Ship Concept 2030

BY

BY

I don’t expect any fantastically futuristic vessels until 2040 —

Skills in data analysis, cybersecurity, and remote operations management will become increasingly important

33 41

2050 is closing in fast and the required actions are extremely complicated to overcome

Everyone’s in the same boat with too many flaky options

The zero carbon future looks like batteries for harbour craft and short distances, sails for most ships, and nuclear power for the big stuff

1 www.splash247.com CONTENTS 3 Editor’s Comment 5 Introduction 9 Maritime CEO Forum 12 Regulation Timeline 15 Environment 21 Fuels 24 Essay 27 Digital 33 Operations 37 Charterers 39 HR 41 Shipyards 44 Opinion: Di Gilpin 45 Opinion: James Wilkes 46 Opinion: Zane Berry 47 Opinion: Andrew Craig-Bennett 48 Splashback

to 2030

Road

Susana Germino,

For the best global shipping news coverage Decarbonisation and environmental

at Swire Shipping

general manager 9

compliance

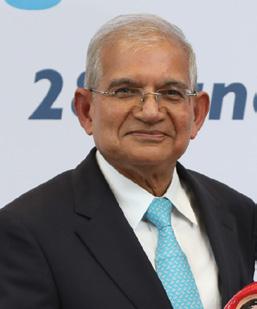

— Kishore Rajvanshy, managing director Fleet Management

37

— Mikael Skov, CEO Hafnia

47

— Dr Martin Stopford Maritime economist

— Andrew Craig-Bennett Splash lead columnist

SHIP CONCEPT 2030

www.splash247.com

Just how different will ships look seven years from now?

ASSOCIATE EDITOR:

Adis Adjin adis@asiashippingmedia.com

ECONOMIST

Paul French

All editorial material should be sent to sam@asiashippingmedia.com

COMMERCIAL DIRECTOR

Grant Rowles grant@asiashippingmedia.com

GENERAL MANAGER

Victor Halder victor@asiashippingmedia.com

Advertising agents are also based in Tokyo, Seoul and Oslo – to contact a local agent please email grant@ asiashippingmedia.com for details.

MEDIA KITS ARE AVAILABLE FOR DOWNLOAD AT WWW.SPLASH247.COM/ADVERTISING

All commercial material should be sent to grant@asiashippingmedia.com

I'd like to start this magazine with a quick note to all PR types who send us an ever increasing volume of approval in principle (AIP) announcements every week: include a snazzy artist's impression pic and you've got a much better chance of me publishing your news.

Approvals in principle are a dime a dozen these days - with many breakthroughs not necessarily going on to see the light of commercial day. But as an avowed shipping nerd I love all the futuristic looking images increasingly weighing down my email inbox.

However, for the journalistic purposes of this magazine, identifying what newbuilds will look like in 2030, it’s important not to get ahead of ourselves.

Panelists at our recent Maritime CEO Forum in Singapore (see page 9) would argue the form of the ships - how they look from the outside - won’t be too

different from today’s trading fleet.

I’d say extra tanks for new fuels, and some wind assist tech might be the two main eye-catching differences to the exterior of many ships come 2030, and by extension a difference in the volume and colour of the gases being exhaled from ships’ funnels. The ship’s insides? That’s a totally different story as will be explained over the next 50-odd pages.

Sam Chambers Editor Splash

A potted history of ship design

Krzysztof Kozdron, managing director of Schulte Marine Concept, gives readers a wry rundown on how today’s ships came to be.

DESIGN Belinda

Printed in Hong Kong

Copyright © Asia Shipping Media Pte Ltd (ASM), 2023

Although every effort has been made to ensure that the information contained in this review is correct, the publishers accept no liability for any inaccuracies or omissions that may occur. All rights reserved. No part of the publication may be reproduced, stored in retrieval systems or transmitted in any form or by any means without prior written permission of the copyright owner. For reprints of specific articles contact grant@ asiashippingmedia.com.

Noah gave our industry a universal vessel’s design describing principal dimensions ratio (Loa 134 m x B 22 m x H 13 m) launching his famous ark in 5,000 BC. Archimedes gave us deadweight in 287 BCE. Benjamin Franklin gave us electricity in the late 18th century.

Nicolaus August Otto and Rudolf Diesel gave us mechanical power generation in the late 19th century. Nikola Tesla gave us AC machinery and Thomas Edison gave us DC machinery in the late 19th century. The duo of

Navier–Stokes gave us super advanced hydromechanics design tool again in the late 19th century, and from the commercial angle Henry Bessemer patented the process for mass steel production, again in the late 19th century.

As you can see, most of the creation has been done centuries ago, and development in our industry has been rather slow over the last century, centered around improving what has largely already been invented by our ancestors in the remote past.

AT THE PROW

The site for incisive, exclusive maritime news and views www.splash247.com EDITORIAL DIRECTOR Sam Chambers sam@asiashippingmedia.com

The maritime industry is innovating fast. So you need to know your connectivity partner can deliver the services you’ll require in the future. That’s why we’re investing so heavily in our world-leading satellite network and capacity to meet ever-increasing demand for seamless, global mobile connectivity.

To read more on innovation at sea, visit: inmarsat.com/maritime

INNOVATION AT SEA

CAN YOUR CONNECTIVITY PARTNER KEEP UP WITH YOUR TECHNOLOGY?

Beyond the low hanging fruit

Just what will ships look like come 2030? How will they be different to newbuilds coming out of yards today, and just how does the evolving regulatory landscape affect the outcome? To answer this, we first need to take a stab at how global regulations will evolve by the end of the decade. While there were many critical voices after the International Maritime Organization (IMO) Marine Environmental Protection Committee 80 meeting in July, the IMO discussions do set a large part of the landscape determining the competitiveness and viability of different ship designs. The meeting agreed significant greenhouse gas (GHG) targets – striving for 30% and 80% well-to-wake reductions by 2030 and 2040, respectively. When translated into GHG intensities (i.e. the reductions for the average ship), these targets correspond to about a 55-61% reduction by 2030 and 86-91% by 2040. However, the chosen baseline of 2008 – a peak year for most freight markets and, hence, vessel speeds - means that good progress has already been made towards those targets, of around 30-40% reduction in GHG

intensity depending on the ship type. Now that the low-hanging fruit has been picked, the 2030 challenge is clear – to find significant further efficiency improvements across all ships, but particularly newbuildings, and to be able to operate whilst rapidly phasing out the use of fossil fuels.

The incentives

The scenario that might incentivise this, which then informs some of the attractiveness of different fuel, technology and operational choices, is currently unclear. IMO will continue to provide strong intentions but no clear language or guidance to give certainty regarding investment decisions. However, if we learn from the experience of how other policies have been applied it is plausible that by 2030 it will include:

● A stronger IMO CII regulation: More effective enforcement, higher stringency, and possibly shifted to focus on efficiency (e.g. J/tnm) rather than merely carbon intensity.

● An initially weak but rapidly strengthening IMO GHG fuel standard.

This could, for instance, include a mandate to use a progressively lower GHG intensity fuel, albeit starting in 2027-30 at a level of GHG intensity reduction close to current fuels with light enforcement but with commitments for increasing stringency and enforcement action over time.

● A global IMO-mandated GHG price - potentially still a low $50-100 and so not closing the price gap to green fuels fully - but with a subsidy system for rewarding those who do use zero and near-zero emission fuels.

Having set the potential regulatory stage – how could this affect ship operation and newbuilding designs?

The design implication is that the industry will be incentivised to maximise energy efficiency for a given transport work, even beyond what pays for itself in fuel savings. However, whilst the need to move away from fossil fuel at some point in the decade will be clear, the optimum time to switch through the lower GHG fuel options (biofuels, ‘blue’ fuels, blends) to your ultimate zero emission molecule will likely not be anytime soon.

5 www.splash247.com INTRODUCTION

Large shifts in the global energy mix always lead to entirely new ship types, freight markets and trades, and new fortunes

Writing exclusively for Splash, Dr Roar Adland, global head of research at SSY, and Dr Tristan Smith, reader at UCL Energy Institute, set the scene.

Future proofing

A couple of developments are fairly certain – and represent trends that are already gathering pace. First, we expect to see the return of wind-assisted propulsion to improve energy efficiency and help comply with a stricter future CII scheme. This will of course be more relevant for some vessel types (e.g. tankers) and trades than others, and so we might see a greater geographical specialisation of such tonnage.

