Finstreet IBS is an ICFAI Business school Hyderabad-affiliated official capital market club which aims to research the capital market as a whole. At IBS Times we serve our readers information from in and around the world and keep them up to date. We try to aid our readers with information and gauge knowledge with better investment solutions. IBS Times encompasses an independent writers club with unbiased thought and wholesome views, fairness, and honesty. We have recognized that our work can influence decisions or perceptions of our readers towards the capital market. Therefore, we commit to publishing our magazines and journals with the highest level of accuracy and impartiality. We strive to be humble and subtle in carrying out this work. Our team realizes that accuracy in the context provided to readers is imperative. Thus, we always strive to reach that level as best as we can.

This Magazine edition focuses on the impending 5G roll out in India. The new generation mobile network has the transformative potential to provide a wide range of benefits to the Indian economy, which when combined with artificial intelligence provides a new face to a connected and autonomous system. As an Editor, it gives me immense pleasure to hear from our readers. We intend to improve ourselves at every stage and would like to invite our readers to support the same. Keep following us on www.finstreetibshyd.in as well as. Please write to us and become a part of the discussion.

E-mail ID: editor.ibstimes@gmail.com

Payel Chowdhury (Senior Editor, Magazine)

POC, Team IBS Times.

"Telecommunications and information technology have advanced the whole world much beyond the expectations of the common people.”

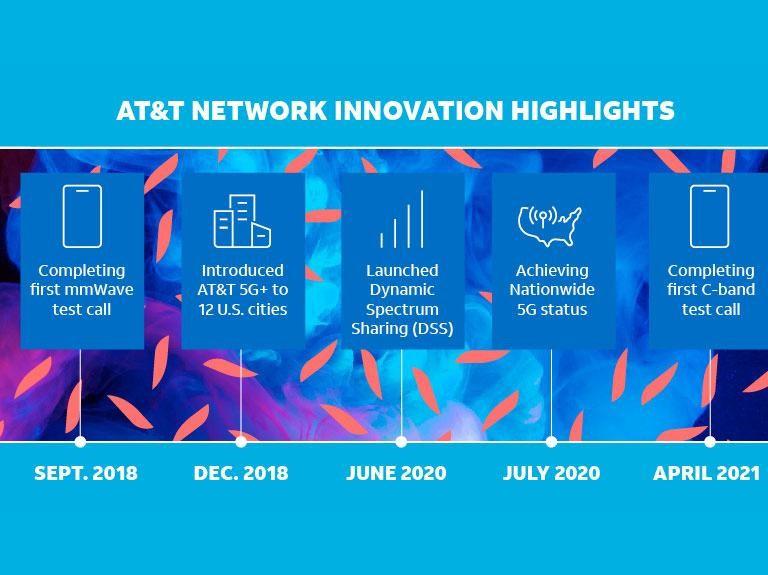

Since the 1980s, AT&T has operated outside of India, with its headquarters located in the New Delhi/NCR region. The goal of AT&T is to assist in resolving the most challenging connectivity and IT issues as the first foreign telecom provider to directly serve the Indian market under its own international and national long-distance and ISP telecommunications licenses.

Customers can set up their businesses with the support of AT&T's extensive service portfolio. Customers have access to an industry-leading portfolio of services, including cloud, hosting, unified communications, mobility management, network connectivity, and application services. These are put into place locally by skilled AT&T engineers, backed up by a local account team. Any company or organization wishing to mobilize its personnel, assets, or information should contact AT&T in India first. The Federal Aviation Administration (FAA) and both carriers agreed to the launch to establish 50 buffer zones where AT&T and Verizon will turn down transmitters for six months close to airports with heavy traffic and regular low visibility situations.

On December 21, 2018, AT&T made their mobile 5G network available to the general public in 12 locations throughout the US.

Atlanta, Charlotte, Raleigh, Dallas, Houston, Indianapolis, Jacksonville, Louisville, New Orleans, Oklahoma City, San Antonio, and Waco, Texas were among the first group of cities.

By the required signal range, they provide two different forms of 5G service. Millimeter wave spectrum is used by 5G+, which is accessible in more than 40 cities. More than 255 million Americans presently have access to the low-band network, which can be used in more than 16,000 cities and towns.

Since AT&T's 5G network is mobile, users can access it from any location where they have AT&T service. The business also intends to provide a fixed wireless access (FWA) solution that will enable 5G Internet connectivity at home. Even though the AT&T 5G mobile plan isn't currently available to the general market, their 5G Evolution service is widely available. In addition to enabling superfast speeds, 5G Evolution also paves the way for the implementation of 5G.

AT&T's market value was $131.33 billion as of November 2022. In terms of market cap, this places AT&T as the 79th most valuable corporation in the world. Market capitalization, often known as Market Company, is worth it. It represents the total market value of all outstanding Shares of a publicly listed company. The Face value of AT&T as of November 2022 is 1.058 of AT&T Company.

The price-to-earnings ratio for AT&T is currently 6.60727 based on the company's most recent financial reports and stock price. The company's P/E ratio was 8.91 at the end of 2021. From 2019 to 2020, AT&T Inc.'s net profit margin ratio declined, but from 2020 to 2021, it improved and surpassed 2019 levels.

In the Year 2018, the stock price of AT&T was around 30 to 33 USD which is before the release of the 5g network. They've seen an upward trend of the share price of AT&T after the release of 5g in December 2018 the share price touched up 40 to 44 USD then after some time, there is a gradual downfall in the share price which is currently 18.32 USD as of today which is November 2022 after almost 3 years of launching 5g networks.

There was a decline in the annual net income of 28.24% in the year 2019 with 13.9 billion USD Company has seen an absolute downfall in the year 2020 which is a year of releasing a 5g network straight went to -5.36 billion USD from 13.9 billion USD. Whereas at present the company’s net income has shown an upward trend since 2001 which is currently around 19 billion USD. Top-level management revamps would also be beneficial for the company.

With a thorough plan for growth and profitability, AT&T has been able to see a significant increase in the value of its stock.

Shares have dropped more than 30% from AT&T's post-spin-off peak after initially rising. The stock price of AT&T has dropped to embarrassingly low levels as a result of the general market selloff.

Surprisingly, AT&T's severely underperformed stock is only trading at 5.8 times the projected EPS for this year. Furthermore, AT&T's valuation is absurd given that the company's dividend yield of 7.45% presently significantly exceeds its P/E ratio. Although there are several challenges the corporation must overcome soon, AT&T has strong long-term development potential. In the upcoming years, AT&T should make considerable strides.

TBL's focus can assist AT&T in streamlining its waste management procedures. This would not only lower the local government's operating expenses but also aid in the development of longterm reuse and recycling initiatives.

Water conservation - The Triple Bottom Line strategy can assist in enhancing societal and organizational initiatives to conserve water.

Improving recruiting - By focusing on the Triple Bottom Line aspects including environmental factors, workforce diversity, climate change, etc., AT&T will be able to attract superior talent from the millennial workforce, which is one of the most socially conscious generations. Investors are more likely to invest in a company with a high ESG score because, in comparison to their rivals, these companies offer greater medium- and long-term returns.

Therefore, focusing on the Triple Bottom line can assist AT&T to attract better investors who are interested in the organization's medium to long-term development. By lowering the company's old copper footprint, AT&T anticipates generating considerable savings as more network traffic migrates to fiber and 5G. By 2025, AT&T anticipates serving 75% of its network through fiber and 5G while reducing the footprint of its copper services by 50%. To maximize profits, the business will properly manage the timing and profitability of the switch from legacy to nextgeneration products.

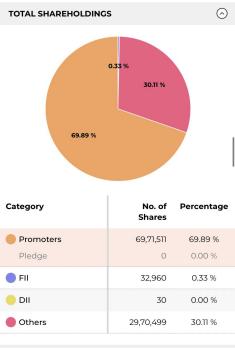

Smartlink Holdings Ltd., formerly known as Smartlink Network Systems Ltd. It was founded in 1993 with the goal of supporting the Indian network infrastructure sector. Smartlink, a pioneer in the field of active and passive networking, has a long history of helping numerous product brands achieve their goals in the Indian and international markets. With its operations divided into 3 wholly owned subsidiaries, Smartlink is now an NBFC company with a targeted business strategy. The business gained attention due to its manufacturing services for cables and networking equipment that would assist in the deployment of 5G services. Through its subsidiaries Digisol Systems Ltd, Synegra EMS Ltd, and Telesmart SCS Ltd, this company engages in the manufacturing and distribution of telecom equipment products. The business has facilities in Goa. The business makes networking and cabling equipment that is useful for setting up 5G services. The company's stock price had a good year, with a 52-week low of Rs. 61.4 and a 52-week high of Rs. 107.45. The cost of the company's shares is currently Rs. 154.80 as of 04/11/22. The company has been reducing its outstanding shares through a tender buyback route continuously for the last 4 years.

The market Capitalization of Smartlink Holdings stock is Rs 154.91 Cr.

Mr. Chandrasekhar Kopparapu's resignation as a Director on the Board of Directors was announced by D-Link India Ltd. in 2016 and was accepted by the Board. With effect from December 26, 2006, Mr. Pradeep Rane has been appointed by D-Link (India) Limited as a NonExecutive & Independent Director on the Company's Board. D-Link India Ltd. has announced that the company opened its new R&D center in Bangalore's Electronic City on December 1, 2007.

D-Link India Ltd. has been replaced by Smartlink Network Systems Ltd. as the name of the company. Additionally, Smartlink Network Systems Ltd. has suggested a dividend of 100% or Rs. 2 per share.

Another notable events for the company in 2019 were the release of the DIGISOL Dual Band AC Wireless USB Adapter. Launch of the 24 Port Gigabit Ethernet Unmanaged Switch by DIGISOL. Launching a Lite Managed PoE+ Switch for the IP Surveillance industry is DIGISOL. Launch of the In-Wall Wireless Access Point by DIGISOL.

