Issue 37: Autumn 2022POWERING THE SMART GRID www.energystoragejournal.com Europe's ESS vision EUROBAT maps out ambitious plans for heady energy future Gigawatts for Africa Long duration storage offers hope for energy starved continent Lithium's great balancing act The new supply and demand equilibrium Flow battery surprise New economic logic starts to stack up for latest redox technology

Gravity GuardTM Delivers Results Cell phone towers around the world have lead battery back up systems. Here, battery life really matters. Longer battery life is one of the reasons we engineered Gravity Guard.TM Hammond’s patent-pending innovation minimizes acid stratification for advanced battery applications. HAMMONDGLOBAL.COM The Performance Solution FOR STATIONARY APPLICATIONS THE CHANGE CATALYST ®

PRICE PROBLEMS AHEAD

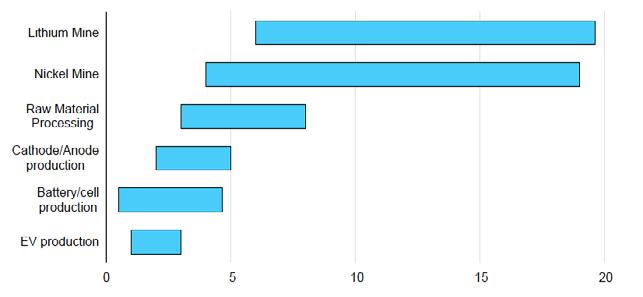

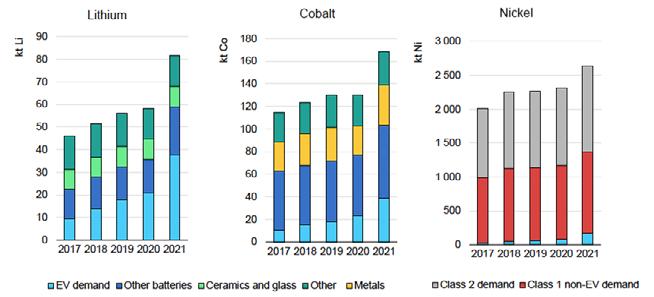

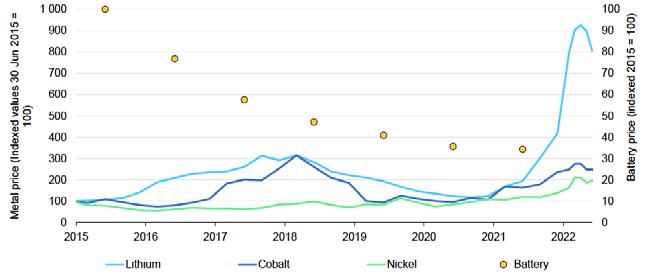

As EV battery makers scramble to source new supplies of raw materials and step up research into cheaper chemistry options, the International Energy Agency warns price increases are inevitable.

DESIGNER VIEWPOINT

The EV industry is on high alert over a spike in raw battery material costs but that’s not to say that the efficient use of artificial intelligence programming and deployment can’t benefit companies’ bottom line.

GETTING THE LCOE RIGHT

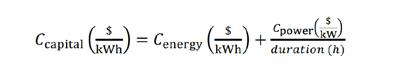

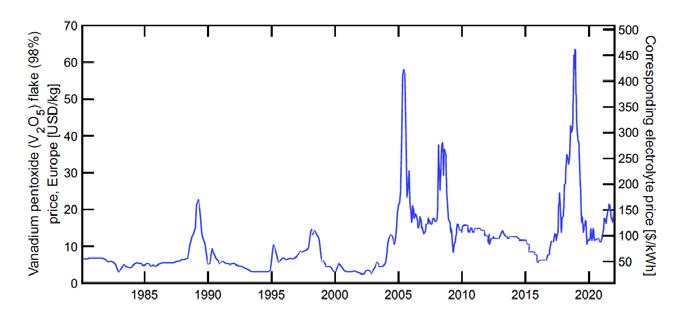

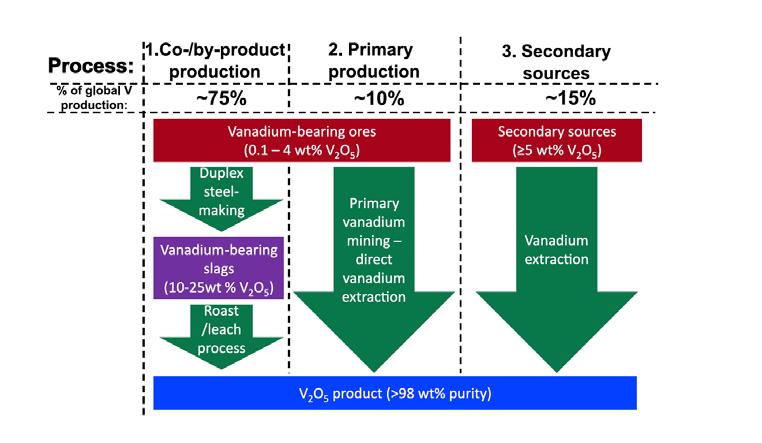

It’s time for a deeper re-assessment of the levelized cost of RFB storage. Vanadium redox flow batteries may be state-of-the-art in terms of being technology-ready but the price of the electrolyte is still a sticking point. anding its lithium capabilities

Report: lithium-powered so-called ‘green energy’ revolution is increasingly hazardous for shipping safety

Finance: Juanita Anderson | email: juanita@batteriesinternational.com | tel: +44 7775 710 290

Subscriptions and admin: admin@energystoragejournal.com | tel: +44 1 243 782 275

Design: Antony Parselle | email: aparselledesign@me.com

Reception: tel: +44 1 243 782 UK company no: 09123491 “Europe geopolitical realities”. 2022 Convention

A FLOW BATTERY REVOLUTION

A FLOW BATTERY REVOLUTION

CONTENTS www.energystoragejournal.com Energy Storage Journal • Autumn 2021 • 1 Contents Energy Storage Journal | Issue 37 | Autumn 2022 The new titan of lead Ecoult’s UltraBattery, ready to take lithium on, head-to-head The CEO interview Anil Srivastava and Leclanché’s bid for market dominance Next gen integrators Coming soon to a smart grid near you, the ideal middle man Let cool heads prevail The lead-lithium storage debate steps up a notch IN THIS ISSUE: 2 EDITORIAL: EV battery pricing may have climbed by $8000 a pack, time to rethink the economics of change 4 PEOPLE NEWS | 6 GENERAL NEWS | 22 COVER STORY: EV BATTERIES: Supply chain problems and a surge in pricing across the whole supply chain does not bode well for vehicle electrification | 26 ADDIONICS, A VIEWPOINT: It’s a good moment to look at cutting costs by better battery design | 28 VRFB PRICING: A new look on flow battery economics makes the technology look surprisingly attractive | 37 EVENT REVIEWS: EUROBAT annual meeting, Four events in one in the UK’s NEC 41 FORTHCOMING EVENTS: ESJ details conferences and shows coming up Editor: John Shepherd | email:john@energystoragejournal.com | tel: +44 7470 046 601 Advertising manager: Jade Beevor | email: jade@energystoragejournal.com | tel: +44 1 243 792 467 eporter: Hillary Christie | email: hillary@batteriesinternational.com

275 The contents of this publication are protected by copyright. No unauthorized translation or reproduction is permitted. Every effort has been made to ensure that all the information in this publication is correct, the publisher will accept no responsibility for any errors, or opinion expressed, or omissions, for any loss or damage, cosequential or otherwise, suffered as a result of any material published. Any warranty to the correctness and actuality of this publication cannot be assumed. © 2022 HHA Limited.

Energy Storage Journal — business and market strategies for energy storage and smart grid technologies Publisher: Karen Hampton karen@energystoragejournal.com +44 7792 852 337 Editor-in-chief: Michael Halls mike@energystoragejournal.com +44 7977 016 918 37 Zoellner:

is facing new

EUROBAT Forum

and Annual

review. 5 Freyr Battery appoints Michael Brose to the new post of VP of US operations. 2 The basic premise of constantly falling lithium ion battery prices needs rethinking. 8

OPINION: ADDIONICS 26 COVER STORY: EV COSTS SURGE 22

FEATURES ALSO IN THIS ISSUE ABOUT US

28

The revolution that stalled (or may just be about to)

What if many of the assumptions people have made about the so-called EV revolution are based on false premises?

Let’s go through two of them.

Premise number 1: the price of lithium batteries will continue to fall until they are below the price of lead ones. This will underpin the EV revolution — cheaper batteries mean cheaper cars: consumers will vote with their feet.

