Issue 9; 2023 All Markets

T.I. kicks off 2023 With Improved Productivity & Enhanced Processing Capabilities

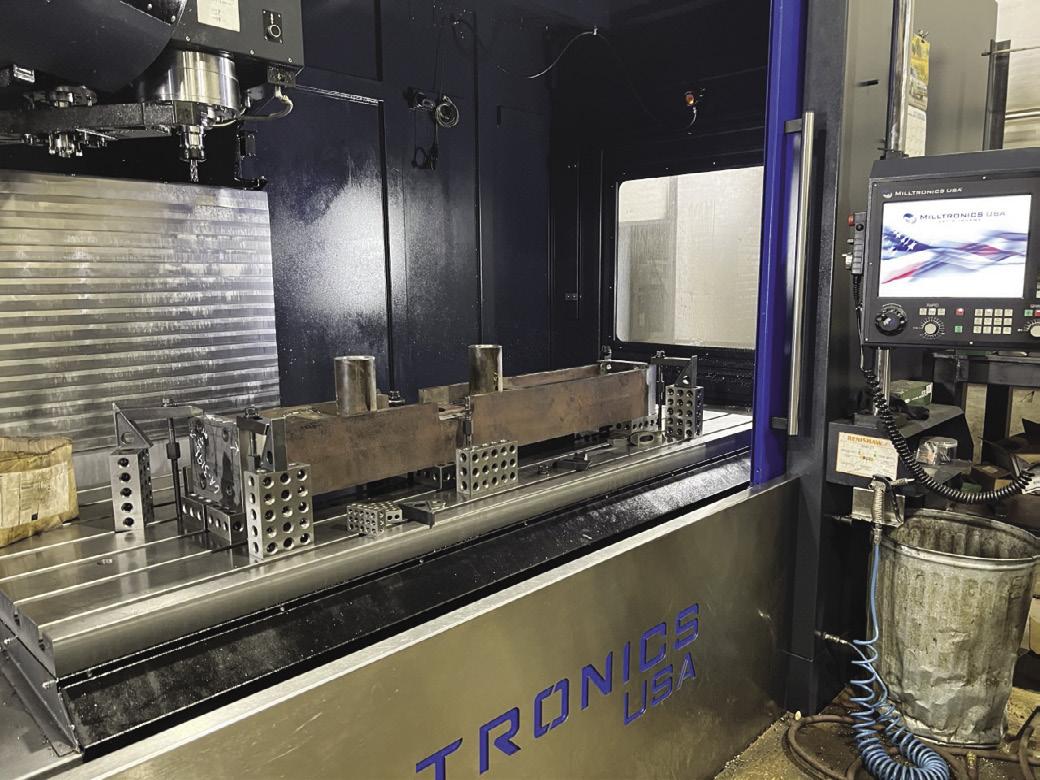

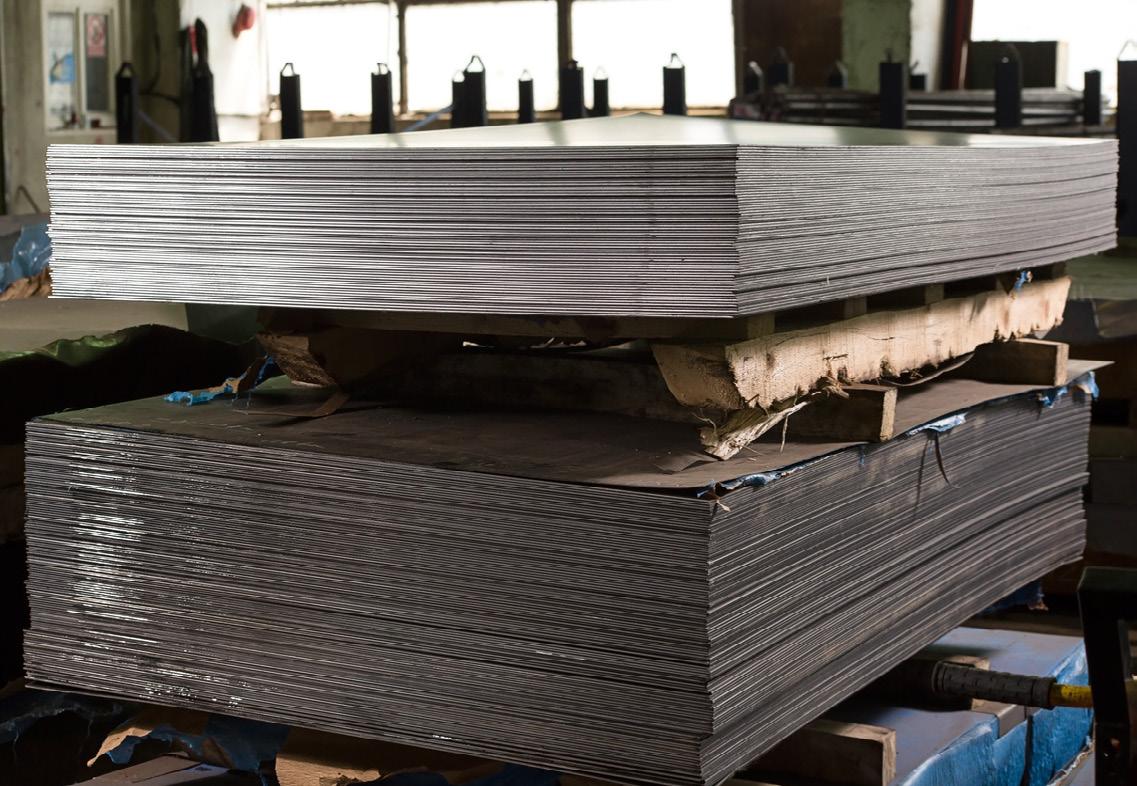

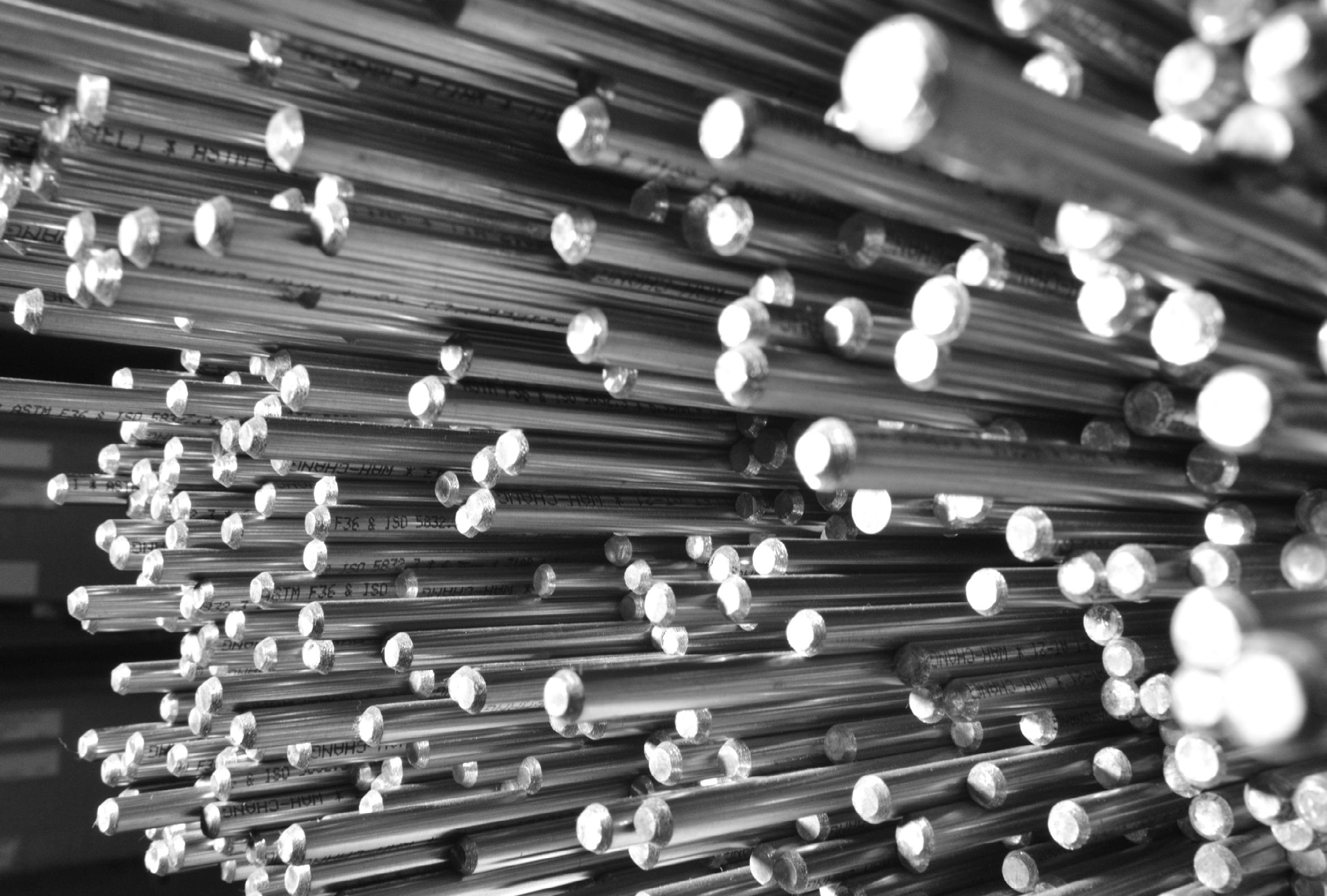

Titanium Industries closed out our 50th anniversary year in 2022 with much success, and 2023 will be even more exciting with new equipment additions in several U.S. facilities. As always, T.I.’s aim for these improvements and investments is to ensure increased productivity and logistic success, which translates to added value for our customers.

Titanium Industries is always a step ahead of the competition when it comes to being able to fulfill our customers’ current and anticipated needs.

T.I.’s improvements will ensure increased productivity and logistic success as we continue to strive to stay up to date with the latest metal cutting customization machinery. We will continue to be the go-to, one stop metal supply solution choice while maintaining and updating our facilities to keep up with all our client's needs.