Energy Efficient Gigabit Ethernet Unmanaged Switch is introduced by DIGISOL. Smartlink Network - DIGISOL makes a forceful entry into the Indian market for structured cabling.

The business promises 5G users faster data speeds than 4G. Internet speeds on 5G could reach 10 Gbps at its maximum, compared to the 100 Mbps high on 4G.

Smartlink will provide 5G technology with a 1ms minimum latency. For the uninitiated, latency is the amount of time it takes for a device to deliver data packets and receive a response. The answer is faster the lower the latency.

Smartlink will provide seamless 5G connectivity across the nation in off-the-grid locations. Energy, spectrum, and network efficiency will all rise as a result.

Smartlink will provide 5G, ushering in technological advancements like Virtual Reality (VR), Augmented Reality (AR), and more across the nation. The healthcare, agricultural, educational, disaster management, and other sectors will all be directly impacted by these technologies.

Smartlink will provide 5G, which will improve the fan experience at sporting events like football games and live music festivals. Sports fans will have an immersive experience because to 5G's minimal latency.

According to Global Data, a top provider of data and analytics, the corporate networking market in India is expected to rebound in 2021 after experiencing a brief fall in 2020 and have a compound annual growth rate (CAGR) of 5.2% between 2019 and 2024. The investment in ICT infrastructure, particularly networking, is anticipated to recover quickly as company activity gradually returns to normal and businesses speed up their digital transformation activities to recover faster from the crisis and position themselves for similar disruptions in the future. Through the projected period, networking services will continue to represent India's largest and fastest-expanding market category in terms of value. Fiber optic (FTTH/B) networking services will have the most growth during the projection period. Growth in FTTH/B services will be supported by rising enterprise demand for high-speed broadband services and expanding nationwide availability of fiber-optic broadband connectivity.

To keep up with technological advancements and meet the expanding demands of consumers, market participants are consistently enhancing and developing their product lines. However, there are some risk considerations, one of which is that in the event of a catastrophic global slowdown, declining foreign demand would have a significant negative impact on the economies of Asia, including India. Smartlink is subject to credit risk, market risk, and interest rate risk as a result of its investments in a variety of financial instruments, including mutual funds, bonds, non-convertible debentures, and other securities. In the markets where the company's subsidiaries operate, there is a very high danger of technological obsolescence. Furthermore, the major OEM players control the direction of technological growth. To increase our reach and reputation among customers and channel partners, on the other side, we must continually invest in developing new items.

The macroeconomic effects of COVID-19 may potentially leave our clients with money problems, such as insolvency or restricted access to the credit markets.

However, the impact will be much bigger than in past network generations if all these issues are resolved. The new 5G network's development requirements go beyond the established participants in mobile networking across all sectors.

Siemens is a tech giant with a focus on healthcare, transportation, infrastructure, and industry. The company designs technology with the intention of creating actual value for clients, from resource-efficient industries, resilient supply chains, smarter buildings, and grids, to cleaner and more pleasant transportation as well as cutting-edge healthcare. By fusing the physical and digital worlds, we enable our clients to alter their markets and industries, changing daily life for billions of people.

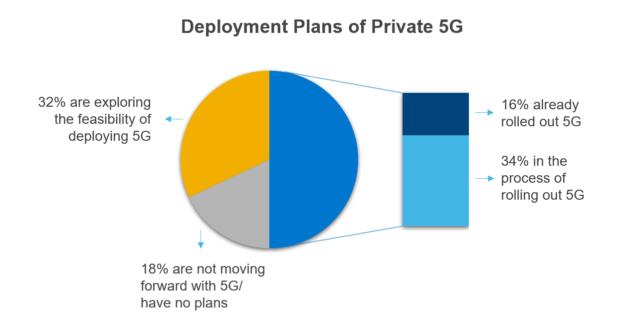

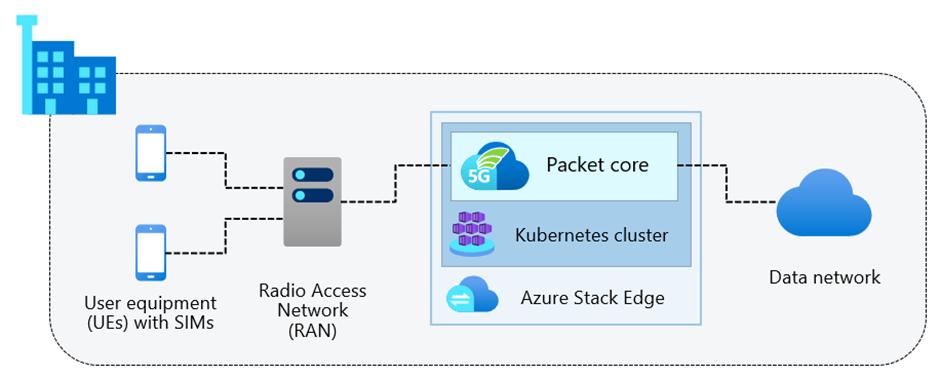

Private 5G wireless networks will be installed at industrial locations during the next several years wherever businesses want reliable, ultrafast networks with high bandwidth. The new mobile communication standard will be able to control hundreds of thousands of devices per square kilometer, including industrial lines, robots, and automated racking systems.

Siemens tests industrial applications on a private, independent 5G network built to advance the technology to the point where it may be applied in the industry at its Automotive Test Centre in Nuremberg. Additionally, prototypes of this technique were erected at the Amberg and Karlsruhe facilities.

In a private 5G network in 2022, interested parties will be able to test their apps quite quickly. The largest exhibition site in the world will include a test area and a display for the usage of 5G in the industry when the 5G Smart Venue opens in Hanover.

It is clear why 5G is appealing to smartphone users: for instance, it enables them to watch 4K films wherever they are. But the importance to industry is far greater. It's a significant step toward Industrie 4.0, a future in which end-to-end digitization and the Internet of Things will enable smart factories to become more adaptable and productive. Compared to current LTE, 5G is 10 to 20 times quicker and uses a thousandth as little energy each bit sent.

Private networks, according to Sander Rotmensen, Siemens' Head of Product Management for Industrial Wireless Communication, "open up previously unimagined opportunities for the industry". "Low latencies, extremely high bandwidths, control over one's own data, having control over the network performance".

But in order for private networks to become a reality, a number of steps must be finished in the upcoming years, according to the program. In March of last year, Germany finished the first phase. The Bundesnetzagentur (Federal Network Agency, BNetzA) reserved a portion of the spectrum, between 3,700 MHz and 3,800 MHz, for local networks in business, research facilities, and agriculture as part of an auction of 5G frequencies to mobile network operators.

Funding from Siemens and other well-known industrial businesses and organizations had a significant role in this accomplishment. Small-scale applications work well in this frequency range. According to Rotmensen, "It seems reasonable that business should have direct access to these frequencies." "We are the best at understanding what our plants need. In the end, the industry must operate as effectively as possible, which also implies that the network infrastructure must be as available as feasible.

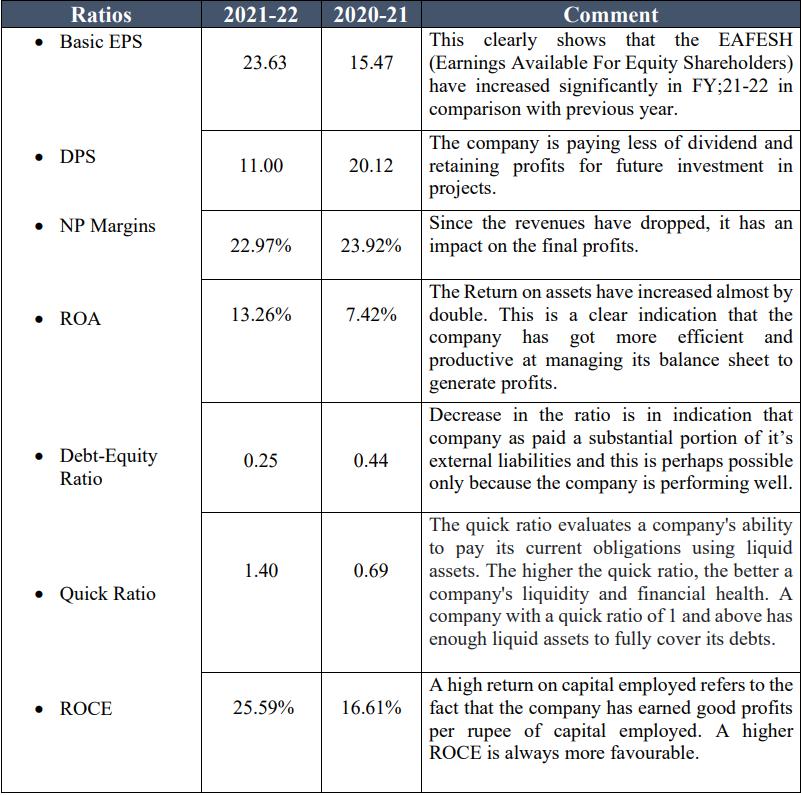

Financial Performance

Holder's Name

No of Shares

% Share Holding

No of Shares 356120255 100 Promoters 0 0

Foreign Institutions 19309668 5.42

N Banks Mutual Funds 10019772 2.81 Central Government 2264 0 Others 8302000 2.33 General Public 27067415 7.6 Financial Institutions 24329223 6.83 Foreign Promoter 267089913 75

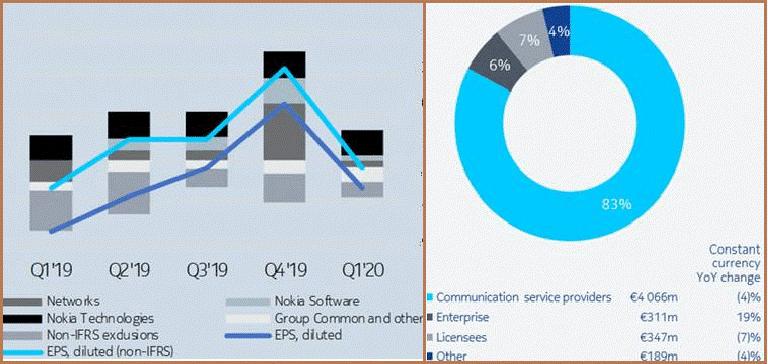

The profitability of Siemens Portability is supposed to emerge at 7.5 to 8.5 percent in 2022, Siemens said in its monetary show for the second from last quarter delivered on Thursday. The organization had recently tagged 10-10, 5 percent. Income is supposed to remain level.

