CRE MARKETPLACE (pg.16):

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE & INVESTMENT FIRMS

REAL ESTATE LAW FIRMS

CRE MARKETPLACE (pg.16):

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE & INVESTMENT FIRMS

REAL ESTATE LAW FIRMS

Driven by a confluence of factors including a booming population, e-commerce expansion and aging infrastructure, the Chicago area is experiencing a surge in cold storage development. These state-of-the-art facilities are crucial for storing and preserving temperature-sensitive goods, ensuring a steady supply of fresh food and vital products to consumers. Illustrating this race to meet demand, Karis Cold is building a 100,000-square-foot facility in Chicago's historic Stockyards district, while Alston Construction is underway on a 389,880-square-foot

freezer storage facility in Plainfield, Illinois, in partnership with Barber Partners.

"Chicago's an industrial hub, a food manufacturing hub,” said Jake Finley, CEO of Karis Cold. “Throughout the city, you've got the restaurant supply chain, you've got the retail supply chain and the shift to more and more food that we're consuming being temperature controlled throughout its life cycle.”

Tom Degan, vice president of cold storage for Alston Construction Company, added that population shifts to the east, availability of skilled labor in the Midwest and access to major transportation networks also make Chicagoland a go-to for temperature-controlled space.

“The pandemic greatly increased e-commerce in all markets but especially in the grocery sector,” Degan

COLD STORAGE (continued on page 14)

PUBLISHER

Mark Menzies menzies@rejournals.com 312.933.8559

MANAGING EDITOR Dan Rafter drafter@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Frank E. Biondo Frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2024 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system.

Dan Barrins Associated Bank

Ron Behm Colliers International

Susan Bergdoll CRG

Corey Chase Newmark

Dan Fogarty Stotan Industrial

Barry Missner The Missner Group

Adam Moore

First Industrial Realty Trust Inc.

Joe Pomerenke

Arco/Murray National Construction Company, Inc

Adam Roth NAI Hiffman

Mike Yungerman Opus Group

1

Ice-cold innovation: Chicago ramps up cold storage infrastructure Driven by a confluence of factors including a booming population, e-commerce expansion and aging infrastructure, the Chicago area is experiencing a surge in cold storage development.

4

Too much building? That could be the industrial market’s top challenge today Too much supply? That might be the biggest challenge facing the industrial sector today, according to the latest research from Crexi.

6

Chicago industrial vacancy up, market fundamentals remain strong The Chicago industrial real estate market, once on a blistering pace, is experiencing a period of recalibration in 2024. While vacancy rates have ticked up slightly, experts see this as a course correction after a period of extraordinary growth, adding that the market fundamentals remain strong.

8

A big reason for higher industrial vacancies? Corporate give-backs Corporate give-backs boosted the vacancy rate in the Chicago industrial market during the first quarter of the year.

10

Normalcy returning to the industrial market? That’s what Savills is predicting The U.S. industrial market saw a dip in leasing activity and an increase in vacancy rates in the first quarter of 2024. But it also saw early signs of a recovery.

12

Reimagining workspaces: Office-to-warehouse conversions address Chicago’s industrial space crunch A scarcity of industrial space in the Chicago area is driving a growing trend: the conversion of aging office buildings into warehouses. This shift reflects both the booming e-commerce market and the changing nature of office work in a post-pandemic world.

16

CONSTRUCTION COMPANIES/ GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE & INVESTMENT FIRMS

REAL ESTATE LAW FIRMS

Too much supply? That might be the big challenge facing the industrial sector today, according to the latest research from Crexi.

As Crexi says in its first quarter 2024 National CRE Trends Report, the e-commerce boom and an increased focus on reshoring to help strengthen supply chains led to an industrial building boom during the first half of the COVID19 pandemic.

And that building boom left the industrial market with so much space that this formerly red-hot sector is finally starting to show some weakness.