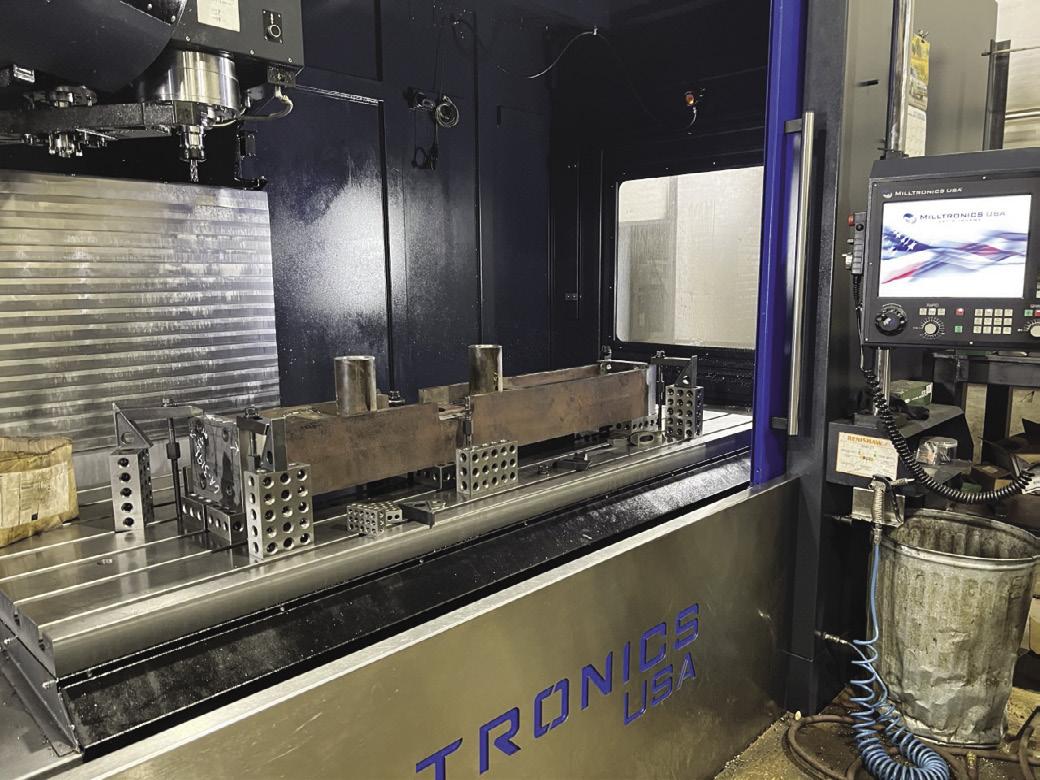

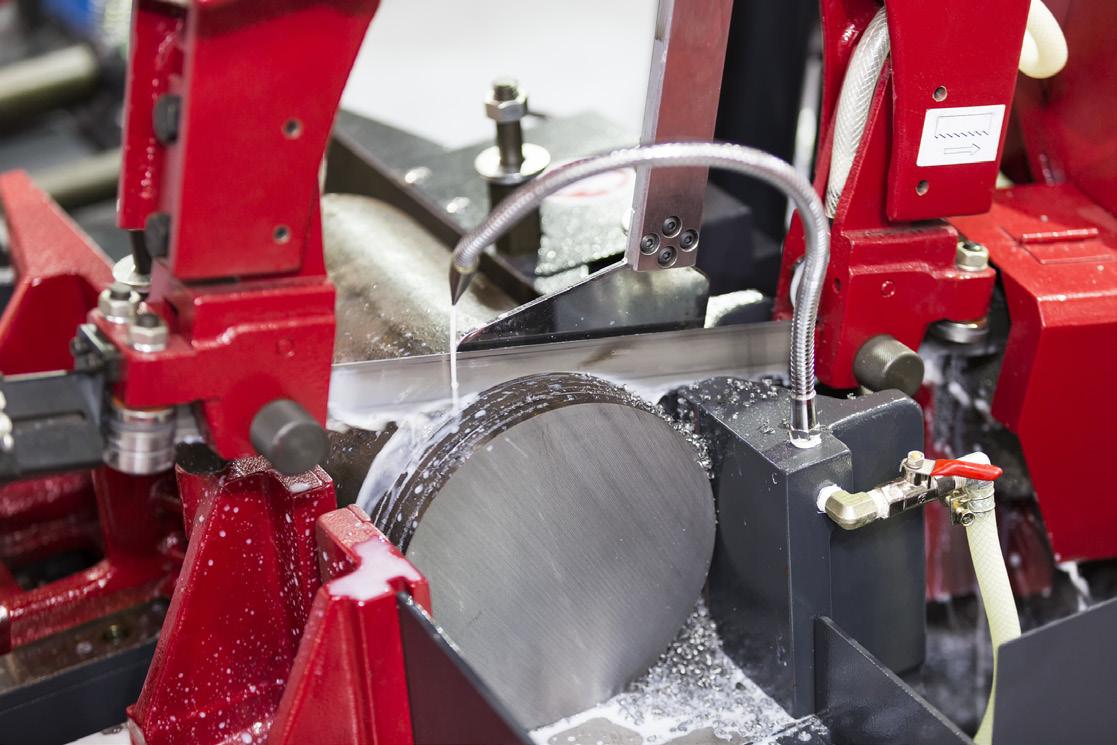

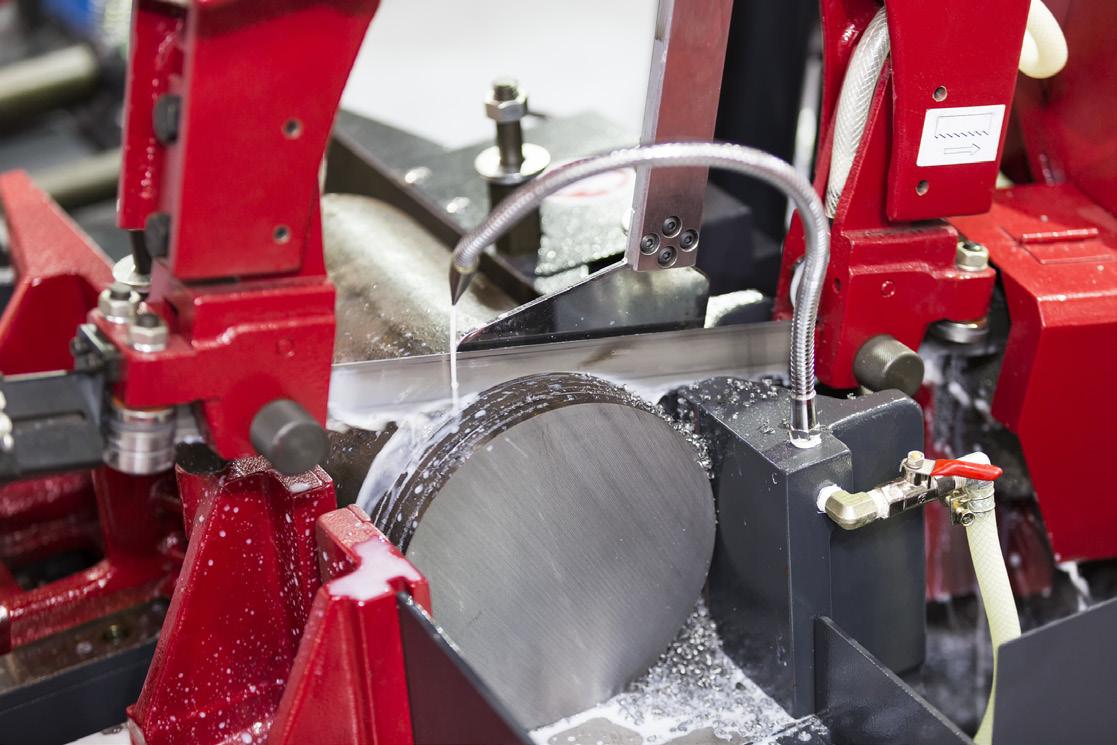

The new plate saw that arrived in Titanium Industries’ Plymouth, Michigan facility is ready to service all Midwest and central US customers.

water jet machine installed in our headquarters in Rockaway, NJ will enhance our cutting capability and capacity.

The expansion of our rack storage system in Jacksonville, Florida has been completed. This enhancement dramatically increases the overall rack capacity in Jacksonville allowing for increased utilization of the space.

It also supports future growth and further expansion of product breadth, not just for the Jacksonville region, but also for the entire T.I. global distribution network.

T i t a n i u m I n d u s t r i e s S t r e n g t h e n s F a c i l i t i e s w i t h I n v e s t m e n t s

RACK EXPANSION JACKSONVILLE, FL

NEW PLATE SAW PLYMOUTH, MI

S P E C I A L T Y M E T A L S S U P P L Y S O L U T I O N S A E R O S P A C E | D E F E N S E | M E D I C A L | I N D U S T R I A L | O I L A N D G A S T I T A N I U M . C O M | S A L E S @ T I T A N I U M . C O M

NEW WATER JET MACHINE ROCKAWAY, NJ

TITANIUM TODAY 3 Editorial Published by: International Titanium Association www.titanium.org 1-303-404-2221 Telephone ita@titanium.org Email Editor & Executive Director: Jennifer Simpson EDITORIAL OFFICES International Titanium Association PO Box 1300 Eastlake, Colorado 80614-1300 USA DISTRIBUTION LIST Join this free distribution by emailing us at ita@titanium.org www.titanium.org All Markets EDITION CONTENTS Meet the ITA 4 Editorial: Charles Edwards Analysts Provide Outlook On Growth of Titanium, Aerospace Markets, By Peter Zimm 8 Conard Stitzlein Traces Journey from Ohio Farm To a Pioneering Leader in the Titanium Industry, By Michael Gabriele 16 TriTech Titanium Focuses on MIM To Design, Produce Net-Shape Parts, By Patricia Radice 22 EB Systems Offers Insights on Benefits, Challenges of Electron Beam, Laser Beam Titanium Welding, By Cory Yaeger 28 IperionX Unveils Mission to Develop First 100-Percent U S Titanium Recycling Plant, By Michael C. Gabriele 36 New Orders for Wide-Body Boeing 787s, Airbus A350s Signal Encouraging Prospects for Aerospace Business, By Michael C. Gabriele . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 India Gains Momentum as Emerging Force In Global Aerospace, Titanium Industries, By Michael C. Gabriele . . . . . . . . . . . . . . . . . . . . . . . . 50 From the Wire 56 Remembering Lanny Martin 61 ITA Member Roster 2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62 Advertiser Index 64

MEET THE ITA

Board of Directors

Executive Committee

Dr. Markus Holz Professor, ITA Academic Member Education Committee Co-Chair

Titanium Europe Conference Chair

ITA President 2022-2024

Dr. Markus Holz is currently Professor at University of Applied Sciences Anhalt starting from 2020. There he is the program director of Logistics Management, teaching Operations Management and is currently involved in several national and international research programs in the field of sustainability and digitization in the industry.

Dr. Holz graduated in Aerospace Engineering in 1986 and earned his PhD in 1992. Following his 10 years of service in the German Airforce, Dr. Holz began his career with ThyssenKrupp in 1992, where he assumed several executive positions mainly in the stainless steel and special metals branch. In 1999, Dr. Holz became Managing Director of ThyssenKrupp Titanium GmbH (formerly Deutsche Titan GmbH) and in 2002 he was appointed Managing Director of ThyssenKrupp Titanium S.p.A. (formerly Titania S.p.A.). Furthermore, he was responsible for Tubificio di Terni, Italien, from 2004 through 2007. From 2007 to 2009 he was CEO of the ThyssenKrupp Titanium Group (Germany and Italy). In January 2010 he joined the Managing Board of Hempel Special Metals, Oberhausen, Germany. After joining as MD the ALD Management Board in October 2011, Dr. Markus Holz was the President of AMG’s Engineering Systems Division and CEO of Vacuum Technologies GmbH from 2012 to 2019.

Martin Pike VP of Global Commercial Strategies

Martin Pike VP of Global Commercial Strategies

ATI Specialty Materials

ITA Vice President 2022-2024

Martin Pike is the Vice President - Commercial for ATI Specialty Materials with responsibilities which include international product management, sales, and long-term agreements with customers. Martin joined ATI in August 2001 and held several positions with increasing responsibility including Titanium Rolled Products, Product Manager and Director of Sales. Prior to joining ATI, Martin worked in manufacturing where he held various commercial positions including Regional Vice-President of Sales. His educational background includes a Bachelor’s Degree from the University of North Carolina at Charlotte.

Sam Stiller Vice President – Commercial Howmet Structure Systems

ITA Secretary/Treasurer 2022-2024

Sam Stiller is Vice President, Commercial for Howmet Aerospace. All Sales, Marketing, and Customer Service, globally, is led by Sam’s commercial team..

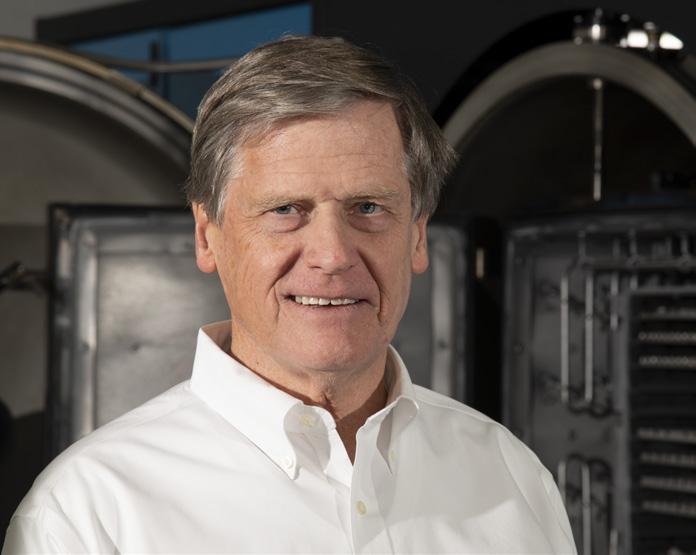

Frank L. Perryman President and Chief Executive Officer Perryman Company

Frank L. Perryman President and Chief Executive Officer Perryman Company

ITA Past President 2022-2024

Mr. Perryman graduated from Millikin University in 1986 with a Bachelor of Science in Industrial Engineering. In 1988 he co-founded Perryman Company with his father and brother. Since December of 2008 he has held the position of President and CEO of Perryman Company. Perryman Company is a fully integrated supplier of specialty titanium products. From melting through finishing, founded in 1988, Perryman Company is headquartered in Houston, Pennsylvania, with office locations in Philadelphia, Los Angeles, London, Zurich, Tokyo and Xi’an. Perryman is an integrated titanium producer from melting of ingot to finished products. The company’s product portfolio includes ingot, bar, coil, fine wire, net shapes, and hot rolled products. The Forge and Fabrication group offers medical device contract manufacturing in a range of materials including plastics and titanium. A titanium global leader, Perryman supplies and services customers in the aerospace, medical, consumer, industrial, recreation, additive/3D printing and infrastructure markets worldwide.