Secondly, until a clear zero-carbon fuel winner emerges from the race, for the next few years will still see newbuilding designs with a focus on technological optionality and ‘future proofing’ – multi-fuel engines, strengthened decks for fuel tanks, fully automated or remotely operated engine rooms, etc. Additionally, designs will increasingly include minor tweaks that improve energy efficiency, such as more advanced waste heat recovery and integrated energy management systems (i.e. across electricity, heat and mechanical power consumers). We also expect to see significantly increased electrification, with the use of batteries and hybrid generator solutions.

Ammonia

The good news is that by 2030 we will almost certainly know the answer to the biggest question holding back real progress towards shipping decarbonisation: Can the safety concerns surrounding ammonia as a ship fuel be addressed to the satisfaction of international regulators, seafarers and the general public?

From a purely economic point of view, few would disagree that ammonia is the frontrunner: The production of sufficiently cheap hydrogen is the constraint for all alternative fuels, but all green fuels except ammonia are subject to the additional cost and constraint of carbon extraction.

The need for access to enough cheap renewable energy for green

fuel production combined with safety precautions could potentially force changes in terms of bunkering operations for the global fleet. Naturally, zerocarbon fuels should be produced where conditions for renewable energy production (solar and wind) are optimal. Promising locations happen to be near the key existing global trade routes, sparsely populated and with relatively small local markets for energy – Mauritania, Djibouti and West Australia being good examples. While both ammonia and other synthetic green fuels can be readily transported to current bunkering hubs such as Singapore and Rotterdam, safety concerns may in any case lead to bunkering operations for the global fleet being moved further away from highly populated areas.

Safety concerns may also lead to more visible changes in newbuilding designs, such as a return to the forward- or midship-based superstructures of pre-war cargo vessels to clearly separate living quarters from fuel systems and engine room, with the latter being fully automated. Some proponents of unmanned vessels have already raised the toxicity of

alternative fuels as a reason to accelerate the development of fully autonomous ships, though we see that as exchanging one set of challenges for entirely new ones.

Further changes to propulsion and emission abatement technology would be highly interrelated with the path of future regulations. For instance, the potential for much more stringent global NOx regulations and, crucially – the IMO also targeting the much more potent greenhouse gases such as nitrous oxide (N2O) in addition to CO2 – could force the phasing out of combustion ship engines in 2030 newbuilds and introduce fuel cells as the most competitive technology with their higher efficiency and low-temperature operation.

While the challenges and uncertainties are many, these changes also represent massive opportunities for global shipping and, if maritime history has shown us anything, it is that large shifts in the global energy mix always lead to entirely new ship types, freight markets and trades, and along with it – new fortunes.

7 www.splash247.com INTRODUCTION

Panel debate

The topic of this magazine was also the focus of one of the sessions at this year’s Maritime CEO Forum in Singapore.

Ashipowner, shipmanager, class society, propulsion specialist, and technology provider led discussions for the Ship Concept 2030 session at this year’s Maritime CEO Forum held at the Fullerton Hotel in Singapore.

Kicking off the session on how the global merchant fleet will look like in terms of propulsion, nuclear propulsion proponent Mikal Bøe, chairman and CEO of CORE POWER, predicted that in 2030 the world will continue to complain that we’re not making much progress, that emissions will go up by a lot compared to today and that there will be no large commercial zero-emission ships on a wellto-wake basis with 75% of ships running on VLSFO, 20% on LNG and the remaining 5% on methanol as an additive to VLSFO.

David Barrow, vice president of Southeast Asia, Bureau Veritas Marine & Offshore, told the audience it will be a mixture of fuels with carbon capture, battery hybrids and even nuclear as an option. “The technology is there”, Barrow said, but noting that: “The issue with nuclear is you’ve got a whole different array of stakeholders to deal with.”

There are so many things you need to take into account what is going to be the leading fuel, Barrow said, highlighting pillars such as technology, policy and regulation, social aspects, and the people aspect.

Susana Germino, general manager of decarbonisation and environmental compliance at Swire Shipping and Swire Bulk, said she does not see any major

changes in ships by 2030 but stated that by that time they’d be more flexible with voyage optimisation, carbon capture and dual-fuel technology and also much more connected, pointing to data sharing, which today’s industry is lacking.

Germino also highlighted the energy efficiency technologies and stressed that when it comes to dual-fuel technology, “it is not about the fuel, it will be a multi-fuel industry.”

“Everything will be specific to the geographic regions where you want to operate and where technology and fuel is going to be available. If you need to use, let’s say, ammonia in 2040 and you’ll only have it in the Atlantic, you’re not going to have your vessel working in the Pacific,” she said.

9 www.splash247.com MARITIME CEO FORUM

The only zero-emission ship that will exist in 2050 is a sailing ship without any engine

In terms of nuclear, Germino added that she does not see ships moved by nuclear power but being absolutely necessary for the production of green fuels. “There is not enough green hydrogen for us and for other industries. I don’t expect any fantastically futuristic vessels until 2040,” she concluded, with the hope that Swire might at least have dual-fuel technology by 2030.

Ships in the near future will be a lot more connected. “I believe that this is something that is going to happen very easily and very fast. The technology is there, it is not that we need to discover anything or invest. It is cheap, it is easy, anybody can connect the vessel,” said Eleni Polychronopoulou, CEO of METIS Cyberspace Technology, who envisions north of 50% of ships with good connectivity onboard by 2030.

Commenting on the cost of investing in the new tech, Polychronopoulou said: “It is nothing compared to what is coming, the visibility that you get, the fact that you know what is happening onboard the vessel, especially with the lack of skilled crew. It is very important that you have full visibility of the vessel, to know exactly what is happening, when

and why. You can do an easy root cause analysis with all this data, which would be very difficult otherwise.”

Rajesh Unni, head of Synergy Marine Group, said the Singapore-based shipmanager has been working on several propulsion and decarbonisation options, including LNG, methanol, carbon capture, what to do with the captured carbon onboard, and batteries. Synergy is also heavily invested in collecting data from ships to improve efficiencies, but Unni said he doubts that would bring behavioural changes. “If all work onboard will be about collecting data, then, in my opinion, we create a faster caterpillar and not a butterfly,” he said, adding: “The question is what to do with that data. You need to give people insights that help them change the way they behave and act. Only when that happens can you expect people to change. So, will shipowners or anybody else, even the ship’s staff, be happy to have visibility and data? Absolutely yes, but it is only when you turn that into insights.”

In terms of ship design by 2030, Unni

sees wind-assisted propulsion and dragreduction technologies coming.

Speaking from the floor, Kris Kosmala, a partner at Click & Connect and Splash columnist, said that for the ships of the future in 2030 to materialise, you actually have to have people ordering those ships.

“If I’m waiting five years to get a fully loaded green ship with the technologies and fuel that we know today, well then we are looking at 2029,” Kosmala pointed out.

“If there is no orders being placed for it, then the ship by 2030 is going to look pretty much like the ship today. It is still going to operate on bunker and is still going to carry a very sophisticated scrubber,” Kosmala said.

While bringing the session to an end, Swire’s Germino noted: “There are no zero-emission fuels; there are none. Even with nuclear, unless it is used on the ship, there will be some sort of emission associated with it. So, the only zeroemission ship that will exist in 2050 is a sailing ship without any engine.”

11 www.splash247.com

MARITIME CEO FORUM

If all work onboard will be about collecting data, then we create a faster caterpillar and not a butterfly

Rules rain down

Splash identifies the key inbound legislation that will affect ship design in the remainder of the 2020s.

The EU ETS will require shipping companies to surrender allowances for 40% of verified emissions

IMO’s Maritime Autonomous Surface Ships (MASS) Code to enter as an interim measure

Amendments to MARPOL VI, to include a Mediterranean SOx Emission Control Area

Ship operators of ships of 100 gt and above will need to keep a Garbage Record Book onboard and record all discharges into the sea or reception facilities or completed incineration

IMO new SOLAS Chapter XV and mandatory Code addressing safety standards for the carriage of more than 12 industrial personnel

The EU ETS will require shipping companies to surrender allowances for 70% of verified emissions

FuelEU Maritime to cover shipping to ensure that the greenhouse gas intensity of fuels used by the sector gradually decreases over time, by 2% in 2025 to as much as 80% by 2050

The Red Sea and the Gulf of Aden to become special areas under MARPOL Annexes I and V

Draft amendments to the LSA Code and MSC.81(70) on a revised recommendation on the testing of life-saving appliances for the ventilation of totally enclosed lifeboats*

Guidelines for the control and management of ship’s biofouling to minimise the transfer of invasive aquatic species

All fuels to require a bunker delivery note, but gas fuels and low-flashpoint fuels are not required to provide information on density, sulphur content and flashpoint

CII and EEXI likely to be amended * 2025

2024

12 Ship Concept 2030 REGULATORY TIMELINE

The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships enters force

The EU ETS will require shipping companies to surrender allowances for 100% of verified emissions

IMO’s enhanced green targets reducing emissions by at least 20%, and striving for 30%, by 2030 compared to 2008 levels, and at least 70%, striving for 80%, by 2040 to come into force

A technical element which will be a goal-based marine fuel standard regulating the phased reduction of marine fuel GHG intensity and an economic element which will be some form of a maritime GHG emissions pricing mechanism, potentially linked directly to the GHG intensity mechanism *

IMO’s Maritime Autonomous Surface Ships (MASS) Code enters force

Comprehensive review of the 1978 STCW Convention and Code *

* Still under discussion

13 www.splash247.com 2026

2027

2028

REGULATORY TIMELINE

Yara Marine Technologies

Why wait to reduce emissions?

