In this issue:

Additive Manufacturing and Supply Chain Readiness for Aerospace Production

Concerns Rise Over Possible

Titanium Shortages in 2024

Aerospace Industry Outlook; Have We Recovered Yet and What Do We Expect in 2024?

IATA Upgrades Its Global

Aerospace Industry Outlook To $25.7 billion profit in 2024

Issue 10; 2024 All Markets

YOUR SPECIALTY METALS SOLUTIONS CENTER COIL SHEET STRIP PLATE BAR NEAR NET SHAPES 888.282.3292 | www.upmet.com | sales@upmet.com NICKEL TITANIUM STAINLESS STEEL COBALT PRODEC® ALLOY STEEL CCM ALUMINUM DUPLEX AS9100D — ISO 9001:2015 — ISO 13485 DFARS COMPLIANT UNITED PERFORMANCE METALS HEADQUARTERS — 3475 SYMMES RD, HAMILTON, OH 45015 OAKLAND, CA | LOS ANGELES, CA | HARTFORD, CT | CHICAGO, IL | GREENVILLE, SC INTERNATIONAL — BELFAST, NORTHERN IRELAND | BUDAPEST, HUNGARY

TITANIUM TODAY 3 Editorial Published by: International Titanium Association www.titanium.org 1-303-404-2221 Telephone ita@titanium.org Email Editor & Executive Director: Jennifer Simpson EDITORIAL OFFICES International Titanium Association PO Box 1300 Eastlake, Colorado 80614-1300 USA DISTRIBUTION LIST Join this free distribution by emailing us at ita@titanium.org www.titanium.org All Markets EDITION CONTENTS Meet the ITA 4 itorial: Additive Manufacturing and Supply Chain Readiness for Aerospace Production, By Bill Bilhman 8 oncerns Rise Over Possible Titanium Shortages in 2024, By Michael Gabriele 16 Aerospace Industry Outlook; Have We Recovered Yet and What Do We Expect in 2024?, By Tom Captain 22 IATA Upgrades Its Global Aerospace Industry Outlook To $25 .7 billion profit in 2024, By Michael Gabriele 30 From the Wire 36 In Memoriam . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 International Titanium Association Scholarship Program 48 ITA Member Roster 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50 Advertiser Index 52 Industry Spotlight featuring Rex Heat Treat 52

MEET THE ITA

Board of Directors

Executive Committee

Dr. Markus Holz

Professor, ITA Academic Member

Education Committee Co-Chair

Titanium Europe Conference Chair

ITA President 2022-2024

Dr. Markus Holz is currently Professor at University of Applied Sciences Anhalt starting from 2020. There he is the program director of Logistics Management, teaching Operations Management and is currently involved in several national and international research programs in the field of sustainability and digitization in the industry.

Dr. Holz graduated in Aerospace Engineering in 1986 and earned his PhD in 1992. Following his 10 years of service in the German Airforce, Dr. Holz began his career with ThyssenKrupp in 1992, where he assumed several executive positions mainly in the stainless steel and special metals branch. In 1999, Dr. Holz became Managing Director of ThyssenKrupp Titanium GmbH (formerly Deutsche Titan GmbH) and in 2002 he was appointed Managing Director of ThyssenKrupp Titanium S.p.A. (formerly Titania S.p.A.). Furthermore, he was responsible for Tubificio di Terni, Italien, from 2004 through 2007. From 2007 to 2009 he was CEO of the ThyssenKrupp Titanium Group (Germany and Italy). In January 2010 he joined the Managing Board of Hempel Special Metals, Oberhausen, Germany. After joining as MD the ALD Management Board in October 2011, Dr. Markus Holz was the President of AMG’s Engineering Systems Division and CEO of Vacuum Technologies GmbH from 2012 to 2019.

Martin Pike

VP of Global Commercial Strategies

ATI

ITA Vice President 2022-2024

Martin Pike is the Vice President - Commercial for ATI with responsibilities which include international product management, sales, and long-term agreements with customers. Martin joined ATI in August 2001 and held several positions with increasing responsibility including Titanium Rolled Products, Product Manager and Director of Sales. Prior to joining ATI, Martin worked in manufacturing where he held various commercial positions including Regional VicePresident of Sales. His educational background includes a Bachelor’s Degree from the University of North Carolina at Charlotte.

Sam Stiller

Vice President – Commercial Howmet Structure Systems

ITA Secretary/Treasurer 2022-2024

Sam Stiller is Vice President, Commercial for Howmet Aerospace. All Sales, Marketing, and Customer Service, globally, is led by Sam’s commercial team..

Frank L. Perryman President and Chief Executive Officer Perryman Company

ITA Past President 2022-2024

Mr. Perryman graduated from Millikin University in 1986 with a Bachelor of Science in Industrial Engineering. In 1988 he co-founded Perryman Company with his father and brother. Since December of 2008 he has held the position of President and CEO of Perryman Company. Perryman Company is a fully integrated supplier of specialty titanium products. From melting through finishing, founded in 1988, Perryman Company is headquartered in Houston, Pennsylvania, with office locations in Philadelphia, Los Angeles, London, Zurich, Tokyo and Xi’an. Perryman is an integrated titanium producer from melting of ingot to finished products. The company’s product portfolio includes ingot, bar, coil, fine wire, net shapes, and hot rolled products. The Forge and Fabrication group offers medical device contract manufacturing in a range of materials including plastics and titanium. A titanium global leader, Perryman supplies and services customers in the aerospace, medical, consumer, industrial, recreation, additive/3D printing and infrastructure markets worldwide.

4 TITANIUM TODAY

High standardsfor hightemperatures.

Stainless steel and special alloys designed for high temperature applications are in stock at Ulbrich. Our extensive metallurgical staffis available to assist you in providing various titanium, nickel, stainless and cobalt alloys in the form of precision rolled strip, foil, round, flat and shaped wire for all of your manufacturing needs.

Titanium 47.867 Nickel 58.6934 Niobium 92.90638

ULBRICH.COM 1(800) 243-1676

Phil MacVane Vice President, the Americas PCC Metals Group Global Sales

Michael Marucci Chief Technology Officer Kymera International

Safety Education

Robert G. Lee President Accushape Inc Industrial Applications

Christopher Wilson Director of Research and Development NobelClad

John J. Scherzer Vice President – Medical Markets Carpenter Technology Corporation

Edward Sobota Jr. VP, New Product Development STS Metals

Jennifer Simpson Executive Director Ex-Officio Member of the Board International Titanium Association

Women in Titanium

Holly Both

Vice President of Marketing

Plymouth Tube / Plymouth Engineered Shapes Medical Technology

Eric Baum

Senior Business Development Manger Laboratory Testing Inc

6 TITANIUM TODAY

ITA Directors

Ti Today Contributor

ITA Committee Chairs

Michael C. Gabriele

(+1) 610-693-5822 rai.sales@kymerainternational.com www.kymerainternational.com Master Alloys & Titanium Powders for Critical Applications

Additive Manufacturing and Supply Chain Readiness for Aerospace Production

By Bill Bihlman

Since 1980s neoliberalism, the United States and European governments have become less involved in research and development (R&D). Consequently, emerging technologies such as artificial intelligence, quantum computing, and additive manufacturing are largely left to the market to develop and commercialize. Markets are generally considered efficient for attracting capital and driving “solutions.” Many technologies, however, still require fundamental government oversight.

Due to safety implications, parts fabricated via additive manufacturing (AM) for aerospace is one such example. It is a very complex process. Successful adoption requires collaboration between the public and private stakeholders. Consensus standards bodies also play a vital role in developing a flexible, robust production framework.

This entire system requires a certain amount of intellectual property (IP) to be shared amongst the Original Equipment Manufacturer (OEM) – that controls the design – and its suppliers. The small AM “service bureaus” offer a critical perspective, as well. Many of these emerging enterprises possess expertise in print parameter development and design-formanufacturing optimization.

Brief History of Additive Manufacturing

Additive manufacturing has been heralded as the catalyst for the manufacturing renaissance

here in the United States. Its genesis dates back to the 1980s. There were three critical milestones for the industrialization of metal additive manufacturing for its eventual use as structural parts in aerospace.

The first stage was the initial development and commercial launch of 3D-printing itself. In 1984, Chuck Hall of California invented stereolithography (SLA). This technique uses ultraviolet lasers to cure a photopolymer resin. Hall founded the 3D Systems corporation and subsequently developed the universal STL computer-aided design (CAD) file format. This is now the de facto standard for digital slicing and AM tool path generation.

Bill Bihlman President, Aerolytics LLC

Bill Bihlman President, Aerolytics LLC

GE Aviation. Initially, MTI only had one software license and SLS printer. Morris was introduced to the concept of printing metal parts during a 2003 trip to visit EOS in Germany. Shortly thereafter, MTI started experimenting with printing cobalt chrome (CoCr). Previous alloys were prone to cracking and deleterious porosity. They used SLS CoCr for high pressure turbine blades for limited use on test engines –these parts were much quicker to produce than an investment casting. Rapid iteration was essential given the developmental status of the GE9X engine program.