4 TITANIUM TODAY

Phil MacVane

Vice President, the Americas PCC Metals Group Global Sales

John J. Scherzer

Vice President – Medical Markets Carpenter Technology Corporation

Michael Marucci Chief Technology Officer Kymera International

Edward Sobota Jr. President TSI Titanium

Brett Paddock President and Chief Executive Officer Titanium Industries, Inc .

Jennifer Simpson Executive Director Ex-Officio Member of the Board International Titanium Association

Safety Education

Robert G. Lee President Accushape Inc

Industrial Applications

Robert Henson Manager, Business Development VSMPO-Tirus, US

Women in Titanium

Holly Both

Vice President of Marketing Plymouth Tube / Plymouth Engineered Shapes

Medical Technology

Eric Baum

Senior Business Development Manger Laboratory Testing Inc

6 TITANIUM TODAY

ITA Directors

Ti Today Contributor

ITA Committee Chairs

Michael C. Gabriele

(+1) 610-693-5822 rai.sales@kymerainternational.com www.kymerainternational.com Master Alloys & Titanium Powders for Critical Applications

Charles Edwards Analysts Provide Outlook On Growth of Titanium, Aerospace Markets

By Peter Zimm

By Peter Zimm

Introduction

Earlier this year, Charles Edwards completed their latest aerospace market report: “2023 Aerospace Titanium - Global Market Outlook and Supply Risk Assessment,” authored by Peter Zimm and Cliff Collier, Charles Edwards principals. Zimm and Collier indicated that, by the time this article goes to press, this report will be available on a new platform: AeroOutlook.com. AeroOutlook is a new resource that offers premium aerospace industry market reports meticulously curated and authored by distinguished aerospace market experts. This article summarizes some of the key findings from that report.

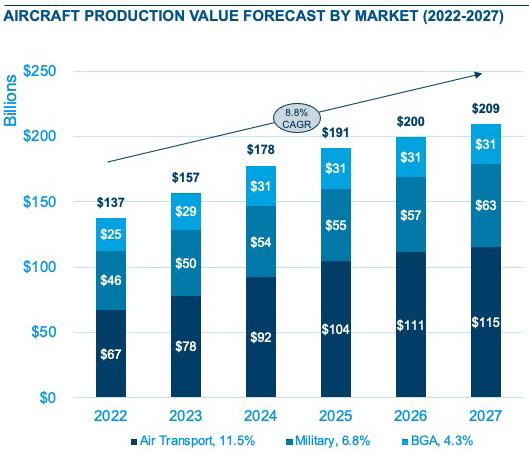

Aerospace Market Outlook

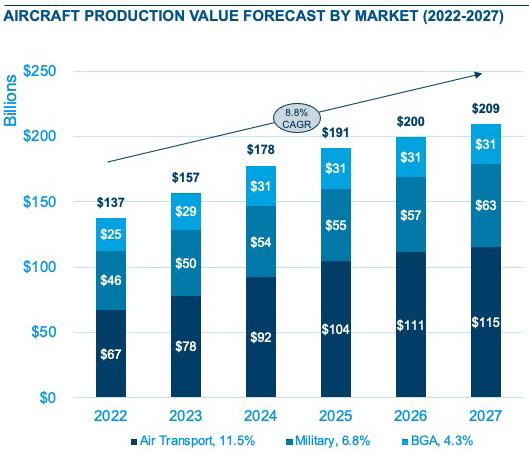

Total aircraft production value was $137 billion in 2022 and is expected to grow to $157 billion in 2023, almost a 15 percent increase from 2022 but still 24percent below 2018’s peak of $181 billion. Commercial air transports are approximately 50 percent of global aircraft production value; military is about one third and business and general aviation are about one fifth.

Aircraft production rates continue to grow but the industry continues to face numerous challenges as it recovers from the COVID downturn. The labor shortages that plagued the early recovery appear to be easing, especially for OEMs and Tier 1s. However, despite the improvement in attracting and retaining talent, many experienced workers were lost during the downturn so more workers are needed to achieve the same output. This will persist until new workers

become more experienced – a multiyear long proposition in our industry.

Sub-tier suppliers also face liquidity challenges as ramping rates require cash to invest in raw materials and work in process. OEM payment terms are now 90-120 days versus net 30 for raw material purchases and biweekly labor costs. Adding to this challenge, interest rates are higher and, due to greater risk oversight, banks are less inclined to make loans.

Suppliers throughout the supply chain also face cost and margin challenges. Pricing for products they sell are still sometimes based on higher, pre-pandemic volumes. At lower volumes, part costs are higher (e.g., lower build rates mean less volume over which to spread fixed costs). Furthermore, material, labor, and other costs have risen sharply, Further shaving margins. Lastly, production interruptions from other suppliers not delivering on time as well as increased quality oversight in the wake of crashes and highly publicized quality escapes have hampered the return to higher volume output.

MRO Market Dynamics, Growth

On the aftermarket side (titanium demand is partly driven by titanium replacement parts), the maintenance, repair and overhaul (MRO) market value was $211 billion in 2022 and is expected to grow to $226 billion

this year. A number of factors are contributing to MRO market growth. First of all, although the MRO market experienced a similarly deep decline in 2020, it has seen a quicker, V-shaped recovery. During the pandemic, air travel was low but airlines flew at levels exceeding underlying demand. This means there was more wear and tear on aircraft than expected given air travel demand. Of course, once travel restrictions were lifted, air travel resumed with a vengeance. Even though business air travel is about 2/3 what it had been in 2019 and the start of international air travel recovery was delayed, air travel is nearly back to 2019 levels. (I’m sure you’ve seen completely full airplanes again.)

The MRO market faces its fair share of recovery challenges as well. MRO markets (and for that matter airlines and airports) also experienced considerable labor shortages and continue to do so. MRO also experienced inflation for spare parts as well as for labor. MRO is also seeing significant shortages of spare parts. Used and surplus material availability has been particularly low due to a very low rate of retirement of older aircraft. Older aircraft are remaining in service for longer because airlines cannot receive enough new aircraft from manufacturers.

Overall, we forecast total aircraft

8 TITANIUM TODAY

Peter Zimm

We Deliver Actionable Clarity

PUT OUR INDEPENDENT & PRACTICAL PERSPECTIVE TO WORK FOR YOU

Charles Edwards helps aerospace companies worldwide develop greater intelligence about their markets, uncover opportunities, become more efficient, and strategically position their business.

We bring an independent viewpoint, giving you perspective beyond your personal networks and day-to-day operations. We bring experience – decades of it – plus that of our extended network – to your business challenges. And we provide actionable solutions, the specifics you need to decide not only where to make changes but how

Our Services Include:

Strategy & Market Studies Operations Improvements Mergers & Acquisitions Support

Leveraging our extensive aerospace expertise, industry network, and proven tool kit, and working as an extension of your team, we can help you address strategic and market challenges while they are happening.

Drawing from our on-the-ground experience and tools, we save you time and money by helping to solve operational and supply chain challenges in a shorter time frame.

Applying our market analysis, strategy development, and operations improvement capabilities to provide investors objective and independent assessments, as well as implementation plans of prospective acquisitions.

We have extensive experience assisting clients in all aspects of aircraft production and supply:

+1 (480) 734-4265 | charles-edwards.com

Aerostructures - Engines - Equipment systems - Avionics - Interiors Assembly and manufacturing - Aircraft design and technology - Additive manufacturing

production value will grow at 8.8-percent compound annual growth rate (CAGR) from $137 billion in 2022 to $209 billion in 2027. We forecast MRO will grow at 3.3percent CAGR from $211 billion in 2022 to $248 billion in 2027.

Aerospace Raw Material Outlook

Aerospace raw material demand is based on material for aircraft production as well as material consumed in spare parts for MRO. Charles Edwards’ raw material model breaks down aircraft fly weight into material composition by material family (i.e., aluminum, steel, titanium, nickel, and composites), aircraft system (i.e., aerostructures, engines, equipment systems, interiors, etc.), and other distinctions. Our forecast considers material substitution over time, changes in aircraft and engine OEM production mix, and other market dynamics. We then build up buy-to-fly ratios based on typical material removal during processes

such as machining, forging, and melting. The result is a buy weight composition by aircraft which we apply to the production forecast to arrive at aggregate raw material demand based on production. MRO material demand is based on expected spares requirements for repair and overhaul events.

The aerospace industry demanded 1.37 billion pounds of raw materials in 2022 across all the raw material families (an increase of 12 percent over 2021) We forecast aerospace raw material demand will grow at 5.9 percent CAGR from 1.37 billion pounds in 2022 to 1.83 billion pounds in 2027. The reason the CAGR is lower than overall production value is that raw material production precedes finished aircraft production by some period of time; therefore, raw material production is starting from a higher base in 2022 relative to final production.

Aerostructures

titanium content has grown as aerostructures’ composites content has grown. The latest round of clean sheet aircraft designs has seen much more carbon fiber composites, particularly in widebody aircraft (most notably the Boeing 787 and 777X and the Airbus A350 also has increased composites content due to its new wings) although the Airbus A220 narrowbody jet also boasts new composite wing. Charles Edwards forecasts that titanium demand will grow at 7.7 percent CAGR from 157 million pounds in 2022 to 228 million pounds in 2027.

10 TITANIUM TODAY

Outlook On Growth of Titanium, Aerospace Markets (continued)

AEROSpace Raw Materials Reports

by Charles Edwards Principals Cliff Collier and Peter Zimm

by Charles Edwards Principals Cliff Collier and Peter Zimm

Stay Ahead with Market Intelligence

At AeroOutlook, we take pride in offering comprehensive market research specifically tailored to the aerospace and defense materials market. Our team of expert analysts and consultants boasts extensive experience in delivering in-depth analysis of global markets, ensuring you're always ahead of the curve.

Manage Risk in Your Aerospace Supply Chain

In the aerospace and defense sector, supply chain management isn't merely a logistical puzzle; it's a mission-critical challenge. This dynamic industr y grapples with a distinctive set of complexities that can have a profound impact on production and return on investments

+1 (480) 734-4265 | AeroOutlook.com Anticipate potential supply interruptions Get the reports that help you take action today!

Aerospace Aluminum Report Scan the QR Code to get the ReportS Aerospace titanium Report

Authored

Actionable Intelligence for Success Comprehensive Geopolitical Risk Assessment Market Size, Segmentations, and Growth • Key Trends Shaping A&D Materials Markets • Assessment of Supply Chain Challenges and Aerospace Mill Capacity Issues • Key Supplier Pro les • Risks in Ore Extraction and Primar y Metal Processing • For All Elements Used in Aerospace Alloys •

Aerospace Titanium Demand

Titanium is used throughout the aircraft: in the engine (e.g., compressor discs, blades and vanes, and cases), components/equipment systems (landing gear, ducting), and aerostructures (chords, spars, wing boxes, and pylons). Titanium is also used in the nacelle, hardware fasteners and brackets, and interior parts. Charles Edwards estimates 2022 aerospace titanium demand was 157 million pounds. Engines (about 40percent), equipment systems (about 25percent), and aerostructures (about 30percent) consumed most of aerospace titanium. Two-thirds of total aerospace titanium consumption ends up as finished parts on either an Airbus or a Boeing aircraft. The other one-third is ultimately consumed by the rest of the aircraft OEMs. The majority of aerospace titanium is processed into either forgings or plate. Although there are several commonly used aerospace titanium grades, Ti 6-4 accounts for the majority of the consumption.

A number of trends are impacting the aerospace titanium market.

