Prices set to stay firm PALM OIL Gdynia: leader on the Baltic TRANSPORT & LOGISTICS OILS & FATS INTERNATIONAL JANUARY 2023 ▪ VOL 39 NO 1 WWW.OFIMAGAZINE.COM OFFICIAL PARTNER 6-8 MARCH 2023

www.desmet.com

Customer Service Our team understands the importance of close relationships with our customers to provide the best service prior, during and after the project execution. ■ Deliver project fast and at the full scope ■ Reactivity and prompt availability of our team ■ Local presence in most markets globally ■ Engineering support to improve performance

Excellent

Alkion Terminals and Koole Terminals are officially one group now, working together toward a more sustainable future. With 20 terminals in seven countries, 900 employees and a total capacity of 5.3 million cubic meters, Alkion Terminals and Koole Terminals have significantly increased their potential together. The new organization aspires to become the European market leader in innovative and integrated services for storage, processing, and logistics. Larger scale, larger portfolio.

TOGETHER. TOWARD EUROPEAN MARKET LEADERSHIP

20 TERMINALS IN EUROPE TOTAL STORAGE CAPACITY 5,300,000 CBM OILS & FATS INTERNATIONAL IN THIS ISSUE – JANUARY 2023 FEATURES NEWS & EVENTS Comment 2 One step forward? Ukraine/Russia News 4 Black Sea export corridor extended for 120 days News 6 COP27 group pledges to end deforestation by 2030 Biofuels News 10 Eni ends palm oil use at Venice and Gela refineries Renewable News 12 Sinarmas expands bio-chemicals production Transport News 14 Hungary rail terminal aids Ukraine shipments Biotech News 16 India approves release of GM rapeseed in environment Diary of Events 17 International events listing International Market Review 18 Further price volatility ahead Statistics 36 World statistical data Plant, Equipment & Technology 30 Global round-up of projects OFI reports on some of the latest projects, technology and process news and developments around the world Technology 32 Pumping solutions Oils and fats have varying temperatures, pressure, viscosity and flow rate characteristics which require different pumping technology Shipping, Transport & Logistics 33 Gdynia: leader

the

The

agricultural products and has

Ukraine as it looks for new export routes CONTENTS www.ofimagazine.com OFI – JANUARY 2023 1

22 Prices set to stay firm Weather, labour supply, currency factors and geopolitical stability of

exporting nations

palm oil supply and demand

2023

on

Baltic

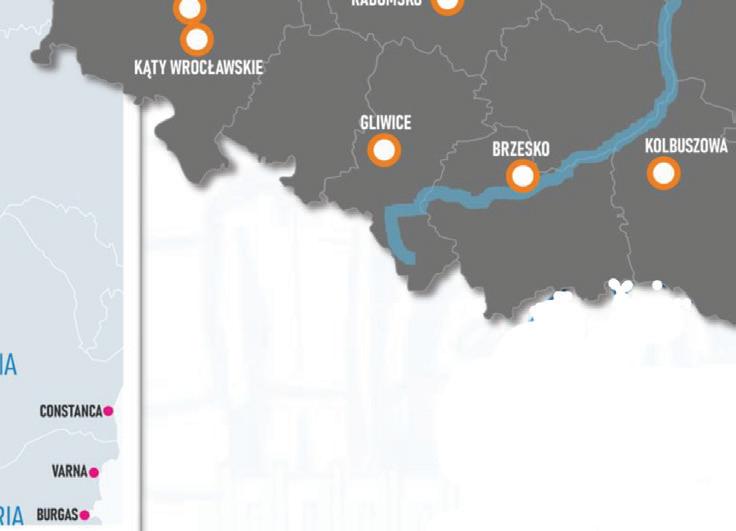

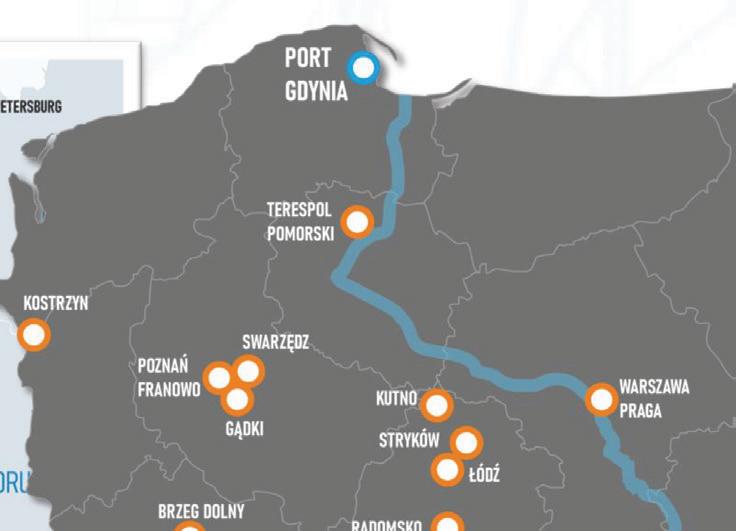

Port of Gdynia in Poland handles some 4-5M tonnes/year of

attracted interest from

Palm Oil

producing and

will shape the

balance in

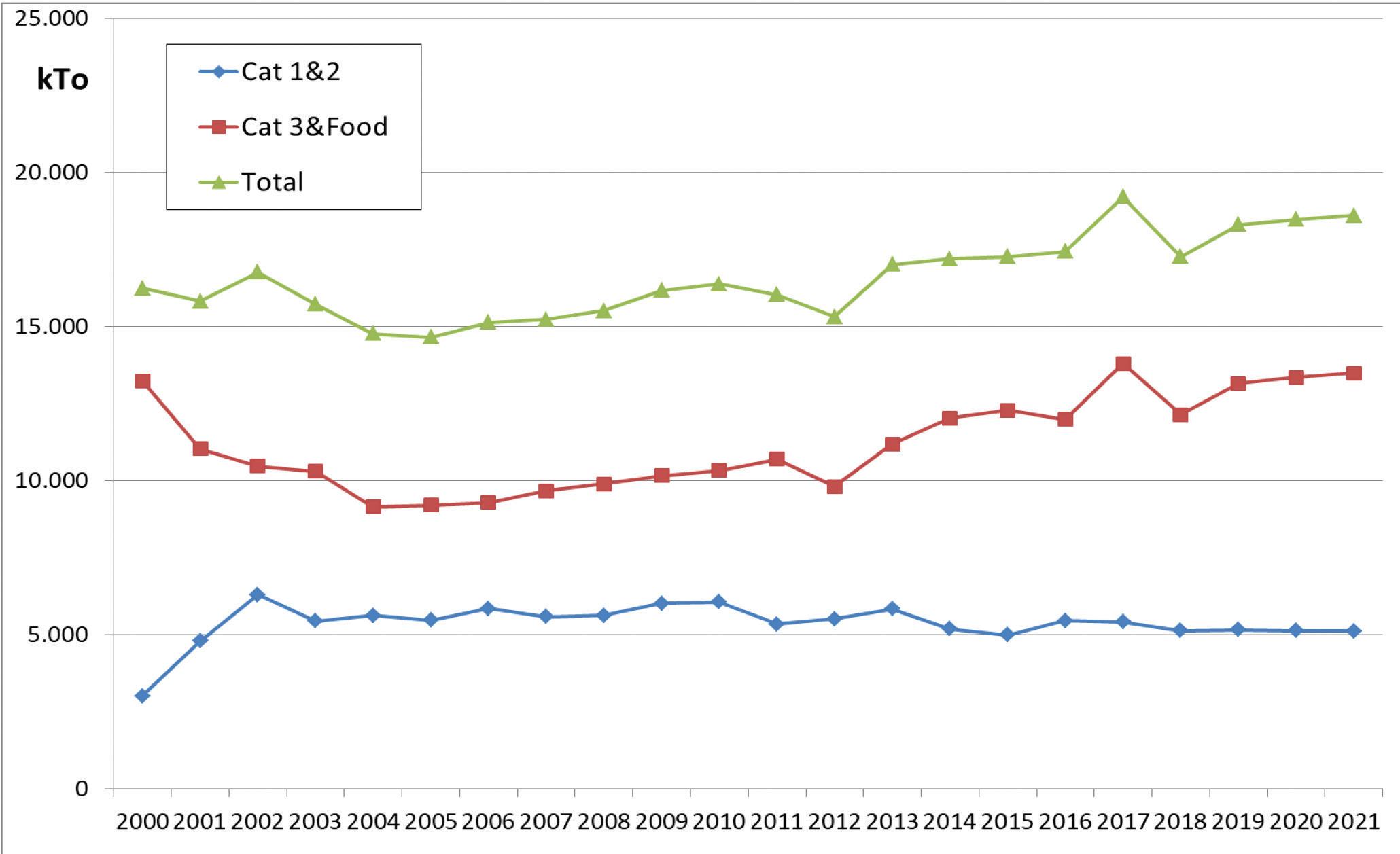

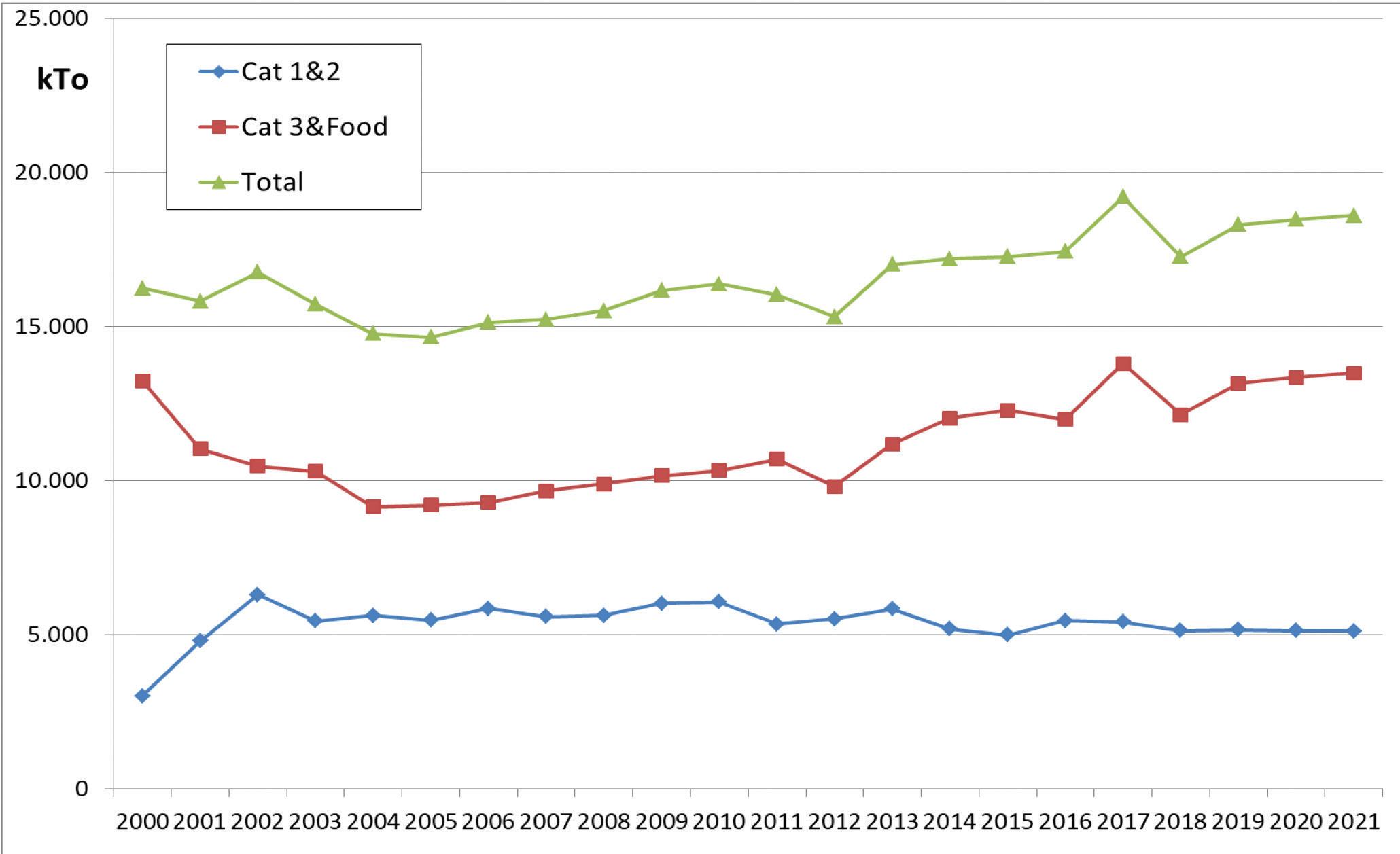

Rendering 27 EU looks to exports The EU’s move to allow the use of processed animal proteins in poultry and pig feed, as well as insect meal, is allowing renderers to expand their markets

Photo:

Adobe Stock

Photo: Adobe Stock

Photo: Adobe Stock

VOL 39 NO 1

JANUARY 2023

& FATS INTERNATIONAL

EDITORIAL: Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES: Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION: Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE: Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028 Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2023, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed by Pensord Press, Gwent, Wales

@oilsandfatsint Oils & Fats International

One step forward?

COP27 came and went on 6-18 November in Sharm El-Sheik with a breakthrough deal to set up a loss and damage fund for vulnerable countries devastated by extreme weather but with no significant progress on limiting the world’s temperature rise to 1.50C above pre-industrial levels.

Also seen as setbacks was the deletion of a resolution to cause emissions to peak by 2025 and the inclusion of a provision to boost ‘low-emissions energy’, which could include gas, as well as coal-fired power stations fitted with carbon capture and storage.

Whether the 27th Conference of the Parties to the United Nations Framework Convention on Climate Change achieved anything meaningful is up for debate, and the same could be said about progress on curbing deforestation related to the cattle, soyabean and palm oil sectors, promised at COP26.

Roll back a year ago to Glasgow and some of the world’s largest agricultural commodity traders agreed to develop a shared roadmap by COP27 to step up action on eliminating commodity-driven deforestation.

This roadmap was announced a day after COP27 began by 14 companies familiar to all of us in the oils and fats trade – ADM, Amaggi, Bunge, Cargill, COFCO International, Golden Agri-Resources, JBS, Louis Dreyfus, Mafrig, Musim Mas, Olam Group, Olam Food Ingredients, Viterra and Wilmar International.

The roadmap specifies that all palm oil, as well as soyabeans grown in the Amazon, Cerrado and Chaco regions of South America, must not contribute to deforestation by 2025. For the cattle sector, the document sets a date for the Amazon region of no deforestation for direct suppliers by 2023 and for indirect suppliers by 2025. For the Cerrado region, the target is to phase out illegal deforestation by 2025.

However, the World Wildlife Fund (WWF) says that while the palm oil sector should be commended for commitments that cover supply from all origins, the roadmap “falls well short of what is needed on soya”.

WWF CEO Carter Roberts said there were no commitments from the cattle sector to address issues of deforestation and land conversion (the transformation of grasslands and savannahs for agricultural production) in biomes apart from the Amazon. The soyabean sector had not included habitat conversion as well, cherry picking which lands it would cover and leaving out significant parts of the most important landscapes, including 74% of the Cerrado in Brazil.

“A commitment that doesn’t clearly encompass forests, savannahs and grasslands will only shift agricultural expansion further into places like the Cerrado, which are immeasurably important for biodiversity and climate mitigation,” Roberts said. “The Cerrado is already the source of 50% of Brazil’s soya output, and further destruction of it takes us further away, not closer to, the 1.50C pathway that the traders committed to.”

WWF says the food and agriculture sectors contribute to roughly 30% of the world’s greenhouse gas emissions, much of which is associated with deforestation and land conversion.

“This roadmap is a step forward in some respects, but it still falls far short of putting the agri-commodities sector, and therefore our planet, on a 1.5C pathway,” the organisation says.

Serena Lim, serenalim@quartzltd.com

EDITOR'S COMMENT

OILS

2 OFI – JANUARY 2023 www.ofimagazine.com

Follow us on our LinkedIn page to stay up-to-date!

New offices are now located in Malaysia: CMB Malaysia Sdn Bhd D-23 A-03, Menara SuezCap, KL Gateway, Jalan Kerinchi, 59200 Kuala Lumpur, Malaysia

IN BRIEF

UKRAINE: The country's high oleic sunflowerseed planted area is expected to fall by 55% in the 2022/23 marketing year compared to the previous season due to Russia's occupation and lower seed exports in the most productive sales months of February and March, UkrAgroConsult reported on 2 November.

In the 1 September 202130 August 2022 marketing year, the high oleic sunflower planted area fell by 10% compared to the previous season but the harvest rose by 6% to total 1M tonnes, due to higher yields.

Ukraine exported its high oleic sunflower oil to more than 50 countries in 2021/22. Among key importers, purchases from EU countries and the USA rose by 2% and 18% respectively.

UKRAINE: Andriy Vadaturskyy has succeeded his late father, Oleksiy Vadaturskyy, as the CEO of leading agribusiness Nibulon.

Oleksiy Vadaturskyy and his wife, Raisa, were killed on 31 July during Russian aerial bombardment of the southern city of Mykolaiv.

In a message on the company’s website, Andriy Vadaturskyy said his father's death had seriously disrupted the company’s operations.

“Our production, logistics and exporting capabilities have all been affected,” he said. “Twenty per cent of the company’s assets are under occupation in the southern and eastern regions of Ukraine, and our export volumes have dropped sharply compared to previous years.”

Andriy Vadaturskyy said Nibulon had completed the first construction phase of its newest terminal in Izmail, Odessa, to alleviate some of the disruption to its established export routes.

Nibulon's stores, processes and ships grain and oilseeds in Ukraine.

Black Sea export corridor extended for 120 days

The Black Sea Grain export corridor deal was extended for 120 days just before it was due to expire on 19 November, according to a statement from the Ukrainian Ministry of Infrastructure.

Although there had been hopes that the deal would be extended for a much longer period, the extension provided certainty for the rest of the year, AgriCensus wrote on 17 November.

The agreement also confirmed that the port of Mykolaiv was not included in the United Nation's-brokered deal, despite Russian troops being pushed out of the Kherson region.

Proposals for improving the efficiency of the corridor were also made, the Ukrainian infrastructure ministry said.

With ships currently facing congestion waiting for inbound and outbound inspections in Istanbul, the rate of inspections was falling below the planned 10 vessels/day, AgriCensus wrote. Measures discussed by market participants

included improvements to the inspection process and proposals to increase the number of teams – a measure that had shown good results when Russia walked out of the deal in October and the remaining parties had increased teams to 10. Those measures had allowed teams to inspect up to 40 vessels/day, the report said.

Another proposal discussed was the elimination of the requirement to inspect outbound vessels as they left the Black Sea, the report said.

Russian authorities had requested inspections to ensure vessels trading into Ukraine were not carrying military equipment or other war supplies, but some in the trade had said it made no sense to check vessels leaving the region.

Since the deal was signed in July, Ukraine has exported around 11.1M tonnes of agricultural goods, including 4.6M tonnes of corn, 3.1M tonnes of wheat, and around 730,000 tonnes of sunflower oil.

Low volume of sunflowerseed exports

Less than 250,000 tonnes of sunflowerseed products left Ukraine under the Black Sea Grain export deal agreed on 22 July up to the end of the 2021/22 marketing year, according to a US Department of Agriculture (USDA) report.

Sunflowerseed products made up a small percentage of total export volumes compared to feed grains in the period, while sunflowerseed shipments were minimal, the Foreign Agricultural Service (FAS)’s 'Oilseeds: World Markets and Trade' November report said.

“Prior to the conflict, Ukraine ranked as the top producer of sunflowerseed and top exporter of sunflowerseed products, representing about half of global trade in 2020/21,” the report said. Before the war, Ukraine produced sunflowerseed primarily to crush domestically and then exported the meal to China, the EU and Turkey; and oil to China, the EU and India.

Now faced with limited opportunities to export through regular shipping routes and reduced storage capacity, the USDA said domestic processors had reduced operations.