As Crexi says in its first-quarter report, the demand for industrial space soared during the last cycle, leading to stiff competition for existing warehouses and manufacturing sites. This demand surged particularly during the COVID19 pandemic. You can blame part of this on consumers who wanted products delivered quickly during the pandemic, and companies realizing that their justin-time approach wasn’t going to work when consumers across the country flocked to online shopping.

While the U.S. office market struggled mightily during the pandemic, along with the retail and hospitalization sectors, industrial thrived. Crexi pointed to average absorption rates in 2021 that doubled that of the previous five years. In 2022, industrial absorption rates

"The U.S. industrial sector benefits from a longterm positive outlook, thanks to e-commerce’s gains, healthy consumer spending and continued onshoring incentives."

were 60% higher than the five years prior to 2021.

To address a shortfall of space in the face of this surging demand, companies scheduled a record-breaking wave of construction that was to begin at the end of 2023, despite certain markets experiencing ultra-low vacancies and robust rent growth across the U.S. This has led to a tapering off of the sector’s fundamentals, with an abundance of supply eating into the high-velocity rent growth that the industrial sector had seen for so long.

Crexi’s report isn’t all bad news, though. It’s not even mostly bad. That’s because despite construction hurdles, such as high costs, supply chain issues

and protracted delivery timelines, the U.S. industrial sector benefits from a long-term positive outlook, thanks to e-commerce’s gains, healthy consumer spending and continued onshoring incentives.

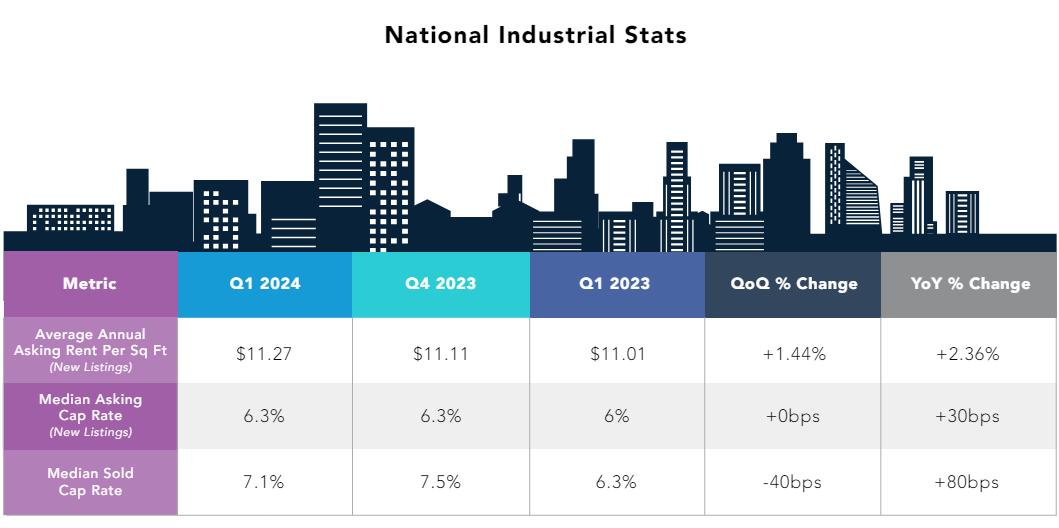

Some of the industrial sector's metrics remain solid, too, according to Crexi's research.

The average industrial asking rent per square foot for new industrial listings stood at a solid $11.27 in the first quarter of 2024. That is up slightly from the fourth quarter of last year, when this figure stood at an average of $11.11 and is up from the average of $11.01 a square foot in the first quarter of 2023.

And what about sales? Crexi reported that the median sold cap rate stood at 7.1% for industrial sales that closed in the first quarter of 2024. That is down from 7.5% in the fourth quarter of last year and up from 6.3% in the first quarter of 2023.

Crexi reported that Houston recorded the highest average cap rate for industrial assets in the first quarter of the year at 8.18%. San Diego had the highest average asking industrial rent in the first quarter at $15.51 a square foot. And Los Angeles saw the highest average industrial price in the first quarter of 2024 at $431.42 a square foot.

