Salt Lake Housing Forecast Report: A Review and Forecast for the Salt Lake County Residential Real Estate Market

Salt Lake Housing Forecast Report: A Review and Forecast for the Salt Lake County Residen>al Real Estate Market

Despite experiencing the steepest two-year surge in housing prices on record from 2020 to 2022, Salt Lake County's housing market displayed a remarkable resilience against even modest declines, maintaining stable prices despite a decrease in home sales.

Despite experiencing the steepest two-year surge in housing prices on record from 2020 to 2022, Salt Lake County’s housing market displayed a remarkable resilience against even modest declines, maintaining stable prices despite a decrease in home sales.

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

Prices Surprise in 2023

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

With the highest mortgage rates since 2002 and worries about a recession, 2023 was bound to be a tough year for the housing market How severe would the housing correction be? Mark Zandi, a highly respected economist at Moody Analytics, predicted housing prices would fall 15% to 20% in “overvalued” markets.1 Salt Lake qualified as an overvalued market with the median sales price increasing by 40% in two years; jumping from $380,000 in 2020 to $530,000 in 2022, Table 1.

Prices Surprise in 2023

With the highest mortgage rates since 2002 and worries about a recession, 2023 was bound to be a tough year for the housing market. How severe would the housing correction be? Mark Zandi, a highly respected economist at Moody Analytics, predicted housing prices would fall 15% to 20% in “overvalued” markets.1 Salt Lake qualified as an overvalued market with the median sales price increasing by 40% in two years; jumping from $380,000 in 2020 to $530,000 in 2022, Table 1.

1

Table 1

Table 1

2017 $293,000 10.6%

2018 $320,000 9.2%

2019 $343,500 7.3%

2020 $380,000 10.6%

2021 $465,000 22.4%

2022 $530,000 14.0%

2023 $515,000 -2.8%

*Includes single-family homes, condominiums, townhomes, and twin homes.

Source: UtahRealEstate.com

Despite the most rapid two-year rise in housing prices ever (2020 to 2022), prices in Salt Lake County were surprisingly resistant to even a modest decline. Last year, prices declined by only 2.8%, falling from $530,00 in 2022 to $515,000 in 2023. A look at past price declines helps explain the stubborn price resistance in 2023. In the past 50 years of price history there have been only two periods of price declines, the 1980s and Great Recession (20082011), Figure 1.

Despite the most rapid two-year rise in housing prices ever (2020 to 2022), prices in Salt Lake County were surprisingly resistant to even a modest decline Last year, prices declined by only 2.8%, falling from $530,00 in 2022 to $515,000 in 2023. A look at past price declines helps explain the stubborn

10 | Salt Lake Realtor ® | February 2024

A 20% Home Price Decline?” Fortune, December 7, 2022.

Sales Price of

Home in

Median

a

Salt Lake County

Median Year Sales Price* % Chg.

Median Sales Price of a Home in Salt Lake County

Figure 1

Positive labor market conditions in 2022-2023 protected the residential real estate market from short sales and foreclosures, the main causes of falling housing prices in the Great Recession. For example, in 2009, the number of jobs in Salt Lake County declined by over 6%, a loss of 35,000 jobs, which in turn meant a loss of income and default on mortgage payments for some households. During the Great Recession forecloses and short sales accounted for 18% of home sales, over 2,000 of the 11,000 residential sales in 2011. This record level of foreclosures and short sales, driven by a shocking level of job loss and reduced household income during the Great Recession caused housing prices to fall for 16 consecutive quarters. No such downward pressure exists in today’s housing market. In 2023, only 57 of the 11,194 sales in Salt Lake County, about one-half of one percent, were foreclosures or short sales. Hence, Utah and Salt Lake County’s strong employment conditions helped prevented housing prices from any serious declines in 2023.

Increasing Likelihood of Modest Price Increase in 2024

sales. Hence, Utah and Salt Lake County’s strong employment conditions helped prevented housing prices from any serious declines in 2023.

Increasing Likelihood of Modest Price Increase in 2024

A comparison of prices on a year-over monthly basis indicates an uptick in the median sales price is likely in 2024. Over the last six months of 2023 the monthly price data show slight increases over prices in the same month previous year, Table 2. Partial monthly data for January 2024 show a continuation of the upward trend in the median sales price. Although prices look to be ticking up it will be many months before the monthly median sales price exceeds the May 2022 peak price of $565,300.

