profit amid 91% claw back fall

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

COMMONWEALTH

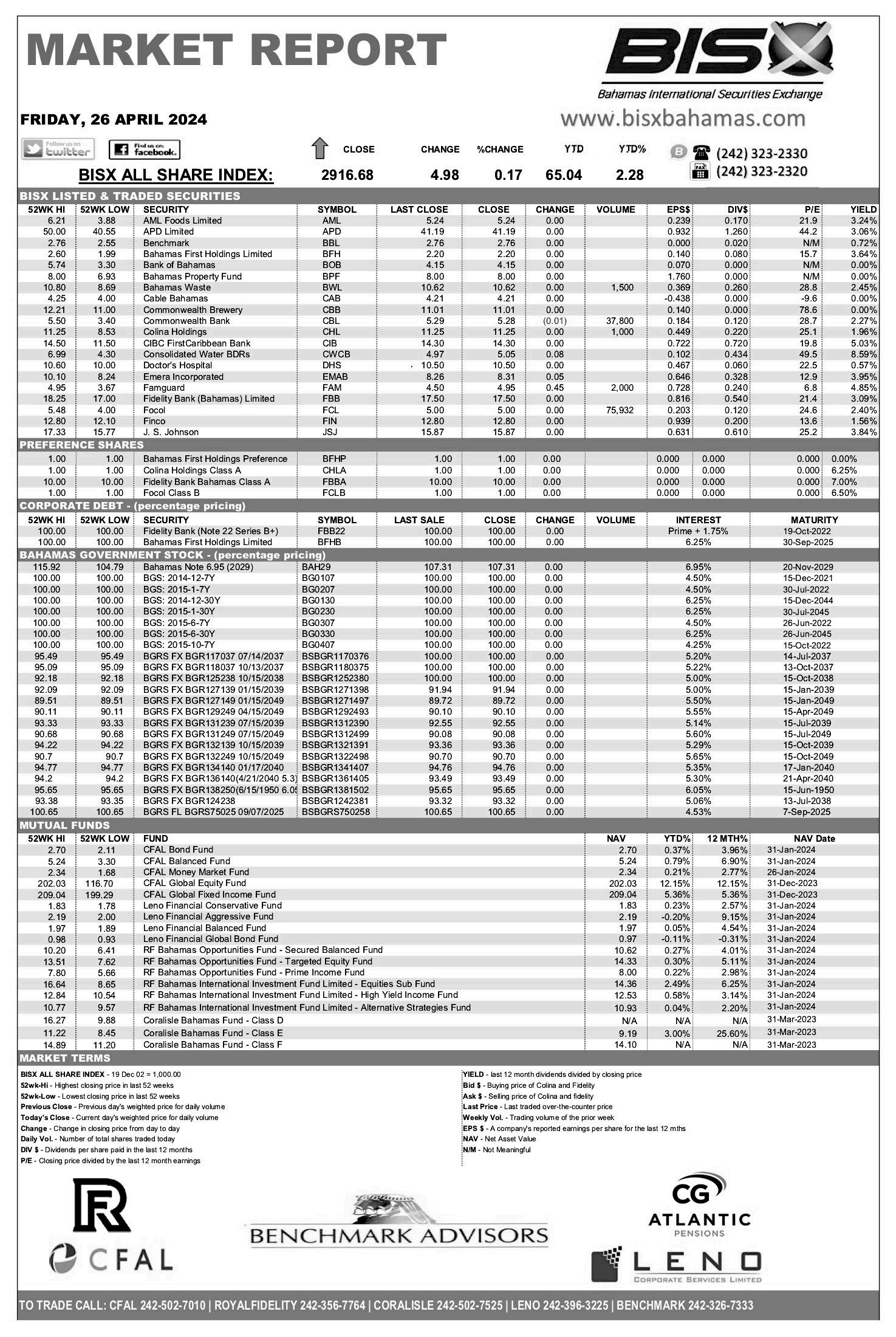

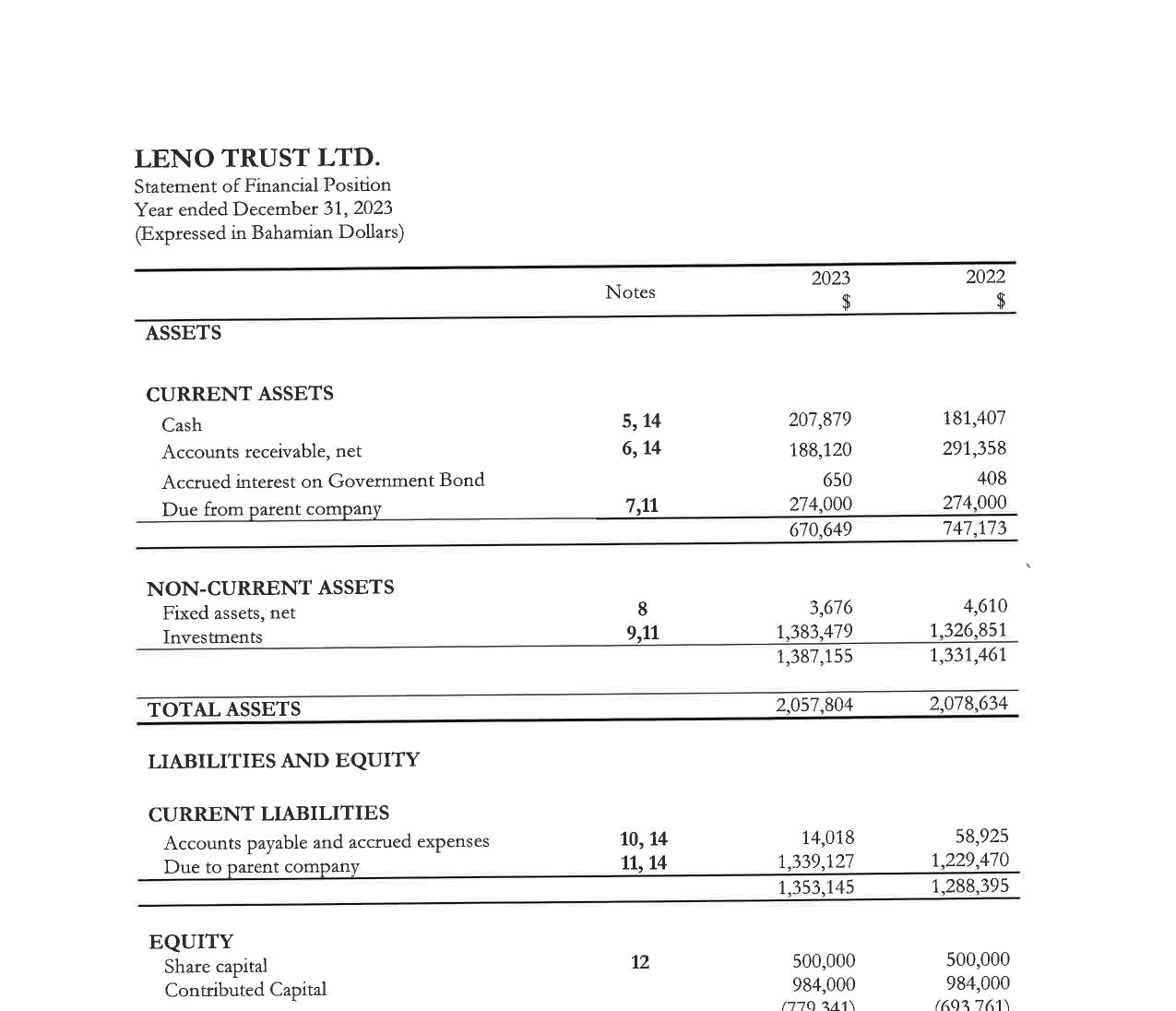

Bank yesterday hailed its “second most profitable” year-ever through $63.5m in net income that was generated despite a near-91 percent drop on COVID loss provision write-backs.

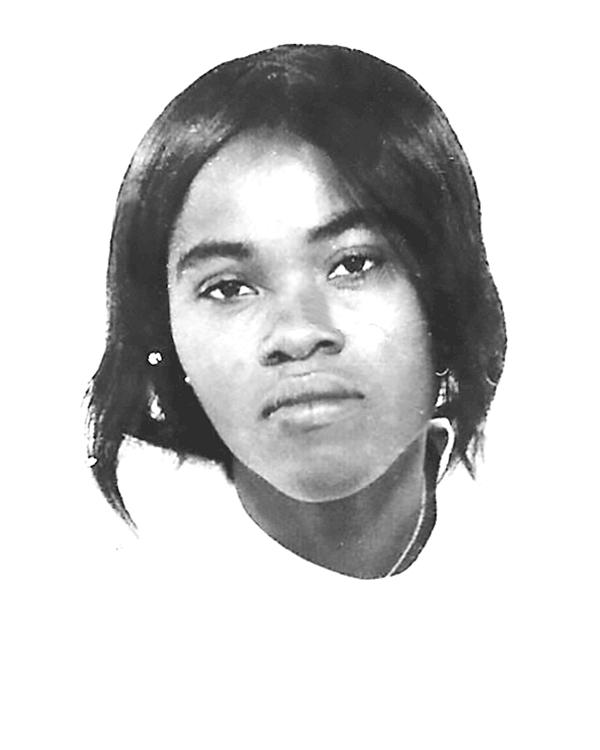

Tangela Albury, the BISX-listed lender’s vice-president and chief financial officer, in written replies to Tribune Business questions said its bottom line - which exceeded prepandemic performance - had in 2023 been driven by its core banking business and loan book growth with “double digit” rises in interest and net-interest income.

One-off factors, such as the recovery of COVID loan loss provisions, were chiefly responsible for Commonwealth Bank posting its record $75.491m

• Second-best year not reliant on loan loss recovery

• But non-interest expenses 9% higher than forecast

• Deposit insurance premiums to double to $800,000

annual profit in 2022 - a result boosted by more than $25m in writebacks. But, despite that latter number shrinking to just $2.339m in 2023, Ms Albury said the consumer credit specialist beat its net profit forecast for the year by “double digits”.

Speaking after the bank’s full-year audited results were unveiled, she added that the $63.5m bottom line was achieved despite significant cost and expense pressures

that saw Commonwealth Bank exceed its projected non-interest expenses (excluding loan loss impairments) by 9 percent or $7.6m. Besides the return of a $3m annual Business Licence fee, the BISXlisted lender was also faced with an increase in general insurance costs due to a hardening reinsurance market that drove premiums higher across the Bahamian property and casualty market and

surging energy costs due to Bahamas Power & Light’s (BPL) efforts to reclaim under-recovered fuel costs. Ms Albury disclosed that such pressures are set to continue in 2024, with its premium paid to the Deposit Insurance Corporation to insure all bank deposits up to $50,000 in value set to double to $800,000. Despite this, she revealed that interest and

SEE PAGE B4

GBPA bracing for arbitration notice

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

Superwash ‘bites bullet’ on $1.25m in upgrades

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

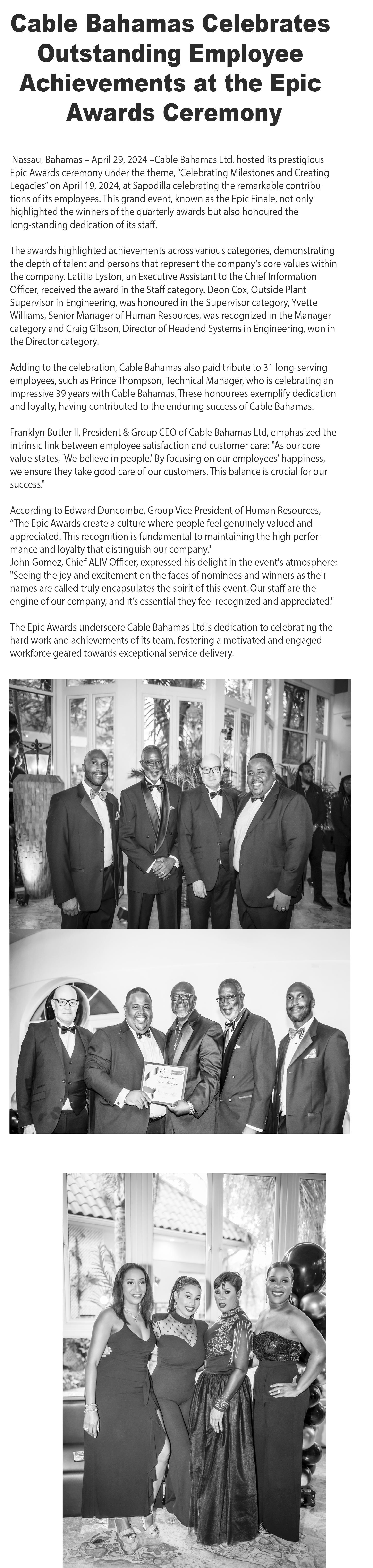

SUPERWASH has decided to “bite the bullet” by investing more than $1.25m this year to-date in upgrading multiple locations as it bids to “stay ahead of the game” on customer service.

