ASHLEY MALLETT Head of B2B Division, Paysend Executive Spotlight: PAYMENTS B2B IS THE NEW FRONTIER Around the Globe: Priscilla D’Oliveira Friedman CrossTech, COO Industry Leader: Alberto Guerra UniTeller, CEO Industry Innovator: Hebert Hernández Bantrab, CEO Coming Out: Jennifer Holguín CrossTech, Lead Consultant Inside Job: Arina Anapolskaya CashQ, Co-Founder & COO To Keep in Mind: CrossTech 13th edition

Become a Sponsor or Exhibitor

MORE THAN 400 ATTENDEES

FROM OVER 40

COUNTRIES

NOV 14 - 16

Seminole Hard Rock Hotel & Casino Mami, USA

By partnering with us, your business will be showcased throughout our platforms that reach a broad audience within the industry.

Past Sponsors and Exhibitors

Leave your footprint in the industry!

Be a sponsor and exhibitor.

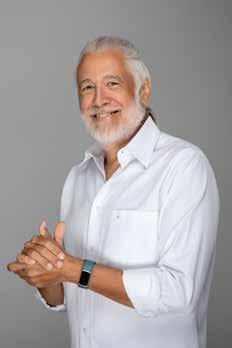

Hugo Cuevas-Mohr

is the founder of CrossTech, and The Platinum Network, Inc (PNET). The company that developed and manages the IMTC Conferences, founded in 2010 and Mohr World Consulting (MWC), founded in 2001.

Welcome to the CrossTech Payments 2023 Magazine Edition. We could not have done this with out the support of all our partners, sponsors and exhibitors. We are so excited to bring together our industry leaders with incredible discussions, panels, workshops and we can't forget, networking!

In this edition, you can expect insights from our industry's leading organizations like UniTeller, Bantrab, Paysend, CashQ, and many more.

One benefit of our industry is the close ties between companies and people that open the door to a wide range of opportunities, giving birth to many solutions and, above all, connecting and improving the lives of families in all senses.

We also want to mention the importance to remember the intimacy of our events and the platform that it becomes to leverage your company, your goals and your future projects in 2023. Let the networking begin!

CrossTech

EDITOR’S LETTER

3

CEO,

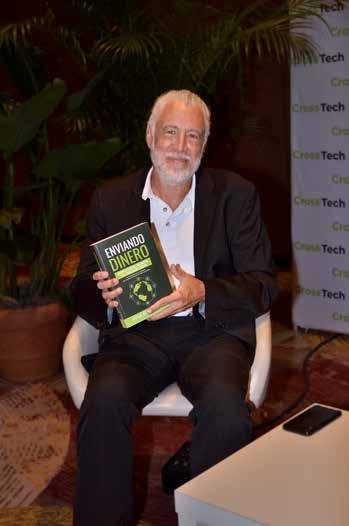

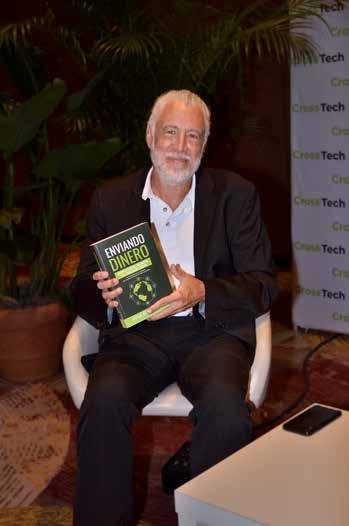

COMPRE AHORA!

ENVIANDO DINERO

CAMBIO, REMESAS, MIGRACIÓN Y LA REVOLUCIÓN FINTECH

La Evolución de la Industria de Servicios Financieros Internacionales.

Esta obra compendia los conocimientos y experiencias de Hugo Cuevas-Mohr - Especialista en Transferencias de Dineroen torno a la provision de servicios financieros internacionales y las tendencias tecnologicas que permitieron su fortalecimiento y evolución.

En sus paginas se cuenta, con decenas de testimonios de los emprendedores que hicieron posible esta industria, la crónica de visionarios que han hecho posible le envio de dinero de migrantes a sus familias y su contribución a la actual revolución fintech.

BUY YOUR BOOK

AROUND THE GLOBE

PRISCILLA D’OLIVEIRA

FRIEDMAN

INDUSTRY LEADER

ALBERTO GUERRA

INDUSTRY INNOVATOR

HERBERT HERNÁNDEZ

COMING OUT

JENNIFER HOLGUÍN

INSIDE THE JOB

ARINA ANAPOLSKAYA

TO KEEP IN MIND

CROSSTECH

Page 28

Ashley Mallett Head of B2B Division Paysend

Page 8

EXECUTIVE SPOTLIGHT

5

MAY 2023

ASHLEY MALLET - EXECUTIVE SPOTLIGHT

Ashley Mallett joined Paysend in January 2021 and leads the delivery and execution of Paysend’s B2B and Enterprise product suites, overseeing revenue and customer acquisition targets. He manages multiple teams under each division, including Product, Sales, Marketing, and Operations. With over 15 years of experience in financial services, he formerly led sales and business development teams at Geoswift and Western Union, building market strategy and developing and implementing new products.

PRISCILLA D’OLIVEIRA FRIEDMAN - AROUND THE GLOBE

Priscilla D’Oliveira Friedman is a senior executive with an extensive background in developing strategies in the payment industry, call center management, and strategy process improvement. Her career started at American Express in 2001 where she led teams across LATAM, US, and Europe. In October 2021, she joined CrossTech formerly known as IMTC/Mohr World Consulting as Chief Operating Officer.