A comparison of prices on a year-over monthly basis indicates an uptick in the median sales price is likely in 2024. Over the last six months of 2023 the monthly price data show slight increases over prices in the same month previous year, Table 2. Partial monthly data for January 2024 show a continuation of the upward trend in the median sales price. Although prices look to be ticking up it will be many months before the monthly median sales price exceeds the May 2022 peak price of $565,300

*2023, year-over comparison through three quarters.

*2023, year-over comparison through three quarters.

Source: Federal Housing Finance Agency, all transactions index, estimated using sales price and appraisal data.

Table 2

Year-Over Comparison of Monthly Median Price of Home*

Salt Lake County

Year-Over Comparison of Monthly Median Price of Home* Salt Lake County

Month

January $501,000 $495,000 -1.2%

February $520,000 $500,000 -3.8%

March $540,000 $520,000 -3.7%

April $560,000 $500,000 -10.7%

May (peak monthly price) $565,300 $535,000 -5.4%

June $545,000 $525,000 -3.7%

July $526,000 $539,000 2.5%

August $525,000 $525,000 0.0%

September $523,750 $525,000 0.2%

Source: Federal Housing Finance Agency, all transactions index, estimated using sales price and appraisal data.

Both periods were marked by high rates of unemployment, above 6%, and either job losses or meager rates of job growth, less than 1% A far cry from job conditions in 2023. The 2023 unemployment rate in Salt Lake County was 2.57%, the second lowest annual estimate ever; only 2022 was lower In 2023 the number of jobs in the county hit 800,000 up 2.4%, an increase of 19,000 jobs from the previous year. A strong increase in the average wage was also recorded in 2023 of 5%, pushing the average wage in Salt Lake County to $70,175 This wage gain followed the record-breaking increase of 6.3% in 2022.

October $522,947 $530,000 1.3%

November $504,500 $510,000 1.1%

December $485,000 $495,000 2.1%

*Includes single-family homes, condominiums, townhomes, and twin homes.

Source: UtahRealEstate.com

Sales Continue to Slump

Sales Continue to Slump

ositive labor market conditions in 2022-2023 protected the residential real estate market from short sales and foreclosures, the main causes of falling housing prices in the Great Recession For example, in 2009, the number of jobs in Salt Lake County declined by over 6%, a loss of 35,000 jobs, which in turn meant a loss of income and default on mortgage payments for some households During the Great Recession forecloses and short sales accounted for 18% of home sales, over 2,000 of the 11,000 residential sales in 2011. This record level of foreclosures and short sales, driven by a shocking level of job loss and reduced household income during the Great Recession caused housing prices to fall for 16 consecutive quarters No such downward pressure exists in today’s housing market In 2023, only 57 of the 11,194 sales in Salt Lake County, about one -half of one percent, were foreclosures or short

Both periods were marked by high rates of unemployment, above 6%, and either job losses or meager rates of job growth, less than 1%. A far cry from job conditions in 2023. The 2023 unemployment rate in Salt Lake County was 2.57%, the second lowest annual estimate ever; only 2022 was lower. In 2023 the number of jobs in the county hit 800,000 up 2.4%, an increase of 19,000 jobs from the previous year. A strong increase in the average wage was also recorded in 2023 of 5%, pushing the average wage in Salt Lake County to $70,175. This wage gain followed the record-breaking increase of 6.3% in 2022.

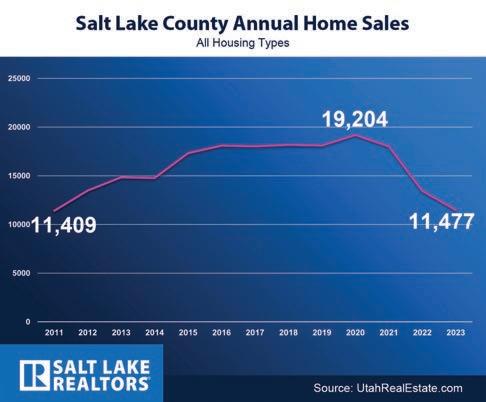

While prices held firm in 2023 sales slumped to their lowest level since 2010. Residential real estate sales totaled 11,195 homes last year, down 15% from 2022 and 41% below the all-time high of 19,041 in 2020, Figure 2. The impact of higher mortgage rates took the greatest toll on sales in 2022 as rates increased from 3% to over 7% in less than 12 months. The rapid rise in rates caused