In the second last quarter, income emerged at 2.5 billion euros, up 4% contrasted with a similar period last year. Siemens Portability's benefit emerged at 704 million euros, for the most part, determined by the offer of Yonex. The Portability division kept 2.8 billion euros in orders. This was fundamentally not exactly the 5.1 billion euros enrolled last year, yet that was because of a phenomenal 2.8-billion request at that point.

Siemens Portability followed different divisions - Advanced Ventures and Brilliant Foundationby some edge. Siemens' absolute requests developed from 20.5 billion to 22 billion euros year on year, with income up 4% to 17.9 billion euros. The organization recorded an overall deficit of 1.5 billion euros for the quarter regardless, because of a weakness in its stake in Siemens Energy.

Siemens presents the principal modern 5G switch for interfacing nearby modern applications to a public 5G organization. The gadget will be accessible in spring 2021. Utilizing the recently evolved Scalance MUM856-1, modern applications like machines, control components, and different gadgets can be gotten to remotely by means of a public 5G organization, giving a basic far-off support choice for these applications utilizing the high information rates presented by 5G. The Sinema Remote Associate administration stage for VPN associations can be utilized to give simple and secure admittance to these remote plants or machines - regardless of whether they are coordinated in different organizations.

In industry, notwithstanding the requirement for neighbourhood remote networks, there is expanding interest in remote admittance to machines and plants. In these cases, correspondence requirements connect significant distances. Public portable organizations can be utilized to get to gadgets that are situated at an extensive distance, for instance in different nations. Furthermore, administration experts can interface with the machines they need to support through versatile organization while in a hurry.

Public 5G organizations are hence a significant component of remote access and distant support arrangements. They can be utilized, for instance, to furnish clients with extremely high transfer speeds in metropolitan regions with few radio cells and high frequencies. In provincial regions, radio cells need to cover a huge region, which is the reason lower frequencies are utilized. Especially at the edges of radio cells, for instance for LTE or UMTS, there are many times critical misfortunes with regard to both the data transfer capacity and steadiness of the correspondents association. Also, it is precisely in these distant regions where stable data transfer capacity transmission is expected for far-off support or video transmission, for instance for water stations.

With imaginative 5G correspondence innovations, extensively more transmission capacity with more prominent dependability is accessible at the edges of radio cells and the typical information rate for clients inside a radio cell increments. The new Scalance MUM856-1 likewise upholds 4G so activity is conceivable regardless of whether a 5G versatile organization isn't accessible. The gadget can likewise be coordinated in confidential neighbourhood 5G grounds organizations. Siemens is trying this utilization case in their own Car Test Centre in a private independent 5G test organization, which depends on Siemens parts. There, mechanized directed vehicle frameworks are associated with utilizing 5G to test current and future modern applications and to drive forward the utilization of 5G innovation in the industry.

Sterlite Technologies Limited is an Indian multinationals era agency, based in Mumbai. It additionally has places of work in China, the US, SEA, Europe, and MEA. It has facilities in India, Italy, China, and Brazil, and software program improvement centers. It has 636 patents and is active in over a hundred and fifty international locations 5,000 employees with $10 million in earnings and $1 billion in marketplace capital. The employer is specialized in optical fiber and cables, hyper-scale network design, and deployment and community software programs. To provide a lift to the Indian government's make-in-India initiative, STL invested in 5G assembling an atmosphere of partners. It has the first optical fiber cable plant in India to receive 0 waste landfill certification. STL Partners with provider carriers globally in reaching an inexperienced and sustainable digital future in alignment with UN SDG goals.

Category of shareholders

Indian shareholders 9

Foreign shareholders 1 Indian Shareholders

Central and state government 1 Mutual Funds 10 Insurance companies 1

For developing the 5G network in India STL has signed MoU for research and advancement with IIT Madras a premier academic and research institute. There is a need to develop efficient and affordable standards which this partnership will help. The chair occupant will be the institute's full-time faculty, working towards the development and advancement of 5G with the STL’s domain knowledge and IIT Madras’s research in end-end connectivity and 5G. This partnership will also help to boost young minds and discover unique opportunities.

STL is planning to produce OFC as it is required at a large scale for 5G, knowing the demand it is increasing its capacity recently. Later SLT will increase the production capacity of optical fiber to 50fkm (Fluoroelastomers or Fluorocarbons).

STL has committed itself to ambitious net-zero goals by 2030 and societal as well as CSR goals by 2025. STL aims towards creating digital networks that are green and sustainable. Keeping this in view, STL has planned to deliver on its commitment towards its sustainability and social goals including - Net-zero emissions in manufacturing facilities by 2030, 100% plants 'Zero Waste to Landfill' certified by 2030, 100% sustainable sourcing, and Water positivity by 2030. It has recently signed an MoU with NASSCOM to increase the number of certified professionals in India by ~10X by 2024.

Orange S.A. formerly France Télécom S.A. (stylized as France telecom) is a French multinational telecommunications corporation. Orange S.A. is the main telecommunications company in France, the third-largest in Europe, and one of the largest in the world. It has 266 million customers worldwide and employs 89,000 people in France, and 59,000 elsewhere. In 2015, the group had a revenue of €40 billion. The company's head office is located in the 15th arrondissement of Paris.

Orange has been the company's main brand for mobile, landline, internet and Internet Protocol television (IPTV) services since 2006. The Orange brand originated in the United Kingdom in 1994 after Hutchison Whampoa acquired a controlling stake in Microtel Communications: that company became a subsidiary of Mannesmann in 1999 and then was acquired by France Télécom in 2000. The France Télécom company was rebranded to Orange on 1 July 2013.

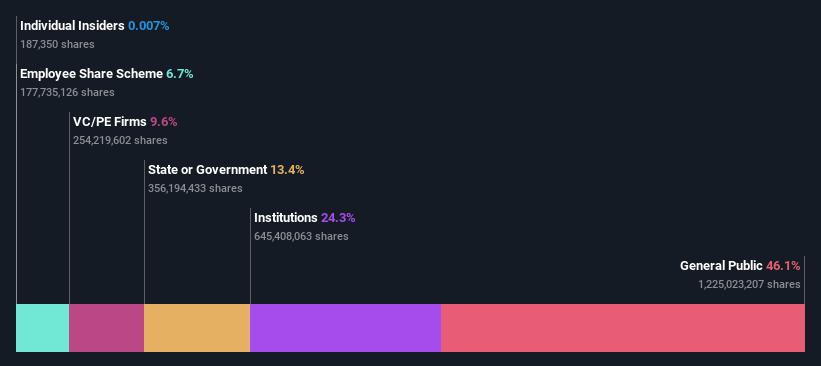

The major shareholders of Orange as of 31 December 2015 are the state. As of mid-2013, Orange employees owned 4.81%, and the company itself owned 0.58%. Currently, the company's largest shareholder is France, with ownership of 13%. In comparison, the second and third largest shareholders hold about 9.6% and 6.7% of the stock. Institutional investors have a fair amount of stake in Orange. This can indicate that the company has a certain degree of credibility in the investment community.

Spanish operator Orange is already offering 5G services in 1,222 towns and cities in 51 provinces across the country. According to the European operator, its 5G network infrastructure reaches 65% of the Spanish population. The telco ended June with a total of 1.27 million subscribers in the 5G segment, after a net addition of over 164,000 5G subscribers in the second quarter of the year. Orange Spain is currently offering 5G services through frequencies in the 3.5 GHz and 700 MHz bands.

The operator launched commercial 5G services in Spain in September 2020, using equipment provided by Swedish vendor Ericsson. Orange initially launched 5G technology in Madrid and Barcelona with the deployment of Ericsson’s 5G Radio Access Network (RAN) and core products and solutions. Operating on a 3.6 GHz spectrum, the 5G network in Madrid and Barcelona is powered by the Ericsson Radio System (Baseband 6648 and AIR 6488 antenna), delivering massive multiple-input multiple-output, which increases network capacity and spectral efficiency.

During the first half of the year, the Spanish telco invested 465 million Euros, which represents more than 20.5% of the income for the period. This CAPEX was chiefly oriented to the expansion of the telco’s telecommunications infrastructures, especially 5G.

Following the inauguration of the first 5G Lab in Antwerp and with a new 5G Lab opening soon in Liège, Orange Belgium has intensified its activities in preparation of delivering 5G to its customers. In June 2022, Orange Belgium obtained the maximum amount of the new 5G spectrum bands available for auction. With 200 MHz of spectrum acquired, the operator is able to provide high-quality coverage and capacity for 5G network services.

By gradually deploying a better-performing 5G network in Belgium, Orange Belgium is simultaneously counting on the development of more energy-efficient technology. The fifth generation of mobile networks has been designed to be more sustainable than previous generations. By 2025, 5G is set to be up to ten times more efficient than the 2019 generation.

"Hans Vestberg is the chairman and chief executive officer of Verizon, the world’s largest wireless, fiber-optic, and global information networks, and services company."

Verizon Communications was formed on June 30, 2000, and is one of the world’s leading providers of technology and communications services. Headquartered in New York City and with a presence around the world, Verizon generated revenues of $133.6 billion in 2021. The company offers voice, data, and video services and solutions on its award-winning networks and platforms, delivering on customers’ demands for mobility, reliable network connectivity, security, and control. Verizon India is an innovation hub and strategic center for Verizon, a global leader in next-generation communications technology, including 5G and the internet of things. As an innovation hub, Verizon India is playing an important role in the development of 5G in India.

