TIMES

Indices play a crucial role in gauging the performance of the Indian stock market. They offer investors a concise representation of how a specific segment or the overall market is behaving.

Major Stock Exchanges:

• Bombay Stock Exchange (BSE): Established in 1875, the oldest stock exchange in Asia. Its flagship index is the BSE Sensex.

• NationalStockExchange(NSE): Founded in 1992, the leading stock exchange in India. Its benchmark index is the Nifty 50.

Popular Indices:

• BSE Sensex: Tracks the performance of the top 30 blue-chip companies listed on the BSE. Represents approximately 70% of the market capitalization of the BSE.

• Nifty50: Represents the top 50 companies by market capitalization and liquidity on the NSE. Covers around 65% of the market capitalization of the NSE.

• Nifty Next 50: Tracks the next 50 companies after the Nifty 50 in terms of market capitalization and liquidity on the NSE.

• Nifty 200: Covers the top 200 companies by market capitalization and liquidity on the NSE.

• S&P BSE All-Cap: A broader index encompassing over 2000 companies across the BSE's large, mid, and small-cap segments.

Types of Indices:

• Market Capitalization-based: Indices like Sensex and Nifty are based on the market capitalization of the included companies.

• Sectoral Indices: Focus on sectors like banking, IT, and infrastructure.

• Thematic Indices: Track companies based on themes like sustainability or clean energy.

Importance of Indices:

• Benchmarking Performance: Investors compare their portfolio returns against index performance to evaluate their investment strategies.

• Market Trend Assessment: Indices provide insights into the overall market sentiment and direction.

• Diversification Tool: Sectoral and thematic indices help investors diversify their holdings within specific sectors or themes.

In the last five years, the Indian stock market has outperformed many major markets around the world. The following is a breakdown of its performance:

Market as a Whole:

• Nifty 50: Over the last five years (as of December 26, 2023), the benchmark index, which represents the top 50 companies by market capitalization, has delivered an annualized return of 18.8%. This is significantly higher than major developed market returns such as the S&P 500 (6.9%) and the Nikkei 225 (12.1%).

• BSE Sensex: The Bombay Stock Exchange's flagship index also delivered strong returns, with an annualised gain of 17.5% over the last five years. This highlights the Indian market's overall positive performance.

Sectoral Performance:

IT Sector: The IT sector has been a key driver of the market's growth, with the Nifty IT index delivering an annualized return of 27.8% in the last five years. This is due to factors like India's strong IT talent pool, growing domestic demand, and the increasing adoption of technology globally.

Pharma Sector: The pharma sector has also been a bright spot, with the Nifty Pharma index delivering an annualized return of 21.6% in the last five years. This due to factors like India's growing healthcare market, increasing government spending on healthcare, and the rising demand for generic drugs.

Key

• Strong Economic Growth: India has been one of the fastestgrowing major economies in the world, with GDP growth exceeding 7% in recent years. This strong economic growth has fuelled corporate earnings and boosted investor sentiment.

• Government Reforms: The Indian government has implemented various reforms aimed at improving the business environment and attracting foreign investment. These reforms have helped to make the Indian market more attractive to investors.

• Rising Disposable Income: Rising disposable income in the hands of Indian consumers has led to increased demand for goods and services, which has benefited companies across various sectors.

• In 2023, the Indian stock market displayed dynamic fluctuations influenced by both domestic and international factors. The year began with a bullish rally but encountered a corrective phase in October, creating a challenging period for blue-chip stocks. November saw remarkable milestones, with BSE Sensex and NSE Nifty reaching unprecedented highs.

• The market's year-on-year return for 2021 stood at an impressive 21.5%, outperforming the global average. Strong corporate earnings, economic recovery, and supportive policies contributed to this robust performance. However, challenges included elevated inflation, rising interest rates, geopolitical tensions, and valuation concerns.

• As the year concluded, experts expressed caution for 2024, citing potential headwinds like slowing growth, regulatory uncertainties, and increased competition from emerging markets. The Indian market exhibited resilience, paralleling global trends and surpassing Hong Kong to become the seventh-largest in the world.

• The events that are to be noted included the Nifty 50 index reaching a historic high and a significant market valuation milestone. By the end of November, the Nifty 50 index showed a remarkable year-to-date performance, surging by 16%.

• Despite a gradual economic slowdown, market experts predicted a 9% rise in India's stock market by the end of 2023. The Reserve Bank of India's (RBI) decision to maintain the repo rate at 4% and adopt an accommodative stance on December 8, 2023, was pivotal.

• The accommodative stance signals the RBI's commitment to supporting economic growth by boosting liquidity and encouraging borrowing. Maintaining the repo rate at 4% suggests a pause in the current rate cycle, influencing borrowing costs and economic activity. This stance is expected to stimulate investment and consumption, fostering a positive market sentiment.

India has emerged as the fifth-largest equity market globally, showcasing relative resilience compared to the impact of the Covid pandemic and the Ukraine war on globalequities in 2022. The country's share in global market capitalization has reached an all-time high of 3.5%, rebounding from a low of 2.05% in 2020 after the pandemicinduced market collapse. This outperformance is attributed to India's robust economic growth, leading to increased attractiveness for investors. Despite short-term decoupling from global markets, the absolute performance of the Indian market has been nearly flat. However, high valuations pose a risk, especially in the face of adverse events, with potential vulnerabilities including elevated US interest rates and a strong US dollar. Foreign institutional investments (FIIs) have played a significant role, driving Indian markets since August, and the MSCI India index has outperformed the MSCI Emerging Market index by 27%.

India has rebounded from the COVID-19 pandemic shock to become the fifth-largest economy, with a strong 7.8% GDP growth in the first quarter of FY23. The services sector, driven by pent-up demand and vaccination coverage, is anticipated to be a key growth driver in 2022–2023. In April-September 2023, India's service exports reached US$ 164.89 billion, while overall exports (services and merchandise) stood at US$ 376.29 billion. The government's future capital spending is expected to be supported by factors like tax buoyancy, low tax rates, and digitization. Increased investment in infrastructure and assetbuilding projects, along with a revival in agriculture, is set to boost growth. India's status as the fastest-growing major economy is reinforced by its robust democracy and global partnerships, making it an attractive investment destination amid global unpredictability.

While the Indian stock market has performed well in the last five years, some challenges could impact future performance. These include rising global interest rates, geopolitical tensions, and potential domestic economic slowdown. However, India's long-term growth prospects remain strong, and the stock market is expected to continue to deliver attractive returns for investors over the long term. Investors are keenly watching for future rate cuts, contingent on economic conditions and inflation trends remaining within the central bank's comfort zone. Global factors, including the U.S. Federal Reserve's decisions and global economic conditions, also impact India's monetary policy.

The Indian derivative market is a vital component of the financial landscape as it allows investors and traders to manage risk, speculate on prices, and develop various investment strategies. The Indian derivatives market has expanded rapidly in recent years, with a yearly

increase of more than 20% on average. The Indian derivatives market is young relative to established markets, but it has enormous growth potential in the future. Technological advances and regulatory initiatives are expected to improve market transparency and efficiency even further. The Indian derivatives market has grown significantly

since its inception in 2000, overtaking the cash market in terms of volume and contracts traded. The derivatives market's share of the total financial market turnover in India has almost doubled in the past decade, now exceeding 25%.

Products of derivative Markets.

Derivatives derive their value from an underlying asset, which can be stocks, indices, commodities, currencies, or even interest rates. The introduction of new products and reforms by SEBI (Securities and Exchange Board of India) has further boosted market activity.

Exchange Traded Derivatives (ETDs): These are standardized contracts traded on the exchange itself. Examples include futures and options on stocks, indices, and commodities.

• Equity Derivatives:

1. Futures: Contracts to buy or sell a specific stock/index at a predetermined price and future date.

2. Options: Right, but not obligation, to buy or sell a stock/index at a set price by a certain date.

3. Index Derivatives: Futures and options based on major indices like Nifty 50, Nifty Bank, etc.

• Commodity Derivatives: Contracts based on underlying assets like agricultural commodities, metals, etc.

• Currency Derivatives: Futures and options on various currencies for managing foreign exchange risk.

These are customized contracts negotiated directly between two parties, not traded on the exchange.

These platforms are electronically driven and fully automated, ensuring transparency and fast execution of trades.

