make their

make their

Editorial Director: Sam Chambers sam@asiashippingmedia.com

Associate Editor: Adis Adjin adis@asiashippingmedia.com

Correspondents:

Athens: Ionnis Nikolaou

Bogota: Richard McColl

Cairo: Camelia Ewiss

Cape Town: Joe Cunliffe

Dubai: Yousra Shaikh

Genoa: Nicola Capuzzo

Hong Kong: Alfred Romann

London: Paul Collins

New York: Suzanne Smith

Oslo: Hans Thaulow

San Francisco: Donal Scully

Shanghai: Colin Quek Singapore: Grant Rowles

Sydney: Ross White-Chinnery

Taipei: David Green

Tokyo: Masanori Kikuchi

Contributors: Nick Berriff, Andrew CraigBennett, Paul French, Chris Garman, Lars Jensen, Jeffrey Landsberg, Dagfinn Lunde, Mike Meade, Peter Sand, Neville Smith, Eytan Uliel

Editorial material should be sent to sam@asiashippingmedia.com or mailed to 24 Route de Fuilla, Sahorre, 66360, France

Commercial Director: Grant Rowles grant@asiashippingmedia.com

Maritime ceo advertising agents are also based in Japan, Korea, Scandinavia and Greece — to contact a local agent email grant@asiashippingmedia.com for details

MEDIA KITS ARE AVAILABLE TO DOWNLOAD AT: www.asiashippingmedia.com

All commercial material should be sent to grant@asiashippingmedia.com or mailed to 30 Cecil Street, #19-08 Prudential Tower Singapore 049712

Design: Mixa Liu

Printers: Allion Printing, Hong Kong

Subscriptions: A $120 subscription is charged for 2022’s four issues of Maritime ceo magazine. Email sales@asiashippingmedia.com for subscription enquiries.

Copyright © Asia Shipping Media (ASM) 2022 www.asiashippingmedia.com

Although every effort has been made to ensure that the information contained in this review is correct, the publishers accept no liability for any inaccuracies or omissions that may occur. All rights reserved. No part of the publication may be reproduced, stored in retrieval systems or transmitted in any form or by any means without prior written permission of the copyright owner.

reprints of specific articles contact grant@ asiashippingmedia.com

Twitter:

Inour business ecosystem, we like to think of shipowners as being at the very top of the food chain. Their decisions influence the fortunes of everyone below them. They wield power, are feted wher ever they go, and more often than not live rather pampered lives. The life of a shipowner is generally a rather exciting one, not for the fainthearted, mind.

Aware of their position atop the shipping jungle, owners tend to be pretty selective about their public appearances, something that became more acute with the explosion in overpromising, under delivering maritime conferences and exhibitions over the past 15 years.

Go to any shipping conference these days and you’d be hard-pressed to get more than one in 100 attend ees being a shipowner. That said, these lions of industry are easy to spot at any of these shows for the swarm of flies circling them, trying to sell them their goods and services.

A shipowner wants to feel com fortable when attending an industry event. He or she would prefer to be with their peers in pleasant sur roundings, and not being on the receiving end of myriad sales pitches.

Such gatherings are all too rare hence my delight at the return after a three-year covid hiatus of our very own Maritime CEO Forums, the first one took place at the Fullerton Hotel in Singapore last month with the Monaco Yacht Club providing another spectacular, luxurious loca tion for an October meet-up.

If you’re lucky enough to attend our exclusive, by-invite-only bashes – which we have dubbed as anti-con ferences – you’d be agog at who you’d be rubbing shoulders with. Rather than a one in a hundred ratio, our owner to lesser mortals ratio works out at nearly two to one in favour of the former. These forums, a process we have been pioneering carefully and delicately over the past decade, are unique in their access to the industry’s real decision-makers.

By way of gratitude for you being a Maritime CEO reader, if you’d like to find out how you could attend a future event of ours get in touch with me.

●

Sam Chambers Editor Maritime ceo

The US economy has shrunk for the second quarter in a row. In most economies this would be the definition of a recession, however America calculates that equation differently. So whether you think the US has slipped back into recession depends on whose definitions you prefer. Either way though the US is not experiencing growth and that has to be a worry for Washington DC and globally given America’s global economic weight.

America’s economy contracted at an annual rate of 0.9% in the three months quarterly to July 2022. Inflation in the US hit 9.1% in June, the fastest pace of price appreciation in more than four decades. Inflation and price rises are of course a major

concern – the cost of groceries, pet rol and other basics are rising at the fastest pace since 1981. The US cen tral bank has raised borrowing costs rapidly to try and stop the economy over-heating.

It’s not all bad news in America. Unemployment is low - 3.6 % with hiring rates remaining strong after the 2020 covid dip (see below). Additionally, the US is less exposed than China and Europe from the surge in energy prices from the war in Ukraine. Though the US is obviously offering a lot of financial and material aid and has reduced its investments in, and exports to Russia, significantly.

However, the best news for the American economy is exports. The US trade deficit in goods narrowed sharply in June 2022 as exports surged, while business spending on equipment remained strong, reduc ing the economy contraction in the second quarter.

Exports though may not be enough to boost the US economy into the third and fourth quarters. Soft housing data, weak business and consumer sentiment surveys indi cate that domestically things may be tough. Overall though many analysts

believe the economy will pick up in the second half of the year. For instance, investment bank JP Morgan now forecasts that the economy grew at a 1.4% annualised rate instead of the previously forecast 0.7% pace and that the US’s goods trade deficit shrank 5.6% to $98.2bn, the smallest since last November.

By way of contrast imports of goods fell $1.5bn to $279.7bn. American imports were adversely affected by imports of cars and food while imports of consumer and capital goods, however, increased strongly.

So, is the United States in recession or not? Some economists say that the country is in a “techni cal recession”. By the metrics used in the UK, EU and most countries this is the case. However, America’s National Bureau of Economic Research determines recession based on a range of factors such as GDP, real income and employment and the NBER has not yet designated the US economy as being in recession. In a sense the technical argument is unimportant. What is important is whether the spate of bad numbers from America spooks the markets or not.

Europe is straining from the ongoing war on its eastern flank

The European Union is the international block obviously mostly adversely affected by the war in the Ukraine. However, the two powerhouses of the EUFrance and Germany - have both returned to some, limited as it may be, economic growth, though Germany saw economic stagnation in the second quarter after a boost in the first. Additionally, Spain and Italy have also performed reason ably well given global events from pandemic to regional war. In July the French finance minister Bruno Le Maire announced France’s return to growth, with a 0.5% rise in GDP

in the last quarter of 2022. Le Maire believes France will meet its target of economic growth of 2.5% this year. Spain saw growth of 1.1%, and the Italian economy expanded by 1%. While France’s growth was largely based on manufacturing and produc tivity, in both the cases of Spain and Italy, the service sector, especially tourism were largely responsible for the boosted growth.

Some other regional economies performed less well. For instance, Portuguese GDP fell by 0.2% in the second quarter of the year, accord ing to the Lisbon-based National Statistics Institute (INE). Lisbon claimed this was largely due to weaker domestic demand. Still, this was disappointing as Portugal saw relatively strong bounce back growth of 2.5% in Q1 2022. Some Eastern European Baltic economics saw a poor quarter – for instance, Latvia saw GDP drop by 1.4%, and Lithuania saw GDP down 0.4% quarter on quarter.

The major EU bloc-wide issue is inflation. Eurostat, the EU statistical body, announced that the eurozone economy as a whole grew by 0.7% in the second quarter of 2022, accel erating from 0.5% in the first three months of the year. This rather defies

earlier expectations of a significant slowdown. However, headline infla tion accelerated to 8.9% in July, up from 8.6% in June. Food, alcohol and tobacco were part of this inflation ary trend but, obviously given the Ukraine war, the main driver was energy prices, up 40% year on year driven by the Russian invasion of the country. Now the EU awaits devel opments in the Ukraine and how the European Central Bank will interpret this.

EU exports have taken a few dents – sanctions against Russia leading to a drop off in business for many European companies, and also the port disruptions caused by the zero covid policies in China. Germany has been particularly hit by both of these political issues.

A final factor for Europe is consumer push back. Soaring global energy and food prices have severely squeezed European consumers and businesses who may demand a range of political responses from govern ment subsidies for fuel and food costs as well as rising transportation costs. So much of the next two quarters of the EU’s economy will inevitably depend on both China’s bounce-back rate and the progress of the war in the Ukraine.