February 2024 | Salt Lake Realtor ® | 11

Table 2

Art_me2541©/Adobe Stock

Figure 1

Percent Change in Housing Price Index for Utah

-10.00% -5.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023* 17.90% 16.60% 15.70% -7.90% 22.20% 19.30% 0.00%

While prices held firm in 2023 sales slumped to their lowest level since 2010. Residential real estate sales totaled 11,195 homes last year, down 15% from 2022 and 41% below the all-time high of 19,041 in 2020, Figure 2. The impact of higher mortgage rates took the greatest toll on sales in 2022 as rates increased from 3% to over 7% in less than 12 months. The rapid rise in rates caused residential sales to fall by 26%, 4,500 fewer sales than the previous year. In 2023, rates fluctuated in a narrower range, from 6% in February to a high of 7.8% in the last week of October. By year-end 2023 rates dropped to 7% and drifted even lower to 6.6% in January 2024. 2022 2023 % Chg.

Percent Change in Housing Price Index for Utah

Source: U.S. Bureau of Labor Statistics

Residential real estate sales have been much more sensitive to rising rates than prices And with rates expected to move lower in 2024, further declines in sales are unlikely thus leaving the 11,195 home sales in 2023 as the low point in sales for the current price cycle. Mortgage rate forecasts for 2024 rates trending toward 6% and dropping below 6% in 2025, which will help support higher levels sales.

residential sales to fall by 26%, 4,500 fewer sales than the previous year. In 2023, rates fluctuated in a narrower range, from 6% in February to a high of 7.8% in the last week of October. By year-end 2023 rates dropped to 7% and drifted even lower to 6.6% in January 2024.

Figure 2

Residential Real Estate Sales in Salt Lake County

Source: UtahRealEstate.com

Source: UtahRealEstate.com

toward 6% and dropping below 6% in 2025, which will help support higher levels of sales.

Table 3

Mortgage Rate Forecasts

Year-end 2024 2025

Source: U.S. News and World Report, January 8, 2024.

Fewer Listings Contribute to Slumping Sales

Fewer Listings Contribute to Slumping Sales

Sales in 2023 were lower, not only due to higher mortgage rates, but also to fewer listings entered.

Notice the yellow bars representing new listing entered in 2023, Figure 4. In the first 10 months of listings entered were lower than the previous three years. However, in November and December 2024, when mortgage rates declined listings increased, exceeding November and December of 2022

On a monthly average the number of listings entered statewide in 2020 was 4,745, in 2021 4,444, 2022 4,513, and in 2023 falling to 3,830.

The decline in rates follows positive news on inflation. The rate of inflation peaked in June 2022 at 9.1%, Figure 3. At the time many economists predicted high rates of inflation would persist over the next few years. They were wrong Inflation has fallen much faster than expected while avoiding a spike in unemployment and loss of jobs, again surprising many experts. The rate of inflation was below 4% from June to December Consequently, the Federal Reserve has signaled rate reductions are likely in 2024. The core inflation rate (excluding energy and food) fell primarily due to lower prices for goods (autos, apparel, appliances, household furnishing, etc.). In addition, falling gasoline prices, the deceleration in rent increases, and relief from supply chain bottlenecks have contributed to lower rates of inflation

The decline in rates follows positive news on inflation. The rate of inflation peaked in June 2022 at 9.1%, Figure 3. At the time many economists predicted high rates of inflation would persist over the next few years. They were wrong. Inflation has fallen much faster than expected while avoiding a spike in unemployment and loss of jobs, again surprising many experts. The rate of inflation was below 4% from June to December. Consequently, the Federal Reserve has signaled rate reductions are likely in 2024. The core inflation rate (excluding energy and food) fell primarily due to lower prices for goods (autos, apparel, appliances, household furnishing, etc.). In addition, falling gasoline prices, the deceleration in rent increases, and relief from supply chain bottlenecks have contributed to lower rates of inflation.

Figure 3

Year-Over Monthly Percent Change in the Consumer Price Index (U.S. city average, all urban consumers)

Source: U.S. Bureau of Labor Statistics.