The Chicago industrial real estate market, once on a blistering pace, is experiencing a period of recalibration in 2024. While vacancy rates have ticked up slightly, experts see this as a course correction after a period of extraordinary growth, adding that the market fundamentals remain strong.

Data from NAI showed that net absorption, a key metric reflecting overall demand, dipped into negative territory in Q1 2024, for the first time since 2017. Occupier demand, though still present, has shown some moderation compared to the frenetic activity of 2021 and 2022.

“It’s a unique period of time in our world because we still have varying levels of user demand and leasing activity, which is very different across submarkets and size ranges yet generally exists, but

the development market has dramatically slowed due to capital markets turbulence and moderating absorption levels,” said Kelly Disser, executive vice president of NAI Hiffman. “Historically, we may expect to see the entire industry slow at the same time, but we fortunately still have some activity and growth. Certain segments of our business plan remain strong, while others are currently relatively nonexistent”

Disser pointed to the record-breaking 39 million square feet of new industrial space delivered in 2023 as a key factor, explaining that most of the projects got their start 18 to 24 months before delivery.

“Looking back at 2021, every developer who had access to land and capital was pushing to get an industrial building

built,” Disser said, adding that a record number of projects and square footage came into the pipeline. “Our market is correcting. Now there are a lot fewer buildings and a lot less square footage under construction for delivery in 2024, approximately 18 million square feet.”

Vacancy rates, which at one point dipped to a record low of 3.9 percent, have increased to 5.7 percent, what Disser described as a “normal vacancy rate,” and an increase of about 180 basis points.

“This is oversimplifying some more detailed inputs which exist in reality, but if you take 180 basis points on the 1.3 billion square feet that comprise the Chicago market, it breaks down to about 22 million square feet. That’s very close to the difference of the 39 million square

feet that was delivered and the 15 million square feet of absorption that we had last year,” Disser said. “In our very recent past, it was a time when space was limited relative to the demand at the time, the resulting market increases in rental rates were 20 to 35 percent on an annual basis. After 2-3 years of that, we now see rents in some cases 150 percent to 200 percent of their pre-pandemic levels.”

Disser highlighted that with only 13 million square feet currently under construction, compared to the massive influx of 2023, the market is poised for a more sustainable pace of development, especially when it comes to the types of buildings going up.

“What’s under construction currently is much closer to a 50/50 split of build-to-

suit to speculative development,” Disser said. “In 2023, that was closer to 85 percent spec, 15 percent build-to-suit. The rising vacancy rate is largely due to surplus inventory of spec development that has not yet been absorbed outside of maybe one particular submarket, I believe the vacancy levels are very healthy at this time.”

Meanwhile infill, second-generation, shallow-bay space maintains historically low levels of available space.

"We get on the ground and really go find assets, tenants, opportunities and add value for our clients from being out in the market all the time."

“It really is an amazing market dynamic because we have examples right now in which we represent a particular tenant requirement which has 15 legitimate alternatives to choose from,” Disser said. “At the same time, we represent a landlord/owner in another submarket where we are the only available space in the submarket – at that size we have no competition. This is where we create value and look to monetize the leverage we create.”

Disser sees opportunities for developers in infill markets, where land avail-

ability is limited, significant barriers to entry exist, but demand for new space remains high. He emphasized the importance of navigating the permitting process efficiently to capitalize on these opportunities.

The future of the Chicago industrial market also holds promise for a diverse range of users. While traditional sectors like e-commerce and distribution may see some adjustments, Disser pointed to continued strength in data centers, food processing and even manufacturing.

“At Hiffman, we present an institutional level of sophistication and understanding of the leasing market and the capital markets,” Disser said. “At the same time, we have an entrepreneurial approach focused on long term relationships in order to execute for our clients. We get on the ground and really go find assets, tenants, opportunities and add value for our clients from being out in the market all the time.”

Corporate give-backs boosted the vacancy rate in the Chicago industrial market during the first quarter of the year.