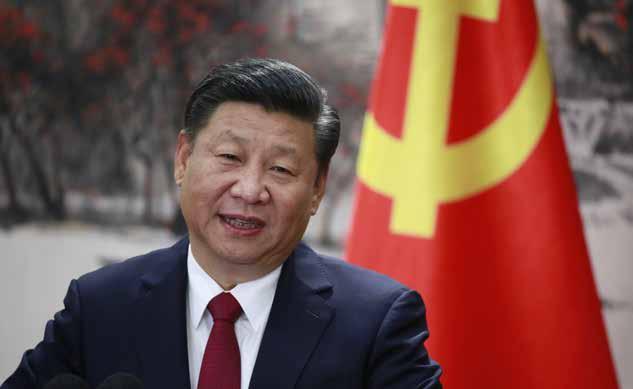

Xi Jinping has a

InJuly China officially, via its Politburo - the ruling Communist Party’s top policy-making bodysignalled that it may miss its annual economic growth target. This is an effective admission that China’s hard core Covid restrictions are adversely affecting the world’s second largest economy. The official growth target set at the start of the year was 5.5% but with so many cities in partial or total lockdowns and massive dis ruption to manufacturing, retailing, travel and logistics still hampering a resumption of normal service the slowdown is not unexpected by anybody. For a while the Chinese

government tried to maintain that growth had been maintained but this was largely ridiculed, and it appears the authorities have decided to give up this pretence. Now the target has been revised down to around t3 - 4%.

China’s current new strategy appears to be to maintain its zero covid policy and to encourage larger provinces to make up for those that were more affected by the lockdown. However, the longest and most severe lockdowns have occurred in China’s highest performing provinces and municipalities – for instance Shanghai, Guangdong and else where. It is also the case these have tended to be seaboard provinces and municipalities, and home to most of China’s major and busiest ports, which means imports and exports have been significantly disrupted.

As well the massive disruption to logistics the biggest fall out from the zero covid policy appears to be the property market slumping. Property sales have fallen for more than a year, there have been reports of ‘mortgage strikes’ by unhappy buyers and some perilous finances at many of the nation’s largest property developers, some of who have halted the construction of homes that had already been sold, because of

a new term in office

concerns over cash flow.

Of course economics is always highly political in China. The property crash is fuelling worries of social instability just at the time that President Xi Jinping is begin ning an unprecedented third term in office for another five years. He will have plenty of economic problems to deal with - of debt, bad assets, unfavourable demographics and poor productivity. However, it must be considered that China, despite the harshness of its zero covid policy, has managed to avoid the death rates seen in other countries.

The major global issue is how the Chinese showdown and contin uing disruption will affect the rest of the world economy. Both Germany and South Korea have recently posted rare deficits with the world’s second-largest economy. Imports of foreign high-tech products and mechanical and electrical goods into China fell 8% in June with South Korea’s exports to China falling 2.5% in the first 20 days of July, according to recently released Chinese customs data. It does seem that, outside Japan and Korea, it will be the European Union who will suffer most from China’s reduced ability to process imports.

far India’s bounce-back from covid has been extremely impressive and perhaps surpris ing. However, there are cautionary notes to be stated as regards the expectation of very high inflation that may curb a further growth trajectory. Inflation hit 7.01% in June, second only to Thailand among larger Asian economies.

Having the country open again

after covid is making a big posi tive difference for India’s economy. Services and consumption rather than foreign trade are the biggest drivers of Indian growth so good internal logistics and the ability of consumers to get out and shop are essential. This is somewhat of a contrast to the far more closed and disrupted China. How good will the rebound be? If inflation continues to grow then price inflation could hit the crucial domestic consumption number.

The war in the Ukraine is spreading its costs to India too. Crude oil, natural gas and coal prices remain high after seven months of war in Ukraine. However, New Delhi has always maintained a close rela tionship with Moscow and, despite the war and western sanctions, has continued this proximity. Narendra Modi’s government has been buying oil at a discount from Russia since Vladimir Putin’s invasion of Ukraine. However, this is still not enough to cushion the energy shock hitting the country. Fuel accounted for 30% of India’s imports by value, over double the average of 14.7% for other leading

Asian economies, according to the World Bank.

And, we should always remem ber, that India is India, and the highly localised farming economy remains massively important to the overall economy. Therefore, covid or no covid, war in Ukraine or no war, the severity or otherwise of the annual monsoon season will be critical. When India has unusually heavy rains or a late end to the monsoon, staples such as onions, potatoes and tomatoes are affected. If this happens then any hopes of bringing the inflation down will be impossible. India’s exports are remaining reasonably strong despite problems of port back up in China and issues stemming from the Ukraine war and India’s shipments to Russia. Still, India’s surged about 42% to nearly Rs 1.17 lakh crore in the last fiscal quarter, according to minister of state for electronics and IT Rajeev Chandrasekhar. India is also looking stronger in the international textiles market too, largely thanks to China slowing down production and the US boycott of Chinese (or particularly Xinjiang) cotton.

CNBChost Jim Cramer ends his daily show – Mad Money – with a signature say ing: “There’s always a bull market somewhere”.

One of the unique pleasures of being a shipping investor, especially since February 2020, has been to figure out how to deploy capital in an environment in which there always seems to be one shipping sector in a raging bull market. But it’s not as easy as it might seem from studying the stock charts in retrospect: the enthusiasm which coincides with the apex of a rising trend is also usually the sign that it’s time to start deploy ing money elsewhere.

The past few months have been a humbling experience for many ship ping investors. Just as dry bulk stocks seemed invincible, daily freight rates halved in a matter of months. Many of the most vocal bulls among analysts, shipping executives, and shipping investors failed to foresee the dip at all. Typically, those least experienced have been left holding the bag, with stocks 30-50% lower.

A different trend has taken shape in the oil tanker segment: after mild corrections in June — probably the result of a broader sell-off in oil and energy-related names — the vast majority have regained momentum and made new 52 week highs.

The Russian invasion of Ukraine has had an outsized impact on vessel classes which transport Russian crude, such as aframaxes and suez maxes. But the real bull market has emerged in the clean petroleum prod uct transport, as voyage distances have lengthened to take advantage of crack spread differentials, which have varied wildly in different geographies.

Companies which just six months ago had liquidity concerns, such as

Scorpio Tankers, have made progress in shoring up their balance sheets, and are even inferring that share holder returns may be on the table, if rates continue at these levels.

But while tankers have seen analysts, one after another, hail a continued rates bonanza leading into Q4 and Q1, usually the strongest quarters of the year, some astute observers have been eyeing the dry bulk sector, with a view to getting back in. The supply-side picture remains historically strong, as ship owners have by and large remained disciplined and chosen to repair balance sheets instead of order ing more vessels. This means that although the demand side has taken a hit due to Chinese economic woes, the dry bulk party seems destined to resume when demand fundamentals improve.

What is especially intriguing about the current dry bulk set-up is that freight rates – in particular capesize – seem like they could be close to bottoming. They cer tainly can’t get much lower, as they are already unprofitable for most

owners. The $BDRY ETF, composed of a ‘special sauce’ of dry bulk for ward freight agreement derivatives, has risen from $4 to $42, and now back just below $9.

Some investors have noticed that while dry FFAs, often considered a bellwether for future freight rates, have plummeted, the stocks have remained comparatively resilient. As access to dry bulk derivatives is limited, the BDRY ETF is the only way for most investors to speculate on the probability that rates will rise from here.