“The resulting glut of unprocessed sunflowerseed found new export destinations in geographically-accessible countries with available crush capacity such as the EU, Turkey and Moldova,” the report said.

In total, Ukraine exported more than seven-and-a-half times as much sunflowerseed, 26% less sunflowerseed meal, and 15% less sunflower oil in the 2021/22 marketing year (September 2021-August 2022) compared to the previous year.

“The tumultuous year has left the country with massively bloated sunflowerseed stocks heading into the 2022/23 marketing year,” the report said. However, the USDA said shipments had picked up significantly in September.

For the 2022/23 marketing year, Ukraine’s exports of sunflowerseed, sunfowerseed meal and sunflowerseed oil were forecast at 1.95M tonnes, 2.75M tonnes and 3.6M tonnes respectively. The forecasts reflected lower production expectations as well as the assumption of continued distorted trade patterns and limited crushing, the report said.

The EU was expected to continue importing large volumes of sunflowerseed due to drought impacting its own oilseed crops.

UKRAINE/RUSSIA NEWS 4 OFI – JANUARY 2023 www.ofimagazine.com

Photo: Adobe Stock

Product

Innovation to full commercialization.

ACCELERATE IT.

Develop, scale and commercialize with Crown – the proven, single-source partner for product and process optimization.

Bring new products to market faster and more sustainably with Crown. As a leader in oilseed extraction for 70 years, Crown’s technical expertise, guidance, proven technologies and Global Innovation Center transform your ideas for protein concentrates, food/beverage, botanicals and other new product segments into pro table realities. With Crown’s full-scale, state-of-the art pilot plant, analytical lab and training facilities, you can test product and process feasibility, run benchtop scale to custom processing and commercialize with ef cient, continuous operations backed by Crown’s aftermarket support and eld services. Accelerate your market opportunity — partner with Crown for a full lifecycle solution. Start up, scale up and expand with CPM and Crown’s expertise.

Protein Concentrates | Hemp | Food/Beverage | Nutraceutical/Pharma/Botanicals | Fibers/Polymers/Waxes | Specialty Chemicals Contact CPM and Crown today 1-651-894-6029 or visit our website at www.crowniron.com

Feeding, Fueling & Building a Better World

IN BRIEF

USA: Swiss speciality chemicals company Clariant said on 1 November that it had completed its US$60M acquisition of German chemical giant BASF’s US attapulgite business.

The business generated sales of around US$36M in 2020 and produces attapulgite-based products for a wide range of applications, including bleaching earths for edible oils. It has mining operations in Georgia and Florida and processing operations in Quincy, Florida.

The acquisition included the transfer of land and mining rights and the Quincy processing facility, which would be integrated into Clariant’s Functional Minerals Business unit. It also included an agreement for the long-term supply of attapulgite-based products to BASF.

Attapulgite is a naturally occurring mineral with colloidal and adsorbent properties. Adsorbent clays, such as attapulgite, remove contaminants in both edible oils and renewable fuels.

THE NETHERLANDS: Independent vegetable oils and fats storage, processing and logistics company Koole Terminals said on 17 November that it had completed its acquisition of Dutch bulk liquid storage operator Alkion Terminals.

The combined group would operate 20 terminals in seven countries with a total capacity of 5.3M m³ but the two names would be kept for the time being, Koole Terminals CEO John Kraakman said.

Koole operates 11 terminals in Europe – in the Netherlands, Poland and the UK – and has a total storage capacity of 4.1M m3

Alkion operates nine terminals in France, Italy, the Netherlands, Portugal and Spain, with a storage capacity of 1.2M m3

COP27 group pledges to end deforestation by 2030

A group of more than 25 countries at the COP27 climate talks in Sharm El-Sheikh, Egypt, launched a group to hold each other accountable for a pledge to end deforestation by 2030 and announced billions of dollars to finance their efforts, Reuters reported on 7 November.

The first meeting of the Forest and Climate Leaders’ Partnership took place on 7 November – a year after more than 140 leaders made a commitment at COP26 in Glasgow, UK, to end deforestation by the end of the decade.

Three major initiatives to protect forests were launched at COP26, The Guardian wrote on 8 November. These included: a commitment by more than 140 world leaders to halt and reverse deforestation; the creation of a working group of producers and consumers of commodities linked to deforestation; and a commitment by commodity traders of cattle, cocoa, palm oil and soyabeans to prepare a roadmap to align their business practices with the target of limiting global warming to 1.5°C. However, since making

the commitment at COP26 progress has been patchy, according to the Reuters report. Only around 22% of the US$12bn in public funds pledged in Glasgow for forests by 2025 had been delivered to date, Reuters wrote.

The new group announced at COP27 – which includes Colombia, Japan, Pakistan, the Republic of Congo, the UK and others – accounts for around 35% of the world’s forests and aims to meet twice a year to monitor progress. Brazil and the Democratic Republic of Congo were not currently part of the group, Reuters wrote. However, Brazil is expected to join the initiative under incoming President Luiz Inácio Lula da Silva, according to an 8 November Guardian report.

New sources of financing announced at COP27 included a commitment by Germany to double its financing for forests to €2bn (US$1.97bn) until 2025, Reuters wrote.

President Gustavo Petro of Colombia also said his country would spend US$200M/year for the next 20 years to save the Amazon rainforest.

Global food import bill to near $2tn

finding it difficult to finance rising international costs, potentially heralding an end of their resilience to higher international prices,” the report from said.

The global food import bill is expected to rise to US$1.94tn this year – higher than earlier estimates, according to a new report by the United Nations (UN)’s Food and Agriculture Organization (FAO).

The forecast in FAO’s Food Outlook report would mark an all-time high and a 10% increase compared to the record level in 2021, the organisation said on 11 November.

The bulk of the increase was accounted for by high-income countries, due mostly to

higher world prices, while volumes were also expected to rise. Economically vulnerable country groups were more affected by the higher prices with, for example, the aggregate food import bill for the group of low-income countries expected to remain almost unchanged, although a 10% volume decrease was forecast, pointing to growing accessibility issue for these countries.

“These are alarming signs from a food security perspective, indicating importers are

The Food Outlook report, which breaks down food trade patterns by food groups, warned that existing differences were likely to become more pronounced, with high-income countries continuing to import across the full spectrum of food products, while the focus in developing regions was increasingly on staple foods.

Against this backdrop, the FAO welcomed the International Monetary Fund’s approval of a Food Shock Window as an important step to ease the burden of soaring food import costs among lower income countries. The window will provide, for one year, a new channel for emergency financing to member countries with urgent balance of payment needs due to acute food insecurity, or a sharp increase in their food import bill.

NEWS 6 OFI – JANUARY 2023 www.ofimagazine.com

Photo: Adobe Stock

Indian consumption to hit 27M tonnes

The consumption of edible oils in India is forecast to reach 26M-27M tonnes by 2025/26, according to estimates by the country’s Solvent Extractors Association (SEA) reported by AgriCensus

Presented at the Indonesia Palm Oil Conference (IPOC) in Bali on 2-4 November, the SEA’s figure was higher than 2021/22 season estimates, which were forecast at 22.7M-23M tonnes, the report on 2 November said.

India‘s oilseed production was projected at 38M-40M tonnes in 2025/26 com-

Darling to buy Polish rendering

fi rm Miropasz

US renderer and renewable diesel producer Darling Ingredients is set to acquire Polish rendering company Miropasz for €110M (US$110M).

The acquisition was expected to close in the third quarter of next year, subject to post-closing adjustments, Darling Ingredients said on 2 November.

“As the number one poultry producer in Europe, Poland plays a significant role in feeding the world,” Darling Ingredients chairman and CEO Randall C Stuewe said.

“We believe meat production in Poland will continue to grow, and this acquisition provides a nice bolt-on to Darling’s existing three plants in central and western Poland.”

Miropasz operates three poultry rendering plants in southeast Poland – in Mirowice, Pszczonow and Krasnystaw – with a processing capacity of approximately 250,000 tonnes/year.

According to its website, Miropasz processes poultry animal by-products (ABP), which are used in the manufacture of fat and processed animal products (PAP).

Darling Ingredients operates more than 270 plants in 17 countries and repurposes nearly 15% of the world’s meat industry waste streams into products such as green energy, renewable diesel, collagen, fertiliser, animal proteins and meals and pet food ingredients.

pared with 33M tonnes in 2021/2022.

Domestic vegetable oil production was also expected to rise by 2025/26 to 13.5M-14M tonnes, compared to 10M tonnes in 2021/22.

“This gap of 11M-12M tonnes may be bridged through imports. The type of oil is dependent on price parity and availability in the international market,” SEA executive director Dr B V Mehta said at the conference.

“Imports of vegetable oils have reduced from their peak at 15.5M tonnes in

2018/19 to 13.5M tonnes last year due to COVID-19. In the past 20 years, import volume has increased 2.6 times while cost has gone up close to 27 times,” he added.

In terms of edible oil types consumed in India, palm oil represented 33% of the total, while soyabean oil, rapeseed and sunflower oil comprised 23%, 15% and 8% respectively. Cottonseed oil and groundnut oil made up the remainder.

According to SEA’s forecast, India is expected to import 13M tonnes of palm oil and 1M tonnes of soyabean oil in 2023.

NEWS www.ofimagazine.com OFI – JANUARY 2023 7

USA: Finnish renewable fuels producer Neste said on 17 November that it would acquire Crimson Renewable Energy’s used cooking oil (UCO) collection and aggregation business in the USA.

Neste said the move would add UCO collection, logistics and storage services in California, Oregon and Washington to its business. It also included shares in SeQuential Environmental Services and Pure, as well as a UCO processing plant in Salem, Oregon.

“We continue to execute our renewables growth strategy by expanding our renewable raw materials sourcing platform to the US West Coast, which is also a location for our upcoming joint renewable diesel production operation in Martinez, California,” Neste CEO Matti Lehmus said.

Together with recently acquired Mahoney Environmental, the business would form a nationwide UCO collection and aggregation network.

Neste currently has a renewable products global production capacity of 3.3M tonnes/year.

INDIA: Swedish vegetable oils and fats producer AAK has acquired India’s Arani Agro Oil Industries.

Arani operates out of the southeast port of Kakinada supplying vegetable fat products including confectionery fats, ice cream fats, dairy fat substitutes and bakery fats.

Including acquisition costs, AAK said it would be investing an estimated total of US$193M-US$289M to increase capacity and improve efficiency at the production facility.

The acquisition was in line with AAK’s strategy to increase its market share in India's speciality oils and fats market, the company said on 25 November.

EU set to ban products related to deforestation

European Union (EU) lawmakers and governments have reached a deal to ban the import of products which contribute to deforestation, including beef, cocoa, coffee, palm oil and soyabeans.

The preliminary agreement, which still needed to be formally adopted by the EU parliament, would require companies to verify that the goods they sold in the EU had not led to deforestation and forest degradation anywhere in the world as of 2021, AP News wrote on 6 December.

Companies would need to show that goods they imported complied with rules in the country of origin, including on human rights and the protection of indigenous people.

Pascal Canfin, who chairs the European Parliament’s environment committee, was quoted by AP News as saying that the agreement by the 27-nation bloc marked a “world first”.

“Europe will close its doors to the everyday products that have the highest impact on deforestation in the world if their importers are not able to demonstrate, with supporting documents, that they do not come from deforested areas,” he said.

EU trade association for cereals, rice, feedstuffs, oilseeds, olive oil, oils and fats COCERAL; EU vegetable oil and protein meal industry association FEDIOL; and EU feed manufacturers’ federation FEFAC welcomed aspects of the deal including guidelines, the 18-month timeline for implementation and lower percentage of checks for low-risk countries, World Grain reported on 6 December.

However, the groups said the requirement for traceability and implied chain of custody could lead to the exclusion of smallholders or to disinvestment from high-risk areas.

European olive oil production to fall by 25%

the rolling five-year average.

Production in Spain and Italy was expected to fall by 30% and output in Portugal was expected to be 40% lower than last year, the report said.

EU volumes were set to fall in all producing countries except in Greece.

Olive oil production in the European Union (EU) is expected to drop by 25% in 2022/23, according to the European Commission (EC)’s latest short-term agricultural outlook reported by Olive Oil Times on 17 October.

Production is expected to fall to 1.7M tonnes in the 2022/23 crop year although some involved in the trade said this was too pessimistic.

Yield this year was also expected to fall by 25% compared to last year, 20% below

“The drought that enveloped significant areas in Portugal, Spain, France, Italy and portions of North Africa since last winter did not harm the main Greek production areas,” Vasilios Frantzolas, an olive oil taster and quality consultant, told Olive Oil Times. In contrast, southern and western Europe had faced one of the hottest summers on record, with arid weather stunting the development of olive trees at critical moments.

Bunge to partner French oilseeds originator

Global agribusiness giant Bunge is forming a partnership with French grains and oilseeds originator BZ Group in which it would acquire 49% of the group while the Beuzelin family would retain the remaining 51% share, Bunge said on 22 November.

The BZ Group originates products from independent farmers and sources grains, oilseeds and pulses from suppliers in the northwest of France

to export via its port terminal in Rouen.

Bunge said the two countries had developed a strong relationship after working together for a number of years and the move to combine BZ’s expertise in the French market with Bunge’s global reach was a natural progression expected to strengthen operational and commercial cooperation. It would also provide the opportunity to expand the Rouen port terminal.

NEWS 8 OFI – JANUARY 2023 www.ofimagazine.com

IN BRIEF

Photo: Adobe Stock

ITALIAN KNOW-HOW FROM DESIGN TO CONSTRUCTION AND COMMISSIONING. WE BUILD YOUR PLANTS FROM A TO Z. EXPERTS IN EDIBLE OIL EXTRACTION AND REFINING – OLEOCHEMICALS – BIODIESEL PRODUCTION USED MINERAL OIL RE-REFINING – WASTE OIL PRE-TREATMENT FOR BIOFUEL PRODUCTION www.technoilogy.it

USA: Consumption of renewable diesel is set to overtake biodiesel in the country for the first time, representing a milestone for the domestic fuel sector as well as global edible oil markets, Reuters wrote on 8 November.

US renewable diesel production capacity expanded by more than 90% in 2022 to 2.1bn gallons (7.9bn litres), from 11 facilities in the US Gulf coast region and western states, according to data from the US Energy Information Administration (EIA).

In comparison, biodiesel production totalled just under 2.1bn gallons (7.9bn litres) at 72 plants spread more evenly across the USA.

Further increases in renewable diesel production capacity were expected in the near term, with the EIA projecting capacity to increase to 5.1bn gallons/ year (19.3bn litres/year) by 2024, compared to 3.7bn litres/year in 2020.

The rapid growth in renewable diesel production would have a significant effect on the main feedstock – soyabean oil – in the USA, Reuters wrote.

Biofuel production currently accounts for more than 40% of total US soyabean oil demand, according to the report, with its share of consumption expected to rise further as renewable diesel production increases.

Eni ends palm oil use at Venice and Gela refineries

Italian oil and gas company Eni has stopped the procurement of palm oil for use at its Venice and Gela refineries, the company announced on 25 October.

The last shipments arrived in the middle of October, in line with the company’s goal of becoming ‘palm oil free’ by the end of 2022, Eni said.

Prior to the move, Eni said its refineries in Venice and Gela were fuelled with “waste and residue” raw materials, such as used cooking oil (UCO) and

animal fats, for more than 85% of their processes, as well as other biomass regulated by current national and European regulations.

In November, the first load of vegetable oil produced at Eni’s Kenyan Makueni agri-hub left for delivery to the Gela biorefinery.

The agri-hub processed castor, croton and cottonseed grown in degraded areas, harvested from wild trees or derived from agricultural

by-products, Eni said.

In addition to the vegetable oil shipments – which would reach 2,500 tonnes by the end of 2022 and 20,000 tonnes by 2023 – the Kenya hub would also collect waste and residues, including UCO, with up to 5,000 tonnes expected to be delivered by 2023, the company said.

Eni’s biorefineries produce hydrotreated vegetable oil (HVO) biodiesel and sustainable aviation fuel (SAF).

Repsol to develop renewable fuels for space

Spanish energy firm Repsol is partnering with aerospace technology developer PLD Space to develop renewable fuels for space vehicles.

The partnership would include feasibility studies and the development of renewable fuels from waste raw materials or synthetic fuels produced from renewable hydrogen and CO2 removed from the atmosphere, Repsol said on 20 October.

PLD Space is developing two reusable micro-launchers – the suborbital MIURA 1 and orbital MIURA 5 – which can send small satellites into space, and aims to provide commercial launch services worldwide.

The company’s range of liquid-fuelled engines, called TEPREL, is powered by kerosene and liquid oxygen. For MIURA 1, the firm currently uses Jet-A1 fuel – the fuel commonly used in aviation – while the fuel planned for MIURA 5 is RP-1, the standard for rocket engines.

“Our responsibility is to maintain vehicle performance while minimising its environmental impact,” said Francesco Spalletta, propulson manager at PLD Space, which is planning to undertake its first real space transport mission

with MIURA 5 in 2024.

Repsol produces biofuels from feedstocks such as vegetable oils, biomass, agricultural and forestry waste and used cooking oil. It plans to open a new plant in Cartagena to produce advanced biofuels from waste. It also plans to open a synthetic fuels plant in Bilbao, which is due to start demonstration phase production in 2024.

Brazil’s new government signals rise in biodiesel mandate

The new government of Brazil has indicated that it plans to ramp up the country’s biodiesel programme in a move likely to lead to higher blend requirements this year, sources told AgriCensus

The biodiesel sector is a major outlet for soyabean oil, accounting for about 70% of the feedstocks used to produce biodiesel in Brazil, the 11 November report said.

According to sources in contact with members of the new government’s tran-

sition team, the goal was to increase the mandate to 14% (B14) from January to March, and to 15% (B15) from March.

The timetable followed the original schedule set out in 2018 by the National Energy Policy Council (CNPE) and would reverse a decision made by outgoing president Jair Bolsonaro, AgriCensus wrote.

Brazil’s biodiesel blend mandate was reduced from 13% to 10% in May 2021 and remained at that level in 2022.

Daniele Siqueira, senior market analyst for Brazil-based consultancy Agrural said B15 from March onwards could be achieved without major issues, especially if the country had a good 2022/23 soyabean crop.

Brazil’s soyabean production in the 2022/23 marketing year is forecast at a record 153.5M tonnes, according to estimates by the country’s national food agency Conab.

BIOFUEL NEWS 10 OFI – JANUARY 2023 www.ofimagazine.com

IN BRIEF

Photo: Repsol

Repsol is developing renewable space fuel at its technology lab in Madrid

www.ofimagazine.com OFI – JANUARY 2023 11 When you choose Oil-Dri, you get more than a reliable adsorbent . You gain a world-class team of technical service experts to help you make tough decisions and save re nery resources for pre-treatment of oils and fats. LEARN MORE AT OILDRI.COM/GETMORE EDIBLE OILS | BIODIESEL | RENEWABLE DIESEL Proudly Owned and Manufactured in the U.S.A. © 2022 Oil-Dri Corporation of America. All rights reserved. MORE THAN A MINERAL GekaKonus GmbH · Siemensstraße 10 · D-76344 Eggenstein-Leopoldshafen Tel.: +49 (0) 721/94374-0 · Fax: +49 (0) 721/94374-44 · info@gekakonus.net · www.gekakonus.net MORE THAN ENERGY Services by GekaKonus: Engineering | Design | Consulting Commissioning | After Sales Service Efficient high temperature energy solutions with steam and thermal oil.

Sinarmas expands bio-chemicals production

Sinarmas Cepsa (SCPL) is expanding production of bio-based chemicals at its site in Lubuk Gaung, Indonesia.

A 50/50 joint venture of agribusiness giant Golden Agri-Resources (GAR) and Spanish oil and gas firm Cepsa, SCPL said the increase in production was expected to advance the company’s growth strategy, contribute to solving environmental challenges and support sustainable farming practices in Indonesia.