The falling cost of lithium batteries has been one of the core principles behind the belief that EVs will overtake internal combustion vehicles.

There was good reason to think this realistic: from 2010 to 2020, the price of lithium ion battery packs fell by almost 90%. The average price of a lithium ion battery pack stood at an eye-watering $1,200/kWh in 2010. In 2020 it was around $105/kWh.

But that’s taken a huge hit in the past year. In 2021 Bloomberg New Energy Finance analysts warned that the higher costs of raw materials could push the average price of a lithium-ion battery pack up to $135/kWh.

But that was before the supply chain problems around the world kicked off after the pandemic and, now the energy crisis caused by the Russian invasion of Ukraine.

During the first quarter of 2022, the average cost of lithium ion battery cells shot up to $160/ kWh. One recent study estimated that this year, between March and June, global cell prices have risen by 20%-30%.

S&P Global Mobility predicts it could cost car

S&P Global Mobility predicts it could cost car manufacturers up to $8,000 more to make an EV battery pack by the end of 2022.

manufacturers up to $8,000 more to make an EV battery pack by the end of 2022. Part of the first premise: cheaper batteries mean cheaper cars: consumers will vote with their feet is now the opposite.

More expensive batteries means dearer cars: consumers, already concerned that EVs are still more expensive than their ICE counterparts, will vote with their feet — in the other direction.

Premise number 2: EV adoption rates will rapidly climb once phase-out dates for manufacturing ICE cars come in. This is meant to be a corollary of the first. Unfortunately, it is equally flawed.

One British analyst recently said that in the UK, where the sale of new ICE cars will be discontinued by 2030 and hybrid vehicles by 2035, the second-hand car market will receive a huge and unexpected boost in the run-up to the end of the decade.

“At the top tier of the market,” he said, “there is marginal price sensitivity over high-end cars. But when you come to the family saloon level and below, price increases of as little as a couple of thousand pounds will affect buyer decisions. Affordability is key.”

A similar picture is seen in the US where first quarter 2022 sales of fully-electric vehicles reached 5% market share for the first time. However, of the nearly half a million EVs sold in America last year, roughly 70% were Teslas.

The reality is that for most middle-class Americans EVs are still too high to be practical — and look set to stay that way.

This appears to be one of the major worries of its carmakers. “At the end of the day,” one consultant told Energy Storage Journal at the annual Battery Council International meetng this May, “our nation’s automakers just want to sell cars. That’s what they do. They’re not politicians (or they shouldn’t be!)

John Shepherd • john@batteriesinternational.com

EDITORIAL 2 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

“They’re worried and acutely conscious of the disincentives that they see coming from the price hikes that they will have to impose on new vehicles — many of which have still yet to see the manufacturing line. More expensive battery packs are just bad news for them.

“Moreover, their enthusiasm for electrification of the nation’s fleet is decidedly lacklustre. They’re having to respond to legislative pressure on CO2 tailpipe emissions and state strictures on what cars we should be driving in a few years’ time.”

The consultant added that CEOs had been actively lobbying the federal and state governments for the last few years to slow down the pace of change.

Oddly enough another figure at the BCI conference said that there was mounting opposition — but behind the scenes— by electric utilities to the decarbonization of the vehicle sector. “They’re not anti-environmental in the slightest — most are embracing the low-cost renewable energy being generated by renewables. They’re just worried about having to ramp production up by as much as a factor of five in the next seven years and beyond.

“Any transition to EVs looks set to be bumpy to say the least.”

And utilities may have to. This year 12 states have announced that they are seeking to set a target date for the nationwide phase-out of ICE car sales. California, Connecticut, Hawaii, Maine, Massachusetts, New Jersey, New Mexico, New York, North Carolina, Oregon, Rhode Island, and Washington are all pushing for a nationwide ban of gasoline and diesel-powered light-duty vehicles starting in 2035.

In the free-for-all that characterizes state governments and individual cities in the US, there is even talk that California’s ICE ban will be accelerated to 2030 and, irrespective of that, the cities of Oakland, Culver City and Berkeley are already targeting a 2030 deadline.

Additionally, the premise that cheaper EV batteries are inevitable in the long run is flawed — at least for this coming generation. The shift away from fossil fuels to renewables has meant that global demand for raw battery materials — namely nickel, lithium, copper, and cobalt — will be increasing rather than otherwise.

John Shepherd, Editor

EDITORIAL www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 3

Nebreda takes over as CEO of Fluence

(employees) all over the world, who work so hard to create the success this com pany has enjoyed,” he said.

Fluence Energy president and CEO Manuel Pérez Du buc announced he was step ping down from the post effective August 31 — to be succeeded by board member Julian Nebreda (pictured above).

Pérez Dubuc said he would also resign as a direc tor of the company.

“I want to express my gratitude to the Fluence board, our executive leader ship team, and our ‘Fluents’

“I congratulate Julian, my long-standing friend and colleague, for taking over the lead of this transforma tional company as it enters its next chapter, the future is bright for Fluence.”

Nebreda has been a mem ber of the Fluence board since September 2021 and will retain his board seat.

Most recently, Nebre da was executive VP and president of US and global business lines for the AES Corporation, which formed Fluence in 2018 with Sie mens.

Nebreda was responsible for renewables’ growth in the US for AES through its

clean energy business and he previously led the South America and Europe busi ness units for AES, includ ing various publicly-listed subsidiaries.

Meanwhile, Fluence said Krishna Vanka would join the company as senior VP and chief digital officer as of August 29, to lead the expansion of Fluence’s ‘soft ware-as-a-service’ business Vanka was most recently chief product officer at a start-up that provides infra structure, maintenance, and network solutions for elec tric vehicle chargers.

Prior to that, he was the founder and CEO of MyShoperoo, which Flu ence said was ranked sixth among the most fundable start-ups in the US.

Dedo joins board of Li-Cycle

North American lithium ion battery recycler Li-Cycle said on August 8 it had appointed Jacqui Dedo as an in dependent director of the board.

Dedo has more than 40 years of experience across the automotive in dustry with a focus on strategy devel opment and customer value and has previously served as chief strategy and

supply chain officer for Dana Holding Corp.

She also sits on the boards of plas tics converting industry firm Cadillac Products Automotive Company and the Workhorse Group, which is an OEM for commercial electric delivery vehicles and delivery drones.

Li-Cycle CEO Ajay Kochhar said:

Sion Power said on June 15 that Mack Treece had been appointed as the company’s CFO.

Prior to joining Sion, Treece was CFO and then chief strategic alliances offi cer at EOS Energy Storage.

Sion CEO Tracey Kel ley said Treece’s extensive strategic and financial ex perience in the energy sec tor “will be essential as we enter into the next stage of commercial EV develop ment”.

The company is develop ing its Licerion technology as an “advanced approach” to lithium-metal batteries, which Sion claims contain twice the energy in the same size and weight battery, compared to a traditional lithium-ion batteries.

“Jacqui is a proven leader in the auto motive industry and we look forward to leveraging her experience and in sights as we continue to build a more circular supply chain for electric ve hicle batteries.

“As we indicated at our 2022 annu al meeting, we are committed to en hancing the balance of independence, diversity and skills of the board as LiCycle continues to execute on its growth strategy.”

Celina Mikolajczak has joined advanced materials company Lyten as chief battery technology officer, the company announced on July 21.

As the leader of Lyten’s Battery Product Innovation Group, Mikolajczak is re sponsible for advancing the development of the LytCell lithium-sulfur battery to full commercial readiness and optimization.

She brings decades of EV battery development experience from cell engineering and manufac turing positions at bat

tery companies including Tesla, Panasonic and most recently QuantumScape.

Mikolajczak has exten sive experience in research ing and delivering commer cially viable and qualified battery architectures to the EV marketplace.

Her technical consult ing practice at Exponent focused on lithium ion cell and battery safety and quality. She then took a senior management posi tion at Tesla focused on cell quality and materials engineering.

In 2019, she joined

Panasonic Energy of North America, where she became VP of engineering and battery technology.

As chief battery technol ogy officer, Mikolajczak joins Kevin Rhodes, VP of battery development and former chief engineer

at AVL, Jim Paye, VP of product management and former head of R&D at A123 Systems, and Zach Favors, VP of battery R&D and former CTO of NexTech Batteries in heading up Lyten’s Battery Product Innovation Group.

Mikolajczak will also partner with Greg Deve son, who was recently promoted to COO after serving as president of automotive. He oversees the firm’s operations engineering, manufactur ing, program management, and materials teams.