• Increasing aircraft production rates. At the base is increasing aircraft production rates as well as robust MRO demand. As we saw earlier, aircraft production is expected to grow at 8.8 percent CAGR over the next 5 years (ironically, aircraft production growth rate is expected to be higher during this period because it was slower to recover than MRO).

• Material substitution.

Aerostructures titanium content has grown as aerostructures’ composites content has grown. The latest round of clean sheet aircraft designs has seen much

more carbon fiber composites, particularly in widebody aircraft (most notably the Boeing 787 and 777X and the Airbus A350 also has increased composites content due to its new wings) although the Airbus A220 narrow-body jet also boasts new composite wings. This is due to titanium’s higher compatibility with carbon, compared with aluminum’s compatibility. At the same time, titanium saw its position erode in engines, as nickel superalloys have moved forward into the high pressure compressor to handle increasing temperatures and fan blades on some latest generation engines are now made from composites.

• Aircraft production mix . The early air traffic recovery favored short haul routes which are primarily served by narrowbody aircraft. Meanwhile, recovery of long haul routes served by widebodies languished until China finally removed its COVID restrictions. As widebody production finally recovers in earnest, these higher-titaniumcontent aircraft will drive higher titanium growth rates.

• Ukraine invasion. As everyone in the titanium industry knows, Russia’s invasion of Ukraine has had, and continues to have, a significant impact on aerospace titanium supply. Although Russian titanium is not subject to western sanctions, the threat that supply might be interrupted by Putin or that it may become subject to sanctions later have caused buyers to seek other sources of supply.

• Additive Manufacturing. While the hype around additive manufacturing has cooled,

development work continues on this technology and titanium alloys are among the most popular metals with which to work due in part to its high cost. Even though the number of additively manufactured titanium parts (whether in development or in production) is impossible to ascertain with certainty, it does appear that heart development and part approvals using titanium materials continues.

Charles Edwards forecasts that titanium demand will grow at 7.7 percent CAGR from 157 million pounds in 2022 to 228 million pounds in 2027.

Upstream Supply Risks

Titanium is extracted from ore, refined into sponge and then into primary metal, then melted into alloys used in aerospace production. As Russia’s invasion of Ukraine starkly reminded us, the locations where all three levels of titanium production take place are important. But this goes well beyond titanium. The most-utilized aerospace alloys include other elements such as vanadium, aluminum, magnesium, and molybdenum and where these are mined and refined is important as well. Overall, the elements that comprise aerospace titanium alloys are mined or refined in 36 different nations, seven of which are considered medium-high or high risk places to do business (risk equals the prospect of a force majeure event in the next three years). The upstream supply risk assessment in our report helps consumers of titanium evaluate vulnerabilities and identify areas for which to develop contingencies.

12 TITANIUM TODAY

Outlook On Growth of Titanium, Aerospace Markets (continued)

Leading Titanium Manufacturer

Premium Quality, Stability and Reliability. One-Stop titanium alloy production and service.

ABOUT US

A dozen years of titanium alloy production and research experience, with more than 100 patents and achievements to its credit, mastering a number of core technologies; Accredited with Nadcap non-destructive testing certificate and AS9100D, ISO14001, ISO 45001 and other certifications;

CORE PRODUCTS

Titanium bar/billet

Size range: Φ15-500mm

Grade: Ti6Al4V, Ti-6242, Ti-6246, Ti-38644, Ti-15333, etc.

Titanium wire rod coil

Size range: Φ1.0-20.0mm

Grade: Ti6Al4V, Ti6Al4V ELI, Ti-38644, Ti-6242, Ti-6246, Ti-15333, Ti-422, etc.

Titanium forging

Size range: customized, disc, bar, ring, etc. L(max):14m, W(max):4m, H(max):4m.

Grade: Ti6Al4V, Ti6246, Ti6242, Ti662, Ti38644, Ti15333, Ti1023, Ti422, etc.

For more information, please visit www.tcae.com/en/

—TC

Aerospace

Shaanxi TianCheng Aerospace Co., Ltd.

+86-29-33336000 tc@tcae.com No 3, Gaoke 3rd Rd, Qindu District, Xianyang, Shaanxi, China. 1 2 3

Aerospace Titanium Supply

While titanium metal is used in multiple industries – medical, dental, oil and gas, recreational products, and aerospace – and titanium mills melt product that goes into multiple industries, four mill product suppliers are the largest providers of titanium bound for the aerospace market: ATI, Howmet, Timet (part of PCC), and VSMPO supply over 80 percent of total global aerospace titanium demand. Even though most of their facilities are located in North America or Europe, as noted above VSMPO’s facilities in Russia have been a major source of supply to the global aerospace industry. These suppliers vary in their emphasis on structural versus rotary grade titanium, what grades and forms they specialize in, how vertically integrated they are, and which end customers are most important to them.

There have been various announcements of aerospace mill product capacity expansion plans (e.g., Timet’s expansion in West Virginia), but the long-term response of the aerospace mill product supply base to the loss of Russian titanium capacity is a critical issue—one we also grapple with in our 2023 Aerospace Titanium report. n

(Editor’s note: Charles Edwards Management Consulting, based in Gilbert, AZ, [website: https://charles-edwards.com/] is a specialist advisory group focused on the aerospace industry and related titanium market trends. As stated on its website, the Charles Edwards organization assesses external and internal environments through focused field research, domain expertise, and industry-wide access to key decision makers to develop sustainable and actionable strategies, market analysis, strategy development, and operations improvement capabilities to give strategics and investors objective and independent assessments and implementation plans of prospective acquisition.)

14 TITANIUM TODAY

Titanium H Grades Win Approval For ASME Boiler and Pressure Vessel Specifications (continued)

ITA 2023 Lifetime Achievement Award

Conard Stitzlein Traces Journey from Ohio Farm To a Pioneering Leader in the Titanium Industry

By Michael C. Gabriele

Sixty-four years ago, Conard Stitzlein had an idea, that a commercial market would help stabalize the Titanium Industry. He borrowed $500, found an office, had a phone, and a farm truck with a 15-foot cargo bed. Blessed with an entrepreneurial spirit and keen business instincts, he decided to start a company and called it “Astro Fab.”

“I had a folder full of inquiries from chemical processing companies looking for titanium samples,” he recalled. “I wondered if I could start a business by supplying titanium to customers.”

It was from these humble beginnings that he built a successful six-decade career in the U.S. Titanium Industry. As a tribute to his efforts, Conard Stitzlein is the recipient of the International Titanium Association’s (ITA) prestigious Lifetime Achievement Award for 2023.

The mid-1950s were the very early days of the U.S. titanium industry, when commercial business markets were just beginning to take shape for the “wonder” metal. Though optimistic, Stitzlein may have had some initial qualms. “I remember reading an article in American Metal Market that said ‘the bloom is off titanium’s rose.’” Cancellations were rocking the metals industry and government programs were being cut.

Warehouses were overrun with excess inventory.

Despite the grim news reports, Stitzlein persevered and spotted business opportunities that others didn’t see. He worked at Johnson and Funk Metallurgical, where he served as a sales manager, beginning in the spring of 1956. In 1958 the company acquired Mallory Sharon Steel. One year later, Stitzlein left the company to pursue his own ambitions.

Flying solo at Astro Fab, good fortune smiled on him in 1959 when his friends at Johnson and Funk/Mallory Sharon

told him that they had accumulated a large pile of unwanted titanium scrap. “They didn’t know what to do with it as remelting had not been developed,” Stitzlein recalled. “They told me to take whatever I needed, so I loaded up my farm truck with titanium mill forms that did not meet aerospace specs, which included bar stock, plate, and cut shapes.”

Stitzlein now had the material he needed to address his folder full of inquiries from chemical processing companies. Astro began to supply corrosion samples and made parts and pieces for corrosion evaluation. Sales started to grow and Stitzlein made $123,000 in his first year, with 50 percent margin, followed by revenues of $373,000 the following year. “It was a fun start,” Stitzlein said. Feeling restless, Stitzlein left Astro and got into the metal heat treating business in the Los Angeles area. In 1965 he returned to Astro, then known as Astro Metallurgical, as president to help re-energize the company. A series of other moves followed, such as managing various companies and starting up titanium wire operations in California and Fabrication/Warehouse in Texas. Eventually,

16 TITANIUM TODAY

Conard Stitzlein ‘Astro Difference’ promotional flyer, circa 1974

YOUR SPECIALTY METALS SOLUTIONS CENTER COIL SHEET STRIP PLATE BAR NEAR NET SHAPES 888.282.3292 | www.upmet.com | sales@upmet.com NICKEL TITANIUM STAINLESS STEEL COBALT PRODEC® ALLOY STEEL CCM ALUMINUM DUPLEX AS9100D — ISO 9001:2015 — ISO 13485 DFARS COMPLIANT UNITED PERFORMANCE METALS HEADQUARTERS — 3475 SYMMES RD, HAMILTON, OH 45015 OAKLAND, CA | LOS ANGELES, CA | HARTFORD, CT | CHICAGO, IL | GREENVILLE, SC INTERNATIONAL — BELFAST, NORTHERN IRELAND | BUDAPEST, HUNGARY

he established Tricor Metals in Wooster, OH, (purchasing the former Astro Metallurgical facility), a 150,000-square-foot facility with three crane bays.

The company, now known as Tricor Industrial Inc., also opened a facility in Conroe, TX. Today Tricor (website: https://tricormetals.com/) touts itself as a leading international distributor of titanium mill products (plate, sheet, bar, billet, pipe and forgings) according to its website. Tricor also is involved in custom fabrication and builds process equipment in titanium, tantalum, zirconium, high-nickel alloys, duplex and 300-series stainless steel, as well as offering field repair crews. Stitzlein’s son, Michael, serves as president of the company.

His extensive resume in the industry also includes being tapped in 1984 as the first president of the ITA, which evolved from a group of metal industry executives known then as the Titanium Development Association. Stitzlein said one secret to the success in his career is that he was always willing to ask for help, and then he honorably held up his end of the bargain. “This is not just my award,” he declared, citing his gratitude for being the recipient of the ITA’s Lifetime Achievement honor. “There were a lot of other people who helped me along the way. I’m just a farm boy from Ohio. I knew where to go to get answers. People were anxious to help me.”

All throughout his dealings in the titanium industry, Stitzlein held onto his livestock farms in Ohio and Montana, which provided him with a measure of security during volatile periods in the metals business. His wife, Nancy, kept the farm operations going, raised five children and bought real estate, proving to be his best business partner and supporter.

18 TITANIUM TODAY

ITA 2023 Lifetime Achievement Award: Conard Stitzlein (continued)

Reflections of a Son

“My father likes to joke that he didn’t get very far in life. He only got two houses up the road from where he was born,” Michael Stitzlein, Conard’s son and the current president of Tricor Industrial Inc., said, providing a heartfelt words to honor his dad’s long career. “He put me on a tractor at an early age. I think I was six years old. I remember helping him shear sheep and listening to him play the trombone and call square dances. He instilled in me a strong work ethic and gave me responsibility at an early age and that our mission is to create employment. With his backing the last 30 years has been a journey putting the former Astro Metallurgical back together as Tricor in the same location in Wooster. When our family went on vacation together my dad would make sales calls along the way. I admit to doing the same. However the most important thing I have learned from my father is to surround yourself with good people. Once titanium gets in your blood it’s there to stay and that’s why Wooster is one of hubs in the world for titanium.”

According to the accolades listed on his nomination form, Stitzlein was a pioneer in first developing and then promoting the titanium service center model to the chemical processing industry (CPI). “He eventually grew his business into a major player in the fabrication of titanium equipment to chemical plants, as well as being a major source of stocked titanium for other fabricators and end users. He helped to develop the markets for titanium in the chlorine industry, the terephthalic acid industry, and the mining industry by having a ready supply of titanium in stock. In addition, he developed a stable

Conard Stitzlein said one secret to the success in his career is that he was always willing to ask for help, and then he honorably held up his end of the bargain. “This is not just my award,” he declared, citing his gratitude for being the recipient of the ITA’s Lifetime Achievement honor. “There were a lot of other people who helped me along the way. I’m just a farm boy from Ohio. I knew where to go to get answers. People were anxious to help me.” His extensive resume in the industry also includes being tapped in 1984 as the first president of the ITA, which evolved from a group of metal industry executives known then as the Titanium Development Association.

of competent engineers that could design titanium into these various process equipment requirements. He created a network of companies that were instrumental in promoting early adoption of titanium into industrial applications.”