JLL in its Industrial Insights report said that these give-backs played a role in Chicago's industrial vacancy rate inching up to 4.6% in the first quarter. This rate was a jump of 30 basis points from the fourth quarter of 2023 and a rise of 170 basis points from the first quarter of 2023.

JLL said that a growing number of corporations returned industrial space that they had leased on a short-term basis during the height of the COVID19 pandemic. During this time, corporations needed to deliver products as quickly as possible to consumers, which caused many to lease warehouse space on a short-term basis.

Now, though, many of these corporations are returning this space. This new round of give-backs is only boosting the Chicago market's industrial vacancy rate.

According to JLL, give-backs were most prevalent in the I-88 corrioder, where 1.3 million square feet of industrial space was returned during the year's first quarter.

Another key finding of JLL's Chicago report? Chicago saw 3.7 million square feet of industrial space delivered in the first quarter. That was significantly less than the 12.5 million square feet delivered in the fourth quarter of 2023.

Developers are also slated to build just 12.4 million square feet of new indus-

trial space this year, according to JLL. That is half of the market's five-year average of 24.9 million square feet.

Tenant demand for industrial space, though, did hold steady. JLL reported that tenant demand measured 7.4 million square feet in the first quarter. Demand was strongest for industrial facilities in the 100,000-square-foot to 150,000-square-foot size. A total of 12 leases for industrial facilities of this size were signed during the first quarter in the Chicago market.

Speculative construction is down, too. JLL reported that 3 million square feet of speculative industrial construction was completed in the first quarter. There is just 8.2 million square feet of industrial construction scheduled for completion by the end of 2024.

Industrial asking rents in Chicago have flattened, too, hovering at $7.06 net in the first quarter, a slight dip from the $7.13 net reported in the

fourth quarter of 2023. The Chicago North market continues to command the highest pricing at $12.83 a square foot.

A bright spot? JLL did say that the Chicago industrial market is poised for a strong finish to 2024 because of the limited amount of new speculative developments now underway. Coupled with an increase in tenant inquiries, Chicago could see the absorption of a major portion of the market's remaining big-box speculative products.

The U.S. industrial market saw a dip in leasing activity and an increase in vacancy rates in the first quarter of 2024. But it also saw early signs of a recovery.

That's the takeaway from the State of the U.S. Industrial Market first-quarter report released in May by Savills.

Savills reported that the U.S. industrial market is shifting from a historically tight market to one that is more bal -

anced. That can be seen in the market's rising vacancy rates.

According to Savills, the U.S. industrial market's vacancy rate rose 240 basis points in the first quarter of this year when compared to the first three months of 2023. The vacancy rate for this sector hit 6.7% as of the end of the first quarter.

Demand for industrial space by tenants is cooling, too. Savills reported

that industrial absorption dropped to 26 million square feet in the first quarter of the year. That's the lowest amount of absorption in the first quarter in eight years.

Just look at the first quarter last year: Savills reported that the U.S. industrial market saw 91.4 million square feet of net absorption during the first three months a year ago.

Industrial construction activity remained high in the first quarter, with 462.1 million square feet of new industrial space under construction. But this activity is slowing, too, and is down a significant 44% from its peak in 2022.

During the first quarter of last year, the industrial sector saw a far higher 782.1 million square feet under construction.

Savills reported, too, that industrial deliveries fell to 122.4 million square feet in the first quarter. That is down, too, from the 163.1 million square feet of industrial space that was delivered during the first three months of 2023.

One number that is moving in the right direction? Asking rental rates. Savills reported that the average asking rental rate for an industrial property in the United States rose to $9.47 a square foot in the first quarter. That is up from an average of $8.67 a square foot last year during the first quarter.

What about in Chicago? How does the Chicago-area industrial sector compare to the national market?

In its first quarter 2024 Chicago industrial report, Savills said that industrial activity in the first quarter throughout the Chicago area looked more historically normal than did the boom times the market saw in 2020 and 2021.

As Savills said in its report, fundamentals in the Chicago-area industrial market "reverted to more commonly observed levels."