IN BRIEF

BRAZIL: Brazilian petrochemical company Braskem said on 25 October that it would invest around US$60M to expand its production of sugarcane-based biopolymers.

Braskem said it was also exploring the possibility of building a new biopolymer factory in Thailand in partnership with local chemical company SCG Chemicals.

The firm said it was looking into collaborations in other areas, including one with Lummus Technology for biopolymer technology licensing, which would lead to the development of new bio-based materials.

BELGIUM: Production at renewable product developer Stora Enso’s new US$9.4bn pilot bioplastics plant at the company’s Langerbrugge recycled paper mill near Ghent is due to start by year end.

The company said on 3 November that it would test its FuraCore technology to produce furandicarboxylic acid (FDCA), a major building block of polyethylene furanoate (PEF), which could replace PET bottles, aluminium cans and glass jars.

Initially, the facility would use industrially-available sugar (fructose) as feedstock but the aim was to use cropbased sources, specifically sugars extracted from wood and other non-food biomass.

The plant was expected to move from pilot stage to industrial scale in 2026.

“Sustainably-sourced, bio-based alternatives are key requirements for our customers and the markets we serve,” SCPL CEO Kung Chee Wan said on 8 November.

SCPL operates a fatty alcohol plant in Indonesia and produces surfactants in Germany for the European market.

GAR’s primary activities in Indonesia include cultivating and harvesting oil palm trees; processing fresh fruit bunches into crude palm oil (CPO) and palm kernel oil

(PKO); and refining CPO into products such as cooking oil, margarine, shortening, biodiesel and oleochemicals; in addition to selling palm products globally. GAR also operates oilseed businesses including soyabean-based products in China and sunflower-based products in India.

As well as its global oil and gas activities, Cepsa manufactures products from plant-based materials and is active in the renewable energy sector.

Groundbreaking for ECH project in Bintulu

Malaysia’s OCiKumho Sdn Bhd held a groundbreakiing ceremony for a RM1.7bn (US$373,436M) epichlorohydrin (ECH) plant at the Samalaju Industrial Park in Bintulu on 2 November.

When operational, the new plant will produce ECH using glycerine as a feedstock, according to an Everchem Specialty Chemicals report on the same day.

ECH is traditionally produced from petrochemicalbased propylene but can also be made from glycerine, a by-product of biodiesel and oleochemical production.

OCiKumho is a joint venture between Malaysian chemicals firm OCIM Sdn Bhd and South Korea-based Kumho P&B Chemical Inc.

The Malaysian Investment Development Authority (MIDA) said on 8 August that the 100 kilotonne/year plant would be the first to manufacture ECH in Malaysia, with construction due to begin in the first quarter of this year, and test operations

Glycerine is a by-product of biodiesel and oleochemical production

to start in first quarter 2024.

The project was in line with Sarawak state’s Post COVID-19 Development Strategy 2030, which encouraged more development in green and renewable industries, Deputy Premier Datuk Amar Awang Tengah Ali Hasan said in the Everchem report.

Global glycerine supply comes from the biodiesel and oleochemical sectors. In oleochemical production,

most glycerine is outputted as refined glycerine, with almost half of demand coming from the food and pharmaceutical sectors. ECH is the next largest user of refined glycerine.

The main application for ECH is epoxy resin, which is used in a wide variety of coating applications including paints, electronics, construction, composites and adhesives.

Huntsman launches vegetable oil-based foam

Global chemicals company Huntsman has launched a visco-elastic foam with a vegetable oil content of up to 20% for moulded acoustic components in the car industry, Plastics Today wrote on 4 November.

According to the company’s website, the new Acoustiflex VEF BIO product comprises a mix of a polyol blend with methylene diphenyl diisocyanate (MDI) and additives. It can reduce the carbon footprint of carpet underlay in cars by up to 25% compared with existing Huntsman

systems for this application, according to the Plastics Today report. The technology could also be used for dash and wheel arch insulation.

The bio-based content in the Acoustiflex VEF BIO system has no impact on the acoustic or mechanical characteristics required by manufacturers, according to Huntsman.

The lightweight semi-rigid foam product could also be used to create components with complex geometric shapes and sharp angles, the company said.

RENEWABLE NEWS 12 OFI – JANUARY 2023 www.ofimagazine.com

Photo: Adobe Stock

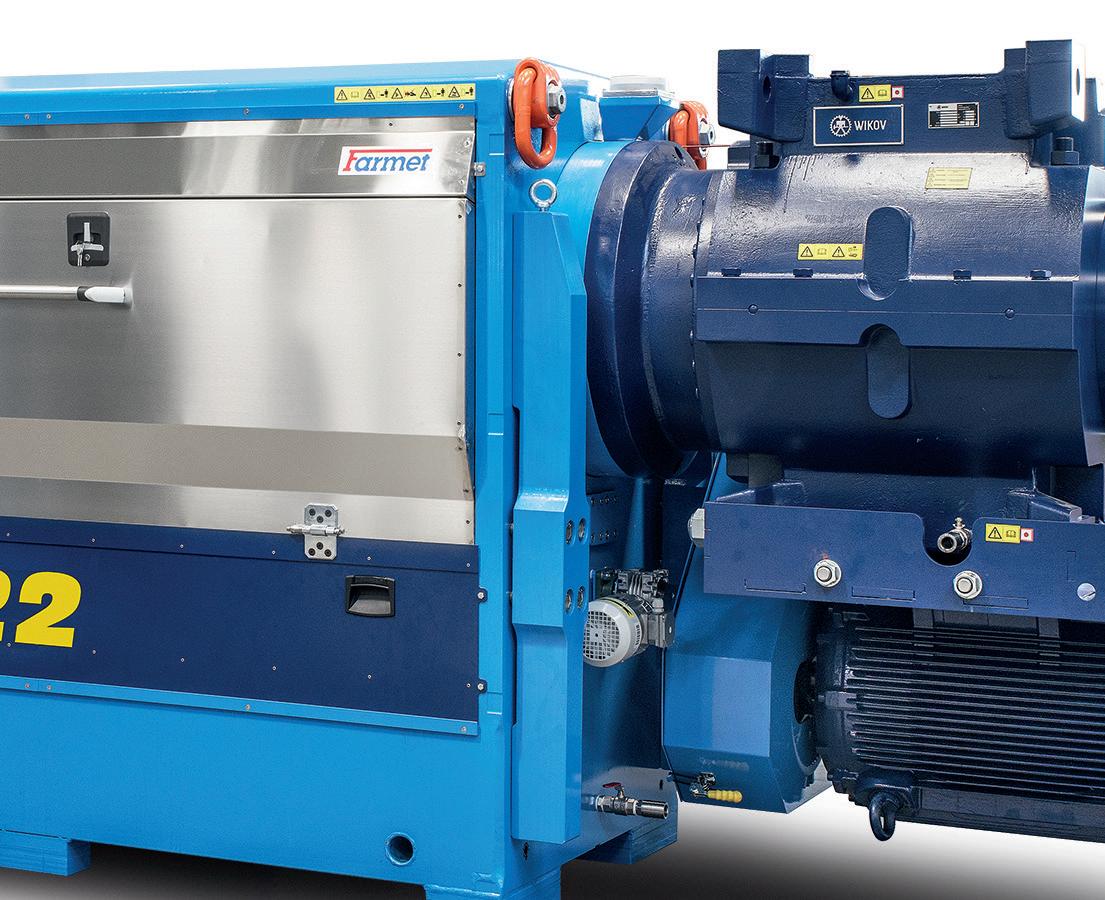

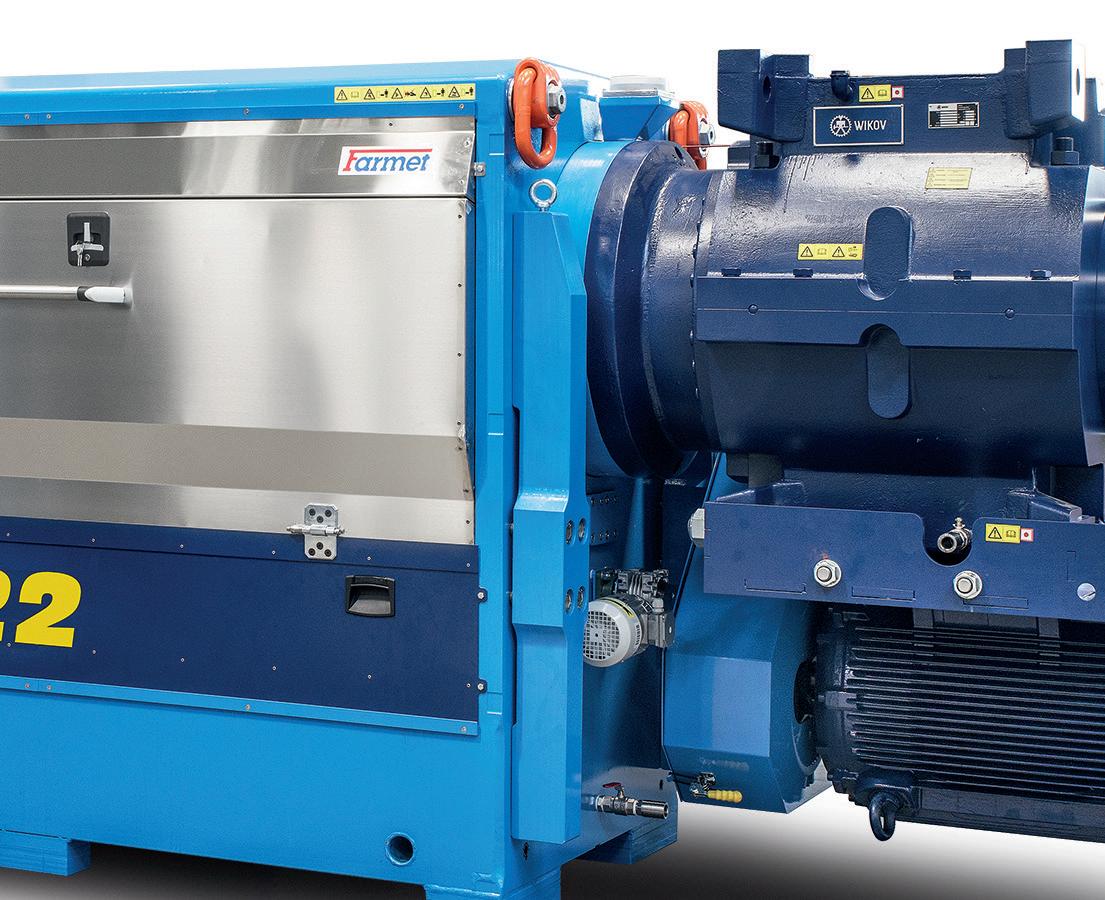

www.ofimagazine.com OFI – JANUARY 2023 13 STATE-OF-THE ART OILSEEDS AND OIL PROCESSING TECHNOLOGIES ● Horizontal agriculture ● Local mechanical processing ● Patented system of energy recovery ● Complex approach ● Unique combination of extruders and screw presses The effective technology and complex services www.farmet.eu

IN BRIEF

PAKISTAN: Global agribusiness giant ADM has formed a joint venture with Canada-based IMGS Group to handle grains, oilseeds, pulses and other food stuffs in Pakistan, as well as sell goods in the country.

ADM said on 15 November that the move would help the company extend its marketing platform to new territories, support its commitment to increase food security, and provided the opportunity to move large volumes of food and agricultural products from production to demand areas.

IMGS is a cargo handling and port operations company that owns and operates cargo terminals in Africa, Asia and North America and has a growing network of 65 ports globally.

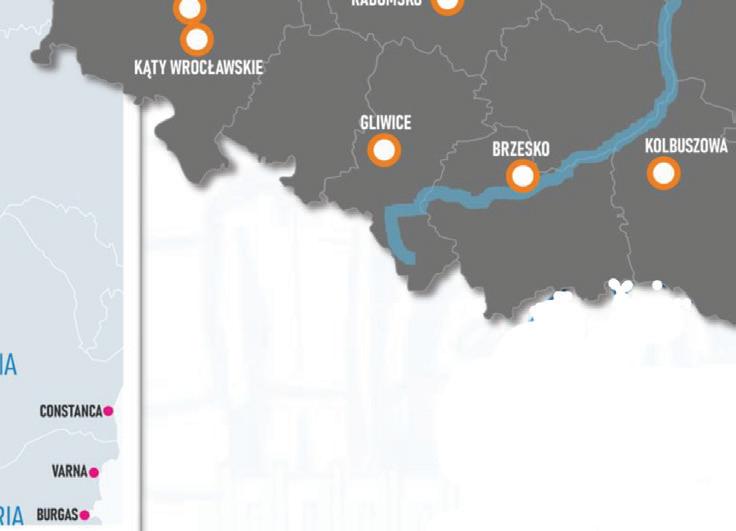

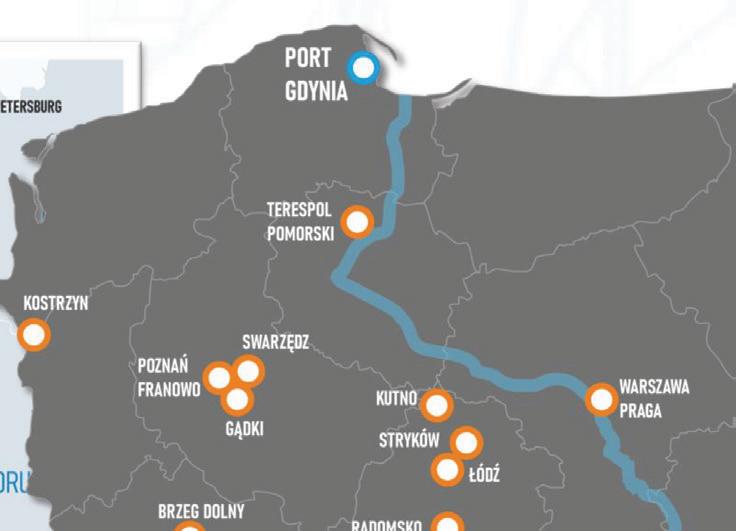

Hungary rail terminal aids Ukraine shipments

A new rail terminal in Hungary is expected to lead to an increase in grain shipments out of Ukraine, World Grain reported on 20 October.

Speaking at the opening of East-West Gate, a high-tech wireless 5G intermodal logistics terminal in Fényeslitke, the country’s Foreign Minister Péter Szijjártó said that investment in the project started in 2018 in a bid to increase trade between China and Europe. However, Russia’s invasion of Ukraine had made continued and consistent grain shipments out of Ukraine the immediate priority.

“We realise that Russia and the Ukraine are pretty much the pantries of the world because the grain [and] wheat grown in these two countries play a huge role to… many regions of the world supplying foodstuffs [and] raw materials,” Szijjártó said. “This terminal… will play a huge role in shipping grain from Ukraine. The area from Fényeslitke to the Adriatic Sea is the fastest and most efficient route, making sure that food supplies can be guaranteed in the most remote

areas of the world.”

Located in eastern Hungary on the border with Ukraine and Slovakia, the terminal is expected to handle 800 tonnes/hour of grain and 450m³/ hour of sunflower oil from November, according to the report.

In addition to shipping grain, Szijjártó said the US$72.5M terminal had extensive storage capacity and would be able to handle 1M 6m (20ft) containers (TEUs)/year following the development of railway infrastructure.

Built by Vodafone Hungary with wireless network equipment supplied by Chinese technology company Huawei, the Fényeslitke terminal is the first land-based intermodal logistics terminal in Europe using 5G technology to control cranes remotely, World Grain wrote.

The terminal’s primary function is to trans-ship incoming rail shipments, which is necessary as Europe uses 1,435mm gauge rails, while Russia and many Asian countries use 1,520mm gauges, according to the report.

Adani Agri Logistics to build new silo complexes in India

Bulk grain handler and distributor Adani Agri Logistics (AAL) will build and operate four silo complexes after signing an agreement with the Food Corporation of India (FCI) as part of a government plan to modernise India’s storage infrastructure, Maritime Gateway wrote on 17 October.

The complexes would be located in Kanpur, Gonda and Sandila in Uttar Pradesh province, and Katihar in Bihar state, adding 3,500 tonnes to AAL’s current capacity to total

15,250 tonnes in 24 locations.

Farmers currently had to wait two to three days while their agricultural produce made its way through the traditional farm–to–mandi procurement chain but the project would reduce the processing time to one to two hours, the report said.

AAL said farmers would be able to deliver their produce directly to FCI procurement centres, with delivery, cleaning, drying, storage and transportation to field depots completed in bulk.

Potential 3-MCPD contamination from tank seawater wash

The Federation of Oils, Seeds and Fats Associations (FOSFA) is changing several of its documents, effective 1 November, to highlight the risk of potential contamination of vegetable oil with sodium chloride from a seawater wash.

“The presence of sodium chloride (NaCI) in residual seawater after the tank wash procedure can potentially result in formation of the processing contaminant 3-monochloropropane diol (3-MCPD) and related 3-MCPD esters,” FOSFA technical

manager Gretel Bescoby said on 3 November. “Although a final freshwater rinse is usually performed by shippers, it was felt that highlighting the requirement to perform a freshwater rinse with drying will create an awareness and be an additional safeguard to prevent potential formation of the processing contaminants.”

Bescoby said text changes specifying that the final rinse after washing must be performed with freshwater followed by drying would be included in the following

FOSFA documents:

• Qualifications and operational procedures (Carriage of Oils and Fats) introduction

• Combined Master Certificate

• Certificate of Compliance, Cleanliness and Suitability of Ship’s Tanks

• Code of Practice for Superintendents

FOSFA provides standard contract forms for the oils, oilseeds and fats industry, and trade arbitration services.

TRANSPORT NEWS 14 OFI – JANUARY 2023 www.ofimagazine.com

Photo: Adobe Stock

AAL’s silo complexes will speed up farmer delivery and grain handling

U .S. S oy h as th e lo wes t c a rbon f ootprin t w h e n comp a re d

ith s oy o f oth e r origins

U S Soy farmers are committed to advancing the United Nations Sustainable Development Goals We are leading the way by producing more while using fewer resources, implementing farming practices that reduce carbon footprint, a nd helping to preser ve forestland. Since 1980, U S Soy farmers have:

• Increased soy production, using roughly the same amount of land by 130%

• Improved water use efficiency per bushel by 60%

• Improved land use efficiency per bushel by 48%

• Improved GHG emissions efficiency per bushel by 43%

• Improved soil conservation per acre by 34%

• Improved energy use efficiency per bushel by 46%

From 1982–2017, the U S increased forest land by 2 1 million hectares and reduced crop land by 21 4 million hectares But we won’t stop there. U S Soy farmers’ ongoing commitment to sustainability enables you to produce food, feed, energy and other products to suppor t a healthy society, even as we preser ve the planet for future generations

See how we’re going fur ther for you, your customers and the planet at ussec.org/sustainability

w

INDIA: German chemical giant Bayer has started the commercial use of drones for crop protection in India, Krishak Jagat reported on 14 October.

The drone services would be introduced in phases for use by corn, cotton, rice and soyabean smallholder farmers in the states of Punjab, Haryana, Madhya Pradesh, Odisha, Maharashtra, Andhra Pradesh and Karnataka, and other regions, the report said.

As part of the service, Bayer would offer machinery, crop and product expertise, business support and training.

KENYA: Kenyan farmers will begin planting GM maize seeds early next year following the government’s recent lifting of a 10-year ban on the cultivation of GM crops, according to a 9 November BBC report.

The drought-resistant seeds would be planted on 202,342ha of land, the country’s agricultural authority was quoted as saying.

Following four consecutive failed rainy seasons, Kenya was facing a severe water shortage.

Grown on 90% of all Kenyan farms, maize is a staple food in the country.

In October, the government lifted its ban on the cultivation of GM crops, as well as the import of food and animal feeds produced through genetic modification, such as white GM corn, the BBC report said.

India okays release of GM rapeseed in environment

India has approved a domestically-developed genetically modified (GM) mustard/rapeseed for environmental release, paving the way for commercial use in several years, Reuters reports.