Treece is new CFO at Sion Power

Celina Mikolajczak

Lyten appoints Mikolajczak as chief battery tech officer

PEOPLE NEWS 4 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

Freyr Battery names Brose as VP for US

Freyr Battery said on Au gust 23 it had appointed Michael Brose to the new post of VP of US opera tions, to lead the expansion of its battery cells business in the region.

Prior to joining Freyr, Brose was VP of operations for manufacturing com panies including, most re cently, working as the Chi cago-based plant manager for chemicals and materials supplier WR Grace.

Freyr CEO Tom Einar Jensen said the US was a “central element” of its ex pansion roadmap — more so following the signing into law of the Inflation Reduc tion Act by the president, Joe Biden, on August 16.

Brose said: “This is a piv otal time for the battery

industry and for the de velopment of clean energy solutions in major end mar kets such as the US.”

Experience in operat ing and managing chemi cal manufacturing facili ties, “emphasizing efficient processes and high safety

standards”, would under pin Freyr’s investment in clean energy growth in the US, Brose said.

Freyr has started building the first of its planned fac tories in Norway and has previously announced its potential development of

industrial scale battery cell production in Finland and the US.

The company plans to de velop up to 43GWh of bat tery cell production capacity by 2025, with an ambition of up to 83GWh in total ca pacity by 2028.

SES appoints Pilkington as chief legal officer

Kyle Pilkington has been appointed chief legal of ficer at SES effective July 1, the company has an nounced.

Pilkington, who was previously VP for legal, is based in the US and suc ceeds Joanne Ban on the company’s executive team.

SES said Ban is retir ing from the position due to health reasons but will continue to serve SES as an advisor to the CEO.

Pilkington’s career to date has included advising public and private compa nies in the US and interna tionally on a wide variety of transactions and other corporate matters.

Prior to joining SES, Pilk ington served as associate general counsel at Interna tional Game Technology, where he was responsible for securities and corporate governance matters. Before that, he spent 14 years in private practice at Gibson, Dunn & Crutcher, Baker McKenzie and Sullivan & Cromwell in New York,

Sydney and Singapore, spe cializing in cross-border transactions, securities law and capital markets trans actions.

SES founder and CEO Qichao Hu said Pilkington brings a wealth of global

experience, particularly in securities laws matters and the effective oversight of legal, governance and regulatory matters.

“He will play a key role working with me, our board and the rest of our

team as we continue to grow and strengthen the company. We also thank Joanne for all the valuable contributions over the past few years and wish her speedy recovery and great health.”

San Francisco EV charging network company Volta announced several key appointments on June 13 including Vincent Cubbage as interim CEO.

Volta said it had hired Stephen Pilatzke as its first chief accounting officer while Brandt Hastings, formerly interim CEO and chief revenue officer, had been promoted to the post of chief commercial officer.

Additionally, chief strategy officer Drew Lipsher was promoted to

chief development officer.

Cubbage is a former CEO, president and chairman of Tortoise Acquisition Corp II, which completed its initial business combination with Volta in August 2021 — at which time he joined the Volta board.

Cubbage has served as co-chair of the Volta board since March 2022. In his new role, Cubbage will continue to serve as a member of the Volta board, but will not be cochair while he is interim CEO.

Effective with Cubbage’s appointment, Kathy Savitt, a director and previously Volta’s cochair, has become the board’s sole chair.

Cubbage is Volta’s new interim CEO in board shake-up

Michael Brose

Vincent Cubbage

PEOPLE NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 5

California utility plans two new V2G, V2H programs

to the grid and provide power during an outage.

PG&E said it expects its findings will help deter mine how to maximize the cost-effectiveness of bidi rectional charging technol ogy in providing a variety of customer and grid ser vices.

US utility Pacific Gas and Electric Company (PG&E) said on May 5 it will de velop three new pilot pro grams in California to test how bidirectional EVs and chargers can provide pow er to the grid.

The pilots will be in addi tion to similar programs in collaboration with General

Motors and Ford that were announced in March.

PG&E said the new pilot projects will test bidirec tional charging technol ogy in a variety of settings, including in homes, busi nesses and with local mi crogrids in high fire-threat areas.

Financial incentives will

be offered to those taking part in each of the projects with “additional benefits for those in disadvantaged communities”, the utility said.

All three projects are to be rolled out in 2022 and 2023. This tests the ability of EVs to send power back

According to the utility, the 400,000 EVs registered in its service area — along with the fast-growing number of EVs across the state — “represent a flex ible grid resource, which could offer cost savings associated with operating and maintaining the grid as well as for customers who own an EV or are a part of a bidirectional EV-enabled community microgrid”.

Additionally, using EV batteries for residential and commercial power could reduce the need to build new standalone en ergy storage systems, PG&E said.

Generate Capital acquires esVolta battery storage jobs

North American lithium ion energy storage devel oper esVolta has been ac quired by Generate Capital for an undisclosed sum, the firms announced on July 21.

Generate said the deal would boost its plans to ex pand into the front-of-me ter battery storage market by adding a “fast-growing and experienced team with a pipeline of attractive proj ects”.

Founded in California in 2017, esVolta has a portfo lio of more than 900MWh of operational and utilitycontracted projects in the US and Canada.

The BESS company is de veloping projects in Texas, Arizona, Montana, Cali fornia, Virginia, Colorado, Washington and New Mex ico.

Generate, which was launched in 2014, invests in assets and conducts eq uity raises every 18 to 24 months to attract corporate equity from global infra structure investors.

Generate founder and CEO Scott Jacobs said: “Battery storage is critical to building a sustainable energy system and ensuring grid reliability as we scale up renewables and acceler ate the energy transition.”

Nearly 70,000 workers were employed in the US battery storage sector in 2021, according to latest data published in June by the Department of Energy’s Office of Policy.

The 2022 US Energy and Employment Report said jobs in batteries made up 80% of all stor age technology jobs — an increase of 4.4% from the previous year.

Employees involved in battery storage numbered 69,698, which USEER said was nearly nine times the 7,901 employed in pumped storage hydro power — the next storage sector in terms of jobs.

According to the report,

more than half of work ers in the battery storage sector (53%) were in construction, followed by manufacturing (18%), “various professional services roles” (17%), wholesale trade distribu tion and transport (11%), while 2% were listed un der the category of other services.

Jobs in the US energy sector overall in 2021 increased by more than 300,000 from 7.5 million total energy jobs in 2020.

The Department of Energy said the findings of the USEER showed that energy sector jobs outpaced overall US employment in 2021.

NEWS 6 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

US

rise to nearly 70,000

Plans for 22 large-scale solar and battery stor age projects for some 2,408MW in New York State were announced by governor Kathy Hochul on June 2. The projects would attract more than $2.7 bil lion in private investment.

EDF Renewables North America was awarded three of the contracts, amounting to a combined 1GW of solar plus storage in New York.

The EDF projects include 20MW of co-located bat tery storage facilities at

Rio

Rio Tinto is to invest $10 million in a battery met als partnership with Nano One.

Nano One said on June 9 that the equity investment boost would accelerate its multi-cathode commercial ization plans, support cath ode active materials manu facturing in Canada and the commercialization of its One-Pot and M2CAM technologies.

The partnership follows Nano One’s announcement on May 25 of its C$10.25 million ($8 million) acqui sition of Johnson Matthey

each of three sites — the Columbia, Ridge View and Rich Road solar en ergy centers — represent ing nearly 40% of the total 2,408MW of procurement announced.

Hochul said: “These projects will allow us to exceed our goal of obtain ing 70% of our electricity from renewable resources and will further cement New York as a national leader in the fight against climate change.”

Hochul said the decision marked the state’s largest

land-based renewable en ergy procurement to date.

In June 2020, New York State’s grid operator, NY ISO, announced the most aggressive clean energy mandates in America, ac cording to its CEO Rich ard Dewey.

Last July, New York’s Queens borough was given the go-ahead to deploy a 100MW/400MWh battery storage facility system as part of a 300MW portfolio of projects to be rolled out by utility Con Edison by 2023.

South Korea’s LG Energy Solution (LES) is teaming up with two German research insti tutes to develop a next generation electrolyte and a “green process” for lithium ion battery manufacturing, the BESS and auto batteries giant announced on June 7.

LES said it is partner ing the University of Münster and Forschun gszentrum Jülich as part of a research program funded by LES’ Frontier Research Laboratory.

Battery Materials (JMBM) Canada.

Nano One CEO Dan Blondal said the Rio Tinto agreement would build on the JMBM Canada acquisi tion and support the min ing group’s own growing battery metals business.