Exchanges

• National Stock Exchange (NSE):-Leading exchange for equity derivatives, accounting for over 90% of market share.

• BSE India: The other major exchange offering equity and currency derivatives.

• MultiCommodityExchange(MCX): Largest platform for commodity derivatives.

• National Commodity and Derivatives Exchange (NCDEX): Another important commodity derivatives exchange.

The use of derivatives for hedging by corporations and institutions is increasing, which helps to maintain market stability. Since 2000-2001, market turnover has increased nearly 4600-fold, from Rs. 2365 crore in 2000-2001 to a staggering Rs. 11010482.20 crore in 2008-2009. The Indian derivatives market had a daily average turnover of around Rs. 8.5 lakh crore (approximately USD 102 billion).

Open Interest is estimated to be around Rs. 3.8 lakh crore (approximately USD 46 billion), indicating market participants' expectations and positions. The NSE-Nifty 50 F&O segment is the most actively traded, with an ADT of Rs. 5.5 lakh crore (approximately USD 66 billion). Similarly, the number of contracts traded has skyrocketed. The National Stock Exchange (NSE), which accounts for 99% of Indian derivatives trading, saw a record 58.54 billion contracts traded in the equity derivatives segment alone in FY23, nearly reaching the entire previous year's volume of 41.76 billion. Recent regulatory changes are SEBI implemented stricter margin requirements for certain derivatives contracts in August 2023, aiming to reduce volatility and leverage concerns.

Orders placed on the platform are matched automatically based on price and time priority. Buyers and sellers with matching orders are connected, and the trade is executed at the agreed-upon price. Derivatives trading involves leverage, meaning you only need to deposit a fraction of the contract value as a margin. However, this also amplifies gains and losses. If the price of the underlying asset moves against your position, your margin can be eroded, and you may be required to deposit additional funds to maintain your position. All trades executed on the platform are cleared and settled by a clearing corporation to ensure smooth delivery of contracts and minimize counterparty risk.

For the first time in 2018, the NSE's equity derivatives segment had a higher turnover than the NSE's cash market. This was a significant milestone. The volume of the derivatives market has surpassed that of

the cash market by a wide margin. While historical data is difficult to compare, recent statistics show a significant difference. Nifty futures and options contracts on the NSE recorded a turnover of Rs. 8.28 lakh crore in October 2023, dwarfing cash market activity. This dominance is also reflected in the trading velocity. India has a significantly higher ratio of derivatives trading volume to cash market volume than other major economies, indicating a vibrant and active derivatives market.

Improved liquidity and price discovery:- Derivatives may enhance underlying asset liquidity by bringing in more investors who can take positions without directly buying or selling the asset. As a result of the market reacting faster to new information and changes in supply and demand, price discovery may become more efficient.

Risk management:- Derivatives enable investors to hedge existing positions and better manage risk. Options, for example, can be used to limit potential losses on a stock holding, whereas futures can be used to lock in a future price for an asset.

Expanded investment opportunities:- Derivatives provide investors with a broader range of investment options and strategies. For example, they can be used to take leveraged positions, speculate on future prices, or build customized investment portfolios.

Increased market efficiency:- Derivatives can increase market efficiency by facilitating the transfer of risk and capital to those best suited to manage it. Lower transaction costs and a more stable market environment may result.

Increasedvolatility:- Derivatives, especially when used for speculation, can increase the volatility of the underlying asset. This is since large derivative positions can quickly magnify price movements in the underlying asset.

Systemic risk:- The derivatives market's interconnectedness can increase systemic risk, which means that problems in one part of the market can quickly spread to other parts. This was evident during the 2008 financial crisis, when the subprime mortgage market collapse triggered a domino effect that resulted in widespread financial instability.

Market manipulation:- If derivatives are not properly regulated, they can be used to manipulate markets. Short-selling derivatives, for example, can be used to drive down the price of an asset.

Lack of transparency: - The complexity of some derivatives can make it difficult to understand the risks involved, which can lead to problems for investors.

Although growth is undeniable, there are still worries regarding investor education and possible systemic risks due to high leverage. However, with ongoing regulatory efforts and market advancements, the Indian derivatives market is projected to maintain its robust growth trajectory, offering a platform for efficient risk control and advanced strategies for investment.

Corporate bonds have an inverse relationship to interest rates; their value decreases with an increase in interest rates and increases with a decrease in interest rates. Generally speaking, the percentage of price volatility increases with maturity. The significance of corporate bond funds is distinct. Investors might make a judgment by taking important risk considerations into account.

Because one will get the bond at face value, or par value, at maturity, holding the bond until maturity reduces the risk of price swings, often known as market risk or interest-rate risk. The bonds are less worthy because of the negative relationship between interest rates and bonds.

The highest-rated investment-grade bonds are designated as AAA bonds. These ratings are given by Indian credit-rating organizations such as CRISIL, ICRA, CARE, and India Ratings, following an evaluation of the risk associated with each bond as well as the issuer's operational and financial stability.

Below are the top 10 bonds rated AAA in the bond market in India:

Investment-grade bonds with an AA rating are highly regarded. PSU and corporate bonds in India are rated by several Indian rating agencies, including CRISIL, ICRA, CARE, and India Ratings. The bond rating of a corporation is determined by these rating agencies based on a variety of variables, including financial indicators such as leverage and interest coverage ratios.

These bonds are rated as investment-grade, and the coupon rate represents the interest rate paid by the issuer to the bondholder. Investors often consider such information when making investment decisions, taking into account factors like the issuer's creditworthiness, maturity date, and prevailing interest rates in the market.

Bonds with a AAA rating provide a dependable investment option with advantages for diversification, stability, and consistent income. These bonds are backed by issuers who maintain sound financial standing and sound management procedures. If you want to buy safe investment products, you can buy AAA-rated bonds.

These bonds are considered investment-grade, with an AA rating, suggesting a relatively high credit quality. Investors often look at factors like coupon rates, maturity dates, and the financial health of the issuer when considering such bonds for investment.

1. Government bonds issued by entities like PFC, IRFC, REC, and NHAI are typically considered safe investments due to their AAA ratings.

2. Treasury bills and Cash Management Bills are short-term debt instruments issued by the government for managing its short-term financial needs.

3. Investors often consider factors like coupon rates, ratings, and tenures when deciding to invest in government bonds as they play a crucial role in the fixed-income market and are considered relatively low-risk investments

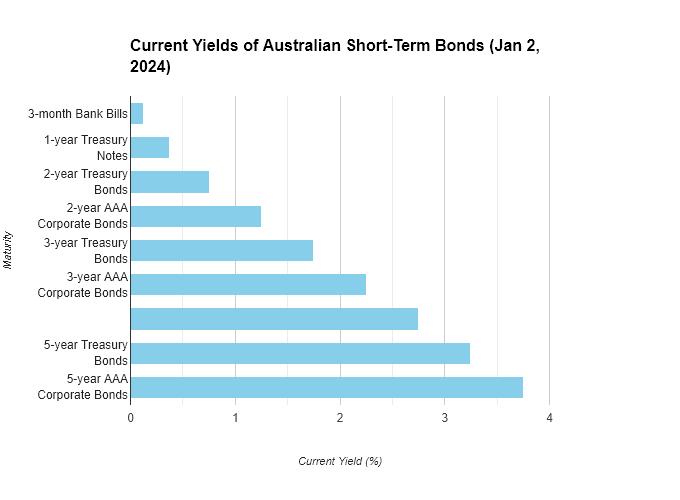

The current yield in India's bond market short-term and long-term:

India Short-Term Government Bond Yield

▪ India: Month-end yield on short-term government bonds In September 2023, one year was recorded at 7.06 percent pa, up from 6.99 percent pa the month before.

▪ Data on India's Short-Term Government Bond Yields is available from May 1996 to September 2023 and is updated every month.

▪ The data set a record low of 3.46% pa in November 2020 and an alltime high of 13.01 percent pa in January 1998.

▪ CEIC Data reports on the yield on short-term government bonds.

The Year 2022:

The year 2022 presented challenges for the bond market, as reflected in the performance of the widely used bond benchmark, the Crisil Composite Bond Index. This index saw a modest increase of approximately 3 percent, which was notably lower compared to the returns of other major asset classes. Gold outperformed with a growth of about 14 percent, equities showed a 6 percent increase and even cash saw a 5 percent gain.