Next generation green newbuilds

What do new environmental rules mean for ships coming out of yards in 2030?

Let the experts guide you.

The impact of the revised strategy to decarbonise the global shipping industry adopted by the International Maritime Organization (IMO) will be felt by the industry for decades to come. Shipbuilding is probably the sector looking at the most drastic changes from 2030 onwards when the first target is set to come into force.

In July, IMO members agreed on socalled indicative checkpoints of reducing emissions by at least 20%, and striving for 30%, by 2030 compared to 2008 levels, and at least 70%, striving for 80%, by 2040, reaching net-zero “by or around, i.e., close to 2050” – qualified by whether “national circumstances allow.” Today, shipping produces 2.3% of global CO2 or 855m tonnes per year.

According to class society DNV, all these targets are on a well-to-wake basis rather than the tank-to-wake figures we have become accustomed to looking at in the context of the original strategy. So, fuel production is coming under much greater scrutiny.

At the time, many Western nations and environmentalists were pushing for more firm commitments from the 80th gathering of the Marine Environment Protection Committee (MEPC).

The Pacific Island countries, supported by Canada, the US, and the UK, fought hard for a 1.5°C- aligned action but were opposed by China, Brazil, Argentina and others.

A global carbon price, supported by over 70 developing and developed countries, has been moved forward as

an economic measure under the IMO’s basket of measures and will be up for further investigation and debate at future MEPCs.

This means that changes to the very tools of the maritime industry – the ships themselves – would have to align themselves with the new measures, either through retrofitting the old or building a newbuild fleet of IMO-compliant vessels set to enter use from 2030 onwards.

The 2023 IMO Strategy on Reduction of GHG Emissions from Ships makes specific reference to an ambition to increase the uptake of zero or near-zero GHG emission technologies, fuels and/or energy sources to represent at least 5%, striving for 10% of the energy used by international shipping by 2030.

But before we take any sort of look

15 www.splash247.com ENVIRONMENT

Crowning Your Journey with Exceptional Care

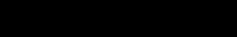

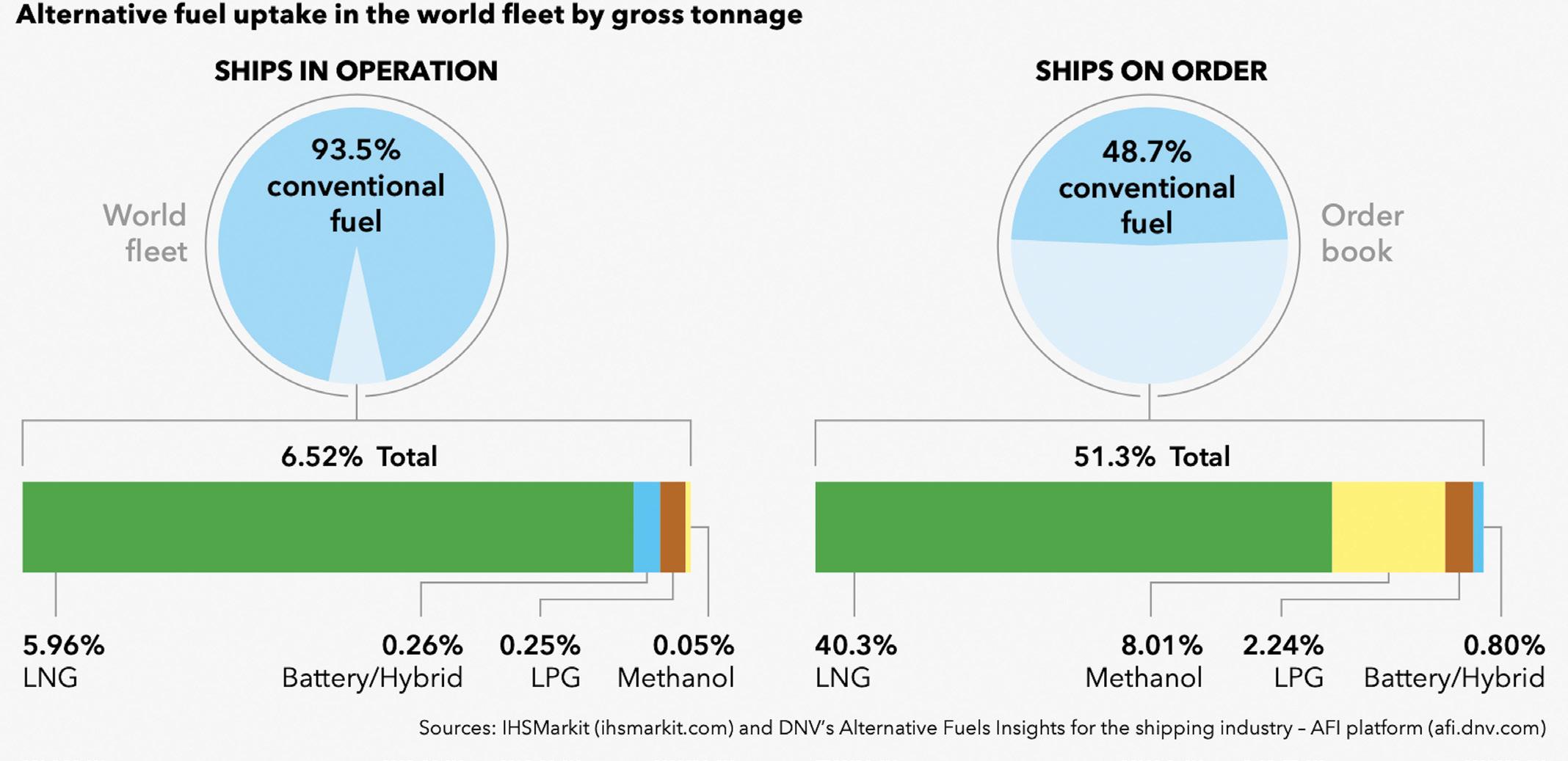

towards the future, we must know what is going on in the here and now. Clarksons Research, in its recent mid-year report on the world shipping fleet, estimates 44% of newbuild tonnage ordered in the first half of 2023 was alternative fuelled. Namely, methanol accounts for 62 orders, slowly catching up to LNG’s 86 orders.

In its 2022 Shipbuilding Review Clarksons claimed that 61% of tonnage ordered – 35% by number of orders –was alternative-fuelled. Over half of the tonnage ordered (397 orders, 36.7m gt) was LNG dual-fuelled, 7% was methanol (43 orders, 5m gt), 1.1% LPG (17 orders, 0.8m gt) and 1.2% included battery hybrid.

There were also 10.8% of orders that were ammonia-ready (90 orders, 7.7m gt), 1.4% of orders were LNG-ready (31 orders), 0.1% were hydrogen-ready, and 22 orders were methanol-ready.

As the data suggests, changes are underway and it is obvious that new, more environmentally friendly fuels, have become the norm and that steps are being taken to ensure the IMO measures are met.

BIMCO deputy secretary general, Lars Robert Pedersen, agrees that the IMO strategy was a lot about now and less about the distant future.

ships by 2040 would already have to be at net zero. If that is to be met, the capability of burning zero-emissions fuels is already a requirement.

“By 2030 this translates into ships being built for burning at least one type of alternative low- or zero-emission fuel. That entails differently configured engines and special fuel supply and storage systems onboard. It also requires much more efficient ships than what is the standard today. Wind-assisted propulsion may prove to be critical for the success of such new ships where possible,” Pedersen adds.

At this current moment, not all less

Lynn Loo, CEO of the Global Centre for Maritime Decarbonisation, says that there is industry confidence in dual-fuelled methanol vessels as there have already been over 200 orders for such vessels –mostly across the container, dry bulk, and tanker segments.

But this is likely to change. According to Liz Shaw of the IMO, the technologies and fuels needed to meet the demand of a more ambitious decarbonisation scenario will be technically and commercially ready in time.

