BY

HUB ROARS BACK

Maritime mapped for the next generation

Singapore Market Report 2023

Fuel for thought Alternative Fuel reports from Lloyd’s Register Scan the QR code to subscribe or visit: maritime.lr.org/FFT Lloyd’s Register and variants of it are trading names of Lloyd’s Register Group Limited, its subsidiaries and affiliates. Copyright © Lloyd’s Register Group Limited, 2023. A member of the Lloyd’s Register group.

1 www.splash247.com CONTENTS 3 Editor’s Comment 5 Introduction 11 Economy 15 Port 19 MPA 21 SMF 23 Shipyards 27 Decarbonisation 31 Bunkering 35 Digital 39 HR 47 Lines 52 Offshore 54 Opinion 56 Data Singapore Straight Singapore has put in substantial investment into alternative fuel development alongside with first movers

many industries offer you the sense of purpose that maritime and logistics do

Not

— Carl Schou, president Wilhelmsen Ship Management

NXT 31 55

hope to identify more roles for job redesign

marked the return of life back to pre-pandemic days

— Punit Oza, founder Maritime

We

2023

Maritime Foundation

Association 21 47 There will be many opportunities in the green economy — Teo Eng Dih, chief executive Maritime and Port Authority of Singapore 19 For all the latest breaking shipping news from Singapore

— Beng Tee Tan, executive

director Singapore

— Caroline Yang, president Singapore Shipping

The site for incisive, exclusive maritime news and views www.splash247.com

EDITORIAL DIRECTOR

Sam Chambers sam@asiashippingmedia.com

ASSOCIATE EDITOR:

Adis Adjin adis@asiashippingmedia.com

ECONOMIST

Paul French

All editorial material should be sent to sam@asiashippingmedia.com

COMMERCIAL DIRECTOR

Grant Rowles grant@asiashippingmedia.com

GENERAL MANAGER

Victor Halder victor@asiashippingmedia.com

Advertising agents are also based in Tokyo, Seoul and Oslo – to contact a local agent please email grant@ asiashippingmedia.com for details.

MEDIA KITS ARE AVAILABLE FOR DOWNLOAD AT WWW.SPLASH247.COM/ADVERTISING

All commercial material should be sent to grant@asiashippingmedia.com

How to improve Singapore Maritime Week

Singapore Maritime Week in April was absolutely buzzing, a brilliant convocation of diverse maritime events covering all manner of topics and giving attendees a strong glimpse of the future of our industry.

Themed ‘Ambition Meets Action’, this year’s maritime week had more than 50 events dotted around the republic and an attendance of around 20,000 participants with Splash one of many companies footing incredible bar bills to welcome everyone.

Singapore was the first country to institute a maritime week, something that has now been copied around the worldbut the original remains the best.

To my mind, I’d say Singapore Maritime Week is now the third big gathering worth attending in the global maritime events calendar after Posidonia in Greece and Hamburg’s SMM. However, I’d add the caveat that as it stands this holds true every other year - ie in the odd years (2023, 2025, etc) when the Sea Asia exhibition is on.

DESIGN Belinda

Printed in Hong Kong

Copyright © Asia Shipping Media Pte Ltd (ASM), 20223

Although every effort has been made to ensure that the information contained in this review is correct, the publishers accept no liability for any inaccuracies or omissions that may occur. All rights reserved. No part of the publication may be reproduced, stored in retrieval systems or transmitted in any form or by any means without prior written permission of the copyright owner. For reprints of specific articles contact grant@ asiashippingmedia.com.

It’s not that Sea Asia is particularly good, it’s just that it’s better than the Asia Pacific Maritime expo which takes place in the alternate, even years.

Indeed, it is here that the authorities at the likes of the Singapore Maritime Foundation and the Maritime and Port Authority of Singapore need to have a sit

down.

If Singapore Maritime Week wants to kick on it needs to get its exhibition size up to, say, a Posidonia scale, something it is far from achieving at present.

Like it or not, exhibitions form the anchor events around which other maritime gatherings coalesce. In short, Singapore Maritime Week deserves a better, bigger exhibition to pull more people in.

Sam Chambers Editor Splash

EDITOR

Exhibitions form the anchor events around which other maritime gatherings coalesce

Market Report 2023 www.splash247.com Singapore

The preeminent shipping hub of the 21st century

Splash still detects no complacency when it comes to the Lion Republic looking to burnish its maritime credentials

Singapore’s maritime mantelpiece needs reinforcement, groaning from all the trophies, accolades and awards lavished towards the Lion Republic, the preeminent shipping hub of the 21st century.

Singapore remains the world’s leading maritime hub according to multiple global surveys. Despite concerns over human resources and soaring prices, there’s an argument to say Singapore has bolstered its maritime credentials compared to rival cities in the year since Splash’s last magazine on the city-state. Regionally, the close-in of China, seen through covid and in general with the direction

of Xi Jinping, has curtailed expertise in Shanghai, while the Sinofacation of Hong Kong has eroded that entrepôt’s claims to being Asia’s world city. More globally, a declining economy, soaring costs and political instability have seen London lose some of its shipping shine.

“Singapore continues to improve its standing as a global maritime hub, backed by supportive government policies, robust port infrastructure and a comprehensive range of maritime service providers,” says Dr Harry Banga, chairman and CEO of the

Caravel Group.

“Without a question, Singapore maintains and is building on its position as the leading maritime capital of the world,” says Raymond Peter, managing director of BSM Singapore.

Nevertheless, Peter is keen to stress that decision-makers and institutions of the country are not becoming complacent.

“We need to remain watchful, agile and flexible to remain relevant to the very demanding nature of our industry,” he says.

5 www.splash247.com INTRO

We need to remain watchful, agile and flexible to remain relevant

More maritime More mature More Monjasa

Monjasa means personal business in the oil and shipping industries and has been sustaining maritime trade developments across Asia since 2008.

Today, we are located in Singapore, Shanghai and Ho Chi Minh City and positioned as a global top 10 marine fuels supplier. monjasa.com

“Singapore maintains a leading position due to the accessibility of travel as well as the ease of doing business in the country, access to capital, assurance in a robust legal system and the unique opportunity Singapore gives to leverage its diverse multicultural business and talent environment,” says James Forsdyke, client marketing director at Lloyd’s Register, conceding, like many others, that there are issues over rising costs and securing the services of foreign talent.

Sectors for improvement

Citing the the 2022 Leading Maritime Cities publication, authored by his company and Menon Economics, Dr Shahrin Osman,·DNV’s regional head of maritime advisory, notes Singapore ranked a comparatively low eighth in the

world when it comes to maritime finance and law.

“The city needs to focus on developing shipping finance activities,” Osman says, adding: “Specifically, there is a need to encourage the growth of listed maritime companies in the local stock exchange, increase the shipping portfolio of banks with headquarters in Singapore, and expand the number of maritime syndicate-mandated loans.”

“Weaker areas, such as ship finance, capital and equity markets remain,” says Charles Maltby, CEO of BW Epic Kosan.

Rama Chandran, head of marine at QBE Singapore, is one of a number of respondents who points to insurance as a weaker part of Singapore’s maritime armour.

“Though we are well represented by

international insurers, only two local insurers provide marine insurance despite the maritime sector contributing to 7% of Singapore’s GDP,” Chandran says.

Matt Cannock, managing director of Latitude Brokers, describes the local marine insurance market as “somewhat lightweight”.

“It has excellent representation from the P&I sector but needs more capacity and lead markets for hull and machinery risks,” Cannock argues.

Cost concerns

All those polled for this 56-page magazine have voiced familiar concerns about the high costs of doing business in Singapore. For all the awards and accolades the citystate receives, the one authorities cringe

7 www.splash247.com INTRO

The cost element is presently a topic of concern in all board rooms

CONTINUOUS CONNECTIVITY GUARANTEED PERFORMANCE CONTROLLED COSTS FULLY MANAGED SERVICE BUSINESS APPLICATIONS CREW INTERNET INTEGRATED IoT EDGE COMPUTING Experience the next level of maritime communications with exceptional performance, simplicity and reliability – wherever you operate in the world. Fleet Xpress, enabling the maritime data revolution. Powering global connectivity inmarsat.com/gxfx Discover the power of

Singapore has gone from a high-cost place in which to run a business, to an excessively expensive place

at is the the regular annual crowning by The Economist of Singapore as the world’s most expensive city.

“The cost element is presently a topic of concern in all board rooms,” concedes BW Epic Kosan’s Maltby.

Philippe Lecloux, head of marine at Aderco, describes the cost of local office space and accommodation as “crazy”, saying, like others, that his company is having to consider alternatives.

“Office and accommodation rents have tripled over the past year and Singapore needs to be careful that it doesn’t become a too costly place to do business in,” says a spokesperson for OSM Thome.

“Thanks to inflation, Singapore has

gone from a high-cost place in which to run a business, to an excessively expensive place,” says Bjorn Hojgaard, CEO of Anglo-Eastern, adding that he is confident the authorities will know how to reel in inflation and stay competitive.

Vinay Gupta, managing director of Union Marine Management Services, says it is hard to survive keeping the entire workforce in Singapore and more and more companies are strengthening their back offices and shifting roles outside of Singapore.

“The good part or the silver lining is that it is bringing in efficiencies and digitalisation as a continuation of what was started during the covid time,” Gupta says.

“Cost remains a key consideration,” concedes Chandran from QBE Singapore, “but technology and AI have helped to outsource back-end functions to low-cost markets or even done away with such tasks entirely. The challenge is to develop and retain top talent, an increasingly scarce commodity.”

Another familiar issue brought up by Heidi Heseltine, who heads up Halcyon Recruitment, are the high amounts of red tape and administrative burden.

Combined with the human resources issues (covered in depth on page 39) there’s clearly a lot for Singapore’s mandarins to be working on to ensure the maritime trophy case continues to swell.

For all the latest shipping and offshore news from Singapore

9 www.splash247.com INTRO

Feeling the heat

Things are hotting up in Singapore – literally and figuratively (not to mention statistically).

Recently the Southeast Asian citystate has experienced record-breaking temperatures reaching 37 degrees C. The National Environment Agency (NEA) has reported that this temperature equals a 40-year record for the highest daily maximum temperature. Nobody is enjoying the weather particularly –heatwaves are not much fun even if you’re used to pretty high temperatures. Similarly nobody much likes economic slowdowns – even if you’re experienced them before. And 2023 is proving to be a tough one with the dreaded combo of slow growth and high inflation.