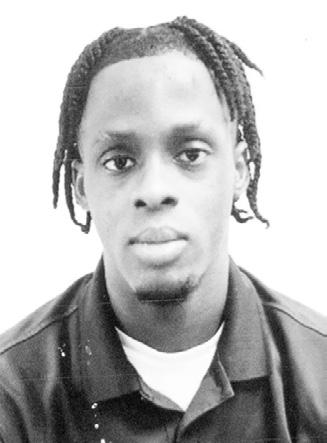

Dionisio D’Aguilar, the 11-strong laundromat chain’s principal, told Tribune Business that three out of four targeted sites have now seen their previously “extremely shabby” parking lots totally repaved as it seeks to elevate the customer experience at all sites.

Revealing that some $750,000 is being invested in the repaving, with the location at the Carmichael Road and Faith Avenue junction the only one one waiting to be worked on, he added that Superwash also spent around $500,000 earlier this year replacing all the equipment - including washing machines and

dryers - at its Gibbs Corner location.

Describing depreciation as “a real expense” for his capital-intensive business, Mr D’Aguilar told this newspaper that the laundromat operator is sticking to its policy of replacing machines when they reach the end of their depreciable or useful life. He added that the Charles Saunders Highway location will be the next to undergo a full equipment replacement

“The next step is to get a formal notice of arbitration, which I suspect the Government will serve on the GBPA this week,” one source, speaking on condition of anonymity, said yesterday. The Government team at the talks, which took place during the middle and end of last week, was headed by Ryan Pinder KC, the attorney general, while the GBPA was represented by Fred

SEE PAGE B8

THE Grand Bahama Port Authority (GBPA) is bracing for the Government to formally initiate arbitration proceedings as early as this week after talks failed to break the deadlock over the latter’s $357m demand. Tribune Business understands that last-ditch talks involving attorneys representing both sides made little headway in resolving the dispute over whether Freeport’s quasi-governmental authority owes such a sum, representing how much the Government alleges it has spent in the Port area over and above tax revenues generated by the city between 2018-2022, to the Public Treasury.

‘Improper conduct’ attorney is rescued from strike-off

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN attorney, twice found guilty of professional misconduct and whose law firm was once placed into receivership, was last week saved from being disbarred by the Court of Appeal.

Domek D. Rolle, who saw receivers appointed over a $167,722 debt owed to a client, was rescued from being struck-off the roll of practicing attorneys on the basis that the Bahamas Bar Council’s disciplinary tribunal did not permit him to present a “plea of mitigation” before deciding his punishment.

He was the subject of two Court of Appeal verdicts, both of which upheld Bar Council disciplinary tribunal findings that he was guilty of “improper conduct”. The first case was brought by Scott Deal, who had alleged that Mr Rolle “misappropriated” $167,722, or 28 percent, of $595,000 that he was supposed to be holding in trust for him from the sale of a property in Harbour Island. The Court of Appeal ruling recalled how Mr Rolle “continually made excuses” for why the $167,722 balance could not be paid to Mr Deal, “primarily blaming it on banking problems”. The latter initiated a Supreme

SEE PAGE B6

business@tribunemedia.net MONDAY, APRIL 29, 2024

SEE PAGE B7

$63.5m

Commonwealth hails

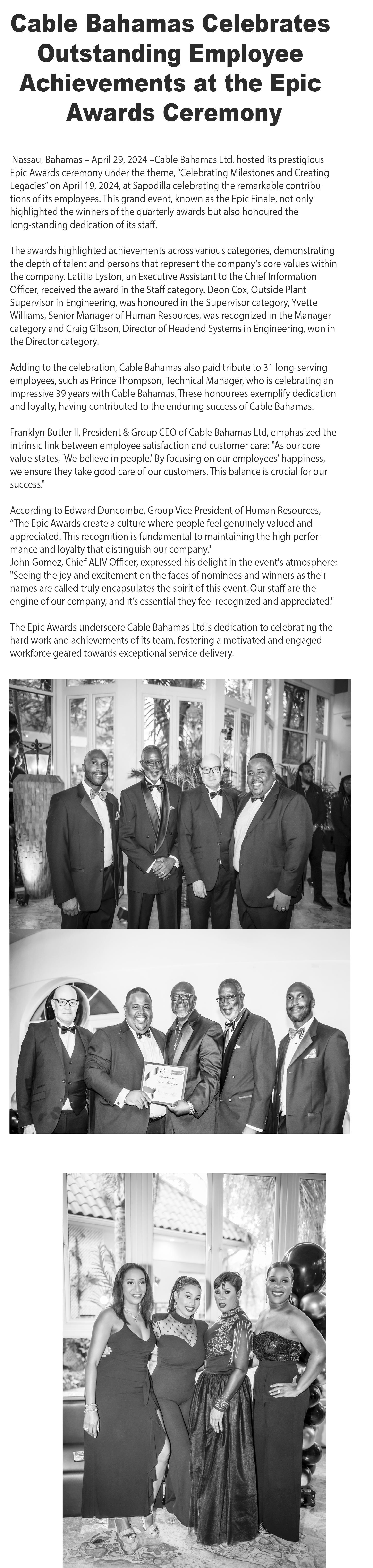

DIONISIO D’AGUILAR TANGELA ALBURY $5.80 $5.85 $5.92 $5.96

How to stay ahead of the risk factors

On a recent trip to Eleuthera, Bahamas, my observations of the Glass Window Bridge made me think about how a robust risk strategy can make or break the difference between business growth in a regulated environment (the calm Caribbean Sea to the west) or fines, breaches and a loss of human capital (the rough Atlantic Ocean to the east).

Regulatory fines for non-compliance are skyrocketing. SAAS solutionsfirm, Fergano, said: "Penalties for failing to comply with anti-money laundering (AML), KYC (Know your Customer), environmental, social and governance (ESG), sanctions and customer due diligence (CDD) regulations totalled $6.6bn in 2023, up considerably from $4.2bn in 2022 and $5.4bn in 2021."

As this statistic demonstrates, modern businesses face an increasingly complex regulatory and compliance landscape. Throughout 2024, companies will face a wide range

Derek Smith By

Derek Smith By

of emerging risks that threaten their operations and bottom lines. Due to technological advances, geopolitical tensions and shifting regulatory landscapes, these risks are not only multi-faceted but are also intensifying. In order to stay ahead of these emerging threats, businesses need to rethink their approach. I will now highlight areas in which companies should reassess their strategies, controls and actions.

Cyber security: A perennial concern

There are two sides to companies' digital transformation journeys. As well as offering unprecedented opportunities for growth and efficiency, this also poses heightened cyber security risks. Data breaches can lead to severe financial and reputational damage, with cyber attacks becoming more sophisticated and more frequent.

To combat these threats, companies need to invest in robust cyber security frameworks, adopt advanced threat detection tools and train their employees continuously on cyber hygiene practices.

Regulatory compliance:

Staying ahead of the curve

Complying with global regulations has become a major concern as they multiply and become more complex. Finance, healthcare and the technology industries are especially vulnerable to regulatory changes. In The Bahamas, what appear to be almost annual reforms to our Business Licence Act is just one

Atlantis and PI hotels appeal Wendy’s site plan approval

example of how sudden shifts can impose compliance challenges. To stay up-to-date on relevant laws and regulations, businesses must enhance their regulatory monitoring systems, leveraging technologies such as artificial intelligence (AI) and machine learning.

Environmental, social and governance (ESG): Beyond compliance Sustainability has pushed ESG factors to the forefront of risk management strategies. Customers and investors increasingly hold companies responsible for their environmental impact. Companies must demonstrate their commitment to sustainable practices beyond merely complying with environmental regulations in 2024.

Integrating ESG goals into corporate strategies, reporting transparently and adopting sustainable business practices aligned with global standards are key components.

Geopolitical instability: Navigating through uncertainty

In the current geopolitical climate, global businesses face a volatile environment.

A trade war, economic sanctions or political unrest can dramatically change the business landscape, and impact supply chains and international operations.

To respond swiftly to global crises, companies must diversify supply chains, carry out regular risk assessments and develop contingency plans.

Cultural adaptation and inclusion

It becomes increasingly important for businesses to understand and integrate into different cultural contexts as they expand globally. It is possible to experience significant setbacks as a result of cultural adaptation mistakes. A company must foster inclusive workplaces, and adapt its products and services to meet diverse consumer preferences and cultural norms, so as to enhance global competitiveness and reduce reputational risks.

In short, a proactive and dynamic approach to risk management is necessary

to manage emerging business risks throughout the remaining quarters of 2024. To succeed, companies need to anticipate and prepare for future challenges, and react to risks as they arise. The key to success is leveraging technology, cultivating a risk awareness culture and adapting continuously to changing conditions.

• NB: About Derek Smith Jr

Derek Smith Jr. has been a governance, risk, and compliance professional for more than 20 years with a leadership, innovation and mentorship record. He is the author of ‘The Compliance Blueprint’. Mr Smith is a certified anti-money laundering specialist (CAMS) and the assistant vice-president, compliance and money laundering reporting officer for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas, St Vincent & The Grenadines, St Lucia and Curaçao.

of developers have outweighed objections from stakeholders and the location is not appropriate.

ATLANTIS and other resorts are arguing that the proposed Wendy’s and Marco’s Pizza joint restaurant on Paradise Island is not a suitable land use and fails to match the location’s development model.

Viola Major, the attorney for Atlantis, told a Subdivision and Development Appeals Board hearing that as Paradise Island does not have a formal land use policy, and the Government has not considered its offer to assist in crafting one, the “look, feel, and brand concept of the area” should be considered in deciding whether to approve Wendy's restaurant.

She argued that the Town Planning Committee’s decision to grant site plan approval for Aetos Holdings, the Wendy’s and Marco’s Pizza franchise holder, was not supported by Paradise Island’s large commercial enterprises or residents. Ms Major, leading Atlantis’ bid to overturn the approval, said the “commercial interests”

She argued: “The commercial interests of the developers seem to have outweighed all of the objections, and all of the pros that were made about what do we want for Paradise Island; what is the trend of development on Paradise Island?