The stocks, on the other hand, are at levels which do not offer suffi cient margin of safety. They “should have” fallen further considering the weakness in freight rates, and the uncertainty regarding China’s economy, which is a red flag for commodities demand. The diver gence between dry derivatives and the stocks does not usually last long. Therefore I suggest investors consider going long the BDRY ETF; if you are looking for downside protection, you can buy puts on some of the most liquid dry bulk names. ●

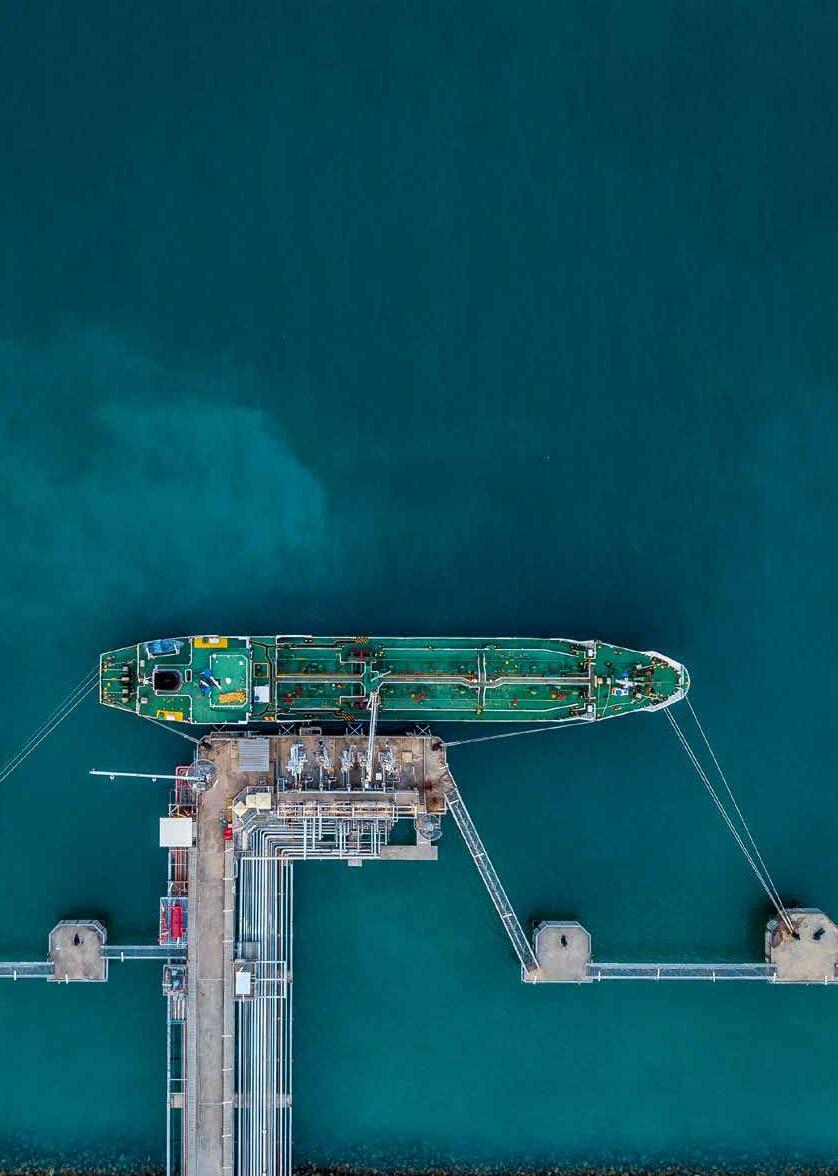

China’s Asian neighbours are soaking up surplus crude volumes and creating new routes in the process, writes Tim Smith, director, Maritime

Strategies International

trade volumes in 2022 are seeing conflicting dynam ics. The historical ‘engine’ of growth, China, is contracting. We expect China’s import volume growth to be negative for the second consecutive year, dropping by 0.7%.

Given the country’s weak demand and well publicised, and intensive, fight against COVID-19, this will come as little surprise. More at risk is our view that imports will see a big increase in 2023.

Whilst China has been in the doldrums, other regions have been soaking up crude. We have made significant upward revision to European and South Asia crude imports in 2022 helping offset the impact of China and continuing to drive crude tanker demand higher. The major Asian economies of Japan, South Korea and India are all seeing substantial increases in imports this year, supporting our view on net crude trade growth of 4.5% in 2022.

This ‘volume’ factor is key in explaining the revival in tanker markets – it is not all about chang ing route dynamics. Adjusting for overland flows, seaborne crude trade volumes are also revised up, with the 2022 growth rate increased from 3.9% to 5.1%.

Europe and North America are also playing a major role in the positive growth of crude trade in

2022 with European import growth particularly notable. However, we don’t expect this to last.

Much like our forecasts for over all consumption, 2023 is expected to see crude trade growth drivers switch dramatically.

Europe’s ban on seaborne Russian crude is expected to pres sure import volumes next year; even though we have revised up overall levels (from a higher base in 2022), we still project a net decline in the region’s crude imports.

In terms of Europe’s sourcing of crude, we expect to see a major switch in the latter part of 2022 – the EU’s ban on seaborne crude comes into effect on December 5th. Our pro jections for flows combine an overall decline with more weight now added to African imports which have been growing strongly, alongside Middle East and US crude imports.

FSU imports still contribute to the region’s intake as other coun tries comprising the region, e.g. Kazakhstan, are not affected by the ban. Nonetheless, outlets for these countries’ crude are subject to related disruption with the CPC pipeline that moves crude into the eastern Mediterranean being subject to Russian interference.

Stronger Chinese crude import demand in 2023 is predicated on both COVID-19 policy easing and

limited macroeconomic downside – neither are guaranteed – support ing VLCCs. Seaborne crude cargo is expected to reach pre-pandemic levels by 2024 and during 2024/25 trade growth reverts more closely to pre-pandemic ‘norms’ with volumes driven by China/Asia.

At the same time, Americas import demand declines as domes tic production rises and demand growth slows. However, with Russia’s invasion of Ukraine, we should only refer to any ‘normal’ in a limited con text. The oil market map has been changed permanently. Oil tankers are likely to continue to benefit from this restructuring and with markets all but shut off in Europe and North America, Russian crude must, if is to continue to be produced and exported, head primarily to Asia supporting tonne miles. ●

Thelatest data from the Xeneta Shipping Index (XSI) reveals long-term contracted rates fell by 1.1% in September. This is the first drop since January and one of only three declines in the past 21 months. However, we expect it won’t be the last, with market fundamen tals suggesting the halcyon days of ever-increasing rates for carriers may be drawing to a close.

It had to happen sooner or later. We’ve seen a steady, and at times spectacular, uptick of long-term contracted rates since the early days of the pandemic. This has fuelled record-breaking carrier profits, much to the dismay of a financial ly-stressed shipper community. But, over the past couple of months, clear signs of a market shift have emerged.

Spot rates have been dropping across the board and have, on some key corridors, plunged over the

course of the last month as lower demand and easing port congestion take effect. The divide between the long- and short-term market is now wider than ever before on many trades, despite record numbers of blank sailings in what would nor mally be considered a peak season.

In short, this means the shoe is finally on the other foot when it comes to upcoming contract negotiations for Q4 and beyond. The shippers are in the ascendancy while carriers will now be competing to lock-in volumes in the face of lower global demand. Therefore, we expect this month’s relatively marginal decline to pick up pace as the year draws to a close.

That said, the industry has to bear in mind that these rates falls should be seen in a context of a market that’s been in overdrive for a sustained period of time.

So much of the focus has been on profits and performance, but it might be helpful to move to an atmosphere of establishing trust and building solid relationships between stakeholders. That attitude would certainly help around the negotiating table.

There is a very long way for rates to fall before we start talking about any major corrections in line with pre-pandemic levels. Of course, it could be a case of the bigger they are the harder they fall, but the carriers have proven very adept at managing the supply-demand balance in recent times, so nothing’s certain here. We certainly expect rates to soften in the near-future… but by how much? ●

“ The shoe is finally on the other foot”

Banksare very much back into shipping, and my guess is they will be for the following few years as markets are good - the ClarkSea Index still at more than double the 10-year average. It’s hard to recall a year where so many different sectors of our industry have registered all-time high freights rates, whether it’s containers, car carriers or LNG - and we’ve still got a couple of months left for VLCCs to pull something extraordinary out of the bag.

The Petrofin Index for Global Ship Finance, a key barometer for the sector, showed its first uptick in 11 years, in an annual report issued from Athens last month. The top 40 banks’ lending to shipping was higher thanks to the growth of Greek, Asian and Australian banks.

The one thing I would add though is that when banks come back in to shipping I tend to be a bit careful, they do have a history of

mistiming the markets.

Banks want to keep their bal ance sheets so if they want to keep up in shipping finance they will need to seek new business to justify the set-up, because these days the ship ping companies are cash rich and do quicker paybacks and refinancings so it will be hard for the banks to keep the preferred size of their books.

