A full stop? Not even high interest rates can do that to Omaha’s CRE market

By Dan Rafter, Editor

Aslowdown, not a full stop. That’s how Omaha’s commercial real estate professionals describe the impact of higher interest rates on sales, leasing and development activity in their market.

Omaha has long boasted a resilient commercial real estate sector, one that doesn’t experience the high peaks of some markets but also doesn’t see the low valleys that other cities suffer. And that is holding true today, even as the Federal Reserve Board continues to raise interest rates and inflation keeps slamming consumers.

The Federal Reserve raised its key interest rate by 0.25% in late July, increasing this benchmark rate to a target range of 5.25% to 5.5%. The board has been increasing this rate steadily for more than a year to fight persistent inflation.

The move marked the Fed’s 11th interest-rate hike in the last 17 months.

David Levy, partner with Omaha law firm Baird Holm, said that higher rates, along with the higher costs of construction, have slowed projects in the city and its suburbs from either starting or reaching fruition. What it hasn’t done is caused developers to scrap these projects completely.

“We are still seeing an active commercial real estate market here,” Levy said. “Deals are happening. People are interested in new projects. There is a positive outlook. The interest rate situation and construction costs are maybe slowing things down. But they are not causing projects to stop or not happen.”

Two commercial sectors here – industrial and multifamily – are performing especially well today, even with higher interest rates. Levy said that Omaha is seeing an increase in hotel and hospitality projects, too.

Technology companies are increasing their activity

PROPERTY MANAGEMENT

The Foxconn Enphase Energy deal is just more evidence: The Milwaukee area has become an up-andcoming industrial player

By Dan Rafter, Editor

Foxconn earlier this summer signed a contract with Enphase Energy to manufacture computer parts for solar power generators at the company’s Mount Pleasant, Wisconsin, campus. This is one example of how companies are looking to the greater Milwaukee area as a destination for a wide variety of manufacturing and industrial uses.

ASSET/PROPERTY

DEVELOPERS MULTIFAMILY FINANCE REAL ESTATE LAW FIRMS FIRMS WWW.REJOURNALS.COM VOLUME 35 ISSUE 4 AUGUST 2023 MINNESOTA | MISSOURI | NEBRASKA | OHIO | TENNESSEE | WISCONSIN | THE DAKOTAS | ILLINOIS | INDIANA | IOWA | KANSAS | KENTUCKY | MICHIGAN OMAHA (continued on page 14)

CRE MARKETPLACE PAGE 40:

MANAGEMENT FIRMS

The Retail District in the Heartwood Preserve development.

MILWAUKEE (continued on page 24)

TWO PENINSULAS. UNLIMITED OPPORTUNITY.

PURE OPPORTUNITY ® MACKINAC BRIDGE From the majestic beauty and high-tech entrepreneurial spirit of the Upper Peninsula to the thriving cities and global innovation centers of the Lower Peninsula, Michigan is the land of unlimited opportunity. Discover why our state is the ideal place to live and work. Seize your opportunity at MICHIGANBUSINESS.ORG

MICHIGAN

Commercial Real Estate Lending Capital Markets 8 Reasons to Choose BankFinancial 's Mult ifamily Loan Program Loans of $250,000 to $3,000,000 1 Multifamily 5 Units and Above 2 LTV: Up to 65% / 80% (Dual Note) 3 Acquisition, Rate & Term, and Cash-out Refinances 4 5 3, 5, 7 & 10-year ARM Loans 6 Up to 30-year Amortizations 7 8 2nd Lien Line of Credit Loans and Investment Equity Loans Available* Capital Markets Loan Program Available Call Us Today to Discuss Your Next Commercial Real Estate Deal! 1.833.894.6999 1.833.894.6999 | BankFinancial.com All loans subject to credit and collateral approval. *BankFinancial must be the rst lien holder.

The Midwest’s commercial real estate publication, providing useful, unbiased and accurate coverage of the industry and its professionals since 1985.

WWW.REJOURNALS.COM

Publisher | Mark Menzies menzies@rejournals.com

Editor | Dan Rafter drafter@rejournals.com

ADVERTISING

Vice President of Sales & MW Conference

Series Manager | Ernest Abood eabood@rejournals.com

Vice President of Sales | Frank E. Biondo frank.biondo@rejournals.com

Classified Director | Susan Mickey smickey@rejournals.com

A full stop? Not even high interest rates can do that to Omaha’s CRE market: A slowdown, not a full stop. That’s how Omaha’s commercial real estate professionals describe the impact of higher interest rates on sales, leasing and development activity in their market.

The Milwaukee area now an up-andcoming industrial player: Foxconn earlier this summer signed a contract with Enphase Energy to manufacture computer parts for solar power generators at the company’s Mount Pleasant, Wisconsin, campus. This is one example of how companies are looking to the greater Milwaukee area as a destination for a wide variety of manufacturing and industrial uses.

The forgotten powerhouse?

Indianapolis’ industrial market keeps chugging along: The Indianapolis industrial market remains hot, with demand for warehouse and distribution space continuing to soar. But when people talk about the busiest industrial markets in the United States? You’ll rarely hear them mention Indianapolis.

Meeting the need for new multifamily units in Indianapolis: Like most major cities across the United States, Indianapolis has a shortage of apartment units when compared to the demand for them. That’s why the two new multifamily projects being developed by The Garrett Companies here are so important.

In tough times? Your local economic development corporation is more important than ever: Karaline Cartagena Edwards was tired of the snide comments she’d often hear about her home region of Northwest Indiana. As Edwards says, the area’s critics don’t understand how many talented people live and work in Northwest Indiana, how strong the business community here and how enticing the area’s restaurants, shops and entertainment offerings are.

Waiting for stability as Milwaukee’s commercial real estate market slowly working through interest rate challenges: The story of Milwaukee’s commercial real estate market is a common one today: The city’s CRE professionals are waiting for stability from the Federal Reserve Board on interest rates. And the hikes that the Fed has already launched have slowed commercial sales in this key Wisconsin city.

The office repositioning a key tool to bringing workers back to downtown and the suburbs: Minneapolisbased architecture firm NELSON Worldwide has handled more than a dozen office repositioning jobs in the last two years in the Twin Cities. The firm has designed plans that call for everything from adding worker-friendly amenities to skyscrapers to improving the walkability and outdoor meeting areas of sprawling office parks.

A flight to quality and the hope that conversions bring: The flight to quality? In the office sector, it’s more than a group of buzzwords. It’s reality. A growing number of companies are seeking less office space but in amenity-filled Class-A office buildings.

34

LightBox report: A CRE recovery pushed back to 2024? Commercial real estate’s path to recovery has been pushed back into 2024, given the fallout from rising interest rates and disrupted deal flow. There is long-term optimism for commercial real estate, however, particularly for the multifamily and industrial sectors, according to the LightBox 2023 Mid-Year Sentiment Report.

