The Finance and Investment Club O C T O B E R DEALS BREWERY COVER STORY MINI BUDGET GONE WRONG ANUBHAV KATHAN TWITTER HOSTILE TAKOVER THE FALL OF ASIAN TIGERS NIVESHAK NIVESHAK

Dear Niveshaks,

We are delighted to present the October edition of Niveshak October was the month of festivals, with the stock market celebrating Muharat trading The one hour special trading session saw Sensex climb 525 points and NIFTY soar above 17,000. The same could not be said for the Indian rupee with it touching a record low of 83.002 against the dollar. Despite inflationary headwinds, Indian stock markets remained a bright spot, and October ended on a positive note, with NIFTY crossing the 18,000 barrier

We begin the magazine with "The Month That Was" a segment covering the world's key financial and economic happenings This month we covered the mammoth penalty imposed by the CCI of google, digital banking units, the falling Indian rupee, and much more

Liz Truss's Mini Budget remained a hot topic for discussion, which has been covered in depth in the cover story section of our magazine. The story investigates the rationale behind implementing substantial

N O T E

TEAM NIVESHAK

NIVESHAK

Nikhil Chadha

Aayush Jain

Akriti K. Shashwati A.

Darshan K.

Aagam Parikh Akshat Sharma

Unnati Tanwar

Mayank Goenka

Sankalp Parakh Shantanu M.K. Tanya Sharma

Pulkit Gubgotra Sahishnu S

Vikram Mathur

Abhinandan Jain Amit Tyagi

E D I T O R ' S

Q U I N ' A V A N C E P A S R E C U L E

NIVEsHAK

Gaurav Soni

C T O B E R

O

ax cuts and the infamous U turn which led Rishi Sunak to become the first British Asian prime minister of the UK

In this edition FinView, we invited Mr. Vineet Suchanti, managing director of the financial services firm KEYNOTE With him, we explored various themes, including stock markets, evolving regulatory requirements in banking, and much more

In the "Know your sector" segment, we explored the niche industry of defence. Our primary focus remained on "Atmanirbhar Bharat" and how this desire for self sufficiency is a crucial tailwind for growth The article also covers the role of the "Russian disruption" and how it can act as a catalyst for change

Elon Musk's acquisition of Twitter became the theme of our Deals Brewery section The article covers the unique angles of the takeover, including Elon's stake, which is increasing to 9%, Financing steps, and his possible retraction strategy to get out of the deal. It also covers the deal execution and Elon's likely plans for the company.

The "Fin Supervise" section explores the theme of a Hindu United Family and the tax benefits one could have just by being a part of this family This segment discusses various deductions, exemptions, and also some possible drawbacks "Anubhav Kathan" or learning from experiences, covers the Asian financial crises of 1997 It covers the role of government, currency devaluations, global response, and finally, learnings from the crises

The 'Let's FinUp' section again comes with an enjoyable puzzle The game is called "Guess The Company" where readers, in the set of six questions, need to identify organizations based on given hints

We would love to hear your thoughts, feedback, and ideas. Please feel free to reach out to us to let us know what you think!

We hope you derive something from this edition and stay safe and sound in these exciting times!

Stay Invested, Team Niveshak

All images, design, and artwork are copyright of IIM Shillong Finance Club © Finance Club Indian Institute of Management, Shillong

Disclaimer: The views presented are the opinion/work of the individual author and the Finance Club of IIM Shillong bears no responsibility whatsoever.

STAYINVESTED

STAY INVESTED

N I V E S H A K

CONTENT THEMONTHTHATWAS THE FINANCE BULLETIN Page 5-6 THENIVESHAKINVESTMENT FUND MONTHLY PERFORMANCE Page 7-8 COVERSTORY THE MINI BUDGET CRISIS Page 9-12 FINVIEW IN CONVERSATION WITH VINEET SUCHANTI Page 13-16

KNOWYOURSECTOR

DEFENCE INDUSTRY

Page 17-18

ARTICLEOFTHEMONTH

CENTRAL BANK DIGITAL CURRENCY

Page 19-22

DEALSBREWERY

HOSTILE TAKEOVER OF TWITTER

Page 23-24

FINSUPERVISE

TAX BENEFITS OF HUF

Page 25-26

ANUBHAVKATHAN

THE FALL OF ASIAN TIGERS

Page 27-28

LET'SFIN-UP

GUESS THE FIRM Page 29-30

CCI Penalty on Google

The Competition Commission of India imposed two penalties of ₹ 1,338 Cr and ₹ 936 44 Cr on Google in the month of October The first fine was related to anti competitive practices related to the Android OS on smartphones in the country Google was found abusing its position with respect to manufacturers and forcing them to use Google version of Android if they are to use Google’s proprietary applications such as Google Maps or Gmail. Google ensured these devices also had to carry Google’s search widget and an entire suite of Google applications without giving the manufacturers or users the choice to delete them

The second order was related to Google’s practices relating to the Play Store The Play Store is like a retailer from which users can download applications of their choice If, for example, a developer lists their Gym and Training app and requires users to pay a monthly subscription, It demands that since the application was downloaded from the Play Store, the subscription amount

must go through Google, every time a payment is made. Google pockets a hefty 15 30% service fee whereas other application aggregators charge a fee of roughly 1 3%.

Launch of Digital Banking Units

75 Digital Banking Units (DBU) were dedicated in 75 different districts of the country. Twelve private banks, 11 public sector banks, and one small finance bank participated in opening these units. A DBU is a physical brick and mortar unit delivering basic digital banking infrastructure, including services like loan application, FD investments, funds transfer, new account opening, tax payments, applications for credit or debit cards, etc It will have an assisted mode where a bank staff will be present to help in the transactions and a self service way where the customers will perform all the tasks independently. Such a step aims to improve digital banking literacy with a special focus on education on cybersecurity and digital banking accessibility to every corner of the country

NIVESHAK

T H E M O N T H T H A T W A S

T H E F I N A N C E B U L L E T I N

NIVESHAK 05 O C T O B E R

Goodbye, old friend!

Cartoon Network, which was the home to various shows such as ‘The Powerpuff Girls’, ‘Dexter’s Laboratory’, ‘Scooby Doo’ is going to merge with Warner Bros Animation On 12th Oct, 2022, Warner Bros Discovery, the parent company of Cartoon Network Studio (CNS) announced the merger of CNS with Warner Bros. Animation as part of their restructuring process. Warner Bros. Studios has called the merger of the animation teams a part of their “strategic realignment” While the two animation studios will share development and production teams, all labels and content will be retained by the original studio The consolidation is a part of cost cutting measures being undertaken by Warner Bros Discovery.

