Industrial sector continues to drive commercial real estate growth

By Mia Goulart, Senior Staff Writer

Industrial remains the "it" sector of commercial real estate, and though there has been a pullback in sales activity as demand patterns continue to shift, experts’ concerns primary stem from overwhelming demand, not a lack of it.

Chicagoland is experiencing a shortage of available product for sale, and the demand for space, especially from distribution-related companies, is high. While

there is slightly more product on the leasing side, it’s still limited, particularly taking into account the specific needs of each user.

Brown Commercial Group is witnessing especially high demand in O’Hare and DuPage due to their proximity to transportation routes and comparatively lower taxes, yet this is not new, and Broker Candace Scurto said clients are having to get creative by either

compromising on location or finding ways to optimize their current space until a suitable property becomes available.

Small- and medium-sized users in Southeast Wisconsin are facing a similar issue.

INDUSTRIAL (continued on page 10) VOL.33 NO.4 JULY/AUGUST 2023 THE LEADING NEWS SOURCE FOR INDUSTRIAL REAL ESTATE PROFESSIONALS & USERS CRE MARKETPLACE (pg.16): CONSTRUCTION COMPANIES/GENERAL CONTRACTORS FINANCE & INVESTMENT FIRMS

INVESTS DEVELOPS MANAGES

Our experts have the creativity and know-how to tackle your toughest supply chain challenges, continuously giving you a competitive edge to realize your success.

centerpoint.com

PUBLISHER

Mark Menzies menzies@rejournals.com

708.622.0074

SENIOR STAFF WRITER

Mia Goulart mia.goulart@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES

MANAGER

Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES

Frank E. Biondo

Frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

DIRECTOR, NATIONAL EVENTS & MARKETING

Alyssa Gawlinski agawlinski@rejournals.com

Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2023 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system.

2023 EDITORIAL BOARD

Corey Chase Newmark

Joe Pomerenke Arco/Murray National Construction Company, Inc

Dan Fogarty Stotan Industrial

Adam Moore First Industrial Realty Trust Inc.

Ron Behm Colliers International

Adam Roth

NAI Hiffman

Mike Yungerman Opus Group

Glen Missner The Missner Group

Dan Barrins Associated Bank

1

Industrial sector continues to drive commercial real estate growth Industrial remains the "it" sector of commercial real estate.

4

The potential impact of artificial intelligence on industrial property management? We turned to Cushman & Wakefield Over the last few decades, Artificial Intelligence (AI) has impacted many industriesincluding commercial real estate.

6

LinkedIn Workforce Report: Hiring lower from last year in Chicago and U.S. LinkedIn helped me get this job. This is true for a lot of us, as LinkedIn continues as one of the most valuable platforms for job seekers.

8

“Cautious optimism” shared among 100-plus attendees of REjournals’ 20th Annual Industrial Real Estate Summit On June 20, 100-plus leading real estate professionals gathered to mark REjournals’ 20th Annual Industrial Real Estate Summit.

12

Industrial market shows signs of normalization, based on recent report by Cushman & Wakefield Following a streak of heightened demand in recent years, the industrial real estate market is cooling to normal levels.

14

Sears HQ to be bought by Dallas-based data center developer, Compass Datacenters The Dallas-based company is reportedly under contract to purchase the 273-acre former Sears headquarter campus in Hoffman Estates, Illinois, by the end of the year.

16

MARKETPLACE

CONSTRUCTION COMPANIES/ GENERAL CONTRACTORS

FINANCE & INVESTMENT FIRMS

Plenty of industrial sublease space in Chicagoland, according to new data by JLL It’s no secret Chicagoland has some of the most high-quality sublease options available when compared to other markets in the U.S.

17

3 JULY/AUGUST 2023 CHICAGO INDUSTRIAL PROPERTIES

CONTENTS

www.conor.com

TRUST IS THE FOUNDATION OF EVERY DEVELOPMENT

The potential impact of artificial intelligence on industrial property management? We turned to Cushman & Wakefield

By Mia Goulart, Senior Staff Writer

Over the last few decades, Artificial Intelligence (AI) has captured the collective imagination, and found its way into movies, literature and cartoons, transforming various aspects of society. But AI’s growth has impacted several other industries, too, including commercial real estate, by offering opportunities to enhance efficiency, cut expenses and boost revenues—yet it’s only just beginning.

While AI is primarily utilized now in back-of-the-house administrative applications, there are emerging and relevant technologies that are starting to be seen across various sectors.

Chris Taylor, executive managing director at Cushman & Wakefield, and a member of an Atlanta-based AI committee, recently shared with Chicago Industrial Properties his predictions regarding the potential effects of AI on industrial owners/operators.

The key takeaway? Third-party property management might be in for a challenge.

Chicago Industrial Properties: How do you foresee AI technology affecting industrial property management (IPM) in terms of efficiency and cost-effectiveness?

Chris Taylor: We are very early on with AI, and most of what we are seeing now focuses on back-of-house billing efficiencies with Robotic Process Automation (RPA/BOTS).

Illinois Real Estate Journal: What specific tasks or processes within IPM do you think can be enhanced or automated through the use of AI?

Taylor: I do see a time in the near future when AI will have the ability to abstract leases and assist property managers in some day-to-day customer service functions. For example, a tenant emails about an HVAC issue, and AI helps to cite specific portions of the tenant’s

lease that are applicable to responsibility. However, most of tenant interactions remain nuanced and certainly require a personal response and solid relationship, especially within the context of all the decisions that come into play when

a tenant is up for renewal, their AR balance, etc. There is no one size fits all.

