Killed by Ca rbon Monoxide: Appraiser Blamed Indemnification Clauses ADUs and What’s In It for You? What Is BIPD? Real Estate Appraisers 14 HOURS FREE CE PAGE 37 Read Working RE Online – Keep up with the latest news – workingre.com NAVIGATING A CHANGING MARKET Working RE 6353 El Cajon Blvd, Suite 124-605 San Diego, CA 92115-2600 Fall 2022, Volume 60

If you’ve been asleep at the wheel when it comes to your E&O insurance, you likely aren’t enjoying the best pricing and you may have some serious coverage gaps!

Here

key

1) $100,000 Discrimination Claim Coverage

Did You Know: Discrimination is excluded in most Appraiser E&O policies!

OREP includes $100,000 of Discrimination Claim Coverage.

2) $100,000 BIPD Coverage

The majority of Appraiser E&O policies do not provide Bodily Injury and Property Damage Coverage (BIPD). OREP covers you for any accidental damage to property or bodily injury (BIPD) at an appraisal inspection.

3) State Board Complaint Coverage

Did You Know: Some appraiser policies exclude coverage for disciplinary proceedings? OREP includes up to $50,000 aggregate coverage for board complaints.

(Back to your original Prior Acts date)

YOU

Has It Been 16 Years… Since You Shopped Your E&O Insurance? Trusted by Over 10,000 Appraisers—Serving

Over 20 Years

are some

coverages you may be missing out on:

All policies include Prior Acts

Calif. Lic. #0K99465 *Not approved in IL, MN, GA Fast, Easy and a great price. Not sure why it took me 16 years to try someone new but I’m glad we did. —Anthony Howell Plus, You Get More Than Just Great Coverage OREP Members also Enjoy: • 14 Hours of Appraiser CE* ($250 value) • Guaranteed Delivery of Working RE magazine • Pre-Claims Assistance and Risk Management • Expert State Board Complaint Consulting • Corporate Savings ($500 value annually) • Webinar Trainings ($200 value) Call Today: (888) 347-5273 Or Get a Quote Online in 4 Minutes at OREP.org/appraisers OREP Insurance Services, LLC Premiums Start at $401—You Don’t Have to Choose Between Price and Coverage!

Serving Real Estate Professionals

From the Editor Readers Respond

Navigating a Changing Market

Isaac Peck, Editor

Killed by Carbon Monoxide: Appraiser Blamed

Kendra Budd, Associate Editor

E&O Insurance Experts (www.orep.org

OREP Insurance Services, LLC. Calif. Lic. #0K99465

Questions Appraisers Have on Desktop Appraisals

John Dingeman, Chief Appraiser at Class Valuation

ADUs and What’s In It for You?

Richard Hagar, SRA

Long Have Appraisers Been Told

Tim Andersen, MAI

Insurance IQ: What Is BIPD?

Isaac Peck, Senior Broker at OREP.org

Let’s Confer

Hal Humphreys, Appraiser eLearning

Indemnification Clauses: What Appraisers Should Know

Isaac Peck, Senior Broker at OREP.org

Excess or Surplus Land: Which Is It?

Philip G. Spool, ASA

VA as a Model for Appraisal Industry

Isaac Peck, Editor

Professional Marketplace

Industry News

Mission

Working RE is published to help readers build their businesses, reduce their risk of liability and stay informed on important technology and industry issues.

Subscribe to Print and Receive Premium Content

www.workingre.com (click subscribe) Subscription included with purchase of E&O insurance from OREP.

Comments & letters are welcome! All stories without attribution are written by the editor.

Editor

Isaac Peck isaac@orep.org

Marketing and Design Manager

Ariane Herwig ariane@orep.org

Associate Editor

Kendra Budd kendra@orep.org

Graphic Design

Maria Cornelia mj@orep.org

CHECK OUT:

OREP’S LIVE CHAT at OREP.org. 5am-5pm PST, Monday-Friday.

Working RE

6353 El Cajon Blvd, Suite 124-605 San Diego, CA 92115

(888) 347-5273 Fax: (619) 704-0567 subscription@workingre.com www.workingre.com

Working RE is published quarterly and mailed to real estate appraisers, agents and other real estate professionals nationwide. The ads and specific mention of any proprietary product contained within are a service to readers and do not imply endorsement by Working RE. No claims, representations or guarantees are made or implied by their publication. The contents of this publication may not be reproduced either in whole or in part without written consent.

Working RE Fall 20222

Published by

)

65 4 14

Fall 2022, Volume 60 18 28 24 22 32

36 38 37 10 26

From the Editor

Between a Rock and a Hard Place

by Isaac Peck, Editor

As I write this, I just finished up a webinar on discrimination claims that I did in a podcast style with Craig Capilla, one of the nation’s foremost appraiser defense attorneys. (Visit OREP.org/ CapillaWebinar to listen to the replay.)

Our conversation reminded me that over 2,000 state board complaints are filed against appraisers yearly, according to my friend Tim Andersen, MAI and CEO at TheAppraisersAdvocate.com

That means roughly three to four per cent of all appraisers in the U.S. have a complaint filed against them every year!

Of course, the majority of com plaints (and claims) against appraisers come from homebuyers and borrow ers. This is a frustrating reality for appraisers—the vast majority of the con sumers do not understand the appraiser’s role, methodologies, or standards.

Enter the specter of discrimination accusations and innuendos. With dozens of national news stories publicly accus ing appraisers of discrimination, federal

and state appraiser regulators proposing changes to appraisal standards, and new “Task Forces” being organized—apprais ers are now caught firmly between a rock and a hard place.

If a person of color has an appraisal come in low and they can’t buy or sell a house for the contract price (without the buyer bringing additional funds!), or they don’t get the value that they wanted when refinancing—it must be the appraiser’s fault, and it must be because the appraiser is racist!

This is the reasoning that we see playing out across the U.S. Dozens of HUD complaints have been filed against appraisers alleging discrimina tion and Janette Miller, a California appraiser, is being sued for discrimi nation. In Miller’s case, and in the majority of the HUD cases, the com plainants/plaintiffs were homeowners who were refinancing and, one may assume, didn’t get the value they were hoping for.

While this dynamic is, for the most part, outside of the appraiser’s control— there are still steps you can take to pro tect yourself. First, be sure that your E&O insurance covers you for discrimination (many policies actually exclude discrimi nation!). Second, now is the time to step up the quality of your reports and build a defensible workfile that documents what you did and why you did it.

Third, thoroughly review all of your canned commentary and the wording you use in your appraisal and remove any mention of race, national origin, etc., as well as any of the “taboo” words Fannie Mae is warning apprais ers against using to describe neigh borhoods—like ”desirable,” “superior,” “inferior,” and many more.

Lastly, take extra care to treat everyone you meet in the scope of your busi ness with the utmost care and respect. If you have any questions or need liability advice, please check out OREP Insurance (OREP.org). Stay safe out there! WRE

(and News) Await!

In at WorkingRE.com

Working RE Fall 20224

WRE Online Opportunity

Opt

Readers Respond

Grappling with Desktop Appraisals

To me, it’s all about the liability. Who can we rely on to provide the site info that is not biased in some way? The Realtor? The homeowner? The lender? Regarding fees, you claim desktops are, at least now, similar to full 1004s. But if we will require someone to pro vide info they have not before, like a Realtor’s floor plan, or a professional onsite walk-through in person, I am sure they will not do this for free.

Coupling their fee with ours, where is the savings? And what happens when they get backed up? Are we really saving time? This also harkens back to our arguments of why we need comp photos. If we trust the Realtor for room counts, photos and list/sale prices for comps, why do we need to drive to the comp sales? If we do a desktop appraisal, are we now trusting the Realtor for the comp photos? Call me old, but this is obviously a push to get rid of that pesky appraisal fee altogether. When it crashes again just like 2008, and it always does, who will you blame? —Nathan

I’m sure the homeowner will include a photo of that hole in the sheetrock, which they haven’t repaired. Or note the smell of pet urine. It looks like a good time to retire. —Deborah A.

selection. While adjustments tend to be made on a monthly basis, the rapid change in pricing often reflects more of a ‘stair-step’ than a straight line. If the comparables are very recent, then it may be entirely reasonable to assert that those comparables con tracted during similar market condi tions and are thus on the same ‘step’ as the market as of the effective date. There is valid criticism from the per spectives of both anchoring bias in some cases and the lack of market conditions consideration in other cases. It is best to be careful not to paint with a broad brush. —Brent B.

Many real estate agents I have spoken with in the past week who have been in the business for 30+ years are stat ing the market has stopped increas ing in most areas and they expect a decline in the coming months. Also, in our current market where buyers are waiving appraisals and contract prices are well over list prices and buyers are paying the difference between appraised value and contract price in cash, are these sales truly fair market value sales? It does not appear to meet the definition. —Joshua R.