The new investment will also support Nano One’s acquisition of JMBM Can ada’s 2,400 tonne per an num capacity lithium iron phosphate production facil ity in Quebec and “indus trial scale piloting of other Nano One CAM technolo gies, and for working capi

tal purposes”, the company said.

The deal also paves the way to launch a study of Rio Tinto’s battery metal products, including iron powders from the Rio Tinto Fer et Titane facil ity in Québec, as feedstock for the production of Nano One’s cathode materials.

Rio Tinto has gradually been ramping up its inter ests in the battery industry, including the purchase of the Argentinian lithium brine project Rincon for $825 million, announced last December.

The work with the university’s Münster Electrochemical Energy Technology unit and the Helmholtz Institute Münster of the Forsc hungszentrum will focus on ways to boost battery cell performance, includ ing its energy density and cycle life.

LES established the laboratory program with the University of California San Diego to develop a new type of an all-solid-state battery, using solid-state elec trolyte and advanced electrode techniques.

Finnish renewable products firm Stora Enso said on July 22 it was branching out into batteries with Swedish giga factory developer Northvolt — to create a “sustainable battery” featuring anode produced using lignin-based hard carbon made from Nordic forest wood.

The partners have entered into a joint development agreement for the project that will use renewable raw materials sourced sustain

ably in Nordic countries.

Lignin is a plant-derived polymer found in the cell walls of dry-land plants, the companies said. “Trees are composed of 20%–30% of lignin, where it acts as a natural and strong binder. It is one of the biggest renew able sources of carbon any where.”

Stora Enso’s pilot plant for bio-based carbon materials, at the group’s Sunila pro duction site in Finland, has

been producing lignin on an industrial scale since 2015 with an annual production capacity of 50,000 tonnes.

Northvolt chief environ mental officer Emma Neh renheim said: “With this partnership, we are ex ploring a new source of sustainable raw material and expanding the Euro pean battery value chain, while also developing a less expensive battery chemistry.”

The battery maker also launched a separate initiative under the program in October 2021 with the Korea Advanced Institute of Science and Technology — a national university for base techniques on elements of next-genera tion batteries.

NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 7

Tinto battery metals deal with Nano One LG Energy Solution in German R&D partnerships IF YOU HAVE A NEWS STORY YOU WOULD LIKE TO FEATURE PLEASE CONTACT: john@energystorage journal.com Northvolt looks to ‘wood-based’ batteries New York says 2,408MW BESS plans add up to near $3bn investment boost

Allianz warns of EV batteries risk to safe shipping

A new report released on May 10 warns that the lithium-powered so-called ‘green energy’ revolution is increasingly hazardous for shipping safety — with EV battery fires contributing to clean-up costs and causing environmental concerns.

According to the Safety & Shipping Review 2022, published by corporate insurance carrier Allianz Global Corporate & Spe cialty (AGCS), the rise in popularity of EVs repre sents “a significant differ ence in risk profile for ship pers when compared with traditional vehicles”.

Following more than 70 reported fires on container ships alone in the past five years, the report says a ma jor rethink of vessel designs, fire detection and fire-fight ing capabilities may also be required.

The report cites the inci dent last February, when a fire broke out aboard the car carrier Felicity Ace in the Atlantic.

The vessel sank in March with 4,000 vehicles, includ ing EVs, worth an estimat ed $400 million-$500 mil lion on board, while being towed to rescue, the report says.

“Given the vessel sank, the exact cause of the fire may never be known. How ever, it is thought the pres ence of lithium ion batteries on board aggravated condi tions.

“EV lithium ion batter ies could potentially ignite if damaged, are susceptible to cargo shift in rough seas if not adequately secured and can also combust with an increase in temperature from a nearby fire or even during on board charging,” the report says.

“Fires require a large vol ume of water to extinguish and cool the surrounding

area, which can, in turn, endanger the stability of the ship. Crews will need to be specially trained and equipped with appropriate detectors and fire extin guishing equipment.”

Captain Rahul Khanna, AGCS’ global head of ma rine risk consulting, says in the report: “The costs of responding to incidents and clean-up are now typically many multiples of the ship’s value.

“Larger vessels mean larger losses. An incident involving a container ship or car carrier can now cost as much as $1 billion, once salvage and environmental considerations are factored in. A major incident involv ing two mega container/ passenger vessels in an environmentally-sensitive region could cost in excess of $4bn.

“We now have ships that are almost too large for the crew to fight fires effective ly. There needs to be an ur gent review of fire detection and fighting protections and equipment on board

large container ships.”

Cargo mis-declaration is another problem, the re port says, citing an incident in August 2021 when a container full of discarded lithium batteries caught fire in the US while being trans ported by road to the Port of Virginia, where it was due to be loaded on to a container ship.

The cargo had been wrongly declared as ‘com puter parts’ and the US Coast Guard said that the

incident could have been catastrophic had the con tainers caught fire after be ing loaded aboard the ship.

Cargo vessels accounted for half of all 27 vessels lost around the world in 2021, according to AGCS.

Energy Storage Journal reported on March 3 that China had called on the In ternational Maritime Orga nization to consider a shake-up of maritime safety rules for EVs being shipped by sea.

Batteries insurance warranty scheme launched

Batteries insurance and warranties company

Altelium has teamed up with Tokio Marine Kiln (TMK), an international insurance underwrit ing business, to launch what the partners say is a world-first warranty programme for battery energy storage systems.

Warranties are is sued based on battery properties, behaviours and data analytics. An online platform is used to gather the information, including data capture, performance and risk

assessment, to the pricing of the premium.

The companies say such warranties can be used to support the use and tradein of second life batteries, and so lowering technol ogy and operational risk.

Purchasing warranties enables battery manufac turers “to free up trapped capital”, allowing greater resources to be focused on growth, UK-based Altelium said.

Altelium co-founder Ed Grimston said the aim was to “help ac celerate the transition to

renewables by providing real-time, data-driven insurance solutions for first and second-life BESS and EVs”.

TMK head of innova tion Tom Hoad said: “Providing insured warranties for BESS will unlock the deployment of large-scale capital invest ment.

“We are all aware of the urgent need to improve energy security and slash carbon emis sions. Partnering with start-ups like Altelium helps us support this.”

The smoke-engulfed Felicity Ace Photo: Allianz

NEWS 8 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

Europe trails US, China in ESS growth, study reveals

European investment in energy storage systems has stalled — and the region is lagging behind the US and China in terms of market growth in the sector, ac cording to a new study.

Cumulative storage de ployments worldwide are expected to reach 500GW by 2031, says Wood Mack enzie’s Global Energy Stor age Outlook, published in July.

But the study says Eu rope demand is lagging behind as the region’s gridscale market “struggles to stabilize”, with only 159GWh forecast for the region by 2031, compared to 422GWh for China and 600GWh for the US.

One commentator blames the over-regulation of the European Commis sion, the civil service arm of the EU, as the reason for the slower rates of adoption: “In the US com mercial imperatives, which are mostly understood by federal states, underpins

the growth. In China the central government’s grip on the economy means it can impose its will across the nation.

“But in Europe, decisionmaking by committee and by politicians with little commercial experience has caused the region to talk big, put too many rules into place and then lag behind the others. If there is any good to come from the Rus sian invasion of Ukraine it has stirred up a greater sense of urgency about en ergy storage across the EU.”

Dan Shreve, global head of energy storage at Wood Mackenzie, said: “Growth has stalled in Europe as regulatory barriers fail to improve storage project economics. In addition, limited access to power markets and a lack of reve nue stacking opportunities, combined with a lack of capacity market auctions, has lowered investment for grid-scale storage assets in Europe.”

EASE urges 14GW p/year ramp-up of energy storage for renewables

Europe needs a ramp up of energy storage capac ity at the rate of at least 14GW per year within the next nine years — or the bloc will be unable to inte grate energy supplies from the rapid expansion of re newables and miss climate goals, says a study released in June by the European Association for Storage of Energy (EASE).

Existing European Com mission assumptions on en ergy storage need to be re vised, according to EASE’s Energy Storage Targets re port* — which estimates a ‘no-regret storage require ment’ of about 200GW by 2030 and 600GW by 2050, including 435GW from power-to-X-to-power solutions for energy shift ing and storage for varying

durations.

“Establishing these 2030 and 2050 values as energy storage targets at EU level, with a dedicated energy storage strategy, will pro vide a clear signal to the energy storage industry and investors to begin building the infrastructure needed to drive large-scale deploy ment in parallel with sup porting renewables integra tion,” the report says.