What 5G Products and Plans does Verizon offer?

Verizon's 5G Ultra Wideband offers ultra-fast speeds, ultra-low lag times, and the capacity to support more devices in the same place and time. Customers that have a 5G smartphone can access the 5G Ultra Wideband network on a 5G smartphone through 5G Ultra Wideband Unlimited plans.

Verizon 5G Nationwide uses a “low-band” spectrum, which allows 5G service to run simultaneously with 4G LTE on multiple spectrum bands. If you move outside Verizon's Ultra Wideband coverage area, your 5G-enabled devices stay on 5G technology using the lower bands.

Verizon 5G Home Internet is a fixed wireless access service, powered by 5G Ultra Wideband, that provides ultra-fast Wi-Fi connections to the home.

From factory floors to customer experiences, 5G Business Internet promises the transformational performance of 5G Ultra Wideband.

Verizon is listed on the New York Stock Exchange and the NASDAQ Global Select Market. Verizon stock began trading on July 3, 2000. Prior to this date, the stock was trading as Bell Atlantic. Institutional investors purchased a net $23.3 million shares of VZ during the quarter that ended June 2019, and now own 64.60% of the total float, a percentage that is typical for companies in the Major Telecommunications industry. Major institutions include financial holdings companies, banks, insurance companies, mutual fund managers, portfolio managers, and self-managed pension and endowment funds.

Verizon Business India is the trading name of a joint venture between Verizon Business and the Videocon Group of Mumbai. Verizon Business holds a 74 percent stake in the joint venture, called Verizon Communications India Private Limited, and does business as Verizon Business India; Videocon Group holds the remaining 26 percent. Verizon India is not listed on NSE or BSE.

The share price as of November 4, 2022, is 37.24 / share. Previously, on November 5, 2021, the share price was 52.24 / share. This represents a decline of 28.71% over that period.

Verizon’s low P/E Ratio indicates that the current stock price is low relative to earnings. P/E Ratio in 2021 was 9.75 which means the P/E Ratio in 2022 has decreased by 1.69. It has a P/B ratio of 1.78, indicating that the company is floating shares at a premium of 1.78 times its book value. The P/S ratio is 1.153 which indicates that the stock is overvalued. As the P/S ratio falls between 1 and 2 we can conclude that the P/S ratio is good.

The company has an EPS of 5.32$ which is relatively low indicating that the firm is not very profitable.

Dividend Yield and Profit Margin indicate decent performance of the company.

Financial Year 2017-18 2018-19 2019-20 2020-21 2021-22

P/E 6.267 16.15 11.51 13.66 9.569

ROE 68.36 29.316 31.49 26.486 27.185

P/B Ratio 3.879 4.595 3.693 3.575 2.632

EPS 10.954 13.24 15.193 16.739 19.819

Investors frequently use the P/E Ratio as a benchmark for stock valuation. The P/E ratio steadily increased in FY 2018-19 but then we can see a sharp decline in FY 2021-22. ROE assesses a company’s profitability in relation to its stockholder’s equity. The ROE of the company went on an increase-decrease trend for the past 5 years. The price-to-book-value ratio was on an increasing trend until 2019-20 when it hit a low point and is still on a decreasing trend in 2021-22.

The Book-value has been an increasing trend and looking at the trend for the past 5 years, we can assume it will keep increasing in the future.

Higher EPS indicates that a company is more valuable. Over the past 5 years, we can see a steady increase in Verizon’s EPS value.

Verizon Business is significantly expanding its presence in India to support the direct delivery of advanced telecommunications services to multinational companies with operations in India, as well as to India-based multinationals. 5G is a once-in-a-generation breakthrough with the potential to transform every aspect of a fully networked economy and Verizon can help this new world reach its full potential. Over the years Verizon has successfully implemented 5G in many countries and now Verizon India is now going to bring advantages like 5G speed, ultra-low latency, massive capacity, expanding coverage, and ultra-fast wireless internet benefits to Indian homes and businesses.

The share price as of November 4, 2022, is 37.24 / share. Previously, on November 5, 2021, the share price was 52.24 / share. This represents a decline of 28.71% over that period. Though there is a decline in the share price recently, but we can expect a positive change in the near future. Verizon delivers seamless experiences for consumers, including content partnerships with Disney, Discovery+, and Apple Music as well as for business customers seeking mobile edge compute solutions. In its consumer and enterprise businesses, Verizon offers clients maximum optionality. Verizon has consistently provided customers with the most reliable 5G network in the United States, and we can expect the same in India soon.

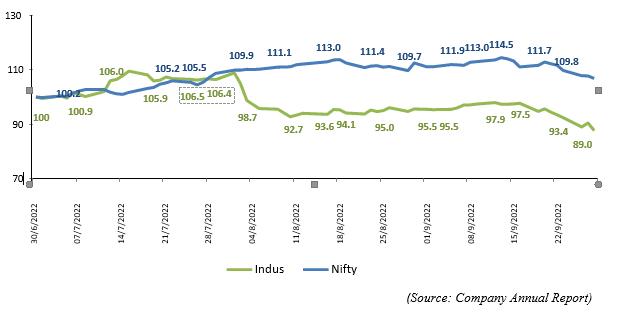

Airtel is the brand name of Bharti Airtel Limited, an international telecommunications services provider with headquarters in New Delhi. With a $60 billion market value, a $600 million net profit, $15 billion in revenue, and 70,000 workers, it conducts business in 18 nations in South Asia, Africa, and the Channel Islands. Airtel currently offers 4G and 4G+ services throughout India and 5G services in a few key cities. On July 7, 1995 — 27 years ago — Sunil Bharti Mittal started it.

India's government has given the go-ahead for 5G spectrum sales there. The first 5G spectrum auction in India started on July 26, 2022, and ended on August 1, 2020, with a total value of Rs 1.5 lakh crore. It began in October 2022. The government claims 5G will be about ten times faster than 4G in India. Reliance Jio, Bharti Airtel, Vodafone Idea, and Adani were the four companies that participated in the bidding. In India's 5G spectrum auction, Mukesh Ambani-led Reliance Jio came out on top, winning 24,740 spectra for Rs 88,078 crore, while Airtel's bids were projected to be above Rs 46,500 crore. While Adani has spent Rs 800-900 crore, Vodafone Idea is paid above Rs 18,500 crore. In India, Airtel has slowly started providing 5G services. The telecom company, Airtel 5G Plus, provides as Airtel 5G Plus, is providing 5G service in eight cities, including Delhi, Mumbai, Hyderabad, Bengaluru, Chennai, Siliguri, Varanasi, and Nagpur. Until the rollout is finished, Airtel customers with 5G-capable smartphones will be able to utilize the most recent network on their current data plans. By March 2023, Airtel hopes to provide 5G coverage in India's main metropolises. Customers of Airtel can use the Airtel Thanks App to check whether the 5G network is available. However, customers will receive an automatic notification via the app if their smartphone is 5G ready. Airtel claims that its 5G service will provide 20–30 times faster high-speed internet and voice call quality than 4G, even though it hasn't yet demonstrated its viability.

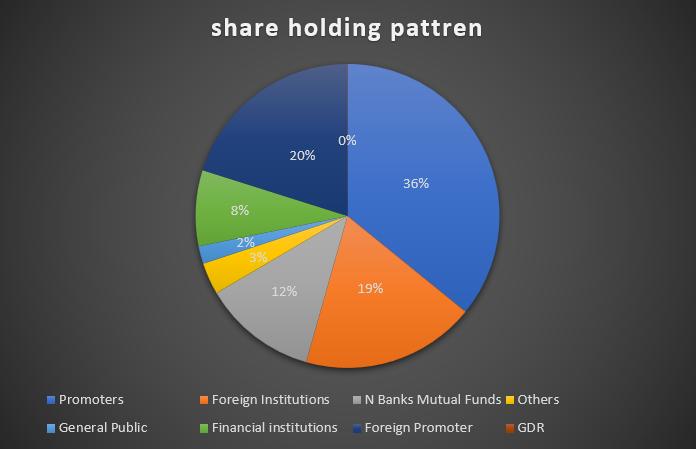

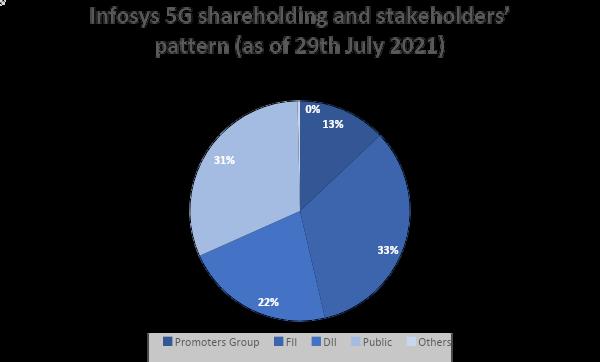

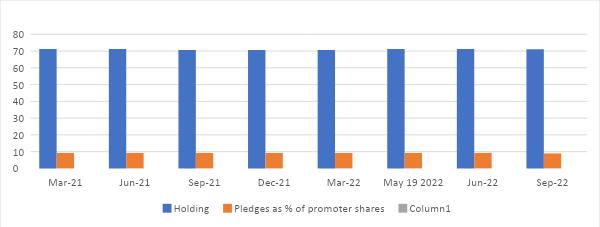

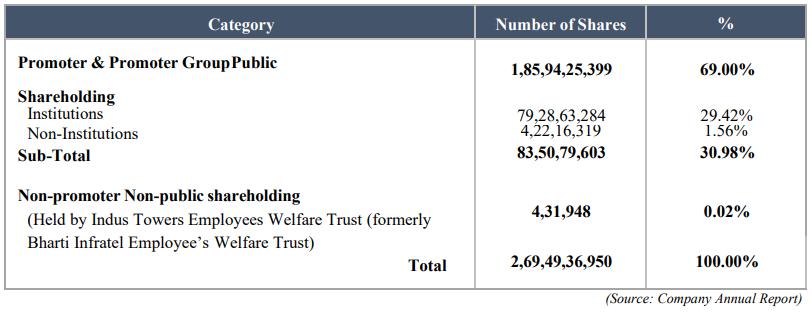

The Shareholding Pattern page of Bharti Airtel Ltd. presents the Promoter's holding, FII's holding, DII's Holding, and Shareholding by the general public.