The Reserve Bank of India (RBI) responded to economic conditions by raising policy rates by 225 basis points, bringing the rate to 6.25 percent. This move was part of a broader trend among major global central banks to address inflation concerns aggressively. The central banks, including the RBI, conveyed a commitment to combat inflation, even if it meant sacrificing some economic growth. This resulted in a notable rise in both domestic and global bond yields.

The impact of these developments was evident in the muted gains across various bond mutual fund categories. The environment of rising interest rates and central banks prioritizing inflation control created headwinds for bond investors, influencing the relative performance of different bond categories.

The Year 2023:

The assessment for 2023 is more favourable for bond investors, with the expectation of stabilized yields, an attractive yield environment, and a perceived value in bonds relative to equities. The dynamics of central bank policies and real yields in comparison to other emerging markets play a significant role in shaping this outlook.

Hedge funds is a type of Mutual Funds that is Funded by HNI’s (High Net worth Individuals), Institutional Investors and Accredited Investors. Usually is regulated by Fund managers in India It may also refer to Investment pools like Venture Capital Funds, Private Equity Funds and Commodity pools.

In India Hedge Funds is being Regulated by SEBI (Securities Exchange Board of India) in 2012 by Alternative Investment Funds Regulation.

Hedge Funds in India use different Trading techniques because of Multiple assets and Securities they invest like Fine/Modern Arts, Crypto Currency, Foreign Currencies, and even Patents.

They are total 3 types and 4 strategies Broadly used in Hedge Funds.

Types:

1) Offshore: Located in less tax environment countries regardless of home country

2) Domestic: Fund located within the country limited to investors subject to taxation.

3) Fund of Funds: Operates as a mutual fund that directs investment into diversified portfolio of multiple hedge funds

Strategies:

1) Long or Short Equity: Seeks to generate Returns by taking long and short positions in Individual tasks

2) Global Macro: In this they consider Macro Economic Factors like Interest rates and Forex rates to invest

3) Event Driven: If the company is going through significant corporate events such as Merger, Acquisition and bankruptcy.

4)Quantitative: Most important of all strategies as this uses Mathematical Models and Algorithms to identify Investment opportunities.

Tax Rate in India:

Right now in India hedge funds belong to category III AIF (Alternative Investment Funds) If the Annual Earnings exceed 5 Cr then the tax rate is 42.74% and If its below 5 Cr then 30% and also the Fees of Hedge Funds 2% Management Fees and 20% Performance Fees.

Hence the Risk and Return in the Hedge Funds and extremely Volatile and also because of the Low level Regulation in SEBI.

Top Performing Indian Hedge funds:

The world's largest stock market, accounting for approximately 42.5% of the global stock market, is the United States Stock Market. Right now, the U.S. stock market is valued at $46.2 trillion overall. Over the past few decades, U.S. stocks have frequently outpaced those of other wealthy countries. An investor's 1990 $100 investment in the S&P 500 would have grown to almost $2,000 in 2023, or four times the returns observed in other industrialized nations.

• Dow Jones Industrial Average (DJIA): 30 sizable, publicly traded corporations that are listed on the Nasdaq and the New York Stock Exchange (NYSE) are represented by the DJIA. The index is priceweighted. The DJIA has a market value of US$10.9 trillion. It is now trading at US$ 37,385.97 as on December 25, 2023.

• S&P 500 Index: 500 of the biggest publicly traded firms in the United States are included in the market capitalization-weighted S&P 500 index. It is a comprehensive indicator of the U.S. stock market's overall performance. S&P 500 Index market capitalization is $33.8 trillion USD. It is now trading for $4,754.63(as of December 25, 2023).

• Nasdaq Composite Index: All of the stocks listed on the Nasdaq stock market are part of the Nasdaq Composite. It is renowned for having a large concentration of stocks linked to technology and the internet.

The largest, most liquid, and most efficient equities markets in the world, the U.S. equity market will hold 42.9%, i.e., $45.5 trillion, of the $106.0 trillion global equity market valuation in 2023. This exceeds China's market share by a factor of 4.1. Over the past ten years, the U.S. market share has averaged 38.9%, peaking at 42.9% in 3Q23 and falling to 36.6% in 2015.

The Magnificent Seven:-

The Magnificent Seven stocks are a collection of prominent and profitable U.S. stock market firms, including Tesla, NVIDIA, Amazon, Apple, Meta Platforms, Microsoft, and Alphabet.

By December 15th, the return on the S&P 500 was primarily due to the Magnificent Seven. total weight of these businesses exceeds the total weight of top 7 corporations in S&P history.

Trillion

table shows the Top 5 Performing sectors in US Stock Market in 2023. Consumer Durables Sector has the best Performance. Investors are confident in long-term growth rates and are upbeat about the US consumer durables market. Compared to its three-year average PE of 10.6x, the industry is currently trading at a PE ratio of 14.8x.

Graph shows the Comparison between the Total market cap and Earnings and revenue of the Consumer Durable Industry performed very well in US stock market when compared to other sectors

Throughout 2023, interest rates have stayed consistently high. The goal of the Fed's interest rate increases was to reduce inflation and slow down the economy. The federal funds target rate, which the Federal Reserve (Fed) controls, was raised by the Fed through July and is now between 5.25% and 5.50%.

The aim is to avoid sending the economy into a recession by bringing inflation, which peaked at 9.1% in the middle of 2022, closer to its target of 2%. If interest rates move higher, stock investors become more reluctant to bid up stock prices because the value of future earnings looks less attractive versus bonds that pay more competitive yields today. Increasing interest rates can create a more challenging environment for stocks in the face of more attractive yields for certificates of deposit and other vehicles.

Since 2003, the size of the world's equities markets has almost tripled, reaching a total market capitalization of $109 trillion. The expansion of the money supply and exceptionally low interest rates have supported soaring asset values in all economies during the past few decades.

In 2024, the Magnificent Seven stocks, generative artificial intelligence, economy+, Presidential Elections will all be significant factors.

• Fed Rate Reductions

The Federal Reserve paused short of declaring that rate hikes will end at its December meeting, as policymakers scheduled 75 basis point reductions in interest rates for 2024. The Fed committee members anticipate reducing its key policy rate from the current range of 5.25% to 5.5% to 4.6% by the end of 2024, according to the most recent set of quarterly predictions. This is less than the September forecasts that stated the federal funds rate would end the next year at 5.1%.

• The Presidential Election

The stock market has a lengthy history of outperforming during presidential election years and even the years leading up to the election. Election years typically see a rise in stocks. The S&P 500 has never had a negative year in a year when there is a presidential re-election since 1952. The net market gain during the final two years of each of the 48 presidential administrations since 1833 was 772%, far more than the gain of 336.5% during the first two years of these terms.

• Regional Banking Crisis 2023

The regional banking crisis of 2023 sent shockwaves through the financial sector, with certain banks suffering substantial unrealized losses due to quickly increasing interest rates. Larger firms will be comparatively well-positioned to maintain their market share as regional banks lacking in scale will be disproportionately pressured to reduce cost bases and optimize loan composition, hence diminishing their ratings.

• Artificial Intelligence Stocks

Driven by the excitement about generative artificial intelligence, the year 2023 saw a surge in semiconductor, computer hardware, and software investments by tech businesses. Nvidia was the largest AI stock in 2023. The Magnificent Seven, C3.ai (AI), and Palantir Technologies (PLTR) are important AI stocks. The focus in 2024 will shift from AI's "creators" to AI's "adopters," spanning a wide range of sectors and industries, as businesses prioritize capital expenditures that increase productivity.

Despite persistent pressure from rising interest rates, Wall Street experts predict S&P 500 earnings will continue to rise in the upcoming quarters. Analysts predict that the S&P 500 will rise even more in the upcoming year. For the S&P 500, the average analyst price target is currently 5,038.15, indicating more gain in the upcoming 12 months.

The Dow Jones Industrial Average will probably lag in 2024 if investors' desire for growth and tech stocks doesn't abate. However, if the US economy enters a recession, investors might turn to blue-chip companies for protection. Salesforce, Microsoft, Intel, and other

technology stocks have been among the Dow's best-performing equities of 2023.

The NASDAQ index had an exceptionally good start to the year, but Treasury yields continued to rise until October. Although it will be difficult to match this year's performance, another 15% gain is a feasible goal, and the NASDAQ might very well touch the 19,000 mark in 2024. In 2023, the NASDAQ and interest rates showed minimal relationship. The NASDAQ index had an exceptionally good start to the year, but Treasury yields continued to rise until October.