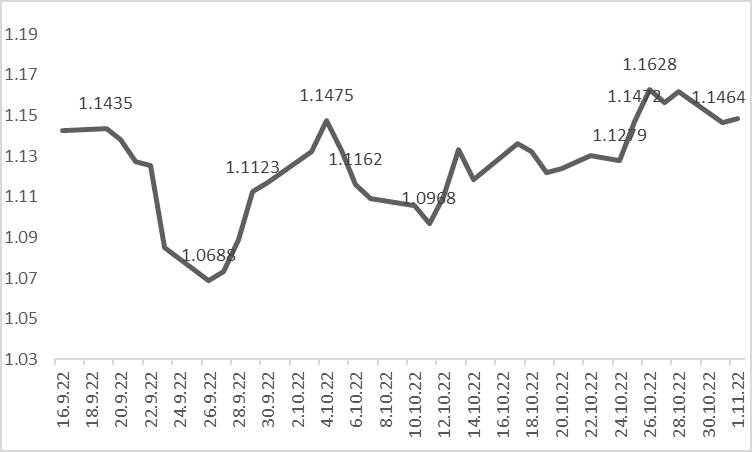

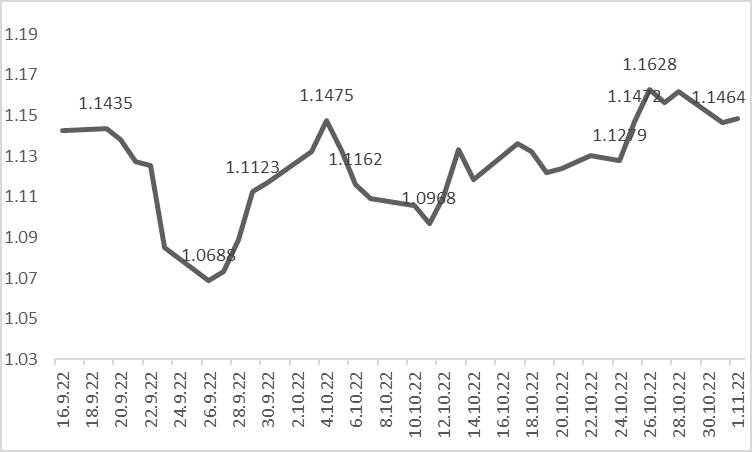

INR slips to all-time low versus the USD

The Indian Rupee has lost approximately 10% of its value against the US Dollar in the calendar year The US Fed rate is presently in the 3.75 4% range and the greenback is acting as a safe haven against most of the volatile currencies. Further, the US faring much better than it’s European counterparts does not leave investors with much of a choice but to invest in the US and pump up the value of the dollar The INR has done well against other currencies. It has soared 12% against the British Pound, 8% versus the Euro and 18% against the Yen in this year itself. Finance Minister Nirmala Sitharaman recently commented, “I would look

at it as not (the) rupee sliding, I would look at it as (the) dollar strengthening”

INR v USD in 2022

Source: Statista

Mandatory Tokenisation

All the credit or debit card details of a customer, which the merchant stores, need to be deleted and replaced by a tokenization system. This system generates a random string of cryptic code for every card and will be stored in the merchant's database

If the merchant in its operating system has not implemented this change by October 1, 2022, it will no longer be able to save the card details of a customer, forcing them to enter their card details every time they try to purchase something from the merchant. This step is essential to prevent any cyber attacks and data breaches, thus providing customers with an additional layer of security. It also streamlines the card storage compliance for the merchants as they only need to store one token code for a card instead of a couple of data related to one card

Debit/Credit Card Fraud

4,000 3,000 2,000 1,000 0

Source: Mint

2017 2018 2019 2020 2021

N I V E S

A K 06 STAY INVESTED

H

3432

To foster classroom learnings in the practical world with an intent to generate long term capital appreciation by investing in companies across large cap, mid cap and small cap brackets However, there is no assurance that the scheme's objective will be realized The Scheme will invest in Equities as notified in NIFTY 500. Portfolio construction will be based on bottom up/top down stock picking

NIVESHAK A U G U S TS 106 95 As on 31st Oct 2022 Large Mid Small Value Blend Growth Style S i z e N I V E S H A K I N V E S T M E N T F U N D T H E F A C T S H E E T NIVESHAK 07 O C T O B E R October Fund Performance Benchmark Return 1M Return AUM (₹) NAV (₹) Index 1M Return +1 87% As on 31st Oct 2022 1 44 Lakhs As on 31st Oct 2022 NIFTY 50 +5 37% As on 31st Oct 2022 Investment Objective

Performance & Other Metrics Equity Style Box Cap Wise Allocation 65 60% 27.10% 7.20% Large Mid Small *asofOctober31st,2022

NIF Insights

The banking sector saw a significant rise as firms posted impressive results on the back of higher Net interest margins.

The automotive sector index saw a rise of 5 37% in the month of October on account of easing Semiconductor supply chain issues,

0% 10% 20% 30% Banks Capital Goods Automobiles & Components Energy Food, Beverage & Tobacco Software & Services Materials Pharmaceuticals, Biotechnology Consumer Durables & Apparel 844% Asset Allocation 10 Year Indian Bond YTM Repo Rate US Fed Funds Effective Rates USD INR Generic 1st Crude Oil, Brent 7 45% 5 90% 3.08% 82.79 7,126 PMI PMI Manufacturing PMI Services Industrial Production Index India CPI Combined YoY 55 10 55 10 54.30 0.80 7.41 N I V E S H A K 08 STAY INVESTED Sectoral Allocation 28.37% 21.84% 18.77% 09 56% 07 64% 05.96% 03.47% 02 85% 01 53% Best & Worst Performing Stocks Worst Performing stock Best Performing stock *asofOctober31st,2022 basedonthepurchaseprices.Onlyaccountsforstocksthatexistintheactiveportfolioasof October31st,2022. Banks Consumer Durables 27 20% 18 08% of Assets invested in Equities C a s h Tracking Macroeconomic

Indicators

C O V E R S T O R Y

The Rise

With the promise of reducing the cost of living within the country and reducing the taxes if elected as prime minister, on July 10th, Luiz truss announced that she would be running in the conservative party election, replacing Boris Johnson Post successfully winning the election, on September 10th, she and her cabinet took pledges and started their new journey. As promised, she immediately announced the Energy price guarantee for two years to help the public with the rising cost of living.

This measure would put an upper limit on the average household bills to £2500 per year On average, every household was expected to save £1000 from this measure from October 1st at the prevailing energy prices The cap on energy prices was expected to reduce inflation within the country by 5%.

