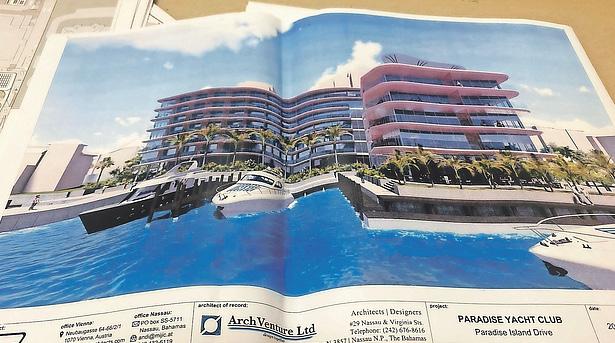

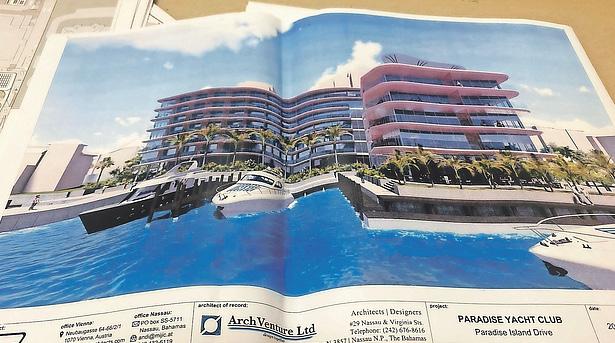

RESIDENTS last night argued that plans to transform the former Paradise Harbour Club site into a seven-storey hotel represent an “overdevelopment” that will impact quality of life and devalue their properties.

Joshua Brooks, representative for HotelConsult Bahamas, pledged after the Town Planning Committee’s public hearing on the project that the developer will “do everything we can” to address the concerns of neighbours and

Opposition challenging $133m fund ‘draw down’

other Paradise Island residents as it seeks to forge a “partnership” approach to make the development a success.

“We are glad the community came out this evening to learn more about the project and voice their concerns,” he said. “We look forward to continuing to be a constructive member of the Paradise Island community.

“Residents can rest assured that we will do everything we can to resolve their concerns where possible, and hope to work in partnership with the community to make the project a success to the benefit of Paradise Island, our existing and future Bahamian workforce and The Bahamas as a whole.” Neighbours voiced concerns over the extra traffic the development will generate in a residential area of Paradise Island. They also expressed opposition to the proposed rezoning of one of HotelConsult’s land parcels, lot 13, from residential to commercial to facilitate a 74-space parking facility. A resident of the Shangri-La Condominiums said the planned resort should not be given permission to

THE Opposition yesterday urged the Government to “focus its energies” on moving Freeport’s $2bn investments from approval to jobs while agreeing the Grand Bahama Port Authority (GBA)

By NEIL HARTNELL Tribune Business

THE Opposition’s finance spokesman yesterday challenged whether the Government may have violated public finance laws by drawing on $133m from its “sinking funds” to pay debts coming due.

Kwasi Thompson, former minister of state for finance under the Minnis administration, told Tribune Business that the Government’s 2023-2024 fiscal second quarter and half-year report reveals a more than $190m ‘reversal’ of its “sinking fund” strategy as set out in last May’s Budget. That, as confirmed by this newspaper, showed the Davis administration planned to expand the total assets held in its four “sinking” funds by almost $60m during the 12 months to end-June 2024. Yet it has instead reduced, or drawn down on, these assets by $132.7m “for the servicing of debt obligations” during the first six months of the 2023-2024 fiscal year. Mr Thompson argued to this newspaper that this represents a likely breach of section 56 in the Public Finance Management Act, which the Davis administration brought to the House of Assembly in 2023. This stipulates in clause two that “the minister [of finance] shall, as part of the annual budget, disclose the particulars of government securities and loans to be redeemed from the sinking funds”.

By NEIL HARTNELL

over the payment demand, describing it as “argumentative, combative and impolitic” and likely to lead to a complete breakdown of what remains of the relationship between the two parties.

Suggesting that the late Sir Jack Hayward and Edward St George, the

current shareholders’ predecessors, would “never have engaged in such public high jinks”, Mr Mitchell warned that the very public row between the two sides over the payment demand - which will almost certainly have to be determined via arbitration - threatens to “irretrievably damage” the value of the GBPA and its Port Group Ltd affiliate. “The Grand Bahama Port Authority astounded

me yesterday by issuing a statement directly in the face of the Government,” he blasted. “The statement was ill-advised, argumentative, combative, impolitic and injudicious.

business@tribunemedia.net TUESDAY, APRIL 9, 2024

the lot as its commercial use will devalue neighbouring

Atlantis non-compliant on redundancy notice AN ATLANTIS doorman, who lost his claim for wrongful and unfair dismissal after alleging he was victimised, has been awarded an extra 30 days’ pay because the resort was a day late in complying with the law. Rionda Godet, the Industrial Tribunal’s vicepresident, while finding that Kevin Lightbourne was made redundant for legitimate reasons also ruled that the Paradise Island property breached the Employment Act provision mandating that it give the minister of labour (then Keith Bell) two weeks’ notice when 20 or more workers are to be terminated. Her March 19, 2024, verdict disclosed that Mr Lightbourne was among 170 workers set to be By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net Mitchell: GBPA ‘most important generational fight since 1973’ THE Government’s battle with the Grand Bahama Port Authority (GBPA) was yesterday branded “the most important fight in a generation since Independence” by the PLP’s chairman. Fred Mitchell, in his daily voice note, again accused Freeport’s quasi-governmental authority and its owners, the Hayward and St George families, of “abandoning” Grand Bahama International Airport post-Hurricane Dorian by dumping responsibility for its rebuilding and associated multi-million costs on the Government. This led several examples cited by Mr Mitchell in a bid to show how the GBPA and its shareholders have failed to live up to their Hawksbill Creek Agreement obligations to maintain and develop Freeport, thus leaving the Davis administration with no choice but to issue its $357m payment demand in a bid to force their exit. The Fox Hill MP, who is also minister of foreign affairs, pronounced himself “astounded” by the GBPA’s statement hitting back “directly in the face of the Government”

convert

properties.