Illinois Real Estate Journal: Are there any potential challenges or risks associated with integrating AI technology into

4 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

Chris Taylor

IPM? If so, how do you propose addressing them?

Taylor: Our biggest hurdle revolves around sharing sensitive client data (leases).

Illinois Real Estate Journal: How do you envision AI technology improving maintenance and facility management practices?

Taylor: We are seeing PropTech being developed that can help drive decisions on when repairs are needed and how to forecast repairs over a longer-term hold. For example, we have technology that utilizes drones to evaluate a parking lot’s condition and identify immediate needs for repair.

Illinois Real Estate Journal: What impact do you think AI will have on tenant engagement and satisfaction?

Taylor: I see this as a tool to accelerate tenant request and resolution processes, but by no means will AI eliminate the role of property managers. There are too many situations requiring judgment calls that have to be made based on experience.

Illinois Real Estate Journal: What skills and expertise would IPM professionals

Supply chain problem solved.

need to develop or acquire to effectively utilize AI technology?

Taylor: We all need to learn how to integrate systems (i.e., how to get accounting systems talking to property inspection systems).

Illinois Real Estate Journal: How do you think AI will impact the decision-making

process in IPM, such as lease negotiations or property valuation?

Taylor: I do not see this as impactful in the short term. There are too many nuances at the market- and location-level that drive valuation and lease negotiations.

Illinois Real Estate Journal: In your opinion, what is the timeline for widespread adoption of AI technology in IPM, and what factors might influence this timeline?

Taylor: Five to ten years, with the main hurdle being how we solve data-sensitivity issues.

Principle Construction is currently constructing a new building for Superfast Trucking Inc. using split faced block for the exterior façade due to the long lead of precast. The new building will include a 3,900 SF warehouse, 2,300 SF office, 1,000 SF mezzanine along with a retention pond, on a 1.9-acre site. The 6,200 SF building will offer 15 trailer stalls, and three drive-in truck service bays.

6,200 SF Office/Warehouse Batavia, IL

5 JULY/AUGUST 2023 CHICAGO INDUSTRIAL PROPERTIES

"By no means will AI eliminate the role of property managers. There are too many situations requiring judgment calls that have to be made based on experience."

9450 West Bryn Mawr Avenue Suite #120 • Rosemont, IL 60018 (847) 615-1515 fax (847)

615-1598

PCC2023 CIP July Ad (f).indd 1 7/13/23 2:20 PM

LinkedIn Workforce Report: Hiring lower from last year in Chicago and U.S.

By Mia Goulart, Senior Staff Writer

LinkedIn helped me get this job. This is true for a lot of us, as LinkedIn continues as one of the most valuable platforms for job seekers. But how many have considered its usefulness to track hiring and migration trends?

With over 202 million LinkedIn members in the United States, the platform has unique insight into the real-time dynamics of those starting new jobs and moving to new cities.

In Chicago, LinkedIn’s July 2023 Workforce Report reported hiring was 0.3% lower in June 2023 compared to last month May 2023 and was 21.6% lower in June 2023 compared to last year June 2022.

Chicago gained the most workers in the last 12 months from Urbana-Champaign, Illinois, and Detroit, Michigan, likely due

to the migration of recent college graduates from both regions.

It was Dallas-Fort Worth, Texas; Denver, Colorado; and Tampa Bay, Florida that gained the most workers from Chicago in the last 12 months. This means for every 10,000 LinkedIn members in Chicago, 1.92 workers moved to Dallas-Fort Worth, Texas, in the last year.

The same patterns can also be seen throughout the U.S.

Nationally, across all industries, hiring in the U.S. was 2% lower in June 2023 compared to last month May 2023. National hiring was 20.9% lower in June 2023 compared to last year June 2022.

The industries with the most notable hiring shifts month-to-month in June 2023 were financial services (3.7% higher); farming, ranching, forestry (1.7% higher); and holding companies (1.5% higher).

6 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

"The platform has unique insight into the real-time dynamics of those starting new jobs and moving to new cities."

Chicagoland’s Union Electrical Team LEARN MORE AT POWERINGCHICAGO.COM

“Cautious optimism” shared among 100plus attendees of REjournals’ 20th Annual Industrial Real Estate Summit

By Mia Goulart, Senior Staff Writer

On June 20, 100-plus leading real estate professionals gathered at the Hyatt Lodge Oak Brook in Oak Brook, Illinois, to mark REjournals’ 20th Annual Industrial Real Estate Summit.

Among the speakers who shared their expertise and insights on various aspects of the industrial real estate

REjournals’ Ernest Abood, who hosted the event, expressed the prevailing sentiment as one of “cautious optimism.”

Despite a cooling down period, the sector continues to show positive signs, with rising rents being a particularly encouraging trend.