DEPARTMENTS/COLUMNS

6 Editor’s Letter

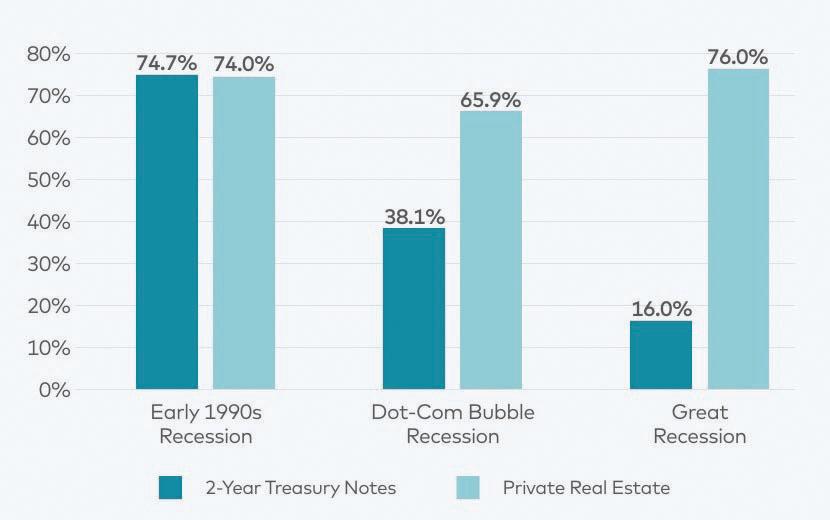

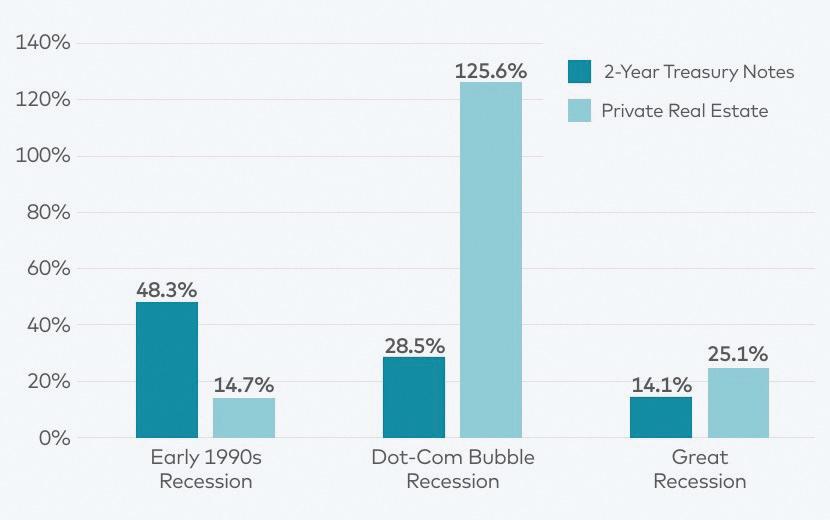

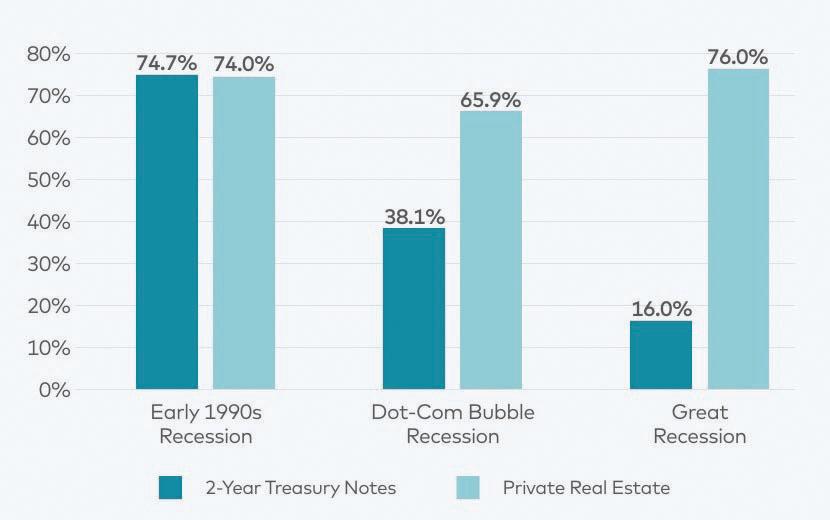

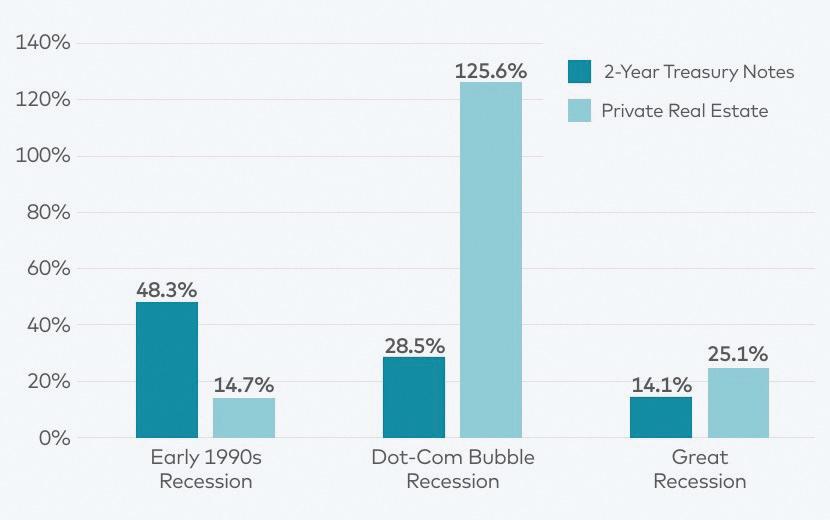

32 Investing in commercial real estate during challenging economic times is a winning strategy

35 Smart buildings vs. hackers

37 People on the move

40 August Marketplace

ADDRESS

1010 Lake St Suite 210, Oak Park, IL 60301 Midwest Real Estate News® (ISSN 0893-2719) is published bimonthly by Real Estate Publishing Corp., Oak Park, Il 60301 (rejournals.com). Current and back issues and additional resources, including subscription request forms and an editorial calendar, are available on the internet at rejournals.com.

4 | Midwest Real Estate News | August 2023 | www.rejournals.com

1 1 7 10

FEATURES

30

12 22 28

Midwest Real Estate News brings real estate leaders together to explore the challenges and opportunities unique to their markets.

28

pdbgroup.com ADAPTIVE REUSE COMMERCIAL INDUSTRIAL INTERIORS MEDICAL MULTIFAMILY

Think Be the Build.

Still a struggle: Until employees return to the office in greater numbers expect a sluggish office sector

By Dan Rafter, Editor

Companies trying to bring their employees back to the office even on a hybrid basis continue to struggle to fill those conference rooms, cubicles and corner offices with workers. And that has led to a continued slowdown in the demand from companies across the country for new office space.

According to numbers from the latest quarterly VTS Office Demand Index (VODI) employers are no more active in seeking office space today than they were nearly 18 months ago.

The VODI tracks unique new tenant tour requirements, both in-person and virtual, in core U.S. markets, serving as the earliest available indicator of upcoming office leasing activity. VODI remains the only commercial real estate index specifically monitoring new tenant demand for office space.

Nationally, demand for office space declined by 15.9% quarter-over-quarter, dropping the VODI to 53 from its March 2023 value of 63. A VODI of 100 is considered normal based on historical norms.

This quarter’s downward shift is an example of fairly typical office-market behavior as demand for this space usually peaks in early spring and gradually decreases throughout the summer before rising again before the holidays. However, in 2023, excluding the prime pandemic years of 2020-2021, the second-quarter shift was more dramatic compared to previous years. In 2018, demand fell by 0.9% during this summer lull, followed by decreases of 4.5% in both 2019 and 2020.

“There is a disconnect between what we’re hearing in the news and what we’re seeing on the ground,” said Nick Romito, chief executive officer of VTS, in a written statement. “City leaders and employers have by and large publicly stressed their desire to get em-

ployees back into the office, but inside their walls, their executives are dealing with analysis paralysis.”

Romito said that many employers are still uncertain if now is the time to make bets on office space. Others, though, are moving forward, capitalizing on favorable lease terms.

“Right now, the former is dominating the market, and we predict that will continue for the foreseeable future,” Romito said.

While most major commercial real estate markets typically experience a second-quarter decline in demand, New York City and San Francisco diverged from the trend this year. San Francisco witnessed a recent surge in new demand growth, with a 10.2% increase quarter-over-quarter, contributing to its 5.9% year-over-year growth in office demand.

In contrast, New York City’s demand for office space remained nearly flat for the quarter, only down by 3.9%,

but showed a year-over-year increase of 7.4%. Among all office markets covered in the report, New York City performed the strongest with a VODI of 73, indicating that new demand for office space has reached 73 percent of pre-COVID levels.

Demand for office space in Chicago fell, too, during the second quarter. According to VTS, demand for office space in the city fell 20.4% when compared to the first quarter of the year. It is down 35.8% on a year-over-year basis.

Struggling office markets like Seattle have faced challenges in getting employees back to the office, as pack leaders like Amazon and Microsoft encountered difficulties despite their desire to have employees return. Loose rules around returning to the office made it challenging to implement a cohesive plan.

Boston reported the lowest rate of new demand for office space among all major office markets covered in the report, with a VODI of 28.

Midwest Real Estate News | August 2023 | www.rejournals.com 6 FROM THE EDITOR

“There is a disconnect between what we’re hearing in the news and what we’re seeing on the ground.”

The forgotten powerhouse? Indianapolis’ industrial market keeps chugging along

By Dan Rafter, Editor

The Indianapolis industrial market remains hot, with demand for warehouse and distribution space continuing to soar. But when people talk about the busiest industrial markets in the United States? You’ll rarely hear them mention Indianapolis.

That doesn’t bother the brokers working this market. They’re just happy that leasing activity remains so strong here and sales activity, while slowed by higher interest rates, hasn’t cratered.

