IT’S GOOD FOR PRIVATE AND PUBLIC SECTOR ALIKE

Directional Aviation Capital has acquired charter broker Sentient Jet and aviation fuel management company Everest Fuel Management for an undisclosed sum from Australia-based Macquarie Global Opportunities Partners. Directional Aviation also owns Corporate Wings, Constant Aviation, Nextant Aerospace, Sojourn Aviation and Spinnaker Air, as well as a majority share of fractional provider Flight Options. / More from www.directionalaviation.com

/ More from www.eclipseaerospace.net

26

WORLD AIRCRAFT SALES MAGAZINE – July 2012

▼

Eclipse Aerospace launched production of the Model 550 twin-engine very light jet last month, alongside its first international Eclipse dealer and sales conference, which was attended by dealers from more than 30 countries. Production for 2013 is already sold out to US customers, according to Eclipse, and orders taken from the international dealers will be delivered during 2014 and 2015.

Governments using Business Aviation can derive the same types of benefits and efficiencies as private-sector enterprises do, according to a study just released by NEXA Advisors, LLC. The study was commissioned as part of the No Plane No Gain advocacy campaign, which educates policymakers and opinion leaders about the value of Business Aviation to citizens, companies and communities across the U.S. Working in conjunction with the National Association of State Aviation Operators (NASAO), NEXA President and Founder Michael Dyment said his study shows the use of General Aviation assets by local, state and federal governments provides a wealth of benefits. “We found many state agencies and departments, and even some counties with large territories to cover, having the ability to execute

www.AvBuyer.com

public health mandates much more efficiently with aviation,” Dyment said. “In many cases, there was no other way to accomplish the mission without aircraft.” The study found a total of 196 agencies nationwide operating a fleet of 2,002 aircraft (including jets, turboprops, helicopters and large piston aircraft). The vast majority of those aircraft – 1,337 – were operated by the federal government. The most common use involved transportation of key government officials, such as the president, members of Congress, governors and state employees on special missions. On a state and local level, the study found government aircraft were crucial in the timely movement of state officials to areas not served by the airlines. “The most recurring taxpayer value measure, but far from the largest in aggregate, is the

budget savings for travel, given that aircraft use often leads to far fewer hotel stays, lower cost for car rentals, fewer restaurant meals, and reductions in related business travel expenses. Tax dollar efficiency is a measure of how effectively the public budget is managed and the ability to maximize the value of each dollar spent. Government aircraft have been cited as key contributors to economic development, for example, bringing project developers together with key policy makers to locations where the economic development initiative will form,” the study said. The NEXA report concludes that a majority of governors in the U.S. have officially recognized the value of Business Aviation with proclamations to that effect. / More information from www.nbaa.org or www.nexacapital.com continued on page 32 Aircraft Index see Page 4

Gulfstream July 18/06/2012 16:33 Page 1

2006 Gulfstream G550 S/N 5086

2007 Gulfstream G200 S/N 164 2052 TT, 662 Landings, Engines and APU enrolled on JSSI Select. Sixteen (16) Passengers with a Forward Galley $36,950,000

2006 Gulfstream G450 S/N 4039

2511 TT, 1445 Landings, Engines enrolled on ESP Gold. Auto Throttles. Ten (10) Passenger Configuration $9,950,000

2003 Gulfstream G200 S/N 063 2440 TT, 1241 Landings, Fourteen (14) Passengers with a Aft Galley. 26" Club Seats & Enhanced Soundproofing $24,250,000

2002 Gulfstream GV S/N 662

2732 TT, 1547 Landings, Engines enrolled on ESP. Nine (9) Passenger Configuration. Fresh 8 year Inspection $7,500,000 4834 TT, 2086 Landings, Engines enrolled on Rolls Royce Corporate Care. Enrolled on PlaneParts. Sixteen (16) Passengers with a Forward Galley and Forward Crew Rest $27,995,000

2003 Gulfstream G200 S/N 050

2001 Gulfstream GV S/N 634

5526 TT, 1516 Landings, Fourteen (14) Passengers with Aft Galley and Forward Crew Rest $23,000,000

3421 TT, 1497 Landings, Engines enrolled on ESP. Ten (10) Passenger Configuration. Interior refurbished in 2010 $7,000,000

2000 Gulfstream G200 S/N 007

1998 Gulfstream GV S/N 518

7213 TT, 2813 Landings, Fourteen (14) Passengers with Forward Galley and Forward Crew Rest. New Paint February 2012 LEASE ONLY

5815 TT, 3936 Landings, Engines enrolled on ESP Gold. Ten (10) Passenger Configuration. Fresh 12 year Inspection $6,150,000

1995 Astra/ Gulfstream 1125 SP

2010 Gulfstream G200 S/N 233

519 TT, 244 Landings, Engines enrolled on ESP Gold. Auto Throttles. Nine (9) Passenger Configuration. $13,900,000

5471 TT, 3838 Landings, Engines on MSP. Seven (7) Passenger Configuration plus a Belted Toilet. Recent Refurbishment by Duncan Aviation. Flight Environment Sound Proof Package. Airshow. $2,475,000

Gulfstream Pre-Owned. Contact Lynn Beaudry. lynn.beaudry@gulfstream.com Tel: (912) 965-4000 • Fax: (912) 965-4848

Main Office

Bell Aviation West

Colorado (GJT) 970.243.9192 / 970.260.4667 cell

South Carolina (CAE) 803.822.4114 e-mail: mail@bellaviation.com

Bell Aviation Texas

Dallas, Texas 214.904.9800 / 214.952.1050 cell

Aircraft Sales & Acquisitions

Challenger

Falcon

2011 Falcon 7X | 111

Citation XLS+

2009 Citation XLS+ | 560-5060

Citation Ultra

1996 Citation Ultra | 560-0366

Citation S11

1985 Citation SII | S550-0041

Citation Jet

2007 Citation CJ2+ | 525A-0345

1985 Challenger 601-1A | 3044

Citation V11

1996 Citation VII | 650-7074

Citation Excel

2002 Citation Excel | 560-5288

Citation 11

1994 Citation II | 550-0732

Citation 1SP

Also Available: 550-0047

1982 Citation ISP | 501-0255 Also Available: 501-0687, 501-0229

For Full Specs & Additional Photos on Exclusive Listings by Bell Aviation, please Visit our Website at www.BellAviation.com

