JOÃO VITOR MENIN

CEO, Inter&Co

Coming Out:

UniTeller

Around the Globe:

CashQ & CEMLA

Inside Job:

Beeteller

Fintech Insights: Paysend

FERNANDO FAYZANO

CEO, Inter&Co US

PERSON OF THE YEAR

12th Edition

Become a Sponsor or Exhibitor InterContinental Hotel Miami, USA Seminole Hard Rock Hotel & Casino Mami, USA

THAN 400 ATTENDEES MAY 11 - 12 NOV 14 - 16 FROM OVER 40 COUNTRIES By partnering with us, your business will be showcased throughout our platforms that reach a broad audience within the industry.

MORE

Past Sponsors and Exhibitors Leave your footprint in the industry! Be a sponsor and exhibitor.

3

Priscilla D'Oliveira Friedman COO, CrossTech

Page 20

The Special Awards Session is a highlight of the Global Forum on Remittances, Investment, and Development. It recognizes and the innovative and impactful contributions made by individuals and organizations in the remittances, investment, and development space in The Remittance Evolution Award, Innovation Remittance Solution, Top Service Provider, Best in Class Compliance Solution, and Partner of the Year. Page 30.

FINANCIAL INCLUSION

João Vitor Menin & Fernando Fayzano

REVOLUTIONIZING

COMING OUT UniTeller Page 7 AROUND THE GLOBE CashQ Page 10 CEMLA Page 12 INSIDE JOB Beeteller Page

FINTECH INSIGHTS Paysend Page

4 PRISCILLA D'OLIVEIRA FRIEDMAN CrossTech, COO Industry Leader: FINTECH FORECAST, THE YEAR OF B2BPAYMENTS 2023FINTECHTRENDSFROMARTIFICIALINTELLIGENCE,DEFI(DECENTRALISEDFINANCE),BLOCKCHAIN, EMBEDDEDFINANCE,RECTECH(REGULATORYTECHNOLOGY).B2BPAYMENTSANDBEYOND. Column of Opinion: Vivian Portella B&TGroup,Director To Keep in Mind: HugoCrossTech,Cuevas-Mohr CEO Fintel Insights: Nabil Kabbani Neofie,CEO

Industry Leader

16

18

PAYMENTS 2023 WORLD 2023

OUR BUSINESS ECOSYSTEM

CONSULTANTS CONFERENCES

ALBERTO GUERRA - COMING OUT - Page 7

Alberto Guerra, CEO of UniTeller Financial Services, a subsidiary of Grupo Financiero Banorte, one of the largest Financial Groups in Latin America and the second-largest in Mexico, began his career with Banorte where he held different positions in International Banking, Corporate, and Investment Banking. Alberto was part of Banorte’s M&A and Structured Finance Group that executed GF Banorte’s expansion into the U.S., which resulted in the acquisition of Inter National Bank, a National Chartered Bank in 2006, and UniTeller in 2007. In March ‘07, Alberto became the President & CEO of UniTeller. UniTeller has since been transformed from a small cash-to-cash traditional remittance business into a major global cross-border processing platform serving Financial Institutions, Remittance and Cross-Border Companies, FinTech, Corporations and Individuals.

ARINA ANAPOLSKAYA - AROUND THE GLOBE - Page 10

Arina Anapolskaya is the Founder and Chief Operation Officer of CashQ embedded cross-border payment platform for banks and neobanks. CashQ instant cross-border payment network covers 120+ countries with multiple rails, including traditional bank accounts, neobanks, cards, mobile money providers, and electronic wallets.

JESUS GONZALEZ - AROUND THE GLOBE - Page 12

Director of Economic Statistics and Coordinator of CEMLA's Forum on Remittances in Latin America and the Caribbean. CEMLA is the association of the central banks of Latin America and the Caribbean. Before working at CEMLA, he worked for 33 years at Banco de México as Director of Economic Measurement. He holds a bachelor’s degree in economics from the Autonomous University of Nuevo León, a master’s degree in economics from El Colegio de México, and master’s and Doctoral studies from the University of Chicago.

RODOLFO BERMAN - AROUND THE GLOBE - Page 12

Senior Economist at the Center for Latin American Monetary Studies (CEMLA). He has a master’s degree in economics from the Colegio de México, a bachelor’s degree in finance from the Technological University of Mexico, and a bachelor’s degree in economics from the National Autonomous University of Mexico. He was Head of the International Trade Statistics Section at the OECD, Director of Input Product at INEGI, and Head of the Measurement Office of the Primary and Tertiary Sectors at Banco de México.