Midwest Real Estate News spoke with Steve Schwegman, Indianapolis market lead and executive managing director with the Indianapolis office of JLL, about the reasons behind this market’s strong and steady performance.

Why is the Indianapolis industrial market so resilient? It’s all about location, a strong labor force, the availability of space and a government willing to support companies doing business from the city and its suburbs.

Can we start by talking about interest rates? How have higher rates impacted the industrial market in the Indianapolis area?

Steve Schwegman: It has had an impact, but I don’t think that’s been unique to Indianapolis. The rates have had an impact across the country.

From a development standpoint, it makes it more difficult to justify new development when you consider that higher rates, higher construction costs and higher land prices are all coming together at once. It makes new construction more expensive. Because of that, owners need to see higher rental rates to justify a development and earn

their investors’ required returns. That has caused it to be more difficult to underwrite a new development.

From the tenants’ standpoint, it makes their inventory carrying costs higher. The higher the interest rates, the more expensive it is just to have inventory on hand. During the pandemic, companies discovered that they didn’t have enough inventory. They tried to over-correct and carry more inventory so that they wouldn’t run out of products. Now many companies are over-inventoried, which means that they have needed more warehouse space.

Carrying that extra inventory and space

worked well for the last few years, but now that the cost of getting new warehouse space is that much more, companies are working to get rid of their excess inventory. They are finding ways to use their existing industrial facilities more efficiently instead of buying another 100,000 square feet.

I know higher rates have slowed sales, even in the industrial market. Do you think we’ll see more sales activity once rates finally stabilize?

Schwegman: We will. From a development side of things, rental rates have continued to increase. That is the good news. Rental rates in industrial had been relatively flat for the first 20 years

The rising demand for electric vehicles will only boost the demand for industrial space.

of my career. During the last five years, we’ve seen annual market-rent growth of about 10% to 15%. There’s been a dramatic hockey-stick-shaped curve for rent growth in our market. That’s been a long time coming. Because the rental rates have continued to escalate, once the interest rates normalize, it will help developers justify additional spec development.

Speaking of spec development, are you still seeing a lot of spec industrial development in the Indianapolis market?

Schwegman: More so now than ever before. In 2021, our net absorption for the Indianapolis industrial market was close to 18 million square feet. In 2022, that was over 20 million square feet. Those are big numbers for Indianapolis. Developers looking in the rearview mirror saw that record absorption and figured that it would continue to go up. They figured they’d need to add even more spec space. That’s not surprising: Indianapolis has always been a strong spec market. We’ve typically been light on build-to-suit space. We’ve always been more of a ‘If you build it, they will come’ market.

We will now have more than 28 million square feet of industrial product available by the end of this year. For this year at the midpoint, we have had just more than 6.5 million square feet of absorption in our industrial market. If we do

the same absorption for the remainder of the year, we’d end up at around 13 million square feet, plus or minus. This means that we will have more industrial space than can be absorbed.

That’s good news for end users looking for space, at least.

Schwegman: It is good news for end users. If you are an end user, you will have options in nearly every submarket. You’ll have space available for any size facility that you need. Tenants are very fortunate to be in this market right now.

What we haven’t seen is any softening of rental rates. That’s good. We don’t want to go backward on rental rates. Because almost all the space available is new spec construction, the developers are on a level playing field. They all face similar construction costs and interest rates, too. It’s not like any developers can try to give space away. That has kept rents strong here.

Do you think the Indianapolis industrial market, considering how consistently strong it’s been, has been overlooked over the years?

Schwegman: Over the last five years, that has changed. Today, Indianapolis is looked at as a core market. It might not be on par with Inland Empire, New Jersey, Dallas, Atlanta or Chicago, but it is pretty darn close. If those are ‘A’ markets, Indianapolis is an ‘A-.’

Midwest Real Estate News | August 2023 | www.rejournals.com 8

INDIANAPOLIS

The explosion of online shopping has also provided a boost for Indianapolis’ industrial market.

“If you are an end user, you will have options in nearly every submarket. You’ll have space available for any size facility that you need. Tenants are very fortunate to be in this market right now. ”

That can be proven by the amount of institutional investment in the market. You have big-name developers and institutions investing in our industrial market. There is a real belief in Indianapolis from those who are investing in real estate. I can’t say that was the case 10 years ago. You didn’t see the global institutions taking a strong look at Indianapolis then.

What are some of the benefits for tenants locating in the Indianapolis market?

Schwegman: We have the great fundamentals of distribution and fulfillment here. We are very lucky to be a two-day drive to two-thirds of the United States and Canadian population. By virtue of where we sit, we are a very good market from a logistics standpoint. Add onto that the interstate infrastructure and we have great and quick access to so many markets across the United States.

Then there is our labor pool. We have a very strong labor force in terms of availability and work ethic. Our occu-

pier clients tell us that they have less turnover in the Indianapolis area than they have compared to their other facilities across the country.

Real estate is always available here, too. We have a highly speculative market. Tenants always have options. There is always a robust inventory of available real estate here.

I should mention the incentives, too. The greater Indianapolis area has

traditionally offered a 10-year real estate tax abatement. That is attractive to tenants but is more like the icing on the cake. The real drivers that bring tenants here are the logistics, labor and availability of real estate.

Why has the industrial real estate market for the entire country been so strong for so long?

Schwegman: The rise of ecommerce has certainly played a major role. Ecommerce has exploded. Online sales were already on a fast trajectory to become a bigger segment of retail sales. But the pandemic made it so that you couldn’t shop in stores. You couldn’t go out. That only accelerated the growth of ecommerce. It has had a generational impact. Folks who refused to shop online were forced to. Companies needed a place to keep all the products that people were ordering. That caused an explosion in the demand for industrial real estate.

On the investors’ side, everyone saw the necessity of industrial real estate. We saw during the pandemic

how important it was to have enough warehouse and distribution space. As a percentage of the overall commercial real estate market, both industrial and multifamily are not only growing on their own but are also growing as part of the percentage of the pie. Those asset classes occupy a greater percentage of the commercial real estate pie.

How about during the next two to three years? Do you think demand for industrial space will remain high?

Schwegman: it will stay steady if not grow. We are starting to see new uses for industrial facilities that are growing. A good example is the electric vehicle market. That market is growing and we need industrial space to accommodate it. Those vehicle makers are going to set up shop here. Advanced manufacturing uses will cause the industrial market to grow even more.

www.rejournals.com | August 2023 | Midwest Real Estate News 9

INDIANAPOLIS

Steve Schwegman

Meeting the need for new multifamily units in Indianapolis: Garrett Companies developing more than 400 new apartment units here

By Dan Rafter, Editor

Like most major cities across the United States, Indianapolis has a shortage of apartment units when compared to the demand for them. That’s why the two new multifamily projects being developed by The Garrett Companies here are so important.

The Garrett Companies is currently developing The Hangar at Emerson Pointe and Oliver Springs multifamily developments in the southern Indianapolis suburb of Greenwood, Indiana.

The Hangar at Emerson Pointe will include three buildings with 218 total units. The first building of 62 units opened at the end of June and has already welcomed its first residents.

Oliver Springs, the second luxury multifamily property, will bring 226 additional units to Greenwood. These units will each be two stories and resemble townhomes instead of traditional apartments. This project is under construction now and is expected to welcome its first residents in the spring of 2025.

The two projects will help alleviate at least some of the demand for new apartment housing in the Indianapolis market. This is especially important in the Greenwood area. This southern suburb isn’t quite as filled with multifamily options as are other Indianapolis suburbs such as Fishers and Carmel.

“Our headquarters is just down the

street from the Hangar project, so we are excited to bring high-quality housing to the south side of Indianapolis,” said Rob Martinson, chief investment officer for The Garrett Companies. “Mayor Mark Myers’ vision is to continue to develop and grow Greenwood into a world-class destination, the same way that Carmel and Fishers have been able to develop on the North Side. We wanted to create that same opportunity on the south side of the Indianapolis market. “

The Hangar at Emerson Pointe will boast good walkability in the Greenwood community. This includes Runway 19, a coffee shop that will open on the first floor of the development in the fall of 2023.

The Hangar will also provide the amenities that today’s renters want, including key fob access for each building, mail and package delivery kiosks, valet trash and recycling pickup, and rentable corridor access garages.

The property also includes a fitness center, yoga room outfitted with on-demand fitness software, a bike repair station, a heated resort-style pool and poolside cabanas with USB charging tables, hot tub, outdoor kitchens with gas grills, an outdoor fire pit and an indoor dog wash station.