Main Office

Bell Aviation West

Colorado (GJT) 970.243.9192 / 970.260.4667 cell

South Carolina (CAE) 803.822.4114 e-mail: mail@bellaviation.com

Bell Aviation Texas

Dallas, Texas 214.904.9800 / 214.952.1050 cell

Aircraft Sales & Acquisitions

Learjet

Beechjet

1993 Learjet 31A | 31A-086

King Air 350

1998 King Air 350 | FL-221

King Air 200

1976 King Air 200 | BB-169

Pilatus

1998 Pilatus PC-12/45 | 195

Meridian

2001 Piper Meridian | 4697110

1992 Beechjet 400A | RK-36 Also Available: RK-107

King Air B200

1983 King Air B200 | BB-1140

Conquest

1980 Conquest II | 441-0116

Meridian

2008 Piper Meridian | 4697324

Meridian

2001 Piper Meridian | 4697056

For Full Specs & Additional Photos on Exclusive Listings by Bell Aviation, please Visit our Website at www.BellAviation.com

Heliasset_FullPage-205x270_print.pdf

1

16/01/12

16:31

Your worldwide helicopter sales and acquisition partner

2006 A109E S/N 11679 AIR CONDITIONING

1990 AS365N2 S/N 6364

SP IFR

FRESH INSPECTIONS

LIGHT EMS / PAX CONF.

SOUND PROOFING WEATHER RADAR

FIXED PART FOR SAR

2005 EC120B S/N 1394

CV-FDR

AUTO PILOT GLASS COCKPIT INTEGRATED AVIONICS FRESH 72m INSPECTION

Available for Sale visit heliasset.com for full inventory

GLOBAL NETWORK With multiple offices around the world, its network spans 6 continents.

HELIASSET.COM main office : 21 av Georges V, 75008 Paris, France +33 1 5367 7100 - enquiry@heliasset.com

YEARS

EXPERTISE

A Regourd Aviation partner company, it capitalizes over 35 years of helicopter transaction know how & network.

Global reach, local expertise

FREESTREAM AIRCRAFT LIMITED Sales & Acquisitions

Boeing BBJ/28579

Boeing BBJ/29273

Boeing BBJ/30076

Boeing BBJ/36714

Global XRS/9195

Gulfstream GV/512

Gulfstream G450 2Q 2012

Gulfstream GIVSP/1317

Hawker 850XP/258812

Hawker 800B/258058

freestream aircraft limited

freestream aircraft usa ltd

freestream aircraft (Bermuda) Limited

London +44 207.584.3800 sales@freestream.com

New York 201.596.5044 aircraftsales@freestream.com

Hamilton, Bermuda +441.505.1062 sales@freestreambermuda.bm

new york | LAS VEGAS | london | hong kong | new delhi | mexico | Moscow | Bermuda

www.freestream.com

BusAviationNewsJuly12_Layout 1 20/06/2012 11:08 Page 2

BizAvRound-Up Flying Colours Corp. presented, in partnership with Maine Aviation, its latest ExecLiner/CRJ conversion at last month’s NBAA Regional Forum at Teterboro, NJ. The aircraft is configured for 16 passengers and is the ninth CRJ conversion Flying Colours Corp. has completed. Functionality includes state-of-the-art equipment including a fully-digital touch screen cabin management system, Airshow 4000, iPod connectivity and dual galleys. Forward and aft lavatories have also been fitted for maximum passenger comfort.

2 CHALLENGER 300 IN DEMAND

/ More from www.flyingcolourscorp.com

BOMBARDIER MAKES HISTORY (AGAIN) Guernsey, one of the Channel Islands situated in the English Channel, is to launch a business aircraft register. The Island will team with Dutch company SGI Aviation, which will be responsible for the operational aspects of the registry, including safety inspections, under a public-private partnership. The registry is expected to be up and running within 12 to 15 months. / More from www.gov.je

Gulfstream has opened a full-service multimedia center at its Product Support headquarters to enhance and increase communication with operators. The center, which includes a broadcast studio, control room and equipment room allows Gulfstream to produce live streamed webcasts, videos and recorded broadcasts.

Last month, just over one year after the largest business aircraft sale in its history, Bombardier surpassed the record, announcing a firm order from NetJets for 100 Challenger business jets with options for an additional 175 aircraft. Bombardier also announced a longterm aftermarket support agreement with NetJets. The transaction for the firm aircraft order is valued at approximately US$2.6 billion based on 2012 list prices. If all the options are exercised, the total value of the order is approximately US$7.3 billion (also based

on 2012 list prices). The aftermarket agreement is for a term of up to 15 years. Assuming certain aircraft usage projections and a 15-year term per firm aircraft, it is valued at up to US$820 million. If all options are exercised, the aftermarket agreement is valued at up to US$2.3 billion. The combined sale and aftermarket agreement are valued at approximately US$9.6 billion if all options are exercised. The firm order comprises 75 Challenger 300s (deliveries scheduled to begin in 2014) and 25

Challenger 605s, with deliveries scheduled to begin in 2015. The options comprise 125 Challenger 300s and 50 Challenger 605s. NetJets' new aircraft will be operated in North America and Europe. In addition, Bombardier announced that London Air Services (LAS) has placed firm orders for five Learjet 75s, valued at approximately US$65 million. LAS is the first Canadian operator to place a firm order for the new light jet / More information from www.bombardier.com

/ More from www.gulfstream.com

/ More from www.jetaviation.com

London Stansted Airport now has four FBOs, with The Diamond Hangar opening to coincide with the 2012 Olympic Games this month. The new FBO, trading on the renowned Aero Toy Store brand, has Ben Shirazi, son of the U.S. aircraft sales and completions group’s founder, Morris Shirazi, as the major shareholder. The new venture acquired the former SR 32

WORLD AIRCRAFT SALES MAGAZINE – July 2012

Technics maintenance facility and has invested approximately $3 million in redeveloping it to provide ground handling and aircraft maintenance services. It also intends to get into aircraft management with its own air operator certificate and will seek to exploit its connection with Aero Toy Store by marketing aircraft sales and interior refurbishment work conducted by the U.S. company’s alliance with Italian design group Pininfarina. / More from www.aerotoystore.co.uk

Pratt & Whitney Canada (P&WC) has signed a 15-year on-condition Fleet Maintenance Program (FMP(R)) with NetJets for the PW306D turbofan engines that will power the fleet of Cessna Citation Latitude aircraft that the fractional jet ownership company will begin flying in 2016. P&WC www.AvBuyer.com

evaluates each engine enrolled in the FMP(R) and makes maintenance decisions based on ongoing performance. The oncondition FMP(R) agreement covers 50 installed engines and options for an additional 50 P&WC PW306D engines. / More from www.pwc.ca