DENISSE TORRES - AROUND THE GLOBE - Page 12

Center for Latin American Monetary Studies (CEMLA) economist, with a degree in Economics from the Autonomous Metropolitan University (UAM-A) in Mexico City. She has participated in seminars and courses on migration, remittances and financial inclusion, and the balance of payments. Likewise, she is co-authored various CEMLA Remittance Notes and has worked on developing and analyzing surveys on Latin American migrants.

RÔMULO BARRETO - INSIDE JOB - Page 16

Mestre em Administração de Mercado. MBA em Gerenciamento de Projetos. Graduações em Relações Públi cas e Engenharia. Head de Marketing e Produtos da Beeteller, fintech especialista em pagamentos interna cionais e segurança.

JAIRO RIVEIROS - FINTECH INSIGHTS - Page 18

Jairo is the Chief Strategy Officer and Managing Director of the U.S. and Latin America at Paysend, a global fintech payments company born in 2017, based in the UK and regulated by the FCA, servicing over 7 million customers, reaching 170+ countries worldwide.

6

UniTeller acquires Oh My Card COMING OUT

UniTeller Financial Services, a leader in the cross-border payments space, is pleased to announce its recent acquisition of “Oh My Card!”, a gift card payment platform that has redefined the way Central Americans build loyalty and send gifts to their loved ones.

Since its launch in 2013, OMC has provided a solution on how Corporates remunerate and reward employees, and on how Guatemalans support their loved ones. The OMC multi-brand gift card allows companies to reward their employees through rechargeable and customizable gift cards that are accepted at a large network of retailers in the region.

UniTeller is excited about the synergies that the Oh my Card platform and distribution network will create within its cross-border payment services. We envision solutions that will bring an expanded product portfolio to our remittance customers and business partners.

7

“The growing demand for P2P cross-border remittance services coincides with the increasing dominance of electronic transactions which will create important synergies with UniTeller.” said Francisco Contreras, CEO of OMC.

“OMC’s products present us with an opportunity to bring another unique element into the equation by offering alternative payment channels” said Oscar Moreno, Head of Global Expansion at UniTeller.

This acquisition is aligned with UniTeller’s vision to enhance and strengthen its product capabilities to solidify its stance and emerge as a leader in the cross-border payments space. “At UniTeller, we are committed to making business decisions that drive financial inclusion for the unbanked and underbanked populations.

By allowing our immigrant communities living in the U.S. to support their loved ones back home with prepaid reloadable gift cards, we will be providing an essential tool that enables them to have broader access and the much-needed financial freedom to improve their livelihoods.” concluded Alberto Guerra, CEO of UniTeller.

While the market for remittances with gift cards as a delivery method is broad and complex, UniTeller remains optimistic and foresees promising opportunities for growth with the right mix of strategy, product, and marketing. UniTeller plans on investing further in the expansion of its distribution channels, network of affiliates, technology, and operations.

Alberto Guerra UniTeller, CEO

Alberto Guerra UniTeller, CEO

8

COMING OUT

9

How to empower Banks and Neobanks to conquer International Markets with Cutting-Edge Technology.

CashQ API is a revolutionary solution for the cross-border payment industry. The outdated technology used by traditional banks like Bank of America or Citi and the limitations of some neobanks like Chime or CashApp has resulted in high costs and slow transactions. This has led to bank revenue leakage as customers turn to third-party companies for their cross-border payment needs.

According to the FDIC National Survey of Unbanked and Underbanked Households, 95% of US households have access to a bank interface, including 46 million foreign-born people. Despite this, they need help accessing competitive and convenient cross-border payment options. This leads to bank revenue leakage as customers turn to third-party companies for their cross-border payment needs.

The market opportunity for outbound cross-border payments in the US, including personal remittances and gig payments, is a significant $0.5 trillion. To address the limitations of traditional banks and neobanks,

CashQ API was developed as a global push payments platform for banks and neobanks. The platform enables funds to be sent instantly, securely, and seamlessly to any account using card or phone numbers.

CashQ API eliminates the need for complex origination processes and uses cutting-edge technology to provide fast, cost-effective, and convenient cross-border payments to customers. This results in a better customer experience and helps banks capture the $0.5 trillion market opportunity. The platform is easy to use and helps banks stay ahead of the curve in the cross-border payment industry.