Holder's Name No. of Shares % Shareholding

Total Shares 5884314930 100% Promoters 2109640745 35.85%

Foreign Institutions 1090783124 18.54%

N Banks Mutual Funds 714824500 12.15% Others 198962600 3.38%

General Public 110656973 1.88%

Financial Institutions 474983884 8.07%

Foreign Promoter 1181599934 20.08%

GDR 2863170 0.05%

Bharti Airtel reported a net loss of Rs 763 crore for the quarter that including 4G services before included 4G services before the launching of 5 g technology (Q2). After making a provision for the unpaid AGR, the company reported a combined net loss of Rs 23,045 crore for the same quarter last year. It sold its 49.5% interest to the Government of Ghana as part of its withdrawal from the Ghanaian telecom sector. As a result, it took an Rs. 184 crore impairment charge.

After getting into 5G services within 30 days of the commercial debut of its 5G network, Bharti Airtel claimed that it had reached 1 million users—even as the network was still being developed. Before this, Airtel indicated that its 5G services would be rolled out across Delhi, Mumbai, Chennai, Bengaluru, Hyderabad, Siliguri, Nagpur, and Varanasi in phases. The number of unique 5G users on its network has surpassed a million; the company reached this milestone less than 30 days after its commercial launch.

The corporation reported its highest-ever revenue growth due to increased customer growth and data usage, primarily to increased customer growth and data usage, the corporation said its highest-ever revenue growth. Compared to a year ago, revenues climbed by 22% YoY to Rs 25,785 crore from Rs 21,131 crore. Consolidated EBIT was significantly higher than experts' expectations, coming in at Rs 4,412 crore (up 121% YoY). The same is true for the cash profit from operations, which increased 32% YoY to Rs 8,048 crore (before derivative and exchange movements).

India is currently experiencing another once-in-a-lifetime crisis. We can propel the country to the top of the new global order for talent, innovation, and commerce as digitization drives our most significant accomplishments and addresses our most considerable difficulties. More importantly, India may be a model for utilizing technology for positive social change. We think the connection will be the most important motivator for economic and social change along this trip, with 5G likely to take the lead. It can build the digital highway that will be the basis for success in the industry 4.0 era. In 2025, 5G can increase the country's GDP by $500 billion. However, given that India is anticipated to have 612 million 5G connections by 2030, according to KPMG, the network needs to be redesigned to achieve this potential.

When it comes to Airtel, to complete a pan-India rollout by March 2024 and increase its market share and revenue, Bharti Airtel has put in motion specific 5G network expansion plans for 5,000 towns and also vital rural areas.

"We will continue to expand our network to link the entire country," the top Airtel official concluded. According to Vittal, CEO of the company, Apple will issue the software update in the first week of November. By the middle of December, all of its devices need to support the provider's 5G services. It is currently offering 5G services at 4G rates, but in the ensuing 6 to 9 months, the company will probably decide how much to charge for the services of the next generation.

There are probably 27 different 5G versions from Samsung. There are presently 16 enabled and prepared models. Rest will come between November 10 and 12. All 17 OnePlus models will function on our network. All 34 models of Vivo and Realme will work on our network. Oppo's 14 models and all 33 of Xiaomi's models are compatible. Apple has 13 models. Around the first week of November, they will release the (software upgrade), and by the middle of December, they should be prepared entirely, "Informed Vittal. 5G smartphones are anticipated to reach a 50% market share by 2023, according to market research firm IDC, which estimates that 5.1 crores were supplied between 2020 and the first half of 2022.

Sterlite Technologies Limited is a global leader in end-to-end data network solutions. The Company designs and deploys a high-capacity converged fibre and wireless networks headquartered in Mumbai with a $10 million profit and $1 billion market capital.

The firm combines the strength of optical, wireless, virtualization, and deployment approach to construct reliable 5G infrastructure for India and the rest of the world. It is one of the first indigenous companies with 100% domestic 5G-ready solutions.

The 5G portfolio from STL meets the requirements of top network builders all over the world. High fibre count (6912 fibre) Celesta Intelligently Bonded Ribbon [IBR] Cable with StellarTM bend-insensitive fibre and optical interconnect products like IBR compatible Splice enclosures for quick and seamless installation and quality make up STL's Opticonn, its optical connectivity solution. High capacity in constrained duct space is essential for 5G networks.

The LEAD 360o deployment technique from STL is enabling 2X quicker fiberization in 5G networks with speedier deployment and an intelligent fibre rollout strategy for backhaul and front haul. Along with its 5G solutions, STL is building a talent pool for a quick and seamless rollout of 5G. An agreement was recently reached between STL Academy, a corporate initiative, and NASSCOM to conduct training programmes in cutting-edge technologies like 5G for 100,000 young people in an effort to turn India into a magnet for digital talent.

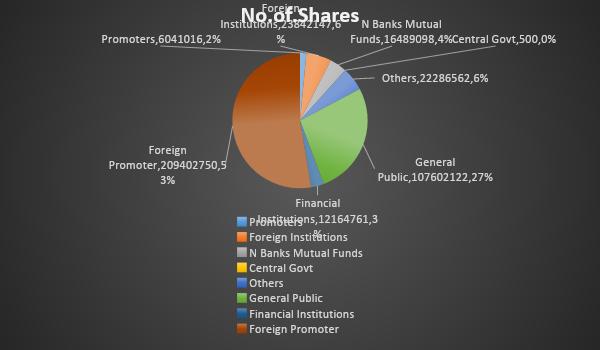

Holder's Name No. of Shares % Shareholding

Total Shares 397828956 100%

Promoters 6041016 1.52%

Foreign Institutions 23842147 5.99%

N Banks Mutual Funds 16489098 4.14% Others 500 0%

General Public 22286562 5.60%

Financial Institutions 107602122 27.05%

Foreign Promoter 12164761 3.06% GDR 209402750 52.64%

Right from its inception, Sterlite technologies have been performing consistently well and In July 2006, STL acquired the transmission line business of SIL to foray into the power transmission cables business. STL has grown over the years to become the largest Optical Fiber and Optical Fiber Cables manufacturer in the country. The company also has a sizeable presence in overseas markets with an established presence in the global optical fiber market.

With a Compound Annual Growth Rate of 20% in the stock price and 15% in the return on equity from the last 10 years, Stl ltd has been Providing fruitful returns to its investors. With its foray into 5G in 2016 Sterlite has been performing extremely well with a

The company has been maintaining a healthy dividend payout of 31.2%

Market Cap of ₹ 6,560 Cr Current Share Price of ₹ 165 ROE of 2.93%

Pondering into new markets expanding its horizons and enlarging its market penetration provides a positive and augmented view for its investors to invest and contribute to even better projects Sterlite is stepping into.

According to Sterlite Technologies' managing director Ankit Agarwal, the worldwide scale-up of networks and the deployment of 5G are expected to result in roughly 20% growth in business across the US, Europe, and India in FY2023.

In order to create virtual network functions for 5G Access Solutions for convergent wirelinewireless technology, Sterlite Technologies Ltd., a pioneer in global data networks, has announced a partnership with VMware, a top innovator in corporate software. When they become available, these solutions will make it simple for large businesses and telcos to deploy sophisticated 5G networks with just a single click.

Vodafone is trialing vehicle-to-vehicle communication and geo-messaging solutions for cars along the A9 in Germany as part of a testbed for future 5G services. The trial is currently running on an advanced version of 4G whilst waiting for the arrival of 5G infrastructure. It enables vehicles to talk to each other and to roadside infrastructure over greater distances and at higher speeds.

The report highlights how 5G can support massive increases in data volumes and provide highly resilient, secure and low-latency communications. The success of 5G will depend heavily on policies and financial incentives that promote the deployment and availability of fiber. Fiber will be critical for moving the massive amounts of data generated by 5G connected devices and objects between cell towers. Without fiber, 5G won't be able to deliver ultra-fast, reliable, lowlatency connections on which new applications and services rely.

In 1982, Vodafone's parent company Racal Electronics was awarded the second UK mobile phone network license. The first non-Racial employee to make a UK mobile call was comedian Ernie Wise, from St Katharine Docks, London on 1 January 1985. Racal Telecom was demerged from Racal Electronics as Vodafone Group in 1991, with Gerry Went as its CEO. In 1996, the company acquired the two-thirds of Talkland it did not already own for £30.6 million. In 1998, Vodafone introduced its Speechmark logo, composed of a quotation mark in a circle, with the Os representing opening and closing quotation marks and suggesting conversation. On 17 December 2001, Vodafone introduced the concept of "Partner Networks", by signing TDC Mobil of Denmark. The new concept involved the introduction of Vodafone international services to the local market, without the need for investment by Vodafone. In 2011, it acquired Readingbased Bluefish Communications Ltd, an ICT consultancy company.

In 2006, Vodafone announced the then-biggest loss in British corporate history (£14.9 billion), and plans to cut 400 jobs; it reported one-off costs of £23.5 billion due to the revaluation of its Mannesmann subsidiary. On 19 December 2006, the company announced the sale of its 25% stake in Switzerland's Swisscom for CHF4.25 billion (£1.8 billion). In 2007, Vodafone launched VIP mobile, a service with Windows Live Messenger and Yahoo! Messenger. On 30 October 2008, the company announced a strategic, non-equity partnership with Mobile TeleSystems group of Russia. On 20 March 2009, it was announced that the group's Luxembourg partner LuxGSM was not renewed.

Vodafone Idea plans to begin the journey to roll out 5G services, matching rivals Reliance Jio and Bharti Airtel. The struggling telecom has offered no specific timeline for the launch or coverage of the ultra-high-speed internet services. Financial pressure has been mounting on cash strapped Vodaphone Idea, despite converting about Rs 16,000 crore of interest liability payable to the government into equity.