It’s generally acknowledged that, by global standards, Singapore’s emergence from covid has been better managed than in most places. Despite restrictive measures due to the pandemic, the global trade slowdown, reduced shipments passing through Singapore port and a dent in consumer spending and tourism revenues, 2022 wasn’t all bad – indeed GDP finished 3.6% up yearon-year. Most analysts had pretty rosy predictions for 2023 based largely on Singapore doing the things Singapore does best – facilitating global trade in an improving worldwide market, and then

going shopping thus boosting domestic consumption. But things haven’t worked out quite that way. Exports have not been as robust as hoped, industrial production is down and all this uncertainty about recovery combined with multi-year high inflation has meant the many malls of Singapore have been quieter than expected.

The interventionist Ministry of Finance has launched some additional stimulus measures with enhancements to the assurance package but that didn’t prevent first quarter GDP numbers falling fell by -0.7% on a quarter-on-quarter basis. With no end in sight for high inflation and global trade remaining weaker than hoped for GDP predictions for 2023 have, by most analysts, been revised down from just over 2% to just under.

Where the problems lie

It’s clear where some of the trade problems are. Shipments to markets east of Singapore - China, Taiwan and Hong Kong as well as Japan and South Korea are all significantly down while local destinations – Vietnam, Malaysia, and Thailand – are displaying weak demand

too. Going the other way, the US, UK, and EU all remain more buoyant than East Asia, but still somewhat wobbly demandwise. When it comes to electronics in general, and chips in particular, Singapore really needs China’s post-covid recovery to be stronger than it is presently looking. But it’s a see-saw approach – hoping for more demand from China while it’s all too possible the US and Europe could reduce demand. Getting the balance right is hard and, though important to Singapore, largely out of their control.

As an entrepôt economy with a relatively small domestic market slow trade means slow industrial output for Singapore. Industrial output has been contacting for six consecutive months now in just about every significant sector except food (which, again due to a small population, virtually zero agriculture etc is relatively small). The key areas – the areas Singapore’s government prioritises such as precision engineering, transport engineering and biomedical – were all contracting or at best flat in the first quarter of this year. Again the key is Chinese (and to a lesser extent Japanese and South Korean) economic recovery.

11 www.splash247.com ECONOMY

2023 is proving tough with the dreaded combo of slow growth and high inflation

Splash takes the feverish pulse of the local economy

By pairing our technical knowledge with the latest digital technologies, ABS leads the maritime industry in providing customers with innovative, tailored sustainability solutions that deliver results.

Learn more today at www.eagle.org/sustainability.

Slow trade means slow industrial output for Singapore

China Jiayou

Singapore is currently looking more nervously at China than it has in some time. Consider China’s importance as an export destination for Singapore in 2019 (see below) – a situation Singapore would like to get back to. For two decades now Chinese importers, as well as Chinese nationals offshoring their wealth and often families, have been a crucial component of Singapore’s bread and butter in everything from container shipping and FABs to the art market and casinos. Put simply, Singapore needs China to jiayou – “add oil”. Increased Chinese shipments of Middle Eastern oil and goods from points west of the Malacca Straits would be good for the port as would the returning containerships. Tourism revenues (mainland Chinese constituted 16% of visitors in 2019 and a high percentage of spend on luxury goods, etc) would be a handy way to reboot consumer spending right now in the face of a local slump due to economic concerns, cost-of-living rises and particularly high property prices (including a rise in the Additional Buyer’s Stamp Duty (ABSD)). There are definitely signs that Chinese tourists are returning and if the upswing continues in the

second half of 2023 as it has in the first since the ending of covid-zero then this objective could be achieved.

The Asian hub?

Slightly tough times for Singapore and the continuing heatwave isn’t providing much respite for anyone. Still, it does seem that Singapore is perhaps winning the so-called ‘battle of the Asian hubs’. This is essentially taken to mean that Singapore is winning a lot of business, as well as high net worth individuals (HNWIs) from Hong Kong. A recent Financial Times survey of the two rival entrepôts, looking at real estate prices, air traffic and other

indicators, tipped Singapore as clearly ahead. Partly this was due to foreign MNC frustration with Hong Kong’s tough quarantine measures and slow opening up process but clearly there are concerns, concerns that are far from going away, about the rule of law and political trajectory of the Special Administrative Region (SAR) that affect everything from the territory’s investment climate and legal protections to simple quality of life issues for many HWNIs and expatriates.

Gains have been made – in 2022 Singapore bested Hong Kong as the region’s busiest airport. Foreign funds appear to be growing in Singapore and declining in Hong Kong. However, the notion that Singapore will replace Hong Kong completely, especially in financial services, is some way off – such things take time. However, the Singapore government does appear eager to win the fight and has been prioritising key innovative areas such as fintech. And there does appear to be a trend. While many financial firms are not closing their offices (including Black Rock, Wells Fargo and a number of others) keen not to annoy Hong Kong (read Beijing) they are only adding staff in Singapore.

Hong Kong is still far ahead of Singapore, with stock market turnover and market capitalisation but right now the momentum appears to be towards Singapore more than the SAR.

13 www.splash247.com ECONOMY 44.9% 4.9% 7.4% 8.0% 10.9% 11.8% 12.2% China Hong Kong Malaysia Indonesia USA Japan Rest of World China Hong Kong Malaysia Indonesia USA Japan Rest of Item 1 11.8 10.9 8.0 4.9 44.9 Rest of World Japan USA Indonesia Malaysia Hong Kong China Singapore: Major Export Destinations Source: Department of Statistics, Singapore

Rising in the west

The last steel remnants of a former port powerhouse protrude the skyline by Vivo City shopping mall (pictured above), ready for dismantling as the full scale relocation of PSA Singapore to the western edges of the republic nears completion.

At the end of February, PSA Singapore celebrated the millionth teu handled at its state-of-the-art Tuas Port. Staff, management, and unions gathered in honour of the occasion. This feat was achieved just six months after the official Tuas opening ceremony on September 1 last year.

Commemorating this milestone, regional CEO Southeast Asia Ong Kim Pong said: “With five operational berths at Tuas, we now operate one of the world’s most advanced and automated ports. Such achievements are made possible by the strong partnership and commitment of our team and the unions. Besides

developing Tuas Port into an extensive and well-connected maritime hub, we will be developing an adjacent cargo hub –the Tuas Port+ Hub – offering container freight station, warehousing and flow centre services in the immediate future.”

The development of Tuas Port and the surrounding logistics ecosystem will unfold in the coming decades as PSA Singapore continues to expand on its comprehensive suite of value-added port services, innovative cargo solutions, and supply chain orchestration. When fully completed in the 2040s, Tuas Port will have a handling capacity of 65m teu annually, close to double the volumes being handled in Singapore today.

The Maritime and Port Authority of Singapore (MPA) and PSA recently reaffirmed a 12-year partnership with fresh cash injections to support research aimed at improving the productivity and sustainability of port operations.

As part of the agreement, which was first inked in 2011, MPA and PSA will each commit $12m to support transformative research and development projects in areas such as automation, robotics, digital solutions and sustainability.

Speaking before the signing ceremony, senior minister of state for finance and transport Chee Hong Tat said the renewed partnership will prioritise new technologies, such as robotic solutions for handling containers and the testing of smart grid and energy storage systems.

PSA will be working with industry partners, institutes of higher learning and research institutions on many of these projects, he said. “Through these initiatives, we provide support for our local innovation and research ecosystem, and attract more research and start-up activities to Singapore,” Chee said.

Since 2011, the MOU has resulted in

15 www.splash247.com PORT

Developments at Tuas Port on the western edge of the republic are happening thick and fast

Tuas will ensure that Singapore remains a relevant hub

Singapore will be the first port in the world to provide full 5G connectivity across our port waters

many improvements at PSA ports, such as the deployment of automated guided vehicles – which are battery-powered –at Tuas Port.

Chee said steps are also being taken to enable new technologies, such as the use of maritime drones, to increase the flexibility and efficiency of ship-to-shore deliveries and conduct remote ship inspections.

Drone port

Singapore wants to set up a drone port for the delivery of ship supplies and will launch a call for proposals (CFP) later this year. The move was announced at Singapore Maritime Week.

“The CFP will act as a pathfinder for public agencies and private companies to develop a concept of operations for drones that is suited to Singapore’s operating environment as a busy hub port,” said senior minister of state for finance and transport Chee Hong Tat.

Singapore has been trialing drone deliveries for quite some time. In 2020, F-drones was the first company in Singapore to receive authorisation

Singapore is also in the process of rolling out its maritime 5G network in phases between now and mid-2025.

“When completed, Singapore will be the first port in the world to provide full 5G connectivity across our port waters,” said Chee.

Overall, visitors to Tuas today are able to get a privileged view of port operations which are many years ahead

of the vast majority of other terminals around the world.

Comments Andy Lane, who runs Singapore container advisory CTI Consultancy, “The peninsular design at Tuas ensures minimal transhipment container movement distances. It is highly automated with automated rail mounted gantries and automated guided vehicles patrolling the yard, making it virtually greenhouse gas-free. Tuas will ensure that Singapore remains a relevant hub and a top 25 performer in terms of efficiency for decades to come.”

from the Civil Aviation Authority of Singapore to conduct beyond visual line of sight (BVLOS) drone deliveries to ships in Singapore, with Eastern Pacific Shipping as its first paying customer. The company then teamed up with offshore vessel owner and operator Marco Polo Marine to codevelop what are claimed to be the

world’s first large-scale, electric aerial delivery drones for offshore wind farms.

Also, Singapore’s sole multipurpose port, Jurong, has joined forces with advanced air mobility infrastructure developer and drone operator Skyports to explore the development of ship-toshore infrastructure.

16 Singapore Market Report 2023 PORT

MOMENTUM WHERE IT MATTERS

Building from a one-country operation at the Port of Manila in the Philippines, ICTSI has pressed forward across 35 years. On six continents, currently in 19 countries, we continue developing ports that deliver transformative benefits.

All across our operations, we work closely with our business and government partners, with our clients and host communities: to keep building momentum where it matters, in and through ports that keep driving sustainable growth.

ARGENTINA • AUSTRALIA • BRAZIL • CAMEROON • CHINA • COLOMBIA • DR CONGO • CROATIA • ECUADOR • GEORGIA • HONDURAS • IRAQ INDONESIA • MADAGASCAR • MEXICO • NIGERIA • PAPUA NEW GUINEA • PHILIPPINES • POLAND

www.ictsi.com

At the helm

Last September Teo Eng Dih moved from the Ministry of Defence to assume one of the most heavyweight positions in global shipping, replacing Quah Ley Hoon as chief executive at the Maritime and Port Authority of Singapore, one of the world’s most influential maritime regulators.