In conclusion, CashQ API is a game-changer for banks and neobanks that are looking to offer competitive and innovative cross-border payment solutions to their customers. With its easy-to-use platform and cutting-edge technology, CashQ API is a must-have for banks that are looking to stay ahead of the curve and retain their customers in the growing cross-border payment market.

10

AROUND THE GLOBE

Arina Anapolskaya Founder of CashQ

11

FUERTE AUMENTO EN 2022 DEL INGRESO LABORAL DE LOS TRABAJADORES

EN ESTADOS UNIDOS

MEXICANOS INMIGRANTES

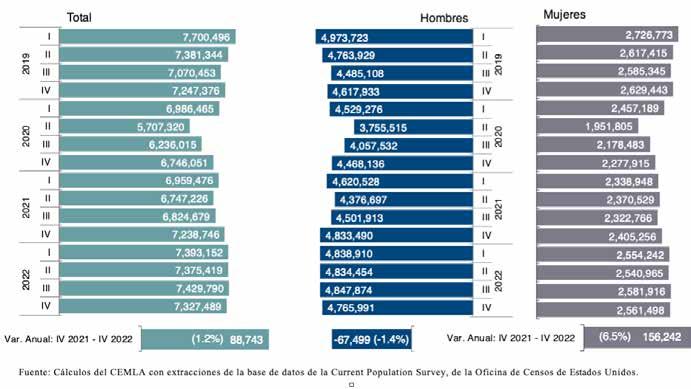

En este artículo se analiza la evolución en el cuarto trimestre de 2022, del empleo en Estados Unidos de los trabajadores mexicanos inmigrantes. Asimismo, se cuantifican sus remuneraciones medias y su ingreso laboral, distinguiendo género.

DESACELERACIÓN DEL EMPLEO DE LOS TRABAJADORES MEXICANOS INMIGRANTES

En el cuarto trimestre de 2022, el nivel de empleo de los trabajadores mexicanos inmigrantes en Estados Unidos resultó de 7,327,489 ocupaciones y se integró por 4,765,991 trabajadores de género masculino y 2,561,498 mujeres (Gráfica 1). En dicho trimestre, el 87.7% de las ocupaciones fueron de tiempo completo (jornadas de trabajo semanal de 35 horas o más), con 92.9% en el caso de los hombres y 78% en las mujeres. Asimismo, en el trimestre referido se presentó un modesto incremento anual de solo 88,743 ocupaciones y de 1.2% de dicho empleo, como saldo neto de una caída de 67,499 empleos (-1.4%) de género masculino y un aumento de 156,242 ocupaciones (+6.5%) de las mujeres.

12

SECTORES DE ACTIVIDAD EN QUE LABORAN LOS TRABAJADORES MEXICANOS INMIGRANTES

El cuadro 1 muestra los sectores de actividad en que laboran los trabajadores mexicanos inmigrantes en Estados Unidos e indica que hay diferencias significativas según género. En el cuarto trimestre de 2022: i) el 35% de los trabajadores ocupados fueron de género femenino; ii) los dos sectores con mayor presencia de trabajadores mexicanos son los de construcción y el de servicios de administración, seguidos por el de alimentos, recreación y hospedaje; iii)

tanto los hombres como las mujeres tienen una presencia significativa en manufacturas, en comercio al mayoreo y menudeo, así como en alimentos, recreación y hospedaje; iv) la construcción absorbió el 31.4% de los trabajadores de género masculino; v) el 96% de los mexicanos inmigrantes en los servicios en hogares fueron mujeres; y vi) el sector de alimentos, recreación y hospedaje representa la principal fuente de empleo para las inmigrantes mexicanas, seguido por el de salud y asistencia social.

REMUNERACIONES MEDIAS DE LOS TRABAJADORES MEXICANOS INMIGRANTES

En 2022, en Estados Unidos la remuneración media anual de los trabajadores mexicanos inmigrantes alcanzó 43,344 dólares, como resultado de la combinación de 46,457 dólares en ocupaciones de tiempo completo y de 21,449 dólares en las de tiempo parcial (Gráfica 2).

13

En las ocupaciones de tiempo completo la remuneración media fue de 49,618 dólares en los hombres (un promedio de 4,135 dólares mensuales) y de 39,314 dólares en las mujeres (un promedio de 3,276 dólares mensuales).