Equity Derivatives:

Stock Options: Granting the option to purchase or sell a particular stock by a specific date at a predefined price, but not the duty to do so.

Exchanges: NYSE Arca, Nasdaq, CBOE

Stock futures: Contracts to purchase or sell a certain stock at a fixed price on a future date.

Exchanges: Nasdaq, CME, and CBOE

Index Derivatives:

Index Options: Comparable to stock options, but determined by an index of the market's performance, such as the S&P 500. Exchanges: Nasdaq, CME, and CBOE

Index Futures: contracts to purchase or sell a market index at a fixed price on a future date. Exchanges: CME and CBOE

Commodity Derivatives:

Commodity Options: Options to purchase or sell a particular good, such as maize, gold, or oil, at a set price by a given date. Exchanges: ICE, NYMEX, CME

Commodity Futures: are agreements to purchase or sell a certain good at a fixed price on a future date. Exchanges: ICE, NYMEX, CME

Currency Derivatives:

Currency Options: Options to buy or sell a particular pair of currencies by a given date at a fixed price. Exchanges: ICE, CME, CBOE

Currency Futures are agreements to buy or sell a particular currency at a fixed price on a future date. Exchanges: ICE and CME

Other Derivatives:

Interest Rate Swaps: Contracts to swap cash flows at various interest rates. Exchanges: ICE and CME

Credit Default Swaps (CDS) : A default or failure to repay a loan is referred to as a "credit default”. The "swapping" occurs when an investor "swaps" with another investor or insurance business the risk of receiving their net worth back. The buyer of a CDS pays the seller on a regular basis until the credit maturity date in order to swap their default risk. The seller agrees in the agreement to reimburse the buyer for all premiums and interest that would have been paid up until the date of maturity if the loan issued by the buyer of the CDS defaults.

Food Price Index comprises price indices for cereals, vegetable oils, meat, fish, sugar, and other foods.

Base Metals Price Index include price indices for iron ore, aluminium, cobalt, copper, nickel, tin, uranium, zinc, and lead.

Fuel Energy Index include price indices for coal, natural gas, propane, and crude oil (petroleum).

Fertilizer Index include prince indexes for potash, urea (carbamide), and DAP (diammonium phosphate).

November saw a 6.8% annual increase in the consumer price index, mostly due to increases in the costs of food, energy, and housing. The increase in core inflation, which does not include volatile categories like food and energy, was 4.9%, the most since 1991.

November saw an increase in food costs of 6.1% and home prices of 4.8% due to disruptions in the raw material supply that hindered construction activities.

After rising by 30% in October, energy prices increased by 33.3% in November. In November, gasoline prices increased by an astounding 58.1% from the previous year.

REASON FOR PRICE FLUCTUATIONS

The conflict in Ukraine has affected the world's energy sources, driving increasing the price of gas and oil and directly affecting the cost of gasoline.

Monetary policy: The pandemic-related low interest rates and quantitative easing programs of the Federal Reserve raised the money supply and may have exacerbated inflationary pressures.

Corporate profits: Some contend that despite the fact that costs haven't increased proportionately, firms are using the current circumstances to boost prices and profits.

Government spending: By raising the money supply and demand for products, recent stimulus plans intended to combat pandemic recovery may exacerbate inflation.

U.S. The loan market has developed dramatically over the last five years, formed by way of diverse financial and political occasions.

• From growing interest rates and exchange disputes to international pandemics and the conflict in Ukraine, permit’s take a more indepth examine the key factors and activities that have defined this dynamic landscape.

• Rising Interest Rates and Policy Regularity 2018-2019. The Federal Reserve, led by way of Chairman Jerome Powell, embarked on a direction of slow, focused hobby fee increases on to normalize the present financial coverage after the economic disaster after the financial disaster.

• This pushed up Treasury yields throughout the curve, affecting bond segments along with corporate, municipal and mortgages. The growing rate environment has pushed bond charges down, as

their constant coupon payments have come to be much less appealing relative to other higher yield issues

• In 2019-2020, Rising change warfare in the US. And China, as well as geopolitical uncertainty, have weighed on international economic increase and chance appetite.

• This aviation security situation drove investors into Treasury’s, inflicting yields to say no and bond expenses to upward push. In COVID-19 Pandemic, the global outbreak of COVID-19 has led to a slowdown within the financial system and considerable marketplace panic.

• The Fed replied via lowering the emergency rate to close to zero and beginning quantitative easing rules that flooded the market with cash.

• This triggered Treasuries to upward push sharply again, with the 10-12 months yield falling to a rock bottom of 0.5% by way of March 2020. Economic instable and inflation pressures 2021-2022 S&P U.S. This means the bonds issued by the US. the government considers it more secure.

• In the U.S the bonds are rated by the three agencies Moody's, Standard & Poor's, and Fitch. The top government bonds in the U.S according to the ratings there are TLT, BIL, IEF, SHY and corporate bonds are SPDR, Schwab, ISHARES, PIMCO

Compare the S&P Bond Index with the SPDR High Yield Bond Index.

Government bonds: Generally considered a safe haven, short-term funds (1-3 years) benefited from risk aversion during periods of market turmoil such as the onset of the pandemic in 2020. Initially, the yield a yield on these bonds fell, driving up inflation , and that too Before it went up when the Fed started raising rates.

Corporate bonds: High-quality, short-term corporate bonds with strong credit ratings reflected the Treasury’s attitude, providing some stability in times of uncertainty but substantial volatility in cheap corporate bonds in due to credit concerns about the issuers.

Long-term performance:

Government bonds: Cash dividends (10+ years) were initially lifted in 2018-19 on concerns of trade tensions and global growth, which lowered yields and raised inflation. However, the pandemic, and subsequent economic recovery, raised prices, pushing sales and yields up sharply in 2021-23.

Corporate bonds: Long-term corporate bonds, especially those issued by financially strong companies, offered higher yields compared to the Treasury but also carried higher credit risk Their performance varied across sectors, some benefited from the issues created by the epidemic, while others faced challenges.

A hedge fund is a group investment vehicle that makes profits by investing in securities or other financial instruments. Three-quarters of the Assets Under Management (AUM) in this industry worldwide are located in the United States. Out of the 5,383 active hedge fund managers and 5,523 active institutional investors, 3,405 and 3,319 respectively are based in the US. AIML, or artificial intelligence and machine learning, is another tool that fund managers are increasingly employing to boost returns and boost operational efficiency.

Over the forecast period (2023–2028), the US hedge fund market is expected to grow at a compound annual growth rate (CAGR) of more than 5%.

An industry benchmark for evaluating the overall health and performance of the hedge fund business is a hedge fund index. These indices are compilations of various hedge funds, frequently divided into groups according to investment approach, regional emphasis, and/or other factors. Following are the major Indices for hedge funds in United States.

• HFR Index

• Leading hedge fund indices

• Morningstar Index

• Barclay Hedge Fund Index

• Eureka hedge North American Hedge Fund Index

Hedge Fund Assets Under Management(AUM)

Bridgewater Associates $124,317,200,000

Renaissance Technologies $106,026,795,439

AQR Capital Management $94,523,700,000

Two Sigma $67,471,220,893

Millennium Management $57,670,000,000

Citadel $51,573,787,000

Tiger Global Management $51,000,000,000

D.E. Shaw $45,772,700,000

Coatue Management $42,338,946,229

Davidson Kempner $40,800,000,000

The Federal Reserve of the United States has executed an unprecedented series of eleven consecutive increases in the Federal Funds Rate over the past twelve meetings. This aggressive monetary policy includes four consecutive hikes of 0.75%, signifying the most rapid rate escalation since the early 1980s. Within a compressed timeframe of 16 months, spanning from March 2022 to July 2023, the Fed Funds rate surged by around 500 basis points. This dynamic shift in monetary policy implies a significant recalibration of strategies for hedge fund managers, who find themselves adapting to an altered economic landscape.

Against this backdrop, hedge funds have notably amplified their net short position in the US Treasury futures market, reaching an extraordinary level of approximately USD 800 billion by the close of November. This strategic positioning reflects a concerted effort by asset managers to shield themselves from the inherent risks associated with fluctuations in interest rates. In a counterbalancing manoeuvre, these financial entities have concurrently expanded their net long positions, indicating a nuanced and proactive approach to navigating the intricate challenges posed by the evolving economic environment.