ALBERTO GUERRA - INDUSTRY LEADER

Alberto Guerra, CEO of UniTeller Financial Services, a subsidiary of Grupo Financiero Banorte, one of the largest Financial Groups in Latin America and the second-largest in Mexico, began his career with Banorte. During his tenure in Banorte, he held different positions in International Banking, Corporate, and Investment Banking. Alberto was part of Banorte’s M&A and Structured Finance Group that executed GF Banorte’s expansion into the U.S., which resulted in the acquisition of Inter National Bank, a National Chartered Bank in 2006, and UniTeller in 2007. In March of 2007, Alberto became the President & CEO of UniTeller Financial Services.

6

HERBERT HERNÁNDEZ - INDUSTRY INNOVATOR

Herbert Hernández has more than 25 years of banking experience in Guatemala and the United States, he is a Business Administrator with Masters in Business and Marketing and a certification in Strategic Management of Innovation and Digital Transformation. An expert in designing and executing commercial strategies and channels. He has a superior ability to innovate and manage changes. He has experience in strengthening new markets and implementing corporate projects, as well as leading and developing comercial teams. He has been a panelist and national and international speaker on issues of banking, family remittances, digital and commercial channels. He joined Bantrab in October 2017, with the purpose of modernizing and restructuring the business area.

JENNIFER HOLGUÍN - COMING OUT

Jennifer Holguin is a lead consultant with a finance, sales, and marketing background. Jennifer started her career in the banking industry in 2010 with solid experience in business development in LATAM and US market. Since June 2020, Jennifer is the consulting lead for CROSSTECH CONSULTANTS where she manages partner consultancy firms as well as partner companies.

ARINA ANAPOLSKAYA - INSIDE THE JOB

Arina Anapolskaya is the Co-Founder & COO of CashQ embedded cross-border payment platform for banks and neobanks. CashQ instant cross-border payment network covers 120+ countries with multiple rails, including traditional bank accounts, neobanks, cards, mobile money providers, and electronic wallets.

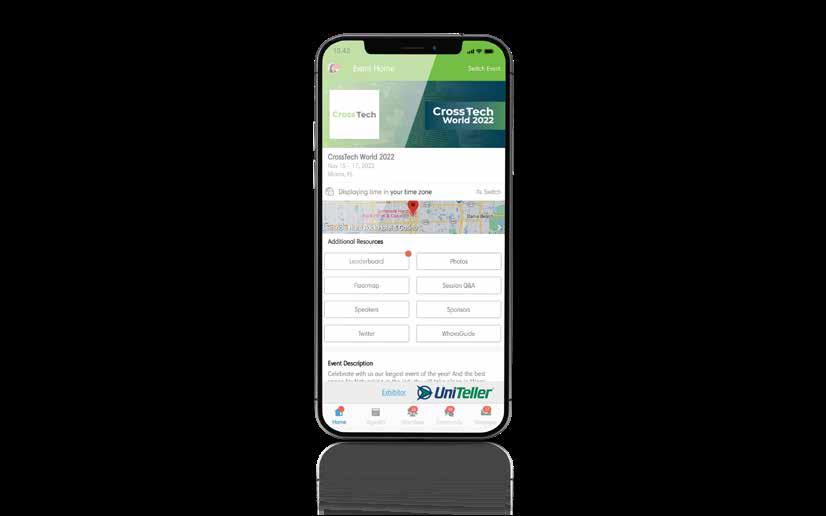

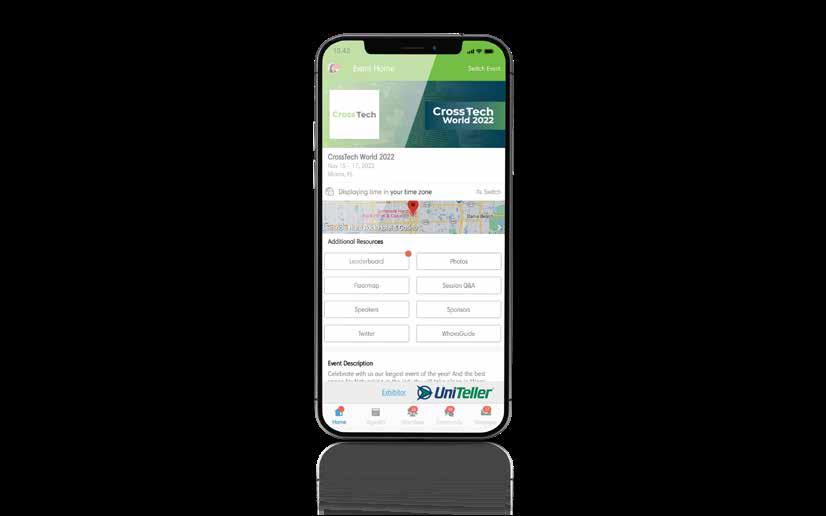

CROSSTECH - TO KEEP IN MIND

CrossTech offers a range of services and solutions to support businesses in the payment processing industry. With international conferences, businesses can participate in high-impact networking and listen to the best speakers and companies in the field. Our consultants provide in-depth research consultancies to help businesses gain qualitative and quantitative insights and reports to improve their efficiency. Our magazine provides up-to-date news and trends in the remittance payment sector, keeping our readers informed about the latest developments in the industry. Our community appconnects over 8,000 members of our network, allowing them to publish their opinions, receive newsletters, and network digitally. Finally, our awards program recognizes the best companies or individuals in the payment processing industry, providing recognition and prestige to the winners.

7

EXECUTIVE SPOTLIGHT

As we continue our rapid expansion, our focus is on enhancing our capabilities in the Americas to meet the increasing demand for seamless, fast, and cost-effective cross-border payments.

Ashley Mallett Head of B2B Division, Paysend

Paysend has expanded rapidly in the last few years, what is your vision for the future of the company, and what markets are you hoping to penetrate?