Then there’s the debt market. Slowly, slowly the capital markets are coming back, there’s a lot of Norwegian projects recently, and I’ve hardly seen an IRR for these projects under 20%. These are fantastic terms. Investors are clearly doing well at the moment. The question is whether the German capital market will come back or not - and do the shipping companies actually need it?

Many headlines have been written recently about the declining container market. Renegotiations on chartered-in tonnage are ongoing, with tonnage providers exposed. At

some stage there will be a natural clean-out of tonnage, especially in the 3,000 to 10,000 teu range. We might see some 15-year-old ships being scrapped within a year I pre dict. Nevertheless, investors need to bear in mind the container market is completely different from any other sector.

In general, aside from the fizzling-out container sector, I am very bullish on the shipping markets despite the jittery global economy. Personally I do not see a global recession happening in terms of global production. Sure, there might be a change of trading patterns, but volumes will remain high. I don’t see tonne-miles going down. With the growth in population and global GDP you will not have a reduction in shipped volumes - but then I have always been an optimist. ●

“ I do not see a global recession happening in terms of global production”

China, shipping’s most important economy, is changing its relationship with the West. What does this mean for the international maritime community?

Shipping’s constant focus on the double Ds of decarbonisation and digitalisation these days ought to spare a thought for a poten tially equally disruptive D, namely decoupling, something the Oxford English Dictionary describes as the action of separating from something or becoming independent. Few industries are so beholden to one country for its fortunes as shipping is with China. Whether its oil, iron ore, LNG or containers – and plenty more besides – China domi nates seaborne trades, and has done throughout the 21st century follow ing its accession to the World Trade Organization. Yet many are watching today’s changing geopolitical situ ation with concern, suggesting the glory years of so called Chimerica are

coming to a close.

According to World Bank figures, China represented just 9.4% of global manufacturing capacity in 2005 with the US and Japan being number one and two at 21.8% and 13.5% respec tively. By 2020, China had propelled itself to the top spot with 28.5%, while the West’s share declined from 70.5% to 53.2% – including Japan and South Korea, a 17-point decline almost exactly matching China’s 19-point gain.

Covid, a more strident China, tensions along the Taiwan Strait have all played their part in many compa nies looking for alternative places to manufacture their goods lately.

The posturing between Beijing and Washington DC has grown and grown, reaching fever point earlier

this month when US House speaker Nancy Pelosi touched down in Taipei for a highly controversial visit that subsequently saw chunks of the busy Taiwan Strait closed off to merchant traffic for six days as the Chinese carried out military war-games.

There has been a raft of other news showing how relations with China and the US have deteriorated.

Five large, state-run Chinese companies with a combined market value of $380bn recently announced their intention to delist from the New York Stock Exchange.

The passage of the CHIPS and Science Act was another marker of Washington’s urgent economic realignment, providing $52bn for chip companies that set up shop in America.

Apple announced plans to make some products in Vietnam for the first time, while Jeep decided to close its last factory in China, significant news given that the car brand opened the first ever Sino-foreign joint ven ture vehicle factory in 1984.

Other car manufacturers includ ing Honda and Mazda have let it be known they’re looking at increasing production outside of China.

“The developments we have seen – especially in 2022 – is leading to a situation where companies over the next five years to some degree will be shifting production out of China –most likely to other locations across Asia,” says Lars Jensen, CEO of liner consultancy Vespucci Maritime.

Mark Williams, managing director of UK consultancy Shipping Strategy, has been writing about geopolitical risk and shipping for years. He argues decoupling is already underway, pointing to recent meetings of the Joe Biden-created Indo Pacific Economic Framework for Prosperity (IPEF), a new trade group that excludes China, much to Beijing’s chagrin.

“It may be then that decoupling is not a symptom of US-China strate gic competition, but more properly a symptom of the disintegration of the world order established by the liberal democracies and now undermined by them, encouraged by China and Russia,” Williams suggests.

For shipping, decoupling is one of the major strategic risks the industry faces, Williams says.

“Reshoring and onshoring have been joined by the concept of friend shoring, whereby the US and its allies move manufacturing and assembly from China and Russia to friend lier countries, offering economic sweeteners to political allegiance,” Williams explains.

“The geopolitical risk for investors in shipping, an industry so reliant on a single importer/exporter – a country that is turning inwards – is absolutely massive and increas ing. What will be left for Western shipping companies to transport in a decoupled world?” muses Dr Roar

Adland, a professor at the Norwegian School of Economics.

Graham Porter, formerly with Seaspan and now in charge of Tiger Group Investments, has had a ring side seat watching China’s maritime rise. As he points out, what’s happen ing in the People’s Republic today is not dissimilar to the rise of other East Asian economies.

“I have long said the trend was towards securing national interest versus the open global market. And realistically why should the Chinese be any different than the Koreans and the Japanese, who used their shipbuilding capacity to build a fleet to dominate their own cargo needs and more?” Porter questions.

And this, he argues, is without the overlay of the greater strate gic concerns of sanctions or trade disruptions, which further enhanced the argument for China’s need for self-sufficiency in all aspects.

Porter is sure that China will continue to build a fleet to cover its logistical needs for all imports and exports – and this extends to its growing naval presence too.

Another overlooked issue, according to Porter, is that China has become more capable and independ ent in all other aspects of marine whether it is finance, insurance or legal thus becoming more and more sanction-proof.

The more interesting question for world shipping, Porter suggests, is how the world fleet would operate without China support to maintain it – where would all these ships go for drydocking and spares?

Andreas Sohmen-Pao is the chairman of the Singapore-based BW Group, one of the world’s largest shipping companies. Like many shipowners surveyed for this article, Sohmen-Pao is adamant that China will not rock the apple cart.

“It will be a large and grow ing part of the global economy in the years to come,” Sohmen-Pao believes.

In some areas such as energy and minerals, Sohmen-Pao sees China extending its supply chains,

while in others such as semicon ductors, the People’s Republic will shorten its supply chains.

Recent events such as taking a stand on territorial matters or protecting its citizens from a pan demic should not be construed as the country stopping its engagement with the rest of the world, SohmenPao stresses.

Khalid Hashim, managing director of Thailand’s Precious Shipping, argues that China is growing on the international stage peacefully, espousing inter-con nectedness via its Belt and Road Initiative.

“Far from turning inwards, I am of the view that China is trying to actively promote globalisation, based on their actions and not the rhetoric spewed by the mainstream media acting as the mouthpiece of the various aggressor, inward looking, nearshoring, friendshoring nations,” Hashim says.

For Bjorn Hojgaard, the CEO of Hong Kong-based shipmanager Anglo-Eastern, his base case in the decoupling debate is that we live in a connected world.

“Both China and the rest of the world are aware that we are all better off through trade and commerce; and there’s too much at stake for everyone in a real decou pling,” Hojgaard reckons, going on to concede that global supply chains may become more nuanced and bal anced, and regional trade may grow faster, but intercontinental trade will continue to rise, albeit perhaps not at the rate seen for the past 25 years.

Quite so, argues Kris Kosmala, a columnist for Splash. “While it may look like the world has reached some sort of breaking point at which the national economies will neatly separate themselves along the lines of political beliefs and with no water between them, I am not expecting major changes in how the world views specialisation and finding ways to trade goods and services that one country or economic bloc can produce more efficiently than others,” Kosmala concludes. ●

The Maritime CEO Forums are back after a three-year covid hiatus. The first event took place last month in the stunning surround ings of the Fullerton Hotel in Singapore. Ahead of the four sessions, organis ers created a ‘power hour’ workshop, sponsored by Inmarsat, looking at how connectivity at sea is driving digitalisa tion, decarbonisation and crew welfare. Panellists were asked to debate where we are at and where we are headed when it comes to connected vessels.

Taking place on World Maritime Day, whose theme this year was new tech nologies for greener shipping, the ses sion kicked off by questioning whether all the new tech coming onboard ship was developed with sufficient feedback from the end user, namely the world’s seafarers.

Vinod George, deputy managing director at shipmanager OSM Asia, hit out at the lack of engaging seafarers

when it comes to technology and the whole decarbonisation and digitalisa tion debate comparing the situation to a pilot getting on a Boeing airplane he or she had never seen before.

From the audience, Johan Gustafsson, chief revenue officer at Ocean Technologies Group, said: “If you don’t have the engagement of the crew nothing will ever succeed.”