Although this may sound like the right way to help people in your country, the government will have to increase their borrowing by nearly 60B over the next six months, pushing their lending to the third highest level since WW2 and way beyond the government’s previous projections

conversion rate for USD (GBPUSD)

" I A M A F I G H T E R N O T A Q U I T E R "

NIVESHAK 09

C T O B E R

O

Source Institute for Financial studies

1GBP

The beginning of the end

Soon after such a measure, Chancellor Kwasi Kwarteng introduced a “Mini Budget.” The term mini here is used in relative terms as this was not an actual budget, but the impact this had on the government and market sentiment was not mini in any way. These announcements were again a historic measure as this was the highest tax cut proposed since 1972, almost 1 5% of the GDP “Tax cuts” is the simplest way to describe the measures announced in the mini budget These were as follows

1.

Income Tax

The most impactful tax cut was on the income tax, which was earlier at 20% and will be 19% from the next fiscal year. It aimed to help people with a higher cost of living and increase their disposable income A person was expected to have £170 of savings from this move

Similarly, an additional tax rate of 45% for the higher income bracket would also be slashed to 40% This would help nearly 6,60,000 people with almost £10,000 in savings.

2. National Insurance

NIC contributions which were hiked in April earlier this year by 1 25% by the previous government, were to be revoked, helping both employees and employers as they have to pay 1 25% less in the contribution

This would impact nearly 28 million of the population and help them save an extra £330, while the corporations would also keep a portion of their profits due to reduced costs.

NIC National Insurance contributions are very similar to how pension schemes work in our country, where the employer, employee pay a certain amount, the only difference is the purpose for which this is used and also self employed people have to pay this form of tax

3 Dividend

Similar to a reduction of 1 25% in the NIC contribution, an equal measure introduced in April this year would be reversed on the dividend.

All these measures were to help the people save more of their earnings and reduce the tax burden on them, helping them deal with the rising cost of living caused due to an unprecedented rise in inflation

Such policy measures aimed to help firms and other entities spend more and have more liquidity alongside the main objective of helping revive economic growth This was utterly contrary to the stance and plans of the previous government and Finance minister, Rishi Sunak.

The picture is more complex; it is true that the people would have more to spend and would help in dealing with inflation, but someone has to pay for all these expenses, i e The Government

N I V E S H A K 10 STAY INVESTED

These tax cuts were speculated to be funded through government borrowings These changes would cost an overall £45B to the government as there needed to be more clarification given on how the government was planning on financing these tax cuts

When coupled with the borrowings the government would take for the Energy price guarantee, we can see a considerable increase in the expected borrowings by the government. This had a major impact on the government yields as they rose to record highs

The markets did not spare the government for their radical economic policy

The pound went to a record low level against the US dollar This was accompanied by a considerable fall in the prices of the UK Gilts as there was a massive selling of both these assets in the market post the announcement of the mini budget

GILTS The bonds issued by governments while borrowing money is called Gilt Gilt is popularly used in the reference of UK, while other countries may call it G Sec etc

This poses a lot of risk in the current volatile and high inflation environment, as pumping in so much liquidity could further fuel inflation as the money supply would increase rather than giving a boost to growth within the economy, this could push the prices of commodities up. This coupled with higher interest rates and geo political uncertainties form the perfect circumstances for an experiment the government was undertaking with the economic stability

A significant drawback of this proposed budget was that OBR was not taken into the loop, which was not required in measures such as the Energy price guarantee. Still, for actions that had permanent tax implications in the economy, this was an essential part of the process which was avoided and hence was further criticized by all major stakeholders The assessment by OBR could have helped them understand the possible consequences, not only short term but also long term

The U-Turn

NIVESHAK 11 O C T O B E R

UK GILT 10YR Yields

Source Bloomberg

Source Bloomberg

(GBPUSD)

1GBP conversion rate for USD

The Interventions

The Bank of England was also not informed about these tax cuts, and further had to enter and buy the UK Bonds being sold on a spree to prevent the increase of yields (Interest rates) on these bonds, scraping the plan they had announced earlier to buy these bonds.

There was also a subsequent increase in mortgage rates within the country and a fall in housing prices

Along with this, BOE also had to increase the repo by 75 basis points which was higher than previous increments of 50 basis points.

Interest rate hikes

Injecting demand into the economy also goes against the Bank of England which is moving towards increasing the interest rate and reducing the money supply in the economy. The gravity of the situation became so intense that the International monetary fund (IMF) also criticized the government’s measures and claimed that these measures would increase the economic inequality within the country

Redemption?

Post heavy criticism, Lis truss sacked her finance minister and replaced by Jeremy hunt, alongside an apology by truss regarding the economic policy announced

One of the first tasks undertaken by Jeremy was to reverse most of the economic reforms announced, except a few.

All the Tax cuts were scrapped except the reduction in NIC contribution and stamp duty cut Alongside this, the Energy price guarantee timeline was reduced to 6 months from the two years announced earlier This would now reduce the expected borrowings by nearly £32B.

The main objective was to stabilize the markets, which was achieved as the pound recovered slightly alongside a reduction in borrowing costs after the announcements of the reversal of measures

Post these U turns announced and resignation from her party in the form of her National secretary and losing the confidence of many others within the cohort under her leadership, Lis Truss announced her resignation, having the shortest tenure as the UK prime minister of just 45 days.

This paved the way for the rise of Rishi Sunak as the new Prime Minister, who has promised to bring back economic and financial stability to the country After all, he was proven correct as he always questioned the policies of Liz truss and mentioned that they would bring financial instability

12 STAY INVESTED

N I V E S H A K

Source Bank of England

F I N V I E W

Mr. Vineet

MD

MD

Suchanti

Could you tell us about your 3 decade journey at KEYNOTE? Some of the learnings, unique features, how you overcame numerous challenges, and anything you believe is relevant to young aspirants like us to learn and imbibe?

Let me give you a brief background of what Keynote is Keynote is a full service boutique Investment Bank & Advisory practice supported with its brokerage license and proprietary book. The firm started in 1993 I completed my Under graduation in Mumbai from Sydenham College of Commerce and economics. I completed my Master's in finance and marketing from the University of Rochester Simony, the William E Simon School of Business Before my Master's, I worked in the advertising business for two to three years We, as a family, also own a company called concept communication, which is a leader in financial communication, advertising,and PR business for three years

There, I used to deal predominantly with investment bankers who were our clients. Keynote, too had the aspirations. And that's when I started feeling that the world of investment banking is very interesting and powerful Because the job of an investment banker is to advise companies on how to raise money, advise on various aspects of M&A to enter into every aspect of the financial world, but through the mentorship of a senior advisor, we decided to be focused and build a boutique investment bank where the cornerstone of our business is Lifecycle Advisory services One of the key learnings from the last three decades of running Keynote has been that while investment banking is the sort of gateway, you do make more money on managing funds and proprietary investments.