VA as a Model for the Industry

The article is correct. The VA is the best run of any and they deal in logic; they don’t have stupid requirements and they know about the appraisal practice. I don’t do AMC work unless the market is exceptionally slow because they waste my time and basically drive me crazy with inexperienced so-called reviewers. The VA uses experienced appraisers and they don’t waste our time. They have their rules and all of them make sense. It’s a straight rotation and is not about fast and cheap. —Billie N.

I’d add that the VA supports and respects the appraiser and their opinion. As long as the report is well written, explained and compliant, as any “good” appraiser typically does, you do not need to respond or comply with some of the checkbox underwriting requests. The SARs reviewing the work don’t typically ask for these and they are also a large part of the success of the program. —Benjamin B.

If You Call a Dog’s Tail a Leg

Time Is of the Essence

Appraising in a “Crazy” Market

Well done Isaac, with the astute observation about the inconsistency between the concerns about anchor ing versus the concerns about apprais als below the contract price. The criti cism about the lack of time adjustments depends entirely upon the comparable

Can anyone tell me why the lender will wait soooo long to order the appraisal when “time is of the essence?” I agree we can define ourselves by what we do or even the process and what we bring to the client, but wouldn’t it help just a little if the lender also paid attention to the contract? Maybe they hope qualifying at a higher rate or charging additional fees to hold a rate is beneficial to them. Do they operate in their best interests or their clients? —Christopher C.

It is ludicrous to utilize a measurement system not utilized by the local assessor’s office. In the last 3 months I’ve delivered several reports with the subject 1000+ sq. ft. smaller than all the comps and they’re all model matches. It just means more explanation by the appraiser. I’d like to see a common-sense change in the process developed by appraisers in the field. If I can do a desktop without ANSI, why am I using it in the first place? If I don’t need original comp photos for one form, why do I need them for any of the forms? —Mike WRE

Fall 2022 Working RE 5

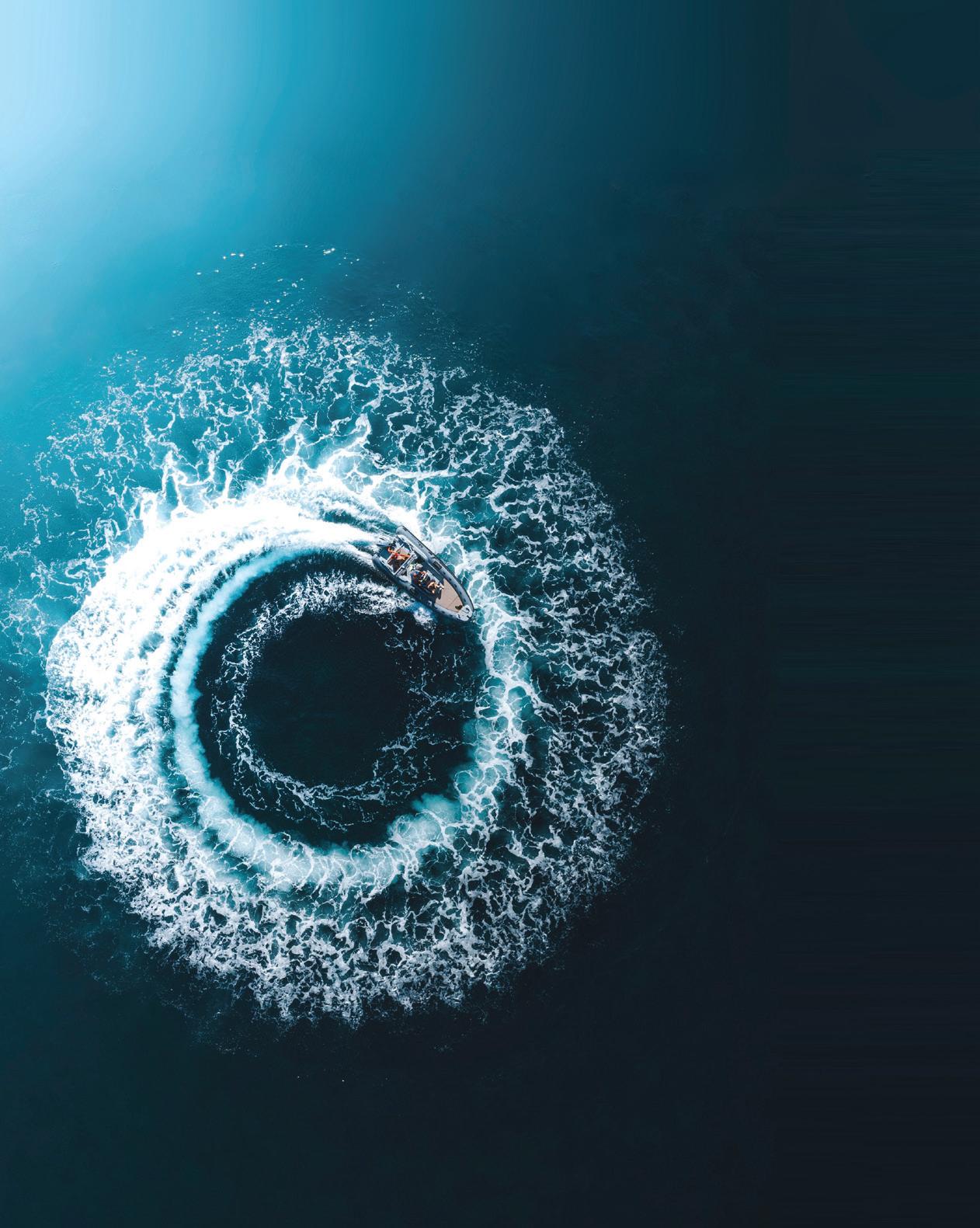

Navigating a Changing Market

by Isaac Peck, Editor

Both real estate appraisers and the real estate market as a whole have been on quite a journey for the last two years. The median price of a home in the U.S. has risen rapidly in the last two years with an average increase of over 30 per cent—but some high-demand markets have seen price growth of 50 to 75 per cent or more.

During that same time, appraisers have seen record appraisal volume and most have been busier than ever.

However, since the Federal Reserve (the Fed) began raising rates in 2022, the market has begun to shift. The tem perature of the market has slowed sub stantially because of higher interest rates and the number of appraisals being com pleted is also declining due to a sharp halt in refinance activity.

The result is a shifting market for appraisers—appraisal volume is declining and price acceleration is stalling—and even showing signs of declining in some select markets.

Here are the details on what apprais ers are facing and some tips on how to adapt in this changing market.

Appraisal Volume

In late 2020 and 2021, appraisal volumes across the U.S. exploded. The number of full 1004 appraisals performed on both a monthly and yearly basis broke new records in 2021.

After an incredible run, the tide began turning in January 2022 and ap-

praisal volume has been steadily declin ing since then. (See Figure 1.)

However, the good news for apprais ers is that despite this decline, on the whole, appraisal volume still remains substantially higher than the volume seen in 2017 2018. (See Figure 2.)

In other words, while changing mar ket conditions certainly indicate a further decline in appraisal volume, ulti mately what appraisers are experiencing can be best described as a return to nor mal rather than a complete drop-off in appraisal orders.

Waivers and Purchases

Another positive sign (in a way), is that appraisal volume has held steady even despite the sharp increase in appraisal waivers over the last two to three years. While the GSEs have massively expanded the use of appraisal waivers, appraisal volume has actually increased during that same time (See Figures 2 and 3.)

Additionally, since appraisal waivers were primarily being used on no-cashout refinances, waivers have retreated substantially since their high point in 2021 when they reached nearly 50 per cent of all GSE mortgage transactions.

With interest rates skyrocketing, GSE no-cash-out refinances have cra tered—dropping from over 500,000 transactions per month in 2021 to under 100,000 starting in March 2022. (See Figure 4, pg. 8.)

Use of appraisal waivers have been declining across all types of mortgage transactions with the following prod uct mix average in 2022: (a) 55 per cent appraisal waivers used on tra ditional (no-cash-out) refinances,

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over

appraisers with

and

OREP

not

“I’m constantly changing what I say in my appraisals and I’m very careful of boilerplate and canned statements. A quick change in interest rates has led to a quick change in the market. “

Working RE Fall 20226

10,000

comprehensive E&O coverage, competitive rates,

14 hours of free CE for

Members (CE

approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

400,000

300,000

200,000

100,000

0 Jan

Figure 1:

600,000

400,000

‘22Apr ‘22May ‘22Jun

from AEI.org)

(b) 30 percent appraisal waivers used on cash-out refinances, and (c) 11 percent appraisal waivers used on pur chase transactions.