Satcom Direct opened two new offices. The new Satcom Direct Savannah office is located in the General Aviation area of Savannah/Hilton Head International Airport at 100 Eddie Jungmann Drive in Suite 101E of the Sheltair Aviation Services building. The new International office will be located inside Hangar 2 at TAG Farnborough Airport, UK, where Satcom will also extend its wireless service to customer aircraft flying in to TAG Farnborough Airport. / More from www.satcomdirect.com

▼

Jet Aviation Dubai received approval from the Federal Aviation Authority (FAA) to perform base and line maintenance on Bombardier Challenger 604 and Airbus A318/A319/A320/A321 series aircraft. Meanwhile, Jet Aviation Basel has completed its fifth Dassault EASy II avionics flight deck installation on Falcon 900EX/DX/LX series aircraft.

continued on page 36 Aircraft Index see Page 4

Eagle July 19/06/2012 15:55 Page 1

Eagle Aviation, Inc. 2861 Aviation Way, West Columbia, SC 29170 Phone: (800) 849-3245 International: (803) 822-5520 Email: sales@eagle-aviation.com or visit www.eagle-aviation.com

1997 CITATION JET, S/N 525-0206

2002 CJ2, S/N 525A-0064

1982 CITATION II, S/N 550-0416

1982 CITATION I/SP, S/N 501-0242

2006 MALIBU MIRAGE, S/N 4636394

2008 CESSNA T206H STATIONAIR, S/N T20608805

2007 CIRRUS SR22, S/N 2470

After hours contact • Jet Sales: Dennis Dabbs +1 803 822-5533 • Lee Thomas +1 803 822-5526 • Piston Sales: Ralph Lacomba +1 803 822 5578

Aircraft Sales, Maintenance, Avionics, Completions, Executive Charter, 24/7 Line Service

JetBrokers July 18/06/2012 16:39 Page 1

2004 Hawker 800XP, S/N 258674, 3052 TT, MSP Gold, Support Plus, Delivered with Fresh G Check, JAR Ops, TCAS II, CAMP, 8 pax interior, Asking $4,495,000.00

1989 Falcon 900B, S/N 071, 9464 TT, MSP Gold, 4C c/w Nov 11 by Duncan, 12 pax Interior, Triple IRS’, Asking $9,500,000.00

2001 Hawker 800XP, S/N 258503, 3159.7 TT, Engines/APU on MSP, TCAS II, TAWS-A, Dual NZ-2000’s, L/R Oxygen, Honeywell EFIS, Asking $2.995,000.00

1980 Falcon 50, S/N 010, 7977 TT, JSSI, Collins FDS-2000 EFIS, TCAS II, Dual UNS-1F w/ WAAS, C&CPCP c/w 3/09, Gear O/H in 2/12, Asking $2,200,000.00

2005 Hawker 400XP, S/N RK-411, 615 TT, Garmin GMX-200 MFD, XM Weather, Sat Phone, Like New, Airshow, Freon, One Owner, Asking $2,795,000.00

2002 Premier I, S/N RB-48, 2620 TT, Engines on TAP Elite, TCAS 2, Dual FMS3000, 8.33 Spacing/FM Immunity, Asking $2,000,000.00

2010 King Air 350i, S/N FL-689, 450 TT, Venue Cabin Mgmt – Aircell Axxess II, TCAS 2, Hi-def Video Displays, L3 ESIS, Asking $6,850,000.00

2008 King Air C90GTi, S/N LJ-1902, 1356 TT, Pro-line 21 w/ IFIS, One Owner, Engine Fire Ext., Skywatch, Asking $2,500,000.00

Also Available Beechjet 400, S/N RJ-47 Citation V, S/N 560-0112 Citation V, S/N 560-0059 Citation Bravo, S/N 550B-0871 Citation II/SP, S/N 551-0039 Citation II, S/N 550-0326 Citation II, S/N 550-0216

Citation II, S/N 550-0127 Citation II, S/N 550-0094 Citation II, S/N 550-0082 Citation CJ2, S/N 525A-0204 Citation CJ2, S/N 525A-0016 Falcon 20C-5BR, S/N 142 Falcon 20 Cargo, S/N 31 Learjet 35A, S/N 138 Sabreliner 65, S/N 465-67

King Air 200, S/N BB-263 King Air 200, S/N BB-48 King Air F90, S/N LA-45 King Air F90, S/N LA-9 King Air C90, S/N LJ-601 Socata TBM700B, S/N 232 Socata TBM700B, S/N 193 Aerostar Superstar 700, S/N 601P-472-188

JetBrokers July 18/06/2012 16:40 Page 2

2008 Gulfstream G200, S/N 213, 619 TT, SATCOM, Recent 3C Check, Honeywell FDR, Ext Lav Service, Asking $11,500,000.00

2008 Citation Sovereign, S/N 680-0216, Owner Looking for a partner!, 1023 TT, JAR Ops, Pro Parts, Power Advantage, Asking $5,500,000.00 for ½ share

1983 Challenger 601-1A, S/N 3013, 11,579 TT, Engines on GE On-Point, Landing Gear O/Hed 3/12, 60 M/CPCP c/w 11/11, APU on MSP, Asking $2,795,000.00

1999 Citation Bravo, S/N 550B-0891, 5452 TT, On Power Advantage Plus and Pro Parts, Freon Air, Phase 5 c/w 5/10, Belted Potty, Asking $1,950,000.00

1988 Citation III, S/N 650-0164, 10552 TT, MSP Gold, PATS In-flight APU, KMD-850 MFD, Dual GNS-XLS, Doc 8 c/w 12/10, Asking $995,000.00

1977 Hawker 700A, S/N 257010, 8612 TT, MSP Gold, HonAS I, RVSM, 48 Month c/w 12/09, Gear O/Hed 8/08, New Interior 2010, Asking $899,000.00

1977 King Air 200XPR Blackhawk, S/N BB-226, 7678 TT, 1193 TSN on -61 Engines!, Dual Garmin 430W, , Skywatch, Raisbeck Performance Mods, Asking $1,595,000.00

2002 Socata TBM700C1, S/N 244, 1885 TT, KMD850 MFD, Dual Garmin GNS-530, RVSM Compliant, Mode S w/ Diversity, Asking $1,395,000.00