The UK stock market, renowned for its longevity and reputation, hosts diverse companies, from global giants to smaller enterprises. It operates through various exchanges, primarily the London Stock Exchange (LSE) in the City of London is the dominant exchange, handling over 90% of UK stock market trading., The remaining exchanges like Aquis Exchange, BATS Europe: and Chi-X Europe combined account for less than 10% of the market share

The UK stock market features several key indices within the FTSE umbrella, each providing distinct insights into diverse market segments. The FTSE 100 mirrors economic shifts and growth prospects for mid-sized companies, impacting innovation and job creation.

Contrarily, the FTSE 250, while short-term volatile, offers long-term growth and diversification, often outperforming larger indices. Encompassing over 350 companies, the FTSE All Share Index offers a comprehensive view of nearly all of the UK market's capitalization. The FTSE 350 combines the FTSE 100 and FTSE 250, providing exposure to both large and mid-cap companies.

Furthermore, sector-specific indices within the FTSE 100, spanning Financials, Consumer Goods, Industrials, Healthcare, Energy, and Basic Materials, enable focused tracking of individual sector performance. Supplementary indices like FTSE AIM All-Share, FTSE SmallCap, FTSE Fledgling, and FTSE tech MARK 100 cater to growth potential, smaller Main Market companies, the smallest Main Market entities, and technology companies respectively.

Based on year-to-date (YTD) performance some sectors have emerged as frontrunners:

1. Technology :- The reasons were Shifting investor sentiment, strong earnings reports and increased demand for technology products and services. Some of the best-performing tech stocks in the UK YTD include ASOS (+107.5%), Ocado (+83.2%), and Deliveroo (+73.4%).

2. Communication Services:- The reasons were Increased reliance on communication technologies and Positive regulatory developments. Some of the top performers in the communication services sector include Airtel Africa (+123.6%), TalkTalk (+81.5%), and Vodafone Group (+55.4%).

3. Consumer Discretionary The reasons were Easing cost-of-living pressures and Pent-up demand. Some of the standout performers in the consumer discretionary sector include Rightmove (+80.5%), JD Sports (+70.3%), and Flutter Entertainment (+46.5%).

The UK stock market, represented by the benchmark FTSE 100 index, has experienced a period of up-and-down performance over the past five years (from December 2018 to December 2023).

• The FTSE 100 delivered a negative return of 4.56% in this period. However, the journey wasn't linear.

• The index reached an all-time high of 8,174.36 in May 2021, fuelled by economic recovery hopes and loose monetary policy.

• Subsequently, it plunged due to various factors:

1. The ongoing trade war between the US and China dampened investor sentiment.

2. The UK's withdrawal from the European Union created economic and political instability.

3. Central banks around the world, including the Bank of England, increased interest rates to combat inflation, making stocks less attractive compared to bonds.

The UK stock market, represented by the total market capitalization of companies listed on the London Stock Exchange (LSE), currently holds around 2.5% of the global market share. This translates to roughly $3.4 trillion in market capitalization as of December 2023.

Comparison to Larger Markets:

• The United States dominates the global stock market with a whopping 45.5% share, boasting a market capitalization exceeding $50 trillion.

• The second-largest market is China, representing around 12.5% of the global share with a market capitalization of approximately $14 trillion.

• Japan follows closely behind with a 7.4% share and a market capitalization of around $8 trillion

The UK Stock Market: December 2023 and Beyond

In December 2023, the UK stock market presents a complex scenario, blendingpositivefestivevibes with concerns about a looming recession and ongoing economic issues. The FTSE 100 exhibits modest growth fuelled by holiday spending, US market positivity, and a robust energy sector. However, persistent worries over inflation, escalating interest rates, and uncertainties impacting retail due to Brexit persist.

Central banks' measures against inflation and global tensions, especially the Ukraine conflict, influence investor sentiment. Holiday closeness might lessen trading activity, but the new year might usher in increased market fluctuations as the UK's global economic ties become clearer.

Investors are urged to conduct thorough research aligned with their risk tolerance and seek professional advice to navigate this uncertain period. Despite economic challenges, preparedness and guidance can position investors to seize opportunities in the UK stock market amidst its current challenges.

An increase in interest rates in the UK, whether prompted by the Bank of England or in response to changes by the US Federal Reserve, could bring multiple effects to the UK stock market.

• it might lead to reduced stock prices as higher rates often lure investors toward bonds, diminishing demand for stocks and causing their prices to fall.

• higher borrowing costs for businesses could hinder investments and slow economic growth, impacting companies' earnings and stock valuations.

• breed uncertainty and market volatility, making investors more risk-averse and leading to erratic stock price fluctuations. However, there could be positive consequences too.

• Elevated interest rates serve as a tool to combat inflation, potentially stabilizing the economy and bolstering long-term investor confidence in the market.

• It may attract foreign investments, benefiting companies with international operations by increasing their revenue in real terms.

• Certain sectors, like financial institutions, might also see advantages due to widened lending margins.

The US Federal Reserve's actions, especially alterations in the Fed fund rate, can indirectly influence the UK stock market through various channels. Changes in the Fed rate can sway global capital flows, affecting investor movement in and out of the UK market based on relative interest rates and economic situations. Moreover, a rising Fed rate can strengthen the US dollar, potentially making investments in

countries like the UK more expensive and impacting UK stock prices. Additionally, US monetary policy decisions can influence global investor sentiment towards riskier assets, potentially impacting UK stocks either positively or negatively.

The derivatives market in the United Kingdom is large and varied, providing a broad selection of products to satisfy the requirements of traders and risk managers. Contracts known as derivatives get their value from an underlying asset, which could be a currency, stock, bond, or commodity. They can be used as a risk hedge, to make predictions about future stock prices, or just to make money.

The following are a few of the most popular variants available in the UK -

1. Equity derivatives: These are linked to exchange-traded funds (ETFs), equities, or indices. Investors can utilize them to produce income through dividends, speculate on future stock prices, or act as a hedge against stock market volatility.

2. Interest rate derivatives: These products are connected to fixedincome securities or interest rates. They can give income through coupon payments, enable speculation on future interest rates, or offer insurance against interest rate risk.

3. Commodity derivatives: These are based on actual commodities, such as gold, oil, or agricultural products. They can be used to speculate on future prices, protect against volatility in commodity prices, or even make money by physically delivering the commodity.

4. Derivatives on currencies: These have to do with the rates at which currencies are exchanged. They are used by traders as a hedge against exchange rate risk, a way to make money from currency swings or to speculate on future exchange rates.

Derivative trading in the UK offers two avenues: over-the-counter (OTC) for bespoke contracts and regulated exchanges for standardized ones. Before engaging, understanding the risks is crucial, given the sophistication and potential financial losses associated with derivatives. Traders should approach derivative trading with caution and a deep understanding of market dynamics.

In the UK, derivatives get traded on two main exchanges: London Stock Exchange (LSE): This major exchange offers a wide variety of derivatives, like equity, interest rate, commodity, and currency options. It has platforms like SETS and Turquoise for trading.

1. Equity Derivatives:

I. Stock futures: Popular examples include FTSE 100 futures, IOB DR futures, and individual stock futures for major UK companies. These allow you to lock in the future price of a stock.

II. Stock options: You can choose between calls (right to buy) and puts (right to sell) on individual stocks or FTSE 100 and other UK indices. This flexibility can offer limited risk protection or leverage depending on your strategy.

III. Equity index futures and options: Track the performance of UK indices like the FTSE 100, FTSE 250, and FTSE All-Share, allowing you to speculate on the overall market direction.

2. Interest Rate Derivatives:

I. Interest rate futures and options: Based on future UK interest rates, enabling you to hedge against potential interest rate fluctuations or speculate on their movements.

II. SONIA futures and options: Specifically based on the Sterling Overnight Index Average (SONIA), the UK's benchmark for overnight interest rates.

3. FX Derivatives:

I. Currency futures and options: Allow you to lock in exchange rates for various currency pairs like GBP/USD, GBP/EUR, etc., protecting against adverse currency movements.

4. Commodity Derivatives:

I. Futures and options on commodities traded on UK markets, such as gold, silver, and Brent crude oil. These can be used for hedging or speculation on commodity prices.