With traditional refinances drying up, the leading indicator of appraisal volume will now be purchase mortgage transactions. Thankfully, appraisal waiv ers are remaining (for the most part), around 10 percent of purchases. (See Figure 5, pg. 8.)

As far as what the future holds for purchase transactions, the National Association of Realtors (NAR) predicts purchase transactions will be down 13 percent in 2022 overall, but expects to see a trend reversal in 2023.

Fees and Turn-Times

It goes without saying that as appraisal volume declines, the rapid run up in appraisal fees seen during COVID-19 has also seen a small retreat. Appraisers are reporting that many AMCs have returned to their familiar practices of sending appraisal orders out for “bid.”

200,000

Jul

Figure

50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

Jan

Mar

May

Jul

Sep

Sep

Nov

Jan

Mar

May

Jul

Sep

Nov

Jan

Mar

May

Jul

Sep

Nov

Jan

Mar

May

The practice of “bidding” out appraisal orders is seen by many appraisers as one of the key causes of abnormally long appraisal turn-times and tanta mount to an open admission by AMCs that they’re just looking for the cheapest appraisal, not a quality appraisal. “I have just received my fourth request for a bid on the same property. I started bidding on this over one week ago. Today I received the fourth request from a fourth AMC for the same lender,” wrote one appraiser on an Appraiser Facebook group. “I NEVER bid. If everyone would stop answering the emails they would stop sending them & fees would be customary & reasonable. These tactics impact all of us in the long run,” wrote another appraiser.

Nov

Jan

Mar

May

Jul

Figure 3: Appraisal Waivers (Data from AEI.org)

Sep

Nov

Jan

Mar

May

Jul

Sep

Nov

Jan

Mar

May

At the same time, senior leaders at AMCs, lenders and the GSEs have noted that slower appraisal volume will favor those appraisers who can stay in communication with their clients and

Fall 2022 Working RE 7 page 88

Total Appraisals Avereage / Decline in Appraisal Orders in 2022 (Data

‘22Feb ‘22 Mar

‘22

2: Total Appraisals (Blue) versus Total Waivers (Red) - (Data from AEI.org)

0 Jan ‘1 7 Mar ‘1 7 May ’1 7 Jul ‘1 7 Sep ’1 7 Nov ‘1 7 Jan ’1 8 Mar ‘1 8 May ’1 8 Jul ‘1 8 Sep ’1 8 Nov ‘1 8 Jan ’1 9 Mar ‘1 9 May ’1 9

‘1 9

’1 9

‘1 9

’2 0

‘2 0

’2 0

‘2 0

’2 0

‘2 0

’2 1

‘2 1

’2 1

‘2 1

’2 1

‘2 1

’2 2

‘2 2

’2 2

‘1 9

‘19

‘1 9

‘19

‘1 9

‘1 9

‘2 0

‘20

‘2 0

‘20

‘2 0

‘2 0

‘2 1

‘21

‘2 1

‘21

‘2 1

‘2 1

‘2 2

‘22

’2 2

7page 7

provide faster turn times. “During the heyday of 3 percent interest rates, it was acceptable for appraisers to take three to four weeks to complete an appraisal and forget to update the client. Now that volume has declined to normal levels, those appraisers who aren’t providing good customer service may see their businesses suffer,” remarked a senior executive at a major bank.

Market Changing: How Appraisers Can Handle

Alongside the discussion of appraisal waivers, appraisal fees, turn-times, and overall appraisal volume, another thing that is increasingly on appraisers’ minds is the changing temperature of the real estate market.

Of course, real estate is always local, but it is now undeniable that the real estate market is slowing down nationally. It’s possible that prices may continue to rise modestly in some mar kets, but the majority of markets are seeing prices begin to stagnate (with a few declining).

All throughout 2021, and even in the first few months of 2022, buy ers were routinely offering $20,000 to $50,000 over list price (at least here in California), but today many sellers are lowering their list prices and buyers are making more modest, negotiated offers.

Ryan Lundquist, a Certified Residential Appraiser and avid blogger at SacramentoAppraisalBlog.com—a topranking appraisal blog in the United States, says that in times like these, it is more important than ever for appraisers to cultivate a position of neutrality. “A lot has changed in the last six months with interest rates nearly doubling. There is so much sensationalism float ing around—if you watch a bunch of YouTube videos or read articles about how the market is crashing, it’s easy to get caught up in the hype. But as appraisers we need to actively work to remain objective and remain neutral,” argues Lundquist.

600,000 400,000

200,000

Figure 4: No-Cash-Out Refinances (Data from AEI.org)

Figure 5: Appraisal Waivers as Percent of Purchases (Data from AEI.org)

Neutrality, Lundquist says, is what sets appraisers apart in tumultuous markets. “It is a battle of narratives for many in the market today—and I really have to fight to stay objective. I don’t want to wear rose-colored glasses and I don’t want to wear doom-andgloom glasses. People are looking to appraisers now more than ever to tell the truth, report the market, and avoid sensationalism and hype. Some people have been promoting a ‘crash’ for so many years, which really means they’ve been misinterpreting market trends all this time. It’s like they keep repack aging the same prediction until one day they’re right. But in the midst of

perpetual prophecies, they’ve lost cred ibility and shown they don’t really have a pulse on the market,” says Lundquist. The appraiser’s job, then, is to report what is happening in the market right now as objectively as possible. After all, nobody (or very few) people could’ve predicted that COVID-19 would lead to double digit appreciation in real estate prices—many actually predicted the opposite, Lundquist points out.

But just how can appraisers keep a close eye on the pulse of the market?

Lundquist recommends finding people in your local market who are parsing trends and doing a good job telling the story. “You can find people like that on

Working RE Fall 20228

0 Jan ‘2 1 Fe b ‘2 1 Mar ‘2 1 Apr ’2 1 May ‘2 1 Jun ’2 1 Jul ‘2 1 Aug ’2 1 Sep ‘2 1 Oct ’2 1 Nov ‘2 1 Dec ’2 1 Jan ‘2 2 Fe b ’2 2 Mar ‘2 2 Apr ‘2 2 May ’2 2 Jun ‘2 2

Jan ‘2 0 Fe b ’2 0 Mar ‘2 0 Apr ’2 0 May ‘2 0 Jun ’2 0 Jul ‘2 0 Aug ’2 0 Sep ‘2 0 Oct ’2 0 Nov ‘2 0 Dec ’2 0 Jan ‘2 1 Fe b ’2 1 Mar ‘2 1 Apr ’2 1 May ‘2 1 Jun ’2 1 Jul ‘2 1 Aug ’2 1 Sep ‘2 1 Oct ’2 1 Nov ‘2 1 Dec ’2 1 Jan ‘2 2 Fe b ’2 2 Mar ‘2 2 Apr ’2 2 May ‘2 2 Jun ’2 2 15.00% 10.00% 5.00% 0.00%

YouTube, or perhaps other real estate professionals, and you can even look to the big data companies. Redfin has a great tool where they update stats by the week in a lot of markets across the country. What’s happening with the number of pending contracts? What’s happening with price reductions? Altos Research puts visuals out every single week in most markets across the coun try. There are a lot of things appraisers can pay attention to,” says Lundquist.

In terms of specific metrics to watch, Lundquist says watching the relationship between listings, sales, and pendings, is a great place to start. “Days on Market, concessions, price reduc tions, the ratio of listings, to pendings, to sales—all of these are indicators. Price is often the last thing to change in a market. I am much more inter ested with the number of sales. What’s happening with pending contracts? Are pendings going up or going down? This is indicative of demand. In my market, June pending volume will be down 25 percent compared to last year. We are seeing a huge difference in the number of buyers that are able to play the game right now because of interest rates,” Lundquist reports.

Another part of it is studying the market to the point where appraisers can understand what is normal and what is not for their local market. “We’ve had a really, really aggressive trend for two years; it’s almost unfathomable that a property will take 30 days or longer to sell. So as the market begins to shift, we are getting back to normal in a sense. That doesn’t necessarily mean the market is crashing. I am often looking at stats from 2016 to 2019. Almost all of our recent history has been on steroids and I don’t think it’s a good barometer for interpreting the market overall,” Lundquist says.

Another technique that Lundquist uses is he is always in communica tion with his peers in the real estate community. “I’m constantly asking people: ‘What are you hearing from buyers and sellers right now?’ Join local forums where people are talking about the housing market. You have to sift through the sensationalism, but hearing people’s stories can be really powerful. Collect as much information as you can and then try to see the forest for the trees. There are a lot of properties getting into contract and there are still multiple offers. These are

the trees. But what is going on with the whole forest? What’s happening with the properties that are not getting into contract right away? It’s easy to judge the market based on what’s on my desk if I’m only seeing it through these 10 appraisals I’m working on. But what is the bigger picture?” asks Lundquist.