There is an evolving demand for regulatory compliance in investment banking like the adoption of Basel 3 norms. How does this added layer of complexity affect the cost of doing business? What is your view on this regulatory driven business approach?

NIVESHAK

13

C T O B E R NIVESHAK

S

P O T L I G H T F O R S U C C E S S

O

Keynote Corporate Services Ltd

I firmly believe that the world is hard to change unless things are made mandatory. For example, if you make emission norms voluntary, the environment changes by only 5 or 10%. In my opinion, SEBI has a significant role in India's capital markets SEBI strikes a balance between Investor Protection disclosures, reducing market fraud, and developing

capital markets. Let's remember that a true regulator's role is to control and protect markets, ensure their discipline, and grow and develop them by ensuring more retail or institutional participants, domestic or global. And if you look at the numbers, it's incredible that the mutual fund industry in India has grown through the roof into lakhs of crores, possibly 20 lakh crores of money being managed. Twenty years ago, this was a 20,000 or 10,000 Crore market Monthly investments in SIP schemes top Rs. 13,000 crores on a monthly basis The regulators are trying to incorporate best practices from around the world, so there's a considerable evolution Basil's three norms pertain more to commercial banking than investment banking or capital markets. I think, if you were to look at the whole banking sector, the entire framework on which a bank was built, where the number of branches determined the number of customers you could have is now changing So, people are challenging the basic fundamentals based on technology and digitization With digitalization and impersonal customer relationships

it's essential to meet capital structure and CASA norms, and as a bank, you are safe and secure.Many public sector banks have merged, as you probably know. The plan is to have five or six public sector banks and rationalise all branches I think it's good, but there will be tough years when these rules are implemented, and growth suffers On a macro level, unless you implement this, you won't have sound financial markets, which is essential for any economy to grow and function, especially in India, where financial inclusion is still low, and banking penetration has a long way to go Whether it's multilingual banking apps, capital market products, or wealth management products, they're trying to take shape. You've seen Zerodha's phenomenal growth, and other brokerage firms and banks are trying to grow similarly. So, all in all, I'm in favor of regulation I think regulation is something that keeps evolving It's not one set of rules that get implemented Regulating is essential, but so is monitoring it

Do you think that craze of new age start ups getting listed is getting over and the ball has again fallen in the court of the traditional businesses with stable earnings and reasonable valuation?

So, I think that one question of yours contains many questions So, I'm a firm believer that you need a reasonably vibrant environment for the start up world The question of valuation is always broad, whether this is the proper valuation or overpriced, whether you're going to value a company based on page views, number of customers, GMV,

INVESTED

N I V E S H A K 14

STAY

earnings etc , so a lot is going on there. The short point is that valuation will rise or fall, a function of external markets It is also affected by the amount of money available. However, I believe that these businesses are here to stay People's lifestyles are changing, as are the products they purchase There could be some froth to it, as there will always be some businesses that fail and some businesses that will succeed However, it is a new area posing a threat to traditional companies. And I'm seeing that every conventional business is pulling up their socks to say how can they use technology to their advantage So, I believe the key lies in identifying successful companies, whether traditional or new that are using technology to grow their business to scale and size.. Those are exciting areas that we are seeing now There will be waves of E commerce, FinTech, and robotic companies, and all of this will continue But that is simply a result of market forces I don't believe any valuation norm will change in the long run It will always be about Cash Flows

The past 3 quarters, especially Q3 have seen a kind of funding winter, in the VC space. Capital Markets too seem to be having a seesaw year. How do you see this panning out over the next few years?

Good businesses will find funding

As you said, the question is at what value, and good managers understand that What is critical is that money is available when they need it. And valuation is just another parameter So it's not only about the valuations Over the years, valuations can be created.

If you're determined to create a market, build a product, or a service, you should be able to have access to that capital The VC community is cautious and waiting to get a good deal as well as continuously evaluating businesses that sustain But I'm also sure that there are good companies getting money, even in the funding winter The last three months have seen VCs re evaluate companies, and that's bound to happen when you have the global turmoil, the US markets tightening up and Europe having its challenges with the war continuing, inflation, energy crisis, and various other geopolitical, challenges on a day to day basis But India is very attractive if you take a five year view.

Q. How do you see the relationship between various global markets playing out? For eg, recently the massive layoffs and significant fall in stock prices while the Indian bourses closed at near record highs. Are we not more connected globally? Are the variables for Indian markets very different?

There is an ongoing debate about whether the Indian markets are decoupled or in tandem with the global markets. The question is that India, as a market the Nifty or the Sensex that's, represents how the Indian markets are functioning. From a global perspective, we had the USD at Rs 75 which is now in the range of Rs. 81 82. At 10% devaluation, looking at it from a foreign investor perspective, suddenly, this country seems a bit cheaper to put money in because your dollars are getting converted at Rs 82 when you invest. And if you are already

15 O C T O B E R NIVESHAK

invested, it looks more expensive because it's more challenging to repatriate your money back And I think that one of the things that we don't consider is that a huge part of the foreign investment is dollar denominated. And that's why we got to look at USD returns rather than only rupee returns And when you put a matrix, you feel that while Indian markets have given you 16 17% CAGR over the last 10 15 years from USD Return perspective, it's a single

digit return So, are there challenges? I would say yes, because a large part of our economy still depends on the flow of investment from the western world. And that does affect the entire economic scenario here So we are coupled from that perspective. The thing that is changed is that the domestic inflow of money has become 5 times the size that it was, which is the retail money that's going into the markets And that's, again, got to do with how capital markets were developed here The momentum is going to continue So the more self reliant we become, the more decoupled we will become But until we reach that point where we rely on our own and depend only on domestic funds we will continue to be impacted by global markets. That's my take on it.

How do you see the Eurozone economies as an investment avenue (primary markets, M&A, bond markets) especially when they are seeing record inflation (10.7% in Oct 2022), a slowing economy, and a looming energy crisis? How do you see the impact of Brexit on the UK and EU economic relationship now?

.Our focus is purely and mainly on India I can share what I see and hear I'm not sure if everyone in the UK feels Brexit was the right step, even though it's a fact Brexit has brought challenges in terms of crossing borders, exporting within the Eurozone community, and a more selfish approach is driven across Europe. France's energy situation isn't as bad as Germany's because Germany has more manufacturing.

Russia plays a prominent role in the energy crisis, I believe. The Eurozone is in a tough spot. Some auto ancillary companies and IT companies have manufacturing facilities in Europe. All face Eurozone challenges today In the midterm, I'm not bullish on the Eurozone state of economy because I believe they will continue to face challenges These countries lack growth and the Euro's fluctuating exchange rate hasn't helped Inflation, high living costs and energy costs have contributed Even if the war ended, it could take a couple of years for the economies to recover. Now, from India's perspective, there is a vast amount of technological research and development in Italy, France, Germany, and the UK. And while India is great at adapting and absorbing some of these technologies, from a research and development perspective, we do not create most of the technological innovations. You can buy out some of these companies, which is an ample opportunity Secondly, China plus one strategy shifting manufacturing to India, which is ongoing and catching pace. I think many backend processes and manufacturing can be moved to India Yes, India should seize this opportunity.