The second major milestone was the creation of selected laser sintering (SLS). This modality has become ubiquitous among metal printers and synonymous with powder bed fusion (PBF) – although the original process used polymers. SLS was commercialized by Carl Deckard while at the University of Texas. Deckard co-founded Desk Top Manufacturing (DTM) for rapid prototyping based upon his 1990 patent. His company was acquired by 3D Systems in 2001.

The third major development for metal additive manufacturing involves Greg Morris. Morris cofounded Morris Technologies Inc. (MTI) in 1994 in Cincinnati, home to

Prompted by the sale of MTI to GE Aviation in fall of 2012, the AM industry has experienced a series of fits and starts. Even after decades of sizable investments by private industry and government actors, including the US DOD, the level of technology development is still “lumpy.” Why?

The AM Business Case

Over the past decade, the discussion around emerging technologies is often framed in terms of its Technology Readiness Level (TRL). This 1-to-9 scale was conceptualized by NASA in the 1970s as a program-management tool, used during the early stages of product development. High TRL signifies that the “technology” is sufficiently proven within its operational environment. Nowadays, this concept is used

8 TITANIUM TODAY

Premium Quality, Stability and Reliability. One-Stop titanium alloy production and service.

ABOUT US

A dozen years of titanium alloy production and research experience, with more than 100 patents and achievements to its credit, mastering a number of core technologies; Accredited with Nadcap non-destructive testing certificate and AS9100D, ISO14001, ISO 45001 and other certifications;

CORE PRODUCTS

Titanium bar/billet Size range: Φ15-500mm

Grade: Ti6Al4V, Ti-6242, Ti-6246, Ti-38644, Ti-15333, etc.

Titanium wire rod coil Size range: Φ1.0-20.0mm

Grade: Ti6Al4V, Ti6Al4V ELI, Ti-38644, Ti-6242, Ti-6246, Ti-15333, Ti-422, etc.

Titanium forging Size range: customized, disc, bar, ring, etc.

L(max):14m, W(max):4m, H(max):4m.

Grade: Ti6Al4V, Ti6246, Ti6242, Ti662, Ti38644, Ti15333, Ti1023, Ti422, etc.

For more information, please visit www.tcae.com/en/

Titanium Manufacturer —TC Aerospace

Leading

Shaanxi TianCheng Aerospace Co., Ltd.

No 3, Gaoke 3rd Rd, Qindu District, Xianyang, Shaanxi, China. 1 2 3

+86-29-33336000 tc@tcae.com

Additive Manufacturing and Supply Chain Readiness for Aerospace Production (continued)

liberally and is often confounded with Manufacturing Readiness Level (MRL). There are examples of aviation AM parts with high TRL/MRL; nevertheless, most working closely with this technology would likely concur that additive manufacturing is mid-to-upper MRL range. The supply chain still lags.

Indeed, the adoption of any technology eventually requires some type of favorable business case. With numerous examples of TRL/MRL level 9, additive manufacturing has proven that “real” parts can be created quickly in comparison to conventional manufacturing. Moreover, it can produce structurally optimized parts that could not be manufactured otherwise. For aerospace, where lightweight strong parts are paramount, this was a boon.

In essence, there are two fundamental business cases for additive manufacturing. First, new parts – these leverage novel, complex, lightweight designs. Part-count reduction is another important consideration. The second, replacement parts – this capitalizes on the rapid time-to-market and lowcost-per-unit aspects of printing in low volume. This latter case is possible since additive manufacturing does not require initial tooling, in contrast to forgings, castings, and extrusions.

Aviation is considerably risk averse. The cost of failure can be catastrophic. Thus, designs and material systems change more slowly compared to most other heavy industrial product industries. One notable exception was the rapid iteration from the early 1940s to the late 1960s precipitated by WWII, and subsequently fueled by the Cold War and US/USSR Space Race. New parts are feasible for “cleansheet” designs. In aviation, structural examples often include smaller engine parts, using difficult-to-machine

materials such as titanium and nickel or cobalt-based superalloy. Portions of the gas turbine frame and component casings/housings are becoming more prevalent examples. For non-load bearing parts, aluminum heat exchangers are popular. By printing in sequential layers, additive manufacturing enables designers to create complex internal features – for instance, conformal cooling channels to optimize heat transfer.

In general, novel parts are slow to be adopted. This is a consequence of the long development cycles of aviation and the cost and time required to substantiate designs. And there is an additional challenge –conventional alloys were developed to be casted, forged, or extruded. Additive manufacturing is analogous to welding and parts are often prone to cracking. Furthermore, the chemistry of the alloy may be adulterated due to the different melting points of the constituent elements. Titanium alloys, namely TI AL and TI 6-4, have suffered this fate.

Opportunities to incorporate new AM parts are heavily influenced by new product launch. But at the same time, these materials need to be sufficiently mature to guarantee aerospace-grade (i.e. failure proof) performance throughout the design life of the component. Broadly speaking, these data are not available for additive manufacturing; however, volume 2 of the Metallic Materials Properties Development and Standardization (MMPDS) handbook by Battelle will include a framework for adoption. Specifically, MMPDS will delineate a government-industry approved construct for data generation and analysis to ascertain the “bulk material allowables” for AM-printed metal test coupons.

Bulk material allowables provide an important foundation for an

OEM’s design values, which ultimately include a structure’s margin-of-safety. Future versions of MMPDS will include bulk material allowables for nickel superalloy (Inconel) 718 and aluminum 6061, both printed via laser PBF, and TI 6-4 using directionenergy deposition (DED) wire systems.

The second market – replacement parts – are popular for maintenance, repair and overhaul (MRO) of older aircraft. This is especially true for the US Air Force and Navy that struggle to maintain their fourth-generation aircraft. Parts obsolescence is an ongoing challenge.

In either case, the OEM must empirically prove to regulators that its product is safe. As an illustration: for an air transport aircraft, Boeing and Airbus must demonstrate that the likelihood for a catastrophic system failure is limited to one-in-a-billion occurrences. The aircraft and engine OEMs own the design and shoulder the liability. However, regulators also police the production quality management system (QMS) of its Tier 1 and 2 suppliers.

As intimated, there are multiple successful metal AM use cases. The GE Leap Fuel nozzle tip, which led to the acquisition of Morris Technologies, arguably started this journey towards additive manufacturing. This is still the most prominent example. Other notable instances include: low-pressure turbine blades (GE9X), engine casings (GE turboprop engine), actuator flight controls (A380 by Liebherr), and thrust reverser cascade arrays (Collins Aerospace).

Changes in the Regulatory Landscape

As discussed, commercial aviation is heavily regulated. It is therefore essential to understand the basic regulatory environment. To help partially offset the decrease

10 TITANIUM TODAY

MEDART PROCESSING TECHNOLOGIES

..# MPT specializes in billet peeling, bar processing, straightening, cutting, grinding, and polishing of Titanium, Nickel, Stainless and Exotic Alloys.

✓ We manufacture our own Medart brand equipment, giving you immediate access to spares and back-up machines to support 1 your uptime requirements.

•••

ra1 With customers in Aerospace, Transportation, Medical and Energy, we can meet your needs for Quality, Cost, & Delivery.

� Since forming MPT in 2019, we have grown 30% year-over-year. Please reach out to let us know how we can help you succeed. (j]EDART

Street

City, PA 16117 (724) 752-2900

SINCE 1875

Clyde

medartglobal.com 199

Ellwood

Additive Manufacturing and Supply Chain Readiness for Aerospace Production (continued)

in federally funded R&D projects, there has been an increase in public consensus standards, both in the United States and in Europe.

The National Technology Transfer and Advancement Act of 1995 Circular mandated US Government Agencies to use voluntary consensus standards in lieu of governmentunique standards. The only exception was standards deemed inconsistent with law or otherwise impractical. All branches of the government were obligated to comply.

Specific to US commercial aviation, there was another significant pivot away from federal oversight. The Federal Aviation Administration (FAA) has moved towards “performance-based” regulations. These are policies that are less prescriptive – focusing on the objectives and outcomes – and not necessarily the process itself. One noteworthy example is Amendment 64 of the Code of Federal Regulations Part 23 (General Aviation) “Rewrite,” published by ASTM International in 2018.

Meanwhile, the FAA has decreased the number of Advisory Circulars issued. These policy guidelines support a “means of compliance” to certify a part or structure, for example. Given the complexity and rate of change for additive manufacturing, this change of approach can retard adoption.