“Yes, maybe the plaza next door could use renovation and maintenance, but that doesn’t take away from the fact that all of the development on Paradise Island is trending in a particular direction and we all, speaking for myself, we like Wendy’s, we like pizza, we like Marco’s, but that doesn’t mean that it is necessarily an appropriate location to put a next Wendy’s and Marco’s facility.”

Dwana Davis, attorney for the Paradise Island Tourism Development Association (PITDA), argued that although the island is not a gated community, it is an exclusive community with residents that have all made significant investments in their

properties and are opposed to the project.

She said that although the investment made by Wendy’s developers may be “significant” for them, it is ‘insignificant’ when compared to the investments of those against the project.

Ms Davis said: “If you go now into Old Fort Bay or Lyford Cay, and you say I want to put something in here that is good for my commercial interests and the people say ‘no’, that is good for your commercial interests, but these are the people who have invested in this community, who live in this community, who have established families, businesses, other interests in this community.

“We have not just our immediate goals but we have future goals for this community, and it can’t be determined by someone who makes a significant investment in his respect, but insignificant compared to the number of people who are opposing it.”

Ms Davis also highlighted several issues with the approval process, including the decision to grant Wendy’s the go-ahead without having a land use plan in place to reference and not requiring the developer to submit a traffic assessment as a part of the process.

She said although the fast food location will not be operating a drive-through there is no guarantee its operation will not increase traffic on Paradise Island, and a traffic impact assessment should have been conducted on that location as they have before approving other projects.

PAGE 2, Monday, April 29, 2024 THE TRIBUNE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ATLANTIS RESORT AND CASINO

APPEAL COURT SPLIT ON CIBC ‘UNCONSCIONABLE’ MORTGAGE

By NEIL HARTNELL

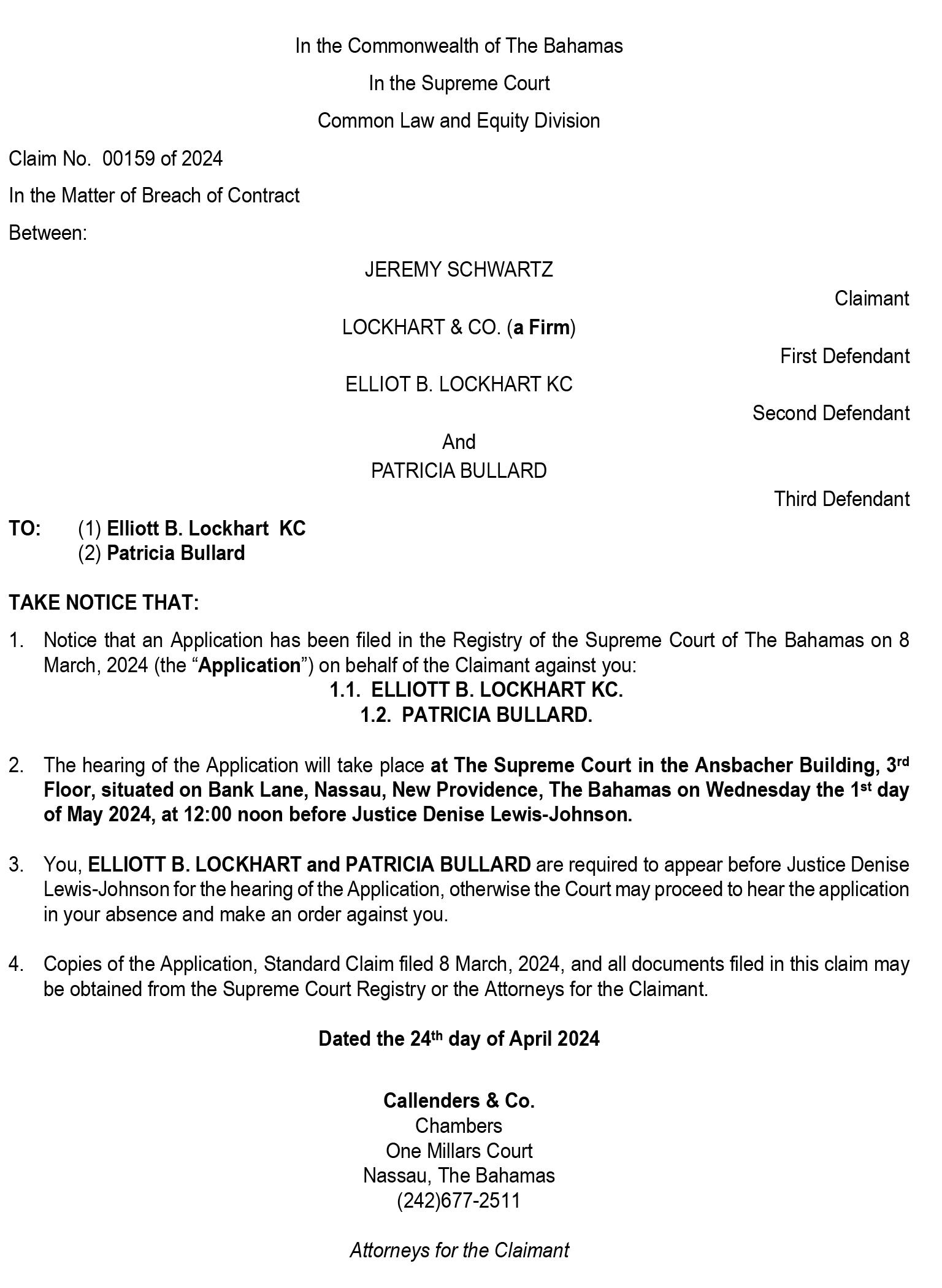

THE Court of Appeal has split over whether a CIBC FirstCaribbean International Bank (Bahamas) mortgage, advanced to a borrower now ordered to pay a $321,000 debt, is an "unconscionable bargain".

The majority, while voicing "sympathy" for April Penn, who now faces having to pay a six-figure sum to make good a loan secured on a "condemned" property, disagreed with the dissenting opinion voiced by appeal justice Jon Isaacs that it was "morally reprehensible" for the BISX-lender to proceed with advancing the mortgage given that it been warned about potential title defects.

The Court of Appeal's split centred around whether McKinney, Bancroft & Hughes, one of Nassau's leading commercial law firms and which provided the title opinion on the subject property, was working for Ms Penn or acting as an agent for CIBC. Ms Penn was also a McKinney, Bancroft & Hughes employee, though not an attorney, at the time the mortgage transaction occurred some 20 years ago on March 5, 2004.

Appeal justices Milton Evans and Gregory Smith agreed with then-justice Indra Charles, who heard the dispute at the Supreme Court level, that McKinney, Bancroft & Hughes were representing Ms Penn, while appeal justice Isaacs determined that the law firm was instead representing the bank's interests.

The dispute erupted after Ms Penn stopped making loan payments on the $150,800 mortgage that was secured on lot 20 in the Bricknoch subdivision in the Carmichael Road.

CIBC initiated legal action more than 12 years ago, on December 28, 2011, alleging that she had failed to

make monthly payments of $1,318, resulting in arrears that totalled $304,761 as at January 29, 2020.

This sum was split into $164,718 in principal and $140,043 in interest. Ms Penn had hoped to develop a duplex on the property, but it was the site of a former dump and contained multiple sink holes, making it unsuitable for construction.

"Since the grant of the mortgage, the property was condemned due to significant structural problems based on an engineer's report dated March 12, 2010, and is useless for the purposes intended. The bank asserted that, as a result, it has suffered loss and damage and claimed the outstanding sums," appeal justice Evans wrote in the majority verdict.

Ms Penn alleged, in her defence, that the mortgage was void or voidable because the property's defects meant she was "frustrated" from living up to the loan's terms. "The bank averred that it acted on the title opinion of McKinney, Bancroft & Hughes, which led it to disburse the loan proceeds to Ms Penn and accept the property as security," appeal justice Evans wrote.

"The bank also alleged that Ms Penn selected the firm arising from her employment and it would not have issued the sums under the facility arrangement but for receipt of a title opinion from that firm indicating that title to the property was good and marketable.

"The bank also contended that once Ms Penn identified an attorney to act for her, the bank issued instructions to that attorney to investigate title and to prepare its standard loan documents."

Justice Charles, in her initial ruling, found that Ms Penn as a McKinney, Bancroft & Hughes employee was granted concessions in not having to pay legal

fees - normally 2.5 percent of the $150,800 loan value - and was also allowed to cover the then-Stamp Tax and conveyance recording costs via salary deductions rather than having to pay them upfront.

"Although Ms Penn tried to suggest that she did not select the firm to be her attorney, I find that she did. There were obvious perquisites to be derived by selecting the firm, namely she did not have to pay legal fees and she did not advance the stamping and recording fees as it was taken out of her monthly salary," then-justice Charles wrote.

However, appeal justice Isaacs disagreed with both her and the majority in the Court of Appeal. He found that McKinney, Bancroft & Hughes were acting for CIBC, not Ms Penn, based on a March 4, 2004, letter from one of its employes, Gia Williams, who wrote that the "legal work for the preparation and completion of the mortgage will be done on the bank’s behalf by its attorneys-at-law".

Appeal justice Isaacs added: "In my judgment, it is clear that the bank is stating that attorneys working on the bank’s behalf are responsible for preparing and completing the mortgage." He added that this was reinforced by a reference on CIBC's website to the list of "approved attorneys" allowed to work on its mortgage transactions, which states "the criteria for selecting firms to represent our interests in mortgage transactions..."

"This clearly shows that by the bank's own admission, attorneys on the approved list represent 'our', i.e. the bank's interest. Therefore, notwithstanding that the transaction fee was paid by Ms Penn, the firm was actually the bank's attorney," appeal justice Isaacs wrote/ "This view is fortified by the fact that Ms Penn, notwithstanding that she

works for the firm, was not the recipient of the letter from Campbell Cleare, dated March 5, 2004 which warned that there could be a document impacting title."

Mr Cleare, a McKinney, Bancroft & Hughes partner, warned Ms Williams at CIBC that "a document affecting the title of the borrower may have been lodged for record at the Registry of Records (and obtained priority under the provisions of the Registration of Records Act), but was not available for inspection or otherwise made known to the public at the time of our searches.

"In the event of such an occurrence, we do not accept responsibility." Other than that, Ms Penn was said to have clear and good title. "From the emphasised portion of the letter, it is clear that Gia Williams, as the bank's representative, was alerted to the fact that there was a document affecting the title but that it was not presently available for inspection," appeal justice Isaacs wrote.

"Therefore, had the bank and its agents acted prudently, it would not have proceeded with the mortgage until some further investigation had been conducted to see what the document affecting title was.

"However, in my judgment, it appears that the bank, eager to close a mortgage transaction, ignored all of those observations by the firm and only relied on the portion of the letter that stated 'we are of the opinion that the borrower has a good and marketable title to the above-mentioned properties'."

Appeal justice Isaacs said that as the letter was addressed to CIBC, and not Ms Penn, only the bank know of the potential issues impacting title to the property. "Therefore, it was unconscionable for the bank, with knowledge of the potential title defect,

as opposed to Ms Penn who had no knowledge at that time of the potential title defect, and who also relied on the bank's approved attorney, to then insist that Ms Penn is liable for a transaction where there is now no good security," appeal justice Isaacs wrote.

"In my judgment, had the bank done a thorough investigation, the same means by which Ms Penn's industry was able to discover the title defect later, the bank would have discovered the title defect prior to issuing the mortgage. Accordingly, the Bank in reliance on the firm who by the bank's own admission was to represent the bank's interest in mortgage transactions, failed to ensure that it had good title to its own security.