A study within IMO’s Future Fuels Project assessed the state of availability and readiness of low- and zero-carbon ship technology and marine fuels.

“The strategy contains some indicative checkpoints of which the one for 2040 is the most interesting. By 2040 the total emissions from ships must have been reduced by at least 70%, striving for 80%. As the industry is still expected to grow towards 2040 and beyond, the reduction at ship level would have to be around 90% compared to the baseline ship of 2008,” Pedersen says.

As 2040 is only 17 years away, new ships already on the water today will also be part of the fleet in 2040. Therefore, an average 90% reduction means that new

GHG intense fuels are created equal with LNG being the most abundant and cheapest for use. In complete contrast, Maersk recently paid $2,500 a tonne, almost five times the cost of conventional fuels on an energy-equivalent basis, for the bio-methanol loaded onto the company’s first-ever methanol-powered containership ahead of its maiden voyage to Copenhagen. This is due to the low-carbon variants of methanol fuel still being scarce and commanding a substantial price premium.

Regardless of the bio-methanol price,

According to the data from the study, several energy efficiency technologies are already mature with a potential for greater roll-out. Other energy-saving technologies are already operating commercially or transitioning to commercial development by 2030.

Biofuel and e-fuel production pathways are forecast to be fully mature before 2030 while blue hydrogen and ammonia production pathways are forecast to reach full maturity before 2030 and mid-2030s, respectively. Fuel combustion engine technologies with new candidate fuels are forecast to reach commercial operation by 2030 whereas fuel cell technologies may take until the late-2030s to fully mature.

17 www.splash247.com ENVIRONMENT

A very clear demand signal has been sent to the fuel supplier industry

WEBSITE: WWW.HIGHLAND-MARITIME.COM FACEBOOK: HIGHLAND MARITIME - ALL SEASON CERTIFIED LLOYD’S REGISTER DOC, MLC, ISO OUR MARITIME EXPERTISE INTERNATIONAL THAI SHIPMANAGEMENT E st.2009 BETTER MANAGE D VESSELS FOR LESS COST ! BULK OFFSHORE RO RO CONTAINER CALL US NOW!.... WE CAN REALLY HELP! ANDREW J. AIREY - MANAGING DIRECTOR TEL: +66-81-845-6269 E-MAIL: ANDREW@HIGHLAND-MARITIME.COM We Manage… You Smile…!

All these forecasts are considered as maximum durations under conservative assumptions because, with higher demand and supporting follow-up policies, technology development should accelerate. So, Shaw believes that the commercial rollout of fuels is not expected to hinder anything.

Eirik Nyhus, director for the environment at DNV, is a bit more cautious, telling Splash: “The future fuel mix is highly dependent on fuel prices and policy ambitions. Shipowners therefore need transition plans that reflect the uncertain future and fuel flexible solutions that provide robustness and reduce carbon risk. Design options for newbuildings should enhance a vessel’s ability to utilise multiple fuel options, increasing resilience and the ability to stay in compliance and remain competitive as regulations and stakeholder requirements tighten.”

He adds that allocating sufficient space for fuel storage, while minimising carrying capacity loss and maintaining safety levels, is the main design challenge going forward.

Nyhus also points out several aspects

to look out for when talking about potential newbuilds in the near future.

“Vessels operating on alternative fuels such as the dominant LNG and methanol may face reduced operating range. This may result in shorter bunkering intervals where operating patterns for vessels with regular routes are optimised towards storage volumes/bunkering intervals,” Nyhus says.

Onboard carbon capture (CCS) is a hot topic, but Nyhus says it’s uncertain whether this tech can scale fast enough to play a significant role in attaining the 2030 goals of the greenhouse gas strategy. Post-2030, however, it may see increasing use and impact, he reckons.

Nyhus also believes that digitalisation could deliver up to 15% of the GHG emission savings required by 2050, by enabling more energy-efficient ship design, construction, and operation along with the use of digital twin technology for fleet optimisation and vessel utilisation.

Shaw also chips in on the topic by pointing out other technologies that would push towards GHG emission reduction.

“We already see some ships using

wind-assisted propulsion to boost their carbon intensity ratings. These are visible changes, for example, the use of rotor sails or high-tech wind kites attached to ships. Many other energy-saving devices are already mature and available for existing and new ships. Shore power may become more widely available,” she tells Splash.

All respondents to Splash believe the 2030 target is one where energy efficiency, and sustainable biofuels, possibly supplemented by increased uptake of hybrid and wind assistance power systems, would be expected to play the most significant role.

In conclusion, ships in 2030 might not be visibly different but will most certainly be equipped to use new fuels, have different piping arrangements, and have seafarers trained to handle new potentially hazardous substances.

As DNV’s Nyhus puts it: “The course is set, the speed is set, and a clear signal has been sent as to what is expected from us as a sector. A very clear demand signal has also been sent to the fuel supplier industry. There is now a much greater certainty when it comes to future demand for green fuels.”

It is now just a matter of further developing new technologies and new fuels as well as waiting for the arrival of new regulations. MEPC has already initiated the development of a basket of mid-term measures delivering on the reduction targets, comprised of both a technical element (fuel standard) and an economic element (GHG emissions pricing mechanism), expected to be approved in the spring of 2025.

With all this set to go ahead and accelerate the way shipping is conducted in the future, all we need to do is keep our eyes on the shipowners and shipyards and watch the future become the present.

For all the latest environment news

19 www.splash247.com ENVIRONMENT

Estimated maturation timelines for energy converters, onboard CCS technologies, and corresponding safety regulations for onboard use with alternative fuels other than LNG/LPG (DNV)

marine products © 2023 Chevron. All rights reserved. All trademarks are the property of Chevron Intellectual Property LLC. solutions for your journey chevronmarineproducts.com understand your marine equipment FAST ™ lubricant analysis services ✔ Accurately monitor all your ship’s lubricated equipment with FAST™ ✔ Use the FAST™ OnBoard portable kit to quickly trend oil performance — download the app: ✔ Immediate main engine drip oil analysis results using DOT.FAST®

Shipping’s $64bn question

What will be the percentage breakdown of fuel types for all the ships that come out of yards in 2030?

It's the crystal ball guesstimate that divides shipping more than any other topic these days. The winner of the future fuels debate. For the purposes of this magazine, too, the breakdown of fuel types for all ships coming out of yards in 2030 will be the single defining characteristic of how vessels will look like at the start of the next decade.

For the moment though it’s still all conjecture as the industry tests and trials all manner of bunker replacements.

Philippe Lecloux, chief operating officer at fuel specialist Aderco, says drop-in fuels will still dominate come 2030 with a much larger bio component.

“LinkedIn is already bunkering and

LinkedIn is already bunkering and burning ammonia on a daily basis

burning ammonia on a daily basis,” quips Lecloux. “It will be more a reality in 2030 but less frequent than today on LinkedIn.”

Quite so, agrees Patrick Ryan, chief technology officer at ABS.

“Any predictions we make today about alternative fuels are destined to be incorrect,” Ryan observes, adding: “We are learning more everyday, but there are still many unknown factors that will drive the answer to this question. In the end, the regulatory landscape is coming into focus, but could still change again. With that as a backdrop, it will be economics

that will drive the future fuel selection process.”

“Given the evolving nature of technologies and the regulatory environment, it's challenging to provide a percentage breakdown – however we can be confident that LNG will continue to dominate the fuel mix, followed by methanol and ammonia,” says Kishore Rajvanshy, managing director of Fleet Management.

“What amazes me is how quickly the pendulum swings,” says Raal Harris, chief creative officer at Ocean Technologies Group, discussing the future fuels race.

“Ammonia seemed like the worst option six months ago and today is being heavily backed with some commitments to have ships on the water by 2026,” Harris explains, going on to predict a big percentage of 2030 newbuilds being hybrid and bio-fuels dominating.

“I also think we may see more LNG than people might like as pragmatism takes over,” Harris adds.

21 www.splash247.com FUELS

Where dry bulk deals are sealed Minor Bulks Agri-commodities Coal Iron Ore Decarbonisation Hotel President Wilson Geneva, Switzerland May 2 & 3, 2024 GOLD SPONSORS

genevadry.com

SPONSORS

Green fuel scramble

The reality also is that by 2030 shipping will be fighting many other industries for every prized drop of the myriad new green fuels.

Increasing regulatory pressure to decarbonise, including stricter targets set by the International Maritime Organization (IMO) this July, means the shipping industry now needs to achieve a 20% reduction in emissions by 2030 and net-zero emissions by or around 2050. To meet the anticipated demand of 17m tonnes of oil equivalent annually by 2030, the maritime sector needs to access a 3040% of the projected worldwide carbonneutral fuel supply, according to a new report by DNV.