The rise of consensus standards has partially offset this shortfall of government-sponsored information. Standards Development Organizations (SDOs) derive their legitimacy from the size and diversity of its membership. Members include the OEMs, tiered suppliers, research institutions, and the regulators themselves, among other relevant entities.

The consensus standards development process endeavors to strike a balance between large OEMs and its major supply partners (e.g. Tier 1s and Super Tier 2s) that are well endowed with resources (e.g. including qualified personnel, equipment, and procedures) and smaller organizations that typically seek more guidance in executing complex builds. An analogy is “buildto-spec” versus “build-to-print” manufacturing – lacking engineering depth, a Tier 3 machine shop often prefers the latter.

OEMs have thousands of qualified suppliers; collectively, suppliers build 70 to 80% (by value) of the product. Clearly, IP and business objectives are key concerns. Regardless, consensus standards provide a solid baseline, basically offering an initial “twothirds” solution.

Global Standards Bodies

Both the United States and Europe have a rich history of SDOs that support technology adoption. Many of these are engineering societies that responded to a persistent, widespread need to create guidance materials on a pre-competitive basis. For additive manufacturing, there are several relevant SDOs.

Headquartered in the United States are Fullsight (formerly SAE International), American Society of Testing and Materials (ASTM), American Society of Mechanical Engineers (ASME), American Welding Society (AWS), National Institute for Standards and Testing (NIST), and American National Standards Institute (ANSI). The latter two are involved more in the harmonization between organizations. Finally, though not an SDO, National Aeronautics and Space Administration (NASA) has

developed a series of seminal AM standards for space applications. In its unique role, it functions as consumer, developer, and regulator, and has proven vital to this technology’s adoption.

In Europe, each country has its own primary standards body. The key organizations include Deutsches Institut für Normung (DIN) in Germany, Association Française de Normalisation (AFNOR) in France, and British Standards Institution (BSI) in the United Kingdom. These efforts are largely coordinated by the European-based standards organization Comité Européen de Normalisation (CEN). International Organization for Standardization (ISO) is also European based, yet develops its own standards through committees supported by national delegations.

The SDOs help solve many of the pressing technical issues related to additive manufacturing. This ranges from the rather mundane, but critical, definitions and ontologies, to the more nuanced detailed instructions on raw material handling and manufacturing process control. Other topical areas are: part design, post-processing, finished material properties, qualification and certification, non-destructive evaluation, maintenance and repair, and production (meta)data.

The Fullsight AM Ecosystem

Last year, SAE International launched its new brand, Fullsight, further aligning its three global business units – ITC, PRI, and SAE. Each actively participates in the AM value chain. The goal was to streamline information flow between the units and its customers, while leveraging the digital engineering transformation.

12 TITANIUM TODAY

Titanium Stainless steel Polymers

ACNIS GROUP SETS UP A NEW SUBSIDIARY IN CHICAGO

Established in France (Lyon), the stockist Acnis Group is one of the world leaders in the distribution of metal alloys especially in TITANIUM, in all forms : sheets, bars, tubes and powder for 3D printing.

ISO 13485 certified since 15 years, the family business has specialized in the medical field since its creation in 1991, to meet the demand of orthopedic manufacturers and dental implants, as well as surgical instruments.

ACNIS Group acts as a buffer between producers and users, thanks to its 600 to 700 tons rotating stock and 1,300 references of different origins. Our unique cut-to-size service center (15 machines: waterjet, high-definition waterjet, plate sawing, bar sawing, shearing, machining, chamfering) allows us to reduce your costs by optimizing scrap rates.

As a result, the company is able to deliver very quickly its customers, in barely a week, no matter the ordered quantity. Major implant manufacturers among the main American and European OEMs themselves call on ACNIS Group to source their metal alloys.

The last creation of ACNIS USA stock in 2023 in Chicago has changed the game. Acnis Group is now the only distributor that can stock and deliver any quantity in North America (ACNIS TITANIUM & ALLOYS USA-Chicago), South America (ACNIS DO BRAZIL-Sao Paulo), Europe (ACNIS FRANCE-Lyon), South Asia (ACNIS CHINAShanghai) for global worldwide contracts.

Acnis is your one-stop shop for all TITANIUM grades, stainless steel (316L, 420B, cobalt chrome, 17/4 PH, high nitrogen alloy, Custom 455, Custom 465…) and polymers.

Our dental subsidiary BCS, a European leading distributor of CAD CAM products for additive manufacturing, is registered with the FDA for titanium powder & discs, and cobalt chromium powder.

1940

Devon Elk Grove

60007 -

- USA qgoliot@acnis-titanium.com +1 (312)

ACNIS TITANIUM & ALLOYS

E

Village

IL

826-6850

Additive Manufacturing and Supply Chain Readiness for Aerospace Production (continued)

The ITC houses the Additive Manufacturing Data Consortium (AMDC). It is developing bulk material allowables to help lower the barriers-of-entry to qualify/ certify AM parts for aerospace. These data will be submitted to the MMPDS handbook. The 11-member consortium concluded its IN 718 project and is working on TI 6-4 datasets.

PRI is the organization that oversees the Nadcap supplier quality program. In Spring 2023, they established an independent supplier audit system, formally separating from the welding task group. The group developed a checklist for metal PBF and are drafting a second document for wire DED. This should facilitate the qualification of aerospace-grade AM parts suppliers.

The third business unit, SAE, comprises the AMS (Aerospace Material Specification) AM standards and G-37 committees. The AMS AM was created in 2015 per an FAA request to aid with documents to certify AM parts. To date, the group has released 38 engineering documents, with an additional 50 under development.

The G-37 is a new committee tasked with developing documents to assist with the certification “process intensive materials” (PIM). PIM are highly engineered material systems, spanning metal additive manufacturing, carbon-fiber composites, and high-temperature ceramics for mission-critical applications. Manufacturing is inevitably stochastic. It has been argued that PIMs are more sensitive to the myriad input parameters –called key process variables (KPVs) –than traditional materials. The timing for this committee is motivated by

both the increased use of PIM parts in more critical applications, and the proliferation of small, non-traditional manufacturers (i.e. service bureaus).

These three business units comprise the upstream (data generation and standards development) and downstream (supply chain development) components of the AM ecosystem. Fullsight will also help manage the looming digital transformation, disrupting all stages of the product life cycle. Digital thread/twin will be a fundamental aspect of the AM production ecosystem and factory-ofthe-future.

The Future of Additive in Aerospace

The journey for additive manufacturing in commercial aerospace started well over a decade ago. There are numerous success stories. Nonetheless, two fundamental challenges remain – part cost and consistent quality. The dedicated supply base is still small. There are roughly two dozen metal AM service bureaus involved in aerospace production in the United States. Less than 10 would be sufficiently qualified for serialized production for commercial aviation, requiring a robust QMS (first-article inspection, part-depositing process, etc.) and associated credentials (e.g. Nadcap, AS9100, ISO13485). Regardless of enterprise, at the heart of additive manufacturing adoption is data management.

The factory-of-the-future will require that all suppliers are connected to the digital tapestry. The technical data packages (TDP) need to be well defined and meticulously documented. NIST has proffered important guidelines via their FAIR

(Findable, Accessible, Interoperable, Reusable) Common Data Dictionary. And numerous SDOs have published a litany of much needed standards to reduce the ambiguity during the partproduction process.

Furthermore, there is meaningful government support. In the United States, America Makes plays an important role regarding R&D. And there are activities within the various national laboratories like Sandia and Lawrence Livermore. The effort seems less orchestrated in Europe. Indeed, there has been substantial progress.

Notwithstanding, there still is opportunity for improvement. There are exogenous factors that buffer the industrialization of additive manufacturing. At the societal level, these include: a) the data glut and “need” to analyze; b) a general aversion to risk, slowing R&D; c) the impatience of capital markets for ROI; and, d) the erosion of the manufacturing expertise/ infrastructure in the United States and Europe.

None is intractable. But perhaps it is time that Western governments revisit their investments in general materials and manufacturing research. Alas, it is unlikely that we will ever return to the froth of the 1950s and 60s. Although concerted government involvement just might help additive manufacturing finally reach its commercialization tip point. n

14 TITANIUM TODAY

Concerns Rise Over Possible Titanium Shortages in 2024

By Michael C. Gabriele

There was a buzz among attendees at the annual TITANIUM USA conference, held last October in Aurora, CO, and the topic of conversation involved the potential for titanium metal shortages in 2024. And while most panel speakers or industry executives at the conference wouldn’t comment in public or on the record, it’s fair to say that, at the very least, there is a measure of concern among industry leaders that metal shortages might occur. At this stage, it’s unclear how or if that scenario might play out in the months ahead.

The situation is complex and involves many industry (and geopolitical) developments during the last four years, not the least of which is that the United States no longer is a domestic producer of titanium sponge.