Tribune Business Editor

SEE PAGE B4

nhartnell@tribunemedia.net SEE PAGE B5

Editor nhartnell@tribunemedia.net SEE PAGE B4

needs new ownership. Kwasi Thompson, the Free National Movement’s (FNM) finance spokesman, told Tribune Business the party backs fresh investors with the necessary vision and capital taking equity positions in Freeport’s quasi-governmental authority but does not support how the Government is trying to drive change. Suggesting that there were multiple “options” to achieve the new investment and ideas that Freeport desperately needs, he also argued that the GBPA’s 3,000-plus licensees should collectively gain an ownership interest. New investors, the east Grand Bahama MP added, could either replace or join the Hayward and St George families, with the Opposition hinting it would take a more collaborative approach if elected. Speaking after the Government formally demanded that the GBPA pay $357m to reimburse it for the cost of providing public services in Freeport over and above tax revenues generated by the city between 2018 and 2022, Mr Thompson said the situation reminded him of the shareholder battle between the Haywards and St Georges that was fought more than a decade ago. Opposition backs GBPA owner change - but not Gov’t method By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B3 SEE PAGE B2 Residents voice objections to new PI resort proposal By FAY SIMMONS Tribune Business Editor jsimmons@tribunemedia.net ATLANTIS RESORT AND CASINO KWASI THOMPSON FRED MITCHELL PARADISE YACHT CLUB RENDERING $5.60 $5.61 $5.75 $5.96

New highs

By CHRIS ILLING CCO @ ActivTrades Corp

Since the beginning of February, the price of gold has been rushing from one record to the next. With his statements about possible interest rate cuts, the head of the US Federal Reserve, Jerome Powell, is now driving the rally further. Thus the record run on gold prices continues unabated. On Friday, the precious metal rose to $2,329 (2,146 euros) per troy ounce (around 31.1 grams) in New York. The prospect of interest rate cuts by the US Federal Reserve (Fed) this year continues to provide a tailwind. In addition, central

banks worldwide continue to buy the precious metal. As the latest data from the World Gold Council industry association shows, central banks continued to increase their gold holdings in February for the ninth month in a row. China dominated the purchases, but India and Kazakhstan were also keen buyers.

Mr Powell confirmed last Wednesday that the US central bank should begin lowering key interest rates “at some point this year”. Lower interest rates are

generally positive for precious metals, which do not pay interest.

Given the recent strong economic data, there is still uncertainty as to when the US Federal Reserve will lower the key interest rate. Better-than-expected developments in the US labour market underlined investors’ fears that the US Federal Reserve could take longer than hoped to cut interest rates. An interest rate hike is no longer expected in July but, rather, in September.

Labour places four extra services online

THE Government’s labour director yesterday said his department has placed an additional four services online in a bid to enhance the efficiency of public services.

Howard Thompson said the extra Department of Labour Services were launched on the MyGateway Platform on March 4, 2024.

The US economy created significantly more jobs in March than expected. Some 303,000 jobs were added outside of agriculture, the US Labour Department announced on Friday. Analysts on average had only expected 214,000 new jobs.

Gold has been surging since the beginning of March, and set a price record every day last week.

Investors are betting that gold prices will benefit from the Federal Reserve’s upcoming interest rate hike.

The gold price is receiving additional support from

geopolitical risks, such as the Middle East and Ukraine.

However, gold’s rally is also surprising some market observers because real US interest rates remain high, which is usually detrimental to gold.

The price of silver is also continuing to rise and reached its highest level in around three years at $27.49 per troy ounce last Friday. But not all precious metals had a stellar week. Palladium experienced a 1.7 percent decrease, dropping to $1,003.50 per ounce, and was set for a weekly downturn. The savvy investor must consider many aspects if he/she wants to get out or join the rally.

Recalling how Freeport, and investor confidence in the city, was undermined by that battle, he added that the present confrontation between the Government and GBPA threatens to inflict similar harm. “I think everyone is very concerned. We in the Opposition are extremely concerned, and I think everyone in Grand Bahama ought to be very concerned,” Mr Thompson said. “Again, it reminds us of the previous public fight involving the families concerning the GBPA. The families went to court, and investment suffered. Investor confidence suffered.

I think the Government should be more focused on any investor that has a proposal for Grand Bahama that benefits Grand Bahama.

Mr Thompson said the new MyGateway online services include new trade union registration; the transfer of trade union licence; trade union document requests; and the report of trade disputes.

He added that, on Friday, April 12, 2024, the Department of Labour in partnership with MyGateway will be hosting a registration drive between 9am and 1pm at its Rosetta Street location. The event is designed to expand the accessibility of labour services by assisting

“These four services were miraculously designed to streamline operations, enhance efficiency and, more importantly, augment accessibility for trade unions, their members and employees and employers,” he = said yesterday.

“Approval should be given, and they must be focused on moving those investments from the approval phase to shovelsin-the-ground and creating jobs in the shortest possible time. That’s where their energies and focus should be, creating jobs. It’s no good touting $2bn in investments if you can’t progress them from approvals to creating additional jobs.”

Mr Thompson, while suggesting that the Opposition does not agree with the Government’s approach of head-on confrontation with the GBPA, nevertheless said in relation to the latter: “We also believe that there should be a change in ownership that provides the vision and resources that will benefit the island in the long-term.”

When asked what the FNM would do differently

individuals who may not have access to a mobile device, Internet connection or may experience challenges using their mobile devices with signing on to the platform.