AUSTIN +1-512-530-6900 Phone DETROIT +1-248-666-9800 Phone

ST. LOUIS +1-636-532-6900 Phone

Email: jetbroker@jetbrokers.com

CHICAGO +1-630-377-6900 Phone FARNBOROUGH +44 (0)1252 52 62 72 Phone

Web: www.jetbrokers.com

BusAviationNewsJuly12_Layout 1 20/06/2012 11:09 Page 3

Market Indicators

3

JP MORGAN VIEW

JETNET VIEW

JP Morgan’s Business Jet Monthly Report for June reports that economic weakness would hamper the bizjet recovery. Just recently, JP Morgan's economists lowered their global GDP growth forecast for 2H12 to 2.1% from 2.6%. If it persists, the disappointing economic data should pressure new bizjet demand, further postponing a recovery in a market in which 2011 deliveries were still 40% below the 2008 peak. They say that data points could soften amid macro concerns, as they have during the past two summer slowdowns. In 2011, used inventories bottomed at 10.3% in July before rising 80 bps the next four months, while in 2010, inventories hit 11.4% in July before bouncing 50 bps the next three months. In addition, US flight ops growth stalled out in 2H11 and have yet to recover. JP Morgan says that economic weakness should reinforce relative strength of large cabin jets. High net worth individuals in emerging markets have supported this segment and JP Morgan believes a weaker economy affects these customers less than other buyers, such as public companies. For China in particular, low penetration should mean more pent up demand, even amid a slowdown. Finally, large bizjet buyers are less reliant on financing, which could become scarcer. The company says that the NetJets order is a bright spot. NetJets ordered 100 Bombardier Challengers (plus 175 options) and 25 Cessna Latitudes (plus 125 options). The market often views fractional operators' orders as less firm, but JP Morgan still sees this as a positive development, especially for Bombardier and Cessna. Gulfstream's focus on large jets and the introduction of the G650 should enable it to hold up relatively well if slower growth reduces overall bizjet demand and GD's US defense exposure could be less of a liability in a falling market. Bombardier also has exposure to large jets (as well as small and medium) and the stock's valuation should mitigate downside. The company said that the used inventory declined 10 bps in May. Used inventory of in-production models is now 10.6%, down from 11.1% in February. Heavy and Light jet inventories declined 10 and 30 bps, respectively, while Medium jet inventories increased 20 bps. JP Morgan reports that the average asking price fell 0.9% sequentially in May. A bottom remains elusive for used bizjet pricing, with May representing a new low for the cycle. Prices for Heavy and Light jets were down 1.5% and 0.3%, respectively, while Medium jet prices were up 0.6%. More from www.jpmorgan.com

36

WORLD AIRCRAFT SALES MAGAZINE – July 2012

For Sale Fleet % For Sale 2012 Fleet % For Sale 2011 % Change For Sale

13.6%

9.2%

6.2%

5.8%

14.3%

10.5%

6.7%

6.8%

(-0.7) pt (-1.3) pt (-0.5) pt J anuary - April 2012 Full Sale Transactions 705 432 393 Avg Days on Market 340 345 414 Avg Asking Price $4.220 $1.281 $1.432 (US$m) Y TD January to April 2012 vs 2011 Change 4.1% 3.1% -14.9% Transactions Change - Days on -70 46 7 Mkt Change - Ask Prices 0.1% 1.7% 5.4%

JETNET has released its April 2012 and first four months of 2012 PreOwned Business Jet, Business Turboprop and Helicopter Market Information. Highlighted in the table above are key worldwide trends across all aircraft market segments comparing April 2012 to April

2011. The “Fleet-ForSale” percentages for all market sectors were down in the April comparisons. Both Business jet and Business turboprop sales transactions increased 4.1% and 3.1% YTD ending April 2012, compared to 2011. However, both turbine and piston helicopters

(-1.0) pt 283 371 $0.212

-21.2% 84 -4.9%

saw double-digit declines in sales transactions YTD at 14.9% and 21.2% respectively. The Piston Helicopter market was the only market segment to show a decrease (-4.9%) in average asking prices in the YTD numbers. / More from www.jetnet.com

Find an Aircraft Dealer Business Aviation

The World’s leading aircraft dealers and brokers - find one today

avbuyer.com/dealers ▼

/

APRIL

W ORLDWIDE TRENDS B usiness Aircraft H elicopters J ets T urbos T urbine P iston 2537 1246 1139 542

www.AvBuyer.com

continued on page 38 Aircraft Index see Page 4

J Hopkinson July 18/06/2012 16:42 Page 1

Tel: (403) 291 9027 Fax: (403) 637 2153 sales@hopkinsonassociates.com www.hopkinsonassociates.com

follow us on twitter@HopkinsonAssoc

Challenger 604 SN 5364, 5903 TTAF, Engines On Condition, Collins ProLine IV, Honeywell EGPWS, Collins TCAS II w/Change 7, Dual Collins FMS-6000 FMS w/Dual GPS4000, DVD, VCR, 9 Pax

Saab 340B SN 166, 48,386 TTAF, 5 Tube EFIS, Mod 3114, Gravel Operation Mods, 34 Pax Interior, EGPWS and GE ECMP Engine Program

Astra SPX SN 117, 2908 TTAF, Collins Proline IV, Color weather Radar, TCAS II/w change 7, Airshow 400

Falcon 2000 SN 088, 4702 TTAF, Enrolled on CSP, Collins EFIS 4000 4-Tube, Dual Honeywell Laser REF III Inertial Reference System, Heads-Up Display, 3-Tube EIED, RVSM

Citation S/II SN S550-0036, 8576 TTAF, 6755 Cycles, 1304 SMOH, Cosmetics Refreshed & Perma-guarded (08/2011), GNS-XLS, GPWS, New Windows 2007, RVSM

John Hopkinson & Associates Ltd. 1441 Aviation Park NE, 2nd Floor, Box 560, Calgary, Alberta, T2E 8M7

BusAviationNewsJuly12_Layout 1 20/06/2012 11:10 Page 4

Market Indicators

4 $21.3 billion and 2,571 turboprops worth $15.2 billion. Of the traditional business jets in our forecast, 65% of these (by value) will be Class Four, Five, and Six (highend) models. This is up from 50% before the 2009 market drop. This change reflects our belief that the bottom half of the market will not recover faster than the top half, implying a permanent shift in favor of more expensive models.