According to EASE, most recent Commission studies, published in March 2020, estimated 456GW of flexi bility would be needed by 2030, but EASE said this is based on “outdated climate targets” and should be re viewed as the EU starts to cut back on fossil fuel im ports such as those from Russia.

However, the study said Germany’s energy storage market is continuing to grow and is set to become the third biggest energy storage market by 2030 after the US and China — with 32GWh forecasted for the country, 61% of which derived from residential storage.

The study notes that the European Commission’s REPowerEU plan — aimed at severing dependence on Russian gas before 2030 — will boost the EU energy storage market further as it pushes for a higher share of renewable supply in EU member states.

Europe has already seen a 12 GWh increase since the plan was launched this May, which set out a 600GW target for the solar PV market and pledged to ease permitting processes for storage and PV systems.

Shreve said: “While RE PowerEU does not set out a specific target for energy storage, higher renewable supply targets will drive demand for flexible power solutions, including energy storage assets.”

Meanwhile, the US re mains the energy storage market leader, with aver age annual installations of 54GWh through to 2031, 83% of which will be grid-

scale, the study says.

But Wood Mackenzie’s US outlook shows 2022 and 2023 demand downgrades of 34% and 27% respec tively because of what the company says are disrup tions within the grid-scale and distributed segments from an anti-dumping and countervailing duties (AD/ CVD) tariff suit from the second quarter of this year.

“The US solar and stor age market was hit hard by the AD/CVD tariff pe tition, with approximately 35% of 2022 hybrid gridscale installations delayed,” Shreve said.

On China, the study high lights the country’s “contin ued dominance” in the Asia Pacific market, with more than 400GWh of demand forecast through to 2031.

Shreve said this has main ly been driven by China’s 14th ‘Five-Year New En ergy Storage Development Implementation Plan’, which reiterated the central importance of energy stor age in national decarbon ization plans.

China’s plan proposes that by 2025 energy storage will enter the large-scale de velopment stage, with sys tem costs falling by more than 30% through im proved technology perfor mance.

EU nations urged to fast-track storage and cut red tape

The European Commis sion said on May 18 that battery storage and re newables projects should be fast-tracked and planning red tape slashed, as Europe scrambles to combat a looming energy crisis.

The Commission recommended that EU countries speed up ap provals for the planning, construction and opera tion of plants producing

electricity from renewa bles — together with energy storage facilities — and ensure such pro jects “qualify for the most favourable procedure available in planning and permit-granting proce dures”.

All such projects should be “presumed as being in the overriding public interest and in the interest of public safety”, the Commission said.

NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 9

Hong Seng in BESS and EV batteries production hub plan for Malaysia

Hong Seng Consolidated and EoCell unveiled pro posals on June 14 to de velop a regional battery manufacturing hub in Ma laysia to initially supply electric vehicles and then energy storage systems.

The companies have signed a memorandum of understanding that paves the way to select a site for the facility and work with Malaysia’s government to “obtain incentives and necessary authoriza tions”.

Silicon Valley-based next-generation lithium batteries firm EoCell is set to licence the use of its products and manufac turing technology for the project with Hong Seng, a Malaysian conglomerate.

Hong Seng managing director Dato Teoh Hai Hin said: “The global en ergy storage market has a bright outlook, with a valuation of $10.37 bil lion in 2020 and forecast

to reach $37.06 billion by 2027.

“This translates into a compound annual growth rate of 19.9% between 2022 and 2027, and the batteries segment is ex pected to account for the largest share in the energy storage market.”

EoCell holds a number of patents in battery tech nology in the US and is in a collaboration arrange ment with Norwegian cells development compa ny Morrow Batteries.

Michael Loh, EoCell’s CEO, said: “We believe Hong Seng is poised to become one of Southeast Asia’s leading battery producers with a focus on sustainable production facilities powered with clean green energy.

“The Southeast Asian electrification movement is underway and Hong Seng has a great strategy to fulfil this upcoming de mand.”

Banks financing energy boost for Guyana

Guyana is to develop eight utility-scale solar and bat tery storage projects in the South American country with investment financing worth around $83 million, the Inter-American Devel opment Bank (IDB) an nounced on June 17.

The IDB and the Nor wegian Agency for Devel opment Cooperation have approved the non-reim bursable financing for the photovoltaic solar projects totaling 33MWp with an associated 34MWh of en ergy storage systems.

Guyana “will now make a transformational leap to wards decarbonization by expediting climate-resilient

renewable energy in the electricity generation ma trix”, the IDB said.

The program will also support a step-change by digitalizing electrical sys tems in three areas of the country, moving them from manual systems towards real-time, automated moni toring and control, improv ing efficiency, reliability, and stability, the IDB said.

Utilities Guyana Power and Light and the Linden Electricity Company will also benefit from the use of solar photovoltaic technol ogy that will displace sig nificant amounts of fossil fuels and reduce generation costs, the IDB said.

Freyr signs new battery materials supply deal

Gigafactories developer Freyr Battery said on June 15 it had signed a further battery materials deal with two companies to supply its customer qualification plant being built in Nor way.

Freyr said China-based Changzhou Senior New Energy Materials and Se nior Material (Europe), based in Sweden, have reserved unspecified sup plies of separator material through 2028 and Freyr has an option to extend supplies until 2031.

The supply deal follows Freyr’s signing of nine agreements with key bat tery material suppliers, announced on February 2, for “more than 90%” of its raw material requirements for initial facilities, includ ing the customer qualifica tion plant.

Executive vice president of supply chain manage ment for Freyr, Tilo Hauke, said the latest agreement

“ensures that we won’t lose any speed when it comes to securing the re quired separator materi als to start production at our customer qualification plant and Gigafactory 1 & 2”.

Changzhou Senior is a pre-qualified supplier of 24M Technologies — which signed a licensing agreement in 2020 for Freyr to have unlimited production of lithium ion battery cells based on its SemiSolid technology.

Robin Olsson, Senior Material COO, said the intention was to eventually meet Freyr’s supply needs through the firm’s facility in Sweden, “which aligns well with Freyr’s mission to source materials as lo cally as possible”.

Freyr plans to develop up to 43GWh of battery cell production capacity by 2025, with an ambition of up to 83GWh in total ca pacity by 2028.

InoBat cells deal with Impact Clean Power

Energy storage battery systems manufacturer Impact Clean Power Technology has signed a battery cells development and supply agreement with Slovak battery tech developer InoBat, the companies announced on July 14.

The cells will be used to develop high voltage bat tery systems at Impact’s planned GigafactoryX plant in Poland, which Impact said on June 29 is being built to serve the stationary energy stor age, public transport and railway sectors.

Financial terms of the agreement were not disclosed.

However, Impact and InoBat said they expect to have an “early prototype sample cell” ready for performance testing dur ing 2023.

InoBat co-founder and CEO Marian Bocek said the partners plan to cre ate “a truly differentiated electric battery cell” for Impact’s battery systems.

Impact says Gigafacto ryX is expected to start producing power systems based on lithium ion cell technologies — LTO, LFP and NMC — in 2024 and boost the company’s existing production capacity from around 1MWh to up to 5GWh per year.

NEWS 10 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

Canadian Solar enters UK utility-scale ESS market

Canadian Solar has entered the UK’s utility scale energy storage market after sign ing agreements for four battery storage projects, the company said on May 9.

The agreements with Pulse Clean Energy, include converting four diesel gen eration sites into grid-scale battery storage facilities, together with engineering, procurement and construc tion services for the more than 100MWh of projects.

Pulse, which launched earlier this year, said the sites are in South Wales, Warwickshire and northeast England.

The companies did not disclose financial details or specify the battery technol ogy involved, but said the deal marked the start of a

KORE Power battery tech chosen for new BESS in UK

KORE Power said on June 8 it had been selected to supply its battery technology for a 10MW/20MWh lithium ion BESS being developed in the UK by ABB.

The US-based battery cell tech company will provide its Mark 1 storage modules equipped with high energy density NMC pouch technology for the facility, which will be installed at renewable energy company Ecotricity’s existing 6.9MW wind farm in Gloucestershire in 2023.

The BESS will use Ecotricity’s proprietary ‘Smart Grid’ platform to dispatch stored electricity according to system needs, KORE said.

Mark Meyrick, head of smart grids at Ecotricity, said: “We’ve been working towards our first grid scale battery as we’ve been developing our Smart Grid platform and we’re looking forward to taking this next step with ABB.

“This project is a first

long-term partnership be tween the companies.

In addition to providing the battery storage systems and construction services, Canadian Solar will main tain and operate the proj ects under a 10-year longterm service agreement.