In his opening year as head of the port authority, Teo (pictured on the left with IMO secretary-general Kitack Lim) has worked hard to extend relations with key partners around the world, as well as providing clear guidance on where Singapore sees the most pressing issues of the day facing the shipping industry.

In one of his first high profile speeches, Teo gave a hint of how all

matters green would be paramount in his tenure, telling delegates attending a forum for the Singapore registry: “As a small, low-lying country with an open economy, Singapore is particularly vulnerable to the adverse impact of climate change. At the same time, there will be many opportunities in the green economy as we embark on the energy transition.”

Teo said the Singapore government’s recent announcement to raise the republic’s climate ambition to achieve net-zero emissions by 2050 would provide a clear target for businesses and the MPA to work towards.

“It positions maritime Singapore as the choice location for global investors and stakeholders keen to be part of a growing

green economy,” Teo said, explaining: “A net-zero emissions commitment guides our maritime efforts for our port infrastructure, logistics and domestic harbour craft sector. And our commitment anchors the stance and trajectory of efforts to decarbonise our maritime sector.”

During this year’s Singapore Maritime Week the MPA and eight top classification societies signed a letter of intent (LOI) to collaborate in the areas of maritime digitalisation and decarbonisation.

Under the LOI, MPA and the eight classification societies will strive to collaborate in areas such as smart and autonomous shipping, cyber security, electrification, and zero- and low-carbon fuels.

MPA and the classification societies said they would work together to develop standards and technical references in the areas of maritime digitalisation and decarbonisation with a focus on meeting Singapore’s requirements as a start. This could cover zero or lowcarbon marine fuels such as methanol, ammonia and hydrogen, as well as marine electrification.

The group will also work together to enhance future vessel designs for both ocean-going and domestic harbour craft to enhance safety, security and efficiency of new designs. To prepare the maritime workforce to operate increasingly sophisticated vessels, an area of potential collaboration would be to develop new training curriculum for emerging skills relating to digitalisation and decarbonisation.

Similar tie-ups have been announced by the MPA in recent months with key maritime players including energy giant Shell and Finnish tech firm Wärtsilä.

19 www.splash247.com MPA

Teo Eng Dih has made his mark in his first year in charge of the republic’s port authority

Maritime Singapore is the choice location for global investors and stakeholders keen to be part of a growing green economy

CHAMPIONING TOMORROW

First we pioneered digital shipping. Then we promoted fuel transition. Now we deploy non-flammable rechargeable batteries.

Singapore | Mumbai | New Delhi | Chennai | Pune | Kochi | Houston | Hong Kong | Makati | Ioilo | Muntinlupa | Seoul | Busan Copenhagen | Tokyo | Dubai | Hamburg | Perth | Dalian synergymarinegroup.com

Redesigning jobs

The SMF’s Maritime Workforce Transformation Guidebook is essential reading

Among the many publications and research documents released from the Singapore maritime community this year the Singapore Maritime Foundation (SMF) could lay claim to having authored the most important one to ensure the republic remains a vital shipping hub.

The SMF has launched a Maritime Workforce Transformation Guidebook which offers a practical approach for companies in the maritime sector to embark on job redesign to better attract talent to the industry, a crucial piece of research as reflected in the overarching human resources theme of this magazine.

The guidebook is distilled from key findings and actionable recommendations of a job redesign pilot conducted in 2022 by SMF in partnership with Pacific Carriers Limited (PCL) and Pacific International Lines (PIL). The pilot, which focused on the roles of a technical superintendent and a vessel operator, was supported by the Maritime and Port Authority of Singapore (MPA).

Maritime companies in Singapore

will find the job redesign methodology in the guidebook useful for other roles beyond technical ones. The launch of the guidebook represents a concrete step forward by the maritime sector in Singapore to improve the attractiveness of maritime jobs to the talent pool and to develop a sustainable career development path for these roles.

Professional services organisation Ernst & Young was appointed by SMF to provide advice by applying their job redesign methodology to refresh the value propositions of both the two technical roles, plan interventions across career development, enhance work processes and spur digital adoption.

Through insights gleaned from extensive interviews with stakeholders at both PCL and PIL, the guidebook proposes pathways to redesign the job of a technical superintendent from that of a technical problem solver to a people leader and data-driven decision maker. For vessel operators, the guidebook suggests ways to redesign the job from one that is operational in

nature to one that offers strategic value through operational excellence.

“By developing pathways to enhance and elevate the jobs of the technical superintendent and the vessel operator, we demonstrated the potential and possibilities of job redesign as a methodology to transform the maritime workforce. Going forward, we hope to identify more roles for job redesign,” said Tan Beng Tee, executive director of the SMF.

“The pilot has sharpened our employees’ aspirations and crystallised areas for reskilling and upskilling with emphasis on digitalisation and sustainability. We also gained clarity on the pathways to evolve the two roles – technical superintendents and vessel operators – to be stronger value generators to the business,” said Hor Weng Yew, CEO of PCL.

Lars Kastrup, CEO of PIL, commented, “The job redesign has certainly helped to transform the traditional scope of a technical superintendent into a more comprehensive and meaningful role as a vessel manager. We hope that this will make shipmanagement an attractive and interesting career option.”

21 www.splash247.com SMF

We hope that this will make shipmanagement an attractive and interesting career option

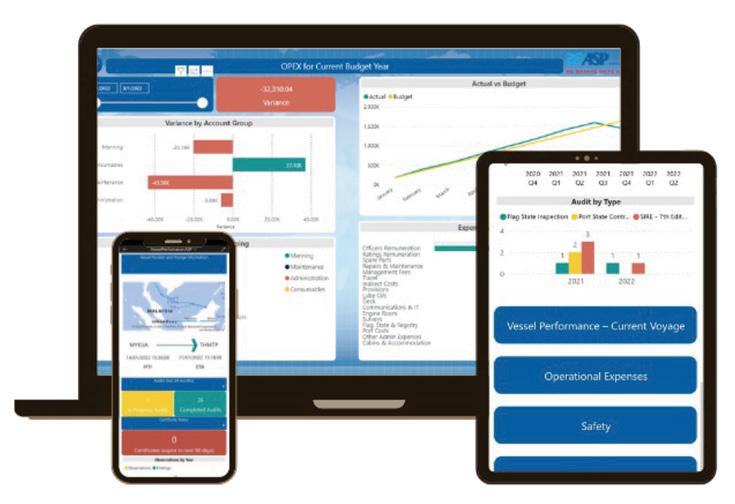

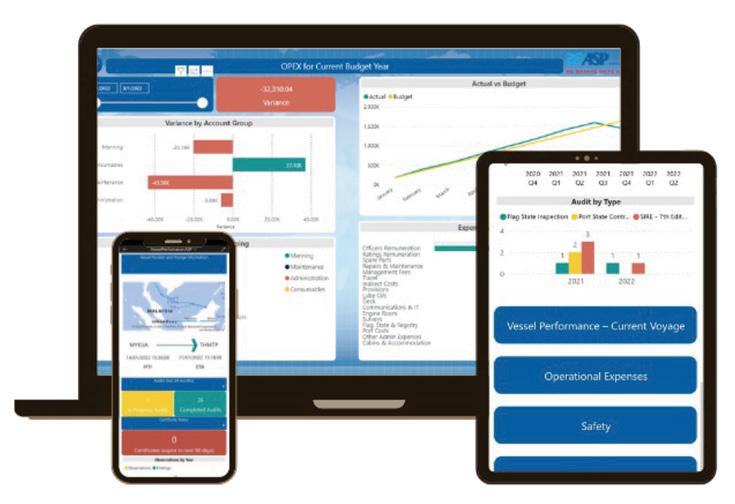

Digital Ship Management Solutions for Ship Owners

We manage maritime assets more efficiently, ensure compliance, and minimise risk by using modern digital systems.

Our global network of offices allows us to manage ships trading worldwide and provide crew from a wide range of nationalities.

BENEFITS OF DIGITAL SYSTEMS

• Real time access to information – vessel position, routing, machinery status, operational performance and financial data

• Single source of truth for all stakeholders onboard ship and ashore

• Improved decision making

• Enhanced operational efficiency

ASP DIGITAL SOLUTIONS

We focus on the key areas where we can deliver tangible benefits to ship owners – reduced costs, lower risk, improved voyage performance and better compliance management.

We utilise the best technology to provide huge benefits but at a low cost. We also employ the latest AI technology to avoid expensive monitoring and onboard installation costs.

Then we integrate all of our systems to provide real time transparent data for the ship owner.

This allows us to reduce costs; optimize voyage routing; and closely manage speed/consumption, emissions reporting and engine/hull performance.

Ship Management

Technical Support

Crew Management

Newbuilding Supervision

Marine Logistics

• Improved Safety

• Lower Costs – bunkers, lubes, maintenance, crew rotation

• Better compliance management

UNIQUE DASHBOARDS

ASP provides transparent real time data to our ship owners – carefully curated to offer a high level snapshot of key data. Then we display this in our unique dashboards that are accessible on-line.

Simple, effective and beneficial for our clients.

Contact us for more details

Should you be interested in using ASP for the Technical Management of your fleet then please contact us at:

ASP Ships Group

Singapore

njmoore@aspships.com or enquiry@aspships.com

+65 9755 7024 (mobile)

New name, new beginnings

Keppel Offshore & Marine and Sembcorp Marine

Fresh from its combination with Keppel Offshore & Marine, Sembcorp Marine has rebranded and is now known as Seatrium, creating a monster name in the Asian shipyard scene.

The new name is a “reflection of the business and its aspiration to be a premier global player providing innovative engineering solutions for the offshore, marine and energy industries”, the company said in a release.

Singapore’s top two yards completed their mega merger at the end of February.

The combined yard group has a total orderbook of more than $13bn lasting through to 2026.

have finally

completed their long mooted merger

“While integration of this scale will present challenges, the enlarged group is expected to benefit from greater synergies from the broader geographical footprint, larger operational scale and enhanced capabilities of Singapore’s two leading O&M companies,” the newly merged company said.

Merging the shipyard units of Keppel and Sembcorp has been mooted many times over the past 20 years as Singapore faces up to cheaper shipyard competition across Asia.

In May Seatrium secured a new contract worth over $377m with Empire Offshore Wind, a joint venture between

Equinor and BP, to deliver two substations for offshore wind farm projects on the US East Coast.

The scope of the project involves the engineering, procurement, construction, offshore hook-up and commissioning of two platforms for the Empire Wind 1 and 2 offshore wind farms located about 31 km south of Long Island, east of the Rockaways.