Paysend is the next-generation payment platform enabling customers and businesses all around the world to pay, hold and send money online anywhere, anyhow and in any currency. Our mission is to develop the next generation of integrated global payment ecosystem to help people and businesses around the world save time and money.

As part of this strategy, we are happy to announce that starting this month, the Paysend Business platform will be available in the United States to offer instant and reliable cross-border payments to small and medium-sized enterprises (SMEs). With its intuitive interface and powerful features, Paysend Business makes it easy for SMEs to manage their finances across borders. Businesses can receive, spend, and exchange money in over 30 currencies, without worrying about hidden fees or complicated exchange rates.

There are many digital payment providers out there, what sets Paysend apart from its competitors, and how do you plan to stay ahead of the curve?

What sets Paysend apart from its competitors is our unique approach to providing simple, secure, and affordable money transfers across borders. With Paysend, customers can send money to over 170 countries worldwide directly to Visa, Mastercard, China Union Pay and to our own global network of banks, international and local payment systems. Our proprietary technology allows us to offer competitive

8

exchange rates with low fees while ensuring that transactions are completed within minutes rather than days. Additionally, our user-friendly platform makes it easy for customers to send money internationally without any hassle.

To stay ahead of the curve, we continuously invest in research and development to enhance our product offerings and explore new technologies that can improve the overall customer experience. We also closely monitor industry trends and collaborate with strategic partners who share our vision of revolutionizing the digital payments landscape.

In a rapidly changing technological landscape, how do you ensure that Paysend remains at the forefront of innovation and continues to provide the best possible experience for your customers?

To remain at the forefront of innovation in this rapidly changing technological landscape, we have established a dedicated team of experts who are committed to exploring cutting-edge solutions in areas such as blockchain technology, artificial intelligence (AI), big data analytics, and cybersecurity. Additionally, our brand-new business platform, was designed and built in house to cater the unique requirements of our business customers.

This cutting-edge proprietary tech stack is a testament to Paysend's commitment towards innovation and continuous development to provide unparalleled services to its customers. By leveraging our own technology and continuously enhancing our platform, we can offer our customers seamless and efficient solutions tailored for their needs while staying ahead of the competition.

Ultimately, Paysend's priority is always focused on delivering an exceptional experience for our customers by providing innovative products that cater directly to their needs while maintaining transparency throughout every step of the process.

9

B2B IS THE NEW FUTURE FOR CROSS-BORDER DIGITAL PAYMENT COMPANIES

AROUND THE GLOBE

Priscilla D’Oliveira Friedman CrossTech COO

Business payments has transformed how payment companies around the world are positioning their new business model to provide digital services and facilitate the flow of funds internationally.

Accordingly, to the last report from Deloitte, the global B2B Payment Market is valued at USD 994 Billion in 2022 and is projected to reach USD 2146 Billion by 2030 at a CAGR of 10%. These figures show a largely untapped opportunity for payment companies.

By connecting businesses and communities with partners and suppliers worldwide, these products and services help create a more dynamic and diverse business ecosystem. This will allow businesses and communities to tap into a wider range of skills, knowledge, and resources to boost their capacity to innovate, grow, and thrive.

Looking ahead, the future of B2B cross-border products and services is very promising.

10

As the global economy becomes increasingly interconnected, the demand for these products and services will likely continue to grow. Moreover, the ongoing evolution of technology and data analytics is opening new possibilities for more efficient and effective cross-border payments, further enhancing the potential impact of B2B cross-border products and services. Mid-market and enterprise-level companies can now leverage B2B digital payments to support their growth.

The reason why we decided to host our new conference this year with the theme of B2B is because of this disruption and the new trend in the market. Some of the companies joined us to explain the state of the market along with new ways of doing business such as Uniteller, Payoneer, Paysend, and Nium have taken the new business opportunity and position themselves as leaders of the market.

11

INDUSTRY LEADER

Alberto Guerra UniTeller CEO

What do you see as the biggest challenges facing the cross-border payments industry in the next 5-10 years?

There are still some inefficiencies in the cross-border payments space that need to be addressed. Technologies and products like cryptocurrencies and blockchain are promising but have failed to make an impact, at least for now. Although some countries have embraced cryptocurrencies and have established clear regulatory frameworks for their use, others have been cautious by imposing restrictions or bans altogether.

12

With the world becoming increasingly interconnected each day, there's a growing need for efficiency in the industry to facilitate real-time, low-cost, and transparent cross-border payments.

Cross-border payments have a significant impact on our global economy, and partnerships among entities such as Banks, Payment Processors, Corporations, and Fintechs play an important role.

Such partnerships will continue to facilitate how cross-border payment transactions are paid and collected, not only for individuals but also for businesses and between them.

Therefore, partnerships and interoperability between different, new, and existing technologies are crucial for the development and growth of the industry.

As new technologies emerge, it will be important to ensure they can work seamlessly with existing payment systems to provide secure and cost-effective cross-border payment solutions for individuals and businesses.

Lastly, the regulatory landscape for cross-border payments is constantly changing. It will continue to be challenging, costly, and time-consuming for businesses to keep up with the evolving requirements. Settlement costs, liquidity issues, and financial inclusion also pose significant challenges that affect these efficiencies.

10 years ago, we envisioned the potential factors and changes that would allow us to play a positive role in the industry. Based on that analysis, we then decided to invest primarily in the following areas:

Digital Capabilities: We invested considerably in improving our Digital Capabilities not only for the consumers but also by offering them to our business partners who can leverage our technology and licensing to serve their customer base.

13

How has UniTeller adapted to the changing landscape of cross-border payments in recent years?