The Covid-19 pandemic snarled supply chains and upended many business operations around the world. Russia invaded Ukraine in February 2022 causing turmoil among two major titanium producers. The United States Geological Survey recently discontinued its titanium report.

In March 2022 ATI announced the termination of Uniti, LLC, its joint venture with Russian-based VSMPOAVISMA (https://www.prnewswire. com/news-releases/ati-announcestermination-of-joint-venture-withrussian-based-vsmpo-301499464.

html#:~:text=PITTSBURGH%2C%20

March%209%2C%202022%20

%2F,of%20commercially%20pure%20

titanium%20products).

Jeff Carpenter, Boeing’s senior director for contracts, sourcing and category management, speaking at the 2022 TITANIUM USA conference held in Orlando, FL, said the aerospace giant suspended major operations in Russia, discontinued procuring Russian-origin titanium, and would develop alternate titanium sources to support production.

A Financial Times article posted online on May 3, 2023, quoted Guillaume Faury, the chief executive officer of Airbus (https://www.ft.com/ content/9f12db31-742d-4fdd-b20843d684e10211). The story indicated that Airbus still sees problems in the global supply chain for titanium and aluminum, a hangover from the pandemic years, as well due to disruptions from the current Ukraine/Russia conflict. Faury, in the article, described supply chain delays as an “overall challenging situation that would last all along 2023 and potentially till (2024).”

Willy Shih, a senior contributor to Forbes and a teacher at Harvard Business School, penned an online article, posted March 2, 2022, stating that “the terrible war in Ukraine and subsequent sanctions placed on many Russian organizations have raised questions about potential supply chain vulnerabilities. While Russia is mostly an exporter of resources like oil, gas, and metals, one market where it is a dominant player is for titanium and titanium forgings. Many people are waking up to the potential

consequences of a longer-term stoppage in the flow of these critical materials” (https://www.forbes. com/sites/willyshih/2022/03/06/ the-titanium-supply-chain-for-theaerospace-industry-goes-throughrussia/?sh=44f96f54a268).

Takeshi Nakashima, the deputy general manager of the titanium division of Toho Titanium Co. Ltd., Japan, a producer of titanium sponge, during his presentation at TITANIUM 2023, warned that the global aerospace supply chain will face a sponge shortage. “The sponge demand and supply gap will keep increasing, even if OEMs ramp up production gradually. A shift of sponge allocation from the industrial market to the aerospace market might occur to catch up with increasing demand.”

The worry is that these developments, taken as a whole, are altering the U.S. titanium industry landscape, which might result in a supply pinch. Underlying all these dynamics is that titanium remains a “strategic” metal for U.S. industrial and military manufacturing. However, concerns on this topic are not new and have been raised by industry and government agencies in recent years.

The Federal Register, in an online post dated Oct. 26, 2021, indicated that the Bureau of Industry and Security (BIS) published a report completed on November 29, 2019. The report’s executive summary stated that “titanium sponge is

16 TITANIUM TODAY

Harness our leading-edge vacuum technology to help assure your flight-critical parts go the distance.

Aerospace Vacuum Heat Treating Services

Annealing

• Degassing

• Creep Forming and Flattening

• Stress Relieving

• Brazing

Solution Treat and Age (STA)

• Homogenizing

• Sintering

• Hydriding/Dehydriding

Advantages

• Bright, clean, scale-free surfaces with minimal distortion

• Furnace capacities up to 48 feet long and 150,000 lbs

• Full line of major aerospace approvals

• Titanium and high nickel alloys

1-855-WE-HEAT-IT solaratm.com

Eastern PA

• Western PA

• California

Solar Atmospheres heat treated the titanium manifold weldment used on the Orion Launch Abort System for the NASA Artemis I Program.

• South Carolina

• Michigan

Concerns Rise Over Possible Titanium Shortages in 2024 (continued)

essential to the manufacturing and maintenance of U.S. defense systems. Titanium sponge is the intermediate product resulting from the conversion of titanium ore into a form of titanium metal that can be melted to manufacture slab or ingot, which in turn is used to produce finished titanium products. Consequently, titanium sponge production is essential to the production and sustainment of many U.S. defense systems, and preserving this critical capability is imperative to the national security” (https://www.federalregister.gov/ documents/2021/10/26/2021-23301/ publication-of-a-report-on-the-effectof-imports-of-titanium-sponge-onthe-national-security-an)

The Titanium Sponge Working Group (TSWG), established under the Trump administration in 2020, released an online report, dated August 3, 2023 and posted on the Washington Tariff and Trade Letter, which highlighted the increased dependence of the United States on imported titanium sponge. The report came in the wake of the closure of the Timet’s Henderson, NV, plant, marking the end of domestic sponge production (https://www.wttlonline. com/stories/us-dependency-onimported-titanium-sponge-at-100bis-working-group-finds,10874).

The TSWG reported that “U.S. dependency on imported titanium sponge rose dramatically from 68 percent in 2020 to 100 percent today, emphasizing a severe reliance on overseas supplies. These findings underscore the urgency for measures ensuring access to this critical input, which plays a pivotal role in the defense and industrial sectors, particularly in aerospace applications. The top four global producers of the sponge since 2010 have been China, Japan, Russia, and Kazakhstan.

The TSWG report found Japan has exhibited the capability and willingness to meet varying U.S. titanium demands. Similarly, six respondents cited Kazakhstan as a reliable alternative to Japan, offering high-quality sponge.”

Freelance writer Peter Suciu, in an online article that appeared on the website ClearanceJobs, dated

Japan currently supplies upwards of 92 percent of the U.S. titanium sponge imports, according to Suciu’s report. “More ominous is the fact that as the United States was retreating from the market following the global COVID-19 pandemic, China’s titanium sponge production capacity grew by 1,050 percent, according to the Department of Commerce.

‘Titanium sponge is essential to the manufacturing and maintenance of U.S. defense systems. Titanium sponge is the intermediate product resulting from the conversion of titanium ore into a form of titanium metal that can be melted to manufacture slab or ingot, which in turn is used to produce finished titanium products. Consequently, titanium sponge production is essential to the production and sustainment of many U.S. defense systems and preserving this critical capability is imperative to the national security.’

—The Federal Register, online post dated Oct 26, 2021

Jan. 2, reported “that after decades of diminishing domestic production capacity, the U.S. withdrew from titanium sponge production by 2020 and now relies entirely on foreign sources. (https://news.clearancejobs. com/2024/01/02/titanium-is-astrategic-metal-and-the-u-s-mightnot-have-enough-of-it/)

Russia, which had long dominated the sector, also increased its output by 66 percent. Together, China and Russia now own 70 percent of the global titanium market.”

In his article, Suciu quoted Andriy Brodsky, a crucial minerals expert who serves as chief executive of Ukrainian titanium feedstock producer Velta. Brodsky wrote a guest article for Stars and Stripes, the U.S. military news organization. “This isn’t some trivial matter. By withdrawing from the titanium production market and failing to support more diverse supply chains, the U.S. has handed the keys to its national security and economy to its two greatest power competitors and geopolitical threats.”

Brodsky further noted “that there are 16 critical infrastructure

18 TITANIUM TODAY

Titanium Industries, Inc. titanium.com sales@titanium.com Please contact your local representative for an immediate quote. Toll free number: 1-888-482-6486 SPECIALTY METALS SUPPLY SOLUTIONS AEROSPACE | DEFENSE | MEDICAL| INDUSTRIAL | OIL AND GAS

Concerns Rise Over Possible Titanium Shortages in 2024 (continued)

sectors—including communications, financial services and agriculture— whose assets have been deemed so essential by the federal government that any blackout would have a debilitating effect on the country. Titanium supports 15 of these 16 sectors, according to a report by the Commerce Department’s Bureau of Industry and Security.”

Journalist Sarah Edwards, in a Dec. 18, 2023 online article for Thomas Insights (Thompson Reuters Corp., the international news conglomerate), wrote that “the global titanium shortage is a stark reminder of rare metal scarcity and its impact on manufacturing processes. The titanium supply chain is deeply rooted in Eastern Europe, with Russian titanium accounting for nearly one-third of the titanium bars and rods used in the United States. While titanium demand has remained steady, supplies have dwindled, driving up prices and directly impacting the aerospace industry” (https://www.thomasnet. com/insights/titanium-shortage/).

According to Edwards’ report, the titanium shortage has been exacerbated by four factors:

• Geopolitical Factors: The UkraineRussia conflict has played the biggest role in the shortage

• Mining Challenges: Titanium is hard to mine, especially amid strict environmental regulations

• Production Disruptions: Labor shortages, war, and factory shutdowns have decreased output

• Increased Demand in Aerospace: The aerospace sector is using titanium especially frequently She went on to write that “unfortunately, supply chain challenges like the titanium shortage are cyclical and can quickly snowball. The titanium shortage has led to significant manufacturing disruptions, forcing aerospace companies to push back deadlines and cancel deliveries. In response to the shortages, many manufacturers are exploring alternative materials. However, finding materials with similar properties has proven

challenging. Even if organizations find viable materials, they must thoroughly test them before integrating them into production.”