Regarding the state of the market, SVN Managing Director John Joyce said: “After years of unprecedented growth, the Chicagoland industrial market has cooled. Due to high construction deliveries, the current vacancy rate for core markets has increased to 3.4%, up from the start of the year's historical low mark of 3.2%. Additionally, the Federal Reserve has enacted ten interest rate

8 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

market: Adam Moore of First Industrial Realty Trust; Ben Bartel of National Property Consulting Group, LLC; Chris Moore of FCL Builders; Ed Halaburt of JLL Capital Markets; John Joyce of SVN; Joshua Hearne of Cawley Chicago; Kate Coxworth of JLL; Kelly Disser of NAI Hiffman; Matthew Grusecki of Northern Builders, Inc., Michael Brazeal of CenterPoint Properties; Mike Llewellym of

Alston Construction; and Peter Tsantillis of Liston & Tsantillis, P.C.

hikes since March 2023 to try to tame inflation. With an estimated two more expected interest rate hikes, it is unknown if the Fed's plan is working. The lending environment has impacted the commercial real estate markets, as it is more

difficult to fund projects and expansions. As a result, overall transaction volume has decreased. Rental rates continue to grow due to limited new construction for buildings under 200,000 square

feet, resulting in double-digit growth for three consecutive years.”

As the industry continues to evolve, events that foster in-person connection play a pivotal role in shaping the trajec-

tory of real estate in Chicagoland. If you missed this event and want to stay up to date with all things REjournals, visit our EVENTS page.

9 JULY/AUGUST 2023 CHICAGO INDUSTRIAL PROPERTIES SINCE 1973 info@krusinski.com | 630.573.7700 | krusinski.com KNOWN EXPERIENCED TRUSTED

State of Chicagoland Industrial Real Estate Market panel: Kelly Disser, Exec VP NAI/Hiffman; Adam Moore, Sr Reg Director, First Industrial Realty Trust; Matthew Grusecki, President, Northern Builders, Inc. ; Michael Clewlow, Acquisitions Associate, Venture One; Ed Halaburt, Managing Director, JLL Capital Markets; Moderator: Peter Tsantilis, Partner, Liston & Tsantilis, P.C.

Industrial Development, Leasing Trends and Construction Challenges panel: Chris Moore, Assoc VP Project Development, FCL Builders; Kate Coxworth, VP, JLL; John Joyce, Managing Director, SVN Chicago Industrial; Joshua Hearne, Principal, Cawley Chicago; Mike Llewellyn, Operations Manager, Alston Constuction; Moderator: Ben Bartel, Principal Engineer, National Property Consulting Group, LLC.

In the years leading up to and after the pandemic, space scarcity became prevalent across all submarkets, leading to an increase in spec development, which has continued in recent years. Despite over 10 million square feet of industrial development in the region since 2020, with an additional four million square feet underway, the market has primarily focused on large warehouse spaces, creating a void for smaller users.

DarwinPW Realty/CORFAC International Vice President Dan Prendergast said that buildings under 150,000 square feet are not presently being constructed, leaving those seeking spaces under 50,000 square feet with limited options and/or the inability to enter the market.

Despite the increase in vacancy rates driven by new developments in Southeast Wisconsin, there is still available land for future development, though appropriately-zoned sites along I-94

are becoming scarce. That said, there is enough supply in the market to last well into 2024, and Prendergast said some developers are presently waiting for the current product to be absorbed

before going vertical with new spec in the market.

And as far as capital that’s already been deployed, developers are still booked and busy with the 10 spec projects ex-

pected to be delivered by the end of the year.