Strengthen our compliance function: We not only take compliance very seriously, but we also believe that it may be a key differentiator that brings added value to the table. Businesses that demonstrate a strong commitment to compliance can build trust with their clients and partners, which can lead to increased loyalty and long-term success.

AI and data analytics: Proper and active use of AI and data analytics brings significant value as these technologies help identify trends, optimize processes, and improve decision-making. UniTeller has already seen the benefits of these technologies, and we still see a lot more potential in the near future.

Global Reach: We believe that niche regional players will find it challenging to compete with global providers.

However, having a global presence is easier said than done. It goes far beyond just having a global footprint. It’s about having a global footprint with local capabilities.

Business Payments: The efficiencies that we witness in the P2P payments arena should be leveraged for business payments as well. In fact, there are significant opportunities to improve business payments using P2P channels and technologies.

It is because of all these efforts and investments that have helped transform the capabilities of UniTeller into one of the top 100 Companies in cross-border payments by FXC Intelligence. Being ranked at this level is a testament to our commitment as we continue to deliver value to our clients and business partners.

We are a solution provider for all types of companies. We are not just a network aggregator providing a regional network. We provide a full umbrella of solutions and a global network not just for P2P remittance payments but for all types of cross-border payment needs.

From licensing, compliance, settlement, risk underwriting, and multi-channel digital capabilities to a global payment network, UniTeller has become the go-to solution for digital and processing services, not only for the consumer, but also for Fintechs, Neo-Banks, Telcos, and Corporations that seek a comprehensive solution to access cross-border payments efficiently.

14

How does UniTeller differentiate itself from other players in the cross-border payments industry?

My first visit to a Hispanic commercial street in California was an eye-opener into a world I had not previously seen. I learned about the importance of remittances. I understood the critical role that payments play in supporting individuals and communities around the world. It made me realize that remittances were indeed a crucial source of income for many people, particularly those who live in developing countries or regions with limited economic opportunities.

I was captivated by the ability to facilitate money transfers from a small bodega in LA to a rural community in Oaxaca, Mexico on the same day. I was drawn to study the opportunities and advances in technology and innovation to deliver a more efficient experience to consumers and businesses. To provide a system that offers greater convenience, speed, and flexibility than the traditional methods.

It was this experience, a simple visit to a bodega, that inspired my passion for payments and the thought that I could play a part in providing real-life solutions to real-life problems.

The payments industry is ultimately about people. Getting to know people from different backgrounds and cultures with the same ideals and goals was an enriching experience for me in my early days. I truly believe that it all comes down to being open to new experiences and recognizing the potential for innovation.

What inspired you to pursue a career in the payments industry, and how did you get your start in this field?

What are the key qualities that you believe have contributed to your success as a CEO?

There’s no simple answer to this question because there is a combination of attributes that come into play. However, if I were to narrow it down to a few contributors to my career as CEO, it would be:

- Building a great team. A team with diverse skills and values is important, as it allows for a more well-rounded approach to problem solving and decision making.

- Listen to your team. They often have valuable insights and perspectives that can inform your strategy.

- Listen to your Business Partners and your Customers. This is related to the point above. Get to the bottom of the needs of your customers and business partners. Don’t invent the wheel from your corner office. Instead, get out of your box and take the time to understand the market, and focus on understanding what drives the needle. Sometimes, it’s easy to get lost in a given idea or a trend published by someone, but understanding the needs of the market and the industry is key.

- Read, read, and read some more.

- Be humble. Learn. Adapt.

- Lastly but most importantly, interpret what you see, read, and learn, and translate that into a strategic vision of the future with very clear action plans to achieve them.

16

Herbert Hernández Bantrab CEO

Herbert Hernández Bantrab CEO

With the rise of fintech and digital banking, how do you see traditional cross-border banking evolving to stay relevant in the coming years?

Traditional cross-border banking began to evolve in the late 1980s when travelers still carried money as parcels. Later, this was transformed into money orders, which gave way to electronic transfers.

There were more innovations, but electronic transfers represented one of the best inventions for banking. This advance has caused large companies such as Google, Apple, and Meta to be part of the financial ecosystem. I am sure its involvement in the financial arena will bring more breakthroughs and innovations. In the near future, I see that Super apps will generate new business models and be a fundamental part of cross-border banking.

How is Bantrab addressing the challenge of foreign exchange rates and currency volatility in cross-border payments? What tools or solutions are you offering to mitigate this risk for customers?

It must be understood that the exchange rate is affected by internal and external factors. For example, in California, United States; Guatemala must have a fixed exchange rate. On the other hand, some companies buy Quetzals, Pesos, and Dollars through their treasuries and execute their financial planning when they see the remittance flows to Latin America. On the contrary, the banks have an established plan based on the volume received, which the financial industry already records as part of its day-to-day activities. This means that it does not have a major impact on the exchange rate of each operation. In the case of Bantrab, we already have an established schedule, which allows us to have the necessary flow two months in advance to respond to the family remittance business properly.

INDUSTRY INNOVATOR 18

We must also highlight in this analysis that the nominal exchange rate in Guatemala is free, determined by the supply and demand of foreign currency in the market. According to the Banco de Guatemala, it is characterized by low volatility, which reflects public confidence in the national currency and the country's macroeconomic strength.

What partnerships or collaborations has Bantrab established with other organizations or community groups to further support the Latin community in the United States, and what impact have these partnerships had?

Bantrab has approached this issue from two perspectives. The first is from the financial field, which has allowed us to design technological and innovative solutions, such as the Bantrab Remittances App; an application for residents of the United States to send money, free of charge and in real-time, to their family and friends in Guatemala. In addition, we provide free insurance that provides the repatriation and funeral assistance service, while your family member in Guatemala has access to unlimited medical consultations with a general practitioner and preferential cost with specialists and laboratory diagnostic tests, among other benefits.