Stitzlein promoted new welding techniques for titanium in CPI applications. “He tested and introduced novel design methods, such as using titanium Grade 2H per Division 2 of ASME to expand the use of titanium in the purified terephthalic acid (PTA) industry by making fabrications lower cost and more competitive with nickel alloys. Conard pushed the application of titanium for flue gas desulfurization (FGD) scrubbers in the electric power market, and worked with Timet on

joint technical efforts in the 1980’s to get titanium secured as an accepted corrosion resistant material in this market.”

He created and developed Astro Metallurgical in the 1970s and 1980s and Tricor Metals in the 2000s and “positioned these entities, through expansion and reinvestment, as experts in titanium fabrication, with company representatives routinely providing technical, technical marketing, and commercial presentations around the world on the design, fabrication, and corrosion resistance of titanium in CPI applications.” n

20 TITANIUM TODAY

ITA 2023 Lifetime Achievement Award: Conard Stitzlein (continued)

Titanium Stainless steel Polymers

ACNIS GROUP SETS UP A NEW SUBSIDIARY IN CHICAGO

Established in France (Lyon), the stockist Acnis Group is one of the world leaders in the distribution of metal alloys especially in TITANIUM, in all forms : sheets, bars, tubes and powder for 3D printing.

ISO 13485 certified since 15 years, the family business has specialized in the medical field since its creation in 1991, to meet the demand of orthopedic manufacturers and dental implants, as well as surgical instruments.

ACNIS Group acts as a buffer between producers and users, thanks to its 600 to 700 tons rotating stock and 1,300 references of different origins. Our unique cut-to-size service center (15 machines: waterjet, high-definition waterjet, plate sawing, bar sawing, shearing, machining, chamfering) allows us to reduce your costs by optimizing scrap rates.

As a result, the company is able to deliver very quickly its customers, in barely a week, no matter the ordered quantity. Major implant manufacturers among the main American and European OEMs themselves call on ACNIS Group to source their metal alloys.

The last creation of ACNIS USA stock in 2023 in Chicago has changed the game. Acnis Group is now the only distributor that can stock and deliver any quantity in North America (ACNIS TITANIUM & ALLOYS USA-Chicago), South America (ACNIS DO BRAZIL-Sao Paulo), Europe (ACNIS FRANCE-Lyon), South Asia (ACNIS CHINAShanghai) for global worldwide contracts.

Acnis is your one-stop shop for all TITANIUM grades, stainless steel (316L, 420B, cobalt chrome, 17/4 PH, high nitrogen alloy, Custom 455, Custom 465…) and polymers.

Our dental subsidiary BCS, a European leading distributor of CAD CAM products for additive manufacturing, is registered with the FDA for titanium powder & discs, and cobalt chromium powder.

ACNIS TITANIUM & ALLOYS 1940 E Devon Elk Grove Village 60007 - IL - USA

+1 (312) 826-6850

qgoliot@acnis-titanium.com

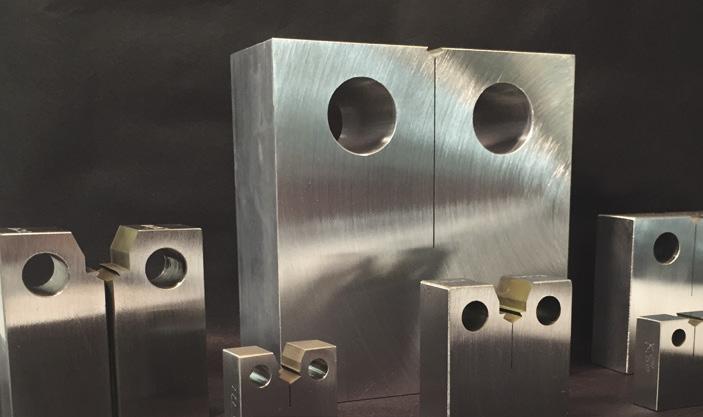

TriTech Titanium Focuses on MIM To Design, Produce Net-Shape Parts

It’s not often that a new company springs to life fully formed, with decades of experience at its back. TriTech Titanium Parts in Detroit is one of those rare companies. Founded by Bob Swenson, president of TriTech, in April 2022, TriTech was spun off from its parent company, AmeriTi Manufacturing Company, formerly owned by Swenson, when he sold the bulk of the business to Kymera International. Swenson retained the parts division of the business, which is well on its way to meeting its ambitious first-year growth target to double its revenue.

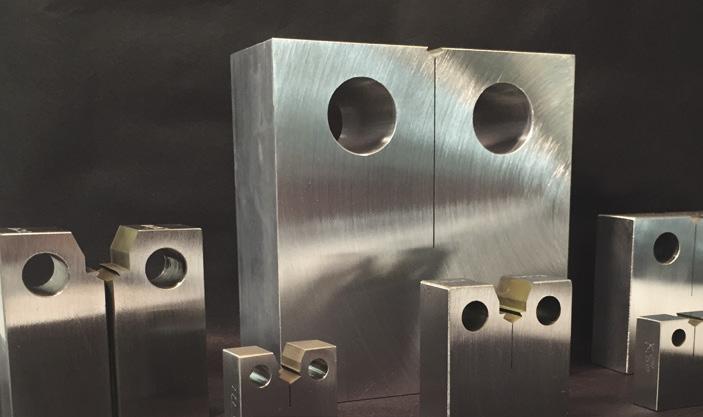

An ISO 9001:2015 certified company, TriTech specializes in producing net shape titanium parts for a wide array of industries and offers several production methods. Its titanium metal injection molding (MIM) operation is focused on industrial applications and firearms accessories. The company operates with a full domestic North American supply chain to ensure it can procure supplies for its customers when they need them and to avoid potential delays due to unexpected disruptions in the global supply chain.

“There are very few companies producing titanium precision net shape parts using metal injection molding,” Swenson said. “At TriTech, we’ve developed our MIM technology throughout years of in-house process research and process improvements.”

Titanium MIM is especially suited for producing small net-shape parts that have intricate designs or complex geometries, including profiled holes,

internal and external threads, finely detailed surface textures, embossed and debossed lettering, sharp edges, markings and more. The mold design process offers great flexibility to create custom-made small net shape parts that are often in the range of a halfgram to as large as 200 grams.

It starts with the custom-made mold design for each part. TriTech, per its ISO designation, does not design the parts. The parts are designed by its customers. TriTech prefers to get involved with customers early in the design phase to enhance the part design for manufacturability. Its skilled engineering team specializes in designing and producing titanium parts and can modify the design so the injected powder feedstock can flow freely and evenly through the intricacies of each custom mold.

For the more complex parts, TriTech uses detailed computermodeled flow analysis to make sure the part injects completely to fill the die cavity with no porosity or variation in density throughout the

part, ensuring uniformity of the injected titanium alloy.

“Customers come to us with a solid model file,” said Swenson. “This is the stage where we collaborate with them to optimize the design for manufacturability, while at the same time giving customers all the features that they want and reducing scrap.” Swenson said that his engineering team can incorporate features, such as putting a logo on the part or adding a texture on the surface while not adding to the cost of the part.

Titanium Metal Injection Molding

To power its MIM operations, TriTech’s Detroit factory uses two Arburg ALLROUNDER injection molding machines. One machine operates with the original factory settings, while the other has been upgraded to manage a higher capacity to make bigger parts that weigh 200 grams. “As we grow, we will add additional capacity with new in-stock machines,” Swenson said.

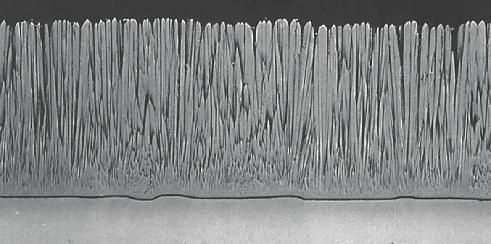

TriTech uses the standard Titanium 6–4 alloy for its high tensile strength, high corrosion resistance and lightweight properties. It does not customize the alloy. Customization is introduced when the TriTech team collaborates with each customer to refine parts design for manufacturability. TriTech uses a spherical titanium powder, with spheres measuring 25 microns or less. (By comparison, a single human hair measures about 40 microns.)

With a high-shear mixing device, the spherical titanium powder is

22 TITANIUM TODAY

(The following is a guest article from TriTech Titanium Parts LLC, written by Patricia Radice of The Quell Group, Troy, Mich., with direct input from Bob Swenson, TriTech company president.)

Bob Swenson, President, TriTech Titanium Parts LLC.

blended with an organic binder to create a mixture in the form of a pelletized feedstock. The feedstock is measured to the exact “shot” size needed for the specific part. The feedstock is heated and injected into the part mold, which, when cooled, yields a “green part.” At this stage, the green part is prepared for sintering by removing the binder material from the titanium.

TriTech uses two debinding processes to ensure the effective removal of the binder material. If sintering took place with insufficient removal of the binder material, it would cause deformation and cracking, and likely lead to part failure. TriTech uses solution debinding as the initial step in its two-part debinding process. The

green part is submerged in an organic solvent to remove approximately one-half of the binder. Next, the remaining binder material is removed during thermal debinding, a process that takes place in the sintering oven while preheating the parts to sintering temperature. After debinding, the “brown part” emerges that is ready for sintering.

TriTech’s uses an Elnik MIM 3000 Series vacuum sintering furnace and the sintering takes place at temperatures

computer aided design (CAD) model for accuracy.

Growth is an ‘Odyssey’

As TriTech continues to pursue its ambitious growth strategy, it recently adopted an enterprise resources planning (ERP) system to streamline management of the entire manufacturing process. The Odyssey ERP system is cloud-based and was developed to meet the specific needs of metal parts producers. TriTech is implementing it to run its entire operation, from procurement through manufacturing and parts delivery.

of 2,300ºF to 2,400ºF. The heat causes the compact powders in the brown part to bond and form a fused mass, significantly increasing its strength and structural integrity. The parts are designed so that, once the sintering process is complete, they need no subsequent machining, which is a considerable cost and time savings for customers. Additionally, TriTech uses vision and scanning systems to measure parts dimensions and firm tolerances. For final inspection, the finished part is scanned and compared with the

“The Odyssey system is a comprehensive solution that we use to manage the entire scope of business operations, from forecasting to capacity planning to ordering raw materials to managing operating requirements and scheduling, productivity, record keeping and data collection, while significantly reducing our reliance on paper documents,” said Swenson. “A major advantage to using the system is that it records production data in real-time, for example, productivity, dimensions, weights, and other and records the weight of the part and other valuable information. We can export that data to our statistical process control program.”

Swenson stated that, with the Odyssey system, all of TriTech’s data is stored in one place where team members can access it when needed from wherever they are in the plant, which creates efficiencies while increasing accuracy and quality.

24 TITANIUM TODAY

TriTech Titanium Focuses on MIM To Design, Produce Net-Shape Parts (continued)

Removing green part from MIM machine

Loading trays of “brown parts” into a MIM vacuum sintering furnace.

TriTech’s vision and scanning systems measures parts dimensions and firm tolerances.

Positioned to Respond.

Our continued investment and expansion has us in the right place to meet your needs.

Our capacities and resources are aligned. We are prepared and well positioned to supply a full range of products including ingot, centerless ground bar, precision coil, additive wire, premium fine wire and shapes – all at competitive lead-times.

We are expertly equipped to address the growing demands of the aerospace, medical, recreation, infrastructure, and industrial markets worldwide. We understand the ever-changing factors of the industries we serve and are committed to supporting the growth of your business.

Fully Integrated Titanium Manufacturing

| www.perrymanco.com

724.746.9390

Titanium MIM is especially suited for producing small net shape parts that have intricate designs or complex geometries, including profiled holes, internal and external threads, finely detailed surface textures, embossed and debossed lettering, sharp edges, markings and more. The mold design process offers great flexibility to create custom-made small net shape parts that are often in the range of a half-gram to as large as 200 grams.

TriTech is dedicated to quality production and performance throughout the organization and is a firm believer in compliance with ISO standards. TriTech is also committed to continuous improvement.