INVESTED

N I V E S H A K

16

STAY

K N O W Y O U R S E C T O R

Introduction

India is the 3rd highest military spender in the world, making the defense sector strategically crucial for the country The defence sector covers combat aircraft, military land vehicles, missiles, submarines, and artillery

The market is expected to grow at a CAGR of about 4% by the year 2026 27, with increased budget allocation and exports. The sector is on positive lines as the government focuses on liberalizing the industry for better production capacity and intends to achieve a production target of $25 billion by 2025.

Atmanirbhar Bharat : A key government intiative

Atmanirbhar, or the desire for self sufficiency, is a crucial tailwind driving the defence manufacturing sector The union budget clearly outlines this sentiment, with over 68% allocation to defence spending compared to about 58% last year This indigenization effort aims to reduce India’s heavy import bill and increase its export capabilities.

The scheme has a multi pronged approach to challenge the existing status quo The primary emphasis is creating a research ecosystem through development centers and project management units.

A big piece of this scheme is the setup of two DICs or defense industrial corridors, the first in Uttar Pradesh and the second in Tamil Nadu. The implementation will consist of a strategic matrix with critical cities as nodal points

The benefits here are two pronged. The first is that this initiative aligns with the plan for private player partnerships The second is that it will lead to direct and indirect employment opportunities It would also allow the involvement of MSMEs and startups to expand their operations

NIVESHAK

T H E D E F E N C E S E C T O R

NIVESHAK 17

Source:Statista O C T O B E R

The question now arises why these two states? Well, The UP government plans to leverage its large labor force and MSME base(1st and 4th, respectively), while Tamil Nadu provides a strategic advantage In terms of Naval capabilities, international airports, and submarine connections.

Russian disruption -A Key driver?

India imports over 66% of its military equipment from Russia. Under the Atmanirbhar scheme, the government imposed a self import ban for the first time in its history. Out of the 718 technology bans, about 107 are from Russia This is a phased out approach spanning over six years. Pressure due to geopolitical tension is just one side of this decline What the conflict leads to is a more significant issue India signed a $5 5 billion deal with Russia to deliver the S 400 missiles in 2022. But supply chain disruptions due to the conflict have delayed the delivery of the 3rd segment. Though Moscow has assured timely delivery, the speed of western sanctions has spurred renewed interest in attaining

“technology autonomy ” Thus an added urgency for indigenization efforts is fuelling the cause for Atmanirbhar Bharat.

Future Outlook

The Defence sector is booming, with most stocks at their all time high, indicating a strong positive outlook for the industry At Rs.8,000 crore worth of exports in the first half of FY23, the government targets to reach Rs 30,000 crore by 2025, which reflects a strong order book from abroad Further, the annual defence expo provides a massive opportunity for Indian manufacturers to display their products to the world, where the Indian manufacturers showcase their advanced models and products Manufacturers like HAL and BEL have already started increasing their R &D spending to compete in the global market South America and ASEAN countries are the major importers and have shown further intent to purchase more, given the sector's innovation.

K N O W Y O U R S E C T O R

Key metrics

Military Firepower Index

A global index to determine a country’s military capabilities through conventional means(i e no nuclear weapons).zero on this scale denotes a theoretically perfect government, and the nation closest to 0 is considered superior.

Order Book

It refers to the number of pending orders that will be delivered in the future In this case, a strong order book indicates the powerful revenue capabilities of defence companies

T H E P H A R M A C E U T I C A L S E C T O R

N I V

A K 18 STAY

E S H

INVESTED

Source:Statista

A central bank digital currency (CBDC) is a digital currency issued by a central bank and is also known as digital fiat currency or digital base money Their value is pegged to the value of the country's fiat currency. CBDC central bank digital currencies and cryptocurrency technologies may sound similar to the uninitiated. After all, they are both digital currencies. However, combining the two is extremely misleading

Decoding CBDCs

Fiat money is a currency issued by the government that is not backed by a physical commodity such as gold or silver. It is regarded as legal tender and can be used to exchange goods and services A central bank digital currency (CBDC) is essentially a digital banknote Individuals could use it to pay businesses, shops, or each other (a "retail CBDC"), or financial institutions could use it to settle trades in financial markets (a "wholesale CBDC").

Over 80 central banks are investigating digital currencies

China's digital RMB was the first major economy to issue digital currency The Central Bank of The Bahamas (Sand Dollar), the Eastern Caribbean Central Bank (DCash), the Central Bank of Nigeria (e Naira), and the Bank of Jamaica have all launched CBDCs as of July 2022 (JamDex)

Administrative CBDC

A central bank digital currency would most likely be implemented through the use of a database managed by the central bank, the government, or approved private sector entities. The database would keep track of the amount of money held by each entity, such as people and corporations, with appropriate privacy and cryptographic safeguards The central bank digital currency would be centrally controlled (even if it was on a distributed database), and thus a blockchain or other distributed ledger would be unlikely to be required or useful despite being the concept's original inspiration.

C T O B E R

O

C E N T R A L B A N K D I G I T A L C U R R E N C Y

A R T I C L E O F

T H E M O N T H

B Y H I M A N S H U B H A N G O T R A I I M S H I L L O N G

.

NIVESHAK 19

Objectives of CBDCs

CBDCs are currently being studied and tested by governments and central banks to realize the numerous benefits they provide for financial inclusion, economic growth, technological innovation, and increased transaction efficiencies. Some of the potential objectives are listed as follows The first advantage is the possibility of a more efficient payment system in areas where managing currency is costly. Money transfers and payments could be made in real time, directly from the payer to the payee, rather than through intermediaries such as banks and clearing houses There are some advantages to being in real time as CBDCs would reduce the maintenance required for a complex financial system, lower cross border transaction costs, reduce risk & complexity and

provide lower cost options to those who currently use alternative money transfer methods

Second, CBDC has the potential to increase financial inclusion because it does not require users to have a bank account. Safe money accounts at central banks could be a powerful tool for financial inclusion, allowing any legal resident or citizen to receive a free or low cost basic bank account. If a currency becomes unavailable for any reason, the CBDC may take steps to ensure that people can obtain legal tender If CBDC and cash were issued as legal currency, they would be legally recognized as valid methods of payment

Cost savings associated with physical cash management, as well as furthering the cause of digitization to achieve a cashless economy.The growing use of electronic payment methods has not yet resulted in a decrease in

STAY INVESTED 20

N I V E S H A K

the demand for cash. The percentage increase in the value of banknotes was 16 8 percent in 2020 21 and 9 9 percent in 2021 22, respectively, and the cost of cash management in India has remained high CBDC may be a preferred mode of holding central bank money rather than cash Furthermore, if reasonable anonymity is assured, the preference for cash transactions for regular expenses and small payments for its anonymity may be redirected to CBDC acceptance. Private virtual currencies are diametrically opposed to the historical concept of money. Because they have no intrinsic value, they are not commodities or claims on commodities. In recent years, the rapid proliferation of private cryptocurrencies has attempted to challenge the fundamental concept of money as we know it Cryptocurrencies, which claim the benefits of decentralization, are being heralded as an innovation that will usher in decentralized finance and disrupt the traditional financial system The inherent design of cryptocurrencies, on the other hand, is more geared toward avoiding the established and regulated intermediation and control arrangements that play a critical role in ensuring the integrity and stability of the monetary system.