Source: U.S. Bureau of Labor Statistics

Sales in 2023 were lower, not only due to higher mortgage rates, but also to fewer listings entered. Notice the yellow bars representing new listing entered in 2023, Figure 4. In the first 10 months of 2023 listings entered were lower than the previous three years. However, in November and December of 2024, when mortgage rates declined listings increased, exceeding November and December of 2022. On a monthly average the number of listings entered statewide in 2020 was 4,745, in 2021 4,444, in 2022 4,513, and in 2023 falling to 3,830.

Figure 4

Figure 4

Number of Listings Entered in Utah by Month

Number of Listings Entered in Utah by Month

Source: UtahRealEstate.com

Source: UtahRealEstate.com

An Offsetting Factor: Housing Affordability

An Offsetting Factor: Housing Affordability

While the housing market will benefit in 2024 from lower mortgage rates and increased listings, affordability will continue to be an offsetting factor preventing a sales recovery to the pre -pandemic level of 18,000 sales (2016-2020). An often-used measure of severity of housing affordability is the median multiple, which is a price -to-income ratio; the median house price divided by the median household income. Table 4 shows the affordability rating of the median multiple for Salt Lake County

From 2013 to 2016 the median multiple in Salt Lake County was under 4.0. Housing was moderately unaffordable. But by 2017 the ratio moved up to the 4.1 to 5.0 range, a seriously unaffordable rating. And by 2021, the acceleration in housing prices pushed the median multiple to 5.8 in 2021 and 2022

With the absence of a price increase in 2023 the ratio dropped slightly to 5.4, still a severely unaffordable rating for Salt Lake County, Table 5

Table 4

Residential real estate sales have been much more sensitive to rising rates than prices. And with rates expected to move lower in 2024, further declines in sales are unlikely thus leaving the 11,195 home sales in 2023 as the low point in sales for the current price cycle. Mortgage rate forecasts for 2024 show rates trending

Residential real estate sales have been much more sensitive to rising rates than prices And with rates expected to move lower in 2024, further declines in sales are unlikely thus leaving the 11,195 home sales in 2023 as the low point in sales for the current price cycle. Mortgage rate forecasts for 2024 show rates trending toward 6% and dropping below 6% in 2025, which will help support higher levels of sales.

Salt Lake County Median Multiple Affordability Rating, 2023

Housing Aordability Median Multiple Rating Ratio

Affordable ≤3.0

Moderately Unaffordable 3.1 to 4.0

Seriously Unaffordable 4.1 to 5.0

While the housing market will benefit in 2024 from lower mortgage rates and increased listings, affordability will continue to be an offsetting factor preventing a sales recovery to the pre-pandemic level of 18,000 sales (2016-2020). An often-used measure of severity of housing affordability is the median multiple, which is a price-to-income ratio; the median house price divided by the median household income. Table 4 shows the affordability rating of the median multiple for Salt Lake County. From 2013 to 2016 the median multiple in Salt Lake County was under 4.0. Housing was moderately unaffordable. But by 2017 the ratio moved up to the 4.1 to 5.0 range, a seriously unaffordable rating. And by 2021, the acceleration in housing prices pushed the median multiple to 5.8 in 2021 and 2022. With the

Severely Unaffordable 5.1 & over

Source: Demographia International Housing Affordability

12 | Salt Lake Realtor ® | February 2024

Figure 2

Residential Real Estate Sales in Salt Lake County

10,335 19,041 17,760 13,215 11,195 8,000 10,000 12,000 14,000 16,000 18,000 20,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Figure 3 Year-Over Monthly Percent Change in the Consumer Price Index (U.S. city average, all urban consumers)

Table 3

Fannie Mae 6.5% 6.2% Mortgage Bankers Association 6.1% 5.5% National Association of Realtors 6.3% 9.1% 3.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% Jan-19 March May July September November Jan-20 March May July September November Jan-21 March May July September November Jan-22 March May July September November Jan-23 March May July September November Year-end 2024 2025

Mortgage Rate Forecasts

Fannie Mae 6.5% 6.2% Mortgage Bankers Association 6.1% 5.5% National Association of Realtors 6.3% National Association of Homebuilders 6.7% 5.8% Wells Fargo 6.4% 5.8% Realtor.com 6.5%