As of January 31, 2022, Canadian Solar’s energy storage portfolio included 300MWh of projects under a long-term service agree ment, 2,043MWh of proj ects under construction and a remaining pipeline of over 4GWh. Canadian So lar’s Energy Storage Team says it continues to expand its regional footprint, exe cuting storage projects and deploying resources in Can ada, the US, UK Australia, and China.

for us and will enable us to manage demand for renewable energy, as well as develop a greater understanding of the deployment of storage for flexibility requirements.”

On March 23, KORE said it had acquired energy storage company Northern Reliability for an undisclosed sum — and had launched a new division called KORE Solutions.

First phase of China 200MW flow battery on the grid

The first phase of a planned 200MW/800MWh vanadium redox flow battery energy storage system has been connected to the grid in China, the China Energy Storage Alliance (CNESA) reported on July 19.

CNESA said the initial 100MW/400MWh system in Dalian achieved grid connection on May 24 after six years of planning, construction and commissioning, at a total investment cost of Rmb1.9 billion ($281 million).

Umicore launches Korea R&D plant for cathode materials

Materials technology and recycling group Umicore has formally opened a new global research and devel opment center for cathode materials in South Korea, the company announced on May 10.

Umicore said the 30,000m2 (330,000 square feet) center, built next to the company’s existing R&D and cathode materials pro duction plants in Cheonan, became fully operational in early April, providing ser vices for the energy storage, automotive and portable electronics sectors.

The centre also houses a new battery cells and test ing laboratory.

Product research at the centre will continue to fo cus on next-generation bat tery materials, including high-nickel NMC, low co balt NMC, manganese-rich

chemistries as well as solidstate battery materials tech nology, Umicore said.

Umicore’s executive vice president for energy and surface technologies, Ralph Kiessling, said: “This will enable us to continue to develop cathode materials that exceed customer ex pectations in terms of qual ity, reliability, safety and in novation.”

In May 2021, Umicore and BASF said they had signed a cross-licence agree ment to develop cathode materials and precursors in a wide range of battery chemistries based on nickel and manganese.

The chemistries named as in line for development were nickel manganese co balt, nickel cobalt alumini um, nickel manganese co balt aluminium and high manganese.

Miba acquires majority Voltlabor stake

Automotive and en ergy systems company

Miba has acquired an undisclosed majority stake in battery systems producer Voltlabor, the Austrian companies an nounced on May 23.

The deal builds on the 25.1% stake Miba acquired in 2019 and Voltlabor will be re named Miba Battery Systems.

Voltlabor develops and produces battery systems incorporating a novel temperature management system for sectors including energy storage and e-mobility.

Miba is building a 3,900 square metre (42,000 square feet) ‘VOLTFactory’ battery

production plant in Bad Leonfelden, Austria and says other such plants are planned to meet enormous demand.

Miba CEO Peter Mit terbauer said acquiring a majority stake in Volt labor was an important milestone in his compa ny’s corporate strategy.

“We want to grow to sales of €1.5 billion ($1.6 billion) by 2027 with technologies for end applications for the efficient generation, transmission, storage and use of energy. Batteries as storage for energy are an important pillar in this context and an optimal addition to the Miba product portfolio.”

NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 11

New CellCube unit in US targets VRFB business

CellCube brand owner Enerox said on May 5 it had launched a subsidiary in Colorado to take ad vantage of “exploding de mand” for long duration energy storage systems in the US market.

The Austria-based vana dium redox flow battery (VRFB) company said it would target a range of services including support for renewable energy sup ply and microgrid appli cations.

CEO of CellCube Aus tria and US, Alexander Schoenfeldt, said: “Be ing a global leader in this space, we are very en thusiastic about our new presence in North Amer ica, as it will allow us to build and use local supply chains and engage with our business and R&D

partners in the US more easily.”

CellCube was among the group of companies that formed the Long Duration Energy Storage Council in November 2021, with the stated aim of achieving grid net-zero by 2040.

Last February, Enerox signed an expanded fiveyear supply agreement with electrolyte supplier, US Vanadium, for three million litres per year, to gether with a price cap over the five-year term.

Schoenfeld said then that the agreement was part of the company’s “go-to-mar ket in North America” strategy using electrolyte that had been regionally processed within North America, “ensuring longterm deliverability at a competitive price”.

Energy Vault starts work on China gravity-based ESS

Energy Vault Holdings has broken ground on its first gravity-based energy stor age system in China, the company announced on May 5.

Energy Vault said the 100MWh ‘EVx’ is being built next to a wind farm and national grid site in Rudong, near Shanghai, in partnership with Atlas Re newable and China Tiany ing (CNTY).

The launch of work in Rudong follows a $50 mil lion licensing agreement between Energy Vault, USbased Atlas Renewable — which supports companies in project dealings with Chi nese institutions and regu latory authorities — and CNTY, a Chinese environ mental services firm.

Energy Vault uses a block tower system to store and release renewable energy from wind and solar opera tions. It uses surplus renew

able energy to store power by constructing the tower with a crane. When demand rises, the crane unstacks the tower, producing kinetic en ergy by dropping the blocks so that they can turn genera tors and create electricity.

Company chairman, cofounder and CEO Robert Piconi said: “Our first com mercial EVx deployment in China is a significant mile stone.

“China is rapidly expand ing its use of renewable en ergy coupled with annual energy storage mandates in order to meet its decarbon ization goals. We are very pleased that EVx and our energy management soft ware platform have already received local regulatory en dorsement and is being de ployed now as a critical en abling technology to support China’s energy transition and carbon neu trality goals.”

Powin BESS system earmarked for Idaho Power project

Energy storage company Powin is set to provide 120MW/524MWh of bat tery storage, to come online next summer in the US state of Idaho, Idaho Power an nounced on May 2.

The lithium iron phosphate ‘stack’ batteries are set to be the first utility-scale stor age systems in Idaho. They would help maintain reliable service during periods of high use, while furthering the company’s goal of providing 100% clean energy by 2045.

Proposals for the Powin storage projects were filed in April with the Idaho Public Utilities Commission, which will determine whether the

project is in the public inter est.

If the project is approved, the batteries should come online by June 2023 across several locations.

Idaho Power senior vice president and chief operat ing officer Adam Richins said: “Not only are we add ing capacity to serve our cus tomers, but we are taking ad vantage of advancements in technology that will be key to our future.

“Battery storage enables us to use existing genera tion sources efficiently while setting the stage for more clean energy in the coming years.”

California Li-tax law triggers battery materials supply alert

California is to slap a tax on lithium production in the state to generate cash to spend on environmental re mediation projects — amid warnings the move could disrupt the battery materi als supply chain and hit the state’s investments in energy storage and electric vehicle production.

The Lithium Extraction Tax Law — part of a pack age of budget proposals signed off by state governor Gavin Newsom — will comprise a tax of $400 per tonne for the first 20,000 tonnes of lithium produced annually, $600 per tonne for the next 10,000 tonnes and $800 per tonne with output of 30,000 tonnes or more.

The law comes into ef fect on January 1, 2023 and would affect projects such as lithium production in California’s so-called ‘lithium valley’ Salton Sea region.

According to the bill, the aim is “to promote a robust California-based lithium extraction industry that considers the needs of the

local communities where the lithium extraction occurs, while recognizing the significant benefit of having a domestic supply of lithium for the state’s goals for reducing the emissions of greenhouse gases”.

However, Controlled Thermal Resources, whose ‘Hell’s Kitchen Project’ at Salton Sea is set to recover lithium from geothermal brines using renewable energy and steam to pro duce battery grade lithium products, said the tax as it stands would “severely impact the development of ‘Lithium Valley’.

CTR said: “Supporting a tax that ensures lithium imports from China are less expensive for auto manu facturers will devastate this promising Californian in dustry before it has begun.”

Eric Spomer, the CEO of privately held EnergySource Minerals, reportedly told Reuters: “This tax would stifle our industry before it even begins. We’re willing to pay and contribute to the local community, but it has to be a rational tax.”

NEWS 12 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

TotalEnergies commissions second BESS in French deal

TotalEnergies has commis sioned a 25MWh battery storage facility at its Car ling industrial site in northeastern France, the group said on May 9.

The BESS comprises 11 lithium ion battery contain ers designed and assembled by TotalEnergies’ subsid iary Saft.

The company has re vealed plans to launch a third BESS facility in France by the end of 2022, as it fi nalizes its portfolio of proj ects awarded by the French Electricity Network (RTE).

Carling is the second BESS built under tenders awarded to TotalEnergies by RTE.

The energy company com missioned its first BESS for RTE, a 61MWh Dunkirk facility, last December.