Types of CBDCs

CBDCs are classified into two types: wholesale and retail Financial institutions are the primary users of wholesale CBDCs The Retail CBDCs are like physical forms of currency,which

are used by both consumers and businesses.

Wholesale CBDCs are analogous to central bank reserves The central bank opens an account for an institution to deposit funds or use to settle interbank transfers Central banks can then influence lending and set interest rates by using monetary policy tools such as reserve requirements or interest on reserve balances. Individuals would be the primary users of retail CBDCs. People could essentially use them as digital cash, with the assurance that the currency is issued and backed by the country's central bank. This innovation has the potential to eliminate the need to carry physical currency while also lowering the economic rents associated with transactions in the legacy financial system Retail CBDCs are classified into two types CBDC can be structured in two ways: token based or account based. A token based CBDC is a bearer instrument, similar to banknotes, which means that whoever holds the tokens at any given time is presumed to own them. In contrast, an account based system would necessitate the keeping of a record of all CBDC holders' balances and transactions, as well as indicating ownership of the monetary balances In addition, in a token based CBDC, the person receiving the token will verify that his ownership of the token is genuine, whereas an intermediary verifies the identity of an account holder in an account based CBDC.

NIVESHAK 21

C

O

T O B E R

Risks associated with CBDCs

·One concern is that with the ability to provide digital currency directly to its citizens, depositors will leave the banking system In addition to the fractional reserve banking system, commercial banks have created money through deposits CBDCs are fully reserved, so if someone wants to use them, they must purchase them from the central bank. Commercial banks do not create the debt or new money in this case, and they do not earn interest, resulting in banking system disintermediation.

·The potential demand for a CBDC is highly uncertain. Its design and implementation framework would have an impact on it There are two major concerns: first, that CBDC may result in faster bank runs in times of financial crisis; and second, financial disintermediation may force banks to rely on more expensive and less stable sources of funding. In a CBDC system, it will be critical to consider how privacy is respected and data is protected. The appropriate level of anonymity in a CBDC system is a political and social issue, not a narrow technical one CBDC would be required to comply with AML regulations, which would rule out truly anonymous payments Even if CBDC payments are not truly anonymous, CBDC payments could be designed to protect the privacy and give users control over whom they share data. The central bank collects a variety of customer related data when issuing CBDC, so it is critical to have defined privacy principles and data subjects' rights.

RBI and e₹ (digital Rupee)

When the wholesale digital rupee (e₹ W) is used on a trial basis beginning on November 1, 2022, the Reserve Bank of India (RBI) will become one of the world's first major central banks to begin a pilot project with its virtual currency. State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank, and HSBC were chosen by the central bank to participate in the pilot project in this segment These banks will use the new platform to trade government securities using digital currency among themselves The new platform is called NDS OM CBDC The finance minister stated in the Union Budget for 2022 23 that the RBI would launch a digital equivalent to the rupee in the current fiscal year. Finance Minister Nirmala Sitharaman proposed a 30% tax on gains from the transfer of virtual digital assets in her February budget speech, which went into effect on April 1 "We are currently at the fore of a watershed movement in the evolution of currency that will decisively change the very nature of money and its functions," she added CBDC, the central bank digital currency, holds a lot of promise in terms of ensuring transparency, low operational costs, and the potential to expand existing payment systems to meet the needs of a broader category of users. Extensive stakeholder consultation and iterative technology design are required to develop a solution that meets the requirements and makes CBDC as appealing as cash, if not more so

N I V E S H A K STAY INVESTED 22

Introduction

After months of prattling, lawsuits, verbal mudslinging, and a near miss of a full blown trial, the world's richest man, Elon Musk, now owns Twitter. He completed the deal on October 28th 2022, just a day before the Delaware Chancery court trial would have proceeded Over the course of this saga, Elon Musk has been cast as an admirer, critic, and legal adversary of Twitter This article will help you understand how this deal went about.

Musk increasing stake

Elon Musk had quietly started gathering a stake in the social media company in late January. His stake exceeded 5% by March, but he chose not to disclose this until the following month An SEC filing later revealed that by March end, Musk had already spoken to Twitter founder and former CEO Jack Dorsey regarding the future of social media and open source protocol. On April 4th, Musk surprised the world by disclosing a 9.2% stake in Twitter which was worth $2.89 billion, making him the single largest shareholder.

D E A L S B R E W E R Y

The Offer

Twitter's then CEO Parag Agarwal, on April 5th, announced that Elon Musk would be joining the Board of Directors, which Musk later rejected In a surprising turn of events, on April 14th, Musk offered to acquire Twitter at $54 20 per share, which valued the company at about $43 million This amounted to a 38% premium above the price Twitter was at before Musk had made his investment public. On April 15th, Twitter offered shares to current shareholders at a discount to make the acquisition difficult for Musk. Eventually, on April 25th, Twitter accepted Musk's offer to buy the company at $44 billion

Financing the deal

Elon Musk revealed that he had secured financing provided by Bank of America, Morgan Stanley, Barclays and MUFG for a potential offer to acquire Twitter. This funding consisted of $7 billion of senior secured bank loans, $6 billion in subordinated debt, and $6.25 billion in bank loans to Musk personally, secured by $62.5 billion of his Tesla stock. $20 billion in cash equity from Musk

NIVESHAK NIVESHAK

T H E B I R D I S F R E E D

23 NIVESHAK O C T O B E R

was to be provided by sales of Tesla stock and the remaining $7 1billion in equity from 19 investors