At the end of the day, Lundquist says his goal is to report what is hap pening in the market right now—accu rately and without sensationalism. “I’m constantly changing what I say in my appraisals and I’m very careful of boilerplate and canned statements. A quick change in interest rates has led to a quick change in the market. My appraisals talk about more sta ble prices in my area but also about uncertainty regarding the future. Pending volume is softening, available listings are skyrocketing, and it is taking longer to sell—but there are still stats that suggest there is heavy competition for certain homes. It changes by the week. There’s no easy way to quickly do this, it takes effort. There’s no such thing as being a market expert without putting in the time to be an expert,” argues Lundquist. WRE

Keep up-to-date on the latest news and information by subscribing to Working RE’s email newsletter.

Publishing to appraisers for over 20 years, Working RE is the #1 source of news for real estate appraisers across the United States.

Opt In for FREE at WorkingRE.com

Fall 2022 Working RE 9

Se r vi n g Re a l E s t a te P r o f ess o na l s Winter 2020 Volume 52STAY INFORMED!

Killed by Carbon Monoxide: Appraiser Blamed

by Kendra Budd, Associate Editor

Editor’s Note: The names, location and details of this case have been changed to protect the privacy of the individuals involved.

F or decades, appraisers have been gently reminded to pay careful atten tion to smoke alarms and carbon mon oxide (CO) detectors—especially not ing when they are absent altogether. Many experts advise that the state and federal standards requiring these important systems exist for a reason.

A recent case in which a young couple died from carbon monoxide poi soning while they slept highlights the life and death importance of these sim ple alarms—and brings this issue front and center for the real estate appraiser community as a whole.

Here’s what happened.

A Deadly Mistake

John and Suzy Smith (names changed for privacy) were a young couple and first-time homeowners, living in their home for just over 18 months. On the night in question, they planned a dinner out with friends and were hurrying to get home, get ready, and head out.

In a rush to get in her husband’s car, Suzy left her car in the garage—key in the ignition and still idling. When the couple returned from dinner, John parked his car outside on the driveway. They retired for the evening to their

third-floor master bedroom suite and went to bed.

All through the evening and into the night, Suzy’s car sat idling— pumping the garage, and then the home, full of carbon monoxide.

The result was the Smiths, along with their pets, were found dead the very next day. Suzy’s car was still run ning in the garage when police arrived on the scene. Lab tests confirmed the cause of death for both John and Suzy was “Carbon Monoxide Toxicity.”

After a thorough investigation, detectives found five hard-wired alarms in the ceiling throughout the town house but all were actually smoke detectors. Not a single carbon mon oxide alarm was found in the home.

The couple was well-known in their small community and news of their death was covered extensively by state and local news alike. The news of such a young couple losing their lives just as they were starting a new life together hit the community hard.

Lawsuit

As you might expect, it didn’t take long for both John and Suzy’s parents to hire a law firm and start going after all the real estate professionals involved.

As it turns out, both the appraiser and the home inspector had each independently inspected the home 18 months prior and both mistakenly reported a few of the smoke alarms present at the home, as CO detectors.

As an appraiser, you know appraising a home requires careful diligence, time and a keen-eye, even if your client plans on hiring a home inspector.

Kendra Budd is the Associate Editor of Working RE magazine and the Marketing Coordinator for OREP, a leading provider of appraiser E&O insurance—trusted by over 10,000 appraisers. She graduated with a BA in Theatre and English from Western Washington University, and with an MFA in Creative Writing from Full Sail University. She is currently based in Seattle, WA.

Working RE Fall 202210

Consequently, both the appraiser and home inspector ended up on the receiving end of a “wrongful death” legal claim.

The legal team for the parents of the deceased young adults (plain tiffs) alleged that the appraiser, Darcy Doe (name changed for privacy), had negligently appraised the Smiths’ home and had reported the presence of a CO detector when in fact, none were present. Unfortunately for Doe, she labeled her photograph inaccu rately in her own appraisal report to the lender.

The legal demand notes that the appraiser indicated they would note any physical conditions that could affect livability and adverse environ mental conditions. Furthermore, the appraiser represented that their photo graphs were a “true and accurate repre sentation of the subject property” and acknowledged that any intentional or

negligent misrepresentations could result in civil liability.

The plaintiff’s attorneys point to a photograph included in the appraiser’s report of a First Alert smoke detec tor on the ceiling of the townhouse. However, the smoke detector was incorrectly labeled as a CO detec tor rather than a smoke alarm in the appraisal report. The legal demand is quick to assert that the appraiser was negligent, stating: “Given its ori entation, next to a ceiling light and adjacent to a staircase, the device depicted appears to be on the second floor near the staircase to the third floor, where the bedrooms are located. It would not have been properly located even if it was an actual CO alarm.” Their argument is clearly that any well-focused appraiser would have known this fact, and should be able to easily tell the difference between the two.

The plaintiff’s attorney reviewed the matter of potential negligence by interviewing other appraisers, “Apparently, the [lender], as do many other lenders, specifically requires that the appraiser confirm the pres ence of a statutorily required CO alarm as a condition for approving the loan. One appraiser advised me that he has had to return to a prop erty to provide that confirmation,” the attorney wrote. However, Doe did not properly confirm the pres ence of a CO alarm.

It was further argued by the legal team that the lender “obviously relied upon [Doe’s] appraisal report in approving the loan. Had there been no CO alarm present, the loan would not have been approved unless and until a CO alarm was provided (which could have been readily accomplished).”

Fall 2022 Working RE 11

page 128 Take Your Appraisal Business to the Next Level with Dustin Harris The Appraiser Coach If you’re on the fence about getting some coaching, fence sit no longer! You can’t go wrong with Dustin! - Blaine Feyen Increase your efficiency Double your income Work fewer hours “ “ 10%SAVE TheAppraiserCoach.com/Coaching COUPON CODE: 10%OFFCOACHING SINGLE COACHING SESSION

The attorneys go as far to argue that the law requiring carbon monoxide detectors in homes was increasingly necessary because “newer motor vehicles run quieter and smoother” and the “technological advances have lessened the required interaction and sensory feedback between operator and vehicle in driving and parking.”

The combination of these items gave the plaintiffs’ attorneys a strong claim against both the appraiser and the home inspector that they had incorrectly reported the pres ence of a CO detector (which never actually existed), and consequently that this negligent misrepresentation contributed to the wrongful death of the Smiths.

Ultimately, both cases were set tled privately out of court.

CO Detector vs Smoke Alarm

One important lesson in these cases is that it can be extremely difficult to tell the difference between CO detectors and smoke alarms. This is a reminder to appraisers to take a second look at all CO detectors and smoke alarms—and to test them as well.

Rick Bunzel, home inspector and Washington firefighter was able to give us some tips on how to not only tell the difference between the two detectors, but offers additional safety tips on smoke alarms and carbon monoxide detectors as well.

For starters, the difference between a smoke alarm and a CO detector is quite simple. “The item will be clearly labeled, written on the exterior shell of the device, so you’ll be able to see it easily,” advises Bunzel. However, this can be hard to read because the signage could be the same color as the shell, so it’s incredibly important for you to get close enough to the alarm or CO detector to read it clearly (and test it!).

Bunzel reports that the alarms

usually have different locations. “Carbon monoxide detectors are usually mounted high or low,” Bunzel says. He also points out that this isn’t a fool proof method because carbon monox ide and oxygen have only one mol ecule difference, so they have the same density. “In theory you could place a CO detector anywhere but they’re usually out of reach of kids or pets that’s a good rule of thumb,” says Bunzel. However, it is important not to rely on location alone, as that can lead to the same type of problems encoun tered by Jones above.

Lessons Learned

Bunzel was also able to provide some helpful tips for appraisers as far as how to communicate with their cli ents about CO detectors. For example, Bunzel says that appraisers and home inspectors should make it clear to their clients that they do not warranty if the device is working, just that it is there. “The test but ton doesn’t test the workability of a device—only the alarm. Just because it squeaks doesn’t mean it works,” reports Bunzel. This disclaimer lan guage should be included in the appraiser’s report.

Another tip is to check the date of a CO alarm and smoke detec tor. “It’s amazing how many smoke alarms I find from the ‘80s,” Bunzel says. Carbon monoxide alarms expire after six years, and smoke alarms expire after 10. In fact, The National Fire Protection Association (NFPA) requires smoke alarms to be replaced after 10 years. Appraisers, home inspectors and homeowners should be checking these dates.

However, as an appraiser it is imperative you are making your client aware of the expiration. “We should be calling out if they’re older than 10 years. From a safety perspective we need to be doing that,” Bunzel warns. Especially as a firefighter he

tells us he has seen too many expired alarms. He keeps it simple by stating simply, “Having working alarms that are within their lifespan saves lives.” This is the code every appraiser and home inspector should be living by, argues Bunzel.