Carling, which is also home to two combined cycle gas turbine power plants, will be used to sta bilize the grid and to sup ply power during peaks in consumption, especially in winter.

Meanwhile, Saft said on May 11 that it had won a

contract to supply a 10MW BESS to provide capacity and firming and smooth ing for what will be Côte d’Ivoire’s first solar plant.

The Boundiali plant BESS will comprise six of Saft’s lithium-based Intensium Max high energy contain ers, providing a total of 13.8 MWh of energy storage, to gether with power conver sion and medium voltage power station systems.

TotalEnergies said the BESS is scheduled for com missioning in September 2022.

Britishvolt acquires EAS, agrees Bühler tech deal

UK gigafactory developer Britishvolt announced on May 24 it had signed a sales purchase agreement to acquire German battery cells producer EAS Batter ies from the Monbat group, in a cash and shares deal worth €36 million (about $38 million).

Monbat CEO Viktor Spiriev said his company would “continue to be part of the expected growth of the lithium ion industry through the minority stake that the group will hold in Britishvolt”.

“We believe Britishvolt is the right partner that has the necessary resources to become a leader in provid ing lithium ion solutions for electrified transporta tion and energy storage.”

Britishvolt founder and CEO Orral Nadjari said

the acquisition would al low the company to scale up the final part of its ‘46xx cell’ development and com mercialization program and “put this leading cell product in the hands of our automotive customers”.

“Our 46xx cell format, developed as part of our wider R&D program, gives Britishvolt a significant competitive advantage in the battery race.”

EAS has more than 25 years of experience in de veloping and producing large format cylindrical lithium-ion battery cells from 7.5Ah to 50Ah.

Monbat, a predominantly lead battery manufacturer, acquired EAS in 2017. The sales and purchase agree ment for Britishvolt to acquire EAS is subject to various commercial and

regulatory approvals.

Separately, Britishvolt said on June 7 that Swiss manufacturer Bühler is to supply the gigafactory de veloper with “low-carbon” battery mixing technology.

Britishvolt said its first gigaplant, in Northumber land, will use large scale Bühler production lines for the manufacture of electrode slurries for the first go-to-market phase of 4.8GWh, which will be ex panded to 38 GWh towards the end of the decade.

This corresponds to enough battery cells for well in excess of 300,000 electric vehicles per year, Britishvolt said.

Britishvolt’s ramp-up and production lines are sched uled to be commissioned in September 2023 and spring 2024, respectively.

CATL joins winners of EES awards in Germany

Chinese battery giant Con temporary Amperex Tech nology (CATL) was among the winners of the 2022 an nual innovation prize at the Electrical Energy Storage (EES) exhibition in Munich, Germany, the organizers an nounced on May 10.

CATL joined German in verter company STABL En

ergy and second-life electric vehicle batteries firm Volt fang in receiving the award in the electrical energy stor age category.

EES said CATL’s EnerOne LFP battery storage system, the STABL SI 100 modu lar multi-level converter and the Voltfang industrial commercial storage system,

made from second-life car batteries, were all examples of innovative products with in the storage industry.

The EES award was pre sented along with others for innovation from across the three other exhibitions held in conjunction with EES — Intersolar, Power2Drive and EM-Power.

Grid connection green light for BESS

Australian renewables company Maoneng Group has been given the green light to connect its 240MW/480MWh bat tery energy storage sys tem to a grid substation in the state of Victoria.

The company said on May 18 that the Aus tralian Energy Market Operator had given the go-ahead for grid connec tion of the lithium iron phosphate BESS, on the Mornington Peninsula, which is scheduled for completion in early 2024.

The facility will be connected to Australian energy firm AusNet’s Tyabb substation in the southern part of the state’s grid, although no connection date was an nounced.

Maoneng said the BESS, which represents “hundreds of millions of dollars of investment”, will draw and store energy from the grid dur ing off-peak periods and dispatch energy during peak periods, generating power for the equivalent of 40,000 average homes.

Company co-founder and CEO Morris Zhou said battery storage was “vital to the clean energy transition… this project is progressing at a time when demand for renew able energy and associ ated storage capacity is increasing, and we are seeing a lot more inter est in battery projects in Australia and interna tionally.”

In a related move on May 1, Maoneng unveiled details of a proposed energy hub comprising a 550MWac solar farm and 400MW/1,600MWh BESS in New South Wales.

NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 13

Australian

Powin in Australia deal with BlackRock’s Akaysha Energy

Energy storage systems company Powin has en tered the Australian mar ket under a partnership deal with Akaysha En ergy to deploy more than 1.7GWh of energy storage systems over the next two years, the companies said on August 30.

The deal came just days after global funds manag er, BlackRock, said it was acquiring Akaysha — and injecting A$1 billion ($700 million) in capital to sup port the roll-out of BESS projects across Australia.

Powin, under the terms of a framework agreement, will deploy its lithium ion Stack products line and advanced power plant con trol systems.

Powin said its engineer ing team has been working with Akaysha for several months and was well ad

vanced in the grid inter connection process, includ ing meeting the generator performance standard re quired by Australia’s grid operator for entry into the market.

Geoff Brown, Powin’s CEO, said the deal was “a key milestone as we ex pand our footprint glob ally and invest in new re gions”.

Akaysha MD Nick Cart er said: “It is critical to have a diverse competitive landscape in the Austra lian ESS market. Powin’s vertically integrated and flexible business model re duces project cost and risk by having multiple trusted cell suppliers, proprietary software, and an in-house power plant controller.”

The acquisition of Akay sha is the first battery stor age investment made by

Japan supercharges battery ambitions with ESS targets

Japan’s government un veiled targets on August 31 to expand the annual do mestic production of elec tric vehicle and energy stor age batteries to 150GWh by 2030.

Ministers also want to see 30,000 workers trained up to support the country’s fu ture battery manufacturing industry and supply chains.

The government said new educational programs should be introduced at technical institutions to help attract a new genera tion of workers to the bat teries sector.

Japan’s Ministry of Econ omy, Trade and Industry (Meti) said a panel of ex perts would have the task of formulating a national bat tery strategy, as the country launches a fresh push to counter strong competition

from battery manufactur ing rivals across Asia.

Meti said the goal also included achieving “fullscale commercialization of all-solid-state batteries by around 2030”.

The panel will work with battery industry leaders in Japan to agree on a specific plan by the end of March 2023.

Meti also said the govern ment would step up support for Japanese companies that can secure battery ma terials supply chains, such as by forging alliances and partnerships with mineralrich countries worldwide.

But the ministry said it would be up to private Jap anese companies to also raise capital on the markets to take part in large-scale investments in battery proj ects overseas.

BlackRock’s Climate Infra structure business — part of BlackRock Real Assets — in the Asia-Pacific re gion.

Akaysha is developing nine BESS projects in Aus tralia’s National Electricity Market, which Akaysha says will reduce more than 15 million tonnes of CO2 equivalent emissions over the lifetime of the projects.

The nine projects, when operating at full capac ity, will help accelerate the deployment of a further 4,000MW of supply of renewable energy across Australia, BlackRock said.

Asia-Pacific co-head of climate infrastructure for BlackRock, Charlie Reid, said: “As renewable energy

infrastructure continues to mature in Australia, invest ment is required in battery storage assets to ensure the resilience and reliability of the grid, especially with the continued earlier-than-ex pected retirement of coalfired power stations.

“We see tremendous long-term growth poten tial in the development of advanced battery storage assets across Australia and in other Asia-Pacific mar kets.”

Akaysha, established in 2021, has longer-term plans that include develop ing additional BESS sys tems in other markets in the region, with a “nearterm focus on Japan and Taiwan”.

NGK in grid storage batteries order

NGK Insulators said on September 12 it had received an order from Toho Gas in Japan for its sodium sulfur battery to provide grid electricity storage services.

The NAS batteries have an output of 11.4MW and a combined capacity of 70MWh, which the ceramics group said is equivalent to one day of electrical power con sumption by about 6,000 average homes.

The batteries will be installed at Toho’s Tsu former liquefied natural gas plant. Construction was set to start in Sep tember 2022.

NGK did not disclose

financial details of the order but said the bat teries would be directly connected to an electrical power grid and intended to stabilize supply and demand.

The project aims to support continued use of renewable power including solar and wind generation in the region, NGK said.

NAS batteries have been installed at more than 200 locations world wide to date, NGK said.

In August 2022, the company said it would deploy its batteries with solar at manufacturing sites in the country to reduce CO2 emissions.