The Garrett Companies recently broke ground on another luxury multifamily community in Greenwood, the Oliver Springs project. The community, which

Midwest Real Estate News | August 2023 | www.rejournals.com 10

INDIANAPOLIS

The Hangar at Emerson Pointe

includes a clubhouse and many of the same amenities being offered at the Hangar, will consist of 226 units resembling townhomes that will each feature private entries and direct access to an attached garage. Green spaces will separate the 10- and 14-unit buildings.

“We love the city of Greenwood — it’s quite literally our headquarters — and we’re incredibly gratified by this project and its role in meeting the growing housing needs of Johnson County and the city,” said Eric Garett, chief executive officer of The Garrett Companies, in a written statement.

Martinson said that both projects will serve a need in the Greenwood community.

“Our goal was to continue to build on the base of high-quality housing in Greenwood and Johnson County,” he said. “The sites for these projects meet the criteria for high-quality multifamily: They are near quality retail. Residents will have access to good public schools in the city of Greenwood. And there are good employment opportunities here.”

Martinson said that Greenwood is in growth mode today, building up its downtown and adding new multifamily and retail to the community.

The multifamily component is especially important. Indianapolis needs more apartment units for its residents. And many renters are searching for higher-quality developments that offer the amenities provided by projects such as Oliver Springs at The Hangar.

Multifamily, of course, remains one of the strongest commercial real estate sectors, with demand for new apartment units rising across the country. Martinson said that this demand won’t lessen anytime soon.

“Everyone needs a place to live,” Martinson said. “People want a quality place to live.”

As mortgage interest rates have risen, the cost of buying a single-family home have soared, too. Combine the higher rates with the higher prices of existing homes today, and many people who would have bought have chosen to rent instead.

“Buying a house has become more expensive,” Martinson said. “It requires a large down payment. Some apartment

options provide a good transition for people who want to transition into homeownership at a slower pace.”

Today’s higher interest rates also mean that a smaller number of homeowners are selling their properties. These owners have locked in low interest rates, sometimes rates under 3%. They

aren’t eager to sell their homes and move into a new home that comes with a mortgage with an interest rate over 6.5%. Instead, they’re waiting out today’s interest-rate environment to see if mortgage interest rates might fall.

“The natural laws of supply and demand are driving prices up for single-family

homes,” Martinson said. “There is very little inventory out there. That, too, has driven up the demand for apartment living, and especially for Class-A higher-end apartments.”

Then there are those renters who are renting by choice, not necessity. This group of renters is continuing to increase, too, Martinson said.

“They like the maintenance-free aspect of an apartment community,” he said. “The like the transient nature of an apartment community, too. They are no longer locked into a house and the challenges that can come with selling a home. An apartment offers more flexibility.”

These renters-by-choice are especially interested in the amenities that projects such as The Hangar and Oliver Springs offer, Martinson said. This includes pools, fitness centers, business centers and smart-home technology.

What sets The Hangar and Oliver Springs apart are the quality of these amenities, Martinson said. Renters here don’t just get a pool. They get a resort-style pool, Martinson said. They’ll have access to valet trash services.

Martinson describes it as the “hospitality component” of these developments.

“These amenities are no longer nice to have. They are must-haves,” Martinson said. “When we develop properties, we are always looking at doing the right thing and providing the best quality of life for our renters.”

www.rejournals.com | August 2023 | Midwest Real Estate News 11

INDIANAPOLIS

“The sites for these projects meet the criteria for highquality multifamily: They are near quality retail. Residents will have access to good public schools in the city of Greenwood. And there are good employment opportunities here.”

Oliver Springs

In tough times? Your local economic development corporation is more important than ever

By Dan Rafter, Editor

Karaline Cartagena Edwards was tired of the snide comments she’d often hear about her home region of Northwest Indiana. As Edwards says, the area’s critics don’t understand how many talented people live and work in Northwest Indiana, how strong the business community is here and how enticing the area’s restaurants, shops and entertainment offerings are. So Edwards decided to make a difference. After having worked as a teacher for seven years in Texas, she returned to this slice of Indiana to take on a key job: economic development manager of the Michigan City Economic Development Corporation.

And since returning home to Northwest Indiana? Edwards has discovered that the region is even stronger today than it was when she left seven years ago.

“Northwest Indiana often gets a bad rap,” Edwards said. “Being away let me see and appreciate all the good things the area has to offer. I wanted to get involved in something that was positive, wanted to make a positive difference in the area. I never liked our area getting that negative reputation. When I saw the opportunity that the EDC had, I jumped at it.”

Edwards says that she is impressed with how Michigan City has grown while she lived in Texas. The area has attracted

new restaurants, shops and entertainment centers. It offers green space and recreation. And it remains a tourist destination thanks to its location along

the shores of Lake Michigan and the entrance to the newest national park in the country- the Indiana National Dunes.

“The whole area feels a little more suburban,” Edwards said. “You can feel that growth. This is starting to feel like the beginning steps of our area becoming the new Chicago suburbs. My job is to recognize that and work with the growth that we see happening while also making sure to take care of the people that have been here for years.”

And this recent growth? It’s helping Michigan City’s EDC attract new businesses to the area. And that’s especially important today.

Midwest Real Estate News | August 2023 | www.rejournals.com 12

MICHIGAN CITY

A new train station will bring 220 multifamily units and 16,000 square feet of ground-floor retail to Michigan City.

Karaline Cartagena Edwards.

A strong relationship

It’s no secret that the national economy is sluggish today. Consumers are struggling with persistently high inflation and interest rates. This makes the partnership between EDCs and local governments even more important: Cities and towns need all the tools they can wield to keep their business community strong.

Fortunately, the Michigan City EDC has long worked closely with Michigan City’s government bodies and business community. That hasn’t changed today, with the local EDC and community organizations working together to entice businesses to the area.

It helps that Michigan City boasts a strong location in the center of the country and a skilled workforce. The city is also friendly to businesses, providing them with incentives and financial breaks.

Edwards says that her job is to keep these relationships strong while also selling potential new businesses on the merits of setting up shop in Michigan City.

Part of this involves maintaining a strong online presence. As Edwards says, many site selectors go online before they take any future steps. Once businesses express an interest in Michigan City, the EDC provides them with all the resources, information and data they need to understand the benefits of locating here.

“They need the data and demographics of the city,” Edwards said. “They want information on what the key industries are and how strong the quality of life is. That’s why we keep our website optimized. Before we ever get a call, businesses are looking at our site to learn more about our community.”

This means, too, that the Michigan City EDC maintains a strong social media presence.

“We use social media to spotlight everything,” Edwards said. “We promote anything business-related regarding expansions and retention. We promote our inclusive and economic initiatives. It’s about spotlighting any opportunity that we can showcase.”

Michigan City itself is in a period of growth, thanks partly to strong investment in the city’s downtown core.

Edwards says that several core projects are fueling Michigan City’s growth today.

First is the South Shore Line’s Double Track project. The South Shore Line, the commuter rail line that connects South Bend, Indiana, and the communities of Northwest Indiana to downtown Chicago, is adding a second rail line along a 17-mile stretch between Michigan City and Gary, Indiana. This is expected to shave about 40 minutes off the trip from Michigan City to Chicago.

This project, Edwards said, is expected to boost Michigan City’s efforts to attract both new residents and businesses.

“A lot of people from Illinois, both residents and businesses, are looking to move to Indiana,” Edwards said. “The taxes are lower. There are more incentives for businesses. With the double track, you can hop on the train and

Also under construction is Woodland Ridge, a 32-acre development of 113 new homes at market-rate prices. The city is also eager for a redevelopment of the struggling Marquette Mall, a 50-acre site centrally located in the City of Michigan City. Developers have expressed interest in transforming the site, with the city hoping for a mixed-use entertainment and multifamily town center.

Michigan City is also involved in a socioeconomic initiative known as Vibrant Michigan City. This project is supported by the Brookings Institution’s Bass Center for Transformative Placemaking and the Local Initiatives Support Corp., both of which are working with Michigan City officials on a learning lab to help create a more economically inclusive community.

The goal, after several meetings with residents and city officials, is to create a blueprint that Michigan City can follow to become an even stronger community, one that offers economic opportunities to all its residents.

not worry about having to drive in. You can be in Chicago in an hour and then, at the end of the day, come back to a community with a smaller-town feel. You get both the small-town feel and the big-city amenities.”

To complement the double track project, a new Michigan City train station is under construction. This $100 million investment will include 220 apartments with 6,000 square feet of retail on its main floor.