MASA SALARIAL DE LOS TRABAJADORES MEXICANOS INMIGRANTES EN ESTADOS UNIDOS

En 2022, la masa salarial o ingreso laboral obtenido en Estados Unidos por los trabajadores mexicanos inmigrantes alcanzó 319,942 millones de dólares (Gráfica 3), cifra que representó un incremento de 37,122 millones y de 13.1% con relación a la registrada en 2021. La referida masa salarial anual se integró de 230,163 millones de dólares obtenidos por los trabajadores de género masculino y 89,779 millones por las mujeres, el 28.1% del total.

14

La menor participación de las mujeres que de los hombres en la masa salarial refleja factores, tales como: una tasa de participación en el mercado de trabajo más baja de las mujeres que la de los hombres; una mayor proporción de mujeres que lo que se observa en los hombres en ocupaciones de tiempo parcial, cuyas remuneraciones son cerca de la mitad de las obtenidas en las de tiempo completo; una composición sectorial del empleo de las mujeres con mayor presencia en ocupaciones con menores remuneraciones medias, particularmente en algunas actividades de servicios. Asimismo, también hay casos en que las mujeres reciben menores remuneraciones que los hombres en ocupaciones en que desempeñan la misma actividad laboral.

AROUND THE GLOBE

COMENTARIO FINAL

El repunte que en 2022 presentó en Estados Unidos la masa salarial de los trabajadores mexicanos inmigrantes favoreció el incremento significativo que registró el ingreso de México por remesas. No obstante, en el cuarto trimestre de 2022, en Estados Unidos el empleo de los trabajadores mexicanos inmigrantes se debilitó y, de hecho, en varios sectores presentó una caída anual como los de manufacturas y de comercio al mayoreo y menudeo. El impacto de dicha evolución se reflejó en los últimos meses de 2022 en una desaceleración del ingreso de México por remesas.

15

Jesus Gonzalez Director of Economic Statistics and Coordinator of CEMLA

Rodolfo Berman Senior Economist of CEMLA

Denisse Torres Economist of CEMLA

INVALID CPF: BIG RISK FOR INTERNATIONAL COMPANIES THAT SELL THEIR SERVICES IN BRAZIL

The Brazilian market is one of the main in the world. Companies worldwide have sought to enter this market or expand their revenues in the main country of Latin America. In 2020, online sales grew by 34.76% in Brazil. In 2021, the growth was still strong, at 28.45%. The expectation is that in 2022 and the coming years, the growth will be at 20% per year and that in 2025 the sales volume will already reach an impressive R$465 billion reais.

There are several segments with an eye on this market. Service companies in entertainment, streaming, education, tourism, sports betting, financial services, Forex, and many others have been closely watching every opportunity.

Considering the high volumes handled, the level of risk of the business, and the regulatory needs in Brazil, companies operating in these sectors must remain attentive to the regulation and legal requirements of the country. These international companies, which have their headquarters in several countries around the world, must comply, in addition to the regulations

imposed by the countries of origin, with the Brazilian legislation on the Prevention of Money Laundering and Financing of Terrorism (PLD-FT). The law deals with the crimes of laundering or hiding assets, rights and values, and establishes measures to prevent using the financial system for these crimes.

Payment method operators in Brazil are required to create a risk classification and monitoring system for suspected Money Laundering or Financing of Terrorism operations, providing periodic reports to the government on these operations.

Beeteller, a Fintech specializing in payments throughout Latin America, with customers in several countries around the world, also offers its customers a specialized service for onboarding and KYC that helps international companies throughout the onboarding process (completion of data) and validation of its clients, guaranteeing a simplified and quick adhesion, and, preventing the companies from the risk of denied financial operations or even the acquisition of unwanted users, which exposes them to fines and legal risks.

16

Through a simplified CPF smart query API, Beeteller's artificial intelligence allows any company to block registrations with invalid or false CPFs, ensuring the veracity of the user's information at the time of registration, checking, for example, whether the CPF entered matches the name and date of birth.

In addition to this query, it is possible to cross over 100 international databases with data on the Identification of Politically Exposed Persons (PEP), National and International Sanctions Lists, Interpol, and Terrorism.