"The Bank and Ms Penn were not meeting on equal terms, because it is clear that it was the bank who had the expertise in mortgage transactions as opposed to Ms Penn who was conducting a first time transaction. In all of the circumstances, in my judgment, the Bank acted in a morally reprehensible manner and took unconscientious advantage of Ms Penn in proceeding to sign a mortgage with her in circumstances where only the bank knew that there was a potential impediment to having a good title."

However, his view was not shared by the Court of Appeal majority who saw no reason to interfere with the Supreme Court verdict

that McKinney, Bancroft & Hughes was representing Ms Penn especially as the grounds cited by appeal justice Isaacs were not included in the legal pleadings or argued before the courts.

"In the final analysis, it cannot reasonably be disputed that the circumstances in which Ms Penn has made a contract to repay a loan but has no viable property as the fruit of her labour is unfortunate. However, an appellate court, while having some room to show empathy whenever possible, must ultimately focus not on whether something is unfortunate, but whether it is legal," appeal justice Evans wrote.

"The judge commented that these are unfortunate circumstances, and I do concur. Thus, I am not without sympathy for the fact that Ms Penn has secured a loan from the bank, with the hope that it would materialise into a duplex, but the result is that she is being pursued by the bank for the loan, while the defects in the property makes it prohibitively expensive to develop."

And appeal justice Smith added: "While I feel some sympathy for the plight of Ms Penn, the bank was not at fault for this. In any event, the amassing of this debt was not challenged by a plea in the defense of limitation, so there is not much we can do to alleviate the predicament in which Ms Penn now finds herself."

THE TRIBUNE Monday, April 29, 2024, PAGE 3

Tribune Business

nhartnell@tribunemedia.net

Editor

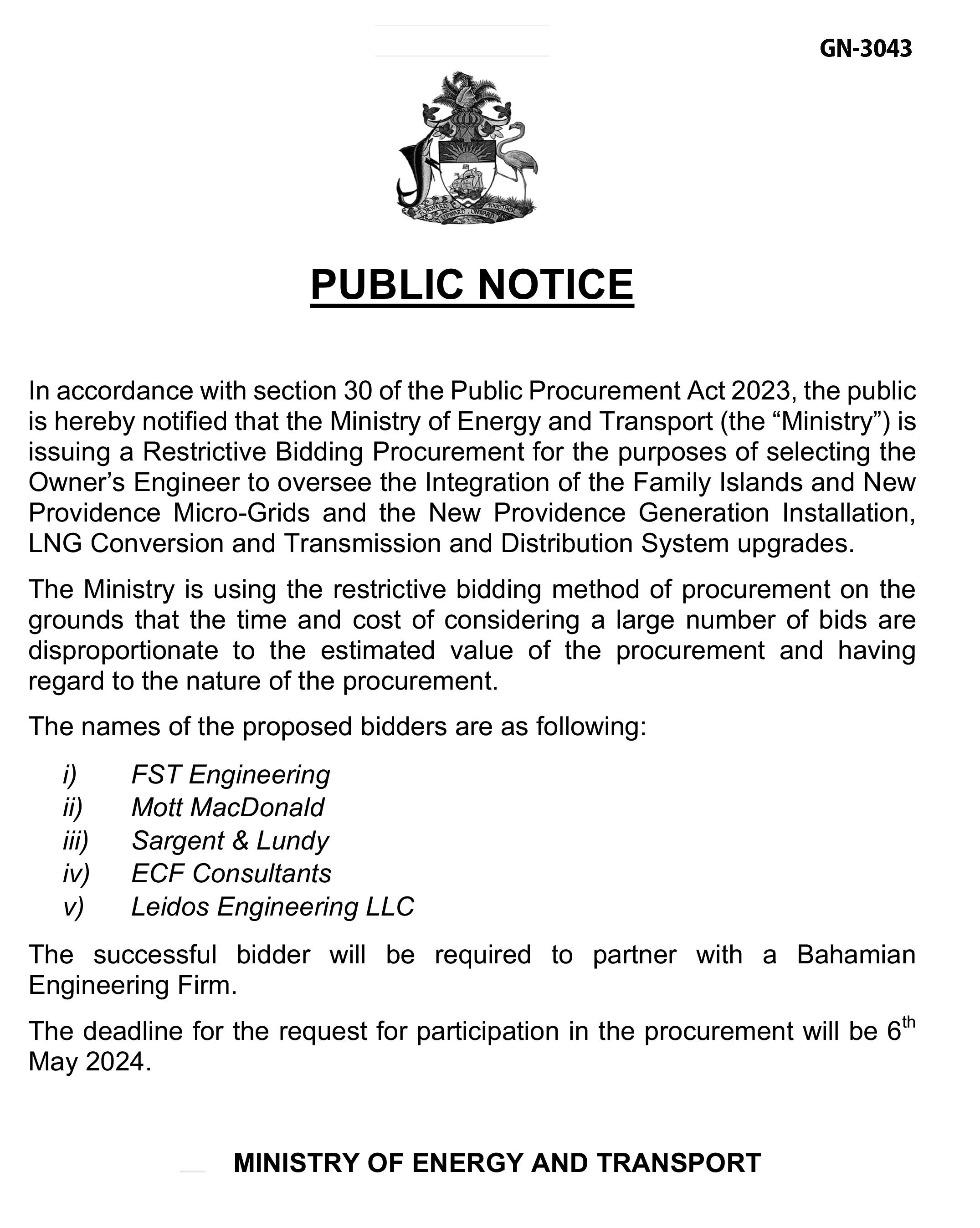

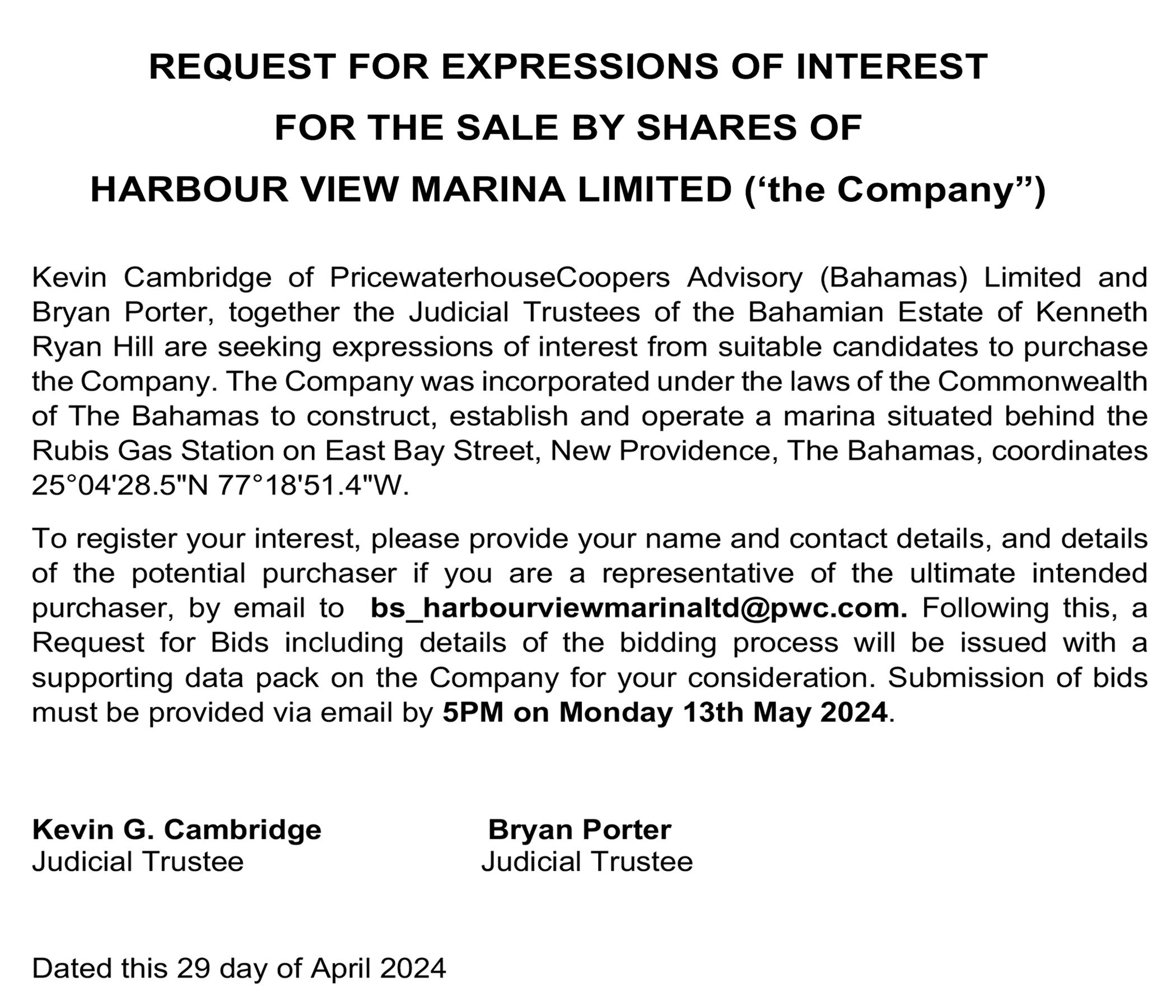

BAHAMAS POISED TO JOIN LATIN AMERICAN

THE Bahamas has completed the final steps before formally becoming a member of the Development Bank of Latin America (CAF).

Michael Halkitis, minister of economic affairs, has signed two agreements with the multilateral institution to move The Bahamas towards full membership in the organisation. The signing of the immunities exceptions and privileges agreement and share subscription agreement are the penultimate steps to membership before the Government formally joins the institution.

“CAF’s commitment to improving quality of life strategically aligns with the Government of The Bahamas’ goals to achieve the development objectives of

the country through the application of key social and economic activities and programmes,” said Mr Halkitis upon signing the agreements.

“Food security, climate change, water and energy, digital transformation and transportation are all areas that figure importantly in the Government’s development policy initiatives and strategy.” The Government believes membership in CAF will provide The Bahamas with new opportunities to improve the quality of life for all Bahamians. It added that the move underscores The Bahamas’ commitment to development, environmental protection and preparing for the growing impacts of climate change.

“Undoubtedly, this relationship will enhance the socio-economic and environmental development of The Bahamas,” added Mr Halkitis. “The Bahamas looks forward to joining the other 21 member states in this organisation with a more than 50-year history of making an impact for people in the region.”

CAF is a development bank with more than $54bn in assets and a "robust credit rating". Its role is similar to that of the Caribbean Development Bank (CDB) and Inter-American Development Bank (IDB). CAF promotes sustainable development and regional integration with an aim of converting the organisation into a 'green' and 'blue' bank, thus linking in to The Bahamas' own initiatives.

COMMONWEALTH HAILS $63.5M PROFIT

three cent quarterly dividend payouts for the full year.

“The 2023 net profits were ahead of budget expectations in double digits, and

on target with our forecast net profit range for the year end,” Ms Albury told Tribune Business, attributing Commonwealth Bank’s performance to the continued

post-COVID rebound of the Bahamian economy and the institution’s “laser focus on delinquency management and sound credit underwriting”.

