Payment Processing Handbook

Welcome to CUPAY Merchant Services

Thank you for choosing CUPAY Merchant Services as your payment processing partner. We are committed to providing quality merchant services with exceptional support. Our international presence allows us to offer many services, state-of-the-art terminal hardware, and eCommerce payment options.

For more information regarding our products and services, please contact us at: info@cupay.ca

RUNNING TRANSACTIONS

Your terminal is pre-programmed and ready to be used. We invite you to power it on and begin running transactions. If you run into any problems or just need a little help getting started, one of our expert technicians is available to guide you through the process.

Please call us at 1 888 99 CUPAY, we are available 24 hrs/day, 7 days/week.

ONLINE REPORTING

Accessing your statements is easy through our online Merchant Dashboard. Monthly processing statements are available to you online, 24 hours/day, 7 days/week. You will also have access to a full-featured online reporting tool, so you can continuously monitor your business from anywhere. Your login details have been emailed to you.

For more information, please contact our Client Care Team at: Telephone: 1 888 99 CUPAY Email: support@cupay.ca

ABOUT US

We are the payment technology partner of thriving brands. We provide the payment intelligence and technology businesses need to succeed locally and globally, through one integration — propelling them further, faster.

We support a wide range of businesses with the technology, expertise, and customer service they need to stand out. Backed by our full service, globally-connected platform, our vision is to build a network in which entrepreneurs can truly thrive.

SOCIAL MEDIA NETWORKS

As part of CUPAY Merchant Services’ commitment to providing more value to its clients, we have made it our goal to reach out to business owners using online social networking sites.

CONTACT US

At CUPAY Merchant Services, we value your business and encourage you to call if you require assistance with your payment processing needs.

Merchant Support

Phone: 1 888 99 CUPAY

Fax: 1 866 304-8702

Hours: 24 hrs/day, 7 days/week

Customer Service

American Express: 1 800 445-2639

Hours: 24 hrs/day, 7 days/week

Voice Authorization

American Express: 1 800 528-2121

Hours: 24 hrs/day, 7 days/week

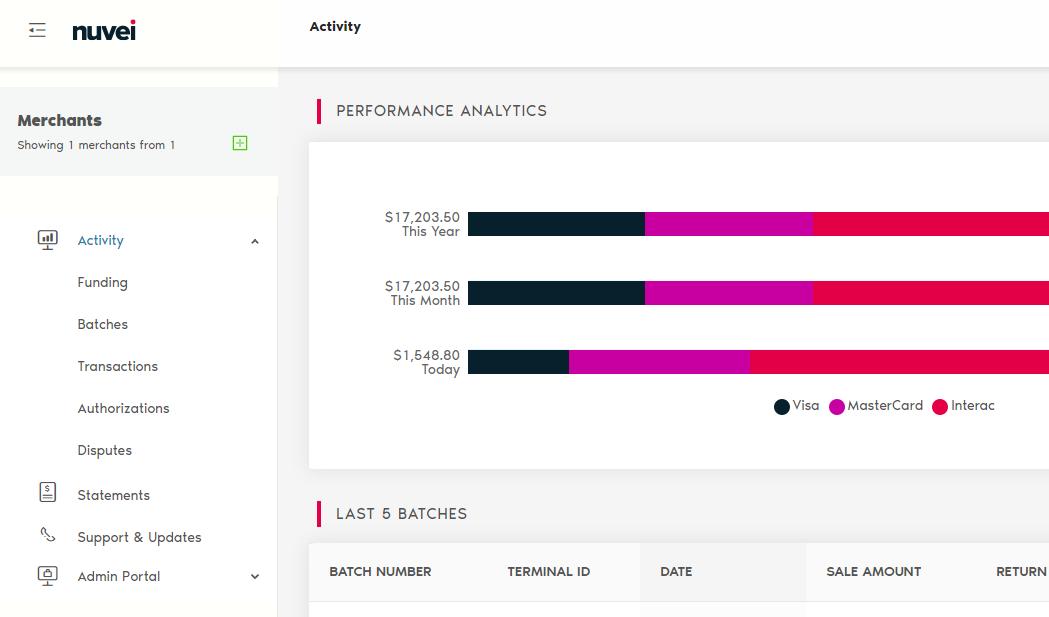

Merchant Dashboard

TRACK YOUR BUSINESS

Merchant Dashboard is an online reporting tool giving you access to payment information and the ability to manage your merchant account data anytime, anywhere.