The percentage mix

According to S&P Global, LSFO consumption in 2030 is projected to be just over 40% while distillates used directly may reach 25% and HSFO with scrubbers is predicted to still make up 20% of the mix. The remaining 10-15% are expected to be split among between alternative fuels, according to S&P Global.

Emilio Lupi, general manager at SeaTec, a maritime technical services

company, predicts that LNG will account for more than 30% of the market share for chemical/product tankers in the coming decade while only making up a small percentage for containerships.

“The total LNG share of the market is expected to reach about 10% for ships that come out of yards in 2030, while methanol on the other hand doesn’t seem to have the same increase in uptake, and isn’t likely to be a key player by 2030,” Lupi says, adding that heavy fuel oil will still count for more than 50% of the total market share by then.

Morten Langthjem, chief commercial officer at Glander International Bunkering, reckons that today there is consensus that LNG and biofuel are the main fuels in the transition phase towards 2030. Also, he says there will be an upscale in respect of methanol and more dual fuel engines are being put in newbuildings.

“There is generally a lack of availability of ammonia and hydrogen. Furthermore, technical, operational and safety advancements needs to be made,” the bunkering executive advises.

“Specifying precise percentages for each fuel type is challenging,” concedes Yeontae Kim, executive vice president of Korean Register’s technical division,

“but it is evident that conventional fossil-fuelled vessels will decline rapidly due to the ongoing reinforcement of environmental regulations.”

Gas-powered ships such as LNG and LPG, which have well-established infrastructure including bunkering ships, will lead gas bunkering by 2030, Kim says with the next most common alternative fuel set to be methanol, which is easier to build bunkering facilities for than LNG and can be stored and transported at room temperature and atmospheric pressure. Ammonia and hydrogen fuelled ships will still be in their infancy by 2030, Kim suggests, while it’ll be a few years after that before nuclear propulsion makes an appearance.

Looking at the smorgasbord of alternative fuels facing him, Ralph Juhl, head of technical at Hafnia, the world’s largest product tanker owner, tells Splash: “LNG and LPG are the most commercially available right now, but we expect they will meet with some challenges further down the line as methanol or other lower emission supply chains build themselves up.” Ammonia will have a significant impact further down the line, Juhl reckons, but Hafnia expects this to be the slowest to develop primarily due to technical and safety challenges.

23 www.splash247.com FUELS

What life will be like onboard at the start of the next decade

The MT Zero is a dual-fuel methanol carrier. It can carry 200,000 cu m of methanol and trades between the Gulf of Mexico and the European Union. The words ‘Powered by Methanol’ are plastered across the side of the vessel and the owners talk proudly of the ship’s green credentials. Unfortunately, in reality, it hasn’t run off methanol since sea trials.

The global methanol shortage has been a good thing for the fleet. Any ship that can carry methanol is constantly in demand, and the charter rates are skyhigh. But it’s such a precious commodity that it can never be used as a ship’s fuel.

Since methanol became the primary feedstock for sustainable jet fuel the price has skyrocketed. While it’s highly profitable to carry methanol, it’s incredibly expensive to burn it. At the same time, as the world has moved further away from fossil fuels, heavy fuel oil

has become the commodity that no one wants. Even with the various carbon taxes in place around the world, it has so few industrial uses that shipping companies are practically being paid to burn it.

This issue has become so pervasive that even the International Maritime Organization (IMO) is involved. At MEPC 94 earlier this year, the committee had to admit that the industry has missed every target set in every greenhouse gas strategy to date. We all expected the EU ETS to kick the IMO into action, but the international market-based measures that were promised in previous iterations of the GHG strategy still haven’t materialised.

It has become such a big issue that the EU is responding by exploring a heavy fuel oil ban from 2035. Until that happens, every newbuild ship rolls out of the yard with a ‘net-zero ready’ certification and then happily continues to burn cheap and dirty heavy fuel oil.

Apart from the ‘Powered by Methanol’ credentials, the only other major advance in ship design is the explosion in wind power. Most newbuild deepsea ships today have some kind of sail. With rotors, kites and wings filling the skies, the modern fleet is far more interesting to look at than it used to be.

On the bridge, the latest autonomy technology is in use. The ship is not just capable of running with an unmanned machinery space but an unmanned bridge. It doesn’t make any difference to the number of crew carried, but it allows those who are still onboard to get better rest.

The IMO’s 2026 Autonomy Framework requires operators to get an exemption from both flag and class for unmanned bridge operations. The exemption takes months to be approved and only applies to a single voyage corridor. Each exemption allows the crew to pass

24 ESSAY Ship Concept 2030

Nick Chubb, founder of UK maritime tech consultancy Thetius, gets creative, giving readers a guided tour of a methanol-powered ship traversing the world’s oceans in late 2030.

navigation and watch keeping duties to an approved shore control center during the open sea passage. Instead of watchkeeping, the crew onboard can rest or take on maintenance tasks, but they need to be ready to step in at any time in case of traffic or if the ship needs to deviate from its approved corridor.

All of this is made possible by the mandatory rollout of the Voyage Data Exchange System (VDES). VDES has replaced AIS for all newbuild vessels. Anyone with a VDES receiver can see the ship’s intended route information, plus nearby ships receive notification if the ship intends to deviate for collision avoidance.

VDES combined with the rollout of LEO networks have made communication between ships and with shore teams much easier. The team onboard can dial into daily stand ups with the shore-based team to discuss live issues and there is

a constant channel of communication between the bridge and the shore control centre.

Just because the crew onboard aren’t watchkeeling doesn’t mean they aren’t working hard. MT Zero is a modular ship. This design philosophy was popularised in the late ‘20s. It makes it possible to swap out the fuel, engine, propulsion, cargo pumps, and navigation systems with new equipment in a standard drydock period. The aim of this is to futureproof the vessel against emerging technologies or alternative fuels becoming economically viable or mandatory.

Modular ships are more expensive to build, but the expectation is that the hull and superstructure will last for a century and the vessel will go through four to five modular upgrades in its lifetime. This

reduces the lifetime carbon footprint of the ship but it means the crew have to be much more proactive on maintenance.

The good news is there is plenty of technology available to help them. Though high bandwidth connectivity between ship and shore has been pervasive for some time, wireless connectivity between compartments onboard the ship has only recently become widely available. Not having to run cables for every device means it’s now possible to connect thousands of sensors into one system for very little investment.

Data gathered by these sensors feeds an AI-driven maintenance system that prioritises jobs for the crew. For visual inspections and simple repair jobs they have access to a range of drones that are capable of either flying into compartments or crawling across the hull. For more complex or specialist jobs the onboard 3D printer can create a range of tools, patches, and parts.

Despite the advanced technology onboard, life for a seafarer hasn’t changed much. The knowledge and training requirements to become a master mariner make no provision for autonomy, VDES, or advanced cyber security. Instead, they still have to learn signal flags and morse code. The UKHO withdrew paper charts a few years ago, but many maritime colleges are still required to teach paper navigation. The basic requirements to sail on a dual fuel ship were bolted onto the last STCW update, but most individuals have very little practical experience of safely bunkering new fuels.

Maybe things will improve in 2040 when we next have an update to the convention? For now though, new technology will march forward and the world’s seafarers will continue to be certified to a standard that was useful decades ago. I guess some things don’t change.

25 ESSAY www.splash247.com

The world’s seafarers will continue to be certified to a standard that was useful decades ago

Your flexible, scalable Crew Management System

Manage your crew and compliance from one place

Save your crew valuable time

Eliminate data errors

Improve your data security

See COMPAS in action at oceantg.com/compas-core

COMPAS simplifies the complex processes involved in manning, crewing, and Maritime HR. It reduces some of the most labour-intensive processes to a single click.

Manage all your crew data from one place, quickly and easily book travel, manage payroll and demonstrate compliance.

Cutting through the noise around digitalisation

Splash moves beyond the sound bites, giving readers a realistic outlook of what to expect digitally onboard in the coming years.

Krzysztof Kozdron, managing director of technical consultancy Schulte Marine Concept, remembers the days when marine engines were equipped with mechanical governors, and when, as a teenager, he was helping his father to repair his car with a hammer and a spanner.

“It all sounds today like Stone Age reality,” Kozdron says, pointing to how quickly his industry is now automating.

Sometimes when discussing digital advances in shipping it’s hard not to conjure up images of sci-fi movies, so rapid and extreme are many depictions of automated ships of the future. Some balance is needed.