Those persons interested in attending are required to bring a Bahamian passport or NIB Smart Card to register on the MyGateway portal. Also attending the press conference were registrar of trade unions, Van Delaney; assistant director of labour, Margo Garrett; and ICT specialist from the Digital Transformation Unit, Tajh Seymour.

to achieve this result, Mr Thompson said: “First of all, we should sit down with the GBPA and make our position very clear that there ought to be a change of ownership that includes persons who have a shared vision and also the resources to make that vision a reality. “That may include bringing in persons as well as changing persons. That’s the approach that ought to be taken at this point. The way they are doing this reminds me and a lot of residents of Grand Bahama of the very public fight the families had that created challenges with investor confidence and the city suffered. “We also need to look at bringing the licensees into a more active role. We need to listen to the concerns of the licensees and I believe that when we look

at the ownership that also should include a portion to the licensees, and that also should include persons who have the vision and persons who have the resources.”

Asked whether the Opposition would seek an exit for the GBPA’s existing owners, the Hayward and St George families, Mr Thompson replies: “That could include bringing in new persons and the existing shareholders remain, and that could include changing out the existing owners. There are different options available. “The focus should be on making sure these existing investments move from the approval stage to the job creation stage. That’s where the energy, focus and time should be placed, and that’s what the people of Grand Bahama would like to see. They’d like to see this $2bn of investment translate into jobs, and that’s where the focus should be.”

The Prime Minister’s Office, responding to GBPA push back on its payment demand, countered by sticking to its position that Freeport’s quasi-governmental authority is not living up to its obligations under the Hawksbill Creek Agreement which has

forced the Governmentvia the Bahamian taxpayer - to step in and incur costs totalling hundreds of millions of dollars that must now be reimbursed.

Accusing the GBPA and its owners of seeking to “muddy the waters”, it added: “The Grand Bahama Port Authority has distinct obligations under the Hawksbill Creek Agreement. Those obligations have not been met, and suffering in Freeport is widespread. “The people of The Bahamas have been paying the bill for services that are legally the responsibility of the Port Authority. Acting under the law, the Government is seeking reimbursement on behalf of the Bahamian people.”

The Prime Minister’s Office confirmed that the PricewaterhouseCoopers (PwC) accounting firm helped determine that the Government was owed $357m by the GBPA for the financial years 2018 to 2022, based in clause 1(5) (c ) of the Hawksbill Creek Agreement.

This, it said, “requires the Port Authority to reimburse the Government within 30 days of the

presentation of a detailed account of the costs associated with providing services and infrastructure which are the legal responsibility of GBPA... Attempts to distract or muddy the waters do not change the legal obligations of the Port Authority. The people of The Bahamas cannot bear their burdens any longer”. The GBPA, though, argued: “As it stands, the shareholders have found it necessary to regularly subsidise the Port Authority in the management of the city from their own pockets to the tune of many millions of dollars each year. Despite this, the economy and standard of living in the Port area remains better than the central government managed areas of West End and East Grand Bahama.

“This claim has sadly created uncertainty for the investment climate of Grand Bahama, which has the potential to undermine the economy as it is just beginning its resurrection from a series of devastating hurricanes, most recently, the hugely destructive Dorian, as well as the COVID-19 pandemic.

“Central government’s co-operation is required. Continued hostility towards the shareholders of the Port Authority is counter-productive and unnecessary. Again, we urge central government to withdraw its unjustified claim and let us jointly resolve the issues in good faith. This is what the residents, licensees and investors in the Port Area deserve.”

PAGE 2, Tuesday, April 9, 2024 THE TRIBUNE

A PRESS conference was held at the Department of Labour on Monday, April 8, 2024, to announce the launch of four additional Department of Labour Services on the MyGateway Platform. Pictured from left: Assistant Director of Labour, Margo Garrett; Registrar of Trade Unions, Van Delaney; Director of Labour, Howard Thompson and ICT Specialist, Digital Transformation Unit, Tajh Seymour.

Photo:Llonella Gilbert/BIS

FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY!

REGULATORS yesterday confirmed that contractors clearing the site for Wynn Development’s 14-storey Goodman’s Bay penthouse project have mistakenly cut down a protected tree species.

Speaking to Tribune Business after the Department of Forestry conducted an onsite visit, Danielle Hanek, its director, said a protected Tamarind tree was cut down and its roots also removed. She added that the department is now reviewing the incident and is “formulating options for mitigation”.

Randy Hart, Wynn Development’s vice-president, could not be reached for comment.

Last week, the Department met with the developers and the

Department of Environmental Planning and Protection (DEPP) to determine if Wynn’s application for certificate of environmental clearance (CEC) mentioned removing the tree.

Ms Hanek said then: “I have gotten a report but I haven’t had a chance to do a site visit to assess it myself for the department. So that’s what we’re doing tomorrow. “Because we have to speak with DEPP to see what their CEC involves. And then if it’s the case that they had a wild tamarind there, they would have needed a permit. But our records state that they don’t have a permit. So, I need to do a site assessment to determine that.”

Ms Hanek confirmed that Wynn has not secured a permit to remove the protected tree and, if they were found to be in violation of the Forestry Act and its accompanying regulations

by cutting down the tree without permission, the developers could face fines of up to $25,000, two years’ imprisonment or both.

She said: “If they would be in violation of that, we would then go through the necessary steps to bring it to their attention and to address the fines to the company. “So if you look in our forestry regulations, you would see what the fines would be. So it really is up to the judge on the caseby-case basis, but it could be they could be fined up to $25,000 or they can give up to two years imprisonment, or both. But it just depends on the case and the parameters.” The Subdivision and Development Appeal Board last week modified the approvals granted for the 14-storey Goodman’s Bay penthouse.

The Board, in its six-page ruling on the challenge to the Town

Planning Committee’s initial approval by the project’s neighbour, Edward Hoffer, moved to clean up the process that Wynn must follow through “a slight variation” addressing stages that may have been missed out or leapfrogged.

It said it was “troubling” that an application for “preliminary support for site plan approval”, which had previously been sent back to the Town Planning Committee after both sides agreed the proper process may not have been followed, was now back before it for a second time as an appeal against “final site plan approval”.

Suggesting that incorrect language may have been employed, the Appeal Board said the leap to “final” approval was “inconsistent with the basis upon which” Wynn’s first permission was overturned and went back before the Town Planning Committee.