Once constructed, Empire Wind 1 and 2 will have a total installed capacity of more than 2 GW and will power more than 1m New York homes. Construction works on the 810 MW Empire Wind 1 platform and the 1,260 MW Empire Wind

23 www.splash247.com SHIPYARDS

The enlarged group is expected to benefit from greater synergies

Commercial Integrity

West is a leading insurance provider to the global maritime industry, combining financial strength with outstanding service to help its Members meet the continually evolving liability environment in which shipowners, operators and charterers operate.

New Club covers for Hull and War risks launched on 1 March 2023. For more information, contact us: WestHull@westpandi.com or WestWar@westpandi.com

www.westpandi.com

2 platform are expected to commence in the fourth quarter of 2023 and the second half of 2024, respectively, at Seatrium’s yards in Singapore and Indonesia.

Seatrium is also building a wind turbine installation vessel (WTIV) for Maersk Supply Service, which will be deployed at Empire Wind. The group

also recently won contracts for three 2 GW high voltage direct current converter platforms for offshore wind farm projects in the Netherlands.

A new name has not been able to dodge old problems however. Singapore’s Corrupt Practices Investigation Bureau (CPIB) has just opened an investigation into business practices at Seatrium.

Seatrium said investigations relate to events that occurred prior to 2015.

In a statement at the end of May, CPIB said that acting on information received, it had begun investigations against Seatrium, as well as individuals in the offshore and marine engineering company, on alleged corruption offences in Brazil.

25 SHIPYARDS

IMPA Singapore Title Sponsor Supported by IMPA Singapore Sponsors www.impaevents.com Register here: https://bit.ly/IS2023Reg or contact Hannah Rice: hrice@impa.net Interested in exhibiting or being a sponsor contact Paul Skinner: pskinner@impa.net IMPA Singapore. 2023

Procurement

21-22 NOVEMBER 2023 Suntec Convention Centre www.splash247.com

World-leading Maritime

Events

The committed partner of progress for everything at sea.

As the world’s largest tanker manager with over 35 years’ experience in managing vessels in the shipping, cruise and energy sectors, V.Ships Singapore is committed to delivering safe and compliant operations through transparency, pro-activeness and strong partnerships.

V.Group serves c. 3,500 vessels globally, offering a unique mix of services across technical management, crew management and our broad range of marine services including decarbonisation, technical services, insurance, catering, travel and supply chain solutions.

With over 300 tankers under full technical management and a 35-year track record, we are committed to delivering safe and compliant operations based on strong partnerships with our clients.