Discussing how far down the track shipping was in terms of having gen uinely connected vessels, Gert-Jan Panken, a vice president at Inmarsat, said his company’s aim was to ensure a connected vessel is the same as a con nected office.

“You should not differentiate between a vessel and an onshore setup,”

Panken said, conceding that there are still some restrictions to achieving this today when it comes to bandwidth.

“Connectivity has always in the past been seen as a cost but I think what it is is an investment in operational effi ciency,” Panken said, turning the debate to one of the key themes of the session – the issue of costs versus investment.

“The conversation is rightly shift ing from cost to benefit,” Panken maintained.

Audience member Peter Schellenberger, the managing director at Vanir Marine, told delegates that a lot of the connectivity debate was related to cost, adding how thrilled he was that new players were coming into the mar ket. Another issue slowing progress was

“ Connectivity is there, it is more about the willingness to pay for it”

the lack of standardisation.

Also speaking from the floor in what turned out to be a highly interactive session, Ronny Waage, a vice presi dent at ScanReach, told attendees: “Connectivity is there, it is more about the willingness to pay for it.”

“We need to show an owner or a

charterer the bottom line, where is the P&L going to be,” urged OSM’s George.

“It is a question of value proposition. It is not a question of price,” argued Sanjay Kuttan, chief technology officer at the Global Centre for Maritime Decarbonisation. Kuttan said areas to bear in mind when thinking about the

price of connectivity include the impact it has on shipping’s decarbonisation journey; on reliability and safety which should bring insurance premiums down; an on compliance and a ship’s actual licence to operate.

The issue could be resolved by changing vessel descriptions, as such getting ships some kind of smart nota tion, suggested Punit Oza, the CEO of Wiz Bulk, who pointed out that the awareness factor of which ships are smart and which are not is extremely low among charterers.

All the equipment is there to create connected, integrated ships, argued Morten Lind-Olsen, the CEO of Dualog, it is the decision-making among owners that is slowing the process, he said, comparing shipping to electronic bank ing, whereby shipping was only at the stage of installing ATMs.

“A newbuilt ship today is, for sure, digital in all respects. You can take as much data out of it as you like. But putting it together and making sense of it all – that is a different thing and shipping is behind on that level,” LindOlsen said.

The hour-long session also touched on ESG and how tomorrow’s sea farers will require a totally different mindset. ●

“ The conversation is rightly shifting from cost to benefit”

centred around fears that ship ping might lose out to other industries in the scramble for alterna tive fuels.

Caroline Yang, CEO of bunker craft operator Hong Lam Marine and president of the Singapore Shipping Association (SSA), told delegates it was vital shipping coalesced and aggregated significant demand for new fuels.

Bunkers have always been the resid ual fuel no one else was willing to use, so supplies and prices have generally been stable, she pointed out. Prices and availability of alternative fuels remain questionable as other better resourced

industries will be chasing the same resources, Yang warned. By way of an example, the SSA president pointed out that shipping’s current transitional fuel of choice – LNG – was not being burned on any ships as it had become too expensive.

Yang, as head of both the SSA and a top local bunker firm, was able to pro vide delegates with the thinking which authorities in Singapore, the world’s top bunkering hub, have when it comes to

the winners in the future fuels race.

“For alternative fuels, Singapore thinks ammonia is a definite fuel of the future,” Yang said, adding that bunker ing standards and guidelines are being worked on this new fuel as well as for biofuels.

Quizzed by audience member, Erik Lewenhaupt, CEO of Swedish tanker player Concordia Maritime, on the lack of a common emissions stand ard for alternative fuels, Yang said the

“ Transformation lies in community – it requires partnerships”

International Maritime Organization (IMO) “must get its act together”, and if the United Nations body did not, Singapore will, with the city-state very close to releasing its own ammonia emissions standards soon.

The wide ranging panel debate, moderated by Steen Lund, the CEO of RightShip, featured two shipowners, a major charterer in the form of Rio Tinto, and tech advice from Denmark’s ZeroNorth with topics covered includ ing all things carbon – credits, capture, and pricing, as well as ESG, and the importance of partnerships to achieve decarbonisation goals.

James Marshall, CEO of Berge Bulk,

one of Singapore’s largest dry bulk owners, laid out how his company aims to be carbon neutral by 2025, and to have a first zero-emission ship on the water by 2030 with ammonia and nuclear forming much of the thinking at his company in terms of future fleet development.

On carbon credits, which Marshall has backed in order to get to his ambi tious 2025 goal, the Berge Bulk boss conceded that they are not “bullet-proof

at all”, however he insisted it was best to focus on what shipping can do today and acting on it fast. Moreover, some form of offsetting will likely to be needed even in 2050, Marshall said, as not all of the global merchant fleet will be net zero by then.

With her own take on carbon credits, Laure Baratgin, head of commercial operations at Rio Tinto, said they were something her company wanted to avoid with concerns over traceabil ity, instead focusing on new fuels, and working with partners to develop green corridors, supporting first movers and pressing for some form of carbon pric ing. Carbon capture is an area Rio Tinto is interested in helping owners, getting technology to bring some circularity to the industry, perhaps to produce green methanol, Baratgin said.

“It’s an end-to-end approach – every one has to do their bit,” the Rio Tinto executive told delegates, adding: “It is all about the carbon price ultimately.”

She stressed it was vital that first movers were not penalised, and the best way to ensure this would be via a global regulation on carbon pricing.

The debate also spent plenty of time discussing harnessing existing tech to bring down emissions of today’s fleet.

“Transformation lies in community –it requires partnerships. If we don’t start venturing out and using the current technologies that are out there then we will never succeed. The industry needs to invest as partners in the technology,” argued Jesper Bo Hansen, chief revenue officer at ZeroNorth.

Hansen said that historically there has been a misalignment in incentives.

“We think by putting data out there and creating transparency there is then a mutual incentive between owners and charterers to reduce emissions,” he said, adding: “We believe that the industry needs to come together – share data and create a mutually incentivised environment in which we all win.”

“ It’s an end-to-end approach – everyone has to do their bit”

No tanker bears were in evidence at the Fullerton in Singapore last month

Tanker sceptics were not just thin on the ground in the ball room of the Fullerton Hotel last month, they were non-existent.

“If everything stays the same 2023 will be a fantastic year for tankers,” stated Erik Lewenhaupt, president of Concordia Maritime, in opening remarks that set the tone for a lively tanker session. The Swede did concede that there were plenty of “grey swans” that could change the direction of the markets such as recession, war, interest rates and sanctions.

The war in Ukraine formed a signifi cant plank of the discussion. Even with out the invasion, Eva Birgitte Bisgaard, chief commercial officer at Maersk Tankers, argued that the fundamen tals of the market were already tight in terms of supply and demand.

“It is like I am talking in echo

“

chamber. I am still trying to find a scep tic or a pessimist in the tanker market,” mused fellow panellist Kevin Wong, director of Indonesia’s Buana Lintas Lautan (BULL).

Audience member Adam Kent, who heads up consultancy Maritime Strategies International (MSI), was

It is like I am talking in echo chamber. I am still trying to find a sceptic or a pessimist in the tanker market”

unable to play devil’s advocate when called upon by the session’s moderator.

“As long as I have been looking at the tanker markets in the last 20 years we are probably at the most positive outlook from a fundamentals perspec tive that I can remember and that is with China crude imports being down 5% so far this year,” Kent said.

Looking at today’s sale and pur chase market in order to glean market sentiment, another audience member, Fergus Gifford, a broker with Arrow, described a two-tier market where

there was immense demand for older crude ships with “crazy prices” for these tankers going into grey trades. These high prices have also pushed up prices for younger tonnage too.

“Supply is very limited. Owners are not willing to release their ships. Prices will continue to go up. Values will con tinue to skyrocket,” Gifford said.

The panel were asked what would happen to the markets in the unlikely event the war in eastern Europe stopped tomorrow.

Reiterating how the fundamentals were great before the Russian invasion started, Maersk’s Bisgaard said the war had added volatility, but had yet to add tonne miles.

“If the war was to stop we’d still have some of these parameters that would come into play because basically we will see more tonne miles coming in,” Bisgaard said, predicting continued strong markets, but without the peaks.

“People don’t realise the impact of sanctions have not been fully felt yet,” warned BULL’s Wong. “Europe has not realised what an uncomfortable position it is,” he added, going on to predict the tonne mile situation would continue to grow even if war stopped tomorrow, a point of view shared by the man sitting to Wong’s left, Alan Hatton, the CEO of Foreguard Shipping.