OVERCAPACITY PROBLEM

22ND ANNUAL TEAL GROUP BUSINESS JET OVERVIEW SUMMARY Business aircraft have been hit harder by the economic downturn than any other aerospace market. After record growth in 2003-2008, the market fell by 28.7% (in value of deliveries) between the 2008 market peak and 2011. This market decline is typical of a downturn. Yet these top line numbers understate the pain felt by a large part of this industry. The top half of the market – jets costing $26 million and above – actually grew through the 2008-2011 downturn, with deliveries rising by 0.3%. The bottom half – jets costing $4-25 million – fell by a catastrophic 56.4%. The market has never seen bifurcation like this in any previous downturn or growth period. The good news is that the market has stopped falling, and while 2011 was bad, we will see growth in the second half of 2012. Key leading indicators offer encouragement. Corporate profits and other global wealth indicators are up very nicely. Used jet availability has fallen to a healthy level. Pricing is still soft, and there are still a few dark clouds in the world economy that could complicate the recovery, but there are enough positive signs to believe that the market is poised for a modest - but welcome - turnaround.

CONSERVATIVE GROWTH Our forecast calls for just 6% growth this year, followed by 8% in 2013, and a four year recovery period with 12% growth per year starting in 2014. Compared with prior market recoveries that have exhibited 15-17% compound annual growth rates (CAGRs), this is a conservative forecast. Our conservatism is largely based on the likelihood of greater financial caution in the aftermath of the global credit crisis of 2008/2009. Unfortunately, with this growth rate we won’t see a recovery to the 2008 peak deliveries level until 2015. Using these assumptions, we forecast production of 13,879 aircraft worth $310.3 billion (in 2012 dollars) over the next ten years (2012-2021). This includes 10,249 traditional business jets worth $249.5 billion, 568 corporate versions of jetliners and regional jets worth a combined total of $42.3 billion, and 3,062 business turboprops worth a total of $18.6 billion. For comparison, the last ten years (2002-2011) saw production of 10,886 business aircraft worth $198.6 billion (also in 2012 dollars). This includes 7,782 business jets worth $162.2 billion, plus 438 jetliners and RJs worth

/ More from www.tealgroup.com

▼

TEAL GROUP VIEW

This shift – from a top half/bottom half to a top two thirds/bottom third market structure – means this industry faces an overcapacity problem in the bottom segment of the market. The five legacy players have been joined by Embraer, with Honda arriving soon as a niche player. Unless we see faster than expected growth, we might see additional product line eliminations or industry restructuring. Hawker Beechcraft is particularly vulnerable due to its heavy debt load and declining military business. Looking at traditional business jets, Bombardier and Gulfstream will be the market leaders (32.8% and 29.9% respectively, by value of deliveries), followed by Dassault (14%), Cessna (10.6%) and Hawker Beechcraft (5.7%). Embraer will have 6.5%, which is up from almost nothing in the last ten years. Embraer’s impressive achievement is particularly impacting Cessna, which had enjoyed a 17.8% market share over the past ten years. Honda will have the remaining 0.6% in our forecast. These figures exclude turboprops, jetliners and corporate regional jets. Some good news: We do not believe the anti-business jet cultural environment we saw in the downturn will impact demand moving forward. Preference for, and acceptance of, business aircraft is returning along with world economic growth and trade. Also, the past 15 years have seen Business Aviation transformed from a backwater market to a key part of the aerospace industry. This transformation will not be reversed. Even at the low point of the market (2010/2011), the business jet industry was over twice as large as it was in any year prior to 1997.

continued on page 40

38

WORLD AIRCRAFT SALES MAGAZINE – July 2012

www.AvBuyer.com

Aircraft Index see Page 4

Aradian July 20/06/2012 09:29 Page 1

FILE PHOTO

2013 Gulfstream 450

Gulfstream 550

1st Quarter delivery position

Several aircraft available including 2012 delivery positions

1997 Challenger 604

2008 Hawker 900XP

8200TT. Beige leather interior. GE On Point. Smart Parts. Satcom

1175TT. Beige leather interior. MSP Gold. Support Plus. Satcom

2007 Beech Premier 1A

2007 Hawker 850XP

2007. 1200TT. Support Plus 2008. 540TT. TAP Elite. Support Plus

1290TT. MSP. Tan leather interior. Satcom

2004 Agusta 119 Koala

McDonnell Douglas MD 600N

1550TT. Recent paint. Air Con. Very well equipped

Three MD600N available

ALSO OFFERING: Beech King Air C90GT/C90/B200/350, Hawker 400XP, Citation XL/XLS/Sovereign, Agusta Koala, Gulfstream G100/G150, Hawker 800XP/850XP/900XP. Call/Email For Details

www.aradian.com UK office Tel. +44 1481 233001 Fax.+44 1481 233002 steverogers@aradian.com

US office: Mesa Tel. +1 480 396 9086 Fax. +1 480 393 7008 rick@aradian.com

US office: Atlanta Tel. +1 770 331 1416 davidb@aradian.com

Also in: South America, South Africa, Russia, Spain, Germany, India & UAE

BusAviationNewsJuly12_Layout 1 20/06/2012 11:11 Page 5

aerosmithpenny.com

BizAvRound-Up

5

ARRIVALS

Dave Eickhoff or Bob Nygren 8031 Airport Blvd. Suite 224, Houston, TX 77061 Phone: (713) 649-6100 • Fax: (713) 649-8417 Email: aspinfo@aerosmithpenny.com

David Dixon – has been promoted to the position of president, Jetcraft Asia, one of the world’s leading business aircraft sales, acquisitions, trading and brokerage services firms. In his expanded role, Dixon will manage overall operations and lead sales initiatives for Jetcraft Asia, spanning a territory from Beijing to Sydney. Robert Frost - Leading Edge Aviation Solutions, LLC announced the hiring of Robert Frost as vice president, aircraft sales. Frost will be based in the Parsippany, New Jersey office. He previously served Gama Aviation for six years as vice president, Aircraft Management.

1990 Citation II, S/N 550-0636

DAVID DIXON JETCRAFT ASIA

Steve Hughes - Hong Kong-based Metrojet has named Hughes as director of maintenance and engineering. He will oversee all aspects of Metrojet’s maintenance, including CAMO DME and Part 145 repair station accountable manager responsibilities.