Table 3 Mortgage Rate Forecasts

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000

June July AugustSeptemberOctoberNovemberDecember

2021

JanuaryFebruary March April May

2020

2022 2023

Source: UtahRealEstate.com

setting Factor

the housing market will bene ordability will continue to be an o 18,000 sales multiple, which is a price household income. Table 4 shows the affordability rating of the median multiple for Salt Lake County 2013 to 2016 the median multiple in Salt Lake County was under 4.0. Housing was moderately ordable. But by 2017 the ratio moved up to the 4.1 to 5.0 range, a seriously unaffordable rating. 2021, the acceleration in housing prices pushed the median multiple to 5.8 in 2021 and 2022 the absence of a price increase in 2023 the ratio dropped slightly to 5.4, still a severely ordable rating for Salt Lake County, Table 5.

absence of a price increase in 2023 the ratio dropped slightly to 5.4, still a severely unaffordable rating for Salt Lake County, Table 5.

“In 2024, the median sales price for all types of homes will increase by 3% to $530,500 from $515,000 in 2023, while the median price of a single-family home will increase by 2.4% to $600,000. Condominiums, townhomes, and twin homes will see a 5% increase to $436,000.” James Wood

Salt

Table 4

Table 4

Salt Lake County Median Multiple Affordability Rating, 2023

Tables 6-7 illustrate the impact of affordability on homeownership opportunities. The income required to finance the median priced single-family home in Salt Lake County is $170,000. Even more, the income required for a more affordable median priced condominium is $125,000.

Tables

Table 5

Median

February 2024 | Salt Lake Realtor ® | 13

Multiple Rating for Salt Lake County, 2013-2023

Lake County Median Multiple Affordability Rating, 2023 Affordable ≤3.0 Moderately Unaffordable 3.1 to 4.0 Seriously Unaffordable 4.1 to 5.0 Severely Unaffordable 5.1 & over Source: Demographia International Housing Affordability 1,000 2,000 3,000 4,000 5,000 6,000 7,000 Housing Aordability Median Multiple Rating Ratio Source: UtahRealEstate.com and U.S. Census Bureau Table 5 Median Multiple Rating for Salt Lake County, 2013-2023 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Year Ratio Rating 3.6 3.7 Moderately 3.8 Una ordable 3.9 5.8 Severely 5.8 Unadable 5.4 4.1 4.3 Seriously 4.3 Unadable 4.7

Mortgage Payment Calculations for the Median Price Home in Salt Lake County, Q2022 and January 2024 (single-family only) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Table 6

Table 6 Mortgage Payment Calculations for the Median Price Home in Salt Lake County, Q2022 and January 2024 (single -family only) Median sales price of home $562,250 $554,750 5% down payment $28,110 $27,735 Amount to finance $534,140 $527,015 Mortgage rate 6.66% 6.63% Principal and interest payment $3,411 $3,365 Private mortgage insurance 1% of the loan $445 $439 Home Insurance $100 $100 Property tax @0.007% of home value $328 $324 Total mortgage payment $4,284 $4,227 Income Required to Finance Median Priced Home $171,360 $169,080 January Category Q4 2022 2024 Year Ratio Rating 3.6 3.7 Moderately 3.8 Una ordable 3.9 5.8 Severely 5.8 Unadable 5.4 4.1 4.3 Seriously 4.3 Unadable 4.7 Source: UtahRealEstate.com and Freddie Mac.

6-7 illustrate the impact of affordability on homeownership opportunities The income required to finance the median priced single -family home in Salt Lake County is $170,000. Even more,

the

income required for a more affordable median priced condominium is $125,000.

Jared©/Adobe Stock

“While the housing market will benefit in 2024 from lower mortgage rates and increased listings, affordability will continue to be an offsetting factor preventing a sales recovery to the pre-pandemic level of 18,000 sales (2016-2020).”

James Wood

forecast from the Utah Department of Workforce Services for 2024 is 1.8%, an increase of 32,000 jobs. Excluding the pandemic year of 2020, this year will have the slowest rate of job growth since 2010. The labor shortage will continue with a low unemployment rate of 2.9%.

Inflation – The rate of inflation will continue to decline to an expected 2.2% by year-end 2024.

Mortgage rate - The mortgage rate will range between 6.0% 6.5% and by 2025 dip into the 5.5% to 6.0% range.

Housing prices - The median sales price for all types of homes (single-family, condominium, townhome and twin home) will increase by 3% to $530,500 from $515,000 in 2023, while the median price of a single-family home will increase by 2.4% to $600,000 and condominiums, townhomes, and twin homes will see a 5% increase to $436,000, thus benefitting from their affordability.