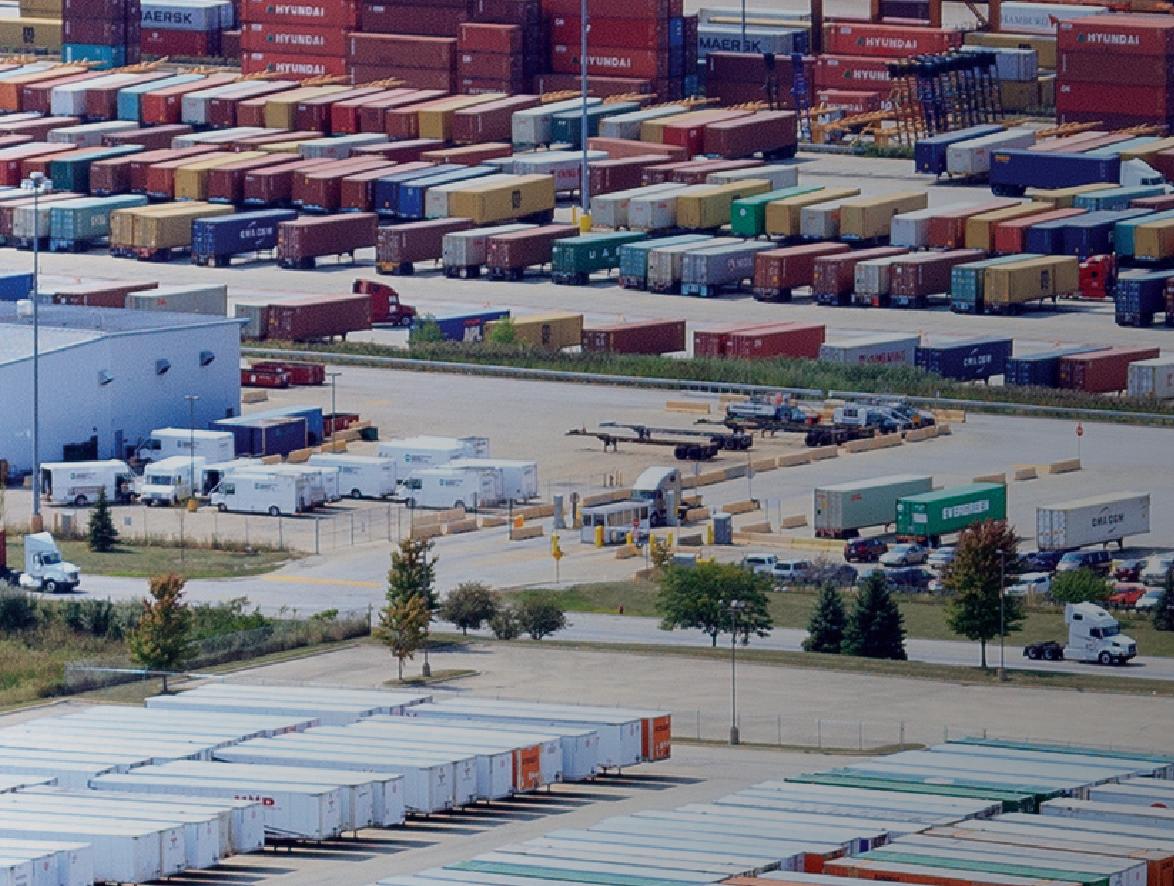

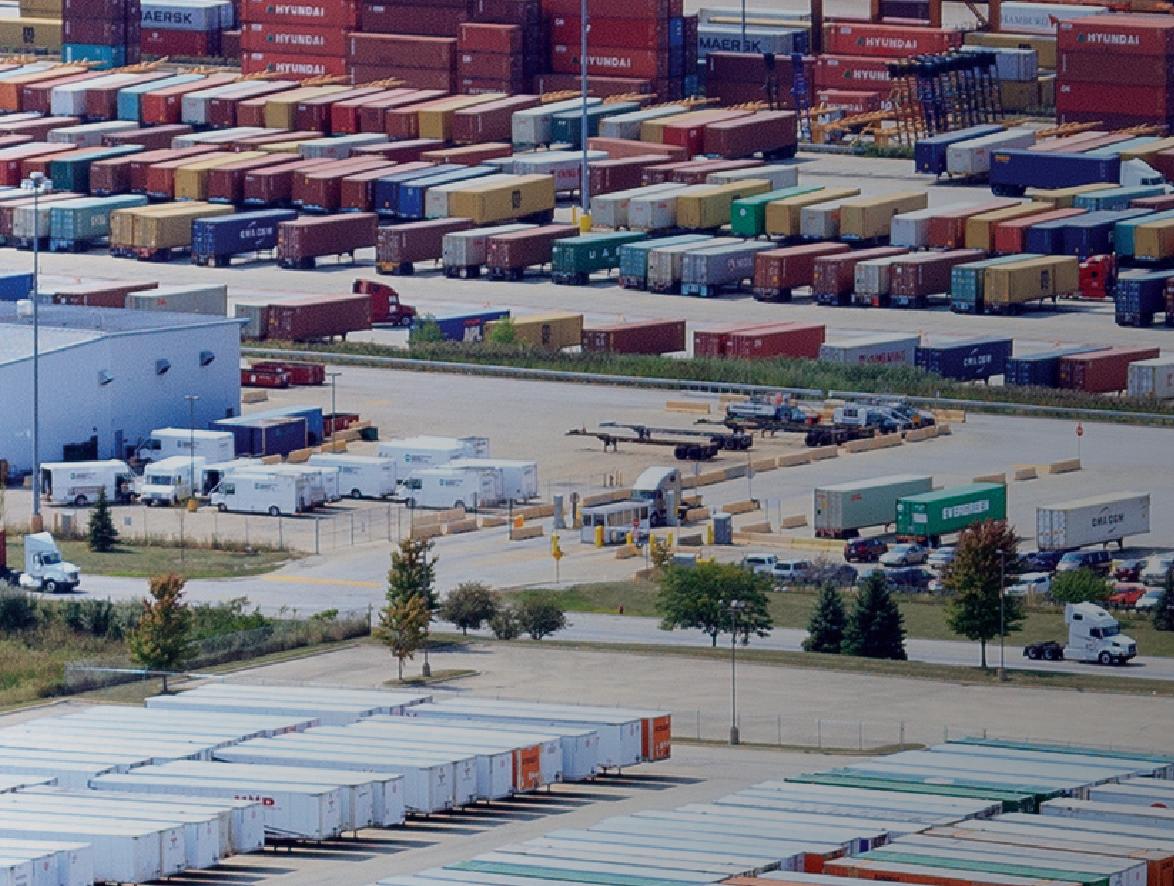

Over the last four to five years, Darwin has developed and sold a 120-acre business park between Hwy 50 and Hwy K in

10 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

INDUSTRIAL (continued from page 1)

"Despite the increase in vacancy rates driven by new developments in Southeast Wisconsin, there is still available land for future development, though appropriately-zoned sites along I-94 are becoming scarce."

Kenosha, Wisconsin, in a total of five different sales. Old Dominion Freight Lines was the original anchor, having built a 25-acre freight transfer facility. Another company bought a 27-acre piece of land for a 600,000-square-foot manufacturing facility that will break ground this

year, and Opus Development Group bought a 15-acre site for a 280,000-square-foot single-load building sold to Pritzker Realty Group, which is being marketed for lease now.

Prendergast also represents a private investment group that purchased an eight-building, 277,000-square-foot portfolio from Zilber Property Group with about 48 tenants, varying from 2,500 to 25,000 square feet. That portfolio is 100% oc cupied and rents are increas ing, further exemplifying the demand for, and subsequent lack of, product—for users of that size range.