“We have continuous improvement meetings once a week to look for new markets and customers and to discuss ways to increase quality, productivity and product yields,” Swenson stated. “We strive to make small titanium net shape parts with complex geometries that do not require subsequent machining that can be immediately used in the customer’s application with no further finishing work.”

MIM is best suited for largebatch parts. “These precision molds can be pretty expensive to make,” said Swenson. “So, it’s best used in applications that produce thousands of parts.”

“The MIM process has been around for decades because it works so well,” Swenson continued. “However, advances in the technology used in MIM parts production continues to be refined, so that we can offer additional benefits to our customers.”

A Bright Future for Titanium MIM

“As our name implies, we’re focused on producing net shape

parts made from Titanium. We’re focused on Titanium and plan to stay that way,” said Swenson. “Before the spin-off, we had been operating for three- to four-years making net shape titanium parts. Now, as an independent company, we’re coming up on our one-year anniversary. Our near-term business goals are to double our sales every year. Longer term, we see it continuing to double, and hopefully, even to triple.”

Alongside MIM, TriTech offers two additional technologies to make titanium net shape parts: 3D binder jet printing and investment casting, all under one roof in Detroit. The three technologies complement each other. There seems to be a specific technology that aligns best with each customer’s needs. Cost, volume and part complexity are all factors the company assesses in matching the right production method to each part.

“There is no one-size-fits-all technology when manufacturing titanium precision parts to produce the best performance characteristics,” said Swenson. “We’ve proven that different technologies provide different results and therefore we have assembled a one-stop production resource offering the best option to many industries. We match the design to the best manufacturing process to make a superior net shape

part.”

According to Swenson, MIM is clearly the winner as to what can be accomplished with titanium. It’s fast, low cost, meets very tight tolerances and provides exceptional surface quality. The 3D binderjet printer can serve as a good prototype tool leading to MIM. It can produce a single test part or a larger number of parts. Binderjet printing also uses spherical titanium powder and finishes with a sintered part much like MIM. The printing process allows some very complex shapes like lattice structures and porous shapes.

As part of TriTech’s growth plan, Swenson said he and his team are proactively pursuing contact with potential customers through several channels. “We’ve been participating in trade shows as exhibitors and speaking at technical conferences,” commented Swenson. “And, we’re marketing our product offerings with our updated website and are even testing out social media.”

So far, the growth strategy seems to be working. Swenson said TriTech has no shortage of customer inquiries, and the business is growing. Most customers are from North America, although the company is currently working with a customer in Europe. “It’s a global market,” Swenson said. “And we’re eager to continue growing to participate in it.” n

(Editor’s note: As mentioned above, this is a guest article provided by TriTech Titanium Parts LLC [website: https://tritechtitanium.com/]. Bob Swenson, an executive in the titanium industry for over three decades, is the owner and president of the company. As stated on the website, TriTech’s expertise in MIM dates back to 2017 at AmeriTi Manufacturing. TriTech’s internally developed its own MIM process technology.)

26 TITANIUM TODAY

TriTech Titanium Focuses on MIM To Design, Produce Net-Shape Parts (continued)

Harness our leading-edge vacuum technology to help assure your flight-critical parts go the distance.

Aerospace Vacuum Heat Treating Services

Advantages

• Bright, clean, scale-free surfaces with minimal distortion

• Furnace capacities up to 48 feet long and 150,000 lbs

• Full line of major aerospace approvals

• Titanium and high nickel alloys

solaratm.com

1-855-WE-HEAT-IT

Eastern PA • Western PA • California • South Carolina • Michigan

Annealing • Degassing • Creep Forming and Flattening • Stress Relieving • Brazing Solution Treat and Age (STA) • Homogenizing • Sintering • Hydriding/Dehydriding

Solar Atmospheres heat treated the titanium manifold weldment used on the Orion Launch Abort System for the NASA Artemis I Program.

EB Systems Offers Insights on Benefits, Challenges of Electron Beam, Laser Beam Titanium Welding

By Cory Yaeger

By Cory Yaeger

(Editor’s note: The following guest article comes from EB Industries LLC, Farmingdale, NY, and provides insights on electron beam and laser beam manufacturing technology for welding titanium. Cory Yaeger is the program manager of EB Industries.)

Electron beam and laser welding are fusion processes that can produce highenergy precision welds in a wide range of metals, including exotic and dissimilar materials that are hard to weld by conventional welding processes. However, there are significant differences between the two. Based upon the industry specifications, materials involved, the weld joint design/purpose, and cost considerations, typically there is a clear choice when determining which process best fits the application.

Other types of fusion welding, such as Arc, tungsten inert gas (referred to as TIG or GTAW), or metal inert gas (referred to as MIG or GMAW) might be an option, but if your requirement is for precision, deep yet narrow, pure (no filler material typically needed) welds, then electron beam (referred to as EB) or laser welding is often the best method of joining. Because the physical components that generate electron beams and laser beams can be CNC controlled, you have a highly repeatable, versatile joining technology capable of welding both the smallest of implantable medical devices and yet also able to deliver the tremendous amounts of power required to weld structural aircraft parts. These welds can meet or exceed all metallurgic, structural, or hermetic sealing requirements while meeting all cosmetic/aesthetic

needs and eliminating or reducing post-weld machining. With proper planning and tooling, both processes can be more cost-effective than conventional joining technologies.

Electron Beam Welding

Although electron beam and laser welding both deliver high-energy precision welds, they significantly differ from each other in terms of underlying physics and functional operation. It is in these differences that one process might have an edge for a particular application.

EB welding technology was developed in the late 1950s and was quickly embraced by high-tech industries, such as aerospace, for the

precision and strength of its resultant welds. An electron beam weld can be very accurately placed, and the weld can retain up to 97 percent of the original strength of the material. Basically, electrons are generated (via a tungsten filament) and then accelerated to very high speeds using electrical fields. This high-speed stream of electrons is then focused, shaped, and directed using magnetic fields (magnetic lenses) and precisely applied to the materials to be joined. As the electrons impact the materials, their kinetic energy is converted to heat, which causes the metals to melt and flow together, producing the weld.

EB welding machines generally

28 TITANIUM TODAY

Glove-box welding unit

YOUR ONLINE SOURCE FOR AEROSPACE GRADE TITANIUM QUOTE, BUY, TRACK... IT’S THAT EASY @ ROLLEDALLOYS.COM 24-7 Instant pricing! • TITANIUM • NICKEL • STAINLESS • DUPLEX • COBALT • WATERJET • LASER • PLASMA • PLATE SAW • AND MORE! ADDITIONAL PRODUCTS & SERVICES

come in two power classifications: low voltage (60 kV); and high voltage (150 kV). A typical high-voltage machine rated to 15,000 watts can produce a weld in steel 3 inches deep with a width of approximately 10 percent of the penetration depth. The power delivered by an electron beam can be massive—up to 10,000 kW/mm3. An EB welding system can throw enough power to simply vaporize metal (a process called EB machining).

The operating environment of an EB welding system is particular. The electrons can only be accelerated in a high vacuum; otherwise, air/gas particles scatter and diffuse them. A vacuum requires a vacuum chamber and a series of vacuum pumps, so the size of a part to be welded is restricted by the size of the chamber. This is a major consideration. Vacuum chambers can be small or large, but the larger the chamber, the longer it will take to establish the proper vacuum level, which is typically (per aerospace specifications) a minimum of 1.0 x 10-3 Torr. The use of a vacuum, as well as the presence of X-radiation (a byproduct of the beam), precludes human handling, so the entire process must be externally controlled, generally using CNC tables. The combination of all these technologies—high-voltage, vacuum, and high-tech automation— means that electron beam welding requires well-trained development engineers, operators, inspectors, and maintenance technicians.

EB technology is not for the faint of heart. High-voltage machines can be in the millions of dollars, and the support to keep these machines running is extensive, especially if you do not have in-house personnel to keep you up and running when delivery deadlines are hours away. Since EB welded assemblies are not manipulated by an operator’s hand,

the part fit-up typically requires a precise fit between the parts being joined. Part designers should have some familiarity with joint design or

get help from an experienced service provider. The success and quality of the final weldment will depend on it.

Along with the joint design, proper tooling to manipulate the part within the vacuum chamber is critical, not only to hold the part together and in place, but possibly to act as a heat sink to minimize shrinkage and warping by absorbing some of the heat going into the part. Tooling can also be designed to shield and protect exposed wires and sensitive components of the assembly against vapor and weld splatter. Well-designed tooling allows for better efficiency—the more parts that can be welded per vacuum chamber cycle, the more cost-effective the process.

Although technology has evolved, and more modern EB machines have routines and automated processes for set-up, an experienced engineer or operator is required for initial weld development. The electron beam must be generated, focused and aligned at setup according to a weld schedule (log) to produce the desired result. It must also be synchronized with the weld feed rate (typically in a CNC program) to produce the width, depth (penetration), heat, and cosmetic finish on the surface that’s required. Once one cycle is complete and all parts in the chamber are EB welded, the technician or operator unloads the welded parts for inspection and loads in another batch until the desired lot quantity is completed. This points out one clear disadvantage of electron beam welding, and that is the need for a vacuum chamber. With pump down times (the time it takes to achieve a ready-to-weld vacuum) ranging from 30 seconds (small chamber) up to over an hour (large chamber), it is imperative that tool design engineers maximize the number of parts run

30 TITANIUM TODAY

EB Systems Offers on Electron Beam, Laser Beam Welding (continued)

Prepping a vacuum chamber

Tooling for EB welding parts

Laser welded titanium medical parts

The project funded by Innovate UK

Epoch Wires is pleased to announce their involvement in an Innovate UK research project as part of the “NATEP helping SMEs innovate in aerospace - Autumn 2021” competition. The project entitled “NanoTi - Grain refinement of Ti-6Al-4V wire to enable Aerospace DED AM” is led by Epoch Wires and supported by TWI.

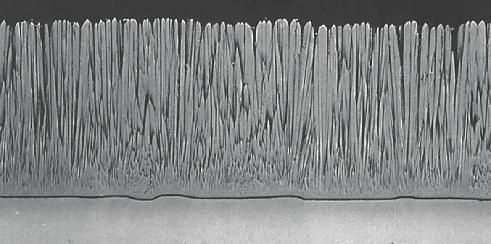

The project aims to design novel-alloy wire chemistry to minimise the grain growth in Ti6Al4V alloys deposited by Additive Manufacturing. In this work, Epoch Wires will produce new wires with a nanoparticle injection, forming equiaxed grains to enhance the mechanical properties of Ti6Al4V alloys. TWI will be depositing the wires using laser, plasma, and electron-beam additive manufacturing techniques. Epoch Wires will be utilising it’s proprietary technology of producing metal-cored wires using continuous laser-seam welding technology, designed for titanium alloys.

The NanoTi project has received funding from Innovate UK under grant agreement No. 10030392.

Nano Ti Wires

Innovative and cost-effective titanium wires for the aerospace industry

Laser-seam welded Ti6Al4V wire

Ti6Al4V material deposited using Nano Ti wires, with laser additive manufacturing technology (image courtesy of TWI)

Contact

Serdar Atamert (CEO)

serdar.atamert@epochwires.com

+44 (0) 7414 866801

Epochwires.com

info@epochwires.com

Unit 8, Burlington Park, Cambridge, CB22 6SA, UK

EB technology is not for the faint of heart. Highvoltage machines can be in the millions of dollars, and the support to keep these machines running can be extensive, especially if you do not have inhouse personnel to keep you up and running when delivery deadlines are hours away. Part designers should have some familiarity with joint design or get help from an experienced service provider. Working closely with an experienced weld or development engineer is extremely helpful. Choosing the right process and the right equipment and service provider to help tool and develop the process is usually the difference between success and failure.

per pump down and that CNC programmers and operators monitor the movement of the parts to save costly time.

EB welding systems can join all weldable metals and some metals that are not typically welded. Electron beam welds are incredibly strong and pure. Impurities in the weld are vaporized, and welding in a vacuum means there are no gases or air that might react and cause oxidation. EB welding is a process of choice to join dissimilar materials that would otherwise be un-weldable due to differences in melting points, which result in intermetallic compounds that cause brittleness. The precise nature of the electron beam and tight heat-affected area allow electron beam welding to melt the lower-temperature material onto the unmelted, higher-temperature material, resulting in a homogenous weld.