5. Other Derivatives:

I. Structured products: Tailored investment vehicles combining derivatives and other instruments to achieve specific investment objectives.

II. Exchange-traded notes (ETNs): Debt securities tracking the performance of an underlying asset, like a UK index or commodity, but issued by a single institution

Intercontinental Exchange (ICE): This global group owns UK exchanges like the London Metal Exchange (LME) for metals and the International Petroleum Exchange (IPE) for European energy derivatives.

A) Equity Derivatives:

I. Single Stock Futures and Options: Trade individual UK and international stocks with various contract sizes and expiry dates.

II. Equity Index Futures and Options: Gain exposure to the performance of broad UK and European indices like FTSE 100, FTSE 250, EURO STOXX 50, etc.

B) Interest Rate Derivatives:

I. Short Sterling Futures and Options: Based on short-term UK interest rates.

II. Eurodollar Futures and Options: Based on US dollar interest rates, relevant for hedging international exposures.

III. Swap Futures and Options: Trade on future interest rate swap rates across various maturities.

C) Commodity Derivatives:

I. Energy: Futures and options on Brent and WTI crude oil, natural gas, electricity, etc.

II. Metals: Gold, silver, platinum, aluminium, copper, etc.

III. Agricultural products: Wheat, corn, soybeans, etc.

D) Freight Derivatives:

I. Dry Bulk Forward and Options: Hedge against movements in freight rates for dry bulk cargo shipping.

E) Other Derivatives:

I. Volatility derivatives: Trade on the implied volatility of underlying assets like equities and indices.

II. Climate change and ESG derivatives: Futures and options linked to climate change indices and ESG-focused assets..

Beyond these top two, smaller exchanges and platforms exist, but LSE and ICE dominate the scene. The exchange choice depends on factors like the underlying asset and target investor. Remember, not all derivatives are listed and some happen over-the-counter directly between parties.

Understanding UK Derivatives: How the Market Reacts to Change

The UK derivatives market is shaped by internal factors like regulatory shifts and market changes, alongside external influences such as global economic conditions and interest rate fluctuations. Regulatory adjustments, such as margin requirement changes, can impact liquidity, while global economic uncertainties and interest rate shifts affect investor behaviour. Commodity-linked derivatives are directly influenced by underlying commodity price changes. High-frequency trading and emerging platforms contribute to market efficiency.

Understanding these sensitivities is crucial for market participants to make informed decisions, manage risks, and identify opportunities. The interconnected nature of these factors, as depicted in the accompanying image, underscores the dynamic and intricate landscape of the UK derivatives market, emphasising the need for vigilance and adaptability.U.S. federal funds rate changes influence the UK derivatives market by affecting global borrowing costs, altering derivative appeal, and influencing currency exchange rates. Swift adaptation is vital for market participants to navigate effectively.

The UK bond market is one of the biggest in the world, worth more than $100 trillion.

There are various kinds of bonds in the UK bond market:

• The UK government issues Government Bonds (Gilts) to raise funds for public spending and debt management. They are considered low-risk investment bonds as they have a strong hand on the government’s creditworthiness. These bonds are issued to finance government expenditures and budgetary needs. They offer fixed interest payments at regular intervals and repayment of the principal amount at maturity.

• Corporate Bonds are issued by companies to raise capital for various purposes such as expansion, debt refinancing, etc. These bonds may have fixed or variable interest rates and can have different maturity periods. All the risk is associated with the creditworthiness of the companies. This may offer higher yields compared to Gilts but also vary in levels of risk.

• High-yield bonds issued by companies with lower credit ratings and higher yields also carry a greater risk of default. Yields on such bonds can reach up to 8%.

• Green Bonds are issued by companies or governments to finance environmentally friendly projects. It offers attractive yields with ethical investment principles.

• Index-linked Bonds are bonds that offer protection from inflation by having their principal and interest payments linked to a consumer price index. UK index-linked bonds currently offer yields of around 1.50%, providing a hedge against rising prices.

Investors choose between these bonds based on their investment goals, risk tolerance, and market conditions. The interaction of these two bonds contributes to the overall dynamic of the UK bond market. UK public holds some awareness of major credit rating agencies and understanding of their specific roles. Continuous education and transparency of agency practices might contribute to enhanced public knowledge in the bond market.

In the UK, there are various key players of credit rating agencies. Big three of them are Moody’s investors service Ltd (arguably most recognized globally), Fitch rating Ltd. (hold strong presence in finance and insurance), S&P Global Rating UK Ltd. and various others like ARC rating Ltd, DBRS Morningstar etc. According to the Fitch rating (Dec1, 2023), it affirms the UK at AA-; the outlook is negative. The global sovereign sector outlook is neutral, with fiscal risks in focus.

The UK bond market was a quiet haven in 2018-2020 with low yields and high demand for Gilts. It experienced a rollercoaster ride from 2021 onwards as rising inflation and interest rates caused yields to spike and the market to become volatile. The trend had significant fluctuations as the yield curve inverted in October 2023, signalling investor's concerns about future economic growth.

Currently, the short-term bonds (2 years and below) are hovering around 4% yield, indicating a rise from previous months but a slight dip from October’s peak, creating a moderate demand in the market. Whereas in long-term bonds (10 years and above) there is a yield of around 3.50%, showing a drop from earlier highs in 2023, creating an increased demand in the market.

The condition of the UK bond market in December 2023 is complex and evolving, marked by divergent trends across maturities and cautious optimism fuelled by recent improvements

The UK hedge fund market is a substantial and growing one, with assets under management (AUM) exceeding £1 trillion. It's expected to grow at a CAGR of over 8% in the coming years. The industry is relatively well-regulated, with the Financial Conduct Authority (FCA) overseeing its activities. This ensures transparency and investor protection.

Hedge funds utilize various strategies, including long/short investing, arbitrage, market timing, and activism. They can also invest in a wider range of assets compared to traditional funds, including derivatives, distressed debt, and private equity. Hedge funds typically charge a "2 and 20" fee structure, which comprises a 2% annual management fee and 20% of profits earned.

1. Capula Investment Management LLP

2. Man Group

3. Brevan Howard Asset Management

4. Lansdowne Partners

5. Arrowgrass Capital Partners

Types of hedge funds in the UK:

• Equity hedge funds focus on investing in stocks and aim to outperform the market through long/short strategies, activism, or other methods.

• Macro hedge funds seek to profit from macroeconomic trends through investments in currencies, commodities, and fixedincome instruments.

• Event-driven hedge funds: These funds capitalize on specific events such as mergers and acquisitions, bankruptcies, or spinoffs by taking long or short positions in the associated companies.

• Quantitative hedge funds: These funds rely on quantitative models and algorithms to make investment decisions, often employing high-frequency trading techniques.

• Credit hedge funds: These funds invest in debt instruments, including bonds and loans, and aim to profit fromcredit spreads and other fixed-income market opportunities.

The past five years (2018-2023) have been a mixed bag for UK hedge funds. The average UK hedge fund has delivered net annualized gains of 7.2% over the past five years, according to Barclay Hedge. This performance compares favourably to the S&P 500's return of 6.5% during the same period. However, it's important to remember significant performance dispersion within the industry. The top 50 UK hedgefunds collectively returned annualized gainsof over 15.5%, more than double the industry average.

Hedged equity strategies proved the most successful, generating average returns of 22.5% per year thanks to concentrated investments in key holdings. Interestingly, smaller and mid-sized funds outperformed larger ones due to their agility and ability to navigate less efficient markets.

Tokyo Stock Exchange (TSE) which is responsible for over 80% of the country's total market capitalization, Osaka Securities Exchange (OSE) focuses primarily on derivatives trading and growth companies both operate under the umbrella of the Japan Exchange Group (JPX), formed in 2013 through the merger of the TSE and OSE.

The Japan Exchange Group (JPX) ranks as the fifth largest stock exchange in the world by market capitalization. Its total market capitalization stood at roughly $6.54 trillion, this represents around 3.3% of the world's total market capitalization. JPX aims to provide a unified and efficient trading platform for investors in Japan and worldwide. Within Asia, JPX is a powerful force. It consistently ranks as the largest exchange in Asia by market capitalization and is crucial in channelling capital flows throughout the continent.