According to Savills' research, the industrial vacancy rate in the first quarter in the Chicago market rose 190 basis points from a year earlier to 6.8%. That marks three consecutive quarters of increased vacancy rates in this market.

The Chicago industrial market also saw 2 million square feet of absorption in the first quarter. That's solid historically, but it's down significantly from the first quarter of last year, when

the Chicago-area industrial market recorded 6.8 million square feet of net absorption.

Developers are reacting to the slowdown in demand for industrial space. Savills reported that there were 11.4 million square feet of new industrial products under construction as of the end of the first quarter. That's down from 38.4 million square feet under construction as of the end of the first quarter of 2023 in the Chicago market.

Savills reported, too, that the Chicago-area industrial market saw 7.1 million square feet of deliveries in the first quarter, down slightly from 7.8 million square feet a year earlier.

This doesn't mean that demand for industrial space has disappeared. In its report, Savills said that tenants are still seeking high-quality industrial space in the Chicago market. Demand for quality buildings in the I-55 corridor is especially solid, Savills reported.

This submarket remains in high demand because of its reputation as a marquee logistics and distribution market and its strong labor demographics. According to Savills, the I-55 corridor commanded some of the region's highest asking rents while its vacancy rate held below the greater market average despite the new construction that has taken place here. Savills said that three of the five largest industrial leases executed in the first quarter in the Chicago market took place in the I-55 corridor.

Ascarcity of industrial space in the Chicago area is driving a growing trend: the conversion of aging office buildings into warehouses. This shift reflects both the booming e-commerce market and the changing nature of office work in a post-pandemic world.

“In Chicago, we’ve got the industrial demand from developers to convert those to industrial projects,” said Kelly Disser, executive vice president at NAI Hiffman. “Chicago's very fortunate, in that regard. If you look around the country, there are other cities that may have some of these office projects, but they just don't have the industrial market to support the conversion at the rate that we do.”

Lee & Associates research revealed Downtown Chicago’s direct vacancy rate for office space hit 19.6 percent in Q1 2024, while the suburbs

saw vacancies hit 24.6 percent. By comparison, the industrial sector in greater Chicago is hovering around 4.5 percent.

In a recent example, Dermody Properties broke ground on The Logistics Campus on the site of the former Allstate Corporation headquarters in Glenview, Illinois. The project’s initial plan aimed to convert the 232acre office campus into a 10-building development with approximately 3.2 million square feet of industrial space. Located in the heart of the north suburban O’Hare industrial market, The Logistics Campus has immediate access to I-294 and with proximity to O’Hare International Airport and downtown Chicago.

“The Logistics Campus’ prime location will help draw world-class companies to the region, bringing jobs and economic opportunity along with

them,” said Neal Driscoll, Midwest region partner at Dermody Properties. “Our customers and the surrounding communities will benefit from this transformation of the office campus into modern logistics buildings – all with access to transportation, labor and amenities unparalleled relative to the entire metro Chicago market.”

The first phase of The Logistics Campus includes roughly 1.2 million square feet of mostly spec development across five warehouses and should be complete by the end Q2 2024. From there, Dermody said it will move forward with more buildto-suit tenants for future phases, incorporating a variety of building sizes and heights.

“Once complete, The Logistics Campus will serve the needs of our customers, the community, and many stakeholders by creating a significant

number of competitive, high-paying construction and long-term jobs in the logistics industry,” Dermody President Douglas A. Kiersey, Jr. said at the groundbreaking. “We are grateful to the Village of Glenview for their partnership in bringing this vision to life.”

Another example of this trend is the planned development of Rolling Meadows Commerce Center in Rolling Meadows, Illinois. Brennan Investment Group purchased a 485,000-square-foot office building on 40 acres of land and plans to demolish the existing structure to create a new 600,000-square-foot industrial park.