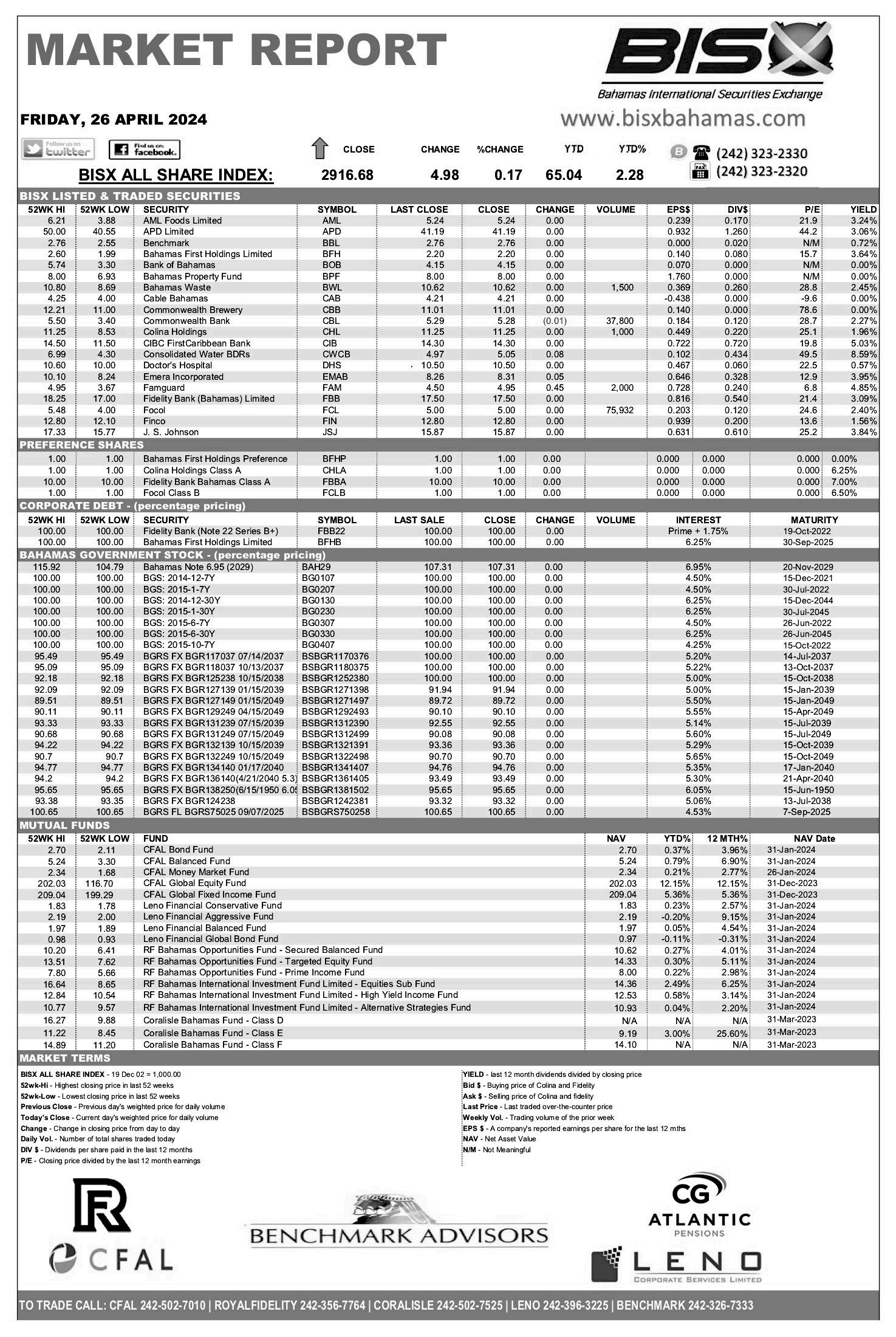

“The 2023 financial results represent the second most profitable year in the bank’s history and exceeded its pre-COVID profitability,” she added. Commonwealth Bank’s interest income increased by 14.8 percent year-overyear, rising from $120.224m in 2022 to $137.961m for the year to end-December 2023, while net interest income was up by 17.3 percent at $120.766m compared to $102.97m.

Total income was ahead by 14.6 percent at $152.159m, as opposed to $133.048m the year before, while Commonwealth Bank’s expanded by more than $21.5m or 2.8 percent to hit $807.984m at yearend. Ms Albury said 2023’s performance was, for the first time since COVID hit, driven by the core lending business rather than loan loss impairment write backs.

“The financial results of operations in 2022 were significantly driven by releases of credit loss allowances into the Bank’s total profits of $25.1m,” she explained.

“However, as of December 31, 2023, the consolidated reversal of impairment expense at $2.3m, a decrease of 91 percent, is only a minor contributor to the bank’s financial results.

“Instead, the bank has seen double-digit growth in both gross interest and net interest income, reversing the declining trend in both factors since the impact of COVID-19. Our bank’s ability to grow organically and position ourselves to benefit from the lift in the Bahamian economy

supports the resilience of the bank’s balance sheet and core income-generating assets.”

Ms Albury said the 2023 figures were achieved despite the surge in cost pressures, which saw general and administrative expenses alone increase by more than $8m - from $78.093m in 2022 to $86.357m this time around.

“As of December 31, 2023, non-interest expenses, excluding impairment expense reversals on financial assets, totaled $91.4m compared to $82.7m in 2022, reflecting a modest increase of 11 percent from the prior year,” she told Tribune Business.

“While we have managed our costs exceptionally well against a budget of $83.8m, expenses were impacted by several noncontrollable operating costs moving ahead of their budgeted expectations. The bank experienced licensing costs with the reintroduction of a business license fee on Authorised dealers (commercial banks) operating within The Bahamas; increased general insurance costs because of reinsurers repricing of the climatebased risks associated with operating in this (and neighbouring) jurisdictions; and increased costs of utility supplies, particularly the cost of electricity.

“The Business Licence fee is approximately $3m for 2023. We expect that its contribution will be the same for 2024, and have accounted for this business cost as part of our normal budgetary projections.” And those same cost pressures are unlikely to slacken in the current financial year.

“The key regulatory initiative for 2024 to impact the cost structure of the bank will be the risk in

Deposit Insurance Corporation (DIC) premiums,” Ms Albury said. “This doubles for the bank in 2024 and will add $800,000 in general and administrative costs to the bank.”

However, Commonwealth Bank expects “to maintain three cents per share as the quarterly dividend for 2024, and our objective is to maintain a dividend payout between 65 percent and 75 percent of net profits”, she added. “This is consistent with our pre-Hurricane Dorian, and pre-COVID-19, dividend payout levels.

“The first quarter of 2024 is pleasing, with both interest income and fee income showing movements above the same period in 2023. However, we are monitoring the general and administrative costs, which have firmed increases over the same period in 2023.

“We are aligned with the Central Bank’s outlook for 2024. Therefore, we continue to see opportunities for the bank to expand targeted loan segments, improve our interest income and explore opportunities to service business owners and individuals in their demand for improved electronic payment services, generating increased fee income for the bank.

“The 2024 outlook for the bank is favourable, with macroeconomic forecasts for the economy in 2024 indicating that the economic growth of the Bahamian economy will normalise towards historical averages.

The bank continues its plan to focus on the organic growth of our loan book and yields, delinquency management and improvements in how we service our customers, which we expect to sustain solid profits for 2024.”

PAGE 4, Monday, April 29, 2024 THE TRIBUNE fee

for

quarter

year

and the bank

to

income

the 2024 first

have exceeded prior

comparatives,

plans

maintain its

DEVELOPMENT BANK

AMID 91% CLAW BACK FALL FROM PAGE B1 JOB OPPORTUNITY Little Switzerland, the chain of luxury jewelry and watch stores across the Caribbean is looking for a Sale Supervisor Diamonds for the Nassau store. This role will be responsible for the rapidly growing Diamond department including person and Store sales, Merchandising, Store Presentation, Inventory, and team training. Must have experience and success in personally selling high end, luxury products, and currently authorized to work For immediate consideration, Please send resumes to HR@littleswitzerland.com with “Sales Supervisor, Diamond” in the subject line.

After the halving

By CHRIS ILLING CCO @ ActivTrades Corp

Bitcoin has already eaten up its gains from the previous trading week. Investors who got in because of last week’s much-hyped “halving” are seeing losses. On Friday last week, one unit of the oldest and most wellknown cryptocurrency cost just $64,045, which is $4,000 less than on the previous Sunday.

Halving halves the reward for verifying Bitcoin transactions. This event prompted so-called influencers to mistakenly speak of a “shortage” and proclaim new price targets for Bitcoin. Those who have followed the ‘buy’ recommendations of the Bitcoin pushers have recorded price losses since the halving. Investors can now focus more on monetary policy developments. The prospect that interest rates in

the US will remain high for the time being makes other investments attractive compared to Bitcoin, and is likely to dampen demand for Bitcoin in the medium term.

The recent price decline was also explained by an outflow from one of the new Bitcoin funds in the US. Since January, investors in the US have been able to purchase Bitcoin ETFs (exchange traded funds) and thus indirectly invest in the crypto currency. Since then, exchange-traded funds have been growing rapidly. Now money is apparently flowing out of individual funds again.

Since the record high on March 14, 2024, the price of

Bitcoin has plummeted by more than $10,000.

Wall Street, meanwhile, continued with the release of the next set of earnings, and investors had mixed results at the end of last week. Positive quarterly figures from Google’s parent company, Alphabet, and Microsoft ensured a conciliatory end to the week on Friday. Both companies impressed with significantly higher sales and profits. The Dow Jones Industrial Average recently gained 0.36 percent at 38,228 points. The technology-heavy Nasdaq 100 also gained 1.59 percent to 17,726 points.

Snap also rose rapidly by 30 percent. The parent company of the photo app,

Snapchat, impressed with a significant increase in sales in the past quarter. In addition to the technology giants, Intel also presented quarterly figures, but the semi-conductor company disappointed with its outlook for the current quarter. Most recently, Intel shares were down more than 9 percent.

The savvy investor will follow the next set of earning results very closely.

Temporary farmworkers get more protections against retaliation and other abuses under new rule

By OLGA R. RODRIGUEZ Associated Press

TEMPORARY farmworkers will have more legal protections against employer retaliation, unsafe working conditions, illegal recruitment practices and other abuses under a Labor Department rule announced Friday. Each year about 300,000 immigrants, mostly from Mexico, take seasonal jobs on U.S. farms. The new rule, which takes effect June 28, will target abuses experienced by workers under the H-2A program that undermine fair labor standards for all farmworkers.

Labor Secretary Julie Su said the rule aims to “breathe life” into existing worker protections.

“Our rule is meant to give H2-A workers more ability to advocate for themselves, to speak up when

they experience labor law abuses,” Su said at a vineyard in Santa Rosa, north of San Francisco. California has a vast agricultural industry, growing over a third of the country’s vegetables and nearly three-quarters of the country’s fruits and nuts and attracting a large number of farmworkers.

The Biden administration announced a proposal for the new rule in September, saying it would boost safety requirements on farms and raise transparency around how such workers are recruited, in order to combat human trafficking. The Labor Department is already required to ensure that the H-2A program doesn’t undercut the wages or working conditions of Americans who take similar jobs. Employers are required to pay minimum

U.S. wages or higher, depending on the region. They are also required to provide their temporary workers with housing and transportation. Reports of overcrowded farm vehicles and fatalities have increased as the number of guest farmworkers has risen, officials say. Transportation accidents are a leading cause of death for farmworkers.

The new rule will require farmers who employ H-2A workers to make sure the vans and buses they use to transport workers long distances — and that are often driven by tired workers — have seatbelts for all passengers.

The new rule also protects temporary agricultural workers from employer retaliation if they meet with legal service providers or union representatives at the

housing provided by the employer. It also protects them from retaliation when they decline to attend “captive audience” meetings organized by their employer.

And in a step intended to counter human trafficking, employers would be required to identify anyone recruiting workers on their behalf in the U.S. or foreign countries and to provide copies of any agreements they have with those recruiters.