www.v.group

Green ties

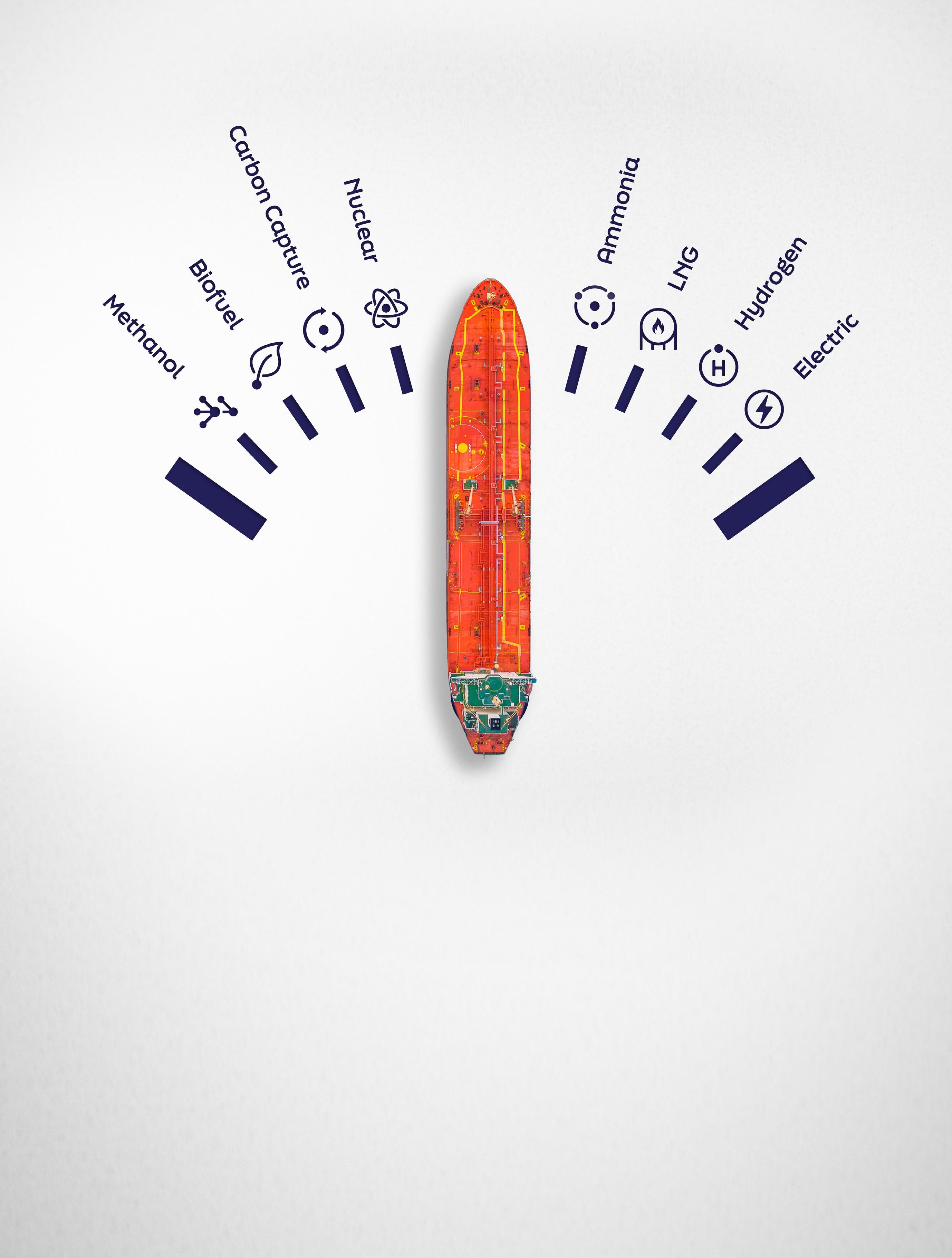

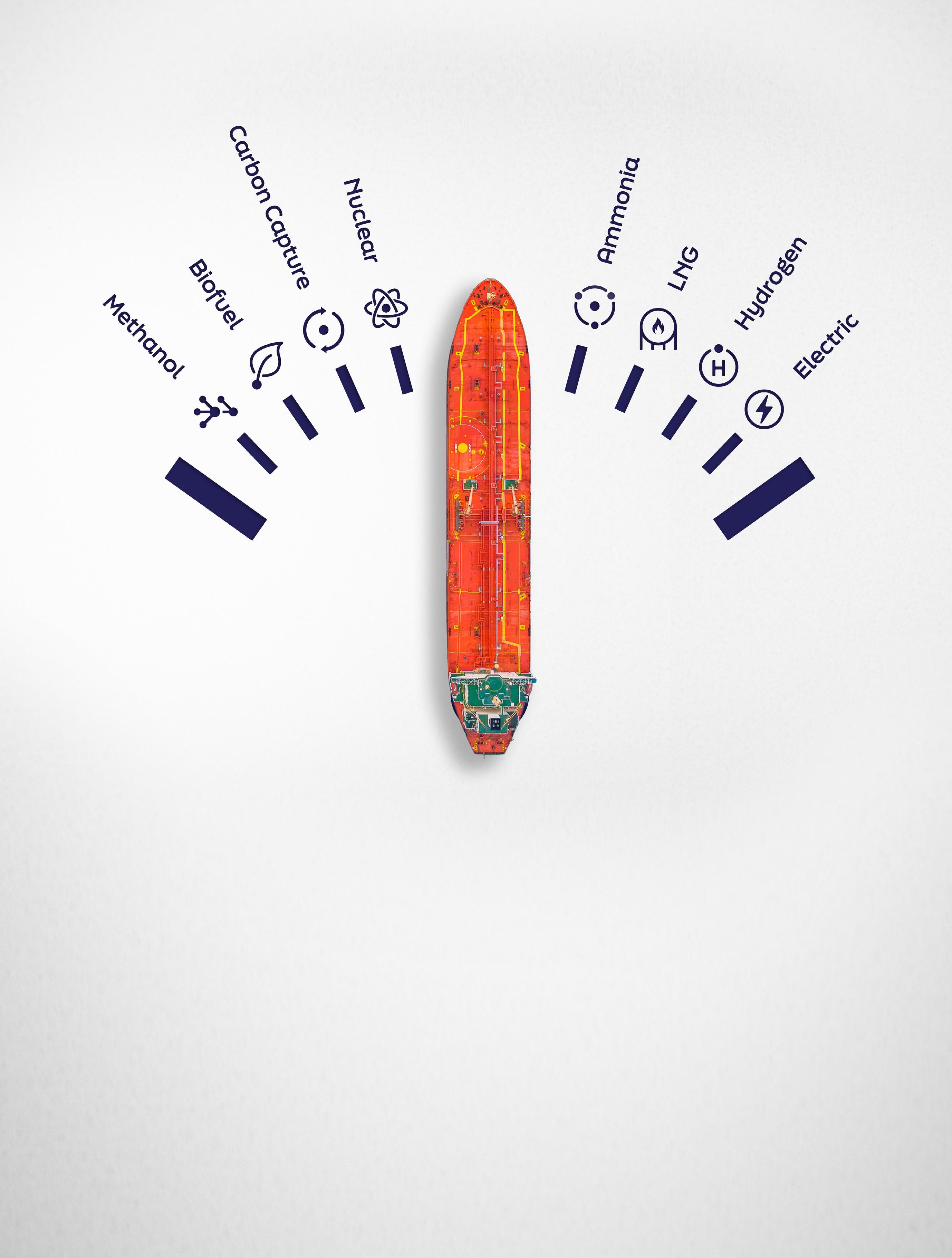

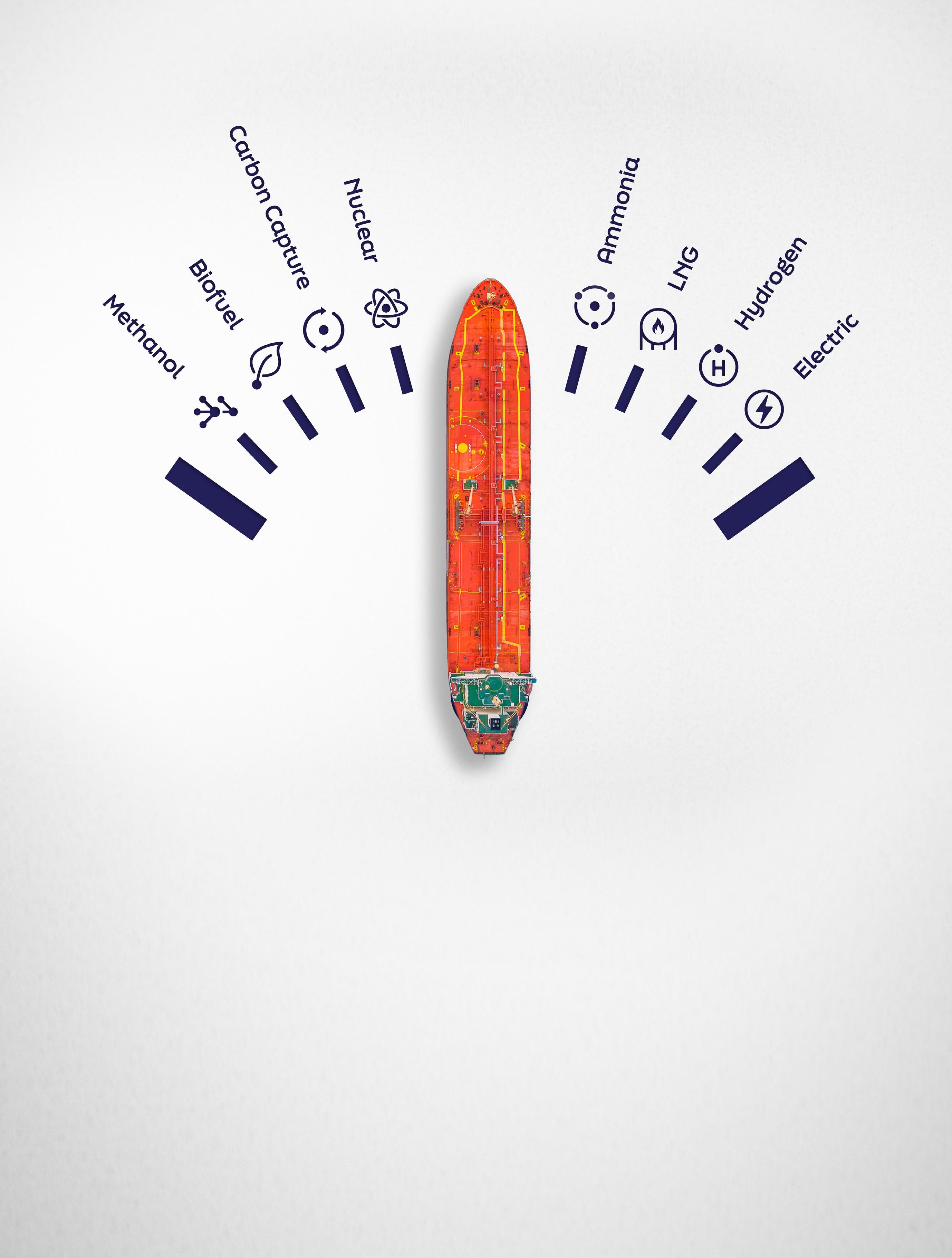

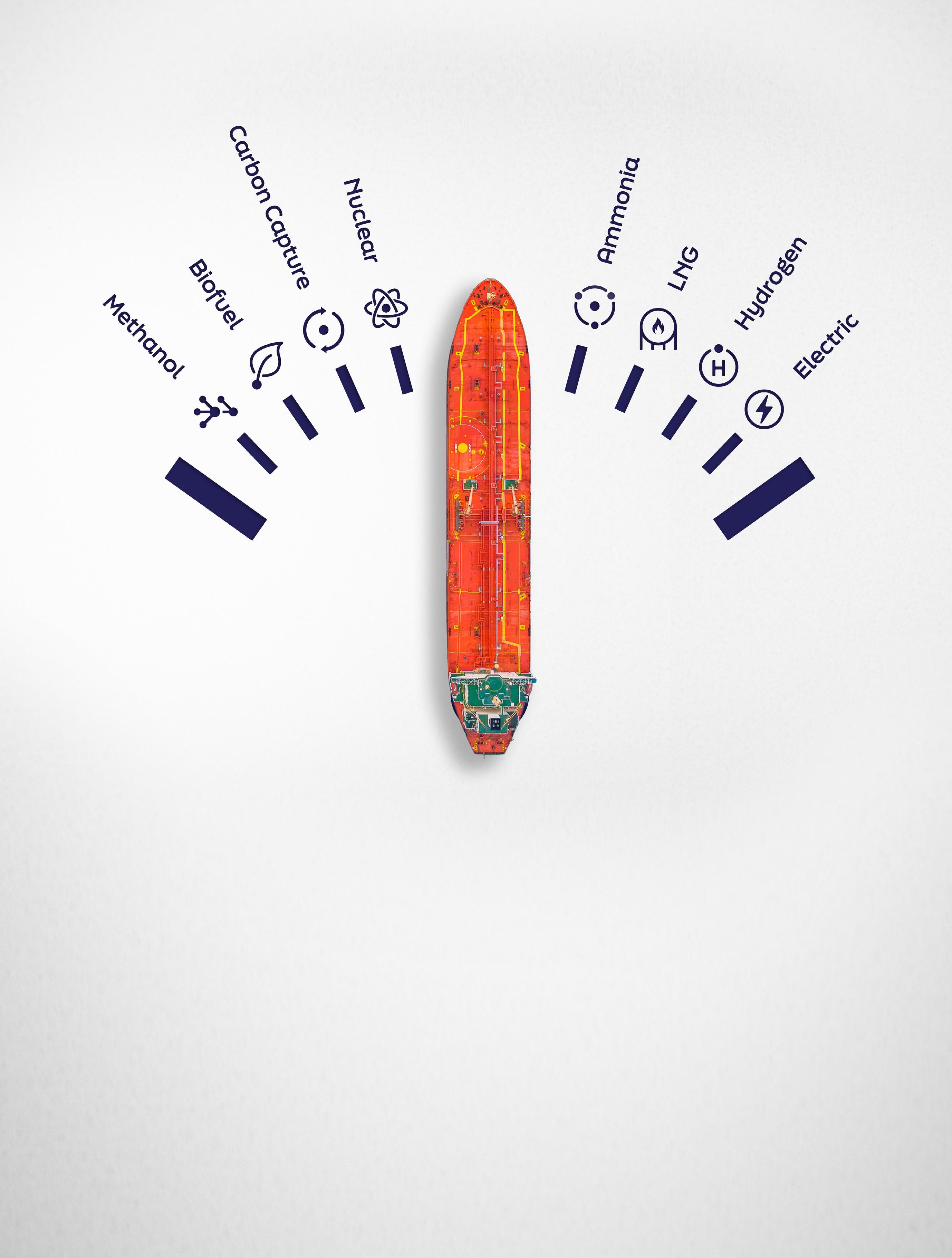

Grab a pencil and draw in the lines of all the proposed green shipping corridors around the globe, and readers will notice that the crossroads of world trade - Singapore - lies at the nexus of many of these new fuel routes.

This green preemptive positioning is not by accident - the canny folk at the Maritime and Port Authority (MPA) of Singapore have ensured - absent of being able to produce the alternate fuels themselves on home soil - that Singapore, the world’s largest bunkering hub, will still be very much at the centre of shipping’s green transition with new fuel links acting as petri-dishes between the Lion Republic and the US, Europe and Australia among others.

Multi-fuel commitments

As the Bunkering section of this magazine (see page 31) makes clear, Singapore is preparing for a multi-fuel future, and has assembled some of the best brain power on the planet when it comes to prepping for the green transition, many of whom work for the Global Centre for Maritime Decarbonisation (GCMD).

Formed two years ago with funding from the MPA, and six founding partners, namely BHP, BW, DNV Foundation, Eastern Pacific Shipping, Ocean Network Express and Sembcorp Marine, GCMD was established as a non-profit organisation to support decarbonisation of the maritime industry to meet or exceed

the International Maritime Organization’s (IMO) goals for 2030 and 2050.

“Singapore recognised early on that decarbonisation is crucial,” says Raymond Peter, managing director of BSM Singapore. The port is now geared up to handle LNG, methanol, biofuels, ammonia and hydrogen, he says.

The Singapore government has set itself a target of achieving net zero emissions by 2050, which will require all sectors, including maritime, to establish clear goals and roadmaps to achieve this.

“It is encouraging to note that with the new national target, the MPA has announced that all newbuilding harbour crafts operating in Singapore waters must be zero-emission ready by 2030 through

27 www.splash247.com DECARBONISATION

The republic has made itself a world-class resource for shipping’s transition away from fossil fuels

Singapore is competing with Copenhagen

DYNAMIC PREVENTION PROGRAM (DPP)

Innovation that helps our ships prepare for inspection.

ALL FLAGS ARE NOT ALIKE

WWW.LISCR.COM

The program monitors an average of 7000+ port arrivals monthly

Reduces Port State detention rates

Identifies vessels which need assistance No additional charge

The roadmap is clearly being formed

electrification, using 100% biofuel or zero-emissions hydrogen-based fuels,” says Dr Shahrin Osman,·DNV’s regional head of maritime advisory.

To accurately monitor progress towards this goal, Osman suggests that an emission-reporting regime is necessary to establish an accurate baseline and track emission reductions.

As well as the multi-fuel preparations, collaborations with other industries and nations are ongoing, while Rama Chandran, head of marine at QBE Singapore, says carbon capture and the requirement for shore receiving facilities are being “heavily discussed”.

“Though we are at the early stages of finding the right options, the roadmap is clearly being formed,” Chandran relays.

Hurdles

“Without policy measures, interventions and bottom-up initiatives, the industry may find it challenging to invest in green solutions to meet the emissions target,” DNV’s Osman says.

Morten Ostergaard Jacobsen, managing director of Asian operations for bunker supplier Monjasa, says Singapore is at a disadvantage when it came to producing its own green powered alternative fuels such as green methanol and green ammonia, which will demand additional resources for energy import.

There’s also the familiar concerns about suitable talent for this transition - a theme that populates many of the pages of this magazine.

“Decarbonisation and sustainability skills and experience are in short supply and Singapore is competing with Copenhagen, which are the two main centres,” says Heidi Heseltine, who heads up Halcyon Recruitment.

Concluding, BSM’s Peter tells Splash: “No doubt, the transition to a greener future will involve costs and trade-offs, but there is no alternative.”