“Manufacturers are prioritizing resource diversification. To do so, they are seeking new mining opportunities and suppliers to reduce dependency on traditional sources. These efforts are part of a global supply chain resilience movement, which focuses on ‘near shoring,’ diversification, and supply redundancy.” n

20 TITANIUM TODAY

YOUR ONLINE SOURCE FOR AEROSPACE GRADE TITANIUM

@ ROLLEDALLOYS.COM 24-7

PLATE SAW

AND MORE! ADDITIONAL PRODUCTS

SERVICES

QUOTE, BUY, TRACK... IT’S THAT EASY

Instant pricing! •TITANIUM •NICKEL •STAINLESS •DUPLEX •COBALT •WATERJET •LASER •PLASMA •

•

&

Aerospace Industry Outlook; Have We Recovered Yet and What Do We Expect in 2024?

By Tom Captain

(This is the fifth in a series of annual guest articles by Tom Captain, offering his insight and observations on the commercial aerospace industry and its impact on the titanium industry.)

Resilient: That would be an apt description of the aerospace industry over the last 4 years. We endured an unprecedented set of existential shocks including: the 737 MAX accidents and their aftermath, the COVID pandemic, aircraft production quality issues, high fuel prices, supply chain disruptions, labor scarcity and inflation and the threat of recession. Then add the geopolitical threats of the Ukraine/ Russia and Israel/Hamas wars and the threats of other conflicts around the world to add to the fiery cauldron of uncertainty.

As a reminder, in March of 2020 at the beginning of the COVID pandemic, airline travel came to a virtual standstill. The International Airline Transportation Association (IATA; website: https://www.iata.org/) concludes that the resulting lengthy pandemic caused the global airline industry to sustain net losses of $201 billion between 2020 and 2022, by far the biggest financial calamity ever experienced for the industry. The Aerospace Industries Association (website: https://www.aia-aerospace. org/) concluded that 87,000 aerospace jobs were lost in the U.S. in 2020 alone. We estimate that an additional 150,000 industry jobs were lost in Europe and Asia in 2020.

In our last writing in September 2022, we stated that the aerospace industry was facing a delay, not a backward step. We did not foresee a

“nosedive”, but rather a halting and delayed recovery, moving in a positive direction. What has happened since then, and what do we expect for 2024?

2023 Retrospective

We can state with confidence that demand for air travel has now recovered to pre-pandemic levels, with global domestic travel growing about 5 percent above 2019 levels and international travel increasing to about 96 percent of 2019 levels, according to IATA. This in turn has provided confidence for airline operators to order more aircraft, resulting in the aircraft producers and their supply chain increasing their output.

Since our last writing, the commercial aircraft industry has certainly rebounded, with orders and deliveries of Airbus and Boeing commercial aircraft continuing their upward trajectory.

IATA forecasts that the global airline industry will experience a net profit of $9.8 billion in 2023, the first year of net profits since 2019. For 2023, airlines placed 3,408 net orders, an all-time industry record, more than twice as many as in 2022. Production and deliveries of commercial aircraft totaled 1,263 units, almost twice the level in 2020, and a 9.3-percent increase over 2022.

The following chart illustrates a six-year history through 2023 for orders and deliveries, showing the strength of the rebound:

22 TITANIUM TODAY

-500 0 500 1000 1500 2000 2500 3000 3500 4000 201820192020202120222023 Aircraft Orders Deliveries Net Orders & Deliveries 2018-2023

Tom Captain

The project funded by Innovate UK

Epoch Wires is pleased to announce their involvement in an Innovate UK research project as part of the “NATEP helping SMEs innovate in aerospace - Autumn 2021” competition. The project entitled “NanoTi - Grain refinement of Ti-6Al-4V wire to enable Aerospace DED AM” is led by Epoch Wires and supported by TWI.

The project aims to design novel-alloy wire chemistry to minimise the grain growth in Ti6Al4V alloys deposited by Additive Manufacturing. In this work, Epoch Wires will produce new wires with a nanoparticle injection, forming equiaxed grains to enhance the mechanical properties of Ti6Al4V alloys. TWI will be depositing the wires using laser, plasma, and electron-beam additive manufacturing techniques. Epoch Wires will be utilising it’s proprietary technology of producing metal-cored wires using continuous laser-seam welding technology, designed for titanium alloys.

The NanoTi project has received funding from Innovate UK under grant agreement No. 10030392.

Nano Ti Wires

Innovative and cost-effective titanium wires for the aerospace industry

Laser-seam welded Ti6Al4V wire

Ti6Al4V material deposited using Nano Ti wires, with laser additive manufacturing technology (image courtesy of TWI)

Contact

Serdar Atamert (CEO)

serdar.atamert@epochwires.com +44 (0) 7414 866801

Epochwires.com

info@epochwires.com

Unit 8, Burlington Park, Cambridge, CB22 6SA, UK

On the defense and space side of the industry, production has increased due to the global conflicts and security environment mentioned above. The space business is expanding with numerous launches of satellites for defense surveillance, internet access and earth observation. With growth in commercial aircraft, defense and space industries, the titanium industry is poised for a significant rebound in the foreseeable future.

2024 Headwinds

Although the aerospace, defense and space industries are forecasted for growth, there are several important factors that could impact and alter the course of the recovery and limit the potential for further sector growth.

Pilot Shortage – Due to the significant fall-off of commercial airline flights during the pandemic, many pilots were furloughed, and when demand for travel rebounded in 2021, many of these pilots did not return. Thus, just as the industry was recovering, there weren’t enough pilots to operate the aircraft. Many of the airline operators started programs to recruit and train new pilots, as well as institute bonus programs to induce early retirees to return to service. Also, in 2023, pilot unions were successful in negotiating significant pay increases across the board for airline personnel, especially pilots, as part of their retention program.

Wage growth will impact airline profitability if operators cannot recover these costs in the form of higher fares and extra fees. According to the Bureau of Labor Statistics (BLS; website: https://www.bls.gov/), the median salary for airline captains, co-pilots and flight engineers in the United States was $203,010 in 2021.

However, average pilot salaries are expected to increase by 20 percent to 50 percent by 2028.

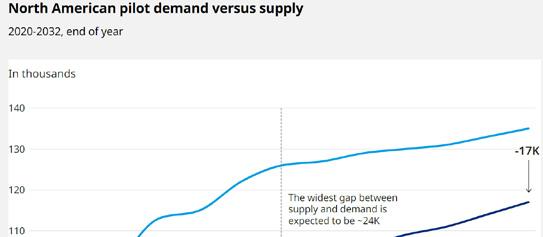

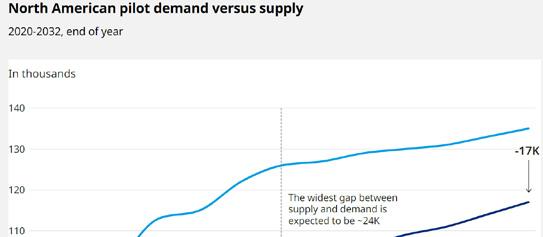

Despite wage growth and programs for training pilots, the industry is forecasted to still be short 24,000 pilots in North America alone by 2026 according to aerospace industry consulting company Oliver Wyman (website: https://www. oliverwyman.com/our-expertise/ industries/transportation/aerospaceand-defense.html), mostly due to aging out of the pilot workforce and not enough pilots being trained and entering the profession.

Airlines will be loath to order new aircraft if they do not have enough pilots to fly them. The following

pay at other employers. Alternatively, during the drop in aircraft deliveries, many aerospace supply chain employers laid off staff. Staffing up due to the rebound has been difficult and slow going.

This was also true for jobs ranging from airline ticket counter staff, maintenance mechanics, air traffic controllers, security personnel, to flight attendants for example. Individuals in a replacement staff require training and often higher pay. Late in 2023, pay escalation has started to level out, job switching has moderated, and staff members are being trained in their new aerospace jobs. Employees are slowly starting to return to the office, from their remote workstations.

chart illustrates the magnitude of the problem.

Workforce and Supply Chain – There have been challenges staffing jobs in the supply chain and industry related positions as well, in the latter part of the COVID pandemic. Many people opted to quit or change their jobs during this period due to the availability of government job support, remote working, and higher

However, continued work force and supply chain problems could hinder the trend of increased aircraft production.