The Genetic Engineering Appraisal Committee (GEAC) – part of India’s environment ministry –gave its clearance following lengthy reviews and political indecision, the 27 October report said.

“I can call it a landmark development,” Deepak Pental, a geneticist and former vice-chancellor of Delhi University, who developed the seeds along with his team, said.

India is a top global edible oil importer, meeting more than 70% of its demand from Argentina, Brazil, Indonesia, Malaysia, Russia and Ukraine.

According to a 31 October report by the United States Department of Agriculture (USDA)’s Foreign Agricultural Service (FAS), the GEAC’s

approval for the environmental release of GM mustard is initially valid for a period of four years and is renewable for a further two years based on compliance report results.

However, the USDA said the approval remained subject to several conditions, including other statutory clearances and relevant clearances from the Food Safety and Standard Authority of India.

“Local experts report that the process may take at least another two years before the GE mustard seeds are made widely available to farmers for commercial cultivation,” the USDA said.

Since allowing the cultivation of GM cotton in 2002, India had not approved any transgenic crop, with many scientists and agricultural experts calling for faster clearance to boost production of staple grains and oilseeds, Reuters wrote.

Japan seeks comment on GE labelling

The Japanese government has opened a public comment period for proposed revisions to genetically-engineered (GE) labelling for nutritionally enhanced rapeseed varieties, the United States Department of Agriculture (USDA) reports.

The revision proposes to add rapeseed varieties that produce eicosapentaenoic acid (EPA) and/or docosahexaenoic acid (DHA) to a list of nutritionally enhanced GE products requiring GE labelling, according to the 19 October Foreign Agricultural Service (FAS) report.

“In Japan, if foreign genetic material is not present in a highly refined product, such as cooking oil, GE labelling is not usually required. However, food items derived from Specific GE Products that

have had their nutritional values significantly modified by inserted foreign DNA must be labelled as GE even if no foreign material remains in the product,” the USDA said.

The comment period was open until 12 November. If the revision is adopted, the

Consumer Affairs Agency would require GE labelling on products derived from the GE rapeseed varieties, the USDA report said. As of October, the agency had only designated stearidonic acid-enhanced soyabeans and high-lysine maize as Specific GE Products.

Mexico's imports of GM yellow corn from USA set to halve

A ban on genetically modified (GM) corn in Mexico is set to proceed with the country on track to halve its US imports of yellow corn, the country’s deputy agriculture minister was quoted as saying in a 27 October Reuters report.

Victor Suarez said yellow corn was used primarily for livestock feed and Mexico would halve its US imports by increasing

domestic production when the ban on GM corn and glyphosate herbicide came into effect in 2024. To make up the shortfall, the country would be looking at making deals with farmers in other countries to grow non-GM corn and sell it to Mexico.

As a top global buyer of corn, Mexico imports around 17M tonnes/year of US grain, according Reuters. Suarez said he was

confident the country could make up about 8M tonnes of corn it would no longer import from US farmers after 2024. The government was working to form agreements with local farmers to increase yellow corn production to 6M tonnes, he added.

US farm lobbies claim Mexico's ban will cause billions of dollars of economic damage to both countries.

BIOTECH

16 OFI – JANUARY 2023 www.ofimagazine.com

NEWS

IN BRIEF

Calyxt says seedless hemp offered improved yields and quality

Photo: Adobe Stock

DIARY OF EVENTS

23-24 January 2023

Fuels of the Future 2023 Berlin, Germany www.fuels-of-the-future.com/en

24-26 January 2023

International Rendering Symposium part of the International Production & Processing Expo (IPPE) Georgia, Atlanta, USA https://ippexpo.org

1-3 March 2023

CSGA Rendering Congress 2023 Mar del Plata, Argentina www.subproductosganaderos.org

6-8 March 2023

Palm & Lauric Oils Price Outlook Conference & Exhibition (POC2023) Kuala Lumpur, Malaysia www.pocmalaysia.com

16-18 March 2023

FOIC 2023, Fats & Oil International Conference & Exhibition

Grand Hyatt Hotel, Mumbai, India https://otaiwz-foic2023.org/index.php#

19-21 March 2023

NIOP 2023 Annual Convention Westin Kierland Resort & Spa, Arizona, USA https://niop.org/annual-convention

29-31 March 2023

International Sunflower Seed & Oil Conference 2023

Hilton Hotel, Buenos Aires, Argentina www.isasunflower.org/fileadmin/news/ files/Save_The_Date_Sunflower_Seed_ And_Oil_Conference.png

30-31 March 2023

4th Sustainable Oils & Fats International Congress Lisbon, Portugal www.fat-associes.com/en/home

19-20 April 2023

European Algae Summit Lisbon, Portugal www.wplgroup.com/aci/event/europeanalgae-industry-summit/

30 April-3 May 2023

AOCS Annual Meeting & Expo 2023 Denver, Colorado, USA https://annualmeeting.aocs.org/

Be part of the annual global gathering of the palm and edible oils industry professionals at the 34th Palm & Lauric Oils Price Outlook Conference & Exhibition (POC2023) organised by Bursa Malaysia Derivatives. This event will be held from 6-8 March 2023 at the Shangri-la Hotel, Kuala Lumpur, Malaysia.

POC2023 provides valuable networking opportunities and a platform for participants to debate topics involving the supply and demand of major edible oils, receive updates on latest price forecasts and discuss trade possibilities.

Many of the world’s leading corporations in the edible oils industry have chosen to become POC sponsors. With a strong track record of attracting participants from across the globe, partnering with Bursa Malaysia gives companies ample opportunity to expand their reach to potential clients.

Bursa Malaysia Derivatives is a wholly owned subsidiary of Bursa Malaysia Berhad, which provides, operates and maintains a futures and options exchange. The exchange offers the world’s most liquid Crude Palm Oil Futures (FCPO) contract, consolidating Malaysia’s position as the global centre for palm oil price discovery.

For POC2023 sponsorship opportunity and other enquiries, please contact: Bursa Malaysia Derivatives Berhad E-mail: poc@bursamalaysia.com Website: www.pocmalaysia.com

4-5 May 2023

13th ICIS World Surfactants Conference Hyatt Regency, Jersey City, USA https://events.icis.com/website/8544/

5-7 June 2023

12th CESIO World Surfactant Congress Rome, Italy https://cesio-congress.eu/

7-10 June 2023

European Fat Processors and Renderers Association (EFPRA) Congress 2023 Naples, Italy https://efpra2023naples.eu/

13-14 June 2023

IGC Grains Conference London, UK www.igc.int/en/conference/ confhome.aspx

12-14 June 2023

4th Annual Biodiesel & Renewable Diesel Summit

CHI Health Center, Omaha, Nebraska, USA https://few.bbiconferences.com/ Biodiesel.html

14-15 June 2023

Oleofuels 2023 Seville, Spain www.wplgroup.com/aci/event/oleofuels

17-20 September 2023

Euro Fed Lipid Congress & Expo Poznań, Poland https://veranstaltungen.gdch.de/tms/ frontend/index.cfm?l=11215&sp_id=2