To clean this up, it ruled that Wynn is granted “preliminary support for site plan approval” while also adjusting the conditions previously imposed by Town Planning. The developer must now first satisfy the Department of Environmental Planning and Protection (DEPP), obtaining its certificate of environmental clearance (CEC) and any other permits, before satisfying the Ministry of Works’ civil design unit.

Town Planning’s original decision had suggested that Wynn address the two agencies’ concerns the other way around, placing civil design before the DEPP and environmental approvals. However, the Appeals Board is understood to have thought this made no sense, given that construction cannot begin until all environmental issues are satisfied and all necessary approvals obtained.

Once these concerns are addressed, Wynn must then seek “final site plan approval”. The Appeals Board verdict possibly adds another planning approval step to the developer’s journey, resulting in extra time and potential delay, but Mr Hoffer’s bid to halt the development - which has evolved into a campaign featuring a website urging Bahamians to oppose itwas rejected.

Wynn’s $100m penthouse complex has already undergone a public hearing and consultation on its Environmental Impact Assessment (EIA). The proposed project is expected to create 300 construction jobs and 30 permanent jobs.

A group opposed to the project, the ‘Say No to Wynn’ campaign, is alleging that the project is an ‘overdevelopment’ of the site and raises environmental and access concerns for neighbours.

He also argued that the project is not financially beneficial to the residents of Cloister Drive, who are mostly Bahamians, adding that one property owner should not make the entire community “suffer”. If the resort proceeds, he warned the developers “leave us no choice but to take legal action”.

“It will not financially benefit the residents of Paradise Island Colony Subdivision; it will benefit someone [else],” he asserted. “I’m sure at some point someone’s going to ask, if you don’t already know, who are the ultimate beneficial owners of that property. And does a portion of one lot within a community dictate that everybody else should suffer?

“For example, if you have a home and there’s a lot built on it next door to you. And they tear it down and they decide, well, we’re going to build a parking garage. We’re going to build a mechanic shop and then everyone and their mother is going to bring cars to it, and they’re going to be on cement blocks. Your value of your home is not what it was the day before. This is why we are here.

“We bought this, we are no different to you as individual residents. Most of us, like you, are Bahamian and we spent hard-earned money to make a difference for our families. I do not believe, and I could be corrected, that the developer is Bahamian, and I do not believe that that development is for the benefit of Cloister Drive nor for the benefit of Paradise Island

Colony subdivision. And you will leave us no choice but to take legal action…” It is understood that the project’s principal is a Bahamas resident. Another Paradise Island resident, meanwhile, argued that the parking garage will attract extra traffic volumes that will negatively affect the quality of life of neighbours. He said: “Cloister Drive east and west is a residential area. Children ride their bicycles; we walk unhindered on Cloister Drive. I’m very concerned about lot 13 and the new entrances being proposed for the parking garage at the top of lot 13. That is of concern to me. And the quality of life of those of us who live on Cloister Drive can be very affected by that particular concern.” Plans submitted to the Department of Physical Planning revealed that the project is being expanded to a seven-storey hotel featuring a 46 percent increase in units compared to earlier plans. The number of hotel rooms and apartments, which will be spread across the upper six floors, is being increased by 32 units - from the 69 cited last year to 101 in the latest version submitted to the planning authorities.

Neighbours questioned why the developers, who had previously met with them, decided to increase the number of rooms by such a large amount. “We want to know why did it change from 39 or 38 units to 100,” a resident inquired. HotelConsult Bahamas said it is working within their rights and that “everyone wishes to

maximise their property. We obviously sat down, we engaged with yourselves, but we just want to point out we all work within our development rights and are not contributing anything that we’re not allowed to do. Everyone wishes to maximize their property,” said Mr Brooks

Another resident asserted that the proposal is an “overdevelopment” of the site and that the property is not wide enough to accommodate the scope of the design. They said: “The width of that property isn’t even 100 feet for most of it. How are you gonna get this huge building on this tiny piece of property?”

In response to traffic concerns during the construction phase, HotelConsult said it has adequate space to accommodate workers and will manage the traffic as best it can.

“We have multiple sites around Paradise Island so we have more than enough space to accommodate construction workers, as well as transporting to and from. They can get dropped off and they can go park on our other properties on Bayview,” said Mr Brooks. “We’ll manage that as best we can within our allowances.”

Architects for HotelConsult Bahamas, owner and developer of the southern Paradise Island site as well as the former Columbus Tavern, revealed to the Department of Physical Planning in a March 5, 2024, letter that the revised proposal calls for a onestorey increase in the hotel/ apartment building’s height compared to previous plans

submitted to the regulator in April 2023. Brent Creary, principal with ArchVenture Ltd and the project’s Bahamian architect, told physical planning chief, Charles Zonicle, that “the primary structure of the project sits on the site of the former Paradise Harbour Club and former Columbus Tavern”. The location was described in accompanying documents as “land currently in a state of disrepair and unused”.

“The project consists of a seven-storey hotel/ apartment building of approximately 101,370 square feet with primary parking housed within a two-level structure on the adjacent portion of lot 13 of Paradise Island Colony Development (PICD),” Mr Creary wrote. “The Paradise Yacht Club consists of 101 units, which range between 372 and 1,004 square feet located across the six upper floors of the structure. The project will comprise of a mix of serviced apartment and hotel rooms. Each unit is provided with a balcony with harbour views. The total conditioned area is 72,920 square feet with nonconditioned areas totalling 28,450 square feet.”

Details such as dollar figures for the total investment and the number of jobs, both construction and full-time, were not included

in Mr Creary’s letter. “The ground floor houses typical amenities including a restaurant (with indoor and outdoor seating), a retail area and a yacht crew lounge area,” he added of the current proposal for the 1.6 acre site.

“An outdoor gym, swimming pool with jacuzzi, as well as back of house administration spaces are also located on the ground floor. A small roof-top bar will occasionally be operating from the fifth floor and would cater to small groups of no more than 25 persons.”