We also have YoLo, our electronic wallet, which allows Guatemalans living in the USA to open accounts from a cell phone. This application won a silver award for best Disruptive Innovation from the CMM Awards and a gold in the Disruptive Innovation in Financial Services category from the Awards for Financial Innovators in the Americas.

Our second front is strategic alliances. We recently partnered with the Guatemalan Consulate in Los Angeles, California, to guide Guatemalans for free in improving their financial health and using digital tools to open accounts and send remittances. The credit part complements this effort because family remittances can already serve as a guarantee to apply for a loan and cover their financing needs for housing or improvements in their lifestyle.

19

In this edition, we present a compilation of technological devices aimed at making your life easier with a touch of fun, emotion, and above all, a practical way of doing things and gettting the best experience you deserve Enjoy!

Ultra-Portable & Compact - Folds by 50% to easily store comfortably in any bag or backpack.

Award-Winning Patented Design - Red Dot Design & Edison Award Winner. Designed and engineered in NYC.

Safety Certified - US CPSC and European EN1078 safety standards for bicycles, skateboards, and e-bikes/scooters under 20mph.

Comfortable, Lightweight, & Adjustable - Integrated dial fit system for precise adjustments and additional padding for the perfect fit.

HELATH CARE $119.00

FEND ONE HELMET 20

Get your head in the content with the Samsung 49 inch Odyssey G9 Monitor, which matches the curve of the human eye for maximum immersion and minimal eye strain.

With the screen space of two side-by-side monitors, you can truly take command on the battlefield. From deepest blacks to vivid colors, Samsung QLED ensures pixel perfect picture quality with every frame.

$1,347.99

RAZER KIYO PRO ULTRA

Ultra-large Sensor 4K Webcam

THE LARGEST SENSOR EVER IN A WEBCAM WINNER OF 8 "BEST OF CES 2023" AWARDS.

Better image quality starts with bigger sensors. So go for the best with the Razer Kiyo Pro Ultra—featuring the largest sensor ever in a webcam. Paired with an ultra-large aperture lens for excellent low-light performance, witness DSLR-like detail and clarity that outclasses all other 4K webcams.

$299.99

ENTERTAINMENT

SAMSUNG 49” Odyssey G9

& PRODUCTIVITY

21

CONSULTANTS MEET OUR TEAM OF CONSULTANTS

Isabel H. Cortes

Jennifer Holguín

CLICK HERE TO BOOK A CONSULTATION 22

Priscilla D'Oliveira Friedman Hugo Cuevas-Mohr

PAYMENTS

WORLD 2023 OUR BUSINESS ECOSYSTEM

2023

CONSULTANTS CONFERENCES

UNLOCKING GROWTH AND MITIGATING RISKS:

The Importance of Collaborations and Partnerships in the Cross-Border Industry

As the world continues to evolve into a global village, cross-border collaboration and partnerships have become increasingly essential for businesses operating in this space. In the cross-border industry, collaborations and partnerships can help to mitigate risks, foster innovation, and create new growth opportunities. In this article, we will explore the importance of collaborations and partnerships in the cross-border industry from the perspective of an experienced consultant.

Collaborations and partnerships are critical in the cross-border industry because it is a complex and highly regulated space. For example, businesses must comply with different laws and regulations in each country they operate in, which can be challenging to navigate without the support of local partners. Collaborating with local partners can help businesses to overcome these challenges and establish a strong presence in foreign markets.

Furthermore, partnerships can help businesses to access new markets and customer segments.

By partnering with established companies in foreign markets, businesses can leverage their partners' existing customer base and local expertise to grow their brand and increase their market share. For example, a company that specializes in cross-border payments could partner with a local bank to offer its services to the bank's customers, creating a win-win situation for both companies.

Partnerships can also help businesses to foster innovation and bring new products and services to market faster. By collaborating with other companies in the cross-border industry, businesses can share knowledge, resources, and expertise to develop new solutions that meet the evolving needs of customers. For example, a company specializing in cross-border remittances could partner with a blockchain startup to develop a more secure and efficient payment solution for its customers.

24

Collaborations and partnerships are also essential for mitigating risks in the cross-border industry. Businesses face many risks when operating in foreign markets, such as currency fluctuations, political instability, political instability, and regulatory changes. By partnering with local companies, businesses can better understand and manage these risks. For example, a company that operates in the cross-border e-commerce space could partner with a local logistics provider to ensure that its products are delivered on time and in good condition.

In conclusion, collaborations and partnerships are essential for businesses operating in the cross-border industry. By partnering with local companies, businesses can access new markets, foster innovation, mitigate risks, and create new growth opportunities. As an experienced consultant in the cross-border industry, I have seen firsthand the benefits of collaborations and partnerships and would encourage businesses operating in this space to embrace these opportunities.

COMING OUT

Jennifer Holguín CrossTech Lead Consultant

Jennifer Holguín CrossTech Lead Consultant

25

26 INSIDE JOB

Arina Anapolskaya Co-Founder & COO CashQ

The Cross-Border Payments Industry is Set to Take Off with the CashQ API

The world of cross-border payments has long been plagued with outdated technology, high costs, and slow transaction times. Banks like Bank of America and Citi still use SWIFT, resulting in long delivery times that can take up to several days and a lot of information required for origination. Meanwhile, neobanks like Chime and CashApp may not offer cross-border payments.

The market for outbound cross-border payments, including personal remittances and gig payments, is estimated to reach $1.2 trillion by the end of 2022. But even though over 95% of households in the US have access to a bank, they still need access to convenient cross-border payment options. As a result, customers turn to third-party companies for cross-border payments, leading to bank revenue leakage.