Important Reminder

Isaac Peck, President of OREP Insurance, a leading provider of appraiser insurance, says that on most con ventional home loans, the lender is typically requiring that the appraiser confirm the presence of a CO alarm as a condition of approving the loan. This opens the appraiser up to liability if they report a CO alarm is present, when in reality that is not the case. “Even in the rare case that an appraiser isn’t required by her scope of work to report the presence of a CO detector, if the appraiser includes a picture of a CO detector in her report if the CO detector turns out to be a smoke detector, a case is still created for negligence and/or misrepresentation,” reports Peck.

This case serves as an incredibly potent reminder of the deadly con sequences that can result when CO detectors either malfunction and/ or are not present. Reporting CO detectors is often a very mundane and routine part of an appraiser’s subject property inspection, but this recent tragedy goes to show how important this issue is for the appraisal industry.

The case also shows how even a very small oversight or mistake can turn into a claim. Peck says that even very experienced appraisers sometimes overlook things. “Nobody is perfect 100 percent of the time. If your firm is doing 200, 300, or more appraisals a year, what are the chances that you might overlook something on one out of 300 appraisals? Mistakes happen. This goes

Working RE Fall 202212

7page 11

to show the importance of having insurance for your business so you’re not risking your entire business or your family’s financial future.

Thankfully, both the appraiser and home inspector were carrying E&O insurance and did not have to face these wrongful death legal claims alone,” reports Peck.

One thing to note is that many appraiser E&O policies actually exclude Carbon Monoxide from their policies! This exclusion is typically a part of a policy’s Pollution exclusion. Please be sure to check with your OREP agent if you want to ensure you get coverage for this important expo sure. (Visit OREP.org to learn more!)

Final Thoughts

Looking for carbon monoxide de-

tectors is a very small part of your subject property inspection, but it is of utmost importance. In this case, both the appraiser and the home inspector cut corners, improperly called the smoke alarm a carbon monoxide detector, and as a conse quence became entangled in a nasty wrongful death legal claim. As a real estate appraiser, you know apprais ing a home requires careful diligence, time and a keen-eye—even if your client plans on hiring a home inspector.

Make sure that you’re taking care ful note of the alarms and detectors, their dates and location. An accurate report not only saves lives, but spares you the headache of being on the receiving end of a lawsuit.

Stay safe out there! WRE

INTRODUCING Contributory Value

Contributory Value is a NEW podcast hosted by Mark “Skap” Skapinetz, who stood up against a big AMC and won! It’s a podcast about all things appraisal and real estate. Skapinetz brings the raw perspective of a boots-on-the-ground appraiser to every episode.

Episodes will feature industry professionals: real estate appraisers, real estate agents, lenders, appraisal management companies, policymakers, everyday consumers, & more.

Contributory Value is authentic, full of energy, fun and informative—contributing knowledge and value to you, the listener.

WITH

Mark “Skap” Skapinetz

WITH

Mark “Skap” Skapinetz

Fall 2022 Working RE 13

BUSINESS SLOWING? FIND THE BEST AMC CLIENTS QUICKLY! 2022 AMC GUIDE OVER 180 AMCs LISTED! MONEY BACK GUARANTEE Purchase at WorkingRE.com/AMC

SKAPTHEAPPRAISER.NET CONTRIBUTORY VALUE

LISTEN TODAY AVAILABLE ON ALL MAJOR PLATFORMS

Looking at the fine print, other requirements could be less obvious. Floorplan exhibits are one example of a less obvious requirement that could complicate things for appraisers.

Questions Appraisers Have on Desktop Appraisals

by John Dingeman, Chief Appraiser at Class Valuation

I n early 2022, a permanent change was made to the Selling Guide when both Fannie Mae and Freddie Mac announced desktop appraisals are coming soon and that floor plans are required. The new guidelines took effect in March of this year.

While this change is considered by many to be a positive move for the industry, it has the potential to create questions in the minds of the profes sional appraiser. In this article, we will highlight the impact the new desktop appraisal guidelines will have on the industry. We’ll also answer some com mon questions appraisers are asking as they implement the new rules.

Industry Impact

The appraisal profession has tradi tionally been resistant to change and slow to adopt new technology. The modernization of the appraisal pro cess promises to integrate the bestin-class technology readily available to us today and should have a major impact on how the appraisal profes sion performs. Furthermore, the availability of desktop appraisals has the potential to help accelerate this mod ernization by opening doors for the use of these technologies.

Unexpected Prevalence

Before the announcements from Fannie and Freddie, it was anticipated that desk top appraisals would only be accepted for loans with a maximum of 80 percent

loan-to-value ratio (LTV), where buyers were making at least a 20 percent down payment. However, the new guidelines apply to properties with up to 90 percent LTV. For appraisers, this means they’ll have the option to conduct a desktop appraisal much more frequently than they might have thought.

Efficiency

With quick and easy access to the information needed to complete a desktop appraisal, appraisers should be able to submit the data and receive reports back in time to meet appraisal deadlines more efficiently.

In the case of rural properties located away from town, desktop appraisals will still allow appraisers to complete an assignment where they have geographic competency, while no longer requiring them to spend additional time and money driving to reach the home for that assignment.

Learning Curve

With the introduction of new guide lines, it’s tempting for industry stake holders to make operational changes before they fully understand the guide lines, as will likely happen with new desktop appraisal guidelines. Resulting mistakes could create short-term chal lenges and increase cycle-times rather than reduce them.

As for appraisers, the new guide lines also come with new require ments. Fannie Mae outlined several such requirements in order for loans to qualify for a desktop appraisal reported on the 1007/70 Desktop form. The basic requirements include:

• A complete subject property address;

John Dingeman is a Certified Residential Appraiser in 11 states, a Registered Property Tax Agent in Arizona, and a Qualifying and Continuing Education Instructor for multiple course providers. Dingeman is the Past President of the National Association of Appraisers and the Coalition of Arizona Appraisers. He has also served on the Arizona Board of Manufactured Housing and the Phoenix Village Planning Committee.

Working RE Fall 202214

• The loan must be for a purchase transaction only, and • The subject must be a one-unit principal residence.

Floorplan Exhibits

Looking at the fine print, other requirements could be less obvious. Floorplan exhibits are one example of a less obvious requirement that could complicate things for appraisers.

When DU (Desktop Underwriter) issues a desktop appraisal eligibility message, and if a desktop appraisal is selected by the lender, then the appraiser must include a floorplan exhibit that has room-labeled door ways, staircases, points of ingress/ egress, and provide the dimensions of all exterior walls used to calculate the square footage. This is in addition to all other required exhibits listed in the Fannie Mae Selling Guide

The requirement for floorplan exhibits could create pains in the industry, at least in the short term while appraisers master the new rules and sourcing for reliable and compli ant floorplans is established. Floorplan exhibits, ANSI standards, and who is responsible for satisfying those requirements will be covered in more detail later in this article.

Common Appraiser Questions

Here are some of the most common questions valuation professionals might have as they navigate the new rules governing desktop appraisals.

1. Will the GSEs (governmentsponsored enterprises such as Fannie Mae and Freddie Mac) continue to use Submission Summary Reports (SSR scores) to verify the validity and qual ity of the appraisal?

Yes, the GSEs will continue to use SSRs to score appraisals, just as they would with a traditional 1004. This also means that the same data and SSR scores will be required by the GSEs to

support their due diligence. Appraisers should not expect differences in the way desktop appraisals are evaluated. Lenders will be reviewing SSR scores and collateral underwriter findings just as they always have, seeking clarifica tion where necessary.

2. Will the American National Standards Institute (ANSI) apply when Realtors® supply the floorplan?

As of this writing, ANSI does not technically apply to desktop appraisals. However, even though it’s not expressly required, many appraisers are wisely using ANSI standards in their measure ments to ensure accuracy and consis tency. As the use of desktop apprais als evolves and takes hold, it is likely that ANSI standards will become required in floorplan submissions. Appraisers are urged to adhere to ANSI standards now, to save themselves hassle in the future when they will likely be a requirement.

3. From an Appraisal Management Company (AMC) perspective, will a desktop appraisal be the same as a 1004 appraisal?

While the desktop appraisal is recognized by an AMC as a different product in terms of how the analysis is conducted, desktop appraisals are required to pass through the same qual ity control standards as a traditional appraisal. Desktop and 1004 appraisals result in the same data being submitted; the data is just collected by different means. Rather than an appraiser walking through the home with a camera and clipboard as they would with a tradi tional appraisal, the data for a desktop appraisal is gathered digitally.

Whether desktop or traditional, the industry standard remains: to submit a complete and accurate appraisal with out the use of extraordinary assump tions. Therefore, a desktop appraisal cannot be any less comprehensive than a traditional one.