The demand for industrial development has also laid the groundwork for other sectors to follow suit as the surround ing regions continue to grow due to the labor needed to operate big-box facilities.

“We’re seeing more multifam ily buildings entering the mar ket in the region,” Prendergast said, “and I do believe it is driv en by the larger industrial de velopment. Employers in the region are paying desirable wages, and because people prefer the convenience of a ‘live, work, play’ environment, multifamily and retail projects in the region should only grow in demand.”

So what can be expected from the second half of the year?

Interest rates haven’t had a significant effect on buyers close to Chicago, as there’s still a lot of cash deals occurring, and Scurto doesn’t anticipate any major change in market conditions in the next

six months. Until there’s more product, the market will continue to face the same supply/demand issues.

As for Southeast Wisconsin, Prendergast said we’ll have to wait and see.

tremendously, but during a slowdown in the economy, markets just outside the “core” are more susceptible to consequences, as developers may opt for “safer” and historically more estab lished markets near Chicago or Milwau

11 JULY/AUGUST 2023 CHICAGO INDUSTRIAL PROPERTIES

Reasons 8 to Choose Bank 's Financial Mult ifamily Loan Program Commercial Real Estate Lending Capital Markets To Learn More, Contact: All loans subjec o credit and co lateral approva Kevin Greer AVP, Commercial Lending 630.425.5813 KGreer@BankFinancial.com Loans of $250,000 to $5,000,000 1 2 5 Units and Above 3 LTV: Up to 65% / 80% (Dual Note) 4 and Cash-out Refinances 5 6 7 8 3, 5, 7 and 10-year Hybrid ARM Loans Up to 30-Year Investment Equity Lines and Loans Available Capital Markets Loan Program Available

seeing more multifamily buildings entering the market

the region,”