“To read some of the claims being made in the shipping market it seems as though if we took all available vessel

optimisation solutions and implemented them across the fleet, shipping would be a net electricity generator,” quips Anders Bruun, the CEO of software provider Coach Solutions.

Digital and decarbonisation allies

What’s undeniable is that digitalisation and decarbonisation have to live side by side for shipping to meet upcoming green targets.

According to shipmanagement giant V. Group, 80% of decarbonisation in the next decade will come from the optimisation

of current assets, with said optimisation coming in no small part from the digitalisation of all operational aspects of shipping both at sea and shoreside.

Casting his eye to what ships will be like digitally come 2030, Manish Singh, who heads investment advisory AboutShips, sets the scene, telling Splash: “Artificial intelligence (AI), machine learning and greater digitalisation onboard will continue to further transform various processes and tasks, ranging from integrated bridge management, engine room management, cargo handling and optimisation, and maintenance planning.”

27 www.splash247.com DIGITAL

80% of decarbonisation in the near decade will come from the optimisation of current assets

Optimize Your Payments

Empower Your Crew

was built one account-holder at a time. Today, our global community of seafarers enjoys instant, transparent payments anywhere on earth, with an easy-to-use mobile app that lets them save, spend and send their money worldwide at the push of a button. MARITIME PAYMENT SOLUTIONS SIMPLIFIED

ShipMoney

paying wages at sea to settling global invoices and minimizing onboard cash, we recognize the unique financial circumstances facing the maritime industry. That’s why we created ShipMoney – the simple, secure, and cost-e ective way to move money across borders and oceans. A BETTER WAY TO PAY STARTS TODAY Contact us for a demo of our award-winning platform sales@shipmoney.com • shipmoneycorporate.com

From

Valid data

Emilio Lupi, general manager, project and newbuilds at SeaTec, a technical service company belonging to V.Group, says that as ships become more complex, the data they produce will become difficult to manage, and will require a consistent investment in software engineering to allow shipowners and operators to keep their vessels fully controlled and their performances optimised.

“Despite the noise around digitalisation, gathering accurate, actionable vessel performance data continues to be a huge issue for vessel operators. It is hard enough on owned assets but on chartered tonnage, getting valid data is a difficult, time consuming process that often still relies on interpreting noon reports,” says Bruun from Coach Solutions, adding: “Without valid data you are just another person with an opinion; the key aspect is the ability to optimise on the right data.”

“Digitalisation is impacting all areas of

shipmanagement and progress is rapid,” Lupi from SeaTec says. “From bringing more predictability in how we manage vessels to supporting the full life cycle of crew management, unequivocally the proliferation of digitalisation and automation is only going to continue apace.”

Automation

“Automation will grow by leaps and bounds,” says Kishore Rajvanshy, managing director of Hong Kong shipmanager Fleet Management.

The engine room, for instance, according to Rajvanshy, will see a high degree of automation with systems for monitoring and controlling engines, fuel systems, and other machinery to be largely automated and AI being used to optimise performance, predict maintenance needs, and detect and diagnose problems.

The bridge will also see advanced automation in navigation and ship control systems. This may include automated

collision avoidance systems, autopilots capable of handling increasingly complex situations, and systems for monitoring and optimising ship performance.

Operational measures using digital technology such as weather predictions, trim and speed optimisation and minimising port operation time will be widely applied to reduce fuel consumption by 2030, according to Yeontae Kim, executive vice president at Korean Register. “This,” he says, “will require future ships to become much smarter.”

Warming to the theme, Kim tells Splash: “In 2030, the expansion of ship automation will continue, integrating sensors and AI-driven automation systems across various ship areas, from the engine room to the bridge. These advancements will reshape ship operations, relying extensively on these new technologies.”

As well as touching on AI and sensors, Kim highlights the growing potential to use robots and drones for repairs and inspections.

29 www.splash247.com

DIGITAL

Without valid data you are just another person with an opinion

It’s not too early to donate to The Mission to Seafarers’ Christmas Appeal Help seafarers in good and difficult times throughout Christmas and the year ahead. Registered UK charity no: 1123613 Contact: jan.webber@missiontoseafarers.org | missiontoseafarers.org/donate

Less crew

Andrew Airey, managing director of Bangkok-based shipmanager Highland Maritime, reckons that shipping’s adoption of big data is still at its infancy, fed by a huge increase in vessel data gathering sensor systems, a substantial increase in satellite communication path bandwidth and all at a much lower cost than today.

The growing automation of all ship operations could lead to one significant design change for ships, Airey suggests. He is sure ships of the future will require less crew, to the point where the accommodation blocks become smaller, possibly being moved towards a vessel’s bow area with more efficient smaller machinery spaces aft, and maximum cargo spaces in between.

Alfonso Castillero, CEO of the Liberian Registry, the world’s largest flag, says new

ship designs will be equipped with more and more automated systems and decision support systems.

“As we approach 2030 we will see an increasing focus on newbuild vessels featuring advanced autonomous systems, however the seafarers can at all times intervene and manually take control of these systems,” Castillero tells Splash.

While many respondents agree that future ships will have less crew onboard, Patrick Ryan, chief technology officer at ABS, has a more nuanced take on the whole automation debate.

“For a long time, automation was seen as a means to reduce staff and crew. However, in the vessels of tomorrow, automation will become more aligned with safety and a component of safety procedures,” the class executive reckons.

With the ships of the future becoming more complex, Ryan says employing duel fuel engines or hybrid-electric

propulsion for example, automation can potentially augment and offset training costs associated with complex systems of systems, and become an important safety feature in new fuel applications that are higher risk than seen today.

Artificial Intelligence

A new report from Lloyd’s Register shows that today’s empirical models process only about 10% of vessel data, compared with 90% for AI models, which can then generate accurate performance insights. In this way, AI-driven models can optimise decision-making, and even address safety issues that may arise due to lack of situational awareness or data.

Generative AI also has applications. SeaGPT, an AI chatbot tool to simplify communication between crew managers and port agents, automates processes such as drafting emails and extracting essential information from communications with the port agency for crewmembers, who highlight email overload as a concern.

“SeaGPT is expected to eventually become an executive assistant to the crew—running in the background and retrieving relevant data to handle communication that does not require direct human involvement,” experts at LR wrote in their recent guide towards shipping in 2050. For widespread AI use, however, it is important to note that interoperability issues, regulation and policy bottlenecks will need to be addressed.

31 www.splash247.com DIGITAL

SeaGPT is expected to eventually become an executive assistant to the crew

DIVERSITY STUDY GROUP

Maritime DEI Experts

+44 (0) 20 2746 3760

EXPERTS IN MARITIME DEI, PROVIDING:

Bespoke consultancy services & DEI programmes spanning the shore and seafaring community that include:

• DEI strategy development

• DEI governance

• Inclusive Leader and Inclusive Manager programmes

• Developing in-house capability (HR support / DEI facilitator support)

• Data and measurement

DSG Corporate Membership:

• DEI data measurement & benchmarking

• Regular networking opportunities

• Sharing of best practice

• Discounted DEI learning and development programmes

HEIDI HESELTINE Co-Founder

+44 (0) 7525 901064

info@diversitystudygroup.com www.diversitystudygroup.com

DEI in Maritime Masterclass Series:

heidi@diversitystudygroup.com

www.diversitystudygroup.com

• Workshops and Executive Coaching

Tomorrow’s skillsets at sea

What will crew need to be adapt at when stepping onboard a newbuild coming out of a yard in 2030?

E-fuel, biogas, biofuels, fuel cells, nuclear propulsion, kite sails, rigid wing sails, Flettner rotors, air lubrication, Mewis ducts, hull antifouling, onboard carbon capture, artificial intelligence and automation - there’s a huge amount of new ‘stuff’ for the world’s seafarers to get their heads around in the coming years. New skillsets and mindsets will be required to navigate shipping’s future.

DNV‘s recently published Maritime Forecast to 2050 made the good point that given the competition from other industries for limited amounts of green fuels by 2030 - a year where more stringent environmental benchmarks kick in - shipping must focus beyond fuels, in particular on what can be done now to achieve energy efficiencies and carbon emission reductions.

“The 2020s marks the decisive decade for shipping. Securing greener fuel supply is critical. However, focusing on fuels alone can distract us from making an impact this decade and ambitious

future declarations are not good enough. What we need is tangible actions that will reduce emissions. Energy efficiency measures can deliver decarbonisation results now and towards 2030,” says Knut Ørbeck-Nilssen, the CEO of DNV Maritime.

Handling advanced tech

As the previous Digital section of this magazine makes clear, a lot more tech is going to be installed on newbuild ships come 2030.

As ships adopt new navigation and propulsion systems as well as alternative fuels, crewmembers will need to be trained in the operation, maintenance, and troubleshooting of these technologies.