4. Will the introduction of desk-

top appraisals have any impact on the number of appraisal waivers offered by DU or Loan Product Advisor (LPA)?

For a GSE like Fannie Mae, the benefit of systems like DU and LPA is that they allow them some control over the flow of appraisals. By fine tuning the data, the GSE can influence the num ber of appraisals that are waived versus those that require a traditional, hybrid, or desktop appraisal.

There could be some overlap in the data parameters that place loans into different appraisal categories. For exam ple, some loans may qualify for either a desktop appraisal or a traditional 1004, and as such be pushed by the GSE toward a 1004. Others may qualify for a waiver but based on the data could breach into the desktop appraisal cate gory. The GSE would have the ability to push those toward a desktop appraisal.

Because of the potential for overlap and the control a GSE has, there could be a decrease in the number or percent age of appraisal waivers that are granted.

There has also been a significant spike in waivers granted over the last two years, which may prompt GSEs and the Federal Housing Finance Agency (FHFA) to push more loans out of waiver territory where possible. This could be a factor in the decision to create an actual policy around desk top appraisals as part of DU.

5. In light of the new desktop appraisal rules, who will be responsible for satisfying floorplan requirements?

While the appraiser is not respon sible for procuring a floorplan, they are, ultimately, required to determine and submit the most reliable floor plan measurements. Appraisers should make sure they understand what floor plan measurement tools or data will be provided by the AMC or lender before accepting an appraisal assignment.

Depending on the circumstances, an appraiser may be required to find the detailed floorplan or procure in-

Fall 2022 Working RE 15

page 168

terior photos. Gathering the data to complete a proper desktop appraisal can be complex. This is why it’s impor tant for an appraiser to understand the breadth of what they are commit ting to when accepting an assignment.

6. How will desktop appraisal disputes work?

Disputes over desktop appraisals will work the same way they do now. The difference is that all parties will look at the same hard data set. In a traditional appraisal, the appraiser experiences the property personally, collecting photos or sketches and writing notes which creates data, but also has the potential to create subjective impressions.

In a desktop appraisal, there are no subjective impressions—just a set of black and white objective data. In theory, this factor alone could reduce the number of disputes and revision requests.

Any disputes that do arise on a desktop appraisal will be solved by taking a closer look at the data, which will not be colored by any subjec tive opinions formed during a personal inspection. This could make resolving those disputes more clear-cut.

7. What if I am missing an impor tant piece of information?

If an appraiser is able to com plete the desktop appraisal, then it’s an expected assumption that all the necessary data is there. If necessary, should data be missing or cannot be located, the appraiser must com municate to the lender or AMC that there is insufficient data to credibly complete the appraisal. In these cases, upgrading the casefile for traditional appraisal is always an option.

8. Where will I get comp photos?

With desktop appraisals, the scope of work has changed so that an ap-

praiser does not have to view a compa rable property from the street or submit an original photo. Instead, apprais ers are allowed to use any reputable and readily available online source for the comparable photographs, such as Zillow, Redfin, or Google.

New guidelines governing desktop appraisals will undoubtedly raise ques tions for a lot of valuation profession als. As rules and requirements evolve, having tools and technology at their disposal will prove incredibly valuable to helping appraisers keep their busi nesses profitable.

One of those tools is Class Valuation’s digital desktop, which features AI-enabled quality assurance, easier data extraction, and 3-D property scans for accurate, ANSI-compliant floorplans. More information and demos can be found at https://www.classvaluation. com/ digital- appraisals/ WRE

Working RE Fall 202216

7page 15

The more we appraised these properties, it became obvious that these are complex appraisals requiring geographic competency and extensive, highest and best use analysis.

ADUs and What’s In It for You?

by Richard Hagar, SRA

Acronyms on top of acronyms—just wait until you see Fannie Mae and Freddie Mac’s upcoming appraisal form regarding these initials.

ADU/DADU

Accessory Dwelling Unit (ADU), Detatched Accessory Dwelling Unit (DADU), Mother-in-Law Apartment (MIL), plus a dozen other names and initials—no matter what you call them, they are becoming more commonplace and likely part of the future appraisal assignment. The new proposed “1004” form goes so far as to include a multi-line section with more than twenty questions devoted to describing, measuring, and valuing these accessory units, including a requirement for multiple interior and exterior photographs. And you won’t believe their impact on value and the size of adjustments.

When I first started appraising and ran across an ADU…I may have not given these units much consideration or value—boy, was I wrong. In the past, many counties and cities across the coun try prohibited ADUs; however, as hous ing and land values have skyrocketed the need for more lower cost housing units has also increased. As demand rises, the prohibitions and scarcity of the past fade away. The need to understand these units has become more important to lenders and appraisers. If you can fully understand, measure, describe, and value a house with an ADU, the more likely you are to earn higher fees…that’s WIIFY (What’s in it for you).

Conflict and Confusion

There’s a lot of confusion regarding ADUs—some cities limit their size to 1,200 square feet, others require a minimum of 200 square feet, but some require their square footage to be no more than 50 percent of the main house. Then there’s the cities that require them to be separate from the main house, but then others require them to be part of the main house. One city may require additional on-site parking space, while another prohibits additional parking. Some cities require special permits, while the State of California goes as far as to pass a law that if ADU per mits aren’t issued within 60 days the units are automatically approved (SB2, SB13, AB881, AB68). Some cities limit a site to only one ADU while others (like Seattle) allot for 2, or (like some areas of California) allow for 4. The lines between multi-family housing and Single Family Residence (SFR) with an ADU are blurred, putting more pressure on analyzing the highest and best use as if vacant and improved.

Adding more twists to all of this, FHA, VA, FNMA, and FHLMaC have slightly different definitions and requirements. Two of these agencies require the owner to live onsite while FNMA remains indifferent. The City of Seattle allows two ADUs on a property; how ever, FNMA will not buy a loan if there are two ADUs on the site. When FNMA won’t buy a loan there can be an impact on the property’s value (was that factored into your last appraisal?). VA doesn’t care if an ADU is only accessible from within the main house but, FNMA requires separate access. Due to all these con fusing and conflicting requirements and definitions, I had to create a “Decision Grid” for my office for appraising.

Richard Hagar, SRA, is an educator, author and owner of a busy appraisal office in the state of Washington. Hagar now offers his legendary adjustments course for CE credit in over 45 states through OREPEducation.org. The 7-hour online CE course “How to Support and Prove Your Adjustments” shows appraisers proven methods for supporting adjustments. Learn how to improve the quality of your reports and defend your adjustments! OREP members save on this approved coursework. Sign up today at OREPEducation.org

Working RE Fall 202218

Duplex or SFR with ADU?

The line between a duplex and an SFR with an ADU is blurry, and appraisers must understand the difference and complexity before quoting a fee. Fortunately, the difference is usually based on zoning (except in Seattle, Oregon, and California) which makes it critical for appraisers to research zoning defi nitions and determine the highest and best use of the land, as if vacant and the property as improved. Appraising a property with an ADU takes more time, is complex and likely precludes licensed appraisers from providing the appraisal (it needs to be completed by a certi fied appraiser). If there’s a chance your subject property has an ADU, expect to spend, at a minimum, 25 percent more time on the appraisal and always make sure to check its zoning and legality before you quote a fee.

ANSI

ANSI and now FNMA, have special requirements on how these units are measured and reported on the 1004 form. Depending on its location and access, the square footage may be part of the living area, below grade area, or separated in the cost and sales com parison sections. ANSI also has spe cial text that must be included in the appraisal addendum. I bet you’re just thrilled with all of these new consid erations. There is no way around the new requirements and complaining won’t help, because nobody is listen ing. There’s no easy explanation for this, so the best recommendation is to take the Working RE webinar: ANSI: New Requirements for Appraisers. In the webinar we will cover these issues in much greater detail.

Value and Adjustments

You won’t believe how valuable these things are. Way back when, I thought these were a minor contributor to value (requiring a small adjustment).

NEW WEBINAR–ON DEMAND!

How to Handle ADUs, Casitas and Mother-In-Law Units

How Do You Value an ADU?

Accessory Dwelling Units (ADUs) are a new wave starting in the West and moving all across the United States. Like it or not, they are already in most major cities. Valuing these units is complex!

This Two-Part webinar will help appraisers understand when and where ADUs are allowed, the difference between an ADU and a duplex, how and where to place the information on the form (and which forms should be used), and much more!

However, after applying proper analy sis, using various adjustment methods (matched—pair, regression, etc.) we’ve determined that they can have a major impact on a property’s market value. The contribution to value and the size of the adjustments have blown us away. One study in Portland indicated a contribu tory value of more than $75,000. In a separate study we completed for a legal case, there was solid evidence that the property’s value was increased by 20–25 percent or more. What is an ADU worth in your market? Well, that’s up to you to figure out and why we get “paid the big bucks.” I recently reviewed an appraisal of a property that had an ADU—the appraiser clearly undervalued the prop erty by tens of thousands of dollars. The value was off so much that the client had to order a second appraisal and turn the first appraiser into the state appraisal board (due to a USPAP failure likely to impact the value conclusion). Pay atten tion when appraising these properties. You don’t want this to happen to you.