Europe will not be sourcing energy from Russia in any great quantity for the foreseeable future, he told delegates with energy security now a top priority in the continent.

Quite so, concurred Concordia’s Lewenhaupt. “There’s so much negative sentiment for Russia in Europe right now. So even if war stopped tomorrow the effect would linger on until you had substantial regime change in Russia, which is not likely to happen,” he said.

Covid had already started to change global trading patterns, as cargoes got stuck, leading to the concept of near shoring rising up the political agenda, said Bisgaard from Maersk.

The hour-long session then turned its attention to one of the main topics du jour, namely the forthcoming EEXI and CII legislation, something BULL’s Wong compared to the introduction of the global sulphur cap in that while there were some in shipping willing to spend cash in preparation for January 1’s implementation, the majority will just go with the flow and depower their ships. The overall impact on the markets of the twin green rules would likely be minimal most panellists felt, as tankers have already been travelling slowly.

How the rules are enforced stirred greater debate however.

“If u get a D or an E rating, you can get away with it for three years,” Bisgaard said of EEXI.

Enforcement is indeed a big issue, agreed fellow Scandinavian Lewenhaupt. “Will it be a paper tiger or will flag and port states be able to enforce it?” Lewenhaupt questioned, suggesting that ultimately it will be a commercial, not a regulatory, enforce ment with charterers in the form of oil majors taking ships with rankings of C and above.

This in turn could lead to an even more tiered tanker market, he said, with several shades of grey fleets including the sanctioned fleet, then one that is 20 years old, and one that is D and E rated. Sometimes these tiers will overlap, sometimes they will not, he predicted, suggesting that in good mar kets they will work niche trades, before finally being scrapped when markets turn south.

The new regulations could easily be played with too, with Foreguard’s Hatton telling delegates: “Anywhere there are rules you will find people who will want to bend them” while Maersk’s Bisgaard described CII as a “weird setup”, which had led many in shipping to take their own carbon emissions plans as CII would not do enough. ●

“ In the last 20 years we are probably at the most positive outlook from a fundamentals perspective”

Last month’s Maritime CEO Forum served as an ideal sound ing board to assess how man agers must transform to stay relevant, carrying on a conversation that had been started earlier in the year with the publication of Splash’s wide-ranging shipmanagement annual report.

The business model of shipman agement has been the same for nearly half a century - it will face some kind of disruption soon, Carl Schou, the president and CEO of Wilhelmsen Ship Management, told delegates.

“I think there will be other busi nesses that will try and get a large piece of the pie,” Schou said.

Schou said economies of scale were paramount in his business in order to to build competencies to face the grow ing regulations coming shipping’s way,

with smaller managers facing a chal lenge to build up this competence.

Vinay Gupta, CEO of Union Marine Management, agreed up to a point, saying managers needed to keep up with all the new fuels and skillsets to manage the future assets of owners, while still retaining a personalised, cus tomised service.

“In the future we need to be more than a service provider, we need to be a value-added partner into their business so whatever fees our clients are paying they should get back - perhaps even

more - in value,” Gupta said.

Taking place on World Maritime Day, which this year had a focus on new technologies for greener shipping, the session questioned whether all the new tech coming onboard ship was devel oped with sufficient feedback from the end user, namely the world’s seafarers.

Conceding that many equipment user interfaces were often poor, Olav Nortun, CEO of Thome Group, said sea farers should be invited to train ashore far earlier, and that development train ing onboard was still not good enough.

“How to move training from

“ There will be other businesses that will try and get a large piece of the pie”

How should shipmanagers position themselves as service providers in the coming years?

theoretical - from simulators - to the real thing is a step we have not yet taken as an industry,” Nortun said.

New technology must be created in tandem with subject matter experts, stressed John-Kaare Aune, the CEO of Wallem Group, adding that managers must bring the right team in to test any gear in-house before rolling them out to the ships.

“I definitely hear it that seafarers would like to be there at the start of the process - and we as shipmanagers wish we could be heard more by IMO and regulators - to have a bigger voice at IMO — or regulators could have a bigger ear sometimes,” Aune said.

Greater standardisation would help, according to Wilhelmsen’s Schou, pointing out by way of an example how a seafarer needs a different certificate

for each different type of ECDIS.

This discussion brought the ses sion neatly on to crew welfare and the thorny issue of how to impart the bonuses of having happy crews to clients.

A happy crew performs better cre ating better efficiency and an improved quality of maintenance, said Wallem’s Aune. However, he admitted that there are some owners who have a stronger focus on the cost aspect and may not be as open to some of the welfare points he and his peers offer.

“It does make for an awkward con versation sometimes,” Aune admitted, saying it was important to bring up sta tistics to show what a good investment in crew can bring overall.

The real challenge when it comes to crew welfare comes with the

charterers, not the owners, something that was more acute during the covid pandemic, Thome’s Nortun maintained.

The Thome boss said a complete rethink was required when it comes to recruitment - the length of time onboard, the structure and hierarchy at sea, all this was anathema to getting a new generation to sign up for a career working on ships.

Aune agreed that post-covid it was proving more difficult to source crew. The pandemic had not been a “positive mirror” on the industry, he said, adding that shore leave still remains an issue in certain parts of the world today.

This next generation discussion sparked a question from the floor with Tabitha Logan, general manager at dry bulk concern Asia Maritime Pacific and co-founder of tech talent competition The Captain’s Table, asking about new skillsets such as data science being needed on ships of the future, and where to source these people from.

Wilhelmsen’s Schou said Africa was coming up as a potential source of new crew, a point of view eagerly taken up by audience member Carl Martin Faannessen, CEO of Manila-based crewing specialist Noatun Maritime, who told attendees that according to studies he had been involved in once a country’s GDP per capita per year enters the $12,000 to $15,000 zone on a PPP basis, this tends to be the moment where sourcing ratings becomes difficult.

“So for the Philippines, India and Indonesia that means we do not have a lot of time,” Faannessen warned, adding that it typically takes between five and seven years to to go from zero to a stable source of crew in a new sourcing nation. Acknowledging the needs to source crew with decent English, a high level of compatibility, in relatively stable countries, where high unem ployment can be a bonus, Faannessen selected Kenya as his top pick for new sources of crew.

“Why more people are not look ing at that place is a mystery to me,” the crewing veteran told invited delegates. ●

Dry bulk concluded the debate in Singapore

Shippingmust prepare itself for market conditions in which Chinese dry bulk imports will peak very shortly, delegates attending the Maritime CEO Forum in Singapore were told.

Concluding the half-day event, a high-level panel representing different strands of the segment took the stage for the forum’s wide-ranging dry bulk debate, moderated by Punit Oza, the CEO of Wiz Bulk.

Conceding that Chinese steel output has likely peaked, Stamatis Tsantanis, chairman and CEO of listed cape

concern Seanergy Maritime Holdings, reminded the audience that regardless the world needs steel and 55% of it comes from China.

“China appears to be quite comfort able at that 1bn tonnes a year mark, which is huge,” said Rob Aarvold, com mercial director at Swire Bulk, suggest ing that the days of 2-3% growth had probably passed. While European steel output was also down this year, Aarvold

noted the strong growth being regis tered among steel mills in Southeast Asia. This dry bulk growth in Southeast Asia was something also picked up by Tsantanis who discussed the hundreds of coal-fired power stations being built in the region at the moment.

On China, the nation that is central to dry bulk’s fortunes, audience member Adam Kent, who heads up consultancy Maritime Strategies International,

“ We are looking closely at the US dollar, interest rates and China”

warned delegates: “Chinese dry bulk imports will peak in next three years and that is primarily down to coal.” He also noted how there was a lot more recycled steel in China these days, something that will impact that market.

“China is the big known unknown,” said panellist Su Yin Anand, head of shipping at miner South32, suggest ing the nation’s economic path would become clearer once big upcoming political gatherings in Beijing are out the way.

“In the short term we are looking closely at the US dollar, interest rates and China,” she said, telling the audi ence to expect pockets of volatility. Long term, Anand, who is also

co-founder of tech talent competition

The Captain’s Table, maintained that supply demand fundamentals support relatively healthy freight rates com pared to pre-covid for the supra, handy and panamax sectors.