Electron beam welding technology has expanded in recent years. EB Industries has developed a new machine that offers several

improvements., such as automatic joint tracking on weld joints that can’t be seen by the human eye. This machine also has parameter monitoring capabilities, including the ability to halt the process if something is out of specification. All of this increases the reliability and consistency of the process. See more information here: https:// ebindustries.com/eb-weldcube-highprecision-eb-welding/.

EB Industries typically opts to electron beam weld titanium rather than using lasers. It’s imperative to keep oxygen away from the weld as Titanium is very susceptible to oxidation, which can result in the weld being brittle and cracking. For this reason, special care must be taken to minimize the weld piece’s exposure to oxygen after cleaning and during welding. Since EB welding happens in a vacuum, there is no oxygen present to cause oxidation. When laser welding titanium, oxidation is mitigated by using a cover or shield gas. Generally, an inert gas, such as argon or helium,

is used to protect the part, and special care must be taken to make sure the gas completely covers the heat-affected area including the back side and/or interior of the part.

Laser Welding

Lasers were developed in the early 1960s, and by the mid-decade, CO2 lasers were being used to weld. The 1970s saw automated laser welding on production lines, and the technology has found wide acceptance in many industries and continues to improve. Laser welding systems are capable of delivering a tremendous amount of energy very quickly and with pinpoint accuracy. The beam can be focused and reflected to target hardto-access welds and can be sent down a fiber-optic cable for more flexibility.

A laser beam is generated by rapidly raising and lowering the energy state of an “optical gain material,” such as a gas or a crystal, which causes the emission of photons. These photons are then concentrated and made coherent (lined up in-phase with each other) and then projected.

32 TITANIUM TODAY

Laser weld fixture with gas nozzles

EB Systems Offers on Electron Beam, Laser Beam Welding (continued)

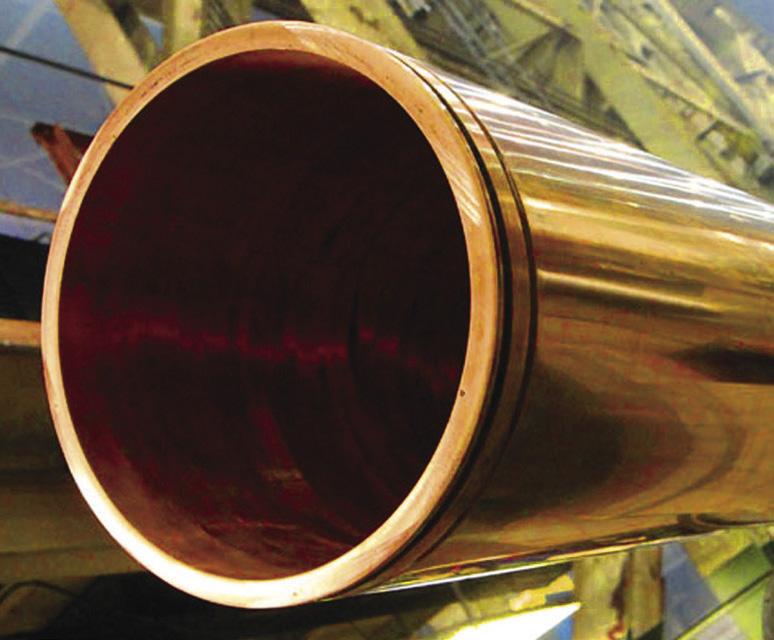

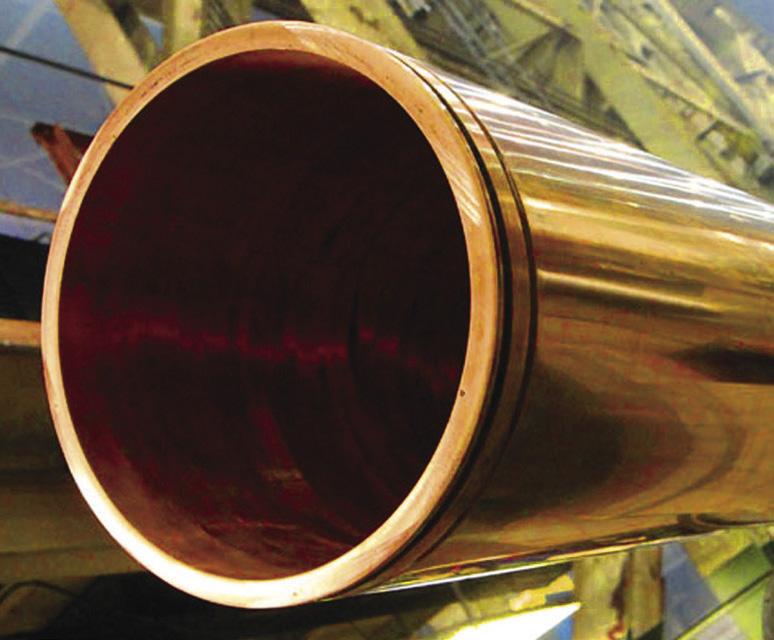

Titanium Mill Products: Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet: Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers: Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Ti sheet, plate, bar, & forgings 6/4,6/4ELI, CP Ti, Welding Wire, & Fabrications tricormetals.com astrolite.com tricoralloys.com Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691 Phone: 330-264-3299 Fax: 330-264-1181 Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304 Phone: 936-273-2661 Fax: 936-273-2669 Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170 Phone: 734-454-3485 Fax: 734-454-7110 Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030 Phone: 805-487-7131 Fax: 805-487-9694

This beam of photons is focused on the surface of a part and “couples” with the material, causing it to melt via conduction. Since the heating of the material starts on the surface and then flows down into the material, the depth penetration per unit of power in a laser weld is less than that of an EB weld.

The power output of a laser can vary from a few watts to hundreds of kilowatts, and different types of lasers have different welding characteristics. As an example, the wavelength of the light produced by a laser can make it more suitable for some applications and less so for others.

In some cases, the laser’s energy can be reflected by the surface of the material, which reduces its effectiveness. To overcome this problem, the laser can be pulsed— varying the power of the laser over time during the weld cycle. By pulsing the laser at high peak powers, the average power can be a fraction of the peak power and the part stays cool, and on highly reflective materials, such as copper and aluminum, the pulsing “breaks” the surface and allows proper coupling.

The alternative to a pulsed laser is continuous wave (CW). As the name implies, CW lasers utilize a laser beam that is on continuously— from the start to the end of the weld cycle. CW lasers are useful for cutting applications or when weld speed is important. For example, an automated GTAW machine might have a welding speed of 10 inches per minute (IPM), while a CW laser could easily run at 100 IPM. When laser welding, high feed rates for CW are necessary to keep the part cool, so heat-sensitive parts are often pulse welded.

Excessive heat can be an issue when welding with lasers, and pulsed laser welding is generally

called out for welding electronics packages, particularly those that require hermetic sealing. Minimal heat means the weld can occur extremely close to sensitive electronic components and solder joints without melting them. Lasers are also popular for medical device applications, as the welds can be tightly controlled and consistently applied, which leads to minimal discoloration of the part and a cosmetically appealing weld that may not need post machining

Laser welding generally requires the use of a cover gas to keep oxygen out of the weld area and improve efficiency and weld purity by minimizing oxidation. The type of gas used depends on the type of laser, the material being welded and the particular application.

Cover gasses in a laser welding application are generally applied using adjustable nozzles, but some applications may require a glove box to assure complete gas coverage of parts with complex geometries. Work has been done with laser welding in a vacuum. This has yielded some positive results, but the cost and complexity of such a system steer many back to the EB welding process, where a vacuum is a requirement of the process.

Which Process to Use?

Which process to use depends on the particularities of the application. EB welding was an accepted process in the aerospace industry before lasers were available. As a result, the specifications for EB welding for aerospace parts are extensive and widely accepted. These specifications control all aspects of the process, including joint design, cleaning, vacuum requirements, machine qualification, operator training and inspection criteria. Electron beam welding of titanium for aerospace and

defense applications is a very good fit.

The medical device field has embraced laser welding. Although there are much fewer standard medical device welding specifications, large OEMs usually define their own. Without the requirement for a vacuum, laser welding is generally less expensive than EB welding, and the parts are easier to tool and fixture without the limitations of a vacuum chamber. Laser welding titanium in glove box environments produces excellent, high-quality welds.

Some applications and part designs have specific requirements that will dictate the process to use. Working closely with an experienced weld or development engineer is extremely helpful. Choosing the right service provider can be a key factor in getting excellent welds that fit the requirement in a cost-effective manner.

Profile of EB Industries

Founded in 1965, EB Industries (website: www.ebindustries.com) has extensive experience in the precision welding of industrial metals (titanium, molybdenum, beryllium, copper, stainless steel and more), specializing in EB and laser technologies. The company’s certifications include AS9100D/ISO 9001:2015, ISO 13485:2016 as well as NADCAP (National Aerospace and Defense Contractors Accreditation Program) certification for EB welding. EB Industries provides services to OEMs as well as Tier 1 and 2 suppliers in aerospace and defense, medical, semiconductor and alternative energy business sectors. EB Industries performs welding as a service and doesn’t sell or license any of its machines. For more information, visit the company’s website, https://ebindustries.com. n

34 TITANIUM TODAY

EB

(continued)

Systems Offers on Electron Beam, Laser Beam Welding

IperionX Unveils Mission to Develop First 100-Percent U.S. Titanium Recycling Plant

By Michael C. Gabriele

IperionX Ltd. (previously known as Hyperion Metals Ltd.), a critical materials company focused on the sustainable reshoring of critical material supply chains to the U.S., recently published additional details regarding its near-term plans to develop the first 100-percent recycled titanium metal production facility in the United States.

The project will roll out in two initial phases, with Phase 1 consisting of a $28.4 million capital investment to develop annual capacity of 125 metric tons of 100-percent recycled titanium metal powders by 2024, followed by an expansion in Phase 2 to 1,125 metric tons of recycled powder capacity by 2026. Both phases will produce high-quality titanium metal powders entirely from scrap metal feedstock. Final engineering and design for Phase 1 is nearly complete and commissioning for the facility is targeted for the first quarter of 2024. The company trades on both the Australian Stock Exchange and the NASDAQ, and recently completed an A$20 million (US$14 million) financing accord to progress Phase 1 development.

IperionX plans to develop Phase 1 of the project as a “titanium demonstration facility” to demonstrate the company’s titanium metal processing technology capabilities at larger scale, and to provide a larger volume titanium metal powder samples to interested potential customers across a range of industries. According to a company statement, IperionX will occupy an existing 50,000-square-foot shell

building in the Southern Virginia Technology Park and plans to expand the facility to 100,000 square feet in the coming years. IperionX will source 100-percent renewable energy to produce recycled titanium to supply advanced industries including automotive and transportation, defense and aerospace, electric vehicles, consumer products and electronics, and 3D printing.

Anastasios

Arima, IperionX founder and chief executive officer, explained that a major thrust for the Virginia plant will be the utilization of the company’s two complementary technologies: the Hydrogen Assisted Magnesiotheric Reduction (HAMR) process and Granulation Sintering Deoxygenation (GSD). Arima said HAMR “is a low

energy, low carbon method to create titanium metal powders. The GSD process leverages the HAMR technology’s superior deoxygenation capabilities to produce spherical powder for additive manufacturing/3D printing applications. The GSD technology is synergistic to HAMR in that it adds a further, very high value, set of applications to this breakthrough titanium deoxygenation technology.”

As detailed on the company’s website (https://iperionx.com/), metallurgist and University of Utah professor Dr. Zak Fang developed the

patented HAMR power metallurgy process technology with funding from the U.S. Department of Energy’s ARPA-E program. The

36 TITANIUM TODAY

Anastasios “Taso” Arima, chief executive officer and founder of IperionX.

IperionX’s industrial building in Halifax County, VA, where the company plans to develop titanium powder production capacity in 2025

HAMR process greatly facilitates the deoxygenation of high-oxygen titanium. It can accept almost any form of titanium metal or scrap feedstock, including high-oxygen scrap that would otherwise be landfilled, and produces low-oxygen titanium powders with lower energy intensity and carbon emissions than the industry standard Kroll process, thereby enabling a low-cost, low-to-net-zero carbon emission, circular titanium supply chain.