Teresa Romero, president of United Farm Workers, said the rule will help prevent employers’ abuse because those found in violation of the new rule will not be allowed to use the program again. She said a requirement for employers to disclose contracts with their agents will make it easier to identify wrongdoers.

TEMPLE CHRISTIAN SCHOOL ENTRANCE

EXAMINATION

On Saturday, May 11, 2024, Temple Christian School will hold its Entrance Examination for students entering grades 7, 8, 9 and 10.

TIME: 9:00 a.m. to 12:00 p.m.

LOCATION: High School Campus, Shirley Street

Application forms are available at the High School Office and should be completed and returned to the school by Friday, May 10, 2024. The application fee is twenty-five dollars ($25).

For further information, please call telephone number: 394-4481/394-4484.

THE TRIBUNE Monday, April 29, 2024, PAGE 5

‘IMPROPER CONDUCT’ ATTORNEY IS RESCUED

Court action in 2018 to recover the funds, which resulted in now-Sir Ian Winder ordering that the full sum claimed be paid to Mr Deal.

In his ruling, the nowChief Justice noted how Mr Rolle’s defence switched from “banking challenges” to outstanding legal fees on the morning of the trial.

He branded the attorney’s defence as “untenable”, and described Mr Rolle’s deduction of VAT from the monies due to Mr Deal as “suspicious” because the property sale was a ‘net’ transaction where the purchaser - not Mr Deal as vendor - was to pay all fees.

Sir Ian’s ruling ultimately led to the appointment of a receiver over Mr Rolle’s law firm, which resulted in the

We’re hiring!

Tax Manager

sale of real estate to satisfy the $167,722 owed. Mr Rolle was eventually released from the receivership, but his legal woes did not end there as he was forced to admit “a rookie mistake” over another client’s separate complaint about his conduct to the Bahamas Bar Council.

Jean Phelps paid Mr Rolle a $5,500 retainer in July 216 to “reseal a grant of probate, advertise and prepare a deed of assent” in relation to real estate in Exuma that was owned by her late husband.

After receiving no progress report for two years, Ms Phelps was informed that probate - and her payment of $5,500 to Mr Rolle - were unnecessary because under joint tenancy, and being the surviving spouse, she automatically became owner of the property.

Having paid for legal services that were not required, she filed a complaint with the Bahamas Bar Council against Mr Rolle in 2018. After being summoned to appear before the Bar’s ethics committee on July 5, 2019, Mr Rolle admitted that he had made “a rookie mistake” but only did so when this was pointed out by the committee.

Then, after promising to refund $5,000 to Ms Phelps within 21 days but failing to do so, Mr Rolle’s case was elevated to the Bar’s disciplinary tribunal. Mr Rolle then bizarrely sent a $3,000 cheque, denominated in Bahamian currency, to Ms Phelps’ US attorney in September 2019 even though this would be impossible to clear in the US.

The $5,000 was not reimbursed until the disciplinary tribunal’s hearing two years later in August 2021. The Bar Council tribunal

The successful candidate will have the opportunity to use their experience in accounting and taxation to provide compliance and consulting services to partners from various jurisdictions, corporations and individual clients. The incumbent must be experienced with the tax consulting process and have the professionalism necessary for the effective diagnosis, development, and implementation of solutions for our clients’ tax needs. They will be responsible for a portfolio of clients on a day-today basis which will include planning, management of the team including review of work, liaison with key client staff and the management of the reporting process.

Essential Functions:

• Manage a portfolio of clients including planning, budgeting, WIP management, management of the team, allocation of resources, reviewing subordinates’ work and reporting

• Organize and execute client engagements while acting as a trusted business advisor and subject matter expert

• Provide superior consultative tax advice to help our clients achieve tax savings by pursuing creative tax strategies

• Conduct research and utilize analytical skills to enable fact-based decision making and to assist with the drafting of complex, well-structured communications in accordance with standard policies and procedures

• Supervise assignments of the tax team in both the local office and across the region as necessary

• Liaise with Deloitte colleagues from around the world to meet the needs of our clients

• Focus on managing the practice to include budgeting, profitability, strategy, developing capabilities, recruitment, training, competitor analysis and managing quality and risk

Minimum Qualifications and Experience:

• Bachelors in Accounting, Finance or related field with strong academic credentials

• Internationally recognized professional accounting or legal qualification

required: CPA, CA, ACCA, JD/LLM

• At least 4-5 years’ experience in a relevant tax practice including extensive technical and strong in-charge experience; at least 4 years’ experience at a Senior Associate level

• Demonstrates potential for the development of new business

Why Deloitte?

At Deloitte, in order to be an undisputed leader in professional services, we commit to:

• Providing our people with a supportive culture, rooted in our shared values and driven by our purpose, to make an impact that matters.

• Promoting a culture of inclusion, collaboration, well-being, and learning and development.

• Providing an equitable and transparent performance and career management experience.

• Providing increased agility and flexibility within our hybrid working model and opportunities for mobility across projects, businesses, and borders.

• Offering a competitive total compensation and rewards package along with a variety of benefits and programs to support you and your family’s needs including our well-being subsidy, paid leave, and YouTime.

We know we’re at our best when we look out for one another; prioritize respect, fairness, development, and well-being; foster an inclusive culture and embrace diversity in all forms. All qualified applicants will receive consideration for employment regardless of their background, experience, ability or thinking style. The preferred candidate will be subject to background screening by Deloitte.

All applications should be submitted online at: https://talentsourcing.deloitte.com/cbcapply.

Talent Deloitte Ltd.

2nd Terrace West Centreville Nassau N-7120 Bahamas

Telephone: (242) 302 4800

ultimately ordered that Mr Rolle be suspended from practicing as an attorney for six months, and that he pay the $1,000 costs of the proceedings initiated by Ms Phelps’ complaint. The attorney, though, appealed both the ruling and the punishment.

The Court of Appeal, in its ruling on Ms Phelps’ complaint, noted that the disciplinary tribunal determined Mr Rolle’s breaches of the legal profession’s code of conduct represented the “most serious and egregious sort” of violations.

The tribunal, in its findings, had said of Mr Rolle: “In taking money and expending effort towards a wholly unnecessary purpose, the attorney demonstrated a level of incompetence that cannot be ignored....

“Nothing short of full and immediate refund and written apology would have sufficed in the current circumstances for what is negligence at an alarming scale.... It is mystifying as to why funds wired to a client in US dollars would be paid by way of a Bahamian dollar manager’s cheque. If it is a legitimate error, it points to a further level of negligence and incompetence that goes to the very heart of this complaint.”

Mr Rolle, in his appeal, alleged that the disciplinary tribunal’s proceedings were “impressed with bias and breached the rules of natural justice”, while arguing that the punishment was “overly excessive”. He claimed that Sean Moree KC, the tribunal’s marshall, had a “vendetta” against but this was dismissed by the Court of Appeal as “wholly unmeritorious”.

“There is an allegation that the tribunal members

kept interrupting and badgering him. However, the instances of alleged interruptions and badgering that the appellant cites were genuine requests for clarification of his evidence which he chose to present orally,” the Court of Appeal’s unanimous verdict said.

“Third, and this is related to the allegation of badgering, the appellant alleges that the tribunal denied him an adjournment to present his case. This, too, is an unsubstantiated allegation.” The hearing transcript showed Mr Rolle concede

“that this was a case of mistake on his part that did not show a lack of integrity” as he urged that punishment be limited to a fine rather than suspension.

But, while the Court of Appeal upheld both the disciplinary tribunal’s verdict and punishment over Ms Phelps’ case, it did not do so with respect to the complaint with Mr Deal. In that instance, it only upheld the finding that Mr Rolle committed another “serious and egregious breach” of the attorney professional code of conduct.

The Court of Appeal dismissed all challenges to this verdict, including assertions by Mr Rolle and his attorney, Romona Farquharson, that the tribunal “was hostile and one sided against the appellant until the appearance of Damien Gomez QC. The tribunal constantly interrupted the appellant presenting the evidence”.

However, the Court of Appeal determined: “The appellant cited certain exchanges between members of the tribunal and himself in support of this ground..... I merely observe that these exchanges reveal legitimate requests from the

members of the tribunal to ascertain and/or probe the appellant’s case and the oral evidence he was presenting.

“The interactions of the members of the tribunal cannot, in my view, be viewed as hostile or one sided, nor do they provide any basis for an appeal.” However, while upholding the “improper conduct” verdict, the Court of Appeal decided to “set aside” the punishment that Mr Rolle be disbarred and struck-off the roll, instead sending it back to the Bar Council’s disciplinary tribunal for a fresh hearing on the matter.

“The appellant contends that the actions of the tribunal in this case were in breach of natural justice. This is because the tribunal found him guilty of professional misconduct and, at the same time, imposed the penalty of striking his name from the roll without hearing any arguments he may have had with respect to the mitigation of the penalty to be imposed upon him,” the Court of Appeal said.

“In the present matter, the tribunal did not hear nor entertain any submissions from the appellant with respect to the mitigation of the penalty to be imposed upon him. This was a breach of natural justice..... In the present matter, the appellant has not been found guilty of dishonesty but instead he has been found to have breached the code of professional conduct.

“This is not a case where an automatic striking out from the roll of attorneys was the inevitable result of a finding of a breach of professional misconduct. Therefore, as I stated before, this was a case where submissions in mitigation ought to have been entertained.... An attorney should normally be given a distinct opportunity to be heard or to make representations before a penalty is imposed.”

PAGE 6, Monday, April 29, 2024 THE TRIBUNE

FROM PAGE B1

FROM STRIKE-OFF

Superwash ‘bites bullet’ on $1.25m in upgrades

in early 2025 at a cost of around $600,000-$700,000.

And, revealing that Superwash’s revenues have rebounded to pre-COVID levels based on washing machine and dryer spins, the former minister of tourism and aviation said any top-line gains have been eroded by post-pandemic inflation that has left his and other businesses struggling to maintain margins.

“The only person benefiting from that is the taxman,”

Mr D’Aguilar joked of the revenue increases.

Explaining the rationale for the repaving roll-out, he told Tribune Business:

“We noticed our parking lots were looking extremely shabby. They’d been patched and patched and patched. We decided to let’s invest in improving the appearance of them and ensure there’s good drainage, proper car stoppers in place, the parking places are properly designated and delineated.

“We thought the time had come. They were making the overall look and appearance of the place look shabby. Your first impression of us is the outside of the building. That’s our first impression, and we felt it was necessary to bite the bullet.

“We started with Nassau Street and Boyd Road opposite Super Value. Then we did Wulff Road and Mackey Street opposite the police station, and now we’re doing the location at Prince Charles Drive and Fox Hill Road opposite Blanco Bleach. The next one on the list is Carmichael Road near Faith Avenue,”

Mr D’Aguilar continued “We started in January and want to get it done before the rains come. Hopefully by the end of this week we’ll have finished three. Then we will start Carmichael Road shortly thereafter. We’re probably investing about $750,000 across the four. Those

ones were in particularly bad shape. They were long overdue.

“It’s somewhat disruptive to operations. You want to keep them open, but your parking lot is being dug up and replaced. We try and get them done as quickly as possible... All this infrastructure, asphalt and paving, it’s a very complex process. You have to get the level right, and water to roll and drain in a proper manner into the drains. There’s a lot of curbing and egresses.

“Parking lots are a lot more complex than you think. Just throwing asphalt down, those days are long gone. You need deep wells so that the water doesn’t pool and degrade the asphalt.” Mr D’Aguilar said upgrades and reinvestment in the business have become routine, especially “changing out when they need to be changed out” when it comes to laundry equipment and machinery.