Learn more about Beeteller and know the international payment solutions and everything else from Onboarding, KYC, gateway, and banking. Access www.beeteller.com

INSIDE JOB

Rômulo Barreto Beeteller Head of Marketing & Products

3 Factors Shaping The Future of Financial Institutions in 2023

FINTECH INSIGHTS

Jairo Riveros

Innovation occurred quickly in 2020, so operations could continue during the COVID-19 pandemic. In the wake of this recovery and adjustment to a new normal, organizations that made decisions in haste now have an opportunity to take a step back and reevaluate their current business model will help innovate and set them up for success in the future. This is especially true for the financial sector.

Moving into 2023, these are some of the factors that we see affecting the growth and success of financial institutions:

Assessing and Improving Payment Regulations

Forces in the macro environment are creating rapid changes within financial institutions.

Advancements in technology have expanded upon what we have thought was traditionally possible. For example, mobile payments, e-wallets, and other payment options have resulted in faster, instant payments as well as 24/7 settlements and reconciliations for the consumer. This has also shaped the customer experience, where embedded finance, placing financial services in non-financial customer experiences, is increasingly commonplace and even expected.

In the near future, increased regulations will enable new business models, improve connectivity and increase the adoption of global financial innovations. For example, CFPB regulators are already assessing open banking in the U.S., driven by consumer and commercial demand.

A Generational Push for Financial Institutions to Change

In addition to regulations making changes to the financial services industry, Gen Zers are also driving change in the market,

18

Paysend Chief Strategy Officer and Managing Director for the Americas

as these digital natives come of age to make more financial decisions. With rising inflation, uncertain economic conditions, and showing greater concern over climate and social concerns, this generation feels as uncertain of the future as ever. With over $140 billion in spending power — and growing as more Gen Zers enter the workforce — financial institutions need to consider the needs of this generation and meet them where they are by zeroing in on their concerns and offering specialized products and messaging that convey a proper understanding of their needs. The rise of ‘finfluencers’ and open discussions on Discord and Reddit forums indicate that Gen Z prefers to engage with others through community forums as global citizens without traditional country borders. This means financial institutions that can offer personalized products, reflect their identities and values, and provide a sense of belonging within a global community will speak most to Gen Z.

Financial Institutions Taking Steps to Innovate Now Will Emerge in 2030

Financial institutions have a unique opportunity to make a positive impact on major societal issues and challenges, starting with financial inclusion. Financial institutions that embrace this momentum while also adapting to shifting consumer preferences and technological advancements will be the ones to emerge in 2030.

These financial institutions center the consumer at the forefront of business solutions and embrace open banking, which allows them to provide consumers with access to financial products that can save them time and money. Financial institutions will offer consumers a menu of ‘a la carte’ financial services, irrespective of traditional barriers and borders. Through the power of open banking, financial institutions will not only serve consumers and empower unbanked populations but transform society through sustainable economic growth.

About the author:

Jairo is the Chief Strategy Officer and Managing Director of the U.S. and Latin America at Paysend, a global fintech payments company born in 2017, based in the UK and regulated by the FCA, servicing over 7 million customers, reaching 170+ countries worldwide.

19

The remittances innovators

How João Vitor Menin and Fernando Fayzano are changing the cross-border scene between US and Brazil

There’s a new player in the US remittances market that is quickly gaining momentum, averaging a whopping 5,500 new accounts daily in its overall operation. With its roots in the Brazilian banking industry and over 25 million customers in its home country, Inter&Co is well on its way to becoming one of the fastest-growing fintech companies in America thanks to its 2022 acquisition of USEND, an American digital money transfer platform.

The combination of Inter and USEND began with a strong partnership and shared vision between João Vitor Menin, CEO of Inter&Co, and Fernando Fayzano, Founder and CEO of USEND. Both Brazilian entrepreneurs, with significant experience in the banking sector, saw an opportunity and necessity to innovate and progress the money transfer process between the United States and Brazil.

INDUSTRY LEADER

20

Menin and Fayzano knew that remittances could only continue growing as the world becomes increasingly interconnected. In fact, cross-border remittances grew 5% globally to $626 billion in 2022 and show no sign of stopping, especially remittances to Latin America, which grew above market: 9.3% in 2022 to $142 billion.

However, hurdles to sending remittances continue to hinder the process, especially for the most vulnerable populations. Last year, sending $200 to Latin America cost 6%, up from 5.6% a year ago. Both Menin and Fayzano, through their backgrounds as Brazilians and expertise in banking, understood that too many people continue to be left behind and throughout their careers, worked towards making banking services more accessible and affordable for everyone.