Vodafone Idea secured midland 5G spectrum in 17 circles and millimeter-wave spectrum in 16 circles across India. The launch of 5G services in the country will depend on several factors such as the evolution of use cases, customer demand and competitive dynamics, said Ravinder Takkar, the company's non-executive chairman. The telecom operators plan to roll out the technology across the country by the end of this year.

The Central government is reportedly going to become the biggest shareholder of debt-ridden Vodafone Idea Limited. The Centre may hold 33% around in the company and become the single largest shareholder in the third-largest telco in the country. The government is likely to convert VI’s interest liability of ₹16,133 crore into equities.

Vodafone Idea announced Q2FY23 results. Revenue grew to Rs. 106.1 billion, a QoQ growth of 2.0% (YoY growth of 12.8%). EBITDA (per IndAS116) improved to £21.2 billion, up from £18.4 billion in Q1FY23. Board approved issuance of convertible debentures amounting to Rs. 16 billion to ATC Telecom Infrastructure Private Limited (ATC India) subject to conditions precedent.

Vodafone Idea has announced that it will soon begin the rollout of 5G services in India. Aditya Birla Groups chairman, Kumar MangalamBirla, confirmed this at today’s 6th Edition of India Mobile Congress. As of now, the telecom operator hasn’t revealed any details on when it plans to release 5G in India - Mumbai, Delhi, Bangalore, and Varanasi will get 5G today.

Company was established in 1985 and was named Qualcomm for “Quality Communication”. For trucking companies, Qualcomm makes the Omnitracs satellite communications system.

In three areas, Qualcomm has been developing technologies for the upcoming 5G standards set of services for Internet of Things applications and radios that would use bandwidth from any network it has access to, combining smaller pieces to create larger spectrum ranges. In October 2017, a prototype of Qualcomm's first 5G modem chip was demonstrated. The announcement came in October 2016. In July 2018, the first 5G antennas from Qualcomm were made public. In order to commercialize 5G technology, Qualcomm has partnerships with 19 mobile device manufacturers and 18 carriers as of 2018. By the end of 2019, a number of phones featured QUALCOMM's 5G technology. Every day, people engage with goods and technology made possible by Qualcomm, which enables the intelligent connection of everything in the world. There powerful connectivity solutions keep people connected even in remote areas. The connected intelligent edge is powered by Qualcomm 5G and AI innovations. there technologies are in and behind the innovations that provide significant value to billions of people worldwide. These products and technologies include 5G-enabled smartphones with professional-level cameras and gaming devices.

0.14%

% of shares held by all insiders 74.21%

% of shares held by institutions 74.32% % of float held by institutions 3012

Number of institutions holding shares

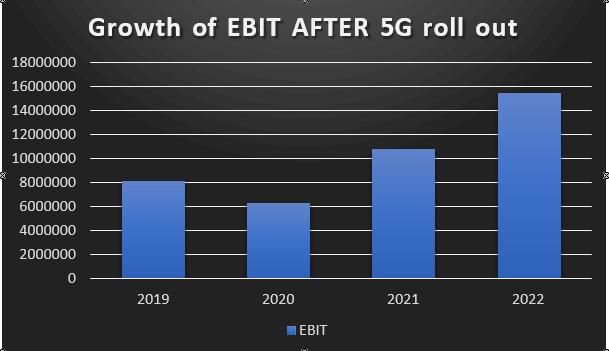

As it began rolling out 5G in 2019, the company's EBIT began to rise. There is no doubt that they saw a decrease in EBIT in 2020 as a result of the COVID-19 pandemic; however, the following year, they saw a steady rise until 2022, and they also have great plans for 5G, which will allow them to increase the EBIT even further.

Qualcomm Technologies, Inc. and Vodafone announced the next phase of their long-standing partnership that is driving innovations in mobile communications in Europe. The two industry leaders plan to work together to develop, test, and integrate next-generation 5G distributed units (DUs) and radio units (RUs) with Massive MIMO capabilities. In the end, they want to make Open RAN available for commercial use in Europe.

Chief Financial Officer of Qualcomm, Akash Palkhiwala, stated that the company anticipates growth driven by its robust design win pipeline for 5G and WIFI seven platforms across handsets, automated, and internet of things.

At its first Automotive Investor Day, the company said that its automotive design-win pipeline has grown to $30 billion, thanks to the auto industry's increased use of its Snapdragon® Digital ChassisTM solutions. Since the company's fiscal third quarter results were announced, the increase is greater than $10 billion. More specifically, Qualcomm Technologies, Inc. has become the preferred partner of the automotive industry for next-generation vehicles, and the expanded pipeline is the result of significant design wins with automakers and Tier-1 suppliers. In addition to it, IT services firm Cognizant is collaborating with Qualcomm to open a 5G experience center in Atlanta.

Tejas Networks is an optical, broadband, and data networking products company based in India. The company designs develop and sell its products to telecom service providers, internet service providers, utilities, security, and government entities in 75 countries. The company has built many IPs in multiple areas of telecom networking and has emerged as an exporter to other developing countries including Southeast Asia and Africa.

The company is an incumbent supplier to all major telcos in India and expects to see an uptick in FY23 business, based on the company's wins in new application areas such as FTTX, OTN/DWDM, and PTN.

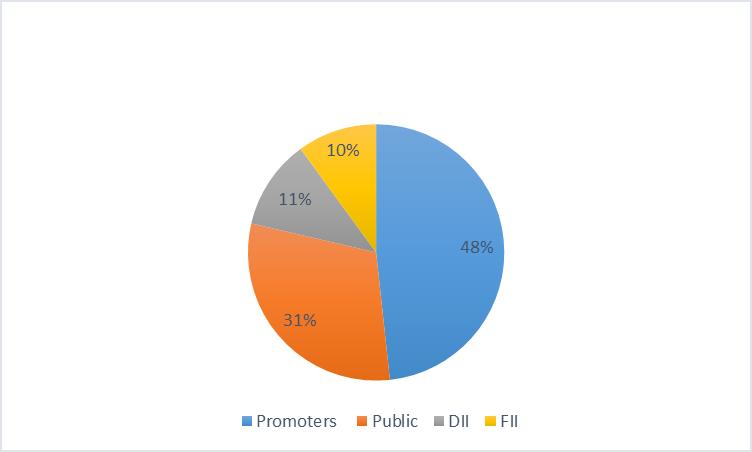

48% of the company is owned by the promoters whereas 31% is owned by the public followed by 11 percent by DII and 10 percent by FII.

The company earns 64% of its revenue from India and the other 36% from international operations. During the year, the company witnessed a strong demand for its products and solutions in the form of new order wins, however, revenue growth was relatively modest due to global chip shortages that impacted our manufacturing operations.

Financial Year 2017-18 2018-19 2019-20 2020-21 2021-22

P/E 31.2 10.6 -1.2 39.5 -77.9 ROE 9% 11% -22% 3% -4%

P/B Ratio 2.88 4.6 3.69 3.58 2.63

EPS 11.73 16.06 -25.72 4.03 -5.48

From the data we can infer that the company has been struggling with the generation of revenue due to the global chip supply shortage and the covid 19 pandemic, however, the company is expected to bounce back this year. Because of this the P/E and ROE of the company is suffering. In terms of the Price to Book ratio shows that the share is available at a good price for the investors since the P/B ratio has been decreasing continuously.

In FY22, Tejas Networks was selected by Airtel as a DWDM equipment supplier for their backhaul capacity upgrades as they prepare for 5G rollouts and as a GPON equipment supplier for their fiber broadband deployments. Post 5G spectrum auctions, the company expects to see a multi-year Capex spend cycle for building both wireline and wireless infrastructure. Besides deployments of next-generation radio products, 5G would also require a significant increase in cell-site fiberization and augmentation of optical backbone capacities which augur well for the business.

During the year the company invested 24% of its revenues (on a fully expensed basis) in R&D, making it one of the top spenders of R&D amongst listed companies in India. In the wireline segment, in order to cater to the ever-increasing demand for carrying high-speed data, they have strengthened their optical transport portfolio with 400G/600G speed interfaces, which will enable customers to build multi-terabit backbone networks. Through its acquisition of Saankhya Labs in July 2022 the company has integrated the R&D teams of Saankhya and Tejas and the focus of Saankhya R&D team now is to strengthen and accelerate the development programs for 5G, radio, cellular broadcasts, satellite communication and other areas like semiconductor chip design.

Himachal Futuristic Communications Limited, popularly known as HFCL, was founded in 1987. It is an Indian telecom corporation that also engages in business in turnkey solutions and research & development. HFCL is traded on the National Stock Exchange (NSE) as well as the Bombay Stock Exchange (BSE). It offers services in telecommunications, security, railroads, textiles, and other industries.

In the past three decades, HFCL has provided cutting-edge, innovative, and competitive products and solutions in the high-tech telecommunications infrastructure sector. These projects include the implementation of satellite communications, wireless spectrum management, CDMA and GSM networks, and DWDM optical transmission networks.

The company's main areas of focus include the railways, homeland security, smart cities, and defense, all of which have tremendous growth potential. Government programs like Make in India, Smart Cities, Defense Self-Sufficiency, Digital Security, and others have accelerated HFCL's growth. HFCL has amassed a knowledge base of building robust telecom networks across all topographies as a result of its substantial experience in the telecom infrastructure space, a skill that is especially important to Indian topography. The fabrication of defense gear and the turnkey installation of a communication and signaling network for railroads are two recent additions to HFCL's business portfolio.

The next generation of wireless communication, or 5G, connects people, machines, businesses, and other objects. The potential of 5G to give higher multi-Gbps data speeds, enormous bandwidth, and network capacity, ultra-low latency, improved availability, and more reliability in comparison to existing mobile networks is what distinguishes it from other mobile networks in India and other countries.