“Preliminary conversations with Paradise Island Utilities have successfully occurred to ensure projected demands are available to the site,” he added. “To meet the project’s goals for sustainability, the roof will be equipped with photovoltaic panels to supplement power consumption.”

Mr Creary added, though, that the project’s parking strategy and needs depend on “extinguishing” the covenant governing its proposed 74 parking spaces site and rezoning this from residential use to commercial.

The proposed parking lot, located at the intersection of Cloister Drive with Paradise Island Drive, will feature 37 spots on both the ground and below grade levels for a total of 74 spaces. A further 15 places will be provided at the main project site for a total of 89. “Staff will be given the option to use a companyprovided shuttle service collecting from multiple locations around New Providence,” said Mr Creary, adding that the project will use utility services provided by Paradise Island Utilities and local communications providers.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

THE TRIBUNE Tuesday, April 9, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

FROM PAGE B1

news

Share your

Opposition challenging $133m fund ‘draw down’

This was not done in May 2023-2024, and both the full-year Budget and halfyear report, the latter of which was released yesterday, show the Government intended to expand the sinking funds’ collective asset base by $59.8m during the course of the fiscal year.

That was to be accomplished via a $1.131m payment from the Clifton Heritage Authority; $3.7m and $1.7m in likely interest received on respective $200m and $100m US dollar bond issues; and the

bulk - some $53.279m - generated from a $750m US dollar bond holding.

However, the 2023-2024 half-year report revealed: “Over the six month period, drawings on the sinking fund for the servicing of debt obligations totaled $132.7m.” This means that some 35 percent, or more than one-third of the total $378.6m in assets spread between the four “sinking funds” at the start of the current fiscal year have been employed to repay debt.

And, of the near-$246m remaining, 37 percent are

NOTICE is hereby given in pursuance of Section 228 of the Companies Act that the

still tied-up in the repurchase (repo) agreement that the Government struck with the Goldman Sachs investment bank in February 2022. That saw the latter advance the Government more than $200m in US dollar-denominated liquidity, with the assets held in the “sinking funds” pledged as security. The Government was to buy them back over a two-year period.

“On a cumulative basis, the four sinking fund arrangements earmarked for scheduled retirement of external bonds amounted to $245.9m at end-December 2023, of which $97.1m is subject to the February 2022 repurchase agreement in which external bonds were sold for repurchase in two years,” the half-year report. Simon Wilson, the Ministry of Finance’s financial secretary, could not be reached for comment before press time last night despite multiple Tribune Business attempts to do so. It thus remains unclear whether the “sinking fund” draw down was, in part, done to help cover the Government’s near-$259m first-half fiscal deficit as some observers have suggested.

That $258.7m deficit represents new debt incurred by the Government during the six months to endDecember 2023, but the half-year report revealed net central government

debt had increased by just $156.9m - some $100m less - during that period.

Mr Thompson told Tribune Business: “In looking at the Public Finance Management Act, the Government it appears is in breach of that Act. Section 56 of that Act speaks to sinking funds, and says if the Government wishes to use the sinking funds it must disclose in its annual Budget the particulars as well as the ways it will use those sinking funds. “The Budget, unfortunately, said the opposite. It said they were going to add to the sinking funds, not use the sinking funds. It appears the Government once again is in breach of the law.”

The east Grand Bahama MP then queried whether the Davis administration was in compliance with section 56’s clause three which requires the appointment of trustees to oversee the “sinking funds”.

“The minister [of finance] shall appoint trustees to administer the “sinking funds” in accordance with the provisions of the Public Debt Management Act,” this clause states. However, the appointment of such trustees has not been announced publicly.

“Section 56 also speaks to trustees that the Government must appoint to oversee the sinking funds,” Mr Thompson said. “If the Government is using the funds, we’d like to know who are the trustees

that the Government has appointed to oversee the funds. The Government has a lot of questions it must answer with respect to usage of the sinking funds.

“The law is clear in terms of the obligations on the Government to articulate how it is, and why it is, and the particulars they’re using the ‘sinking funds’ for. I understand that’s a very important in the usage of the sinking funds to prevent what the Government appears to be doing - if there’s a need or shortfall, it will go into the sinking funds and use the sinking funds.

“I believe that provision was put into law to prevent that, so they must state why they are using it and what they are using it for. That’s what I understand that provision was put in there for.” The Government created the “sinking funds” to help accumulate US dollar and other foreign currency assets to help meet the redemption of The Bahamas’ multi-million dollar international bonds when they mature.

The “sinking funds”, whose assets typically include US Treasuries and other securities, were thus designed to avoid the Government having to come up with large sums of money at once when these bonds fall due and principal must be repaid to their investors.

“You set aside monies to minimise having to

come up with large sums at one time,” one contact, speaking on condition of anonymity, said of the rationale. “There’s no law that directly prohibits them using the sinking funds for other purposes, but that ought to have been laid out in the annual borrowing plan. There’s no explanation for why they’ve made this change in their approach.”

Mr Thompson, in a statement yesterday, added: “The Opposition is concerned that the Government is indicating a drawdown of $133m from the sinking fund assets when the Government’s budget for this year stated that some $59.8m was to be added to the fund.

“This was clearly an unplanned draw down and also inconsistent with the Government’s published annual borrowing plan, which made no mention of using the sinking funds to meet current debt obligations. Once again we find the Davis administration committing to one thing to the Bahamian people and then turning around and doing the opposite.....

“We must ask what caused the Government to take this drastic and unexpected step. Is this evidence that the Government continues to have challenges in sourcing the budgetary financing consistent with its annual borrowing plan?”

DATED this 2nd day of April A.D., 2024.

Attorneys for the above-named Company.

“The predecessors in title to the present shareholders and directors, and I knew them well, Edward St George and Jack Hayward, would never engage in such public high jinks. They stand to damage irretrievably the value of the shareholdings and damage the working relationship between the parties.

“But let me be clear. In any event, talking and rowing, the time for that in the press is done. That ship has sailed. This is now a legal matter and, as I understand it, the letter demand for reimbursement to the Government was delivered on March 26. The Port now has, in law, until April 28 to answer and, failing that, the issue is into arbitration. So no more long talk.”