Fayzano founded USEND in 2005, after operating a small business importing and exporting products. Needing to negotiate the purchase and sale of dollars in the import and export business, he came up with the idea of creating his own transfer company to speed up the trade. Fayzano’s relationships with US and Brazilian financial regulators combined with his expertise of banking and international remittance systems led USEND to grow into one of the largest Brazilian companies in the business of remittance of dollars to Brazil and other countries operating in the USA.

While USEND was growing in the US, Inter was revolutionizing the banking system in Brazil under the leadership of João Vitor Menin. Back in 2015, Menin became CEO of Inter and saw a clear problem to be solved: banking in Brazil. It was a concentrated market, with costly financial products distributed through branch networks that didn’t reach the low-income cities and populations. So, Inter’s initial value proposition included a 100% free debit account, totally cloud-based, with mobile distribution, resulting in a best-in-class experience for its users.

21

João Vitor Menin (CEO, Inter&Co) and Fernando Fayzano (CEO, Inter&Co US).

This triggered a digital banking revolution, as Inter was able to reach everyone in Brazil that had a smartphone. Menin’s vision was to create an accessible Super App to simplify people's lives with financial and non-financial services all under one app, from banking, credit, investments, insurance, shopping, and cross-border services.

After Menin and Fayzano decided to combine forces, Inter began leveraging USEND’s remittances platform and 15+ years of experience operating in the US to offer Brazilians domiciled in US or Brazilians traveling abroad a global account in US dollars and an easy-to-use cross-border payments solution. Inter later rebranded its remittances business from USEND to Inter Global, reflecting the company’s expansion plans in the US market.

Importantly, Menin and Fayzano developed Inter Global Account with financial inclusion as a top priority. The two executives saw that the more remittance users that have a transaction account, the greater the likelihood that money will be transferred through those accounts versus through unregulated channels, preventing high fees while simplifying and making safer the process for users. Inter’s free and easy-to-use Global Account helps solve this problem and meets the needs of an underserved immigrant population in the U.S.

With Inter’s Global Account, users can complete a variety of cross-border financial transactions all from a single app. They can hold funds in US dollars, send money, pay bills, buy gift cards, be issued a prepaid card for global purchases, and more to complete any sort of transaction customers need today.

Following the acquisition of USEND, Inter shares began trading on the Nasdaq stock exchange (INTR) in June 2022 after transferring its listing from the Brazilian stock exchange. The neobank now offers over 130 services in a single app and continues to bring its innovative financial solutions to the US market to cater to the unbanked and underbanked populations. Most recently, Inter acquired US mortgage originator and fund manager YellowFi, adding its capabilities to the Inter Super App. This acquisition helps accelerate Inter’s goal of expanding the suite of solutions offered to clients that want to save, transact and invest in the United States by enabling them to invest in the U.S. real estate sector through YellowFi’s managed fund.

22

The company also continues to make progress on reaching immigrant groups in the U.S., especially through their passions. In October 2022, Inter became an Official Remittances Partner of the New York City Football Club (NYCFC), one of the largest teams in the Major Soccer League (MLS). With a talented contingent of Brazilian players on the team, Inter’s partnership with the NYCFC supports its commitment of connecting meaningfully with the Brazilian and Latino communities in the US.

Inter’s laser focus on realizing its potential in the US market is beginning to pay off. As of February 2023, Inter reached its goal of having over 1,000,000 Global Accounts – nearly double from September 2022. As part of Inter’s expansion, it is now focusing on consolidating its remittances and cross-border payments for Brazilians living in the US and for those traveling abroad, as well as expanding to other underserved immigrant populations. The future of digital banking looks promising, with companies like Inter and leaders like Menin and Fayzano leading the way towards financial inclusion for all.

23

CONSULTANTS MEET OUR TEAM OF CONSULTANTS

Isabel H. Cortes

Jennifer Holguin

CLICK HERE TO BOOK A CONSULTATION 24

Priscilla D'Oliveira Friedman Hugo Cuevas-Mohr

In this edition, we present a compilation of technological devices aimed at making your life easier with a touch of fun, emotion, and above all, a practical way of doing things and gettting the best experience you deserve Enjoy!

HELATH CARE

FORM SMART SWIM GOGGLES

Swim With FORM

These unique goggles are ideal for the average swimmer looking to move a couple of classes up, or for the pros who take the sport seriously as it is. The Smart Swim Goggle’s translucent display allows you to keep up with your pace, time, calories, and even heart rate whenever you find yourself getting those laps in.