NEWS 14 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

Schuler acquires Sovema with pledge on lithium, lead units

The Sovema Group has been acquired by Ger man metal-forming group Schuler for an undisclosed sum, the companies an nounced on August 23.

A Schuler spokesperson told ESJ the deal was not subject to any relevant reg ulatory decisions and is ex pected to close by the end of September 2022.

The acquisition includes both the lithium ion and the lead acid battery parts of Italy-based Sovema’s business — which will “both be continued”, the spokesperson said.

“We consider it a great strategic fit as both compa nies’ technological capabil ities are fully complimen tary and gigafactories are about to come into play soon.”

The acquisition covers all Sovema entities includ ing Solith, which provides equipment for lithium ion cell and module produc tion, Sovel — high-perfor mance formation systems

for lead and lithium stor age technologies — and US-based battery testing equipment company Bi trode.

Sovema general manager Massimiliano Ianniello said the deal would ensure the group can “play a ma jor role in the gigafactory challenge”.

“So far, our size allowed us to serve our customers with high quality and cus tomization. Now, as part

Freyr and Nidec sign $3bn LFP battery cells supply agreement

Freyr Battery said on Au gust 30 it had signed a binding agreement to sup ply 38GWh of LFP bat tery cells to Japan’s Nidec Corporation between 2025 and 2030.

The sales deal is worth in excess of an estimated of $3 billion to Freyr from 2025 to 2030, based on projected raw material prices.

The cells will be pro duced at Freyr’s planned ‘Giga Arctic’ plant in Mo i Rana, Norway and the deal includes an option to “upsize” to 50GWh of cells during the period and to potentially expand sup plies further beyond 2030.

Freyr said the agreement builds on an earlier, con ditional offtake agreement between the companies, for 31GWh of cells.

Freyr and Nidec have also entered into a joint venture agreement to de velop, manufacture and sell energy storage systems using modules and packs produced by Freyr.

The partners said bat tery modules production is expected to be integrated into Freyr’s activities at the Giga Arctic plant.

Nidec is a leading manu facturer of high-efficiency electric motors that is ex panding its reach into the ESS market.

of Schuler, we will finally be able to reach the vol umes required by the mas sive demand for battery manufacturing equipment in Europe and beyond.”

Bitrode president and

CEO Cyril Narishkin said the takeover would help the firm “accelerate new product offerings and help Bitrode reach its techno logical potential”.

Sovema changed its name to Sovema Group in June 2017, in line with the lead battery equipment manu facturer’s expansion into making machinery for the lithium ion battery industry.

Schuler, part of the inter national technology group Andritz, was founded in 1839 and has production sites in Europe, China, and the US, as well as service companies in more than 40 countries. Schuler’s client base includes automotive manufacturers and suppli ers and electrical indus tries.

Orral Nadjari has stepped down as CEO of Britishvolt, which is building the UK’s first lithium ion battery gigafactory, the company announced on August 20.

Nadjari, who is also a co-founder of Britishvolt, has been succeeded by Graham Hoare as acting CEO.

Hoare is Britishvolt’s deputy CEO and presi dent of global operations and chair of the UK Automotive Council.

Nadjari, who did not disclose the reason for the move, said: “Al though it was a dif ficult decision for me to step away from the operational management of the company, now is the right time for me to pass the reins, after laying the foundations, to our hugely talented, world-leading team, who

will drive the business forward as it enters the execution phase.

“I am proud of what Britishvolt has achieved since the business was founded in 2019, exceed ing all expectations and bringing my vision to life.”

A Britishvolt spokes person told ESJ Orral had stepped down, per manently, as CEO “after taking the business from a vision to a company of almost 300 full-time employees.

“Our first cells will be in customers’ hands at the end of the summer for validation.”

Britishvolt announced on February 15 it had secured the further backing of an existing investor, mining giant Glencore, to launch a £200 million ($270 million) funding round.

Britishvolt CEO Nadjari steps down

NEWS www.energystoragejournal.com Energy Storage Journal • Autumn 2022 • 15

New German law recognizes ‘special role’ of energy storage

The Germany Energy Storage As sociation (BVES) said on June 28 it welcomed new legislation aimed at putting energy storage on a “prop er regulatory footing” — but urged the federal government to clear up remaining “legal uncertainties”.

The legislation, which adopts a June 2019 European Union directive into German law, defines energy storage as being when “the final use of electrical energy is post poned to a later point in time than when it was generated”, BVES said.

However, BVES said “legal un certainties” remained in how the definition might impact the use of and investments in energy storage, because a “technical error” had been made in the translation of the EU directive to German.

“This should be corrected quickly,” the association said.

Germany’s parliament approved the definition as part of a raft of changes to national energy laws before legislators started their sum mer break.

The law acknowledges the “spe cial role of storage as the fourth pillar of the entire energy system” and gives storage a “suitable legal

€10m solid state seed funding for Basquevolt

Solid-state battery tech company

Basquevolt said on June 28 it had closed its first round of seed funding of €10 million ($10 million).

Basque’s government led the investment round, which included Basquevolt’s founding consortium members Iberdrola, CIE Automotive, Enagás, EIT InnoEnergy, and CIC energiGUNE — whose research has provided the initial technology baseline for the company.

Basquevolt, based in the Basque capital of Vitoria-Gasteiz in northern Spain, is initially developing technologies that include a proprietary polymer composite electrolyte and a high silicon content anode.

Basquevolt is a spin-off of CIC, the electrochemical and thermal energy storage research centre backed by the government of Spain’s autonomous Basque region.

The firm says its technology will

foundation”, BVES said.

The decision is intended to be the start of an extensive storage strat egy that will also cut red tape to encourage an expansion of “simpli fied digital connections” to support the rapid integration of energy storage with electricity generating systems including solar power.

Urban Windelen, BVES federal managing director, said: “We can finally build on this and develop a stable regulatory framework for the system integration of energy storage systems that is so impor tant.

“No obstacles should be placed in the way of citizens or companies that take the energy transition into their own hands.”

Sales of energy storage systems in Germany rose by more than 25% in 2021 compared to the previ ous year, generating a turnover of nearly €9 billion (about $9.6 bil lion), according to provisional data published by BVES on April 6.

BVES said the residential storage market segment recorded the largest rise, with more than €4 billion in sales in 2021 — a 28% increase over the previous year.

support the mass deployment of electric transportation, stationary energy storage and advanced portable devices.

Battery cells production is planned to start in 2027 with the eventual aim of reaching an annual capacity of 10GWh.

Co-founder and CEO Francisco Carranza said: “Current lithium batteries are reaching the limit of what they can offer and going to the next phase require a technology change, that’s where our products come into play.”

Poland gigafactory start for Impact Clean Power Impact Clean Power Technology has started building a battery systems gigafactory in Poland to serve the stationary energy storage, public transport and railway sectors, the company announced on June 29.

Impact said the GigafactoryX

facility will manufacture power systems based on lithium ion cell technologies — LTO, LFP and NMC — and boost the company’s existing production capacity from around 1MWh to up to 5GWh per year.

Production should start in 2024 with energy for the production process derived from renewable power generation, according to the company.

“Ultimately, half of the raw materials used in production will come from recycling.”

Impact has been selling battery systems in Europe, New Zealand and the US since 2007.

The company said its existing customers include Polish and foreign manufacturers of vehicles based on electric drives, including buses, trams and yachts, as well as companies from the industrial, power rail and telecoms sectors.

Impact CEO and co-founder Bartek Kras said the facility “is the next step in the field of energy production and transformation of public transport and industry to consistently reduce CO2 emissions”.

Minerals group ICL forms ESS unit

Israel-based minerals company

ICL said on May 27 it planned an expansion of its products and services with the launch of a new business unit focused on the energy storage market.

The dedicated energy storage solutions unit follows ICL’s entry into the lithium iron phosphate battery market in China last year.

ICL said it is looking to expand its presence beyond its existing speciality products used in cathode active materials and in bromide-based batteries.

ICL’s executive vice president and chief innovation and technology officer, Anantha Desikan, said the company was committed to expanding in the broader battery market in Europe and the US.

“This new unit has established dedicated battery resources at three of our global R&D centers and research includes exploring battery end-of-life recycling,” Desikan said.

“We are also investigating ways to advance energy storage and battery performance, and we continue to explore capacity expansions, partnerships and other types of collaborations, as part of these efforts.”

NEWS IN BRIEF 16 • Energy Storage Journal • Autumn 2022 www.energystoragejournal.com

Northvolt raises $1.1bn to underpin battery plans

Northvolt has signed a $1.1 billion convertible note to finance its expansion of battery cell and cathode material production in Europe, the Swedish company announced on July 5.