Engine Quality

–Pratt & Whitney (P&W; website: https://www. prattwhitney. com/) has developed a highly efficient new jet engine, the geared turbofan (GTF). This engine option has been chosen by many airline operators to take advantage of significant improvements in jet fuel consumption. However, as with many game changing technology improvements, there have been challenging maintenance and reliability impacts. P&W has recalled 1,200 engines to repair microscopic

24 TITANIUM TODAY Aerospace Industry Outlook; Have We Recovered Yet and What Do We Expect in 2024? (continued)

Titanium Mill Products: Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet: Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers: Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Ti sheet, plate, bar, & forgings 6/4,6/4ELI, CP Ti, Welding Wire, & Fabrications

astrolite.com tricoralloys.com Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691 Phone: 330-264-3299 Fax: 330-264-1181 Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304 Phone: 936-273-2661 Fax: 936-273-2669 Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170 Phone: 734-454-3485 Fax: 734-454-7110 Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030 Phone: 805-487-7131 Fax: 805-487-9694

tricormetals.com

Airframe Quality – Boeing supplier

Spirit AeroSystems (website: https://www.spiritaero.com/) has experienced several quality issues involving elongated fastener holes on the aft pressure bulkhead on certain models of the 737 MAX’s fuselage it produces. In addition, some fittings that attached the 737 MAX’s vertical tail fin were not properly

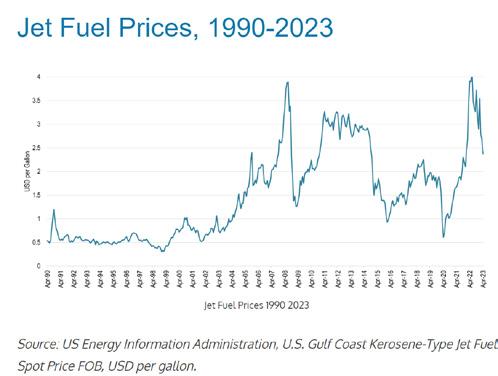

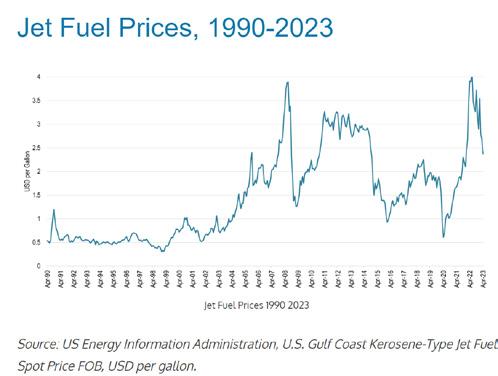

Fuel Costs – The

COVID pandemic caused fuel prices to drop to unprecedented levels not seen since 2001. However, in the span of two years, prices rose dramatically from approximately $0.60/gallon to $4.00/ gallon by April 2022. Fortunately, as of this writing, jet fuel has declined significantly to $2.38/gallon, still relatively high from a historical perspective.

produced by one of their subcontractors. More recently, a near tragic accident occurred with an Alaska Airlines 737 MAX 9, involving a rear door fuselage plug detachment, which caused rapid depressurization. In addition, production flaws halted deliveries of the larger 787 jetliner several times in the past three years. These issues have impacted Boeing’s deliveries, and its upstream suppliers. As of this writing, these airframe quality issues are mostly being addressed and the rate for deliveries for both the 737 and 787 are increasing. Should additional quality issues be discovered, the trend of increased production could be stymied.

Given that fuel prices represent approximately 31 percent of the direct operating costs of airline trips according to IATA, airline profitability can be significantly impacted, and travel demand could be impacted if fares rise to recover these increased costs. As illustrated in

the following chart, jet fuel prices have risen and fallen significantly over the last 20-plus years, creating a dynamic, volatile, and unpredictable trend.

Geopolitical Impacts

-The Ukraine/ Russia war has had some impact on

the demand for air travel globally. More importantly, the conflict is impacting the titanium supply chain, with key producers of raw materials, metal and alloy located on both sides of the border and serving a global customer base. Sanctions and raw material embargoes could threaten a substantial portion of the titanium sponge market.

International flight bookings around the world have fallen since the onset of the Israel/Hamas conflict especially in the Americas as people cancel trips to the Middle East and around the world, according to travel analysis firm Forward Keys. Additional negative impacts to travel demand might arise should further escalation occur. Other geopolitical hot spots could have potential impacts on air travel demand, such as in Yemen, Syria, the South China Seas, Taiwan and continued tensions between India and Pakistan.

In addition to travel demand being affected by geopolitical impacts, the price of fuel can also be impacted. Should there be further instability in access to crude oil, particularly from the Middle East, increases in fuel costs could hamper the airline industry’s recovery. Recent missile attacks on tankers and freighters transiting the Red Sea are cause for

26 TITANIUM TODAY

What Do We Expect in 2024? (continued)

Aerospace Industry Outlook; Have We Recovered Yet and

concern and can be a contributor to increased fuel prices globally.

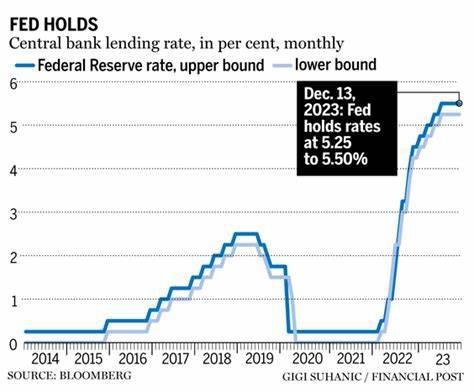

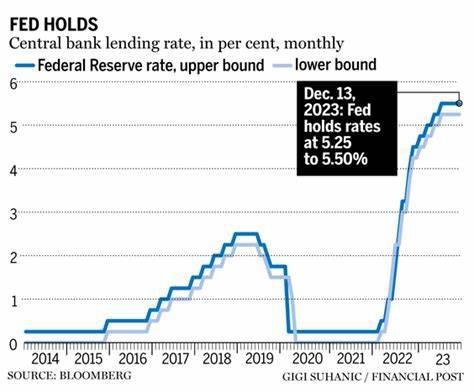

Inflation and Recession – Recent news is that we have reached an inflection point where price escalation and inflation has peaked as of late 2023. The U.S. Federal Reserve (website: https://www.federalreserve. gov/) has indicated there may be three rate reductions in 2024, bringing relief to the broader economy. A global recession was forecasted by many in 2023 and 2024, but the feared outcome has not materialized, thus a “soft landing” is now expected. The following illustrates the Federal rate hikes and cuts over the last 10 years.

Inflation has had a serious impact on the sector over the last 2 years. Wages of pilots, mechanics, and supplier staff have been rising. The prices of new and used aircraft, maintenance, repair, and operations/ overhaul (MRO) services, supply chain parts and systems have been rising. The price of jet fuel is at an elevated level as indicated above. This in turn translates into higher prices for airline tickets. So far this has not significantly moderated demand for travel as would be expected.

However, airline net profit margins, the difference between

revenues and expenses, is forecasted at a slim 2.7 percent for 2023, according to IATA, thus demonstrating that price increases are difficult to hold and cost increases will be difficult to absorb.

2024 Predictions

IATA predicts that the number of passengers traveling by air will reach 4.7 billion in 2024, a jump from the 4.5 billion passengers who traveled in 2019 –that’s 200 million more passengers traveling in 2024. They indicate this increase is driven by changing travel habits. The most recent IATA survey indicates that 44 percent of passengers say that they will travel more in the next 12 months than in the previous year while 48 percent expect to maintain similar levels of travel in 2024. Only 7 percent say they will travel less. Also, according to IATA, airline operating profits are expected to increase by 21.1 percent ($40.7 billion in 2023 to $49.3 billion in 2024). These profits will continue to enable airlines to order new aircraft.

industry are forecasted to rebound, absent the impacts of headwinds as described above. The following illustrates how the aircraft value chain is connected:

Bottom Line

The aerospace industry, particularly the aircraft production business, is recovering to prepandemic levels based on the airline operators’ return to profitability and the return of global and international air traffic demand. It has taken four years for this rebound, and it was gladly welcomed by the aerospace supply chain.

At its root, there is an insatiable

appetite for family, business, and leisure passenger travel, as well as air cargo for package deliveries. The pandemic itself was a significant and unprecedented interruption. But the industry is resilient and should thrive on the demand for air transportation for some time to come. n

Thus, we forecast aircraft producers to deliver over 1,500 twin and single aisle aircraft, a level not seen since 2018, itself a record year. This is good news for the aerospace supply chain and a much-needed boost for the industry.

As mentioned, it all starts with global air travel demand. The supply chain and the titanium

(Editor’s note: Tom Captain is the managing director of Captain Global Advisory, LLC, headquartered in Mercer Island, WA, and is a 40-year industry veteran and expert in the aerospace, defense and space sector. He is the retired vice chairman of a Big Four consultancy where he led their global industry practice. Captain currently serves on the boards of several private and industry-related organizations.)

28 TITANIUM TODAY

(continued)

Aerospace Industry Outlook; Have We Recovered Yet and What Do We Expect in 2024?