Of course, half of all homes sold fall below the median. Do these lower priced homes provide a realistic home ownership opportunity for most renters or first-time home buyers? Sales data for Salt Lake County show that 27% of homes sold in 2023 were priced from $400,00 to $500,000 and another 15% were priced from $300,000 to $400,000. But even these lower priced homes require relatively high household income to qualify for homeownership. At current mortgage rates, a home priced at $300,000 would require an income of $90,000 to $100,000 Daunting income requirements for most first-time homebuyers and renters. Even homes priced well below the median would, in most cases, require two incomes in a household and several years’ experience in the job market.

What to Expect in 2024

Economic conditions - Expect slower job growth, but a recession in Utah is unlikely. The employment growth forecast from the Utah Department of Workforce Services for 2024 is 1.8%, an increase of 32,000 jobs. Excluding the pandemic year of 2020, this year will have the slowest rate of job growth since 2010. The labor shortage will continue with a low unemployment rate of 2.9%

Residential sales – Residential sales will increase from this cycle’s low point of 11,195 in 2023. More favorable rates, improving consumer sentiment, and increased listings will push sales in Salt Lake County up 16% to around 13,000 homes.

Residential sales – Residential sales will increase from this cycle’s low point of 11,195 in 2023. More favorable rates, improving consumer sentiment, and increased listings will push sales in Salt Lake County up 16% to around 13,000 homes.

Inflation – The rate of inflation will continue to decline to an expected 2.2% by year-end 2024.

Mortgage rate - The mortgage rate will range between 6.0% 6.5% and by 2025 dip into the 5.5% to 6.0% range.

Of course, half of all homes sold fall below the median. Do these lower priced homes provide a realistic home ownership opportunity for most renters or first-time home buyers? Sales data for Salt Lake County show that 27% of homes sold in 2023 were priced from $400,00 to $500,000 and another 15% were priced from $300,000 to $400,000. But even these lower priced homes require relatively high household income to qualify for homeownership. At current mortgage rates, a home priced at $300,000 would require an income of $90,000 to $100,000. Daunting income requirements for most firsttime homebuyers and renters. Even homes priced well below the median would, in most cases, require two incomes in a household and several years’ experience in the job market.

Housing prices - The median sales price for all types of homes (single -family, condominium, townhome and twin home) will increase by 3% to $530,500 from $515,000 in 2023, while the median price of a single -family home will increase by 2.4% to $600,000 and condominiums, townhomes, and twin

will see a 5% increase to $436,000, thus benefitting from their affordability.

What to Expect in 2024

Economic conditions - Expect slower job growth, but a recession in Utah is unlikely. The employment growth

20232024% Chg.

Inset Quotes: “In 2024, the median sales price for all types of homes will increase by 3% to $530,500

14 | Salt Lake Realtor ® | February 2024

Table 7

Mortgage Payment Calculations for the Median Price Home in Salt Lake County, Q2022 and January 2024 (condominium, twin home, townhome)

Table 8

Forecast of Economic Indicators for 2024

Source: UtahRealEstate.com and Freddie Mac.

Frank Munch©/Adobe Stock

Table 7

Median sales price of home $405,000 $405,500 5% down payment $20,250 $20,500 Amount to finance $384,750 $385,000 Mortgage rate 6.66% 6.63% Principal and interest payment $2,450 $2,460 Private mortgage insurance 1% of the loan $320 $320 Home Insurance $100 $100 Property tax @0.007% of home value $236 $237 Total mortgage payment $3,106 $3,117 Income Required to Finance Median Priced Home $124,240 $124,680

Mortgage Payment Calculations for the Median Price Home in Salt Lake County, Q2022 and January 2024 (condominium, twin home,

townhome)

Source: UtahRealEstate.com and Freddie Mac

homes

Category Q4 2022 2024

Table

Forecast of Economic Indicators

2024 Utah Employment (000) 1,727 1,759 1.9% Utah Unemployment 2.6% 2.9% U.S. Inflation Rate 4.1% 2.8% U.S. Mortgage Rate 6.8% 6.2% Median Sales Price Salt Lake County All types of housing* $515,000 $530,500 3.0% Single-family $586,000 $600,000 2.4% Multifamily owner $415,000 $436,000 5.0% Residential Sales Salt Lake County 11,195 13,000 16.1%

8

for

Construction We’ve Got You Covered Visit us online at UFirstCU.com or give us a call at 801-481-8840 CONSTRUCTION LOANS NMLS #654272 EQUAL HOUSING LENDER

Younger Buyers Want Baby Boomers to Update Their Homes

Millennials are worried they’ll inherit properties in need of major renovations and repairs, which could further hamper affordability.

By Melissa Dittmann Tracey

Young move-up home buyers are growing increasingly worried that baby boomers, many of whom are staying put in their current home, won’t update their properties and will pass down costly renovations and repairs to the next generation of owners, according to a new study from Morning Consult and Leaf Home, a national home improvement company.

Many baby boomers are choosing not to downsize, with 68% saying they’ve lived in their homes for 30 years or more, the study shows. Many in that group admit

according to a new study from Redfin. But many young families need extra space: Millennials with children comprise about a quarter of three-bedroom-plus rentals in the U.S.—the largest share compared to any other generation.

Some millennials are waiting out the housing market for more larger homes that can accommodate their growing families. Ten percent of millennials say baby boomers are staying in their homes too long and should free up housing for them, the Morning Consult and Leaf Home survey finds.

they’ve never done renovations or replaced major appliances—and they don’t have any plans to, either. Researchers say this could become a nightmare scenario for millennials, who may inherit or purchase these “time capsule” homes. Younger buyers’ budgets already are stretched thin by high home prices and mortgage rates. It’s difficult for many to add pricey renovations to their homebuying budget.

“The housing market is caught in a generational tugof-war,” said Leaf Home CEO Jon Bostock. “Boomers will soon face aging-in-place hurdles, while millennials will face the surprise of homes in need of major updates. With an aging and ignored inventory of homes available in the next decade, we may see a crisis that will overwhelm the home improvement industry and strain the budgets of inheriting millennials, impacting the housing market.”

Taking More Than Their Fair Share?

Empty-nesters own twice as many large homes as millennials with children, 28% versus 14%, respectively,

But baby boomers, like many other homeowners, have little incentive to sell. Some may not want to give up the ultralow mortgage rate they got in recent years while others own their home outright and are sitting on record amounts of equity.

Housing Experts: Crisis Looming

The aging housing stock in America is an issue that experts have been flagging for years. Economists are concerned about the impact aging homes could have on a housing market already struggling with a historic inventory shortage.

The median age of an owner-occupied house is 40 years old, according to the American Community Survey. Slightly less than half of the owner-occupied homes were built prior to 1980; about 35% were built prior to 1970. As homes age, their components need to be replaced or repaired to keep them sellable. `A bloated, aging inventory of neglected homes could be the next big headache for the housing market, researchers warn.

Melissa Dittmann Tracey is a contributing editor for Realtor® Magazine. Reprinted from Realtor® Magazine Online, January 2024, with permission of the National Association of Realtors®. Copyright 2024. All rights reserved.

February 2024 | Salt Lake Realtor ® | 21

Source: “2024 Generational Divide in Homeownership Report,” Leaf Home/Morning Consult

22 | Salt Lake Realtor ® | February 2024

24 | Salt Lake Realtor ® | February 2024

February 2024 | Salt Lake Realtor ® | 25

26 | Salt Lake Realtor ® | February 2024

THE iX THE i4

THE BMW iX & i4. 100% ELECTRIC.

Electrify every drive with the BMW iX and i4. A generation of electric vehicles built like no other.

Confidently get behind the wheel of the 100% electric BMW iX. The new standard of electric driving, defined by elegant detailing, capability and premium experience.

Or experience a futuristic take on timeless style in the 100% electric BMW i4. With dynamic driving capabilities and advanced technology like the BMW Curved Display, you’re set up to take on any adventure.

That’s what you’d expect from the Ultimate Electric Driving Machine. Visit BMW of Murray or BMW of Pleasant Grove today for a test drive.

BMW of Murray

4735 S. State Street

Murray, Utah 801-262-2479

bmwofmurray.com

BMW of Pleasant Grove

2111 West Grove Parkway

Pleasant Grove, Utah 801-443-2000

bmwofpg.com

©2023 BMW of North America, LLC. The BMW trademarks are registered trademarks.

December 2023

Will Home Sales Rise in 2024?

Homes sales (all housing types) in Salt Lake County were up 3% to 816 units sold in December 2023, compared to 790 units sold in December 2022. The uptick in sales was welcome news. Home sales in the county have been falling each month year over year since June 2021 (except for October 2023). In the spring of 2022, the decrease in home sales accelerated as the Federal Reserve started raising short-term interest rates to combat inflation.

In 2023, Salt Lake County home sales fell to their lowest level in 12 years – a decline attributed to high mortgage rates, elevated home prices, and limited housing inventory. This downturn contrasts sharply with the all-time high reached in 2020, fueled by record-low mortgage rates and the Covid-19 pandemic, which stimulated migration from urban centers to suburban and rural areas. Nationally, the trend was similar. According to the National Association of Realtors® (NAR), existing-home sales in 2023 dropped to their lowest point since 1995. NAR Chief Economist Lawrence Yun stressed the importance of facilitating homeownership for current renters. “It requires economic and income growth and, most importantly, a steady buildup of home construction ,” he said.

The median sold price of all housing types in Salt Lake County increased to $489,425 in December, up nearly 2% from $480,000 in December 2022. Single-family home prices climbed to $560,000, up 3% compared to $542,500 a year ago. Prices rose to $415,000 for multi-family homes, up nearly 4% year over year.

In December, properties in Salt Lake County typically remained on the market for 35 days, down from 40 days in the same month of 2022. New listings increased by 9% year-over-year to 752 properties. However, under contract listings fell by 11% to 1,017 units, compared to 1,143 in December 2022.

Nationally, total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 1% from November to a seasonally adjusted annual rate of 3.78 million in December. Year-over-year, sales declined 6.2% (down from 4.03 million in December 2022), according to the National Association of Realtors®.

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year,” Yun said. “Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in upcoming months.”

In the U.S., first-time buyers were responsible for 29% of sales in December, down from 31% in November 2023 and December 2022. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 20234 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 29% of transactions in December, up from 27% in November 2023 and 28% in December 2022.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in December, down from 18% in November and identical to one year ago.

Distressed sales – foreclosures and short sales – represented 2% of sales in December, virtually unchanged from last month and the previous year, according to NAR.

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year.”

Lawrence Yun

Chief Economist National Association of Realtors®

28 | Salt Lake Realtor ® | February 2024

February 2024 | Salt Lake Realtor ® | 29 Local Market Update for December 2023 Source: UtahRealEstate.com

KEY METRICS NO. OF SALES MEDIAN SOLD MEDIAN PRICE NEW LISTINGS PRICE PER SQ. FT All Housing Types 816 $489,425 $236.88 752 Single Family 519 $560,000 $228.53 445 Multi Family 271 $415,000 $272.33 284 COMPARISON TO LAST YEAR 2022 All Housing Types 790 $480,000 $236.77 691 Single Family 552 $542,500 $228.26 475 Multi Family 222 $400,000 $266.45 185 COMPARISON TO LAST YEAR -% DIFFERENCE All Housing Types 3.29% 1.96% 0.05% 8.83% Single Family -5.98% 3.23% 0.12% -6.32% Multi Family 22.07% 3.75% 2.21% 53.51% 3.29% 8.83% -12.50% 1.96% 816 790 NO. OF SALES ALL HOUSING TYPES DEC. 2022 ALL HOUSING TYPES DEC. 2023 ALL HOUSING TYPES DEC. 2023 ALL HOUSING TYPES DEC. 2023 ALL HOUSING TYPES DEC. 2023 ALL HOUSING TYPES DEC. 2022 ALL HOUSING TYPES DEC. 2022 ALL HOUSING TYPES DEC. 2022 NEW LISTINGS MEDIAN CDOM MEDIAN SOLD PRICE AUG 691 752 40 35 $489,425 $480,000

Salt Lake County

We're proud to celebrate alongside our Windermere agents who made the Top 500 Salt Lake Board of Realtors® in 2023.

winutah.com/joinus

Congratulations

Lana Ames

Connie Elliott

Jim Bringhurst

Adam Frenza

Monica Draper

Casey Halliday

Abbey Drummond

Lori Hendry

Peter Clark

Jan Lowe

Cherie MajorAndrew McNeilTaylor PetersonScott Steadman

Laurann TurnerJulia UbertyLisa Woodbury