That's where CashQ API comes in - a global push payments platform changing the game for banks and neobanks. CashQ API enables funds to be sent instantly, seamlessly, and securely to any account using card or phone numbers. With CashQ API, banks and neobanks can offer their customers the necessary

convenience while retaining control over the funds.

CashQ API was developed to meet the demands of a rapidly changing market, and it's already making waves in the industry. Its advanced technology eliminates the need for SWIFT, resulting in faster and cheaper transactions. And because it's so user-friendly, customers won't need to provide much information to get started, making cross-border payments more accessible than ever before.

The cross-border payments industry is poised for massive growth in the coming years, and CashQ API is perfectly positioned to capitalize on that growth. With its advanced technology and user-friendly interface, CashQ API is the future of cross-border payments, and banks that adopt it now will be ahead of the curve.

So if you're a bank or neobank looking to stay ahead of the curve, it's time to consider CashQ API. Its cutting-edge technology and proven track record make it the perfect solution for banks and neobanks looking to take their cross-border payments to the next level.

27

Exploring the Digital Transformation of Cross-Border Payment Solutions

As the demands of customers change and technology continues to advance, the cross-border payments industry is undergoing rapid evolution. To meet the needs of businesses expanding their operations across borders, reliable and efficient payment solutions that can keep up with market growth and evolution are necessary.

Digital transformation is at the heart of the cross-border payments industry's evolution, with businesses looking to leverage technology to deliver innovative and seamless payment solutions. One of the most significant trends in the industry is the adoption of blockchain technology, which offers secure and transparent payment processing while reducing costs and improving speed. Blockchain technology can also help to reduce fraud and enhance compliance, making it an attractive option for businesses that operate in highly regulated markets.

Another area where technology is driving change in the cross-border payments industry is artificial intelligence (AI).

AI can be used to improve the accuracy of fraud detection, reduce processing times, and automate many of the manual tasks involved in payment processing.For example, machine learning algorithms can analyze large volumes of data to identify fraudulent transactions and flag them for further review, reducing the risk of business financial losses.

Mobile technology is another area where cross-border payment solutions are embracing digital transformation. With the rise of mobile devices, businesses are looking to offer customers the ability to make payments on the go. Mobile payments are convenient, fast, and secure, making them an attractive option for businesses that want to expand their customer base.

However, while digital transformation offers many benefits, it presents new risks that businesses must be aware of. Cybersecurity is a growing concern in the cross-border payments industry, with hackers looking to exploit vulnerabilities in payment systems to steal data and funds.

28

Businesses must invest in robust cybersecurity measures to protect their payment systems and customer data from cyber attacks.

The cross-border payments industry embraces digital transformation and the latest technologies to respond to the market's evolving needs. Blockchain technology, artificial intelligence, and mobile payments are just a few examples of how businesses leverage technology to deliver innovative and seamless payment solutions. However, as businesses embrace these technologies, they must also be aware of the new risks they present and invest in robust cybersecurity measures to protect their payment systems and customer data. As the market continues to grow and evolve, businesses that embrace digital transformation and technology will be best positioned to succeed in the cross-border payments industry.

TO KEEP IN MIND 29

May 11-12

InterContinental Hotel Miami, USA

SUPPORT

MEET OUR SPONSORS

SPONSORS, EXHIBITORS & PARTNERS THANK YOU FOR YOUR

YOU WILL BE ABLE TO:

- View Agenda

- Connect with all attendees

- Get to know our sponsors

- Schedule meetings

- Network and more!

OF DOWNLOAD

UP

ON OUR APP NETWORK! WWW.CROSSTECHPAYMENTS .COM

BE PART

SIGN

AND DISCOVER A NEW WAY TO

TRADE FAIR LAYOUT

Diamond Platinum Gold Silver

D1D2P1 -

G1 -

-

33

G2G3S1S2S3

S4

AGENDA DAY 1

WELCOME PARTICIPANTS

Fireside Chat - Global State of the B2B Cross-Border Payment Industry

UniTeller Business Payments Announcement

NETWORKING BREAK

B2B Cross-Border Payment Corridors

Crypto & Blockchain Solutions for Cross-Border B2B Payments LUNCH

Women in Leadership: Navigating the Cross-Border Payments B2B Industry, Fintech Revolution and Future Trends

NETWORKING BREAK

Fintech Track: Innovations in Cross-Border Payment Fintech: Unlocking growth potential

Banking Track: Bridging the Gap: Bank-Fintech Partnerships for Cross-Border

WELCOME RECEPTION

May

08:15 - 09:00 10:15 - 11:15 12:45 - 2:00 02:45 - 04:00 05:30 - 09:00 09:00 - 09:15 09:15 - 10:00 10:00 - 10:15 02:00 - 02:45 04:00 - 04:45 04:45 - 05:30 11:15 - 12:00 12:00 - 12:45 Registration is open

11, 2023

34

Business Session Closing Compliance Session Lunch Networking Welcome 10:15 – 11:15 12:45 – 02:00 02:45 – 04:00 09:00 – 09:15 10:00 – 10:15 09:15 – 10:00 02:00 – 02:45 04:00 – 04:45 04:45 – 05:30 11:15 – 12:00 12:00 – 12:45 Registration is open WELCOME PARTICIPANTS

B2B

B2B

NETWORKING BREAK UniTeller Business

B2B

B2B

LUNCH

WELCOME RECEPTION 35

B2B Payments Workshop: The Partners - Session 3

Payments Workshop: The Market - Session 2 B2B Payments Workshop: The Potential Market and its Challenges - Session 1