As a result, HFCL is creating a wide variety of 5G-related telecom equipment, such as the wireless access network 8T8R macro radio unit (see chart). A 120 Gbps cell site router is an additional item that aids in aggregating traffic from the new 5G sites to the backbone (a highspeed line forming the fastest path through the network). Additionally, the business is working to create international system integration services for 5G private networks.

HFCL anticipates a 15-20% year-over-year (y-o-y) revenue growth, primarily fueled by rising OFC demand and the creation of 5G-focused equipment. In the quarter that ended in September, HFCL reported total revenues up 10.3% QoQ to Rs 1,182 crore, and net profit increased by over 60% to Rs 84.3 crore in the results reported on October 18. After the earnings report, the HFCL shares increased 1.7% to an intra-day high of Rs76.8 at the NSE.

A range of 5G solutions for the Radio Access Network (RAN) and Transport are now being invested in by HFCL. Due to the much higher bandwidth per 5G cell site, densification of cell sites in 5G, Ethernet, and IP-based transport, and new services with strict latency requirements like drones, autonomous vehicles, and robotics-based precision manufacturing, communication service providers (CSPs') transport networks need to be modernized.

To assist CSPs in modernizing their transport network, HFCL is also creating 5G fronthaul, mid haul, and backhaul transport products.

Promoters' holding will continue at 39.20% in the third quarter of September 2022. The number of FII/FPI investors climbed from 138 to 142 in the September 2022 quarter, while their holdings declined from 6.81% to 6.72%.

In the third quarter of September 2022, mutual funds' holdings rose from 1.86% to 2.41%. The number of MF schemes is unchanged in the September 2022 quarter at 21. Institutional investors grew their stakes from 8.84% to 9.30% in the third quarter of 2022Sep.

Wipro is a significant partner for HFCL because of its top-notch engineering, extensive experience with hardware design, embedded software, and internal certification and compliance labs, according to Mahendra Nahata, managing director of HFCL (Tarang). The extensive portfolio of 5G transport devices being developed by HFCL will give CSPs the ability to update their backhaul networks and get them ready for 5G services.

The homegrown company said on Thursday that it has worked with Qualcomm Technologies to design and build 5G outdoor small-cell products. In keeping with its 5G strategy, HFCL said in a statement that its investment in 5G Outdoor Small Cell products will enable a speedier rollout of 5G networks, a better 5G user experience, and more effective use of the 5G spectrum.

To produce telecom items including routers, antennas, and 5G radio equipment, it has agreed to invest Rs 450 crore in the design-linked incentive (DLI) scheme of the Department of Telecommunications (DoT). Due to its in-house product design and manufacture, the company has switched to the DLI plan.

The 5G Outdoor Small Cell from HFCL supports both 5G Non-Standalone (NSA) and Standalone (SA) modes and is an All-in-One Small Cell. According to the business, it provides multiple deployment choices and may be installed on street poles, building walls, and rooftops to bridge network coverage gaps, cover traffic hotspots, and enhance coverage at public locations like train stations, stadiums, and airports.

According to global market research company Fortune Business Insights, the global market for 5G small cells will grow at a CAGR of 54.4% from $740 million in 2020 to $17.9 billion in 2028.

The world's top inventor in wireless technology, according to Mahendra Nahata, Managing Director of HFCL, Qualcomm Technologies, is the partner with whom HFCL is pleased to collaborate on the 5G Small Cell. He added that in order for operators to roll out 5G networks in India seamlessly, outdoor small cells must be added to their macro networks. With India and other regions in mind, Qualcomm Technologies can more swiftly create a portfolio of small cell devices for both sub-6 GHz and millimeter wave using their cutting-edge and fully integrated 5G small cell platform.

"5G

On October 12, 2015, Dell announced that it would buy EMC Corporation, the highest-priced tech purchase at the time. $45.9 billion in debt and $4.4 billion in a common stock were involved in the merger. Texas serves as the home office for the American global technology corporation Dell Technologies Inc. It was created as a result of the merger of Dell and EMC Corporation in September 2016. 80% of the equity in VMWare was owned by EMC. In order to become a publicly traded business on December 28, 2018, Dell Technologies repurchased shares that reflected VMWare's financial health. Dell is traded as "DELL" on the New York Stock Exchange. About 50% of Dell's $101.224 billion in annual revenue comes from the US, according to corporate figures.

In the areas of scale-out architecture, integrated infrastructure, and private cloud computing, Dell offers a broad range of products. Personal computers, servers, mobile devices, televisions, computer software, network security, and information security services are all examples of technological devices. Dell Technologies, a pioneer in digital transformation, will contribute to the definition of the underlying infrastructure technology that will power and propel the revolution of the 5G network-connected everything.

5G will be a crucial component of our data-driven future as the first mobile infrastructure developed in the cloud era. In 2021, 40% of all networks will be covered by 5G, processing 255% of all mobile traffic worldwide, according to Dell. Latitude laptops, which were first sold in early 2021, were the first laptops to be sold with 5G network adapters.

Dell knit all of this together in the form of two strategic initiatives – it's Open Network Ecosystem and Cloud-Native Infrastructure Foundation.

The Open Network Ecosystem aims to offer tried-and-true full-stack reference architectures for 5G core deployments with partners Nokia, and edge services with partners Intel. Dell places a high priority on enabling private wireless deployments through its edge services strategy. Dell announced a lab effort to provide a carrier-grade testing environment to enable multi-vendor configurations and CI/CD pipelines, as well as an incubator for the investigation of new platforms and service offerings, to complete the ecosystem initiative. When it comes to the continuum of cellular networks, Dell has made some excellent partner selections.

is the limitless network the data era demands."

The goal of the Dell Cloud Native Network Infrastructure Foundation is to give mobile network operators flexibility and choice while also delivering open software solutions. A software platform developed by Dell called Project Metal weaver enables zero-touch provisioning, remote diagnostics, telemetry, and streamlined cloud-native lifecycle management. Under the hood, Project Metal weaver makes use of an API-driven infrastructure that should make integration simple, simplify provisioning with intent-based automation, provide users with more choices with modularity, and make it easier to deploy a network as a whole.

Market capitalization, commonly called a market cap, is the total market value of a publicly traded company's outstanding shares and is commonly used to measure how much a company is worth. As of November 2022, Dell has a market cap of $ 28.58 billion. This makes Dell the world's 561st most valuable company by market cap. Fair Value is the price that should be paid for a company's shares based on its earnings and growth rate. Currently, one share of DELL stock costs around $38.50. The most recent closing price is multiplied by the most recent earnings per share (EPS) figure to determine the price-to-earnings ratio. The most popular valuation metric is the PE ratio, which offers a straightforward approach to determining whether a stock is fairly valued or not. As of November 4, 2022, Dell's PE ratio is 5.45.

Before the rollout of the 5g network, Dell's stock price in the year 2019 was about 25.75 USD. After the launch of 5g in December 2021, they observed an upward trend in the share price of Dell stock, which reached a high of 56.43 USD. However, after a while, there was a gradual decline in the share price, which is now 38.26 USD as of November 2022, almost 3 years after the launch of 5g networks.

The annual net income increased by 11.67% as of 1/30/2022 from 1011.97 trillion to 906.21 trillion. The company had a complete decline in 2022, the year that the 5G network was released when its gross profit dropped to 218.91 trillion USD from 250.53 trillion USD. The company's current net income has increased from -191,000 USD to 4,659,000 USD. Restructuring at the top of the hierarchy would also be advantageous for the business. Common Stockholders' Net Income increased from -2,310,000 USD to 5,428,000 USD. Dell has been able to significantly boost the value of its shares thanks to a well-thought-out strategy for growth and profitability. Dell Technologies fundamental earnings per share (EPS) changed from -3.22 in 2019 to 7.30 USD in 2022. Earnings before Interest were reported at 127,000 USD in 2019; by 2022, they had grown to 7,465,000 USD.

From the radio through the core, 5G will also feature the first entirely software-defined end-toend architecture. Dell Technologies, which provides the majority of the world's infrastructure, has mastered software defined in the data center. As the leading supplier of OEM Solutions, Dell is well-positioned to offer the newest products and support for our telecom partners as they take this idea all the way to the Edge.

Off-the-shelf commercial infrastructure, high-touch engineering, knowledge of telecom solutions, adaptability, and the proper partners, as well as our first-rate international support and supply chain, are all advantages. In actuality, network transformation is particularly well suited to the OEM method, especially the hybrid model. Based on a thorough specification, or more accurately, a bill of materials provided by the OEM partner, the end client can in this case acquire the infrastructure directly from Dell EMC OEM.

This shift won't happen quickly or as a straightforward 5G upgrade. Leading service providers, network and technology vendors, as well as organizations that set industry standards, are already cooperating with Dell EMC OEM.

Following 1G, 2G, 3G, and 4G networks, it is a new international wireless standard. In order to connect practically everyone and everything together, including machines, objects, and gadgets, 5G enables a new type of network.

The theoretical top speed of 5G technology is 20 Gbps, compared to 1 Gbps for 4G. Lower latency is another benefit of 5G, which can enhance the performance of corporate applications and other digital experiences (such as online gaming, videoconferencing, and self-driving cars). New user experiences are enabled by increased performance and efficiency, which also connects new industries.

Reliance Jio plans to roll out 5G services in Delhi, Mumbai, Chennai, and Kolkata in October 2022. By the end of 2023, the business will have 5G coverage over the entire nation.

Reliance Industries Limited with its headquarters in Mumbai is a multinational corporation in India. Corporation in India. Energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles are just a few of the many industries it is involved in. One of India's most lucrative businesses, Reliance is also the country's biggest publicly traded business in terms of market capitalization and revenue.

Reliance Industries' market valuation as of November 2022 is $214.01 billion. According to the data, Reliance Industries is the 36th most valuable corporation in the world by market cap. The market capitalization, often known as market cap, is a measure of a firm's value that takes into accounts all of the outstanding shares of a publicly listed company.