Solution

Get educated. Take a class on appraising ADUs, and do it soon! If you haven’t

taken a class regarding the ANSI sys tem…do it now!

When we started appraising prop erties with ADUs I thought it was just another component, similar to a swimming pool or second garage. However, the more we appraised these properties, it became obvi ous that these are complex apprais als requiring geographic competency and extensive, highest and best use analysis. Plus more time measuring, describing, and valuing. I went so far as to create a special required 4-hour class: How to Handle ADUs and MILs, for everybody working in my appraisal office. The webinar version is available at WorkingRE.com/webinars

WIIFY What’s in it For You Appraisers can make themselves more valuable by appraising houses with ADUs, something that computers (AVM) and desktop appraisals can’t properly handle. By learning about ADUs you will be able to provide supe rior appraisals that have more accurate value conclusions and garner higher fees… that’s WIIFY. Trying to keep you safe out there. WRE

Sign up today at WorkingRE.com/webinars

Fall 2022 Working RE 19

S vi R E P S er v i n g Re a E s t a t e P r o f e ss i o n a l s Wi 2020 Volume 52

COME FIND OUT WHY Over 10,000 Appraisers Choose OREP E&O INSURANCE OREP Members Enjoy All This (and More!): 14 Hours of Continuing Education in 46 states* ($250 value) Pre-Claims Assistance and Risk Management Expert State Board Complaint Consulting Guaranteed Delivery of Working RE magazine Serving Appraisers for 20 Years The Experience, Expertise, and Support You Deserve OREP INSURANCE SERVICES, LLC. *(Not approved in GA, IL, MN Coverage Highlights: Premises Coverage Included: Bodily Injury/Property Damage $100,000 of Coverage for Discrimination Claims Up to $50,000 Aggregate State Board Defense Coverage Zero Deductible; Mold Coverage Available Minimum Premium: $401 20 Years, Over 100,000 Policies Issued APPLY ONLINE in 4 Minutes at OREP.org COMPREHENSIVE APPRAISER INSURANCE

“Fast, easy and a great price. Not sure why it took 16 years to try someone new but I’m glad we did.” –Anthony Howell

“I am learning so much that is helping me improve in my appraisal practice and increase the quality of my reports and workfile, thus reducing my exposure to lawsuits. The webinars and education are a great complement to your insurance business. I will be back at renewal time.” –Bruce K.

“I have been using OREP for several years and signing up is very easy. They respond immediately with no hassles.” –Vickey Carly

“I switched my E&O insurance to OREP last month and saved $349 bucks.” –Dave M.

“I found OREP to be significantly cheaper, and provide better coverage than other companies. The savings are real.” –Greg Zieba

“It literally took only one minute to renew. I had my new insurance info later that day. Thanks OREP—Keep up the great service.” –Jeff Wood

“Went with them for the price. Giving 5 stars for service. Same agent since day one. Fast response time and excellent follow through.” –Troy Patterson

347-5273

Expanded Hours: Open 12 hours a day to serve you better! Monday-Friday 8 am - 8 pm EST (5 am - 5 pm PST)

WE ANSWER THE PHONE! (888)

Long Have Appraisers Been Told

by Tim Andersen, MAI

Long have appraisers heard the advice, “a thick workfile is your best defense!”

By extension, therefore, a poor work file, a thin workfile (or, even worse, no workfile at all!) is the prosecution’s best tool against the appraiser. In our case, the prosecution is the state appraisal board and their attorney who presents the case to the board. On the police shows, you’ve heard the arresting officer state solemnly, “Whatever you say can and will be used against you in a court of law!” In our case, what we say (in the report), as well as what we do not say (as in a thin workfile) can and will be used against us. Let’s see how.

Mississippi’s appraisal board keeps a website (visit WorkingRE.com/MScomplaints) to show its disciplinary actions since 2014. For those nine years, the MAB disciplined twenty-nine (29) appraisers for various infractions of USPAP and/or state statutes. Of these, fully 21 (74%) of them specifically mention the ap praiser not having a proper workfile, thus not being able to support adjustments, statements of fact, value opinions, and so forth.

In fact, the general language in all these decisions is:

“[r]espondent does not have verified documenta tion or analysis to support the information used in the [appraisal] in the appraisal report, in violation of [state statute], [USPAP’s} Record Keeping Rule, Scope of Work Rule (Problem Identification, Scope of Work Acceptability and Disclosure Obligations) and [various] Stan

dards Rules…[and] Respondent did not provide verified documentation or analysis in the workfile for various information stated in the Appraisal Report. [Respondent] provi[ded] a limited work file and does not have verified documentation necessary to sufficiently analyze the information for the three (3) approaches stated in the ap praisal report.”

While the analyses and protocols that went into authoring this article are far from scientific, it is interesting to note just how seriously the state of Mississippi takes the importance of the workfile.

Here is another quote from one of the Board’s decisions:

“Respondent did not provide verified documenta tion or analysis in the workfile for certain infor mation stated in the Appraisal Report. The work file contains very limited verified documentation. No cost approach documentation is contained in the workfile to show cost approach analysis or conclusions. There is no apparent explanation for the difference in market value concluded… vs. the concluded value for the cost approach… an unexplained…difference in the two values for the respective approaches. There was no verified documentation reflecting the analysis upon which the appraiser concluded site value.”

This statement from the decision, “[respondent] did not provide…analysis in the workfile” is telling. It makes clear that appraisers are to supply not only documentation, but analyses of their veri fied data to show the process of how and why they arrived at their conclusions and opinions. In other words, just like in high school algebra, the State of Mississippi demands the appraisers in that state to show their work.

One way to support your conclu sions, as well as to fortify your workfile,

While the analyses and protocols that went into authoring this article are far from scientific, it is interesting to note just how seriously the state of Mississippi takes the importance of the workfile.

Tim Andersen, MAI, MSc, USPAP instructor and CEO of TheAppraisersAdvocate.com, is the instructor of of How to Raise Appraisal Quality and Minimize Risk (7 Hours CE) at OREPEducation.org (OREP Members enjoy the course at no cost. Andersen has been in real estate and consulting since 1975 and is an AQB-certified USPAP instructor, USPAP consultant, author, instructor and expert witness. Andersen can be reached at tim@theappraisersadvocate.com.

Working RE Fall 202222

is what our engineering friends call it erations. In simple English, the term iteration means doing something over and over again, usually with one minor change in the process each iteration until you’re happy with the results of your efforts. One example of this is the time adjustment. To show proper due diligence, you really should have your time adjustment from two independent sources (if not more). This could be the FHFA website and/or your local MLS.

Your iterations would be to change your inputs for each source/iteration un til they both begin to center on a small range of results. It is important to un derstand how vital it is to support each of these iterations in the workfile. It is

by keeping them in the workfile that we show not only that we have followed the appraisal requirements of USPAP’s Standard 1, but it also shows that we have not engaged in bias in collecting, verifying, and analyzing the data sup porting the final value conclusion. The various iterations the workfile show that we considered all scenarios before reaching a conclusion.

This concept, that of considering all scenarios, shows that there was no bias in the selection of the data, veri fication of the data, nor in the conclu sions we drew from the data.

This is not the place to show how to adjust the comparable sales, nor how to verify the other data. All that

information is available elsewhere. It is, however, the place to emphasize, again, that a thick workfile is the ap praiser’s best defense. Therefore, an anemic workfile is the prosecution’s best tool to expose a weak appraiser, a non-credible appraisal, and a mislead ing appraisal report. When it comes to workfiles and what to keep in them, as Josh Walitt, SRA, has said many times, “If you see it as part of your appraisal, save it in your workfile!”

And as one final thought, it is a com mon question to hear how long should and appraiser keep their workfile. The easy answer is forever. Store it digitally and it costs nothing. This makes it very easy to keep the files forever. WRE

Fall 2022 Working RE 23

CE not approved in GA, MN, and IL APPRAISERS: Lower Your Business Expenses! Appraisers need ways to lower their business expenses. What’s better than saving over $250 on your Appraiser CE? OREP Members enjoy 14 hours of appraiser continuing education at no extra charge. More than just another insurance agency. ∞ How to Raise Appraisal Quality and Minimize Risk (7 Hrs) ∞ FHA Appraisal Standards (7 Hrs) ∞ Non-Lending Appraisal Assignments (7 Hrs) PICK TWO VIDEO-BASED CE COURSES: Appraiser E&O and Benefits at OREP.org or call (888) 347-5273 Shop Calif. Lic. #0K99465

I’d estimate that 97 percent (or more) appraisers are only carrying E&O insurance and do not purchase a separate GL policy every year.