Compliance Workshop - Session 1

Payments Announcement

Compliance Workshop - Session 2

Compliance Workshop - Session 3

NETWORKING BREAK

AGENDA DAY 2 May 12, 2023

WELCOME PARTICIPANTS

Size of the Market and Consumer Demand for B2B Cross-Border Payment

Miami the New Innovation Fintech Hub

Products & Technology for the B2B Cross-Border Market

Successful Partnerships in Cross-Border B2B

Roundtable: Evolución del Mercado Latinoamericano de Pagos (Español/Spanish)

Roundtable:

FINTECHs Revolutionizing the Instant Payment Method in Brazil (Português/Portuguese)

CLOSING

08:15 - 09:00 10:00 – 10:45 02:30 – 03:15 09:00 – 09:15 09:15 – 10:00 01:15 – 02:30 04:15 – 05:00 05:00 – 08:00 10:45 – 11:45 11:45 – 12:30 12:30 – 01:15

Registration is open

COFFEE BREAK LUNCH 36

10:00 – 10:45 09:00 – 09:15 09:15 – 10:00 Registration is open WELCOME

37

PARTICIPANTS Compliance Officers Discussion Forum: Crypto Compliance Trends and Best Practices Compliance Officers Discussion Forum: US Regulation

SUCCESSFUL PARTNERSHIPS IN CROSS-BORDER B2B

SPEAKERS:

FIRESIDE CHAT - GLOBAL STATE OF THE B2B CROSSBORDER PAYMENT INDUSTRY

SPEAKERS:

DESCRIPTION

Industry leaders discuss the strategies and best practices for building successful partnerships in cross-border business. The panel could cover a range of partnership topics, such as identifying the right partners, building trust, negotiating agreements, and managing the partnership relationship over time.

Partnerships: What partnerships are needed to be successful? Will NBFIs doing domestic business payments or foreign exchange firms be the best partners? What Banks are willing to cater to crosstechs and build a channel that is not wire-transfer based? Are card payment networks such as Mastercard or Visa the partners that you need for B2B payments?

DESCRIPTION

The new face of the cross-border payment industry, the new business payments market, is explored in this presentation which will launch our CROSSTECH PAYMENTS event in 2023.

The Global State of the B2B Cross-Border Payment Industry is a panel session that brings together experts and industry leaders to discuss the current state of the B2B cross-border payment industry worldwide. The panel aims to provide attendees with insights into the industry's latest trends, challenges, and opportunities and explore the future direction of B2B cross-border payments.

The panelists will likely cover various topics related to the B2B cross-border payment industry, including the latest technological advancements, regulatory changes, and emerging market trends. They may also discuss the challenges and opportunities businesses face when making cross-border payments and share insights into the best practices for businesses to adopt.

The session is expected to be highly informative, providing attendees with a deep understanding of the current state of the B2B cross-border payment industry worldwide. The panel is likely to interest professionals in finance, technology, and business, as well as anyone interested in learning more about cross-border payments for businesses. By the end of the session, attendees will better understand the global landscape of B2B cross-border payments and be better equipped to navigate the challenges and opportunities in this growing industry.

SPEAKERS:

DESCRIPTION

Women leaders in the payments and fintech industries come together to discuss their experiences, insights, and strategies for navigating the challenges and opportunities in these rapidly evolving fields.

Hugo Cuevas-Mohr CrossTech CEO

Priscilla Doliveira COO CrossTech

Allison Barbosa Head of Americas RTGS.global

Christina Hutchinson Head of Sales & Business Development LATAM NIUM

Marcela Gonzalez Board Member CrossTech

Payoneer 12:00 PM – 12:45 PM BUSINESS SESSION 2:00 PM – 2:45 PM BUSINESS SESSION 9:15 AM – 10:00 AM BUSINESS SESSION

Alberto Guerra UniTeller CEO Luis Cambronero Managing Director Head of Partnerships and API Sales AZA Finance Phillip Daniel Regional Director Americas TerraPay Hugo Cuevas-Mohr CrossTech CEO Ashley Mallett Head of B2B Division Paysend Lindsay Lehr Managing Director PCMI Brian Frankel Director, Compliance Program Office

5:30 PM – 9:00 PM WELCOME WELCOME RECEPTION

38

WOMEN IN LEADERSHIP: NAVIGATING THE CROSS-BORDER PAYMENTS B2B INDUSTRY, FINTECH REVOLUTION AND FUTURE TRENDS

SIZE OF THE MARKET AND CONSUMER DEMAND FOR B2B CROSS-BORDER PAYMENT

Alberto Guerra UniTeller CEO Christina Hutchinson Head of Sales & Business Development LATAM NIUM

DESCRIPTION

The Size of the Market and Consumer Demand for B2B Cross-Border Payment Panel is a session that brings together experts and thought leaders in the field of cross-border payments for businesses. The panel aims to discuss the current state of the market, including its size and growth potential, as well as the changing consumer demand for cross-border payment solutions.

The panelists are likely to discuss a range of topics related to B2B cross-border payments, including the latest trends, challenges, and opportunities. They may also share insights on the impact of regulatory and technological developments on the industry and explore the best practices for businesses to adopt when navigating the cross-border payments landscape.

PRODUCTS & SERVICES FOR THE B2B CROSS-BORDER MARKET

BUSINESS SESSION

DESCRIPTION

Discover valuable insights into the various solutions available for cross-border payments, as well as the latest trends and innovations in this space. This panel will help businesses and professionals in the payment industry make more informed decisions about which products and services to use to meet their specific needs and challenges in the global marketplace.

Products & Services (P&S): Do these P&S need to be targeted to specific types of clients, corridors, trades? Should the growing SMB payments market be the primary focus? Or will all-around crosstech B2Bs succeed? How might these P&S be differentiated from bank wire transfers, besides speed, cost, and foreign exchange margins? How might sending disbursements cross-border be handled when you mix payments for businesses and individuals?