"We’re

in

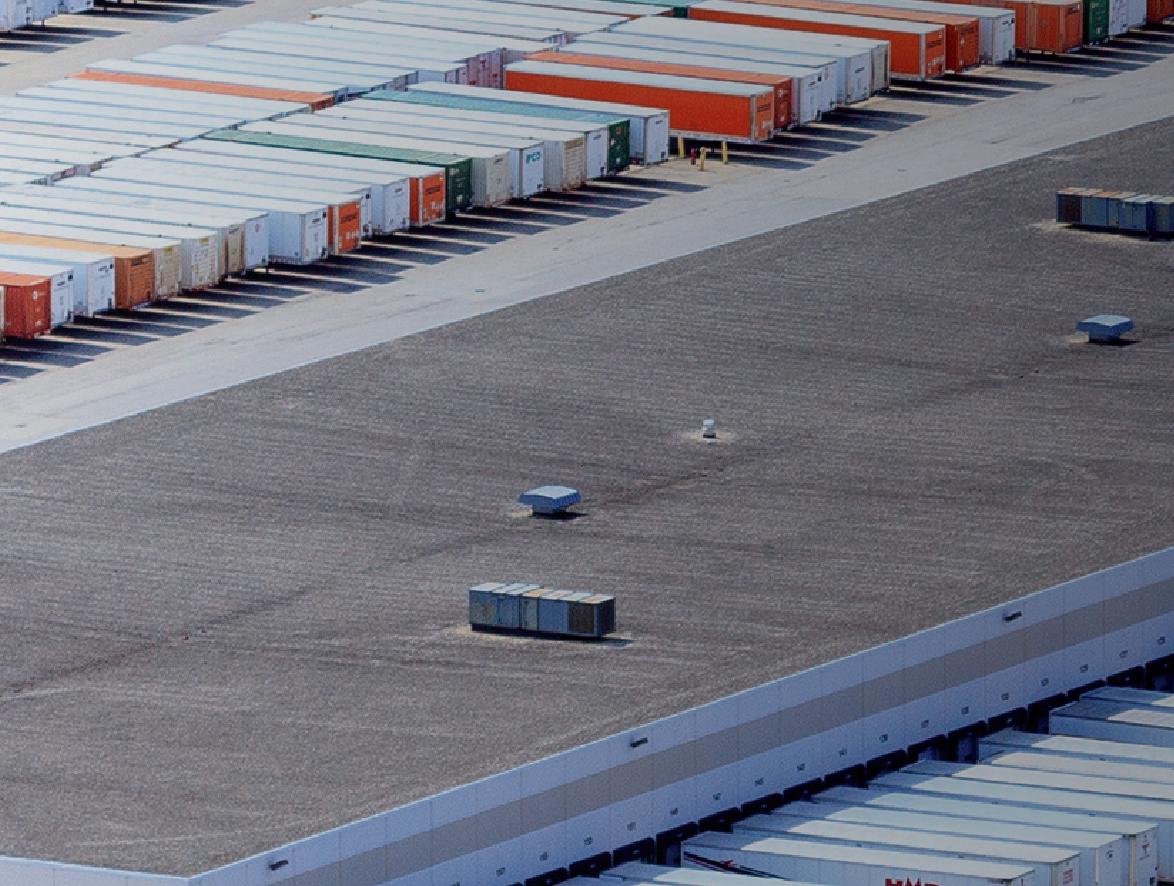

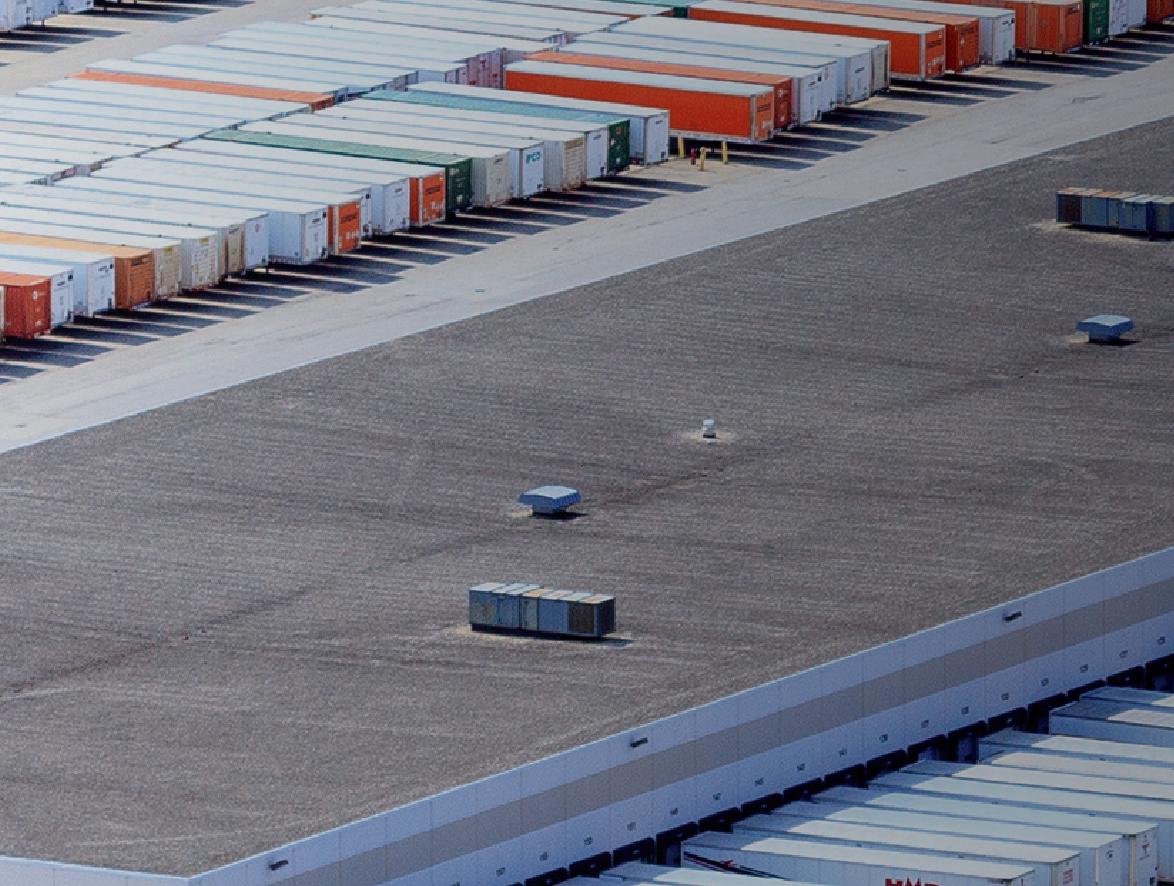

Kenosha Site,

of DarwinPW

6222 77th Site, Courtesu of DarwinPW Realty

Prendergast said, “and I do believe it is driven by the larger

industrial

development. "

Courtesy

Realty

Industrial market shows signs of normalization, based on recent report by Cushman & Wakefield

By Mia Goulart, Senior Staff Writer

Following a streak of heightened demand in recent years, the industrial real estate market is cooling to normal levels, exemplified by the recent increase in vacancy rate, based on the latest report from Cushman & Wakefield.

During Q2 2023, the overall industrial vacancy rate rose by 60 basis points, surpassing the 4% mark for the first time since mid-2021. This increase can be attributed to the completion of spec developments and the resizing of occupiers due to lower consumer demand and higher inventory levels.

Cushman & Wakefield Senior Research Director for U.S. Industrial & Logistics

Jason Price noted: “While we have seen

the amount of industrial space under construction drop, we are now seeing the impact of the robust pipeline of product coming to market and easing pressure on markets that were at historically low vacancy rates through the pandemic. Coupling this with tempered consumer demand, we see generally softening market conditions.”

In terms of new space, Q2 witnessed the delivery of over 139.5 million square feet, marking the third-highest quarterly total on record and surpassing the Q1 total of 134 million square feet. Additionally, the increase in vacant sublease space contributed to the more modest absorption figures witnessed in the first half of 2023. The quarter-over-quarter rise in vacant sublet space amounted to

38%, resulting in a current total of 66.8 square feet, according to the report.

Of course, the market demonstrated resilience in terms of leasing activity. In Q2 alone, approximately 141 million square feet of leasing deals were signed, representing only a 9% decrease compared to Q1. The year-to-date figure of nearly 300 million square feet is in line with the midyear average achieved from 2018 to 2020, indicating a positive trajectory towards reaching nearly 600 million square feet by the end of 2023. Renewal activity experienced significant growth, with almost 73 million square feet of tenants choosing to stay in their current spaces nationwide.

And while it’s true that market conditions have softened, asking rents have continued to rise, increasing by 4.6% since Q1 and over 16% annually, though a portion of the increase can be attributed to the introduction of higher-priced, premium vacant new construction in the market.