“We changed all our equipment at the Gibbs Corner location about two to three months ago,” he affirmed. “That was $500,000 of new equipment. We’ve been upgrading, replacing at every location. We depreciate all equipment over a period of time. When it gets to the end of its depreciable life, we replace it....

“Gibbs Corner was a brand new location in 2014, and we replaced its equipment in 2024. It’s ten years later, and we’ll probably

do the Charles Saunders location upgrades next year; early 2025 some time. Charles Saunders is the same way as Gibbs Corner. We opened it in October 2014 and so we will change out all the equipment in early 2025. That will probably be $600,000-$700,000 because it’s a much larger location.

“We think it’s good corporate policy to replace the equipment at the end of its depreciable life rather than let it deteriorate and impact customer service.”

Mr D’Aguilar said Superwash rarely changes all the equipment at one laundromat at same time in bid to ensure the location remains open and customer disruption is kept to a minimum, instead opting to switch out particular categories such as washers and dryers.

“In my business, deprecation is a real expense,”

Mr D’Aguilar told Tribune Business. “In most businesses, depreciation is a non-cash item, but we can’t let equipment at any location deteriorate or we will get backlash. Our strategy is to stay on top of our game.

“We did not buy any equipment in 2020 or 2021. In that particular instance, the life of the equipment was extended beyond it’s depreciable life. We had to wait for the business to come back until we could replace the equipment again. We had to cut expenses and limp on until cash flow caught back up

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

and now it’s catching up again.”

Mr D’Aguilar disclosed that Superwash’s annual capital investment is typically between $1m-$1.5m, with the likes of tiles and light fixtures also changed out to give its locations a “more modern feel”. He added: “It’s questionable, at the end of the day, whether people will decide to go to Superwash because it has improved its locations.

“It will not make a difference by itself, but combined with other upgrades it will suggest we have maintained and kept up our business, and people will want to

frequent it.” The Superwash principal said sales, or revenues, have recovered to pre-pandemic levels but prices have increased to keep up with inflation that has “the cost of a machine” by some 40 percent.

“The indicator we look at is: Are our machines spinning more?” Mr D’Aguilar explained. “They’re probably up 1-2 percent over 2019. The spins are back to pre-pandemic levels, and because we’re charging a lot more for spins it means our revenues up.

“But all our expenses are up. We’re paying more for staff, paying suppliers more, the cost of equipment is up. The only person benefiting from that is the taxman. We’re just trying to maintain our margins. Our revenues are up because we have had to put our prices up. It isn’t more business. That’s flat over 2023.... “If you’re going to be in business and remain on top of your game you’ve got to invest. There is a filthy and vicious rumour going around that laundry equipment is duty-free. It’s absolutely not. We’re paying the full 45 percent. I’m always asked if we’re getting it duty-free but we’re not.”

thence in a direction of N 272° 22' 15" for a distance of Forty-six and Twenty-seven Hundredths (46.27) Feet to a point, thence in a direction of N 312° 04' 15" for a distance of Thirty-six and Fifty-two Hundredths (36.52) Feet to a point, thence in a direction of N 359° 24' 59" for a distance of One Hundred and Nine and Thirty-two Hundredths (109.32) Feet to the point of origin.

The said lot of land is bounded on the North by Lot No. 367 of the said subdivision on the EAST by Lot Number 365 of the said subdivision on the SOUTH by Lot Number 363 of the said subdivision and on the WEST by B.E.C. Way Leave.

The said lot of land has such position, shape, dimensions and boundary marks as shown on plan.

AND

IN TIIE MATTER of the Quieting Titles Act 1959

AND

IN TIIE MATTER of the Petition of REVILETA

VIRGINIA WALLACE

NOTICE OF PETITION

The Petition of REVILETA VIRGINIA WALLACE of the Island of New Providence, one of the Islands of the Commonwealth of The Bahamas in respect of:

"IN TIIE MATTER OF ALL THAT piece parcel or lot of land (hereinafter referred to as the said parcel of land) containing by admeasurement Nine Thousand Eight Hundred and Thirty-three (9,833) Sq. Ft. or thereabouts being designated Lot Number Three Hundred and Sixty-six (366) in the subdivision known as "Stapledon Gardens" recorded in the Department of Lands and Surveys as 5953 New Providence and situate on the Southwestwardly of Walrus Road and approximately 180 ft. West of Hampden Road in the Western District of the Island of New Providence in the Commonwealth of The Bahamas. The said parcel of land is more accurately described as follows:

Commencing at a point (hereinafter referred to as the point of origin) coordinated N 2.772, 822.59 (m) E 259, 370.93 (m) running in a direction ofN 92 ° 22' 15" for a distance of Eighty and Zero Hundredths (80.00) Feet to a point, thence in a direction of N 82 ° 22' 15" for a distance of One Hundred and Thirty-two and Fifty Hundredths (132.50) Feet to a point, thence in a direction ofN 272° 22' 15" for a distance of Forty-six and Twentyseven Hundredths (46.27) Feet to a point, the.nee in a direction of N 312 04' 15" for a distance of Thirty-six and Fifty-two Hundredths (36.52) Feet to a point, thence in a direction of N 359° 24' 59" for a distance of One Hundred and Nine and Thirty-two Hundredths (109.32) Feet to the point of origin. The said lot of land is bounded on the North by Lot No. 367 of the said subdivision on the EAST by Lot Number 365 of the said subdivision on the SOUTH by Lot Number 363 of the said subdivision and on the WFST by B.E.C. Way Leave.

The said lot of land has such position, shape, dimensions and boundary marks as shown on plan.

NOTICE I S HEREBY GIVEN that REVILETA V IRG INIA W ALLACE claims to be the owner in f ee simple in possession of t h e said land and has made application to t he Supreme Court of the Commonwealth of The Bal1amas pursuant to the Quieting Titles Act, 1959 (Chapter 393) to have their title to the said land investigated and the nature and extent thereof determined and declared in a Certificate of Title to be granted by the Court in accordance with the provisions of the said Act.

AND TAKE NOTICE that copies of the Petition and a plan of the said land may be inspected during normal office hours at the following places:

The Civil Registry of the Supreme Court of the Commonwealth of The Bahamas, British American Building, George Street, on the Island of New Providence, one of the Islands of the said Commonwealth of The Bahamas.

The Chambers of Clement T. Maynard & Company, G K. Symonette Building, Shirley Street, in the City of Nassau, New Providence aforesaid.

AND TAKE FURTIIER NOTICE that any person having dower or right t o dower, an adverse or a claim not recognized in the Petition shall by the 3 01h day after the last day on which the advertisement appears in the papers file in the Supreme Court and serve on the Petitioner of their Attorneys and Adverse Claim in the prescribed form supported by Affidavit.

FAILURE OF ANY PERSON to file and serve an adverse daim on or before the 30 th day after the last day on which the advertisement appears in the papers will operate as a bar t o such claim.

Dated the 22 nd day of March, A.O. 2024.

CLEMENT T. MAYNARD & COMPANY Chambers G. K. Symonette Building, Shirley Street Nassau, The Bal1amas Counsel & Attorneys for the Petitioner.

THE TRIBUNE Monday, April 29, 2024, PAGE 7

FROM PAGE B1

COMMONWEALTII OF TIIE BAHAMAS IN TIIE SUPREME COURT Common Law & Equity Division 2022 CLE'/qu1/01782 IN THE MATTER OF ALL THAT piece parcel or lot of land (hereinafter referred to as the said parcel of land) containing by admeasurement Nine Thousand Eight Hundred and Thirty-three (9,833) Sq. Ft. or thereabout being designated Lot Number Three Hundred and Sixty-six (366) in the subdivision known as "Stapledon Gardens" recorded in the Department of Lands and Surveys as 5953 New Providence and situate on the southwestwardly of Walrus Road and approximately 180 ft. west of Hampden Road in the Western District of the Island of New Providence in the Commonwealth of The Bahamas. The said parcel of land is more accurately described as follows: Commencing at a point (hereinafter referred to as the point of origin) coordinated N 2.772, 822.59 (m) E 259, 370.93 (m) running in a direction of N 92 ° 22' 15" for a distance of Eighty and Zero Hundredths (80.00) Feet to a point, thence in a direction of N 82 22' 15" for a distance of One Hundred and Thirtytwo and Fifty Hundredths (132.50) Feet to a point,

GBPA bracing for arbitration notice

With the 30-day deadline imposed by the Government for the GBPA to pay-up having now expired, and no such payment having been made, arbitration proceedings appear all but inevitable as indicated by Prime Minister Philip Davis KC.

And this newspaper can disclose that the Government is directing “a legal force of hurricane strength” to lead its legal strategy.

That perhaps unfortunate description, given Freeport’s recent history, is the billing given to Harry Matovu KC, the UK-based barrister from Brick Court Chambers, who sources said was present at last week’s negotiations and will head the Government team in its arbitration battle.

He was described by the Legal 500 publication in 2021 as “a legal force of hurricane strength, analytical skills combined with creativity and advocacy, topped by the smoothest and most highly lethal approach to cross-examination that I have ever experienced”.

An arbitration and public international law specialist, he was nominated as Silk (KC) of the Year for international arbitration in the Legal 500 Awards in 2020 and 2022, as well as arbitrator of the year in the Legal 500 Bar Awards 2023.

As previously revealed

by Tribune Business, the Government has also hired UK law firm, Simons Muirhead Burton, to act as Mr Matovu’s instructing and supporting solicitors.

Tribune Business understands that, once the formal notice of arbitration is served by the Government on the GBPA, both parties will then move to appoint the three-strong panel of arbitrators who will hear the dispute and ultimately determine whether the GBPA owes the Government anything and, if it does, how much.

Both the Government and GBPA will then select one arbitrator each, with the two chosen then picking a chairman to head the arbitration panel from a shortlist drawn up and approved by both parties. This is likely to be the start of what could be a long, drawn-out legal process with both sides having to exchange evidence via the discovery process and ‘settle the record’ to determine what will be presented at arbitration.

This process could take months, if not years, and questions were yesterday being asked whether - given the “huge public interest” and issues generated by the dispute - the Government will agree to invoke the waiver in the latest Arbitration Act that allows both sides to agree private hearings should be made public. Besides the potential impact on Freeport’s very

future, and the potential fall-out for the GBPA’s 3,000-plus business licensees and residents, the very nature of the Government’s $357m payment demand raises questions involving the spending of public/ taxpayer monies and the collection of taxes in the Port area.

“They want transparency for the benefit of their licensees and residents,” one contact, speaking on condition of anonymity, said of the GBPA. “They don’t understand why the Government would not readily agree to transparency. That is a very important question that needs to be answered by the Government sooner rather than later/ “This should be out in the open. There should be nothing to hide. The PwC report, there’s no reason for it to be kept confidential. It’s about the expenditure of public money and revenue collected. There’s absolutely no good reason for the Government to have that covered by a veil of secrecy if they are confident it is accurate.”

The PricewaterhouseCoopers (PwC) accounting firm was hired by the Government to analyse, and calculate, just how much the GBPA owes the Public Treasury for public spending in Freeport that exceeds the tax revenues generated by the city. The GBPA denies that anything is owed, alleging that Freeport contributes around

$200m annually in tax revenues.

The Government is seeking reimbursement under section one, sub-clause five, of the Hawksbill Creek Agreement, Freeport’s founding treaty, which stipulates that it can demand payment from the GBPA for providing “certain activities and services” if the costs involved exceed certain tax revenue streams generated in the city.