Indices representing TSE:

Nikkei 225: The most well-known Japanese stock market index, that tracks the performance of 225 blue-chip companies listed in the First Section of the Tokyo Stock Exchange. It serves as a crucial indicator of the market's overall health and performance and a major Asian equity benchmark with global consultation.

Technology dominates the Nikkei 225 landscape, commanding a towering 48%, while Consumer Goods occupy a significant 25%. Financials and Materials contribute 10% each, playing supporting roles alongside Transportation and Utilities (2%) and Capital goods/others (2%).

Among the Nikkei 225's heavyweights, SoftBank Group (4.2%) stands out, with Toyota (3.4%), Fast Retailing (3.3%), KDDI Corp. (2.2%) playing key roles.

Tokyo Price Index (TOPIX): The most comprehensive index of the TSE, tracking the performance of all companies listed in the First Section (large-cap).

Tech dominates the TOPIX landscape, with SoftBank and Sony spearheading a 35.5% weight. Consumer giants like Fast Retailing and Kikkoman holds a 18.2%. Banking powerhouses like Mitsubishi UFJ and Sumitomo Mitsui Financial Group hold a 16.8% weight, while automotive legends like Toyota and Hitachi anchor the Industrials sector at 11.3%. Materials, home to Nippon Steel and Asahi Kasei, rounds out the top 5 with 6.8%.

Apart from TSE, Osaka Securities Exchange (OSE),

the second largest stock exchange in Japan primarily focuses on trading futures and options contracts, unlike the TSE which deals mainly in spot trading of individual stocks. OSE includes two major indices:

JPX-OSE Mothers Index: Tracks the performance of around 80 highgrowth companies listed on the Mothers, a section dedicated to emerging and innovative companies within the OSE. Considered a benchmark for the growth segment of the Japanese stock market. Similar to the Nasdaq in the US, it features companies in sectors like technology, biotechnology, and e-commerce.

JPX-OSE Jasdaq Index: Represents the performance of roughly 300 companies listed on the Jasdaq, another section of the OSE focusing on small and medium-sized enterprises (SMEs). Offers exposure to a broader range of companies compared to the Mothers Index, including more established SMEs alongside high-growth startups. Similar to the Russell 2000 in the US, it provides a way to invest in the potential future leaders of the Japanese economy

The Bank of Japan left its ultra-loose monetary policy unchanged at its final meeting this year on 19th December. The central bank decided unanimously that it would keep interest rates at -0.1%, while also sticking to its yield curve policy that references the 1% upper bound for 10-year Japanese government bonds as its limit. Yields for the 10-year Japanese government bond fell to 0.622%, and the Yen weakened 0.6% against the dollar to 143.70 after the decision. The Nikkei 225 closed 1.41% higher at 33,219.39, while the TOPIX closed up 0.73% at 2,333.81.

After declining in 2022, the Nikkei advanced around 28%, its fastest pace in a decade, to end 2023 at 33,464.17, reaching its highest yearend closing since 1989. This impressive comeback was fuelled by several factors, particularly the strength of export-oriented companies who benefited from the weak yen. With the U.S. Federal Reserve expected to cut rates and the Bank of Japan potentially ending its negative rate policy, the yen is anticipated to rise in 2024. This could pose a challenge for Japanese stocks, especially major players in the auto and electronics sectors, as exports could become less competitive and profit margins face potential contraction.

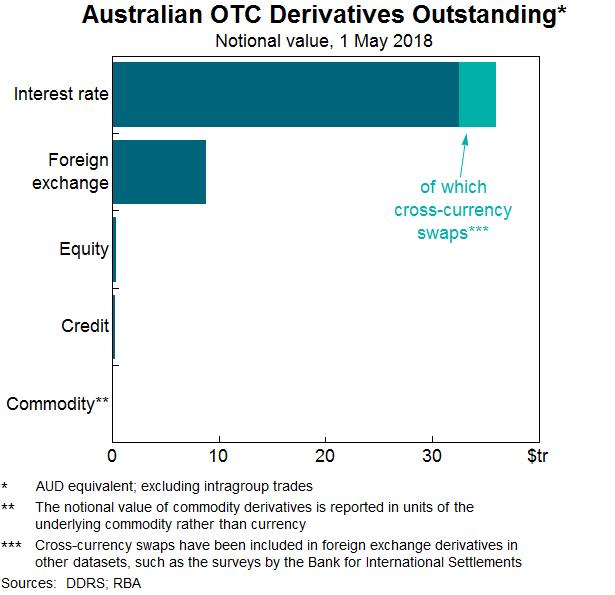

The Financial Services Agency (FSA) is in charge of the derivatives market regulation in Japan. After the US and Europe, Japan has the third-largest derivatives market globally. The notional value of all outstanding derivatives contracts in Japan as of June 2023 was $84 trillion, of which $75.2 trillion came from over-the-counter (OTC) contracts and $8.8 trillion from exchange-traded contracts.

Equity derivatives dominate the market, with interest rate and commodity derivatives following closely behind. Japanese financial

institutions, such as banks, securities firms, and insurance companies, dominate the market.

Various kinds of derivative products of that country which are available in Japan:

Nikkei 225 Futures and options (Large Contracts)

A significant Japanese stock index that serves as a benchmark for a number of financial products is the Nikkei Stock Average, which is the basis for Nikkei 225 Futures and options.

Nikkei 225 mini:

Under the terms of the Nikkei 225 mini stock index futures contract, traders pledge to purchase or sell 100 times the Nikkei Stock Average (Nikkei 225) at a certain price on a future date.

Nikkei 225 micro Futures:

An index futures contract based on the Nikkei Stock Average (Nikkei 225) called Nikkei 225 Micro Futures guarantees to purchase or sell under the following circumstances:

(1) Ten times the Nikkei 225

(2) on a particular future date

(3) for a contractual price that is now agreed upon

"Nikkei 225 micro Futures" was Introduced on May 29, 2023, which can be traded with even smaller amounts than Nikkei 225 mini, in response to the growing demand for more accurate risk management techniques against the backdrop of the trend toward smaller investments in the cash equity market.

Nikkei 225 mini Options:

A stock price index options contract on the Nikkei Stock Average (Nikkei 225) is called a Nikkei 225 mini Options contract.

More thorough risk management is made possible by the Nikkei 225 mini Options because the trading unit is one-tenth that of the Nikkei 225 Options.

Nikkei 225 Total Return Index:

The Nikkei 225 Total Return Index calculates the performance of the Nikkei 225 by taking into account changes in the component stocks' prices as well as the reinvestment of dividend income at the end of the ex-dividend period.

TOPIX Futures

Global investors have another asset to consider with TOPIX futures. Contracts for TOPIX Futures, like Nikkei 225 Futures, are traded through the pledge of collateral, or margin.

Mini-TOPIX Futures

A mini stock index futures based on TOPIX is called mini-TOPIX Futures.

Tenth of TOPIX Futures' contract size is what it is. SPAN is used to calculate the necessary margin. Margin is a requirement for investors to commit in order to trade mini-TOPIX Futures.

TOPIX Options

Only when the option expires may it be exercised. The base price for the price limit range calculation will be multiplied by the following rates to determine the price limit range. The price limit range will ideally be updated every three months (in March, June, September, and December).

JPX-Nikkei Index 400 Futures and options:

The stock index futures and options are based on JPX-Nikkei Index 400. The JPX-Nikkei Index 400 is made up of businesses that are very attractive to investors and that satisfy international investment standards, like effective capital use and investor-focused management viewpoints.

TSE Growth Market 250 Index Futures:

TSE Growth Market 250 Index Futures previously known as TSE Mothers Index Futures was derived from all common companies listed

on the TSE Mothers market and was free-float adjusted market capitalization-weighted. Despite the reorganization of the TSE Mothers market on April 4, 2022, TSE has modified the TSE Mothers index's calculation rules somewhat and is still using them.

TOPIX Core30 Futures:

It is a stock index Futures based on TOPIX Core30. The 30 most liquid and highly market capitalized stocks that are listed on TOPIX are used to construct TOPIX Core30.

RN Prime Index Futures:

Underlying index of Russell/Nomura Prime Index (RN Prime Index). The 1,000 largest stocks, as determined by free-float adjusted market capitalization, are included in the RN Prime Index. These stocks are chosen from all listed equities across all Japanese marketplaces. For this reason, The RN Prime Index is a good gauge of what is actually going on in the Japanese stock market.