24-27 September 2023

16th International Rapeseed Congress Sydney, Australia www.irc2023sydney.com

24-27 October 2023

North American Renderers Association Annual Convention

Ritz Carlton, Naples, Florida, USA https://nara.org/about-us/events

7-9 November 2023

International Palm Oil Congress & Exhibition (PIPOC) 2023

Kuala Lumpur Convention Centre (KLCC) Malaysia http://pipoc.mpob.gov.my/

For a full events list, visit: www.ofimagazine.com Information subject to change

www.ofimagazine.com OFI – JANUARY 2023 17

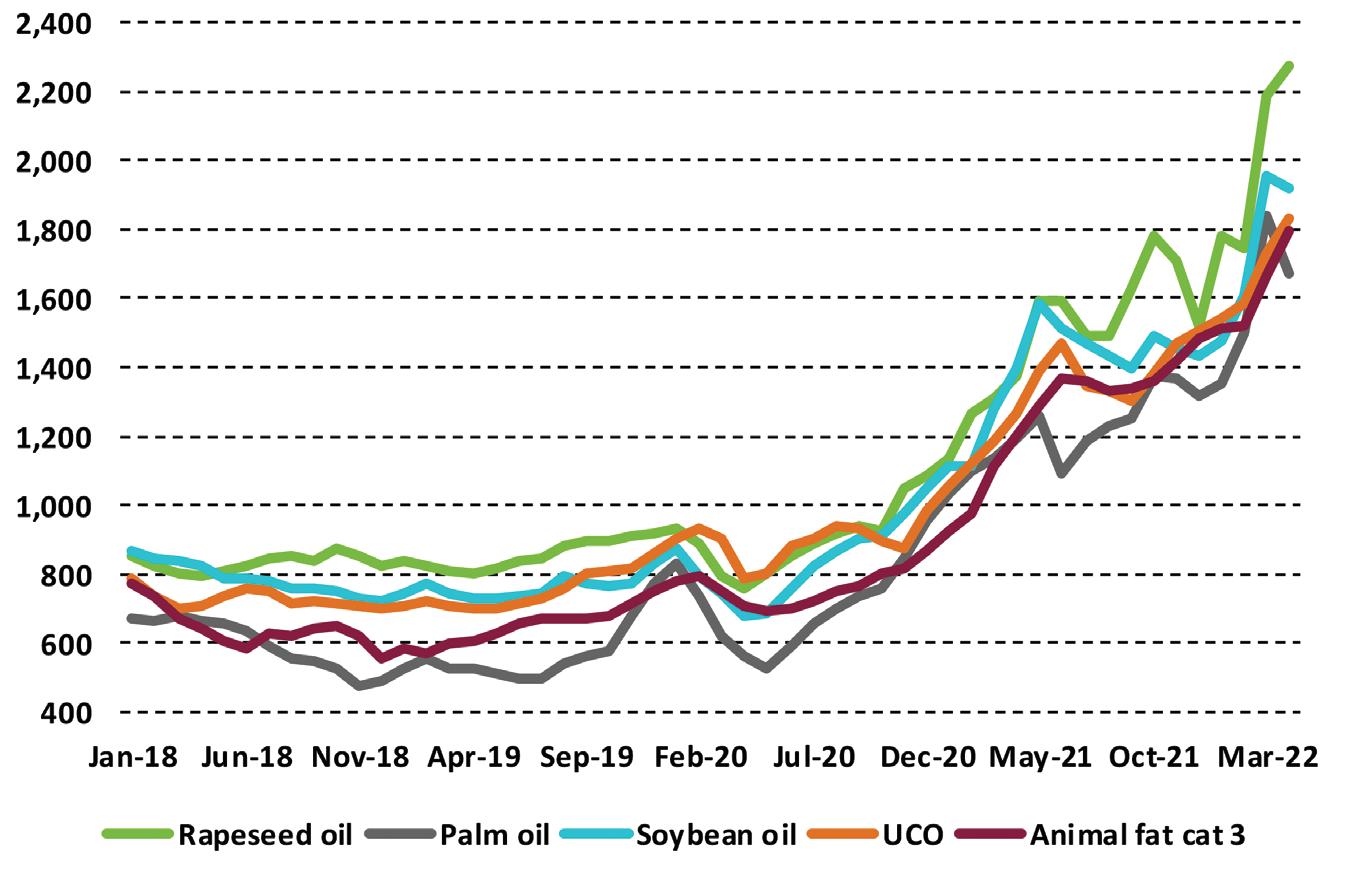

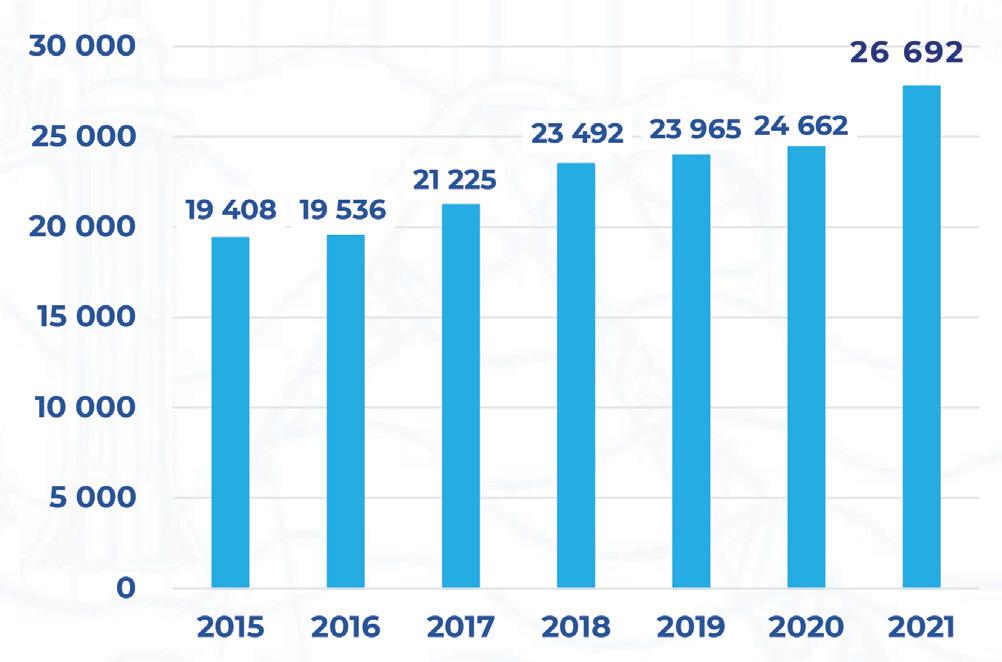

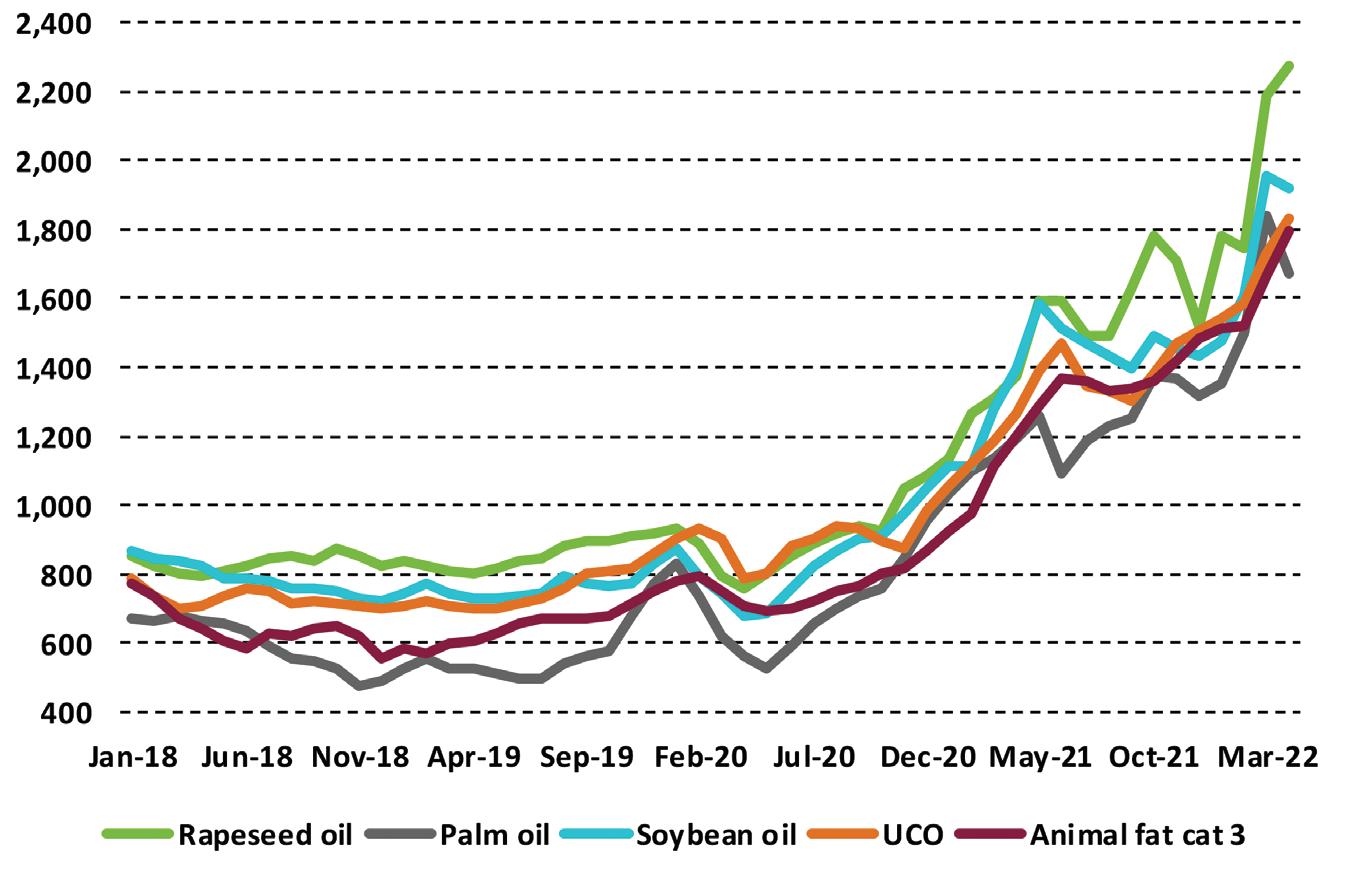

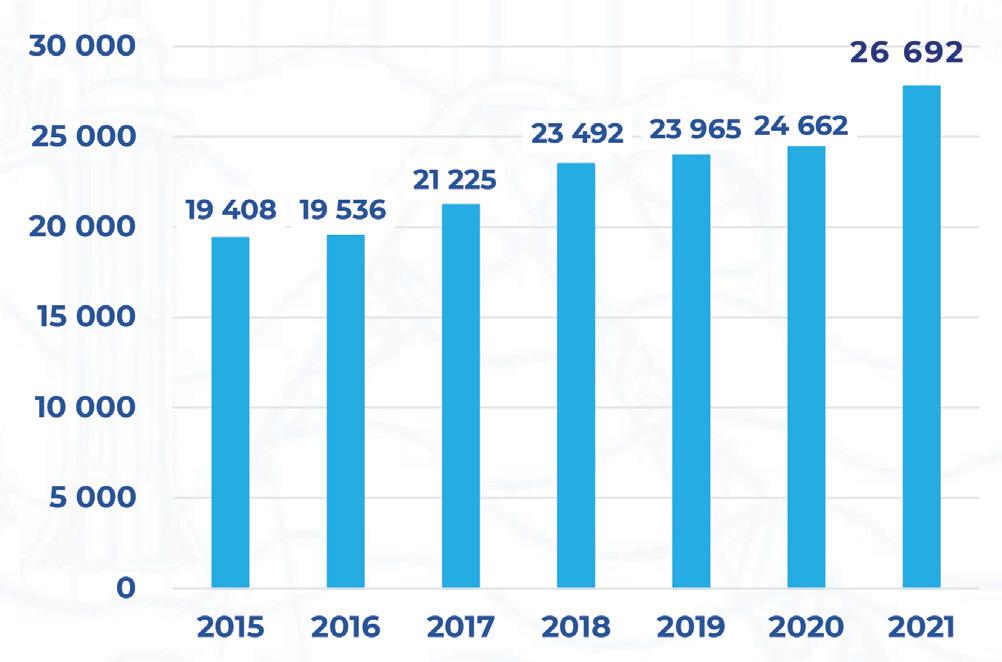

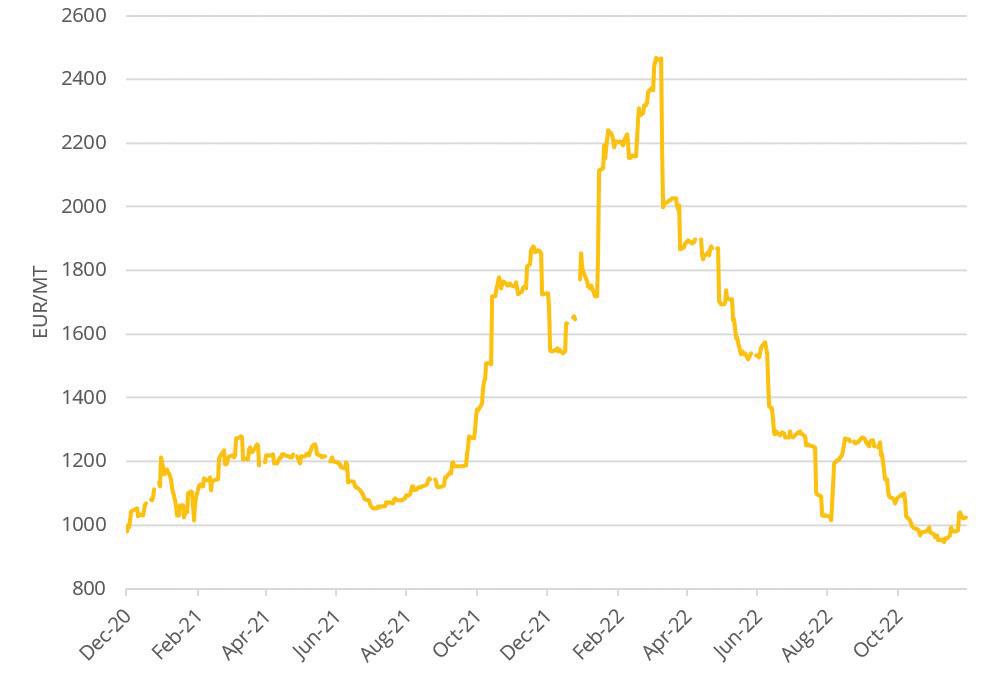

Further price volatility

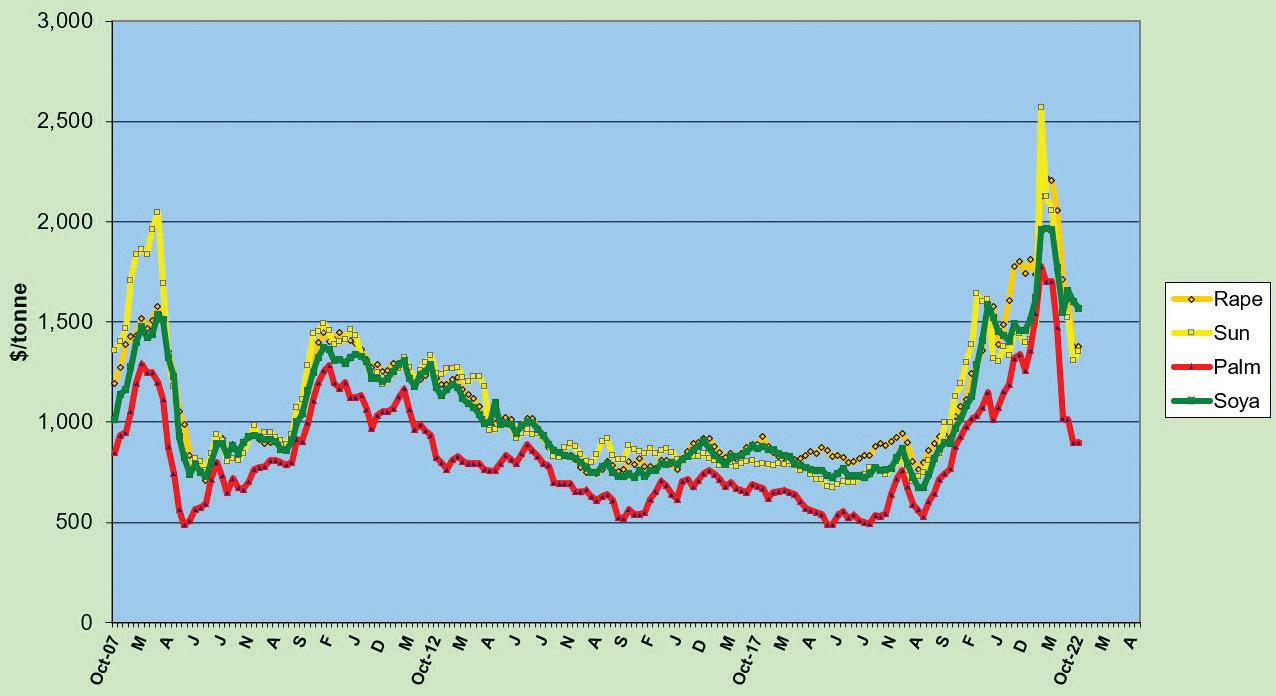

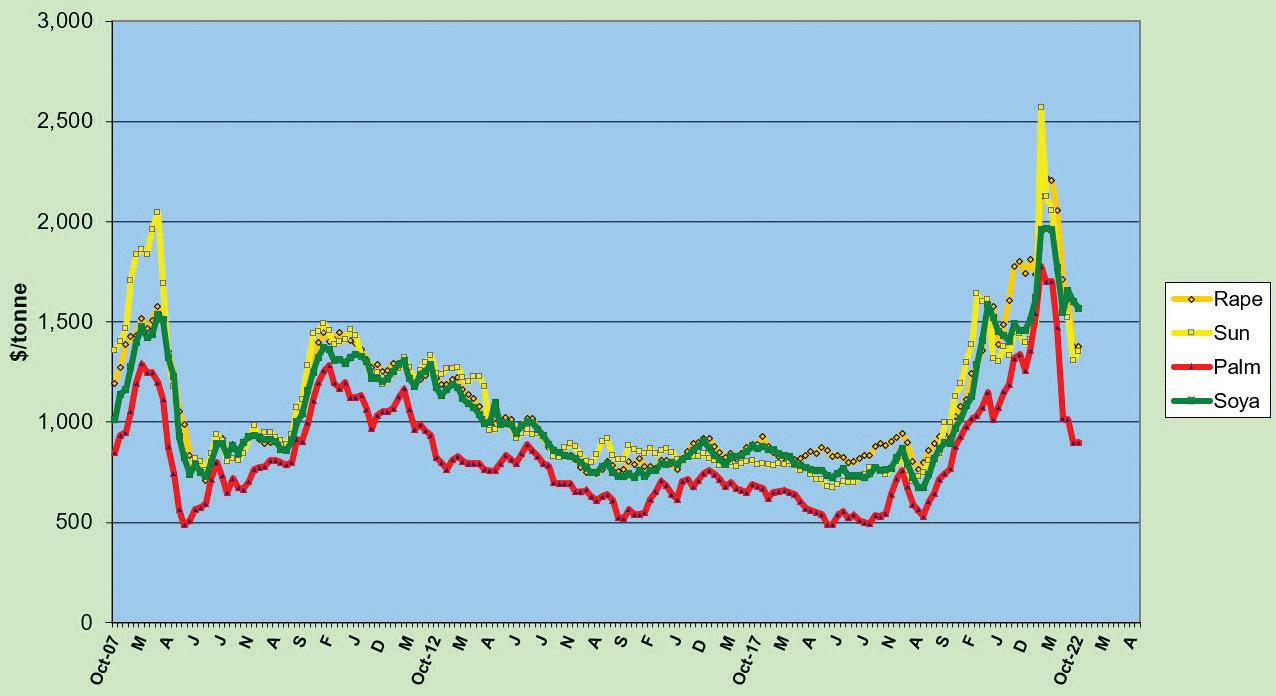

The promise of larger crops and a less fraught response to events in Ukraine pushed oils and fat prices well off the highs seen in the first half of 2022 (see Figure 1, right).

However, amid continued multiple risks from weather, geopolitics, fuel-versusfood competition and broader economic/ currency factors, the lowest levels seen in third quarter 2022 could not hold – and more price volatility may be in the offing as the market enters 2023.

Less than ideal weather in Asia for palm oil, and Latin America for soyabean oil, has required some downgrading of the 2022/2023 season’s global vegetable oil production forecasts. However, if the US Department of Agriculture (USDA) is correct, the market will still see a 3.6% or 7.7M tonne hike in overall supplies – the largest increase since 2017/2018’s near 10M tonne (5%) increase.

Forecast output gains are led by rapeseed oil, the tightest of the major oils in recent years but now expected to rise by 2.66M tonnes as the Canadian crop recovers from its 2021 droughts and heatwaves and other major producers, including the EU and Australia, harvest larger areas, with some also improving yields.

Close behind, soyabean oil could expand its production by 2.55M tonnes or 4.3%, then palm oil by 2.3M tonnes or 3%.

Even sunflower oil, in a year of weak Ukrainian sunflowerseed production, may see a marginal increase in supply as 2021/2022 stocks bottled up by the Russia-Ukraine conflict finally get crushed and into the market.

The trimming of the world vegetable oil production forecast for 2022/2023 is largely down to lower than expected seasonal growth in palm oil amid plantation labour shortages and,

excessively wet weather (see Figure 2, p20). This cut back Malaysian forecasts in November by as much as 1M tonnes to 18.8M tonnes. Indonesia may also have some problems achieving its earlier 46.5M tonne seasonal output estimate.

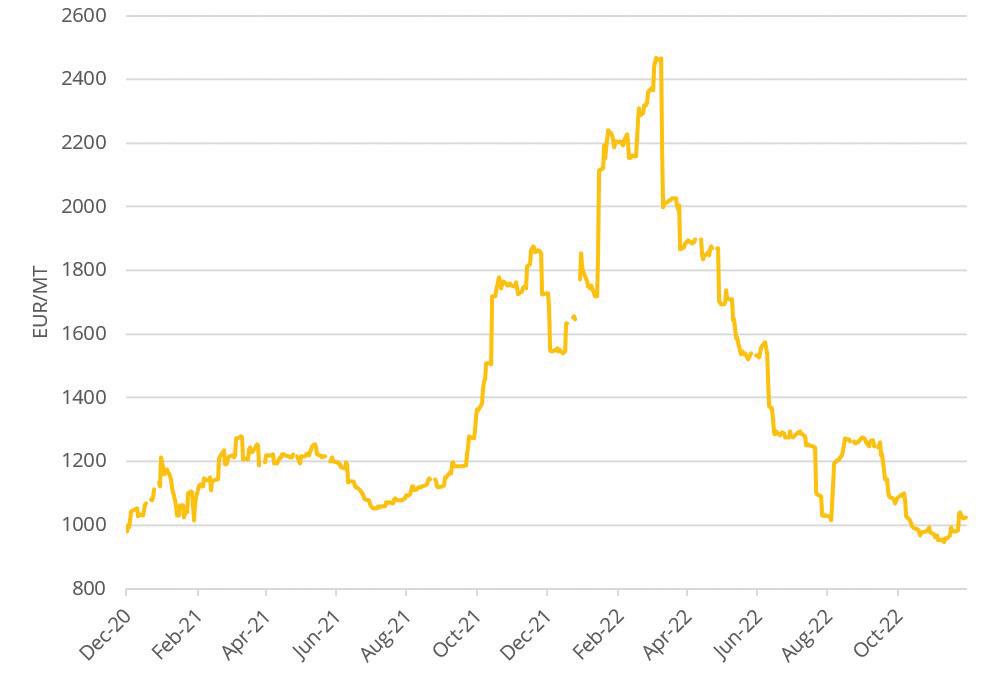

Palm oil

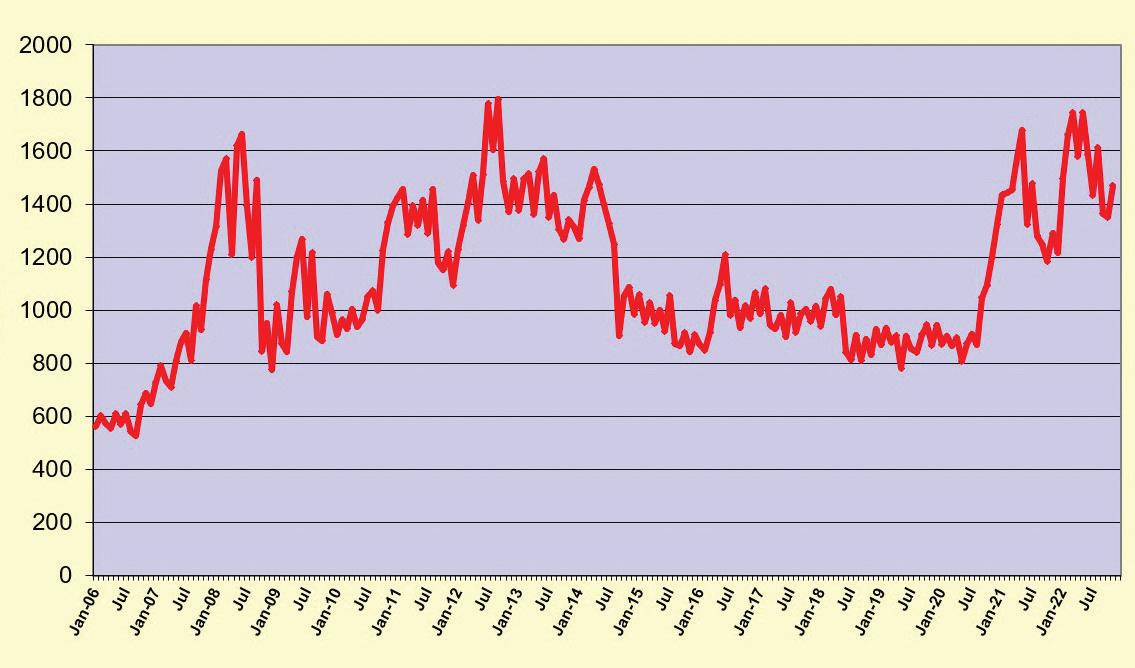

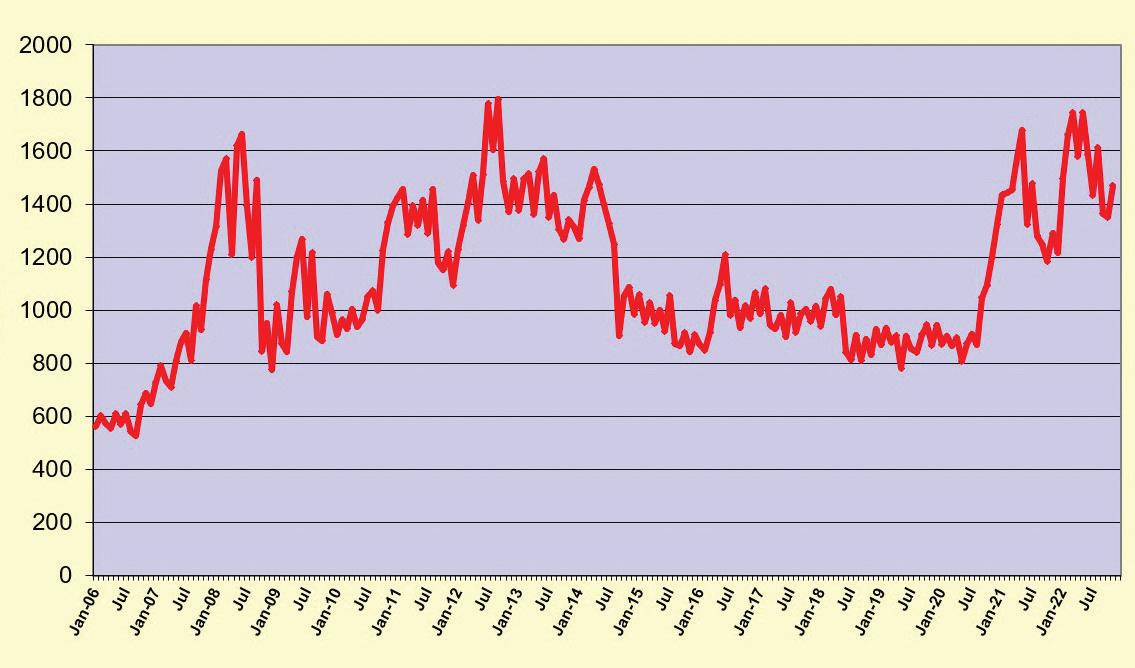

In terms of the US dollar in which most oils are traded internationally, palm oil hit a low in late September when benchmark Bursa Malaysia futures traded under US$700/tonne compared with a May peak of over US$1,600/tonne.

The market has edged back closer to US$900/tonne more recently. The earlier peaks largely reflected Indonesia’s temporary export ban – just as the market was trying to reconcile itself to the loss of Ukraine’s sunflower oil exports. The bottom was hit when Indonesia cut duties to dump the excessive stocks it built during the (now seen as unnecessary) ban after big buyers like India turned to soyabean oil instead. That pressure from Indonesian stock clearance is still on but may ease somewhat over the winter period of lower Asian palm oil production.

Currently, palm oil consumption is expected to keep pace with the expected growth in supply. India, especially, is seen buying more if the return of its wide discount versus soyabean oil persists. The country’s imports are currently forecast at

9.1M tonnes against last season’s 8.1M tonnes, while China could also use more on the same proviso (6.9M tonnes against 5.2M tonnes).

The EU may also consume more palm oil in its biofuel sector – though not as much overall as in 2020/2021.

Indonesia itself has seen massive consumption growth in recent years on the back of its expanding biodiesel blend. Despite the government’s plan to expand the palm oil in diesel mix from 30% to 35%, the USDA currently forecasts Indonesia consuming less palm oil in 2022/23 (18.5M tonnes against 19.9M tonnes in the previous season).

While Indonesia has made a big reduction in its surplus in recent months (from over 7M to around 4M tonnes), it is still expected to carry forward more stock than usual for a second season, which may help keep prices under control.

Not surprisingly, opinions aired at recent palm oil industry meetings have offered mixed views on the oil’s price outlook, depending on how low this winter’s production goes; how competing vegetable oils behave; and how the energy markets respond to a weakening global economy; not to mention the risk of greater cuts in fuel usage in COVIDcurbed, top petroleum oil consumer China.

Supplying 35% of world vegetable

Production gains are forecast for palm oil, soyabean and rapeseed but uncertainties over weather, geopolitics and economic/ currency factors will continue to impact the global oils and fats market John Buckley

INTERNATIONAL

18 OFI – JANUARY 2023 www.ofimagazine.com

MARKET REVIEW

Figure 1: Crude vegetable oil monthly average prices except refined palm oil (US$/tonne)

Graph: John Buckley

volatility ahead

oil exports and about a quarter of consumption, palm oil’s price direction will continue to be a key factor in the value of rival oils.

Against soyabean oil, palm was recently offered at a more than US$400/tonne discount versus a normal US$100/tonne rate, but some analysts see that discount contracting in 2023.

Soyabean

Soyabean demand may benefit from increased supplies if large rises in Latin American crop sowings are rewarded with normal weather.

Top producer Brazil is expected to expand output from 127M tonnes to 152 tonnes, and perhaps as much as 154M tonnes, and is currently enjoying mostly favourable conditions.

Argentina has had some planting delays from dry weather and could end up nearer the 49M tonnes mark, less than earlier forecasts of up to 51M tonnes but still well up on 2021’s 44M tonnes.

Paraguay, also hit by drought in 2021, could rebound from that year’s unusually poor 4.2M tonnes of production back to around 10M tonnes.

In the USA, less than ideal weather appears to have capped 2022’s crop to around 118M tonnes against 121.5M tonnes the previous year. Overall, global soyabean output is seen jumping from 356M tonnes to a record 390/393M tonnes.

Based on crush rising by about 15M tonnes, the USDA sees soyabean oil output hitting a record of almost 62M tonnes.

In the current volatile energy market, more will be used for biofuels, especially in the USA, set to increase usage by 750,000 tonnes to 5.35M tonnes, bringing total soyabean oil US consumption to a new record high of 11.6M tonnes. The strength of demand has been demonstrated by US soyabean oil stocks declining recently to multimonth lows, even amid rising crush.

Despite its expected swing back to cheaper palm oil, top soyabean oil consumer China is expected to increase usage from 16.7M tonnes to 17.8M tonnes, although that forecast could be change if renewed COVID lockdowns

have a worse than expected impact on restaurant consumption.