Plasma Arc • Electron Beam • Cold Wall Induction • Vacuum Arc Remelting • Atomization US: +1 (716) 463-6400 EU: +48 68 38 20 500 www.retechsystemsllc.com Your Global Leader for Titanium Melting Technologies

[Editor’s note: the following article provides excerpts from recent press releases issued by the International Air Transport Association (IATA), Montreal (https://airlines.iata.org/). The IATA is the trade association for the world’s airlines, representing 320 airlines of or 83 percent of total global air traffic. Willie Walsh is the director general of the IATA. The press releases are forecasts by the IATA on the global commercial aerospace industry and the global air cargo industry. The information offers insights regarding the financial status and trends of commercial aerospace carriers and, by extension, potential business opportunities for the titanium industry in 2024. This feature complements the guest article by Tom Captain in this edition.]

IATA Upgrades Its Global Aerospace Industry Outlook To $25.7 billion profit in 2024

By Michael C. Gabriele

The IATA, in a press release dated Dec. 6, 2023, projected strengthened profitability projections for airlines in 2023, which will then largely stabilize in 2024 (https://airlines.iata.org/2023/12/06/ industry-outlook-upgraded-257billion-profit-2024). However, net profitability at the global level is expected to be well below the cost of capital in both years. Very significant regional variations in financial performance remain.

Outlook highlights include:

• Airline industry net profits are expected to reach $25.7 billion in 2024 (2.7-percent net profit margin). That will be a slight improvement over 2023 which is expected to show a $23.3 billion net profit (a 2.6-percent net profit margin).

• Airline industry operating profits are expected to reach $49.3 billion in 2024 from $40.7 billion in 2023.

• Total revenues in 2024 are expected to grow 7.6-percent, year over year, to a record $964 billion. Expense growth is expected to be slightly lower at 6.9 percent for a total of $914 billion.

• Some 4.7 billion people are expected to travel in 2024, an historic high that exceeds the

(Commercial aerospace) industry profits must be put into proper perspective. While the recovery is impressive, a net profit margin of 2.7 percent is far below what investors in almost any other industry would accept. Many airlines are doing better than that average, and many are

struggling.

Airlines will

always compete ferociously for their customers,

but

they remain far too burdened by onerous regulation, fragmentation, high infrastructure costs and a supply chain populated with oligopolies.

—Willie Walsh director general of the IATA

pre-pandemic level of 4.5 billion recorded in 2019.

• Cargo volumes are expected to be 58 and 61 million tons in 2023 and 2024, respectively.

Willie Walsh, IATA director general said that “considering the major losses of recent years, the $25.7 billion net profit expected in 2024 is a tribute to aviation’s resilience. People love to travel and that has helped airlines to come roaring back to pre-pandemic levels of connectivity.

The speed of the recovery has been extraordinary; yet it also appears that the pandemic has cost aviation about four years of growth. From 2024 the outlook indicates that we can expect more normal growth patterns for both passenger and cargo.”

Commercial aerospace revenues and profitability have a “trickledown” impact on the titanium industry in terms of near-term business opportunities. The titanium industry looks for stable aerospace

30 TITANIUM TODAY

Rapid Response. Dependable Delivery.

Exceptional Turnaround From a Proven Partner in Titanium Materials Testing

Product Evaluation Systems, Inc. (PES) is a fully accredited, independent leader in titanium materials testing for aerospace and other applications. With a dedicated, experienced staff and state-of-the-art testing facilities, we offer full-service capabilities for all of your titanium testing needs, including:

• Mechanical Testing

• Metallurgical Analysis

• Chemical Analysis

PES responds to your needs promptly with personal service, customized solutions and expedient turnaround. We work with clients throughout the United States and Europe on projects of all types and sizes.

To request a free quote for your titanium testing needs and to see a full list of capabilities, please visit our website at www.PES-Testing.com or call 724-834-8848.

IATA Upgrades Its Global Aerospace Industry Outlook To

business conditions to drive sales for its showcase market. “Industry profits must be put into proper perspective. While the recovery is impressive, a net profit margin of 2.7 percent is far below what investors in almost any other industry would accept. Of course, many airlines are doing better than that average, and many are struggling. But there is something to be learned from the fact that, on average airlines will retain just $5.45 for every passenger carried. That’s about enough to buy a basic ‘grande latte’ at a London Starbucks. But it is far too little to build a future that is resilient to shocks for a critical global industry on which 3.5 percent of GDP depends and from which 3.05 million people directly earn their livelihoods. Airlines will always compete ferociously for their customers, but they remain far too burdened by onerous regulation, fragmentation, high infrastructure costs and a supply chain populated with oligopolies,” Walsh said.

Commercial Aerospace Outlook Drivers

Overall revenues in 2024 are expected to rise faster than expenses (7.6 percent versus 6.9 percent), strengthening profitability. Although operating profits are expected to increase 21.1 percent ($40.7 billion in 2023 to $49.3 billion in 2024), net profit margins increased at less than half the pace (10 percent) largely due to increased interest rates expected in 2024.

Industry revenues are expected to reach an historic high of $964 billion in 2024. An inventory of 40.1 million flights is expected to be available in 2024, exceeding the 2019 level of 38.9 million and up from the 36.8 million flights expected in 2023.

Passenger revenues are expected to reach $717 billion in 2024, up 12

percent from $642 billion in 2023. Revenue passenger kilometers (RPKs) growth is expected to be 9.8 percent, year on year. Although that is more than double the pre-pandemic growth trend, 2024 is expected to mark the end of the dramatic year-on-year increases that have been characteristic of the recovery in 2021-2023.

The high demand for travel coupled with limited capacity due to persistent supply chain issues continues to create supply and demand conditions supporting yield growth. Passenger yields in 2024 are expected to improve 1.8 percent compared with 2023.

Fuel Costs, Consumption, Emissions

Fuel costs are expected to average $113.8/barrel (jet) in 2024 translating into total fuel bill of $281 billion, accounting for 31percent of all operating costs. Airlines are expected to consume 99 billion gallons of fuel in 2024.

High crude oil prices are expected to continue to be further exaggerated for airlines as the crack spread (premium paid to refine crude oil into jet fuel) is expected to average 30percent in 2024.

Industry CO2 emissions in 2024 are expected to be 939 million tons from the consumption of 99 billion gallons of fuel. The aviation industry will increase its use of Sustainable Aviation Fuels (SAF) and carbon credits to reduce its carbon footprint. We estimate that SAF production could rise to 0.53 percent of airlines’ total fuel consumption in 2024, adding $2.4 billion to next year’s fuel bill. In addition, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a global market-based carbon offsetting mechanism designed to stabilize international aviation emissions. The

CORSIA-related costs are estimated at $1 billion in 2024.

Non-fuel expenses have been controlled relatively well by airlines despite inflationary pressures. With fixed costs being distributed over a larger scale of activity as the industry recovered from the pandemic, nonfuel unit costs are falling in line with pre-pandemic level. In 2024 we expect non-fuel unit costs of 39.2 cents per available ton kilometer (ATK) in 2024 which is 1.6 percent above 2023 levels and matches 2019 levels. Total nonfuel costs are expected to reach $633 billion in 2024.

Global Economic Risks

Industry profitability is fragile and could be affected (positively or negatively) by many factors:

Global Economic developments: Easing inflation, low unemployment rates, and strong demand for travel are all positive developments. Nonetheless, economic strains could arise. In China, for example, slow growth, high youth unemployment and disarray in property markets if not managed properly, could impact global business cycles. Similarly, should tolerance of high interest rates weaken, and unemployment rise significantly, the strong consumer demand that has supported the recovery could weaken.

War: The operational impacts of the Ukraine war and the IsraelHamas war have been largely limited to re-routings due to airspace closures. On the cost side, the conflicts have pushed up oil prices, impacting airlines globally. An unexpected peace in either or both cases would bring benefits to the industry, but any escalation could produce a radically different global economic scenario to which aviation would not be immune.

Supply Chains: Supply chain issues

32 TITANIUM TODAY

billion profit in 2024 (continued)

$25.7

IATA Upgrades Its Global Aerospace Industry Outlook

continue to impact global trade and business. Airlines have been directly impacted by unforeseen maintenance issues on some aircraft/engine types as well as delays in the delivery of aircraft parts and of aircraft, limiting capacity expansion and fleet renewal.

Regulatory Risk: On the regulatory front, airlines could face rising costs of compliance, and additional costs pertaining to passenger rights regimes, regional environment initiatives, and accessibility requirements.

Air Cargo Set for a Positive 2024

In a press release dated Jan. 4, 2024, the IATA projected that global air cargo revenues are expected to fall to $111 billion in 2024 (https:// airlines.iata.org/2024/01/04/aircargo-set-positive-2024). That is down sharply from an extraordinary peak of $210 billion in 2021, but it is above 2019 revenues, which were $101 billion.