Mr Mitchell, who has been the greatest advocate and promoter for the Government’s strategy of forcing a showdown with the GBPA and its owners, added that both families are beneficiaries of their respective family trusts and estates set-up by Sir Jack and Mr St George. Those estate planning vehicles hold their interests in the GBPA and Port Group Ltd, not the families directly. “Some friendly advice is that it is not in their best interests to do anything which might cause the trustees of the trusts that own the shares to be concerned that the value of the investment may be damaged,” he added.

The PLP chairman and former Cabinet minister then denied that the Government was responsible for the leaking of the $357m

demand letter, although its disclosure would appear to benefit it more by escalating the pressure on the Hayward and St George families whereas they would appear to obtain no such advantage from its publication.

Then, identifying examples of what he argued is the GBPA’s failure to meet its obligations under the Hawksbill Creek Agreement, Mr Mitchell added: “Just a reminder to the public that it was not the Government that abandoned the airport. It was the Port Authority who allowed the hospital to deteriorate. It was the Port Authority that sold the essential assets of the Port.”

Arguing that “to this day” the GBPA has failed to clear up all debris from Hurricane Dorian in 2019, he continued: “In each case, the Government has had to step up to the plate to save the city of Freeport.

“How can the present directors tell anyone they have confidence in the city of Freeport when they abandoned the airport, refused to reinvest, allowed us to lose US pre-clearance in Freeport and the Government had to step in to rebuild the facility.”

In a clarion call to PLP supporters and others, Mr Mitchell argued: “It is most important this public policy on the Port; the most important fight in a generation since Independence. Freeport is not a play thing for the PLP, it’s not a play thing for this next generation of shareholders to play around with.

“It is a city with real live people and the Government is now acting in our best interest, so let’s support them, including FNMs. Don’t play both sides against the middle.” Mr Mitchell’s views, especially on Grand Bahama International Airport, which the GBPA and its shareholders - together with Hutchison Whampoa - offloaded on the Government for $1 were not without support in Freeport yesterday.

The Government also had to pick up the $1m staff severance costs, and one Freeport business source, speaking on condition of

anonymity, backed both the PLP chairman and the Government’s $357m demand letter strategy, saying of the two families: “The best thing to do is get their backs against the wall. That’s the correct thing to do.

“They’re going to need at least $150m. They can’t find that. Our roads are falling apart. You can’t go 10 feet without hitting a patch. They have no money. They have no plans. When they sold the airport for $1, it told me they don’t know what the hell to do. Let’s get it out of our hands. Freeport could do nothing without an airport. They should have been leading the charge.”

The GBPA, in its statement that got Mr Mitchell worked up yesterday, accused the Government of “systematically handcuffing” it by preventing it from acting as a “one-stop shop” investment approvals process and thus placing it at a competitive disadvantage versus other free trade zones.

Instead, it argued that Freeport’s tax contribution to the Public Treasury could have been much greater if the Hawksbill Creek Agreement had been allowed to function as originally intended, which would have been “magically transformative” for both the island and wider Bahamas.

While Prime Minister Philip Davis argued that Bahamian taxpayers have been “subsidising” the Hayward and St George families’ profits, on the grounds that the GBPA has not been living up to its infrastructure and development obligations, the latter countered by arguing its shareholders have themselves been funding Freeport’s management “from their own pocket to the tune of many millions of dollars each year”.

“The Port Authority has been systematically handcuffed by central government policies and legislation over decades that prevent the Port Authority from being the one-stop-shop that the Hawksbill Creek Agreement intended, and which other international ‘free port’ areas around the world enjoy,” the GBPA argued.

“As a result, ease of doing business in the Port area has been severely eroded, which has reduced its competitive advantage and the continuing loss of opportunity for The Bahamas has been enormous. “Freeport’s tax contribution to the central government could have been much greater still if government worked with Port Authority rather than against it. Such a partnership would be magically

PAGE 4, Tuesday, April 9, 2024 THE TRIBUNE

FROM PAGE B1

transformative

The

as

FROM PAGE B1

WALK

and benefit

Bahamas

a whole.”

NOTICE

GOOD BAHAMAS LIMITED (In Voluntary Liquidation)

the

day of April A.D., 2024 that the

be wound up

and that the Liquidator be

C. Miller, of Nassau, Bahamas. All

proof

the Liquidator,

C. Miller,

P.O. Box

Nassau, Bahamas

than the 30th day of April, A.D., 2024

the books

be

of the

is

in

of Section

the

an

of the Members of the

at #10

Members of the above-named Company by Resolution passed on

2nd

Company

voluntarily

Michael

persons having claims against the above-named Company are requested to submit particulars of such claims and

thereof in writing to

Michael

c/o

EE-17971,

not later

after which

will

closed and assets

Company will be distributed. NOTICE

hereby given

pursuance

252 of

Companies Act that

Extraordinary General Meeting

above-named Company will be held

Lookout Hill, Winton Heights, Nassau, Bahamas on the 2nd day of May, A.D., 2024 for the purpose of having an account laid before them showing the manner in which the winding up has been conducted and the property of the Company disposed of and hearing any explanation that may be given by the Liquidator, and also of determining by Extraordinary Resolution the manner in which the books, accounts and documents of the Company, and of the Liquidator, shall be disposed of.

Atlantis non-compliant on redundancy notice

severed in November 2021 as Atlantis brought staffing levels in line with business volumes following the COVID pandemic.

Ms Godet, though, found that the resort gave 13 days’ notice to the minister rather than the required 14, as the letter sent on November 15, 2021, set a redundancy date of November 28.

The Employment (Amendment) Act 2017, which governs this procedure, stipulates in its section 26 (3) that employers who fail to give the required two weeks’ notice to the minister are “liable to pay each affected employee 30 days’ pay in addition” to their other severance entitlements.