China’s farm ministry recently estimated it would need to import only 91M tonnes of soyabeans in 2022/2023 against the USDA forecast of 98M tonnes. Even so, China has been a regular, significant buyer of US soyabeans so the threat of a downturn may prove pessimistic.

If the global soyabean crop increase does come through, and demand for soya products requires it, more of the crop could be channelled into crushing and less into stocks (forecast to rise 7.5M tonnes to a four-year high of over 102M tonnes), meaning that soyabean oil should remain in good supply. Early pointers to this year’s US crop, meanwhile, suggest farmers could raise planted area by over 1M acres (404,600ha) which, with trend yields, could put the crop back close to the 2021 level.

Chicago Board of Trade (CBOT) soyabean futures forward markets suggest prices will stay relatively firm right through 2023 within 5% of recent US$14-plus/bushel levels (see Figure 3, p20). Soyabean oil is the weaker product longer term, with futures pointing to a 14% drop with meal only about 5% cheaper by early 2023/2024 than now. u

www.ofimagazine.com OFI – JANUARY 2023 19

INTERNATIONAL MARKET REVIEW

INTERNATIONAL MARKET REVIEW

Rapeseed/canola

The cost of the third most consumed vegetable oil – rapeseed/canola – has dipped sharply in recent months as traders responded to higher world production forecasts and a weaker trend in some rival oils.

Canada’s 2022 crop estimate of 19.5M tonnes was up almost 42% from 2021’s drought/heatwave-afflicted harvest (now estimated a bit higher than earlier forecasts at 13.8M tonnes).

The combined increases point to less tight seasonal ending stocks later in 2023. Another record Australian crop forecast of 7.3M tonnes (versus 6.7M the last two years and below 5M tonnes prior to that) has also weighed on price, along with a larger European crop (up 2.3M at 19.5M tonnes, despite drought and heatwaves).

Russia and Ukraine (the latter’s wintersown rapeseed less affected by the conflict than spring-sown sunflowerseed) have also produced more rapeseed this 2021/2022 season (a combined 7.1M tonnes versus last season’s 5.8M tonnes).

Alongside normal Indian and Chinese harvests, this puts world canola output near 85M tonnes against less than 74M tonnes in the previous two seasons.

For the recently ended 2021/22 season, rapeseed oil prices (converted to US$ terms) averaged almost 42% higher than in 2020/21, more than double the 2019/20 average. As the larger supply starts to work through, there may be some further softening of recently lower costs. The Winnipeg futures nearby position went below C$8/bushel in September for the first time since mid-2021 while Euronext traded down to one-year lows in the €560s.

Canada’s domestic and export demand

will bounce back from the past season’s unusually low levels. Crush capacity has grown considerably after heavy investments in the last year or two and recent margins have been unusually strong as canola costs have fallen faster than the prices of the oil product.

Global crush is also expected to benefit from the larger supply, forecast to recover by 5.5M tonnes or about 7.3% with large gains in Europe as well.

The jump in global rapeseed oil production is expected to fuel a 5%+ (about 1.5M tonnes) rise in world consumption.

Early pointers are favourable for EU 2023 output, adequate rain and mild weather in the main producing states having got crops off to a flying start. Conflict and input challenges keep a question mark over the Black Sea region’s next crop but India’s rapeseed output – a key determinant of its oil import needs –may benefit from a larger sown area for 2023 in response to the past season’s firm markets.

Sunflowerseed

Going against the overall trend, the global sunflowerseed crop is believed to have dropped 10.5% or over 6M tonnes to just over 51M tonnes, mainly due to an estimated 42% drop in conflict-torn Ukraine’s production, resulting from far lower harvested area and, to a lesser extent, lower yields.

After widespread drought and heatwaves, European sunflowerseed output has also dropped to under 9.5M tonnes from last year’s 10.25M tonnes.

These declines were only partly offset by a 1.4M tonne rise for Russia (17M tonnes) and a 150,000 tonne increase in

Argentina’s crop (4.2M tonnes).

Nonetheless, sunflower oil prices have come down with the general trend and some easing of the supply constraints imposed by the Russian invasion of Ukraine in the first half of 2022.

Back in March, as Ukrainian exports ground to a halt, crude sunflower oil prices on the benchmark Rotterdam market were averaging a record US$2,570/tonne. By September, after the UN brokered-deal was agreed with Russia to allow Ukrainian grain and oil exports by their usual main sea routes, the average price had almost halved to just over US$1,300/tonne.

The fall was helped by the fact that global sunflowerseed ‘carryover’ stocks from the previous year’s record world harvest had almost tripled at the close of the past season, mainly resulting from Ukraine’s inability to export these.

The upside is that these stocks are expected to supplement this year’s smaller crop and, in theory, keep global sunflower oil production close to, or perhaps even slightly over, last season’s level.

Given the tighter sunflower oil supply in Europe, some demand is likely to switch to rapeseed oil in the food sector as the latter’s prices ease.

Going forward, other factors expected to impact the global oils and fats market include the unknown effect of a potential third La Niña on Latin American output, flooding this winter in Asian palm oil countries and still frisky energy markets. Despite the possibility of a larger contraction in top consumer China’s COVID-affected oil demand, edible oil suppliers may be cautious about trimming prices further at this stage.

20 OFI – JANUARY 2023 www.ofimagazine.com

●

John Buckley is OFI’s market correspondent

Graphs: John Buckley

Figure 3: CBOT soyabean futures (US$ cents/bushel)

Figure 2: World vegetable oil production (million tonnes)

u

Automated Titration Boosts the Productivity of Oil and Fat Analysis

Simple Operation

Reliable Results

Designed for simplicity, EasyPlus automated titrators start your routine tasks with a single tap on the home screen. Save learning time in your laboratory and benefit from a simple and intuitive user interface that speaks your language and 14 others.

Accurate, and reproducible results are guarenteed thanks to precise burettes, sensors and automated result calculation. With the additional software, all results are stored and easily accessed. Maximizing efficiency in daily tasks and eliminating operational errors.

Speed up your daily tasks with the One Click™ touchscreen interface. The modular design of the Titration Excellence line facilitates multipurpose analyses and guarantees that you are optimally prepared for future needs. Autosamplers, accessories, and software are the right combination for every application.

www.mt.com/titration

Flexible and straightforward

Prices set to stay rm

Palm oil plays a leading role in global oils and fats trade, with Indonesia and Malaysia accounting for more than 80% of world production. Weather, labour supply, currency stability and the policies and geopolitical stability of other oils and fats producing and exporting nations will shape the palm oil supply and demand balance in 2023

Wan Aishah Wan Hamid

Wan Aishah Wan Hamid

The global commodity market has gone through record highs in the first and second quarters of 2022, followed by a period of rapid decline especially in the third quarter of this year.

Price rises have been caused by the geo-political conflict in Russia-Ukraine hitting supplies and disrupting the supply chain due to port and shipping lines either closing or limiting their operations.

The war in Ukraine which began with Russia's invasion on 24 February was followed by a protracted period of weak growth and high inflation as energy prices rose rapidly, which has seen many countries struggle to manage their economies.

Compounding this challenge has been the soaring exchange rate of the US dollar, which has exacerbated concerns that the sharp rise is increasing the likelihood of a global recession.

Palm oil plays leading role

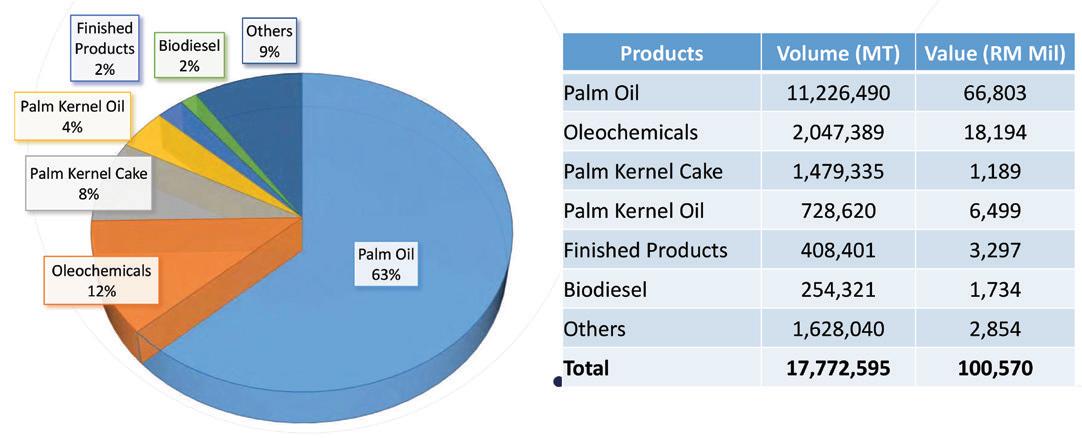

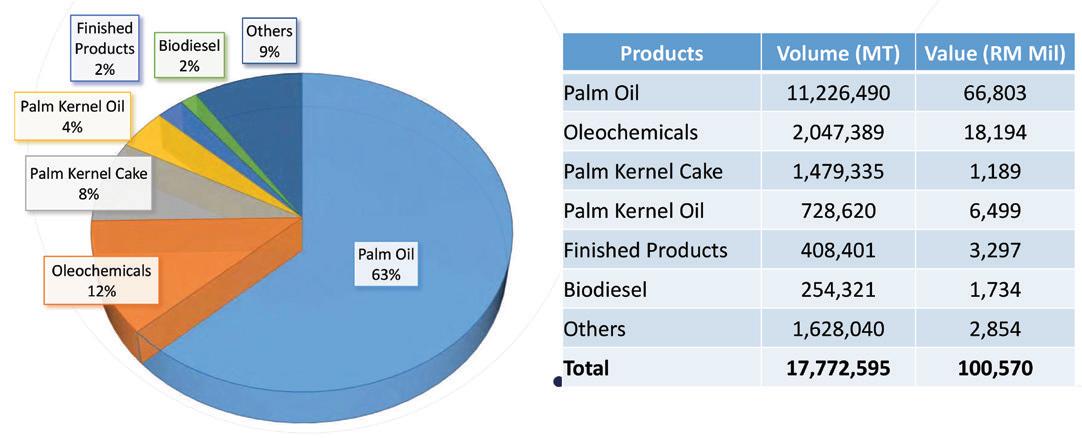

In the oils and fats sector, global production will be led by palm oil, which will play a key role in supplying the world.