MANAGE YOUR BUSINESS BETTER & EASIER

View statements and extract detailed reports in CSV format.

GET INFORMED ABOUT CREDIT & DEBIT CARD TRENDS

Chart transaction percentages by date range or individual card type.

VIEW YOUR TRANSACTIONS AT A

GLANCE

Check daily, monthly, and annual sales data for powerful business intelligence.

MANAGE USER PERMISSIONS

Assign different permission levels for different users. Control and manage what sections and locations each user is able to access.

Merchant Dashboard allows business owners to securely view reports anywhere there is an internet connection.

Merchant Dashboard (continued)

MERCHANT ACCOUNT INFORMATION AT A GLANCE

Merchant Dashboard displays your complete merchant profile, allowing you to browse your merchant account right from the homepage. The dashboard gives an overview of recent account activity.

STAY INFORMED WITH DETAILED TRANSACTION REPORTING

You can quickly view transaction data by day, month or year-to-date. You can drill down to see individual transaction details for more complete information. Managing financials just got a whole lot easier with the Merchant Dashboard.

SEARCH SMARTER, NOT HARDER

Imagine never having to look through the filing cabinet or a stack of invoices for a transaction again. Our Merchant Dashboard is your gateway to better reporting by helping locate transactions individually or by batch. Our smart search feature allows filtering of transactions by any criteria: date range, batch number, sales or return dollar amount or terminal ID.

CUSTOM REPORTS ON YOUR TERMS

Quickly and easily view batches, disputes, funding, statements and basic merchant account information with a few simple clicks. To better maintain financials, Merchant Dashboard offers the ability to export reports in Excel format to be used with many preferred accounting software solutions.

BUSINESS COACH ANALYTICS AND SOCIAL MEDIA DASHBOARD

Business Coach is an all-in-one data analytics and social media monitoring dashboard, embedded directly into your Merchant Dashboard. It delivers actionable, relevant insights, you can use to grow your business.

PC, MAC, TABLET & SMARTPHONE COMPATIBLE

Access your statements and extract detailed reports anytime, wherever you are.

Log in today at: https://merchant.nuvei.com

PCI Compliance

WHO ARE THE FOUNDERS OF THE PCI SECURITY STANDARDS COUNCIL?

Founders of the PCI Security Standards Council are American Express, Discover Financial Services, JCB, Mastercard Worldwide and Visa International.

WHAT IS THE PAYMENT CARD INDUSTRY (PCI) DATA SECURITY STANDARD (DSS)?

The PCI Data Security Standard represents a common set of industry tools and measurements to help ensure the safe handling of sensitive information. Initially created by aligning Visa’s Account Information Security (AIS)/ Cardholder Information Security (CISP) Programs with Mastercard’s Site Data Protection (SDP) program and Discover Information Security Compliance (DISC), the standard provides an actionable framework for developing a robust account data security process—including preventing, detecting and reacting to security incidents.