Jeff Kreide - Gulfstream recently named Jeff Kreide vice president of Business Solutions. Total Time: 6202, Sperry 3 Tube EDS-603 3 Tube EFIS, Global GNS XLS w/GPS, Thrust Reversers, Freon A/C. PRICE REDUCED

1986 Gulfstream III, S/N 477

Joe Lombardo - The National Aeronautic Association (NAA) announced that Joe Lombardo, executive vice president, Aerospace Group, General Dynamics, has been selected to receive the 2012 Cliff Henderson Trophy. The trophy is awarded to “a living individual, group of individuals, or an organization whose vision, leadership or skill made a significant and lasting contribution to the promotion and advancement of aviation and aerospace in the US.” Kenneth Ricci - Flight Options chairman, received the William A. Ong Memorial Award from the National Air Transportation Association. Presented annually since 1984, the Ong Memorial Award is given for “extraordinary achievement and extended meritorious service to the general aviation industry.”

ROBERT FROST LEADING EDGE

KENNETH RICCI FLIGHT OPTIONS

Karen Schaefer – recently joined

Fresh Engines Due 2017 and 2019. 72 Month done C/W Gulfstream Dallas 6/09, Excellent Interior, New Exterior Paint 2009

aerosmithpenny.com 40

WORLD AIRCRAFT SALES MAGAZINE – July 2012

World Aircraft Sales Magazine as an account director for the U.S. Pre-Owned Aircraft sales market. Karen has held a variety of senior positions throughout the aviation industry. Her contact details can be found on Page 8 of this issue.

Paul C. Wood – is named as new director of Sales & Support for Sierra Industries. Since 2008, Wood served as general manager for Landmark Aviation in the Los Angeles, CA & Asheville, NC locations.

www.AvBuyer.com

KAREN SCHAEFER WORLD AIRCRAFT SALES

Aircraft Index see Page 4

BusAviationNewsJuly12_Layout 1 20/06/2012 12:43 Page 6

6

BizAvRound-Up

Not just a tug.

EVENTS

THE ROYAL INTERNATIONAL AIR TATTOO July 7 – 8 Fairford, Glos., UK / www.airtattoo.com

FARNBOROUGH INT’L AIRSHOW July 9 – 15 Farnborough, UK / www.farnborough.com

EAA: AIRVENTURE OSHKOSH July 23 - 29 Oshkosh, WI, USA / www.airventure.org

LABACE Aug 15 – 17 Sao Paulo, Brazil / www.abag.org.br

ILA BERLIN AIRSHOW Sept 11 – 16 Berlin, Germany / www.ila-berlin.de

SIBAS (SHANGHAI INT’L BUSINESS AVIATION SHOW) Sept 4 – 7 Shanghai, China / www.shanghaiairshow.com

BUSINESS AIRCRAFT EUROPE (BAE) Sept 12 – 13 London Biggin Hill Airport, UK / www.miuevents.com

BUSINESS & GENERAL AVIATION DAY (BGAD) Sept 18 Cambridge, UK / www.bgad.aero

NBAA: BUSINESS AVIATION REG FORUM Sept 20 Seatlle, WA, USA / www.nbaa.org

AIRCRAFT INTERIORS EXPO Sept 25 – 27 Seattle, WA, USA` / www.reedexpo.co.uk

INTERNATIONAL AIRPORT EXPO Sept 25 – 27 Las Vegas, NV, USA / www.iaema.org

INTER AIRPORT CHINA Sept 26 – 28 Beijing, China / www.interairportchina.com

JETEXPO Sept 27 – 29 Moscow, Russia / www.jetexpo.ru

SAFETY STANDDOWN-USA Oct 8 - 11 Wichita, Kansas, USA / www.safetystanddown.com

8800 Series

It’s a

.

AOPA AVIATION SUMMIT Oct 11 – 13 Palm Springs, CA, USA / www.aopa.org

800-535-8767 / 503-861-2288 w w w. l e k t r o. co m / s a l e s @ l e k t r o. co m

NBAA: MEETING & CONVENTION Oct 30 – Nov 1 Orlando, FL, USA / www.nbaa.org

HELISHOW DUBAI Nov 6 – 8 Dubai, UAE / www.dubaihelishow.com

AIRSHOW CHINA 2012 Nov 13 – 18 Zhuhai Guangdong, China / www.airshow.com.cn

CENTRAL EUROPE PRIVATE AVIATION EXPO (CEPA) Nov 29 – 30 Prague, Czech Republic / www.cepa.aero

AEROMART TOULOUSE Dec 4 – 6 Toulouse, France / www.bciaerospace.com

GENERAL AVIATION IN THE MIDDLE EAST Dec 5 – 6 Dubai, UAE / www.miuevents.com

MEBA 2012 MIDDLE EAST BUSINESS AVIATION Dec 11 –13 Dubai, UAE / www.meba.aero

If you would like your event included in our calendar email: sean@avbuyer.com Advertising Enquiries see Page 8

www.AvBuyer.com

WORLD AIRCRAFT SALES MAGAZINE – July 2012

41

AirCompAnalysisJune12_ACAn 19/06/2012 10:34 Page 1

AIRCRAFT COMPARATIVE ANALYSIS HAWKER 800XP

HAWKER 800XP

LEARJET 60

Hawker Beechcraft 800XP by Michael Chase n this month’s Aircraft Comparative Analysis, information is provided on a selection of pre-owned business jets in the $2.0 - 4.7m price range for the purpose of valuing the pre-owned Hawker 800XP aircraft. We’ll consider the productivity parameters - specifically, payload and range, speed and cabin size - and consider current and future market values. The aircraft compared with the Hawker 800XP is Bombardier’s Learjet 60.