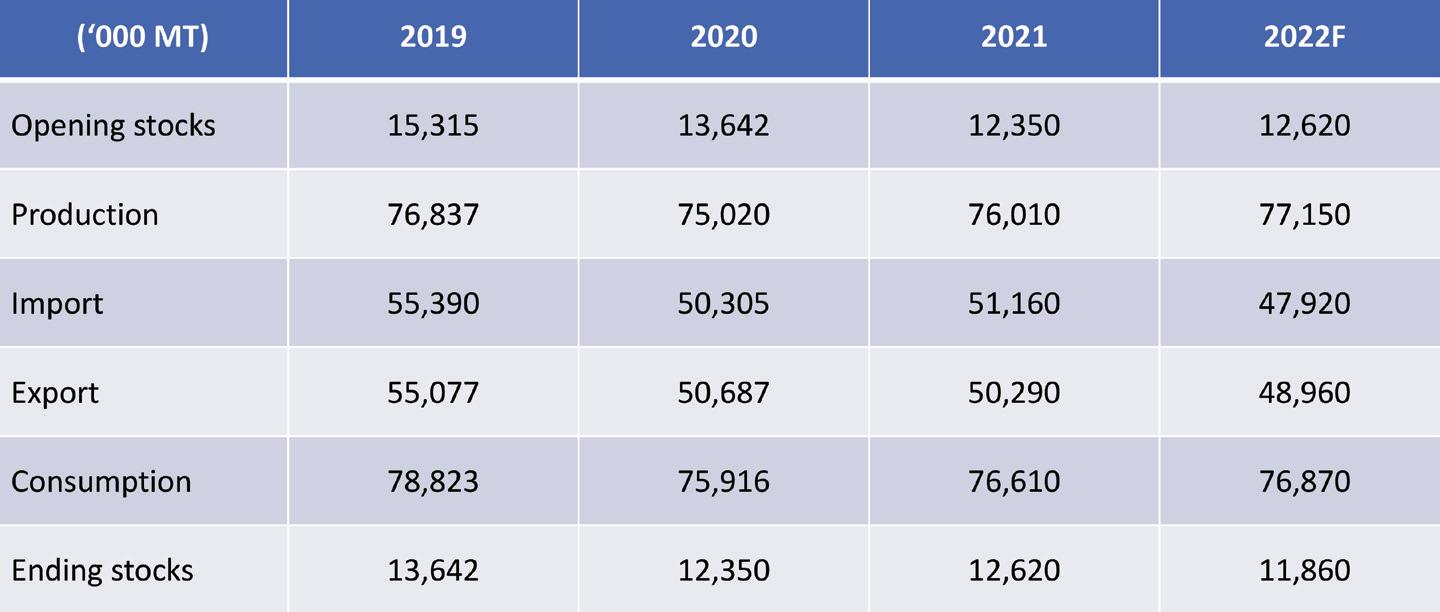

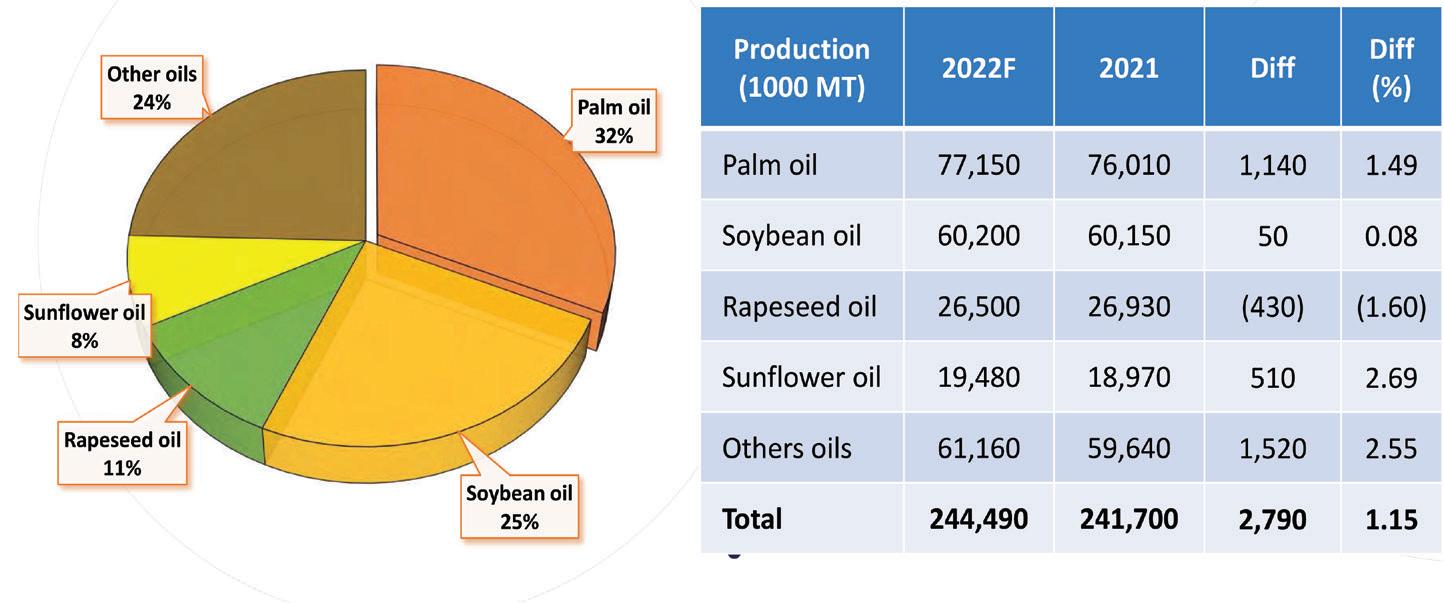

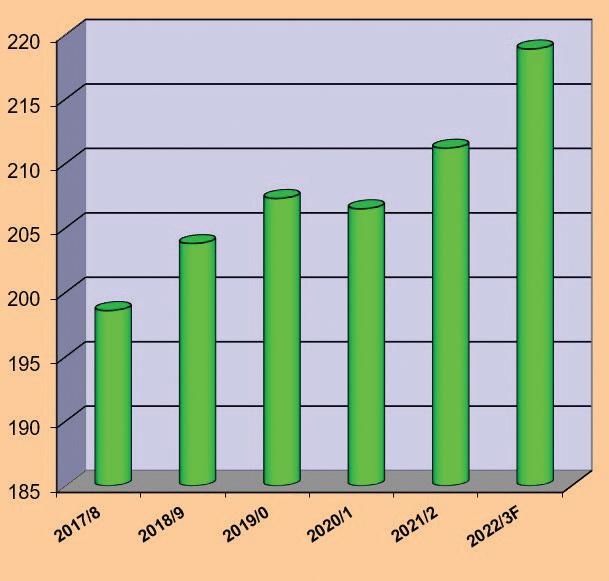

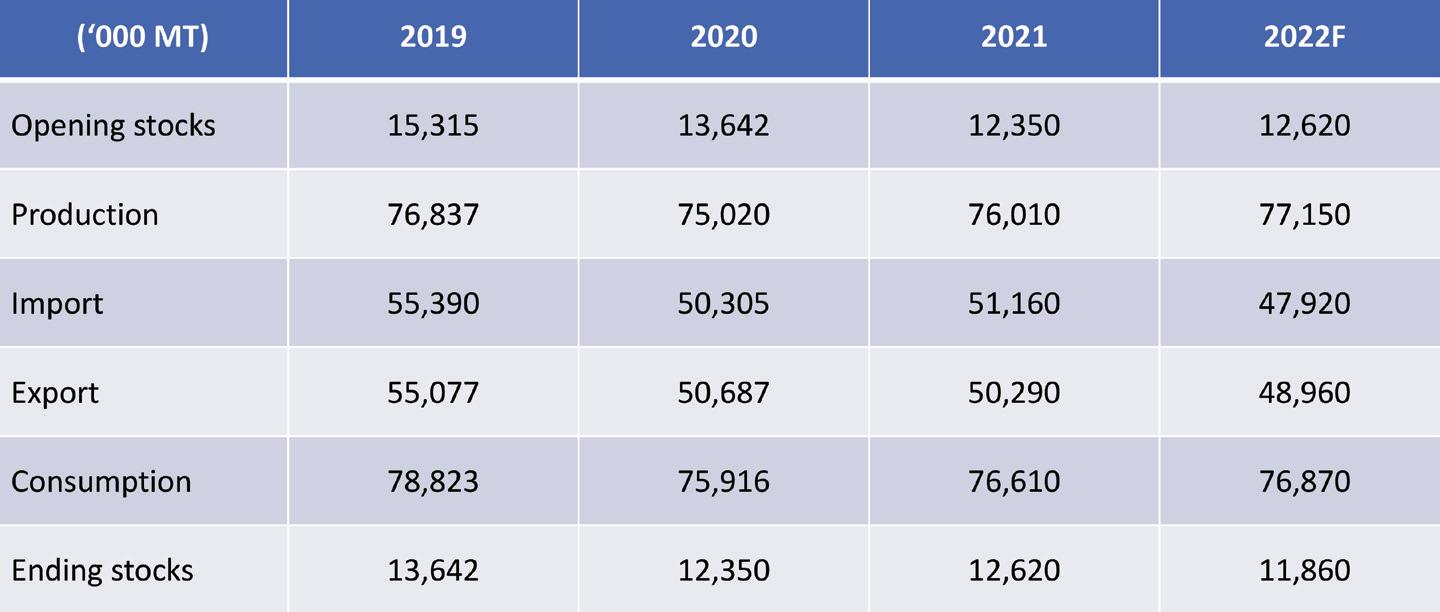

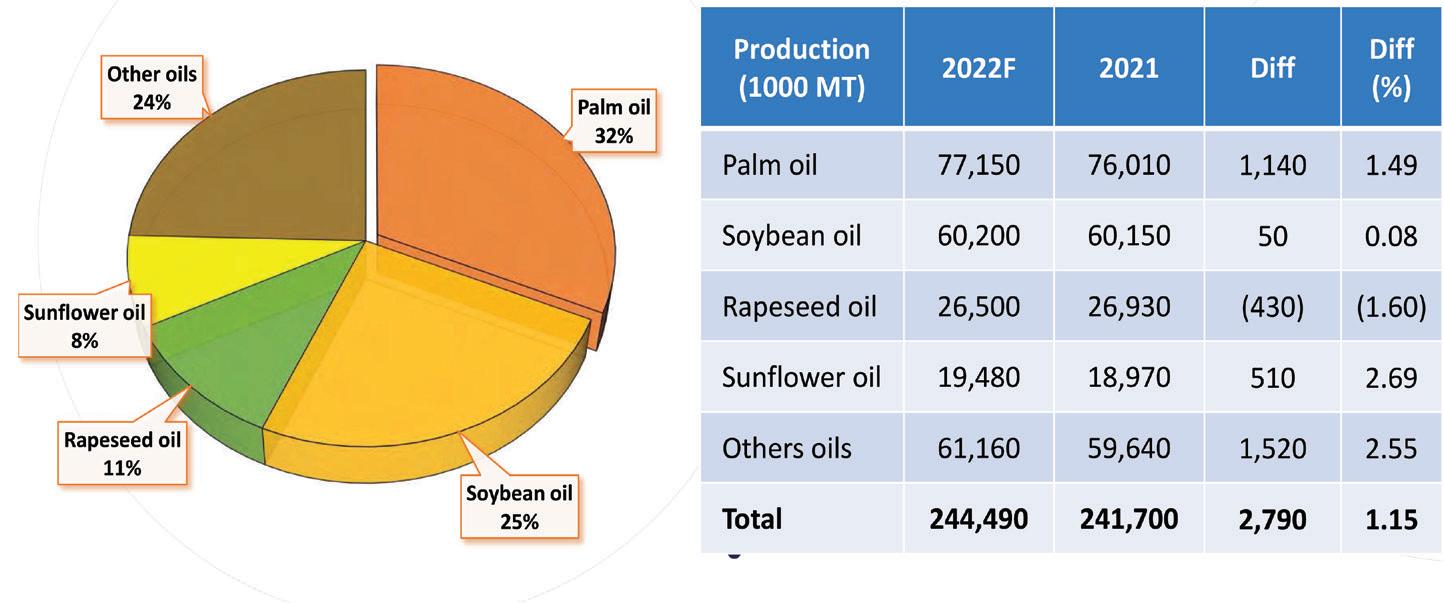

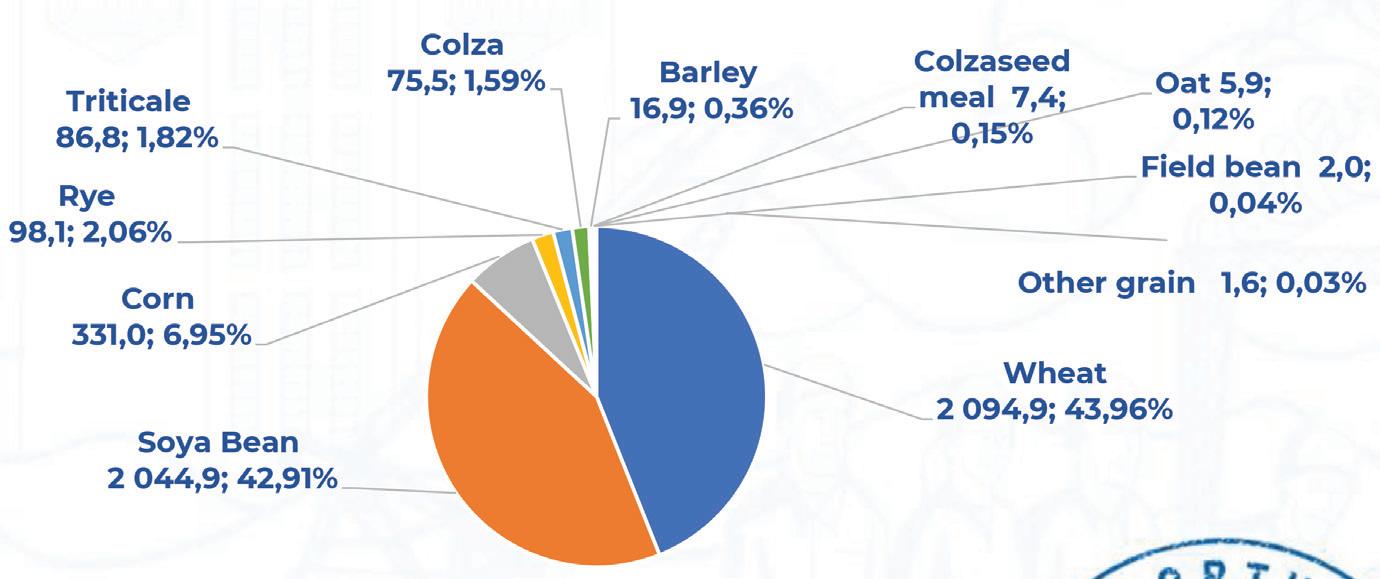

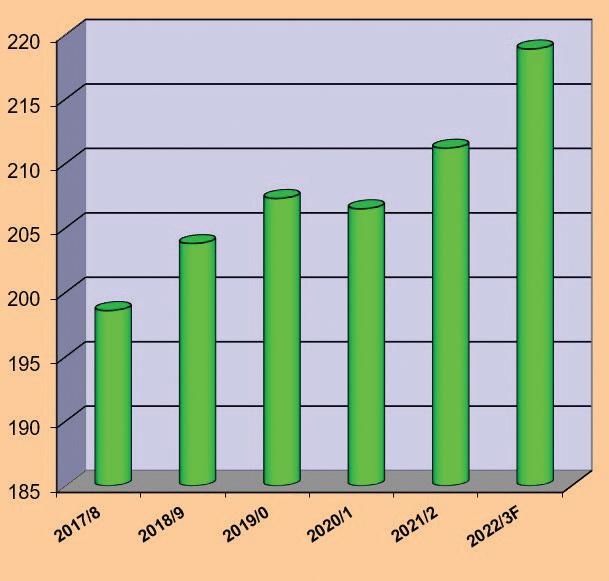

Global palm oil production is set to rise by 1.49% to total 77.15M tonnes in 2022

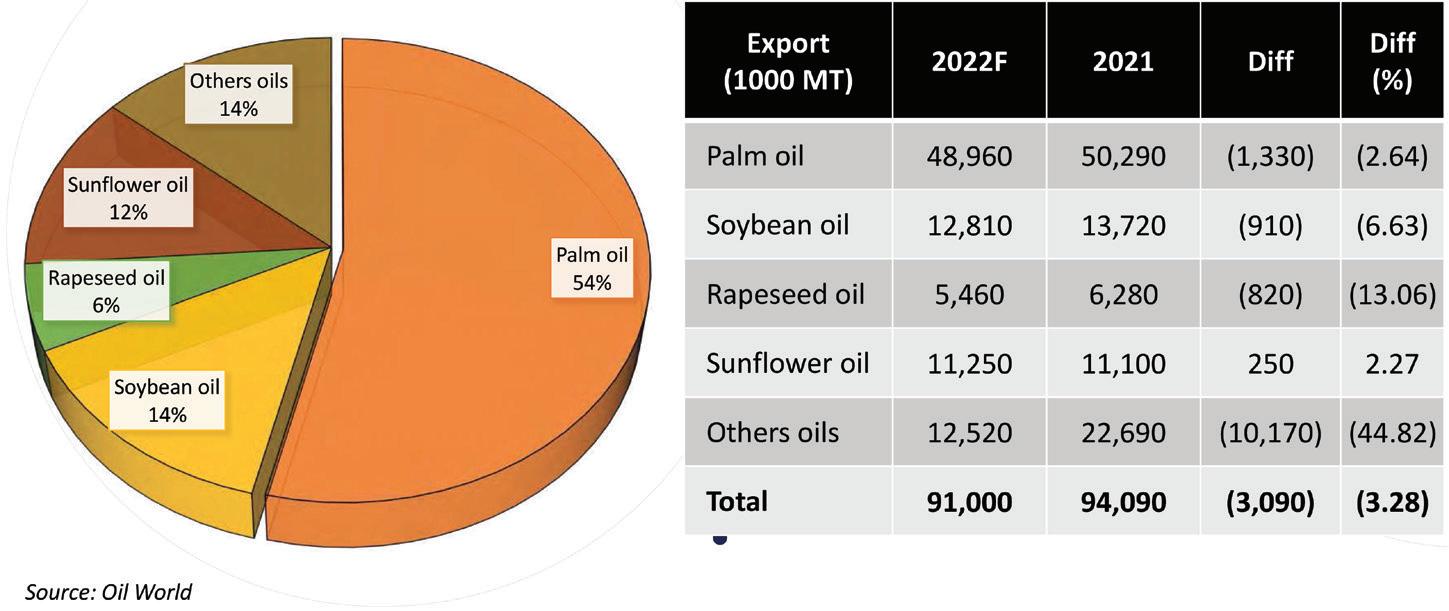

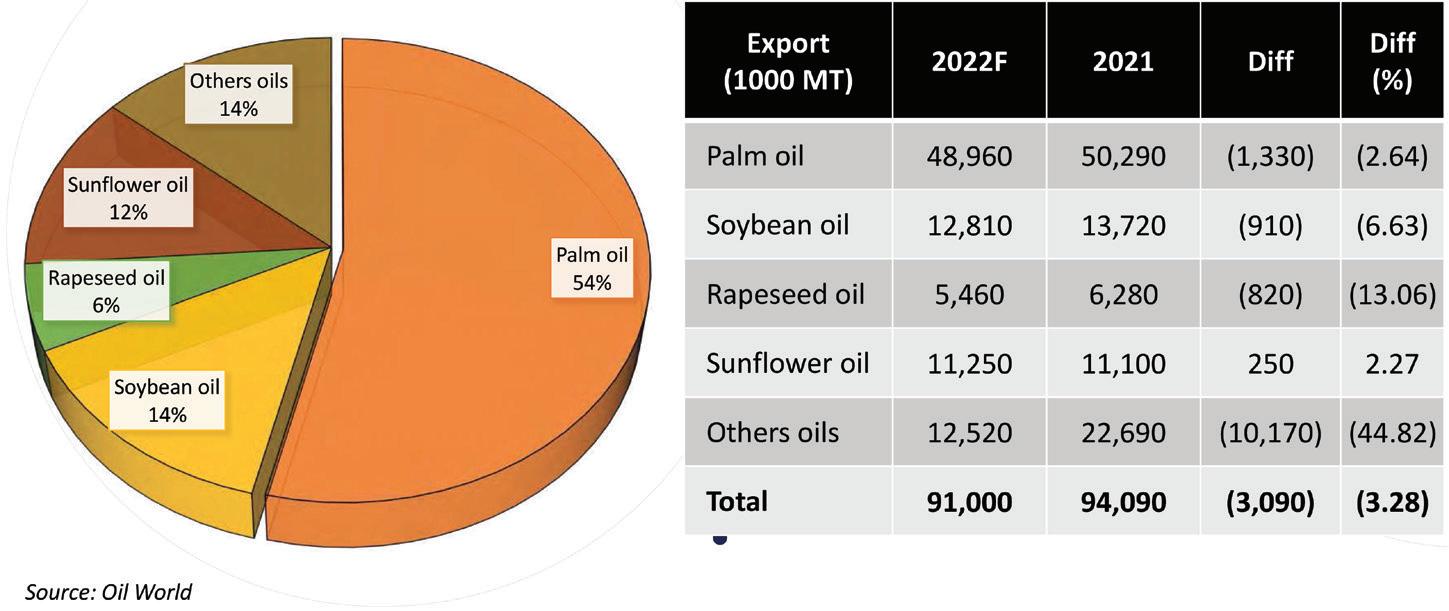

out of a total 244.5M tonnes, according to Oil World and the Malaysian Palm Oil Council (MPOC) (see Figure 1, following page).

This compares to 60.2M tonnes of soyabean oil, 26.5M tonnes of rapeseed oil, 19.5M tonnes of sunflower oil and 61.2M tonnes of other oils.

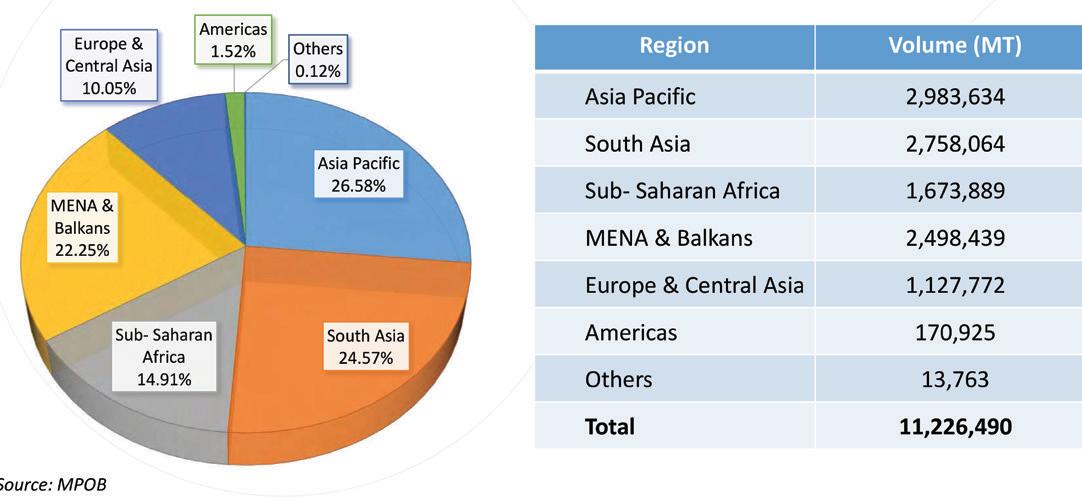

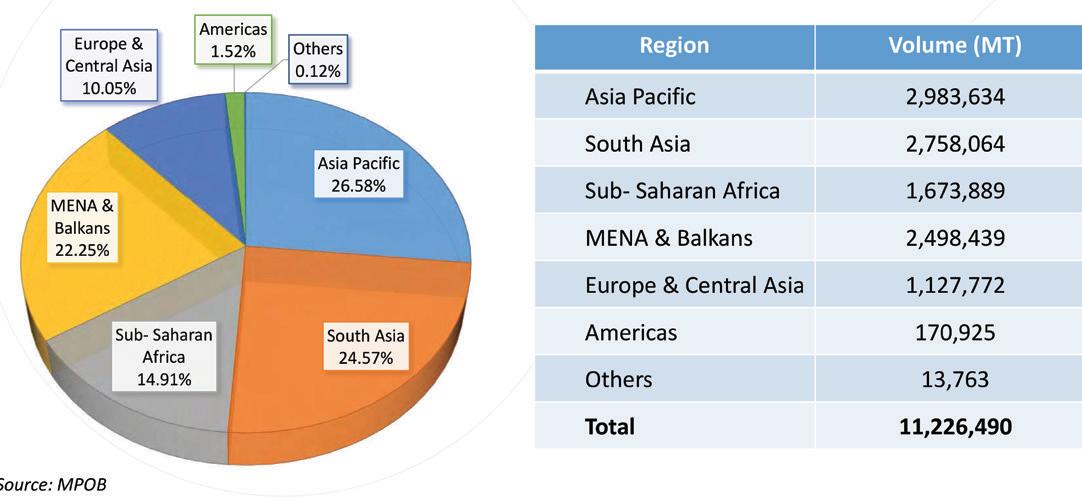

In terms of global oils and fats exports, palm oil leads with a forecast 48.9M tonnes for 2022 out of a total of 91M tonnes (see Figure 2, following page). This compares with 12.8M tonnes of soyabean oil exports, 5.46M tonnes of rapeseed oil, 11.25M tonnes of sunflower oil and 12.52M tonnes of other oils.

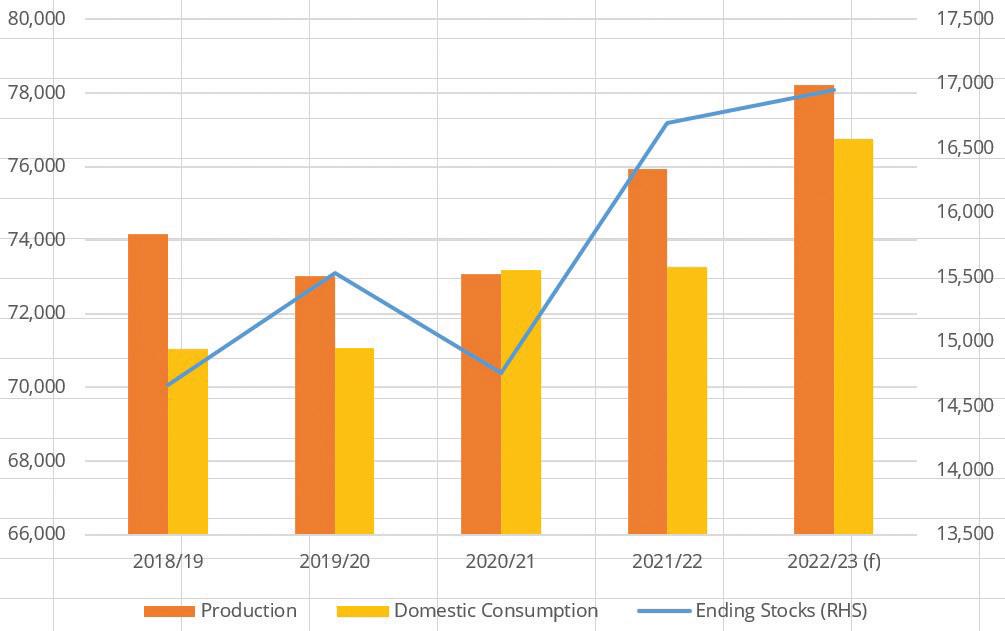

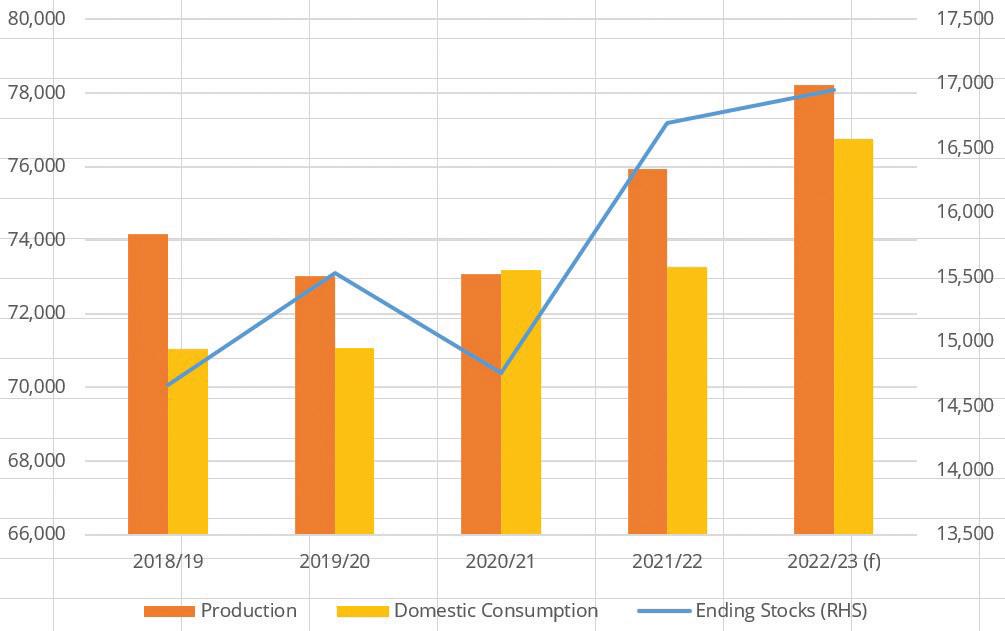

Consumption is forecast at 76.87M tonnes against 78.82M tonnes in 2019 (see Table 1, following page).