“This location is unmatched in terms of its logistical advantages via the confluence of interstate systems, its access to a large and diverse workforce and its proximity to best-

"This location is unmatched in terms of its logistical advantages via the confluence of interstate systems, its access to a large and diverse workforce and its proximity to best-in-class amenities."

in-class amenities, including restaurants, hotels and shopping,” said Kevin Brennan, managing principal of Brennan Investment Group.

While these conversions offer promise for property owners, investors and warehouse tenants seeking space near customers, there are challenges to consider. Regulatory hurdles and community concerns can arise. Residents may oppose increased truck traffic, noise and potential pollution associated with industrial facilities. Additionally, municipalities might be wary of losing the white-collar jobs

typically associated with office spaces.

Despite these challenges, experts believe the trend of office-to-industrial conversions is likely to continue as demand for industrial space shows no signs of abating, fueled by the growth of e-commerce. At the same time, the future of office space needs remains uncertain as remote and hybrid work arrangements become increasingly popular.

Rolling Meadows Commerce Center.

Rolling Meadows Commerce Center.

said. “Now that e-commerce in the food industry is widely accepted, grocery footprints are changing, restaurants are adapting and more cold storage facilities are required to accommodate the increased demand.”

The demand is also responding to aging inventory in the cold storage sector. The average cold storage building in the U.S. is more than 40 years old, Degan pointed out, even as regulations on food safety and refrigeration practices and technological advances in storage height and energy efficiency have forced these older buildings to become obsolete.

In response, companies like Alston and Karis are investing in new product – in Chicago and across the country.

“We have almost $1 billion of new cold storage construction in multiple different markets,” Finley said. “Chicago is a big piece of that.”

Karis’s $30 million, innovative Stockyards facility will utilize advanced technology to maintain temperatures as low as -10 degrees Fahrenheit, ensuring the freshness and quality of perishable goods. The building will be "purpose-built" for cold storage with unique construction materials and systems, and will feature a landscaped setback and public artwork.

" The technology of refrigeration equipment has evolved dramatically, reducing the impact on the utilities from a cost standpoint, as well as from a demand-of-energy standpoint, which I think is good for everybody involved."

“The way that we're building the buildings is unique and modern,” Finley said. “We talk in cubic footage, not square footage. The taller the building, the more energy efficient the building is, the more product can be stored in the same footprint. That's a big piece of it. The technology of refrigeration equipment has evolved dramatically, reducing the impact on the utilities from a cost stand-

point, as well as from a demand-of-energy standpoint, which I think is good for everybody involved.”

Alston’s Plainfield facility boasts cutting-edge technology designed to maintain optimal storage conditions for perishables at -10°F. The project incorporates an ALTA Expert refrigeration system and a glycol under-floor heating

system within the freezer space, showcasing Alston's commitment to innovation. Additionally, the facility will include support offices for multiple tenants, catering to a variety of cold storage needs.

“The increased demand for cold storage facilities is not only driving speculative development in order to expedite speed to market, but also bringing in several

COLD STORAGE (continued from page 1)

new developers and PRW operators to meet the growing needs,” Degan said. “The challenge to the industry will be to maintain the appropriate balance in order to not overbuild these spec buildings, however based on the projections, we’re several years from creating a surplus.”

He added that hiring qualified design and construction teams with cold storage expertise is of utmost importance, citing Alston as one of those.

Looking ahead, Finley anticipated the positive impact the new Karis facility would have within Chicago.

“It's going to create good jobs,” Finley said, noting that the project is currently talking to potential tenants interested in being the flagship of the building. “It's going to create redundant infrastructure for the people of Chicago and the food supply, which is great for everybody.”

With experienced developers like Karis Cold and Alston Construction leading the charge, Chicago is well-positioned to meet the growing demand for temperature-controlled storage solutions, ensuring a steady supply of essential goods for consumers for years to come.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400

Rosemont, IL 60018

P: 847-374-9200 | F: 847-374-9222

Website: www.meridiandb.com

Key Contact: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Venture Park 47, Huntley, IL - 729,800 sf speculative industrial facility for Venture One Real Estate. Lion Electric, Joliet, IL - 928,500 sf electric bus / medium duty truck assembly plant for Clarius Partners. Greenwood Truck Terminal, Greenwood, IN - 125 door truck terminal on 43 acres for Scannell Properties.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A.. Brucato, President, jbrucato@pccdb.com

Services Provided: Principle specializes in commercial and industrial property and is committed to providing clients with the highest level of design/build construction services with an absolute dedication to each project.