A new mixed-use development, SoLa, is also under construction in Michigan City. The building will include two flagship hotels, TRYP by Wyndham and SoLa Hotel, a Trademark Collection by Wyndham, which will offer a combined 235 rooms.

“We think this is going to transform the area,” Edwards said. “We don’t have a building like this. It’s a statement building.”

The initiative is focusing on three areas of Michigan City, its east side, west side and Midtown areas, which Edwards says are most in need of investment. Agenda items include ways to boost the participation of residents in community activities, ways in which to build healthy neighborhoods, how to add more affordable housing to the city and how to strengthen local commercial districts and businesses.

“Housing is a huge need for us,” Edwards said. “We are excited that we are seeing new homes being built. We want to make sure we are attracting mixed-use facilities where we can have retail on the bottom and homes on the top in the downtown near the train station.”

The EDC is focusing on other issues, too. For instance, childcare. Many residents are in need of more affordable childcare so that they can work.

“Collaboration is the key to making things happen,” Edwards said. “It is so important for EDCs to work with local community organizations to strengthen the communities. And it’s not just working with city officials, but with residents, too.”

www.rejournals.com | August 2023 | Midwest Real Estate News 13 MICHIGAN CITY

SoLa, under construction, will bring new hotel rooms and multifamily units to Michigan City in what city officials say is a showcase.

Michigan City has high hopes for the redevelopment of the struggling Marquette Mall.

in the Omaha market, too, Levy said. Investment from start-ups and established tech companies is providing a boost to the local economy.

“Companies are looking for places that are affordable with skilled labor available,” Levy said. “More tech firms are looking at Omaha because we can offer that.”

Jay Noddle, president and chief executive officer of Omaha’s Noddle Companies, said that not only are higher interest rates slowing investment sales in the region, they are also impacting the value of commercial properties.

At the same time, there is now a lack of commercial financing in the market as banks and other lenders pull back during this period of economic uncertainty. That has caused developers to either change the start date of their projects or right-size them, perhaps reducing the number of new units they’ll build in a multifamily development or lowering the square footage they’ll bring to the market in a new mixed-use development.

Finding financing has become difficult today, Noddle said. And the type of financing that developers can land has changed. Terms are tightening and the required debt coverage ratios have increased. At the same time, the duration of loans has become shorter.

“And that’s just for the banks that are in a position comfortable enough to place new debt,” Noddle said. “There are several lenders in the country that have hit pause on new lending.”

That being said, the Omaha commercial real estate market remains resilient, Noddle said. And it’s in a good position to see increased sales and development activity once the Fed stops tweaking interest rates.

“This isn’t doomsday,” Noddle said. “It’s just an interesting time.”

The solid industrial market

Kevin Stratman, an industrial real estate specialist with Omaha’s Investors Realty, agreed that industrial leasing activity has remained strong, even with higher interest rates. There was a slight slowdown, though, during the summer in the new development of warehouses

and manufacturing facilities because of those higher rates.

As Stratman says, those higher rates made new developments more challenging to pencil in. But in good news, those delayed developments are now starting to move forward.

“The tone has changed,” Stratman said. “We are going to see the next wave of construction starting now. We will see an increase in construction in the coming quarters.”

The higher rates haven’t slowed industrial leasing, Stratman said. And activity at existing, slightly older warehouse and industrial spaces has been particularly strong.

Part of this is an indirect result of higher construction costs. As it becomes more expensive to build industrial space, owners are charging higher rents to help make up for those higher costs. At the same time, while rents have been increasing at existing industrial properties, these rents haven’t risen as much as they have in new construction.

Tenants that are interested in saving money, then, are looking at renting space or renewing their leases in more affordable existing space.

“Tenants are looking at the economics of dealing with a little functional obsolescence for a lower lease rate,” Stratman said.

Mike Homa, president of R&R Realty’s Nebraska division, said that higher rates have put a pause on some new projects in the Omaha market. But like others working in this city, Homa said that the slowdown from rates isn’t as significant here as it is in other markets.

“We just haven’t had the kind of slowdown that other markets have seen,” Homa said. “I define what we’re seeing as a pause in new development, a rethinking of projects. Developers are looking harder at value engineering to try to offset capital costs with savings on how buildings are designed and structured. But I can’t say that I’ve heard of too many projects that have pulled the plug.”

Higher interest rates are having an impact on property values in Omaha, too. But again, Homa said, the impact hasn’t been as severe as it’s been in other markets, where some buildings might sell for as little as 40% of the prices they fetched just five to seven years ago.

Homa said that in the Omaha market, prices on commercial properties might instead fall by 10% to 15%.

“It’s spotty,” Homa said. “High-quality, well-located properties are still commanding good valuations. Interest rates have not affected those properties. The more secondary locations and older Class-B and Class-C product have seen the biggest impact from interest rates.”

And when it comes to leasing activity? Homa agrees that interest rates haven’t slowed leasing volume in the Omaha market.

“By nature, the Omaha business community leans more toward the conservative side of how we approach real estate,” Homa said. “We don’t have the big run-ups in value. At the same time, we don’t see the big declines in values like we might see in some of the other markets. We continue to have low unemployment and a good entrepreneurial spirit that is helping to create new markets in Omaha.”

Like other brokers working the Omaha market, Stratman says that sales and construction activity will pick up even more once the Fed puts a halt to its interest-rate hikes.

“Everyone is trying to figure out how to make the numbers work with higher interest rates. They’re waiting on construction costs to stabilize a bit, too,” Stratman said. “We are now starting to see transactions at the higher end of the rent spectrum. That is giving developers more confidence to pursue projects. They see that the demand for industrial space is still there.”

As Stratman says, it’s a combination of factors that is breathing life slowly, but steadily, back into Omaha’s industrial market.

Midwest Real Estate News | August 2023 | www.rejournals.com 14 OMAHA

OMAHA (continued from page 1)

OMAHA (continued on page 16)

A new campus for Applied Underwriters is part of the Heartwood Preserve project in Omaha.

BUILDING A BETTER OMAHA

Whether we are reinventing a space or developing something new, we strive to create places that matter. At Noddle Companies, we are driven by our passion and commitment to making this a remarkable community.

2285 South 67th Street Suite 250 Omaha, NE 68106 info@noddlecompanies.com 402.496.1616

builder’s district: 1501 MIKE FAHEY OFFICE BUILDING spring 2024 completion

aksarben village: INNER RAIL FOOD HALL

aksarben village: SONNY’S

54th & leavenworth: ROWHAUS TOWNHOMES fall 2023 completion

“It’s not just one thing,” he said. “The construction costs are a little more stable. The tenant demand is still there. Interest rates are high but we now have more of an understanding of where they are going to be. It’s a combination of all those factors that is providing a boost to the industrial sector.”

Challenges still facing office sector

Levy is even seeing positive signs in the office market in and around Omaha. Employees are returning to the office, he said, though not yet at pre-pandemic levels.

Providing a boost to Omaha’s office sector? Mutual of Omaha is building a new skyscraper at 1614 Dodge St. in the city’s downtown with an expected completion date in 2026. Mutual of Omaha’s project shows a commitment to the Omaha office sector that is impressive today.

At the same time, Omaha is in the early to middle stages of developing an urban streetcar project that should be ready

to serve riders in 2026. This project, too, will provide a boost to downtown Omaha and the urban office market, Levy said.

“The streetcar project is a great public investment in the infrastructure of downtown and the urban core,” Levy said. “It will connect the different parts of our urban core and allow for the better use of surface parking lots. All those lots will become less necessary as the streetcar connects areas together. It also reduces the reliance on cars downtown.”

The Omaha Streetcar Authority, a local government entity, is now shepherding the streetcar project into reality. Today, the authority is digging into the nuts and bolts of the project’s engineering and construction schedule. The financial structures to support the project are already in place.

“As people learn more about how the streetcar will work and what impact it can have on downtown Omaha, the more support for it continues to grow,” Levy said. “The streetcar is happening in Omaha.”

Homa said that the office market in Omaha is still working through the challenges brought by the COVID pandemic. Like other markets across the country, Omaha’s office sector is seeing higher vacancy rates and a workforce that remains resistant to returning to the office on a full-time basis.

“The CEOs want people back in the office. That’s a very prevailing mindset. But you have to balance that with how employees today want to work,” Homa

said. “Obviously, the balance lies in that hybrid model. With the hybrid model, you still need office space. That’s the approach that business leaders in Omaha have taken. They are still finding value in having people together so that they can interact and collaborate. You still need office space to make that happen.”