Finally, Cushman & Wakefield also revealed a decline in the construction pipeline for the third consecutive quarter. Pre-leasing activity remains low, with only 19.2% of the square footage being built already leased by tenants.

12 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

Sears HQ to be bought by Dallas-based data center developer, Compass Datacenters

By Mia Goulart,

Senior Staff Writer

Compass Datacenters, a Dallas-based company specializing in data center campuses, is reportedly under contract to purchase the 273-acre former Sears headquarter campus in Hoffman Estates, Illinois, by the end of the year. Compass Datacenters is currently in the process of being acquired by Brookfield Infrastructure Partners L.P. and the Ontario Teachers’ Pension Plan, according to the Daily Herald.

Following the acquisition, Compass’s founder and CEO, Chris Crosby, along with the current management team, are expected to continue leading the company.

Crosby expressed optimism in the company’s future prospects, stating that with the strategic expertise and financial resources of Brookfield Infrastructure and Ontario Teachers’, Compass is well-positioned to meet the increasing demand for hyperscale data centers and campuses driven by artificial intelligence and cloud technologies.

Compass Datacenters has developed more than a dozen data centers worldwide, including locations in Minneapolis, Nashville, Montreal, Milan and Israel, according to their website.

The campus in Hoffman Estates is currently owned by Transformco and consists of seven interconnected office

buildings and 120 undeveloped acres. Its assessed value was $50 million in 2021, down from $150 million in 2013.

This purchase is part of a larger data center trend in Hoffman Estates, which started with Microsoft’s acquisition of a 53-acre site nearby, where it is constructing a pair of 207,000-square-foot

data centers, reported the Daily Herald. Moreover, Microsoft acquired an adjacent 30 acres in February, prompting local officials to propose an electricity tax rate increase for high-volume users, such as data centers, to fund the replacement of the village’s aging Fire Station 22 at 1700 Moon Lake Blvd.

14 CHICAGO INDUSTRIAL PROPERTIES JULY/AUGUST 2023

"Compass is well-positioned to meet the increasing demand for hyperscale data centers and campuses driven by artificial intelligence and cloud technologies. "

Credit: The Chicago Tribune

CIP MARKETPLACE

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ALSTON CONSTRUCTION COMPANY

1901 Butterfield Road, Suite 1020

Downers Grove, IL 60515

P: 630.437.5810

Website: alstonco.com

Key Contact: Robert Murray, SVP/ Regional Manager, RMurray@alstonco.com, 908.966.1306

Services Provided: Alston offers a diverse background of design-build experience, general contracting and construction management of industrial, commercial, healthcare, retail, and municipal projects. Company Profile: Alston Construction’s success begins and ends with our approach to planning, scheduling, and choosing the right team. We have been adhering to an open and collaborative approach since our founding more than 35 years ago.

Notable/Recent Projects: Project Heartland 1.5 Million SF build to suit distribution facility for Proctor & Gamble in Morris, IL. Lakeshore Manor 210 unit senior living facility in Northwest Indiana. Dynamic Foods 3PL 500,000 SF build to suit distribution and packaging facility in Wilmington, IL. Brown Deer Distribution Center 420,000SF two building speculative distribution center in Milwaukee, WI. 106,000 SF meat packaging facility in Northwest Indiana.

MCSHANE CONSTRUCTION COMPANY

9500 West Bryn Mawr Avenue Ste. 200 Rosemont, IL 60018

P: 847.292.4300 | F: 847.292.4310

Website: www.mcshaneconstruction.com

Key Contacts: Mat Dougherty, PE, President, mdougherty@mcshane.com

Services Provided: McShane Construction Company offers more than 35 years of experience providing design-build, design-assist and general construction services on a national basis The firm’s diverse expertise includes build-to-suit and speculative warehouse, distribution and manufacturing facilities, as well as multifamily, commercial and institutional developments.

Company Profile: Headquartered in Rosemont, Illinois with regional offices in Auburn, Alabama, Irvine, California, Phoenix, Arizona, Madison, Wisconsin and Nashville, Tennessee, McShane Construction Company provides comprehensive construction services on a local, regional and national basis for a wide variety of market segments. The firm is recognized as one of the Chicago area’s most diversified and active contracting organizations with a reputation built on honesty, integrity and dependability.

Recent/Notable Project: Industry Center at Melrose Park – the construction of three speculative industrial buildings in Melrose Park, Illinois. The new development incorporates a total of 651,617 square feet.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 | F: 847.374.9222

Website: meridiandb.com

Key Contacts: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/ build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/ renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Clarius Park Joliet Building #2, Joliet, IL - 906,517 sf speculative industrial facility for Clarius Partners. Commerce Park Chicago Building B, Chicago, IL - 602,545 sf speculative multi-tenant industrial facility for NorthPoint Development. Halsted Delivery Station, Chicago, IL - 112.000 sf package delivery station on a 17-acre redevelopment site for Prologis.

PRINCIPLE CONSTRUCTION CORP.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A.. Brucato, President, jbrucato@pccdb.com

Services Provided: Principle specializes in commercial and industrial property and is committed to providing clients with the highest level of design/build construction services with an absolute dedication to each project.

Company Profile: Design/Build General Contractor established in 1999 specializing in the design and construction of Build-to-Suit, Speculative, Retail, Food Processing, Expansions/Additions, Tenant Improvements, & Specialty Facilities. Principle also has extensive experience in interior improvements, site evaluation, due diligence, and value engineering.