The original 1955 clause required the GBPA to provide rent-free office and living accommodation to government employees involved in the “the maintenance of law and order, the administration of justice, the general administration of Government, the collection of Customs Duties and other revenue and the administration of the Customs Department the administration of the Immigration Department, Post Offices” and other functions to be mutually agreed.

The GBPA was also required to “reimburse the Government annually” within 30 days of detailed accounts being presented by the latter, but only if “Customs Duties and emergency taxes received by the Government in respect of goods entered or taken out of bond at the Port Area are less than the amount” spent by the Government.

Multiple sources have questioned why the Government has waited until now - some 60 years or six

CBH BAHAMAS

decades - to try and enforce a Hawksbill Creek Agreement clause dating from the 1950s and 1960s. They argued that it smacked of the Davis administration using this as leverage to force the Haywards and St Georges, the GBPA owners, to sell and exit after they declined to accept the Government’s purchase offer. And the Hawksbill Creek Agreement clause at the centre of the dispute may not be all it seems. It was last amended in 1960, when Freeport was five years-old, the city’s development very much in its infancy, and the only revenues earned by the Public Treasury at the time from the Port area were Customs duties. While it indeed stipulates that the Government should not spend any more

in the Port area than it earns in revenues, and that any excess costs over and above the latter should be reimbursed by the GBPA, that clause has not been amended to account for either the Freeport of today or multiple taxes that have been added since then. Thus VAT, departure taxes and a host of other revenue streams have to be factored into the calculation of whether the Government is spending more than it is earning in Freeport.

Several sources have suggested that, rather than go to arbitration, the two sides should instead negotiate amendments to section one, sub-clause five of the Hawksbill Creek Agreement to ensure it is fit for purpose and attuned to the modern world’s realities.

CBH BAHAMAS

PAGE 8, Monday, April 29, 2024 THE TRIBUNE

Smith KC and Robert Adams KC.

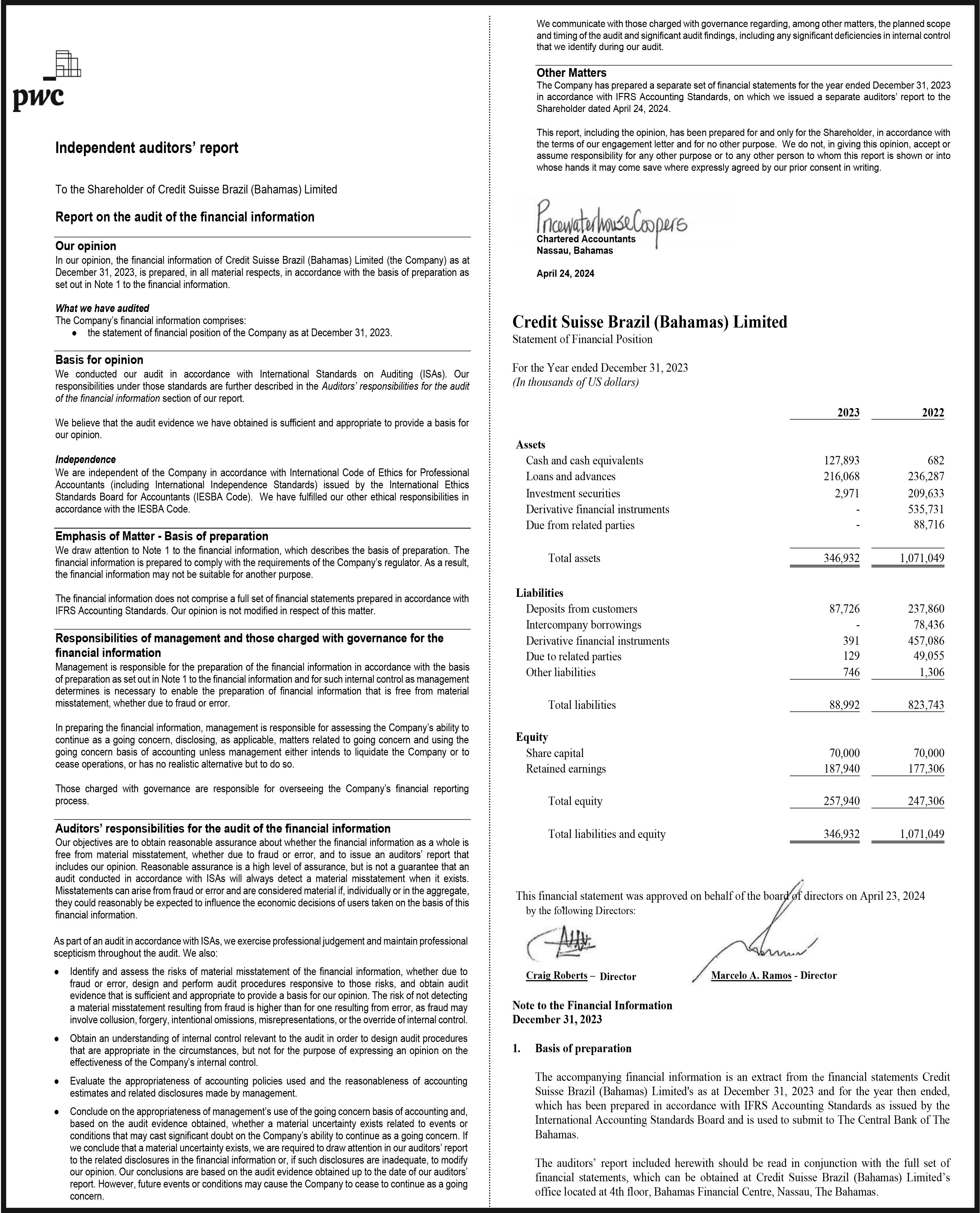

FROM PAGE B1 Phone: 1 242 393 2007 Fax: +1 242 393 1772 Internet: www.kpmg.com.bs ©2024 KPMG (Bahamas) Ltd., a Bahamian partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements (continued) influence the economic decisions of users taken on the basis of these consolidated financial statements. As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control. • Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Group to cease to continue as a going concern. Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. • Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. April 26, 2024 3

LTD. Consolidated Statement of Financial Position December 31, 2023, with corresponding figures for 2022 (Expressed in thousands of Swiss Francs) 2023 2022 Assets Cash 4 11 Due from banks 582,222 206,151 Financial investments 1,754,069 690,015 Derivatives 1,582 1,909 Due from customers 99,757 92,680 Prepaid expenses and other assets 472 531 Property and equipment 576 584 Intangible assets 28 3 Total Assets 2,438,710 991,884 Liabilities and Equity Liabilities Due to customers 751,150 623,353 Due to banks 1,577,715 300,799 Derivatives 1,554 1,884 Accounts payable and accrued liabilities 12,056 4,406 Provision 87 –Total liabilities 2,342,562 930,442 Equity Share capital 45,000 30,000 Retained earnings 51,148 31,442 Total equity 96,148 61,442 Total Liabilities and Equity 2,438,710 991,884 See accompanying notes to consolidated financial statements. These consolidated financial statements were approved on behalf of the Board of Directors on April 26, 2024 by the following:

LTD. Notes to Consolidated Financial Statements Year ended December 31, 2023 (Expressed in thousands of Swiss Francs) 1. General Information CBH Bahamas Ltd. (“the Bank”) formerly CBH (Bahamas) Ltd., was incorporated under the laws of the Commonwealth of The Bahamas on December 19, 1994. The Bank is licensed under The Bahamas Banks and Trust Companies Regulations Act and holds a public banking license to provide a full range of banking, trust and corporate management services. On October 29, 2009 the name of the Bank was changed from Banque SCS Alliance (Nassau) Ltd. to CBH (Bahamas) Ltd. to align with its parent’s name change. The Bank is a wholly-owned subsidiary of CBH Compagnie Bancaire Helvétique S.A., Geneva, Switzerland (“the Parent”). The Parent’s majority shareholder is CBH Holdings SA (“the Ultimate Parent”). The Bank has four wholly-owned subsidiaries, Remus Investments Ltd., Romulus Investments Ltd., Castor Management Ltd. and Pollux Corporate Services Ltd. (collectively described as nominee companies), all of which were incorporated and licensed under the laws of the Commonwealth of The Bahamas. The subsidiaries act as nominee companies for the Bank and its clients and carry on no other trust business. The consolidated financial statements include the accounts of the Bank and its wholly owned subsidiaries (together, “the Group”) of which the assets and liabilities of the subsidiaries were not material The registered office of the Bank is located at CBH House, East Bay Street, P.O. Box N-1724, Nassau, Bahamas. The accompanying consolidated statement of financial position is an extract from the Bank’s consolidated financial statements. The auditors’ report included herewith should be read in conjunction with the full set of consolidated financial statements, which can be obtained at, or requested in writing from, the Bank’s registered office, CBH House, East Bay Street, Nassau, Bahamas. KPMG (Bahamas) Ltd. PO Box N-123 Montague Sterling Centre 13 East Bay Street Nassau, Bahamas INDEPENDENT AUDITORS’ REPORT To the Shareholders of CBH Bahamas Ltd. Report on the Audit of the Consolidated Financial Statements Opinion We have audited the consolidated financial statements of CBH Bahamas Ltd. and its wholly owned subsidiaries (together, “the Group”), which comprise the consolidated statement of financial position as at December 31, 2023, the consolidated statements of comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising material accounting policies and other explanatory information. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at December 31, 2023, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (“ISAs”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the International Ethics Standards Board for Accountants International Code of Ethics for Professional Accountants (including International Independence Standards) (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS Accounting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Group’s financial reporting process. Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to

Biden officials indefinitely postpone ban on menthol cigarettes amid election-year pushback

By MATTHEW PERRONE and ZEKE MILLER Associated Press

PRESIDENT Joe Biden's administration is indefinitely delaying a long-awaited menthol cigarette ban, a decision that infuriated anti-smoking advocates but could avoid a political backlash from Black voters in November.

In a statement Friday, Biden's top health official gave no timeline for issuing the rule, saying only that the administration would take more time to consider feedback, including from civil rights groups.

"It's clear that there are still more conversations to have, and that will take significantly more time," Health and Human Services Secretary Xavier Becerra said in a statement.

The White House has held dozens of meetings in recent months with groups opposing the ban, including civil rights organizers, law enforcement officials and small business owners. Most of groups have financial ties to tobacco companies.

The announcement is another setback for Food and Drug Administration officials, who drafted the ban and predicted it would prevent hundreds of thousands of smoking-related deaths over 40 years. The agency has worked toward banning menthol across multiple administrations without ever finalizing a rule.

"This decision prioritizes politics over lives, especially Black lives," said Yolonda Richardson of the Campaign for TobaccoFree Kids, in an emailed statement. "It is especially disturbing to see the administration parrot the false claims of the tobacco industry about support from the civil rights community."

Richardson noted that the ban is supported by groups including the NAACP and the Congressional Black Caucus. Previous FDA efforts on menthol have been derailed by tobacco industry pushback or competing political priorities. With both Biden and former President

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, KEIRON KENTHON

JOHNSON of P.O. Box FH 14332 Roland Avenue, Nassau, The Bahamas intend to change my name to KEIRON KENTHON BROWN. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

TRAVERTINE FINANCE LTD.

LIQUIDATOR’S NOTICE

Pursuant to Section 138(6) of the International Business Companies Act

NOTICE is hereby given that TRAVERTINE FINANCE LTD., a company registered under the International Business Companies Act, has been dissolved and struck off the Register as of the 27th day of February 2024.

Sterling (Bahamas) Limited Liquidator

Donald Trump vying for the support of Black voters, the ban's potential impact has been scrutinized by Republicans and Democrats heading into the fall election.