Of course, how companies want their employees back to the office has changed since the start of the pandemic. Before, workers went to the office five days a week. Today, that has changed to two or three days.

At the same time, the flight to quality in the Omaha office market is a real phenomenon.

“For our office buildings, the first question potential tenants ask is ‘What amenities do you have?’” Homa said. “That has become so important. People are thinking not just about interior amenities, but exterior, too. They want outside eating areas, walking paths, locations for food trucks. And it’s not enough to have a rooftop patio. Tenants want to know what amenities come with the rooftop areas. Are there firepits up there? Is the space Wi-Fi-enabled? It’s the next evolution of amenities.”

The investment in Omaha’s downtown core is important. It’s also been fairly constant during the last several years.

Developers have brought a steady

Midwest Real Estate News | August 2023 | www.rejournals.com 16

OMAHA

OMAHA (continued from page 14)

The office building at 1501 Mike Fahey is a key component of Noddle Companies’ Builders District project.

stream of new multifamily units to Omaha’s downtown and surrounding neighborhoods.

In addition to Mutual of Omaha’s commitment to downtown, a new development by Omaha-based developer Noddle Companies slated for the north section of the city’s urban core is also bringing new excitement.

Construction company Kiewit provided the impetus for the Builder’s District when it moved its headquarters to 15th and Mike Fahey streets. Noddle’s goal here is to populate the area surrounding this building with multifamily units, office space, retail and an urban park.

The Builder’s District will cover about six city blocks and will include a 130,000-square-foot office building made primarily of timber.

“I think that over the next decade as cities respond to the post-pandemic world, downtowns will become more residential than they already are,” Levy said. “Omaha’s downtown has seen a lot of residential growth over the last decade or so. That will continue. The Omaha Chamber of Commerce has released a core strategic plan on what the urban core can be. No question that it will include a healthy component of residential growth.”

Another boost to downtown Omaha has come from the city’s investment in the Gene Leahy Mall, a sprawling public park

along the banks of the Missouri River. Levy said that the park has brought even bigger crowds to downtown Omaha.

The Kiewit Luminarium, a new science building, has also opened in downtown Omaha at the Lewis & Clark Landing area. This, too, has provided another reason for people to flock to the city’s downtown.

“It is really something to drive around downtown on a sunny Saturday or Sunday and see the number of people spending time in downtown Omaha,” Levy said. “It is amazing. I never saw that before outside of a big event like the College World Series. Families and people are walking about. People are eating and drinking in the sights and sounds of the city. It’s brand new.”

Noddle said that leasing activity remains robust throughout the Omaha market. On the office side, though, many tenants are leasing a smaller amount of square footage and are skittish about signing longer-term leases, Noddle said, with some asking for early termination rights.

Development activity is slower, not only because of higher interest rates but because of higher construction costs, too, Noddle said.

That combination is making it more challenging -- though not impossible -- to get new projects out of the ground.

“We are just starting to see signs of construction costs leveling off a bit,” Noddle said. “But it’s become so darn expensive to build anything. Take that

and combine it with higher interest rates and lenders with tighter criteria, and you need to be careful before starting a new project. That doesn’t mean there isn’t robust activity out there, but you have to be careful. Experience makes a big difference when you are considering a new project today. There is a ton of opportunity out there, but there are some bumps in the road.”

Noddle points to the multifamily market. There has been a significant slowdown in apartment development groundbreakings, he said. That isn’t because the demand for new apartment units isn’t there. It’s because the costs of building new apartment developments have risen.

Fortunately, Noddle Companies has the experience to weather this challenging time, Noddle says.

“We’ve been doing this for a long time, over five decades for the company,” Noddle said. “This isn’t our first major

www.rejournals.com | August 2023 | Midwest Real Estate News 17

10855 W Dodge St, Ste 270 • Omaha, NE 68154 • (402) 330-5480 • www.LernerCo.com OMAHA

OMAHA (continued on page 18) THE MIDWEST’S PREFERRED RETAIL REAL ESTATE COMPANY

The Builders District being developed by Noddle Companies is one of the bigger new developments in downtown Omaha.

financial event. We’ve seen this before. At the end of the day, these financial challenges require the same sort of skills and execution, and we have the experience necessary to work through them.”

Retail resiliency

Trey MacKnight, associate with Omaha’s The Lund Company, specializes in the retail sector. He says that Omaha’s retailers have shown that they, too, are resilient.

MacKnight said that retail sales are slower today, thanks largely to higher interest rates. But leasing activity remains strong.

The formula for retailers’ resilience here? MacKnight says that the savviest of retailers have embraced online sales, enhanced delivery options and curbside pick-up. At the same time, they’ve retained a focus on their physical stores. This combination -- the famed omnichannel approach -- has provided

retailers with several ways to persuade consumers to spend their money.

“A lot of people are thinking that the ecommerce world and digital showrooms are what have been taking over retail. They look at that as the big trend,” MacKnight said. “But what I see is that people want to touch and feel products on the retail side. They want that physical space.”

At the same time, experiential retail remains hot. Consumers today are interested in high-end bowling alleys, indoor miniature golf/bar combinations and, of course, pickleball-themed eateries and bars.

MacKnight said that at least three pickleball concepts have committed to coming to the Omaha market or are actively looking at the market today. And these aren’t small users. MacKnight said each user is looking for 30,000 to 40,000 square feet of space.

But while leasing activity remains strong, sales have slowed. What can change this? MacKnight said that the sellers of retail real estate need to

adjust their expectations in line with today’s economic conditions.

“Sellers want a higher number when they sell, but buyers need a lower number,” MacKnight said. “That has been one of the causes of the lull we are seeing in sales.”

MacKnight said that as interest rates continue to rise, sellers are slowly adapting. Those sellers who don’t have to sell, though, are choosing to hold onto their properties and wait for interest rates to either fall or at least stabilize.

And those who have to sell? They need to be realistic.

“If you have to sell you need to look in the mirror and realize that these are the times right now,” MacKnight said. “This is what the market is telling me this property is worth. Those owners are selling. But those that don’t have to sell won’t sell right now.”

Even with the slowdown in sales, though, many of Omaha’s retailers are thriving today. In part, this is because

of the habits that retailers embraced during the height of the COVID pandemic. As retailers enhanced their online ordering, delivery and pick-up options, consumers responded, ordering more products.

MacKnight points to some of the restaurants he has placed. In 2019, customers would be fighting for seats inside these restaurants. Today, customers can walk in and pick up their boxed orders from a rack at the front of the restaurant. And more often, MacKnight says, that’s what he sees when he steps inside these establishments: rows and rows of to-go orders.

“These restaurants now have two forms of income that are bringing in the revenue,” he said. “They have online ordering and pick-up while still offering dine-in. These new habits that people learned during COVID times have provided such a boost to their businesses. Kudos to the indivduals who brought new options to their customers.”

Sara Hanke, an associate broker with Omaha’s The Lerner Company, said that Omaha’s retail sector has been resilient

Midwest Real Estate News | August 2023 | www.rejournals.com 18

OMAHA

The Omaha RiverFront project has combined three downtown parks into one recreation area.

OMAHA (continued from page 17)

not only in the face of higher interest rates, but during the worst of the COVID pandemic, too.

“Our retailers didn’t really slow down during COVID,” Hanke said. “They shifted, though, to meet the needs of customers. There was a greater need for outdoor space for drive-throughs. A lot of retailers have shrunk the footprints of their stores as they focus more on delivery and pick-up. It’s not that retailers slowed down during the pandemic, it’s more that they right-sized their offerings.”

And, yes, some major retailers have declared bankruptcy recently. But while some of those bankruptcies were spurred by COVID, many of them were inevitable anyway. Even without the pandemic, many legacy retailers were going to fall into bankruptcy as shopping trends changed around them.

Hanke said that the influx of big-box space into the market also comes with a benefit: It provides new space for those retailers looking to break into or add to their existing presence in the Omaha market.

“There is some hope here. The lack of retail inventory is high and there is a huge demand for larger retail space,” Hanke said. “Those spaces left behind by big retailers will get gobbled up.”

The lack of space is a real issue in Omaha today, Hanke said. Retailers want spaces that offer high visibility at busy intersections. The quick-service restaurants are also looking for spaces that have enough room for drivethrough lanes, often multiple lanes.

The problem is, there simply aren’t

enough of these prime spaces for every retailer that wants one, Hanke said.