Recently Completed Projects include:

• 13,500 SF prairie style, mixed use, commercial/residential project at 17 S. Old Rand Rd. in Lake Zurich, IL

• 80,053 SF Speculative Warehouse for Seefried Properties at 2240 S. Busse Rd. in Mt. Prospect, IL

• 178,850 SF Industrial Speculative Building for IDI Logistics at 3700 S. Morgan St. in Chicago, IL

SUMMIT

DESIGN + BUILD, LLC

1036 W. Fulton Market, Suite 500 Chicago, IL 60607

P: 312.229.4630

Website: summitdb.com

Key Contacts: Adam Miller, President, amiller@summitdb.com; Deanna Pegoraro, Vice President, dpegoraro@summitdb.com; Jon Silvers, Business Development, jsilvers@summitdb.com

Services Provided: Summit Design + Build, LLC is a provider of full service general contracting, construction management and design/ build construction services for the commercial, industrial, multifamily residential, office/tenant interiors, hospitality and institutional markets.

Company Profile: Located in Chicago’s Fulton Market and with regional offices in Tampa, FL, Austin, TX and North Carolina, Summit Design + Build has been involved in the design and construction of over 400 buildings and spaces totaling more than 10 million square feet over the firm’s 18 year history.

Notable/Recently Completed Projects: Eli’s Cheesecake (Industrial), 2217 Loomis (Industrial), 1436 W Randolph (Adaptive Reuse Hotel), 718 Main (Multifamily), Prenuvo (Medical TI), 5691 N Ridge Ave (Multifamily).

VICTOR CONSTRUCTION

2000 Center Dr., Suite East C219

Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor. Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors.

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

FINANCE & INVESTMENT FIRMS

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000

Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer, bchapman@centerpoint.com; Jim Clewlow, Chief Investments Officer, jclewlow@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and portproximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

MARQUETTE BANK

10000 W. 151st Street

Orland Park, IL 60462

P: 708-364-9131

Website: emarquettebank.com

Key Contact: Gene Malfeo, Senior Vice President, gmalfeo@emarquettebank.com

Services Provided: Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

MAVERICK COMMERCIAL MORTGAGE

853 N. Elston Avenue

Chicago, IL 60642

P: 312.268.6000 | C: 312.953.4344

Website: mavcm.com

Key Contacts: Ben Kadish, President, ben.kadish@mavcm.com;

Services Provided: Maverick finances all commercial real estate properties for builders, developers, investors and owner-occupied properties. For apartment loans, Maverick has access to every multifamily program available for property owners as we are a correspondent for Fannie Mae and Freddie Mac execution along with Freddie Mac small loan program. CMBS fixed and floating rate non-recourse loans available. Bank, portfolio, and debt fund non-recourse construction and permanent financing available on a national basis.

Company Profile: Maverick Commercial Mortgage, Inc. is a boutique firm focused on middle market borrowers for properties in Chicago and surrounding areas, with a focus on Illinois, Indiana, Wisconsin, Iowa, Missouri, Michigan, and Kentucky. We are a niche lending source for Manufactured Housing Community mortgages and portfolio loans across the country with fundings in excess of $80,000,000 for MHC product on an annual basis. Significant financings for 2022 include a $63,000,000 single asset mortgage on an Illinois manufactured housing community, a $14,000,000 first mortgage on a Home Depot store in Chicago and several industrial building loans on the south and northwest side of the city of Chicago.

Service Territory: Midwest for general mortgage loans, and national for MHC financing.

FOR ADVERTISING OPPORTUNITIES IN THIS SECTION, PLEASE CONTACT SUSAN MICKEY AT SMICKEY@REJOURNALS.COM OR 773.575.9030

Plenty of industrial sublease space in Chicagoland, according to new data by JLL

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

It’s no secret Chicagoland has some of the most high-quality sublease options available when compared to other markets in the U.S. and is increasingly favored by companies seeking to relocate due to its central location and proximity to national markets, abundance of energy/water to sustain operations, diversity of industry and more.

For a closer look at subleasing availability in the area, JLL broke it down by market.

JLL also reported that:

• Although Chicagoland experienced an uptick in sublease space return to the market, it had no impact on vacancy rate.

• The O’Hare market, as illustrated in the chart, posted the most sublease options at nearly 1.4 million square feet.

• Amazon is marketing the most sublease options in the market, encompassing nearly 699,400 square feet.

• The average lease term remaining of sublease space is 57 months.

• Some of the sublease space available is shadow space as occupancy is in question.

• Looking at sublease space broken down by space use, 58 spaces were in warehouse facilities, while 53 were in manufacturing spaces.

17 JULY/AUGUST 2023 CHICAGO INDUSTRIAL PROPERTIES

.pdbgroup com ADAPTIVE REUSE COMMERCIAL INDUSTRIAL INTERIORS HEALTHCARE MU

Zurich HQ, Schaumburg

Audi, Highland Park

Zurich HQ, Schaumburg

Audi, Highland Park

Cabela’s, Hoffman Estates SINGLE PLY MEMBRANE ROOFING ARCHITECTURAL SHEET METAL MAINTENANCE SullivanRoofing.com 847.908.1000 IL License Number 104-011830 WE’VE GOT CHICAGO COVERED

Knoch Knolls Nature Center, Naperville

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

Zurich HQ, Schaumburg

Audi, Highland Park

Zurich HQ, Schaumburg

Audi, Highland Park