The majority of HAMR’s energy and emissions savings are achieved by eliminating the Kroll Process’ need to chlorinate TiO2 to make TiCl4 as an intermediate step, and removing the need for vacuum distillation after the reduction of TiCl4. Post deoxygenation, HAMR process then uses conventional powder metallurgy processing steps to control the size of the particles, add alloying elements, and ensure that the result is high-quality titanium powder.

Regarding a timeline for commercial production of titanium powder using the HAMR/GSD technologies, Arima noted that IperionX has “an operational titanium metal powder pilot production facility in Salt Lake City, currently producing titanium for qualification of commercial applications with prospective customers, and has publicly stated ambitions to construct and commission the titanium demonstration facility in Virginia over the coming 12 months.”

IperionX is already selling titanium metal products into the luxury consumer goods sector in the form of additively manufactured watch cases via its partnership with Officine Panerai, a subsidiary of Compagnie Financière Richemont, the maker of IWC watches. The company has also recently announced a partnership with Canyon Bicycles GmbH to produce bicycle components using IperionX’s 100-percent recycled and low-carbon titanium, as well as a partnership with Carver Pump to produce titanium pump components for the U.S. Navy.

In January, IperionX won the Air Force Research Laboratory’s Grand Challenge, marking the company’s selection as the most commercially promising technology for producing titanium metal powders from scrap titanium. In addition to these commercial

IperionX Looks to ‘Accelerate’ Its HAMR, GSD technologies

Two years ago, TITANIUM TODAY reported on the agreement between Hyperion Metals Ltd. (now IperionX) and Blacksand Technology LLC for the commercial development of low-cost spherical titanium metal powders needed for additive manufacturing. IperionX, through its agreement with Blacksand, secured the exclusive rights to the patented GSD technology developed by Dr. Fang, to supplement its breakthrough HAMR technology. In addition, IperionX established a memorandum of understanding with EOS GmbH of Germany to “accelerate the deployment of IperionX’s HAMR and GSD technologies.”

At the time, IperionX executives said GSD offers major advantages in the production of spherical titanium powder, such as:

Production of titanium and titanium alloy powders with low oxygen, controllable particle size and excellent flowability

Higher manufacturing yields than current processes, leading to significantly lower costs Energy efficient process leading to a netzero carbon process when coupled with renewable power

Ability to utilize lower cost and sustainable feedstocks including recycled titanium metal powders/scrap or HAMR titanium powders. GSD is a thermochemical process for producing spherical titanium powders used in 3D printing and additive manufacturing, invented by Dr. Fang and his team at the University of Utah. The GSD technology significantly improves the yield, by up to 50 percent, and produces a spherical powder with low oxygen, controllable particle size and excellent flowability. The GSD manufacturing process steps are:

• Titanium metal or alloy is hydrogenated to make friable hydride and is then milled into fine particles

• The fine hydride particles are granulated into spherical granules in the desired size

38 TITANIUM TODAY IperionX Mission to Develop First 100% U.S.

(continued)

Titanium Recycling Plant

Deoxygenation furnace at IperionX’s operations in Utah.

Plasma Arc • Electron Beam • Cold Wall Induction • Vacuum Arc Remelting • Atomization US: +1 (716) 463-6400 EU: +48 68 38 20 500 www.retechsystemsllc.com Your Global Leader for Titanium Melting Technologies

applications in the luxury goods, consumer products, and defense sectors, other target applications would include using additive manufactured titanium parts as a cost-effective substitution for industrial applications using stainless steel, along with components anticipated for weight reduction in electric vehicles.

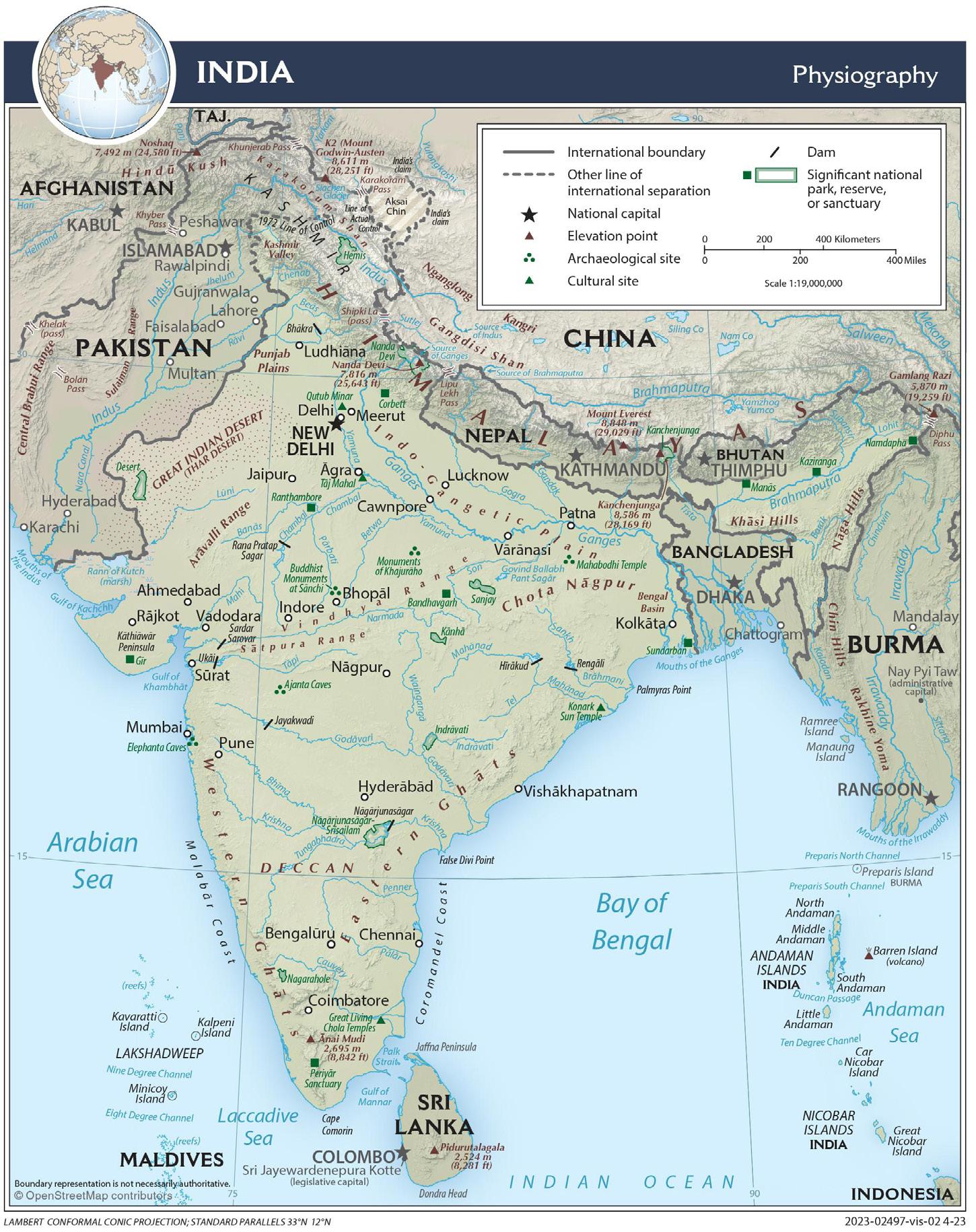

Arima said that establishing the Virginia facility is “a critical step in advancing IperionX’s ambition to reshore an all-American, sustainable source of titanium metal,” noting that “over the last 25 years the United States has transitioned from being among the largest global producers of primary titanium metal (in the form of titanium sponge) to now having no commercial production, and is almost solely reliant on imports, primarily from Japan, to supply its substantial downstream industry.”

In the future, IperionX aims to integrate its titanium processing technologies with high-quality titanium mineral supply from its

“Titan” critical mineral project, an 11,000-acre site in near Camden, TN. According to IperionX, the Titan site and mineral deposit contains rare-earth and titanium minerals and zircon-rich mineral sands. The project benefits from road, rail and water logistics connecting it to manufacturing industries and customers. “The shallow, high grade and unconsolidated nature of the sandy mineralization enables the potential for simple mining operations such as dozer push followed by an industry standard mineral processing flowsheet.”

In February 2022 Hyperion Metals changed its name to IperionX, but retains a head office in Charlotte, NC, industrial pilot facility operations in Salt Lake City, a local office in Camden TN, and will be building commercial-scale titanium production capacity in Halifax County, VA.

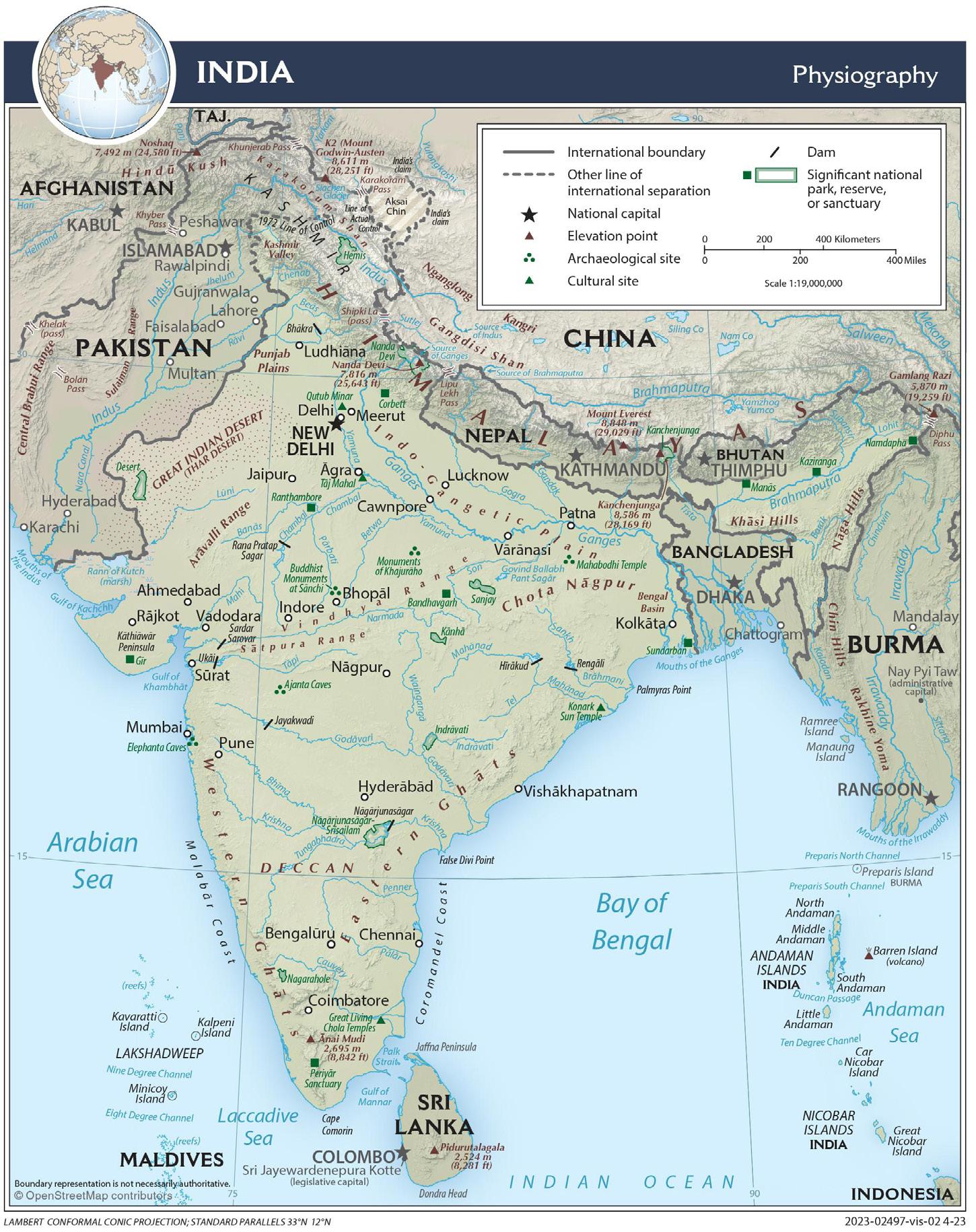

The company’s mission, as stated on its website, is “to be a leading developer of US-based sustainable