“The doomsday narrative was always that retail is dead and the big boxes were going to be empty,” Hanke said. “Well, other retailers are filling those spaces. Those spaces might get divided or entertainment or soft goods users might fill them. But they are getting filled, and we are now at the point where there is not a lot out there for retailers looking to relocate or rightsize their locations.”

MacKnight, like other CRE professionals working this market, is excited about the new development activity that is still taking place in Omaha.

He’s especially pleased with the focus that retailers have on Omaha’s downtown core. He said that projects such as the revitalization of the Gene Leahy Mall have brought activity back to the city’s downtown. This has benefitted not just the center of downtown, but its surrounding neighborhoods, too, including the areas around Creighton University and Charles Scwab Ballpark.

“We are seeing lots of great retail moving to that area,” MacKnight said. “We are seeing national groups and local individuals that are expanding and trying new concepts. The whole downtown and its surrounding areas have become a hub for innovation.”

Hanke agreed that entertainment-based retail is particularly strong in Omaha today. Just look at pickleball. The sport, a combination of racquet-

www.rejournals.com | August 2023 | Midwest Real Estate News 19

OMAHA

“The next time that a Fed meeting goes by without them raising the rate, that will spur activity.”

OMAHA (continued on page 20)

ball and tennis, is growing in popularity across the country. Not surprisingly, several companies are embracing the trend and opening entertainment centers that include pickleball courts, bars and restaurants.

This includes Smash Park, which is planning a new location in Omaha. Hanke said that indoor miniature golf and driving range facilities are also popular, with many of the entrepreneurs behind these concepts targeting the Omaha market for new facilities.

Discount retailers are thriving in today’s economy, too, Hanke said. Franchises such as Five Below and Dollar General are opening new locations across the area.

“In the next year, we will see a lot of new concepts come to our market,” Hanke said. “We constantly get new restaurants, but we’ll get other new concepts, too. Just look at downtown. We are getting new entertainment centers in our downtown, giving us the entertainment hubs that the downtown area has been lacking.”

Downtown Omaha, of course, is reliant partly on a rebound in the office sector. That is happening, but it is happening slowly. Hanke, though, says that people are eager to get out and

visit restaurants, shops and entertainment centers. And when more people are back in the office, that will provide another boost to downtown’s restaurants, shops and retailers, too.

“There has been a real resurgence in social activity after COVID,” Hanke said. “Then there’s the boost that the Gene Leahy Mall has provided. You are seeing more people hanging out and going out to eat in our downtown. There’s a real sense of community downtown today.”

And the future of Omaha? The professionals doing business here predict

that commercial real estate activity will only increase again once the Fed stops increasing interest rates.

“The next time that a Fed meeting goes by without them raising the rate, that will spur activity,” Levy said. “If a couple of meetings go by without any further increase, then activity will really start to pick up. When you talk to people in Omaha and real estate, they are positive. Omaha about cities like it are well-positioned for the future. Yes, this is an uncertain time. But Omaha is poised to do well.”

Stratman says that Omaha’s conserva-

TRUSTED.

Since 1975, Investors Realty, Inc. has been helping clients buy, sell, lease, and manage commercial real estate in the Omaha Metro area. We’ve earned a reputation for providing straightforward advice, developing innovative solutions, and delivering results.

tive nature has helped it avoid the ups and downs that markets on the coasts often see.

Omaha didn’t see many large spec industrial developments before 2015 or so, Stratman said. That was when national developers finally began targeting the market. But before then, developers that were adding spec industrial space mostly concentrated on bringing 70,000- or 80,000-squarefoot warehouses to the market.

Today, developers are finally bringing those larger spec projects to the area. And they’ve discovered that the demand for them is high.

“We have proven that the demand is there for bigger projects,” Stratman said. “Land is hard to find in Omaha. Finding sites is difficult. We now have more demand for sites than there are sites. We have inadvertently kept the pace of construction on the lower end. That has helped us avoid overbuilding. If every developer that was interested in delivering spec sites had been able to, we would have a heck of a different situation than we have today. We didn’t have that huge swing in construction because of the lack of sites. That has worked in our favor today.”

“If you have the industrial space available, it’s not going to last long on the market,” Homa said. “The biggest challenge in Omaha’s market is finding more flex and smaller warehouse space in that 5,000-square-foot to 20,000-square-foot range. There is still a lot of pent-up demand and not a lot of supply in that area.”

Tenants looking for larger distribution space will find it easier to located an appropriate facility, Homa said.

Homa said that the strong demand for industrial space in Omaha isn’t surprising. The city features easy access to major highway Interstate-80 and boasts strong rail service. The market also has a strong workforce and an affordable cost of living.

“Omaha is slowly starting to be seen as a bigger metro area,” Homa said. “We are approaching 1 million people living in our metro. That is one of those benchmarks that make a difference to investors, new retailers and others. I really see the Omaha market remaining strong.”

Midwest Real Estate News | August 2023 | www.rejournals.com 20 OMAHA

12500 I Street ·

160 |

Ste

Omaha, NE 68137 | investorsomaha.com

INDEPENDENT. LOCALLY-OWNED.

OFFICE | INDUSTRIAL | LAND | RETAIL | INVESTMENT PROPERTY · FACILITIES · PROJECT MANAGEMENT

OMAHA (continued from page 19)

“We are approaching 1 million people living in our metro. That is one of those benchmarks that make a difference to investors, new retailers and others.”

Waiting for stability? Milwaukee’s commercial real estate market slowly working through interest rate challenges

By Dan Rafter, Editor

The story of Milwaukee’s commercial real estate market is a common one today: The city’s CRE professionals are waiting for stability from the Federal Reserve Board on interest rates. And the hikes that the Fed has already launched have slowed commercial sales in this key Wisconsin city.

There is hope here, though: Katherine Bills, shareholder in the Milwaukee office of law firm Reinhart Boerner Van Deuren, says that while sales have slowed in the Milwaukee market, they haven’t stopped, even with the impact of higher rates. At the same time, leasing activity here remains strong.

In other words, Milwaukee’s commercial real estate industry has remained resilient. And Bills says that she expects better times for the region’s CRE business in the future.

Here is some of what Bills had to say in a recent interview with us about the state of Milwaukee’s commercial real estate industry.

Let’s start with the big question: How have today’s higher interest rates impacted commercial real estate activity in the Milwaukee market?

Katie Bills: I have seen that the pace of transactions is slowing. That’s not to say that deals aren’t happening. They just seem to be taking a bit longer to put together.

The slowdown is driven in part by buyers who are looking to see what financing they can get to make a deal work. Sometimes, those figures aren’t matching up with sellers’ expectations. As of right now, a lot of sellers are waiting to see if conditions get better. Sellers don’t seem to have lowered their expectations. Instead, they are willing to wait it out to see if a deal can come

together down the road when market conditions improve.

And if a deal doesn’t happen now? Sellers say they’ll hold onto the asset, continue to collect revenues from

it and see what opportunities come down the road.

What are owners and buyers waiting for to get active again?

Bills: Everyone is certainly hoping that the Fed is done raising rates. Everyone involved in the transaction is hoping for that.

It’s important to consider, though, the rate at which interest rates have gone up. It’s been quite a quick rise in rates. As a result, it might take some time for the market to recalibrate.

How about leasing activity? Has that been hit much by higher rates?

Bills: Leasing has remained strong, especially in the industrial sector. There is still certainly a demand for industrial product. We are still seeing strong leasing activity in that sector.

Midwest Real Estate News | August 2023 | www.rejournals.com 22 MILWAUKEE

The Iron District MKE development will include a new professional soccer stadium.

Katie Bills

Office leasing, though, has never rebounded from the pandemic in a way that people thought it might. I know last year a lot of people were predicting that there would be a rebound by now in the office sector. That still hasn’t panned out.

Are you seeing any positive signs in the Milwaukee office sector?

Bills: I know that a lot of Wisconsin companies are pivoting back to stressing in-office work. They aren’t asking employees to come back five days a week, but they want at least some mandatory office component. We have seen large national companies making headlines that they want their employees back to the office. That might end up having a positive impact on the sector.

But I don’t know if the office sector will ever look like it did in 2019. We might see some improvements in the office sector because of a push for bringing workers back to the office. But it’s difficult to see it returning to what it was before the pandemic.

Industrial and multifamily remain strong nationally. Is this true in Milwaukee, too?

Bills: Industrial and multifamily are very strong here. It comes back to demand. There is still a great demand for industrial space and housing. That is driving those two sectors.