29 www.splash247.com

DECARBONISATION

For unrivalled green shipping coverage

wingd.com Variable compression ratio delivering: Reduced fuel consumption Reduced emissions Optimised performance Meet us at EHM, stand 9035

The multi-fuel future

Singapore has maintained its huge dominance in the the global bunkering scene, while prepping for a new fuel future with LNG, biofuels and methanol looking like key alternate fuels for the remainder of the 2020s with ammonia coming into play later on.

Of the top 17 bunkering locations around the world who account for 61% of the global market of 230m tonnes, Singapore held a 36% market share last year, according to data from bunker supplier Minerva. Second placed Amsterdam-Rotterdam-Antwerp (ARA) region had an 11% share with Fujairah filling out the podium with a 6% share, highlighting the extreme dominance the Southeast Asian nation has when it comes

to fuelling the world’s merchant fleet. This year has seen a solid year for bunker sales in Singapore. Monthly sales hit over five-year highs in May. Sales extended gains for a third consecutive month to 4.52m tonnes, up 6.2% monthon-month, Singapore’s Maritime and Port Authority (MPA) data showed.

Quick reactions

“In Monjasa, we continue to see Singapore leading the global shipping industry forward across the most pressing agendas. In particular, the past year has demonstrated Singapore’s dedication to enabling the green shipping transition,” says Morten Ostergaard Jacobsen, who

heads up Asian operations for the bunker supplier. Jacobsen praised the MPA in particular for the way it has gone about communicating fuel developments directly to main stakeholders, regionally and abroad.

In the wake of fuel contamination scandal last year, the MPA acted fast. The MPA switched to electronic bunker delivery notes from physical documents this year, and is following this up with a project to register oil flows digitally in 2024 using mass flow meters.

Biofuel growth

Biofuel take up has been noticeable this year with many operators trialling the fuel out of Singapore.

“There are talks of biofuels reaching 5m tons per year in Singapore by 2030 on the back of the development of the MPA’s

31 www.splash247.com BUNKERING

Singapore is preparing solutions to remain the dominant ship fuelling hub for the 2020s and beyond

With a multi-fuel future ahead, it is unclear if bunkering hubs will remained unchanged

PIONEERING THE SAFETY AND PERFORMANCE OF CARBON CAPTURE, UTILISATION AND STORAGE

CCUS has a pivotal and immediate role to play in meeting your decarbonisation targets. At Bureau Veritas, we’re supporting the development of onboard CCUS, working with key stakeholders to approve and safely integrate systems onboard ships to reduce their emissions.

Download our latest study

Shaping a better maritime world.

quality standard for biofuel blends,” says Jesper Lindegaard Sørensen, managing director of KPI OceanConnect Singapore. What remains clear is that Singaporean

authorities are preparing for a future where no single fuel is dominant - the port will offer the gamut of alternative fuels available in the coming years, albeit

with a clear preference for LNG, methanol and biofuels in the short-term.

“With a multi-fuel future ahead, it is unclear if bunkering hubs will remained unchanged. We note that Singapore has put in substantial investment into alternative fuel development alongside with first movers to progress the development together,” says Carl Schou, president of Wilhelmsen Ship Management, stressing that it is vital the republic leads the alternative fuel debate in order to remain a top bunkering hub.

“More could be done to be the centre of competence not only for alternative fuel technology and bunkering but also for varsities and training centres that truly prepare the seafarers of today for the challenges of tomorrow,” advises Peter Schellenberger, a well known name in local shipping circles who has just set up his own consultancy, Novamaxis.

Methanol moves

Singapore, the world’s top bunkering hub, is getting the infrastructure in place for shipping’s future fuel mix where methanol will play a significant role.

Local firm Consort Bunkers has recently contracted China Merchants Jinling Shipyard to build six 6,500 dwt methanol bunkering tankers while compatriot Global Energy Group is set to receive its first 4,000 dwt methanol bunkering vessel from Japan’s Sasaki Shipbuilding in the final quarter of this year. Another bunker supplier, Golden Island Diesel Oil Trading, is readying to order a methanol tanker up to 12,000 dwt in size for delivery in 2026.

Six companies, including Danish carrier Maersk, have formed a partnership that is building Asia’s first green e-methanol plant which converts captured biogenic carbon dioxide (CO2) into green e-methanol. The plant is being set up in Singapore

with a minimum production capacity of 50,000 tons per annum.

While containerlines have led the way towards methanol propulsion, dry bulk and tanker orders are also now in the mix. Another important shipping sector, the cruise business, is also keen to embrace methanol. Costa, TUI Cruises, Disney, and Norwegian have

declared their interest in moving toward methanol as a fuel for their cruise ships.

Analysis from class society DNV shows methanol was the second most popular alternative fuel choice for newbuild orders last year after LNG, and has continued to be very popular in H1 of 2023.

Dry bulk and tanker orders are also now in the mix

For all the latest bunkering news

33 www.splash247.com

BUNKERING

More could be done to be the centre of competence

First

Transparent ship management should be the best part of your day SHIP MANAGEMENT

class technical

opex & crewing

inhouse

www.mtmshipmanagement.com

management 24/7 online transparency via ShipSoft® Procurement pool rebates back to your ship Fixed

cost options Dedicated

training centers 4,500+ dedicated crewing pool Dynamic energy optimization team

SINGAPORE • MUMBAI • YANGON • MANILA • ATHENS • ROTTERDAM • NEW YORK • HOUSTON

Fully adaptive Ship Management model

The connected country

How Singapore maritime fosters innovation

Singapore’s maritime digital initiatives are being rolled out at speed on land, but also right across its waters.

By 2025, the republic will achieve full maritime 5G coverage over its anchorages, fairways, terminals, and boarding grounds. Provided by M1, the dedicated 5G network has been rolling out progressively across Singapore’s port waters since late 2022 and serves as a testbed to pilot and commercialise maritime 5G use cases.

Onshore, the Agency for Science, Technology and Research (A*STAR) has established a Centre for Maritime Digitalisation (A*STAR’s C4MD) in Singapore to develop advanced digital solutions for smart shipping, port systems and decarbonisation.

The new centre aims to increase

sustainability, safety and efficiency in Singapore’s maritime ecosystem, by translating research capabilities in computational modelling, simulation and artificial intelligence (AI) into deployable maritime solutions. The centre, led by A*STAR’s Institute of High Performance Computing (IHPC), will partner Institutes of Higher Learning (IHLs), industry partners and public sector agencies on collaborative research in key areas such as: Studying various scenarios in the electrification of harbour crafts and their impact on infrastructure and operational activities in Singapore waters; decarbonising the maritime sector with sustainable technologies, for example using Computational Fluid Dynamics (CFD) in tidal turbine designs to convert kinetic energy of moving water into green electricity; conducting CFD-based

risk assessments and mitigation for the safe use and storage of alternative fuels; detecting near-collision events of ship manoeuvring in port waters and providing AI models and explainable outputs to reduce traffic safety risks; improving efficiency by advancing AI research in areas including Just In Time (JIT) operations, predictive maintenance, emissions monitoring and reduction, and supply chain intelligence.

The Maritime AI Research Programme is a flagship initiative hosted under A*STAR’s C4MD to deploy AI technologies in the maritime industry. The programme is funded by the Singapore Maritime Institute (SMI), and will help maritime companies develop the necessary capabilities to implement AI solutions and overcome barriers to adoption.

Initial projects under the Maritime AI Research Programme include near collision detection, predictive maintenance, launch boat optimisation, and energy consumption prediction.

35 www.splash247.com

DIGITAL

It is an exciting time to be in the marine tech industry

Start-ups abound

Elsewhere, a Hafnia-led digital start-up venture, Studio 30 50, was launched earlier this year in collaboration with DNV, Wilhelmsen, IMC Ventures and Microsoft, that aims to identify new solutions to address a broad range of ESG topics concerning the maritime industry, while also funding innovative proposals built by start-ups which seek to improve efficiencies across the whole maritime

“Our first-in-Singapore collaboration with leaders in the global maritime space will infuse innovation in data and AI, sustainability and security into all parts of their industry,” said Richard Koh, Singapore chief technology officer, Microsoft. “We are confident that this ecosystem collaboration will empower Singapore to transform the global maritime industry at scale with homegrown innovation on the Microsoft Cloud, while addressing challenges in sustainable energy use, resourcing and process optimisation.”

“We encourage more venture capitalists

This ecosystem collaboration will empower Singapore to transform the global maritime industry at scale

and maritime corporates to tap into the large base of demand drivers and solutions providers in Singapore, as well as a rich research ecosystem that is supported by a highly educated workforce, strong protection for intellectual property, and quality R&D infrastructure,” said Ng Yi Han, director, innovation, technology and talent development, Maritime & Port Authority of Singapore.

Singapore’s original maritime accelerator PIER71 has just launched its latest round of the Smart Port Challenge

(SPC) to identify promising start-ups, while also awarding grants to past winners, and announcing new venture capitalists.

Looking at all the digital developments going on in Singapore, Bhupesh Gandhi, CEO of ARI Singapore, which just opened its office in the republic, comments: “It is an exciting time to be in the marine tech industry, with the regulatory environment evolving, and the potential to increase safety and efficiency in maritime operations is immense.”

37 www.splash247.com

DIGITAL

For all the latest ship tech news

DIVERSITY STUDY GROUP

Maritime DEI Experts

+44 (0) 20 2746 3760

EXPERTS IN MARITIME DEI, PROVIDING:

Bespoke consultancy services & DEI programmes spanning the shore and seafaring community that include:

• DEI strategy development

• DEI governance

• Inclusive Leader and Inclusive Manager programmes

• Developing in-house capability (HR support / DEI facilitator support)

• Data and measurement

DSG Corporate Membership:

• DEI data measurement & benchmarking

• Regular networking opportunities

• Sharing of best practice

• Discounted DEI learning and development programmes

HEIDI HESELTINE Co-Founder

+44 (0) 7525 901064

info@diversitystudygroup.com www.diversitystudygroup.com

DEI in Maritime Masterclass Series:

heidi@diversitystudygroup.com

www.diversitystudygroup.com

• Workshops and Executive Coaching

The war for talent

More ink has been spilled on human resources issues in this magazine than any other topic, a clear sign of the vexing problems the republic’s maritime industry faces in attracting and retaining the best talent available.

Mark Charman, who heads up global recruitment firm Faststream, argues Singapore is still winning the war for talent in maritime.

“Not only does it continue to be a destination of choice, but maintains itself as an aspirational move for many expats. With so many maritime businesses having moved their global headquarters

to Singapore, it boasts a variety of opportunities that some hubs just can’t compete with,” Charman says.

Over the last five years in Faststream’s global talent surveys, Singapore has continued to come out on top as the most attractive maritime hub, across multiple disciplines from technical and commercial right up to senior executive level.