I

BRIEF HISTORY The Hawker 800XP is a derivative from the

42

WORLD AIRCRAFT SALES MAGAZINE – July 2012

design of the UK-built de Havilland/Hawker Siddely and British Aerospace 125 that was first built in 1962. The Hawker 125 evolved into the Series 400 to 800, produced up to 1993 when Raytheon purchased the Series 800 program and the aircraft was renamed the Hawker 800. The 800 series has a number of modifications and changes over the 700 series, including improved payload capabilities, updated systems, and enhanced performance from an improved wing (incorporating new outer wing sections). 292 Hawker 800 aircraft were built until final production in 1995 when the 800XP entered service. (The 800A (230 built) www.AvBuyer.com

was specifically built for the US market and the 800B (62 built) for non-US markets.) The Hawker 800XP features an uprated engine, enhanced aerodynamics, increased weight and system upgrades on preceding models. The Hawker 800XP was manufactured between 1995 and 2005, and the number of units built in that timeframe totaled 426 aircraft, with 422 still in service today. The Hawker 800XP features Honeywell TFE-731-5BR-1H engines with a thrust of 360 lbs. It is RVSM certified from the factory after serial number 258359, or when service bulletin SB-34-3110 (Honeywell) or SB-34-3166 ❯ (Collins) is complied with. Aircraft Index see Page 4

LEAS July_LEAS 20/06/2012 10:06 Page 1

Exterior File Photo

2005 Hawker 800XP s/n 258703 • Very Late Model - Engines on MSP Gold • APU on MSP • Dual Collins Proline 21 Avionics Suite • Avionics Enrolled on CASP • Aircell ST-3100 Iridium Phone w/ Cordless Cockpit & Cabin Handsets • Aircraft Maintained and Operated Part 135 • One Owner Since New

Specifications subject to verification upon inspection, aircraft subject to withdrawal from the market.

L E A D I N G E D G E AV I AT I O N S O L U T I O N S

Te l i n U S : 2 0 1 . 8 9 1 . 0 8 8 1

AIRCRAFTSALES@LEAS.COM

W W W. L E A S . C O M

AirCompAnalysisJune12_ACAn 19/06/2012 10:35 Page 2

AIRCRAFT COMPARATIVE ANALYSIS HAWKER 800XP

PAYLOAD AND RANGE

TABLE A - PAYLOAD & RANGE

Model

MTOW (lb)

Max Fuel (lb)

Max Payload (lb)

Avail Payload w/Max Fuel (lb)

Max Fuel Range (nm)

Max P/L w/avail fuel Range (nm)

Hawker 800XP

28,000

10,000

2,050

1,750

2,620

2,285

Learjet 60

23,500

7,910

2,228

1,068

2,418

1,745

Data courtesy of Conklin & de Decker, Orleans, MA, USA; JETNET: B&CA May 2012 and Aug. 2011 Operations Planning Guide

Hawker 800XP

453

1,000

500 Cubic Feet

TABLE B - GPH CONSUMED

Fuel Usage (GPH)

Model

Hawker 800XP

300

Learjet 60

229

COST PER MILE COMPARISONS Chart B (left) details ‘Cost per Mile’ and compares the Hawker 800XP to its competition factoring direct costs and with all aircraft flying a 1,000nm mission with an 800 pound (four passengers) payload. The Hawker 800XP has higher cost per mile at $5.17 per nautical mile, which is more expensive to operate by 20.5% than the Learjet 60 at $4.29 per nautical mile.

Source ACC - www.aircraftcostcalculator.com

CHART B - COST PER MILE *

TOTAL VARIABLE COST COMPARISONS

$5.17

Hawker 800XP

‘Total Variable Cost’ illustrated in Chart C (right) is defined as the cost of Fuel Expense, Maintenance Labor Expense, Scheduled Parts Expense and Miscellaneous trip expense. The total variable cost for the Hawker 800XP at $2,137 per hour is more expensive to operate by 15.4% than the Learjet 60 at $1,852 per hour.

$4.29

Learjet 60

$2.00

$4.00

$6.00

US $ per nautical mile *1000nm, 800LBS PAYLOAD MISSION COSTS

44

According to Conklin & de Decker, the cabin volume of the Hawker 800XP - 604 cubic feet - is more than that offered by the Learjet 60 (453 cubic feet) as shown in Chart A (left).

As noted above, the Hawker 800XP has two Honeywell TFE731-5BR engines each offering 4,660 pounds of thrust. The Learjet 60 has two Pratt & Whitney Canada PW305A engines with thrust at 4,600 pounds each. Table B (left), sourced from the Aircraft Cost Calculator (ACC) shows the fuel usage by each aircraft model in this field of study. The Hawker 800XP (300 gallons per hour GPH) burns more fuel than the Learjet 60 (229 gallons per hour). Using data published in the May 2012 B&CA Planning and Purchasing Handbook and the August 2011 B&CA Operations Planning Guide we will compare our aircraft. The nationwide average Jet A fuel cost used from the August 2011 edition was $6.04 per gallon at press time, so for the sake of comparison we’ll chart the numbers as published. (Note: Fuel price used from this source does not represent an average price for the year.)

604

Learjet 60

$0.00

CABIN VOLUME

POWERPLANT DETAILS

CHART A - CABIN VOLUME

0

The data contained in Table A (left) is published in the Business & Commercial Aviation’s May 2012 issue, and is also sourced from Conklin & de Decker. A potential operator should focus on payload capability as a key factor. The Hawker 800XP ‘Available Payload with Maximum Fuel’ at 1,750 pounds is greater by 682 pounds (64%) than that of the Learjet 60 at 1,068 pounds.

WORLD AIRCRAFT SALES MAGAZINE – July 2012

www.AvBuyer.com

Aircraft Index see Page 4

AirCompAnalysisJune12_ACAn 19/06/2012 16:35 Page 3

AIRCRAFT COMPARATIVE ANALYSIS HAWKER 800XP

The points in Chart D (middle, right) center on the same group of aircraft. Pricing used in the vertical axis is as published in Vref. The productivity index requires further discussion in that the factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors. 1. Range with full payload and available fuel; 2. The long range cruise speed flown to achieve that range; 3. The cabin volume available for passengers and amenities. The result is a very large number so for the purpose of charting, each result is divided by one billion. The examples plotted are confined to the aircraft in this study. A computed curve fit on this plot would not be very tight, but when all aircraft are considered the “r” squared factor would equal a number above 0.9. Others may choose different parameters, but serious business aircraft buyers are usually impressed with Price, Range, Speed and Cabin Size. After consideration of the Price, Range, Speed and Cabin Size we can conclude that the Hawker 800XP is competitive with the Learjet 60. The Hawker 800XP has a larger cabin, greater payload capability and offers greater range. However, the Hawker 800XP operates at a slower speed, costs considerably more to operate per mile and the variable cost as well as its fuel burn usage is greater than the Learjet 60. Table C (right) contains the retail prices from the latest Vref edition for each aircraft. The prices shown are for 2003, the last year of Learjet 60 manufacture. The number of aircraft in-operation, percentage ‘For Sale’ and the number ‘Sold’ over the past 12 months are from JETNET. As shown, the Hawker 800XP has the lower percentage of the in-operation fleet ‘For Sale’ at 11.4% (buyer’s market) compared to the Learjet 60 at 15.9%. Over the past 12 months the Hawker 800XP is showing an average of ten sold per month. This sales activity highlights many opportunities for the savvy dealer/broker specializing in the Hawker 800XP.