Retraction consequences

On May 13th, Musk tweeted that the Twitter deal is ' on hold ' , citing concerns over what he said is the pervasiveness of bot and spam accounts on the platform Along with this tweet, he also posted a report about a public filing from Twitter that said that the fake account made up less than 5% of users on the platform. Skeptical of the finding, Musk demanded calculations that would support these details. Market analysts opined that the concern over fake accounts could serve as a pretence for Musk to bargain for a lower price for acquisition or abandon it altogether On May 26th, Twitter shareholders brought in a class action lawsuit against Musk over the alleged stock manipulation Musk threatened to pull out of the deal if Twitter failed to provide the necessary information about fake accounts. On July 8th, he moves to terminate his acquisition. In return, Twitter sued Musk in Delaware Chancery Court to force him to execute the deal and levied a penalty of $1 billion if Musk opted out of the deal The court, on July 19th, granted an expedited timeline and determined that the trial should take place in October

The Whistleblower

On August 23rd, Peiter Zatko, former Head of Security at Twitter, claimed in a federal whistleblower complaint that Twitter had numerous information security

Deal Execution

system lapses Twitter agreed to pay Zatko $7 75 million to settle a compensation dispute Musk used this as another way to get out of the deal since he was not asked prior permission before taking this decision. After days of deposition and uncertain outcomes, Musk reconsidered. He engaged in many discussions in which he tried to negotiate a discount on the deal price Meanwhile, the judge overseeing the lawsuit put the case on hold till October 28th, giving Musk three weeks to close the deal A day before the trial, Musk executed the deal for $44 billion, and Twitter was converted to a private company. All shareholders received $54.20 per share, and the stock was delisted from NYSE on November 8th.

Future Plans

With the goal of reducing prevalent spambots on the platform and promoting free speech, Musk has claimed that he would increase Twitter's annual revenue to $26 4 billion and raise free cash flow to $9 4 billion by 2028 Under Musk, advertising will be 45% of the total revenue, down from 90% in 2020 Twitter aims to bring in a revenue of $1 3 billion from its payments business by 2028. Musk aims to reach 931 million users by 2028. Musk's decision to monetize the blue tick feature is currently on hold due to mushrooming of fake accounts. Since all these changes have very aggressive deadlines, it would be interesting to see if these promises are rolled out in time

24 STAY INVESTED

N I V E S H A K

Introduction

Hindu Undivided Family (HUF) is governed under the Hindu Law Board and can be formed by a married couple or members of a joint family At least one of the members should be a male member. HUF can also be formed by Sikhs, Jains, and Buddhists. The senior most male member is called ‘Karta’, who, in a way, manages the account of HUF. His signature would be required for every document. All the other members are called ‘Coparceners’ In an HUF account, a corpus is created where all the members of HUF can deposit their money This account is handled by ‘Karta’ For tax simplicity, the Income Tax Act of 1961 considers HUF to be a separate legal entity

Provisions relating to income tax

In addition to a specific basic tax exemption of Rs. 2.50 lakh and a disparate tax exemption for each of its members, a HUF is recognized as a separate tax entity This exemption is available irrespective of whether the member of the HUF is a resident or not Investments in real estate, stocks, and mutual funds are allowed for HUF. HUF can also operate a business in its name as a proprietor. Moreover, salaried people can also benefit by creating additional income in the name of HUF. To illustrate this, let's assume a person earns Rs. 20 lakhs per annum through his salary and earns additional Rs 10 lakhs per annum through business If he creates a HUF and the business operates in the name of that HUF, then his total income of Rs 30 lakhs will be taxable under that HUF He will also be able to avail all the other tax benefits that come with HUF. A HUF is taxed separately since it is considered a separate entity for income tax purposes. This makes it easier to distinguish between a person's tax liabilities and those of his family.

F

E

I N S U P E R V I S

T A X B E N E F I T S I N H U F

NIVESHAK 25 O C T O B E R

N I V E S H A K

Formation of Hindu Undivided Family

Owning a house

A HUF can own any property, including a residential home, for which it can also avail of a home loan and avail tax benefits of Rs 1.50 lakhs under section 80C. It can also claim interest on money borrowed to buy/contract/repair or renovate the property under section 24C. Generally, as per income tax norms, a taxpayer can claim only two properties owned by him/her as self occupied, but under HUF, you can provide the provision of claiming two additional properties on which the taxpayer will have to pay no tax

Deductions in Section 80C

An HUF is qualified to deduct certain expenses under Section 80C, including life insurance premiums for its members You can therefore pay the premium from an HUF account and claim tax benefits

Investments in HUF

Despite being prohibited from opening a PPF account in its own name, an HUF is permitted to make contributions for any of its members into PPF accounts Investments in tax saving fixed deposit and ELSS (equity liked saving scheme) are also permitted.

Medical Exemptions

Under Section 80D, an HUF can also pay a health insurance premium when the premium payable amount exceeds Rs. 50,000 for senior citizens and Rs. 25,000 for all others. When HUF has incurred any expenses for medical treatment of its physically

challenged member for Rs 75,000 or purchased life insurance for such member, it can claim a deduction under Section 80DD This deduction can go to Rs 125,000 if the member is suffering from severe disability. Similarly, a deduction can be obtained under Section 80 DDB for the treatment of specified diseases (mentioned in the IT Act) of Rs. 40,000 for dependent members and up to Rs. 100,000 for senior citizens of HUF. All medical exemptions are available to both resident and non resident HUF except for 80 DD and 80 DDB, which are available only for resident HUF

Drawbacks

The corpus of the account may remain empty due to a pervasive sense of unease among the members, and as long as the corpus is empty; the account is inoperable The process for executing a partition in a deposit in an HUF account can become tiresome if any of the HUF members are willing to partition.

Illustration of how an individual can save taxes by forming an HUF

Income from various sources

Income of a Individual before HUF

Income of Indiviudal after HUF formation

Salary 10,00,000 10 00,000

Income of HUF

House Property Rent 5,00,000 5,00,000

Standard deduction on house property 1,50,000 1,50,000

Income from house property 3,50,000 3,50,000

Total taxable income 13,50,000 10,00,000 3,50,000

Section 80C 1,50,000 1,50,000 1,50,000

Net Taxable Income 12,00,000 8,50,000 2,00,000

Tax Payable 1,79,400 85,800 0

Total tax paid by individual & HUF 85,800

Tax Savings due to HUF formation 96,600

N I V E

K 26 STAY INVESTED Source:Tomorrowmakers

S H A

It is said that the government policies of a region have a significant role to play in the functioning of the economy and its financial institutions Therefore, it becomes even more crucial to analyze some of the past policy actions to draw insights and solutions for the future Keeping this objective in mind, this time, we dive into the Asian Financial Crisis of 1997, where we witnessed the fall of Asia's most stable and emerging economies

How it all started?