“Not only do people want to work there, but employers also cite it as one of the top hubs to find the best talent for their business now and in the future,” Charman says.

Maybe, but from a talent perspective,

the country has not improved over the past year, according to Heidi Heseltine, who runs rival HR firm Halcyon Recruitment.

“Restrictions on employment pass allocation are making it increasingly difficult and more expensive to bring in talent and there remains a lack of widely available talent locally,” Heseltine warns.

Peter Schellenberger, founder of consultancy Novamaxis, says the limited possible size of the Singaporean talent pool along with the tight grip on work permits linked to cost of living has indeed made hiring difficult.

Matt Cannock, managing director of

39 www.splash247.com HR

The republic’s maritime community faces many HR hurdles that other hubs are experiencing

Singapore is an aspirational move for many expats

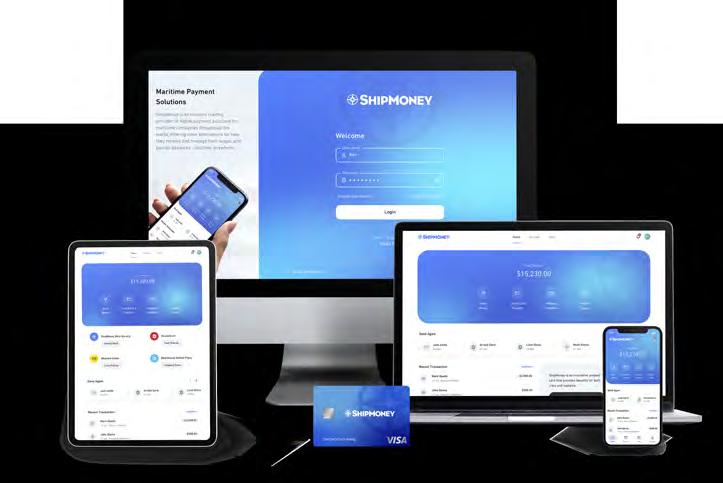

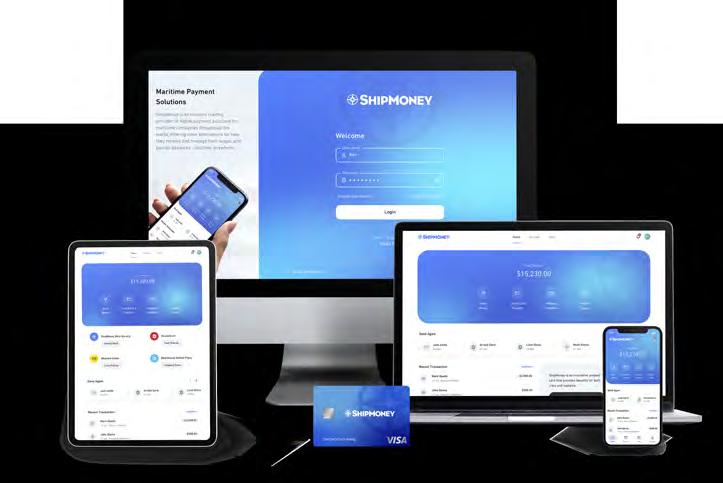

Optimize Your Payments

Empower Your Crew

was built one account-holder at a time. Today, our global community of seafarers enjoys instant, transparent payments anywhere on earth, with an easy-to-use mobile app that lets them save, spend and send their money worldwide at the push of a button. MARITIME PAYMENT SOLUTIONS SIMPLIFIED

ShipMoney

paying wages at sea to settling global invoices and minimizing onboard cash, we recognize the unique financial circumstances facing the maritime industry. That’s why we created ShipMoney – the simple, secure, and cost-e ective way to move money across borders and oceans. A BETTER WAY TO PAY STARTS TODAY Contact us for a demo of our award-winning platform sales@shipmoney.com • shipmoneycorporate.com

From

Latitude Brokers, says that the shortage of talent locally has driven up costs.

Employers are still relying too much on people with a maritime background, accounting for about 90% of the open positions, according to Schellenberger.

Rise of Dubai

Carl Schou, president of Wilhelmsen Ship Management, is one of a host of people surveyed who warns that Dubai is increasingly popular as a maritime hub. From an employer’s side, Schou lists the ease of employment pass, cost and location as being attractive in Dubai. Splash has noted a significant tranche of maritime expertise leaving Southeast Asia for the Middle East over the past year.

Govind Ramanathan, director at Shipfinity International, reckons the tech sector is the biggest competitor for new talent, so maritime must evolve to make it more attractive, something potentially made easier this year with all the lay-offs in tech.

Bjorn Hojgaard, who runs shipmanagement giant Anglo-Eastern, believes the jury is out on whether Singapore maritime is winning the war for the talent.

“Singapore is obviously punching well above its weight in maritime, and as such it’s a great place to pursue a career in the industry, but in recent years it has not felt as welcoming of foreign talent as it used to,” Hojgaard says, advising: “For a small, open economy like Singapore’s

to stay ahead it’s important that talent, whether foreign or local, is embraced as the catalyst for progress that is has been and will continue to be.”

Philippe Lecloux, head of marine at Aderco, hits out at barriers such as military service, which do not facilitate access to a maritime career at sea.

Familiar global problems

Ryan Kumar, managing director of Direct Search Global, says much of Singapore maritime’s recruitment struggles are mirrored around the world.

“There is a global shortage of skilled talent in key areas such as engineering, operations, and logistics, which makes it difficult for any single country to secure

41 www.splash247.com

HR

Singapore has not felt as welcoming of foreign talent as it used to

We must establish a talent pipeline and improve retention rates

enough talent to meet its needs,” Kumar says.

Rama Chandran, head of marine at QBE Singapore, agrees with Kumar saying that Singapore’s HR issues are faced by many other nations, something that was exacerbated by the pandemic.

“We are now at the critical level which would see the gaps not being filled in the next five years,” Chandran warns, urging authorities to work long-term solutions to develop local talent.

Government is listening

The good news is that the government is listening and immigration changes are imminent.

According to Synergy Marine’s COO Ajay Chaudhry, the Ministry of Manpower’s new points-based Complementarity Assessment Framework

(COMPASS) will enable the maritime industry, and others, to improve workforce diversity.

“This transparent system will greatly improve clarity and certainty in hiring, and personnel planning, and from September 1, when this comes into effect, Singapore will be able better to court skilled maritime professionals from across the globe,” Chaudhry tells Splash.

Dr Shahrin Osman, regional head of maritime advisory at DNV, heaps praise on the maritime Singapore ecosystem for its focus on talent attraction and retention, highlighting outreach programmes launched by the Maritime and Port Authority and the Singapore Maritime Foundation, including the appointment of youth ambassadors last year, providing youth leaders a platform to advocate for the maritime sector among their peers. Likewise, Osman hails the recent

establishment of the Tripartite Advisory Panel for maritime talent.

“We must establish a talent pipeline and improve retention rates,” stresses a spokesperson for OSM Thome, praising a recent public-private project called SAILMAP, a 10-year initiative to train 50 new seafarers each year, with a monetary reward of $50,000 for completing certain milestones.

Esben Poulsson, chairman of Enesel and a former president of the Singapore Shipping Association, urges getting the promotion of the industry started earlier at schools, something that will take time to bear fruit, he concedes.

43 www.splash247.com HR

Your new career is just one click away Visit Splash Jobs

Tomorrow’s workforce identified

Where shipping is getting it right and wrong when it comes to attracting and retaining the best talent made for a very lively HR session at the Maritime CEO Forum held at the Fullerton Hotel in Singapore in April.

Cara Carter, a director at Halcyon Recruitment and moderator of the human resources session at this year’s Singapore Maritime CEO Forum, got proceedings underway warning delegates that the talent shortage the industry is currently experiencing is only set to worsen.

Sophie Smith, speaking on the day her firm was revealed to be one of Singapore’s best employers, said it was vital to be future-focused, going after Gen Z and Gen Alpha.

“If we don’t adjust our practices we will be left behind. We need to fish in different talent pools such as tech which is better at looking after young people,” said Smith, the chief human resources officer at BW Group, one of the world’s largest shipowners.

Carter said as many as 250,000 people

have been laid off from the tech sector in recent months, an ideal target labour market if shipping could present itself correctly.

Mark O’Neil, president of Columbia Shipmanagement, said shipping needed to adopt “proper” human resource management.

“We talk about crew and personnel departments but this is antiquated,” the shipmanager said, urging the industry to better identify with crew, something that had improved with covid.

Better communication, and detailed, encouraging career planning were identified by O’Neill as vital. For crew, pay and packages need a relook, O’Neil said, pointing out how many seafarers do not have pension schemes or healthcare coverage in place.

Quizzed about how to make seafaring an attractive prospect going forward given all the talk of autonomous ships, John-Kaare Aune, the CEO of another shipmanager, Wallem Group, told delegates: “We get the message across that the future is human.

It is about treating people with respect, giving them the opportunities and skillets to deal with the new challenges that are coming ahead.”

Ben Palmer, president of maritime at sat comms giant Inmarsat, discussed the battle shipping faces for talent. Staff want to be connected, and different skillsets will be required by shipping’s next generation, Palmer stressed.

The next generation want to believe in what they are doing, to work for a sustainable business and to use tech, Palmer said.

“Shipping has to get better at telling its story. The fierce war for talent is visceral,” Palmer said.

Quite so, agreed O’Neil. “Salary and perks don’t get people out of bed these days, it is things like ESG that do,” he said, urging the diverse maritime industry to come together with one voice rather than all the different organisations and bodies with their competing messages.

“We are telling people it is a great industry but the word is not getting out about shipping until a ship blocks the Suez Canal,” O’Neil said.

Wallem’s Aune called for a greater number of presentations to be made at schools around the world, arguing that shipping is a fascinating career path, so long as you stick with it.

“Shipping is addictive, we just need to get them into a job for a couple of years and then they will be hooked,” Aune said.

Getting them hooked however is not easy with BW’s Smith pointing to statistics from recruitment firm Faststream, which show that one-third of maritime recruits leave the industry within just 12 months.

The discussion finished by looking at how the characteristics of shipping leadership will need to change in the coming years.

“Change is hard and there is going to be a lot of change coming up,” said Palmer from Inmarsat, adding, “Those that are successful will be the ones that develop learning cultures.”