“This,” says Morten Langthjem, chief commercial officer at Glander International Bunkering, “will undoubtedly involve a shift from

traditional mechanical skills to more specialised technical and operational expertise related to alternative fuels and hybrid systems.”

Crewmembers will also require a deeper understanding of environmental regulations, emissions control, and waste management, he reckons.

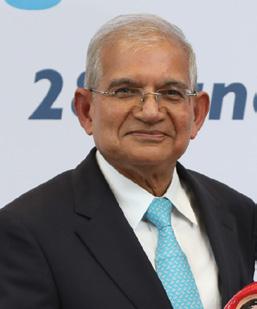

“Onboard, crewmembers will need to be comfortable with advanced technology and able to manage and troubleshoot automated systems. Skills in data analysis, cybersecurity, and remote operations management will become increasingly important,” says Kishore Rajvanshy, managing director of Fleet Management, one of the world’s largest shipmanagers.

Sandith Thandasherry, the CEO of Oceanix, a data science solutions provider, puts it simply.

“The maritime workforce of 2030 will need to adapt to a more technologycentric environment,” he says, adding: “Proficiency in managing and troubleshooting automated systems, data analysis, and software maintenance will be crucial.”

33 www.splash247.com

OPERATIONS

The importance of traditional seafaring skills should not be underestimated

According to Thandasherry there will be an increased demand for engineers and technicians with expertise in automation and digital systems, as well as data analysts who can interpret the vast amounts of information generated by onboard sensors and systems.

Onshore operations

Skillsets are going to be more diverse with a crew having more training and experience with new technologies such as augmented and virtual reality, video, and remote surveys, predicts Patrick Ryan, chief technology officer at ABS.

“One way this could manifest,” he says, “is where highly experienced crewmembers might remain onshore, and be virtually present and deployed on multiple ships manned with skilled, but less experienced, crew.”

This theme is one that has been exercising Raal Harris and all his team at

Ocean Technologies Group (OTG) day in, day out for years. Harris is chief creative officer at OTG, the world’s largest crew management software provider.

“The first point,” he says, discussing ship operations in 2030 with Splash, “is to anticipate a much closer coming together of the shore and shipboard team. It is likely that some roles and operational task will move ashore. We may see a small reduction in crew but those left will need to be highly skilled.”

Harris advises that organisations will need to think about how they manage their workforce and workforce competency in a much more holistic way.

“Traditionally we have front loaded seafarer competency, but the pace of change will mean that new skills will be needed on a continual basis. So life-long

learning and learning in the flow of work will be the norm,” Harris predicts.

Agreed with all the comments thus far, Heidi Heseltine, who heads up Halcyon Recruitment, argues that inter-personal skillsets will also need to be developed to ensure working environments onboard are inclusive, and physically and psychologically safe.

The shipowner perspective

Providing the shipowner perspective on how seafarers will need to have adapted by 2030 is Ralph Juhl, head of technical at product tanker giant Hafnia, who narrows the discussion down to two urgent skillset changes, namely the handling of new fuels and electronic handling of equipment.

34 Ship Concept 2030 OPERATIONS

The maritime workforce of 2030 will need to adapt to a more technology-centric environment

New fuels in 2030 will mainly be gases, he reckons. “This means there is an introduction of a huge range of new technologies and equipment, plus the fact that it is highly complicated to load/ bunker, maintain and handle while oil is very simple and can be done by most people,” Juhl observes, a point also picked up by Alfonso Castillero, the CEO of the Liberian Registry, the world’s largest flag, who voices his concern in particular about ammonia, an “extremely toxic and corrosive” fuel.

Turning to his second point, Hafnia’s Juhl says shipboard equipment is being more and more electronically controlled and operated which means that computer operation with back-up systems and use of service engineers or shore-based distance support are becoming the norm while the former important mechanical skills are becoming less important.

“Think of your car, 30 years back many could do repairs themselves while

it is impossible today as everything is computerised,” Juhl tells Splash by way of illustrating his onboard point.

Traditional skills still required

For all the talk above some might be forgiven for thinking tomorrow’s sea workforce would be totally divorced from the current generation, something Fleet’s Rajvanshy is keen to dismiss.

“The importance of traditional seafaring skills should not be underestimated,” says the veteran shipmanager, who is now in his mid-70s, having first gone to sea in the late 1960s.

“Despite the rise of automation, the need for crewmembers who understand the sea, weather, ship handling, and mechanical systems will always remain. These skills are critical for safety and

handling situations that automated systems might not be able to cope with,” Rajvanshy argues, concluding: “Therefore, in our industry automation doesn't mean job losses – rather, roles will change and evolve. There will always be a need for skilled workers to design, build, maintain and operate the automated and AI-driven systems onshore and onboard.”

35 www.splash247.com

OPERATIONS

New skills will be needed on a continual basis

Are cargo owners doing enough to drive change?

Who will drive the ship changes coming up? Splash takes a look at what customers are doing.

For Khalid Hashim, the veteran managing director of Thai-listed dry bulk owner Precious Shipping, the way to ensure shipping goes green rapidly is with three regulations - a carbon tax, a hard stop to any fuel-burning ships delivered by shipyards on or after January 1, 2030, and finally a deadline for 20 years or older ships to be scrapped by January 1, 2035. This regulatory trifecta would give clarity for shipyards, for owners, for charterers, and for end consumers, with hard deadlines. It would also guarantee charterers tie up long-term contracts with owners who have taken the plunge and contracted zero-emission vessels (ZEVs). Moreover, it would get cargo users to factor in the cost of ‘green’ shipping services and to charge their end consumers for such a green service.

A handful of charterers in 2023 are responsible for some of the more eye-catching vessels coming out yards whether it’s with wind-assisted propulsion, or some alternate fuel, but the scale of such green investments remains far below for what is required to meet shipping’s enhanced environmental goals.

The size of the challenge can be evidenced in the latest annual report from signatories to the Sea Cargo Charter, a global framework for assessing and disclosing the climate alignment of chartering activities, whose members include big-name shippers such as Cargill, Trafigura, Bunge and Shell. The

annual report, published in June and covering 2022, showed emissions data for last year showed no improvement over 2021’s figures.

“Time is running, 2050 is closing in fast and the required actions are extremely complicated to overcome,” says Mikael Skov, the CEO of Hafnia, the world’s largest product tanker owner.

New analysis from UK consultancy UMAS shows that even at the lowest ambition interpretation of the International Maritime Organization's new greenhouse gas (GHG) strategy, an average ship’s GHG intensity will need to have reduced by 86% by 2040.

37 www.splash247.com CHARTERERS

The concerns of consumers regarding global warming are exerting their influence

Splash - for incisive, exclusive maritime news and views 24/7. www.splash247.com More than 800 positions available across the world www.splash247.com/jobs Your new career awaits

“The reality is,” Skov says, “charterers play a big role in this in making the financials work. The cost of the new fuels’ technologies, if unsupported by longterm contracts, will have most owners refrain from taking the financial risk of the future fuel’s technology alone on otherwise already expensive assets.”

Patrick Ryan, chief technology officer at ABS, argues that economics and societal pressures to reduce emissions will drive change.

“For trades that are consumer-facing, the shippers will drive change because their customers are putting pressure on them. For shippers of bulk commodities, it is going to be investors and stakeholders because the finance they require will need to meet ESG requirements,” he explains.

This point of view is supported by Heidi Heseltine, the CEO of Halcyon Recruitment.

“As major chains like Amazon and Ikea get further into the market and are under pressure to demonstrate their commitment to environmental and human sustainability, this will increase pressure on other areas of the shipping industry to follow,” she tells Splash.

“Cargo owners are displaying a growing inclination towards improving their ESG management, prompting a ripple effect throughout the industry. Furthermore, the concerns of consumers regarding global warming are exerting their influence,” states Yeontae Kim, executive vice president of Korean Register’s technical division.

Peter Jameson from Boston Consulting Group argues that establishing new chartering and ownership frameworks can “democratise” access to green assets and create a level playing field for organisations of all sizes. Also,

Jameson maintains that supply-demand partnerships related to fuel sourcing are necessary to distribute the risk associated with setting up green fuel production across the value chain.

“All players in the value chain have crucial roles in achieving the estimated $2.3trn needed to decarbonise shipping by 2050. While addressing the challenges and opportunities, it becomes clear that comprehensive participation and collaboration are vital for a successful transition,” Jameson concludes.