Insurance IQ: What Is BIPD?

by Isaac Peck, Senior Broker at OREP.org

In my role at OREP, I frequently have the opportunity to speak to appraisers about their risk management practices and answer questions that appraisers have about their insurance coverage.

I love talking to the boots-on-theground appraisers who are doing the work in the trenches—plus it helps me keep a finger on the pulse of the indus try so I can continue writing relevant stories for you as Editor of Working RE.

One of the things that comes up repeatedly in my conversations with appraisers is what is the difference between E&O (Errors and Omissions) insurance and General Liability (GL),and along those lines: what is BIPD coverage?

First, here’s a quick definition of the first two:

• E&O Insurance: this is what most appraisers carry because lenders require it. E&O is malpractice insurance against errors or omissions made in reporting/professional services, such as using the wrong zoning, failing to report an easement or unpermitted improvements, measuring square footage incorrectly, or making other mistakes or in your reports.

• General Liability Insurance: few appraisers carry this coverage.

GL is carried by most retail establishments, as well as more “physical” professions such as contractors, plumbers, etc. The coverage can vary but it can cover your tools and it typically protects a business against “slip and fall” lawsuits by providing Bodily Injury and Property Damage (BIPD) coverage.

Now keep in mind that these are two very large, but distinct categories of

insurance. Many businesses only cover their business with one of these policies, while some carry both types of policies.

I don’t have any hard numbers, but if I had to guess I’d estimate that 97 percent (or more) appraisers are only carrying E&O insurance and do not pur chase a separate GL policy every year. This means most appraisers do not have BIPD coverage unless it is specifically endorsed onto their E&O policy (more on this later).

That brings us full circle to our question: what is BIPD?

BIPD stands for Bodily Injury and Property Damage, and in the case of real estate appraisers, BIPD protects them for what E&O does not cover: accidental damage to property or per sons (bodily injury) which you may cause while providing your professional services at an appraisal inspection.

One example is if you knock over a valuable vase (Grandma’s favorite 100-year-old vase, for instance) causing property damage—or if you were to drop a flashlight (from the attic) break ing a homeowner’s toe (bodily injury). These types of claims are not very com mon but they do happen.

Some of the real-life examples of BIPD-related claims that we’ve seen here at OREP include:

• Insured exits the rear sliding door to measure the home but steps into newly poured cement that was just finished by the contractor several hours prior.

• Insured flushes the toilet and it overflows causing water damage to expensive flooring.

• Insured opens an attic hatch and (allegedly) causes damage to popcorn ceiling.

Working RE Fall 202224

•

Insured steps through a ceiling during an attic inspection.

With FHA appraisals now requir ing more and more from appraisers, including testing appliances, flushing toilets, and inspecting attics and crawl spaces, awareness about the need for BIPD coverage is increasing.

For this reason, more and more appraisers are purchasing General Liability (GL) policies, in addition to their E&O, that includes coverage for BIPD at the subject property. GL policies, which also can cover an appraiser’s own office in addition to coverage for inspection site, can range in cost from between $300–$500.

Good News

One bit of good news on this sub ject is that OREP’s flagship E&O pro gram includes (at no additional cost) $100,000 of BIPD premises liability coverage (bodily injury/property dam-

age). OREP members, in most states, now enjoy this valuable coverage at no charge when renewing their E&O insurance with OREP. This allows us to meet the needs of our OREP members while saving them money. Of course, if you have an office and want the additional coverage a GL policy can provide, we offer that too.

Most OREP appraisers also enjoy a zero deductible. In addition, OREP offers 14 hours of free online continu ing education (CE) to all of its mem bers (Approved in 46 states), which includes two valuable courses: FHA Appraisal Standards (7 Hours) and How to Raise Appraisal Quality and Minimize Risk (7 Hours). These courses are designed to improve your professional skills, lower your liability and help you protect your business. The benefit for our members is twofold—it makes them more careful, more successful appraisers and lets them keep a little more hard-earned money in

their pockets, saving them over $250 in education costs.

Visit OREP.org for more and don’t forget to ask your agent about BIPD coverage. Stay safe out there. WRE

BY JOSHUA WALITT,

Fall 2022 Working RE 25 DON’T PUT ALL YOUR EGGS IN ONE BASKET EXPAND YOUR APPRAISAL PRACTICE AND EARN MORE MONEY NON-LENDING APPRAISAL ASSIGNMENTS

SRA, AI-RRS, MNAA, CDEI $126 / 7 Hours Online CE • OREP Member Price: FREE Lessen your reliance on one sector or type of client. Learn the necessary understanding of forms, narrative, and technical aspects of Non-Lending work: • Tax Rebuttal • Pre-purchase • Pre-listing • Divorce • Estate • IRS-related workSIGN UP TODAY AT: at OREPEducation.org[ [ Approved in 46 states (See OREPEducation.org). ENJOY 14 HOURS OF APPROVED EDUCATION for OREP Members (over $250 in value) How to Raise Appraisal Quality and Minimize Risk (7 Hours CE) FHA Appraisal Standards (7 Hours CE) Shop OREP.org today and Enjoy 14 Hours CE + E&O Coverage Call (888) 347-5273 to learn more. CE Not approved in GA, IL, and MN Calif. Lic. #0K99465

Let’s Confer

by Hal Humphreys, Appraiser eLearning

T he mind-numbing slide deck, with 250 words per slide, as if the presenter copied the text from a book and created a 20-foot-tall PowerPoint of unreadable ‘content.’ There’s not a chance anyone on the back row could make out anything other than a vague shape of a paragraph. Maybe transitions—hey presto—bounce each word-heavy slide across the screen, or words drop into place, or appear as if being typewritten across a screen. The speaker who obviously didn’t prepare— in any way. No outline. No slides. Just war stories in a disjointed stream-of-con sciousness-Jack-Kerouac-without-thepoetry ramble. Yeah, sometimes confer ences are a bore.

The chance encounter in a hallway. The shared experience of learning. That exhibitor you’ve always wanted to meet. The company with which you’d love to work. The presenter who entertains and engages with elegant slides and a wellcrafted narrative. That cocktail you share with a new friend after a long day of listening to people speak, some amazing, some, as noted above, not so much.

Taking the time and spending the money to attend a conference can be, if you think of it in the wrong way, a drain. The more accurate way to consider the investment in time and money, is just that—an investment.

Here’s what you need to know about conferences:

First, not all conferences are equal. You’ll be able to suss out pretty quickly if a conference is worth your time by doing a hint of research ahead of time. Check out the conference website. If there is no website. If the landing page

has the feel of Myspace, circa 1994, maybe skip it. If, on the other hand, the website is clean and professional, check it out.

Who’s sponsoring the event? Are vendors you want to learn about spon soring the event? Is there a database or software provider that you’ve been curi ous about going to be there? Spend a little time researching what companies are planning to be in attendance. If a sponsor you’ve always wanted to connect with is going to be there, check it out.

Who’s speaking? Is that one lady, the expert in that one thing, speaking? Is that one guy you’ve always stalked online speaking? There’s a good chance that you will be able to meet the speak ers. Spend a little time researching the speakers and see if there’s a topic or person about which you really want to learn more? If so, check it out.

I’ve been to small conferences, with less than 150 attendees, that were amaz ing. I’ve visited much larger conferences with 3,000 plus attendees that were equally amazing. The sweet spot for me is somewhere between 200 and 1,000 attendees. Too big, and the chance of meeting that one speaker you’re inter ested in diminishes. Too small, and you’re likely to run across the war-story-ramble speaker and not get much out of it. That said, I’ve met some of my favorite people at a 3,000 plus conference. I’ve also made some of the best contacts in my entire professional career at a conference with barely 100 people.

Here’s the thing: You get out of a conference what you put into it. Spend the weekend wall-flowering at the back of the room and you’ll likely not meet new people. Spend the weekend in your room, eating room service and check ing email, and you’ll likely not meet new people.

If you’re going to spend the time

You get out of a conference what you put into it. Spend the weekend wallflowering at the back of the room and you’ll likely not meet new people.

Hal Humphreys is a career-long real estate appraiser. He grew up measuring houses with his father, an appraiser. In the past 30 years, Mr. Humphreys has appraised property across the country, served as a hearing officer for the Davidson County Board of Equalization, and a contract investigator/reviewer for the State of Tennessee Department of Commerce and Insurance. He also assists attorneys who represent citizens accused of crimes. Mr. Humphreys is a founding partner of Appraiser eLearning and is the director of education for StoryboardEMP, llc, an education media company. Reach Hal at hal@storyboardemp.com.

Working RE Fall 202226