45 www.splash247.com

HR

Who said what at this year’s HR session in our Singapore Maritime CEO Forum

www.columbia-shipmanagement.com Discover our innovative and complete range of maritime services at: YOUR PARTNER OF CHOICE

Cyprus | Germany | Singapore | China | Italy | Greece | Norway | Saudi Arabia | Monaco

Powered By

Singapore shipping enjoys post-pandemic environment

2023 looks set to be a fair year for earnings for the local shipowning community

The Singapore Shipping Association (SSA) is back to its prepandemic best, hosting massive events, providing unrivalled network opportunities and valuable advice to its members.

The shipping association is closing in on the 500 mark in terms of the numbers of corporate members, its annual dinner last September welcoming more than 2,000 guests (pictured), while there are

522 operational committee members contributing industry expertise working in collaboration with regulatory agencies and other stakeholders to address key areas of concern.

The SSA’s secretariat moved to a new location recently. The new office, located at the Bank of China building, has more meeting and training rooms and social facilities to accommodate the activities of various committees and working

2023 marked the return of life back to prepandemic days

groups, which continue to grow.

“For Singapore, 2023 marked the return of life back to pre-pandemic days,” Caroline Yang, SSA’s president, wrote in her opening remarks to the association’s annual report.

“Singapore is proud of the reputation it holds within the global shipping industry and works as a collective body to ensure that the entire hub works effectively,” Yang wrote.

Over the next couple of pages we assess what some of SSA’s largest members have been up to in recent months.

47 www.splash247.com LINES

A new force in dry bulk

Maritime Investments and Grindrod Shipping working together with an enlarged, younger, more efficient fleet + taylormaritimeinvestments.com grinshipping.com

Taylor

BW Group

Andreas Sohmen-Pao presides over one of the largest shipping and offshore fleets in the world, not just in Singapore.

BW controls a fleet of over 490 vessels transporting oil, gas and dry commodities, with its 200 LNG and LPG ships constituting the largest gas fleet in the world. In Hafnia, it has the world’s largest product tanker company, which has recently just posted record quarterlies.

In June, Sohmen-Pao and Emanuele Lauro combined forces in the offshore wind arena through a merger deal between the sector’s major construction players, Cadeler and Eneti.

Commenting on the combination, Sohmen-Pao said: “It underpins

Cadeler’s vision and capability to facilitate the renewable transition, and I support the transaction on its industrial and financial merits.”

Eastern Pacific Shipping

The big news at mighty Eastern Pacific Shipping this year came in May when the Idan Ofer-controlled shipping firm signed for four very large ammonia carriers (VLACs) at China’s Jiangnan Shipbuilding.

The 93,000 cu m ships are the first VLACs ordered in China. The 230 m long LPG dual-fuelled ships can transport ammonia, as well as liquefied petroleum gases including propane and butane.

In February, Eastern Pacific installed a first-of-its-kind carbon capture solution onboard one of its MR tankers. A host of other shipping lines are now gearing up to install carbon capture and storage equipment on ships around the world.

For all the latest gas news

49 www.splash247.com LINES

Pacific International Lines

July marks one year since Lars Kastrup was promoted to take sole charge at Pacific International Lines (PIL). Kastrup has done a fine job steadying the ship, and starting to expand the business after a troubled few years at the containerline.

Kastrup was brought onboard in 2020 in a management reshuffle after PIL was bailed out following years of troubled financial difficulties. He has previously served as CEO of APL, and held many senior positions at CMA CGM. His career started with AP Moller-Maersk.

PIL, which completed its restructuring in 2021, has recently teamed with Manilaheadquartered IRIS Lines to offer a new joint intra-Asia service.

Alphaliner lists PIL as the 12th largest containerline in the world with a fleet made up of around just shy of 300,000 slots.

X-Press Feeders

This June X-Press Feeders ordered six 1,250 teu methanol dual-fuel newbuild containerships at CSSC-affiliated Huangpu Wenchong Shipbuilding in China, cementing the Tim Hartnoll-

controlled line’s position as the world’s largest feedership owner.

X-Press Feeders is the 16th largest containerline in the world with a fleet or 136,457 slots according to Alphaliner.

The Sea Consortium-controlled feeder operator is taking a number of proactive steps to reduce the environmental impact of its fleet and becoming net-zero emissions by 2050, including nuclear power, methanol-powered newbuilds and carbon capture retrofits.

Last August Hartnoll’s private equity venture HICO Investment Group bought Bengal Tiger Line (BTL) as well as acquiring a majority shareholding in Caribbean Feeder Service.

Berge Bulk

Walking the walk, Berge Bulk is making good on its aims to be carbon-neutral by 2025 at the latest and to have a zerocarbon ocean-going dry bulk carrier by 2030.

Berge Bulk recently crossed another hurdle on its decarbonisation pathway by signing up one of its ships for a potential conversion to run on methanol.

In what is being described as a pioneering joint development project, the

James Marshall-led company, which owns and manages a fleet of over 80 vessels, has teamed up with class society ABS to explore the possibility of retrofitting the 300 m long heavy fuel oil-powered bulker Berge Mauna Kea.

The 210,000 dwt ship is currently under construction at the Nihon Shipyard in Japan, with delivery expected in mid2024.

Berge Bulk has been an early adopter of wind-assisted propulsion technology, solar power trials, investments in advanced atomic power solutions for shipping, and offering clients an option for carbon neutral cargo delivery via offsets.

Berge Bulk’s first vessel to be fitted with BAR Technologies WindWings by Yara Marine Technologies (pictured) in the coming weeks will be the Berge Olympus newcastlemax.

For all the latest container shipping news

LINES

Offshore wind leads the way

Developments on the wind front have grabbed the most headlines in Singapore this year, led in no small part by Cyan Renewables which was set up by infrastructure investment manager Seraya Partners last year with the aim of investing $1bn over the next three years to own, operate, and lease vessels across the offshore wind farm value chain. It has not hung around.

Opportunities are there to be had with much written about Southeast Asia’s transition from fossil fuels to renewables led by offshore wind with Singapore’s cocktail of expertise, capital and infrastructure leading many to believe the Lion Republic will lead the region’s wind transition.

“Southeast Asia is rich in specialist marine contractors, which can be adapted to installing and maintaining turbines, and sophisticated port infrastructure will

Southeast Asia

be important for ongoing maintenance requirements. Already we have seen some of Singapore’s top marine businesses investing in offshore wind vessels and related electrical equipment,” a recent report from Societe Generale noted.

Grabbing the most headlines this year has been Cyan Renewables which recently inked a letter of intent with China’s Cosco Shipping Heavy Industry to build its first foundation installation vessel (FIV).

The Ulstein-designed FIV will be equipped with a crane of at least 5,000 tons, with the design specifically optimised for efficient installation of the heaviest monopiles and tallest jackets.

“The LOI is the beginning of the growth of the Cyan FIV fleet. With this first step, we are well-placed to work with developers, EPC and T&I companies to resolve the challenge of vessel shortage. Cosco has a strong track record in

delivering modern offshore installation vessels, and I look forward to the partnership,” said Keng Lin Lee, CEO of Cyan Renewables.

Cyan Renewables also recently teamed up with Taiwanese offshore wind developer Taiya Renewable Energy to build vessel capacity and work together on deployment in Taiwan and other markets.

A memorandum of understanding will see the two companies collaborate to support the sector’s growth with additional foundation installation vessels, wind turbine installation vessels and cable-layers.

Earlier in the year, Cyan Renewables signed a deal with Taiwanese owner and operator Seagreen Marine that it says will be an important step towards both companies in the owning and operation of Taiwan-flagged vessels in the offshore

rich in specialist marine contractors

52 Singapore Market Report 2023 OFFSHORE

Singapore has the right ingredients to lead the region’s transition from fossil fuels

is

wind sector.

The two companies have penned an exclusive marketing agreement for the deployment of two service operation vessels in the country and Seagreen with a fleet of nine vessels has issued a letter of intent to Singapore’s ST Engineering Marine for the construction of the units.

Meanwhile, Singapore offshore vessel player and shipyard Marco Polo Marine recently partnered with US-based startup Amogy to install ammonia-to-power

wind transition

systems on its existing or newbuild offshore wind support vessels.

Marco Polo said the collaboration fits into its efforts to decarbonise the shipping sector and reduce the carbon footprint of offshore wind farms, but that it also allows Amogy to fine-tune its technology in order to more effectively support the specific types of wind vessels, including commissioning/service operation vessels (C/SOVs).

“We welcome the opportunity to

collaborate with Amogy and combine our environmentally friendly and innovative technologies. We think that Amogy’s ability to convert ammonia to gaseous hydrogen in our wind vessels is a step in the right direction that brings us closer to our long-term goal of decarbonising the maritime industry by reducing greenhouse gas emissions. Additionally, it will help speed up the global transition towards clean energy sources,” said Sean Lee, CEO of Marco Polo Marine.

Singapore to import wind power from Vietnam

Singapore is looking to import offshore wind power from Vietnam under a joint development agreement struck between the two countries.

The deal was signed between

Sembcorp Utilities and Vietnam’s PetroVietnam Technical Services Corporation (PTSC) to develop offshore wind projects in Vietnam with a total capacity of around 2.3 GW for export to the city state via subsea cables. The announcement was made after a meeting between Prime Minister Pham Minh Chinh and Semcorp deputy chairman Tow Heng Tan in Singapore this February.

PTSC said the collaboration not only

marks the first ever renewable energy cooperation between the two companies, but also strengthens the relationship between the governments, realising the “Digital – Green Economic Partnership” between the two countries, in light of the 50th anniversary of diplomatic relations between Vietnam and Singapore.

The agreement follows the memorandum of understanding signed at the end of October 2022 to research the feasibility of the project.

53 www.splash247.com OFFSHORE

Singapore’s cocktail of expertise, capital and infrastructure could help it lead the region’s

Failure to grasp mega trends will leave CEOs locked out

The international shipping community is scrambling to understand what a post-pandemic global trade system will look like. A failure to understand the implications will leave their businesses adrift.

The coronavirus pandemic has accelerated three trends that were already disrupting world trade, and are highly important to the future of Singapore as an entrepôt economy. First, the increasing use of digital technologies is revolutionising international trade especially in issues related to crossborder investment, trade finance, and supply chain management.

Second there has been a trend towards greater fragmentation. Concerns about supply chain resilience have led governments and businesses to reconsider their supply chain configuration. Geopolitical issues such as the Russian invasion of Ukraine and China-US tension further breaks down the global trade and investment system through new economic barriers and sanctions.

Third, the growing focus on sustainability is also having an impact on maritime trading. Particularly, the International Maritime Organization is leading the discussion for the industry’s decarbonisation agenda.

Make no mistake: these trends of digitalisation, regionalisation, and sustainability were already in motion. What is new is that these trends are increasingly merging into each other.