Yields will continue to be negatively impacted by the continued growth of belly capacity (related to strong growth on the passenger side of the business) while international trade stagnates. Yields are expected to further correct towards pre-pandemic levels with a minus 32.2-percent decline in 2023 followed by a minus 20.9-percent decline expected in 2024. However, they will remain high by historical standards.

All regions are expected to experience air cargo growth in 2024, according to IATA. The Middle East is set for the biggest rise at 12.3

percent while Africa will see a more modest 1.5-percent growth. On average, air cargo is forecast to grow 4.5 percent.

“Yields will likely decline in 2024 but they will still be above their 2019 levels,” Rachel Yuting Fan, IATA sustainability and economics, stated. “Cargo revenue will also be about 11 percent above 2019 and comprise 12 percent of total industry revenue. In other words, 2024 will see sustained revenue growth and the sector outperform pre-pandemic levels.”

Other beneficial factors include the continued growth of e-commerce, the reduction in delivery times, and the robust performance of highvalue specialized products, such as pharmaceuticals, which seem resilient to the industry’s usual volatility. Possible downsides include:

Yields will remain high by historical standards, despite falling in 2023 and 2024. Yield progression has been extraordinary in recent years (minus 8.2 percent in 2019, plus 4.7 percent in 2020, plus 25.9 percent in 2021, plus 7 percent in 2022, and minus 32.2 percent in 2023).

Cargo volumes are expected to reach 61 million tons in 2024.

China’s supply chain and currency fluctuations:

“The air cargo industry is in a better place than it was in 2019,” Brendan Sullivan, the IATA’s head of cargo, said. “We had an exceptional period during the pandemic. We became financially stronger and more efficient.” n

34 TITANIUM TODAY

$25.7 billion profit in 2024 (continued)

To

VACUUM

ALD Vacuum Technologies High Tech is our Business

ALD Vacuum Technologies

High Tech is our Business

SYSTEMS FOR AVIATION INDUSTRIES

SYSTEMS FOR AVIATION INDUSTRIES

MELTING SYSTEMS

MELTING SYSTEMS

� VIM Master Melting

� VAR

� VIM Master Melting

� ESR

� VAR

� EB Melting

� ESR

� PA Melting

� EB Melting

PAM Melting

� PA Melting

NEAR NET SHAPE TECHNOLOGY COATING SYSTEMS

NEAR NET SHAPE TECHNOLOGY COATING SYSTEMS

CASTING SYSTEMS

� VIM-IC

CASTING SYSTEMS

� VIM-IC

� Leicomelt with Cold Crucible

METAL ADDITIVE

MANUFACTURING

METAL ADDITIVE MANUFACTURING

� EIGA: Ceramicfree Metal Powder

� EB-PVD SYSTEMS

� EB-PVD SYSTEMS

� Leicomelt with Cold Crucible

� VAR Skull Melting

Production

� EIGA: Ceramicfree Metal Powder Production

HOT ISOTHERMAL FORGING (HIF)

� VAR Skull Melting

HOT ISOTHERMAL FORGING (HIF)

� VIGA: Inert Gas Atomization Equipment

� VIGA: Inert Gas Atomization Equipment

ALD Vacuum Technologies GmbH

Otto-von-Guericke-Platz 1 | 63457 Hanau, Germany

T: +49 6181 307-0 | info@ald-vt.de

HEAT TREATMENT SYSTEMS

HEAT TREATMENT SYSTEMS

Electron Beam Physical Vapour Deposition (EB-PVD) of Thermal Barrier Coatings (TBC)

CVD SYSTEMS Chemical Vapor Deposition for non metallurgy applications

Electron Beam Physical Vapour Deposition (EB-PVD) of Thermal Barrier Coatings (TBC) Courtesy

ALD Vacuum Technologies North America, Inc. 18 Thompson Road | East Windsor, CT 06088, USA

T: +1 860 386 7227 | info@ald-usa.com

ALD Vacuum Technologies GmbH Otto-von-Guericke-Platz 1 | 63457 Hanau, Germany T: +49 6181 307-0 | info@ald-vt.de ALD Vacuum Technologies North America, Inc. 18 Thompson Road | East Windsor, CT 06088, USA T: +1 860 386 7227 | info@ald-usa.com

METAL POWDER PRODUCTION International Titanium Association

� SYNCROTHERM® Total Integration of Heat Treatment into Component Manufacturing

� SYNCROTHERM® Total Integration of Heat Treatment into Component Manufacturing

www.ald-vt.com

www.ald-usa.com

www.ald-vt.com

www.ald-usa.com

TITANIUM TODAY 35

of SLM Solutions

of SLM Solutions

Courtesy

SYSTEMS AND TECHNOLOGIES FOR METALLURGY AND HEAT TREATMENT

ADVERTISING IN TITANIUM TODAY you connect with a specific target market unlike any other. Each edition includes: Member Profiles, Timely Editorial, Advertising opportunities, Press Releases, Classified Ads, Calendar Events, Executive Summaries from Titanium Conferences

an ITA member, you have the opportunity to submit press releases, classified ads, and host your updated company profile in the trade publication all INCLUDED in your annual membership .

www.titanium.org 1-303-404-2221 Telephone 1-303-404-9111 Facsimile ita@titanium.org Email BY

As

UNITED TECHNICAL WINS NATIONAL AWS ‘EXCELLENCE IN WELDING’ AWARD

American Welding Society WEMCO Committee Selects United Technical in the Small Business Category

Whitmore Lake, MI: On September 13, United Technical Inc. accepted the 2023 Excellence in Welding award at the American Welding Society’s WEMCO (Welding Equipment Manufacturers Committee) awards luncheon at FABTECH. The award recognizes individuals and organizations that are instrumental in raising the image of welding and strengthening the industry, having shown exemplary dedication to promoting the image of welding in their communities. One nationwide winner per category is chosen and previous award winners include: Ingalls Shipbuilding, Hobart Institute of Welding Technology, Lincoln Electric Co., and ‘Dirty Jobs’ host Mike Rowe.

Industry as a career,” stated Bob Ranc, Chairman of the Excellence in Welding Awards Committee of WEMCO. “Their participation, financial support, and involvement at the local and national levels help to boost the image of our industry. We at WEMCO are excited to present them with the Excellence in Welding Award in the Small Business category.”

In his acceptance remarks, Mike Rowe summed up the importance of the WEMCO award, “The awards that matter most are the ones like this. To be recognized by AWS is better than gratifying. It’s humbling. Because fundamentally, it’s a privilege to speak on behalf of so many good jobs that actually exist, and help shine a light on so many great opportunities.”

Echoing those sentiments, Rob Dines, CEO of United Technical, says, “Receiving the Excellence in Welding Award from an

organization like AWS WEMCO is truly the greatest compliment we could receive. Without everyone in this industry working tirelessly to promote welding and skilled trades, this nation suffers. We work as hard to promote the welding industry as we do to deliver great results for our clients.”

“Companies like United Technical are what the WEMCO Excellence in Welding Awards are about. A smaller company who, through their actions, support and promote the Welding

Rob DinesOwner & CEO, Lori Przybylo - President, Rick Slade - VP Operations, and Brad MackWelding Services Director were at FABTECH to accept the award.

For more information on the award: https://www.aws.org/wemco/page/ excellence-in-welding-awards

About United Technical: United Technical is a full-service testing and training facility providing metallurgical examination, destructive/nondestructive testing, technical consulting and custom corporate welding training. Its 25,000 square foot facility houses a vast array of inspection, testing, training, and development equipment and the company is accredited as an A2LA mechanical testing facility (certificate 3990.01), a Nadcap materials testing laboratory (certificate 12538206465), and an AWS test facility (certificate 140608.) http://www.unitedtech1.com

36 TITANIUM TODAY

From the Wire

The solutions we create provide value to your business

ARIES Manufacturing is dedicated to the supply of complex airframe structure components, in both titanium and aluminum alloys, to leading manufacturers in the aerospace industry.

ARIES Manufacturing is part of the ARIES Alliance, a group of companies focused on developing innovative technology that creates value for the aerospace industry.

Superplastic Forming and Hot Forming for titanium airplane structural and engine components Panel mechanical pocket milling, drilling and trimming

ACB Part production facility Nantes - France +33 (0)2 51 13 84 00 DUFIEUX Part production facility Grenoble - France +33 (0)4 76 09 67 44 CYRIL BATH Part production facility Monroe - NC USA +704 289 8531

wwww.aries-manufacturing.com

HSF® process technology for titanium airframe components

Design vupar.fr

sales@aries-manufacturing.com

SOLAR MANUFACTURING SHIPS MENTOR® PRO FURNACE TO A GLOBAL LEADER OF WIRE MESH PRODUCTS