The shareholding pattern of Reliance Industries Limited as on 30th September 2022 is that the Promoters hold 50.57%, Foreign Institutions- 23.53%, Retail, And Others hold 11.79%, Other Domestic Institutions hold 8.43% and Mutual Funds hold 5.68% of the total shares.

Reliance JIO is not publicly traded. It belongs to the Reliance Industries organization. RIL's JIO upended the telecom sector in 2016. They provided 4G services through JIO in India at rates that were 95% less expensive than those of its rivals. With its SIM cards, the company provided free phone calls as well as related services like over-the-top (OTT) platforms.

In India, JIO today appears to be the market leader for 5G service providers. It has created a custom, cloud-based, and digitally managed 5G system. The company has tried out drones with 5G connections.

Reliance Industries Limited has announced its results for the year ended March 2022.

Operating income during the year rose 53.9% on a year-on-year (YoY) basis.

The company's operating profit increased by 32.4% YoY during the fiscal. Operating profit margins witnessed a fall and stood at 18.7% in FY22 as against 21.7% in FY21.

Depreciation charges increased by 12.1% and finance costs decreased by 31.2% YoY, respectively.

Other income declined by 12.8% YoY.

Net profit for the year grew by 26.9% YoY.

Net profit margins during the year declined from 13.5% in FY21 to 11.1% in FY22.

The company's current liabilities during FY22 stood at Rs 3,087 billion as compared to Rs 2,776 billion in FY21, thereby witnessing an increase of 11.2%.

Long-term debt stood at Rs 1,877 billion as compared to Rs 1,637 billion during FY21, a growth of 14.7%.

Current assets fell 7% and stood at Rs 3,470 billion, while fixed assets rose 22% and stood at Rs 11,516 billion in FY22.

Overall, the total assets and liabilities for FY22 stood at Rs 14,986 billion as against Rs 13,201 billion during FY21, thereby witnessing a growth of 14%.

RELIANCE IND.'s cash flow from operating activities (CFO) during FY22 stood at Rs 1,107 billion, an improvement of 310.5% on a YoY basis.

Cash flow from investing activities (CFI) during FY22 stood at Rs -1,101 billion on a YoY basis. Cash flow from financial activities (CFF) during FY22 stood at Rs 173 billion on a YoY basis.

Overall, net cash flows for the company during FY22 stood at Rs 188 billion from the Rs -135 billion net cash flows seen during FY21.

The Jio 5G Plans are going to be affordable so that the people of India may access the fastest internet ever. The Reliance Telecom Company built all new towers beginning in the major cities, then on to smaller cities and towns, and finally to outlying villages. Jio's 5G Postpaid and Prepaid Plans will have a starting price of Rs 239 and deliver internet speeds of up to 1 Gbps. In India, 5G Bands N28, N5, N3, N78, and N258 all operate at various bandwidths.

As per the trials the Jio 5G Plans speed is recorded up to 42.02 Mbps, 485.22 Mbps, and 513.76 Mbps.

By the end of December 2023, every town, talukdar, and tehsil should have access to the Jio True 5G services. Furthermore, Jio 5G won't rely at all on the 4G network because it will be based on a Standalone 5G network. As a result, connectivity will be more rapid and latency will be decreased. In addition, the Jio 5G is expected to deliver speeds of over 1Gbps and be entirely manufactured in India.

India is experiencing a significant increase in digital connectivity because of the less expensive cell phones and bandwidth. Only 5G today has the capacity to successfully meet this demand. Telcos have already begun to move in this direction. Although India fell behind its peers in the adoption of previous-generation technologies, metro areas are expected to have a 5G rollout by the end of 2022.

Just as 4G ushered in an era of mass video adoption on social networks, the advent of ridesharing, and other brand-new use cases and business models born out of fast network speeds, 5G has the potential to revolutionize entire industries and transform society in ways we can’t yet conceive. T-Mobile US Inc. is an American wireless network operator which was founded in 1994 as Voice Stream Wireless before Deutsche Telekom purchased it in 2001 and renamed it after its T-Mobile brand. T-Mobile led the network charge with America’s first nationwide 5G network—but its leadership didn’t stop there.

T-Mobile is now America’s largest and fastest 5G network - a network that covers more than 315 million Americans across 1.8 million square miles. That’s 5G in all 50 states, from big cities to small towns. T-Mobile’s multi-spectrum 5G network delivers both Extended Range and Ultra Capacity 5G, delivering 5G speeds in most places. Not only is T-Mobile the 5G leader in coverage and speed, but they were also the first to introduce standalone 5G nationwide, and continue to enhance it.

21-Dec 20-Dec 19-Dec 18-Dec 17-Dec

Gross profit margin 54.31% 58.67% 58.84% 57.62% 56.39% Operating profit margin 8.60% 9.70% 12.72% 12.26% 12.04% Net profit margin 3.77% 4.48% 7.71% 6.67% 11.17%

Before the rollout of the 5g network, T - the mobile's stock price at the beginning of the year 2019 was about USD 66.83. After the launch of 5g in December 2019, they observed an upward trend in the share price of T-mobile's stock, which reached a high of 78.42 USD and continued to increase showing upward and downward movement during some periods. Its current stock price stands at 149.39 USD.

T-Mobile's US net income for the twelve months ending September 30, 2022, was $1.535B, a 54.21% decline year-over-year.

T-Mobile is delivering game-changing Ultra Capacity 5G to people across the country at an unprecedented pace, putting itself in a network leadership position with a two-year head start on the competition. And that gap is only getting wider as they speed up. The secret to TMobile’s Ultra Capacity 5G – the 5G that delivers super-fast speeds to a lot of people – is the mid-band 2.5 GHz spectrum. When other U.S. operators went all in on millimeter wave (mmWave), T-Mobile executed a multi-band spectrum strategy using low-band Extended Range to blanket the country and Ultra Capacity to bring fast 5G speeds to the maximum number of people – now covering 200 million.

T-Mobile is more than a year ahead of its competition with the deployment of its Ultra Capacity 5G mid-band spectrum and is rolling it out at an unprecedented pace. While T-Mobile already has the best 5G coverage in the nation, the company has also made considerable gains in speeds thanks to the rapid nationwide rollout of its mid-band 5G network, which delivers a real, meaningful performance boost.

Over the next six years, T- Mobile is working to build the highest capacity network in U.S. history. Their goal is to have their 5G network cover 97% of the nation’s population within three years and 99% of Americans within six years, ensuring that T-Mobile will help businesses not just stay competitive, but will help them innovate beyond what’s ever been possible. Also, T- Mobile believes in Empowering the next generation of startups. They are dedicated to unlocking the full potential of tech startups, T-Mobile ventures fund early and emerging growth companies developing transformative 5G products and services.

With the fastest 5G speeds in most places, T-Mobile's multi-spectrum 5G network is better for business. Large or small, rural or urban, T-Mobile can help your business stay ahead of the curve. But their 5G network leadership is just part of how they help you thrive.

An American telecommunications business with its corporate headquarters in New York City is called Verizon Communications Inc., or Verizon. Bell Atlantic Corporation and GTE Corporation merged to become Verizon, established on June 30, 2000, and registered in Delaware (formerly General Telephone & Electronics Corporation).

American telecoms giant Verizon Communications Inc. is a leading global supplier of goods and services in the fields of technology, communications, information, and entertainment. When the business was first established in 1983 as Bell Atlantic, its name was changed to Verizon Communications in 2020. Verizon has a presence all over the world and is headquartered in New York City. The company's primary goals are the growth of society, the economy, and the environment. The company's consumer division focuses on goods and services that cater to consumers.

Verizon offers its clients all network connectivity and security-related goods and services. Additionally, it offers communications services including data, video, audio, conferencing, etc. as part of its extensive line of consumer goods. Verizon is a world leader today, giving individuals, companies, the government, and wholesale clients access to broadband and other wireless and landline communications services. At the end of 2012, the company employed 183,400 varied individuals to serve clients in more than 140 nations. Verizon's mobile network will have 120.9 million users by the end of the fourth quarter of 2020, making it the biggest wireless provider in the country. In the United States, Verizon is the only telecom company that is publicly traded and has two stock exchanges: the New York Stock Exchange (NYSE) and the New York Stock Exchange (NASDAQ) (secondary).

In terms of revenue, Verizon is the second-largest telecommunications operator. The company earned $133.6 billion in revenue in 2021. Verizon's market value as of November 2022 is $156.40 billion. This places Verizon as the 58th most valuable firm in the world, per the data. Market capitalization, sometimes known as a "market cap," is the sum of the market values of all the shares of a publicly listed firm that are currently outstanding. It has an 8.1 P.E. ratio. Verizon Communications Inc. stock is currently trading at $37.24.

Future technology is expected to be transformed by 5G technology; applications range from augmented reality and autonomous vehicles to smart cities and remote surgery. Today's consumers may benefit from near real-time experiences with tremendous speed, extremely low latency, and enormous capacity thanks to Verizon's 5G Ultra-Wideband network. This entails enabling mobile workforce applications and downloading videos in seconds as opposed to minutes.

Verizon set the bar high for 5G innovation and set the pace for its development and deployment. To advance the entire 5G ecosystem, it established the 5G Technology Forum (5GTF) in 2015, bringing together significant partners like Ericsson, Qualcomm, Intel, and Samsung.

With aspirations to deploy 5G in more than 30 American cities by the end of the year, Verizon launched 5G in parts of many cities in the first half of 2019. Parts of Minneapolis and Chicago now get its services. Customers in those cities were the first in the world to connect a 5G network-capable smartphone.

Before the rollout of the 5G network, Verizon's stock price in the year 2018 was USD 46.8365. An rising tendency in the share price is observed in 2019 or following the launch of the 5G network. The share price rose 13.87%, or to USD 53.3314.

Verizon considers technology should enable individuals to do more good deeds as well as more. This concept is what brought Verizon executives to the UN General Assembly in New York this week to talk about how mobile connectivity might help foster global equality and a healthier planet.