$199.00

25

SONY WH1000XM5 with Auto Noise Canceling Optimizer

Industry Leading noise cancellation-two processors control 8 microphones for unprecedented noise cancellation. With Auto NC Optimizer, noise canceling is automatically optimized based on your wearing conditions and environment.

Up to 30-hour battery life with quick charging (3 min charge for 3 hours of playback).Note:If you face issue in Bluetooth connectivity please turn off the Bluetooth function for a couple of minutes, then turn it back on.

$398.00

UNIVERSAL TRAVEL POWER ADAPTER

If you're jet-setting across the world, a universal travel adapter is a must. And you won't find one that'll meet most simple charging needs than Epicka's all-in-one adapter.

This handy plug is designed for phones, laptops, and other smaller devices. The retractable prongs allow it to work in more than 150 countries, and it has six charging ports: four USB ports, one USB-C port, and one universal AC socket.

$22.99

ENTERTAINMENT TRAVEL

EPICKA

26

27

Register now! May 11-12 InterContinental Hotel Miami, USA

Register now! Nov 14 - 16 Seminole Hard Rock Hotel & Casino Mami, USA

DOWNLOAD BROCHURE

Global Forum & RemTECH Awards

The Special Awards Session is a highlight of the Global Forum on Remittances, Investment, and Development. It recognizes and the innovative and impactful contributions made by individuals and organizations in the remittances, investment, and development space in The Remittance Evolution Award, Innovation Remittance Solution, Top Service Provider, Best in Class Compliance Solution, and Partner of the Year.

The awards ceremony will provide a platform for award recipients to share their achievements and inspire others to drive progress in this critical field. Scroll down and select the category you would like to submit your entry to.

This awards a company that demonstrates the most adaptability to the market and transformed itself to its customer needs along with the digitalization timeframe.

Awards Categories

Top Service Provider

Best in Class Compliance Solution Partner of the Year

Experts in international development, economists, and remittances industry leaders..

Awards a new cutting-edge technology that is unknown in the market. A true innovator.

This awards is for the company that has the most complete service solution in the market- in terms of market geography, size, and efficiency.

Deliver an effective KYC system with proven results of staying compliant.

Our Judges

Software as a service solution that engages partnership as its core business and delivers custom packages to adapt to its partner’s needs.

Tech experts, fin-tech innovators and industry analysts.

Investors, development finance experts, and investment analysts.

Industry regulators, compliance experts, and remittance professionals.

Tech experts, fin-tech innovators and industry analysts.

SUBMIT YOU ENTRY

TODAY

Innovation

The Remittance Evolution Award

Remittance Solution

CLICK HERE TO ENTER CLICK HERE TO ENTER CLICK HERE TO ENTER CLICK HERE TO ENTER CLICK HERE TO ENTER Remittances & Development Contributions Innovation and Solutions Investment and Leadership Best Industry Practices and Regulations Fintech and Banking

COMPRE AHORA!

ENVIANDO DINERO

CAMBIO, REMESAS, MIGRACIÓN Y LA REVOLUCIÓN FINTECH

La Evolución de la Industria de Servicios Financieros Internacionales.

Esta obra compendia los conocimientos y experiencias de Hugo Cuevas-Mohr - Especialista en Transferencias de Dineroen torno a la provisión de servicios financieros internacionales y las tendencias tecnológicas que permitieron su fortalecimiento y evolución.

En sus páginas se cuenta, con decenas de testimonios de los emprendedores que hicieron posible ésta industria, la crónica de visionarios que han hecho posible el envio de dinero de migrantes a sus familias y su contribución a la actual revolución fintech.

32

BOOK

PRESENTATION

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

33

Lourdes Soto Spain SpainTech CCO

CONTACT US NOW! CONTACT US FOR SPONSORSHIP PACKAGES TODAY! HYBRID MAGAZINE WITH DIGITAL AND PRINTED ISSUES Published monthly and distributed at our annual events, forums, and other relevant events in the industy. CONTENT DISTRIBUTION READERS 11 Sections 6 Contributors per issue +8,500 Total distribution +21,000 Impressions 42 Countries 23% Female 77% Male TAKE YOUR COMPANY TO THE NEXT LEVEL! VISIT OUR WEB 30 Click here to contact us! help@crosstechpayments.com Our magazine content is reviewed and approved by our magazine committee and subject to eligibility.

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Content Director

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant