P DEALS BREWERY COVER STORY CREDIT SUISSE ANUBHAV KATHAN ADANI-NDTV GOING SHORT, LONG OR BOTH? EDITION I | VOLUME XVI | STAY INVESTED NIVESHAK NIVESHAK

NIVESHAK

Dear Niveshaks,

We are delighted to present the August September edition of Niveshak In these months, the major economies of the world suffered from the problem of inflation To counter that, the monetary policy of these economies came into force. The Fed increased the Fed Fund rate by 75 basis points in August and September. Moreover, RBI also raised the Repo rate for these two months by 50 basis points each month to reach 5.90%. Under these circumstances, the Indian equity markets saw increased volatility, with Nifty touching a high band of 18070 5 points and a lower band of 16818 points

This edition begins with critical financial and economic news from August and September, such as the rate hike spree of the Bank of England, the 5G Spectrum Auction, the Figma acquisition, and KKR's exit

The cover story discusses the troubles of Credit Suisse It mentions liquidity crunch, management issues, defaults, and money laundering cases.

NIVESHAK

Nikhil Chadha

Aayush Jain

Akriti K.

Shashwati A.

Darshan K.

Aagam Parikh

Akshat Sharma

Unnati Tanwar

Mayank Goenka

Sankalp Parakh Shantanu M.K. Tanya Sharma

Pulkit Gubgotra Sahishnu S

Vikram Mathur

Abhinandan Jain Amit Tyagi

E D I T O R ' S Q U I N ' A V A N C E P A S R E C U L E

N O T E

TEAM

Gaurav Soni

NIVEsHAK A U

G U S TS E P T E M B E

R

The story also comes up with possible recommendations and the way forward

In this edition's ‘FinView’, we invited Mr Navneet Sharma, CEO, and Founder of Sampannata Financial Consultants With him, we discussed various themes including Rupee Depreciation, the HDFC Bank and HDFC Ltd merger, prospects of alternate energy, and the impact of US inflation on Indian Equity markets.

In ‘Know Your Sector’, we analyzed the pharmaceutical industry focusing on Active Pharmaceuticals Ingredients (APIs) and Key Starting Materials (KSM). The analysis provides critical insights into industry dynamics, PLI schemes, KPIs, and the associated risks

'Deals Brewery’ covers the NDTV Adani Acquisition Deal The article covers many interesting aspects of the acquisition, including how it was made indirectly through equity warrants and the role of Ambani and Adani in this deal. We also explore SEBI regulations about tender offers and their relation with the hostile takeover of the Roys' brainchild.

The ‘FinSupervise’ section talks about the behavioural biases within finance and economics This covers insightful aspects of human behavior when they make financial decisions in an inefficient market.

‘Anubhav Kathan’ (Learning from experiences) is a new addition to the magazine where we try to look back on companies at a critical juncture in their history and the moves which could have led to their downfall.

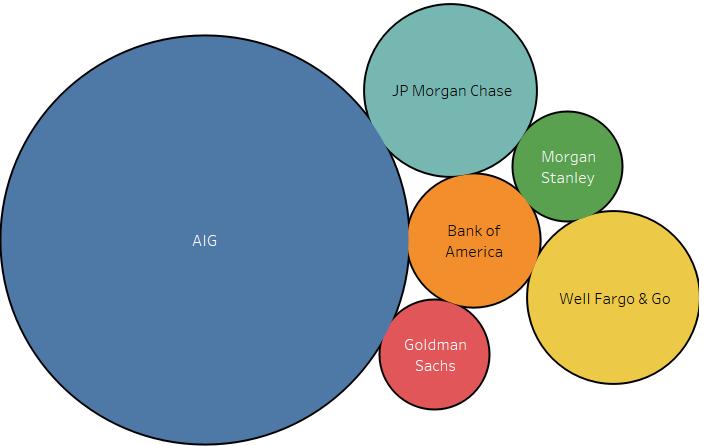

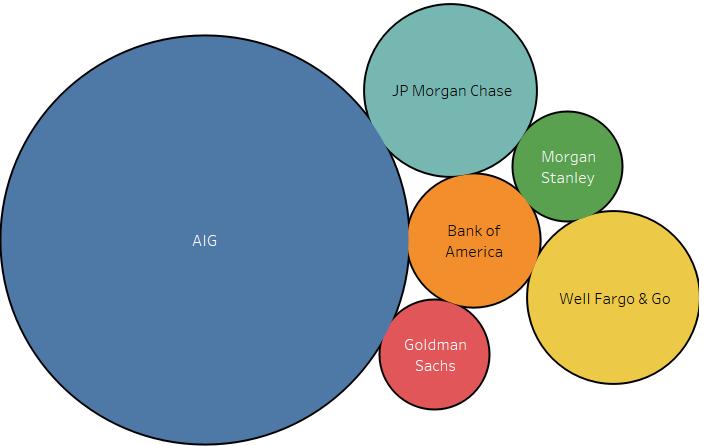

This month's edition focuses on AIG and its aggressive position in CDS, similar to where Credit Suisse finds itself today

The 'Let's FinUp' section is a fun one that will test readers' technical analysis knowledge. The idea is to predict stock movements based on price patterns

We would love to hear your thoughts, feedback, and ideas Please feel free to reach out to us to let us know what you think!

We hope you derive something from this edition and stay safe and sound in these exciting times! Stay Invested,

Team Niveshak

All images, design, and artwork are copyright of IIM Shillong Finance Club © Finance Club

Indian Institute of Management, Shillong

Disclaimer: The views presented are the opinion/work of the individual author and the Finance Club of IIM Shillong bears no responsibility whatsoever.

I V E S H A K

STAYINVESTED

N

STAY INVESTED

CONTENT THEMONTHTHATWAS THE FINANCE BULLETIN Page 5-6 THENIVESHAKINVESTMENT FUND MONTHLY PERFORMANCE Page 7-8 COVERSTORY CRISIS AT CREDIT SUISSE Page 9-12 FINVIEW IN CONVERSATION WITH NAVNEET SHARMA Page 13-16

DEALSBREWERY

ARTICLEOFTHEMONTH SOCIAL IMPACT BOND Page 19-22

ADANI TAKES OVER NDTV Page 23-24 FINSUPERVISE BEHAVIOURAL BIASES Page 25-26 ANUBHAVKATHAN CREDIT DEFAULT SWAPS BRINGS DOWN AIG Page 27-28 LET'SFIN-UP TECHNICAL ANALYSIS Page 29-30 KNOWYOURSECTOR PHARMACEUTICAL INDUSTRY Page 17-18

A U G U S TS E P T E M B E R

BOE goes on a rate hike

In the month of August, the Bank of England raised the Bank Rate by 50 bp from 1 25% to 1 75% Further, in September, the rate was raised from 1 75% to 2 25% The monetary policy of the Bank of England is made to meet the 2% inflation target In July 2022, the inflation rate in England was at 10.1%, rising from 9.4% in June 2022. This is primarily due to an increase in gas prices in England and Europe caused by the war between Russia and Ukraine. The level of inflation is further expected to rise to over 13% in 2022 Q4 and remain at such elevated levels through the end of 2023

Rate hikes

5G Spectrum Auction ccononcludes

Reliance Jio emerged as the largest bidder for 5G spectrum auctions and acquired 24,740 MHz of 5G airwaves for a massive amount of ₹88,000 Crore, approximately. 5G airwaves have the potential to provide speeds 10 times faster than 4G. The government pocketed a total of ₹1 5 lakh crore from the spectrum auctions which ran over 7 straight days and had 40 rounds Adani Data Networks, the new entrant made a purchase of Rs 212 Crore for 400 MHz of spectrum across six cities

Size by Each Firm

NIVESHAK

T H E M O

N

T H T

H A

T

W A S

T H E F I N A N C E B U L L E T I N

NIVESHAK05 A

U G

U

S

T

S E P T E M B E

R Source:BankofEnglandDatabases Bid

BoE Interest

Adobe acquires Figma

Adobe in September entered into a deal to purchase Figma, a design platform for approximately $20 Billion in cash and stock. The synergy will create unprecedented creative collaboration. Figma makes designing for non experienced designers easy In a statement, Chairman and CEO of Adobe Shantanu Narayen, said, “The combination of Adobe and Figma is transformational and will accelerate our vision for collaborative creativity ”

Some analysts say that the acquisition was more about getting rid of future competition and not about making an acquisition to expand.

precise, Max's 260 million shares were sold via bulk deal, and the remaining 7 million shares were sold via ordinary market operations.

K N O W Y O U R S E C T O R

This significant selling is the firm's largest ever exit from an Indian firm. Although, as soon as the shorting happened, US based New World Fund Inc , the Government of Singapore, the Monetary Authority of Singapore, Smaller Cap World Fund Inc , WF Asian Smaller Companies Fund Ltd, and BNP Paribas Arbitrage Fund acquired Max Healthcare's shares from KKR in bulk deals

Moreover, KKR and Abhay Soi held 27 54% and 23 09% of the equity in Max Healthcare and post this shorting, Abhay Soi will become the largest shareholder in the firm

MSCI India decouples from MSCI EM

Largest exit by KKR in Indian Market

KKR and Co , also known as Kohlberg Kravis Roberts & Co., sold its entire stake in India's 3rd largest hospital chain Max Healthcare Institute Ltd., for roughly Rs. 9400 crores. KKR did the deal via its affiliate Kayak Investments Holding Pte. Ltd, and the stocks were sold at Rs 353 apiece, mainly via a bulk deal in the open market To be

The positive trend seen in Indian stock markets since June 2022 has made the Morgan Stanley Capital International (MSCI) Indian index negatively correlated with the broader MSCI Emerging Markets (EM) index, This 20 month run has been the longest since its inception.

Since January 2021, the broader MSCI EM lost 21% while the MSCI India index gained 18.5%.

While this year, till August 12, MSCI EM has seen a decline of 17.5% while the MSCI India index has only fallen 5%.

The top stocks in the MSCI India index include Reliance Industries, Infosys, ICICI Bank, HDFC Ltd., etc.

E

H

K

T H E P H A R M A C E U T I C A L S E C T O R

N I V

S

A

06STAY INVESTED

NIVESHAK A U G U S TS 104 99 As on 30th Sep 2022 N I V E S H A K I N V E S T M E N T F U N D T H E F A C T S H E E T NIVESHAK07 A U G U S TS E P T E M B E R September Fund Performance Benchmark Return 1M Return AUM (₹) NAV (₹) Index 1M Return 3 14% As on 30th Sep 2022 1 44 Lakhs As on 30th Sep 2022 NIFTY 50 2 56% As on 30th Sep 2022 Investment Objective To foster classroom learnings in the practical world with an intent to generate long term capital appreciation by investing in companies across large cap, mid cap and small cap brackets However, there is no assurance that the scheme's objective will be realized The Scheme will invest in Equities as notified in NIFTY 500. Portfolio construction will be based on bottom up/top down stock picking Performance & Other Metrics Equity Style Box Cap Wise Allocation Large Mid Small Value Blend Growth Style S i z e 53 40% 37.60% 9.00% Large Mid Small *asofSeptember30th,2022

NIF Insights

IT sector saw a slowdown in growth owing to the rising inflation in western countries of Europe and America and attrition problem.

a result, both investors and analysts maintained a bearish outlook on all the top IT Stocks. Infosys and TCS both fell more than 9% from the start of August

Tracking

0% 5% 10% 15% 20% 25% Banks Automobiles & Components Capital Goods Energy Pharmaceuticals, Biotechnology Food, Beverage & Tobacco Software & Services Materials Consumer Durables & Apparel 833% Asset Allocation 10 Year Indian Bond YTM Repo Rate US Fed Funds Effective Rates USD INR Generic 1st Crude Oil, Brent 7 34% 5 40% 3.08% 81.85 7,420 PMI PMI Manufacturing PMI Services Industrial Production Index India CPI Combined YoY 58 20 56 20 57.20 2.40 7.00 N I V E S H A K 08STAY INVESTED Sectoral Allocation 23.48% 21.02% 16.55% 10 26% 08 94% 07.53% 06.17% 04 27% 01 42% Best & Worst Performing Stocks Worst Performing Bstock est Performing stock *asofSeptember30th,2022 basedonthepurchaseprices.Onlyaccountsforstocksthatexistintheactiveportfolioasof September30th,2022. Capital Goods Consumer Durables20 42% 16 06% of Assets invested in Equities C a s h

Macroeconomic Indicators

The

As

Introduction

Credit Suisse is facing one of the biggest challenges in its history of operations, because this bank was among the least affected ones by the Global Financial Crisis of 2008. The effects are extensive. In just four months, the stock value fell by 67 84%, and the stock's value decreased from 6 66 CHF in June to 3 68 CHF in September The impact on stock price is passive, but its effect on the global financial market would be huge

Net Losses

Moreover, the bank reported net losses for last 3 quarters on account of high premium payments, defaults and high non operational expenses like Court fees to counter various money laundering cases.

History of the Bank

The story of the bank starts from July 5, 1856 when Switzerland as a nation was trying to fund the expansion of Rail Network At the same time a prominent politician and business leader Alfred Escher founded"Schweizerische Kreditanstalt". The bank aimed at providing capital for the industrial expansion in Switzerland.

Finally, in 1870, the bank’s first foreign representative office opened in the New York. Then in the year 1905, the bank opened its first branch outside Zurich in Basel and soon after that it acquired OberRheinische Bank

Source: Trading View com

NIVESHAK C O V E R S T O R Y T H E C R E D I T S U I S S E I S S U E W I L L I T B E T H E N E X T L E H M A N N ?

09 A U G U S TS E P T E M B E R NIVESHAK

Source:CreditSuisseAnnualReports:

(Mn CHF)

Credit Default Swaps

CDS was one of the primary reasons behind the 2008 Global Financial Crisis Now, after looking at the CDS rates spike to 297 bps for Credit Suisse’s CDS, the fear of the bank defaulting on its bonds has surged

Source:CNBCCDS:

S E C T O R

Clearly, the above chart indicates the surge in the CDS premiums over the months.

When CDS premiums rise, the insurance provider presumes the security to be risky and when one of the borrowers defaults, this poses a threat to the bank that other borrowers might also default and this leads to a domino effect causing the financial system to collapse

Default Issues

Credit default swap (CDS) It is a financial derivative that allows an investor to swap or offset their credit risk with another investor This risk swapping gets accomplished when the lender buys a CDS from another investor who agrees to reimburse them if the borrower defaults.

Another aspect that is hurting Credit Suisses' balance sheet is default issues

Last year, Credit Suisse faced a default of roughly $5 5 Bn primarily due to Archegos Capital Management Archegos Capital was a US hedge fund that placed high risk bets on Technology stocks

The year started with Credit Suisse’s CDS premium interest at 57 basis points After witnessing the bank’s liquidity crunch, the Credit Default Swaps that insures the defaults by the bank started increasing.

In the later part of September, 265 Bps. The rise in the premiums indicates a very interesting behavioural aspect of the Swap Buyers. They clearly view that the bank is on the verge of defaulting on many of its loans and bonds that Credit Suisse issued.

Hedge Fund

It is a limited partnership of private investors whose money is managed by professional fund managers who use a wide range of strategies, including leveraging or trading of non traditional assets, to earn above average investment returns.

Hedge fund investment is often considered a risky alternative investment choice and usually requires a high minimum investment or net worth, often targeting wealthy clients.

I V E S H A K

K R

T H E P H A R M A C E U T I C A L S E C T O R

N

10STAY INVESTED

These bets ultimately tanked, and the portfolio's net value fell down.

In another incident, Credit Suisse froze $10 Bn funds of supply chain finance of the Greensill Capital in 2021 The unethical aspect of Credit Suisse was reflected when it sold billions of dollars' worth of Greensill's debt to its investors, stating in its prospectus that they were extremely safe investments and when, Greensill Capital completely collapsed after losing its insurance cover for the debt issued against its loans to companies, the bank was sued and had to shell out $6.8 Bn. All of the above defaults are few of many which again deny cash inflow into the bank and hence a liquidity crunch

Money Laundering Cases

In the year 2022, Credit Suisse was convicted of failing to prevent money laundering, which involved the Bulgarian gang

The court clearly established that Credit Suisse had a role to play and did not follow anti money laundering rules diligently. However, Credit Suisse denied these allegations and appealed to higher courts.

In another case of fraud where allegedly, one of the Credit Suisse advisers forged the signature of its client, and as a result, the employees suffered extensive damages The case is currently being appealed and expects to cost around $600 million. All of the above mentioned incidents lead to the degradation

of the goodwill of the bank Quantitatively, these issues are adding to the non operational costs of the Bank

K N O W Y O U R

S E C T O R

This again has a downward pressure on the Bank’s Earnings

Management Issues

The company faced many management related issues in the past few years At the peak of Covid 19, Chairman Antonio Horta Osorio had to resign as he flouted quarantine rules The move was speculative as it came less than a year after the Chairman was brought to reform the bank post Archegos and Greensill issues

In 2020, a spying scandal surfaced at the back As a result of which, the then CEO Tidjane Thiam was forced to quit The Financial Regulator of Switzerland claimed that the bank was misleading about the scale of its surveillance. Urs Rohner, who was the former bank chairman quit the office in the year 2021. He admitted to having disappointed clients and shareholders. Management issues gives a negative impression towards its own employees clearly as they point towards lack of leadership in the bank.

The Way Forward

The size of the Credit Suisse has become very big in the recent years. So, if the bank turns insolvent, there is a chance that it might lead to 2008 Global Financial Crisis like situation. Moreover, European economy is under the looming fear of

T H E P H A R M A C E U T I C A L S E C T O R

11 A

U G U S

TS

E P T

E M B E R NIVESHAK

recession The bank is planning to release a blueprint to guide them towards a structural overhaul and eventually help them venture into "capital light, advisory led" business and strategic options for the Securitized Products unit

To restructure, the bank can liquidate many of its assets ranging from stakes in many companies to some of its investments in physical assets like hotels in Switzerland Moreover, the Bank is planning to sell its shares and rights offerings to raise $4 04 Billion The bank will also buy back its corporate bonds to fetch nearly $3 Billion.

In these situations, management communication is equally important There’s a clear need to be transparent from the end of Credit Suisse. The messaging should be honest and empathetic towards shareholders and investors. This will help rebuild trust of both the investors and the customers of the banks A positive outlook about a bank's integrity can turn the wheels around both in terms of Credit Rating agencies as well as the stock markets.

Rights Offering or Rights Issue

It is a group of rights offered to exist shareholders to purchase additional stock shares, known as subscription warrants, in proportion to their existing holdings. These are considered to be a type of option since it gives a company's stockholders the right, but not the obligation, to purchase additional shares in the company In a rights offering, the subscription price at which each share may be purchased is generally discounted relative to the current market price. Rights are often transferable, allowing the holder to sell them in the open market.

Moreover, it can approach its large long term investors to inject some funds. It can also explore the option of issuing convertible debentures to raise money which can later be converted into equity shares as the situations improve

Convertible Debenture It is a type of long term debt issued by a company that can be converted into shares of equity stock after a specified period. Convertible debentures are usually unsecured bonds or loans, often with no underlying collateral backing up the debt.

K N O W Y O U R S E C T O R I N T H E S E S I T U A T I O N S , M A N A G E M E N T C O M M U N I C A T I O N I S E Q U A L L Y I M P O R T A N T . T H E R E ’ S A C L E A R N E E D T O B E T R A N S P A R E N T F R O M T H E E N D O F C R E D I T S U I S S E . T H E M E S S A G I N G S H O U L D B E H O N E S T A N D E M P A T H E T I C T O W A R D S S H A R E H O L D E R S A N D I N V E S T O R S .

T H E P H A R M A C E U T I C A L S E C T O R

N I V E S

H

A K 12STAY INVESTED

Mr. Navneet Sharma

Founder Sampannata Consultants

We at IIM Shillong believe in sustainability. Renewable energy share prices have generated handsome returns in the last 5 years. Companies working with considerable debt and the sector’s reliance on R&D might dent the returns. Please share your views on the prospects of the renewable energy sector

Investing in renewable energy is a new generation business So, capital is not easily available for these types of companies. Even if these companies would have gone for IPOs, people would not have invested. So that is why they had to rely on debt And the debt they are getting is on the basis of their existing companies. The risk capital was not available There's absolutely no doubt about it Eventually, the world will realize that sustainability is the only way of surviving and this we learnt after the COVID Pandemic. So all those companies which are investing in alternate energy will have a better future. For instance, EVs, Tata had started investing in

EVs quite earlier Whereas at the same time, Maruti around a year ago, categorically said that the EV ecosystem is not ready So they decided that would not invest in EVs right now But around six months ago, they took a U turn on that eventually started investing in EVs, and since they are the best company in the country, so they will be able to do it in a much faster manner. So sustainability and the services or the products, or the ideas which are based upon sustainability, will have a future.

As per the Alternate Investment Policy Advisory Committee report, a major chunk of the equity capital for startups and medium sized organizations is sourced from overseas, and just about 20% is funded domestically. Could you please elaborate on the possible reasons for this? And do you see this trend changing in the future?

India as an investment market is still evolving So we have a huge lack of risk capital in our country. There are a lot of reasons for that in terms of financial regulatory systems, for example, safety, transparency, and banking will need time to evolve These

F

I

N

V I E

W

S P O T L I G H T F O R S U C C E S S

NIVESHAK13 A U G U S TS E P T E M B E R NIVESHAK

are things that were not developed around ten years or 15 years ago So, there's a lot of work which has happened in terms of transparency policies and regulations Though the journey has started around 20 years ago, the last ten years have been revolutionary for banking So, the last few years have been vital in increasing a lot of transparency. But earlier, there was reluctance to risk taking by investing in startups because in the startups, mostly the capital comes from the risk capital funds or the angel funds, so, though the entire ecosystem for this risk capital was not there earlier for India People were investing in traditional products only rather, and equity culture is very less in our country

So if you compare it with the developed countries, equity culture in itself is not great here. Although this is true, things have moved positively in the last three to five years. Even if we could, the culture is not there. The risk capital is even riskier So, yes, to some extent, the domestic contribution to startups was less since there was no allocation of funds in terms of risk capital and all those things. So, for example, in terms of SEBI, if you go for an IPO, the basic condition for IPO earlier was that the company should be in profit for the last three years, the last five years So all these startups wouldn't have even the balance sheets with them, leaving aside the profits and all those things. That is why there was a lack of it So now, there are certain things that have changed Angel investing has started in our country, so the ratio of investments will change in the

near future If you look at the brighter side, they will say that our investors are smarter than the rest of the ones. They want to make money out of every single investment though there are a lot of risks. Things are now changing. People are learning Transparency has things are changing, people's behaviour towards risk taking has changed, and transparency has also improved in corporate firms in terms of company regulations. So things will improve

One of the events that the banking industry in India is looking forward to is the merger between HDFC and HDFC Bank. How do you think this will impact the economy since we are not used to having a single entity with such a great amount of control?

This merger will do wonders for both companies. 70% of HDFC clients do not have a bank account with HDFC Bank and 70% of HDFC Bank account holders have not taken home loans from HDFC The merger will have a positive influence on the footfall of customers in both segments India is not familiar with one entity having so much control over a particular sector but in this case, it will prove to be beneficial for the customers, the company, and the economy as a whole The weightage of the banking sector in the Indian economy is immense and will continue to remain bullish With the increase in consumer income and risk taking ability, demand for money will also increase The Indian economy stands in a much better position than Europe and the rest of the world

I V E S H A K

N

14STAY INVESTED

The rupee has been depreciating for the last six months. This should have increased our exports, but it has decreased by 2 22% in August 2022 as compared to the same period last year. Could you please share your opinion on this and do you think rupee depreciation will have a positive effect on our exports in the medium run?

Yes, as far as the rupee is concerned, it was around 75 76 Rupees around six months ago Recently, it has touched a low of 83. In percentage terms, it would be approximately 10% So, the right way to look at depreciation is by using a Dollar Index. So, Dollar Index is an index that shows the US dollar versus currencies of other large economies. Unfortunately, the rupee is not included in the index, but even if we consider it a benchmark, the dollar index has moved from 90 to 115 So, roughly an increase of around 25%. The rupee ’ s depreciation has happened around 10% versus the rest of the large economies where the depreciation of their currencies versus the dollar has happened around 20 to 30%. But in terms of other global currencies, the rupee has improved versus the Pound, Euro, and Yen

Our export happens to US and Europe, When I’m talking about the US, it could have improved in terms of realization since we will be getting more rupees, since we ’ re getting X amount of dollars Some of the exports have definitely decreased because there is some pressure on consumer spending, especially in Europe. Europe is struggling because they are focusing more on its energy

crisis. That might explain the 2% 3% decrease in exports

When spending from the US and Europe starts improving, India will start reaping the benefits of a cheaper currency And then, obviously, our realizations will improve drastically That’s what IT companies have also projected

We run an investment fund called the ‘Niveshak Investment Fund’ or NIF here at IIM Shillong and are bullish on the banking sector Given the rise in NPAs and interest rate related risk due to an increase in inflation, it is a sector with its issues. Could you please share your thoughts?

Whatever direction the economy will move, the banking sector will move. The ratio might vary, but otherwise, it will be directly proportional to the economy's growth. In a developing country like India, the growth rate would be much faster So, whenever there is growth, the banking industry would always be in need because it will only help the country to grow. So, if we are optimistic about the banking sector Now the second part is in terms of NPA and the risks involved in it. There are different types of banking; the banks that cater to large corporates, and the other ones that cater to the retail segment These are two differentiated parts In terms of risks, being a banker, we have an experience that the retail sector behaves much better than the corporate sector.

With the changes in the legal structure, and the corporate law structure, especially the introduction of NCLT, the process of lending and collecting has

NIVESHAK15 A U G

U

S TS

E P T E M B E

R

improved a lot. So, the risk of defaults in the case of large corporates has been reduced But since the transparency has improved, the laws to improve the legal structure have also improved. In the retail sector, your returns are directly proportional to the risk It's not that it's not the case in large corporate, but it's not very easily possible, because large corporate will always ask for very low interest rates. So, the spread in the case of large corporate is always less It will definitely benefit the retail sector if we have good processes, like digitization, KYC, and connectivity improvements So, even in the retail sector also, we have reasons to believe that it is going to expand exponentially And with the improvement in all the infrastructure, it will become more sustainable So, coming back to both the large sector as well as in the retail sector, the efficiency, the collections, and the part of the margin are definitely going to improve and the volatility is going to reduce In, a nutshell the banking sector will always be a bullish sector. So, coming back I personally as well as our clients are bullish about the banking sector, and the choices we have to make as an investor

The famous line 'When the US sneezes, the whole world catches a cold' seems to fit the Indian stock markets perfectly There is a high amount of influence of FIIs, and US policy changes have always impacted movements in our market. Could you throw some light on how this dependence could be reduced?

probably around 10 years ago. In April 2022, FPIs had withdrawn around two lakh crores of money from the Indian market. The Indian market is still hovering between 10 15% of its all time high The correction would have been much more severe had this happened 10 years ago The impact of funds being withdrawn by FPS was tamed by the investments by retail investors That's the beauty of the Indian market today. Secondly, the countries ‘caught a cold’ during COVID followed their old traditional methods of handling their monetary and economic crisis In India, money was not distributed blindly These actions decoupled India from the rest of the world countries which led to a reduction in the impact Coming back to the question, although we are living in a global village now, we can't say that if there is a fire in one house will not get affected. We will get some heat at least, but the way we have evolved over the last 5 10 years, the impact has been tamed to some extent. We, as a market, are probably bigger than the entire Europe. Going ahead, even if the US sneezes, we might face little impact, but it will not be directly proportional. We will be able to sustain ourselves because of our demographic pool We have the youngest educated population in the world. So they'll help the country to grow and to stand out Summing up, we are slightly decoupled now, in terms of bigger economies, we would be in a sweeter spot So whenever somebody will sneeze or somebody will try to take a rest because of some sneezing, we'll use that opportunity to grow our businesses. I'm pretty optimistic about the future

N I V E S H A K

16STAY INVESTED

The Indian Pharmaceutical sector is one of the most prominent sectors in the Indian economy It is the largest generic medicines supplier, with the highest number of patents issued outside the USA The sector has five crucial segments Contract Research Manufacturing Servies (CRAMS), API, formulations, biologics and biosimilars, and vaccines. The pharma industry is expected to touch $120 billion by 2030. In India, 100% FDI is allowed in greenfield projects by the automatic route and 74% is permitted in brownfield investments through the automatic route, and the rest by government approval The sector's major players are Sun Pharmaceutical, Lupin, Dr Reddy's, Biocon, Cipla, Wockhardt, etc.

1 Production Linked Incentive Scheme (1.0) (₹6490 crores) for the promotion of domestic manufacturing of critical Key Starting Materials (KSM)/ Drug Intermediaries (DIs)/ Active Pharmaceutical Ingredients (APIs) in India

2 PLI Scheme for Medical Devices

With a total outlay of over ₹3420 crores, 5% of incentive will be given on incremental sales for a period of 5 years for boosting domestic and foreign investments.

3 Promotion of Bulk Drug Parks

Starting similar plants as China did where heavy volume production will happen using plug and play model

The Umbrella Scheme is known as the Scheme for the Development of the Pharmaceutical Industry. The main objective is to increase the industry's efficiency to ensure the quality and availability of drugs and their accessibility The following are the initiatives

Strengthening of Pharmaceutical Industry (SPI) for MSMEs The purpose of this scheme is to make the existing manufacturing facilities innovative and dynamic to changing demands specifically in MSMEs The scheme has been allocated ₹500 Cr. for 5 years which can also be used for capital subsidy on loans and interest subvention Promotion of medical devices and their development along

4

A U G U S TS E P T E M B E R NIVESHAK

K N O W Y O U R S E C T O R

T H E P H A R M A C E U T I C A L S E C T O R

Introduction Government Initiative NIVESHAK17

with the creation of common facilities (labs. Treatment plants) is also thought of here

Budget Allocation

The total financial outlay has increased to over ₹86,000 crores. There was an increase in the budgetary allocation in the National Health Policy from 1.8% of GDP to 2.50 3% of GDP.

The schemes under healthcare missions are Pradhan Mantri Swasthya Yojana (₹10,000 crores), Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (₹4176 crores) wellness centers, health labs, critical care hospitals, Mission Shakti, Poshan Maah 2.0 and Saksham Anganwadi are new schemes under the belt The increased focus on manufacturing and investments has seen an increase of 200% in the FDI investments in India in FY21.

The new concept of blended finance (combination of govt money and private finance) was launched wherein 20% of funds will be issued by the government and the fund will be managed by the private fund managers to improve R&D and innovation

Challenges

1 Due to the strict implementation of pollution control norms, the costs of manufacturing API are skyrocketing

2. lack of availability of tax incentives to boost API parks and involves higher borrowing and utilities cost combined with lower import duties have led to cheaper imports from China.

Key Metrics

Product Quality Complaint Rate

It is calculated by dividing complaints against a particular drug by the total number of those drugs dispatched This measure is also included in FDI quality guidelines.

Return on Research Capital Ratio

It measures the percentage of gross profit from each rupee spent on R&D It is important to note that since expenses incurred today in R&D are expected to give results tomorrow, so we divide the current year's gross profit by the last year ’ s R&D spending giving investors a way to analyze the tangible development of a pharma company.

Lead, Cycle, and Takt Time

Time taken to get the product from supplier to company is the lead time Cycle Time is the time taken to complete the production of one unit Takt Time is the average time taken between the start of one unit to that of the next unit, and it is the rate at which drugs are produced to meet customer demands.

I V E S H A K

K N O W Y O U R S E C T O R

T H E P H A R M A C E U T I C A L S E C T O R

N

18STAY INVESTED Source:Ibef

Social Impact Bonds are emerging as an innovative way to foster the ever growing development needs of the society In this model, an outcome payer, a public sector entity or a foundation, enters a pay for success contract with a service provider to achieve the quality of social outcomes. Impact investors provide the capital to

scale the work of high quality service providers and get paid by the public entity/development foundation if and when the project achieves outcomes that generate shared value. Hence, effectively, SIBs transfer risk from the public to the private sector and align project partners to achieve a meaningful impact This model helps achive the twin objective of risk and return.

NIVESHAK A U G U S TS E P T E M B E R

A R T I C L E O F T H E M O N T H S O C I A L I M P A C T B O N D : A D A R K H O R S E ? B Y S H A R A D A G A R W A L A I I M S H I L L O N G

What are SIBs and how does it work?

NIVESHAK19

Investors The investors provide the working capital for the service providers and bear the risk of project failure If the expected outcomes are not reached by the end of the period established, the investors may not recover their principal or may partially recover it, depending on the contract

Outcome Funders (Government)

The outcome funder provides the funds to remunerate the investors in case the outcomes are effectively generated,paying the principal as well as the interests established by the contract. In most cases, the outcome funder in a SIB is the government (central or local). Payments are made with the intermediary's intervention.

The Intermediary The crucial role of the intermediary is to bring together all the project's stakeholders. Intermediaries can have different degrees of

Source:Brookings.edu

Implication in the project: they may supervise the project during its implementation and even suggest modifications. . The intermediary is in charge of receiving the funds from the investors and passing them on to the service providers, as well as receiving the payment from the outcome funders and making outcome payments to the investors

The Stakeholders (Source: World Bank)

N I V E S H A K 20STAY INVESTED

Source: Brookig

The Service Providers The service provider, is the party of the contract that has to work with the service recipients and deliver the social outcomes outlined in the SIB contract It receives the funds to be used as the working capital from the intermediary at the beginning of the program Service providers are generally NGOs or nonprofit organizations, and the participation of profit oriented service providers could be complicated on an ethical and economic level

The Evaluator The evaluator is a fully independent entity that determines whether the previously established outcomes were reached by the end of the period The outcome payments will result from its judgment. The methodology by which outcomes will be measured is to be determined in the contract, which is one of SIB's biggest challenges.

SIBs around the world

As of 2021, 206 impact bonds have been contracted in 35 countries across six sectors. Interestingly, most deals are contracted in just a few countries; those contracted in the U K 69, the U S 26, the Netherlands 15, Portugal 13, and Australia 10 make up 69% of the total number of Impact Bonds

T H E P H A R M A C E U T I C A L S E C T O R

T H E P H A R M A C E U T I C A L S E C T O R

This aggregates over $437.27 million in upfront investment in social services

STAY INVESTED

A

U G U S TS E P T E M B E R

NIVESHAK21

and $460 million in total outcome funding committed. India is the leading emerging economy in terms of contracted Impact Bonds Impact Bonds have been contracted across six sectors, most of which are in the social welfare and employment sectors.

Issues associated with SIBs

Notwithstanding the immense opportunities that Social Impact Bonds seem to provide, it needs to be administered with a solid public institutional setup, owing to the potential of large scale manipulations in the impact feasibility and assessment parameters Several experts have been concerned about the entire SIB model as it allows the government to borrow off its annual budget, hiding the economy's actual state. Also, questions are being raised about

the higher cost of social good being borne by the taxpayers to benefit large impact investment funds and their institutional clients while the state shrugs off her responsibility of public good.

Conclusion

In times of budgetary constraints combined with aggravating social challenges, SIBs have emerged as an innovative financing mechanism representing a complementary approach to traditional social policy interventions SIBs are an example of experimentation in financial models for public service delivery and have raised several questions regarding the use of public funds, transparency and accountability, as well as challenges brought by the use of private funds for social services While they look promising at the outset, we'll have to wait for more inputs and analysis to bestow SIBs with a definite success or a failure.

T H E P H A R M A C E U T I C A L S E C T O R

22STAY INVESTED N I V E S H A K

Introduction

Gautam Adani has proved himself to be the king of masterminds by acquiring a 29.18% stake in New Delhi Television Network (NDTV) indirectly via Vishvapradhan Commercial Private Limited (VCPL) which is a wholly owned subsidiary of AMG Media Network Ltd (AMNL), is owned by Adani Enterprises Limited The question here is whether what Adani has done was within his legal right and if NDTV's claim of this being a hostile takeover is justified

About NDTV Promoters

The NDTV promoters Radhika and Prannoy Roy owned 16.32% and 15.94% respectively. Through RRPR (Radhika Roy and Prannoy Roy) they owned 29 18% of shares which is the main point in focus Moreover, the company named LTS Investment Fund also owns a 9 75% stake in NDTV which is an FPI and an analysis of its investments reveals that 97 78% of investment is in Adani Companies.

About Adani’s Recent Diversification

Adani group was recently regarded as overly leveraged The group has deployed strategies to get a loan from banks by pledging the shares of an existing company getting a loan from the banks to buy securities of any other entity, and by pledging the shares of the new company, they take another loan, and the cycle goes on. Companies like Adani Power and Adani Green and Adani Special Ports Ltd have huge debt to equity ratios and loan exposure.

Seeds Were Sown Earlier

The whole controversy started with the plan of NDTV to buy back its 7.73% shares from GA Global Investments in the year 2007. The share price of NDTV was ₹400 at that time but the offer was ₹439 They took a loan of ₹501 crores from India Bulls for that To their surprise, the global financial crisis hit, and the value of NDTV shares dropped to ₹100 This caused loads of trouble and efforts were made to start an entertainment company but all in vain, they ended up firing 25% of their workforce.

D E A L S B R E W E R Y T H E T A K E O V E R O F N D T V B Y A D A N I

NIVESHAKNIVESHAK23 NIVESHAK A U G U S TS E P T E M B E R

To repay the loan from India Bulls, they took a loan of ₹375 crores from ICICI at 19%. The situation worsened since they were not able to pay the interest in time. They took a loan of ₹403.8 crores from VCPL without any interest or security and in return, Roys agreed to give 99.9% of shares of RRPR to VCPL in the form of Equity Warrants It was specifically mentioned in the contract that VCPL can take control of NDTV without any questions asked by promoters even if the loan is repaid Effectively, VCPL had taken the control of RRPR Whatever was done by NDTV was illegal as per SEBI rules and hence Roys were raided by Enforcement Directorate.

What lies ahead!!

SEBI regulations allow the party which has purchased more than 25% of shares in any company an option to offer existing shareholders buy out to increase the total shareholding of the buyer beyond 50%. This option is available to Roys and Adani but here is the caveat, Roys has been disbarred from trading in the stock market by SEBI till Nov 2022.

Now, Roys, surprisingly, is claiming it to be a hostile takeover even though the Roys already knew that the ownership of their company was at stake when they gave equity warrants to VCPL After acquiring 29 18% of NDTV, Adani now has made an open offer of shares worth 26% for its investors at ₹294 per share with a total consideration of $68 million with which it can acquire more than 50% of the share to get its control. If the plan works, Adani will also foray into the media sector through AMG Media Network.

The VCPL Puzzle

VCPL was operating as a shell company with no past records or past transactions. It had taken the loan from Shinano Retail which in turn had taken a loan from Reliance Industries owned by Mukesh Ambani. VCPL’s ownership was transferred in the year 2012 by Nextware Televenture Pvt Ltd whose owner was the Director of Jio Infocomm Now, Adani has purchased VCPL through its company AMG Media Company Ltd Thus, the reason this deal is said to be between Adani and Ambani

Source:IndMoney Source:EconomicTimes STAY INVESTED N I V E S H A K 24

Shareholding Pattern of NDTV

NDTV share rose since deal announcement

A U G U S TS E P T E M B E

OVERVIEW

Traditional Finance and Economic theory are built on the premise that investors act rationally and consider all information present when making decisions related to investing

But in reality, are they rational? Behavioural Finance challenges these assumptions and identifies biases that are present while investing. Now, the markets also behave inefficiently contrary to the efficient market hypothesis and the individuals also divert from rational choices. By understanding these biases, we may be able to make better decisions and analyze the portfolio of stocks held by an individual/institution

EXPLORING THE BIASES

Investors are risk averse loss averse

We always hear that investors are risk averse, but in reality, they are loss averse Loss Aversion may be very similar to risk aversion, but the difference lies in the gains and losses A risk averse investor will hold on to progress and sell off securities at a loss In contrast, a loss averse investor will hold on to loss making securities hoping to recover losses and sell securities in gain because they don’t want to risk the earned profit.

Fascinating, isn’t it?

Investors consider all information available information.

Investors consider quickly recallable information and decide on the probability of an event occurring based on how easy it is to recall a similar instance so, we are very quick to relate the Evergrande crisis to the subprime crisis even though it makes no sense The problem here is that these biases are in our memories

V E S H

NIVESHAK

R

F I N S U P E R V I S E B E H A V I O U R A L F I N A N C E

N I

A K NIVESHAK25 A U G U S TS E P T E M B E R NIVESHAK

So, recent events are easy to remember and made available for use This is the availability bias

Investors act for their long term goals short-term satisfaction.

People display a notorious lack of self control when it comes to money Retirement safety and saving are usually the top priority for individuals, but they often find it difficult to sacrifice present consumption; they would like to spend their income today rather than save for tomorrow This is the self control bias and can lead to asset allocation imbalance in pursuit of short term utility.

Investors frequently infrequently update their portfolios.

Investors are generally more comfortable with maintaining a status quo, keeping things the same, and not looking for opportunities that could be beneficial People choose to do nothing to their initial portfolio allocation because of inertia This is the status quo bias

Furthermore, if given a choice to update or maintain the default allocation, people will generally opt out rather than update the initial asset allocation

Markets cannot can be controlled.

Traders believe they have a sense of control over their investment outcomes leading to excessive trading, which results in lower realized returns than a strategy with less frequent trading

Investors prefer to invest in companies they feel they have control over, like their employer's, which leads to inadequate diversification.

Ltd

adequately inadequately incorporate new information

Investors overweight their initial beliefs about the probabilities of outcomes and under react to new information. They prefer to maintain the prior conviction than deal with the mental stress of incorporating further information. This behavior is related to difficulty in understanding new information, called the conservatism bias, which leads investors to consider only easily understood information Thus, it is crucial to consider various behavioral biases when analyzing or investing These biases are not exhaustive; more biases affect the markets It is gathering more attention from portfolio managers as they have to either moderate or adapt to these biases depending on the risk of the standard of living of each client.

How behavioural biases influence mind

Investors

Individual choices Social Proof Bias Inherent Biases Making Investments Behavioural biases affecting investment decisions 26STAY INVESTED N I V E S H A K

During the 2008 Financial crisis, the fall of the Lehman brothers and bears and Sterns is well known. With the current Credit Suisse crisis in mind, we present to you another firm that almost went down due to the same. Americans International Group, commonly known as AIG, had most of its businesses in auto, business, general, life, travel insurance, and products like fixed and variable annuities.

What was the trouble?

The firm got into trouble when it moved beyond its traditional business AIG was touted as ‘too big to fail. By 2006 2007, AIG became a primary seller of credit default swaps to boost its profit margin Money market instruments were heavily invested in AIG debt and securities Most mutual funds owned the AIG stock, and many financial institutions were significant holders of AIG’s debt

OPTION A right, not an obligation to execute the trade Call option

Where the person has the right to call the asset and buy at the pre decided price Put option Where they buyer gets the right to sell the asset

With the potential fall of AIG, many financial institutions that invested in AIG or bought their swaps were at risk of bankruptcy. Post the fall of the housing market and then the subsequent fall of the CDOs, AIG was pushed to raise capital to cover for the enormous losses As a result, they sold their Aircraft leasing division

CDO Imagine all your student loans were combined and sold to another investor by the bank as one different asset. He would gain all the interest and principal payments after buying the asset at a cheaper price. This helps the bank to regain liquidity to provide loans to more students Adding unsafe loans to this bucket eventually led to the 2008 Financial crisis

Losses from all around?

But there was more to come When the investors exercised their Put options on CDOs, AIG would buy at a price much higher than the actual value of these assets, if it had any. They were also facing pressures for their Commercial papers and Repos.

NIVESHAK

A N U B H A V K A T H A N E X P E R I E N C E S T H A T T E A C H

NIVESHAK27 A

U G U S TS E P T E M B E

R

Yet, most of the blame for their losses goes to their position in CDS, which differed from other banks The other banks would trade on both, selling as well as buying CDS But AIG stayed on only one side and only sold these instruments Unlike other banks which bought as well as sold these CDSs, which moderated their losses which was not the case for AIG.

In case of insurance, one claim might not lead to another, but in the case of CDS, the fall of a CDO and a subsequent claim would have a domino effect too leading to more claims, hence more losses for AIG as more and more claims started coming in along with other pressures as mentioned above Hence most of the firms involved in such business witnessed a massive fall in their income, yet the most significant change can be seen in the case of AIG.

How did they recover?

Looking at the possible effect on all other banks and the overall financial effect this would have on the economy, the US Government and the fed had decided to bail out the firm along with many other firms at the risk of bankruptcy AIG received a package of total $142 Billion, the largest of all bailouts the government had provided to the banks post during the 2008 Global Financial crisis.

of Bailouts

AIG

I V E S H A K

The case proves the importance of understanding your risk profile in various business and asset classes you choose to get in, just like the bank did In 2017, the Federal reserve ended its oversight of AIG, and the company became more committed to working with regulators to reduce overall risk.

STAY INVESTED N

28

BAILOUT Providing with essential capital help to distressed firm and preventing their collapse

Comparison

received Source moneycnncom Source CompanyAnnualReporrts Source CompanyAnnualReporrts Profit/Losses for 2007 & Q2008 uarterly Net Income of AIG

How to Play?

Below we have 10 chart situations where you have to predict the movement of the stock based on the price chart formations The task is to identify whether the chart will go up, down, or sideways You need to match the following chart patterns with their respective names as mentioned below Do mention the assumptions taken into account while providing those recommendations. You can send your answers via e mail to niveshak@iimshillong ac in

1 2 3

L E T S F I N U P ! 4 5 6 L E T ' S F I N - U P

P R E D I C T T H E M O V E M E N T

NIVESHAK A

U G U S TS E P T E M B E R

29

Technical Analysis is essentially the art of pattern recognition It is a trading discipline that uses statistics to identify trading opportunities. These are some of the patterns which you might find in the questions above RESISTANCEHEAD AND SHOULDERS CUP AND SHANDLE IDEWAYS CHANNEL BULLISH HAMMER BREAKOUT DESCENDING CHANNEL THE FLAG W CHART THE DOJI MATCH THE FOLLOWING WITH GRAPHS ABOVE 8 9 7 What is Technical Analysis? N I V E S H A K STAY INVESTED Want a digital copy? Don't worry! Scan this QR Code! 30

ANNOUNCEMENTS Team Niveshak invites articles from participants from all colleges across India We are looking for original articles related to Finance and Economics. Participants can also contribute puzzles and jokes related to Finance and Economics References should be cited wherever necessary The best article will be featured as "Article Of The Month" and would be awarded a cash prize of ₹3000/ along with a certificate. The runner up article would be awarded a cash prize of ₹2000/ along with a certificate. INSTRUCTIONS Send in your articles to niveshak iims@gmail com Mail subject line must be "Article For Niveshak <Title>" Mention your Name & Institute Name along with the article Ensure that article has a word count between 1200 1600 Please DO NOT send PDF Files and stick to the format Number of authors is limited to 2 for each article Also certain entries which could not make the cut to the magazine will get featured on our website Microsoft Word Font: Times New Roman Size: 12 Line Spacing: 1.5 FORMAT ISSUE 1 • VOLUME XVI • AUG SEPT '2022

T H E P H A R M A C E U T I C A L S E C T O R

T H E P H A R M A C E U T I C A L S E C T O R