Some attendees at the show were introduced to a new shipping term: recontainerisation, the process where bulk commodities disappear from the geared sector as box shipping fortunes slide.

Geared ships, which had benefit ted from containers over the past 18 months, now face the challenge of recontainerisation, Swire’s Aarvold said.

“We’ve always said what happens on containers will be a precursor to what

happens on the bulk markets,” said Chris Cheng, managing director of LD Bulk.

Maritime CEO Forum Singapore 2022 was sponsored by Aderco, Cobham Satcom, CyberOwl, Dualog, Inmarsat, Liberian Registry, Ocean Technologies Group, SEDNA, Synergy Group, Vanir Marine, Wallem, WIZ Bulk and Zero North.

The next issue of this magazine will cover the Maritime CEO Forum taking place at the Monaco Yacht Club in October while April 24 has been announced as the date for the event’s return to Singapore, timed to coincide with the start of the city’s busy official maritime week. ●

Maritime CEO Forum Singapore 2022 was sponsored by:

Which country is the best for wine-tasting, what’s the most unexpected place to grow and try wine?

Thevariety and quality of wine on sale in the supermarket these days is increasing, and the rise and ease of interna tional trade means that countries or regions that had lain hidden are now being discovered. Heard about through the grapevine, if you will. Here, we don’t necessarily look at the most famous wine destinations, but those which are underrated or lesser-known.

South America has been known for the quality of its wine for some decades now, but most people will only be familiar with varieties from Argentina or Chile. And that’s a good thing; rich reds and crisp, vivacious whites are what they’re about. More interestingly though, Uruguay has a grape variety known as Tannat, which has taken the position of national grape. Native to southwestern France and imported when European settlers arrived, it produces a smoky, almost spicy wine that is often blended with Cabernet to make it less aggressive.

Uruguayans, however, are very proud of their love affair with this relatively rare grape.

Up next, India. Odd though it may seem, the region around the ancient city of Nashik is known as the wine capital of India, having 22 wineries — around half of the country’s total — and is home to a number of wine festivals. The story begins very recently. In 1996, Silicon Valley employee Rajeev Samant quit his job and, taking a Californian wine-maker with him, repurposed his family’s land in the region. The potential he saw in the area was realised, and now the Sula vineyards are the daddy of them all. Due to the high altitude at which the grapes are grown, the wines can be quite acidic, but the Sula sun-design label is becoming more and more recognised throughout the world.

Staying in Asia, we head east to neighbouring Myanmar. Myanmar was only reopened as a country to tourists in 2011 after decades of sanc tions, and only possesses two wine

estates: Aythaya and Red Mountain. Both opened within the last 10 years, and Myanmar’s climate is their big gest issue; it’s hot enough to burn the grapes, the humidity causes fungus to attack them and monsoons can wash the vines away entirely.

Despite this, the two estates are doing well. High up in the hills and so away from the stifling conditions of most of the country, both offer tastings, tours, and the chance to try traditional food while watching the sunset over the Inle Valley with a glass of Moscato or Shiraz.

And now finally to Europe, and Croatia. The beautiful island of Krk off the northern coast of Croatia is home to the only place in the world that produces Vrbnič ka žlahtina wine, a mouthful in every sense; it’s a light, fresh white that goes extremely well with sheep’s cheese, another Croatian delight. Pliny the Elder wrote in the first century AD that the wines of Krk were the best in the entire Roman Empire for medicinal purposes. ●

Imagine owning a lightweight, fast, electric four-wheel drive ATV that you can ft in the back of a (spacious) five door car. With a top speed of 35 kph, Outrider’s Coyote 4WD ATV with independent suspension fits the bill, weighing in at around 100 kg with a range of 30-50 km on a single battery pack, and 130-225 km on a four-pack, and it’s only 1.55 m long and 85 cm high and wide. For any gadget geek, this sounds like huge amounts of cool fun. For people with quadriplegia, ALS, Cerebal Palsy, MS, and other problems — it’s not just fun, it’s a total game changer: outdoor activities like hiking, fishing and even hunting are back on the table.

Outrider Coyote 4WD outridercoyote.com $16,000 and up

For those seeking a bit of stylish Zen from their furniture, the Sisyphus glass-topped table might just be the answer. Paraphrasing it’s mythical namesake’s fable, the Sisyphus perpetually rolls a metal ball over sand under it’s glass top, creating beautiful Zen garden-esque patterns as it does so. Under the sand container is a two motor robot arm with a magnet on it, that guides the ball. The table comes with a ‘playlist’ of 25 designs to select via browser or phone app, and you can download more or add your own.

Sisyphus Tables

sisyphus-industries.com

$640–$10,000

Earbuds are all the rage now, and it’s increasingly hard to find a set that stands out. Sirius Pro earbuds have that standout factor in spades. The headphones, metal charging case (and bottle opener) and packaging all come in gloriously detailed “weathered space tech” chic. The specs are just as impressive — the buds weigh in at 6 g, run on Knowles balanced armatures, with exclusive DSP audio algorithms, via Bluetooth 5.2 True Wireless Stereo and also sport microphones. They have in-ear detection, 65 ms latency, 3D surround sound, IPX 5, and custom EQs for music, gaming, and movies. And the buds last about four hours on a single charge, and the charging case can deliver three full charges.

Sirius Pro www.gravastar.com $150

Anyone who’s ever worked in the global shipping business will have, at some point, thought that perhaps their experiences would make a good thriller. No need to invent too much. Most people have a chest stocked full of war stories better than any fictional thriller writer could concoct. Bloomberg reporters Matthew Campbell and Kit Chellel must have had this conversation too at some point. And they decided to write Dead in the Water: Murder and Fraud in the World’s Most Secretive Industry.

There can’t be many people in the shipping business who’ve never heard of the Brillante Virtuoso, an oil tanker left drifting through the notorious Gulf of Aden when pirates attacked and set her ablaze in a devastating explosion. Then David Mockett, a British maritime surveyor working for Lloyd’s of London in Aden, inspected the damaged vessel. He was suspicious and left with more questions than answers. Soon after his inspection, he was murdered.

What then follows is a meticulous and rigorous reexamination of the case of the Brillante Virtuoso and the

murder of Mockett. Based on first-hand accounts of those who experienced the hijacking - members of the ship’s crew and witnesses to the attacks – through to those who knew Mockett in Aden and the ex-Scotland Yard detectives turned private investigators who sought to solve the maritime surveyors murder. Dead in the Water is realty multiple mysteries. The Brillante’s captain claimed that he had given the ‘Somali’ pirates the ship’s US$100,000 wage pot. The chief engineer said he’d sabotaged the engine, which explained why the pirates had decided to flee the ship, though they first set off two explosions. These were both not quite true accounts. But the oil aboard was rescued and the ship saved, though later scrapped and chopped up in a breaker’s yard in Pakistan.

As with any good murder-mystery the tale of the Brillante Virtuoso is one surrounded by rumour, gossip and intrigue. It was also a colossal insurance fraud, involving almost unimaginable sums of money. The vessel’s owners subsequently entered a claim for US$77 million in damages to its insurer, Lloyd’s

of London. Add to that David Mockett’s suspicions raised when he asked why pirates would raid a tanker and then flee? When he sought to answer that key question he was killed by a bomb exploding his car in Aden.

We’ll avoid any spoilers for those who don’t know all the ins-and-outs of the tale but suffice to say Dead in the Water raises some real questions about, among other things, how Lloyds of London is organised. Is it a good idea to have an organisation that underpins so much of the global transportation economy so lacking in transparency.

Campbell and Chellel conclude their reinvestigation by saying that much of what happened around the Brillante Virtuoso was exceptional – lies, falsehoods and murder. But, the authors say, it must be acknowledged that, “Shipowners…most of them in London, have spent a half century making their world harder to understand, hiding maritime tycoons’ true identities — and their tax and regulatory obligations.” Rarely has a book been such a gripping read or raised the lid on a secretive industry quite so devastatingly.

●

Thehome of port wine, Portugal’s enchanting second city also offers a winning blend of austere architecture and cutting-edge design, plus buzzy bars and beaches, just up the Douro river.

Porto packs a lot into a small city, it’s 100% walkable, the entrance to the stunning Douro Valley wine region, has better restaurants and hotelsr, and offers a lot more old-world charm than the capital, Lisbon.