With respect to multifamily, there is absolutely a housing shortage, in Milwaukee and across the country. There is a need for new multifamily units. The use of tax credits can help provide some leverage against high interest rates today. Those tax credits can be a valuable component to make sure that multifamily developments are built to address the housing shortage we face.

Where is new multifamily being built in the Milwaukee market?

Bills: There is quite a bit of interest in developing new apartment units in the city of Milwaukee, not just in the suburbs. There is a demand for that urban living. There is a need for new housing in the city of Milwaukee itself.

Are people still interested in living in downtown Milwaukee?

Bills: There is a draw to living in downtown Milwaukee. I don’t think that

the city of Milwaukee saw the same suburban flight that cities like New York City or Los Angeles did during the pandemic. If the city did see that, it wasn’t to the same extent as larger cities experienced it. As a result, there continues to be a real interest and excitement in multifamily developments in the city itself.

The Deer District downtown is a good example. That is an exciting community gathering place where people want to be. There are other developments, though, being worked on throughout the city outside that district. These are also community areas that draw people to them. And these developments need a multifamily component.

We haven’t spoken much about retail. How is that sector doing?

Bills: Retail has performed better than people thought it would. There is a lot of interest in making sure that retail spaces in downtown Milwaukee are filled so that downtown Milwaukee doesn’t look empty. The goal is to have lively communities where people come to work, play and live.

There certainly has been a significant amount of retail activity downtown. There continues to be strong retail activity in the suburbs, too.

It’s a mix of retail, too. We are seeing plenty of stand-alone retail entering the market as well as mixed-use developments that include retail, office and hotel space.

What sets Milwaukee apart? What makes it a good place for companies to do business?

Bills: I think what is special about the state of Wisconsin in general is that our elected officials and municipalities are excited about development within their cities, villages and municipalities. They want to be true partners to help developments move forward. That is what creates jobs and places to live, work and play.

Specifically in the Milwaukee area, we have direct access to airports and

major highways. We have land available for development. It’s an exciting time here. We are very well-positioned for new development because of the atmosphere that we have created to promote growth.

The Iron District MKE is an example of a new multi-use development that people are excited about. It’s a bit like the Deer District, only centered around a new professional soccer stadium. People can watch a sporting event and then grab dinner and a drink. It will be another gathering place for the community.

At the same time, the Deer District isn’t done yet. It will continue to be built out. It has certainly revitalized the area in a great and tremendous way. The positive impact that these districts have had on the businesses operating within them has been impressive.

Generally, the state of Wisconsin and southeastern Wisconsin are well-positioned to continue to be strong when it comes to commercial real estate activity. We seem to have a bumper against some of the potential downfalls.

BUILDING COMMUNITIES

As a national contractor, we understand that every community is unique. That is why we’re committed to investing in local resources and expertise. No matter where we build, our objective remains the same – to deliver residences that your tenants are proud to call home.

www.rejournals.com | August 2023 | Midwest Real Estate News 23 MILWAUKEE

The Deer District has ben a success in bringing new activity to downtown Milwaukee.

www.mcshaneconstruction.com

The West Living West Allis, WI

We recently spoke with two professionals at JLL – Andy Cvengros, managing director for data center solutions, and James Young, senior vice president and lead industrial broker – about the benefits industrial users receive from setting up shop in the Milwaukee area and what needs to happen to boost Southeast Wisconsin’s ability to attract data centers.

Here is some of what they had to say.

Let’s start with the obvious question: What impact have higher interest rates had on the Milwaukee-area industrial market?

James Young: From a boots-on-theground perspective, I can say that demand is still very strong for leasing space. A lot of that is because we are finally getting the product that tenants want. Milwaukee has historically been a market with older industrial buildings. It’s only been about three to six years where developers have realized the opportunities here and have

moved aggressively to build a footprint of more modern industrial facilities.

Now we can offer tenants modern facilities with 28-foot to 36-foot clear heights. That type of product is still limited in certain pockets of the market, in Waukesha County, specifically.

We virtually have no spec industrial buildings available in Waukesha County. We just have a very minimal amount of inventory in certain areas.

When it comes to industrial sales, on the user side of the equation, there is no slowdown. Investors want to buy industrial product. It’s a lack of product that is really slowing the sales activity. I was speaking with an associate in my office yesterday. There’s a 60,000-square-foot industrial listing in Menomonee Falls for sublease. People are interested in knowing whether the owner will sell the building. If the owner is willing, it would sell quickly. But the owner has no interest in sell-

ing. And that is the case today with most industrial properties here. A lack of inventory is continuing to slow the market.

But a 90,000-square-foot building sold in New Berlin for $92 a square foot. If you would’ve asked me five years ago if I thought a 90,000-square-foot building in New Berlin would sell for

Midwest Real Estate News | August 2023 | www.rejournals.com 24 MILWAUKEE

MILWAUKEE (continued from page 1)

Foxconn earlier this summer signed a contract with Enphase Energy to manufacture computer parts for solar power generators at the company’s Mount Pleasant, Wisconsin, campus.

MILWAUKEE (continued on page 26)

“When it comes to industrial sales, on the user side of the equation, there is no slowdown. Investors want to buy industrial product.”

800.553.6215 | reinhartlaw.com Deep Experience. Insightful Counsel. With the largest real estate practice of any law firm in Wisconsin, our attorneys help clients successfully navigate today’s most important commercial real estate issues by delivering innovative, value-added solutions expertly matched to each client’s unique needs.

that much, I would have found it hard to believe.

So we are definitely seeing strong interest on the buy side and strong interest on the leasing side in industrial here. It’s just a matter of getting the product out there.

What about data centers? Are you seeing much demand for data center space in the Milwaukee area?

Andy Cvengos: We are representing a lot of operators and big developers of data center space around the country. The top markets are effectively tapped out on power, places like Ashburn, D.C., Chicago, Dallas and Phoenix. Because of that, a lot of developers are looking at secondary and tertiary markets. They are chasing the power. The transmission power is getting hard to come by. It can be challenging getting the transformers, the lines out to the sites, challenges like that. That can be a three- to five-year process to get the necessary power for new developments.

But I would say that Milwaukee is

not yet a strong data center market. There are no tax abatement programs in place. The pricing of power, then, is more expensive here than in Illinois and other competing states. The availability of power is an issue, though. The activity on the Foxconn site is primarily driven by the power that is there. People are looking for new markets that have not yet been talked about.

In the wake of the latest Foxconn deal in Mount Pleasant, are you seeing a greater demand from tech companies

looking for space in the Milwaukee area?

Cvengos: There is interest, but Wisconsin isn’t yet a big market for, say, electronic vehicle manufacturing. The EV users tend to go toward the southern United States where labor is cheaper. We have not yet seen people looking at Wisconsin for that type of manufacturing.

We have seen interest from solar users. But that has more to with legislative

support and the benefits that they can get.

Just look at data centers. The typical data center abatement is typically a 100% sales tax abatement on IT gear. That can be a big swing in costs for users that go to states that offer that type of abatement. If your state doesn’t offer that, it’s a non-starter in most cases.

From a general industrial standpoint, what makes Wisconsin an attractive place for companies?

Young: Wisconsin has a great business climate. We have municipalities here that are pro-business. The communities offer tax incentives to companies looking to locate here. We also have great labor, a great quality of life and a strong freeway system.

Look at communities like Kenosha, Pleasant Prairie, Germantown and Richfield. There is great land in these communities, land that is easily developable. Milwaukee has always lagged the other big industrial markets, but more companies are looking at us today. We are getting our due. We are relatively affordable compared to

Midwest Real Estate News | August 2023 | www.rejournals.com 26

MILWAUKEE

Andy Cvengos

MILWAUKEE (continued from page 24) 2023 Detroit INDUSTRIAL summit September 20, 2023 Scan for more information and to register: Sponsorship Opportunities Available Mark Menzies menzies@rejournals.com 708-622-0074

James Young

other markets our size. The cost of doing business here is more economical.

Looking at demand from data center users, are there any Midwest markets that are particularly hot right now?

Cvengos: Chicago is a top-five data center market nationally. We continue to see massive demand for data center space in the Chicago market. But one of the strongest Midwest data center markets on the map today is Columbus, Ohio. A lot of the hyperscale users have already set up shop in markets like Chicago. It can be hard, then, to find land in a market like that. Because of how tight land is in these bigger markets, many users are looking to places like Columbus. There, you can find 100 acres for a data center easily.

www.rejournals.com | August 2023 | Midwest Real Estate News 27

“We continue to see massive demand for data center space in the Chicago market. But one of the strongest Midwest data center markets on the map today is Columbus, Ohio.”