The core of the PCI DSS is a group of principles and accompanying requirements, around which the specific elements of the DSS are organized:

BUILD AND MAINTAIN A SECURE NETWORK

• Requirement 1: Install and maintain a firewall configuration to protect cardholder data

• Requirement 2: Do not use vendorsupplied defaults for system passwords and other security parameters

PROTECT CARDHOLDER

DATA

• Requirement 3: Protect stored cardholder data

• Requirement 4: Encrypt transmission of cardholder data across open, public networks

MAINTAIN A VULNERABILITY MANAGEMENT PROGRAM

• Requirement 5: Use and regularly update anti-virus software

• Requirement 6: Develop and maintain secure systems and applications

IMPLEMENT STRONG ACCESS CONTROL MEASURES

• Requirement 7: Restrict access to cardholder data by business on a needto-know basis

• Requirement 8: Assign a unique ID to each person with computer access

• Requirement 9: Restrict physical access to cardholder data

REGULARLY MONITOR AND TEST NETWORKS

• Requirement 10: Track and monitor all access to network resources and cardholder data

• Requirement 11: Regularly test security systems and processes

MAINTAIN AN INFORMATION SECURITY POLICY

• Requirement 12: Maintain a policy addressing information security

Avoiding Chargebacks

Chargebacks occur when your customers contact their credit card issuing bank to initiate a refund for purchases made on their card.

CHARGEBACK MANAGEMENT:

• Use a clear company name customers will recognize. An unrecognized DBA name on billing statements is one of the most common causes of chargebacks.

• Be reachable (put your company phone number and/or website on your invoices) and communicate promptly . A limited amount of time (10 business days) is available to resolve a chargeback.

• Obtain authorization for the full amount of the sale. Declined transactions should not be accepted or split into smaller amounts.

• Encourage Chip & PIN payments.

• Use the fraud services offered by the Processing Bank including AVS (Address Verification), CID and CVV2.

• Never accept an expired credit card.

• Clearly state your refund policy on your website and in your business location.

• Establish a clear policy in case of complaints regarding product quality. Work closely with the customer to establish a mutually satisfactory resolution.

Fraud Protection Guide

Be alert when purchases are made through the phone or over the internet. Several common fraud schemes begin this way.

FRAUD - WHAT TO LOOK FOR:

• Customers emailing credit card numbers. Always follow up email orders with a telephone call.

• Customer offering more than one card. While many of us do carry more than one credit card in our wallet, it is not usual for a customer to try different credit card numbers after repeated declines or similar error messages.

• Orders placed by a telephone relay service. Fraudsters use these services to gain the sympathy and trust of a merchant, then obtain products with a stolen card.

• Customers who seem to care little for the finer details of their order. Fraudsters will often seem careless to the amount being charged, the colors, sizes, models, etc.

• Be wary of orders with domestic billing addresses and international shipping addresses.

• Most cardholders will be confident in the buying power of their credit card. If a customer is contacting you to confirm if the transaction was successful, or to obtain the 6-digit authorization code received on your terminal, you should regard that customer as suspicious.

• Messages to look out for: Lost Card (or LC, combined with another message like Please Call), Do Not Honour, Pick Up Card, Restricted Card, Please Call. If you get these messages, please call our client care center.

• Wire scams. Be suspicious when a customer who shops online requests the value of the purchased item as well as an additional amount of money to be charged on their credit card. Fraudsters would typically request the excess amount to be wired to them through a currency exchange office to presumably pay for alternate shipping arrangements.

Our Merchant Success Team is here to help. If you have any questions about fraud protection, do not hesitate to contact us:

1 888 99 CUPAY support@cupay.ca

Products & Services

We realize that one size doesn’t fit all. That’s why we’ve developed industry-specific solutions that help our clients make more money for their business.

We cater our solutions specifically to your business type, helping you thrive in a world of fast changing technology.

INTERAC DEBIT CARD CASHBACK

Increase your client’s satisfaction with the Debit Card Cashback option and give them the convenience to withdraw money during transactions.

INSTALLMENTS ENABLED BY VISA - BUY NOW, PAY LATER

Consumers want flexible payment options. Provide Buy Now, Pay Later options to help improve sales and conversion rates. Plus, gain loyal customers thankful for the additional payment option. Find out more or sign up at: https://e.nuvei.com/installments

66% of Canadians see installment payments as a convenient way to pay for a purchase, and say that having this option available increases their likelihood to spend more on a given purchase.

For more information or to order any of these products and services, contact our Merchant Success Team at 1 888 99 CUPAY .