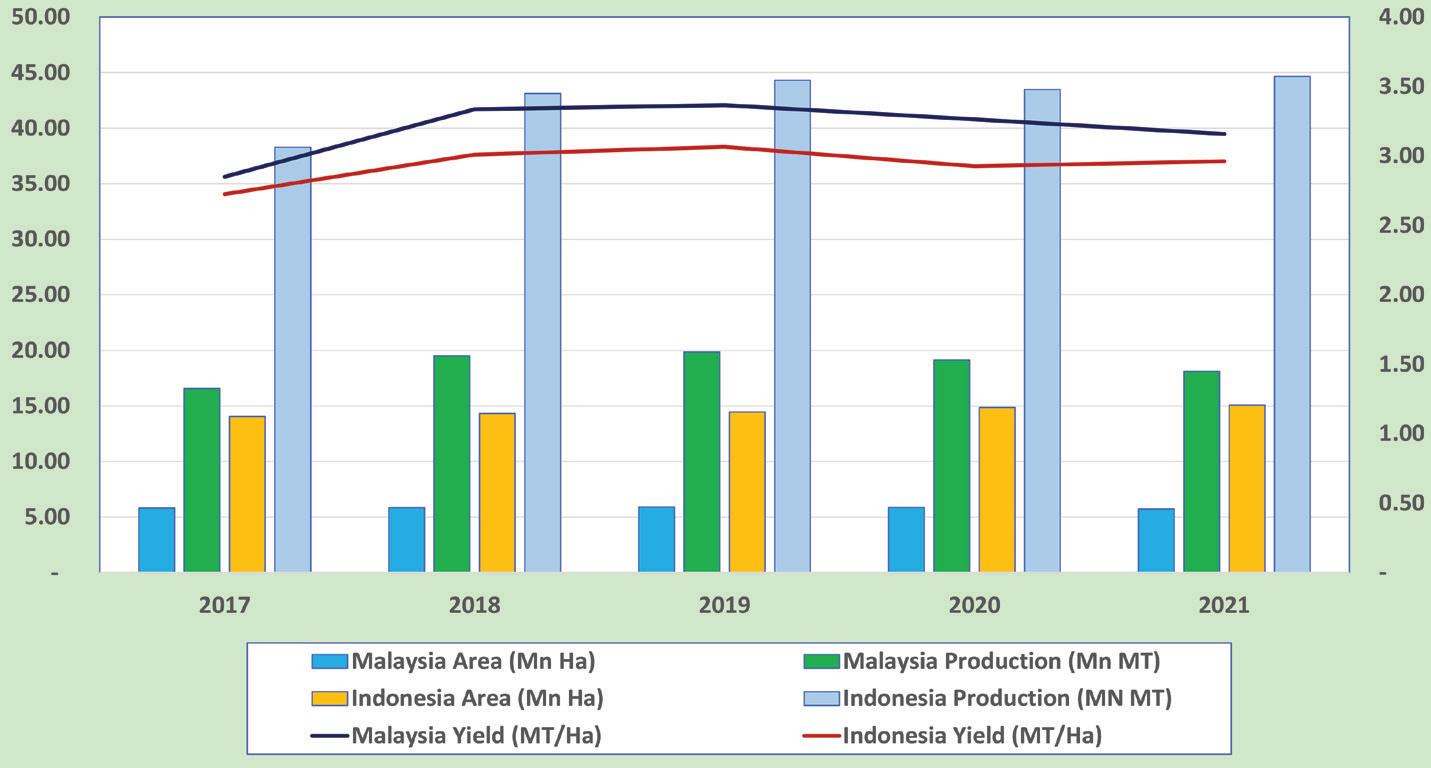

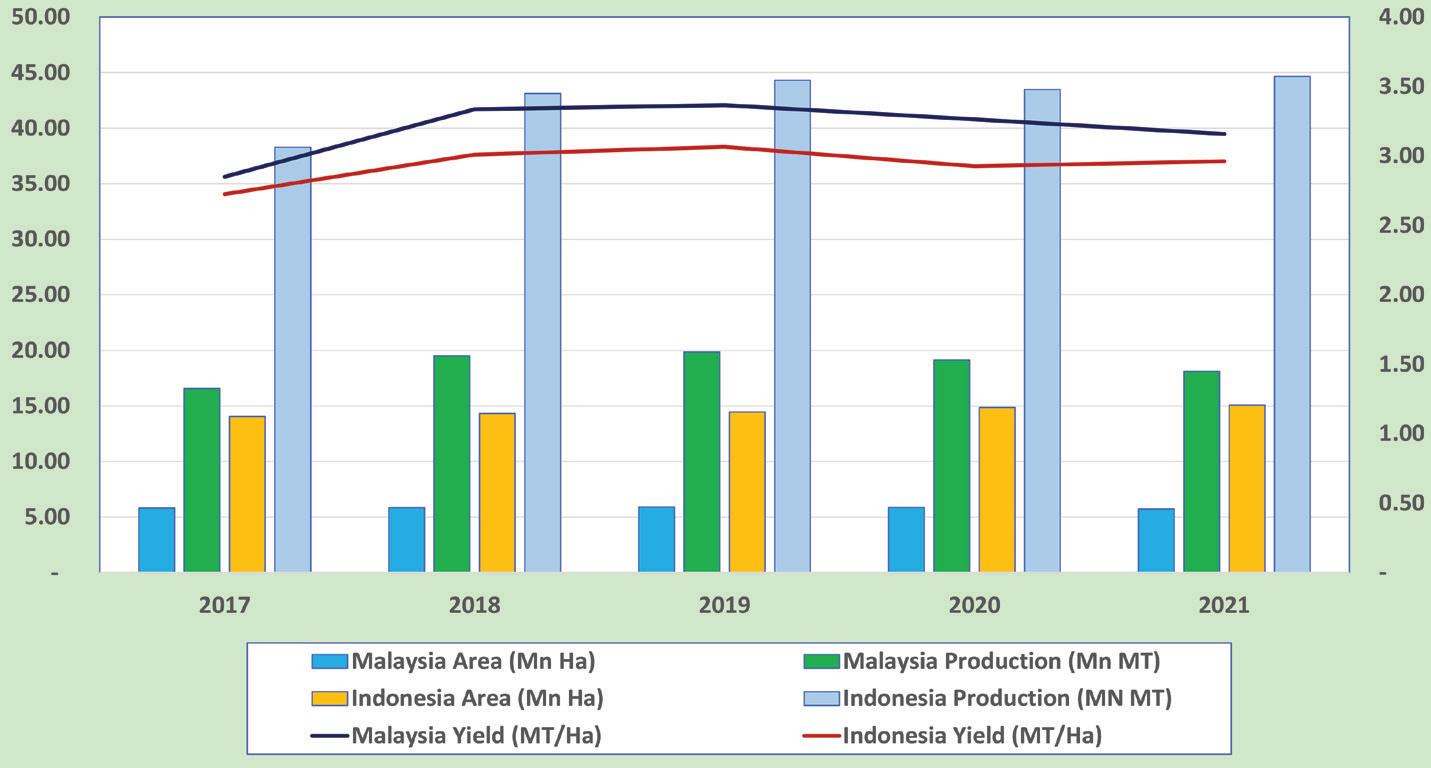

Malaysia and Indonesia will continue to account for the mainstay of palm oil production, accounting for 64.68M tonnes or 83% of global palm oil supply and 30% of global oils and fats production.

Malaysia/Indonesia outlook

Malaysian palm oil production is set to decline for a third year in 2022 to reach

u

22 OFI – JANUARY 2023 www.ofimagazine.com PALM OIL

SOAPS & DETERGENT PLANTS OIL FILLING LINES •EDIBLE OIL FILLING & PACKAGING LINES •SAPONIFICATION PLANTS •SOAP FINISHING LINES •DETERGENT POWDER PLANTS •SULPHONATION PLANTS (for oleo-chemicals) •PACKAGING LINES FOR SOAP & DETERGENTS •LIQUID DETERGENT PLANTS •FILLING LINES FOR LIQUID DETERGENTS •EDIBLE OIL FILLING & PACKAGING LINES •SAPONIFICATION PLANTS •SOAP FINISHING LINES •DETERGENT POWDER PLANTS •SULPHONATION PLANTS (for oleo-chemicals) •PACKAGING LINES FOR SOAP & DETERGENTS •LIQUID DETERGENT PLANTS •FILLING LINES FOR LIQUID DETERGENTS SOAPS & DETERGENT PLANTS OIL FILLING LINES www.binacchi.com • mail@binacchi.com • +39 0332 461354 www.zetasrl.org • info@zetasrl.org • +39 055 9560023 MPSD PATENTED SAPONIFICATION PACKAGING SOLUTIONS FILLING LINES FOR EDIBLE OIL, LIQUID DETERGENTS & LIQUID PRODUCTS SULPHONATION PLANTS everything you need for a one-stop-shop in case of soap & detergents plants ‘‘ ‘‘

18.08M tonnes, compared with 18.1M tonnes in 2021 and 19.1M tonnes in 2020 (see Figure 3, below left).

A labour shortage at oil palm plantations has worsened since 2020, when the Malaysian government temporarily suspended the hiring of foreign workers to control the spread of COVID-19, according to Ahmad Parveez Ghulam Kadir, director general of the Malaysian Palm Oil Board.

"The decision severely affected Malaysian crude palm oil (CPO) production as the sector is highly dependent on foreign workers," he said in a presentation to the POINTERS seminar.

The suspension on hiring foreign workers was lifted in September but despite the move, the labour situation in the oil palm plantation sector failed to recover significantly.

"The labour situation is expected to stabilise in 2023 as the application for foreign workers has been approved in stages," Kadir said.

In Indonesia, a slight increase in CPO production is expected, mainly due to newly mature planted areas coming into harvest. Indonesia's production for 2022 is forecast at 46.6M tonnes, compared with 44.7M tonnes in 2021 and 43M tonnes in 2020.

Both Malaysia and Indonesia have experienced higher than usual levels of rain, which has caused floods in major oil palm planted areas and has negatively impacted production.

The US National Oceanic and Atmospheric Administration (NOAA)’s Climate Prediction Center estimated that that there was a 91% chance of La Niña weather conditions continuing through November 2022. This tends to create drought and dry conditions in many parts of the world, including Brazil, Argentina and the USA, while bringing additional rain to areas such as Australia and parts of Asia.

This would suggest higher palm oil production in the second and third quarters of 2023.

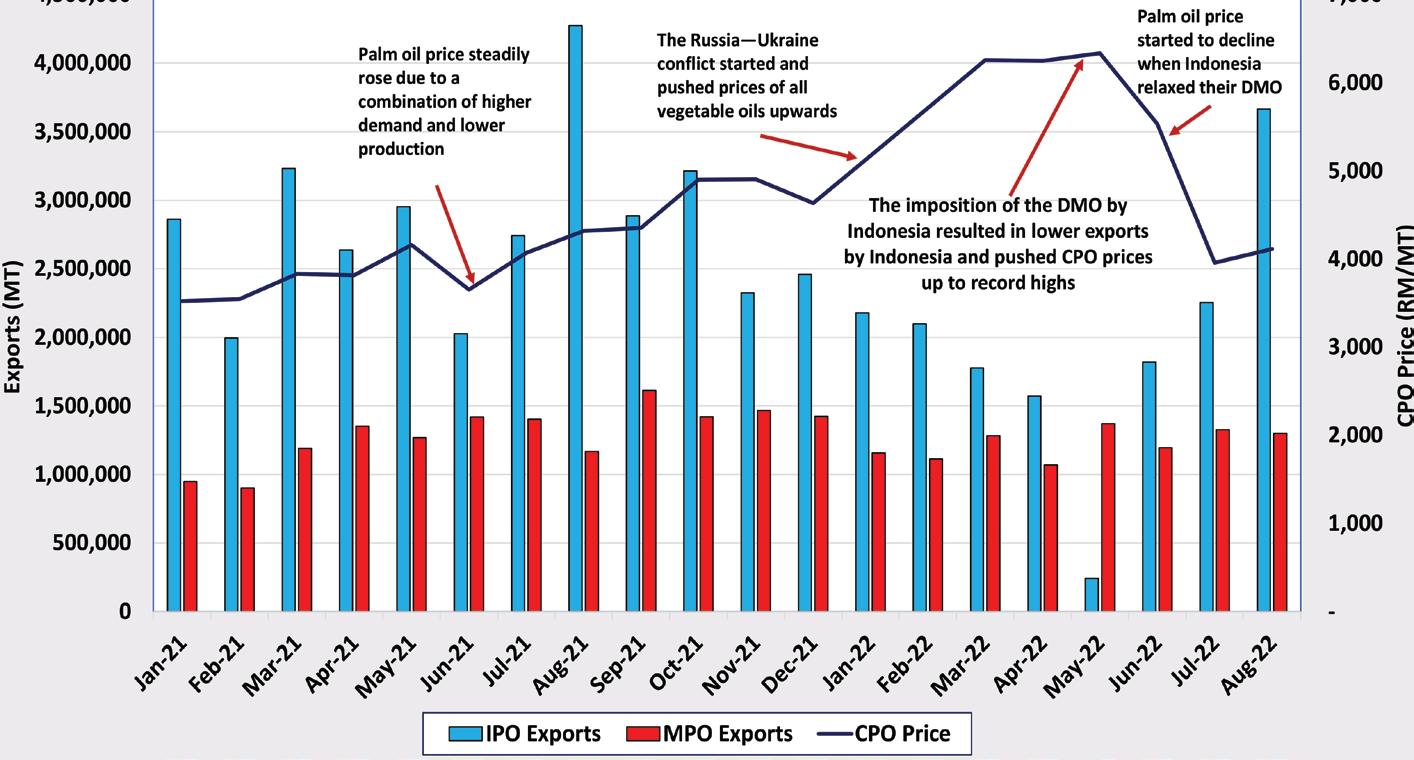

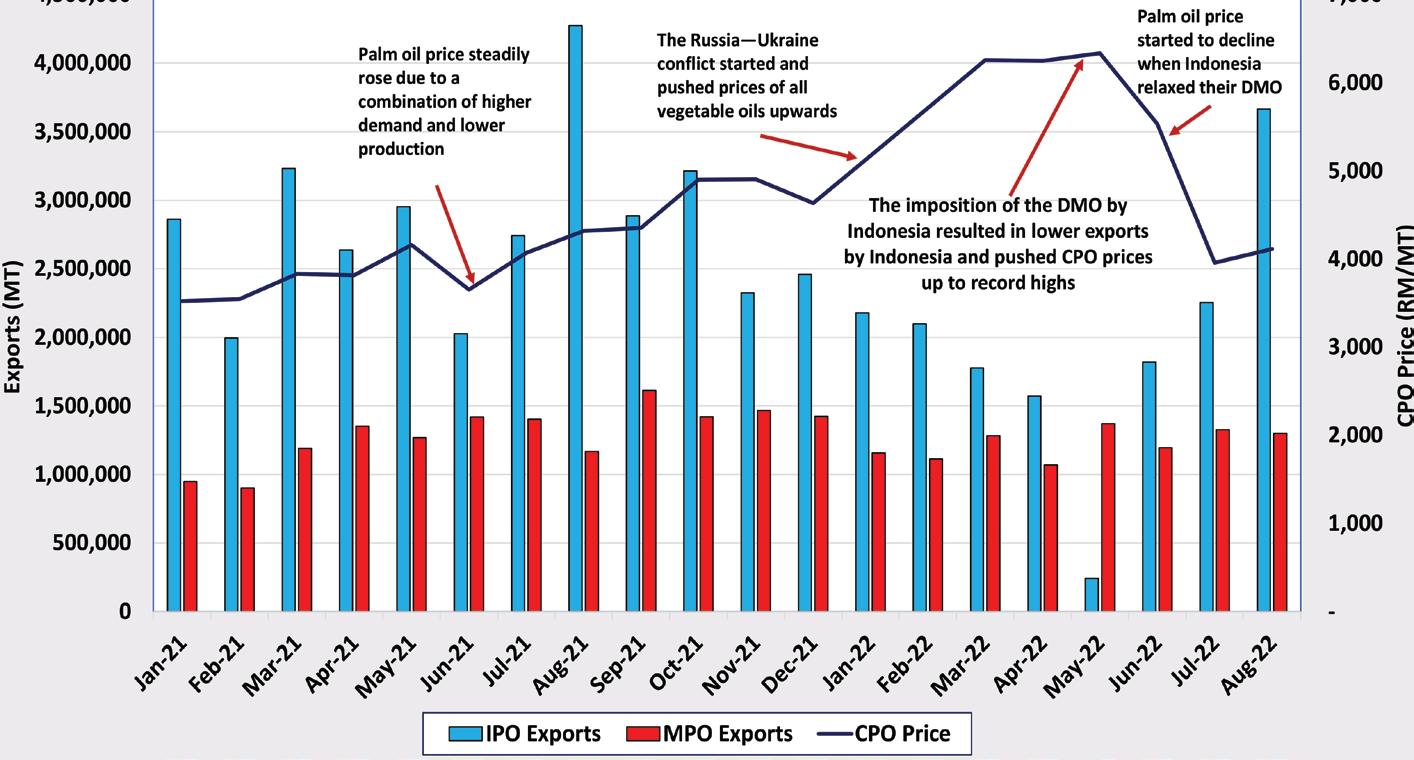

As the largest producer of palm oil, Indonesia has implemented various policy measures since the start of 2022 to ensure supply availability and stabilise prices.

In January, it issued a mandate for palm oil producers to set aside 20% of their crude palm oil shipments for local buyers before they could receive export permits. This Domestic Market Order (DMO) was raised to 30% from 10 March and a threeweek export ban on palm oil products was also introduced in late April.

u 24 OFI – JANUARY 2023 www.ofimagazine.com

u

restrictions

in lower PALM OIL Figure 3: Malaysia vs Indonesia, palm oil area, yield and production

Oil

Figure 1: Global oils and fats production

Oil

2: Global oils and fats exports Source: Oil

estimates Table 1: Global palm oil scenario – 2019-2022 Figure 3: Malaysia vs Indonesia, palm oil area, yield and production

POINTERS, 14-18 November 2022

The

resulted

Source:

World/MPOC

Source:

World Figure

World/MPOC

Source:

exports and pushed CPO prices to record highs (see Figure 4, above). In June, the government relaxed the ruling to ease the high level of stocks which had built up and prices started to decline. From 15 July-31 August, Indonesia also removed the export levy on palm oil and this waiver was extended until the end of 2022, subject to the palm oil reference prices staying below US$800/tonne.

Stocks and prices

Malaysian palm oil stocks had been declining from December 2021 to April 2022 and this was reflected in high prices as stock levels have an inverse relationship to prices.

Since May 2022, Malaysian stock levels have increased and prices have declined. In September 2022, Malaysian palm oil stocks

exceeded 2.3M tonnes, the highest level in 18 months. This resulted in prices declining to their lowest level since June 2021.

According to Kadir, Indonesian palm oil stocks are expected to fall around 5-6M tonnes by early 2023 due to lower production growth, higher stocks and allocation to biodiesel.

"The expected resumption of the country's export levy in 2023 is expected to lift palm oil prices as the price discount to soyabean oil is expected to narrow," he said. "In contrast, Malaysian palm oil stocks are expected to increase due to stiff competition from Indonesia."

At the 18th Indonesian Palm Oil Conference (IPOC) from 2-4 November, leading market analysts such as Thomas Mielke of Oil World, James Fry of LMC International, UK, and Dorab Mistry of

Godrej International all agreed that palm oil prices would remain firm and above RM4,000/tonne until second quarter 2023.

Outlook