Thailand was the gateway through which Asian Financial Crisis entered the region like a contagion On July 2nd, 1997, Thailand had to devalue its currency This was a result of the country losing its much needed foreign reserves Subsequently, the equity, money and property market values also fell in Thailand. Then the contagion spread to other parts of the region when Malaysia, the Philippines, and Indonesia also allowed their currencies to devalue substantially. Moreover, the severe Balance of Payments issue caused South Korea to bust

A N U B H A V K A T H A N

The reasons?

The topic of the Asian Financial Crisis is indeed a complicated one. Hence, pointing out one reason would indeed be difficult. But most experts claim that the crisis was the bursting of a "Hot Money Bubble" It was during the late 1980s and the early 1990s when the economies of Thailand, Singapore, Malaysia, and South Korea were booming Their GDP grew more than 8% every year, and there was tremendous euphoria in the world about the same. These economies were known as the "Tiger Economies" owing to their fast paced growth. If we closely observe, the countries mentioned above are island nations because tourism was their primary source of revenue. Moreover, all of them were export driven economies These features of the economy allowed them to have a fixed exchange rate rather than a floating one Hence, the Thai Baht was pegged to US dollars The monetary policy of these economies was such that they always supported higher interest rates to drive more investments.

NIVESHAK

A S I A N F I N A N C I A L C R I S I S

NIVESHAK 27

O C T O B E R

But the actual problem started when US Economy began to recover from the recession in the 1990s. The US Fed went on a rate hike spree to counter inflation

Due to this, foreign investors flew toward the US Treasuries and other instruments from these Asian Economies

Now, since there was a dollar outflow from these economies, their exchange rates faced downward pressure. As these economies had fixed exchange rates, their Central Bank had to constantly intervene to maintain that fixed rate. However, these economies ran out of foreign reserves in the process and subsequently had to devalue their currencies The first one to fall was Thailand, and then the crisis spread to other parts of the region

Impact of currency devaluation

Since these economies were export and tourism driven, they kept their exchange rates substantially higher The higher exchange rates make the exports cheaper in the foreign market and hence competitive. Unfortunately, the devaluation of the currency impacted the exports first. The exports became expensive and less competitive in foreign markets. These economies then had to rely on imports. As a result of which, the south Asian economies ran into a Current Account Deficit All of this led to a massive downturn in these economies From 1996 to 1997, the nominal GDP per capita dropped by 43 2% in Indonesia, 21 2% in Thailand, 19% in Malaysia, 18 5%

in South Korea, and 12 5% in the Philippines Hong Kong, Mainland China, Singapore, and Japan were affected less significantly There were political repercussions too

The IMF Bailout?

The IMF came out with a bailout package for these economies as they still saw massive potential in the region A total of $118 Billion was extended to Thailand, Indonesia, and South Korea However, the bailout was done on some conditions in which these countries' governments had to intervene by raising taxes and cutting government spending and subsidies. US Federal Bank also extended its support by rolling the short term loans into medium term roles.

It's Lesson Time Now

There were majorly two learnings from the Asian Financial Crisis of 1997

Firstly, the assumption was that the exchange rates would always remain the same, so pegging the currency to USD was necessary. This policy action led to the drainage of foreign reserves when it was needed the most as the Central Banks had to maintain the balance sheets of the currency

The Second lesson is that these Asian Economies were not financially resilient No doubt they had significant Macroeconomic indicators then. Still, when the crisis hit, they had no funds left and hence had to rely on foreign debt, which exacerbated the situation

N I V E S H A K

STAY INVESTED

28

How to Play?

Below we have 6 questions based on companies that have done extremely well so much so that almost every budding manager must have read a case study on them or catastrophically case studies on them are about how not to run a business! Test your wits and see if you can answer all 6. You can send your answers via email to niveshak@iimshillong.ac.in.

This American MNC announced it will pay its shareholders dividend for the first time in its history in 2003 almost 17 years after it released its IPO in 1986 Although most shareholders would generally be happy about receiving dividends, the shareholders of this company were anything but happy with this announcement. Identify the company

in the arguably largest bankruptcy reorganisation in the US till date. The shareholders filed a $40 billion lawsuit on the company after the share plummeted from $90 75 to less than $1 in less than 2 years. The bankruptcy resulted in new legislation including the Sarbanes Oxley Act which increased the accountability of audit firms.

In 2001, this company declared bankruptcy. The firm itself and its accounting firm both got dissolved

Source: begintoinvest com

This initial public offering (IPO) for an Indian company was initiated in June 1993 at a price of Rs 95 per share, but it was

1

L E T S F I N U P !

3

L E T ' S F I N - U P G U E S S T H E C O M P A N Y

NIVESHAK 29

2

Share price during period of dividend announcement Source: Yahoo Finance

O C T O B E R

undersubscribed The company was then saved by Morgan Stanley, which purchased 13% of the company's equity The stock began trading at Rs. 145, representing a gain of more than 52% from its IPO price This rapid rise to the top of the IT industry has continued to this day, as it is now one of the biggest players in the industry and has given more than 100x returns

This American MNC's market cap was more than ₹ 164 lakh crore in 2020 This is more than the combined market cap of BSE 500 companies and twice as big as that of the DJIA 30 share index.

This company ’ s stock price is so high that computers could not handle the numbers In 2021, Nasdaq suspended trading activity on this scrip. The way Nasdaq and most other exchanges handle data is using 32 bits, thus limiting the maximum number that can be stored to approx $430,000 When this company ’ s stock price reached around 98% of the limit, trading was suspended, which necessitated the upgradation of the system in which Nasdaq stores data Identify the company

Source: CNBC

This company suffered extreme losses during the Global Financial Crisis of 2008. Its assets and some of its’ subsidiaries' assets were sold through the implementation of Chapter 11 of the United States Bankruptcy Court This company received $33 Billion in Debtor in possession financing.

5

N I V E S H A K STAY INVESTED Want a digital copy? Don't worry! Scan this QR Code! 30

4

6

Source: Company filings

ANNOUNCEMENTS Team Niveshak invites articles from participants from all colleges across India We are looking for original articles related to Finance and Economics. Participants can also contribute puzzles and jokes related to Finance and Economics References should be cited wherever necessary The best article will be featured as "Article Of The Month" and would be awarded a cash prize of ₹3000/ along with a certificate. The runner up article would be awarded a cash prize of ₹2000/ along with a certificate. INSTRUCTIONS Send in your articles to niveshak iims@gmail com Mail subject line must be "Article For Niveshak <Title>" Mention your Name & Institute Name along with the article Ensure that article has a word count between 1200 1600 Please DO NOT send PDF Files and stick to the format Number of authors is limited to 2 for each article Also certain entries which could not make the cut to the magazine will get featured on our website Microsoft Word Font: Times New Roman Size: 12 Line Spacing: 1.5 FORMAT ISSUE II • VOLUME XVI • OCT '2022

MD

MD