BY CONTINENT The majority of the wholly-owned Hawker 800XP aircraft in operation (377) are located in North America (74.1%), followed by Asia (9.3%) and Europe (8.5%) for a combined 91.9% of the wholly-owned fleet, see Chart E (right). There are 38 fractional and seven shared owners of the Hawker 800XP aircraft ❯ in operation in addition to these. Advertising Enquiries see Page 8

CHART C - VARIABLE COST

$2,137

Hawker 800XP

Learjet 60

$1,852

$1,000

$0

$2,000

$3,000

$4,000

US $ per hour

CHART D - PRODUCTIVITY $8.0

Price (Millions)

PRODUCTIVITY COMPARISONS

$6.0

Hawker 800XP $4.0

Learjet 60

$2.0

$0.0

0.0000

0.4000

0.2000

0.6000

0.8000

Index (Speed x Range x Cabin Volume / 1,000,000,000)

TABLE C - COMPARISON TABLE Average sold per month (past 12 months)

Long Range Cruise Speed

Cabin Volume (Cu Ft)

Max P/L w/avail Fuel Range (nm)

Vref Retail Price $m

In Operation

% For Sale

Hawker 800XP

402

604

2,285

$4.2 ’03

422

11.4%

10

Learjet 60

423

453

1,745

$3.8 ’03

314

15.9%

4

Model

Data courtesy of Conklin & de Decker; JETNET; B&CA May 2012 and Aug. 2011 Operations Planning Guide

CHART E - HAWKER 800XP IN-OPERATION BY CONTINENT 1% Australia South Am Africa 4% 3%

Asia 9% Europe 9%

North America Europe Asia

North America 74%

South America Africa Australia

SOURCE: JETNET STAR REPORTS

www.AvBuyer.com

WORLD AIRCRAFT SALES MAGAZINE – July 2012

45

AirCompAnalysisJune12_ACAn 19/06/2012 10:36 Page 4

AIRCRAFT COMPARATIVE ANALYSIS HAWKER 800XP TABLE D - HAWKER 800XP PRICE TRACKER AVERAGE ASKING PRICES

Year

Table D (right) offers an eight-year summary to provide the historical perspective of the Hawker 800XP aircraft sales activity trends from June 2004 to May 2012. The table is divided between the four years prior to the economic melt-down (6/2004–5/2008) and the four years since (6/2008-5/2012). The largest decline in the average asking prices occurred from 6/2008-5/2009 and 6/2009-5/2010, when the value dropped from $8.91m to $5.81m. At that time the average asking prices declined significantly by $3.1m and the average days on the market (DOM) nearly doubled. However, pre-owned sales increased to 90, reversing the trend of declining sales noted from the previous time periods from 81 (6/2007-5/2008) to just 64 (6/2008-5/2009). Over the past 12 months the Hawker 800XP aircraft has shown the highest number of full retail sales transactions of ALL preowned business aircraft, primarily as a result of the large decrease in the average asking prices by $2.05 million to $3.76 million as reported by JETNET. However, the length of time that the Hawker 800XP remains on the

6/2004 –5/2005 6/2005 –5/2006 6/2006 – 5/2007 6/2007 – 5/2008 6/2008 – 5/2009 6/2009 – 5/2010 6/2010 – 5/2011 6/2011 – 5/2012

Avg. Asking For Sale 12 Months Full Retail Avg. Price $ mil Sale Transactions DOM * May May $9.08 19 104 230 $9.67 24 68 146 $10.05 29 64 181 $9.51 27 81 240 48 64 135 $8.91 $5.81 55 90 251 $4.37 66 81 267 $3.76 53 125 272

Source: JETNET Evolution program; * DOM = Average Days on the Market

market before a sale remains stubbornly high. Clearly, the Hawker 800XP aircraft continues to be very popular within the pre-owned market today, but continues to face the new pre-owned market realities that have resulted in substantial asking price reductions and longer periods of time before selling.

a buying decision, however. The Hawker 800XP evidently fares well among its competition, so those operators in this market should find the preceding comparison of value. Our expectations are that the Hawker 800XP will continue to do well in the pre-owned market for the foreseeable future.

SUMMARY

❯ For more information: Michael

Within the preceding paragraphs we have touched upon several of the attributes that business aircraft operators value in a jet. There are of course other qualities such as airport performance, terminal area performance, and time to climb performance that might factor in

Chase is president of Chase & Associates, and can be contacted at 1628 Snowmass Place, Lewisville, TX 75077; Tel: 214-226-9882; Web: www.mdchase.com

Need Help Navigating Aircraft Operating Costs? Conklin & de Decker products and consulting services are like having a “GPS” for your aircraft acquisition decision or budgeting process.

Aircraft Cost Evaluator The perfect tool for benchmarking variable & fixed costs, performance and specification data for more than 460 aircraft.

Life Cycle Cost A budgeting and financial analysis tool to understand the true cost of owning and operating an aircraft.

www.was.Conklindd.com

+1- 508-255-5975 46

WORLD AIRCRAFT SALES MAGAZINE – June 2012

www.AvBuyer.com

Aircraft Index see Page 4

Wright Brothers November 24/10/2011 15:01 Page 1

Wright Brothers Aircraft Title is a provider of aircraft title management and escrow services for all types of aircraft. Doing business both domestically and around the globe, Wright Brothers offers quick, personalized service from Debbie Mercer, always with the utmost of confidentiality. Available 24.7.365

Wright Brothers Aircraft Title 9075 Harmony Drive Oklahoma City, Oklahoma 73130 Telephone: (405) 680-9289 Toll-Free (within the US): (866) 217-5700 Fax: (405) 732-7457 e-mail: dmercer@wbaircraft.com

Title Search Title Clearing Escrow Services Registration Services Accident / Incident searches Preparation of Documents Domestic and International Services

Boardroom guide 1 July12_FinanceSept 19/06/2012 14:38 Page 1

BUSINESS AVIATION AND THE BOARDROOM

It’s Just Transportation For Directors who may be constrained by the pejorative rhetoric of politicians concerning Business Aviation, consider the use of business aircraft by federal, state and local governments, advises Jack Olcott.