“I do find that there was not strict compliance with the provisions of section 26A of the Employment (Amendment) Act 2017, which required at least two weeks’ notice to be presented to the minister, the penalty of which is the payment of 30 days to be awarded to the applicant [Mr Lightbourne],” Ms Godet ruled.

“The evidence revealed communication dated November 15, 2021, addressed to the minister advising of a redundancy date of November 28, 2021, which does not provide the specific period of two weeks (14 days) as required in the Act. [The] statutory rate of interest on this sum is to be applied until payment.”

It is unclear whether the Industrial Tribunal’s ruling will pave the way for the other 169 Atlantis employees involved in the same termination exercise to file their own legal actions and claim an extra 30 days’ pay due to the Paradise Island

resort’s non-compliance with the Employment Act.

Mr Lightbourne, who worked as a doorman at the Cove property for 14-and-a-half-years from March 28, 2007, until endNovember 2021, had cited failure to comply with the Employment Act among his grievances as well as wrongful and unfair dismissal “under the disguise of redundancy”. “He asserts that his separation from employment was an act of victimisation levied against him by his supervisor in the aftermath of an argument had with her husband,” Ms Godet wrote in her verdict. “It was his evidence that, to the very date, the supervisor held good on her words that ‘your days are numbered. November 25 is right here’ especially when she found out that he had reported her to human resources for her threatening conduct.” November 25 was the date when Atlantis was to decide which workers it would make redundant.

The supervisor was named in the verdict as “Mrs Taylor”, and Mr Lightbourne’s account was backed by Charlotte Williams, one of the witnesses to testify on his behalf. “The witness said that sometime in November 2020 [sic, 2021] she heard the applicant’s supervisor threaten him openly for reporting her,” the Industrial Tribunal verdict read. “She said she heard the supervisor specifically say that the applicant forgot that everything had to go through her, and that his says were ‘numbered’ and that ‘November 25 was right here’. Those were her exact words... When the supervisor said she would deal with

him, she construed that as a threat that like he would not have a job.”

Mr Lightbourne said he was contacted at home by Kapil Sharma, the Cove’s then-general manager, who told him his services “were no longer required” and that due severance pay and other benefits owed would be paid to his account.

Although represented by the Bahamas Hotel, Catering and Allied Workers Union (BHCAWU), he “took matters into his own hands” to protect his interests.

Stephen Rolle, a union executive council member and shop steward, gave evidence on the former doorman’s behalf and said Mr Lightbourne approached him with a complaint in late 2021 “concerning his supervisor’s intimidation based on complaints levied against her husband’s behaviour”.

The two met with Atlantis’ human resources officials, and were told an investigation would be undertaken.

The BHCAWU shop steward said he did not follow-up on the investigation’s progress, as he wanted to give the resort the necessary time. However, he confirmed that Atlantis had discussed with the union combining positions to cope with reduced business volumes in COVID’s immediate aftermath. One of the combinations it sought was that of doorman and valet, but the union rejected this.

Under cross-examination, Mr Rolle said Mr Lightbourne called him after being made redundant and asserted “he felt that he was picked upon and that it was done in a vindictive manner... He told me that he was going to fight... He

Atlantic City casinos were less profitable in 2023, even with online help

By WAYNE PARRY Associated Press

ATLANTIC City’s casinos were less profitable in 2023 than they were a year earlier, even with help from the state’s booming online gambling market. Figures released Monday by the New Jersey Division of Gaming Enforcement show the nine casinos collectively reported a gross operating profit of $744.7 million in 2023, a decline of 1.6% from 2022. When two internet-only entities affiliated with several of the casinos are included, the decline in profitability was 4.1% on

earnings of $780 million. All nine casinos were profitable in 2023, but only three saw an increase in profitability. Gross operating profit represents earnings before interest, taxes, depreciation, and other expenses, and is a widely-accepted measure of profitability in the Atlantic City casino industry. The figures “suggest it is getting more expensive for New Jersey’s casinos to operate, and patron spending may not be keeping pace,” said Jane Bokunewicz, director of the Lloyd Levenson Institute at Stockton University, which studies the Atlantic City gambling market.

“The same forces that might be tightening visitors’ purse strings — inflation, increased consumer prices — are also forcing operators to dig deeper into their pockets,” she said.

Bokunewicz said higher operational costs including increased wages and more costly goods, combined with increased spending on customer acquisition and retention including and free play, rooms, meals and drinks for customers have not been offset by as significant an increase in consumer spending as the industry hoped for.

thought it was unfair and that he was made redundant out of vindictiveness and spite”. He added that, to his knowledge, the redundancies cut the number of doormen from three to one.

Channel Ferguson, the human resources official for the Cove, testified for Atlantis that Mr Lightbourne did not mention “redundancy discrimination” when informed of his severance. She added that the supervisor who allegedly threatened him would not have been aware of the redundancy exercise about to take place, with the impacted employees selected by senior manager.

Russell Miller, Atlantis’ executive vice-president of hotel operations, in his witness statement confirmed the union rejected the proposal to consolidate the doorman and valet positions. Mr Lightbourne was recalled to work from COVID furlough on March 26, 2021, and the resort again discussed him performing a combined doorman/bellman/valet role.

The union, though, said he should work solely as a doorman, and Mr Miller said of Mr Lightbourne: “Thus he was the only team member to execute a job

description as a doorman only.” While there were typically eight to ten doorman at the Cove, he was the only one not performing multiple functions at a time when “business levels were not optimal”.

Mr Miller testified that around eight to nine Cove staff were made redundant, with those impacted chosen by the “operations team” and submitted to senior executives for approval. Confirming that there was a selection process, based on a worker’s job performance and other factors, he added that the Cove’s senior leadership team consisted then of Mr Sharma and former operations vice-president, Carlton Russell.

Mr Miller said Mr Lightbourne’s supervisor, who he alleged was victimising him, would have been part of the redundancy selection process. He, though, was unaware of the former doorman’s complaints, describing Mr Lightbourne’s performance as “inconsistent from day to day” and “somewhat lax from time to time in the execution of his duties”. Noting Mr Miller’s admission that the supervisor was part of the team selecting those employees to be made redundant, the Industrial

Tribunal nevertheless noted this was counter-balanced by testimony that only senior leadership was aware of the pending separations.