Company Profile: Design/Build General Contractor established in 1999 specializing in the design and construction of Build-to-Suit, Speculative, Retail, Food Processing, Expansions/Additions, Tenant Improvements, & Specialty Facilities. Principle also has extensive experience in interior improvements, site evaluation, due diligence, and value engineering.

Recently Completed Projects include:

• 282,588 SF dry-cleaning facility for Tailored Brands, at 2000 Deerpath Rd. in Aurora, IL.

• 31,200 SF facility for Alvil Trucking, at 2570 Millenium Dr. in Elk Grove Village, IL

• 6,200 SF Warehouse for Superfast Trucking, at 1001 Raddant Rd. in Batavia, IL

VICTOR CONSTRUCTION

2000 Center Dr., Suite East C219

Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor. Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors.

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

ECONOMIC DEVELOPMENT CORPORATION

OF MICHIGAN CITY

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211

Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com

Karaline Cartagena Edwards, Economic Development Manager, kcedwards@edcmc.com

Services/Demographic Info: Up-to-date inventory of commercial buildings, site selection and orientation tours.

Incentives: Tax-Increment Financing, Façade Improvement Grants, Property Tax Abatements, Enterprise Zones, Job Training Programs.

Recent CRE Activity: Double Track Northwest Indiana: $1.6 Billion development reducing train travel to Chicago to 60 minutes; The Franklin at 11th St. Station: $100 Million Development with Residential & Retail Space; “You are Beautiful”/SoLa: $311 Million Mixed-Use Multi-Family Development with 235 boutique hotel rooms & 174 Luxury Condos; Burn ‘Em Brewing: $3 Million Expansion project with 30 new jobs.

10987 Main Street

Huntley, IL 60142

P: 847-515-5268

Website: huntleyfirst.com, huntley.il.us

Key Contact: Melissa Stocker, Development Manager, mstocker@huntley.il.us

Services/Demographic Info: Huntley, a northwest suburban Illinois community of greater than 29,000 residents, is conveniently located at the crossroads of Interstate 90 and IL Route 47. Proximity to the interstate and to international and cargo airports in Chicago and Rockford make Huntley an ideal location for businesses looking to escape the congestion of more populated areas while reaping the benefits of a Chicago market location. Village of Huntley staff provides comprehensive services including site selection assistance and demographic resources, visit huntleyfirst.com to start the search for your new home for business. Residential construction continues with three subdivisions actively building. Huntley is home for your business, and home to the right employees for your business.

Population In Primary Trade Area: 97,283

Incentives: TIF District, Fast Track permitting and development approval process

CRE Activity: Huntley is home to leaders in business. Join Weber, Northwestern Medicine, Amazon and many others that chose Huntley as their home for business. Hampton Inn recently opened in Huntley. Amazon has begun operations in two Huntley facilities. E-Logistics firm headquarters are underway. Speculative development is underway and available near the tollway. Multiple retail strip centers are in the planning and construction phases. With land available for custom-tailored facilities, businesses seeking sites recognize Huntley as a prime location for operations.

MARQUETTE BANK

10000 W. 151st Street

Orland Park, IL 60462

P: 708-364-9131

Website: emarquettebank.com

Key Contact: Gene Malfeo, Senior Vice President, gmalfeo@emarquettebank.com

Services Provided: Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

WORSEK & VIHON, LLP

180 North LaSalle Street, Suite 3010 Chicago, IL 60601

P: 312.917.2307 P: 312.917.2312 | F: 312.596.6412

Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their property tax liabilities through ad valorem appeals. We have over 40 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of all property types. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts.

Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused on real estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management, well-researched, creative appeal preparation and aggressive advocacy.