39 www.splash247.com CHARTERERS

Comprehensive participation and collaboration are vital for a successful transition

Fuel flexibility Proven dual-fuel technology Plan with confidence Reduced Methane slip and CO 2 emissions Proven design for reliability and safety Lower fuel consumption wingd.com Meet us at Kormarine, stand 2C43

Building better

Are the world’s shipbuilders doing enough to foster innovation?

Are shipyards doing enough to foster innovative designs? Sure, they have their snazzy marketing material to hand, their impressive stands at trade fairs, but with the end product - are yards actually willing and able to deliver radically different ships. Many in shipping doubt it.

Speaking at this year’s Maritime CEO Forum in Singapore, Wellington Koo, executive director of privately held Valles Steamship and chairman of the Hong Kong Shipowners Association, told delegates: “I am not too concerned about newbuild prices. The bigger problem is the new designs I get from the yards are not so new, just downgraded engines to comply with regulations. I am frustrated with the yards for not offering better,

newer designs.”

Speaking at the same event, Olivia Lennox-King, chief operating officer at Cetus Maritime, one of the largest privately held handysize operators in the world, also expressed her frustration at the yards’ inability to provide solutions for future ships.

“They don’t have the solutions to offer for handysize ships, they don’t have the solutions to install on these smaller ships,” Lennox-King said at the exclusive shipowner gathering held at Singapore’s iconic Fullerton Hotel.

Mikael Skov, who heads up Hafnia, the world’s largest owner of product tankers,

looking at the comments made by fellow owners earlier in the year, points out that yards are only tasked with delivering ships that comply with the selected flag and international legislation.

“It will be difficult for yards to go further than that,” he says.

It’s a mixed picture, says Alfonso Castillero, CEO of the world’s largest ship registry, Liberia, casting his eye over the world’s shipyards. Some are doing enough, he says, others less so.

“There are shipyards that have not yet woken up to the reality of the current and future demand for international shipping,” he warns.

41 www.splash247.com

SHIPYARDS

I am frustrated with the yards for not offering better, newer designs

Downsized yards

Commenting on the owners’ dissatisfaction, Andrew Craig-Bennett, Splash’s lead columnist, says it is a result of the dramatic downscaling seen in the shipyard sector since the global financial crisis 15 years ago.

“The yards cannot innovate. They have been optimised to the point where they have no talent with the time to think,” says Craig-Bennett.

Far more supportive of shipbuilders’ pursuit of new designs is someone at the coalface; Patrick Ryan, senior vice president and chief technology officer at class society ABS.

“Of course they will,” Ryan insists on being quizzed whether yards will do enough to support the green, digital drive of the industry.

“Smarter ships are possible now, and increasing in data collection and connectivity everyday,” he says. “Owners,

OEMs and shipyards are in the driver’s seat, keen to leverage the benefits of being data-driven in terms of what can be connected and how they can adopt a digital operating model across their fleets.”

It’s easy to be distracted by the drive to be green, but yards also have to ensure that future ships are far more intelligent entities, capable of gathering and analysing substantial volumes of high-quality data, points out Yeontae Kim, executive vice president of Korean Register’s technical division.

“In essence, shipyards stand at the nexus of both challenge and opportunity, tasked with aligning their efforts with the industry's dual imperatives of emission reduction and the development of markedly smarter vessels,” Kim says.

Nick Chubb, who runs UK-based maritime innovation consultancy Thetius, suggests the real problem are owners unwilling to pay for innovation.

“If you want to change behaviour you

need to change incentives,” Chubb argues. “The business model for most yards is to produce the cheapest possible vessel. The easiest way to achieve that is by building the same ship over and over again with as little change as possible. They have been incentivised to do this for decades. If owners want the yards to become the industry’s great innovators, they will need to be paid to do it, and handsomely.”

Manish Singh, who heads up maritime advisory AboutShips, says that shipyards by themselves cannot pivot the industry towards smarter vessels.

“This,” he says, “requires concerted effort between regulatory policy, fuel infrastructure development, charterer commitment to early adopters, rapid innovation by OEMs and operational gains by owners and managers.”

Shipyards, according to Singh, are a key piece in the aggregation of such a concerted effort to build and operationalise novel technologies.

42 SHIPYARDS

Yards have been optimised to the point where they have no talent with the time to think

Ship Concept 2030

Shipyards stand at the nexus of both challenge and opportunity

‘Same boat with too many flaky options’

Dr Martin Stopford, the world’s most famous maritime economist, maintains there’s no point blaming the yards.

“Everyone’s in the same boat with too many flaky options,” says Stopford, the author of Maritime Economics, adding: “Only the owners really know what will work but it’s the classic problem. In a time of change you ask your customers ‘what do you want?’ and they just say ‘what have you got?’”

Stopford maintains there’s no quick fixes on shipping’s path towards decarbonisation.

“It’s a major rethink of ship systems and it’s going to be expensive with no guarantee you get your money back,” he warns.

Bear in mind too, says Sanjay Chandra, executive director at Fleet Management, that shipyards’ return on investment is often uncertain, something clearly in evidence in financial results in the 2020s

where despite lengthening orderbooks, profits have been slim.

Regulatory support

“Regulatory support, in the form of standards and incentives, can play a crucial role in encouraging shipyards to invest in these areas,” Chandra says, arguing that ultimately the pace of change will depend on a complex interplay of technological, economic, and regulatory factors.

KD Adamson, a maritime futurist, argues owners cannot have it both ways. On the one hand, she says, owners claim there’s no way they’re going to order ships until they have a level of certainty on where the decarbonisation tech is going. On the other, they blame the yards for failing to deliver them a solution.

“The reality is that market-led innovation is fundamentally unsuited to addressing systemic problems like decarbonisation, because incentives and margins are misaligned,” Adamson claims.

Finally, there’s the issue of scope 3 emissions, something shipyards have yet to properly address, but by 2030 they will need to be on top of, says Carl Schou, president of Wilhelmsen Ship Management.

There is a growing demand to track the greenhouse gas emissions into every stage of the ship lifecycle from design to construction, to operations and recycling.

“We note that shipyards are not ready to incorporate the circularity principles into shipbuilding as measures to reduce owner’s scope 3 emissions,” Schou points out. For all the latest news from the world’s shipyards

43 www.splash247.com SHIPYARDS

Wind is our green bullet

The ongoing climate emergency makes the need to reduce emissions from shipping more urgent than ever. The best way to lower emissions is to use less fuel onboard ships, which will also result in lowered fuel costs – and, if handled correctly, less operational complexity.

At present, maritime has an overwhelming focus on low-carbon fuels, with options such as LNG, ammonia and hydrogen being trialled onboard ships and discussed at forums such as the IMO. However, progress has been slow, the transition will be expensive and many shipowners are frustrated with a lack of clarity, which leaves them vulnerable to stranded assets and unpredictable fuel cost risks.

While there is no single fuel that can replace HFO, there is a solution available in the very short term which will lower fuel costs and emissions – 21st-century retrofittable, autonomous wind-assist technology – which, according to a UK Department for Transport study is suitable for retrofitting onboard at least 40,000 commercial ships. Wind is

an additional, free, clean power source for large merchant ships deployed as a hybrid energy solution.

Advances in technology make it necessary to update the way in which we think about wind for power generation. Not only do we have better data about sea conditions, routing and weather patterns, but equipment such as our FastRig wing-sails are now more robust than ever before and easily retrofitted. Wind is truly GHG-neutral and completely renewable, meaning that this energy source carries no risk of obsolescence and can be used in conjunction with any other fuel or equipment for the entire lifetime of the ship.

This technology is not hot air. There is growing international support from individual investors (including shipowners) and also global governments. I speak from personal

experience. Smart Green Shipping has received multiple tranches of funding from the UK government and private investors for our FastRig rigid wing sail and our TradeWind software tool.

I believe that this funding was underpinned by the increasing market confidence that our diverse group of world-leading project partners brings to the table.

This is not a marketing pitch, but rather evidence that 21st-century wind technology is user-friendly. ‘Wind 2.0’ as I like to call it is an affordable, technologically sound, commercially vetted solution that offers investors peace of mind about their assets as it will always go beyond compliance– and will play an important part in the fuel mix of the future.

Wind is, without a doubt, the fastest, cheapest way that shipping can reduce emissions in line with climate science.

44 Ship Concept 2030 OPINION

Shipping’s singular focus on alternative fuels ignores the most immediate renewable energy solution, writes Diane Gilpin, CEO of the Smart Green Shipping Alliance.

Wind 2.0 is an affordable, technologically sound, commercially vetted solution

Form follows function

American architect Louis Sullivan (1856 – 1924) – the ‘father of the skyscraper’ and ‘father of modernism’ – is credited with the axiom ‘form follows function’ by which he meant the purpose of a building should be the starting point for its design.