Ms Godet said the fact that, out of the Cove’s eight to ten doormen, only Mr Lightbourne was functioning solely in this post indicated that the role was “diminished” as a result of COVID. “Accordingly, on a balance of probabilities, I am satisfied that even if the supervisor’s animus did not exist the applicant’s position would still have been impacted in the redundancy exercise,” she added.

“Therefore, against the preponderance of the evidence led and a thorough review of the correspondence between the parties, I consider it was more likely a legitimate exercise of redundancy of the position held by the applicant, one that was under consideration well in advance of any dispute held between the applicant and his supervisor.”

Mr Lightbourne had already been paid the $7,240 due to him, and the Industrial Tribunal thus rejected his wrongful and unfair dismissal claims.

THE TRIBUNE Tuesday, April 9, 2024, PAGE 5

FROM PAGE B1

SANTA CLARA, Calif. Associated Press

TESLA has settled a lawsuit brought by the family of a Silicon Valley engineer who died in a crash while relying on the company's semi-autonomous driving software.

The amount Tesla paid to settle the case was not disclosed in court documents filed Monday, just a day

before the trial stemming from the 2018 crash on a San Francisco Bay Area highway was scheduled to begin. In a court filing requesting to keep the sum private, Tesla said it agreed to settle the case in order to "end years of litigation."

The family of Walter Huang filed a negligence and wrongful death lawsuit in 2019 seeking to hold Tesla — and, by extension,

its CEO Elon Musk — liable for repeatedly exaggerating the capabilities of Tesla's self-driving car technology.

They claimed the technology, dubbed Autopilot, was promoted in egregious ways that caused vehicle owners to believe they didn't have to remain vigilant while they were behind the wheel.

Evidence indicated that Huang was playing a video game on his iPhone when

he crashed into a concrete highway barrier on March 23, 2018.

After dropping his son off at preschool, Huang activated the Autopilot feature on his Model X for his commute to his job at Apple. But less than 20 minutes later, Autopilot veered the vehicle out of its lane and began to accelerate before barreling into a barrier located at a perilous intersection on a busy highway in Mountain View, California. The Model X was still traveling at more than 70 miles per hour (110 kilometers per hour).

Huang, 38, died at the gruesome scene, leaving behind his wife and two children, now 12 and 9 years old. The case was just one of about a dozen scattered across the U.S. raising questions about whether Musk's boasts about the effectiveness of Tesla's autonomous technology fosters a misguided faith the technology, The company also has an optional feature it calls Full Self Driving. The U.S. Justice Department also opened an inquiry last year into how Tesla and Musk promote its autonomous technology, according to regulatory filings that didn't provide many details about the nature of the probe.

PAGE 6, Tuesday, April 9, 2024 THE TRIBUNE

TESLA SETTLES LAWSUIT OVER MAN'S DEATH IN A CRASH INVOLVING ITS SEMI-AUTONOMOUS DRIVING SOFTWARE NOTICE Any person having an interest in a female child born to Ludy Joseph on the 1st day of December 2020 of #30 Inagua Place, Hawsbill

Bahama is asked to contact McIntosh & Co., Peach Tree Street, Freeport, Grand Bahama. Phone 242 351-1264 or info@mcintoshcolaw.com before April 23, 2024. Legal Notice NOTICE PINK FLAMINGO TRADING CO. LIMITED NOTICE IS HEREBY GIVEN that at an Extraordinary General Meeting of the Shareholders of the above-named Company was duly convened and held on the 23rd day of November, 2023 the following resolutions were passed: RESOLVED that PINK FLAMINGO TRADING CO. LIMITED be wound up voluntarily. RESOLVED that PETER MAILLIS of Fort Nassau, Marlborough Street, Nassau, Bahamas be appointed the Liquidator for the purpose of such winding up. Dated the 23rd day of November, 2023. Maillis & Maillis For the above-named Company Nassau, Bahamas NOTICE EROICA LTD. Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 205650 B (In Voluntary Liquidation Notice is hereby given that the above-named Company is in dissolution, commencing on the 5th day of April A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Welliam Wang, whose address is Rua Afonso Braz 747 AP 91B,Vila Nova Conceicao – 04511-011, Sao Paulo, SP, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 4th day of May A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may such claim is proved. Dated this 5th day of April A.D. 2024. WELLIAM WANG Liquidator LEGAL NOTICE International Business Companies Act (No. 45 of 2000) Evergreen Fund Limited (the “Company”) In Voluntary Liquidation Notice is hereby given that, in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), Evergreen Fund Limited (the “Company”) is in Dissolution. The date of commencement of the Dissolution is the 5th day of April, 2024 Cristiano Freire Amorim is the Liquidator and can be contacted at Rua Prudente de Morais 1620 Apt. 201, Ipanema, Rio de Janeiro, RJ, CEP 22420-042, Brazil. All persons having claims against the above-named Company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before the 6th day of May, 2024 Cristiano Freire Amorim Liquidator NOTICE AWE Business Investment Ltd. In Voluntary Liquidation Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, AWE Business Investment Ltd. is in dissolution as of April 3, 2024. International Liquidator Services Ltd. situated at 3rd Floor Whitfield Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator. L I Q U I D A T O R The Public is hereby advised that I, DERRICK PITTER of West End Avenue, Nassau, The Bahamas, intend to change my name to DERRICK MAJOR. If there are any objections to this change of name by Deed Poll, you may write such N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE Legal Notice NOTICE PINK FLAMINGO TRADING CO. LIMITED (In Voluntary Liquidation) Creditors having debts or claims against the above-named Company are required to send particulars thereof to the undersigned c/o P.O. Box N-4014, Nassau, Bahamas on or before the 8th day of December, 2023. In default distribution made by the Liquidator. Dated the 23rd day of November, 2023. PETER MAILLIS LIQUIDATOR of PINK FLAMINGO TRADING CO. LIMITED

Grand