TOPIX Banks Index Futures and Options:

TOPIX Banks Index Futures and Options stock index Futures based on TOPIX Banks Index. Only Flexible Options Trading offers TOPIX Banks Index Options. According to the industrial sectors as established by the Securities Identification Code Committee (SICC), the TOPIX Banks Index is the index of stocks in the bank sector based on TOPIX Sectors Indices (33 sectors).

S&P/JPX 500 ESG Score Tilted Index Futures:

It is an ESG index Futures based on S&P/JPX 500 ESG Score Tilted Index (0.5). A TOPIX 500-based index, the S&P/JPX 500 ESG Score Tilted Index (0.5) exhibits a tilt in the weights of its constituents away from freefloat market capitalization. This results in an over- or under-weighting of companies with varying S&P DJI ESG scores. This satisfies investors' need to increase their exposure to ESG factors while still having a wide range of varied investment options.

FTSE JPX Net Zero Japan 500 Index Futures:

It is an ESG index Futures based on FTSE JPX Net Zero Japan 500 Index. The FTSE JPX Net Zero Japan 500 Index is a TOPIX500-based index that uses an average 7% annual decrease in carbon emissions to get to net zero by 2050. Additionally, a 30% relative reduction in its climatic qualities is the goal of the indicators. Furthermore, in order to assess whether companies are gaining from the shift to a green economy, the indices achieve a notable increase in exposure to the green revenues of those companies.

Nikkei 225 Climate Change 1.5℃ Target Index Futures:

It is an ESG index Futures based on Nikkei 225 Climate Change 1.5℃ Target Index. The Nikkei 225 Climate Change 1.5°C Target Index is an index that is based on the Nikkei Stock Average (Nikkei 225), with constituent weights adjusted so that the index's overall GHG emissions (normalized by enterprise value) are 50% lower than the Nikkei 225 and will continue to decline by 7% in the years to come.

Sensitivity of that derivative market.

Interest Rate Sensitivity: The market is susceptible to any prospective changes in monetary policy due to Japan's historically low interest rate environment. For some positions, a sharp increase in interest rates could result in substantial losses.

A period of high interest rates would initially cause:

• Reduced contract values: The decreased appeal of holding future cash flows will cause the values of most derivatives, including swaps, futures, and options, to decrease. However traders who anticipate this can benefit from short positions in future contracts.

• Increased volatility: The rate hike-related market uncertainty could cause derivative contract prices to fluctuate more than usual(majorly towards the lower side).

Eventually, as interest rates decline, the opposite consequences will become apparent:

• Enhanced contract values: Future cash flows that are more appealing could increase the value of contracts.

• There could be continued volatility: Future rate changes could cause uncertainty, whichwould prolong the period ofhigh volatility.

Global Interconnectedness: Due to its integration with international financial markets, the Japanese derivatives market is vulnerable to outside shocks such as geopolitical upheavals and economic downturns.

Counterparty Risk: When one partyto a derivative contract default, the market is vulnerable to counterparty risk due to the reliance on OTC (over-the-counter) transactions.

Current Scenario and Future of Japan’s derivatives market:

Japan's extremely minimal rates and global trepidation are driving the market's volatility in the derivatives. OTC transactions are common, but laws are muttered. Technology expedites processes while simultaneously highlighting potential hazards. The times ahead?

Possible Future Patterns:

• OTC (Over-the-Counter) Derivatives Growth: Even though exchange-traded derivatives currently rule the market, over-thecounter (OTC) activity may increase because of its customization and flexibility options.

• PutSustainabilityFirst: Derivatives linked to sustainability, like ESGbased options, may become more popular as social and environmental issues gain more attention.

• Adoption of Blockchain Technology: Investigating blockchain technology for post-trade processing and settlement may result in cost savings and increased efficiency.

Imagine a massive marketplace where governments and businesses can borrow money from investors. That's the bond market in a nutshell. It's also known as the debt market, fixed-income market, or credit market, and it plays a crucial role in financing various activities, from infrastructure projects to corporate expansion.

Whousesthebondmarket?

• Governments: They issue bonds to fund public spending, like building roads or bridges. Japan, for example, boasts one of the largest government bond markets globally, with over $7.9 trillion in outstanding debt.

• Businesses: Companies issue bonds to raise capital for various purposes, such as acquiring other businesses, expanding operations, or simply staying afloat.

• Investors: Individuals, institutions, and even othergovernments can buy bonds to earn a steady stream of interest income. Bonds are

generally considered less risky than stocks, making them a popular choice for conservative investors.

Japan's bond market has been in the news lately due to its yield-curve control (YCC) policy. The Bank of Japan has been keeping interest rates near zero to stimulate borrowing and economic growth. This has made Japanese government bonds less attractive to investors, leading to decreased liquidity in the market. However, the recent expansion of the YCC target band may signal a shift in policy and potentially revive the market. The bond market is a complex and ever-evolving ecosystem, but understanding its basic principles can help you make informed investment decisions and gain insights into the global economy.

Japanese government bonds (JGBs) maturities range from two to forty years. Until the security matures, fixed coupon payments are made semi-annually, with the amount established at the time of issuance. Japanese government bonds (JGBs) are divided into four categories:

1. General Bonds, including bonds for debt financing and building.

2. Bonds issued under the Fiscal Investment and Loan Program (FILP) may be used to raise money for the Fiscal Loan Fund's investments.

3. Bonds for reconstruction.

4. Refunding bonds

• Japan Credit Rating Agency (JCR): The premier credit rating agency in Japan, JCR assesses the financial health of corporations and financial institutions. They cover over 60% of publicly rated Japanese companies and 70% of the financial industry. JCR also provides valuable economic and financial research, solidifying its role as a trusted advisor in the Japanese market.

• Rating and Investment Information, Inc. (R&I): Established in 1996, R&I is another prominent credit rating agency in Japan. They focus on providing credit ratings for structured finance products, assetbacked securities, and local governments. R&I's expertise in these areas makes them a valuable resource for investors and issuers alike.

• Japan Research Institute (JRI): While not strictly a credit rating agency, JRI plays a crucial role in assessing the creditworthiness of Japanese sovereign debt. Their research and analysis are highly respected by investors and policymakers alike, and they are often consulted on matters related to Japan's fiscal health.

• Moody's Investors Service: This global credit rating agency has a significant presence in Japan, providing ratings for a wide range of issuers, including corporations, financial institutions, and sovereigns. Moody's is a valuable source of independent credit analysis for investors around the world.

• Standard & Poor's (S&P): Another global credit rating agency with a strong presence in Japan, S&P provides ratings for corporations, financial institutions, and sovereigns. S&P's ratings are widely used by investors to make informed investment decisions.

There are two main categories of JGBs:

General Bonds and Fiscal Investment and Loan Program Bonds (FILP Bonds).

• Funding sources:

o General Bonds: Redeemed mainly with tax revenue.

o FILP Bonds: Redeemed and interest paid from recovered loans to FILP agencies.

• Market treatment: Both types are issued at the same interest rate and maturity, and are treated equally in the market.

Essentially, while the source of funds to redeem them differs, FILP Bonds and General Bonds are the same financial instruments from an investor's perspective.

General Bonds: General Bonds are a category of Japanese government bonds that can be further divided into four specific types: Construction Bonds, Special Deficit-Financing Bonds, Reconstruction Bonds, and Refunding Bonds. The revenue generated from these bonds is allocated differently depending on their purpose.

Construction Bonds and Special Deficit-Financing Bonds are issued under the General Account, meaning the revenue they raise is incorporated into the overall government revenue stream. This funding is used to support general government operations and infrastructure projects.

In contrast, Reconstruction Bonds are specifically issued to finance the recovery efforts following the Great East Japan Earthquake. The revenue from these bonds is directed to the Special Account for Reconstruction, ensuring it's dedicated to rebuilding efforts.

Refunding Bonds, on the other hand, are issued to raise funds for repaying matured government bonds. The revenue from these bonds is channelled into the Special Account of the Government Debt Consolidation Fund, aiming to manage and reduce overall government debt.

Fiscal Investment and Loan Program Bonds (FILP Bonds): Beginning in fiscal year 2001, the Japanese government introduced a new type of bond called Fiscal Investment and Loan Program Bonds (FILP Bonds) as part of a broader reform of the Fiscal Investment and Loan Program (FILP). These bonds are specifically designed to raise funds for investments made through the Fiscal Loan Fund.