Porto is undergoing a magical moment of rejuvenation and helping drive the transformation is a resurgent cultural scene. But the city is not about to tart itself up and pimp itself out for the tourists just yet, Portuenses “ove their old world ways too much to give them up.

Porto is bursting with beautiful structures: blue-tiled churches here, Eiffel-designed bridges there. Be sure to gasp at twin-towered Sé do Porto cathe dral – and climb to its mesmerising miradouro (lookout) – and nearby Sao Bento station’s blue-and-white azulejo

tiles. Then, for more modern kicks, admire Casa da Musica, a concert hall hewn from stark white concrete, and the Serralves, Portugal’s finest contem porary art museum. The Clérigos Tower, a 75-metre bell tower, which watches lovingly over the city, is arguably Porto’s most iconic silhouette.

Petiscos (Portuguese tapas) are available in most bars and restaurants, but the classic snack is something saltier. Being so near to the sea, Porto is famous for its fish. Try Taberna São Pedro: it’s a very traditional seafood res taurant that few tourists know.

In need of a drink? Five years in the making, the World of Wine is, as the name suggests, a homage to all of the elements that go into producing your favourite tipple. The 55,000sq m site sits just below the famous Yeatman Hotel, with an expansive square at its heart

and spectacular views down to the Douro river and the Dom Luís I Bridge. There’s museums, restaurants, shops and experiences to enjoy in Porto’s wine district.

Porto’s chicest residents clink pink port and tonics at The Yeatman’s sun trap rooftop. Set on the calmer side of Porto away from the bustle at the heart of the city, The Yeatman lies on the south bank of the mouth of the Douro river nestled amongst the old port wine warehouses. Its vantage point means it’s blessed with magnificent views across the waters, taking in the spectacular Luís I Bridge and the city itself.

In terms of other places to stay beyond The Yeatman, the striking Vila Foz Hotel & Spa takes its name from the locale in which it sits, one of Porto’s swankier districts, while the Torel Palace also gets rave reviews.. ●

“ Porto is undergoing a magical moment of rejuvenation”

There is a palpable sup ply-side shortfall in maritime recruitment, particularly in commercial and operational roles. As a result, shipping companies are frequently forced to exceed their recruitment budgets to attract new talent at above-market levels.

The job market is still suffer ing from the effects of the “Great Resignation” which has seen many people reassess what is important to them, and what they expect from their post-pandemic career. Pay rises and bonuses are therefore being handed out to prevent competitors from tempting existing staff away, and a lot of attractive offers are being turned down once existing employers make a defensive counter-offer.

The market for support staff, for graduates and second-jobbers is par ticularly red hot. As a group, these people have more choice than we’ve ever seen before. It’s adding to the headaches for shipping companies, as they are having to pay inflated salaries for people with little or no experience and who, on paper, might previously have been their second choice.

The challenges are not unique to the industry, so shipping com panies are also facing even tougher competition than usual from other sectors suffering from the same

talent-supply problems. Of course, if you need staff, you have to fish in the same pond as everyone else and cope with the market conditions. The good news is that solving the maritime recruitment crisis is not entirely dependent on remuneration.

Employers are also focusing on culture, training, and personal development with a vigour that we’ve never seen before in this indus try. The message seems to have got through that people want to feel that their employer and their individual roles have a purpose – a ‘why’. This isn’t necessarily about grandiose change-the-world missions but about giving people a reason to get up and come in to work in the morning.

A recent survey we conducted revealed that 86% of maritime organ isations have now implemented some form of remote working, and 40% of those remaining are planning to. Companies that do not keep up with changing working culture are already finding themselves facing an even harder recruitment situation. From a work culture perspective, the pandemic has shifted the balance of power when it comes to employee demands to work from home. It’s quite normal in the current market for candidate interest in roles to be subject to some guarantee of hybrid

working. Two days a week from home is the most common request. No flexibility means no candidate interest!

It does feel very much like we have moved from a cynical to a more authentic culture in shipping. Not only do employers seem to ‘get’ the need for purpose and for investment in leadership development, there also seems a genuine desire to get the ESG agenda right. Most of our clients talk about sustainability with an openness and desire to change that goes far beyond meeting min imum regulatory standards. As a result, they are willing to learn – and recruit – from other sectors.

Despite looming recessionary clouds and concerns about inflation, overall recruitment demand is high at the moment and there is a general sense that this will continue.

However, it is always worth bearing in mind that the only con sistent thing about the job market for the last three years is that it has been very inconsistent! If you are in the process of hiring, you may be forced to offer higher salaries to attract candidates. However, re-eval uating working practices, thinking about purpose, investing in people and their development is a far more sustainable and effective approach to talent retention.

The Jones Act always raises the hackles of Splash readers/keyboard warriors

“The Jones Act is such an antiquity, causing the US-built, crewed and owned fleet largely to be non-competitive at world markets. A huge price to pay for so called ‘national security’, which is nothing more than protectionism, successfully lobbied by national US interests,” argued reader Hugo Groeneveld, while Colin Grabow, a research fellow at the Cato Institute claimed the cost of a Jones Act containership is five times that of one constructed abroad.

Staunch Jones Act supporter John McCown fired back at Grabow’s stats, writing: “Cato’s so-called analysis has crossed the line from just hyperbole to analytical chicanery and mathematical impossibility.”

Sam Norton, president and CEO of Overseas Shipholding Group, weighed in on the matter, saying: “Granting even occasional waivers perniciously undermines the stability of these regular supply chain.”

Karl Rugen had this interesting, under-reported aspect of getting a ship built today: “The vast amounts of construction waste involved with the entire shipbuilding process should also be considered. Even well-run shipyards in Korea and Japan have dozens of containers filled daily from massive piles scrap cuttings, plastic, wrappings, wood and packaging, rubber, caballing, paint cans and on and on and a big portion of which is not recyclable and therefore taken to landfills. The amount of waste generated in building a vessel is staggering!”

With bunker fraud cases making plenty of headlines, reader Philip Bacon added his voice for the global rollout of mass flow meters: “This is one of the many, many no-brainers in our Wild West industry of shipping where the resistance is only from the dishonest to benefit the dishonest and serious players are put at disadvantage by a skewed playing field. It takes an inter ested and engaged government like Singapore to very simply sort it, but alas there are few others that realise that shipping exists.”

Finally, Robert Gordon had some useful advice to try and ensure there are no more Ever Given incidents: “The P&I Clubs are all aware that pilot error causes numerous incidents and very expensive claims. In my experience, as both a shipmaster and a pilot, the answer lies in the providing masters with simulator training of the Suez Canal and other high risk area transits so that masters can quickly identify when a pilot is getting it wrong and have the skills and confidence necessary to take over the con and bring the situation under direct and immediate control. Everything else is just howling at the moon.”

International Ship Repair FZE, is a well-established two-decade old company providing expert repair solutions at Fujairah, in the United Arab Emirates. Having successfully accomplished many major repairs along with numerous other small repair attendances be it at anchorages or alongside jetty, we are proud to state that we now serve as a leading afloat repair company in the region.

Mr Vijay Vaz Commercial Manager

Mr Vijay Vaz Commercial Manager

Mr R.C. Yadav General Manager

Mr R.C. Yadav General Manager

Our recent venture into BWTS retrofit, either alongside repair jetty or vide our trained capable sailing squads has earned a reputation as a reliable retrofitter of various BWTS systems.

To ensure comprehensiveness of repair for our clients, we maintain a diverse team to cater to a wide range of services ensuring well planned, efficiently organized schedules with proven record of timely deliveries, this ensuring that the vessel gets back to commercial operation on time, every time. To achieve this goal, we have invested in state of art equipment, good infrastructure, excellent logistics support via a large fleet of vehicles, extensive handling facilities such as forklifts and cranes, efficient supplier network and we ensure continual training for our teams for constant improvement in performance.

We believe that the whole team at International Ship Repair has significantly contributed to the company’s growth. The skill, knowledge, and expertise of our 1000+ employees ensure the quality of output defining us as a positive, capable, and noteworthy company.

Under the guidance of the Chairman & Owner Mr. Ved S Chhabra, the key Management team for the company, headed by the General Manager Mr. R C Yadav, along with the Commercial Manager Mr. Vijay Vaz, and the Marketing Manager Mr. S N Iyer have been instrumental in the phenomenal growth of the company and in honing it as one of the best the industry has to offer.