CRYPTO & BLOCKCHAIN SOLUTIONS FOR CROSS-BORDER B2B PAYMENTS

BUSINESS SESSION

SPEAKERS:

9:15 AM – 10:00 AM

COMPLIANCE SESSION

SPEAKERS:

DESCRIPTION

The forum is designed for compliance officers from financial institutions, fintech companies, and other payment providers to come together and discuss the latest regulatory developments and how they impact the industry.

The forum will focus on compliance in cross-border payments, including anti-money laundering (AML), know-your-customer (KYC) requirements, sanctions, and data protection. Participants will be able to share their experiences and insights on these topics and learn from others in the industry.

DESCRIPTION

Understand the role of cryptocurrencies and blockchain technology in facilitating cross-border B2B payments, as well as the benefits and challenges associated with these emerging technologies.

Crypto & Blockchain Solutions: I believe, as do a number of colleagues in the industry, that the use of Crypto & Blockchain Solutions (CBSs) is a growing trend in back-office and treasury management. Is the advent of crosstechs building their rails using CBSs the way forward? Are stablecoins the best solution available? How will these solutions interact with the rest of the ecosystem?

39

Joe Ciccolo Founder BitAML

Mariano Dall'Orso Board Member CrossTech

Brian Frankel Director, Compliance Program Office Payoneer

Jose Lapadula Global Regulatory Affairs and Compliance Jose Lapadula

Marina Olman-Pal Greenberg Traurig LLP Shareholder

Zachary Plotkin Head of Compliance, Legal & Privacy Madison Davis

Erick Schneider Board Member CrossTech

Daniel Wood Pillsbury Winthrop Shaw Pittman LLP Counsel

Fernanda Zago CEO Wepayments 9:15 AM – 10:00 AM BUSINESS SESSION

Alex Voronovich Founder and CEO CashQ Hugo Cuevas-Mohr CrossTech CEO Ashley Mallett Head of B2B Division Paysend

SPEAKERS:

The session is expected to be informative and engaging, providing attendees with a comprehensive understanding of the market and consumer demand for B2B cross-border payments. The panel is likely to be of interest to professionals in finance, technology, and business, as well as anyone interested in learning more about cross-border payments for businesses.

10:00 AM – 10:45 AM

SPEAKERS:

12:30 PM – 1:15 PM

COMPLIANCE OFFICERS DISCUSSION FORUM: US REGULATION

Managing Director, Americas Ripple

SPEAKERS

40

Robin Garrison Strategic Innovations Director of Compliance, VP First Bank

Edel Gonzalez Senior Consultant Bates Group

Marcela Gonzalez Board Member CrossTech

Christina Hutchinson Head of Sales & Business Development LATAM NIUM

Jose Lapadula Regional Compliance Officer

Hugo Cuevas-Mohr CEO CrossTech

Mariano Dall'Orso Board Member CrossTech

Brian Frankel Director, Compliance Program Office Payoneer

Priscilla Friedman COO CrossTech

Alberto Guerra CEO UniTeller

Herbert Hernández CEO Bantrab

Nabil Kabbani CEO Neofie

Ashley Mallett Head of B2B Division Paysend

Lindsay Lehr Managin Director PCMI

Erick Schneider Board Member CrossTech

Alex Pereira CEO PMI Americas

Vivian Portella Founder IZZI Remesas

41

Daniel Ayala Cross-border Payments Expert 999 Global Ventures LLC

Naushad Contractor CEO Fable Fintech

Philip Daniel Regional DirectorAmericas TerraPay

Ines Fernandez Vice President of Solutions Engineering, Institutional Sales Aquanow

SPEAKERS

Allison Barbosa Head of Americas RTGS.global

Elisabete Botinas Chief Compliance Officer E Cocone US, Inc.

Luis Cambronero Managing Director Head of Partnerships and API Sales AZA Finance

Joe Ciccolo Founder BitAML

Logan Lemberger Global Financial Partnerships MassPay

Todd Maher President BitSource AML Solutions

Oscar Moreno SVP Business Development UniTeller

Marina Olman-Pal Shareholder GT Law

Licely Sanchez Gerente de Remesas Familiares Bantrab

Alex Voronovich CEO and Co-Founder CashQ

Raphael Wander Senior Sales Engineer TethaRay

Zachary Plotkin MD, Head of Compliance, Legal and Privacy Madison Davis

Daniel Wood Counsel Pillsbury Winthrop Shaw Pittman LLP

Fernanda Zago CEO Wepayments

Register now! Nov 14 - 16 Seminole Hard Rock Hotel & Casino Mami, USA

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

Lourdes Soto Spain SpainTech CCO

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

Lourdes Soto Spain SpainTech CCO

CONTACT US NOW! MAGAZINE CONTACT US FOR SPONSORSHIP PACKAGES TODAY! HYBRID MAGAZINE WITH DIGITAL AND PRINTED ISSUES Published monthly and distributed at our annual events, forums, and other relevant events in the industy. CONTENT DISTRIBUTION READERS 11 Sections 6 Contributors per issue +8,500 Total distribution +21,000 Impressions 42 Countries 23% Female 77% Male TAKE YOUR COMPANY TO THE NEXT LEVEL! VISIT OUR WEB Click here to contact us! help@crosstechpayments.com Our magazine content is reviewed and approved by our magazine committee and subject to eligibility.

Herbert Hernández Bantrab CEO

Herbert Hernández Bantrab CEO

Jennifer Holguín CrossTech Lead Consultant

Jennifer Holguín CrossTech Lead Consultant

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

Lourdes Soto Spain SpainTech CCO

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

Lourdes Soto Spain SpainTech CCO